Computers - Software & Consulting

Industry Metrics

January 13, 2026

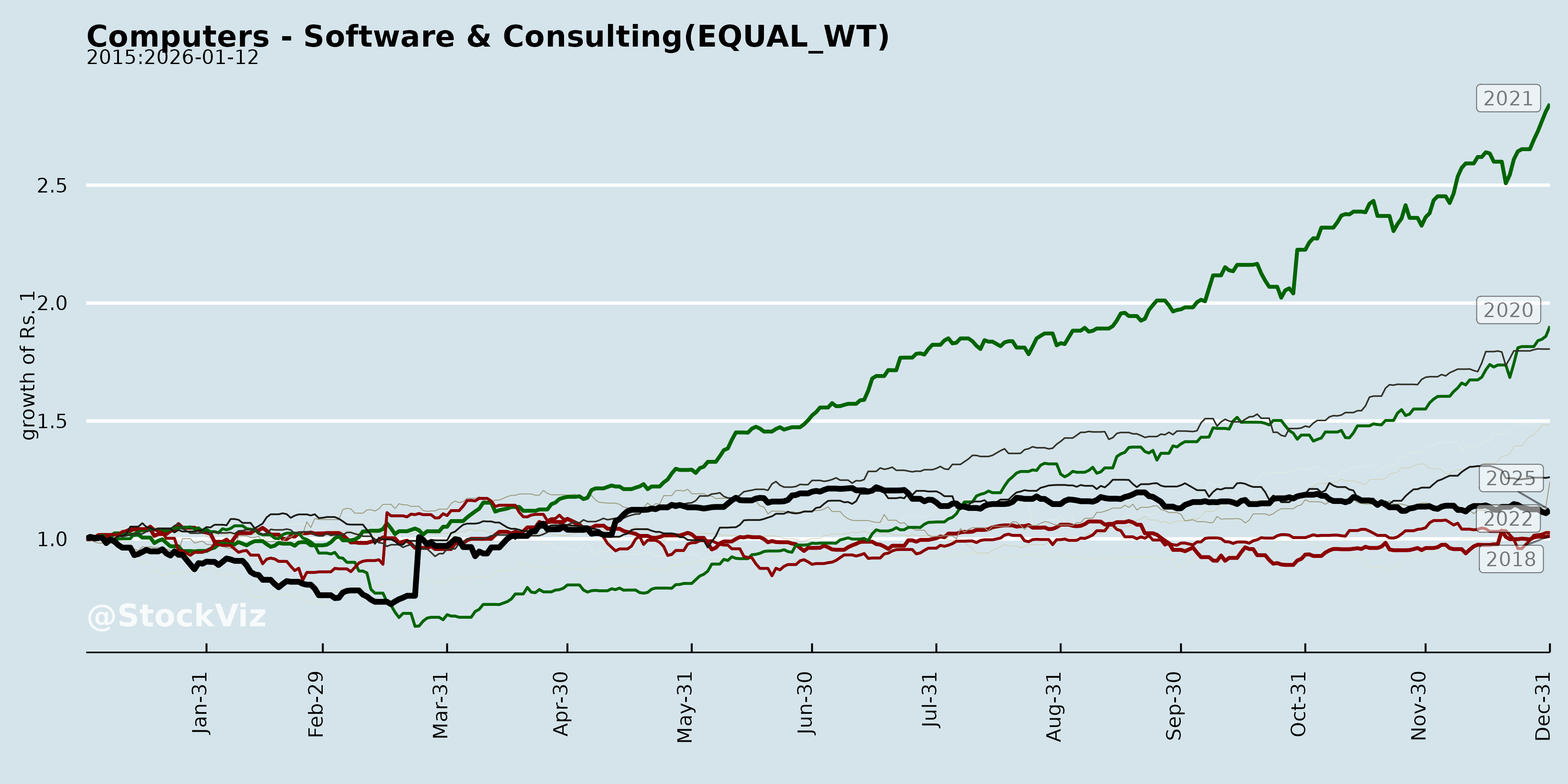

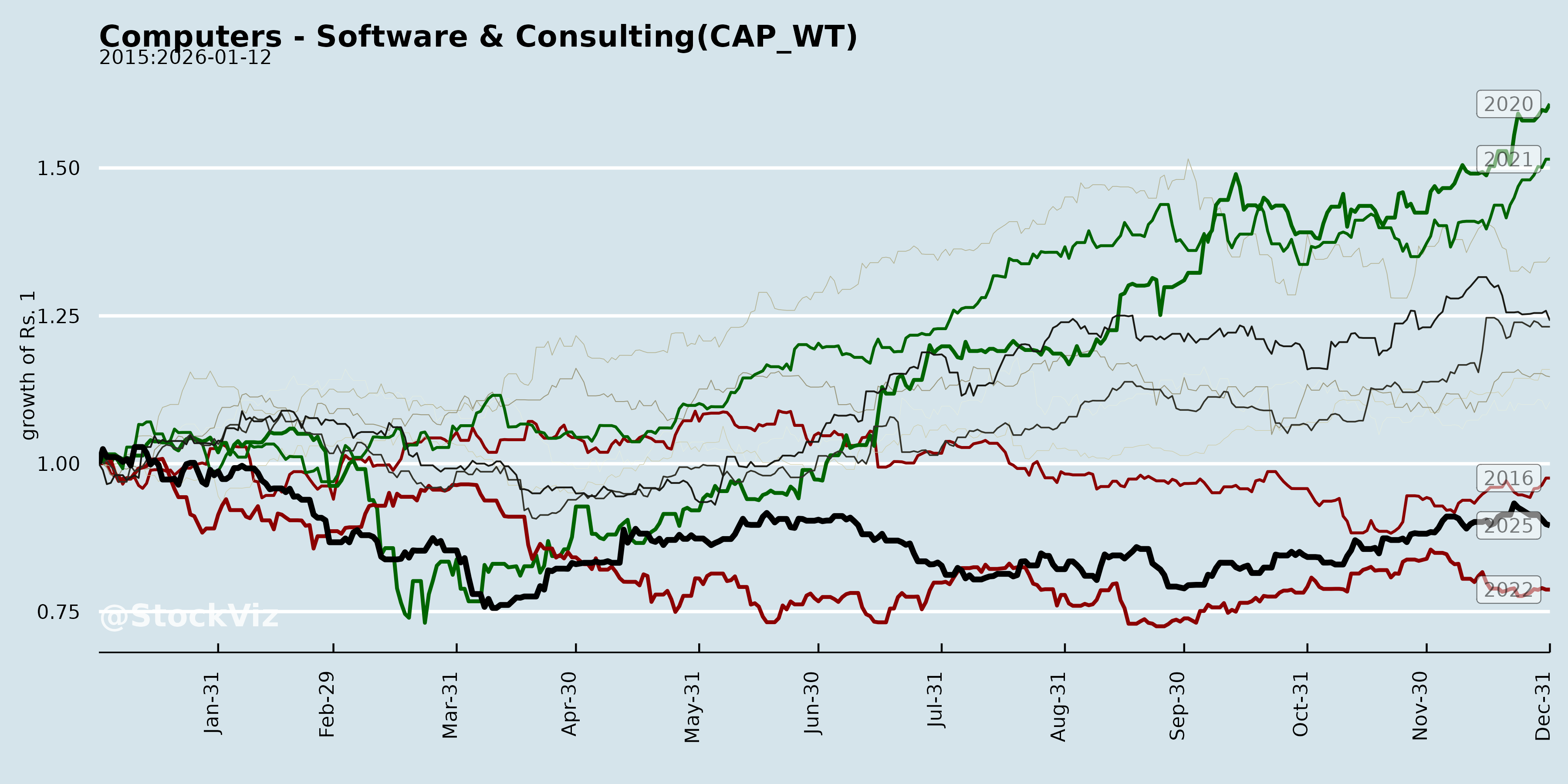

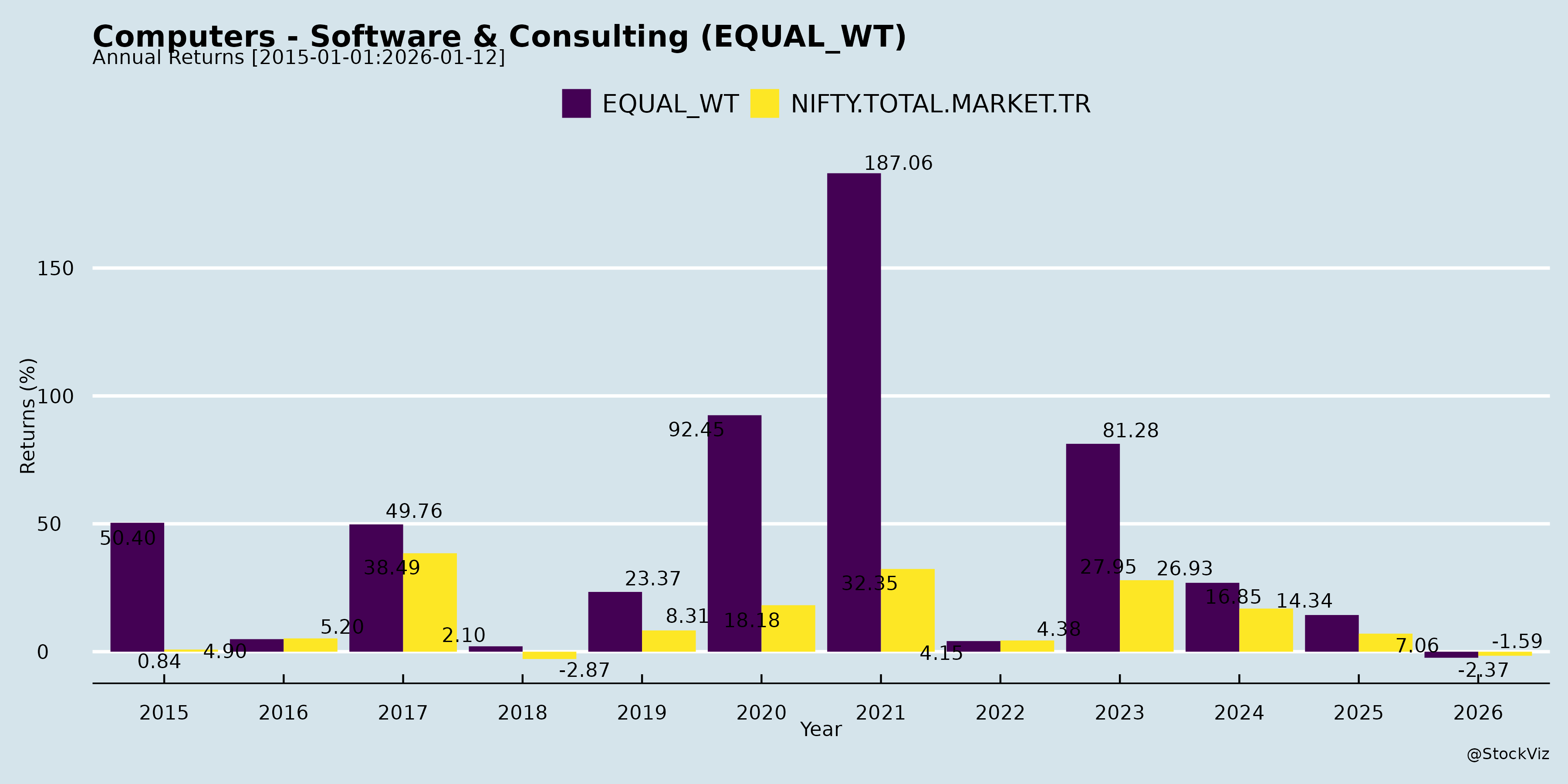

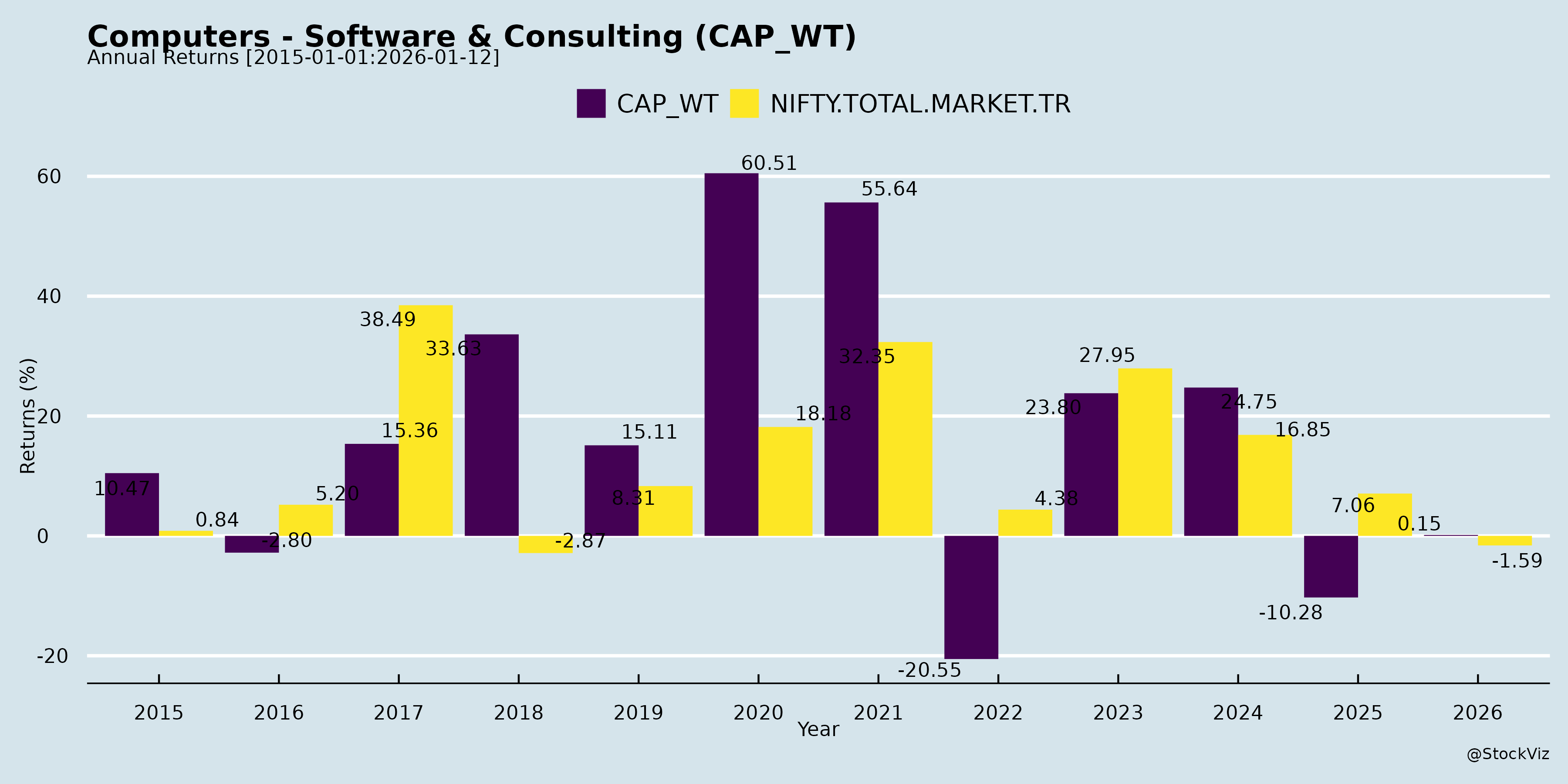

Annual Returns

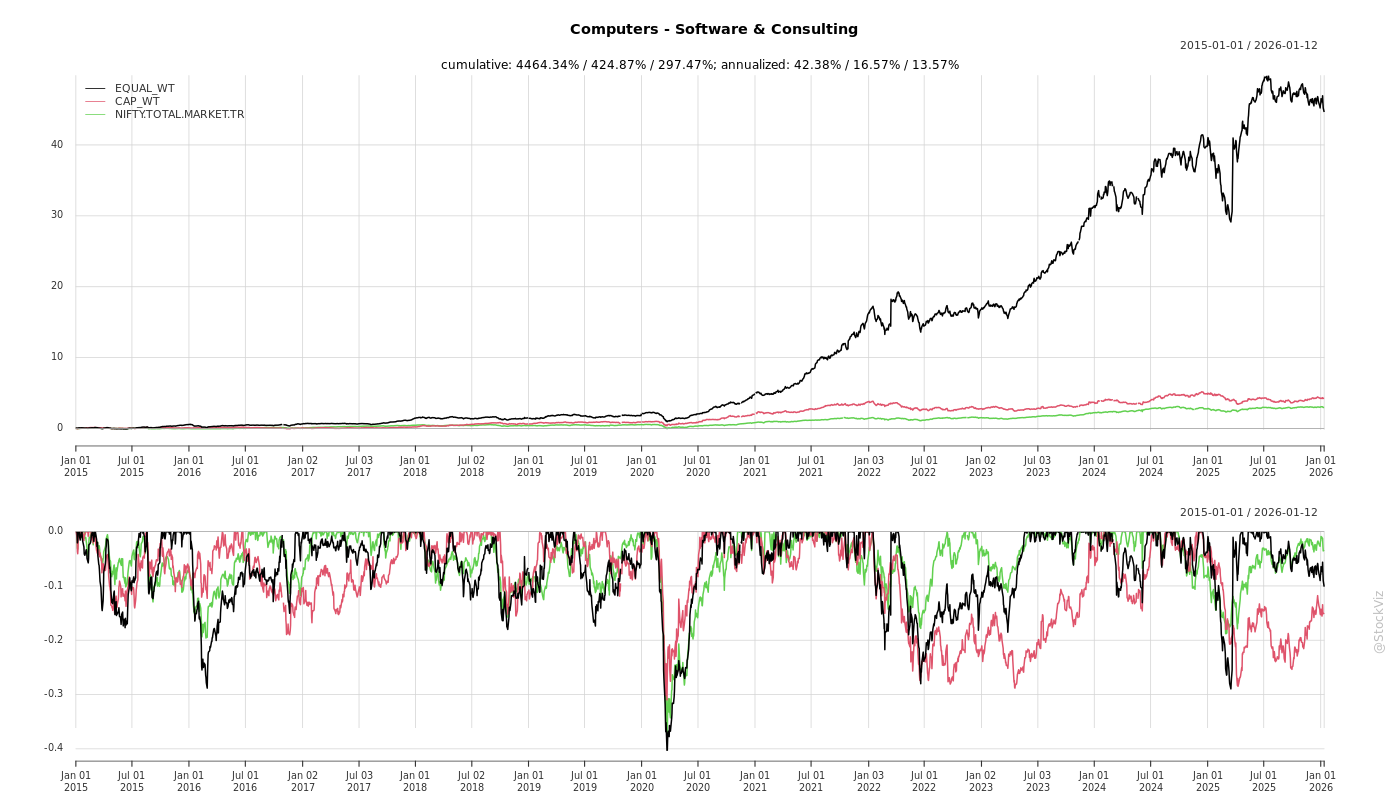

Cumulative Returns and Drawdowns

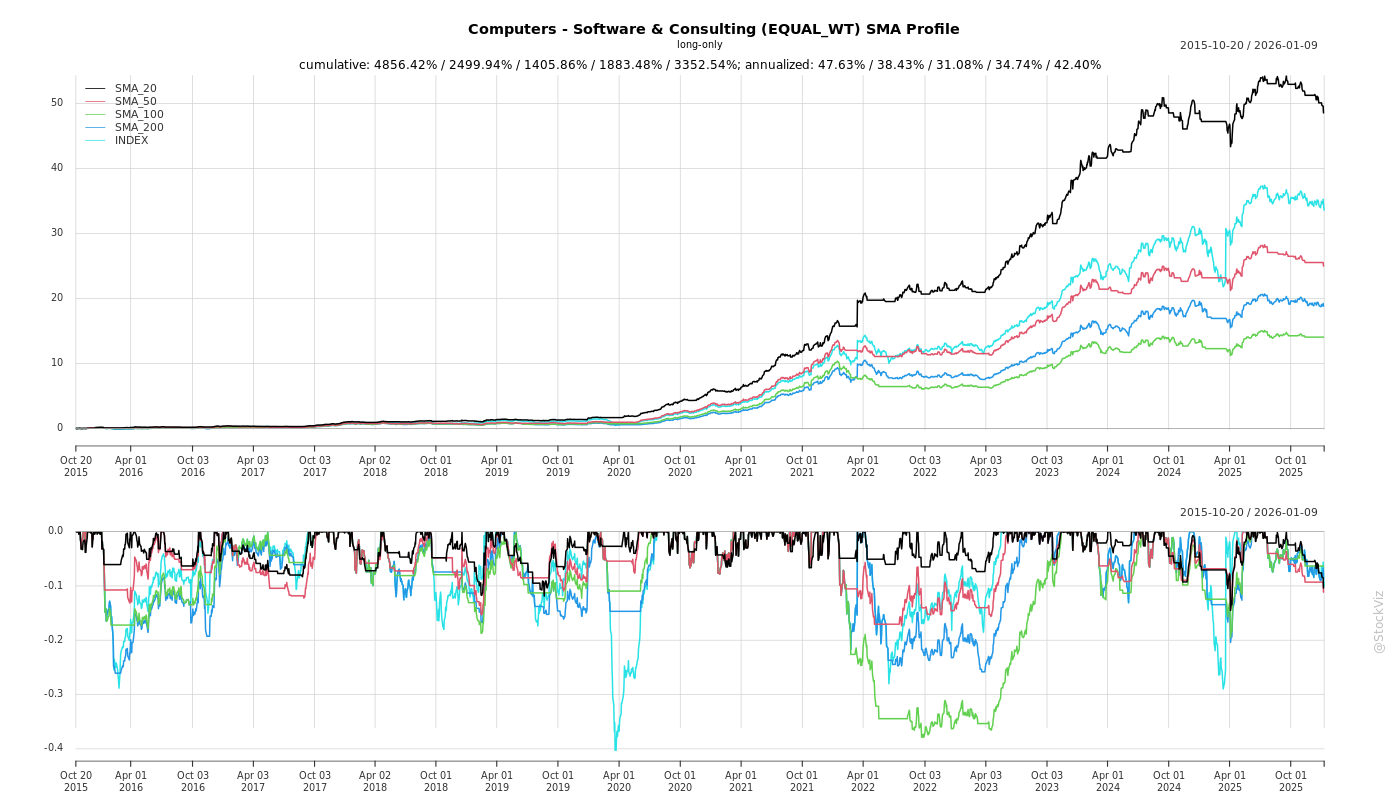

SMA Scenarios

Current Distance from SMA

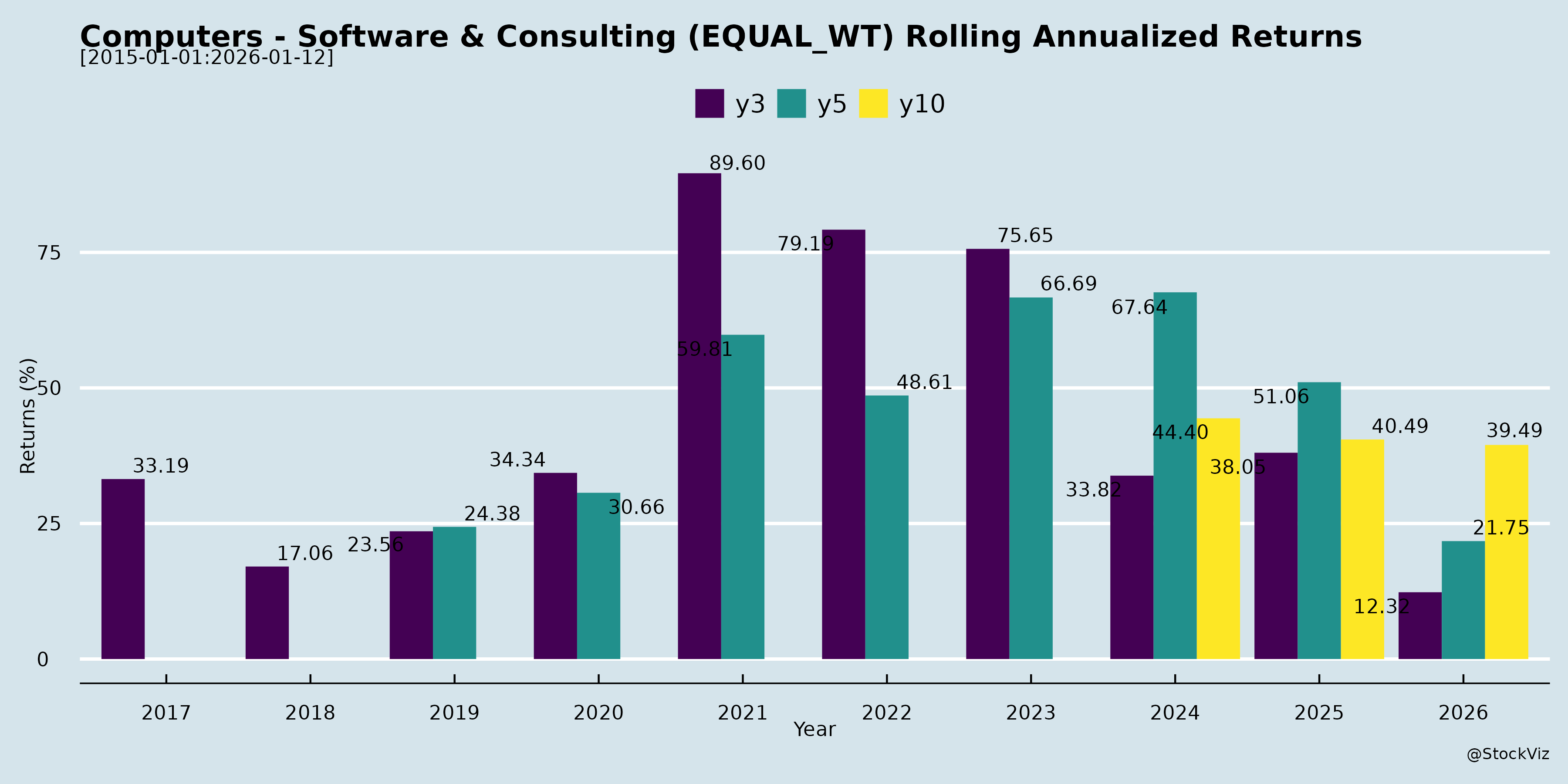

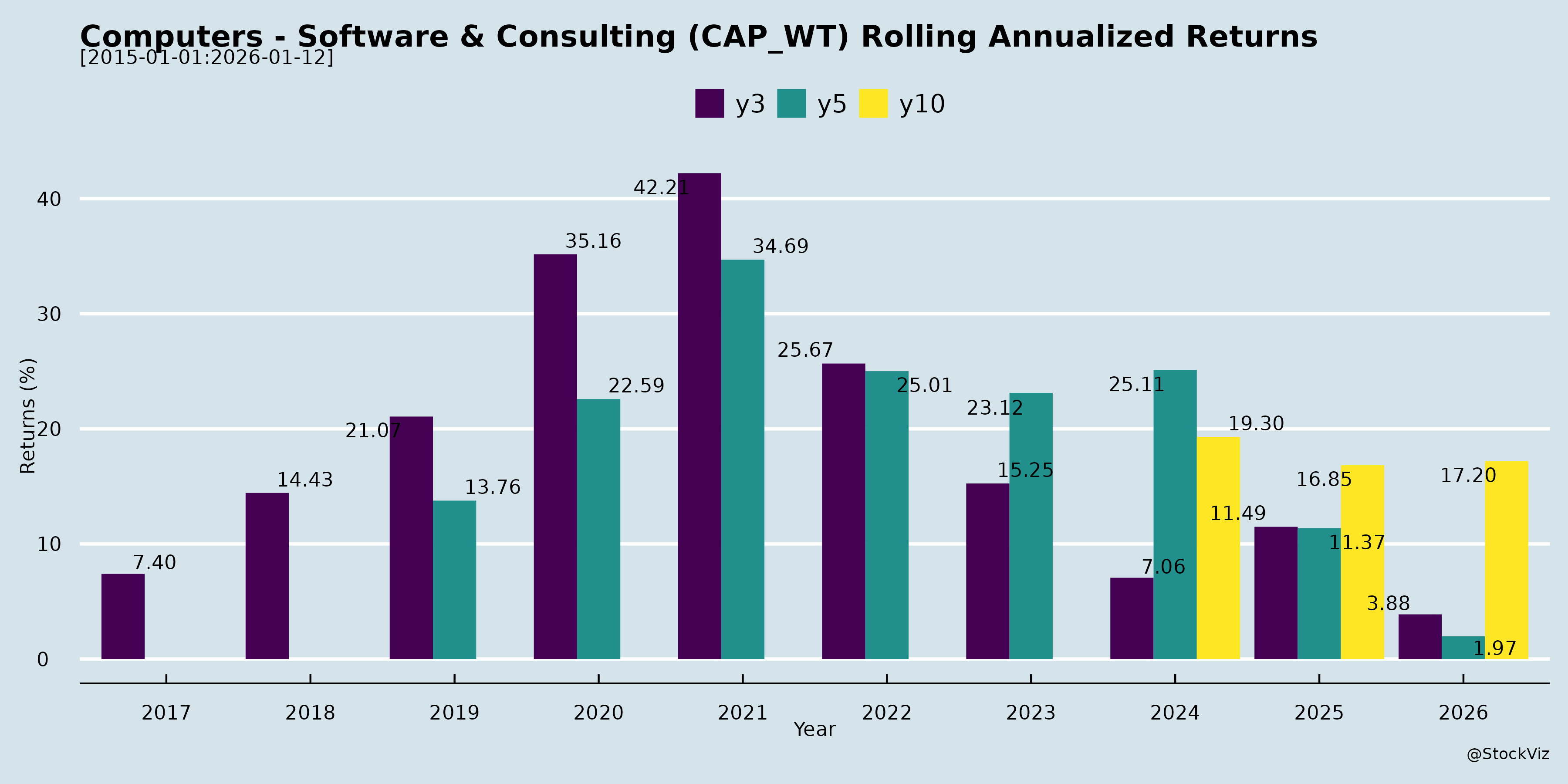

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-30

Indian IT Services Sector (Computers - Software & Consulting): Analysis Summary (Based on Q2 FY26 Filings)

Headwinds

- Vertical-Specific Weakness: Persistent softness in TMT/Hi-Tech (e.g., Zensar: -9.9% QoQ due to CapEx shift to GPUs/AI infra, layoffs, OpEx cuts; HCL: Tech stable but Auto slowdown dragging Manufacturing). MCS also muted (Zensar: -0.6% CC QoQ).

- Macro/Policy Uncertainty: US tariffs, H1B visa changes (low direct impact, <3% dependency for Zensar/HCL; focus shifting to localization). Furloughs expected in Q3 across industry.

- Client Behavior: Cost optimization, vendor consolidation, delayed discretionary spends (non-AI). Q2 TCV soft in some (Zensar book-to-bill 0.97x).

- Operational: Wage hikes absorbed but pressured margins (HCL/Mphasis/Zensar); DSO up (Mphasis: 89 days).

Tailwinds

- AI Momentum: Strong AI traction – HCL: >$100M Advanced AI revenue (3% of total), AI Force v2.0 deployed in 47 accounts; Mphasis: 69% AI-led pipeline, NeoIP launch; Zensar: 28% AI-influenced bookings, ZenseAI platform. Productivity gains (20-70% in SDLC/ops).

- Bookings/TCV Strength: HCL: $2.6B (no mega deals); Mphasis: $528M (H1 $1.3B, LTM >$2B); resilient net-new wins.

- Financial Resilience: Margin stability/expansion (HCL: 17.5%, +116bps QoQ; Mphasis: 15.3%; Zensar: 15.4% EBITDA). Utilization up (Zensar: 84.8%, +200bps YoY); cash generation strong (HCL: FCF 125% of NI).

- Geographic/Vertical Diversification: Growth in BFSI (HCL/Mphasis: 11-17% YoY), Insurance (+25-32%), Healthcare; EMEA/ROW up (HCL/Mphasis).

Growth Prospects

- FY26 Outlook: HCL raised Services guidance to 4-5% CC (company 3-5%); Mphasis: >2x industry growth via deal ramps; Zensar: Positive pipeline (large deals in BFSI/Healthcare/MCS). H1 momentum to accelerate H2 via Q1/Q2 ramps.

- AI-Led Expansion: Shift to IP/platforms (AI Factory, Advisory, modernization); pipeline records (Mphasis +97% YoY, HCL robust). Non-linear growth via productivity (HCL: revenue/employee +1.8% YoY).

- Deal Pipeline: Broad-based (Mphasis: BFS +45%, non-BFS +139%; Zensar/HCL: large deals). Client pyramid improving (additions in $10-100M bands).

- Medium-Term: AI monetization (pilots to scale), vertical diversification (away from TMT), localization offset visas.

Key Risks

- Execution: TCV-to-revenue lag (transformation deals 3-6 months ramp); furlough seasonality (Q3 weak).

- Macro/Geopolitical: US policy shifts (elections, tariffs, visas); currency volatility (INR depreciation aids but hedge losses).

- Vertical Concentration: TMT exposure (20-27% for some) could drag if CapEx persists; Auto/ Manufacturing slowdown.

- Competition/AI: Intense rivalry in AI (platforms, partnerships); productivity deflation (25-50% in SDLC/BPO) risks renewals (HCL: 5/10 top renewals flat).

- Talent/Productivity: Attrition stable (~10%) but AI reskilling needed; non-linearity in headcount-revenue link.

Overall: Sector resilient amid AI tailwinds offsetting vertical headwinds. HCL/Mphasis outperform (growth >4% YoY CC), Zensar stable but TMT drags. Focus on AI IP/partnerships positions for 4-6% FY26 industry growth (per NASSCOM revisions), with leaders targeting 2x via execution. Investor meetings signal ongoing engagement.

General

asof: 2025-12-03

Indian Computers - Software & Consulting Sector Analysis

Based on the provided documents (Q2/H1 FY26 disclosures from TCS, Infosys, HCL Tech, Wipro, LTIMindtree, Tech Mahindra, Persistent, Coforge, MphasiS, Hexaware, KPIT Tech, and Tata Elxsi as of Nov-Dec 2025).

The sector shows resilient but cautious performance amid US-centric revenue exposure (~56-59% per HCL). HCL’s H1 results serve as a strong proxy: revenues +5.6% YoY to $7.2B, profits flat at $936M, with stable margins (~17% OP). Inorganic moves (acquisitions) and employee incentives signal growth focus, but litigation (TCS) adds caution. Below is a structured summary:

Headwinds (Challenges Pressuring Margins/Performance)

- Legal & Litigation Risks: TCS faces confirmed damages in DXC lawsuit (US 5th Circuit, Nov 21, 2025); injunction vacated but provisions needed per accounting standards. Could impact profitability/sentiment (est. material hit pending appeal).

- Macro/Execution Slowdown: HCL revenues grew modestly (Q2 +5.8% YoY), with operating profit flat; other income down sharply (H1 $95M vs. $172M). FX losses in OCI (-$124M Q2) highlight rupee volatility exposure.

- Talent/Operational Churn: Persistent’s SVP-Business Finance resignation (Nov 21, 2025, personal reasons); routine but signals potential key-person risks in high-attrition sector.

- Administrative/Compliance Burdens: Tech Mahindra’s physical share re-lodgement window (to Jan 2026); Coforge RTA transition delays – minor but reflect regulatory pressures (SEBI circulars).

Tailwinds (Supportive Factors Driving Stability/Growth)

- Steady Organic Growth: HCL Q2 revenues $3.6B (+5.8% YoY), H1 $7.2B (+5.6%); IT/Business Services (74% rev) up 5%, Engineering/R&D +13%. Cash flow strong (ops $1.1B H1), net cash +$88M.

- Inorganic Expansion: Wipro completes DTS acquisition (Dec 1, 2025) for connected services; KPIT pays $40M deferred on Caresoft (auto engineering, total ~$157M). Bolsters domain expertise (e.g., AI, auto).

- Employee Retention Incentives: Infosys/Hexaware allot RSUs/ESOPs (59K/2M shares); strong signal amid talent wars.

- ESG Momentum: MphasiS scores 73/100 (S&P Global, Nov 2025; beats industry avg: Env 62 vs. 37, Soc 77 vs. 38) – aids global client wins (esp. Europe/US).

- Routine Positives: LTIMindtree closes non-core sub (minor cleanup); Tata Elxsi streamlines disclosures.

Growth Prospects (Medium-Term Opportunities)

- Segment Diversification: HCL’s Engineering/R&D (17% rev, +13% YoY) and Software (9%, stable) gaining vs. IT Services; acquisitions (KPIT Caresoft, Wipro DTS) target auto/connected tech, GenAI.

- Deal Pipeline & Cash Generation: HCL H1 cash $1.1B ops; dividend ₹30/shr (payout ~$938M). Sector poised for digital transformation (cloud, cybersecurity per HCL notes).

- US/Europe Focus: 84-85% rev; HCL USA/Europe steady at 56%/28%. Potential rebound from macro softening.

- Projections: HCL-like peers could see 6-8% FY26 growth if deals ramp (H1 TCV implied via rev ramp); ESOPs/ESG enhance talent/client appeal.

Key Risks (High-Impact Threats)

| Risk Category | Details | Potential Impact |

|---|---|---|

| Litigation | TCS DXC suit (damages confirmed; appeal/review ongoing). Provisions could dent Q3 margins. | High (financial hit, stock volatility). |

| FX & Macro | HCL OCI FX loss -$182M Q2; USD strength/rupee weakness. US slowdown (56% rev). | Medium-High (earnings volatility). |

| Integration/Execution | Wipro/KPIT acquisitions: post-close synergies (e.g., $15M variable in KPIT). | Medium (if delayed). |

| Regulatory/Tax | SEBI compliance (shares, RTAs); HCL notes MAT/tax audits open (India/US from FY22/2017). | Low-Medium (fines/disruptions). |

| Talent/Geopolitical | Resignations; sub-closures (LTIM). Geopolitics (e.g., HCL divestments). | Medium (attrition >15%). |

Overall Summary: Sector resilient (HCL steady growth, cash-rich), buoyed by acquisitions/ESG/talent tools (tailwinds ~60% weight). Headwinds led by TCS litigation/macro (30% weight), with risks skewed to legal/FX (monitor Q3). Growth prospects solid at 6-10% via inorganics/digital (e.g., Engineering +13%), but appeals (TCS) and US macros key watches. Positive sentiment if HCL peers echo results. Recommendation: Neutral-Positive; hold majors, watch TCS/HCL earnings.

Investor

asof: 2025-11-30

Indian IT Services Sector Analysis (Computers - Software & Consulting)

Based on Q2 FY26 Earnings Transcripts, Investor Presentations, and Announcements from Key Players (TCS, HCLTech, Wipro, LTIMindtree, Tech Mahindra, Mphasis, Zensar, Coforge, Persistent, etc.)

Headwinds

- Macro & Policy Uncertainty: US H1B visa fee hikes and restrictions (impacting localization costs; HCL notes low dependence but potential margin headwind). Tariffs, elections (“Liberation Day”), and government shutdowns delaying decisions (Zensar). Furloughs expected in Q3 (industry-wide, less impact on low-TMT exposed firms).

- Vertical Slowdowns: TMT/Hi-tech under stress due to CapEx shift to GPUs/AI infra, layoffs (tens of thousands announced), and OpEx rationalization (Zensar: -9.9% QoQ; HCL notes weakness). Auto slowdown dragging Manufacturing (HCL, TechM). Renewals seeing deflation (5/10 top renewables flat/down due to AI productivity; HCL).

- Demand Environment: Cautious discretionary spending amid volatility; vendor consolidation delaying deals (Zensar book-to-bill 0.97x). Soft perpetual licenses in Software (HCL: -3.7% YoY).

- Operational Pressures: Wage hikes (absorbed but 70-110 bps margin hit in H2; HCL), restructuring costs (HCL: -55 bps), DSO creep (Mphasis: 89 days due to fixed-price mix).

Tailwinds

- AI Momentum: Shift to monetization (HCL: $100M+ Advanced AI revenue, 3% of total; 42% TCV AI-led). Platforms scaling (HCL AI Force v2.0 in 47 accounts; Mphasis NeoIP™; Zensar ZenseAI). Productivity gains (20-50% in SDLC/BPO; HCL). AI-led pipeline dominant (Mphasis: 69%; Zensar: 28% bookings AI-influenced).

- Strong Deal Flow: Robust TCV/bookings (HCL: $2.6B no mega; Mphasis: $528M, H1 $1.3B; Zensar: $158.7M). Pipelines at record highs (Mphasis +97% YoY; HCL balanced).

- Margin Resilience: Expansion despite headwinds (HCL: 17.5%, +116 bps QoQ; Mphasis: 15.3% stable; Zensar: 15.4% EBITDA). Utilization up (Zensar: 84.8%; offshore mix gains).

- Vertical/Geography Strength: BFSI (HCL +11.4%, Mphasis +13.8%), Healthcare/Lifesciences (+25% YoY multiple), Retail/CPG traction. EMEA/ROW growth (HCL: Europe +7.6%, ROW +17.9%).

Growth Prospects

- Near-Term (FY26): Leaders raising guidance (HCL Services 4-5%; mid-teens margins). H1 strength (HCL +4.6% YoY CC) sets Q3/Q4 ramps (large deals converting; Mphasis expects >2x industry). AI arbitrage unlocking modernization/deals (HCL $2.5B+ run-rate target).

- Medium-Term (FY27+): Non-linear growth via IP/platforms (HCL AI Factory/Advisory; TechM turnaround to 1.3x FY20-27 revenue). Diversification (away from TMT/Auto; into Public Services, Logistics). Client pyramid expansion ($10-50M+ clients up). Sector CAGR potential 4-6% (NASSCOM), leaders >peer avg (TechM aspiration).

- Catalysts: AI pilots to production (HCL: 100 top clients); hyperscaler partnerships (Nvidia, Dell); localization tailwinds.

Key Risks

- Execution: Deal ramp delays (transformation deals 3-6 months; Mphasis). Furlough seasonality (Q3 weak). TCV-to-revenue conversion (lumpy large deals).

- Sector/Vertical: Prolonged TMT/Auto weakness (20-27% exposure for some); top-client dependency (Mphasis top client soft but recovering).

- AI Disruption: Productivity deflation in renewals (HCL: 10-50% across services); over-investment in unproven platforms.

- External: US macro (recession fears, regional banks); currency volatility (INR depreciation aids but hedge losses; HCL/Mphasis). Competition in AI (differentiation via agents/IP critical).

- Internal: Attrition stability (9-10%); underinvestment risk if growth lags (Zensar denies).

Summary

The sector faces near-term headwinds from US policy uncertainty, TMT/Auto slowdowns, and Q3 furloughs, capping growth at low-single digits for many. However, AI tailwinds dominate, driving record pipelines/TCV (AI-led deals 20-70%), margin stability (mid-teens), and vertical diversification (BFSI/Healthcare strong). Leaders like HCL/Mphasis eye 4-5%+ FY26 growth (>industry), with medium-term prospects hinging on AI monetization/non-linearity. Key watch: TCV conversion, AI productivity deflation, and macro stability. Overall outlook cautiously optimistic—AI positions winners for outperformance amid volatility.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.