Fama-French Factor Returns

StockViz

January 25, 2026

5-Factors and momentum

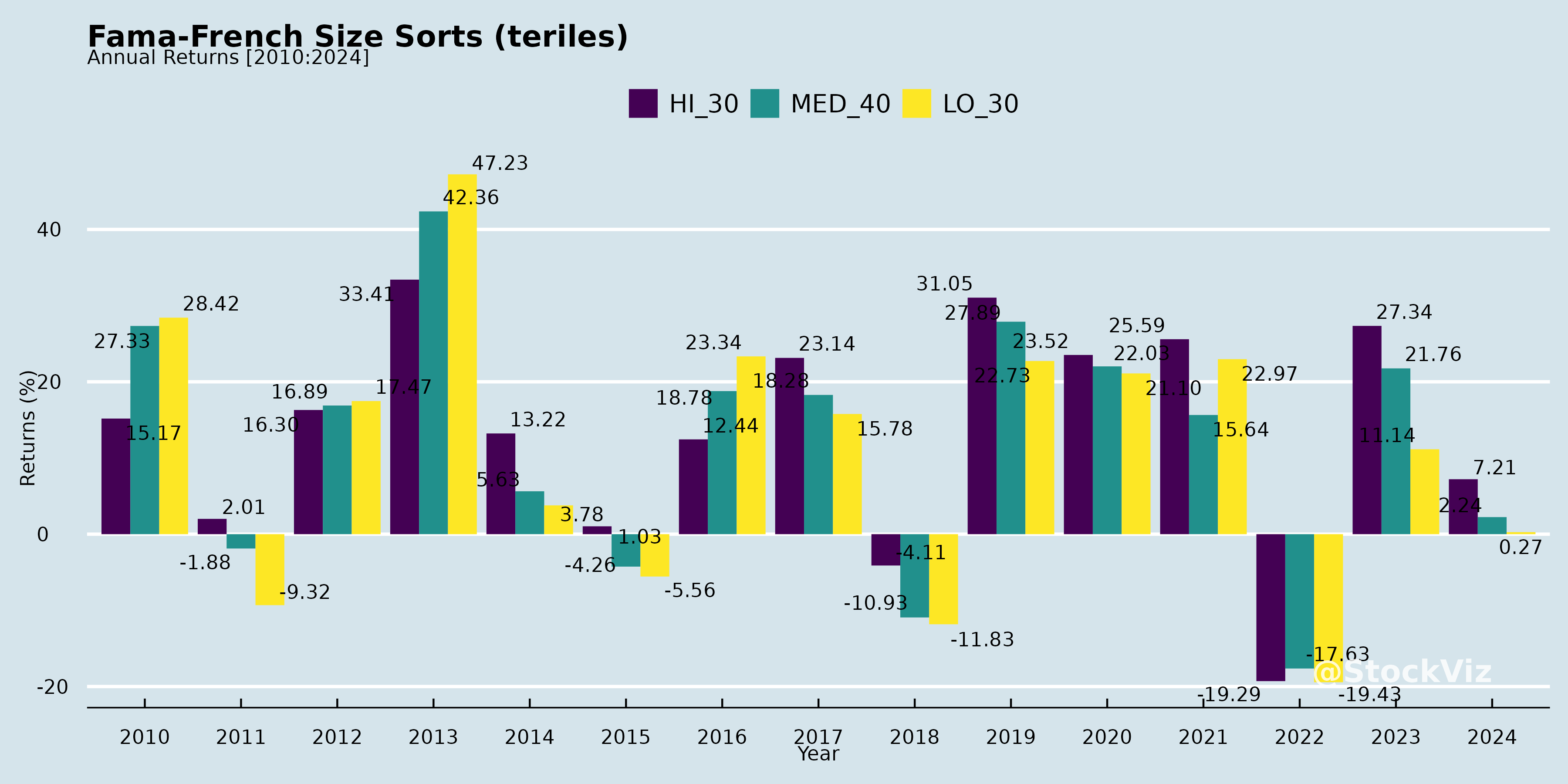

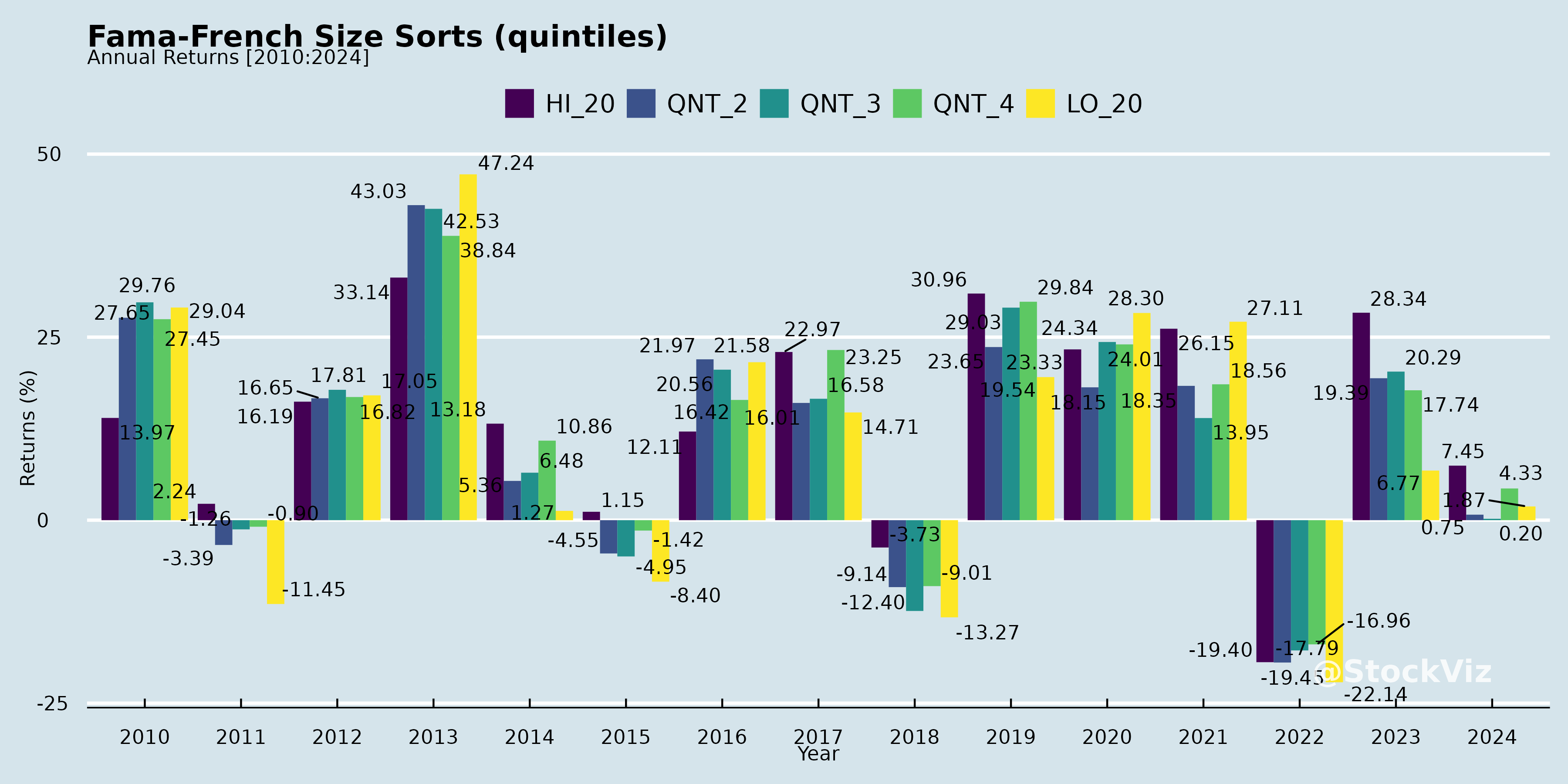

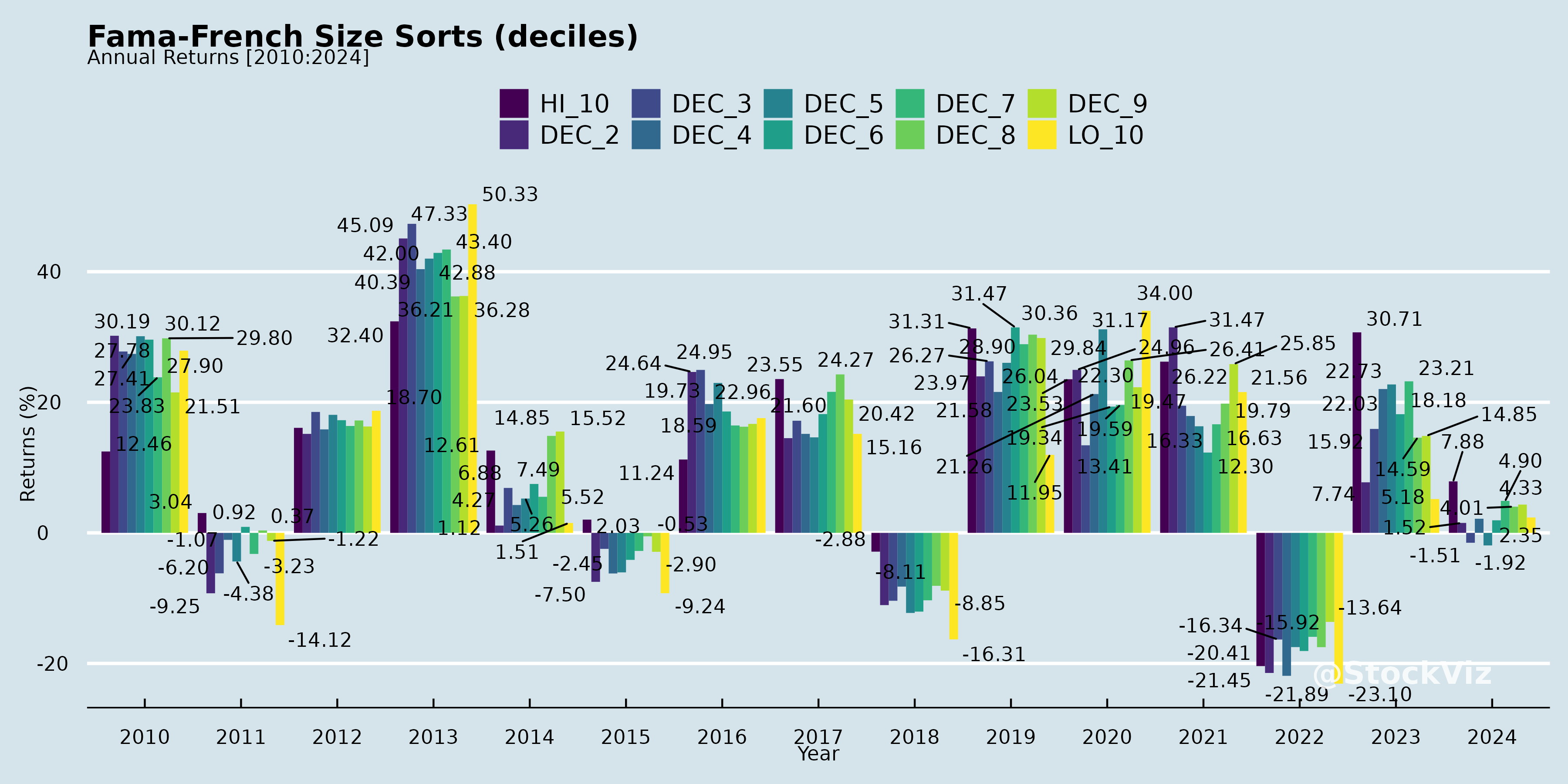

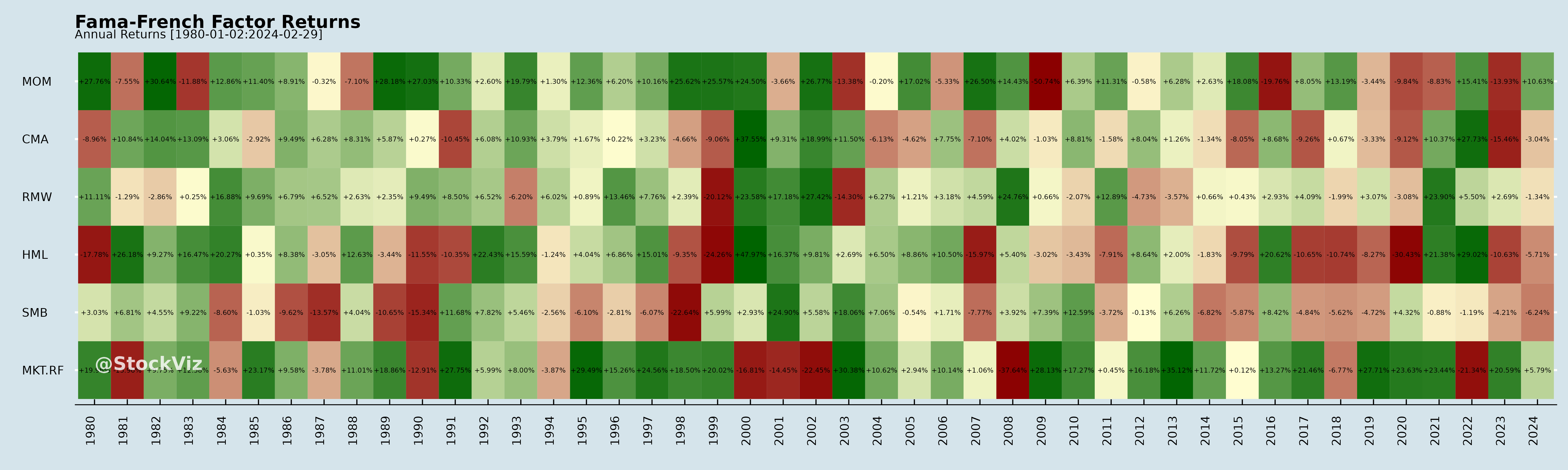

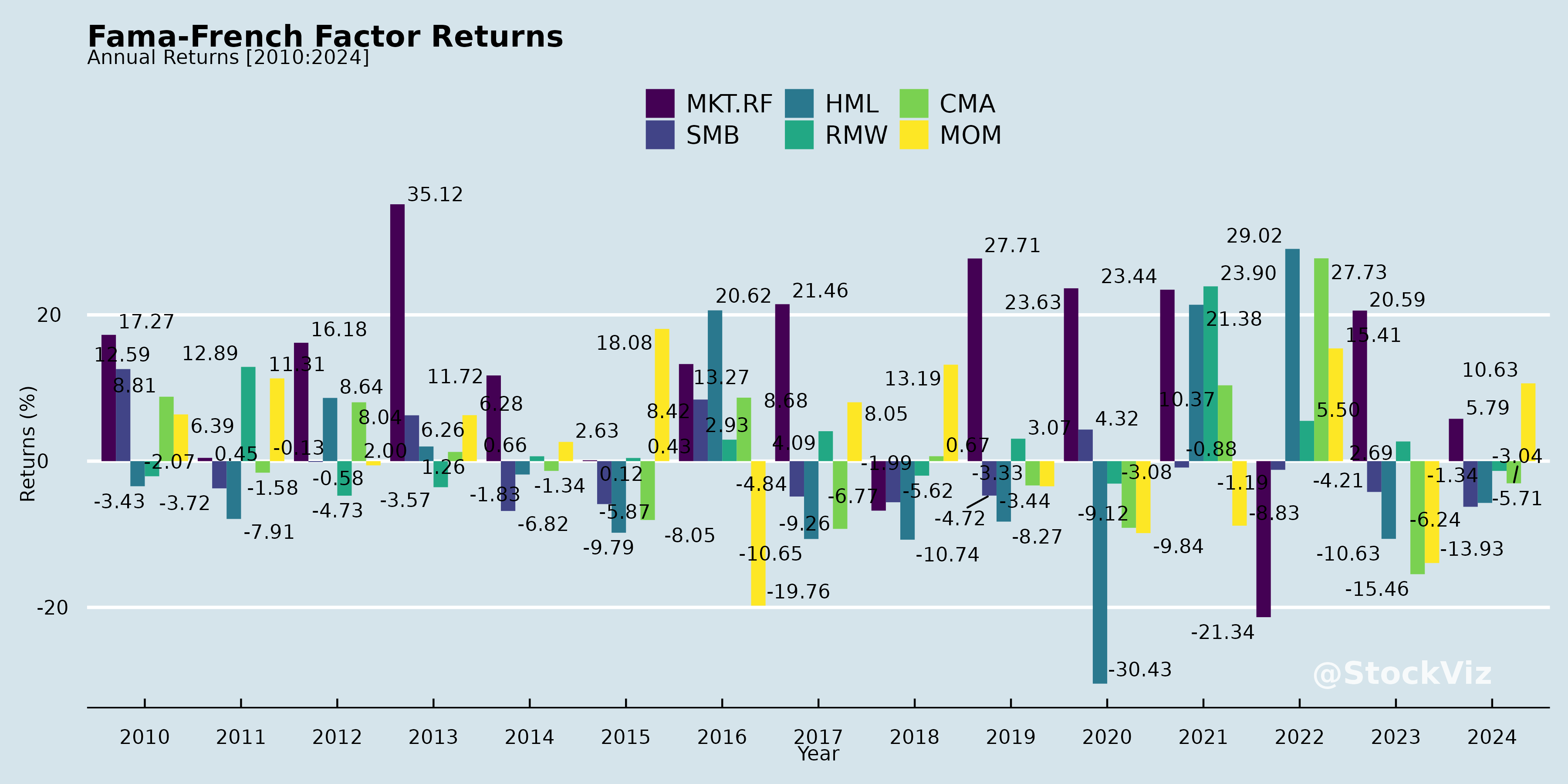

Annual Returns

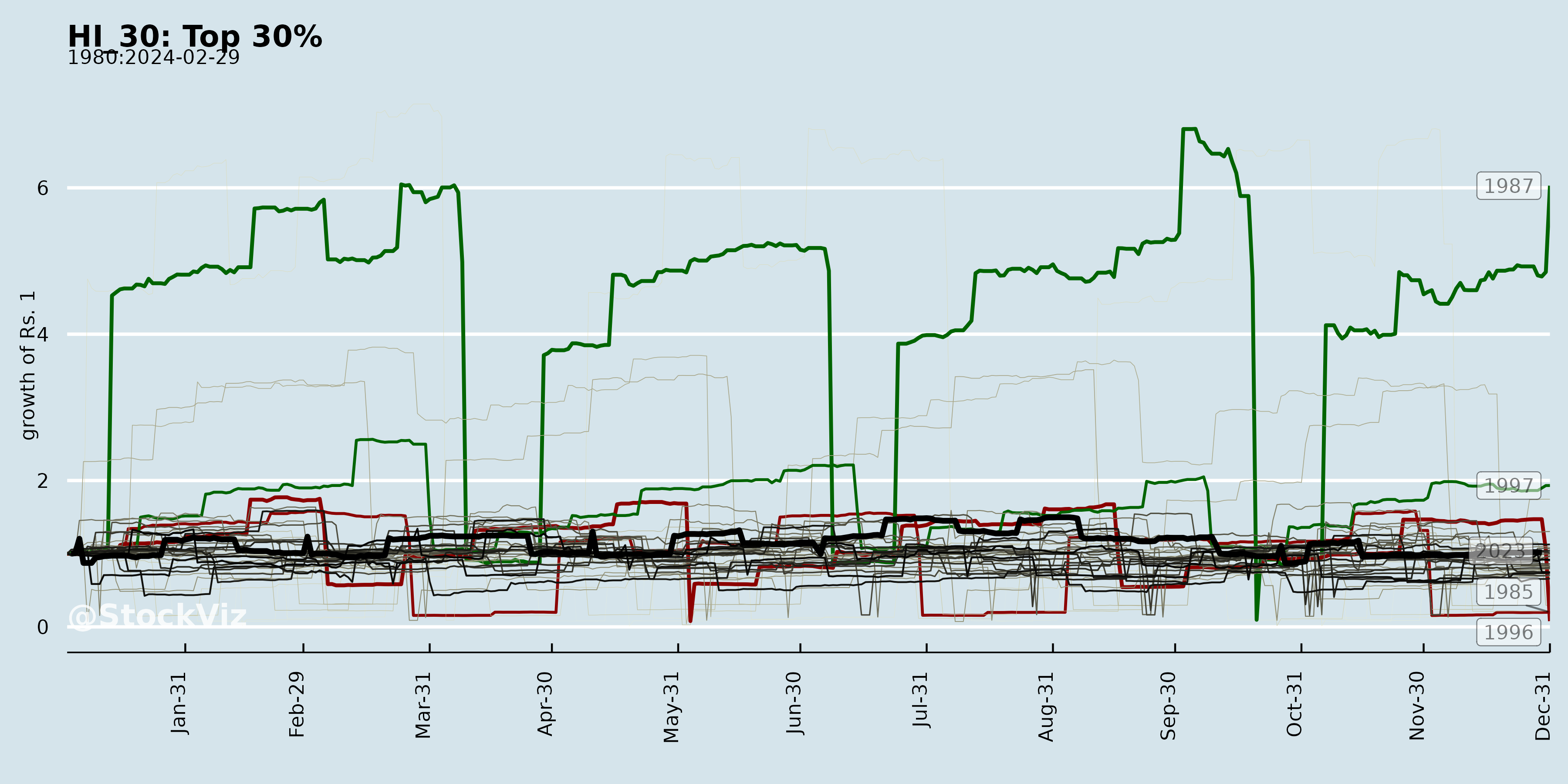

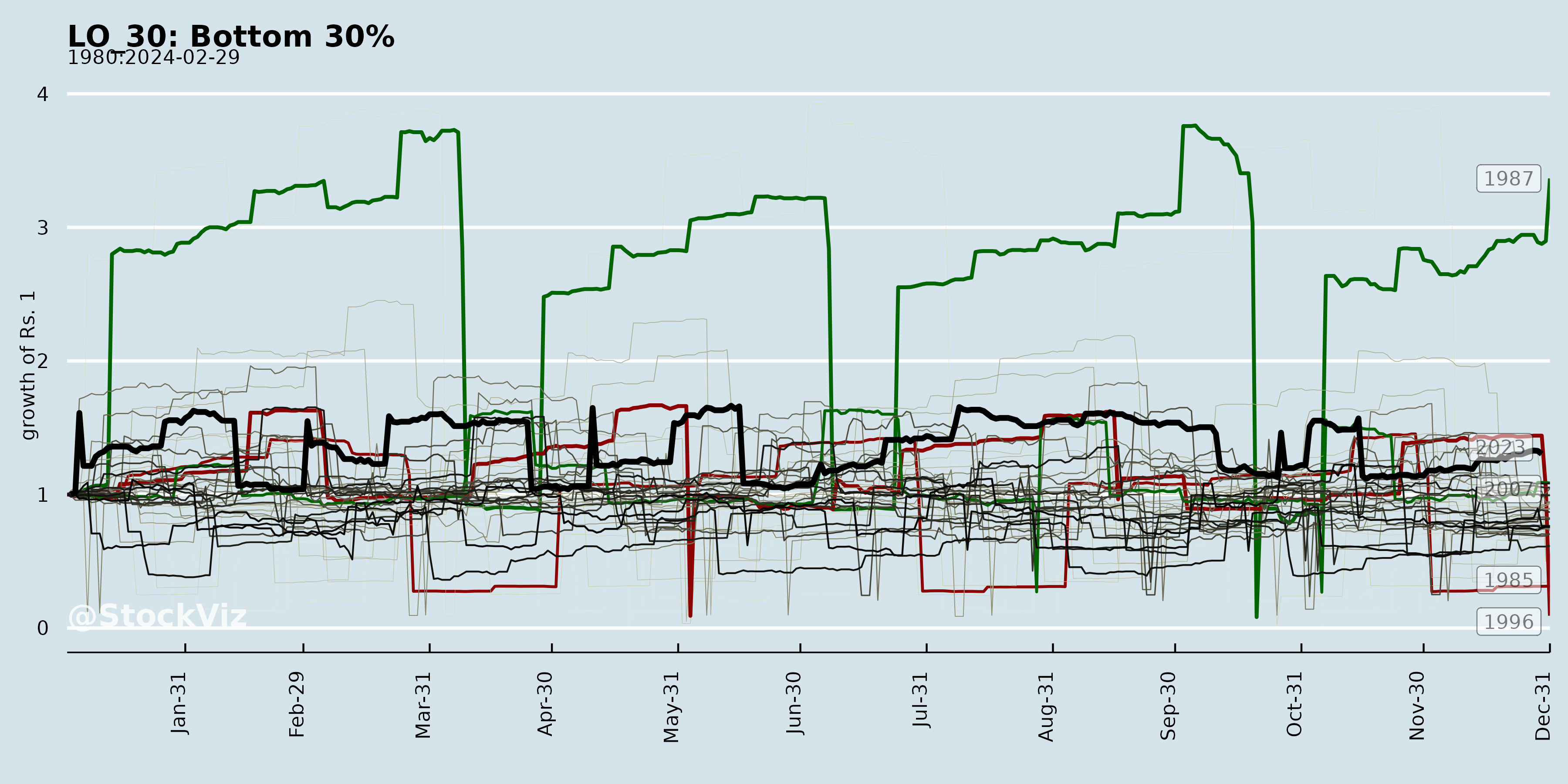

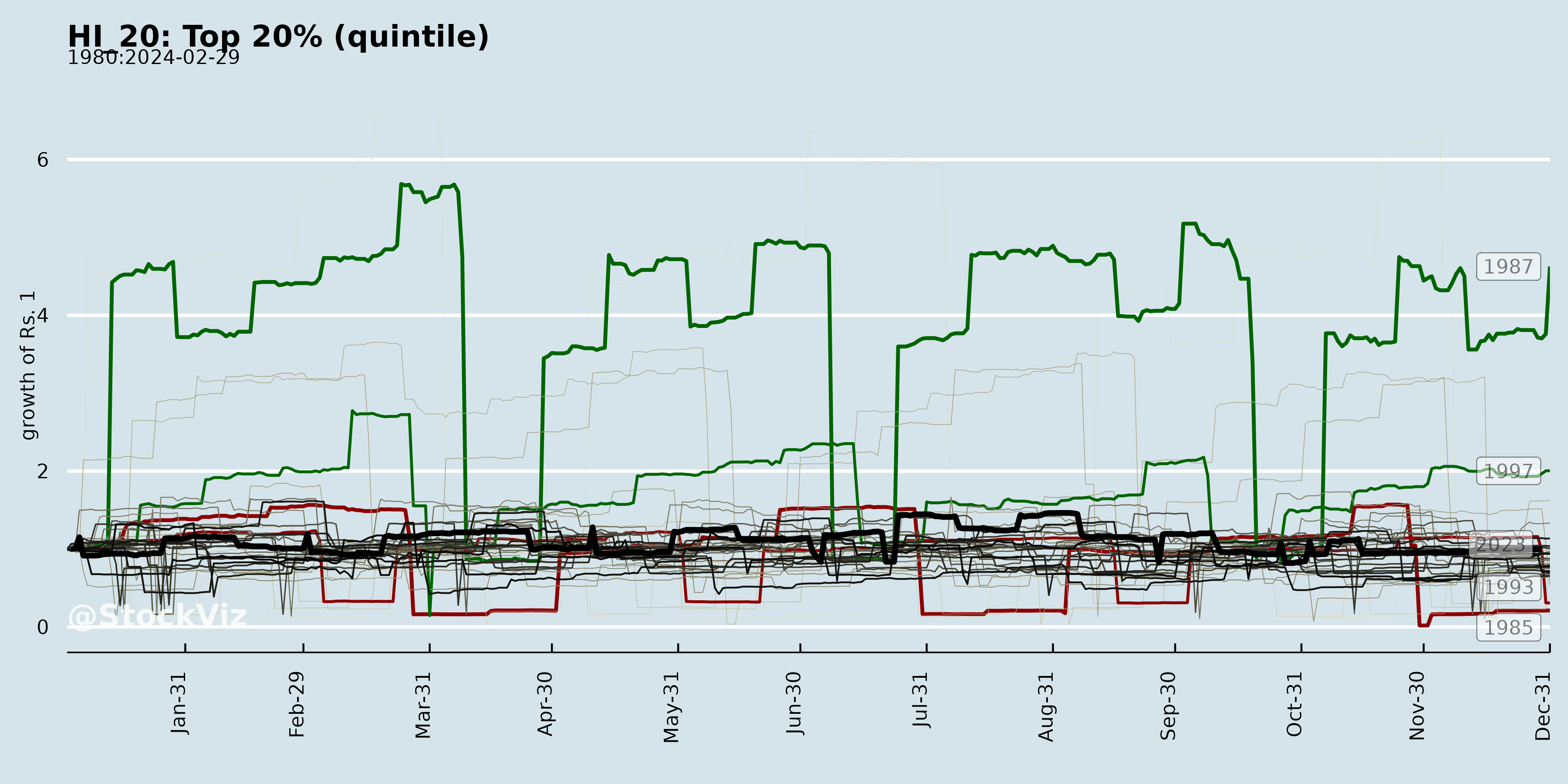

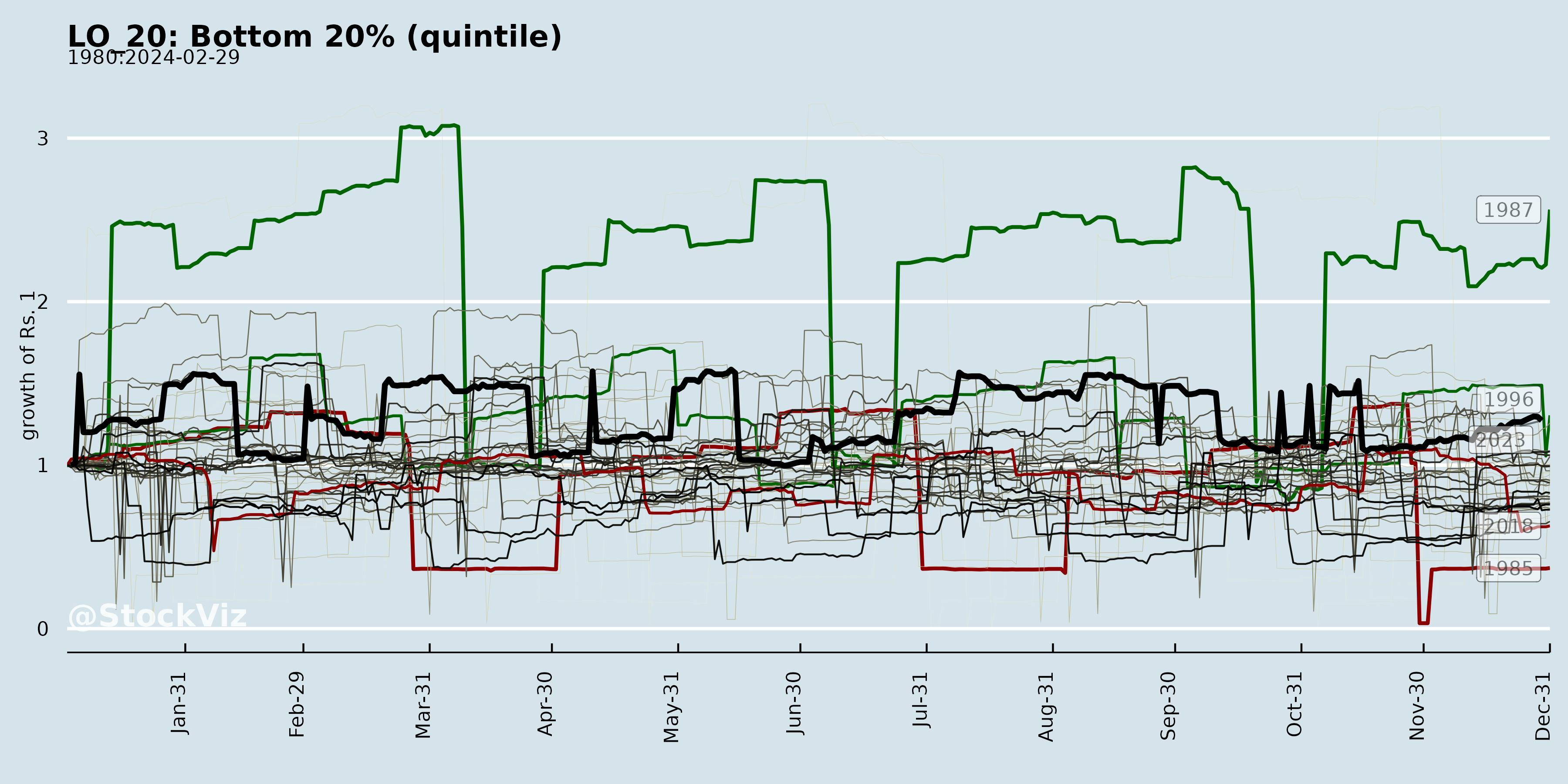

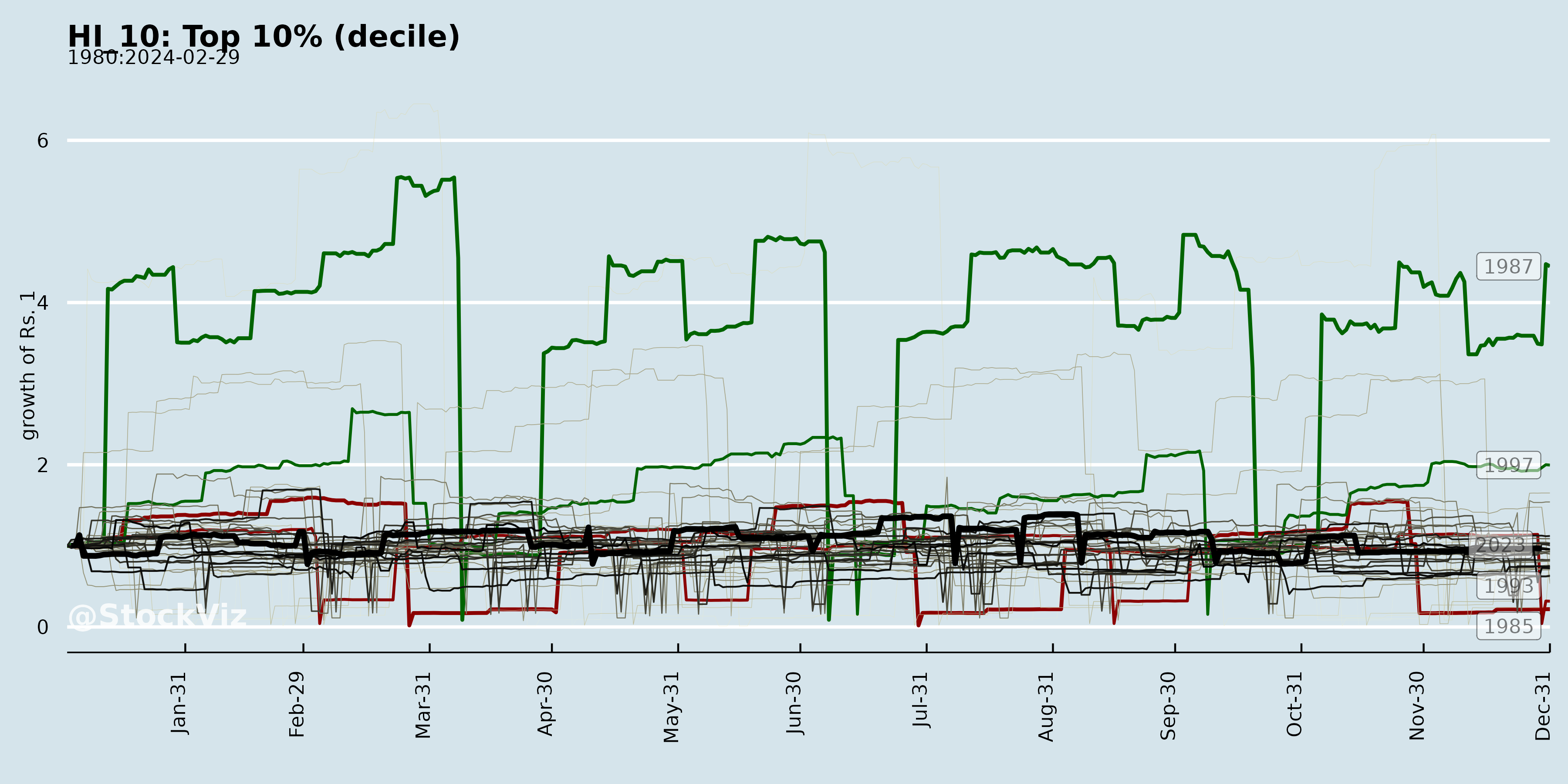

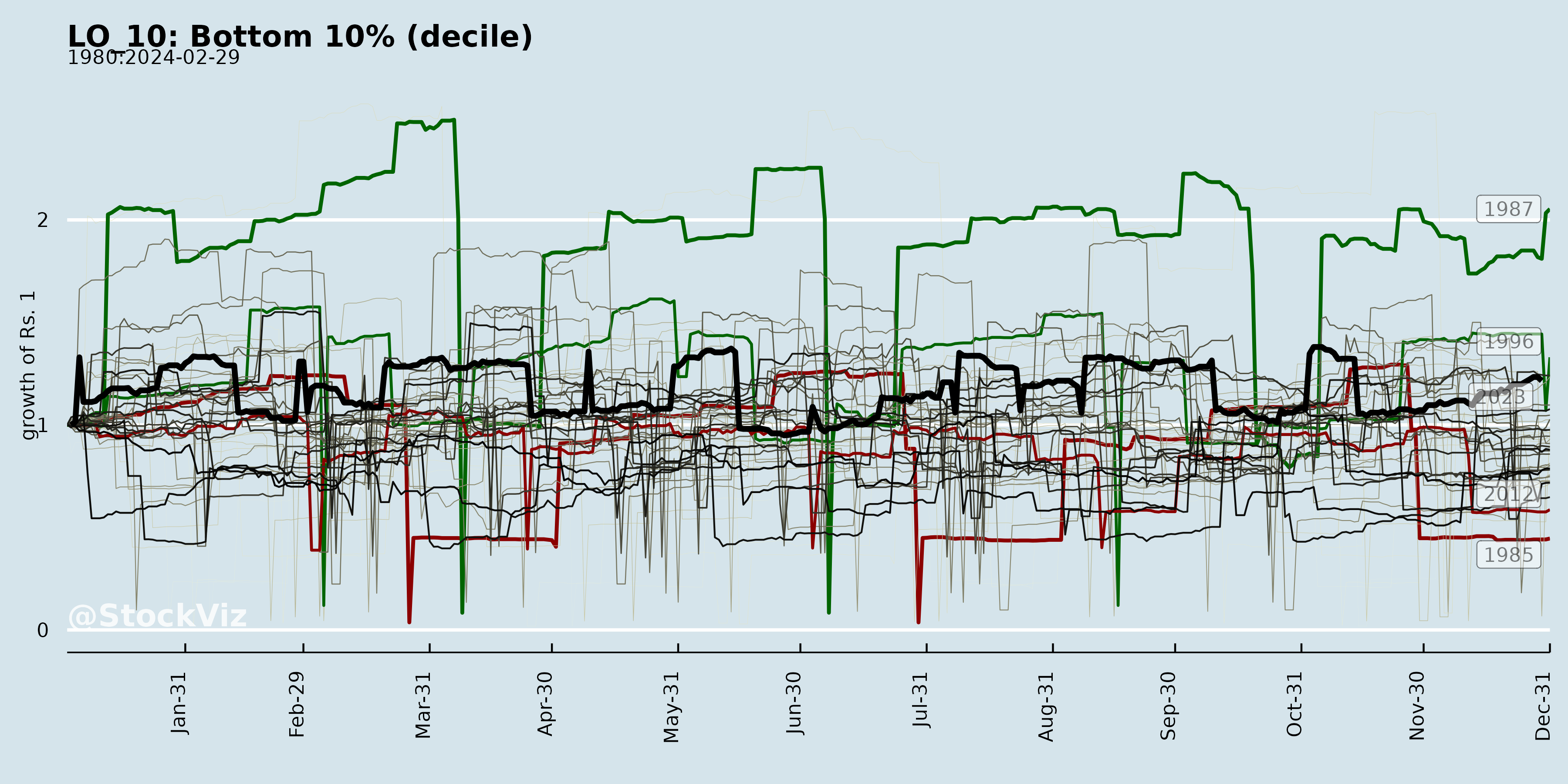

Since 1980

Since 2010

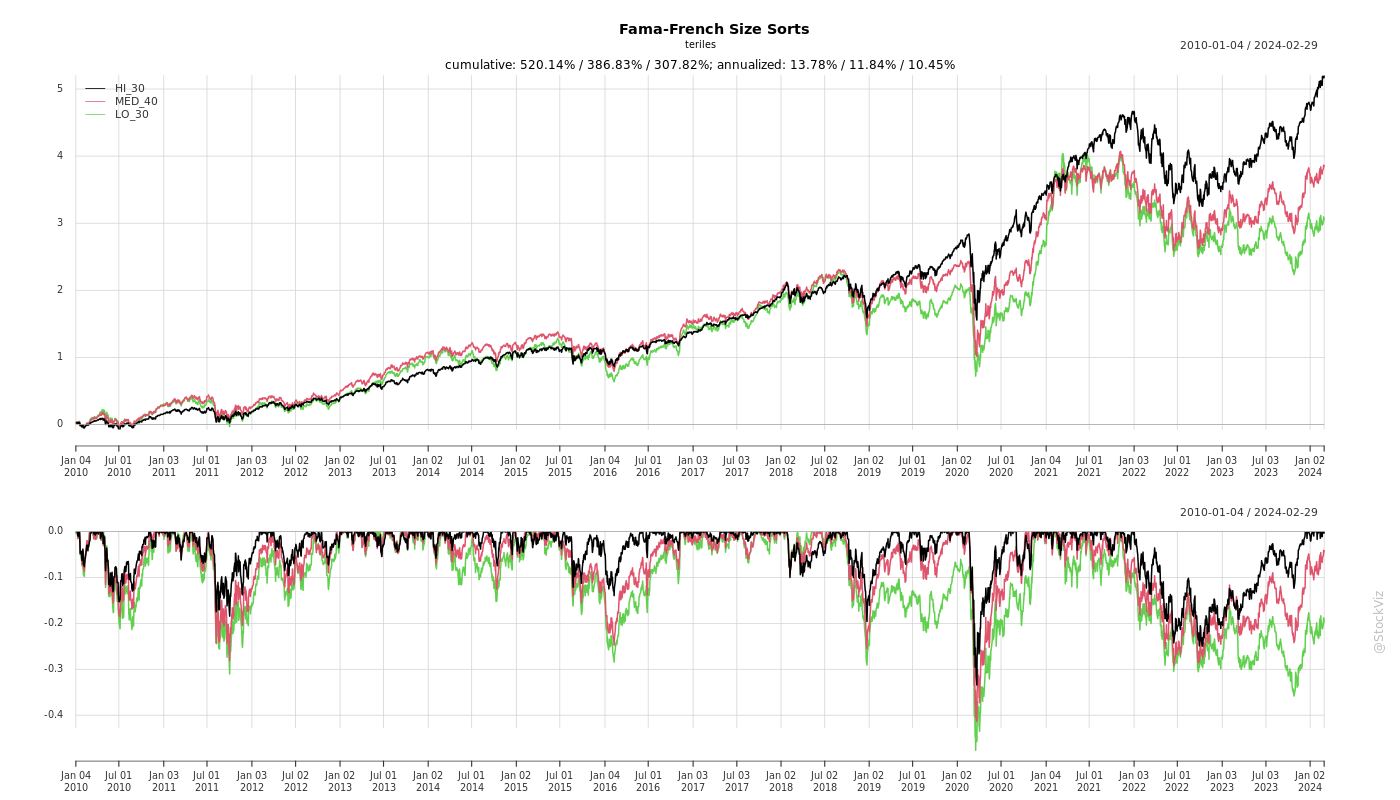

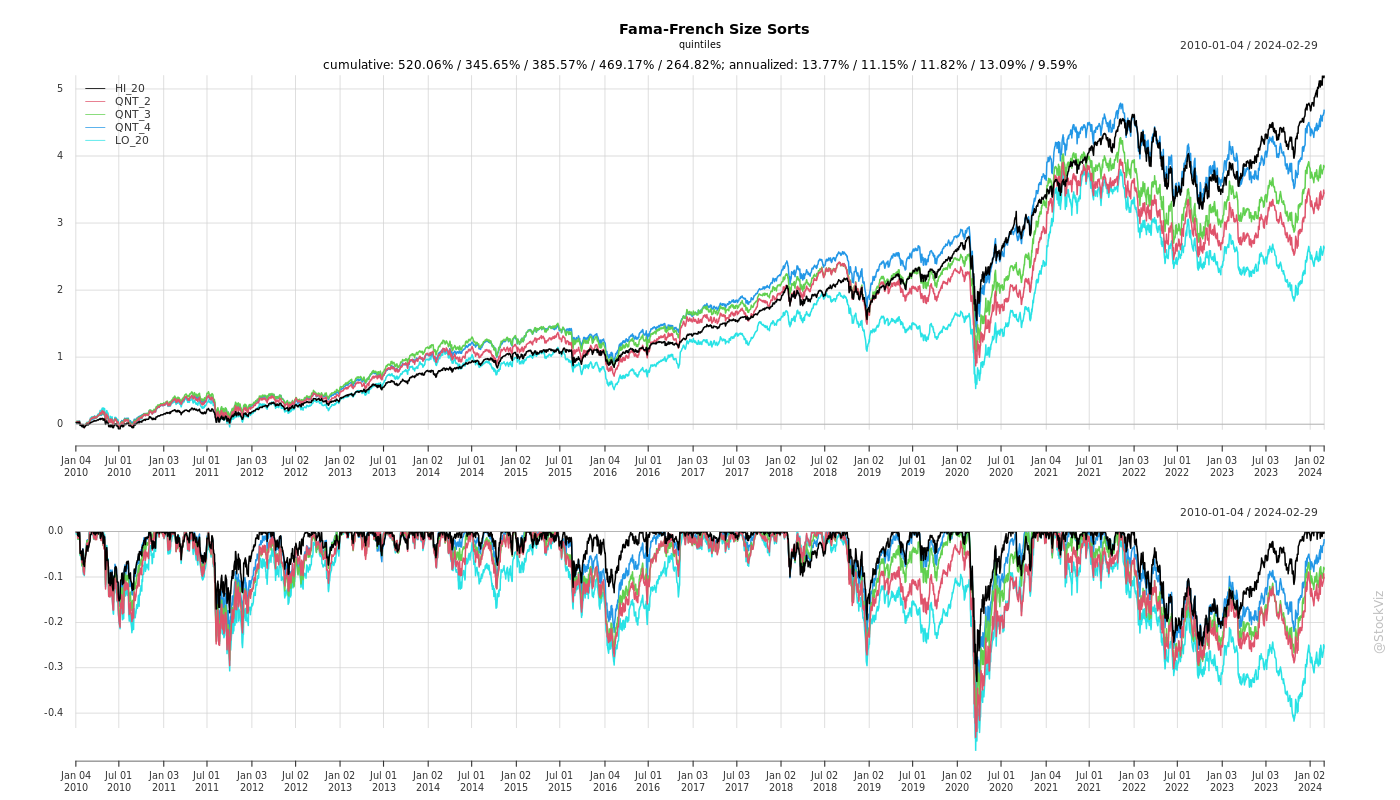

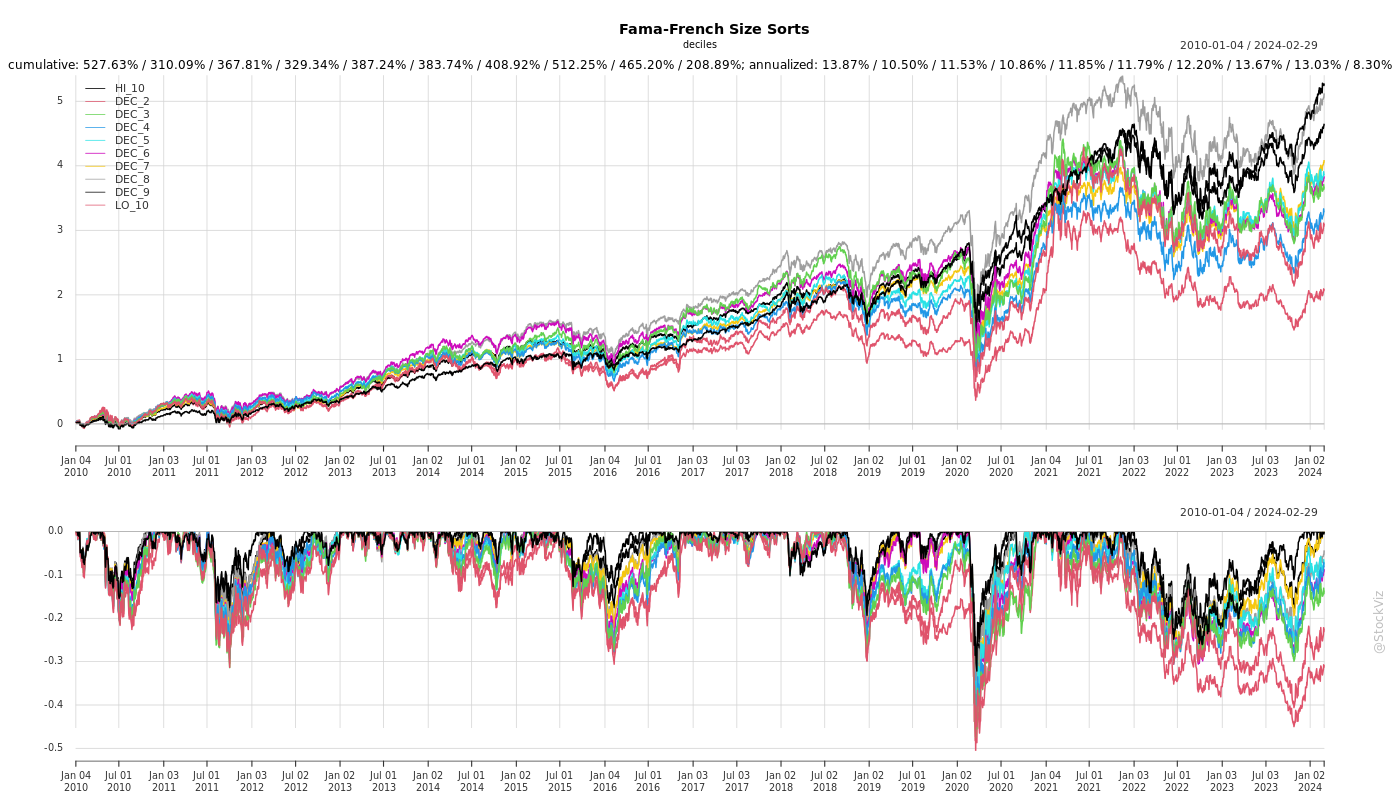

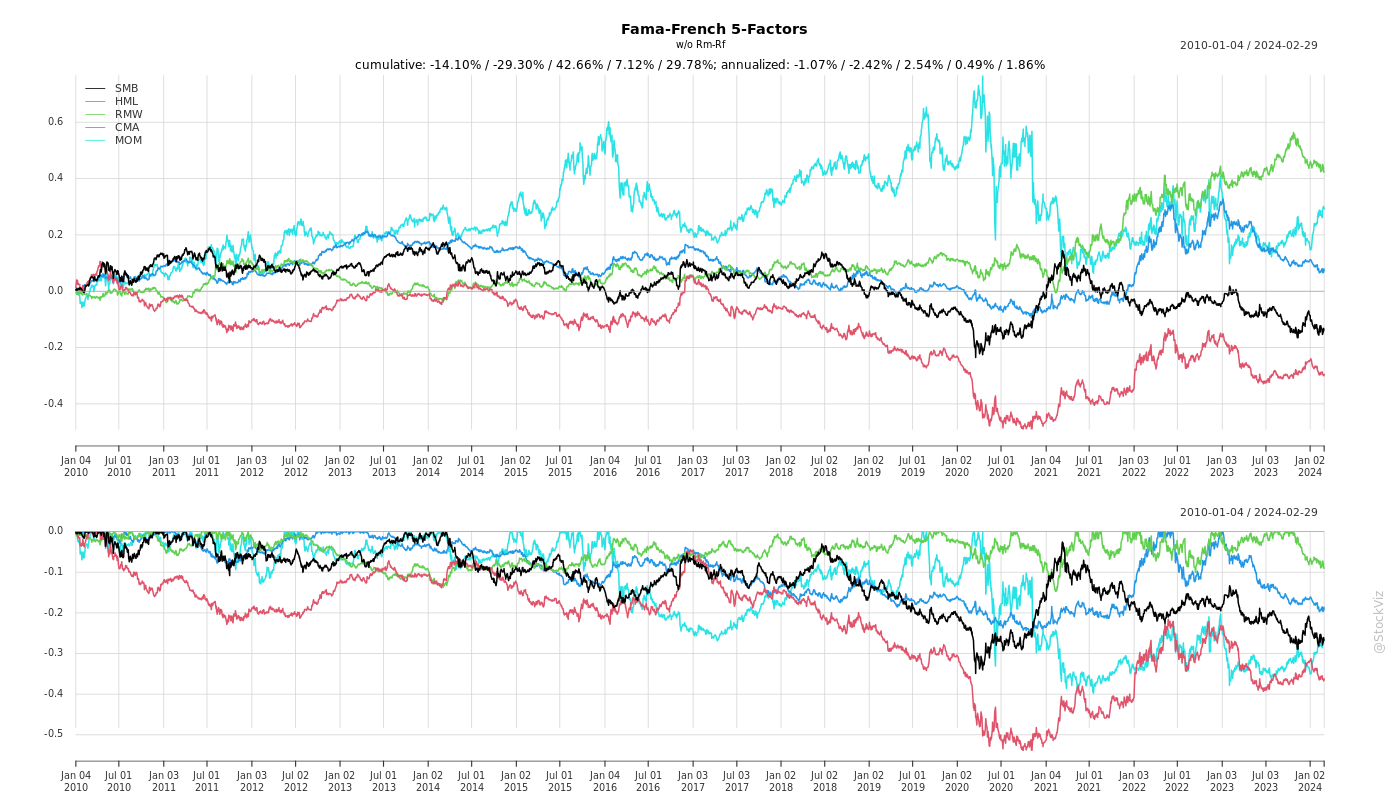

Cumulative Returns

Since 2010

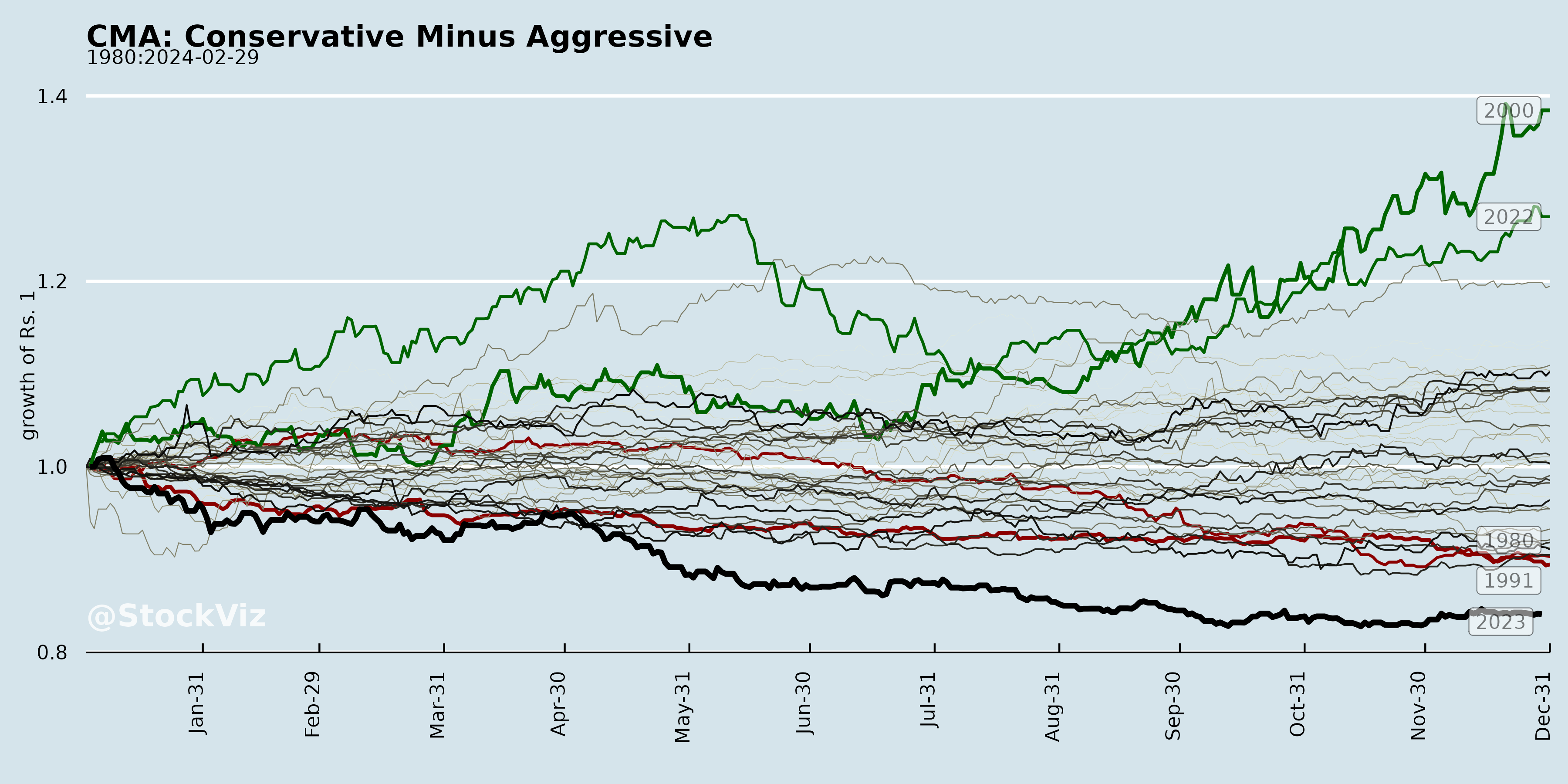

CMA: Conservative Minus Aggressive

average return on the two conservative investment portfolios minus the average return on the two aggressive investment portfolios

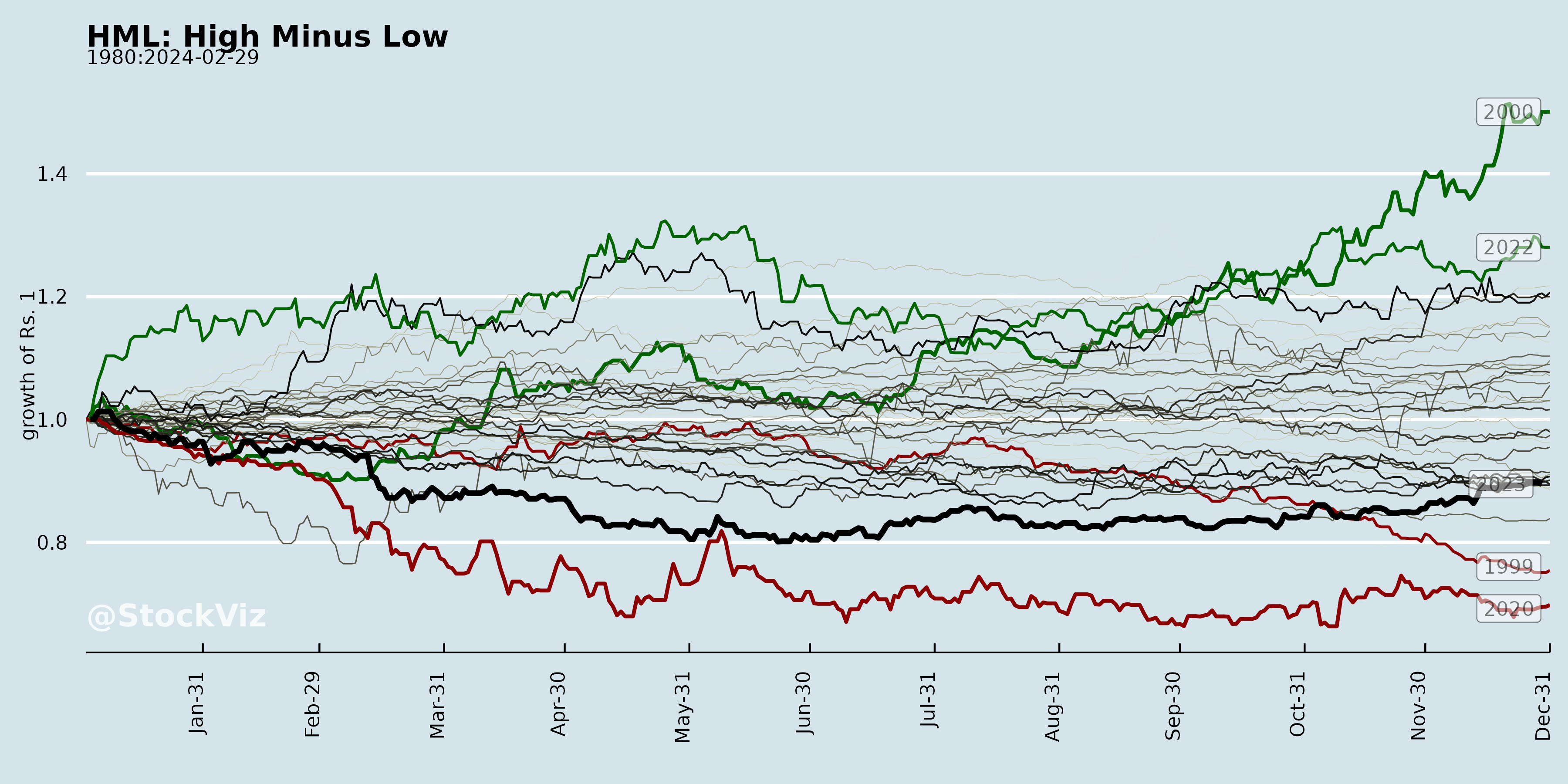

HML: High Minus Low

average return on the two value portfolios minus the average return on the two growth portfolios

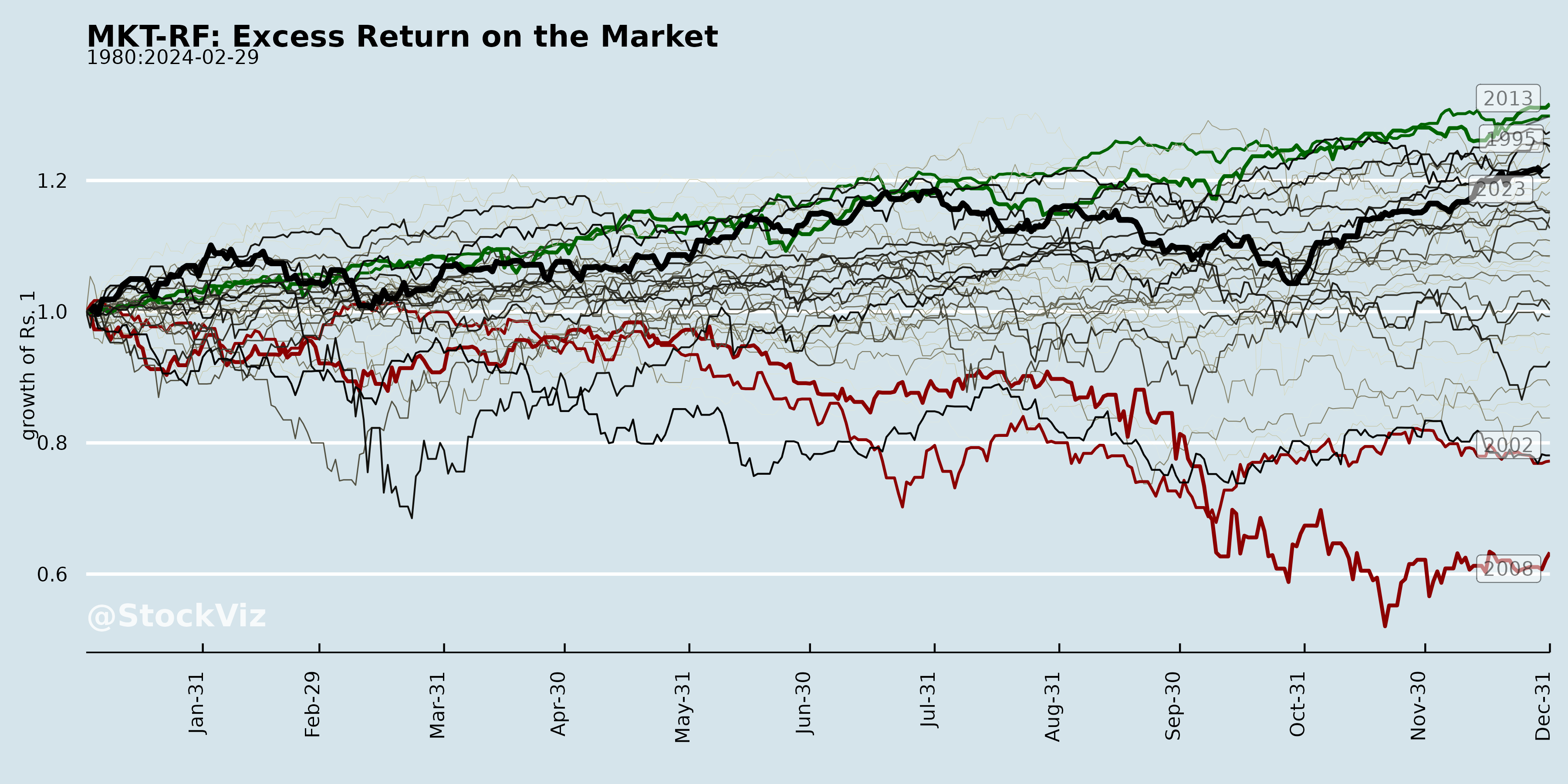

MKT-RF: Excess Return on the Market

value-weight return of all CRSP firms incorporated and listed in the US minus the one-month Treasury bill rate

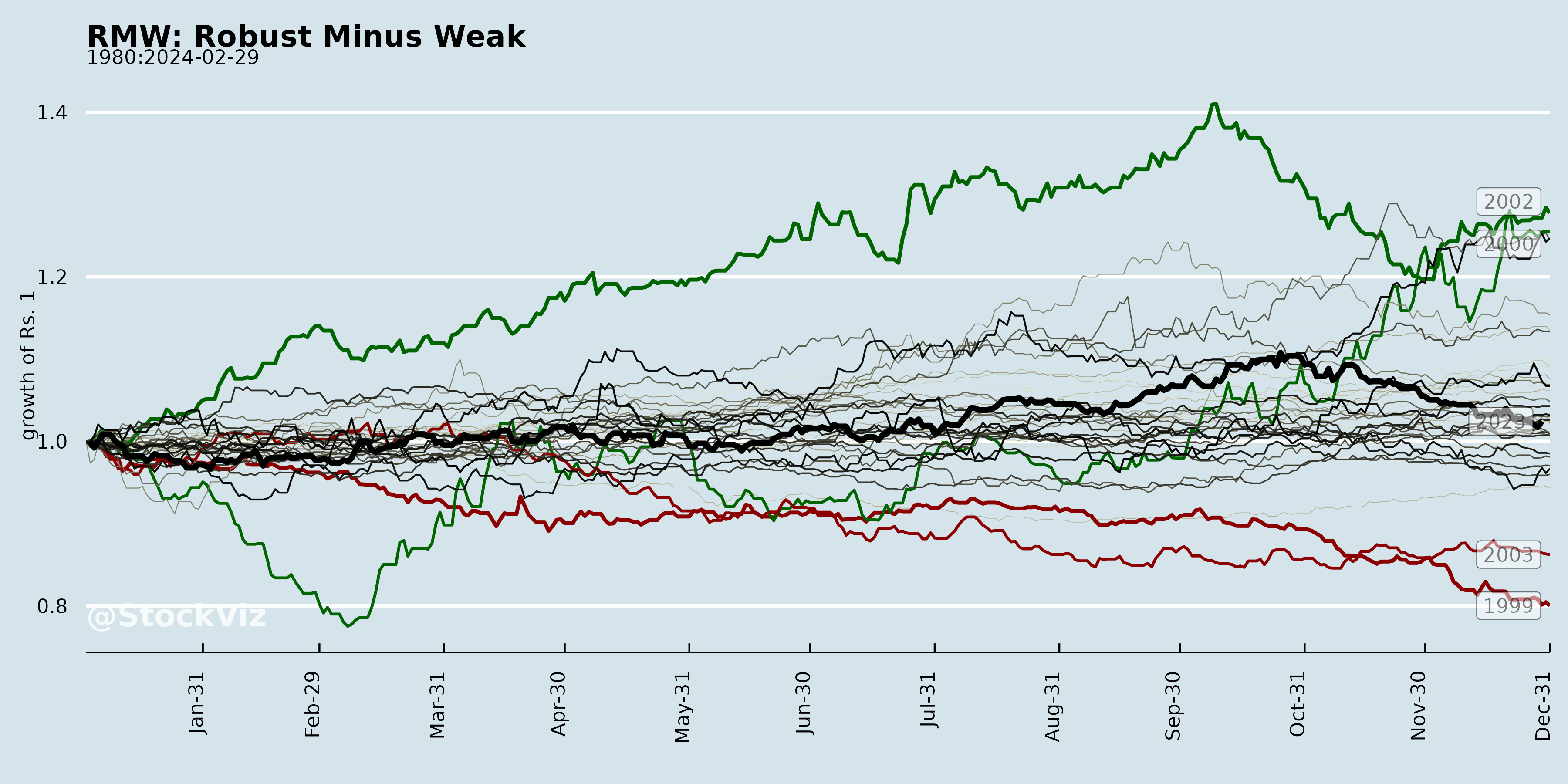

RMW: Robust Minus Weak

average return on the two robust operating profitability portfolios minus the average return on the two weak operating profitability portfolios

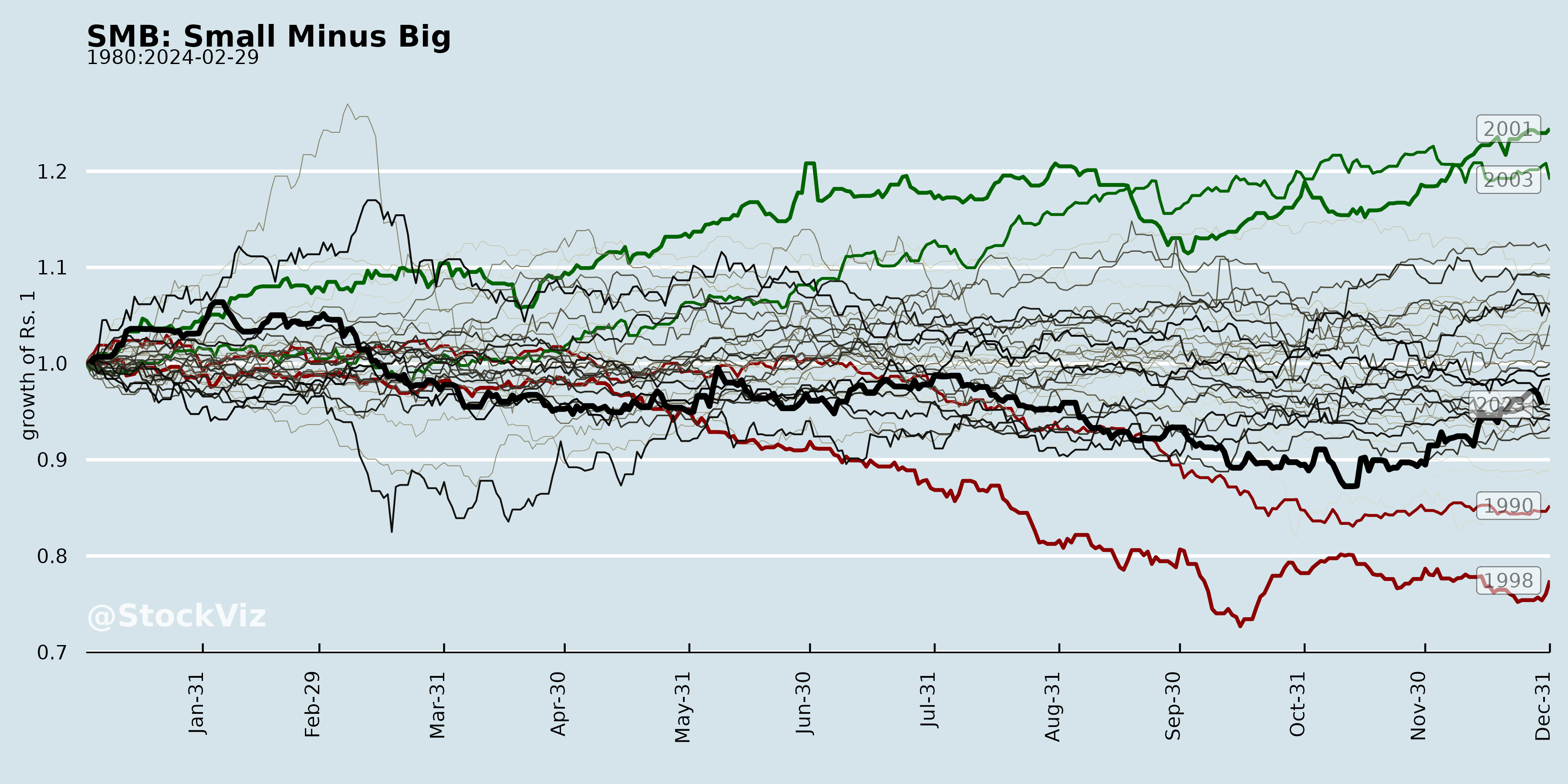

SMB: Small Minus Big

average return on the nine small stock portfolios minus the average return on the nine big stock portfolios

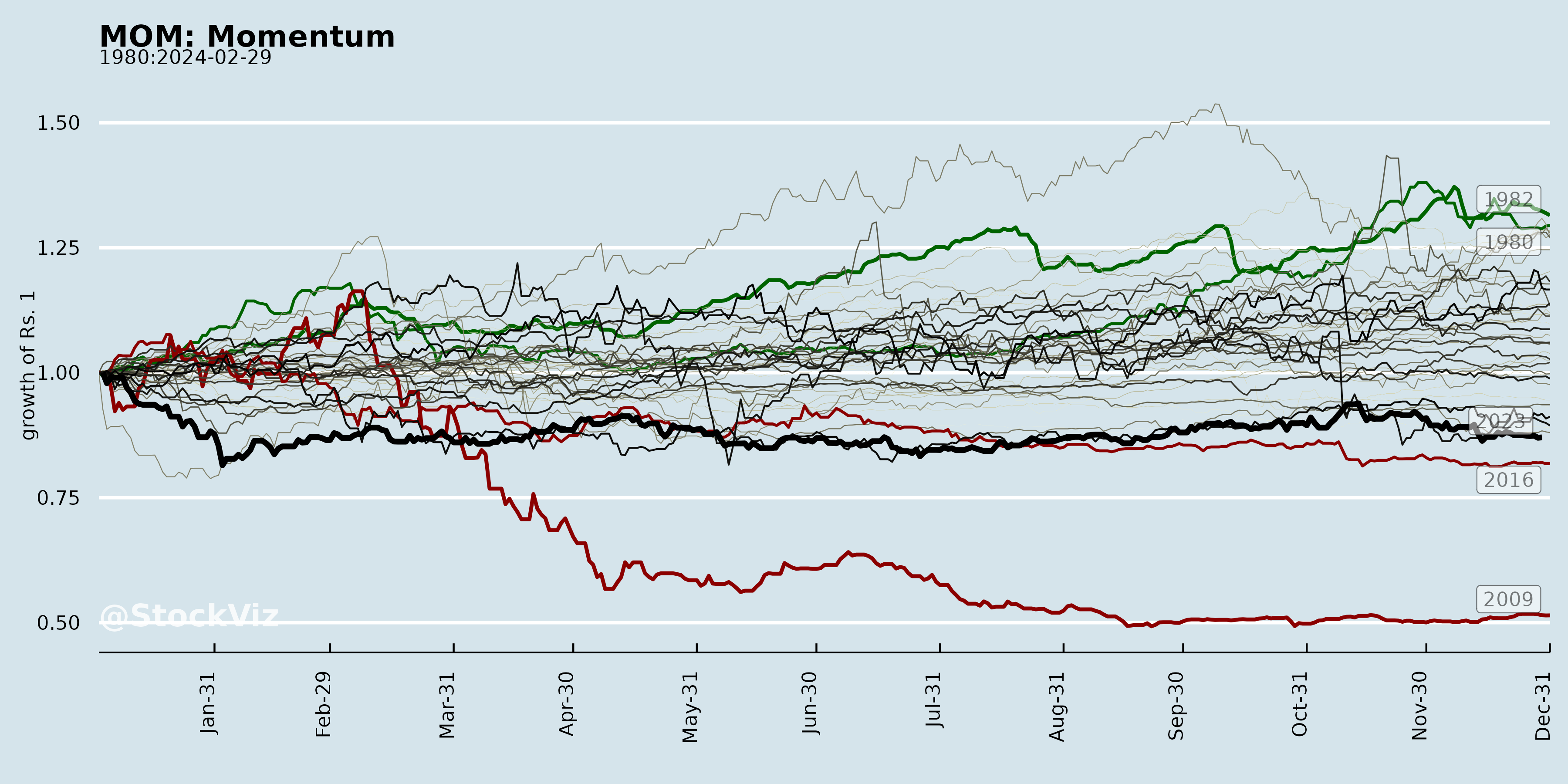

MOM: Momentum

average return on the two high prior return portfolios minus the average return on the two low prior return portfolios

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.