SWIGGY

Equity Metrics

January 13, 2026

Swiggy Limited

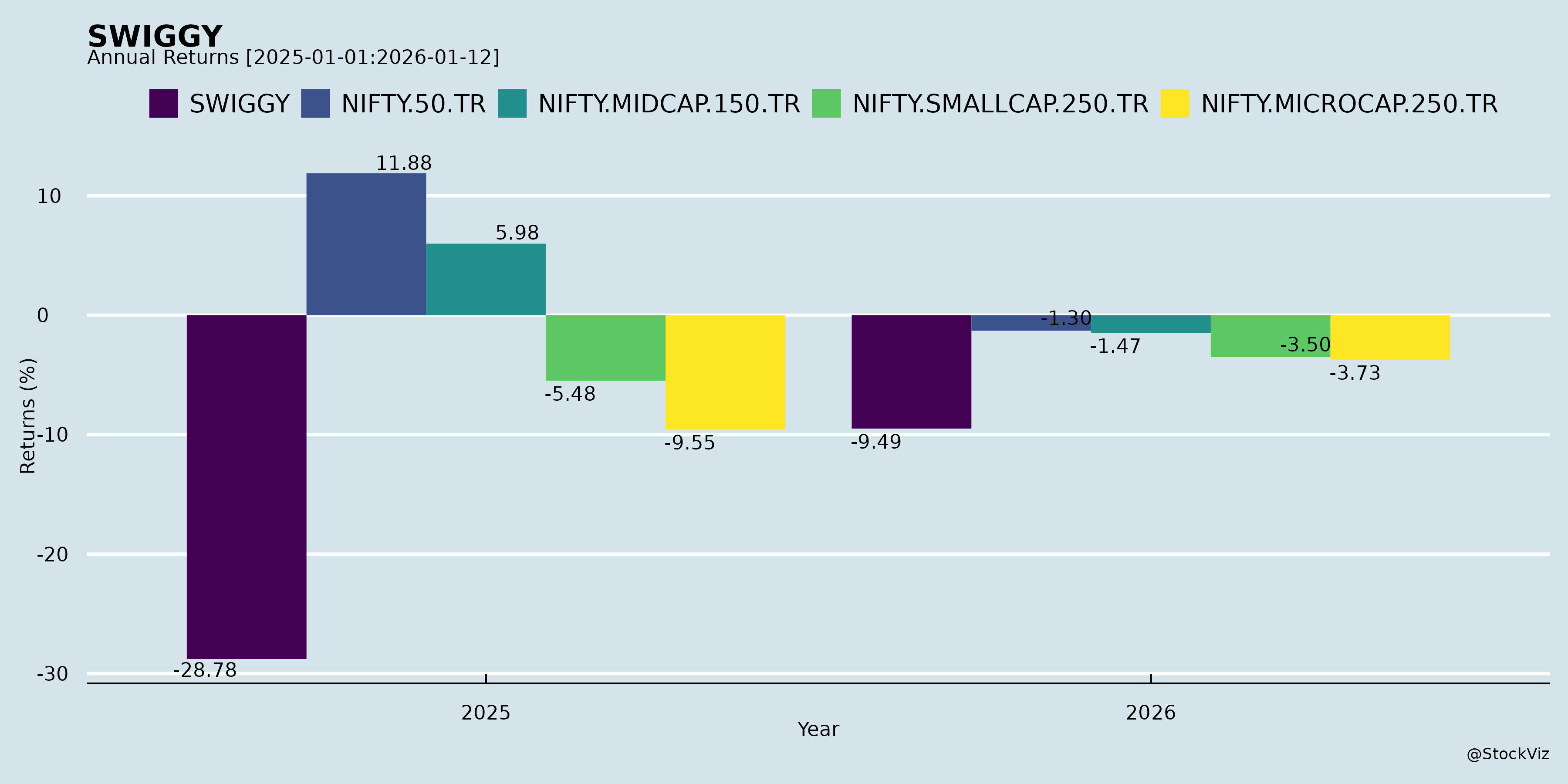

Annual Returns

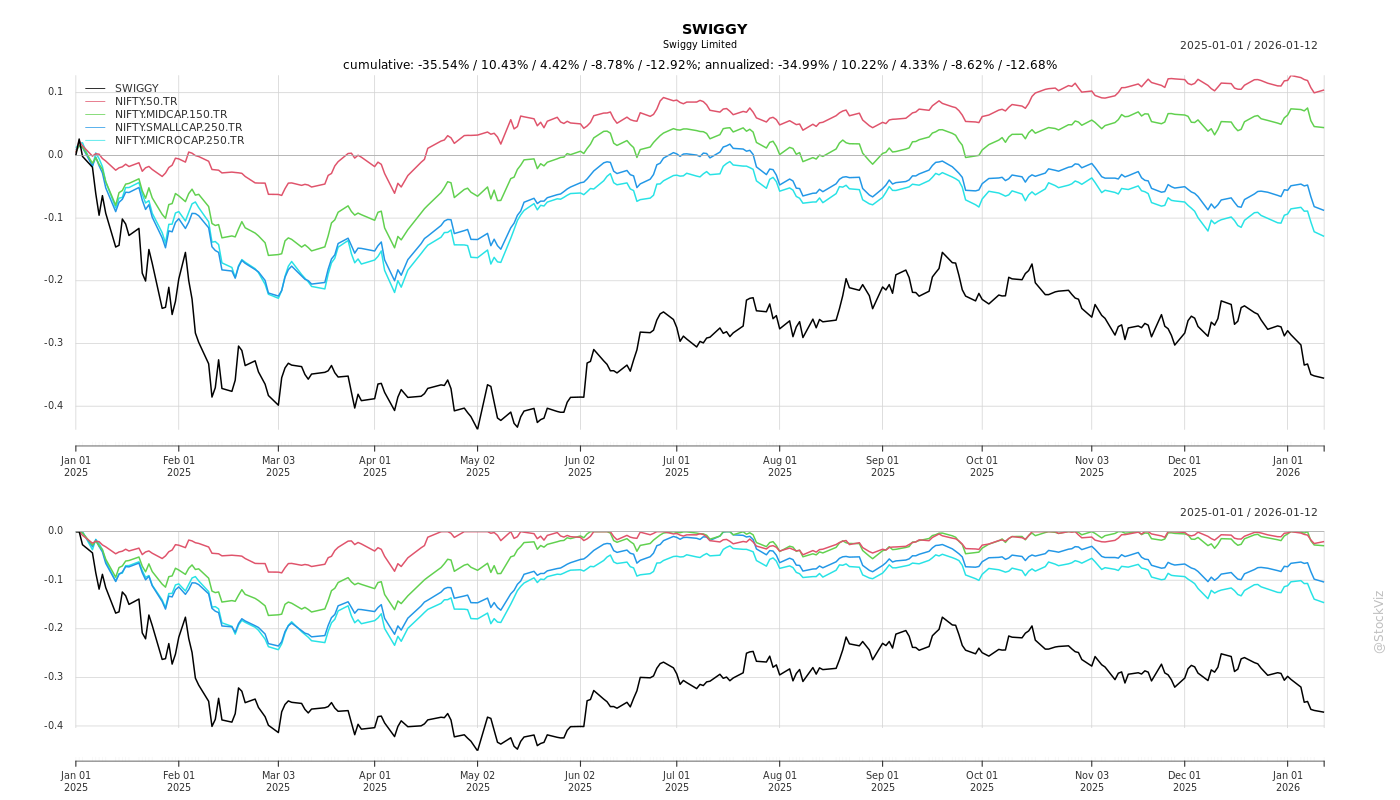

Cumulative Returns and Drawdowns

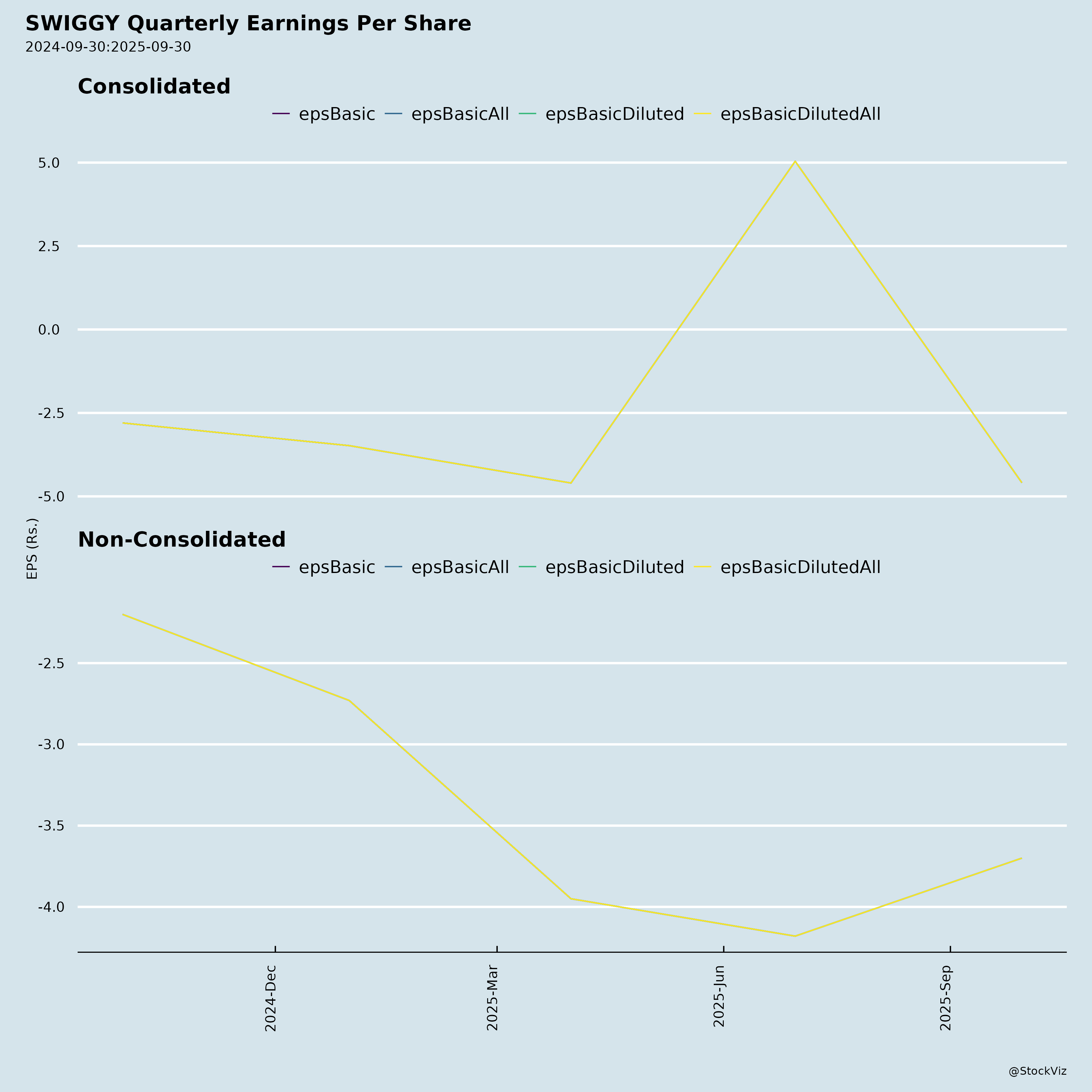

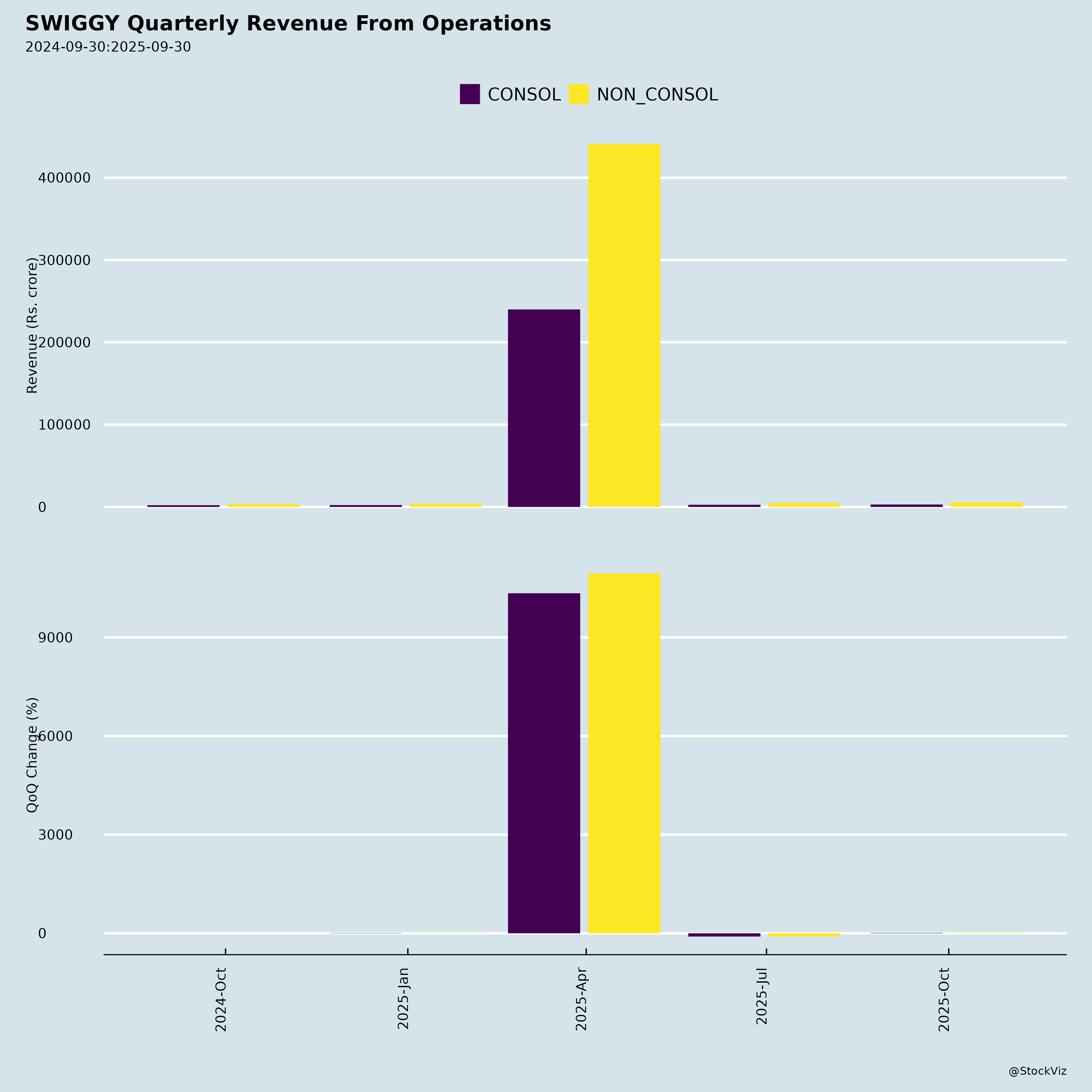

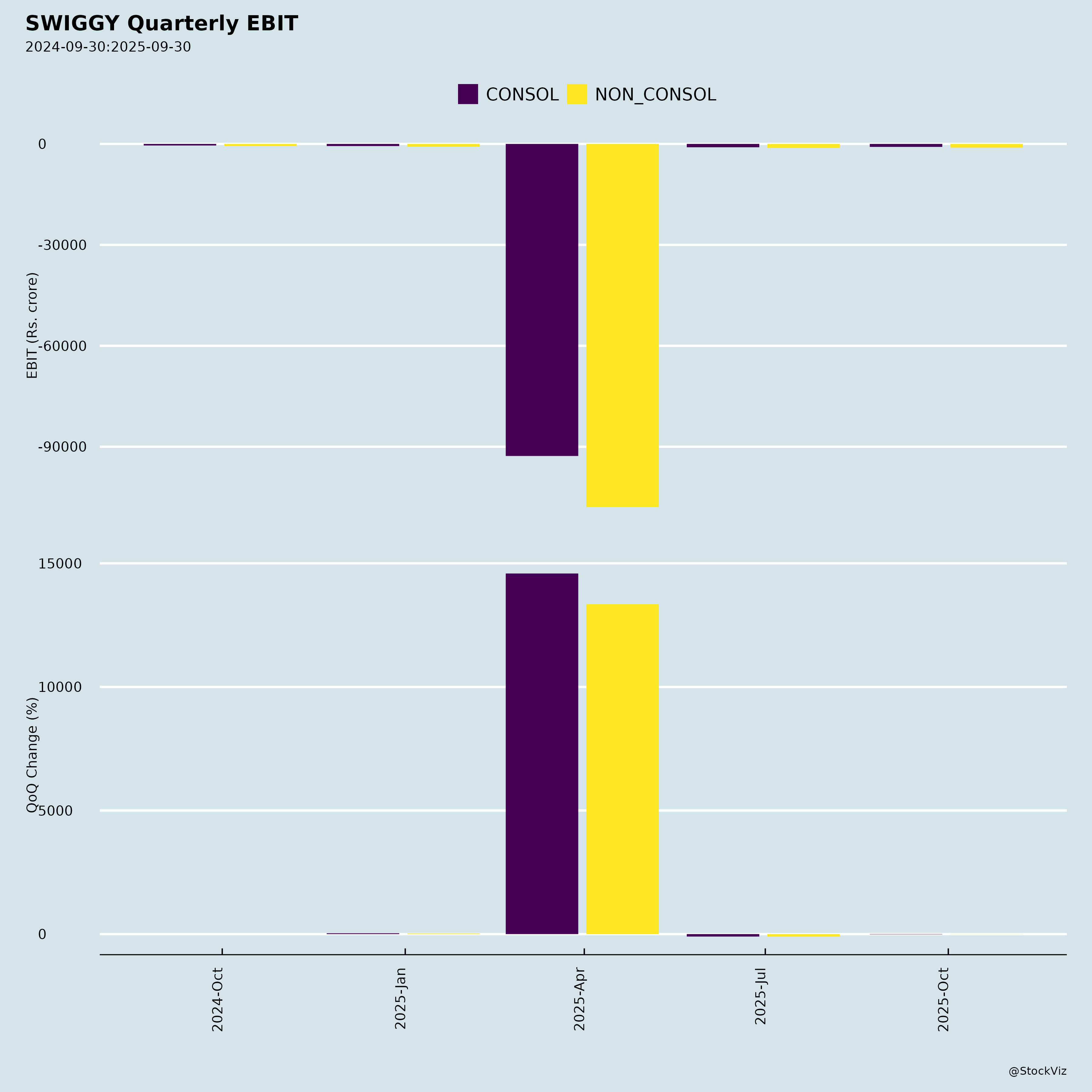

Fundamentals

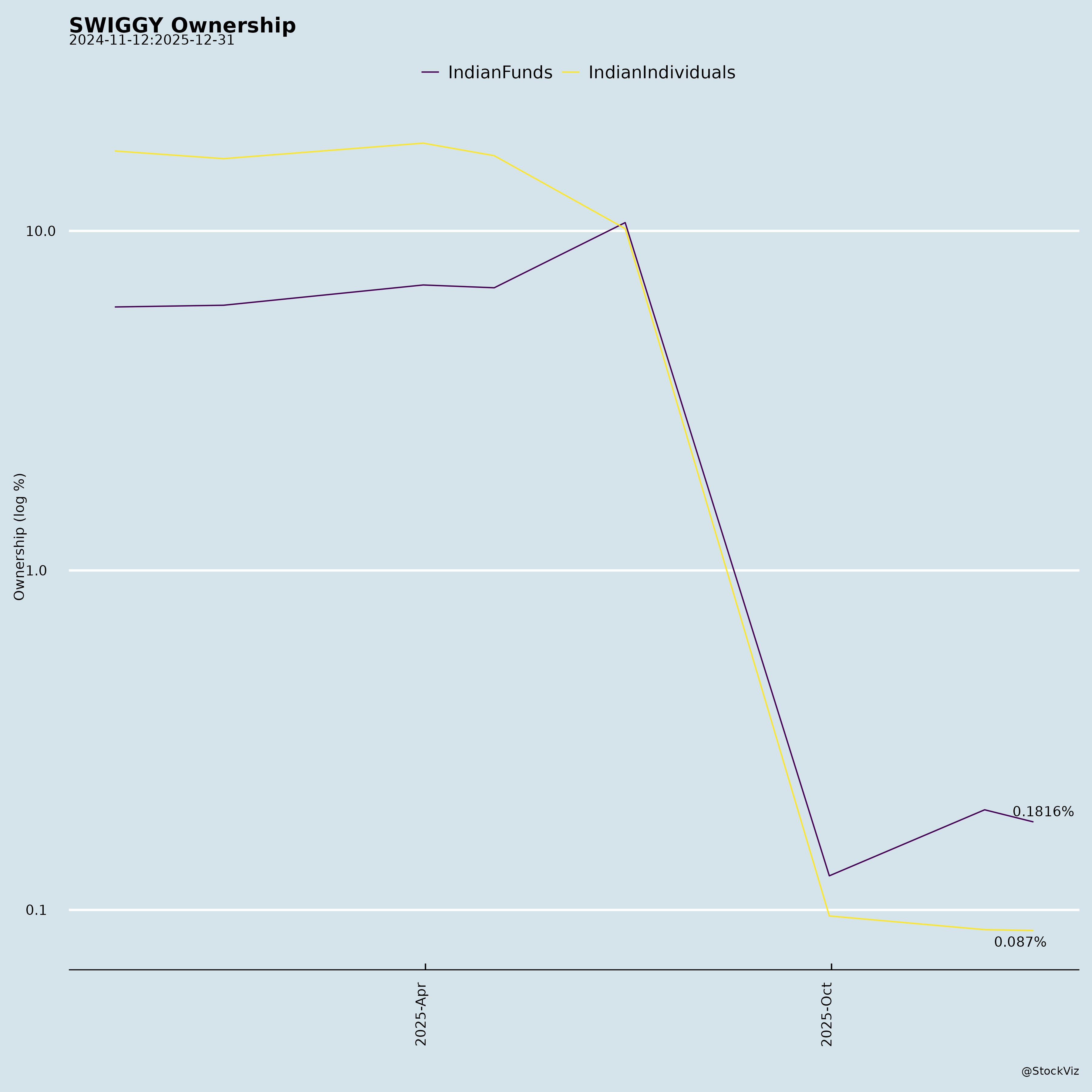

Ownership

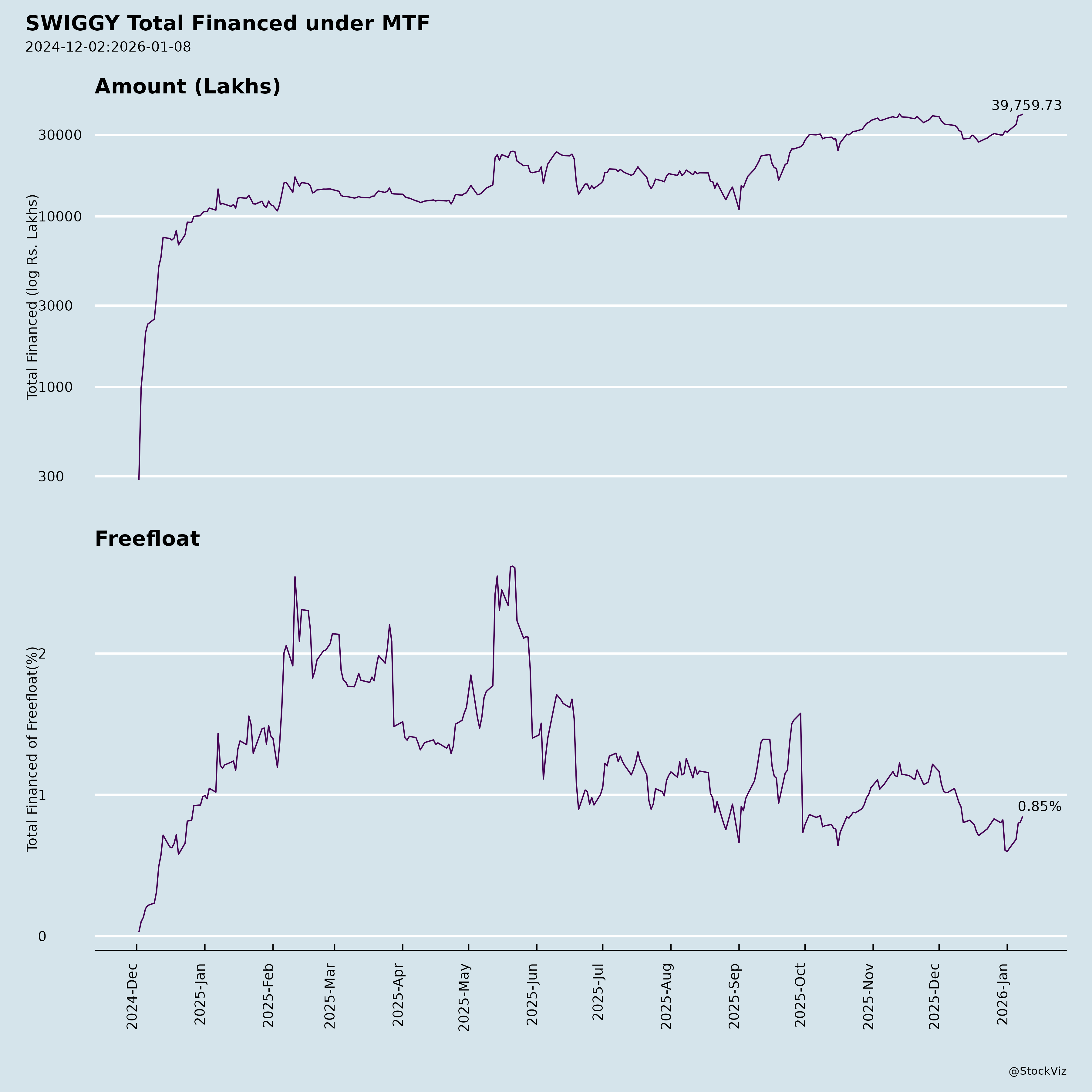

Margined

AI Summary

asof: 2025-12-03

Analysis of Swiggy Limited (SWIGGY.NS): Headwinds, Tailwinds, Growth Prospects, and Key Risks

Swiggy, India’s leading on-demand convenience platform (food delivery, quick commerce via Instamart, out-of-home dining), reported robust Q2FY26 results amid a competitive landscape. Platform B2C GOV grew 48% YoY to ₹16,683 Cr, with consolidated Adjusted EBITDA loss narrowing to ₹695 Cr (QoQ improvement of ₹118 Cr). Food Delivery remains profitable (₹240 Cr Adj EBITDA), while Instamart drives hyper-growth but high losses. The company plans a ₹10,000 Cr QIP to fuel expansion, signaling confidence despite cash burn.

Tailwinds

- Quick Commerce Momentum (Instamart): Triple-digit GOV growth (108% YoY to ₹7,022 Cr; 24% QoQ), fueled by 40% YoY AOV rise to ₹697 (via Maxxsaver basket-building and non-grocery expansion like “Quick India Movement”). Network scaled to 1,102 darkstores (128 cities, 4.6 Mn sq ft), with contribution margins improving 200 bps QoQ to -2.6%. Operating leverage from larger “Megapods” (2x throughput) and ~50% store capacity utilization.

- Food Delivery Profit Engine: Steady 18.8% YoY GOV growth (₹8,542 Cr), MTU +17% YoY, Adj EBITDA margin at 2.8% (+125 bps YoY). New use cases (Bolt 10-min delivery in 700+ cities, 99-store, Deskeats) reactivate users from 125 Mn+ ETV base (MTU only 13%).

- Platform Synergies: 36% users adopt multiple services (up from 30.5% YoY), driving MTU to 22.9 Mn (+34% YoY). Cross-pollination across 720+ cities boosts network effects.

- Out-of-Home Profitability: 52% YoY GOV growth, Adj EBITDA positive at 0.5% of GOV for 3 quarters.

- Financial Discipline: Cash burn halved QoQ to ₹749 Cr; closing cash ~₹7,005 Cr proforma (incl. ₹2,400 Cr Rapido stake sale). Path to group profitability via leverage (e.g., Food Delivery Adj EBITDA margin to 2.8%).

- Regulatory Clarity: No material CoSS impact; proactive welfare (insurance, skills programs) for delivery partners.

- Capital Access: Board-approved ₹10,000 Cr QIP (EGM Dec 8, 2025) for flexibility amid competition.

Headwinds

- Quick Commerce Losses: Adj EBITDA loss of ₹849 Cr (-12.1% of GOV), though improving from -15.8% QoQ. High capex (darkstores) and incentives pressure margins; below-contribution costs at 9.5% of GOV.

- Competitive Intensity: Dynamic sector with rivals (e.g., Zomato/Blinkit) attracting investments; Swiggy notes “external competitive environment” necessitating QIP.

- Cash Burn & Funding Needs: Quarterly burn ~₹700-800 Cr despite reductions; QIP dilution risk (up to 10-15% equity, est. at current mkt cap ~₹1 Lk Cr).

- Macro Sensitivity: Urban consumer focus vulnerable to slowdowns in discretionary spending; affordability key (total fees 5-6% of AOV).

- Regulatory Scrutiny: CoSS rules pending (platform worker benefits); gig economy reforms could raise costs, though Swiggy claims readiness.

Growth Prospects

- Quick Commerce “Everything Store”: Triple-digit growth sustained via category expansion (20+ incl. non-grocery), wallet share gains (GOV/user +15% QoQ to ₹1,950/month), and 161% cohort retention in base quarter. Target: Profitable scale with levers like ads, AOV optimization, and leverage.

- Food Delivery Scale: 230-250 Mn online commerce users; Swiggy captures ~13% MTU penetration. Health curations, office meals to drive mid-teens M1U growth.

- B2C GOV Acceleration: Quick Commerce now 40%+ of mix (vs. Food Delivery’s steady 18-20% YoY); total B2C GOV +48% YoY, with 51% market share in food.

- New Verticals: Out-of-Home +50% YoY; Platform Innovations (Snacc, Toing) for niche touchpoints. Supply chain/value-added services for margins.

- Capital Infusion: ₹10,000 Cr QIP for darkstores, tech/cloud, marketing, M&A (25% max for corporate purposes). Rapido sale adds liquidity.

- 2030 Sustainability: EV fleet 7x growth, eco-saver (30 Mn+ low-emission deliveries), skills programs enhance ESG appeal.

- Long-Term: FY25-FY26 trajectory shows Food Delivery EBITDA-positive, Quick Commerce breakeven path; ROCE potential from low WC/capex.

| Segment | Q2FY26 GOV (₹ Cr) | YoY Growth | Adj EBITDA (₹ Cr) | Margin (% GOV) |

|---|---|---|---|---|

| Food Delivery | 8,542 | +18.8% | +240 | +2.8% |

| Instamart | 7,022 | +108% | -849 | -12.1% |

| Out-of-Home | ~1,119 (est.) | +52% | +6 | +0.5% |

| Total B2C | 16,683 | +48% | -695 | -4.2% (est.) |

Key Risks

- Execution Risk: Quick Commerce profitability hinges on AOV/basket growth and store utilization; delays could prolong losses.

- Competition: Intense rivalry may force incentive wars, eroding margins (e.g., delivery fees, discounts).

- Regulatory/Policy: CoSS implementation (social security for gig workers) or antitrust probes; forex/tax on QIP.

- Dilution & Valuation: QIP at discount (up to 5%) could pressure stock; mkt volatility impacts pricing.

- Operational: Delivery partner welfare strikes, supply chain disruptions, tech outages.

- Macro/Execution: Inflation, urban slowdowns hit GOV; over-expansion risks idle assets.

- Funding: QIP failure delays growth; debt repayment uses proceeds.

Summary

Bull Case (Tailwinds Dominant): Swiggy is pivoting to Quick Commerce (40%+ GOV mix) with improving economics, leveraging Food Delivery’s profitability and platform stickiness for 20-30%+ annual B2C GOV growth. QIP + Rapido sale funds hyper-scale; profitability by FY27 feasible. Target: ₹50-60k Cr FY27 GOV, EBITDA positive.

Bear Case (Headwinds Prevalent): Persistent Quick Commerce burn (~₹3,000 Cr annualized) amid competition drains cash; regulatory hits margins. QIP dilution caps upside.

Overall Outlook: Positive with Managed Risks. Strong execution (MTU/cross-sell), leverage path, and capital raise position Swiggy for market leadership. Near-term stock volatility from QIP/competition; long-term 2-3x potential on quick commerce TAM (₹10 Lk Cr+ by 2030). Monitor Q2FY27 margins and CoSS rules. Recommendation: Accumulate on dips (current P/S ~2x FY26 est.).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.