TECHM

Equity Metrics

January 13, 2026

Tech Mahindra Limited

Computers - Software & Consulting

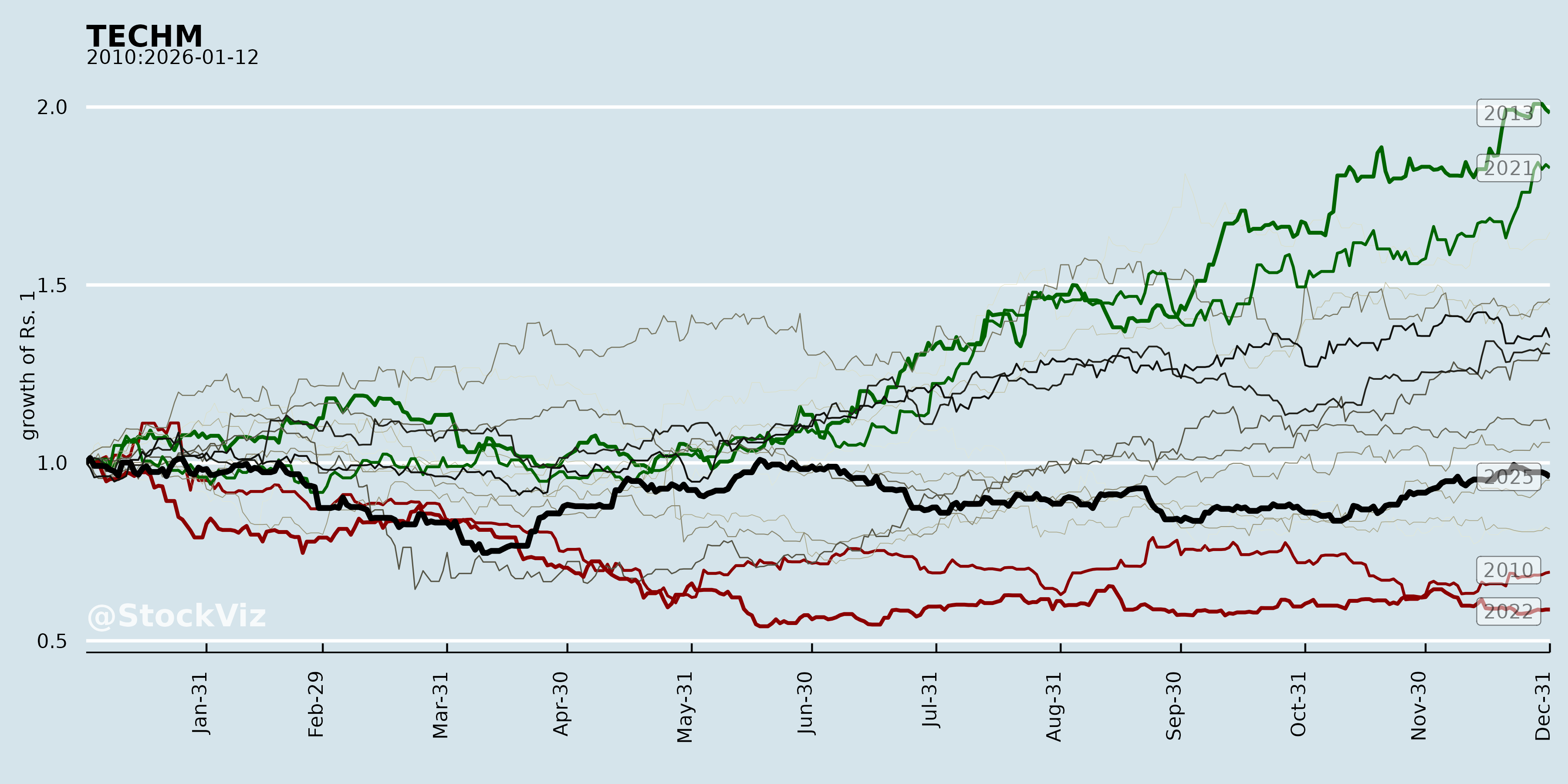

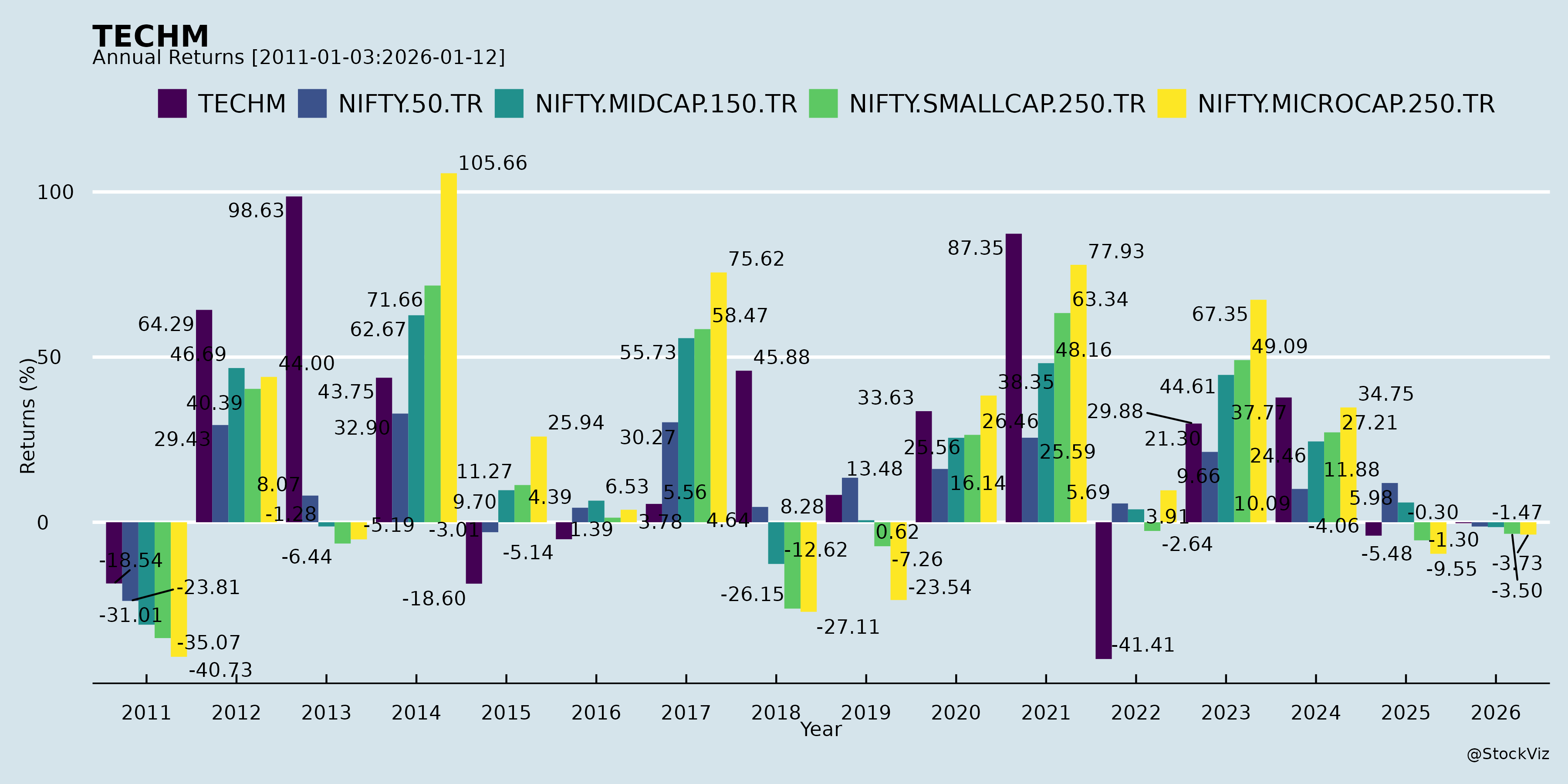

Annual Returns

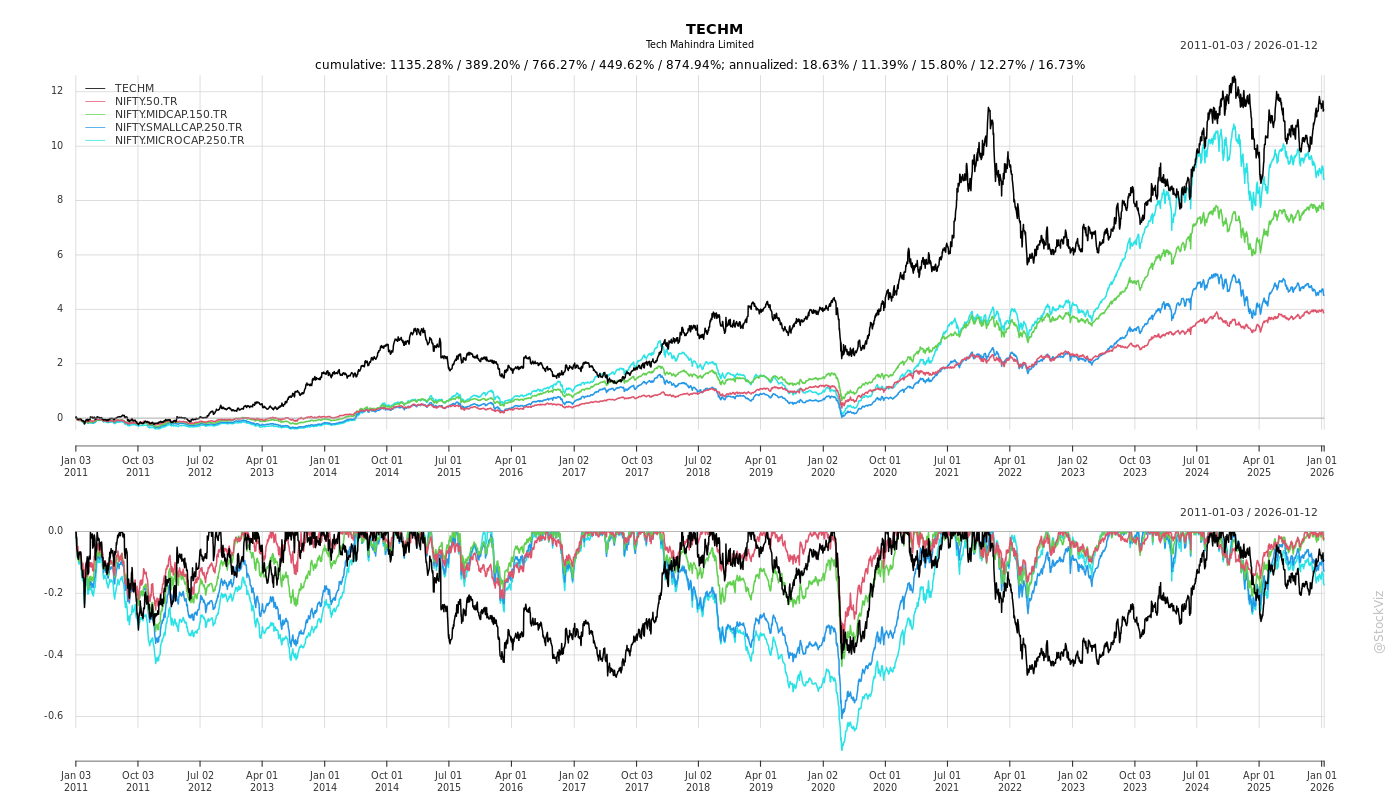

Cumulative Returns and Drawdowns

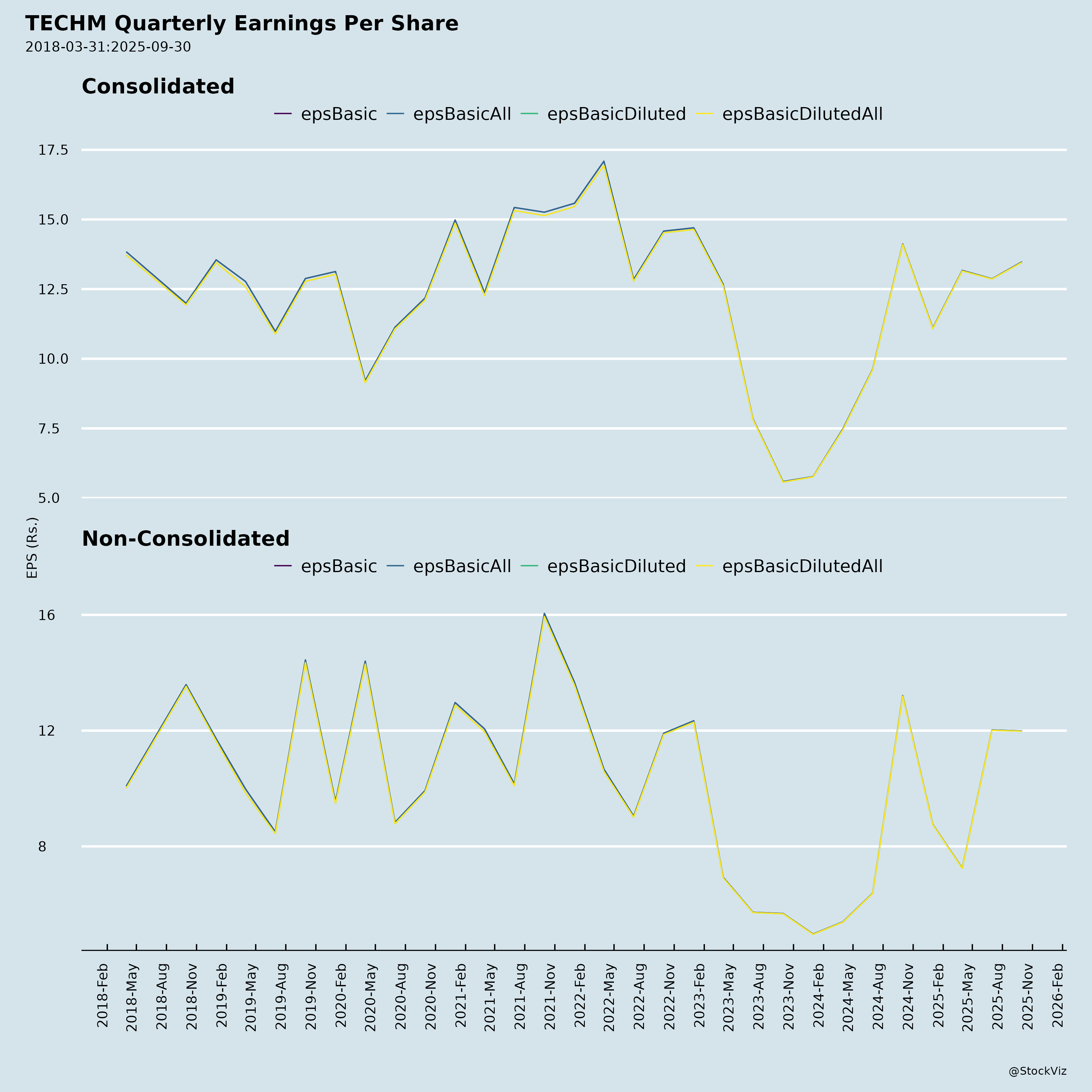

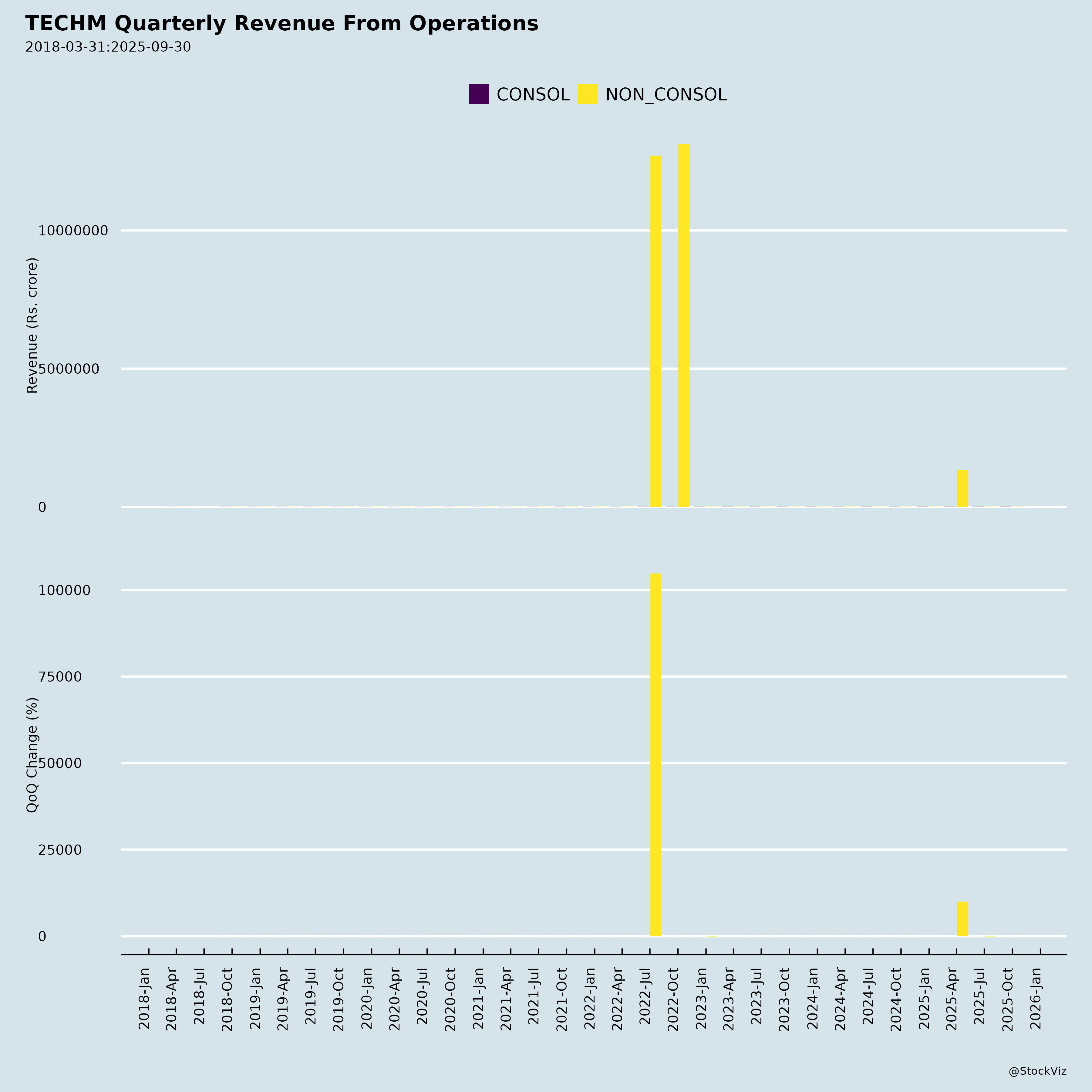

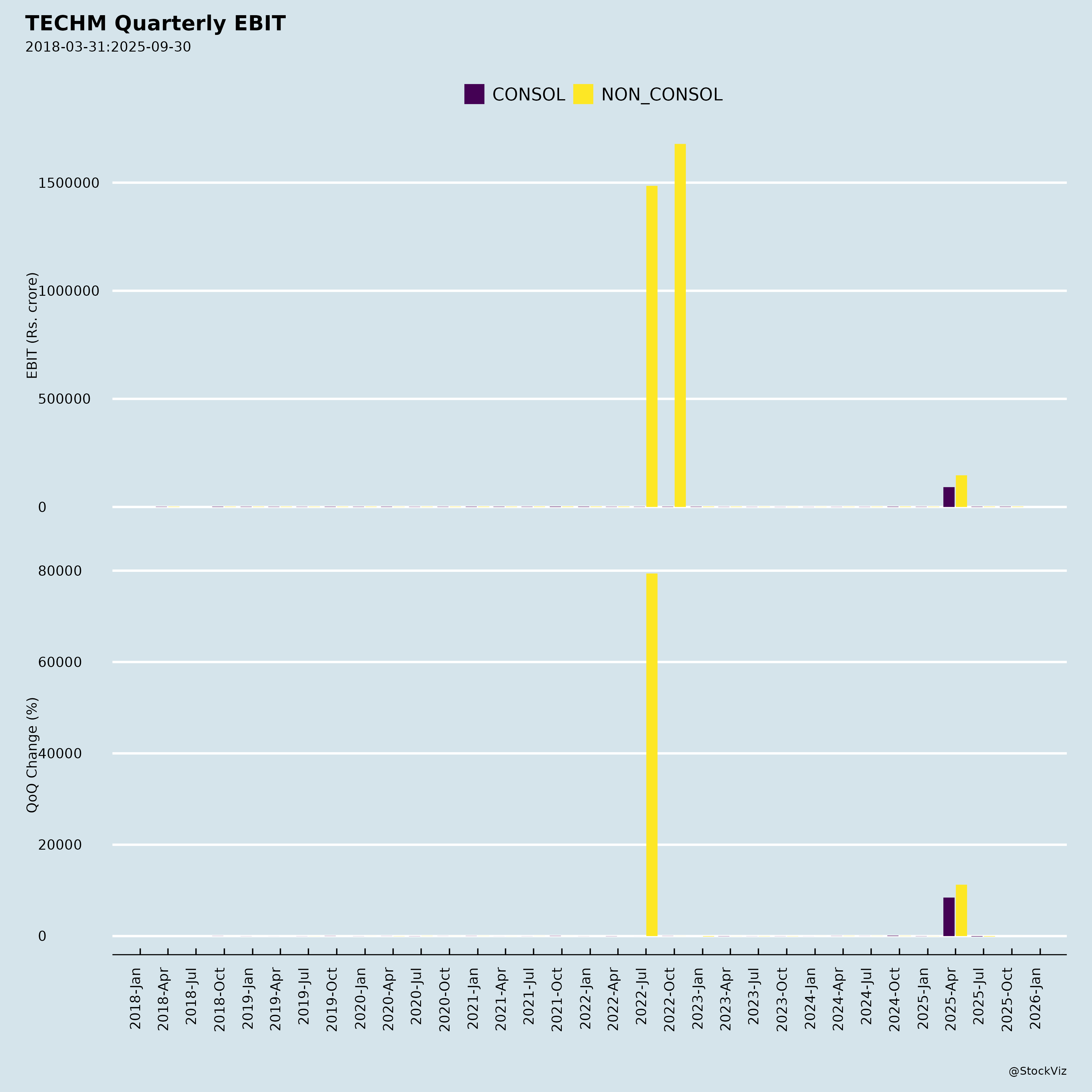

Fundamentals

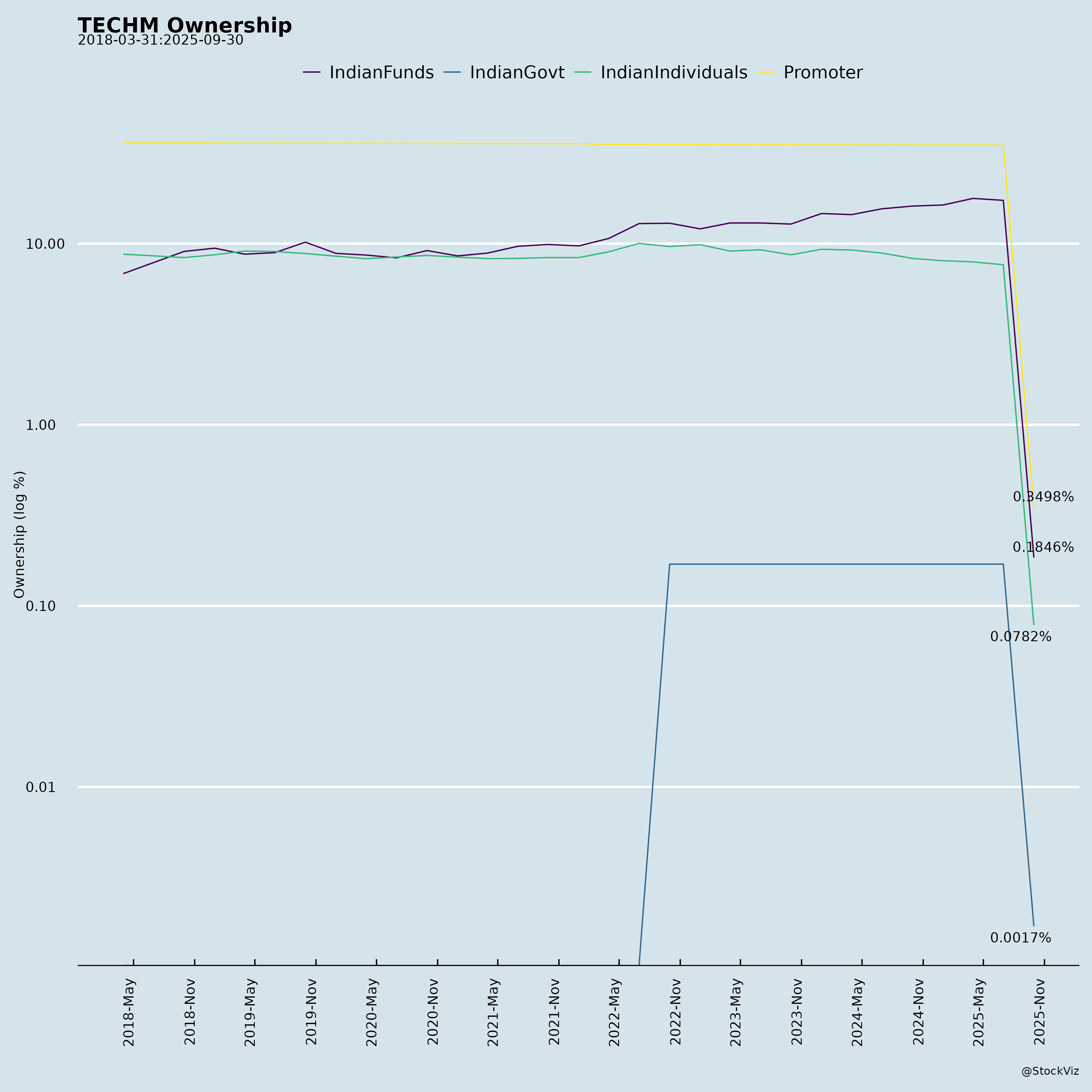

Ownership

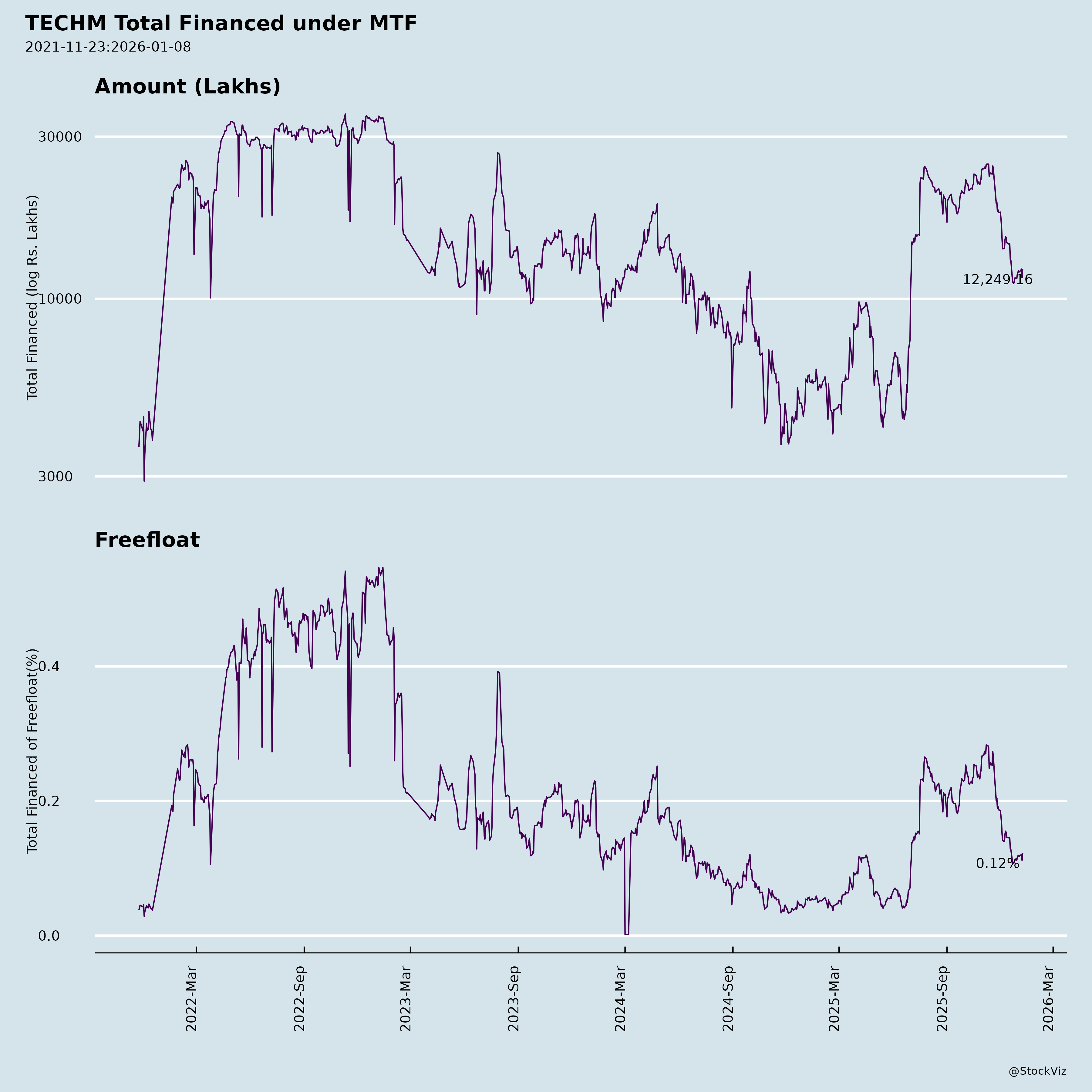

Margined

AI Summary

asof: 2025-12-03

Analysis of Tech Mahindra (TECHM) - Headwinds, Tailwinds, Growth Prospects, and Key Risks

Based on the provided documents (Q2/H1 FY26 results, investor presentations, announcements, and press releases dated Oct-Nov 2025), here’s a structured analysis. FY26 refers to the financial year ending Mar 2026. All financials are audited consolidated unless stated.

Headwinds (Challenges/Negative Factors)

- Revenue Stagnation in USD/CC Terms: Q2 FY26 revenue at $1,586 Mn, down 0.2-0.3% YoY in constant currency (CC); flat growth amid macro slowdowns in key verticals like Communications (down 2.2% YoY) and TME (down 8.8%).

- Geographic/Vertical Imbalances: Americas (49.8% mix) down 2.7% YoY; Europe growth (5.5% YoY) but QoQ decline (-1.2%).

- Attrition and Headcount Pressure: IT LTM attrition at 12.8% (up from 12.6% QoQ); total headcount down 1,559 YoY to 152,714; utilization dipped to 84.4%.

- Cash Flow Volatility: DSO steady at 94 days but high (flat YoY); FCF strong at $237 Mn in Q2 but dependent on working capital (e.g., trade receivables up).

- Legacy Legacy Issues: Ongoing Satyam-related claims (Rs 12,304 Mn in Suspense Account); auditors’ Emphasis of Matter on potential payouts (management believes not payable, but legal risks persist).

Tailwinds (Positive Factors)

- Strong Profitability Expansion: EBIT up 32.7% YoY to 12.1% margin (+254 bps YoY, +108 bps QoQ; 8th straight quarter of expansion); ROCE at 24.4%; PAT margin 8.5%.

- Deal Momentum: Q2 TCV $816 Mn (+35% YoY); LTM TCV up 57% to $3,168 Mn; broad-based wins in AI, telecom, logistics, semiconductors.

- AI Leadership: Launches like TechM Orion (agentic AI platform) and Marketplace; 300+ AI agents; partnerships (NVIDIA, AMD, J.P. Morgan); 79K+ employees AI-trained; multiple Gartner/ISG/Everest “Leader/Emerging Leader” recognitions in GenAI, ADM, cloud.

- INR Revenue Growth & Dividend: Q2 revenue up 5.1% YoY (Rs 13,995 Cr); H1 up; interim dividend Rs 15/share (300% on FV).

- Operational Efficiency: FCF/PAT at 176%; cost controls via Project Fortius; stable leadership and ESG accolades (Terra Carta Seal).

Growth Prospects

- Turnaround Roadmap: FY27 stabilization/reaping phase; ~1.3x revenue growth FY20-FY27; long-term >peer average topline, 15% EBIT, >30% ROCE, >85% FCF payout.

- AI & High-Growth Areas: “AI Delivered Right” (productivity, transformation); prioritized verticals (BFSI +6.2% YoY, Manufacturing +5.2%, Retail +7.2%); $20Mn+ accounts > company average growth; large deals up 57% LTM YoY.

- Strategic Vectors: Growth (turbocharge key accounts/markets), Ops (margin levers), Org (talent skilling, Mahindra synergies, brand refresh); India AI Mission involvement.

- Client Expansion: $50Mn+ clients steady at 26 (+1 YoY); $20Mn+ at 63 (+2 YoY); NPS top quartile.

- Pipeline: Multi-year deals in autonomous ops, GCC setups, GenAI; partnerships for AI/cloud scaling.

Key Risks

- Macro/Execution: Global slowdowns, client concentration (top 10 = 24.3%), seasonality in IT/BPS.

- Currency & Forex: USD/INR avg 88.2 (up from 83.8 YoY); impacts USD revenue reporting.

- Talent & Utilization: Rising attrition could pressure margins; pyramid optimization ongoing.

- Legal/Regulatory: Satyam suspense account (ED freeze); SEBI compliance (e.g., physical shares window).

- Competition/Geopolitical: Intense IT services rivalry; ROW (24.8% mix) exposure to emerging markets volatility.

- Capex/Investments: Continued spend on AI/consulting amid flat USD growth.

Summary

Overall Positive Momentum: TECHM is in turnaround mode (stabilization FY26-FY27), with robust profitability (EBIT 12.1%, ROCE 24.4%) and deal pipeline offsetting flat USD revenue. Tailwinds dominate via AI differentiation (Orion platform, recognitions), margin discipline, and strategic wins, positioning for ~1.3x long-term growth. Headwinds are manageable (e.g., YoY USD dip, attrition) but signal macro caution. Growth prospects strong in AI/high-growth verticals, with FY27 aspirations realistic if execution holds. Key monitor: Legal overhang, attrition, and CC revenue trajectory. Recommendation Outlook: Bullish medium-term (buy/accumulate on dips); target upside to Rs 1,800-2,000 (based on 15% EBIT, peer P/E ~25x). Investor events (CLSA Forum, Mahindra Day) signal confidence.

Data as of Q2 FY26 (Sep 2025); forward-looking statements per disclaimers.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.