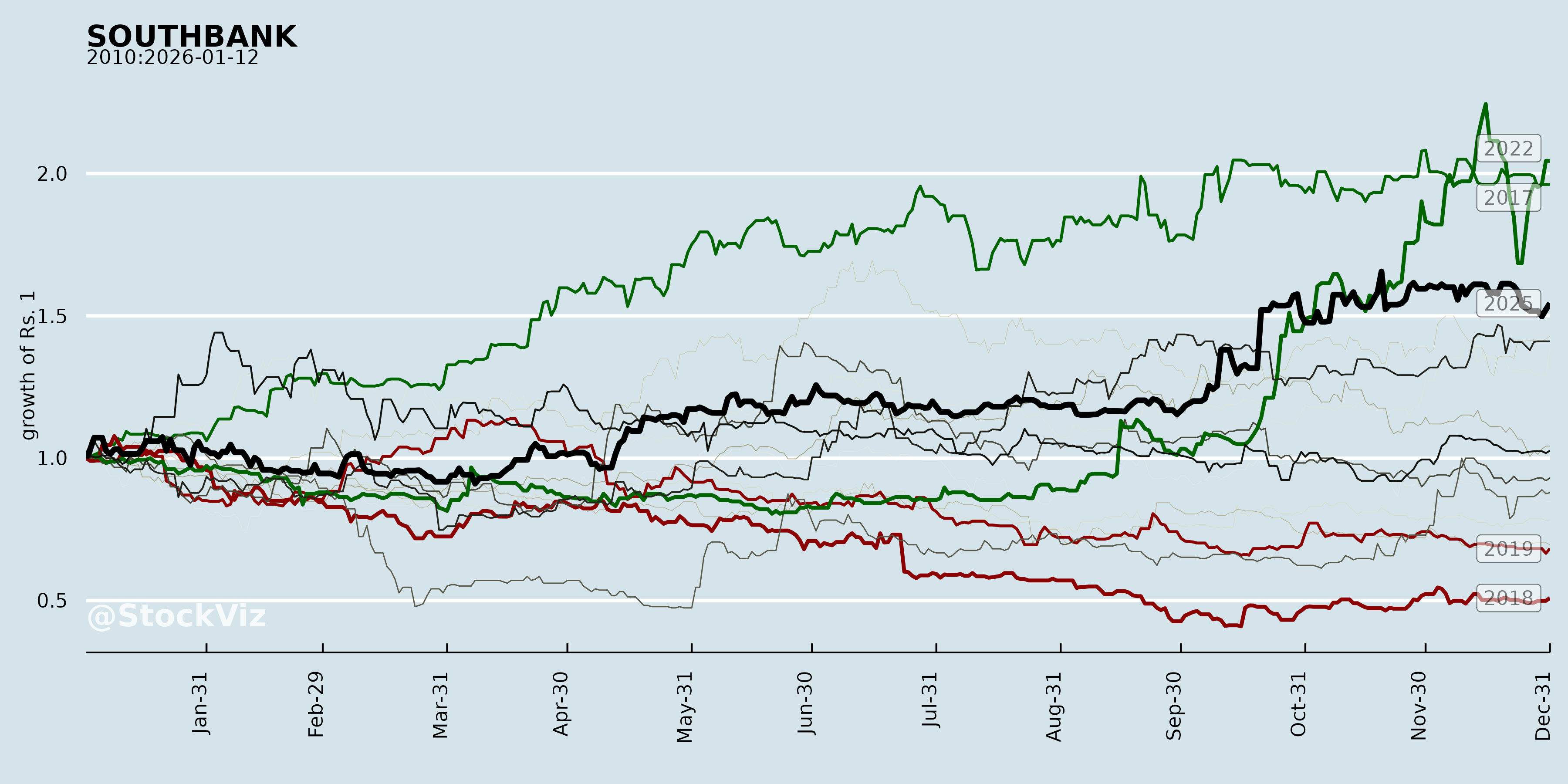

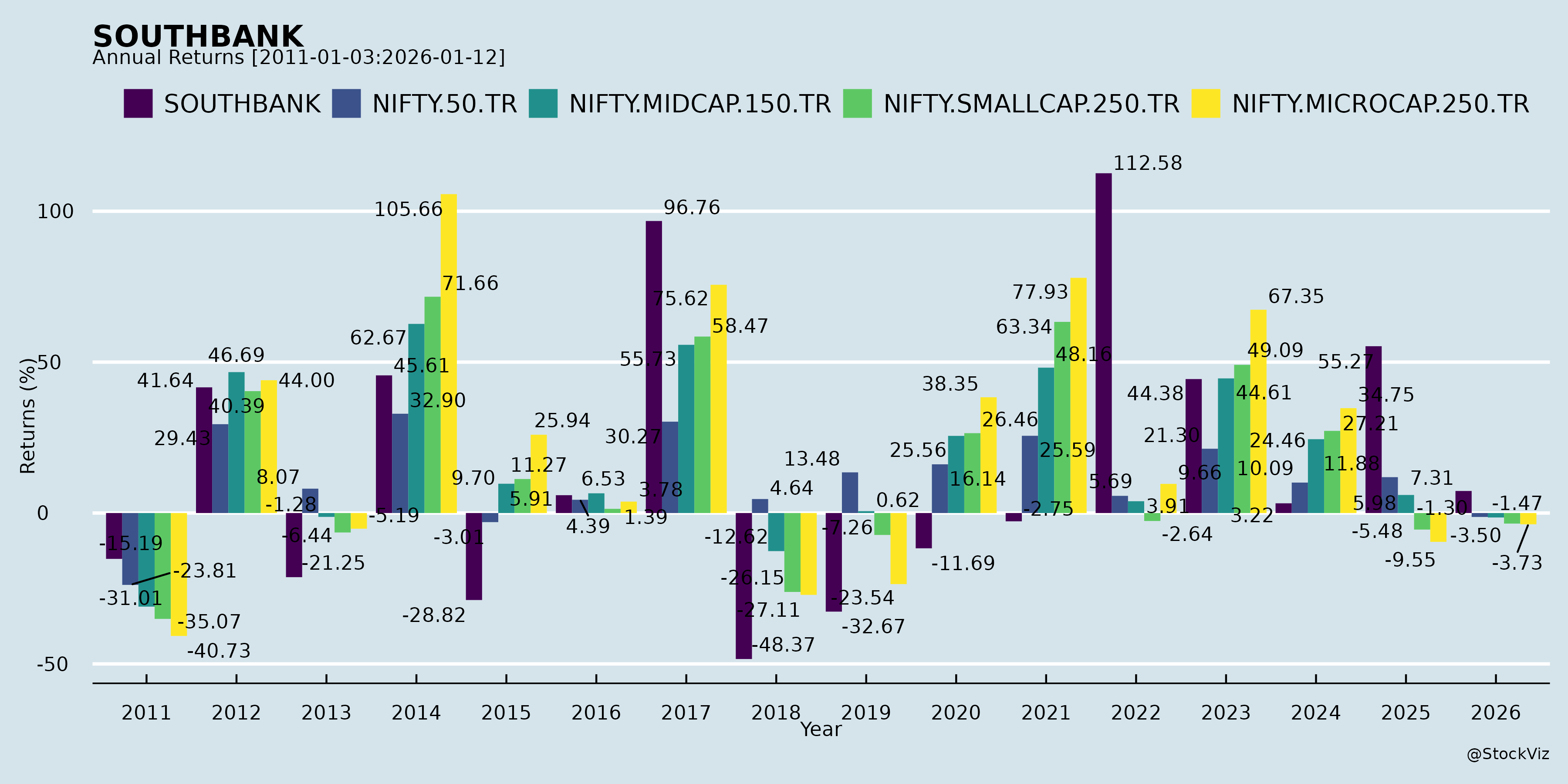

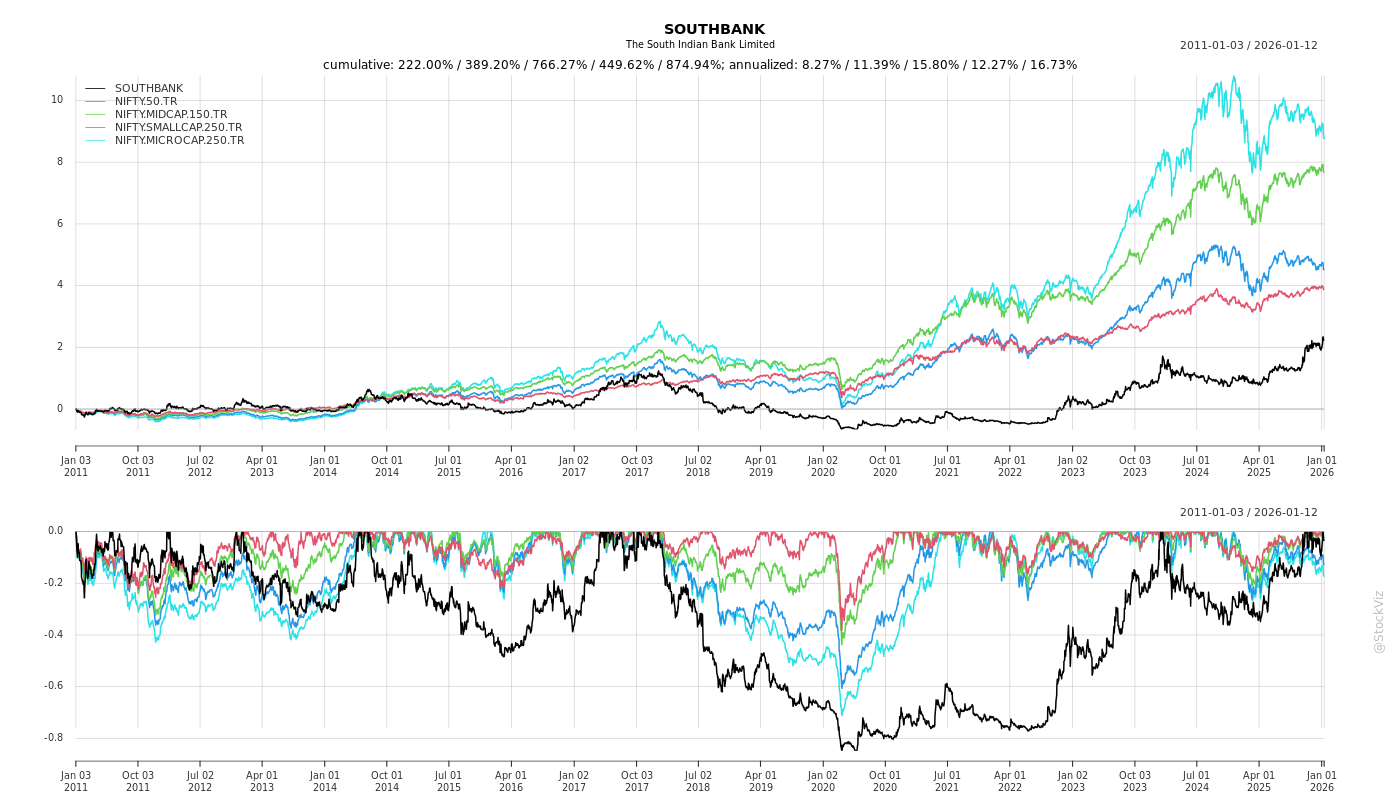

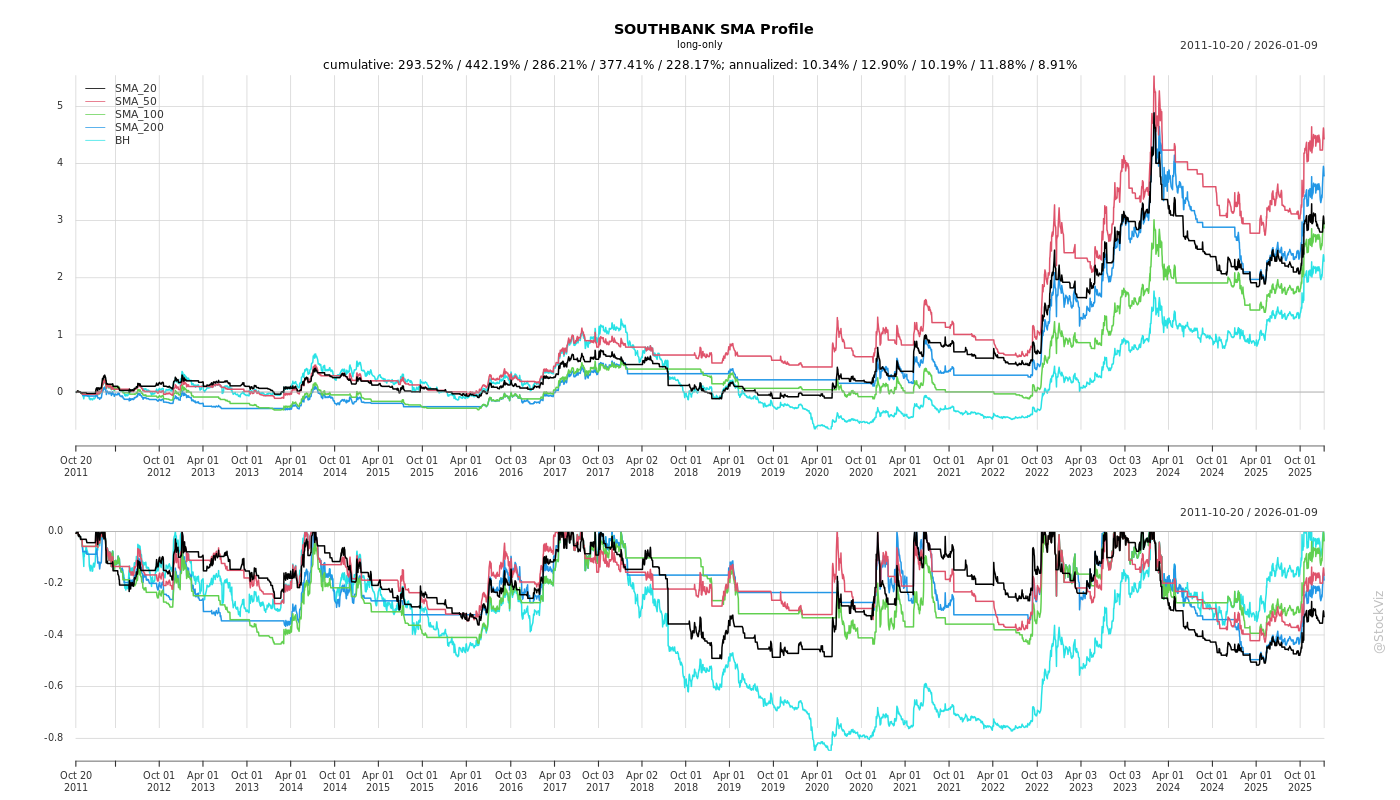

SOUTHBANK

Equity Metrics

January 13, 2026

The South Indian Bank Limited

Annual Returns

Cumulative Returns and Drawdowns

Fundamentals

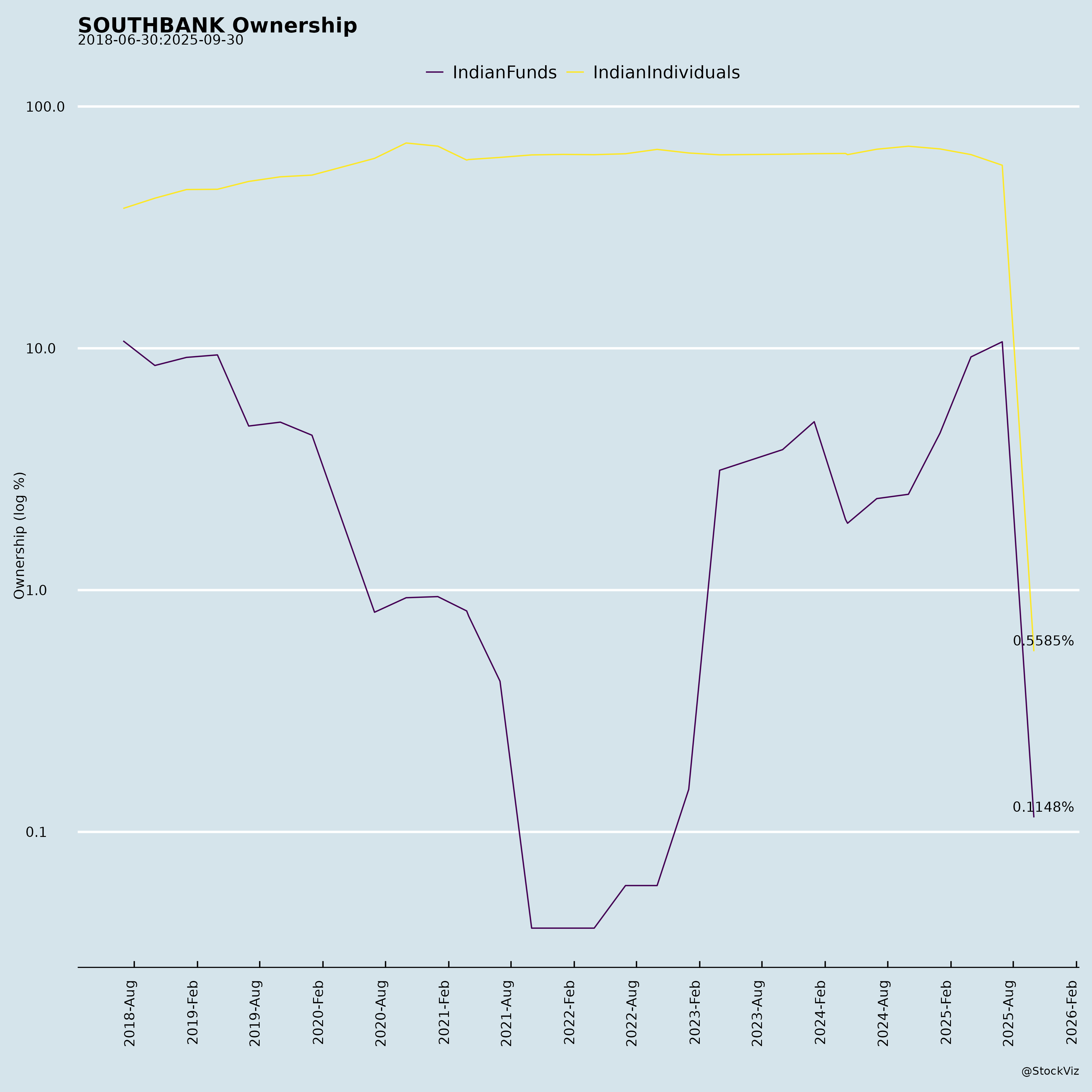

Ownership

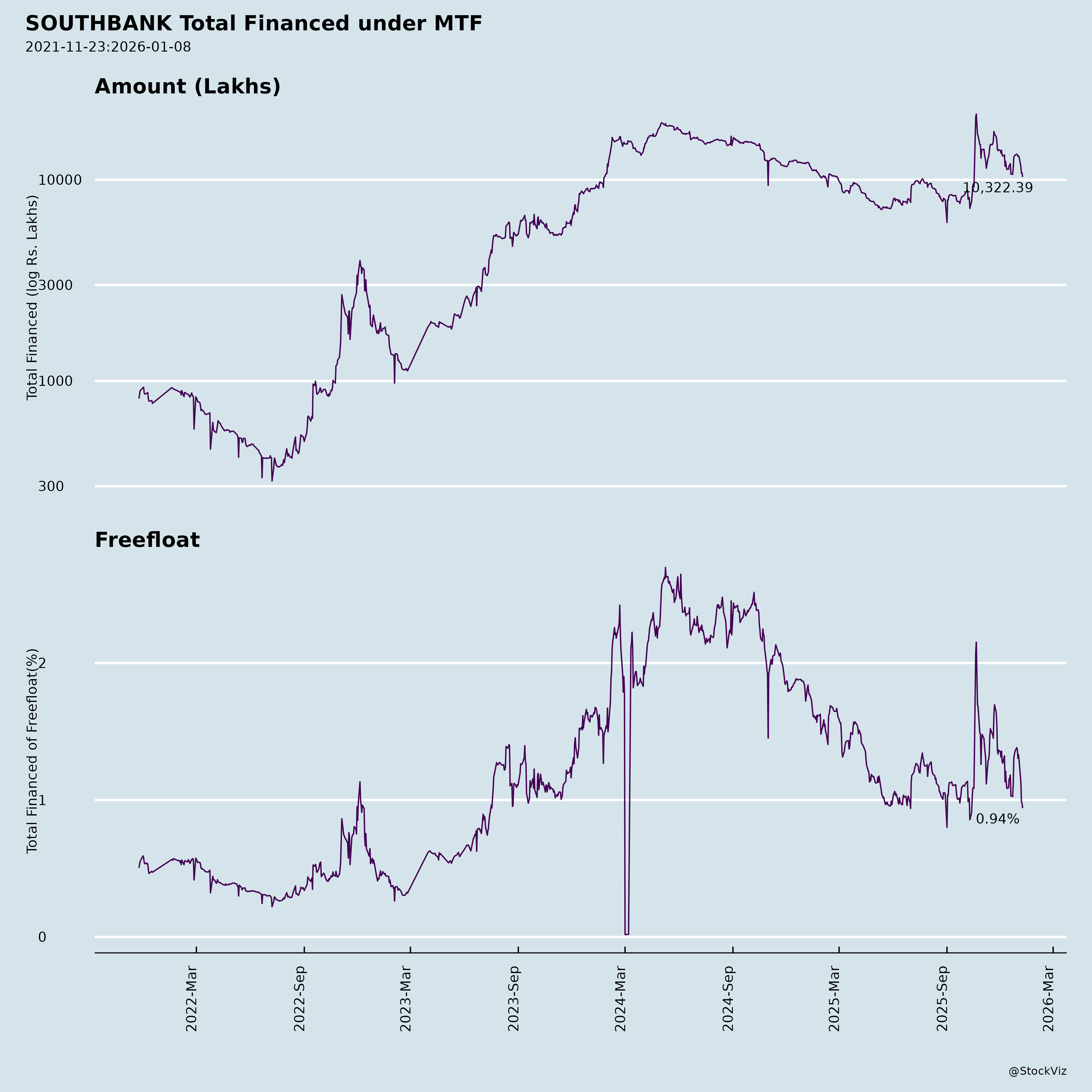

Margined

AI Summary

asof: 2025-12-03

Analysis of South Indian Bank Ltd. (SOUTHBANK) – Headwinds, Tailwinds, Growth Prospects, and Key Risks

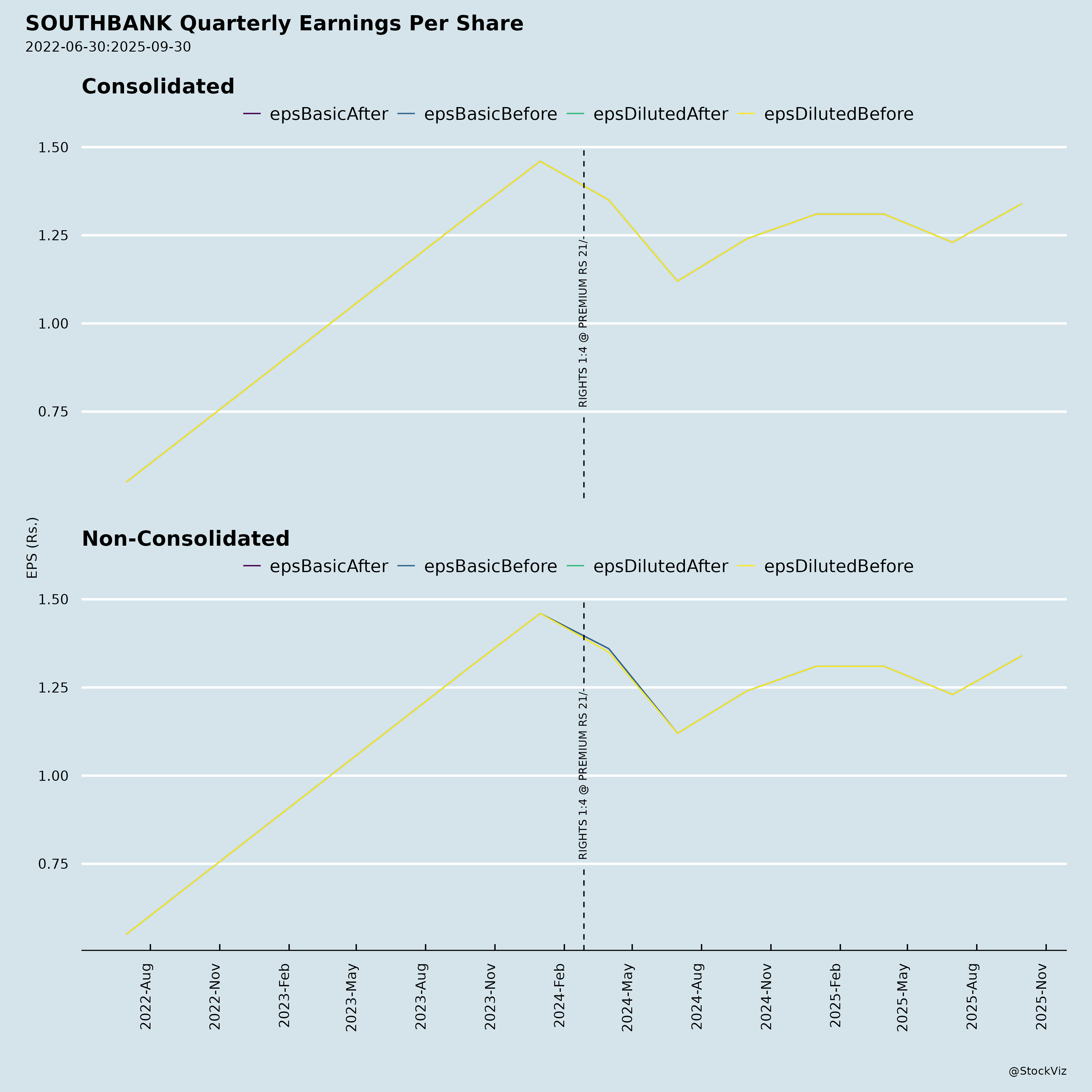

South Indian Bank (SIB) reported robust Q2 FY26 (ended Sep 30, 2025) results, marking its highest-ever quarterly PAT of ₹351 Cr (up 8% YoY), driven by deposit/advance growth, sharp NPA improvements, and non-interest income surge. Total business reached ₹2.08 lakh Cr (up ~10% YoY), with a diversified loan book (~60% retail/MSME). Below is a structured analysis based on the provided filings (investor presentation, financial results, ESOS grant, conference intimation, and press release).

Tailwinds (Positive Drivers)

- Improving Asset Quality & Lower Provisions: GNPA fell 147 bps YoY to 2.93% (PCR excl. w/off at 81.29%, up 1,005 bps YoY); NNPA down 75 bps to 0.56%. 86% of GNPA from “old book” (pre-2020), with new book GNPA at 0.72%. Provisions dropped 43% YoY to ₹63 Cr, aiding profitability.

- Strong Deposit Franchise: Deposits up 10% YoY to ₹1.16 lakh Cr; retail deposits +11% to ₹1.13 lakh Cr. CASA stable at 31.86% (up 6 bps YoY), NRI deposits +9% to ₹3,320 Cr (low-cost focus).

- Healthy Profitability Metrics: PAT +8% YoY; RoA 1.02%, RoE 13.11%. Non-interest income +26% YoY to ₹516 Cr (treasury/forex +21%).

- Operational Efficiency: Cost-to-income at ~59.6%; branch productivity +31% YoY (indexed); digital transactions 98% of total. Employee training (2,777 staff) and process automation (e.g., GST Power, Gold Xpress).

- Capital Strength: CAR 17.70% (well above 11.5% regulatory min.); CET-1 16.79%.

- Diversification & Digital Push: Retail/MSME advances ~58% of portfolio; gold loans +13%, housing +25%, vehicle +25% YoY. 10+ new digital products (e.g., co-lending with Godrej, Moneyview); pan-India network (948 branches).

Headwinds (Challenges)

- NIM Compression: Down 44 bps YoY to 2.80% (from 3.24%), due to higher deposit costs (5.41%) and borrowings surge (+155% YoY to ₹665 Cr for liquidity). Yield on advances dipped to 8.56%.

- Moderate Advance Growth: +9% YoY to ₹92,286 Cr, but Q-o-Q slowdown; corporate shift offset by retail ramp-up.

- Provision Volatility: H1 provisions +36% YoY to ₹303 Cr, tied to legacy NPAs.

- Geographic Concentration: ~38% branches/deposits in Kerala; RoI growth key but slower.

- Forex/Treasury Volatility: Treasury income down 50% Q-o-Q; investments up 41% YoY for SLR compliance.

Growth Prospects

- Retail/MSME Focus: Granular book (avg. MSME loan ₹52 lakh); disbursements strong (e.g., housing +25%). Target: Shift from corporate (42%) to retail (27% personal +17% agri/business).

- Digital & Partnership Expansion: 98% digital txns; co-lending (e.g., Muthoot, Axis) for PL/business loans; 10+ STP platforms live (e.g., LAP Power, Edu Power). Non-branch distribution growing.

- Branch Productivity & Network: +31% YoY value added; 948 branches across 26 states/UTs.

- ESOS Incentives: 2.27 Cr options granted (Tranche 19) to 201 employees, aligning incentives.

- Projections: Advances/deposits trajectory supports 10-15% CAGR; RoE >13%; NIM stabilization via low-cost CASA/NRI mix. Vision 2025: Capital/CASA/Cost focus.

- Investor Interest: Met 21 investors/analysts at Avendus conference (e.g., SBI MF, Kotak AMC); no UPSI shared.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Credit/Asset Quality | Legacy NPAs (86% of GNPA); slippages at 0.21% (improved but monitored). Economic slowdown could hit MSME/retail. | PCR 90% (incl. w/off); sector-based lending; ever-30+ at 6 MOB low (ex-corporate). |

| Interest Rate/Liquidity | NIM pressure from rising deposit rates; borrowings up 285% Q-o-Q. | Stable CASA (31.86%); HTM investments; NSFR/LCR compliant (Pillar 3 disclosures). |

| Operational/Cyber | Digital reliance (98% txns); new platforms increase cyber risks. | Tech-enabled renewals; skill-building; robust IT team. |

| Regulatory/Compliance | RBI norms (e.g., Basel III, ESOS); unhedged forex provisions. | CAR buffer; no material qualifications in LR reports. |

| Concentration | Kerala/South exposure (~50-60% advances); NRI dependence. | RoI branches +20%; diversified sectors (A+ corporates 78%). |

| Market/Competition | Private banks’ aggression in retail; volatile treasury. | Productivity gains; partnerships for scale. |

Summary

Bullish Outlook with Sustainable Momentum: SIB’s transformation (83% loan book churn since 2020) shines through record PAT, pristine asset quality (GNPA <3%), and 10% business growth. Tailwinds from retail/digital shift, efficiency, and capital strength outweigh NIM headwinds. Growth Prospects Strong (12-15% advances FY26e via MSME/retail; RoE 13%+), supported by 6Cs strategy. Valuation Upside: Trading at ~0.8x FY26e BVPS (₹40.6); peers at 1.2x. Risks Manageable but watch NIM recovery and macro (e.g., monsoon/MSME stress). Recommendation: Accumulate for 20-25% upside in 12M (target ₹35-40/share).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.