STANLEY

Equity Metrics

January 13, 2026

Stanley Lifestyles Limited

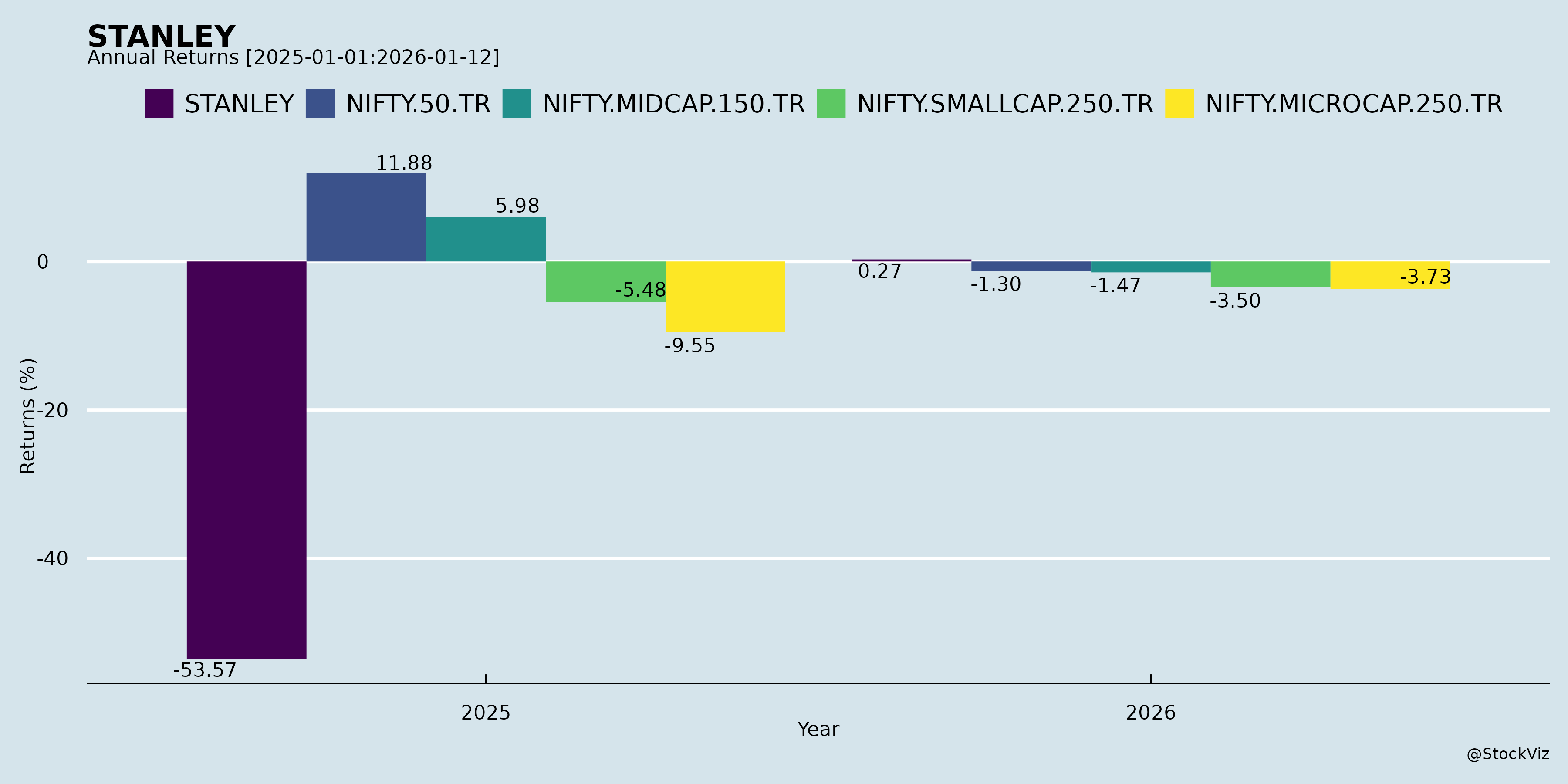

Annual Returns

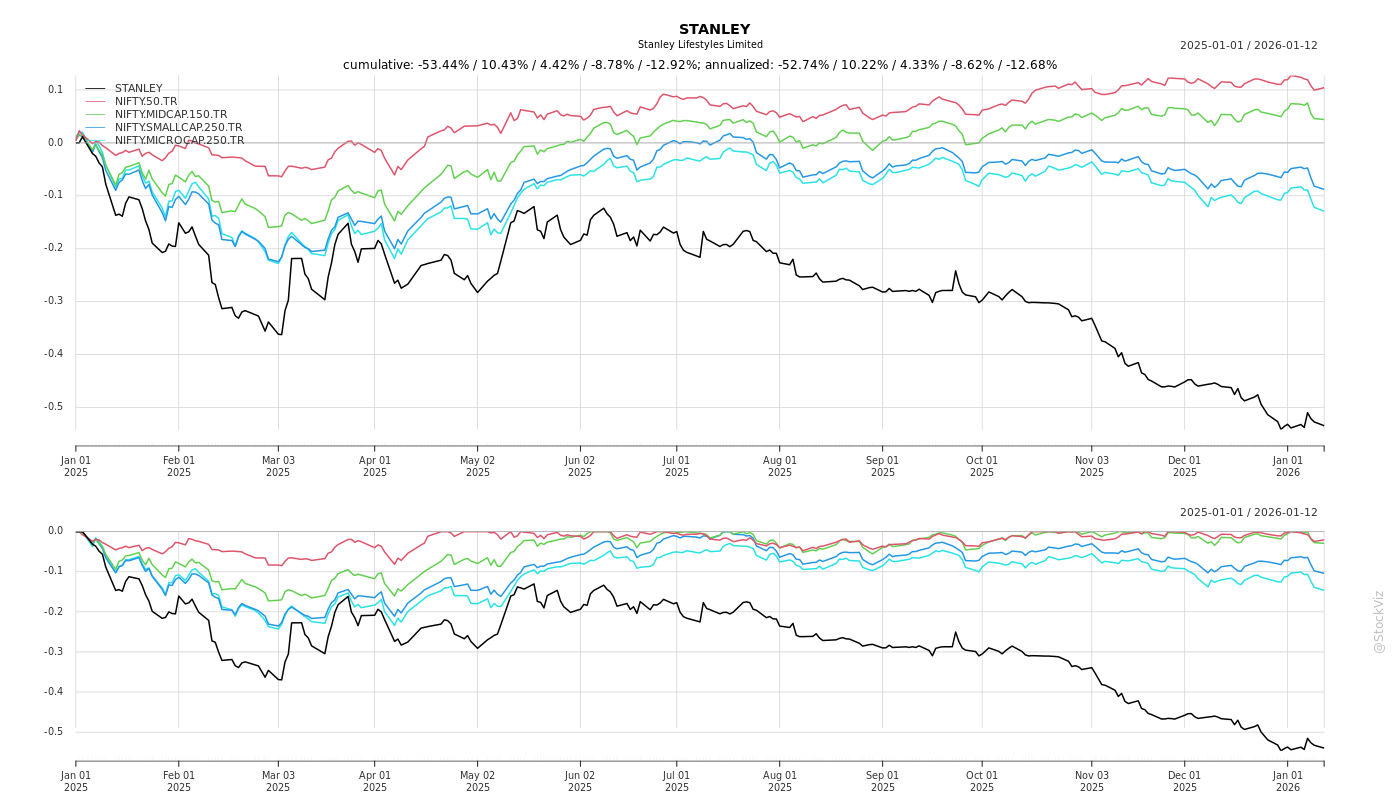

Cumulative Returns and Drawdowns

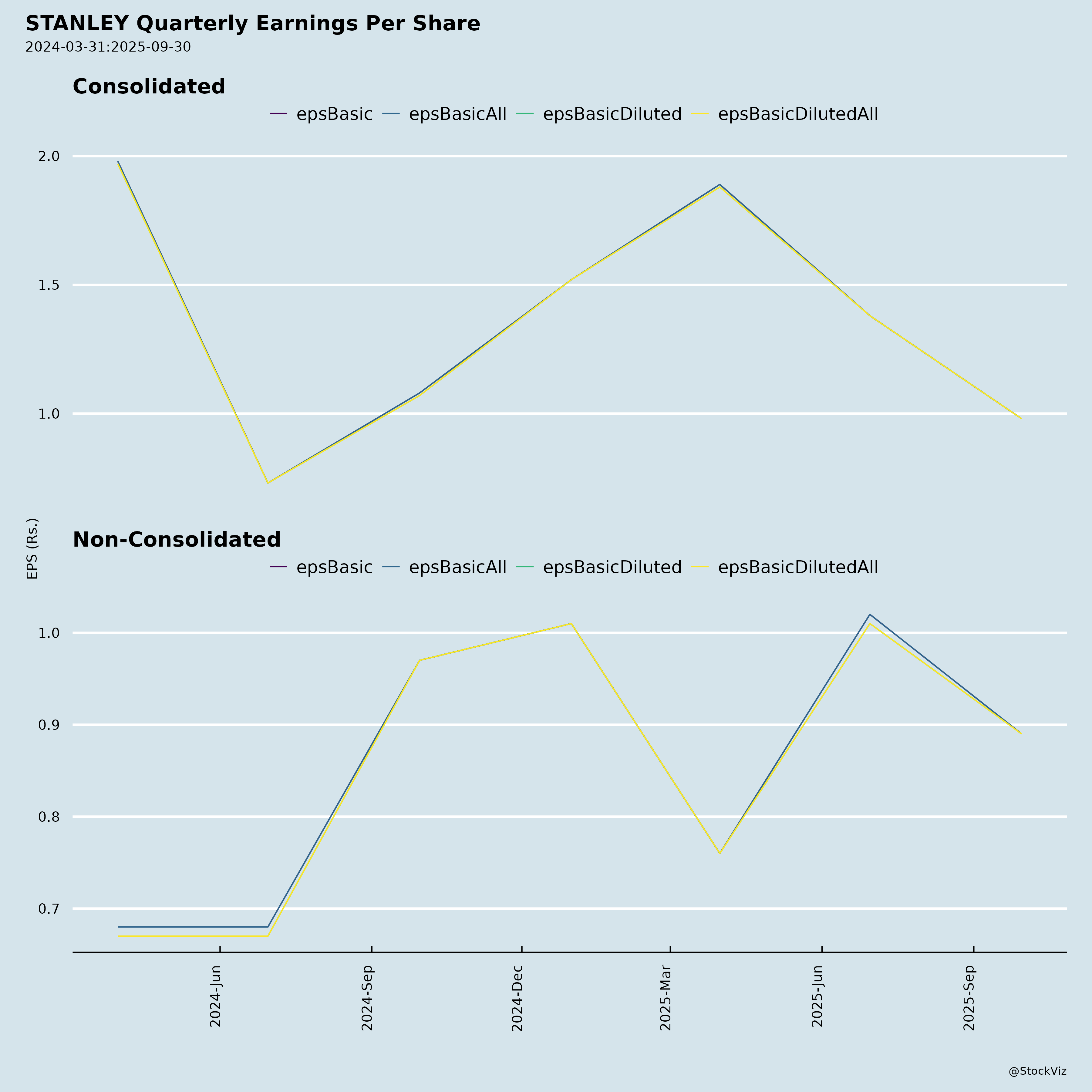

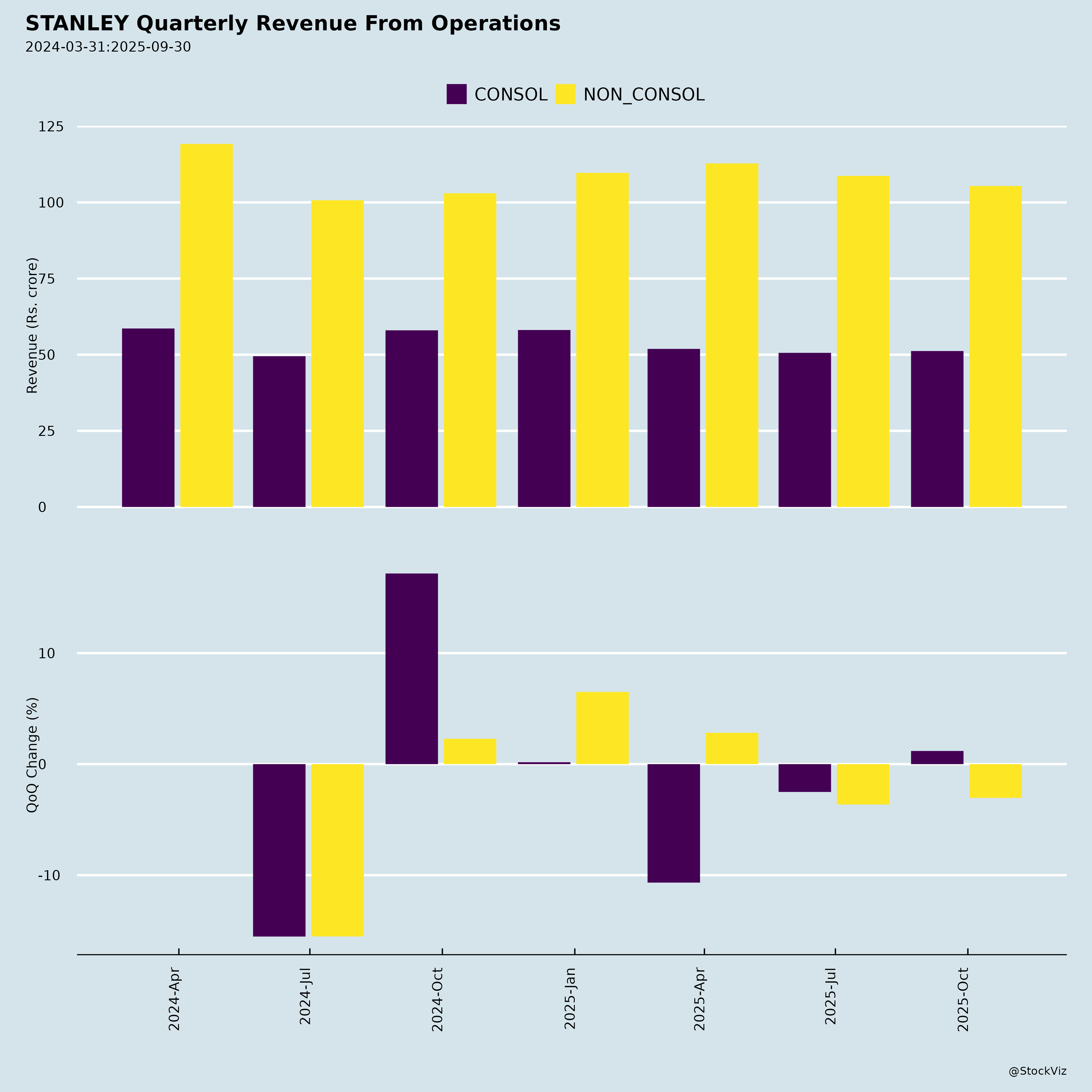

Fundamentals

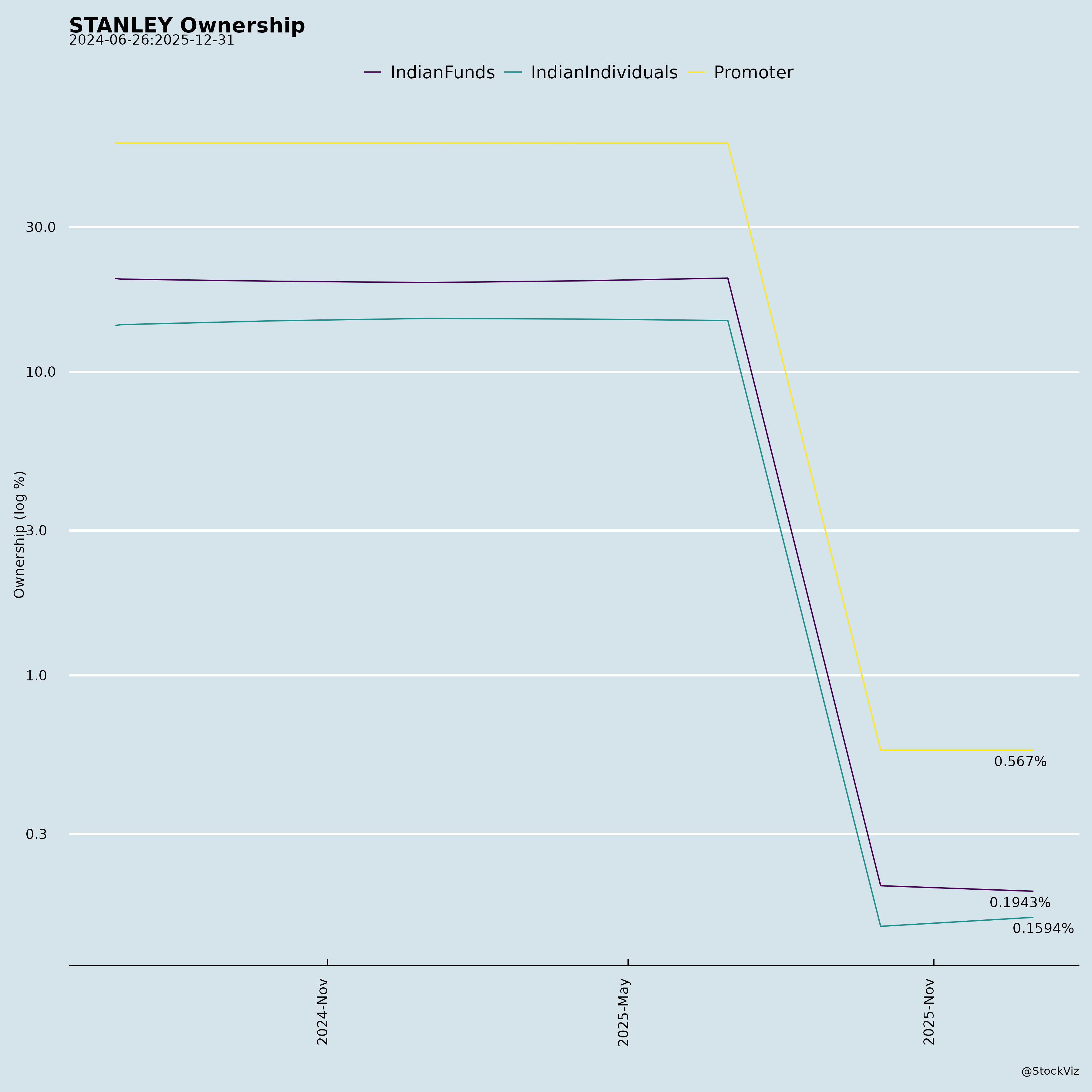

Ownership

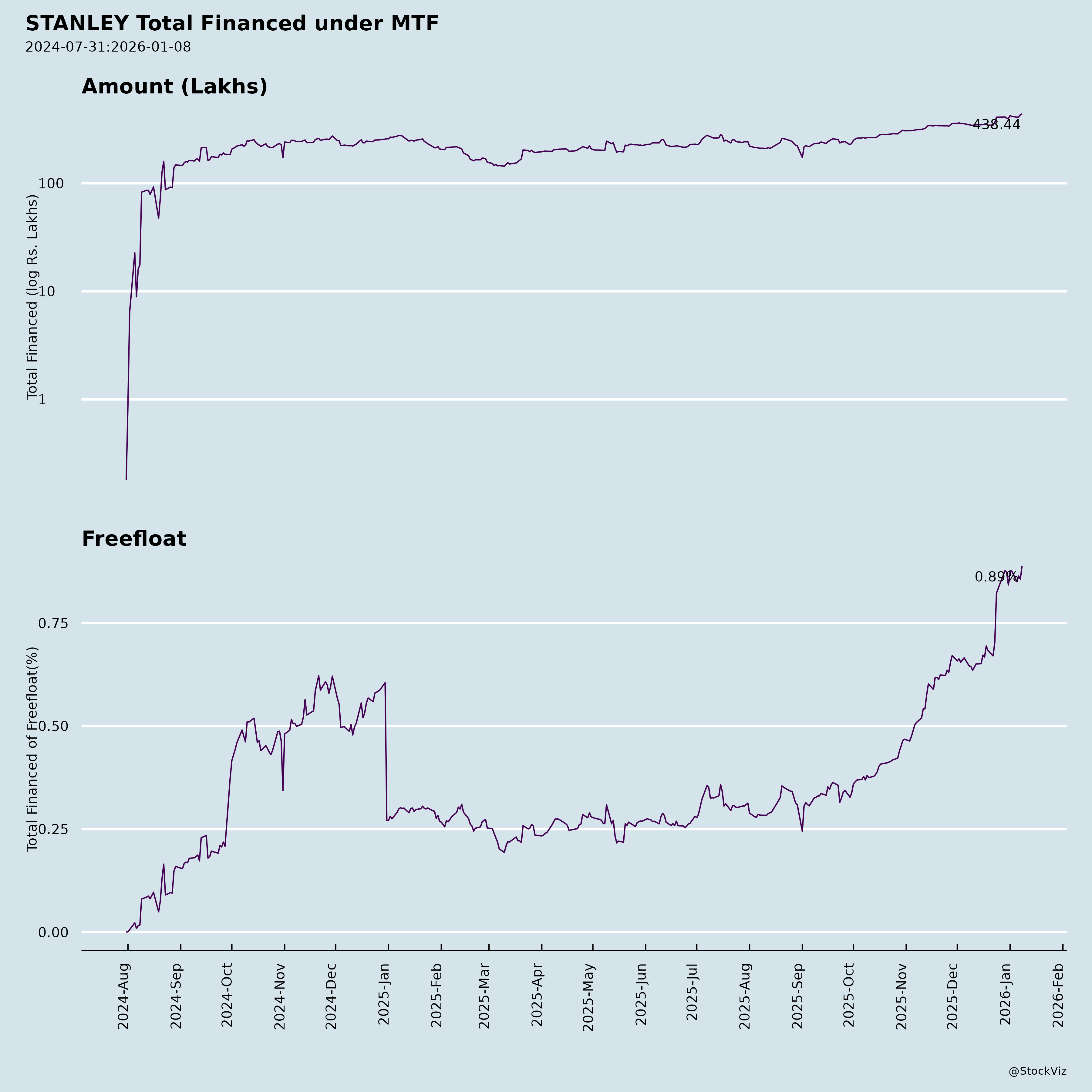

Margined

AI Summary

asof: 2025-12-08

STANLEY LIFESTYLES LIMITED (BSE: 544202 | NSE: STANLEY)

Summary Analysis: Headwinds, Tailwinds, Growth Prospects & Key Risks (as of November–December 2025)

Company Overview

Stanley Lifestyles Limited is India’s leading vertically integrated luxury furniture brand, offering comprehensive home solutions across ultra-luxury (Stanley Level Next), luxury (Stanley Boutique), and super-premium (Sofas & More) categories. Listed in June 2024 after a successful IPO, the company operates 73 retail outlets across 24 cities, with manufacturing facilities in Bengaluru spanning over 300,000 sq. ft.

Its business model combines in-house design, manufacturing, and direct-to-consumer retail, enabling control over quality, cost, and customer experience. The company serves both B2C and B2B segments, including global partnerships with IKEA and Toyota.

Tailwinds: Key Growth Drivers

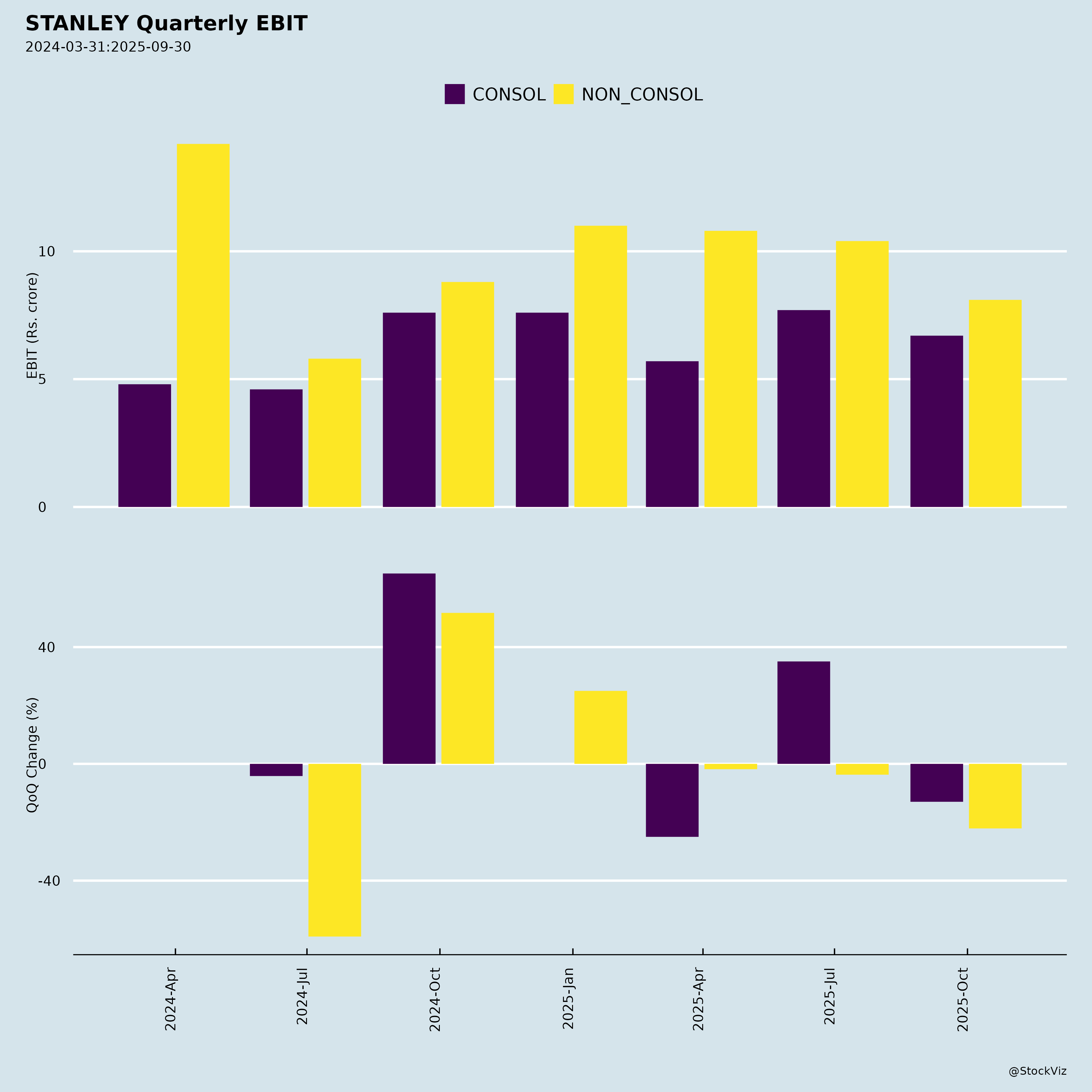

1. Strong Revenue and Profitability Momentum

- H1FY26 revenue: ₹2,141 million (+5.1% YoY).

- Gross Profit Margin: Improved to ~58% (up 330 bps YoY) due to:

- Procurement efficiencies.

- Localization and insourcing of manufacturing.

- Shift toward higher-margin products.

- EBITDA Margin: Expanded to 22.1% (up 320 bps YoY) on operating leverage and cost optimization.

- PAT up 45.3% YoY in H1FY26 (₹138M vs ₹95M), reflecting margin expansion and solid execution.

This sustained profitability sets Stanley apart in the consumer durables space, where scale and margins are rarely aligned.

2. Successful Store Expansion Strategy

- Added 7 COCO (company-owned, company-operated) and 2 FOFO (franchisee-owned, franchisee-operated) stores in H1FY26.

- Total network: 73 stores (19 Stanley Boutique + 43 Sofas & More + 11 Level Next).

- COCO stores contribute majority of sales — 60% of H1FY26 revenue (up from 58%), driving higher control, margins, and brand consistency.

Company is strategically expanding its high-control store format, signaling confidence in unit economics.

4. International Expansion & Diversification

- Launched first international store in Colombo, Sri Lanka, marking entry into global markets.

- B2B contract manufacturing for IKEA (exports) and automotive leather interiors (Toyota), which offer export opportunities and de-risk consumer cyclicality.

Early steps into internationalization open new long-term growth avenues.

5. Capex Discipline and IPO Fund Deployment

- Received ₹1,839 crore net from IPO.

- As of September 2025:

- ₹809 crore deployed (44% of funds).

- Major utilization: investment in subsidiaries for retail expansion and capex in manufacturing (e.g., Stanley OEM Sofas Limited).

- Conservative borrowing with lease liabilities (₹3,043 million) as primary liability — consistent with asset-light retail model.

Transparent tracking of fund use signals management credibility.

6. Leadership Reinforcement

- Appointment of Abhijeet Sonar as CEO, Stanley Retail Limited, in December 2025.

- Former leader from Audi, Villeroy & Boch, Hansgrohe — brings proven luxury brand-building, P&L ownership, and international scaling experience.

- Aligns with Stanley’s ambition to become a “global luxury house from India”.

Augurs well for institutionalization of processes and future scaling.

Headwinds: Operational & Macro Challenges

1. Rising Lease and Amortization Costs

- Amortization + finance cost increased by ₹72 million in H1FY26 due to new lease agreements.

- Right-of-use assets surged to ₹3,232 million (vs ₹1,603 million in Mar ’25) — an increase of 101%.

- Lease liabilities: ₹3,043 million (non-current) + ₹252 million (current).

High store expansion via capital leases impacts near-term PBT (down 8% YoY in Q2), even as PAT grows due to lower tax.

→ Short-term margin pressure possible if sales per store don’t ramp up.

2. Dependence on Urban Affluents

- Target markets: High-income individuals (HNIs), architects, designers — concentrated in metro cities.

- Sensitive to discretionary spending, interest rates, and real estate cycles.

Economic slowdown or consumer sentiment softening could impact sales momentum.

3. Non-controlling Interest Reduction

- Non-controlling interest (NCI) dropped sharply from ₹112 million (Mar ’25) to ₹54 million (Sep ’25).

- Suggests buyout of minority stakes, likely in subsidiaries like SDPL (Shrasta Décor).

- Confirmed: WOS acquired 44.05% of Shrasta Décor Pvt. Ltd. in Aug 2025 for ₹181M, making it 100% owned.

While strategic, it reduces NCI income and ties up capital that could have been used for expansion.

4. Inventory Management Pressure

- Inventories: ₹1,368 million (up from ₹1,404M in Mar ’25), but remains high as % of current assets (~56%).

- Cash conversion cycle needs monitoring as working capital consumes cash.

Risk of obsolescence or write-downs in premium furniture segment if demand shifts.

Growth Prospects: Future Drivers

| Driver | Current Status | Potential Impact |

|---|---|---|

| Store Expansion | Adding ~1 store/month; targeting high-affluence metros & emerging urban clusters | Long-term revenue growth; scale benefits |

| Stanley Boutique Homes (SBH) | First store launched; 10,000 sq. ft. luxury home solution center | High-ticket size (₹0.5M+), sticky client relationships |

| Localization & In-house Manufacturing | Case goods shifting from imports to domestic production | Margin expansion, supply chain control |

| Product Portfolio Expansion | Exploring new categories; leveraging design + manufacturing | Cross-selling, higher customer lifetime value |

| Digital Transformation & Marketing | Strong focus in roadmap; digital engagement with architects/designers | Lower CAC, wider reach, appointment conversion |

| International Markets | Colombo launch successful; expansion feasibility being assessed | Diversify revenue, reduce domestic cyclicality |

Management guidance: Continue prioritizing COCO store growth, luxury experience amplification, and global brand building.

Key Risks

1. Execution Risk in Scaling Operations

- Adding new stores requires skilled workforce, brand consistency, and design talent.

- Integration of acquired subsidiaries (e.g., SDPL) must deliver synergies.

- Failure to maintain high service standards can damage luxury brand image.

2. Lease Liability Buildup

- High reliance on operating leases may strain cash flow if sales disappoint.

- Not debt, but finance costs (₹75M in Q2) are rising, affecting PBT.

Note: Finance costs not due to borrowing, but lease interest under Ind AS 116.

3. PBT Decline Despite PAT Growth

- Q2FY26 PBT fell to ₹81M from ₹88M (Q2FY25) — due to lease-driven amortization and finance costs, despite revenue growth.

- PAT rose due to lower tax, not operational improvement.

Sustainability of earnings growth depends on controlling non-cash lease expenses or faster top-line ramp-up.

4. Reliance on IPO Proceeds for Execution

- Over ₹1,000 crore of IPO funds remain unutilized — dependent on disciplined deployment.

- Delayed capex in manufacturing or missed retail expansion could disappoint investors.

5. New CEO Integration Risk

- Abhijeet Sonar is new and external.

- While background is impressive, cultural fit and execution alignment are crucial.

- Risk of over-promising and under-delivering on transformation goals.

6. Macro Risks

- Indian consumer spending may slow amid inflation, rate hikes, or global uncertainty.

- Luxury spending is discretionary and sensitive to sentiment.

Conclusion: Investment Thesis

⭐ Bull Case

- “Indian equivalent of Roche Bobois or Minotti” in the making.

- Proven profitable growth model with strong EBITDA and PAT expansion.

- Scalable multi-brand, multi-format retail strategy.

- Backed by professional leadership, IPO capital, and deep vertical integration.

- IPO funds allow 3–4 years of aggressive expansion without equity dilution.

⚠️ Bear Case

- PBT under pressure from lease accounting.

- Store expansion may not yield expected ROIs.

- Market may begin discounting future growth, leading to multiple compression post-earings peak.

✅ Verdict

Stanley Lifestyles is executing well, but faces a transitional phase where growth investments are impacting pre-tax profits. The real test will be whether: - New stores become cash-flow positive quickly. - SBH model scales profitably. - Manufacturing localization lifts gross margins further.

With strong fundamentals, a clear vision, and fresh leadership, Stanley is well-positioned to become India’s first home-grown global luxury furniture brand — but valuations should factor in near-term margin headwinds.

Investor Recommendations

- Long-term Buy: For investors seeking exposure to Indian premiumization and consumption upgrade story.

- Monitor Quarterly: Track:

- Sales per store

- SG&A as % of revenue

- Inventory turnover

- PBT vs. PAT trajectory

- Catalyst: Any announcement on international expansion, new product lines, or buybacks/dividends.

Prepared as of December 2025 | Based on Public Filings, Earnings Call Materials, and Press Releases by Stanley Lifestyles Limited

Source: NSE/BSE Filings, Company Website, Earnings Presentation Q2 FY26

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.