TRENT

Equity Metrics

January 13, 2026

Trent Limited

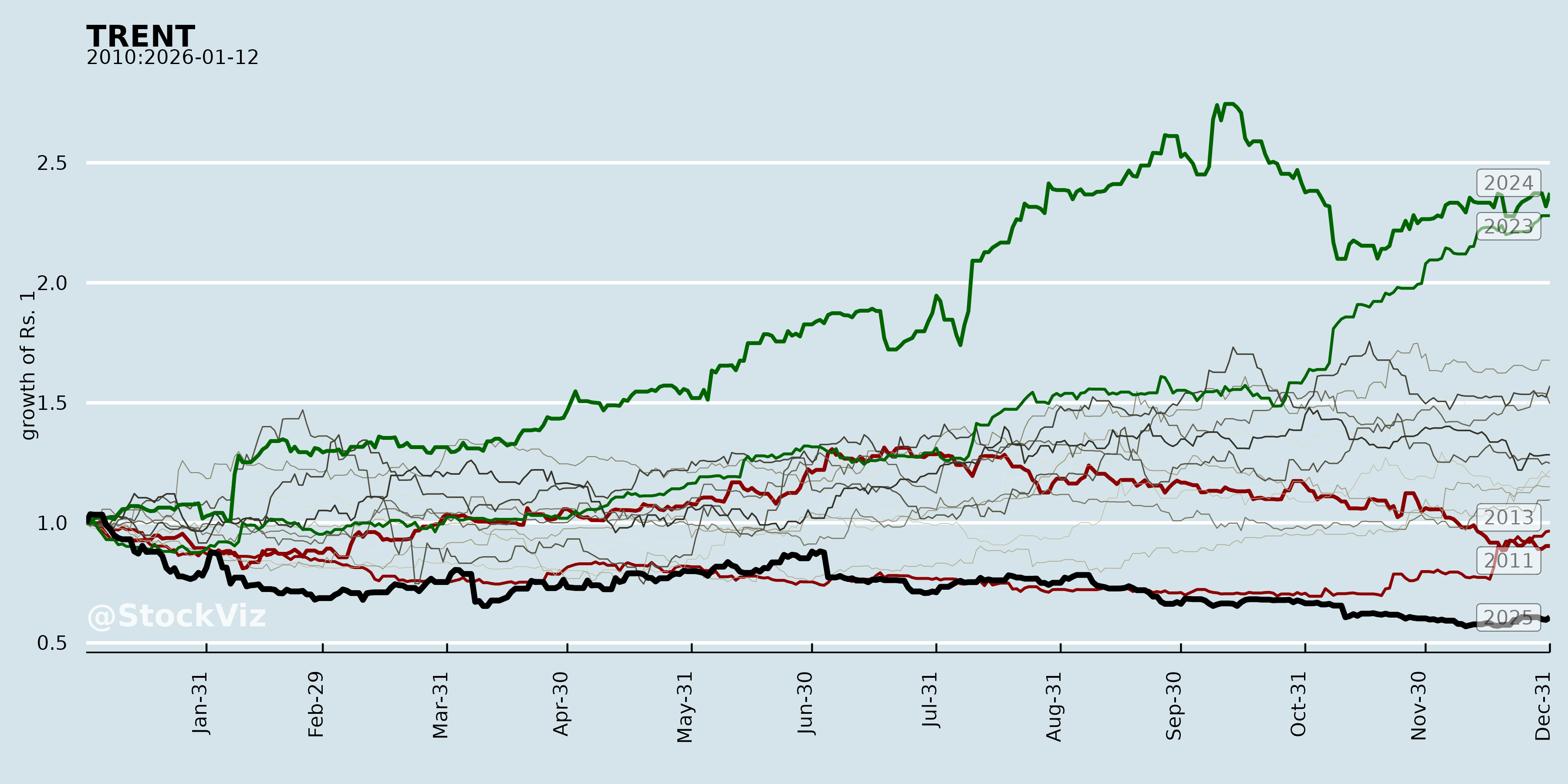

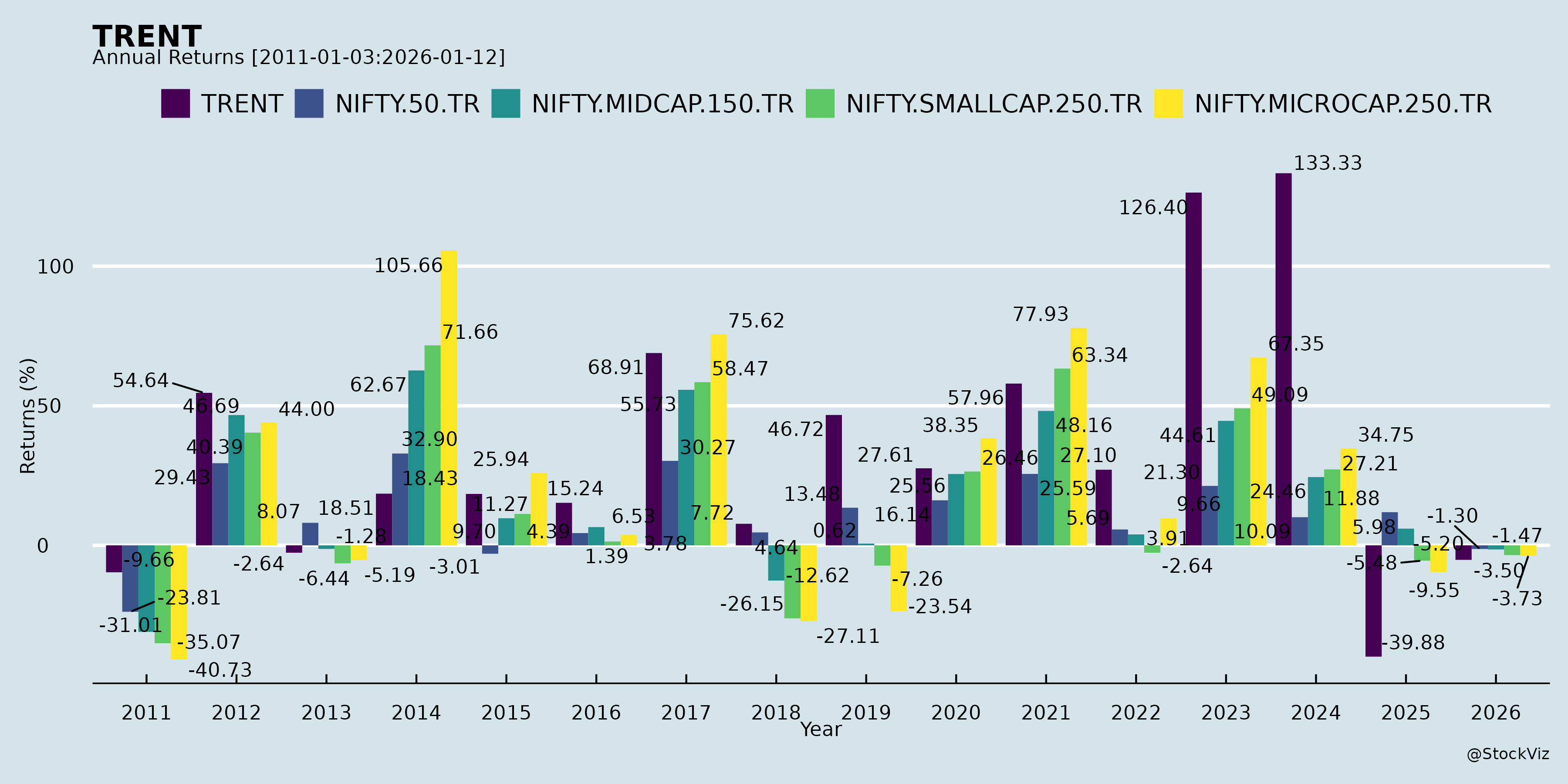

Annual Returns

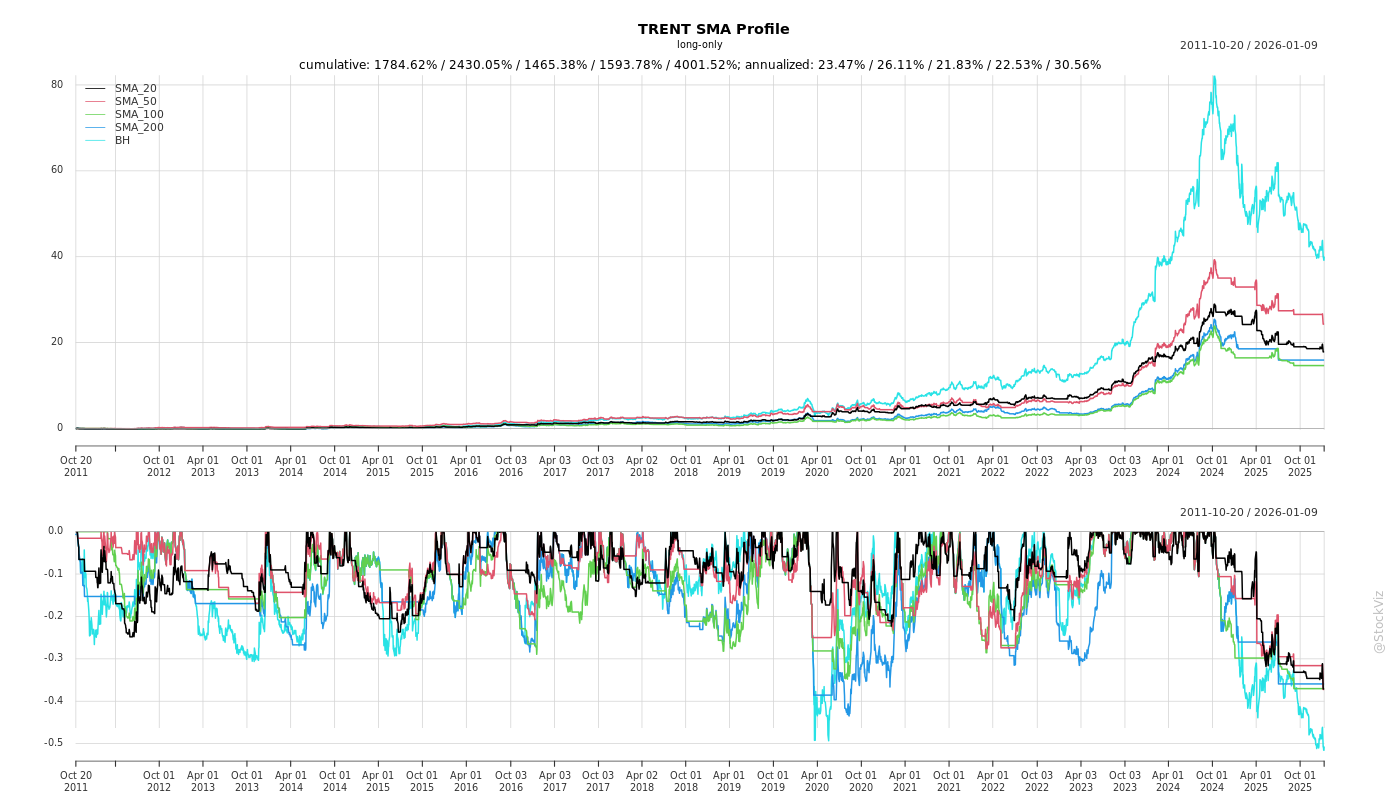

Cumulative Returns and Drawdowns

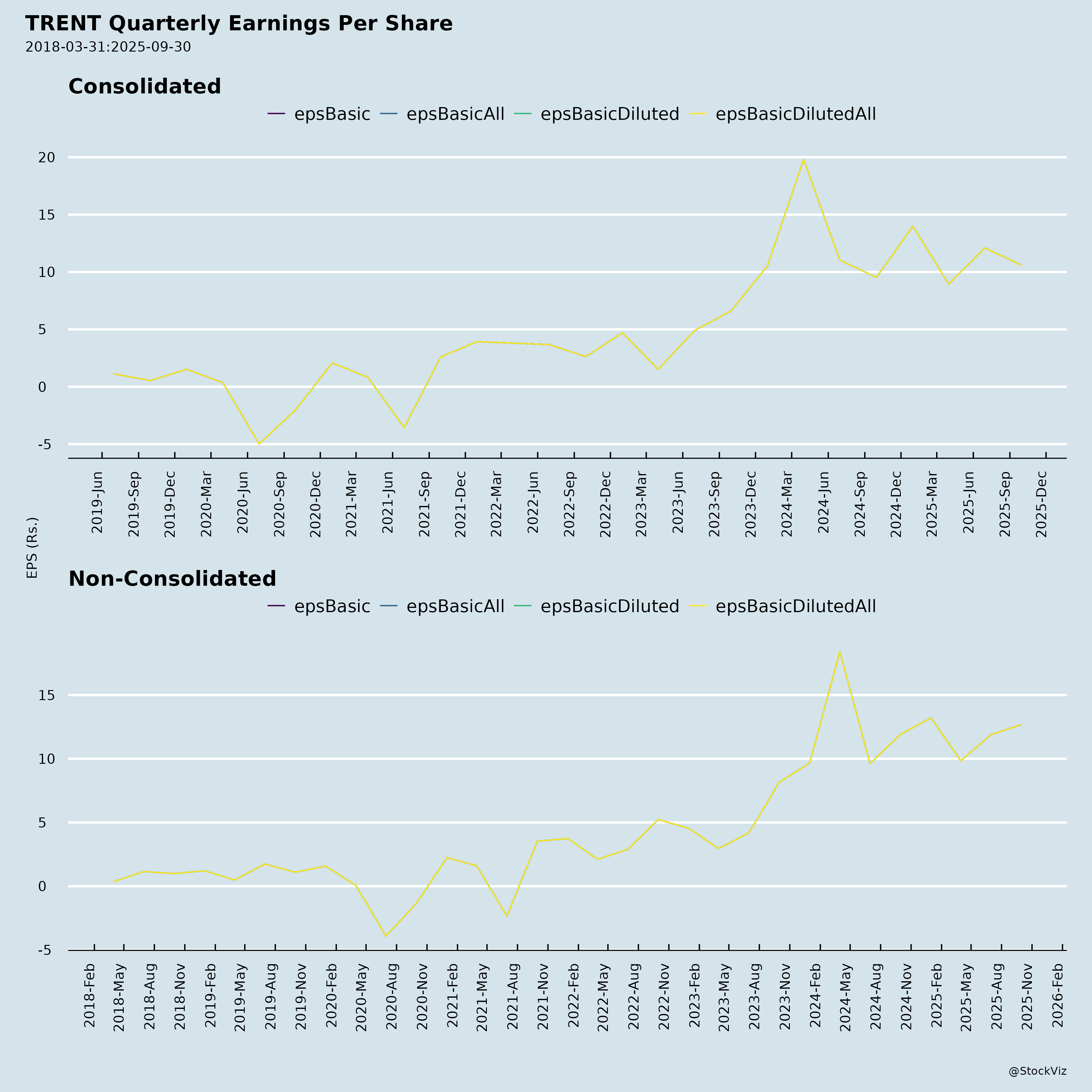

Fundamentals

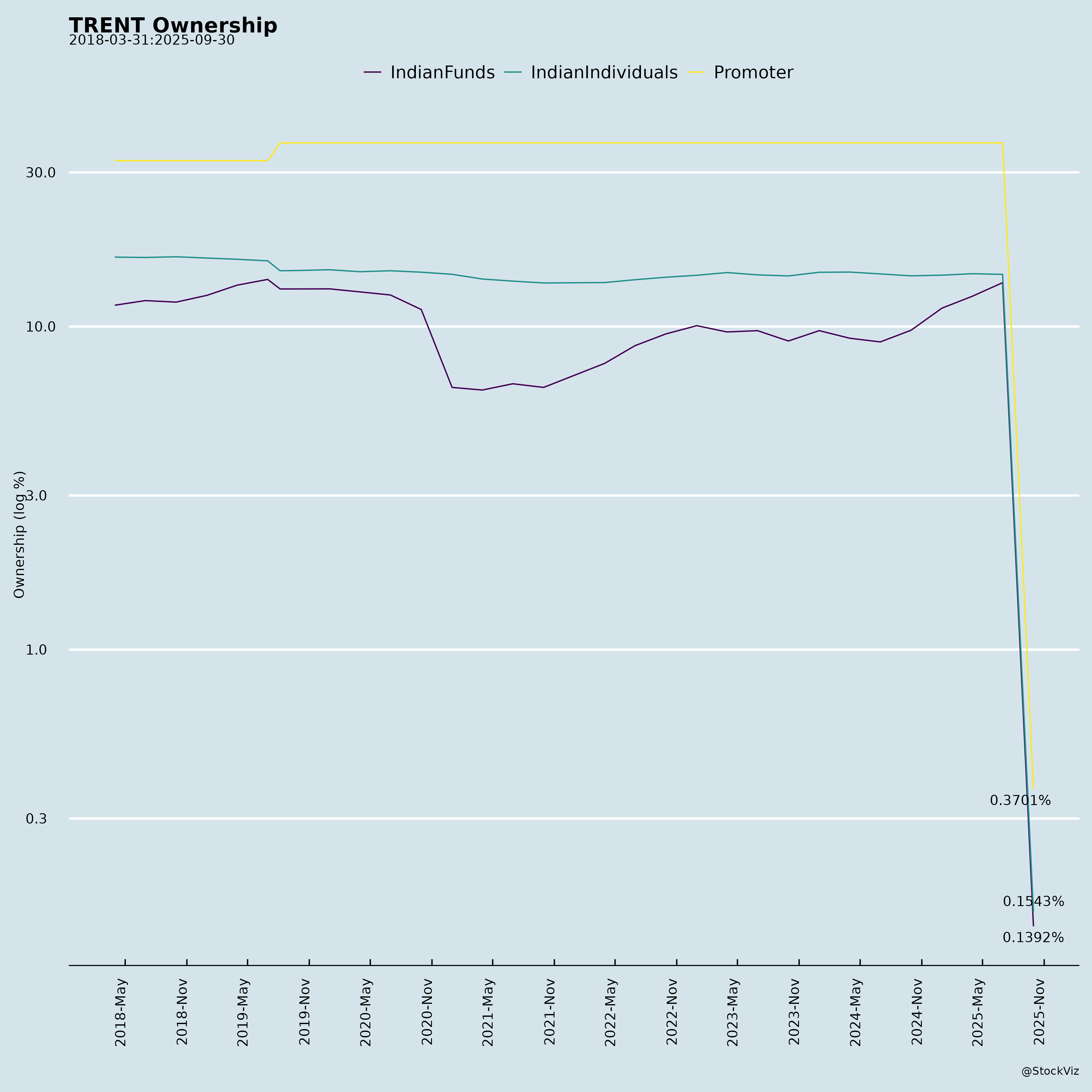

Ownership

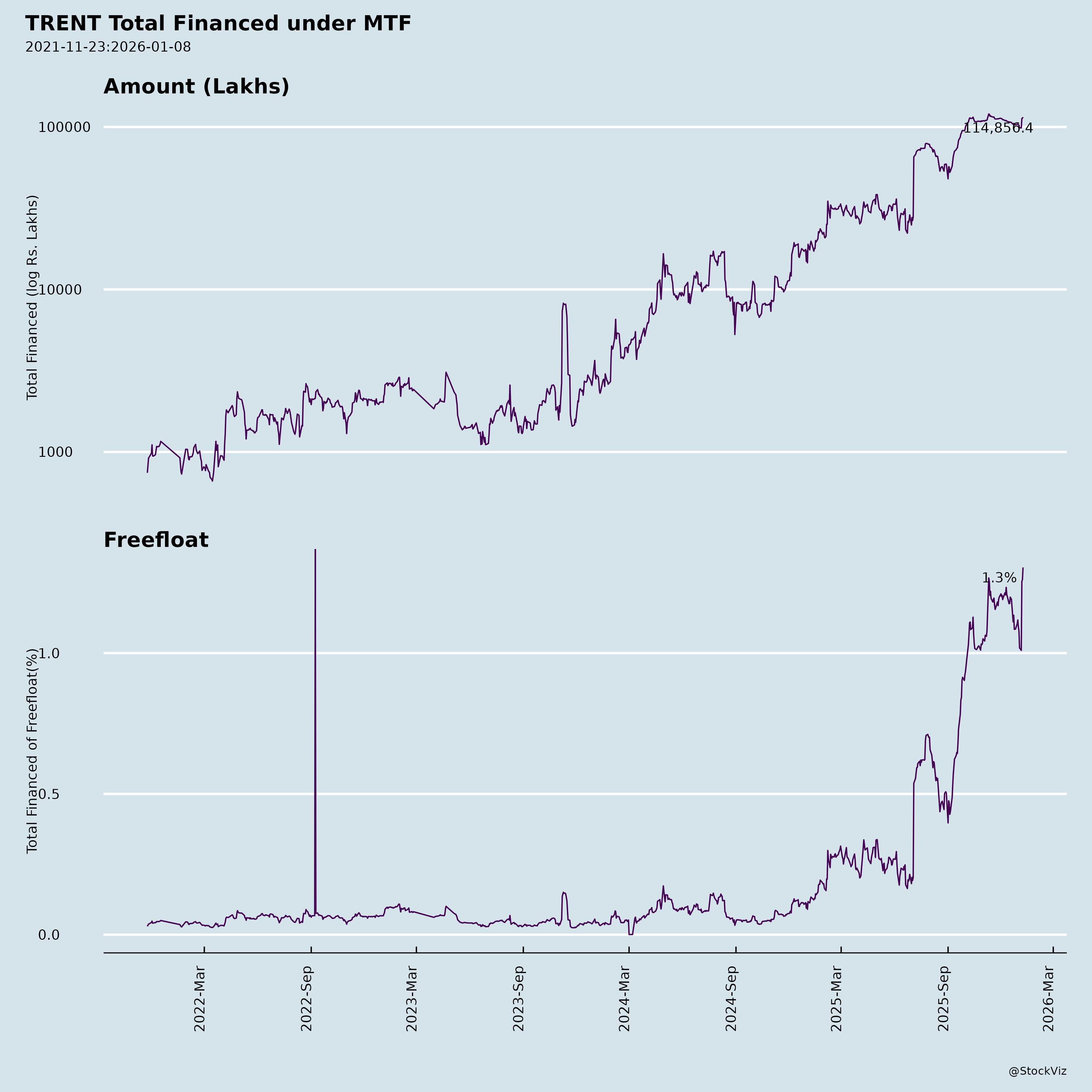

Margined

AI Summary

asof: 2025-12-03

Analysis of Trent Limited (TRENT) - Q2 & H1 FY26 Performance

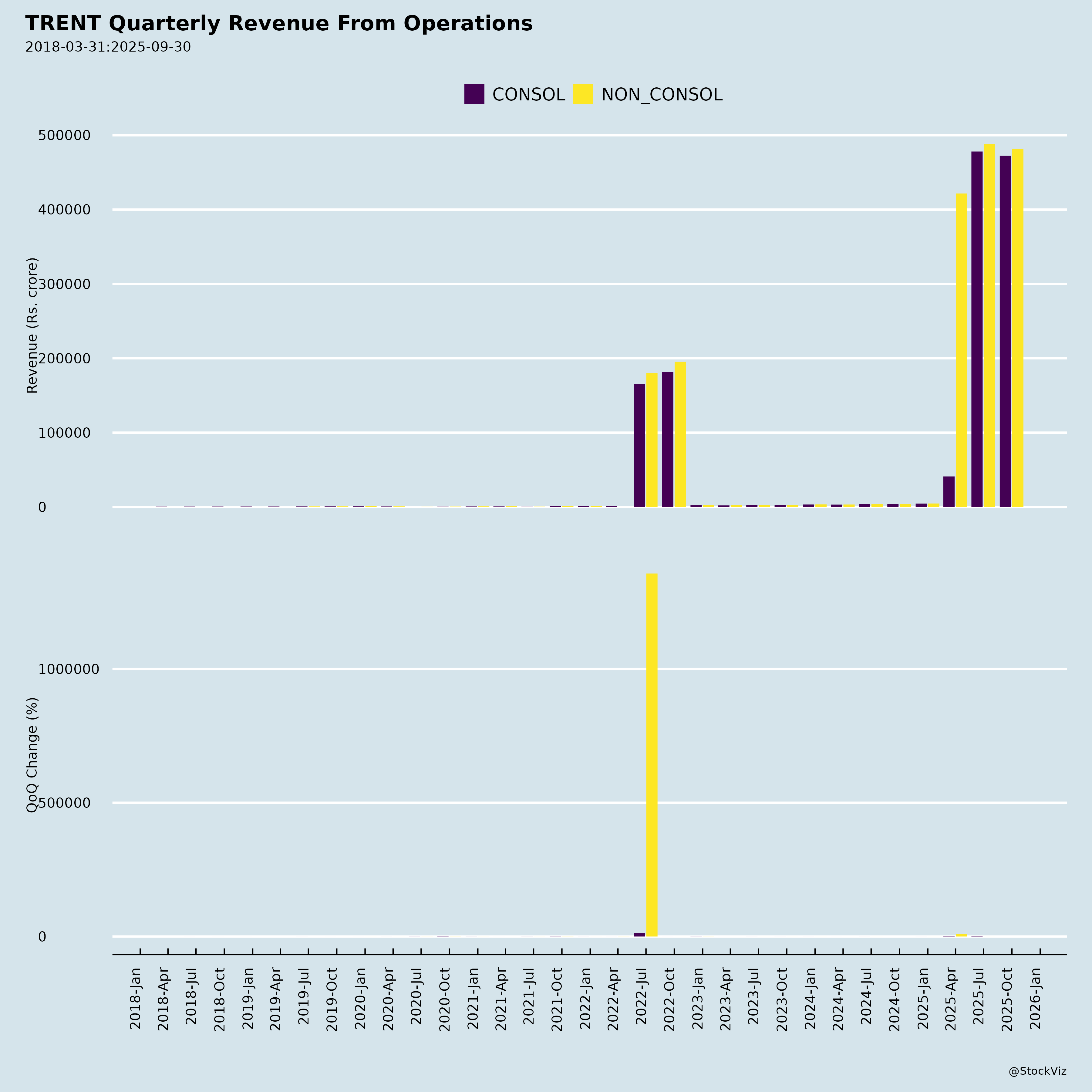

Trent Limited, a Tata Group retail player, operates fashion brands (Westside, Zudio, Burnt Toast), lifestyle concepts, and food/grocery (Star). Q2 FY26 showed resilient revenue growth amid headwinds, driven by aggressive store expansion (1,101 stores across 251 cities, +14.7 Mn sq ft retail space). Standalone revenue grew 17% YoY to ₹4,724 Cr; consolidated to ₹4,818 Cr (16% YoY). PAT growth lagged at 6-11% YoY due to higher costs/depreciation. Key insights below:

Tailwinds (Positive Drivers)

- Aggressive Expansion & Scale: Added 63 net stores in Q2 (19 Westside, 44 Zudio incl. UAE); total fashion stores >1,000. Zudio (806 stores) drives value fashion; Westside (261) premium positioning. Star at 77 stores with 73% own-brand penetration (e.g., Smartle).

- Revenue Momentum: H1 standalone revenue +19% YoY (₹9,505 Cr); online (Westside/Tata Neu) +56% YoY (6% of Westside sales). Emerging categories (beauty, innerwear, footwear) >21% of revenues.

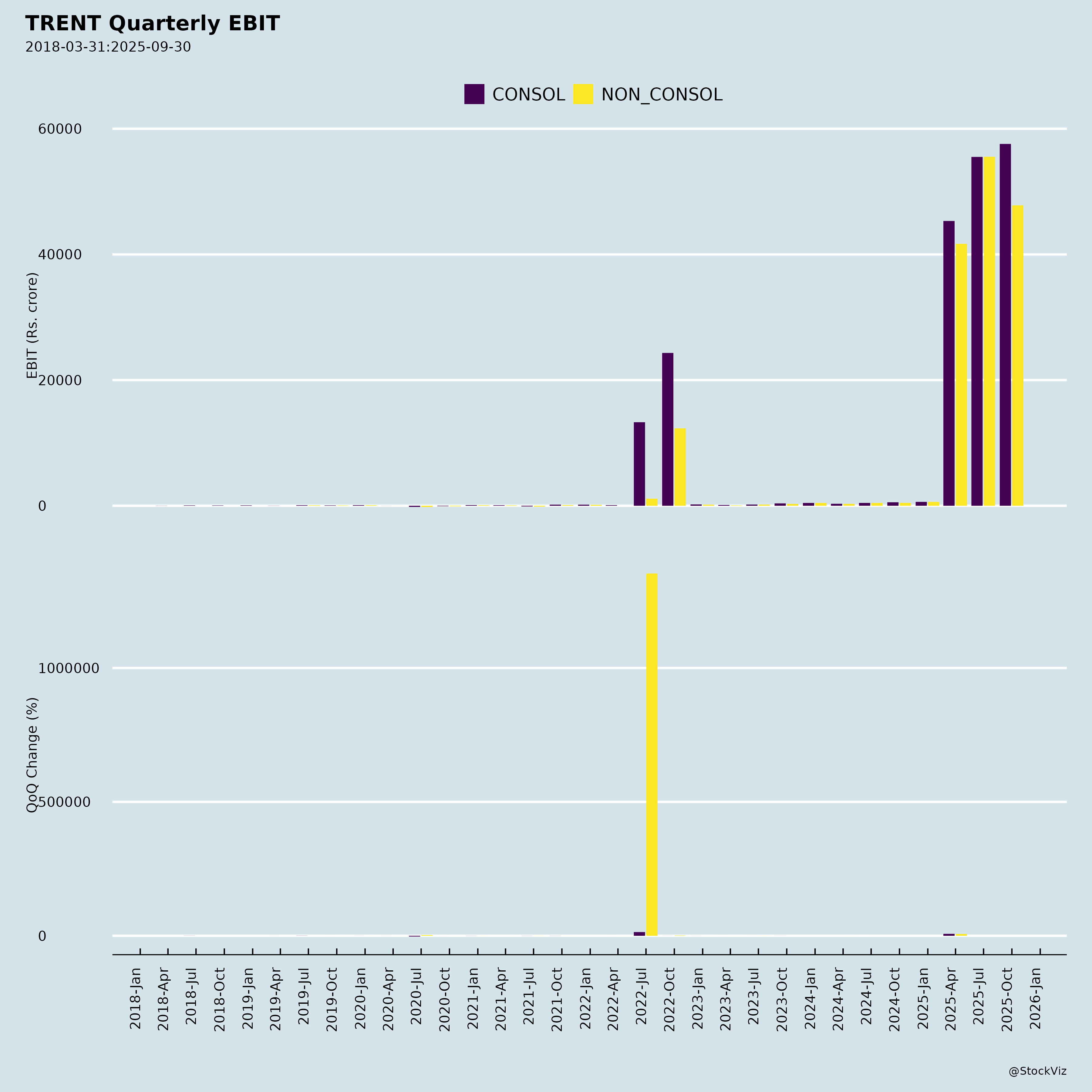

- Operational Efficiency: Op. EBITDA margins stable ~12% (standalone); tech investments (RFID, automation) optimize manpower/supply chain. Variable cost structures (rentals) aid leverage.

- New Initiatives: Launched youth brand “Burnt Toast” (positive early response). Marketing (YNG program, campaigns) boosts engagement; WestStyle Club >19 Mn members.

- Associate/Buyback Gains: ₹146 Cr from ITRIPL buyback; shareholding now 20%.

- Policy Support: GST rate cuts likely to boost discretionary spending long-term.

Headwinds (Challenges)

- Demand Softness: Muted sentiment, unseasonal rains; LFL growth low single digits. GST transition favored big-ticket items over fashion/small-ticket.

- Margin Pressure: PAT growth < revenue (standalone Q2: 9.5% margin vs. 10.5% YoY); higher depreciation (₹315 Cr, +65% YoY) from new stores/IND AS 116. Occupancy costs elevated.

- Grocery Intensity: Star revenues flat-ish (~₹898 Cr H1); competitive pricing wars; multiple upgrades/closures (net +3 stores H1).

- Macro/Seasonal: Evolving tier 2/3 markets slower to mature; no UPSI shared in analyst meets.

Growth Prospects

- High: Massive runway in underserved tier 2/3/emerging catchments (251 cities, incl. UAE). Target: Sizable pure-play DTC across segments. Zudio/Westside scaling to 2,000+ stores; Star differentiation via own brands/tech.

- Medium-Term Catalysts: Online profitability; new brands (Burnt Toast); JVs/associates (e.g., Inditex Trent). FY26 guidance implicit: Steady 15-20% revenue growth via 200-250 store adds.

- Long-Term: ₹50,000+ Cr+ market opportunity; resilience via owned-operated model, inventory discipline.

Key Risks

- Demand/Competition: Prolonged slowdown or e-com aggression (e.g., Myntra, Reliance Retail) eroding LFL. Grocery hyper-competitive (DMart, BigBasket).

- Execution/Costs: New store ramp-up delays; rising capex (₹1,000+ Cr H1); lease/debt costs (D/E 0.35-0.38).

- Inventory/Provisioning: Fashion cyclicality; overstock in slowdown.

- Macro/Regulatory: Inflation, GST volatility, rural slowdown. Forex for UAE ops.

- Governance: Associate dilutions (ITRIPL stake down); no material related-party flags.

Summary

Bullish Outlook with Resilience: Trent’s 17% revenue growth and 1,100+ store scale affirm execution strength amid soft demand (LFL low-single digits). Tailwinds from expansion, tech efficiency, and new brands outweigh headwinds like muted sentiment and costs. Growth prospects strong (15-20%+ CAGR via tier 2/3 penetration), but PAT margins need monitoring. Valuation Context: Trades at premium (P/E ~100x FY26E est.); justified by 25%+ EPS CAGR potential if LFL recovers. Risks tilted macro/competitive—watch H2 demand revival. Recommendation: Accumulate on dips for long-term compounding. (Based solely on docs; no external data.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.