TCIEXP

Equity Metrics

January 13, 2026

TCI Express Limited

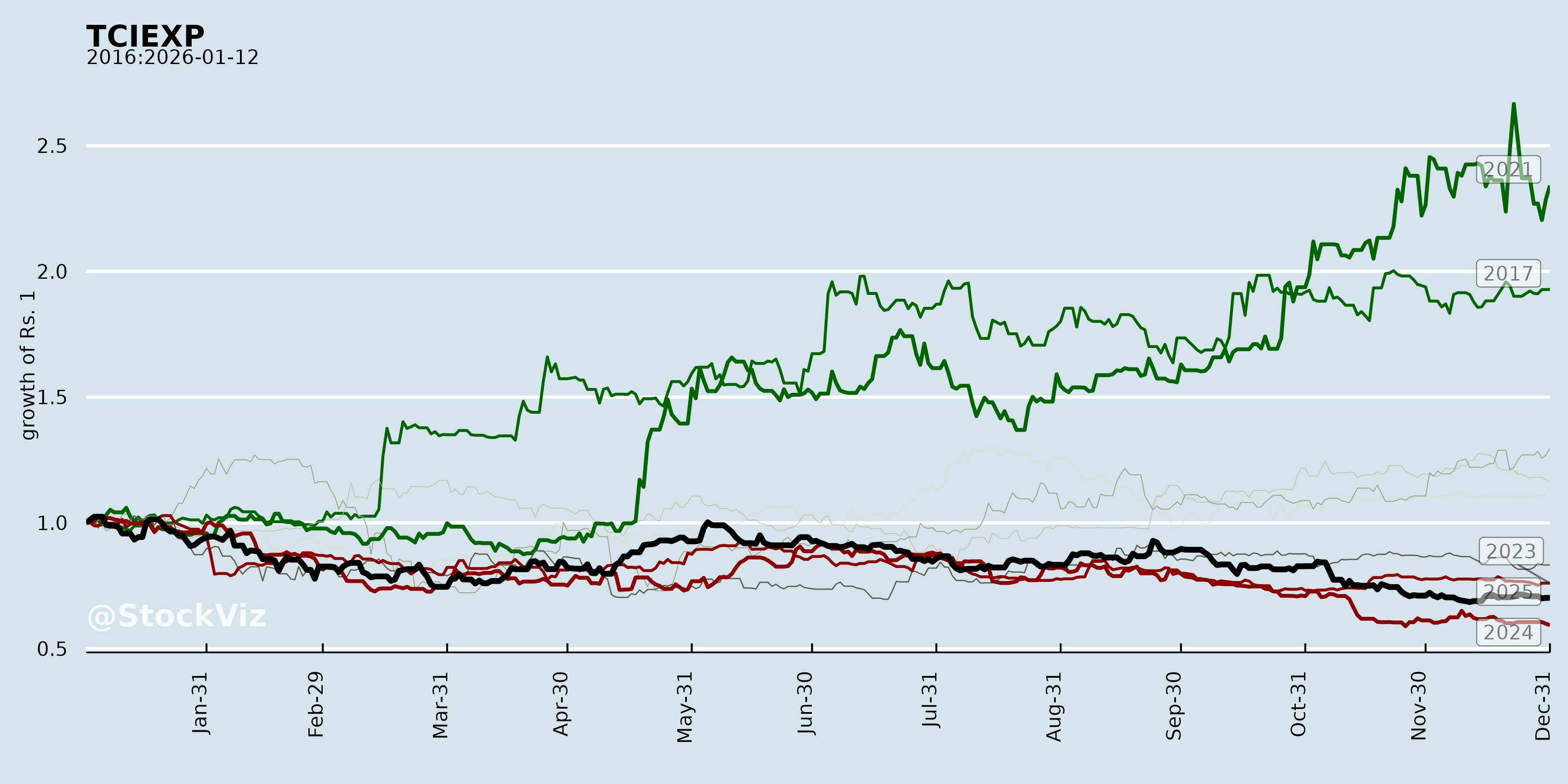

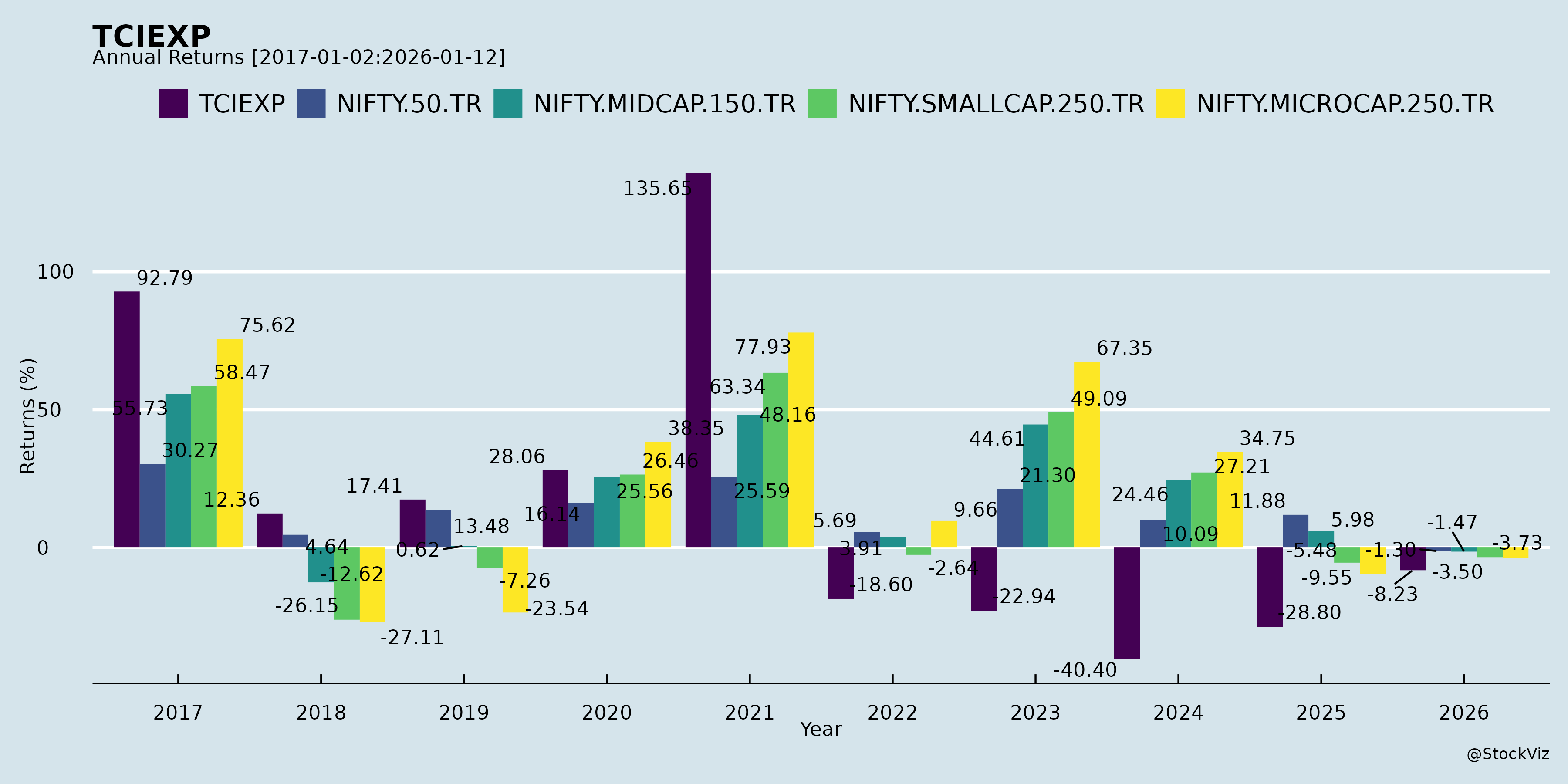

Annual Returns

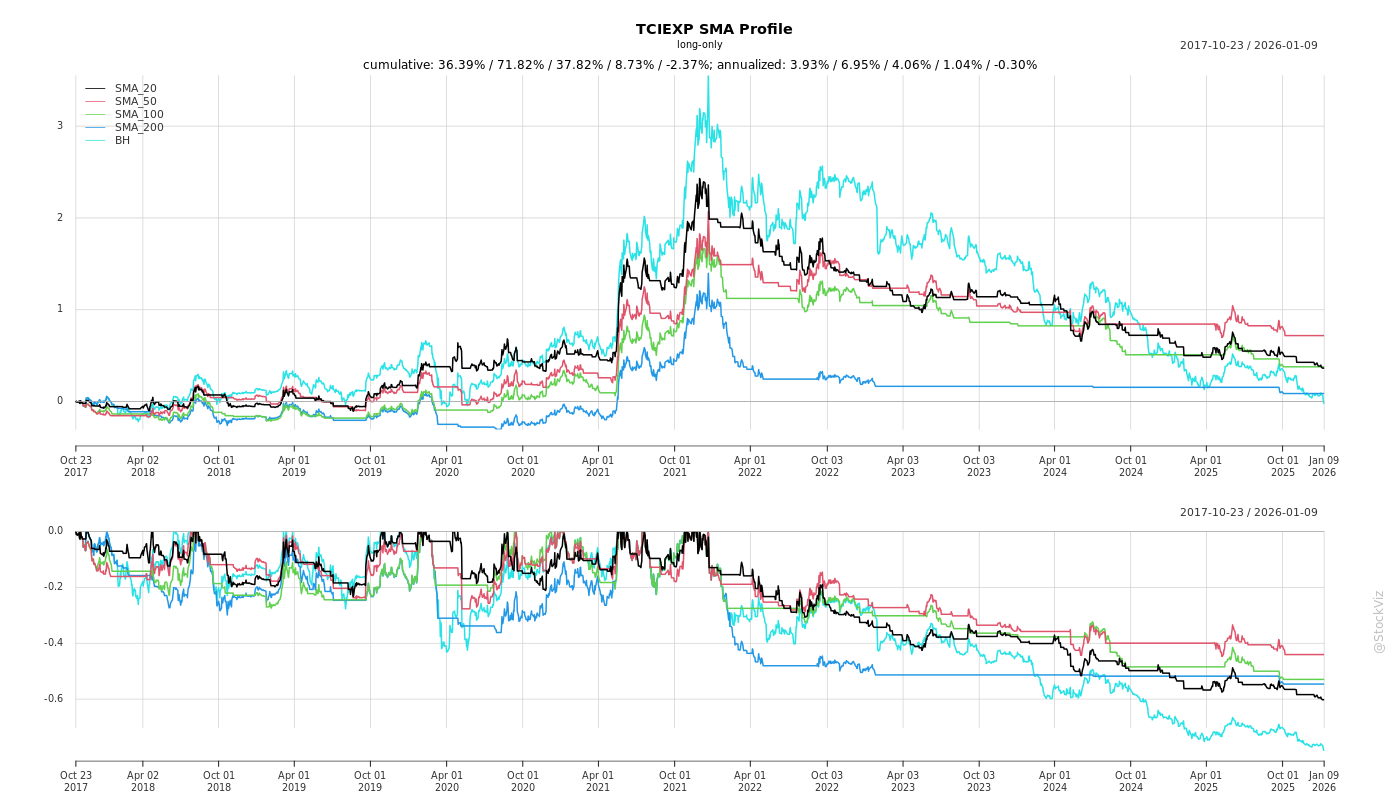

Cumulative Returns and Drawdowns

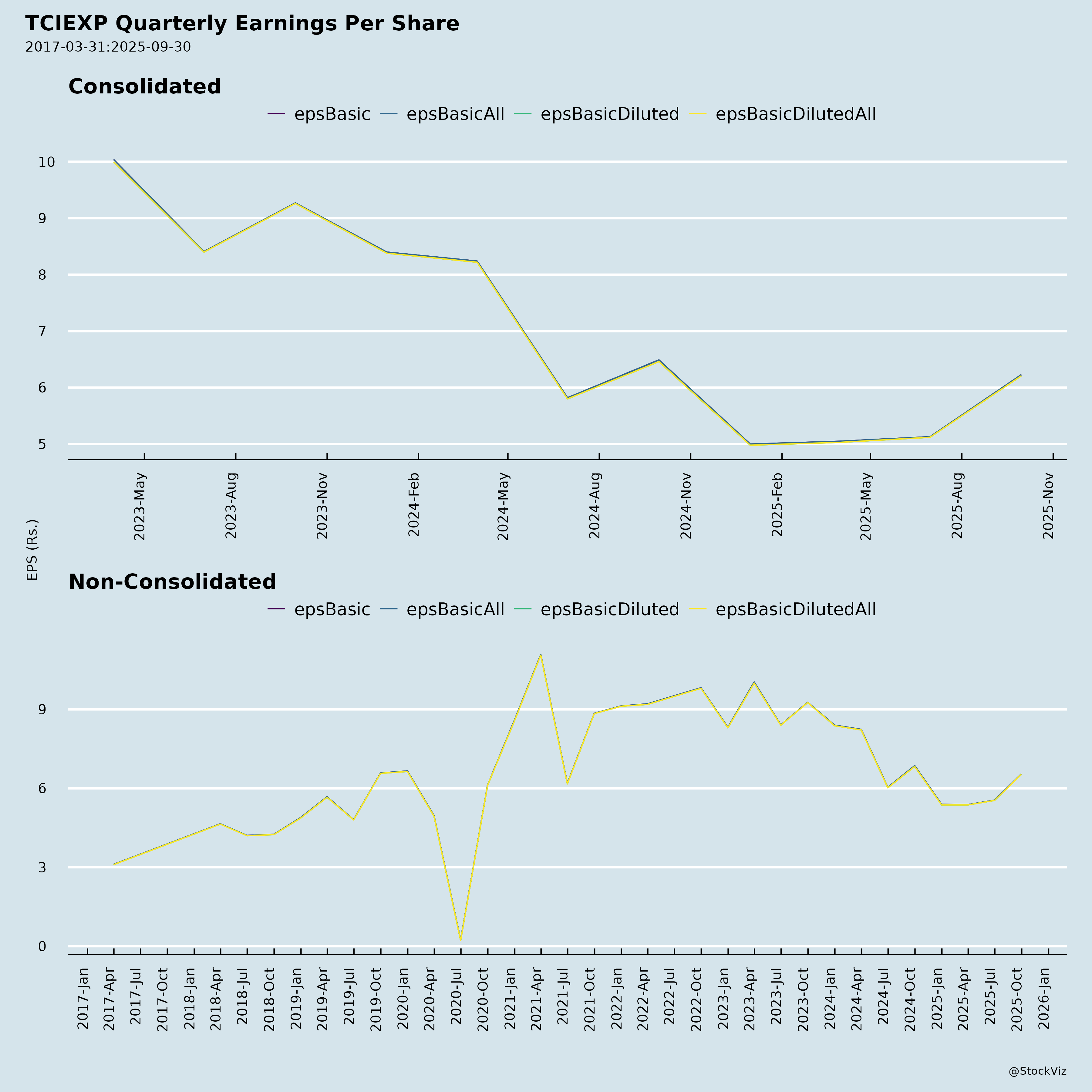

Fundamentals

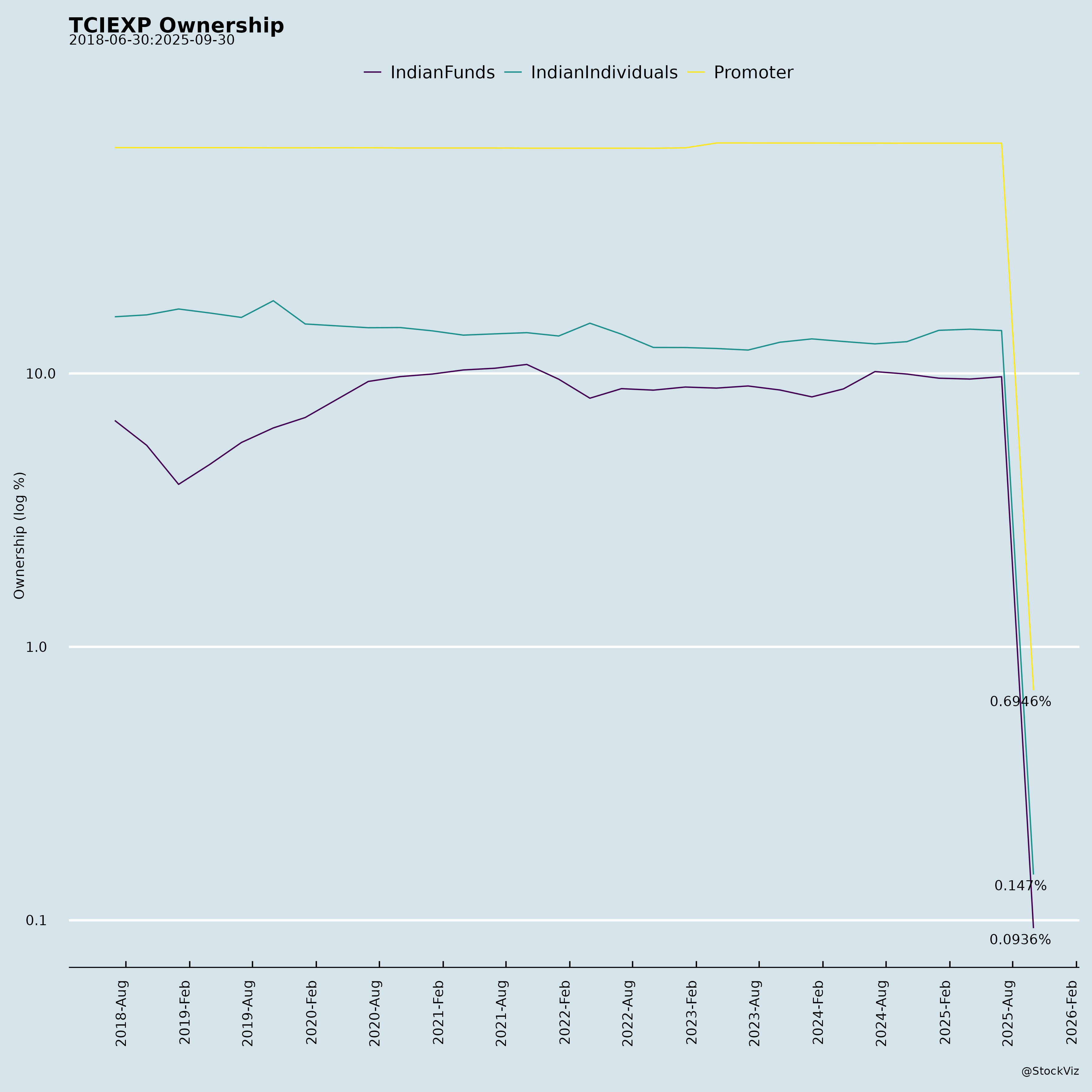

Ownership

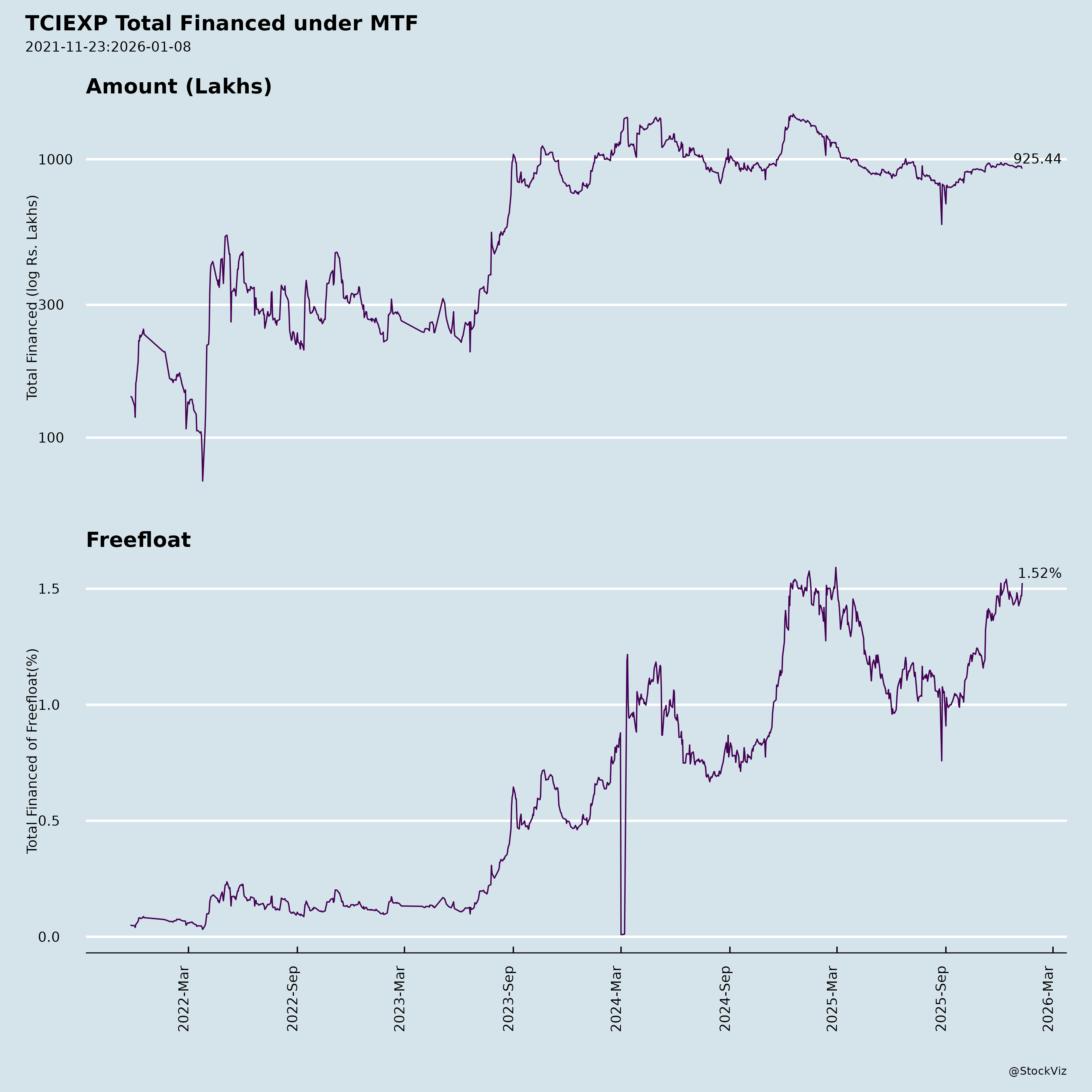

Margined

AI Summary

asof: 2025-11-27

TCI Express Limited (TCIEXP) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

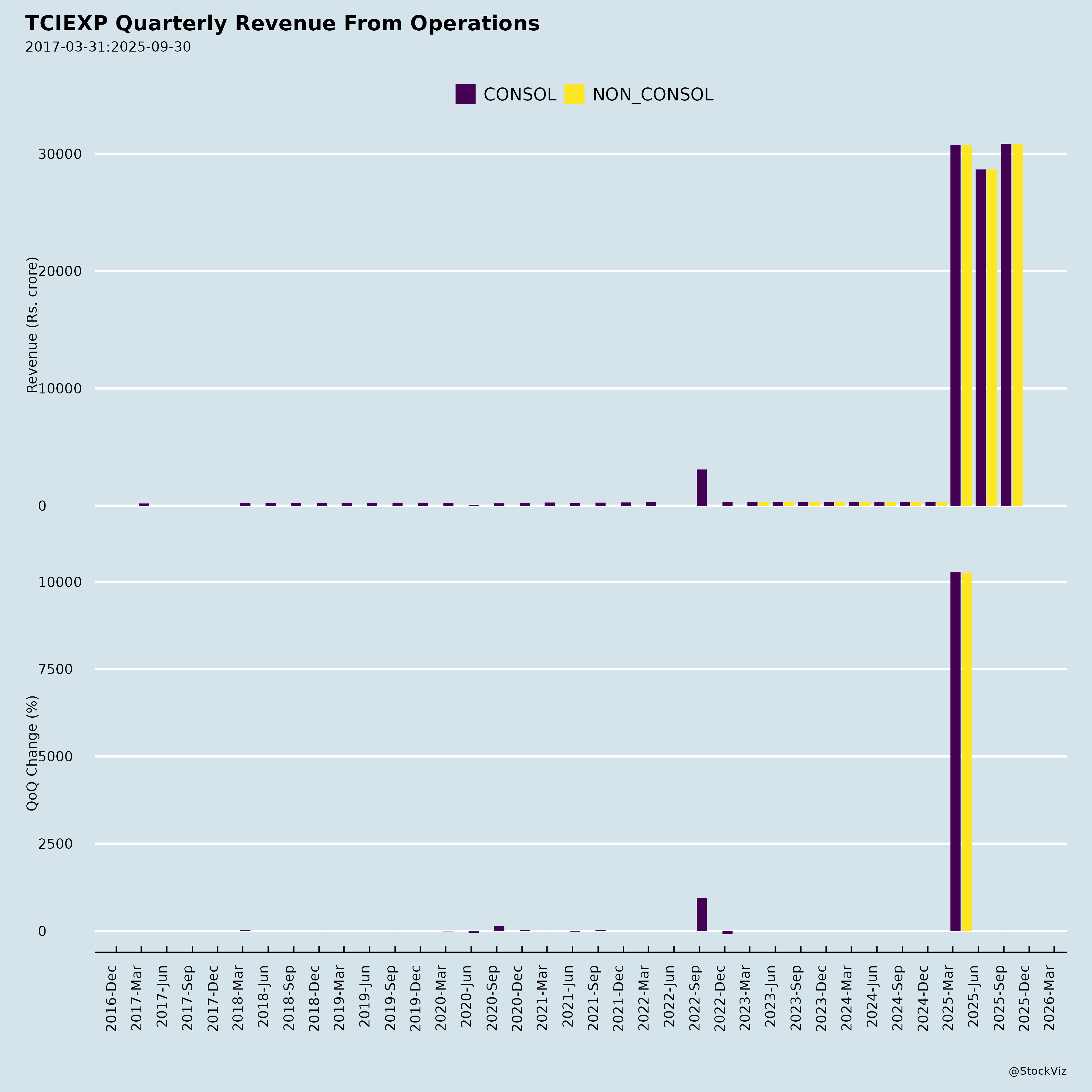

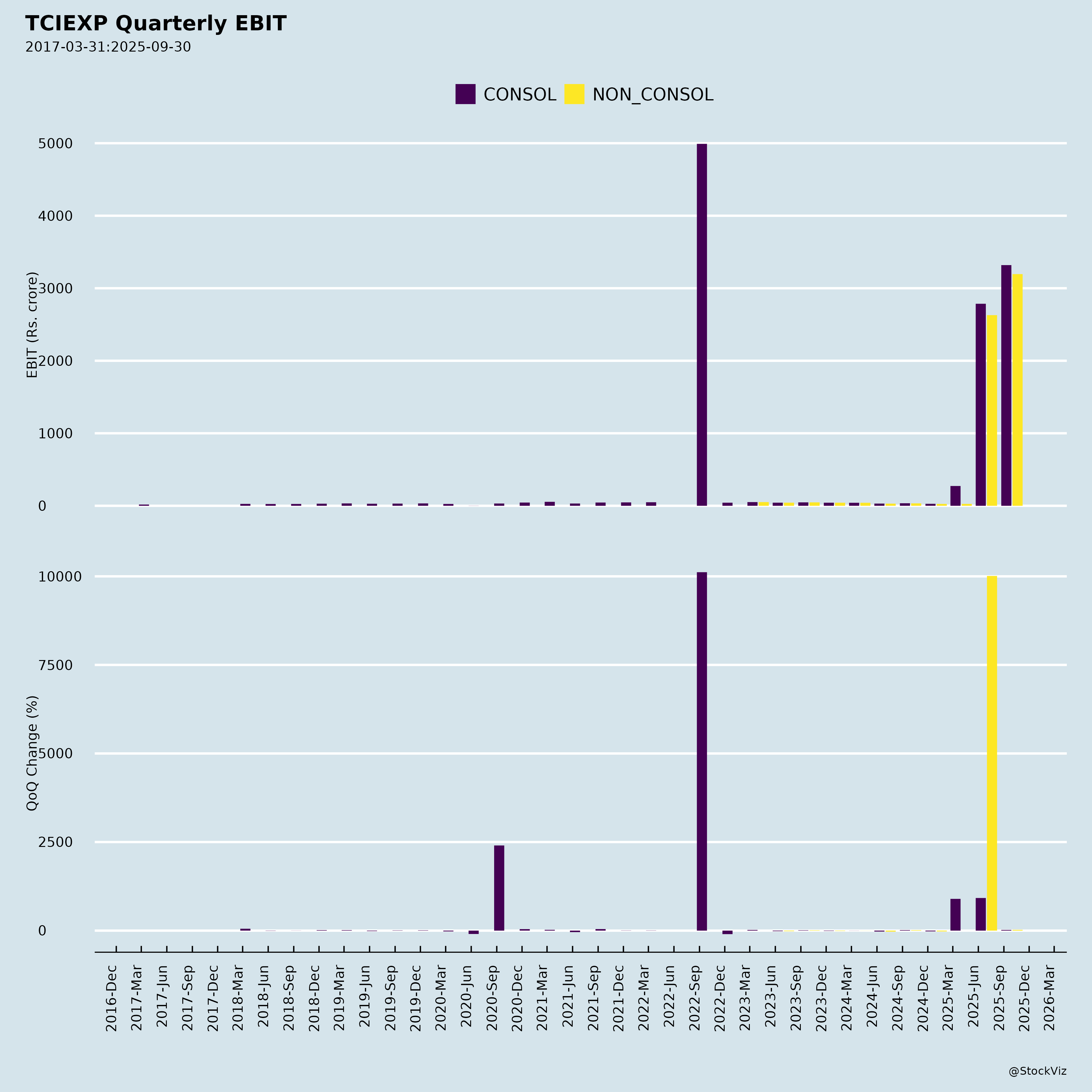

Overview: TCI Express, a leading asset-light B2B express logistics player in India (listed on BSE/NSE, scrip: 540212/TCIEXP), reported flattish Q2/H1 FY26 results amid macro headwinds. Q2 income was Rs 312 Cr (flat YoY, +7.5% QoQ), EBITDA Rs 39 Cr (12.4% margin, -50 bps YoY), PAT Rs 25 Cr (8.1%). H1 volumes flat at ~4.82 lakh tons; non-surface segments (Rail/Air/C2C ~18% revenue) grew robustly. Management guides 8-10% FY26 volume/revenue growth, with margins recovering to 12.5-13% in H2 (target 15%+ long-term). Debt-free balance sheet (net cash Rs 148 Cr), capex Rs 28 Cr in H1 (automation/network).

Headwinds (Near-Term Pressures)

- Volume/Revenue Stagnation: Flat YoY tonnage/revenue due to GST rate cuts/system realignments (paused manufacturing supplies in Sep), MSME slowdown, and weakness in paper/plastics/industrials. Surface Express (82% revenue) declined 4-5% YoY; spillover into Oct.

- Margin Compression: EBITDA margin dipped to 12% (H1) from 12.5% YoY due to network expansion costs, higher air freight rates (+150 bps), toll/labor inflation, and truck utilization drop to 83.5% (from 85-86%).

- Macro/Industrial Weakness: Low PMI (subdued manufacturing), global trade headwinds (US tariffs), and festive timing mismatch (Diwali mid-Oct vs. late Oct last year) impacted demand.

- Surface Segment Drag: Core B2B business (retail/auto/pharma) underperformed vs. industry (9-10% growth); temporary GST shift to faster modes (Rail/Air).

Tailwinds (Supportive Factors)

- Diversified Non-Core Growth: Rail +25% YoY (25 new branches, appointment deliveries), Intl Air +40% (new carrier space), C2C +15% (new clients/regional teams), Domestic Air strong. Non-surface now 18% revenue (up from prior).

- Operational Efficiencies: New 3x larger Mumbai sorting center operational; automation (Gurugram/Pune) cut turnaround 40-50%; Zoho CRM rollout for visibility. Stable direct costs/gross margins.

- Strong Balance Sheet/Network: Debt-free, Rs 150 Cr liquidity, efficient WC (net 20 days). Added 35 branches H1 (10 Surface, 25 Rail); 970+ branches, 60k locations.

- Festive/Macro Recovery: MSME/lifestyle/garments pickup; Oct-Nov combined high single-digit growth visible; GST boost expected.

Growth Prospects (Medium-Term Opportunities)

- Volume/Revenue Guidance: 8-10% FY26 growth (higher single-digit Q3/Q4); non-surface to 20-22% revenue in 2-3 years via 200 dedicated sales teams.

- Multimodal/Vertical Expansion: Rail/Air/C2C/Pharma Cold Chain scaling; new verticals (Defense/EV/Solar/Home Furnishings/Paint). B2C target Rs 100 Cr in 2 years (D2C focus, Flipkart talks).

- Infra/Tech Investments: Rs 170 Cr remaining capex (automation in Kolkata/Ahmedabad by mid-FY27); 60-80 branches FY26-end. Singapore expansion (acq. TCI Global Pte for SGD 18k; SGD 5M guarantee).

- Industry Tailwinds: Logistics mkt to grow 8.8% CAGR (infra: Bharatmala/DFCs/airports); organized shift, PLI schemes, green H2/e-EVs. TCI’s asset-light model positions for 10-12% volume-led margin expansion to 15%+.

- Long-Term: Target top-25 World Bank LPI; ESG focus (solar/EV fleet, IMS cert).

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Demand/Cyclical | Prolonged MSME/industrial slowdown (PMI weakness); festive miss. | Diversification (non-surface 20%+), new verticals/eastern focus. |

| Cost/Operational | Fuel/toll (+ toll hikes), air rates, labor; utilization <85%. | Automation, milk runs/AI routing; stable WC discipline. |

| Competition | Surface pricing pressure (undercutting); B2C margins. | Premium B2B focus (high-value cargo); owned branches/no franchise. |

| Execution | Capex delays (automation/branches); integration post-Singapore acq. | Phased rollout; strong mgmt track record (ROCE 9-12%). |

| Regulatory/External | GST volatility, forex/geopolitics (intl 2% revenue), oil prices. | Hedging, debt-free buffer; minimal intl exposure. |

| Financial | Margin dilution from expansion (new services similar margins but ramp-up costs). | Guides H2 recovery; cash gen Rs 20 Cr H1. |

Summary: TCIEXP faces near-term headwinds from GST/MSME slowdown dragging Surface (flat topline, 12% EBITDA), but tailwinds from multimodal growth (Rail/Air/C2C) and ops leverage support recovery. Growth prospects strong (10%+ FY26, 20%+ non-core mix) via network/tech/verticals, backed by pristine BS. Risks tilted cyclical/executional but mitigated by asset-light model/debt-free status. Investment View: Resilient play in growing logistics; buy on dips for 15%+ margin potential. (Valuation context: Trades at ~25-30x FY26 EPS est.; peers at 20-40x.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.