E-Retail/ E-Commerce

Industry Metrics

January 13, 2026

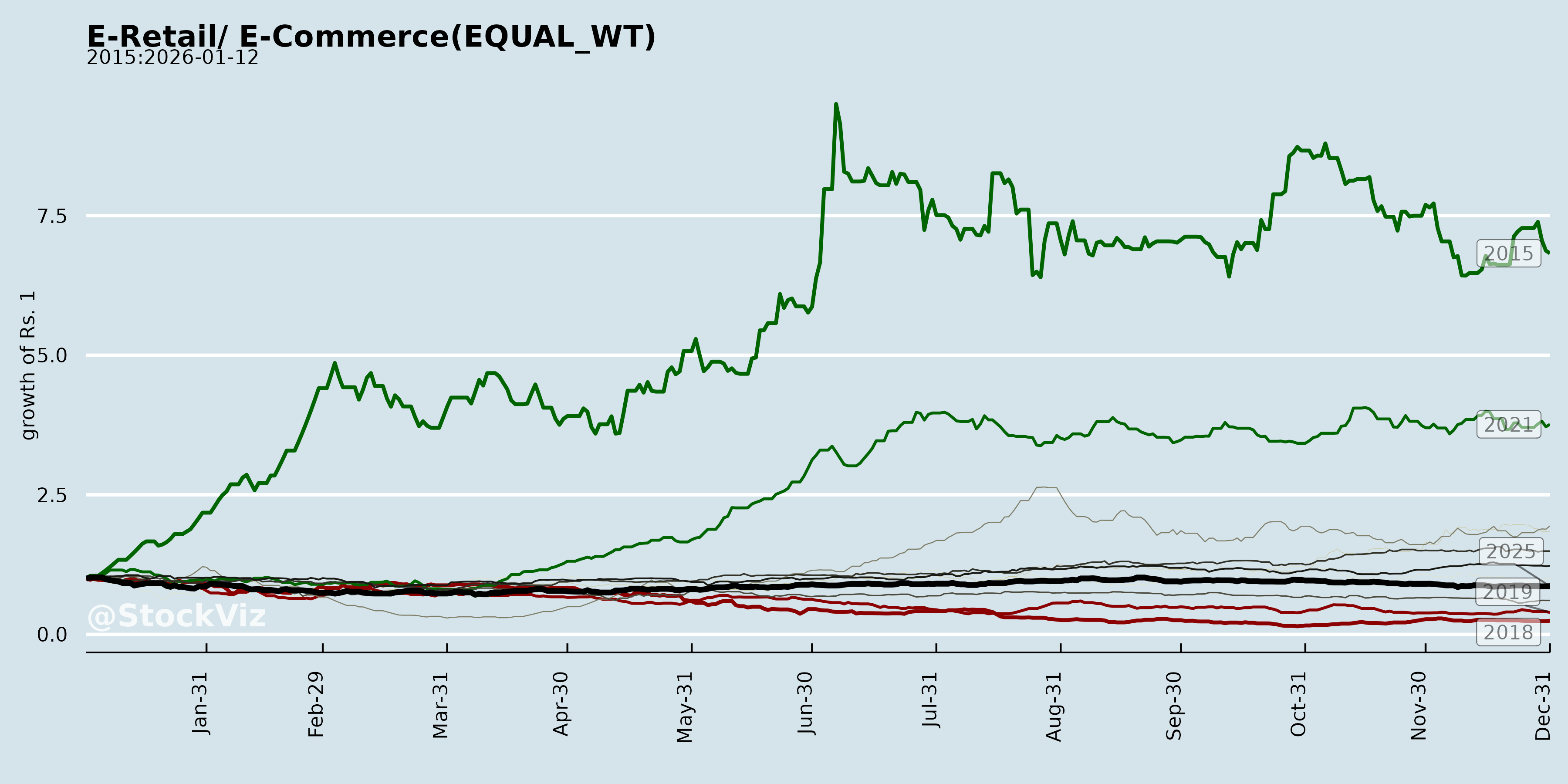

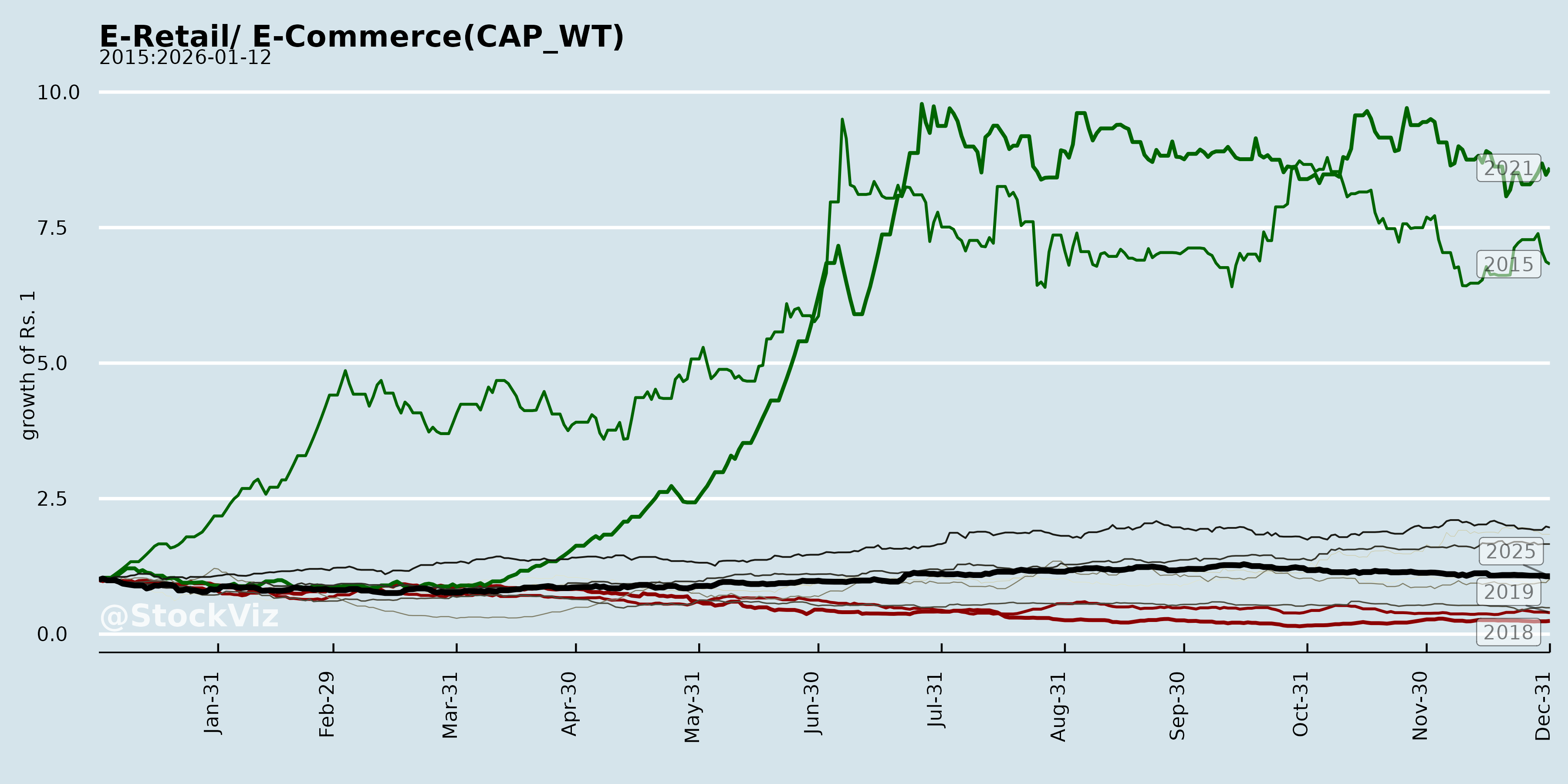

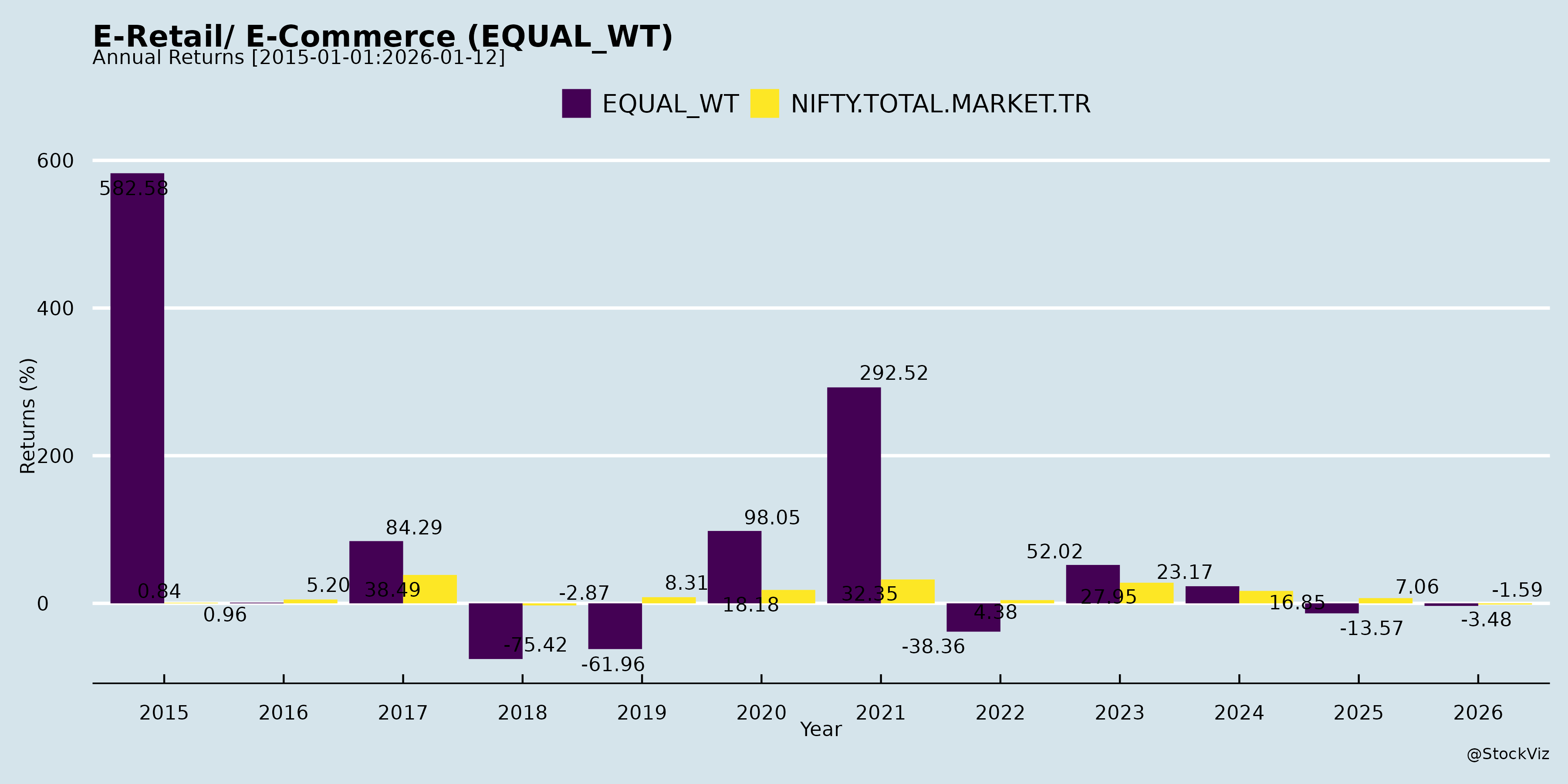

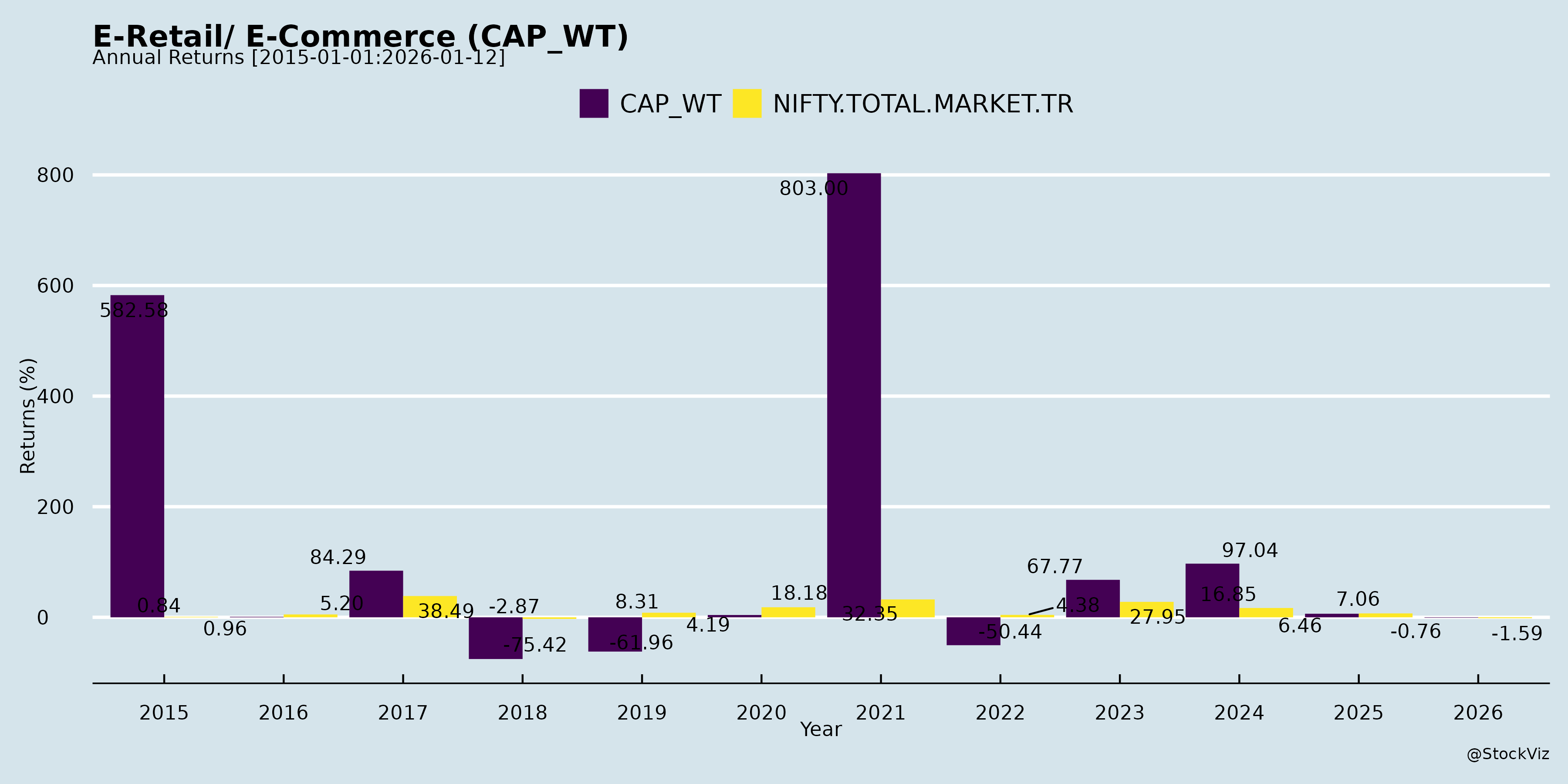

Annual Returns

Cumulative Returns and Drawdowns

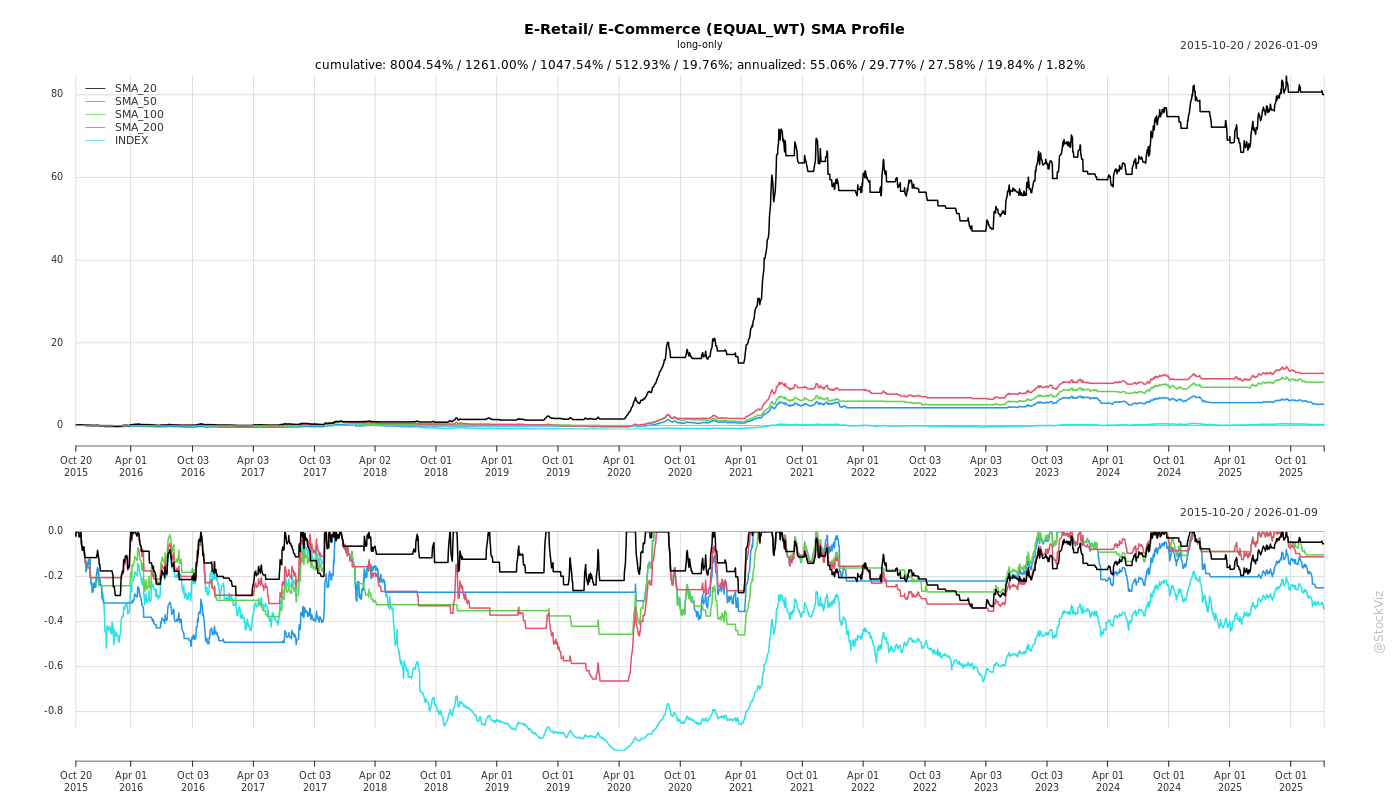

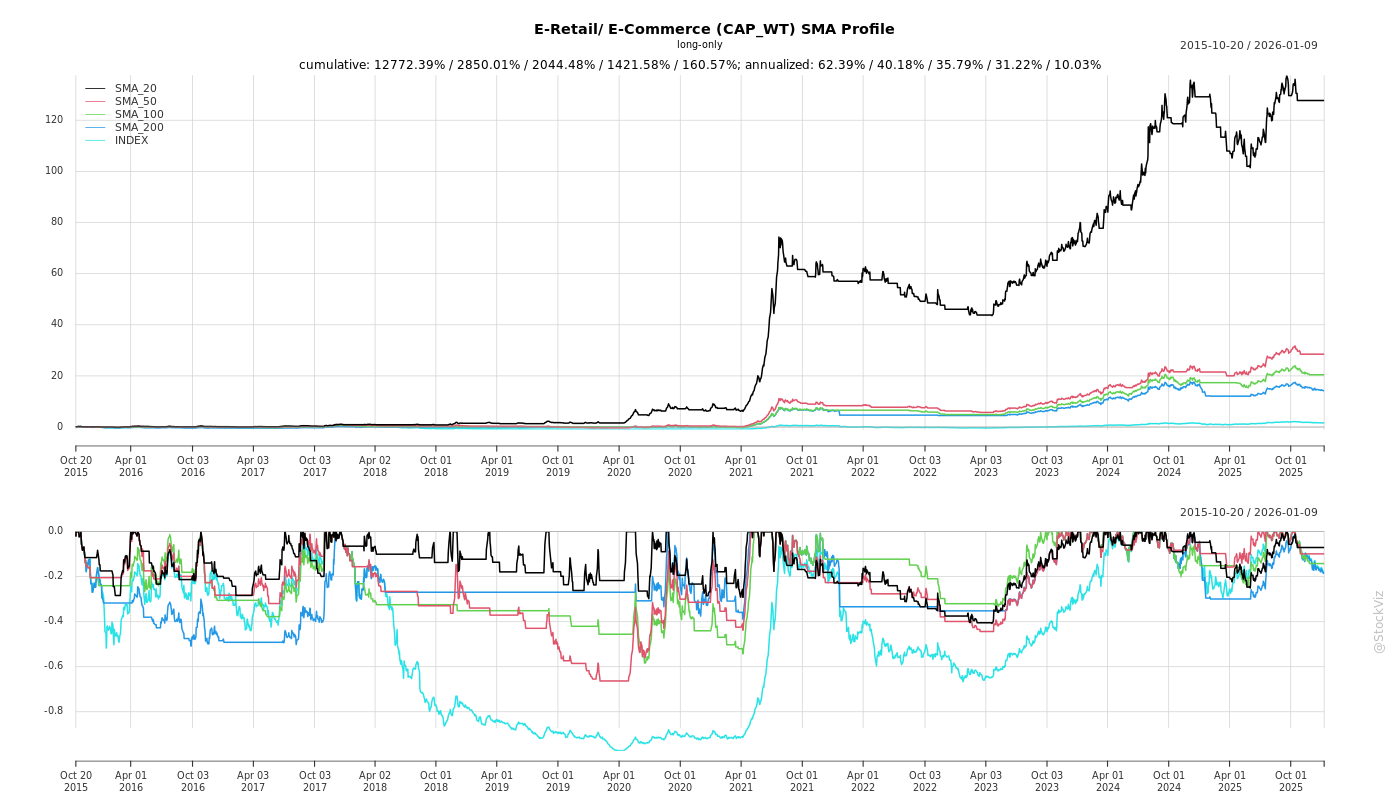

SMA Scenarios

Current Distance from SMA

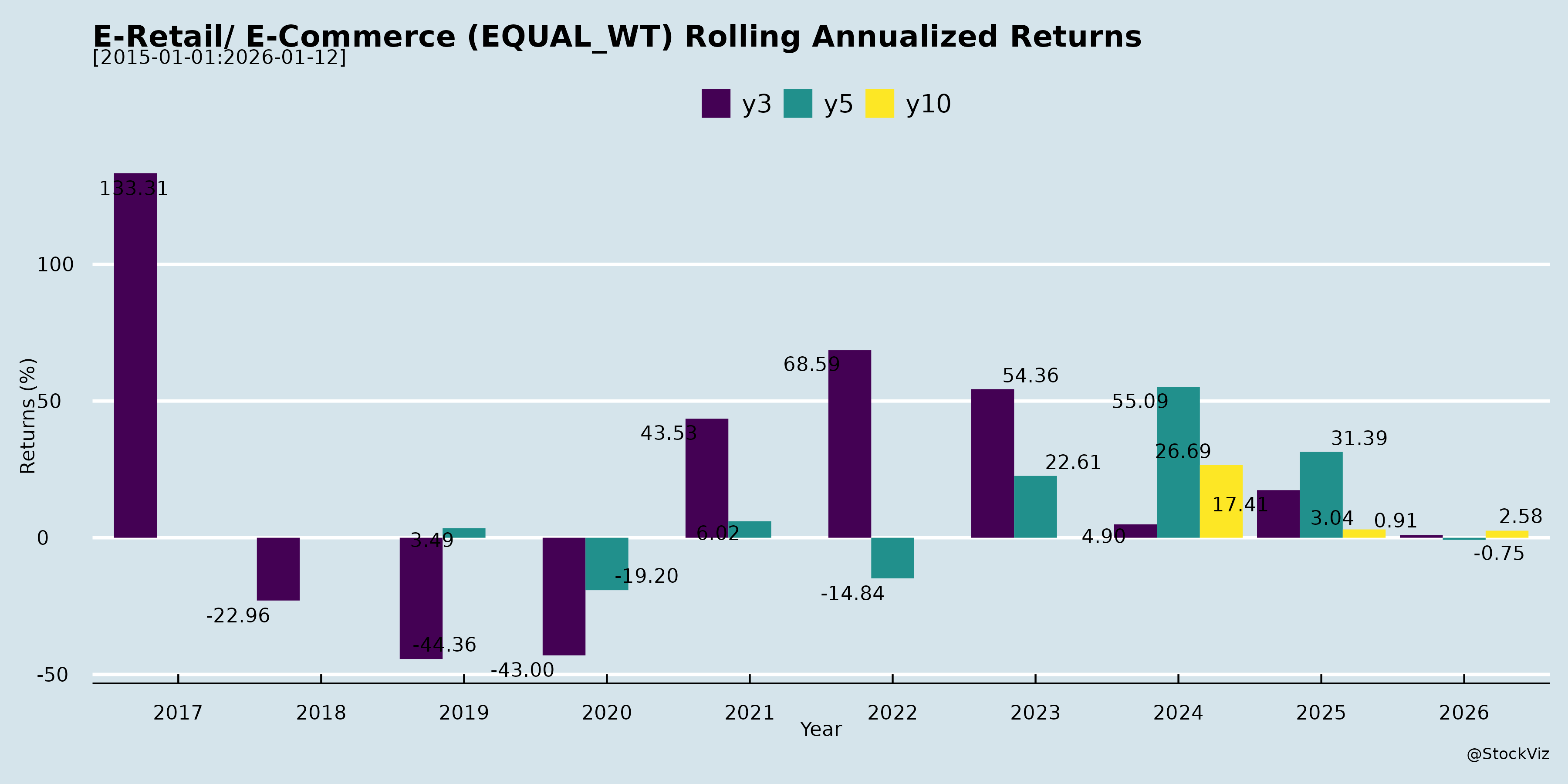

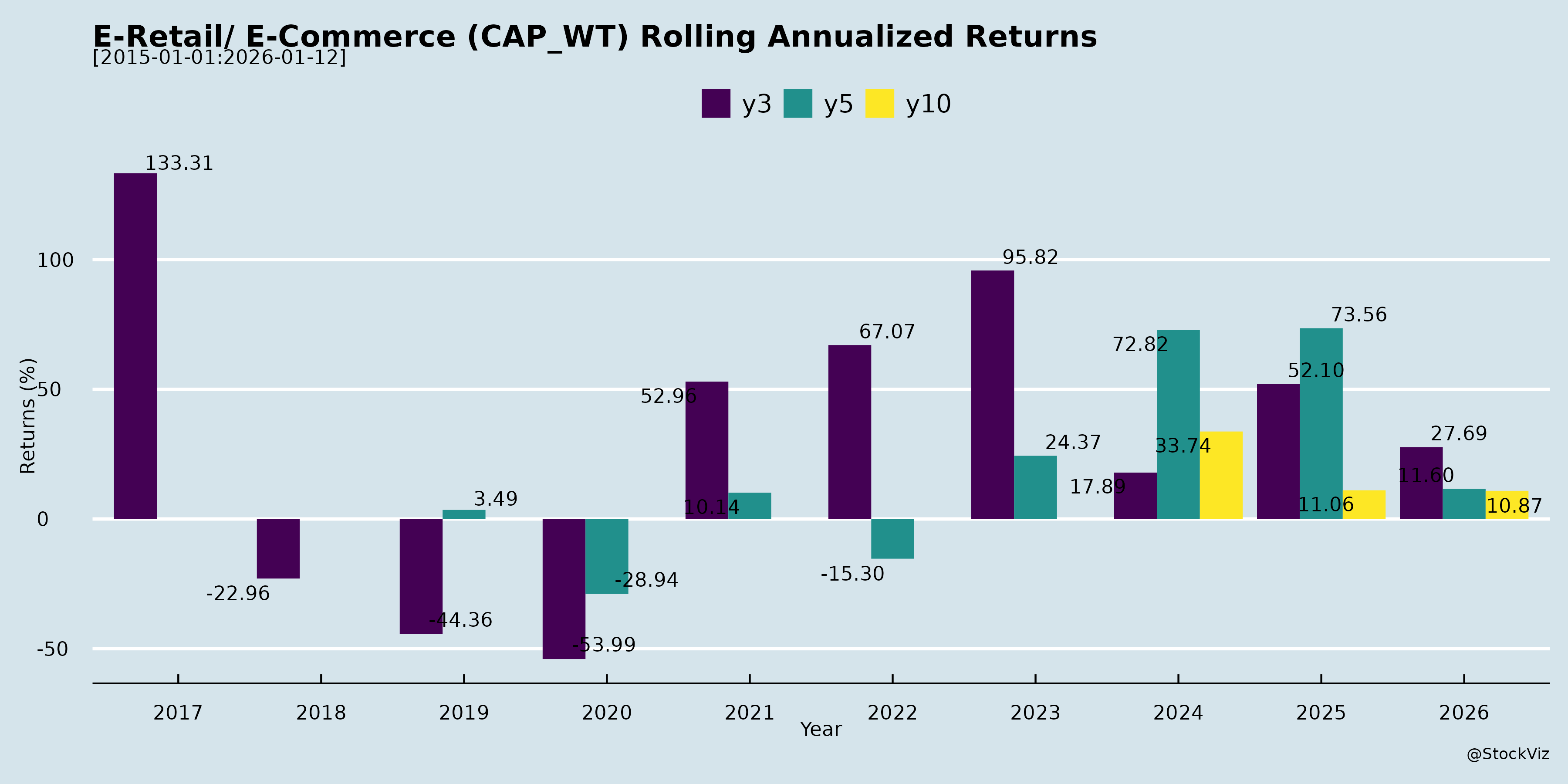

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Summary Analysis: Indian E-Retail/E-Commerce Sector

Based on the provided documents (primarily Q2/H1 FY26 earnings transcripts from Nykaa and FirstCry, alongside investor meeting schedules from Eternal/Swiggy/Urban Company/CarTradeTech/RattanIndia), the sector shows robust momentum in omnichannel beauty/fashion (Nykaa), baby/kids (FirstCry), quick commerce/grocery (Eternal/Swiggy), and adjacent areas (services like Urban Company). Key themes include premiumization, quick delivery, house brands, and store expansions. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Strong Consumer Demand & Premiumization: Nykaa reported 30% YoY GMV growth (highest in 6 quarters), driven by beauty (28% YoY) and fashion revival (37% YoY GMV). FirstCry saw sequential GMV acceleration post-GST reforms, with festive/post-festive strength. Gen Z focus (Nykaa: campus programs, K-Beauty at 60% growth), luxury tie-ups (Prada, La Prairie), and house brands (Nykaa: ₹2,900 Cr run-rate, 54% YoY; FirstCry home brands) fuel premium shifts.

- Omnichannel Expansion: Nykaa added 19 beauty stores (265 total, 90 cities) + 53 Nykaa Now rapid stores; FirstCry building in-house faster delivery (13 cities, targeting 50% shipments). Physical stores drive 70% next-day fulfillment and experiential retail (makeovers, fragrance bars).

- Margin Expansion & Profitability: Nykaa EBITDA at 6.8% (highest since IPO, +53% YoY); FirstCry Adjusted EBITDA +51% YoY consol, India multi-channel at 9.1%. Efficiencies from scale, better brand mix, and operating leverage (fashion EBITDA -3.5% vs. -9% YoY).

- Policy Support: GST cuts (e.g., 1/3 of FirstCry portfolio to 5%) spur demand; minor deflationary benefits across categories.

- Investor Engagement: Active conferences (CLSA/JM Financial for Eternal/Swiggy; Anand Rathi for Urban) signal confidence.

Headwinds (Challenges)

- Demand Deferral from Policy Changes: FirstCry noted mid-Aug to late-Sep slowdown due to GST reforms (customers postponed buys); higher discounts impacted GMV-revenue gap and slight gross margin dip (37% vs. 37.3% YoY).

- Rising Delivery Expectations: Quick commerce (overlap small but growing) forces investments in hyperlocal/rapid delivery (Nykaa Now: 7-min fastest; FirstCry: 13-city network). Fulfillment costs up slightly (Nykaa: +34 bps to 9.7%).

- Marketing Intensity: Customer acquisition investments (Nykaa: 13.1% of NSV, AUTC +32% to 49 Mn) amid competition; early festive pull-forward (Nykaa/FirstCry) risks H2 normalization.

- International Drag: FirstCry Middle East losses halved (₹19 Cr vs. ₹39 Cr YoY) but still negative (EBITDA -8%); scaling young markets (UAE 5 yrs, KSA 3 yrs).

- Portfolio Rationalization: FirstCry’s Globalbees saw moderated growth (14% YoY Q2) due to non-core brand cuts; Nykaa Fashion own brands degrew strategically.

Growth Prospects

- High Double-Digit Trajectory: Nykaa: Mid-20s revenue consistency (12 quarters), H2 acceleration via Pink Friday/NykaaLand. FirstCry: H2 GMV/revenue > H1 (early-teens FY26 guidance, potentially higher); core categories (Globalbees) 30%+ YoY. Sector AUTC growth (Nykaa 32%, FirstCry 11%).

- Omnichannel & Quick Commerce Scale: Nykaa: $2.2 Bn annualized GMV; FirstCry: Offline portfolio realignment by H1 FY27 for footfall/conversion boost. Eternal/Swiggy conferences hint at quick commerce/grocery expansion.

- Category Tailwinds: Beauty (Korean/Gen Z), fragrance/sunscreen (Nykaa: 15/min), baby consumables (FirstCry). House brands: Nykaa 74% beauty GMV growth; international potential (Kay Beauty UK).

- Profitability Path: Free cash flow positive (FirstCry H1); ROCE doubling (Nykaa 14.1%). FY26 EBITDA margins to sustain/improve via leverage.

- Market Penetration: Low beauty penetration (Nykaa); ₹300 Mn kids market (FirstCry, 84% unorganized). H2 FY26/FY27 optimism from initiatives (faster delivery, marketing ramp-up).

Key Risks

| Risk Category | Description | Mitigation/Evidence |

|---|---|---|

| Demand Volatility | Policy shocks (GST), early festive shifts, economic slowdown deferring spends. | Sequential improvements post-GST; festive strength. |

| Competition | Quick commerce (Blinkit/Zepto) eroding share in consumables; horizontal platforms (Amazon/Flipkart). | Differentiation via premium/omnichannel (Nykaa H&M partnership); own networks. |

| Execution | Store/quick delivery scaling costs; portfolio realignment delays (FirstCry offline by H1 FY27). | Proven traction (Nykaa 19 stores/Q; FirstCry 20% shipments covered). |

| Margin Pressure | Sustained marketing/fulfillment hikes; mix shifts (faster-growing loss-making segments like Intl.). | Efficiencies yielding +125 bps EBITDA (Nykaa); losses halving (FirstCry Intl.). |

| External | No UPSI shared in meetings; regulatory (SEBI LODR compliance). International forex/geopolitical (Middle East). | Disciplined burn reduction; organic focus (Globalbees 4 yrs no M&A). |

Overall Outlook: Bullish near-term (H2 FY26 growth acceleration, margin gains) with structural tailwinds outweighing transient headwinds. Sector poised for 20-30% GMV growth, driven by omnichannel and premium plays, but execution on delivery/logistics critical amid quick commerce disruption. Risks are manageable via scale and efficiencies.

General

asof: 2025-11-30

Analysis of Indian E-Retail/E-Commerce Sector

Using the provided regulatory filings (from companies like Eternal/Zomato, Swiggy, Nykaa, Urban Company, FirstCry, CarTradeTech, RattanIndia, and Digidrive), I’ve analyzed the sector’s dynamics. These disclosures highlight operational updates, financials, regulatory challenges, and strategic shifts in e-commerce, quick commerce, on-demand services, and digital distribution. The sector shows robust growth amid regulatory headwinds, with companies like Urban Company and Digidrive exemplifying resilience.

Tailwinds (Positive Drivers)

- Strong Revenue Momentum: Urban Company reported 34% YoY NTV growth (ex-KSA) to ₹1,030 Cr and 44% revenue growth to ₹380 Cr in Q2 FY26, driven by core services (19% NTV growth), Native products (164% growth), and international ops (73% NTV growth). Digidrive’s consolidated net profit surged 95% to ₹791 Lacs on ₹4,978 Lacs revenue.

- Digital Penetration & Market Expansion: Increasing Tier-2/3 adoption (Urban serves 51 cities; Swiggy emphasizes gig economy scalability). RattanIndia’s new UAE subsidiary signals international e-commerce push.

- Tech & Efficiency Gains: Urban’s SAP ERP, AI audits, and logistics APIs improved margins (India ex-Insta Help: 2.4% EBITDA). Digidrive’s e-commerce storefronts and custom apps enhance B2B reach.

- Regulatory Clarity: Swiggy views CoSS positively for gig worker welfare, with no material impact expected; proactive compliance via insurance/health programs.

- Diversification: Urban’s Native (water purifiers/locks) and Insta Help (housekeeping) verticals; Digidrive’s publishing arm (OPEN magazine) adds resilience.

Headwinds (Challenges)

- Regulatory & Tax Pressures: Eternal faces ₹18L GST demand + penalty (FY19); appeals planned but signals scrutiny. Swiggy/Urban investing in CoSS compliance amid gig worker reforms.

- Margin Compression from Investments: Urban’s Q2 FY26 EBITDA loss of ₹35 Cr (vs. profit prior) due to Insta Help scaling (₹44 Cr loss); festive pull-forwards temper Native growth.

- Operational Costs: Urban’s investments in training/audits/user acquisition reduced core margins (3.1% to 2.4%). Digidrive’s inventory fire loss (not quantified here).

- Competition & Consolidation: CarTradeTech aborted Girnar merger; intense rivalry in home services/quick commerce (Urban notes high intensity).

- Macro Slowdown Risks: Unseasonal rains impacted Urban’s summer; global e-comm slowdown indirectly affects via supply chains.

Growth Prospects

- Market Size & Penetration: Urban eyes <1% organized home services penetration; Insta Help scaled to 468K orders in 8 months (15% of India orders). Digidrive’s Carvaan taps nostalgia (5K pre-loaded songs).

- New Verticals & Monetization: Urban’s Native (179% revenue growth), Revamp, Insta Help; long-term FCF/share focus (steady-state 9-10% EBITDA margins ex-Insta Help).

- International & Adjacent Plays: Urban’s UAE/Singapore breakeven; RattanIndia’s Dubai e-comm arm. Swiggy’s welfare initiatives position for CoSS scalability.

- Tech-Led Efficiency: Urban’s AI matchmaking/audits, Digidrive’s ERP/logistics APIs; potential for 325 Bn USD India e-comm by 2030 (21% CAGR).

- Profitability Path: Urban ex-Insta Help profitable (₹10 Cr EBITDA); Digidrive’s 19% margins signal scalable models.

Key Risks

- Regulatory/Compliance (High): GST disputes (Eternal), gig worker laws (Swiggy/Urban), potential CoSS cost hikes (unquantified but monitored).

- Execution & Scaling (High): Urban’s Insta Help investments delay profitability; supply shortages/demand-supply gaps.

- Competition (Medium-High): Quick commerce wars, disintermediation (Urban notes declining but persistent).

- Operational (Medium): Inventory risks (fires), logistics densification; talent retention amid expansions.

- Macro/Economic (Medium): Consumer slowdowns, inflation (Urban cites unseasonal rains); forex/volatility in international ops.

- Financial (Low-Medium): Debt-free but capex-heavy (Urban’s ₹2,136 Cr cash post-IPO); FCF negative short-term.

Overall Outlook: Bullish long-term (high growth via digitalization/tech), but near-term volatility from regs/investments. Companies like Urban (FCF focus) and Digidrive (95% profit growth) exemplify resilience; monitor gig reforms and Q3 festive traction. Sector TAM vast, but execution key.

Investor

asof: 2025-11-29

Summary Analysis: Indian E-Retail/E-Commerce Sector (Based on Provided Documents)

The documents highlight key players like Nykaa (FSN E-Commerce), FirstCry (Brainbees Solutions), Swiggy, Eternal (ex-Zomato), IntraSoft Technologies, Urban Company, and others, revealing a resilient sector amid festive momentum, omnichannel shifts, and quick commerce pressures. Overall, beauty/fashion (Nykaa) and mother-baby/kids (FirstCry) show robust recovery, while food delivery/services (Swiggy/Eternal/UrbanCo) focus on investor engagement. IntraSoft emphasizes Amazon-centric B2B e-retail transformation. Sector GMV/revenue growth is mid-teens to 30% YoY, with profitability improving via scale and efficiency.

Tailwinds (Positive Drivers)

- Strong Consumer Momentum & Premiumization: Nykaa reports highest GMV growth in 6 quarters (+30% YoY to ₹4,744 Cr), driven by beauty (+28%) and fashion revival (+37% GMV). Premium brands (Prada, La Prairie), Korean beauty (+60% YoY), and Gen Z initiatives (campus ambassadors, Snapchat tie-ups) fuel penetration. FirstCry notes post-festive/post-GST surge.

- Omnichannel Expansion: Nykaa adds 19 stores (265 total, 90 cities), hyperlocal delivery (Nykaa Now: 53 stores, 70% next-day fulfillment). FirstCry expands in-house faster delivery (4→13 cities, targeting 50% shipments by mid-FY27).

- Profitability Leverage: Nykaa EBITDA +53% (6.8% margin, highest since IPO); FirstCry Adjusted EBITDA +51% (consol 5.8%). Fashion EBITDA improves -9%→-3.5%. House of Brands (Nykaa: +54% to ₹2,900 Cr run-rate; FirstCry home brands).

- Policy & Tech Boost: GST reforms (1/3 portfolio to 5%) spur demand (FirstCry). Tech (AI skin analyzers, personalization, vendor-direct models at IntraSoft) enhances scalability.

- International & Diversification: Nykaa Kay Beauty succeeds in UK (Space NK); FirstCry Middle East revenue +13%, losses -52%. Globalbees (FirstCry) +21% organic growth.

Headwinds (Challenges)

- Demand Deferral & Seasonality: FirstCry notes mid-Aug to Sep slowdown due to GST anticipation, forcing higher discounts (GMV +12% but revenue lag). Early festive shift impacts Q2 uniformity.

- Quick Commerce Pressure: FirstCry highlights rising delivery expectations (not direct overlap, but forces faster TAT investments). Nykaa counters with Nykaa Now (7-min fastest delivery).

- Category-Specific Weakness: Fashion revival ongoing but lagged earlier (Nykaa). IntraSoft’s past inventory-heavy model led to high WC/debt (now shifting).

- Cost Pressures: Nykaa marketing/S&D at 15.7% (up 44 bps for acquisition); FirstCry fulfillment up slightly. Flipkart settlement policy impacts Globalbees growth optics.

Growth Prospects

- H2/FY26 Acceleration: Nykaa sustains mid-20s revenue growth (consistent 12 quarters); FirstCry eyes sequential GMV improvement (early-teens revenue FY26, H2>H1). Target: Nykaa $2.2B annualized GMV; FirstCry store portfolio realignment by H1 FY27 for footfall/conversion boost.

- Key Levers: | Lever | Nykaa | FirstCry | Others | |——-|——–|———-|——–| | Quick/Omni Delivery | Nykaa Now (luxury in 30-120 min) | 13 cities →50% coverage | IntraSoft vendor-direct scale | | Brands/Assortment | 4,200 beauty +5,000 fashion brands; House of Nykaa +54% | Home brands ↑, depth over width | 300+ partners (IntraSoft) | | Customer Base | 49M cumulative (+32%); AUTC +27% | 10.5M AUTC (+11%) | Gen Z focus | | International | Kay Beauty UK expansion | Middle East profitability path | Globalbees core +30% |

- Long-Term: Penetration in low-consumption categories (fragrance/sunscreen at Nykaa: 15/min); Gen Z (26% population); tech (AI personalization). IntraSoft targets 150K→500K products via brand expansion.

Key Risks

- Macro/Policy Volatility: GST/demand deferral (FirstCry Q2 hit); festive timing shifts. Broader slowdown could amplify.

- Competition & Execution: Quick commerce raising bars (delivery/CAC); Mktplace dependency (IntraSoft/Globalbees on Amazon/Flipkart). Nykaa/FirstCry scaling stores/delivery networks risks capex overruns.

- Margin Erosion: Discounts for demand (FirstCry); marketing reinvestment (Nykaa 13.1% of NSV). Inventory obsolescence lingers if vendor-shift delays (IntraSoft).

- Customer Acquisition/Retention: High CAC/CPMs amid competition; Gen Z shift needs sustained content/events.

- Geopolitical/Intl: Middle East/UK expansions (FirstCry/Nykaa) face regulatory/currency risks.

- Overall Sector: Unorganized dominance (FirstCry: 84%); profitability pre-scale fragile (Intl losses halving but persistent).

Bottom Line: Sector poised for 15-25% FY26 growth with omnichannel/quick delivery as differentiators. Profitability inflection (EBITDA margins 5-7%) supports re-rating, but H2 execution critical amid quick commerce disruption. Bullish on beauty/mom-baby; monitor food/services for spillover.

Meeting

asof: 2025-12-02

Summary Analysis of Indian E-Retail/E-Commerce Sector (Based on Q2 FY26 Results & Reports)

The provided documents cover Q2 FY26 (Sep 2025) results and annual reports from key players like Eternal (Zomato/Blinkit), Swiggy, Nykaa, FirstCry (Brainbees), IntraSoft, Digidrive, RattanIndia (e-com investments), Urban Company (adjacent services/e-com), and CarTrade (auto marketplace). These reflect the sector’s dynamics amid quick commerce boom, festive prep, and profitability push. Overall, revenue growth is robust (20-100% YoY in many cases), but profitability varies with quick commerce driving scale at high costs.

Tailwinds (Positive Factors)

- Explosive Revenue Growth: Quick commerce leads—Eternal H1 revenue ₹20,753 Cr (+131% YoY, driven by Blinkit inventory model); Nykaa H1 ₹4,501 Cr (+20% YoY); FirstCry H1 ₹39,616 Cr (+11% YoY). E-com penetration rising (India e-com to $325B by 2030 per Deloitte).

- Profitability Momentum: Eternal PAT ₹90 Cr (profitable core ops); Nykaa PAT ₹58 Cr; Urban Company scaling EBITDA; Digidrive PAT ₹791 Lacs (+95% YoY). Margins improving (Nykaa OPM 2.2%; Eternal steady).

- Digital/UPI Boom: UPI dominance (83% payments); festive demand; investments (Swiggy QIP ₹10,000 Cr; Eternal capex ₹788 Cr on quick commerce).

- Diversification: Nykaa beauty/fashion; FirstCry baby products; Eternal acquisitions (Orbgen/Waterland for ticketing/events).

- Tech/Infra: ERP, AI personalization (Eternal CarTrade Labs); logistics integration.

Headwinds (Challenges)

- High Costs/Competition: Delivery charges (Eternal ₹4,082 Cr H1); employee expenses up (FirstCry ₹2,880 Cr); marketing heavy (Nykaa ₹1,394 Cr). Swiggy/Zomato rivalry intense.

- Losses in Scale-Up: FirstCry H1 loss ₹976 Cr (investments in stores); Urban Company Q2 loss ₹59 Cr (new segments like Insta Help); quick commerce inventory risks (Eternal inventories ₹1,502 Cr).

- External Shocks: Fires/inventory losses (FirstCry ₹98 Cr exceptional; Eternal ₹9 Cr); GST disputes (Eternal ₹441 Cr orders).

- Macro Pressures: Inventory build-up amid slowing demand (Eternal changes in inventories -₹1,126 Cr); forex/impairments (Nykaa OCI volatility).

- Subsidiary Drag: RattanIndia unrealized losses ₹4,575 Cr on investments; FirstCry subsidiaries losses ₹301 Cr.

Growth Prospects

- Quick Commerce Hyper-Scale: Eternal (Blinkit GMV leader); Urban (Insta Help launch); India quick com market to $5-10B by FY27 (urban penetration <10%).

- Category Expansion: Beauty (Nykaa +20%); baby/kids (FirstCry stores/warehouses via IPO proceeds); diversified (Digidrive Carvaan, publishing).

- Funding/Expansion: Swiggy ₹10K Cr raise; Eternal QIP ₹8,300 Cr prior; Nykaa international push.

- Digital India Tailwinds: UPI/smartphones (1.18B by 2026); Tier-2/3 growth (60% shoppers); ONDC/e-com CAGR 21%.

- Projections: Eternal FY26 rev >₹40K Cr; Nykaa FY26 PAT >₹100 Cr; sector $325B by 2030.

Key Risks

- Execution/Competition: Inventory-led model losses (Eternal quick com losses ₹106 Cr); Zomato-Swiggy duopoly (antitrust probes).

- Regulatory: GST on delivery (Eternal ₹441 Cr demand); FDI norms; data privacy.

- Operational: Supply chain (fires ₹98 Cr FirstCry); forex (Nykaa intl subs); capex (Eternal ₹788 Cr).

- Macro: Inflation/slowdown (FirstCry H1 loss); consumer shift to value (Eternal purchases 11,332 Cr).

- Financial: Debt (FirstCry ₹6K Cr); impairments (RattanIndia ₹4.6K Cr unrealized loss).

- Sector: Margin pressure (delivery 20% rev); dependency on platforms (Amazon/Flipkart).

Overall Outlook: Bullish on quick com/e-com scale (tailwinds > headwinds), but profitability hinges on cost control. High growth (20-50% rev CAGR) expected FY26, risks mitigated by cash buffers (Eternal ₹431 Cr cash). Sector resilient amid India’s digital boom.

Press Release

asof: 2025-11-29

Summary Analysis: Indian E-Retail/E-Commerce Sector (Based on Q2/H1 FY26 Earnings from Swiggy, Nykaa, Urban Company, CarTrade Tech, and IntraSoft)

The provided documents highlight performance from key players in Indian e-retail/e-commerce (Swiggy’s Instamart quick commerce, Nykaa’s beauty/fashion platforms, Urban Company’s Native products and services-adjacent e-com, CarTrade Tech’s automotive marketplaces, and IntraSoft’s cross-border e-com). Overall, the sector shows resilient double-digit growth amid investments in scale, quick delivery, and omnichannel, but with profitability challenges in high-growth verticals like quick commerce. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Explosive GMV/Revenue Growth: Swiggy Platform GOV +48% YoY (₹16,683 Cr); Instamart +108% YoY (₹7,022 Cr). Nykaa consolidated GMV +30% YoY (₹4,744 Cr), Beauty +28%, Fashion +37%. CarTrade Tech revenue +29% YoY (₹222 Cr). Urban Native NTV +164% YoY (₹97 Cr). IntraSoft H1 revenue +5% YoY (₹262 Cr).

- Quick Commerce & Hyperlocal Boom: Instamart AOV +40% YoY (₹697), +200 bps QoQ margin to -2.6%; Nykaa Now (60-120 min delivery) with 2M+ orders. Driving user engagement (Swiggy MTU +34% YoY to 22.9M; Nykaa 49M customers).

- Omnichannel & Premiumization: Nykaa +19 stores (265 total), luxury/K-Beauty additions; Swiggy 1,102 darkstores (+40). Owned brands shine (Nykaa House of Nykaa +54% YoY GMV ₹720 Cr; Dot & Key +110% YoY).

- Profitability Improvements in Core: Nykaa EBITDA +53% YoY (6.8% margin, highest post-IPO), PAT +154%; Swiggy Food Delivery EBITDA +2.1x YoY (2.8% margin); CarTrade PAT +109% YoY; Urban Core India profitable (ex-Insta Help).

- User & Platform Stickiness: Cross-usage (36% Swiggy users multi-service); Nykaa 191M visits (+30% YoY); CarTrade 85M monthly uniques (95% organic).

Headwinds (Challenges)

- Persistent Losses in High-Growth Areas: Swiggy Instamart EBITDA loss ₹849 Cr (-12.1% margin); Urban overall Adjusted EBITDA loss ₹35 Cr (driven by ₹44 Cr Insta Help loss); Nykaa Fashion still negative EBITDA (-3.5% NSV).

- Investment Drag: Heavy capex on expansion (Swiggy darkstores, Nykaa stores/hubs); Urban investing in supply/training for Insta Help/Native. IntraSoft flat PAT (₹7.5 Cr H1, slight YoY dip).

- Margin Pressures: Quick com relies on incentives/basket optimization (Swiggy/Urban); Nykaa Superstore B2B improving but early-stage.

- Geographic/Scale Limits: Swiggy Instamart in 128 cities; Urban 51 cities. IntraSoft US-focused, less India traction.

Growth Prospects

- Quick Commerce Leadership: Instamart/Nykaa Now scaling with speed (10-min delivery), AOV uplift (Maxxsaver/non-grocery), and margin path to breakeven (Swiggy +200 bps QoQ). Potential for ₹2-3T market.

- Category Expansion: Beauty/fashion premiumization (Nykaa Luxe/K-Beauty +60% GMV); automotive digital (CarTrade 1.8M auction run-rate); home products (Urban Native water purifiers/locks).

- Omnichannel & Owned Brands: Nykaa 2.7L sq ft retail (+37% YoY); House of Nykaa ₹2,900 Cr annualized run-rate. Swiggy multi-service (36% cross-use).

- International & Adjacent: Nykaa Nysaa (GCC +38% QoQ e-com GMV); Urban intl breakeven (UAE/Singapore +73% NTV ex-KSA).

- Tech/User Acquisition: AI personalization (Nykaa Skin Analyzer); Gen Z focus (Nykaa Superfan/Ambassadors); 12th straight mid-20s quarter for Nykaa.

Key Risks

- Profitability Sustainability: High burn in quick com/services (Swiggy/Urban losses amid investments); dependence on operating leverage/incentives. Forward-looking disclaimers highlight economic slowdowns, competition (e.g., Zomato/Blinkit implied).

- Execution & Competition: Supply chain (darkstores/pros), customer retention in new verticals (Urban Insta Help early-stage). Intense rivalry in quick com/beauty/auto.

- Macro/Regulatory: Inflation, consumer spending slowdown (noted in Swiggy/Nykaa contexts); SEBI compliance, taxation changes. KSA deconsolidation (Urban) shows JV/geopolitical risks.

- Capex & Cash Burn: Urban cash ₹2,136 Cr buffer, but scaling darkstores/stores risky if demand softens.

- External Dependencies: Brand partnerships (Nykaa 70+ luxury adds), economic volatility, litigation (all disclaimers).

Overall Outlook: Bullish on 20-50% GMV growth driven by quick com/omnichannel, with path to EBITDA positivity in core (e.g., Nykaa/Swiggy Food). Sector poised for ₹10T+ TAM by 2030, but selective profitability key—watch Q3 for margin trends amid festive slowdown risks. Investors favor diversified players like Nykaa (profitable) over pure quick-com burners like Instamart.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.