TCS

Equity Metrics

January 13, 2026

Tata Consultancy Services Limited

Computers - Software & Consulting

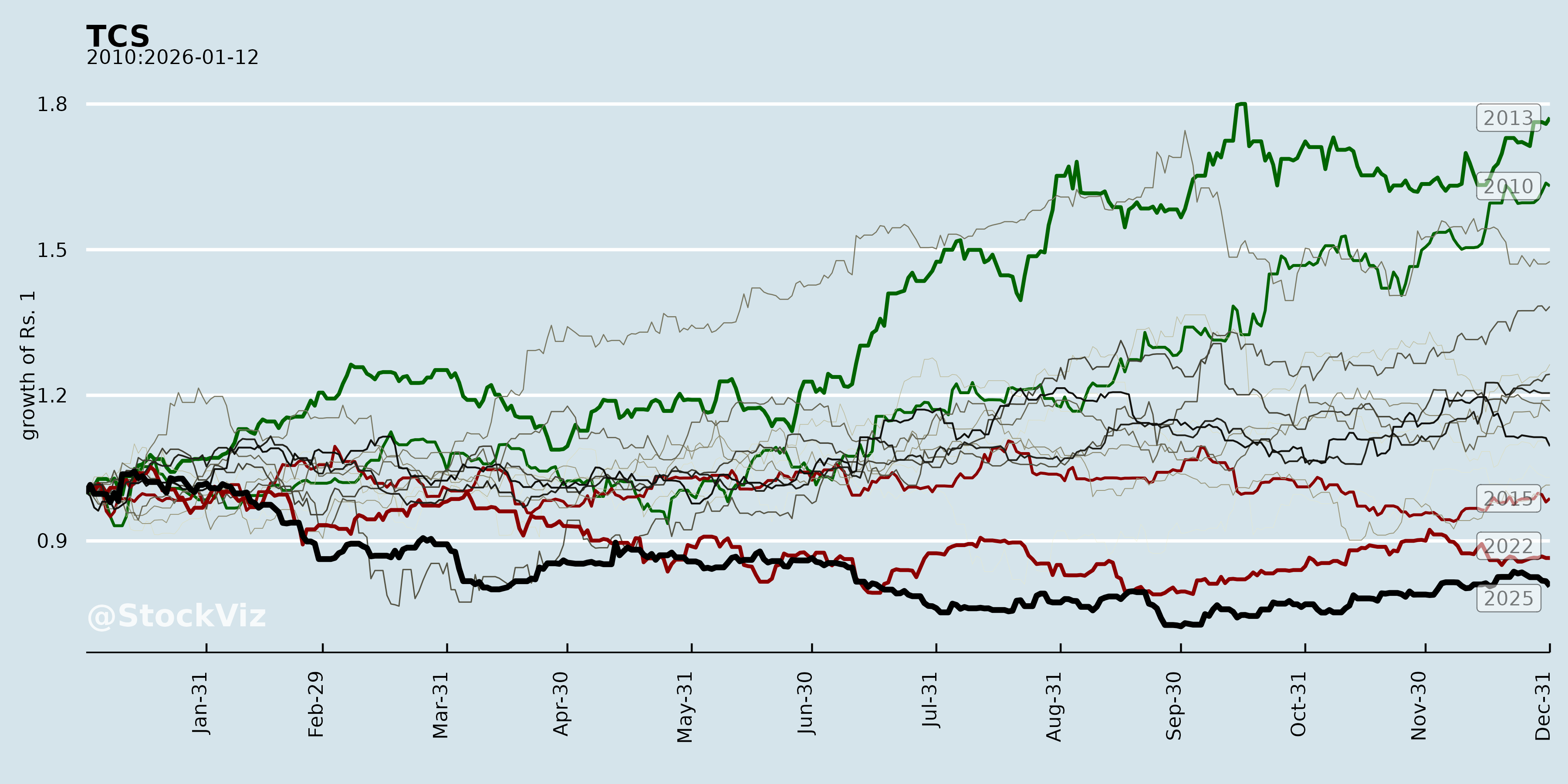

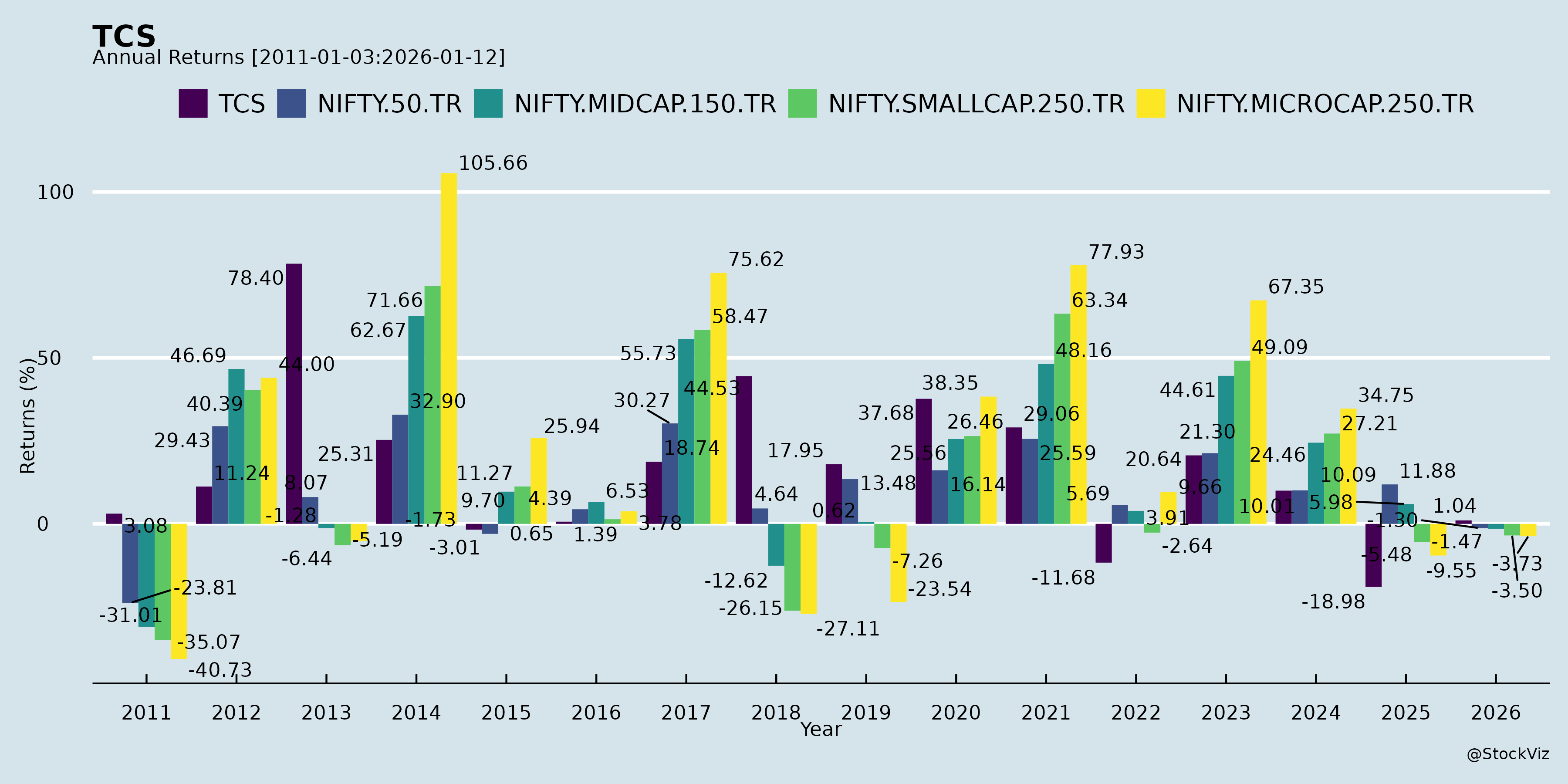

Annual Returns

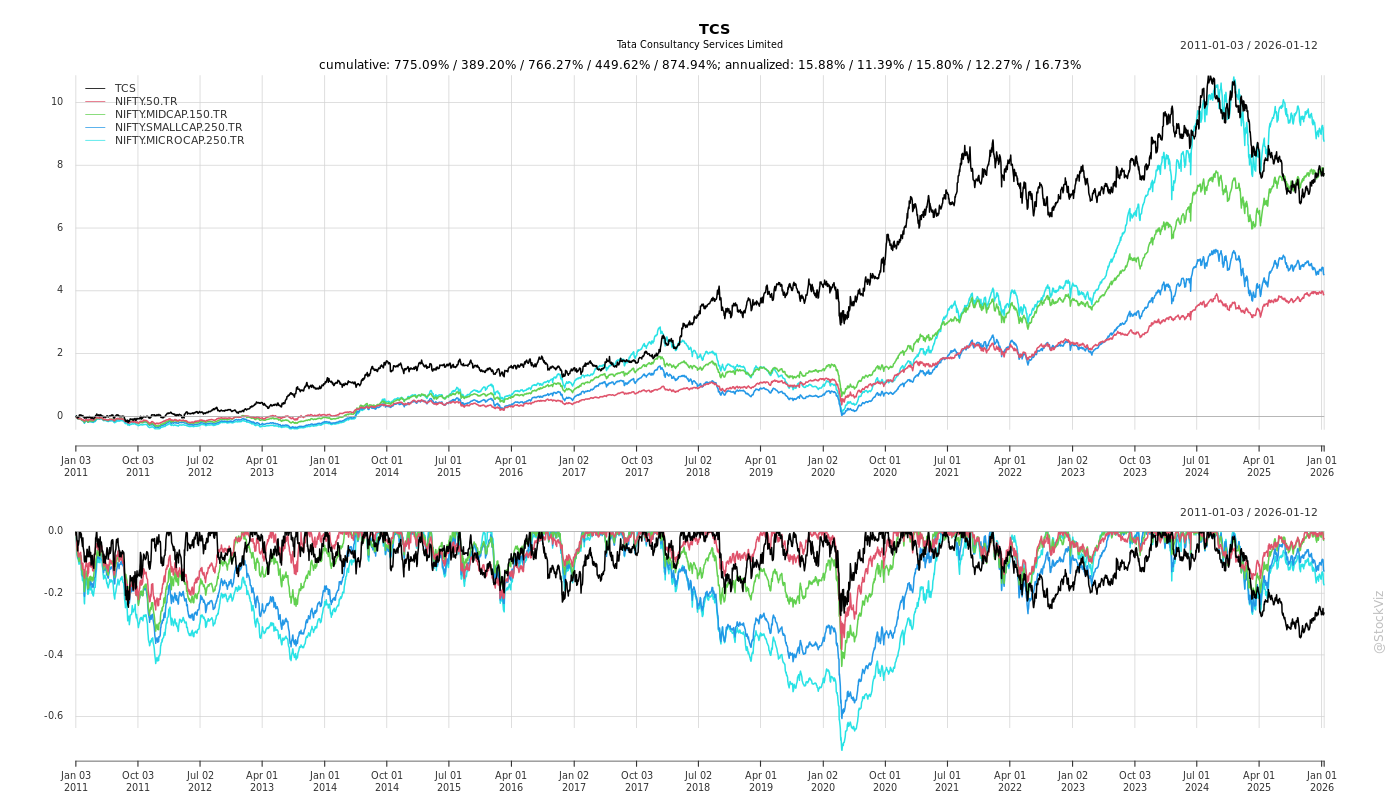

Cumulative Returns and Drawdowns

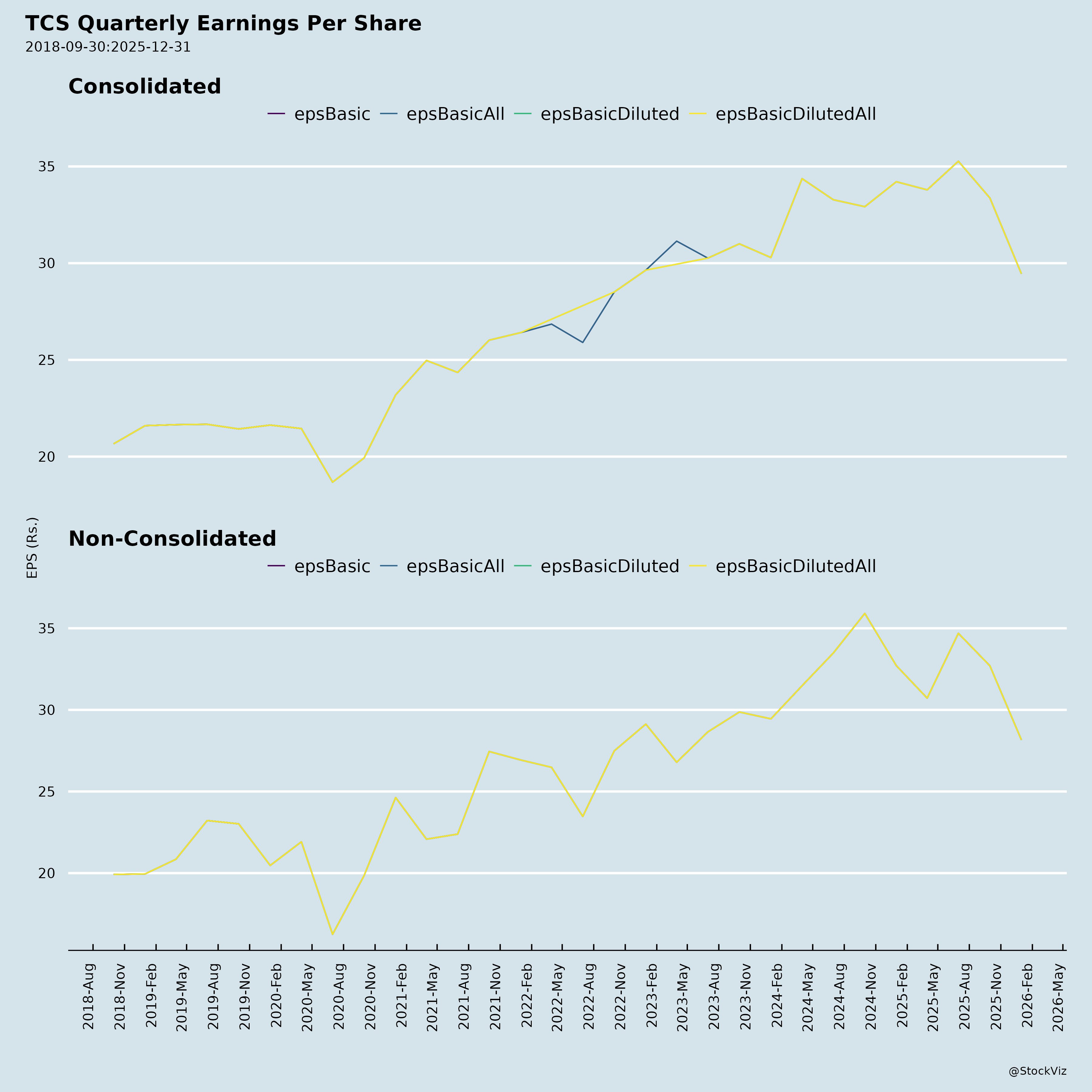

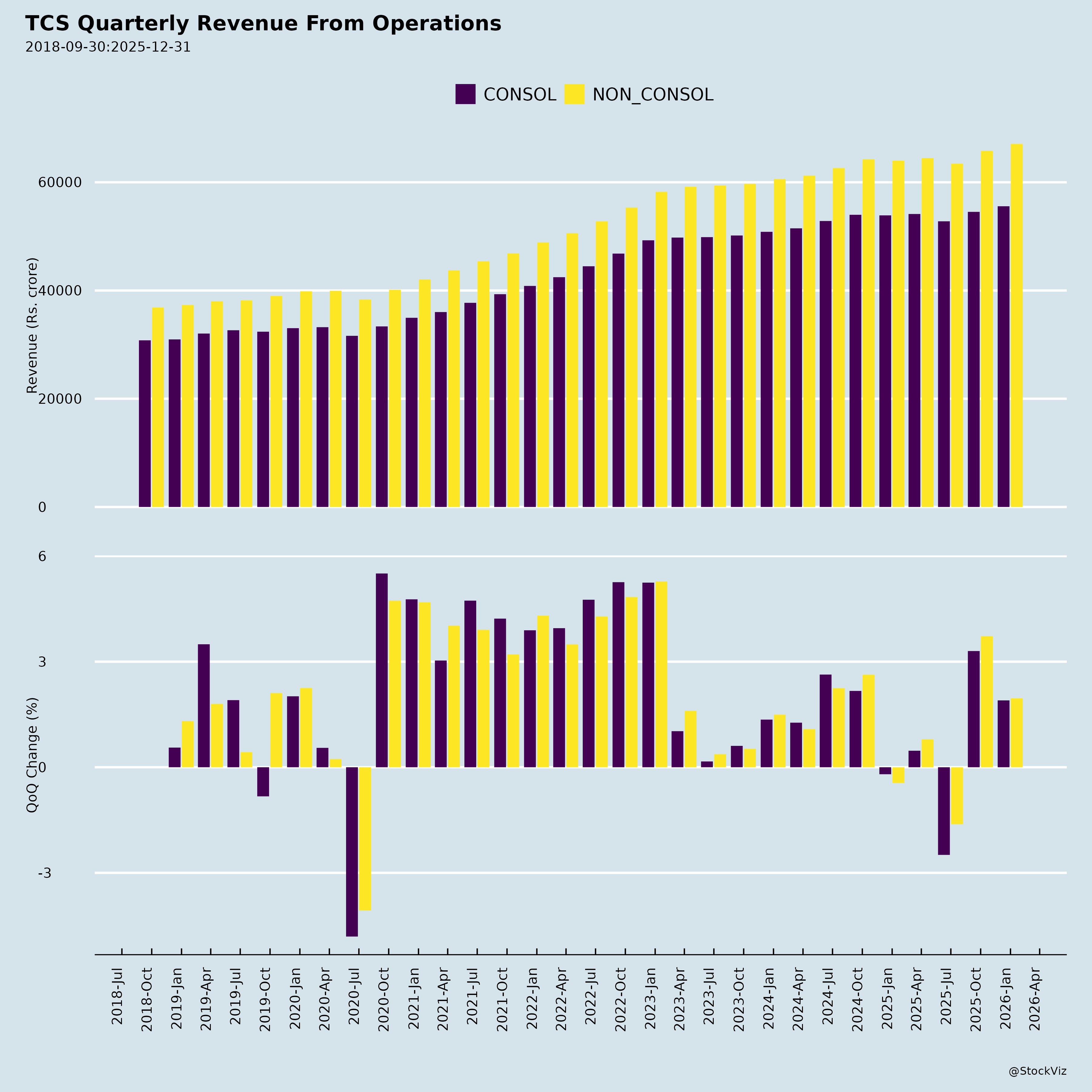

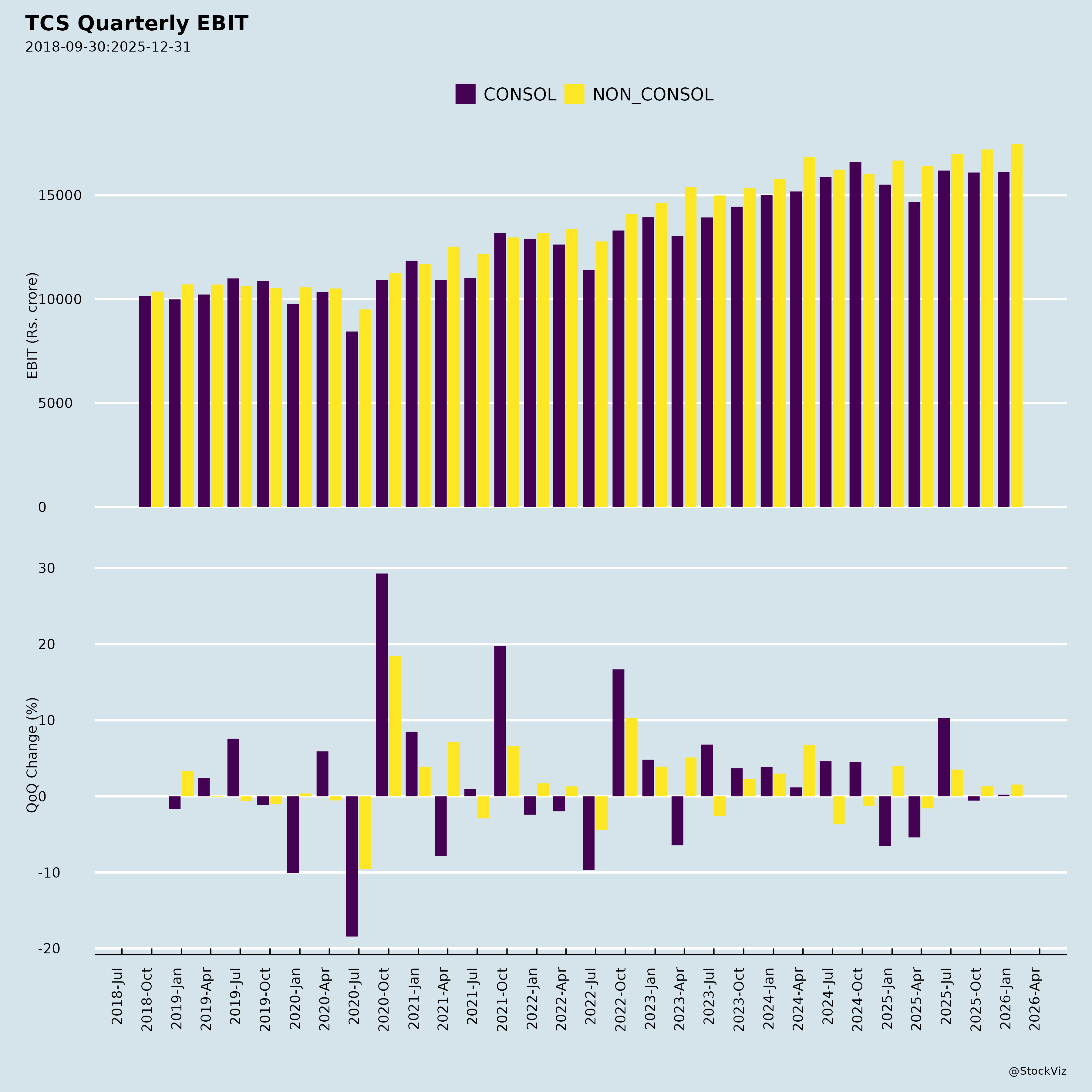

Fundamentals

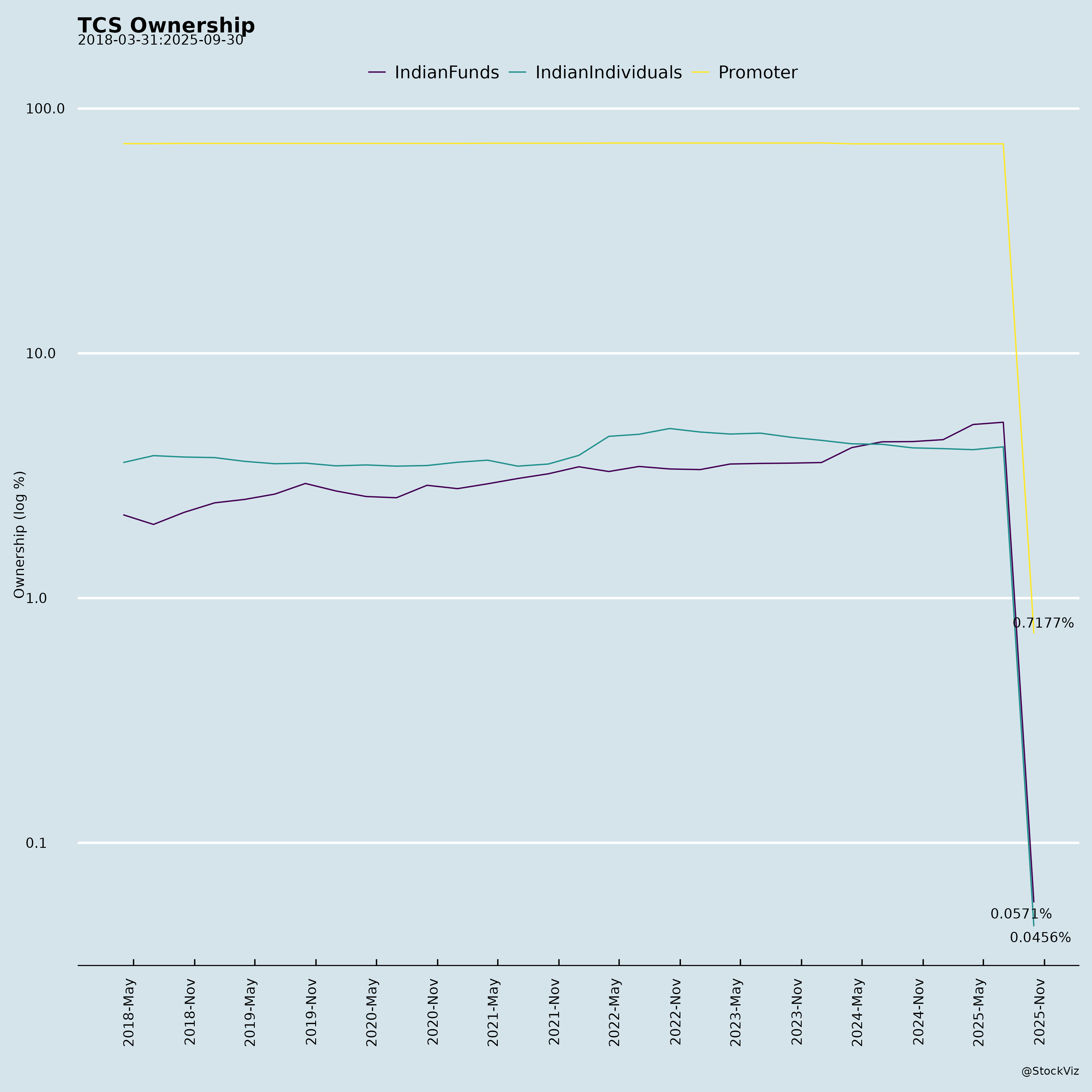

Ownership

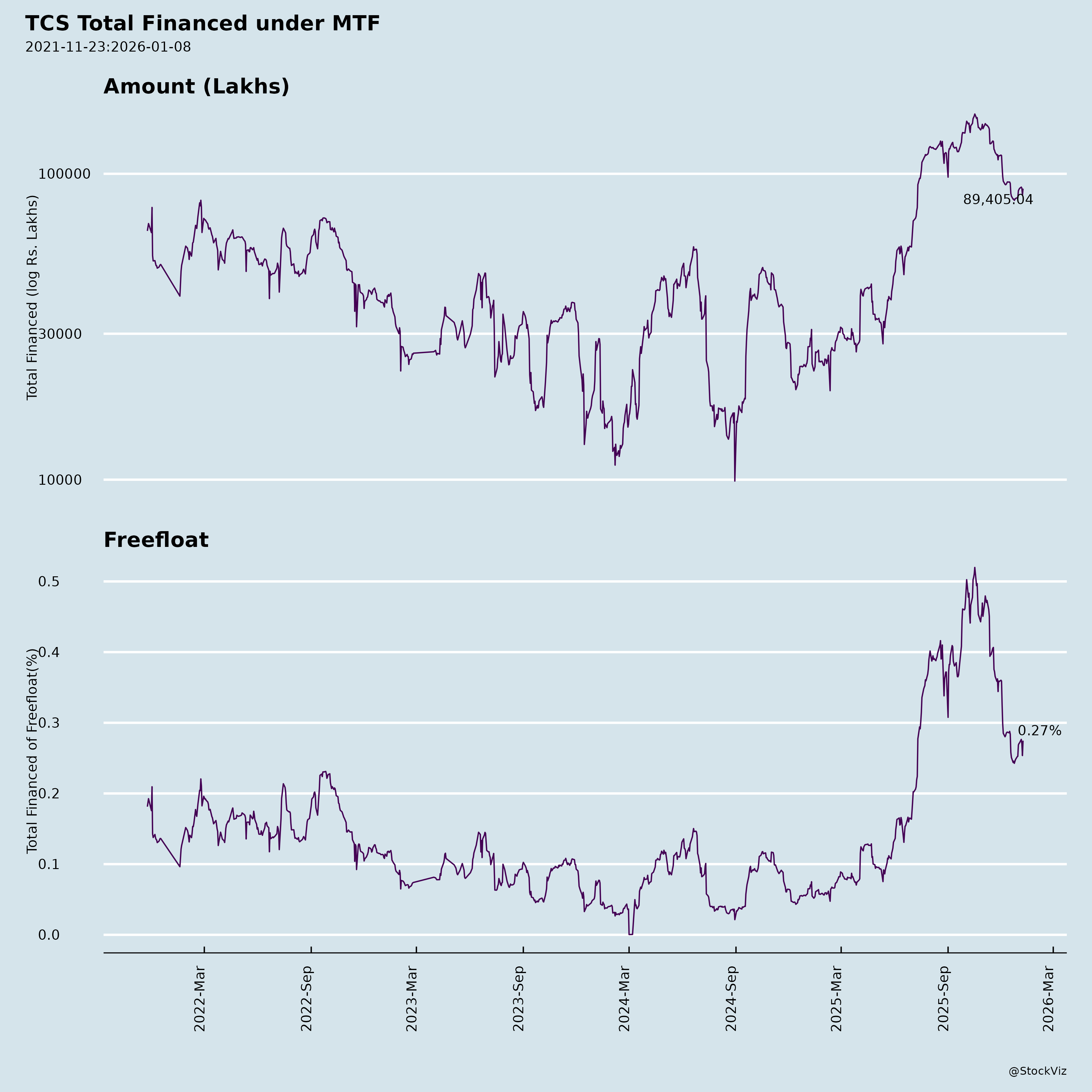

Margined

AI Summary

asof: 2025-12-07

Tata Consultancy Services (TCS) – Stock Analysis Summary

Tata Consultancy Services (TCS), a global IT services and consulting leader, is navigating a dynamic landscape shaped by strategic investments, regulatory challenges, and macroeconomic trends. Here’s a structured analysis of its headwinds, tailwinds, growth prospects, and key risks as of November 2025.

1. Tailwinds (Positive Factors)

a. Strategic Investment in AI Data Centers (HyperVault)

- $1Bn Investment from TPG: TCS has secured a significant investment from TPG, a global alternative asset manager, to fund its AI data center business, HyperVault.

- GW-scale Infrastructure: The investment supports the development of AI-ready data centers with capacity exceeding 1 GW, aligning with the growing demand for AI infrastructure.

- Strategic Partnership: TPG’s involvement brings sectoral expertise in infrastructure, real estate, and sustainability, enhancing TCS’s capabilities.

- Financial Structure: The investment is structured as a mix of equity and compulsorily convertible preference shares, with TCS and TPG committing up to ₹18,000 crore (approx. $2.2Bn) over several years.

- Shareholding: TPG is expected to hold between 27.5% to 49% in HyperVault, with TCS retaining majority control and board representation.

- Long-term Value Creation: The partnership is expected to reduce TCS’s capital outlay, improve returns for shareholders, and position TCS as a leader in AI-driven infrastructure.

b. AI and Digital Transformation Demand

- Global AI Surge: The rapid adoption of AI across industries is driving demand for AI-ready infrastructure, cloud services, and AI platforms.

- TCS’s AI Ecosystem: TCS offers a full suite of AI solutions, including AI data centers, cloud services, AI platforms, and industry-specific AI solutions.

- Hyperscaler Partnerships: TCS is strengthening its partnerships with hyperscalers and AI companies to design, deploy, and optimize AI infrastructure.

c. Market Position and Brand Strength

- Global Leadership: TCS is a top-tier IT services provider with a strong global footprint, serving clients across 55 countries.

- Tata Group Heritage: As a subsidiary of the Tata Group, TCS benefits from a strong brand, legacy, and reputation for quality and reliability.

- Employee Base: With over 590,000 employees, TCS has a large, skilled workforce capable of scaling AI and digital transformation projects.

d. Market Growth in India

- Data Center Expansion: India’s data center capacity is expected to grow from ~1.5 GW to over 10 GW by 2030, driven by digitalization and AI adoption.

- Foreign Investment: The Indian data center market has attracted nearly $94 billion in investments since 2019, creating a favorable environment for TCS’s HyperVault initiative.

2. Headwinds (Challenges)

a. Legal and Regulatory Risks

- US Court Ruling: A recent adverse ruling in the US Court of Appeals for the Fifth Circuit in the Computer Sciences Corporation/DXC Technology Company case confirmed damages and vacated an injunction. This could lead to further legal challenges and financial provisions.

- Saudi Social Insurance Penalty: TCS was fined SAR 47,917.18 by the General Organization for Social Insurance in Saudi Arabia for a Social Insurance contribution registration issue. While the company claims no material impact, regulatory scrutiny in international markets remains a concern.

b. Market and Competitive Pressures

- Intense Competition: The IT services and AI infrastructure sectors are highly competitive, with players like IBM, Accenture, and Microsoft Azure vying for market share.

- Margin Pressures: Increasing competition and client demands for cost optimization could pressure TCS’s profit margins.

c. Economic and Geopolitical Uncertainties

- Global Economic Slowdown: A slowdown in key markets like the US and Europe could impact demand for IT services and AI solutions.

- Currency Volatility: As a global company, TCS is exposed to currency fluctuations, which can affect revenue and profitability.

d. Execution Risks

- Project Delays: The success of HyperVault depends on timely execution of data center projects, which could be affected by regulatory approvals, supply chain issues, or technical challenges.

- Integration Challenges: Integrating TPG’s investment and expertise into TCS’s operations may pose management and cultural challenges.

3. Growth Prospects

a. AI-Driven Revenue Streams

- HyperVault: The AI data center business is expected to become a significant revenue driver, with potential for long-term growth as AI adoption increases.

- AI Platforms and Solutions: TCS’s AI platforms and industry-specific solutions are well-positioned to capture growth in sectors like healthcare, finance, and manufacturing.

b. Expansion in Emerging Markets

- India’s Digital Economy: TCS is well-positioned to benefit from India’s digital transformation, with HyperVault targeting the growing AI infrastructure market.

- Global Expansion: TCS’s global presence allows it to capitalize on AI and digital transformation trends in other emerging markets.

c. Strategic Partnerships

- TPG Collaboration: The partnership with TPG enhances TCS’s ability to scale its AI infrastructure business and access new markets.

- Hyperscaler Alliances: Strengthening ties with hyperscalers and AI companies will enable TCS to offer end-to-end AI solutions and capture a larger share of the market.

d. Innovation and R&D

- Investment in R&D: TCS continues to invest in R&D to develop cutting-edge AI and digital solutions, ensuring it remains at the forefront of technological innovation.

4. Key Risks

a. Legal and Regulatory Risks

- Ongoing Litigation: The outcome of the DXC Technology case could result in additional financial liabilities or reputational damage.

- Compliance Issues: Regulatory challenges in international markets (e.g., Saudi Arabia) could lead to penalties or operational disruptions.

b. Financial Risks

- Capital Intensity: The HyperVault project requires significant capital investment, which could strain TCS’s financial resources if not managed effectively.

- Debt Load: The use of debt to fund the project could increase TCS’s leverage and interest expenses.

c. Operational Risks

- Project Execution: Delays or failures in executing HyperVault projects could impact revenue projections and investor confidence.

- Supply Chain Disruptions: Global supply chain issues could affect the availability of critical components for data center construction.

d. Market Risks

- Demand Volatility: Fluctuations in demand for AI and IT services could impact TCS’s revenue growth.

- Competitive Disruption: New entrants or disruptive technologies could erode TCS’s market share.

e. Reputational Risks

- Public Perception: Any negative publicity related to legal issues or project failures could damage TCS’s brand and client relationships.

Conclusion

Tata Consultancy Services is well-positioned to capitalize on the global AI and digital transformation wave, particularly through its strategic investment in HyperVault and partnership with TPG. The company’s strong market position, global footprint, and innovation capabilities provide a solid foundation for growth. However, it must navigate legal challenges, regulatory scrutiny, and competitive pressures to fully realize its potential. With effective execution and strategic management, TCS has the opportunity to become a leading AI-led technology services company and deliver long-term value to its stakeholders.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.