TVVISION

Equity Metrics

January 13, 2026

TV Vision Limited

TV Broadcasting & Software Production

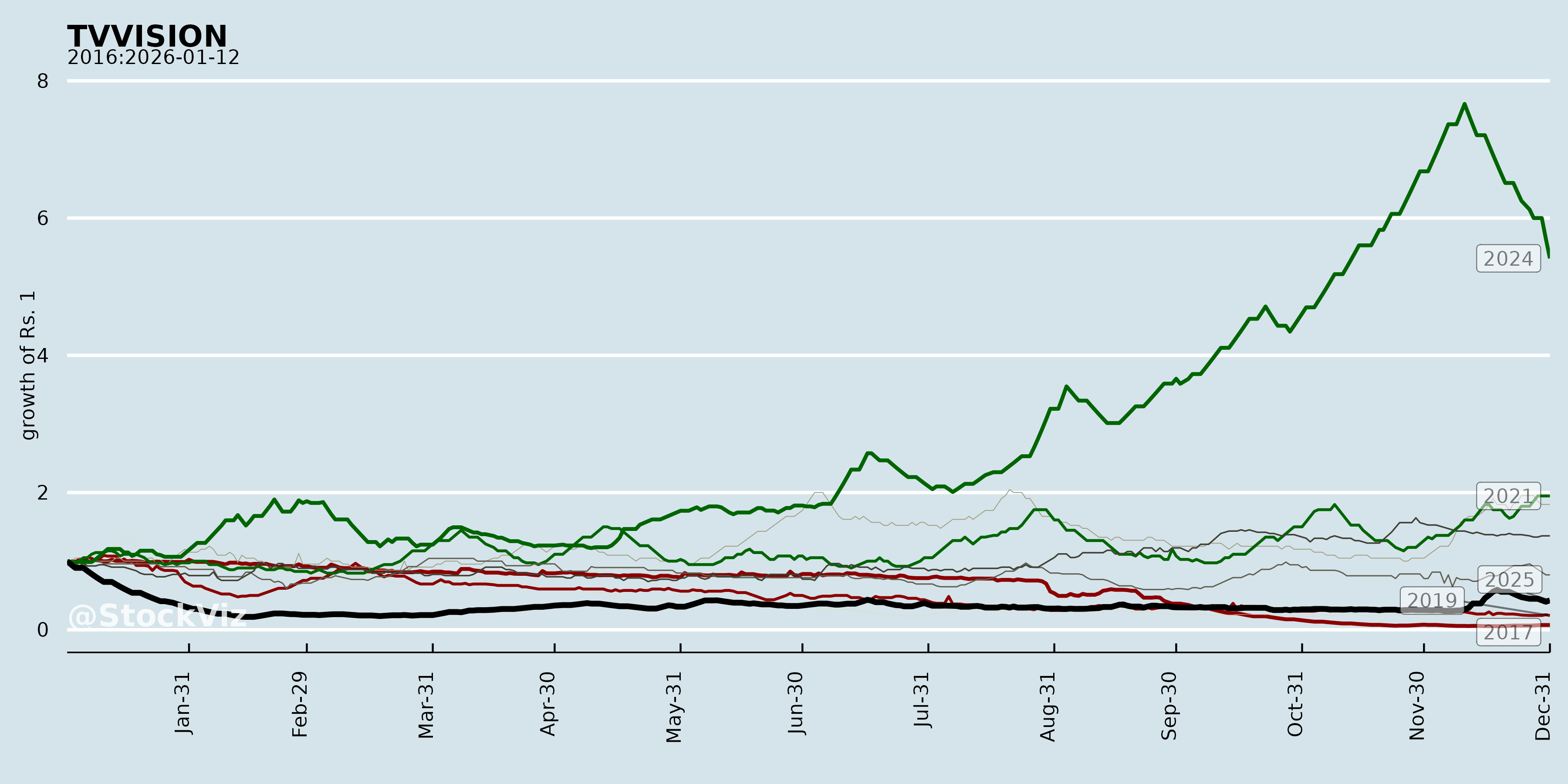

Annual Returns

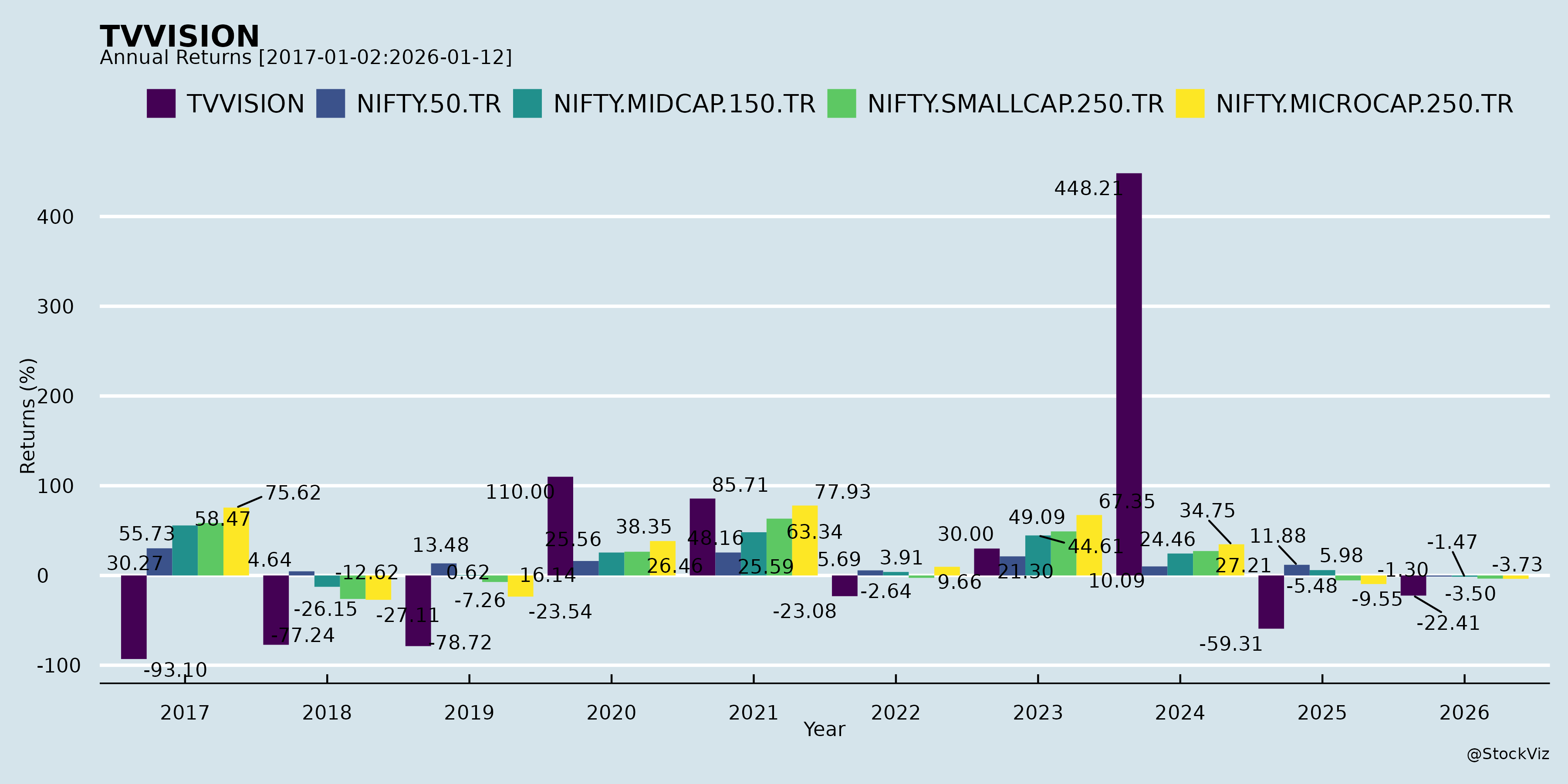

Cumulative Returns and Drawdowns

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-11-27

Analysis of TV Vision Limited (TVVISION): Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview:

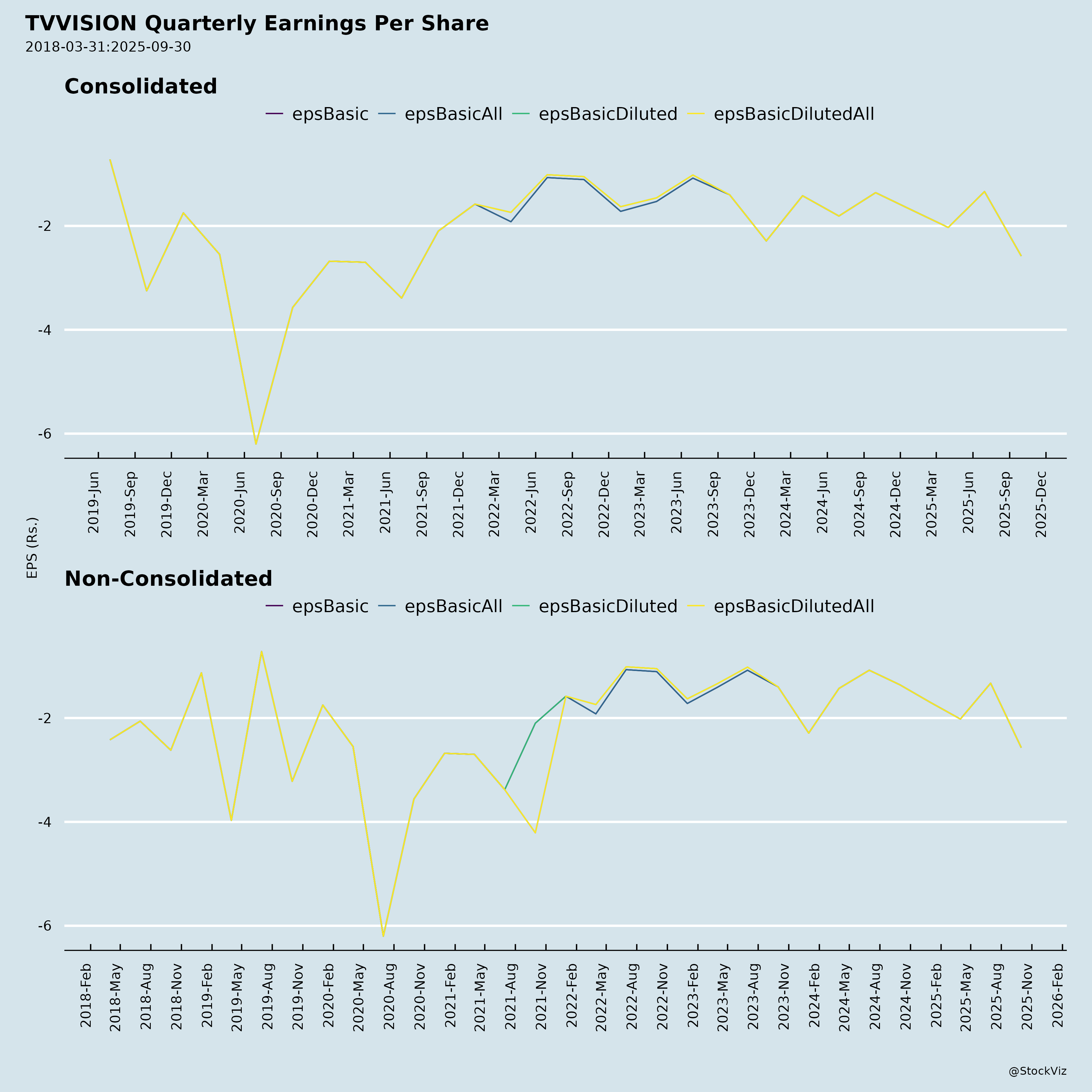

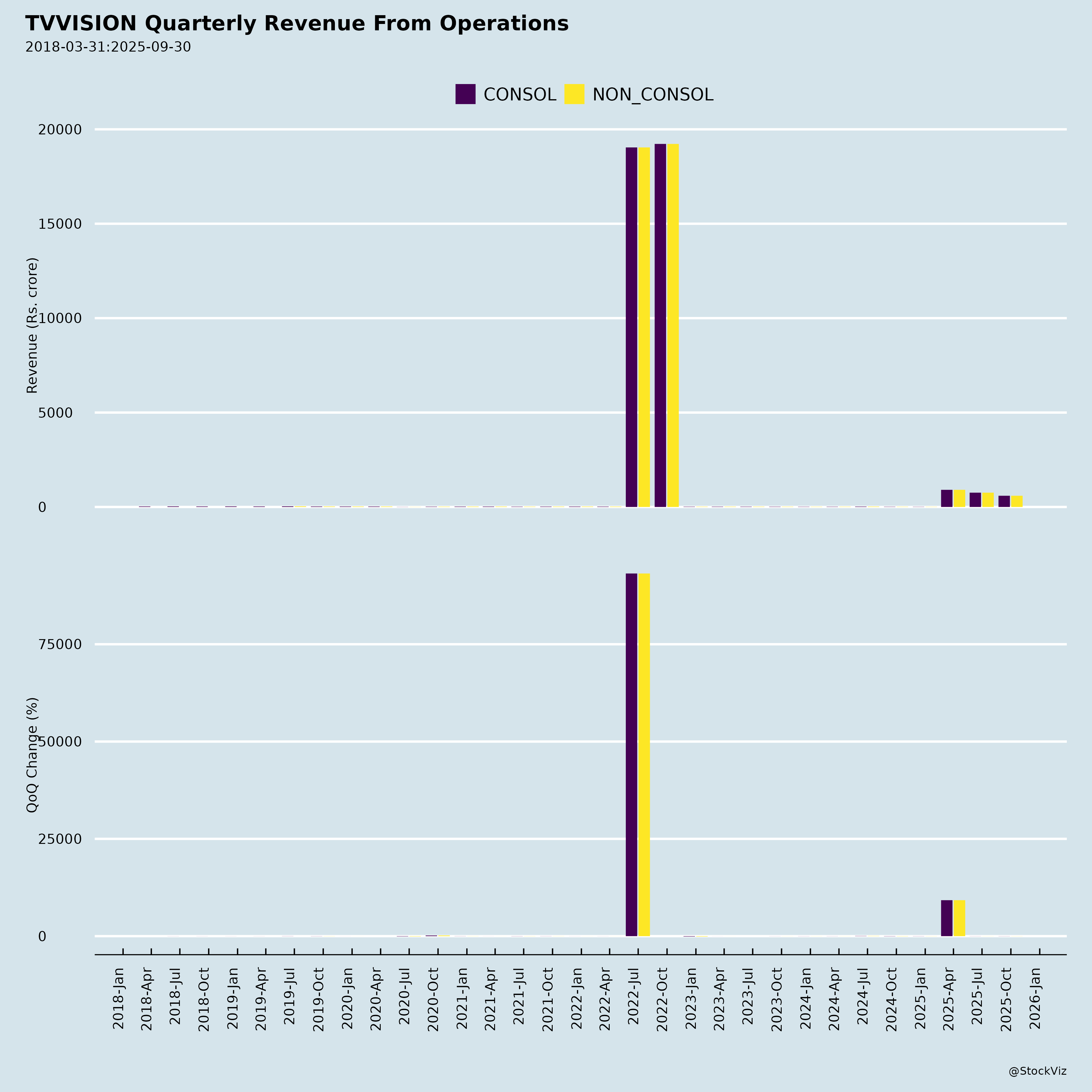

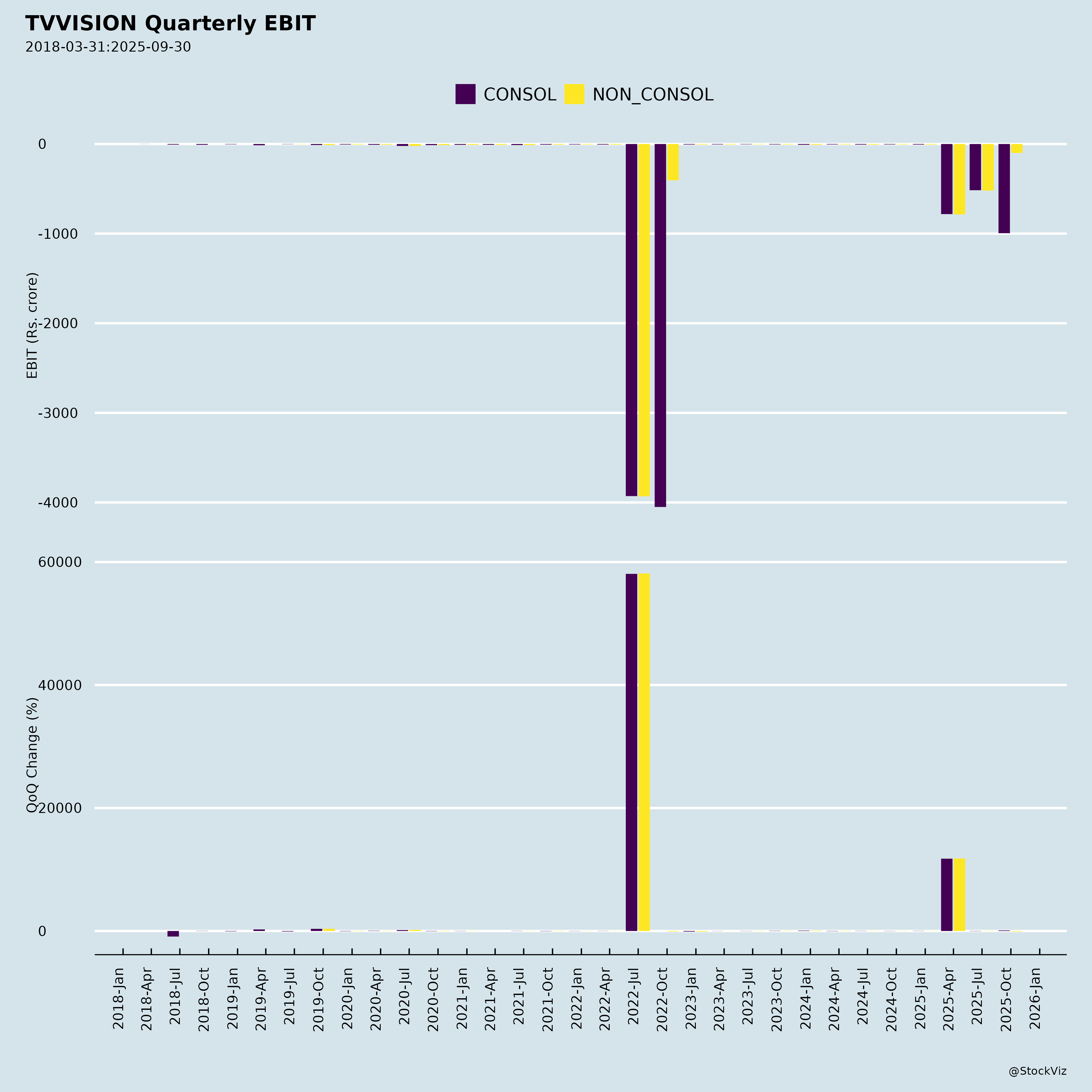

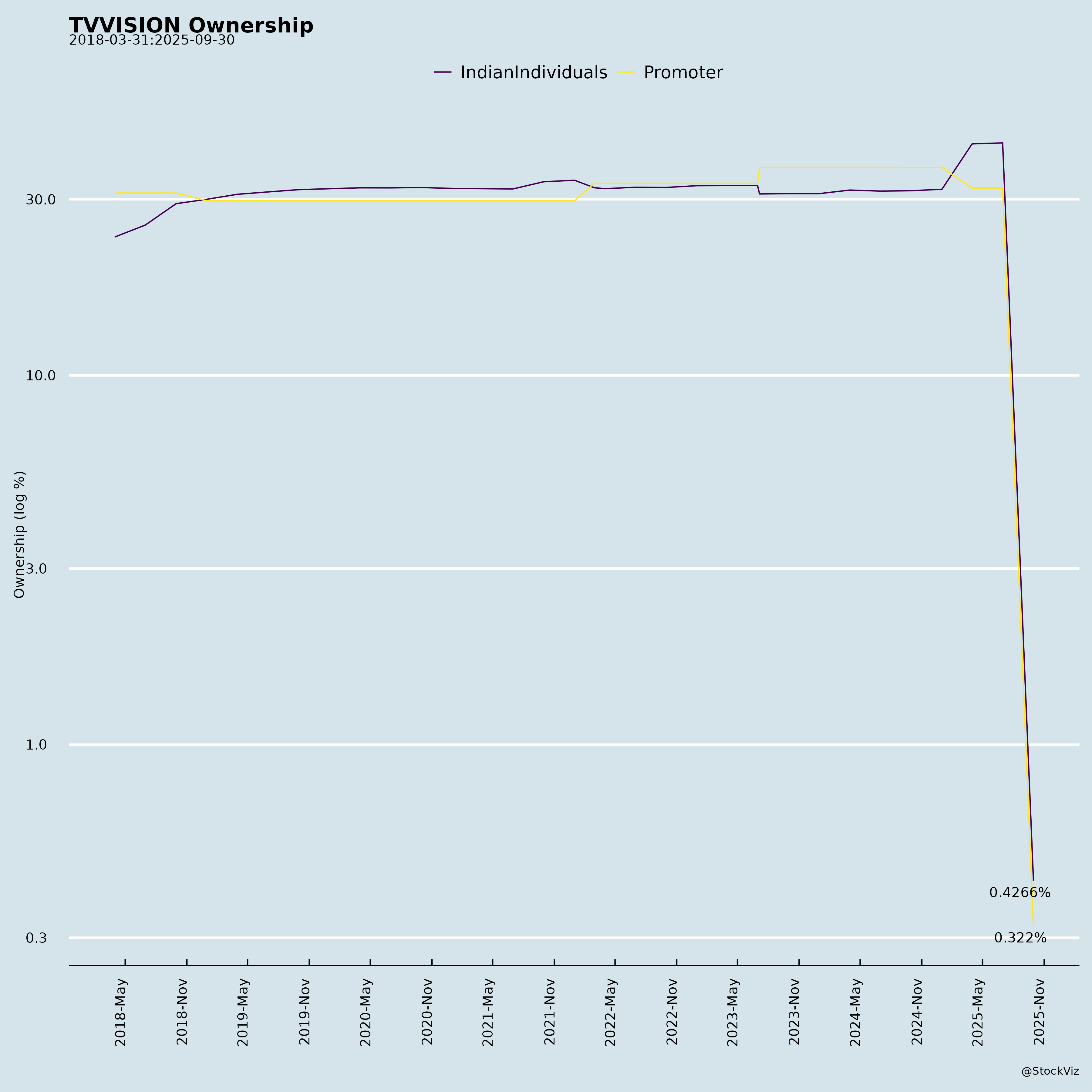

TV Vision Limited (CIN: L64200MH2007PLC172707), a Mumbai-based broadcasting company operating in a single segment (Broadcasting), released key regulatory filings in Sep-Nov 2025. These include board outcomes for Q2FY26 financial results (quarter/half-year ended Sep 30, 2025), AGM voting results (Sep 25, 2025), and CS appointment. Financials show deepening distress: standalone equity at -₹12,489 Lakhs (vs. -₹10,978 Lakhs at FY25-end), consolidated at -₹15,895 Lakhs. Auditors flag material going concern uncertainty and qualified review due to unprovisioned liabilities/losses exceeding ₹6,000+ Lakhs. No revenue details provided, but intangibles (₹1,983 Lakhs) generate zero income. Promoter holding ~32% (inferred from AGM voting). Stock listed on BSE (540083) and NSE (TVVISION).

Headwinds (Strong Negative Pressures)

- Financial Deterioration: Total assets shrank 22% QoQ (standalone: ₹8,916 → ₹6,981 Lakhs). Negative equity worsened 14% standalone/11% consolidated. Pre-tax loss: ₹1,511 Lakhs (H1FY26 standalone) vs. ₹2,669 Lakhs (FY25). High leverage: Current liabilities (₹19,443 Lakhs standalone) dwarf current assets (₹1,197 Lakhs) by 16x.

- Debt Crisis & NPA Status: Loans recalled by banks (classified NPA in prior years); no interest provision (~₹347 Lakhs understated for Q2 alone). Symbolic possession of collateral, SARFAESI notices, DRT recovery proceedings, invoked pledges/corporate guarantees.

- Asset Quality Issues: No impairment on ₹3,312 Lakhs investments (subsidiaries/associate fair value << cost) or ₹1,983 Lakhs intangibles (Business/Commercial Rights idle, no monetization/revenue). Vendor interest unprovisioned (exact quantum unknown).

- Operational Stagnation: Zero revenue from core intangibles despite years of losses. Single-segment exposure to volatile broadcasting (declining ad spends, digital shift).

- Auditor Red Flags: Qualified conclusion; losses/liabilities understated by ₹3,000+ Lakhs (conservative est.). Subsidiaries (HHP, MPCR, UBJ Broadcasting) also face going concern doubts.

Tailwinds (Limited Positive Factors)

- Compliance Improvements: Appointed new Company Secretary (Ms. Aashi Neema, ACS 74936) w.e.f. Oct 17, 2025, signaling governance focus amid regulatory scrutiny.

- Shareholder Support: 18th AGM (Sep 25, 2025) saw 99.99%+ approval on all resolutions (financials adoption, director re-appointments, secretarial auditor). Strong promoter voting (37.7% turnout, 100% in favor).

- Modest Cash Flow: Net cash from operations positive at ₹261/₹230 Lakhs (standalone/consolidated H1FY26), aided by working capital releases (e.g., receivables down 61%). Cash balance up slightly (₹187 Lakhs consolidated).

- No New Dilution: No equity/warrant issuances in H1FY26.

Growth Prospects (Low to Negligible)

- Poor Outlook: Broadcasting segment unmonetized; no revenue visibility from intangibles (key assets). Historical losses persist (₹2,669 Lakhs FY25 loss). No capex beyond minor ₹1.6 Lakhs; focus on survival, not expansion.

- Potential Upside (Speculative): Debt resolution (e.g., via IBC/settlement) could unlock intangibles/content library value. Digital pivot or M&A in media unmentioned. Promoter skin-in-game (pledges invoked but control intact).

- Base Case: Stagnant/declining without restructuring. FY26 loss likely >FY25; delisting/insolvency risk high if lenders enforce.

Key Risks (High Intensity)

| Risk Category | Description | Potential Impact |

|---|---|---|

| Going Concern/Liquidity | NPA escalation, cash burn despite ops positivity; current ratio <0.1x. | Insolvency/liquidation (material uncertainty flagged). |

| Debt/Legal | Recalled loans, SARFAESI/DRT actions, invoked pledges/guarantees. | Asset loss, equity wipeout. |

| Accounting/Impairment | ₹6,000+ Lakhs unprovisioned (interest ₹347L + investments ₹3,312L + intangibles ₹1,983L + vendor interest). Balances unconfirmed. | Earnings restatement, stock suspension. |

| Operational | Idle assets, no revenue; broadcasting cyclicality (ad slowdown). | Continued losses, negative EBITDA implied. |

| Regulatory/Market | SEBI compliance (e.g., disclosures); low liquidity (AGM turnout 33%). Negative equity erodes investor confidence. | Delisting, shareholder lawsuits. |

| Subsidiary/Associate | 3 subs with losses/negative equity; associate not consolidated (NIL investment post-losses). | Consolidated drag. |

Overall Summary:

Highly Distressed Stock – SELL/High Risk. TVVISION faces existential headwinds from debt overhang, unprovisioned losses, and going concern doubts, overshadowing minor tailwinds like cash ops and compliance tweaks. Growth prospects are dismal absent debt resolution; expect further erosion. Key monitor: Lender actions/IBC filing. Investors should avoid; suitable only for deep-value distress plays with restructuring catalyst. Market cap irrelevant (not provided), but negative equity signals ~100% downside risk. Recommend tracking BSE/NSE disclosures for updates.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.