SOBHA

Equity Metrics

January 13, 2026

Sobha Limited

Residential Commercial Projects

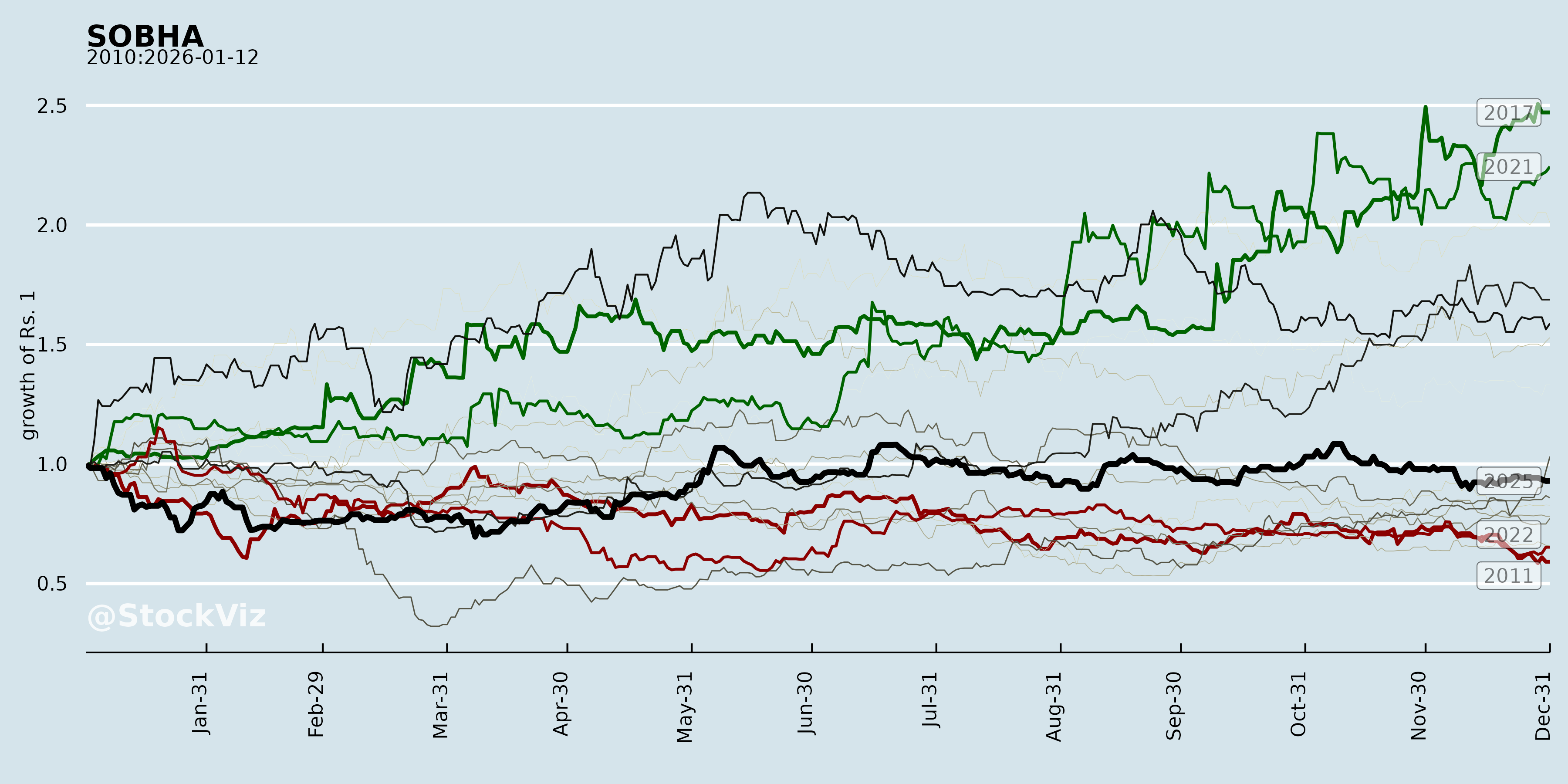

Annual Returns

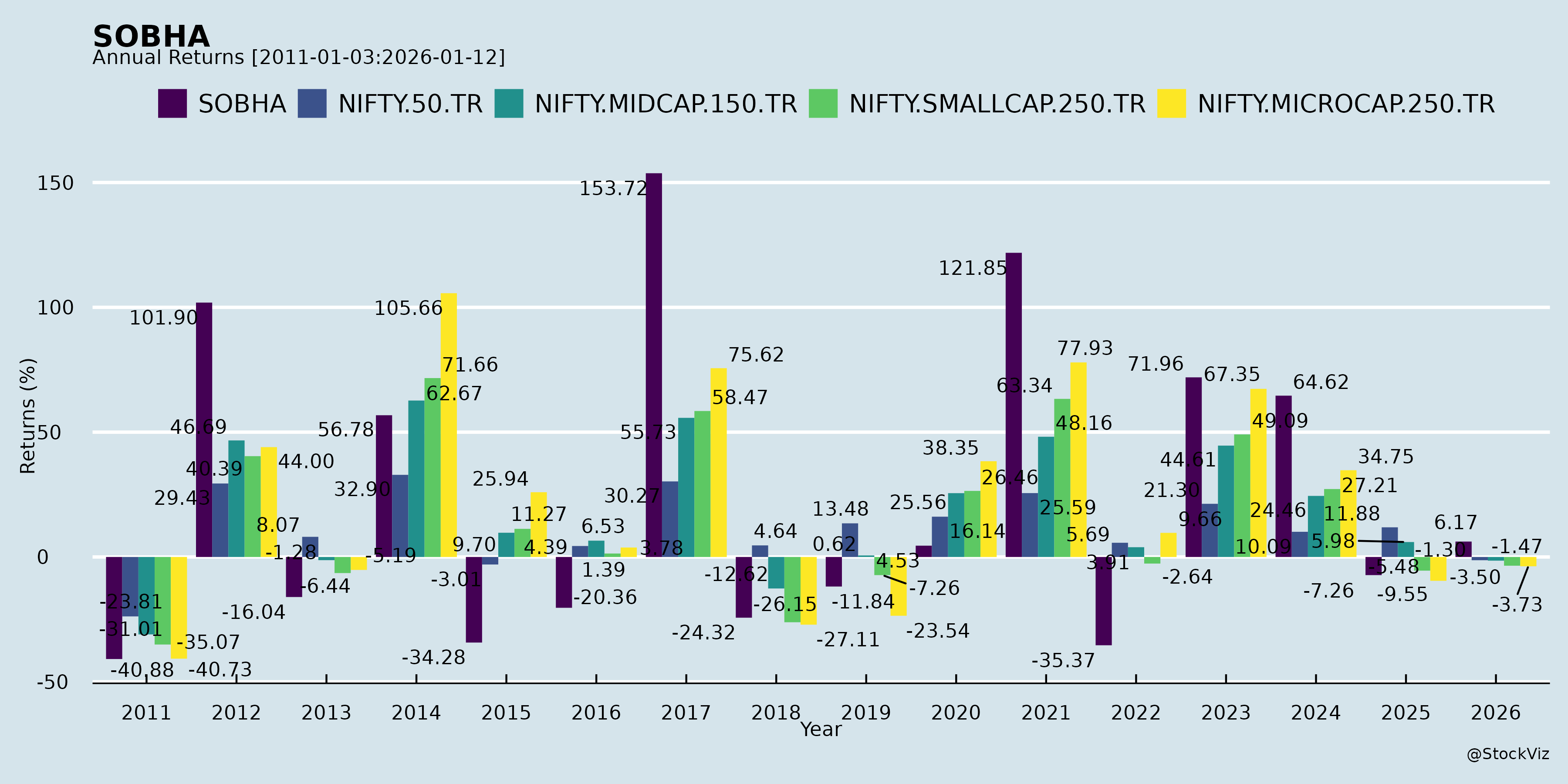

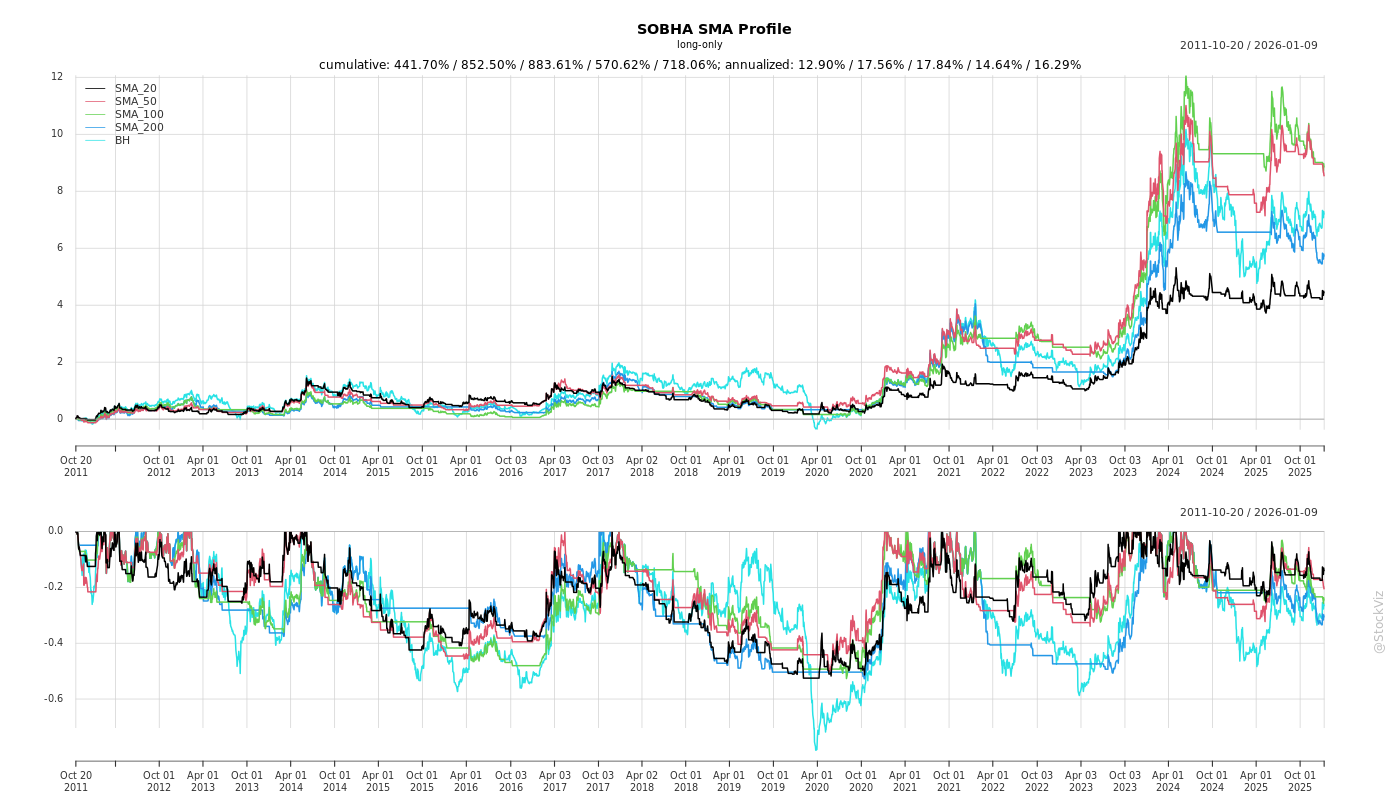

Cumulative Returns and Drawdowns

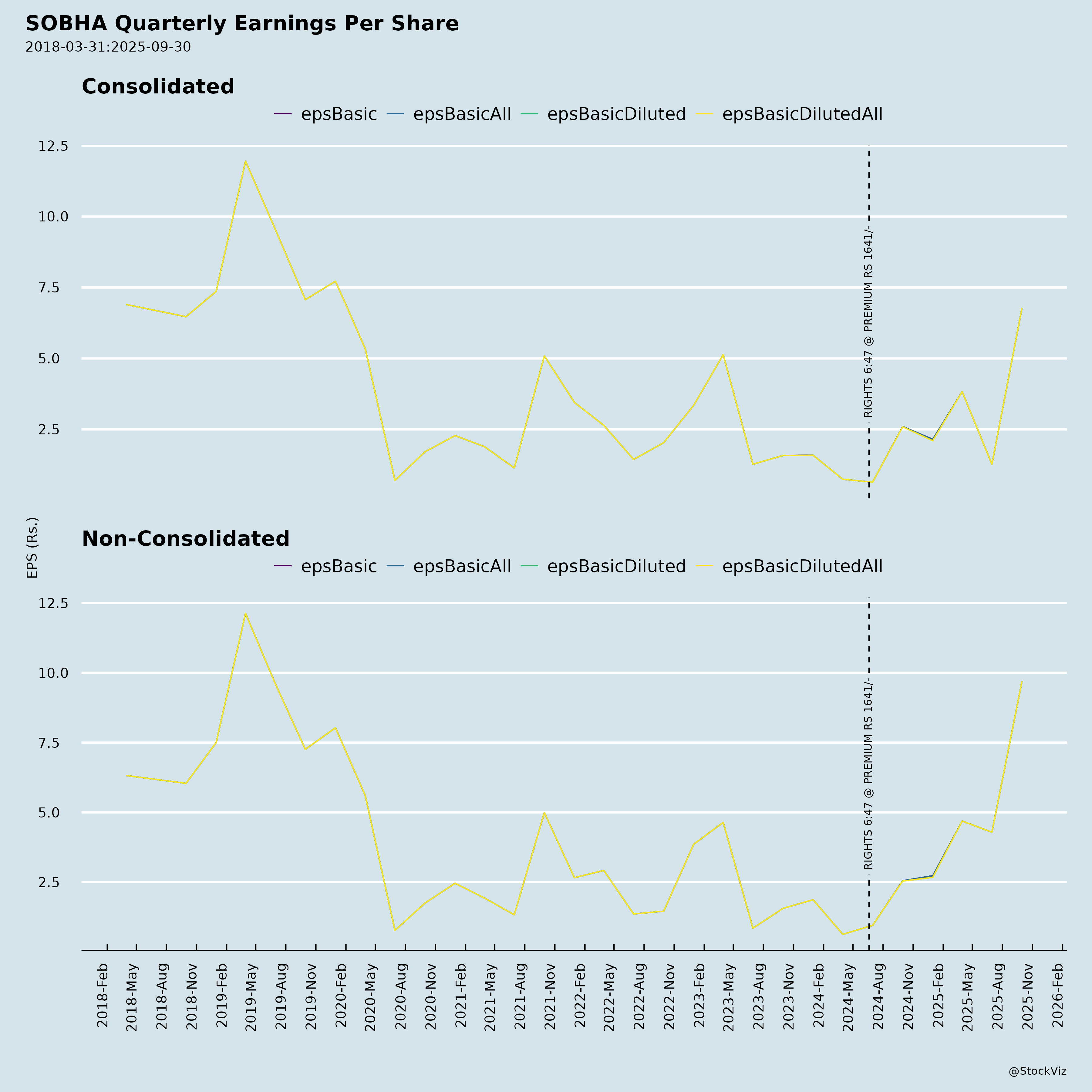

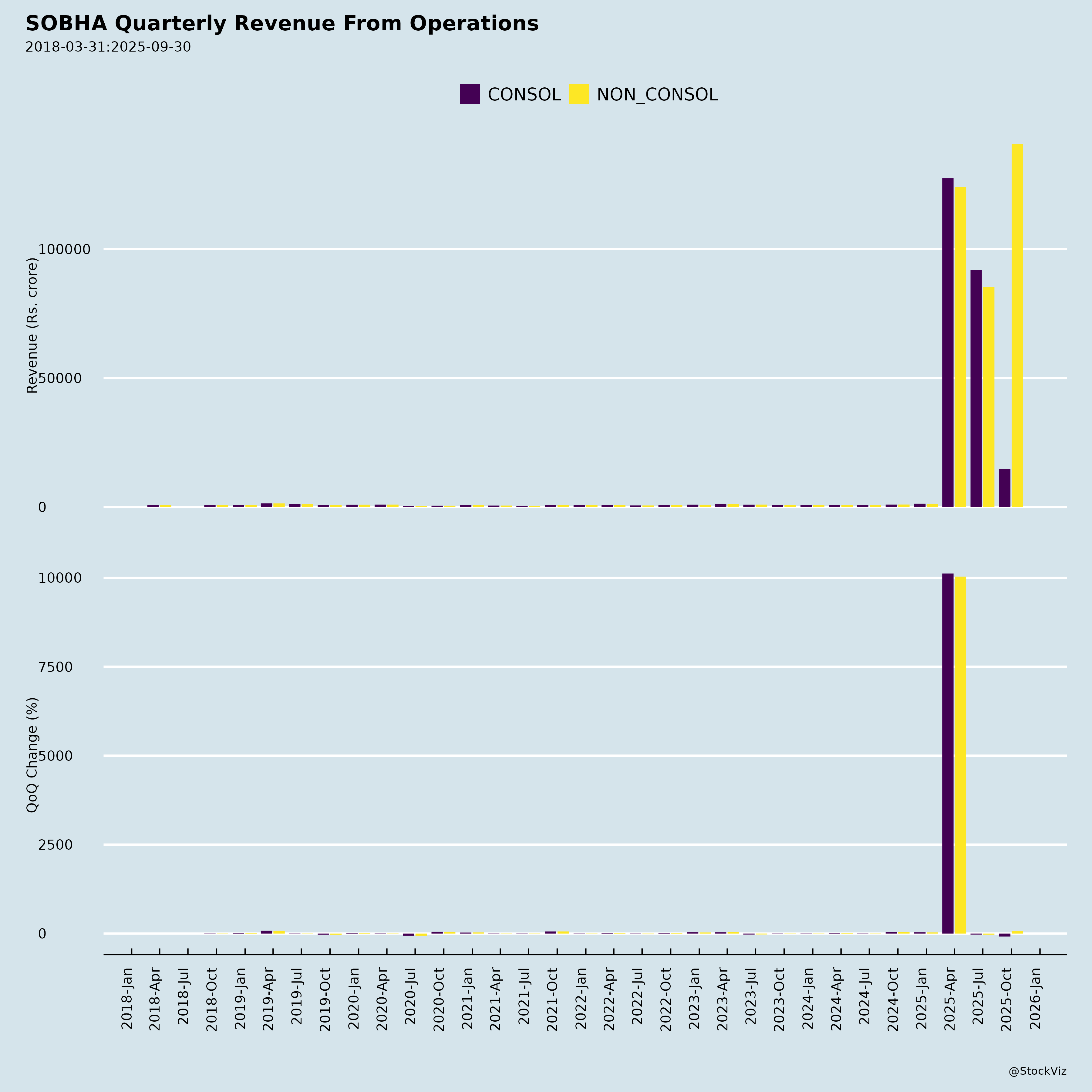

Fundamentals

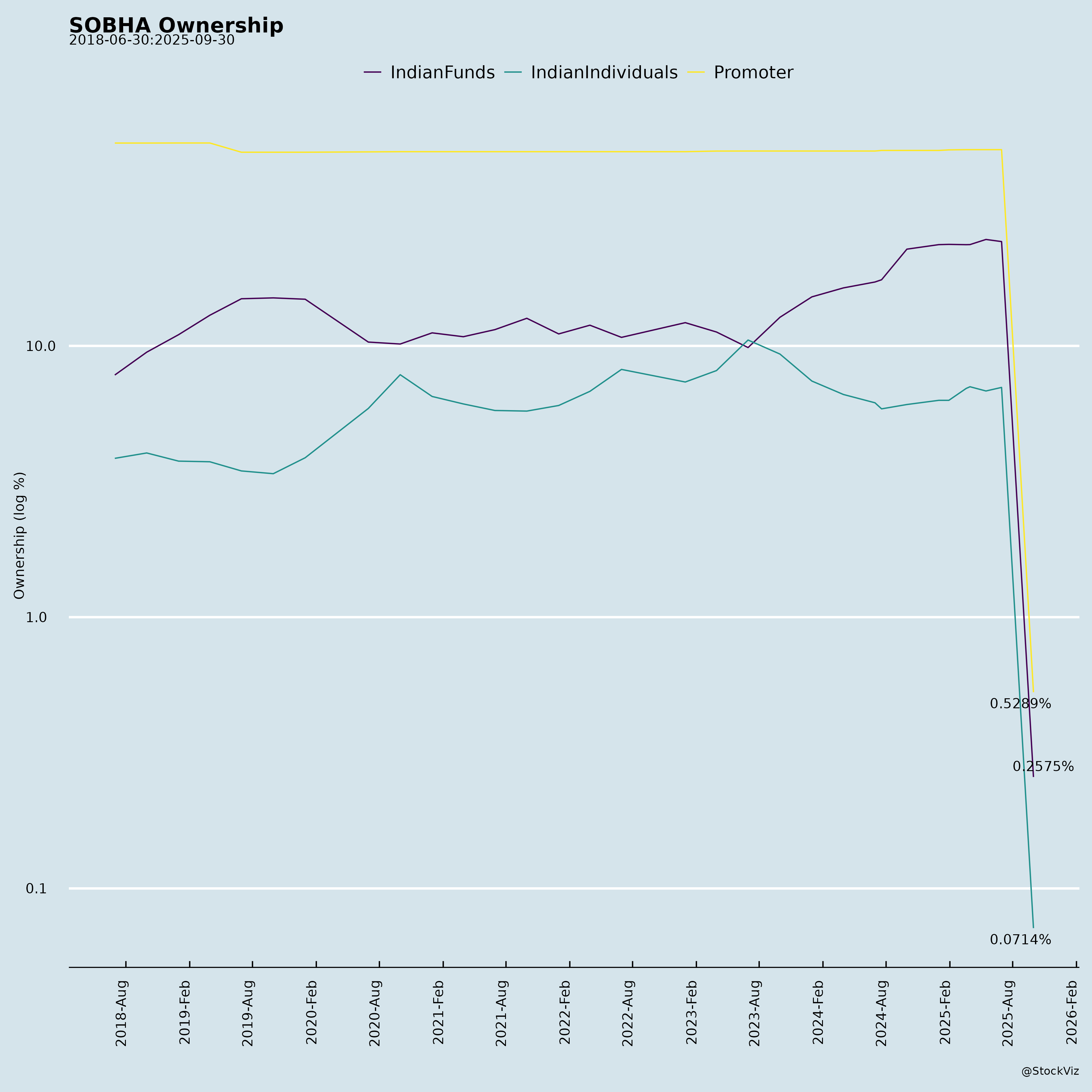

Ownership

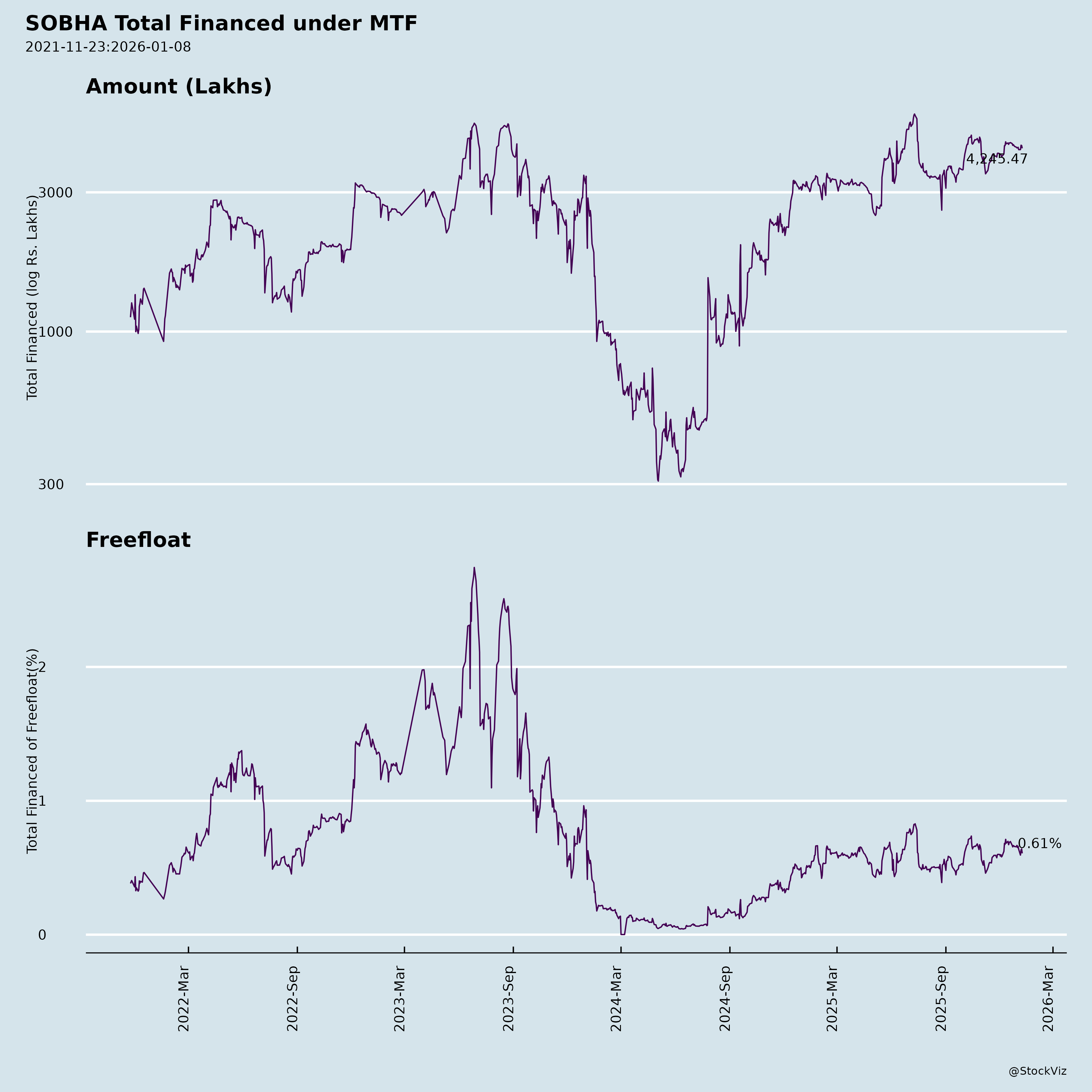

Margined

AI Summary

asof: 2025-12-03

SOBHA Limited (SOBHA) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview: SOBHA, a backward-integrated real estate developer focused on luxury residential (primary revenue driver), reported strong Q2/H1 FY26 results amid robust demand in key markets (Bangalore 48%, NCR 38%). H1 sales hit record ₹39.8 Bn (+30% YoY), collections ₹38.2 Bn (+31% YoY), with net cash position of ₹7.5 Bn. PAT surged 178% YoY in Q2 to ₹73 Cr, driven by sales momentum and cash efficiency. Pipeline supports sustained growth, but legacy margins and regulatory overhangs persist.

Tailwinds (Positive Drivers)

- Robust Demand & Sales Momentum: Luxury segment resilience; H1 sales 2.84 Mn sft at ₹14,028/sft (+3% YoY). Bangalore (Townpark) led Q2 (70% contribution via sustained sales). NCR/Greater Noida gaining traction.

- Record Cash Generation: Q2 collections crossed ₹2 Tn milestone (₹20.5 Bn, +49% YoY); H1 net operational cashflow ₹9.1 Bn (+79% YoY). Net cash balance sheet (debt: ₹10.1 Bn, cash: ₹17.6 Bn) enables aggressive BD/expansion.

- Backward Integration Edge: In-house design/manufacturing controls costs, speeds delivery (H1 completions 2.25 Mn sft/+26% YoY). Targets 5.5 Mn sft FY26, unlocking 33-34% EBITDA margins on ₹18 Bn unrecognized revenue.

- Macro Support: Stable inflation, falling interest rates (avg. cost down 60 bps to 8.25%), S&P upgrade, festive demand boost NRIs/Kerala sales.

- Strategic Expansion: 16.7 Mn sft launches in 6-8 quarters (7-8 projects, incl. Sobha Magnus, Mumbai entry); 40 Mn sft land bank (403 acres).

Headwinds (Challenges)

- Margin Pressure: Q2 EBITDA 10.7% (H1 9.7%), PAT 4.9% due to legacy low-margin JDAs (2021-24 inflation), ₹27 Cr BBMP ground rent provision. Reported margins lag project-level (20-30%).

- Launch Delays: H1 launches slowed by approvals/restructuring (e.g., Magnus delayed to Q3); H2 catch-up critical for ₹85 Bn FY26 sales guidance.

- Geographic Imbalance: Heavy Bangalore/NCR reliance (86% H1 sales); Kerala steady but execution/cost-heavy.

- Competitive BD: Rising land costs amid industry consolidation; premiumization shifting to ₹2-3 Cr ticket sizes (46% Q2 sales).

Growth Prospects

- Near-Term (FY26): ₹85 Bn sales (+33% YoY), 8-9 Mn sft launches (Bangalore/NCR skew). ₹98 Bn marginal cashflow from ongoing inventory; completions ramp-up to boost revenues/margins.

- Medium-Term (FY27+): 41 Mn sft developable pipeline (₹396 Bn GDV potential); Mumbai/GIFT City entry, Hoskote (5+ Mn sft). ₹71 Bn cashflow from forthcoming projects over 5-6 years.

- Long-Term: Backward model sustains 30%+ EBITDA; net cash supports opportunistic BD in high-demand micro-markets (e.g., North Bangalore, Greater Noida). Target sustained 20-30% volume growth via diversification.

| Metric | FY25 Actual | FY26E (Guidance) | Growth |

|---|---|---|---|

| Sales Value | ₹62.8 Bn | ~₹85 Bn | +35% |

| Completions | ~4.5 Mn sft | 5.5 Mn sft | +22% |

| EBITDA Margin | 10.1% | 20-30% (project-level) | Improving |

Key Risks

| Risk Category | Details | Potential Impact | Mitigation |

|---|---|---|---|

| Regulatory/Legal | PMLA attachment (₹201 Cr Haryana land via TDPL); IT search demands (₹67 Cr, appeals filed); Fire NOC dispute (stay granted); SAPL contract termination (₹2.4 Bn claim). | Cashflow blockage, provisions; prolonged uncertainty. | Legal opinions favorable; appeals ongoing; no current adjustments. |

| Execution | Approval delays, supply chain/inflation risks; legacy low-margin completions. | Margin erosion, sales miss. | Backward integration; timely escalations. |

| Market/Competition | Land cost inflation; price sensitivity in mid-luxury (₹2-3 Cr); oversupply in some micros. | BD slowdown, velocity dip. | Strong land bank; focus on demand-supply gaps. |

| Financial | High capex (H1 land ₹6.3 Bn); forex/IT/geopolitical volatility. | Leverage rise if collections slow. | Net cash buffer; 79% cashflow growth. |

| Other | Monsoon/festive slowdown; NRI demand volatility in Kerala. | Quarterly volatility. | Diversified pipeline (14 cities). |

Summary: SOBHA’s FY26 story is compelling—record cashflows, sales momentum, and pipeline visibility position it for 30-35% growth, with margins expanding to 20-30% via completions. Tailwinds from luxury demand/integration outweigh headwinds like low reported margins/launch slips. Risks center on regulatory overhangs (monitor PMLA/IT appeals), but strong balance sheet provides resilience. Investment Thesis: Bullish for growth investors; target FY26 sales beat if H2 launches execute. Valuation supported by ₹228 Bn future inflows visibility. (Data as of Oct 2025 filings; stock reaction post-results to confirm.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.