Residential Commercial Projects

Industry Metrics

January 13, 2026

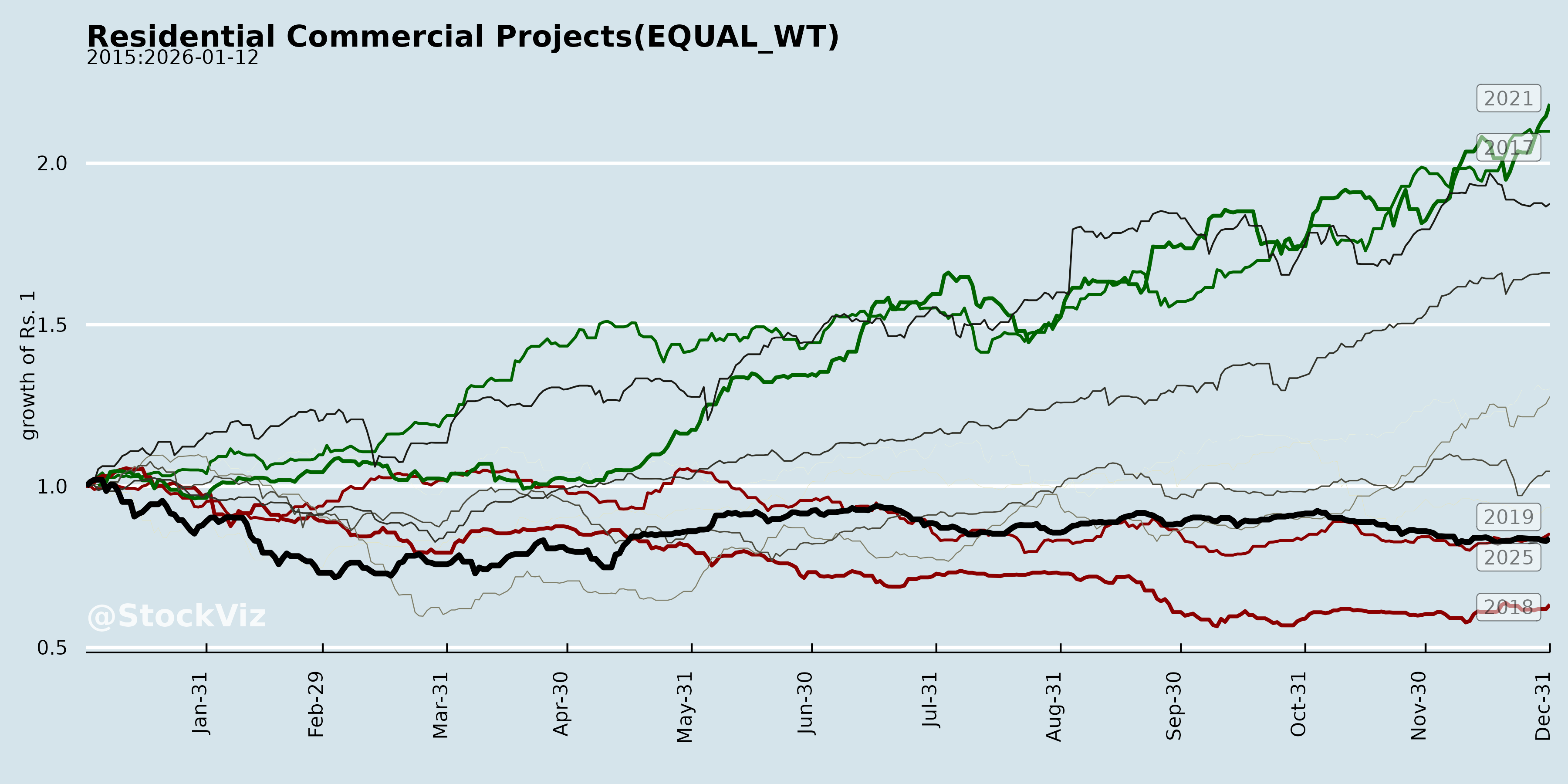

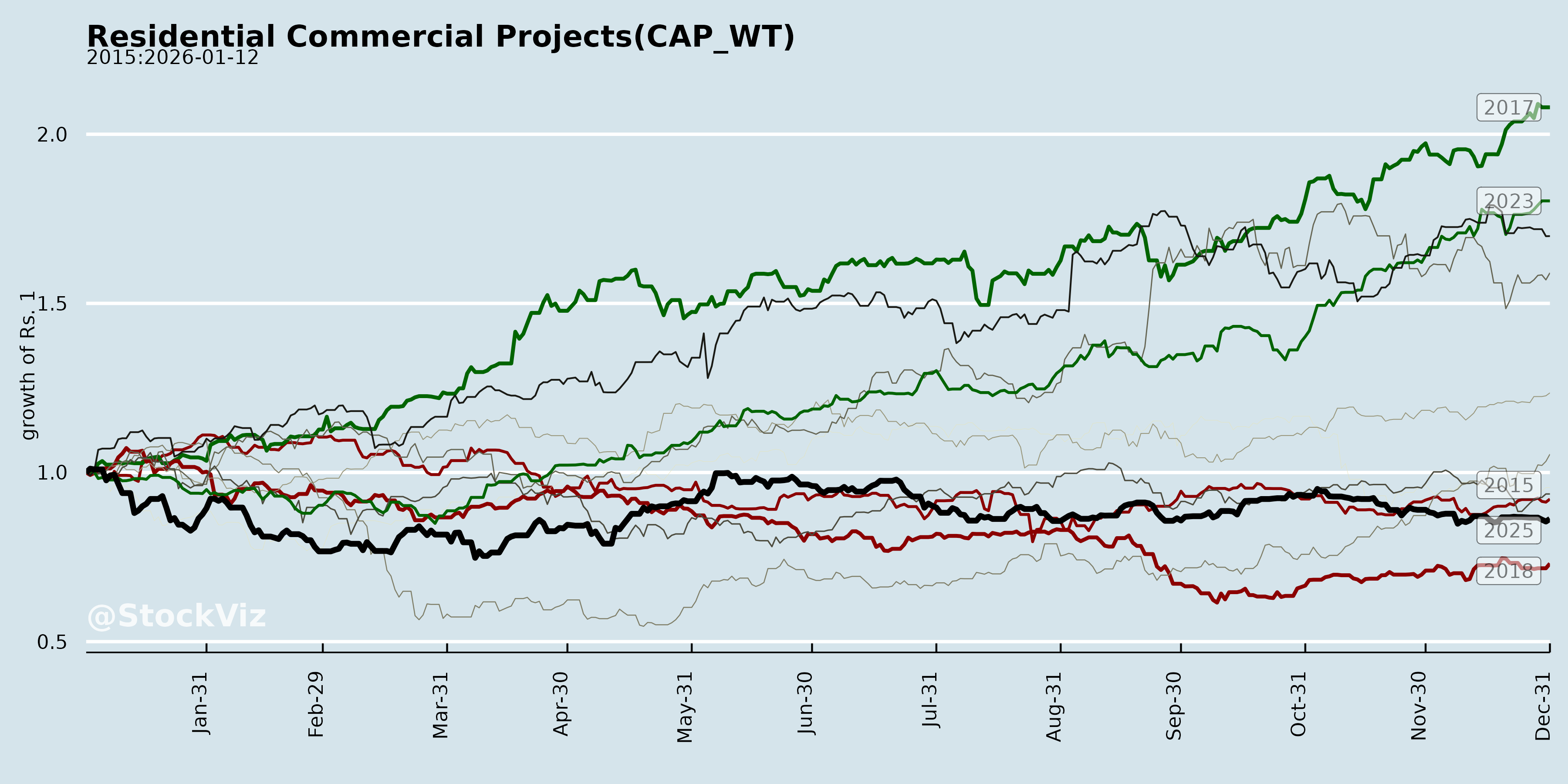

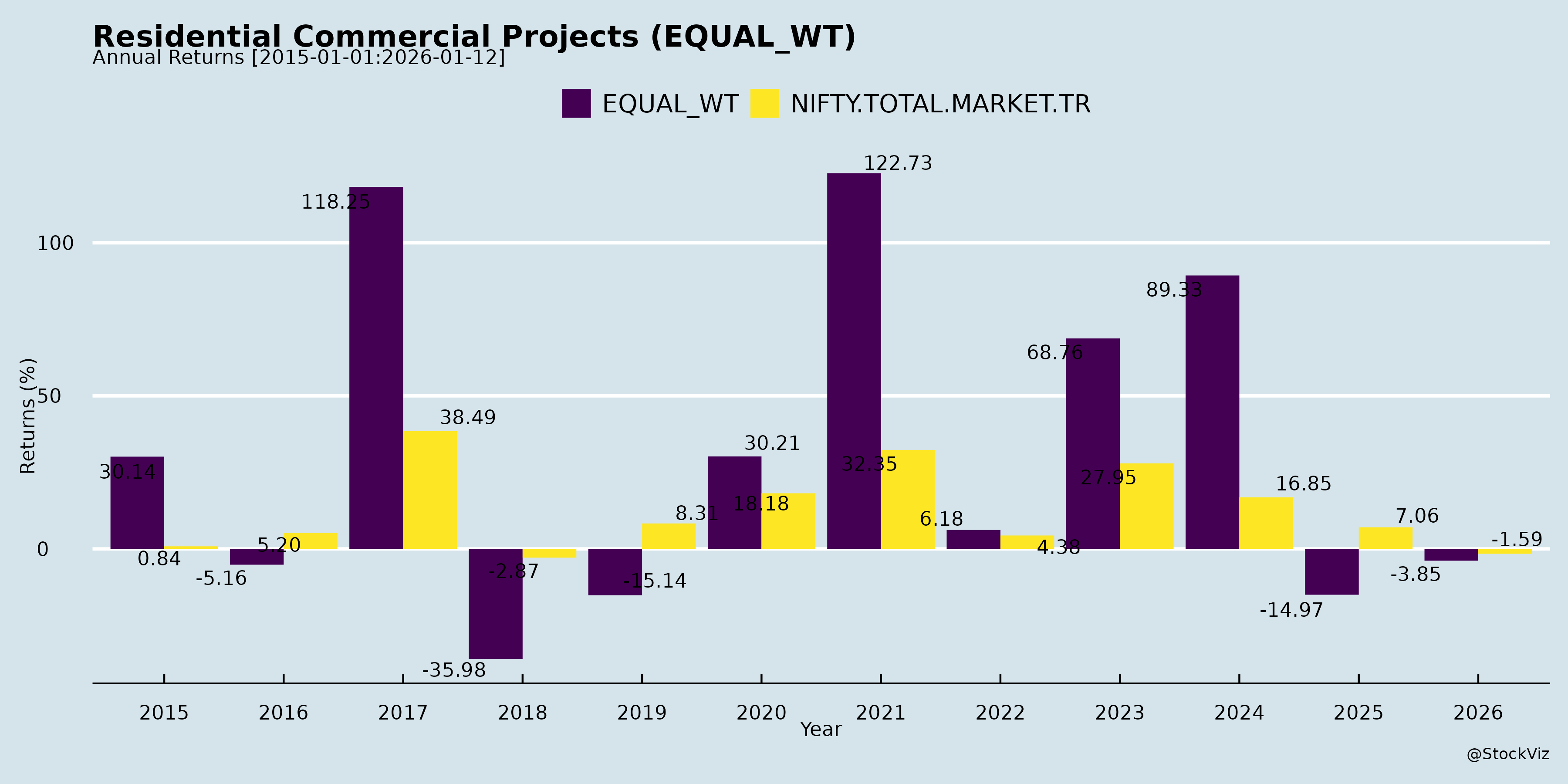

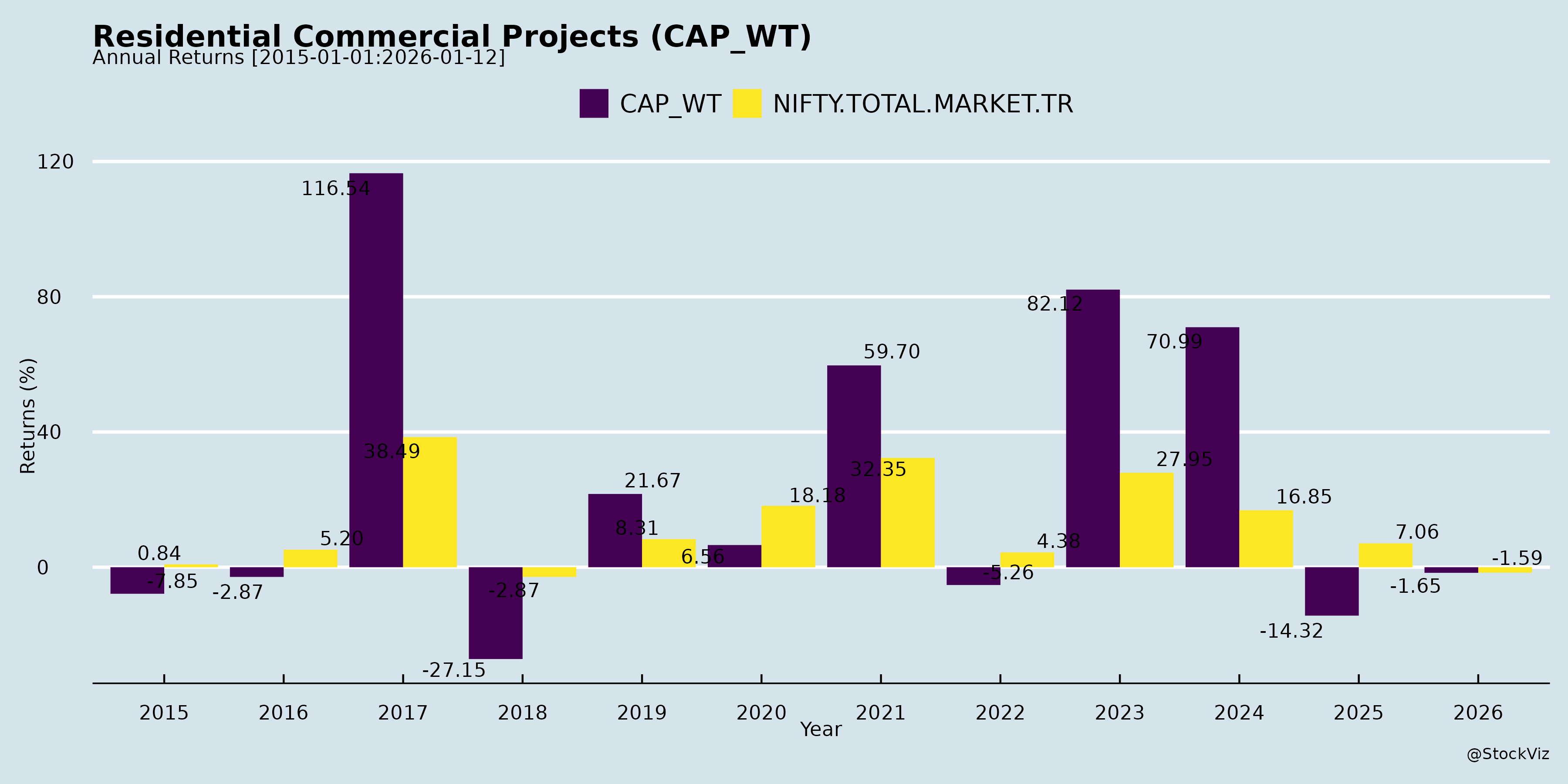

Annual Returns

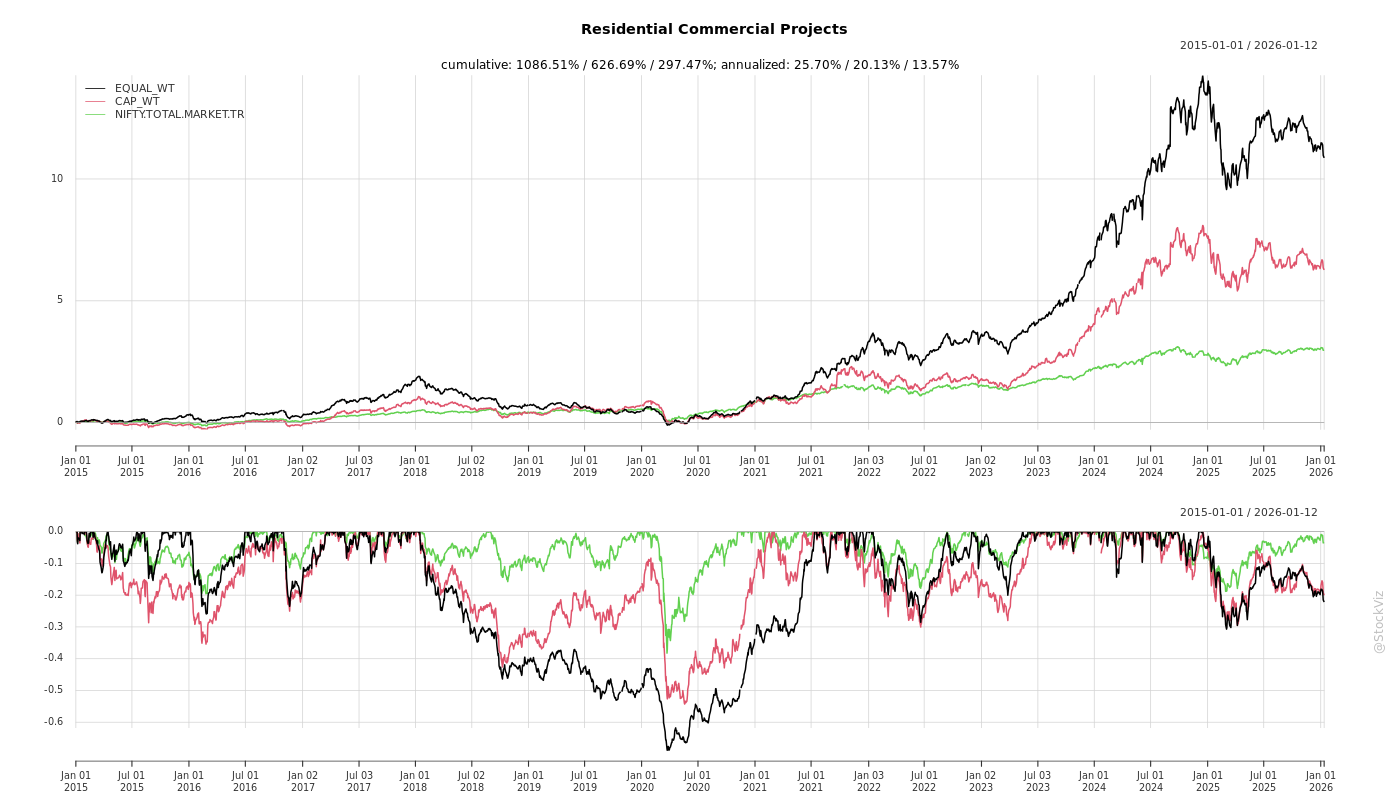

Cumulative Returns and Drawdowns

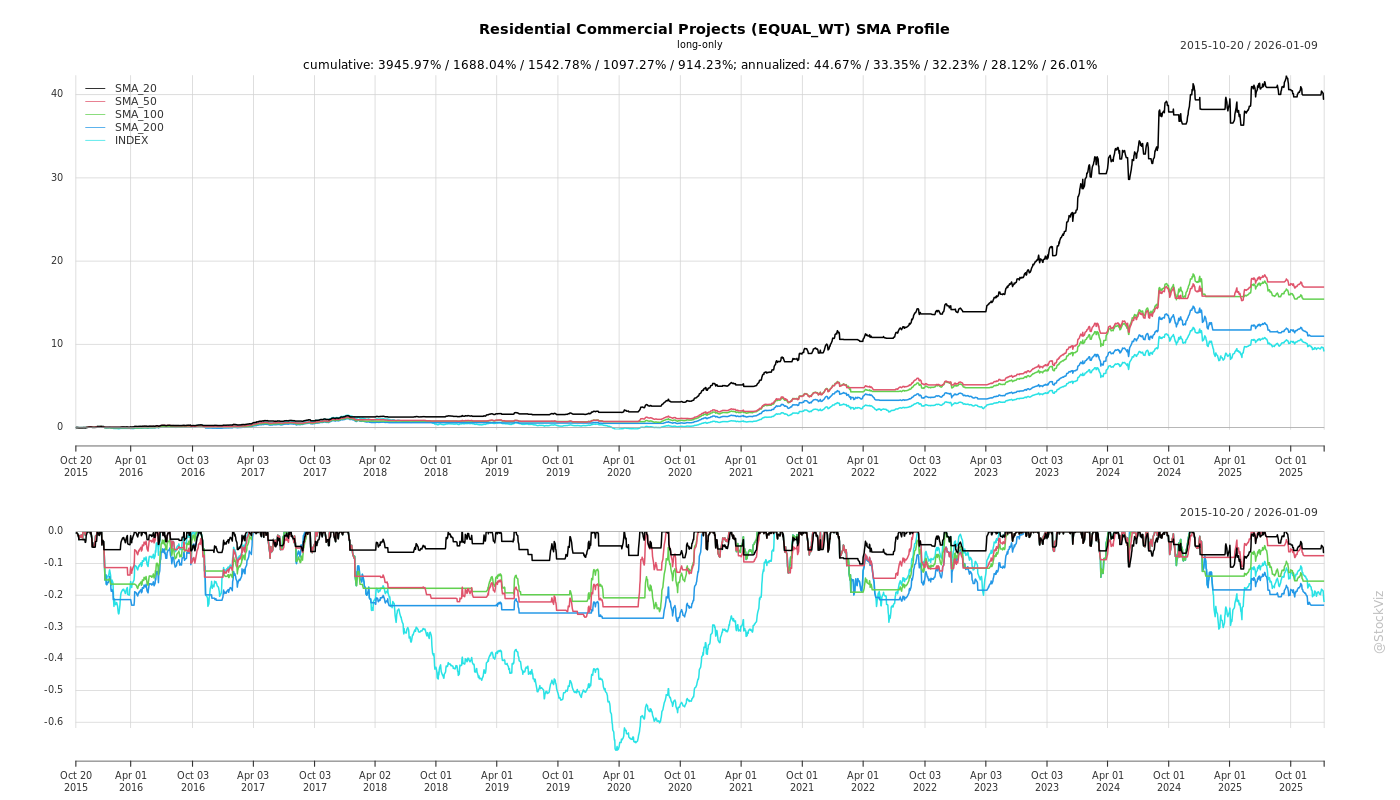

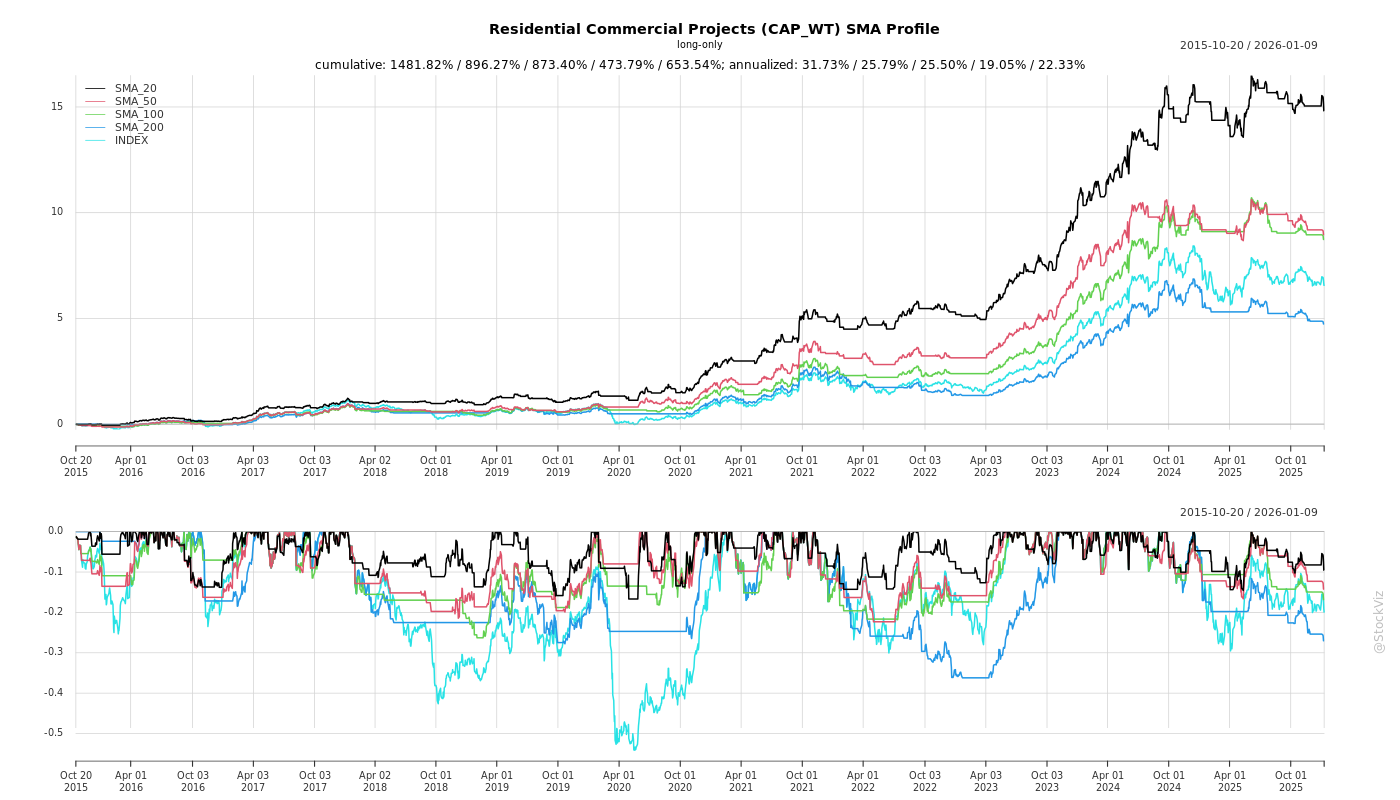

SMA Scenarios

Current Distance from SMA

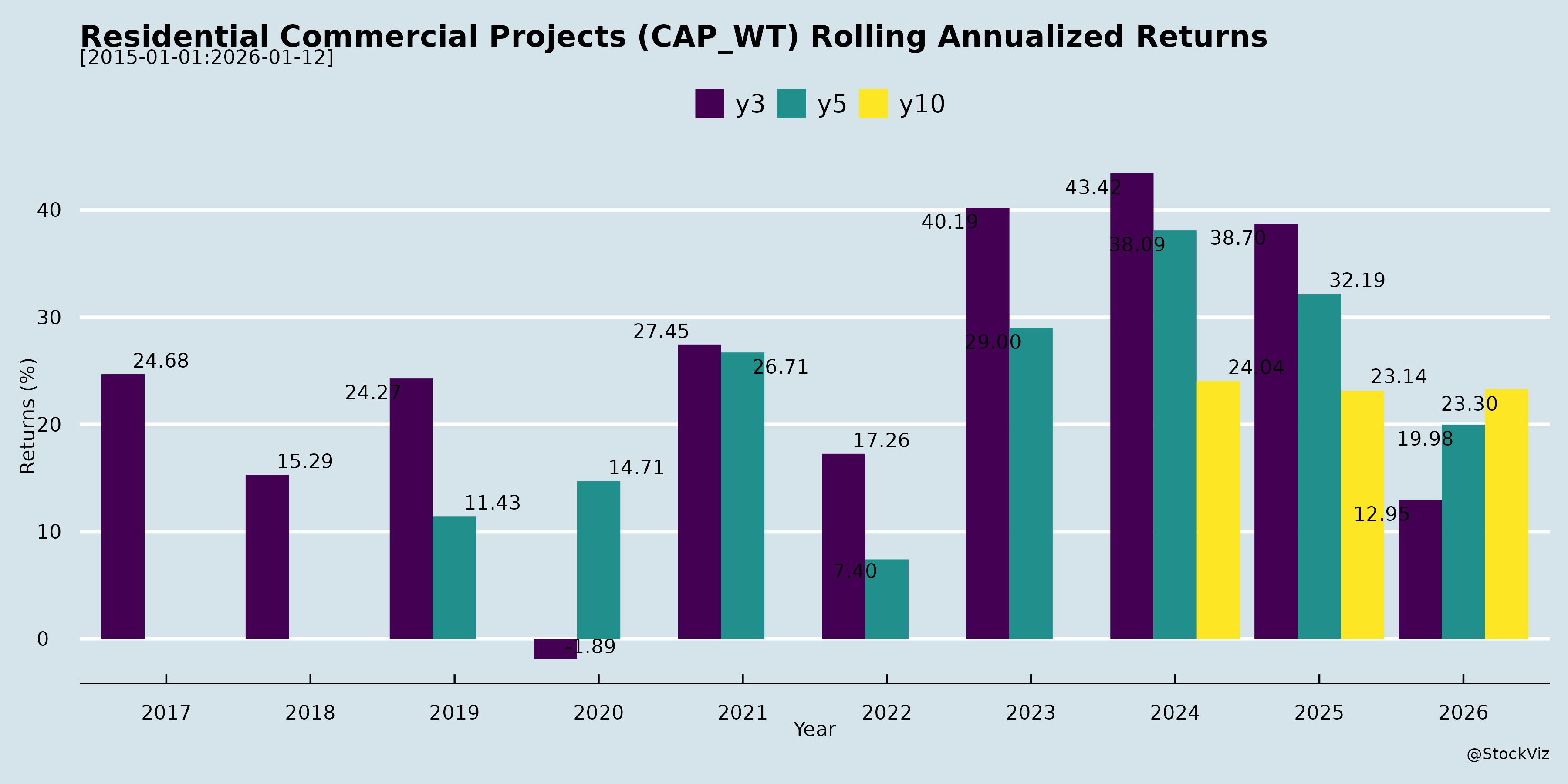

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Summary Analysis of Indian Residential & Commercial Real Estate Sector

Based on the provided disclosures (earnings transcripts, investor meeting intimations from DLF, Lodha, Prestige, Godrej Properties, Sobha, Signature Global, Phoenix Mills, Oberoi Realty, Brigade, Anant Raj, Embassy Developments, Mahindra Lifespaces), the sector shows robust momentum in residential (mid-to-luxury) with steady commercial undertones. Key insights from Q2/H1 FY26 performance: strong pre-sales (e.g., Godrej ~INR 15.6k cr H1, Sobha INR 4k cr, Signature INR 4.7k cr), healthy collections (Godrej INR 7.7k cr H1, Sobha INR 3.8k cr), and massive H2 launch pipelines amid NCR/Bangalore/Mumbai dominance. Below is a structured analysis of tailwinds, headwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Sustained Demand & Premiumization: End-user focus in high-growth micro-markets (Dwarka Expressway, Golf Course Road, SPR/Sohna in NCR; Whitefield/Thanisandra in Bangalore; Worli/Bandra in Mumbai). Ticket sizes INR 2-3.5 cr dominant; 64% YoY bookings growth (Godrej). Mid-income rebound (Signature) complements luxury.

- Infrastructure Boost: Roads (Coastal Road Mumbai, Dwarka Expressway), metro expansions driving 98-151% price appreciation (Gurugram/Sohna). New city entries (Godrej Hyderabad INR 2.6k cr CY25 sales).

- Strong Balance Sheets & Cash Flows: Net cash positions (Sobha INR 751 cr), low debt (Signature <INR 10 bn), IFC funding (Signature). Collections 30-40% of guidance achieved H1; OCF growth (Godrej 62% CAGR).

- Backward Integration & Execution Ramp: Labor at all-time highs (Godrej 32k), top contractors (Ahluwalia, KEC), Bain consulting (Signature). Sustainability rankings boost investor appeal (Godrej #1 GRESB).

- Active Investor Engagement: Widespread conferences (Morgan Stanley, Jefferies) signal confidence; no UPSI shared.

Headwinds (Challenges)

- Execution Delays: NGT/tree-cutting halts NCR construction (3/12 months lost); rains/labor shortages (Signature). Approvals/BBMP restructuring delayed launches (Sobha Magnus).

- Margin Pressures: Low reported EBITDA (Sobha 9.7%, Godrej impacted by JV/accounting); past inflation (2021-24) eroded grosses (20-29%). Provisions (Sobha INR 27 cr ground rent).

- Lumpy Collections/Deliveries: H1 skewed low (Godrej 37% guidance); OC-heavy Q4. Construction spend up 82% YoY but ahead of inflows.

- Inventory & Absorption: Unsold ~INR 5k cr (Signature); Gurgaon speculation led to quality-over-quantity sales (Godrej/Miraya 39% sold but 62% PAT).

- Rising Costs: Land auctions >INR 2k cr/10-11 acres (Hyderabad/Navi Mumbai); input inflation in JVs.

Growth Prospects

- Massive Launch Pipelines: H2 FY26: 8-10 mn sq ft (Signature 8 mn, Godrej phases across 8 cities, Sobha 8-9 mn). GDV potential INR 650 bn+ (Signature recent/forthcoming); annual guidance on track (Godrej INR 32.5k cr bookings, Sobha INR 8.5k cr).

- Market Expansion: NCR/Bangalore >50% sales; new phases (Godrej Worli Trilogy INR 80k-1.5L psf, Hyderabad/Indore). Plotted/group housing mix; 20% CAGR medium-term (Godrej).

- Revenue/Profit Ramp: H2 collections/OC surge (Godrej INR 21k cr FY26); ROE 20% by FY28 (step-up FY28). Total income up 16-39% H1.

- Diversification: Commercial/retail activations (Lodha, Prestige transcripts); plotted in new cities (Raipur, Ahmedabad). FY27+ sales doubling potential (Sobha INR 10k cr).

- Scale Metrics: National share <5% (Godrej); H1 bookings 13-64% YoY across peers.

Key Risks

- Regulatory/Approvals: NGT/BBMP delays (Sobha/Godrej); tree issues (Ashok Vihar). Stuck projects (Godrej Bandra/Ashok Vihar).

- Execution & Supply Chain: Labor attrition, monsoons; over-reliance on milestones (slab/OC 10-20%). Bain aids but unproven at scale.

- Market/Competition: Gurgaon speculation/Noida oversupply risk; pricing plateaus (Pune flattish). Sell-out velocity (Sector 71 55-60%).

- Financial: Debt for large launches (Signature construction ahead); interest outflows (Godrej Q2 NCDs). Equity dilution unlikely but possible.

- Macro: Affordability (rates/incomes), economic slowdown impacting mid-income; festive seasonality unproven H2.

Overall Outlook: Sectorally bullish (48-81% guidance achievement H1), driven by residential pre-sales (NCR/Bangalore 70-80% contribution). Tailwinds from infra/demand outweigh headwinds; growth via launches (upside risk). Monitor execution (deliveries H2) and margins (JV unwind FY27+). Peers on track for 20-30% sales CAGR FY26-28, with NCR leaders (Godrej/Signature/Sobha) leading.

Financial

asof: 2025-12-03

Summary Analysis: Indian Residential & Commercial Real Estate Sector (Q3 FY25 Insights from Key Players - DLF, Prestige, Godrej Properties, Phoenix Mills, Oberoi Realty, Brigade, Anant Raj, Sobha, Signature Global, Mahindra Lifespaces, Rustomjee, Ganesh Housing)

Based on unaudited Q3 FY25 results (standalone/consolidated) from 12 major listed developers, the sector shows resilient residential growth amid regulatory headwinds. Residential sales/bookings dominate (e.g., Oberoi ₹4,136 Cr 9M revenue; DLF ₹4,866 Cr), while commercial/leasing provides stability (Phoenix Mills ₹97,513 Cr Q3 revenue). Overall, revenue up ~20-50% YoY for most, driven by launches/inventory drawdown.

Tailwinds (Positive Drivers)

- Strong Residential Demand & Sales Momentum: High bookings/revenue recognition (Prestige ₹58,210 Cr 9M rev; Godrej ₹2,801 Cr Q3; Brigade ₹3,61,382 Cr 9M). Inventory turnover improving (Oberoi 1,786 days 9M; Signature Global rapid sales).

- Capital Infusion via QIPs/Fundraises: Multiple raises (Prestige ₹5,000 Cr; Godrej ₹6,000 Cr; Oberoi/Brigade ₹1,500 Cr each) for land acquisition/debt repayment, bolstering liquidity (e.g., Prestige debt-equity 0.66).

- Policy Boosts: Capital gains tax cut (Prestige/Godrej deferred tax reversal ₹991-1,539 Cr); Vivad se Vishwas settlements (DLF ₹662 Cr tax relief).

- Commercial/Office Stability: Leasing growth (Phoenix ₹76,588 Cr Q3 property segment; Mahindra steady rentals).

- Balance Sheet Health: Net debt reduction (Oberoi 0.23 D/E; DLF low leverage); high net worth (Prestige ₹1,56,655 Cr).

Headwinds (Challenges)

- High Finance Costs: Elevated interest (DLF ₹288 Cr 9M; Prestige ₹10,477 Cr 9M; Sobha ₹1,505 Cr 9M), eroding margins (Signature Global 42% NPM despite profits).

- Project Phasing/Inventory Fluctuations: Negative inventory changes inflate revenue but mask true progress (Godrej -₹6,208 Cr 9M change).

- Legal/Regulatory Overhangs: Widespread “Emphasis of Matter” (DLF CCI ₹630 Cr penalty, SEBI; Prestige land winding-up ₹923 Mn receivables; Godrej/Oberoi ED/PMLA attachments ₹2,016 Cr land; Sobha IT searches/demands ₹647 Cr; multiple IT/land disputes).

- Subdued Standalone Profits: Many report losses/low PAT standalone (Mahindra Lifespace -₹2,247 Cr Q3 loss; Signature Global volatile).

Growth Prospects

- Robust Pipeline & Launches: New projects/JVs (Oberoi NLRPL acquisition; Brigade 26 subs; DLF 100+ subs). Residential focus with commercial diversification (Phoenix hospitality/residential mix).

- Geographic Expansion: Pan-India push (DLF/Phoenix JVs; Godrej 50+ subs; Anant Raj Gurugram focus).

- Funding & Capex: QIP proceeds for inorganic growth (land buys: Oberoi ₹43,390 Cr). 9M PAT growth 50-200% (Brigade ₹43 Cr; Ganesh Housing ₹439 Cr).

- Sector Tailwinds: Urbanization, RERA compliance, infra (e.g., Delhi-Mumbai corridors) to sustain 15-25% CAGR bookings.

Key Risks

- Litigation/Regulatory (High): CCI/SEBI/ED/IT cases (DLF ₹630 Cr deposit; Godrej PMLA attachment; Sobha fire NOC criminal case) could impair assets (₹2,000+ Cr exposure). Recoverability of advances uncertain.

- Execution/Debt Risks (Medium-High): High D/E (Prestige 0.66; Sobha 0.88); interest coverage <2x in some (Mahindra 0.96). Delays in approvals/launches.

- Cyclical/Market (Medium): Inventory overhang, rate sensitivity (finance costs 10-20% of expenses). Economic slowdown could hit affordability.

- Operational (Low-Medium): Project costs overruns, labor shortages; over-reliance on residential (80%+ revenue).

Overall Outlook: Bullish on residential (tailwind from demand/funding), cautious on commercial (stable but slower). Sector poised for 20%+ growth FY25, but litigations cap upside (monitor DLF/Godrej outcomes). Investors: Favor low-debt players (DLF/Oberoi).

General

asof: 2025-12-03

Summary Analysis of Indian Real Estate Sector (Residential & Commercial Projects)

Based on the provided documents from key players like DLF, Lodha, Prestige, Godrej Properties, Phoenix Mills, Oberoi Realty, Brigade, Anant Raj, Sobha, Signature Global, Embassy Developments, and Mahindra Lifespaces (covering Q1/Q2 FY26 updates, audited FY25 results, operational reports, ESG/BRSR disclosures, and regulatory filings), here’s a synthesized analysis of headwinds, tailwinds, growth prospects, and key risks for the Indian residential and commercial real estate sector. The sector shows robust momentum in residential sales amid economic resilience, but faces litigation and regulatory overhangs.

Tailwinds (Positive Drivers)

- Explosive Residential Sales Growth: Record H1 performances across peers—Prestige: ₹1,81,437 Mn (+157% YoY); Sobha: ₹39,814 Mn (best-ever H1, +30% YoY); DLF: Strong Q4 FY25 revenue (₹2,236 Cr ops); Brigade/Sobha new launches/JDAs adding 0.5 Mn sft GDV >₹800 Cr. Average realizations up 6-43% YoY (e.g., Prestige apartments/plots).

- Geographic Diversification & Demand: Bengaluru/NCR/Mumbai lead (Prestige: NCR 45% H1 mix; Sobha: Bangalore 70% Q2); festive/monsoon-resilient demand (Sobha +61% Q2 YoY).

- Commercial/Retail Resilience: Phoenix: Retail consumption +13% Q2 YoY, office leasing 7.2 lakh sft H1; DLF office ratings AA Positive (CRISIL/ICRA).

- Economic Backdrop: India’s S&P BBB upgrade; declining rates/low inflation boosting affordability; strong collections (Prestige +55% H1 YoY).

- Sustainability/ESG Momentum: Godrej/DLF BRSR reports highlight green certifications (100% IGBC Silver+), water positivity, carbon neutrality targets.

Headwinds (Challenges)

- Seasonal/External Pressures: Heavy monsoons muted Q2 growth (Phoenix MarketCity flat YoY); muted hospitality (St. Regis Mumbai flat Q2 RevPAR; Courtyard Agra -14% Q2).

- Regulatory/Compliance Burden: IEPF campaigns for unclaimed dividends (Oberoi/Mahindra); KYC/SEBI special windows (Anant Raj: 1 rejected transfer); RERA/ environmental clearances delays (Godrej multiple EIAs).

- Hospitality Softness: RevPAR dips in non-premium assets; travel demand volatility.

- Operational Transition: Repositioning impacts short-term (Phoenix Pune/Bangalore flat consumption).

Growth Prospects

- Residential Boom: H1 sales exceed FY25 full-year for some (Prestige); pipeline launches (Sobha SOBHA Lifestyle ext.; Brigade Begumpet JDA); GDV potential ₹11,759 Cr H1 (Prestige). Urban premium demand (Sobha realizations ₹13,648/sft).

- Commercial Expansion: Office leasing surge (Phoenix 76% occupancy); retail footfalls 4.8 Mn Q2 (Prestige 99% occupancy); hospitality upgrades (Phoenix LEED Platinum).

- Market Expansion: Hyderabad/Bengaluru/NCR focus (Brigade JDA ₹800+ Cr; DLF Kolkata SEZ sale); diversified segments (Godrej 96 subsidiaries).

- Sustainability Edge: 100% green buildings (Godrej); SBTi-validated targets; CSR/waste mgmt. (Godrej 99% C&D waste recycled).

- Financial Strength: DLF dividend ₹6/share (300%); debt reduction (Phoenix net cash flow trends); ratings upgrades.

Key Risks

- Litigation/Regulatory Uncertainty (High): DLF’s “Emphasis of Matters”—CCI ₹630 Cr penalty (SC pending), SEBI restraints, land cancellations (Punjab HC, SC stayed), JV disputes (₹637 Cr exposure). Godrej similar (CCI, SEBI, receivables ₹397 Cr sub-judice).

- Execution/Concentration Risks: Project delays (environmental clearances, e.g., Godrej 10+ EIAs); regional reliance (Bangalore 40-70% sales mix).

- Financial/Leverage: Borrowings rise (DLF ₹3,210 Cr current); unclaimed dividends/IEPF transfers (multiple cos. campaigns).

- Market/Cyclical: Demand sensitivity to rates/monsoons/geopolitics; Scope 3 emissions (Godrej 2.7 Mn tCO2e); supplier ESG risks (100% assessed but remediation ongoing).

- ESG/Compliance: Human rights/child labor audits (Godrej 100% coverage, minor observations); waste/emissions intensity (DLF/Godrej tracked but landfill reliance).

Overall Outlook: Strong tailwinds from demand/economic upgrades drive 30-150% YoY growth, positioning residential as a multi-year winner (prospects: 20-30% sales CAGR). Commercial stable via leasing. Mitigate risks via litigation resolutions and ESG compliance for sustained 15-20% sector growth.

Investor

asof: 2025-11-29

Analysis of Indian Residential Real Estate Sector (Based on Provided Filings)

The provided documents primarily consist of SEBI-compliant disclosures from leading Indian real estate developers (e.g., DLF, Lodha/Macrotech, Prestige Estates, Godrej Properties, Sobha, Signature Global, Oberoi Realty, Brigade Enterprises, Anant Raj, Phoenix Mills, Embassy Developments, Mahindra Lifespaces). These include investor meeting schedules, earnings transcripts (Godrej Properties Q2 FY26, Sobha Q2 FY26, Signature Global Q2 FY26), and operational updates. They highlight robust activity in residential (luxury/mid-premium/group housing) and commercial segments across key markets like NCR (Gurgaon/Noida), Bangalore, Mumbai MMR, Hyderabad, Pune. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, derived directly from the filings.

Tailwinds (Positive Factors)

- Strong Demand & Sales Momentum:

- Godrej: Q2 bookings INR 8,505 Cr (+64% YoY), H1 INR 15,587 Cr (48% of FY26 guidance of INR 32,500 Cr). 9th straight quarter >INR 5,000 Cr.

- Sobha: H1 sales INR 3,981 Cr (+30% YoY), Q2 INR 1,902 Cr from sustained demand (e.g., Townpark).

- Signature Global: H1 sales INR 4,660 Cr (40% of FY26 guidance INR 12,500 Cr), across Sohna, SPR, Dwarka Expressway.

- End-user/NRI demand in luxury (INR 2-3 Cr tickets), driven by infrastructure (Dwarka Expressway prices +98% since 2020).

- Infrastructure Boost: Golf Course Road (Godrej Sora INR 633 Cr), Coastal Road (Lodha Worli), Noida/Greater Noida expansions.

- Backward Integration & Efficiency: Sobha/Godrej emphasize in-house execution, labor ramp-up (Godrej: 32,000 laborers, +82% construction spend YoY).

- Favorable Financing: Low interest outflows (seasonal), IFC NCD raise (Signature Global INR 875 Cr for ESG projects).

- Sustainability Recognition: Godrej ranked #1 globally in GRESB/Dow Jones Sustainability Index.

Headwinds (Challenges)

- Execution & Delivery Delays:

- Godrej: NGT issues in NCR (3 months lost/year), rains impacting progress; collections skewed to Q4 (H1 37% of FY26 guidance).

- Sobha: Approval delays (e.g., Magnus launch shifted Q2→Q3 due to BBMP restructuring); legacy project margins hit by inflation (2021-24).

- Signature Global: Heavy rains delayed Q1 progress; 9 Mn Sq Ft nearing delivery but momentum loss.

- Cost Pressures: Rising input/construction costs (Sobha: fixed costs in delays); land auctions >INR 2,000 Cr (Godrej).

- Margin Compression:

- Godrej: Gross margins weak due to JV structuring/OCs.

- Sobha: Q2 EBITDA 10.7% (provision for BBMP ground rent INR 27 Cr); H1 PAT margin 3.6%.

- Signature Global: EBITDA dip from lower revenue recognition.

- Collections Lagging Sales: Godrej/Sobha note lumpy Q4 collections tied to milestones/OCs.

Growth Prospects

- Massive Launch Pipeline: | Company | H1 Launches (Mn Sq Ft / Value) | H2/Future Pipeline | |——————|——————————–|————————————-| | Godrej | Hyderabad (Regal Pavilion INR 1,527 Cr) | 12 projects (INR 10,000 Cr potential); Worli (Godrej Trilogy, INR 80k-1.5L/sq ft), Bandra, Hyderabad/NCR/Pune/Chennai. FY26 bookings INR 32,500 Cr. | | Sobha | Limited (impacted by approvals) | 8-9 Mn Sq Ft (7-8 projects); Magnus (South Bangalore), NCR (3.5 Mn Sq Ft), Mumbai entry, Hoskote (Phase 1 >5 Mn Sq Ft). FY26 sales ~INR 8,500 Cr (+33% YoY). | | Signature Global| 2.45 Mn Sq Ft (INR 4,300 Cr) | 8 Mn Sq Ft (Sector 37D: 3.6 Mn; Sector 71: 4+ Mn; GDV INR 13-14,000 Cr). FY26: Launches INR 17,000 Cr, sales INR 12,500 Cr, collections INR 6,000 Cr. |

- Others (DLF, Lodha, Prestige): Active in Singapore/Mumbai/Bangalore conferences; strong micro-markets (Golf Course Rd, Worli).

- Market Expansion: Hyderabad (Godrej #2 entrant, INR 2,600 Cr CY25), Indore, plotted developments (Pune/Chennai).

- Diversification: Commercial/retail (Lodha, Prestige transcripts), sustainability-led growth (20% CAGR medium-term per Godrej).

- Guidance Confidence: All on-track/exceeding H1 targets; ROE targets (Godrej 20% by FY28); national share <5% (room for 20%+ growth).

- Projections: Sector sales to INR 5-10 Tn by 2047 (20% GDP); NCR H1’25: INR 9,340 Cr.

Key Risks

- Regulatory/Approval Delays: Tree-cutting (Godrej Ashok Vihar), BBMP/NGT (Sobha/Godrej), RERA (Lodha Worli).

- Execution Scaling: Labor/supply chain (Godrej ramp-up to 32k workers); weather (Signature rains).

- Land Acquisition Competition: High prices/auctions (Godrej: Hyderabad/Navi Mumbai >INR 2,000 Cr); BD 81% of guidance in H1 but mixed bag.

- Cash Flow/Debt Mismatch: Collections lumpy (Godrej Q4-heavy); net debt modest (Signature <INR 1,000 Cr) but rising capex (INR 10,000 Cr H1 spend).

- Market-Specific: Speculation in Gurgaon (Godrej quality-led sales); velocity in larger tickets (Signature 12-15 month absorption).

- Macro: Input inflation, interest rates (Sobha compliance burdens); premiumization limits mid-income clawback.

- Accounting/Structuring: JV/POCM variances (Godrej/Sobha margins distorted until OCs).

Summary

The Indian residential sector (NCR/Bangalore/MMR dominant) exhibits strong tailwinds from demand, infrastructure, and launches, with developers like Godrej/Sobha/Signature achieving 30-60% YoY growth and reaffirming ambitious FY26 guidance (INR 8,500-32,500 Cr bookings). Growth prospects are robust (20%+ CAGR, 40+ Mn Sq Ft pipelines, new markets), fueled by urban migration and supply constraints. However, headwinds like delays/costs persist, alongside risks of execution, regulation, and cash mismatches. Overall, sentiment is bullish (global rankings, IFC funding), but success hinges on delivery acceleration (e.g., Godrej Bain partnership). Sector poised for outperformance if macros stable; monitor Q3 launches/collections for validation.

Sources: Direct extracts from transcripts (Godrej/Sobha/Signature) and disclosures (launch schedules, no UPSI).

Press Release

asof: 2025-12-03

Summary Analysis: Indian Real Estate Sector (Residential & Commercial Projects) - Q2/H1 FY26 Insights

Based on the provided press releases from key players (DLF, Lodha, Prestige, Godrej Properties, Phoenix Mills, Oberoi Realty, Brigade, Anant Raj, Sobha, Signature Global, Embassy Developments, Mahindra Lifespaces), the sector demonstrates robust momentum in residential sales and commercial leasing, driven by strong demand in premium/luxury segments across metros (Mumbai, Bengaluru, NCR, Hyderabad). H1 FY26 sales/pre-sales exceeded Rs 3 lakh crore collectively, with healthy profitability and cash flows. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Surging Residential Demand: Record pre-sales/bookings across board—Lodha (Rs 45.7 bn Q2, +7% YoY), DLF (Rs 4,332 Cr Q2, H1 Rs 15,757 Cr), Prestige (H1 Rs 18,144 Cr, surpassing FY25 full-year), Sobha (H1 Rs 3,981 Cr, +30% YoY), Oberoi (H1 Rs 2,938 Cr), Signature Global (H1 Rs 4,660 Cr). Premium/luxury focus (e.g., DLF super-luxury, Embassy villas) with rising realizations (Signature Rs 15,731/sqft vs. Rs 12,457 FY25).

- Strong Financials & Balance Sheets: PAT surges (Lodha +87% to Rs 790 Cr; Prestige H1 +42%; DLF Rs 1,171 Cr Q2; Sobha +178% YoY). Net cash positions (DLF Rs 7,717 Cr; Sobha -Rs 751 Cr debt; Mahindra net debt/equity -0.17). Collections robust (Lodha H1 Rs 348 bn +13%; Sobha Rs 2,046 Cr +49%).

- Commercial/Annuity Stability: DLF DCCDL (Rs 1,822 Cr revenue, +12% EBITDA YoY; 49 msf portfolio). Oberoi retail leasing ramp-up. Mahindra IC&IC Rs 219 Cr H1 revenues.

- Macro Support: Resilient economy, rising homeownership, low mortgage rates, GST cuts, interest rate reductions (Lodha). CRISIL AA+ upgrade for DLF; sector awards/recognition.

- Strategic Expansions: Land acquisitions/JDAs (Godrej 5-acre Hyderabad Rs 4,150 Cr potential; Brigade 0.5 msf Rs 800+ Cr; Embassy 5.6 msf North Bengaluru Rs 10,300 Cr; Signature 33+ acres).

Headwinds (Challenges)

- Quarterly Volatility: Some softness in Q2 revenues (Signature -56% YoY to Rs 33 bn; Mahindra Q2 pre-sales growth but flat YoY in some metrics). Losses in isolated cases (Signature H1 PAT -Rs 12 Cr).

- Execution & Regulatory Delays: Lodha cites Supreme Court clearance for H2 launches; dependency on RERA approvals (Embassy highlights two approved projects).

- Leverage in Segments: Lodha net debt Rs 537 bn (0.25x equity, manageable but noted); aggressive capex (DLF debt repayment Rs 963 Cr despite cash surplus).

- Geographic Concentration: Heavy reliance on metros (MMR, Bengaluru, NCR, Hyderabad); slower non-metro traction.

- Margin Pressures: Adjusted EBITDA dips in some (Signature 6% H1 vs. 11% prior); high business development spends (Lodha met FY26 GDV goal in H1).

Growth Prospects

- Launch Pipeline: DLF H1-aligned annual guidance; Lodha Rs 210 bn FY26 pre-sales (H2 heavy); Prestige/Embassy healthy pipelines; Sobha 16.69 msf next 6 quarters; Mahindra GDV additions Rs 9,500 Cr YTD.

- Emerging Segments: Data centers (Anant Raj 28 MW operational, targeting Rs 1,200 Cr FY27 revenue, 307 MW by FY32). Villas/plots (Embassy 116 acres; Mahindra 1.75 msf H1). Commercial expansions (Phoenix 7 msf retail pipeline; DLF 2.3 msf new assets).

- Market Expansion: Hyderabad boom (Godrej, Brigade, Prestige); North Bengaluru (Embassy Rs 5,000 Cr FY26 target); NCR/MMR sustained (Oberoi Gurugram office).

- Sustainability & Differentiation: ESG focus (DLF 5-star GRESB; Sobha backward integration; Mahindra Net Zero homes). Projected 20%+ CAGR (Lodha); annuity growth for steady cash flows.

- Overall Outlook: Sector poised for 20-30% sales growth FY26, backed by urbanisation, affordability, and branded demand.

Key Risks

- Macro/Economic: Interest rate hikes, political/economic slowdowns, inflation (all disclaimers highlight).

- Regulatory/Execution: Delays in approvals/clearances, litigation (Lodha EC issues), RERA compliance.

- Market/Competition: Over-supply in premium segments, softening demand if affordability dips; competition from unorganized players.

- Financial/Operational: High capex/debt sustainability amid launches; collection delays (key metric); forex/tech risks in data centers.

- External: Geopolitical events, policy changes (taxes, land acquisition), climate/ESG compliance costs.

Overall Summary: The sector enjoys strong tailwinds from demand resilience, premiumization, and healthy finances, positioning it for robust growth prospects (Rs 50,000+ Cr launches FY26). Headwinds are mild (volatility, regulations), but risks center on execution and macros. Bullish outlook with net cash-rich developers mitigating downside; monitor H2 launches/collections for sustained momentum.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.