Private Sector Bank

Industry Metrics

January 13, 2026

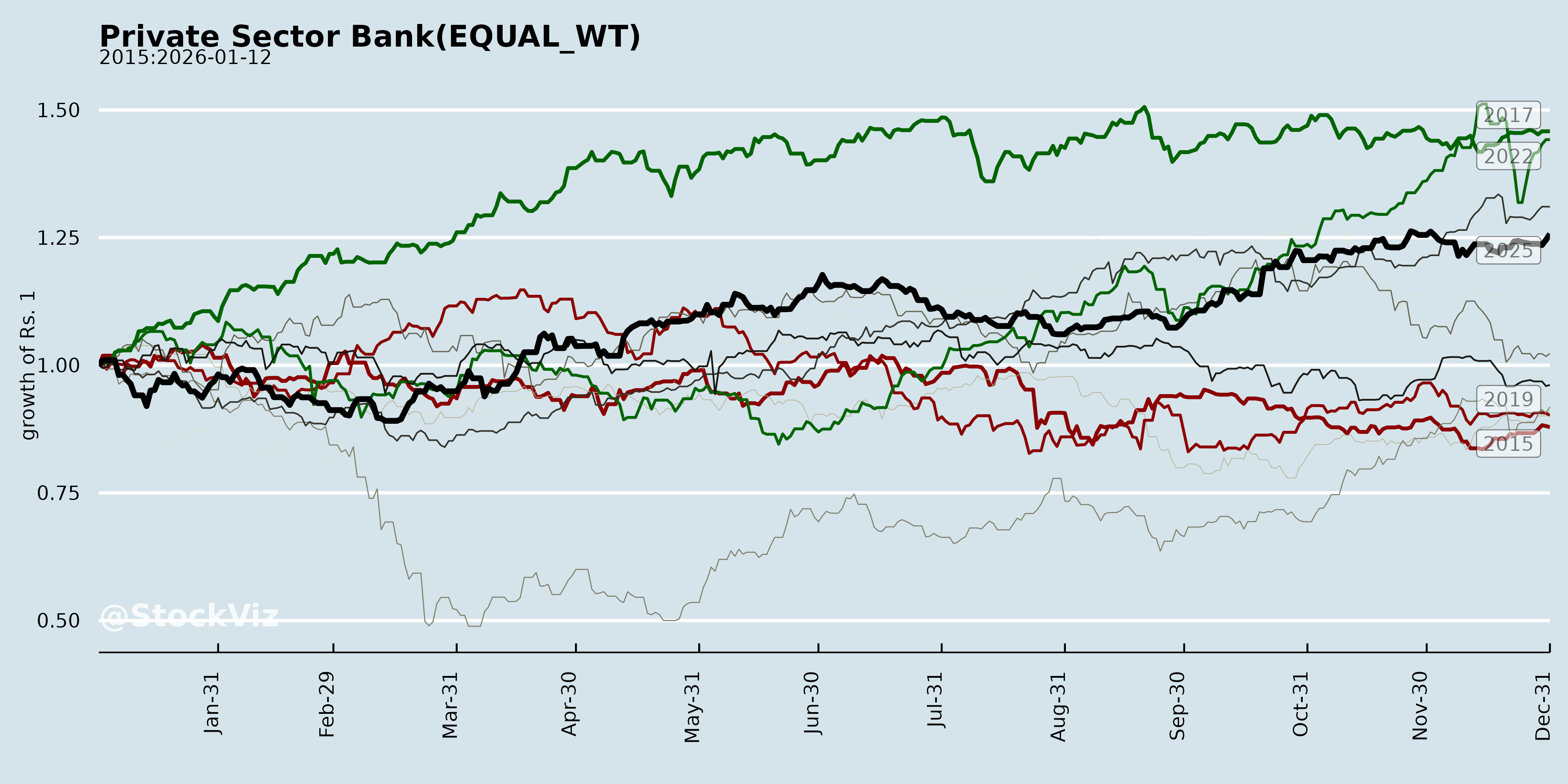

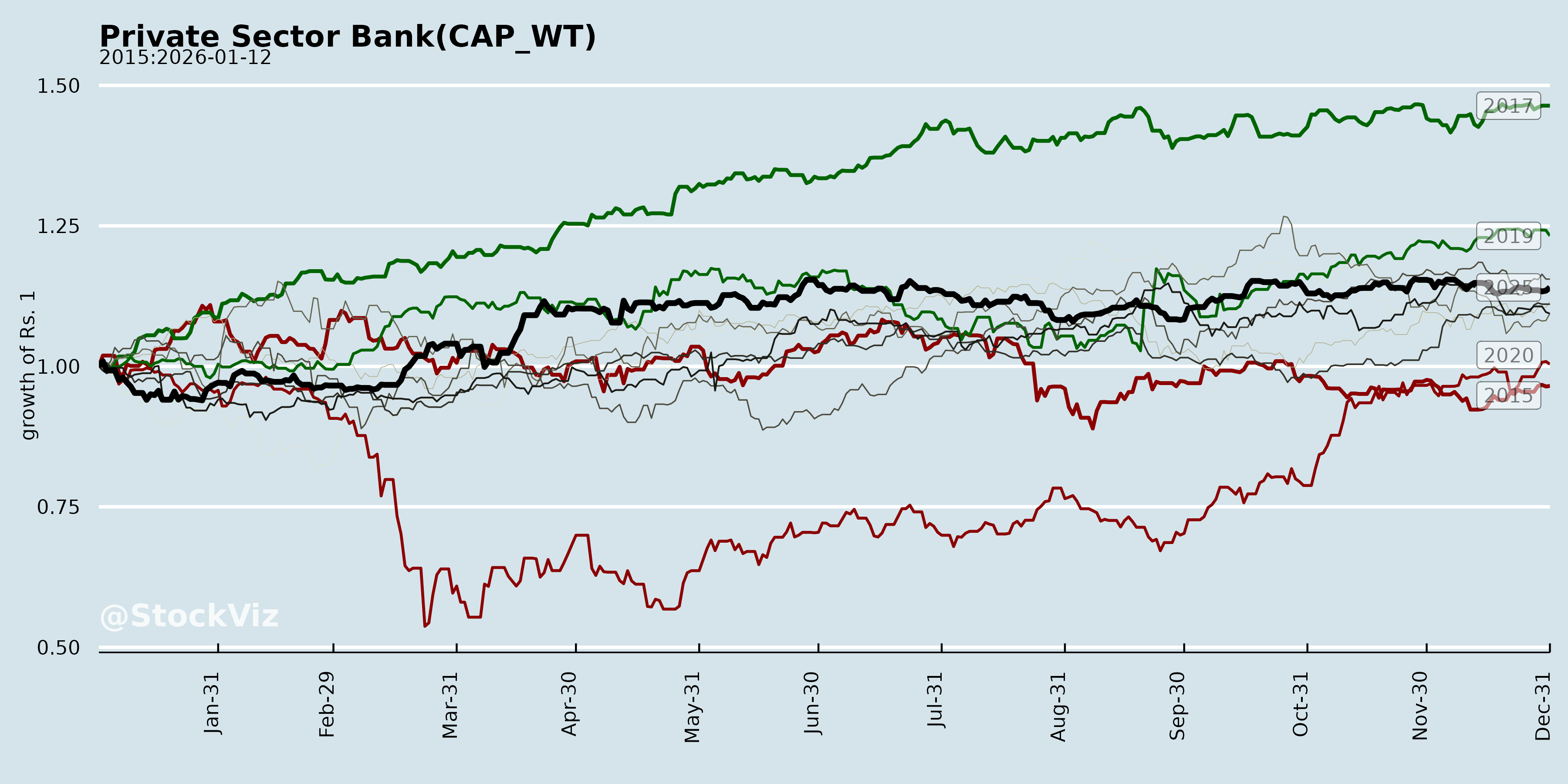

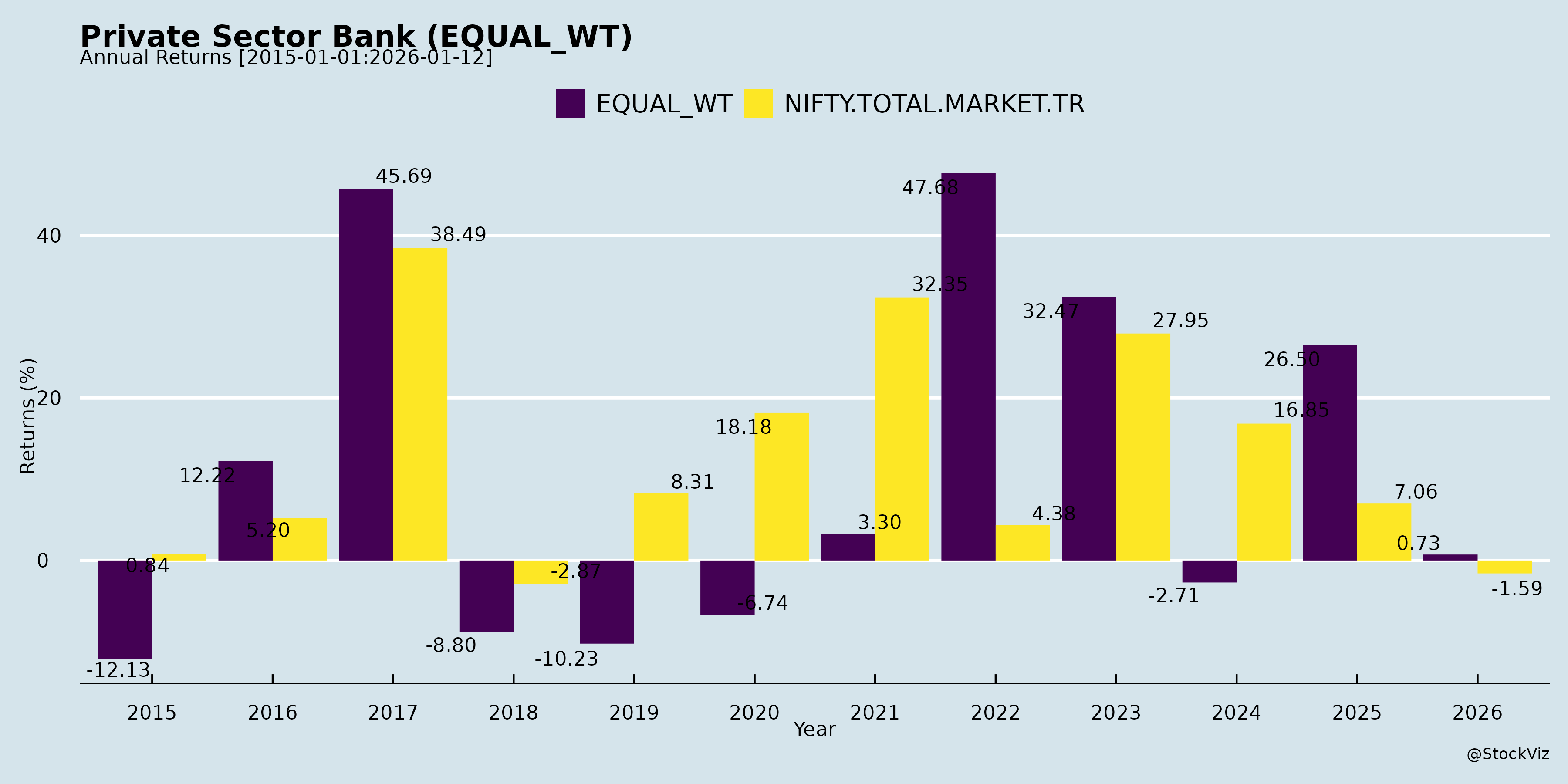

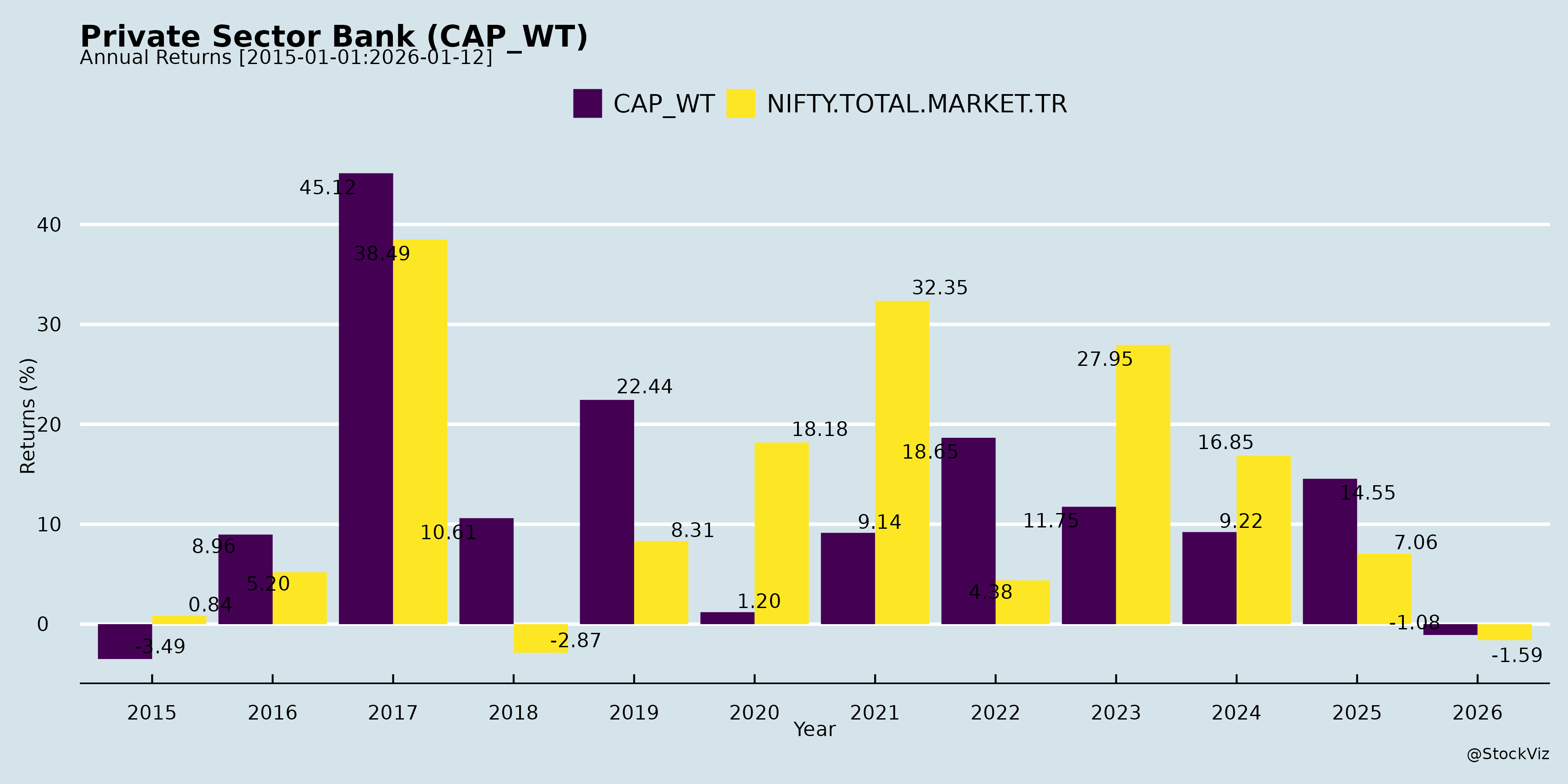

Annual Returns

Cumulative Returns and Drawdowns

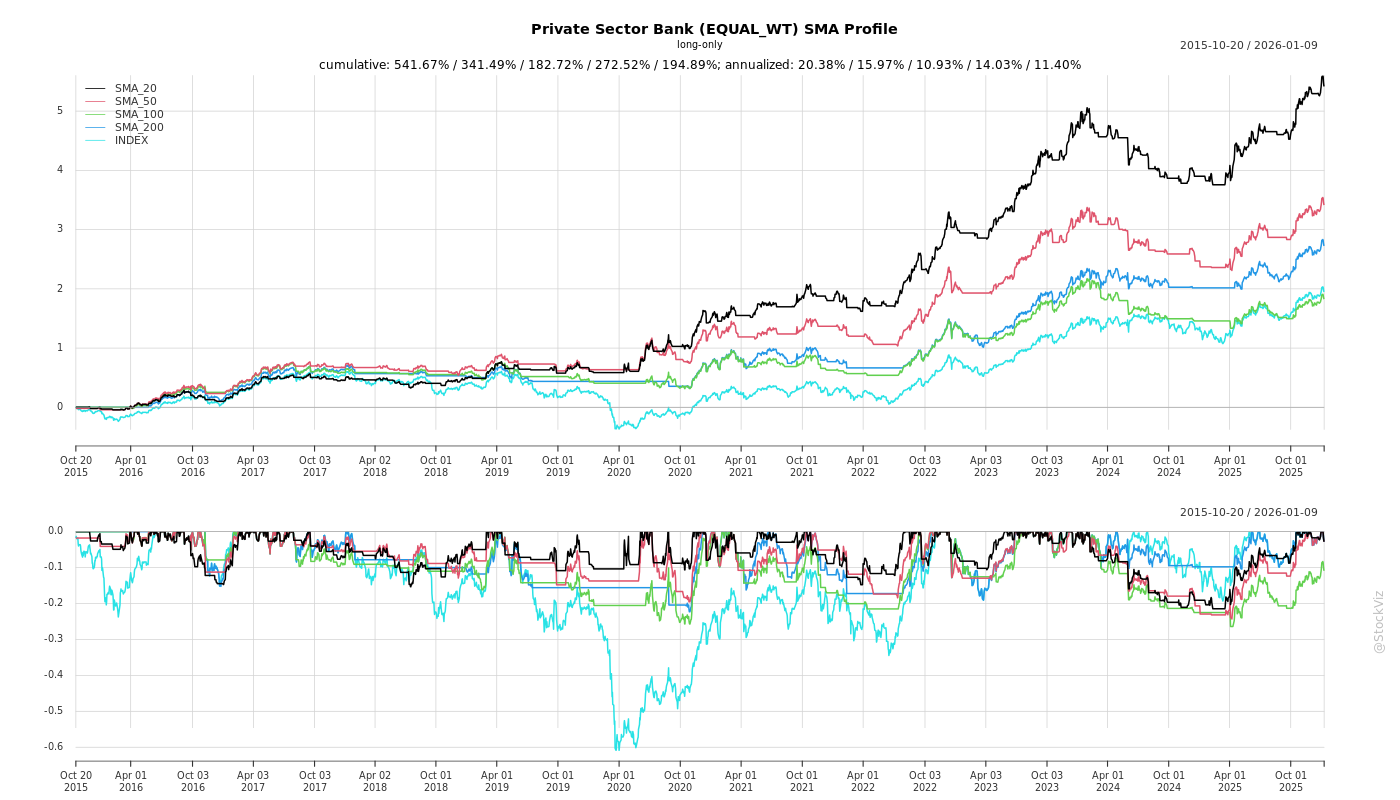

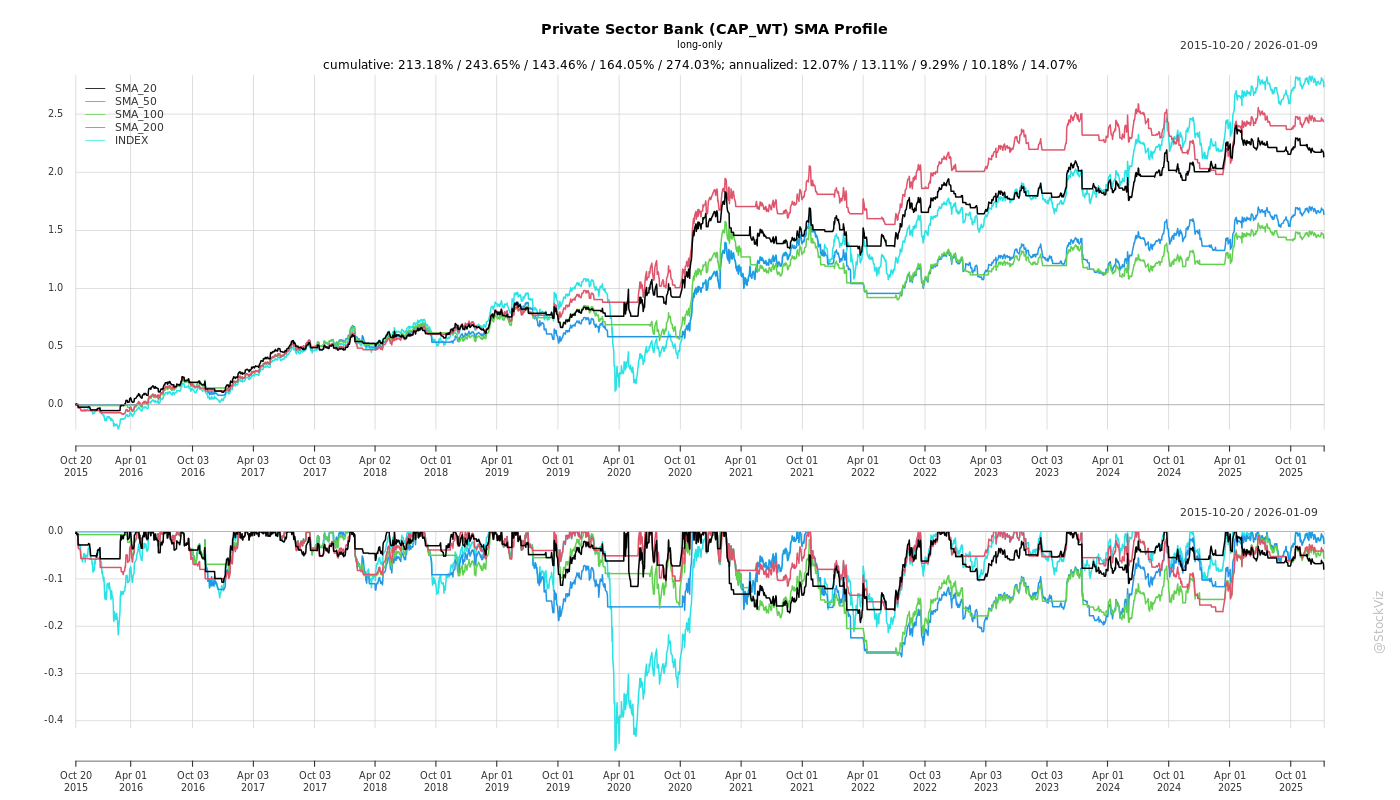

SMA Scenarios

Current Distance from SMA

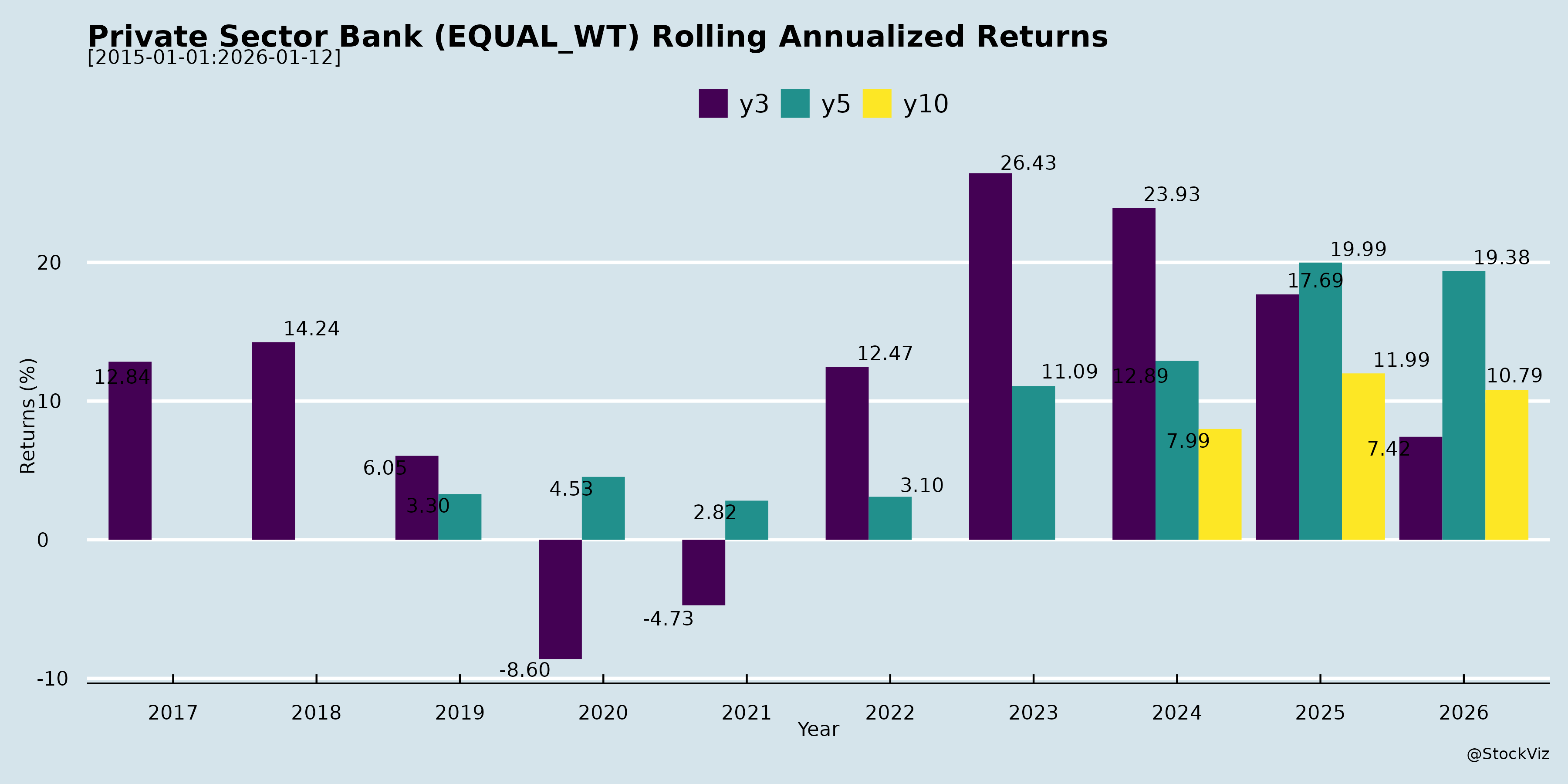

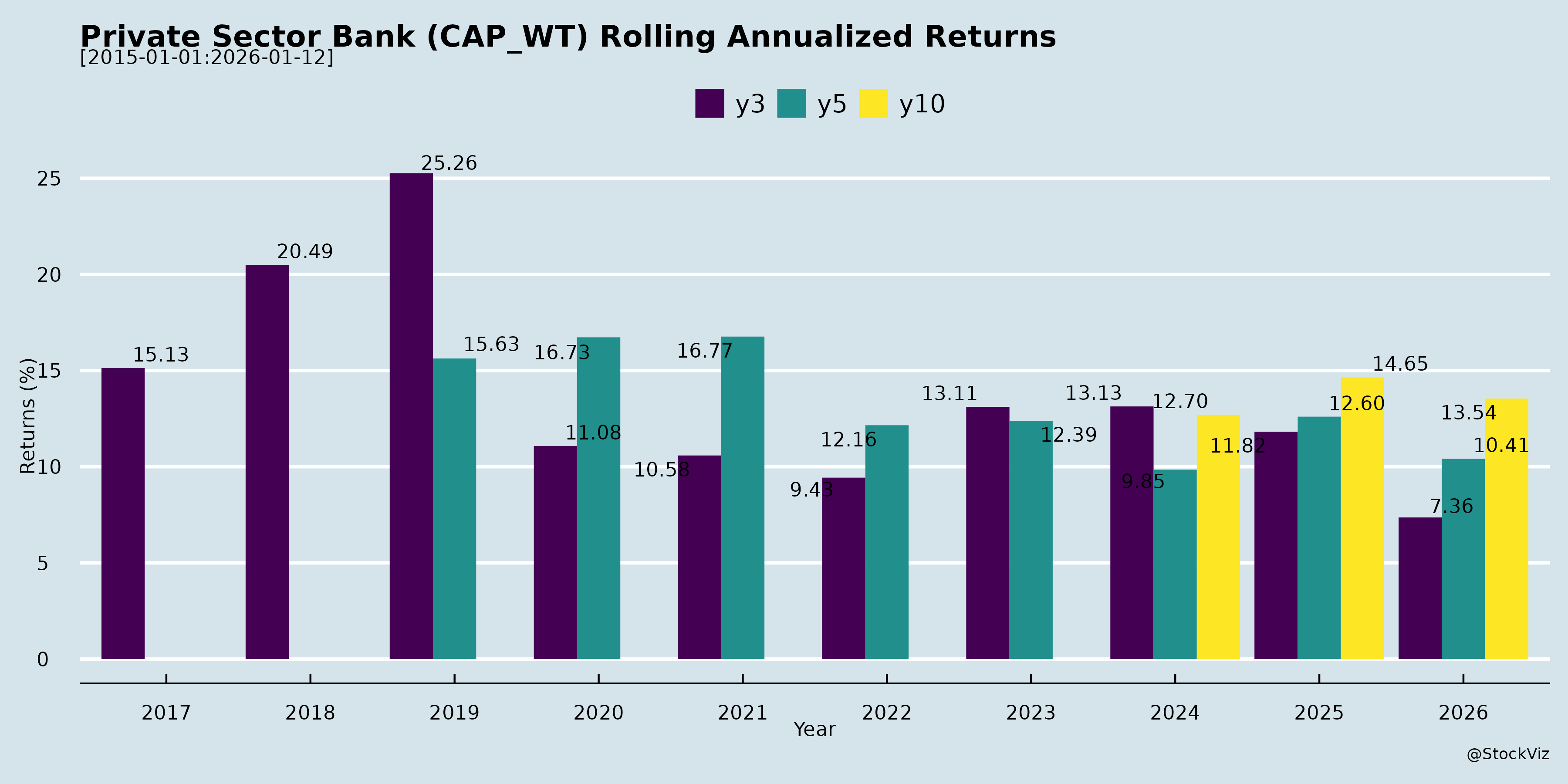

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Analysis of Indian Private Sector Banks (Based on Provided Documents)

The documents primarily consist of analyst/investor meeting intimation letters and earnings call transcripts from key private sector banks (e.g., ICICI Bank, IDFC FIRST Bank, HDFC Bank, Axis Bank, Kotak Mahindra Bank, etc.) for Q2 FY26 (quarter ended Sep 30, 2025). These highlight robust financial performance, strategic focuses, and forward-looking commentary amid a resilient Indian economy. ICICI Bank’s detailed transcripts provide the most granular insights (e.g., 10.6% YoY domestic loan growth, 4.30% NIM, improving asset quality), while IDFC FIRST Bank’s call emphasizes high growth (19.7% YoY loans) but MFI-related normalization. Other filings confirm active investor engagement (e.g., Macquarie tours, Morgan Stanley summits). Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks for the sector.

Tailwinds (Positive Factors)

- Policy Support and Economic Momentum: Banks cite RBI’s repo cuts (100 bps+), CRR reductions, GST rate cuts, and fiscal stimulus boosting liquidity and demand. High-frequency indicators (GST e-way bills, cement/electricity) signal H2 recovery; rural/urban consumption improving (e.g., 2-wheeler post-GST bump).

- Deposit Franchise Strength: Average deposits grew 7-24% YoY (ICICI: 9.1%, IDFC FIRST: 24%). CASA ratios stable/improving (ICICI: ~40%, IDFC FIRST: 50%). Retailization rising (IDFC FIRST LCR retail at 65%), branch expansions (ICICI: 7,246 branches).

- Asset Quality Resilience: Net NPAs low/improving (ICICI: 0.39%, IDFC FIRST: 0.52%). PCR strong (ICICI: 75%, IDFC FIRST: 72%). Slippages down ex-MFI; contingency provisions ample (ICICI: ₹13,100 Cr).

- Revenue Diversification: Fee income up 10-13% YoY (ICICI core op. profit +6.5%). Non-interest income growth via ecosystems (retail 78% of fees). Subsidiaries (e.g., ICICI Life/AMC) performing well.

- Capital Buffers: CET1 ratios robust (ICICI: 16.35%, IDFC FIRST: 12.27% pre-CCPS conversion). Digital capabilities (e.g., IDFC FIRST: 1M loans/month) enabling scale.

Headwinds (Challenges)

- Margin Pressures: NIM range-bound/compressing (ICICI: 4.30% vs. 4.34% QoQ; IDFC FIRST: 5.59%, bottomed out). Rate cuts, deposit re-pricing lags, competition, and KCC seasonality (higher Q1/Q3 provisions) cited. Treasury income volatile (ICICI down sharply).

- Uneven Loan Mix: Domestic loans grew 10.6% YoY (ICICI), but corporate slow (3.5% YoY due to cash-rich firms, equity/bond alternatives). Retail slowdown in some segments (IDFC FIRST MFI degrew to 2.7% of assets).

- Opex and Cost Dynamics: Sequential opex up 3-12% (festive spends, branches). Cost-income sticky in parts (IDFC FIRST ~59% on assets due to MFI income drag).

- Regulatory Transitions: ECL norms (draft; potential Stage 1/2 provisioning hike, offset by Stage 3 floors). Risk weight changes neutral-positive for most.

- External Volatilities: Global risks (e.g., tariffs, Trump policies) impacting exporters/SMEs; microfinance stress lingering (IDFC FIRST utilized ₹75 Cr buffer).

Growth Prospects

- Accelerating Credit/Deposits in H2 FY26: Expect mid-teens loan growth (system +ve; ICICI domestic QoQ 3.3%, business banking +24.8%). Retail (mortgages +9.9%, cards +6.4%), ecosystems/micromarkets key. Deposits to sustain 9-20% (CASA-led).

- Strategic Focus: 360° customer approach (ICICI), universal banking builds (IDFC FIRST: wealth AUM +28% to ₹55,000 Cr, cards >4M issued). Branch/digital expansion; PSL compliance via new products (gold loans, tractors).

- Profitability Trajectory: PBT ex-treasury +9.1% YoY (ICICI); core op. profit improving. RoE 16% (ICICI standalone); ROA targeting 0.9-1% by Q4 FY26 (IDFC FIRST). Operating leverage from digitization (opex < loan growth).

- Sector Outlook: Low-base effects aid smaller banks (IDFC FIRST loans 5x since 2018); large peers (ICICI/HDFC) gain via scale. H2 better on policy tailwinds; 10-15% system credit growth feasible.

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Asset Quality | MFI/unsecured retail slippages (IDFC FIRST); BB+ corporates up slightly (ICICI: 0.3% advances). SMA/NPA trends to watch. | High PCR, contingency buffers; 5-quarter disclosures for early signals. |

| NIM/Rate Sensitivity | Further repo cuts (expected); deposit competition. | Repricing (55% EBLR loans), CRR benefits; range-bound guidance. |

| Regulatory | ECL (provisioning shift, neutral P&L impact per ICICI); risk weights (net +ve). | Model prep underway; conservative norms (e.g., ICICI PCR 75%). |

| Macro/External | Tariff hikes (exporters/SMEs); global volatility. Corporate demand weak. | Diversified retail focus (42.9% portfolio); 73% corporates A-+. |

| Execution | Opex control amid growth; CA share low (IDFC FIRST: 14% CASA). | Digital scale (e.g., InstaBIZ app); disciplined RoC principle. |

Summary

Indian private sector banks exhibit resilience and optimism amid policy boosts, with tailwinds from economic recovery, strong deposits/asset quality, and digital levers outweighing headwinds like NIM pressures and regulatory shifts. Growth prospects are bright for H2 FY26 (10-20% loans/deposits), driven by retail/business banking and operating leverage, targeting sustainable RoEs (15-18%). Key risks center on asset quality normalization (ex-MFI), rate dynamics, and ECL, but buffers and transparency mitigate them. Overall, the sector is positioned for profitable expansion (e.g., ICICI PBT ex-treasury +9%), with larger banks (ICICI/HDFC) leading stability and mid-sized peers (IDFC FIRST) offering high-beta growth. Investors should monitor Q3 NIM/credit costs for confirmation.

Financial

asof: 2025-12-02

Summary Analysis of Indian Private Sector Banks (Based on Q3 & 9M FY25 Results)

The analysis is derived from unaudited financial results (Q3/9M ended Dec 31, 2024) of major private banks including HDFC, ICICI, Axis, IndusInd, Federal, Bandhan, Karur Vysya, City Union, Tamilnad Mercantile, Jammu & Kashmir Bank, and others. Overall, the sector shows robust loan growth (10-20% YoY) driven by retail/wholesale segments, but faces margin pressures and asset quality concerns in select players. Profits grew 10-30% YoY for most (e.g., ICICI +15%, Axis +20%), but QoQ dips in some due to provisions. Capital adequacy remains strong (15-20% CRAR). Key metrics: Avg. Gross NPA ~1.5-2.5% (up from FY24 in microfinance-exposed banks), NIM ~3.5-4.2%, RoA ~1.5-2%.

Tailwinds (Positive Drivers)

- Strong Loan Growth: Advances up 15-25% YoY across banks (e.g., HDFC ₹25L Cr, ICICI ₹13L Cr, Axis ₹10L Cr). Retail (60-70% portfolio) and wholesale segments lead; digital banking sub-segment growing 20-50% (e.g., HDFC Digital ₹1.2L Cr).

- Fee & Other Income Surge: Up 15-40% YoY (e.g., ICICI ₹27K Cr Q3, HDFC ₹11K Cr), driven by FX/derivatives, third-party products, and recoveries.

- Deposit Mobilization: CASA ratios stable/improving (30-45%); total deposits +12-20% YoY (e.g., HDFC ₹25L Cr, ICICI ₹15L Cr).

- Capital Buffers: CRAR 15-20% (well above 11.5% min.); e.g., HDFC 19.97%, ICICI 14.71%.

- RBI Reforms: New investment classification (Apr 2024) led to one-time gains (e.g., HDFC ₹483 Cr net gain); symmetric FV treatment aids treasury.

- Digital Push: Sub-segment revenue/assets growing (RBI DBU mandate); low-cost digital loans boost margins.

Headwinds (Challenges)

- NIM Compression: Interest expended up 20-30% YoQ (e.g., HDFC 4.5% of income, ICICI 2.9%); deposit costs rising amid liquidity tightness.

- Rising Provisions: Total provisions 2-5x YoY in some (e.g., IndusInd ₹17K Cr 9M, Bandhan ₹2.5L Cr); NPA ratios elevated (Bandhan 4.7% gross, IndusInd 2.25%).

- Asset Quality Stress: Microfinance/EEB exposure hit (Bandhan RoA 0.24%, IndusInd provisions spike); slippages in retail/SME.

- Investment Income Volatility: New RBI norms make YoY comparison non-comparable; FV losses in HFT/FVTPL (e.g., Axis ₹83 Cr Q3 loss).

- OpEx Growth: Employee costs +15-25% (staffing for growth); tech spends up (digital infra).

- Slow CASA Growth: Competition erodes low-cost deposits (e.g., HDFC Debt-Equity 0.84 from 1.28 YoY).

Growth Prospects

- High (Medium-Term): Loan book to grow 15-20% FY26 on retail/digital tailwinds; fee income 20%+ CAGR (ICICI/Federal strong). NIM stabilization at 3.8-4.2% post-rate cuts.

- Sector Targets: RoA/RoE 1.8-2%/15-18% feasible with 12-15% deposit growth, NPA <1.5%. HDFC/ICICI lead (scale + diversification); mid-tier (Axis/Federal) via wholesale/retail mix.

- Catalysts: RBI rate cuts (repo ~6.25%), infra push, digital lending (UPI/DBU), recovery in capex cycle. Microfinance stabilization post-RBI norms.

- Projections: 9M FY25 profits up 15-25% YoY sector-wide; FY26 EPS growth 20%+ for leaders.

Key Risks

| Risk Category | Description | Impact (High/Med/Low) | Banks Most Exposed |

|---|---|---|---|

| Asset Quality | NPA rise (microfinance slippages); provisions erode margins (Bandhan/IndusInd >2% GNPA). | High | Bandhan, IndusInd |

| Interest Rate | Beta on deposits > loans; NIM squeeze if rates stay high. | Med-High | All (HDFC/ICICI cushioned by scale) |

| Regulatory | RBI norms (investment FVTPL volatility, risk weights on EEB/SBAL); forex exposure provisioning. | Med | Mid-tier (higher retail %) |

| Liquidity | Deposit crunch (CASA <35% in some); LCR/NSFR pressures. | Med | Axis, Federal |

| Operational | Cyber/fraud risks; high OpEx (tech hires). | Med | Digital-heavy (ICICI/HDFC) |

| Macro | Slow GDP (rural distress), election volatility. | Low-Med | Rural/micro-focused |

Overall Outlook: Positive with Caution. Sector resilient (advances + RoA steady), but divergence: Leaders (HDFC/ICICI) outperform; laggards (Bandhan/IndusInd) need NPA cleanup. Growth intact at 15%+, but risks tilt to asset quality/regulation. Investors favor scale players with diversified books.

General

asof: 2025-12-03

Summary Analysis: Indian Private Sector Banks (Based on Provided Filings)

The filings from major private banks (HDFC, ICICI, Kotak, Axis, YES, IDFC First, IndusInd, Federal, Bandhan, Karur Vysya, City Union) highlight a resilient sector amid India’s robust economic growth (IMF FY26 GDP forecast: 6.2-6.8%), digital acceleration, and turnaround efforts. YES Bank’s detailed investor presentation provides the most comprehensive sector proxy. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Macroeconomic Resilience: India’s fastest-growing major economy (6.6% FY25P growth), low inflation (4.6% FY25 avg., within RBI band), credit-to-GDP gap (55% vs. global 88-140%), and policy support (PLI schemes, GST 2.0, CRR/repo cuts injecting ₹2.5L Cr liquidity) bolster demand.

- Digital Leadership & Inclusion: UPI dominance (#1 Payee PSP at 54% share, #2 Payer at 30%; YES processes 1/3 of digital txns), 1,500+ APIs, super-apps (IRIS, IRIS Biz), 98% digital credit cards, and public infra (AA, OCEN, ONDC, ULI) drive low-cost acquisition (e.g., 42L IRIS users, 70% digital service resolution).

- Capital & Liability Strength: Bond issuances (ICICI ₹39,450 Cr Tier-2), ESOS allotments (Federal, Axis), granular CASA growth (YES: 33.7%, 12.5% YoY), branch expansion (City Union: 900th branch), and marquee investors (SMBC 24.2% in YES).

- Asset Quality & Governance: Improving NPAs (YES GNPA 1.6%, NNPA 0.3%, PCR 81%), ESG leadership (YES top S&P score 72/100), ratings upgrades (YES AA-), and recoveries (₹30K Cr in YES turnaround).

- Profitability Momentum: Operating profit up (YES Q2FY26 +33% YoY), NIM stable (2.5%), fee income growth (cards +26% YoY).

Headwinds (Challenges)

- Regulatory Scrutiny & Penalties: RBI penalty on HDFC (₹0.91 Cr for KYC/outsourcing/interest rate violations); Axis ESOS vesting revised per RBI; domain migration mandate (Bandhan); speculation denial (IndusInd QIP rumors).

- Balance Sheet Drag: PSL shortfall deposits (YES: ₹33.6K Cr, 7.8% assets, though declining); higher borrowings (YES 16.9%); lower advances/assets (YES 58% vs. peers 62-65%).

- Cost Pressures: High C/I ratio (YES 67%), opex growth (though controlled), and tax provisions impacting RoA (0.6-0.7%).

- Sector-Wide Stress: Historical NPAs (YES pre-turnaround GNPA 16.8%), slippages (YES Q2FY26 ₹1.2K Cr), and global headwinds (US tariffs).

Growth Prospects (Opportunities)

- Retail & Granular Shift: Retail/commercial advances 73% (YES, +16.5% YoY commercial); disbursements up (YES ₹24.5K Cr Q2FY26); MSME/rural focus (100% PSL-compliant granular book).

- Deposit Mobilization: Retail/branch-led deposits +14% YoY (YES 58% mix, CASA 39.6%); fintech partnerships (Swiggy, Zomato) for inorganic acquisition.

- Digital & Transaction Banking: UPI/CMS CAGR 38-74%, agency business (tax collections via YES Tax Pay), BaaS/BaaP models; wholesale (corporate/institutional +5.4% YoY).

- Capital-Reliance: Strong CET-1 (YES 13.9%), potential equity raises; branch additions (YES target 80 in FY26).

- Sector Tailwinds: Credit growth 9-11% FY26E, financial inclusion (FI index up), ESG premium (Karur Vysya score 66/100).

Projected Metrics (YES Proxy): Advances CAGR 6-7% FY26E; RoA 0.7-1%; granular retail/MSME to drive 15-20% segment growth.

Key Risks

- Regulatory/Compliance: Ongoing RBI scrutiny (penalties, PSL, KYC); potential rating volatility.

- Asset Quality Deterioration: Slippages (2% annualized), rural/microfinance stress, overdue loans (YES 1.5% of advances).

- Liquidity & Funding: RIDF/PSL deposits drag NIM; borrowing dependence (14-20%); rumor-driven volatility (IndusInd).

- Competition & Macro: Intense rivalry in digital/retail; global slowdown/tariffs; inflation spikes.

- Execution: Digital migration risks, branch integration costs; over-reliance on partnerships.

Overall Outlook: Positive with moderate risks. Tailwinds from digital/economy outweigh headwinds; focus on granular retail/digital to sustain 10-12% sector growth. YES exemplifies turnaround potential (RoA from -7% to 0.7%), but vigilance on regulations key. Investors should monitor Q3FY26 asset quality & NIM.

Investor

asof: 2025-12-03

Summary Analysis: Indian Private Sector Banks (Based on Provided Documents)

The documents primarily cover Q2 FY26 earnings transcripts (ICICI Bank, IDFC FIRST Bank) and analyst/investor meeting disclosures from banks like HDFC, Kotak, Axis, YES, IndusInd, Federal, Bandhan, Karur Vysya, City Union, and RBL. They highlight resilient performance amid policy support, with ICICI showing mature stability and IDFC FIRST demonstrating high growth from a lower base. Below is a sector-level analysis.

Tailwinds (Positive Factors)

- Economic Resilience & Policy Boost: Indian economy supported by RBI’s repo/CRR cuts (100 bps repo easing), GST reductions, and fiscal measures. High-frequency indicators (GST e-way bills, cement/electricity) signal H2 pickup (ICICI: “second half better”; IDFC: GST lift on durables/2-wheelers).

- Deposit Mobilization: Strong growth (ICICI: 9.1% YoY avg.; IDFC: 23.4% YoY, CASA 50%). Retailization improving (IDFC LCR retail at 65%), branch expansions (ICICI: 263 in H1).

- Asset Quality Improvement: Low NPAs (ICICI: net 0.39%; IDFC: gross 1.86% from 1.97%). Slippages down (IDFC non-MFI slippage ratio 3.39%), collections stable (99.5% early bucket).

- Revenue Diversification: Fee growth (ICICI: 10.1% YoY), non-interest income up 13.2%. Subsidiaries strong (ICICI Life/Gen/AMC).

- Digital & Capabilities: Tech-led efficiency (IDFC: 99% e-KYC/mandate; ICICI: InstaBIZ app). Universal banking push (wealth AUM up 28% at IDFC).

Headwinds (Challenges)

- Margin Pressures: NIM range-bound/compressing (ICICI: 4.30% vs. 4.34% prior; IDFC: 5.59% down 12 bps). Rate cuts, deposit re-pricing lags, competition (ICICI: “competitive pressures”).

- MFI Stress Legacy: Degrowth/ high credit costs (IDFC: MFI book down to 2.7%, credit cost ~10%; ongoing for Bandhan-like players).

- Opex Stickiness: Rising sequentially (ICICI: 12.4% YoY), branch/festive spends (IDFC cost-income ~59%).

- Regulatory Transitions: ECL norms (ICICI/IDFC: no material P&L hit expected but data/model work needed); credit risk RWA changes.

- LDR Expansion: Loan growth outpacing deposits (ICICI LDR up; IDFC at 94%).

Growth Prospects

- Loan Book Acceleration: H2 FY26 expected stronger (ICICI domestic 10.6% YoY, business banking 24.8%; IDFC 19.7% YoY). Retail (mortgages 9.9%, cards 6.4%), ecosystems/micromarkets focus.

- Deposit & CASA Momentum: Mid-teens potential (ICICI: CA/SA up 12.6%/8.5%; IDFC targeting mid-80s LDR).

- High-Conviction Segments: Business banking (ICICI 24.8%), vehicles/cards (IDFC 12% QoQ vehicles), wealth (IDFC INR55k Cr AUM, target 2-3L Cr).

- Base Effects & Share Gains: Smaller banks (IDFC) leverage low base (5x retail book since 2018); peers eye 10-15% system growth.

- FY26 Outlook: ICICI RoE 16%, PBT ex-treasury +9.1%; IDFC NIM >5.8% by Q4, credit cost 2.05-2.1%, ROA 0.9-1%.

Key Risks

- NIM Compression & Rate Sensitivity: Further cuts (expected 25-50 bps), KCC seasonality (ICICI provisions down due to this).

- Credit Costs Normalization: Ex-MFI stable ~2% (IDFC/ICICI), but upside from tariffs (Trump impact on exporters/MSMEs; ICICI: resilient corporates).

- Regulatory/Transition Risks: ECL (provision floors), risk weights (net positive but uncertain), operational RWA changes.

- Sector-Specific: MFI runoff (IDFC stabilizing FY26-end), corporate demand weak (cash-rich, alt funding).

- Macro/External: Global volatility, ECL data gaps, competition intensity.

Overall Sector Outlook: Positive momentum with policy tailwinds driving H2 acceleration (loans ~12-20% FY26). Mature players (ICICI/HDFC) emphasize stability (RoE 16%, low NPAs); growth-chasers (IDFC) focus cleanup (MFI peak pain over). Risks manageable via buffers (ICICI PCR 75%, contingency INR13k Cr), but monitor NIM/ECL. Expect sustained mid-teens growth if economy sustains.

Meeting

asof: 2025-12-01

Summary Analysis of Indian Private Sector Banks (Based on Provided Filings)

The provided documents from 11 private sector banks (HDFC, ICICI, Kotak, Axis, YES, IDFC First, IndusInd, Federal, Bandhan, Karur Vysya, City Union) primarily cover Q2/H1 FY26 financial results (where available), board actions (e.g., appointments, remunerations, stock splits), postal ballots/EGMs, and asset sales. IndusInd and City Union provide detailed financials; others focus on governance. Below is a sector-level analysis of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges Pressuring Performance)

- Deteriorating Asset Quality:

- IndusInd reports sharp NPA rise (Gross NPA: 3.60% vs. 2.11% YoY; Net NPA: 1.04%). Q2 net loss of ₹437 Cr due to high provisions (₹2,631 Cr). Notes on derivative trade discrepancies (₹1,960 Cr), MFI interest overstatement (₹846 Cr), and manual entry issues (₹595 Cr).

- Bandhan selling NPAs (₹3,212 Cr) and written-off loans (₹3,719 Cr) via Swiss Challenge/auction, signaling portfolio cleanup amid stress.

- Sector-wide: Provisions/contingencies elevated (IndusInd: ₹4,391 Cr H1; City Union: ₹1,270 Cr).

- Deposit/Profitability Pressure:

- Deposits declining YoY (IndusInd: -5.5%; City Union stable but borrowings up). NIM compression from rising costs.

- IndusInd H1 PAT down 95% YoY to ₹167 Cr; Q2 loss.

- Governance/Compliance Issues:

- IndusInd: Ongoing probes into subsidiary BFIL (operational losses, unapproved practices); disciplinary actions pending.

- Regulatory filings heavy on approvals (e.g., RBI nods for appointments/remunerations in HDFC, YES, Axis, Kotak).

Tailwinds (Supportive Factors)

- Strong Capital Position:

- CAR robust: IndusInd (17.10%), City Union (21.68%), others ~16-17% (Basel III compliant).

- Retail/Digital Focus:

- Segment reporting (IndusInd/City Union) shows Retail Banking dominant (60-70% revenue/assets), with Digital sub-segment growth.

- Corporate actions like Kotak’s 1:5 stock split enhance liquidity/retail participation.

- Operational Resilience:

- City Union: Healthy Q2 PAT ₹329 Cr (+15% YoY), RoA 1.59%; Advances +9% YoY.

- Governance enhancements: Multiple banks appointing tech-savvy directors (e.g., Karur Vysya: Dr. Mythili Vutukuru for IT/cybersecurity).

Growth Prospects

- Capital Infusion & Expansion:

- Federal: Warrants to Asia II Topco (₹2,000+ Cr potential via preferential issue).

- Axis/Kotak: Borrowing approvals (₹3L Cr/₹35k Cr debt; ₹20k Cr equity).

- Retail/MSME push: Strong segment revenue (IndusInd Retail: 65% of income).

- Digital/Tech Transformation:

- Emphasis on Digital Banking Units (RBI-mandated segments); new IT-focused directors.

- Potential recovery post-NPA sales (Bandhan: Portfolio cleanup for balance sheet repair).

- Sector Tailwinds: Improving economy, RBI rate cuts (expected), PSL/PSLC trading (City Union active). Consensus: 12-15% loan growth FY26; NIM stabilization.

Key Risks

| Risk Category | Description | Mitigants/Evidenced Actions |

|---|---|---|

| Credit Risk | NPA spikes (IndusInd 3.6%; slippages from MFI/COVID resolutions). PCR stress (IndusInd notes). | Provisions up; NPA sales (Bandhan); Swiss Challenge auctions. |

| Governance/Operational | Accounting irregularities (IndusInd: ₹3,400 Cr+ discrepancies); BFIL lapses. Manual overrides. | Project Mgmt Groups, disciplinary probes; auditor qualifications (qualified in BFIL review). |

| Regulatory | RBI scrutiny on WTD remunerations (YES/ICICI/Axis/Federal postal ballots); fit-proper norms. | Heavy approvals sought; diverse boards (tech experts added). |

| Liquidity/Market | Deposit outflows; debt reliance. Rate volatility. | Strong CAR/LCR; borrowings approved. |

| Execution | Integration risks (e.g., Axis Citi; IndusInd mergers). Digital shift delays. | Leadership changes (IndusInd new MD/CEO/CFO). |

Overall Outlook: Sector resilient (strong CAR, retail focus) but faces near-term asset quality headwinds (esp. microfinance exposure). Growth via capital raises/digitalization promising, but governance fixes critical. IndusInd/Bandhan most vulnerable; HDFC/ICICI/Kotak stable. Monitor Q3 NPAs/RBI commentary.

Press Release

asof: 2025-11-30

Summary Analysis of Indian Private Sector Banks (Q2 FY26)

The provided documents cover financial results, announcements, and press releases from key private sector banks (e.g., HDFC, Kotak, Axis, YES, IDFC FIRST, IndusInd, Federal, Karur Vysya, City Union, RBL, J&K Bank). Overall, the sector shows resilience amid moderating growth, with strong deposit mobilization, digital traction, and improving asset quality, but faces NIM pressures, provisioning spikes (esp. microfinance), and regulatory/legacy issues. H1 FY26 industry trends: Deposits ~7-23% YoY growth (CASA 10-27%), Advances 6-20% YoY, NIM stable/declining (2.5-3.7%), RoA 0.5-1.6%, GNPA 1.5-3.6% (improving), PCR 70-90%. Strategic moves like SMBC/RBL stake and Kotak split signal optimism.

Tailwinds (Supportive Factors)

- Robust Deposit Franchise: CASA growth outpacing industry (e.g., Axis/Federal 10-13% YoY, IDFC 27%, YES 12.5%; ratios 33-50%). Retail/branch-led focus (Federal 14% YoY) drives granularization and cost efficiency.

- Fee & Non-Interest Income Surge: Record highs (Federal ₹886 Cr, Axis 10% YoY, YES 17%); driven by cards (Axis 26% spends growth), FX/trade (YES 10%), third-party products (Axis 20%). Digital payments leadership (Axis UPI 37% share, YES #1 Payee PSP).

- Asset Quality Stabilization: GNPA down QoQ/YoY (Axis 1.46%, Federal 1.83%, IDFC 1.86%, YES 1.6%); PCR up (Axis 70-147%, YES 81%, Federal 73%). Slippages easing (Axis/Federal down QoQ).

- Capital & Liquidity Strength: CRAR 15-22% (Axis 16.6%, J&K 15.3%, IDFC 14.3%); LCR 119-125%. Strategic infusions (SMBC in YES/RBL USD 3bn, Kotak split).

- Digital & Efficiency Gains: High app ratings (Axis 4.7-4.8), UPI dominance, branch expansions (Karur Vysya/J&K). Cost/income 47-67% (improving jaws in Axis/Federal).

Headwinds (Challenges)

- NIM Compression: Down YoY/QoQ (Axis -59bps to 3.73%, IDFC -59bps to 5.59%, IndusInd to 3.32%); due to deposit re-pricing lags, RIDF unwind (Axis), MFI slowdown (IndusInd/IDFC).

- Provisioning Pressures: Elevated for MFI/unsecured retail (IndusInd loss ₹437 Cr, IDFC MFI down 42% YoY but provisions cut), legacy issues (HDFC allegations/legal risks, J&K flood disruptions).

- Credit Growth Moderation: 6-12% YoY (vs. deposits); calibrated in retail/MFI (IDFC -42% MFI, Axis rural +2%). High C/D ratios (Axis 84-87%).

- Operating Costs Up: 3-20% YoY (Axis 5%, City Union 20%); wage inflation, tech spends.

- External Disruptions: Regional issues (J&K floods/Pahalgam attack), regulatory (HDFC denial of LKMMT claims).

Growth Prospects

- Retail/MSME Expansion: Granular focus (Axis SBB/SME/MC 24% loans +20% YoY; Federal/Kotak retail traction). Cards/digital lending (Axis 15Mn cards, YES 4Mn issued).

- Fee Diversification: Payments/UPI leadership (Axis/YES), wealth mgmt. (Axis Burgundy +16% AUM). Partnerships (RBL-EMIRATES NBD, IDFC govt apps).

- Inorganic/Strategic Boost: Stakes (SMBC in YES/RBL), splits (Kotak), branch adds (Axis/Federal/KVB/J&K 43-80 targets). PSL organic ramp-up (Axis/J&K).

- Digital Scale: Super apps (Axis open/Kotak neo), APIs (Axis 480), UPI innovations. NIM recovery via re-pricing (Federal +12bps QoQ).

- Sector Tailwinds: Economic recovery, IMEC corridor (RBL/ENBD), EV/green finance (Axis/IDFC).

Key Risks

- Asset Quality Deterioration: MFI/unsecured retail stress (IndusInd/IDFC provisions); slippages 2-4% annualized (Axis retail stabilizing but elevated).

- Margin Squeeze: Rate cycles, deposit competition (CASA wars), RIDF unwind incomplete (Axis/IDFC 7-8% assets).

- Regulatory/Litigation: Probes/allegations (HDFC trustees), PSL shortfalls (J&K/IDFC), MFI oversight.

- Macro/Economic: Slowdown, floods/disruptions (J&K), geopolitical (Pahalgam impact).

- Execution: Cost control (rising opex), capital dilution (infusions), integration risks (acquisitions like RBL).

Overall Outlook: Positive momentum with deposit strength/digital edge offsetting NIM/NPA pressures. Sector poised for 12-15% business growth FY26, RoA 1-1.5%, but MFI/legacy resolution critical. Strategic partnerships (SMBC/ENBD) enhance stability/prospects.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.