SENCO

Equity Metrics

January 13, 2026

Senco Gold Limited

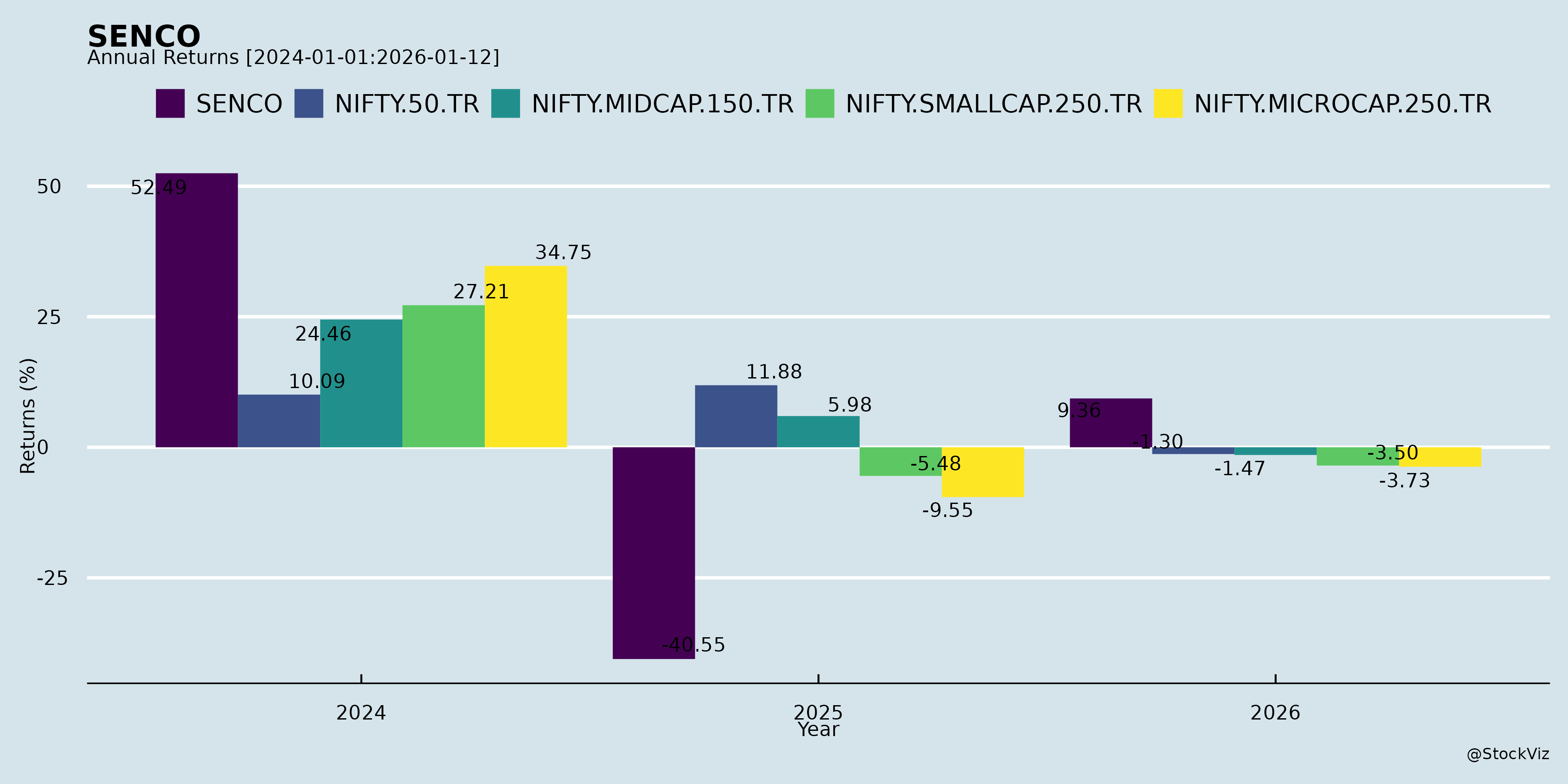

Annual Returns

Cumulative Returns and Drawdowns

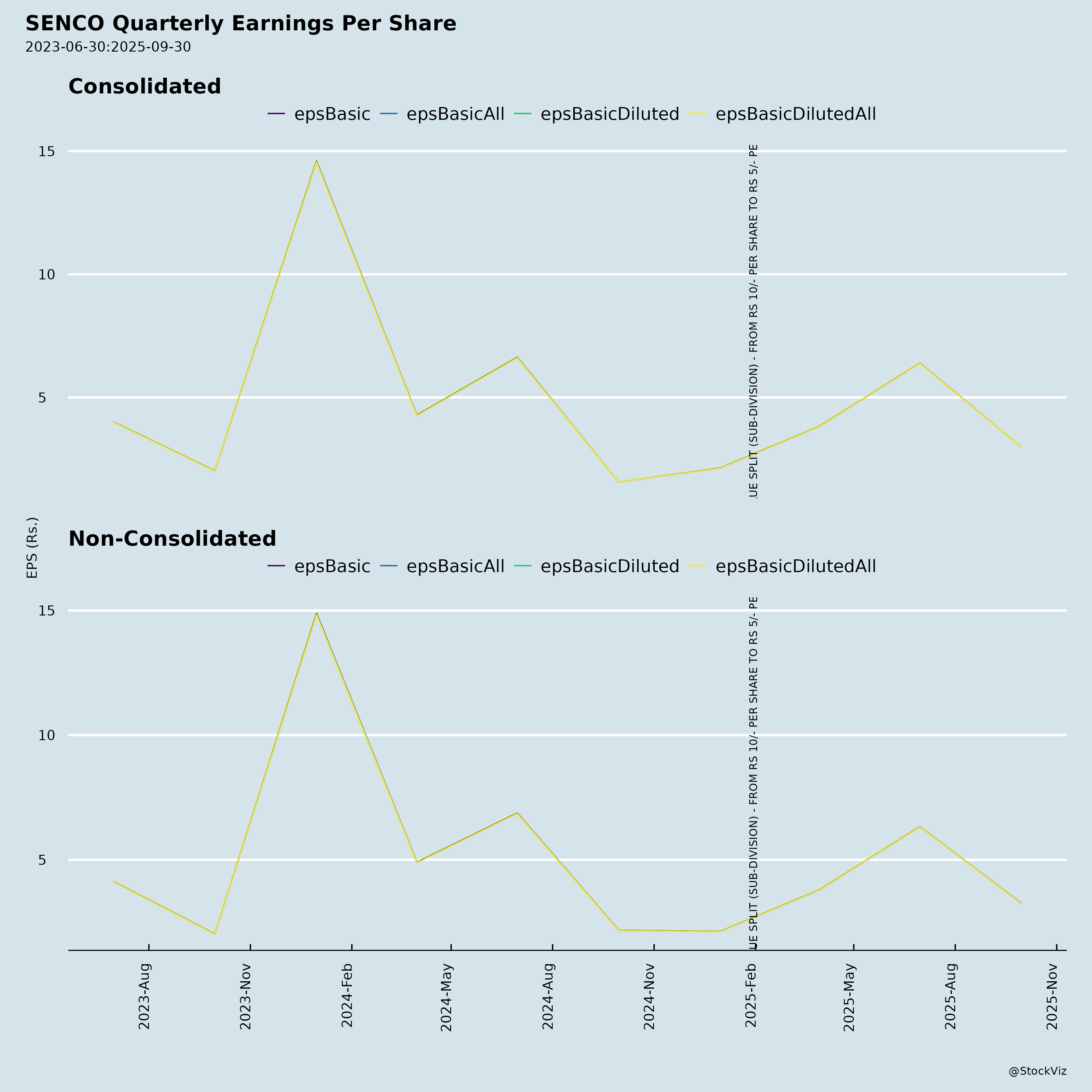

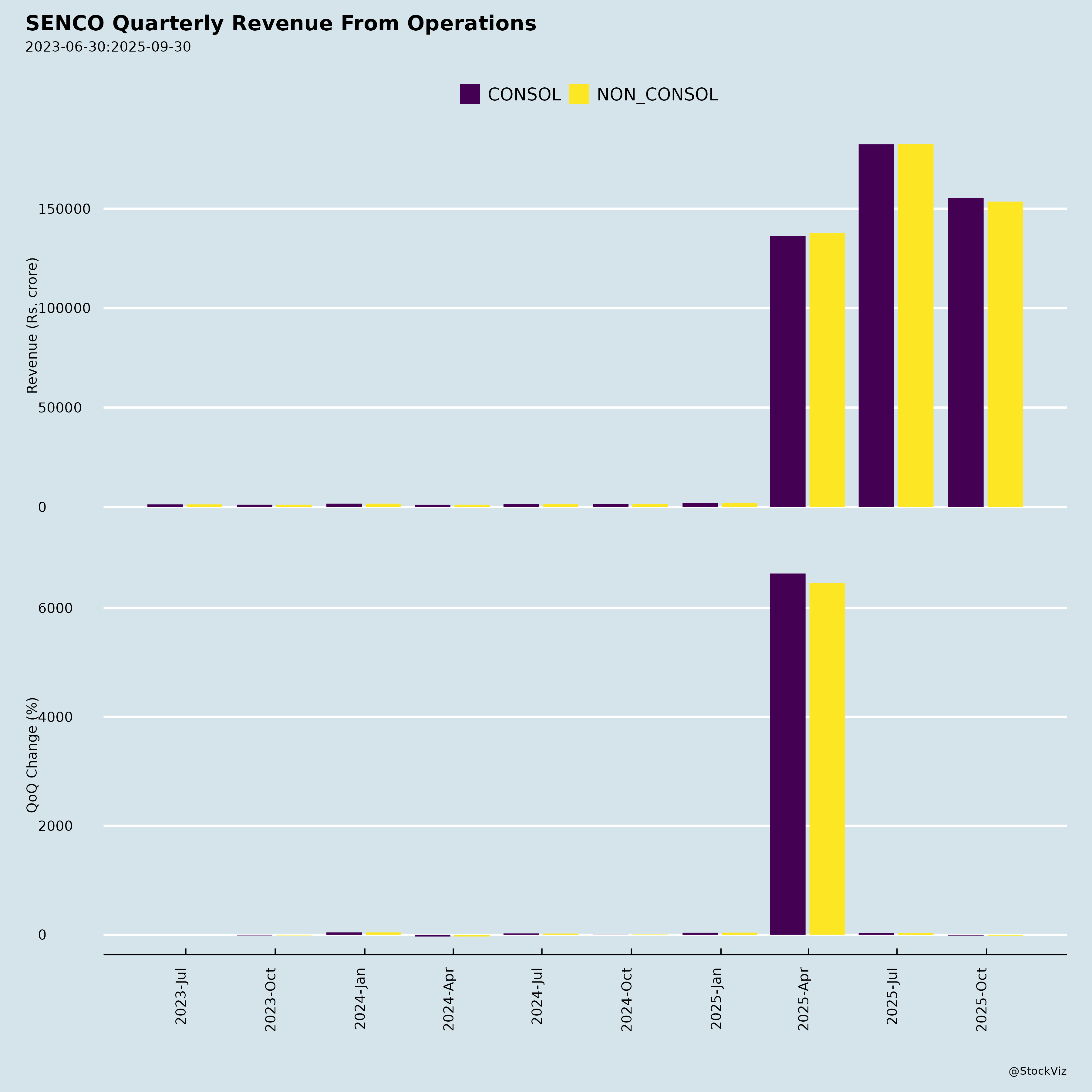

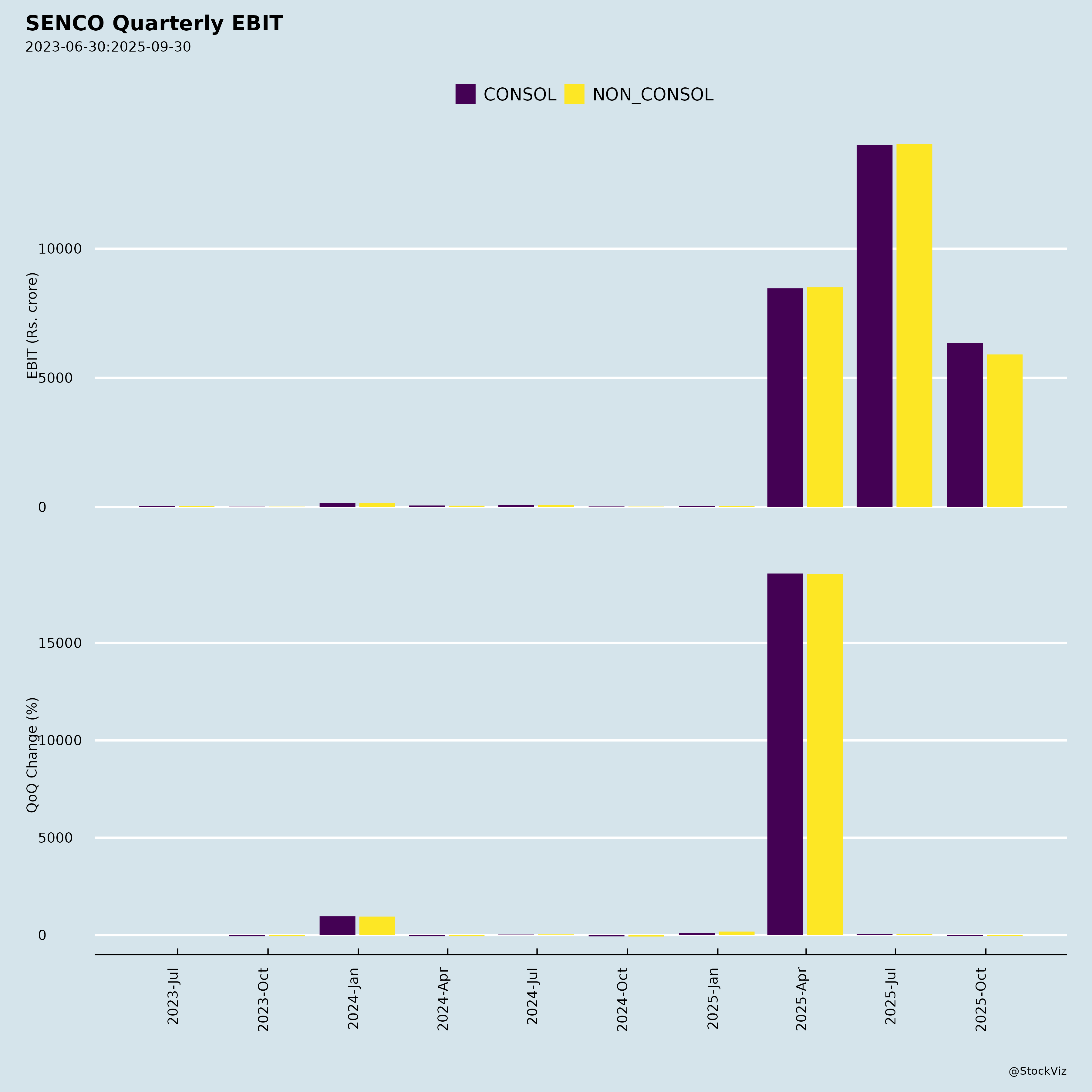

Fundamentals

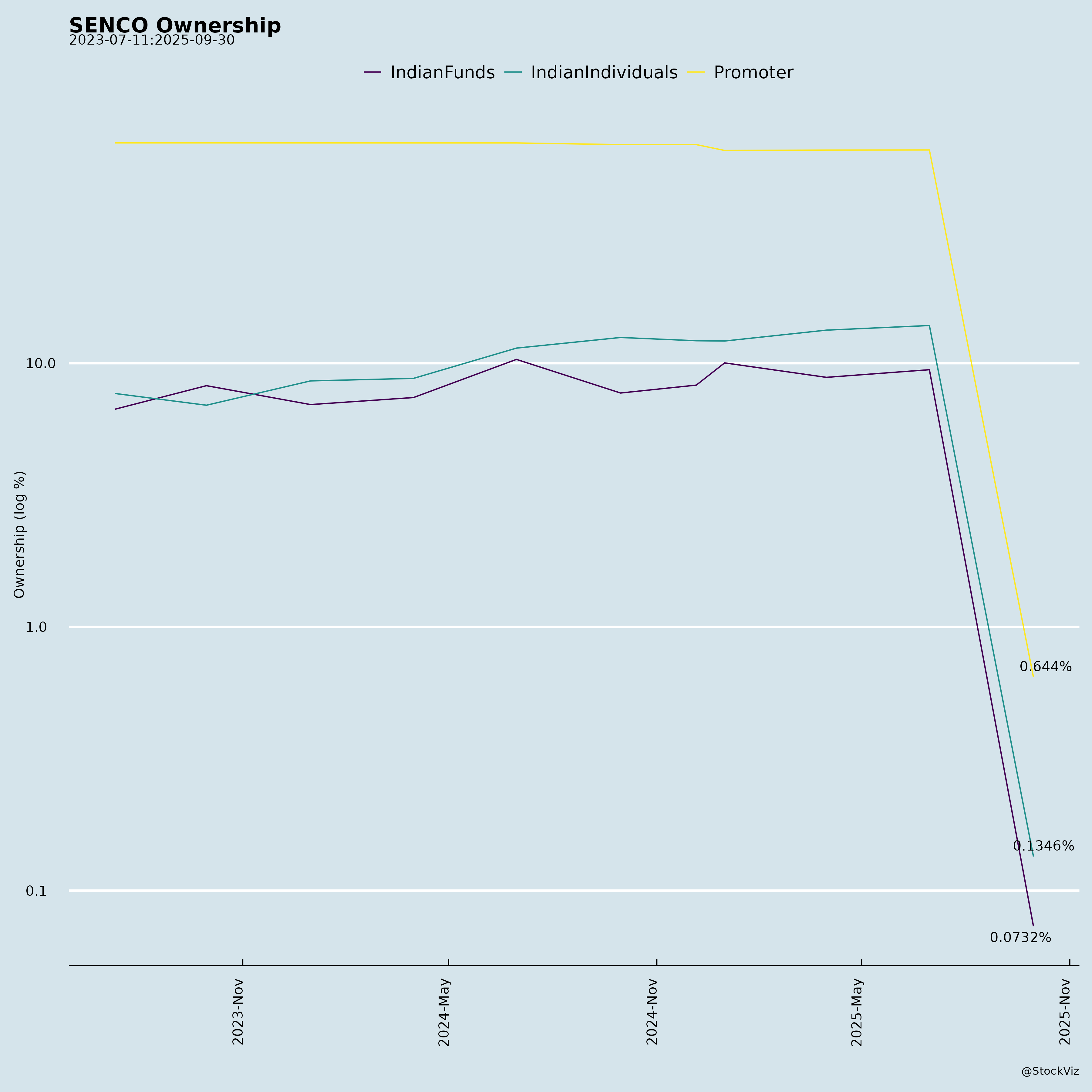

Ownership

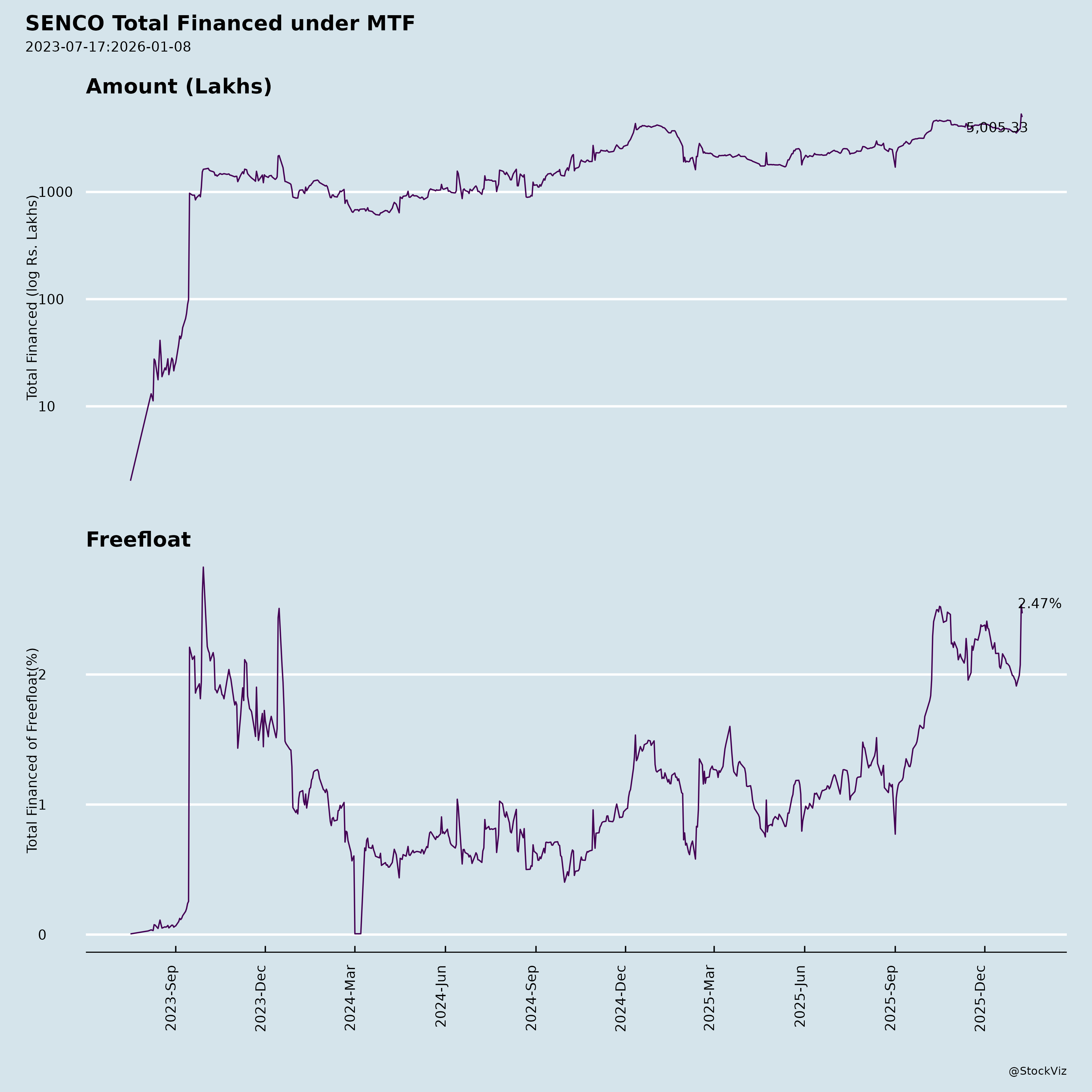

Margined

AI Summary

asof: 2025-12-08

Comprehensive Analysis of SENCO Gold Limited (NSE: SENCO, BSE: 543936)

Based on recent disclosures including Unaudited Standalone & Consolidated Financial Results, Press Release (Q2 & H1 FY26), and Business Update (Oct 2025)

🔍 1. Headwinds (Challenges Faced)

External Challenges

- Record-High Gold Prices (₹1,16,500/10g in Sep 2025)

- Highest ever recorded, impacting consumer sentiment.

- Reduced purchasing power despite resilient demand.

- Adverse Weather Conditions in Eastern India

- Floods and heavy rainfall post-Shraddh period (September) disrupted sales in core markets like West Bengal and Bihar.

- Seasonal Headwinds: Shraddh Period (Sep 7–21, 2025)

- 15-day culturally sensitive mourning period where jewelry purchases are typically avoided, affecting Q2 momentum.

- Global Macroeconomic Uncertainties

- Global volatility, though demand remained strong due to gold’s safe-haven appeal.

- High Base Effect from FY25 (Custom Duty Cut Benefit)

- Easier YoY comparisons made difficult due to exceptional growth in Q2 FY25 driven by a one-time custom duty reduction benefit (~₹57.4 Cr in FY25).

- Shift in Consumer Spending

- Some movement toward capital goods due to GST cuts in other categories, competing for consumer budgets.

🌬️ 2. Tailwinds (Positive Drivers)

Operational Strengths & Market Advantages

- Robust Revenue Growth (H1 FY26 Consolidated)

- +16% YoY growth in revenue (₹3,362.3 Cr)

- Adjusted EBITDA growth of 52% YoY

- Adjusted PAT up 80% YoY

→ Strong operating leverage and margin expansion.

- +16% YoY growth in revenue (₹3,362.3 Cr)

- Improving Profitability & Margins

- H1 EBITDA margin improved +310 bps YoY to 8.6%

- PAT% expanded significantly to 4.5% (vs 2.2% in H1 FY25)

→ Driven by premiumization and improved product mix.

- H1 EBITDA margin improved +310 bps YoY to 8.6%

- Strong Dhanteras-Diwali Sales (Oct 2025)

- Highest-ever monthly retail sale of ~₹1,700+ Crore

- ~56% YoY growth in Dhanteras month

- ~25% YTD growth (as of October 2025)

- ~56% YoY growth in Dhanteras month

- Demonstrates effective branding, inventory readiness, and consumer trust.

- Highest-ever monthly retail sale of ~₹1,700+ Crore

- Increased Demand for Diamond & Lightweight Jewellery

- Diamond jewellery demand up 31% in value and 14% in volume during H1

- Stud ratio increased to 12% from ~9-10% earlier

→ Successfully shifting towards higher-margin segments.

- Diamond jewellery demand up 31% in value and 14% in volume during H1

- Positive ASP & ATV Trends

- Average Selling Price (ASP): ₹56,700 (+15% YoY)

- Average Ticket Value (ATV): ₹86,200 (+16% YoY)

→ Sign of customer migration to more valuable, design-led products.

- Average Selling Price (ASP): ₹56,700 (+15% YoY)

- Successful Retail Expansion Strategy

- Total showrooms: 192 (H1 FY26)

- Launched 16 new stores (net) in H1, including 6 in Q2

- Includes international expansion (Dubai) and 3 new franchise stores

- Includes international expansion (Dubai) and 3 new franchise stores

- Strategic use of franchise model for faster scalability and lower capital intensity.

- Total showrooms: 192 (H1 FY26)

- Enhanced Inventory Management

- Elevated inventory (~₹4,309 Cr in H1) proactively built for festivals and expansion.

- Optimized stock of lightweight, budget-friendly designs to align with customer purchasing patterns.

- Elevated inventory (~₹4,309 Cr in H1) proactively built for festivals and expansion.

- Favorable Macro Impact: GST Rate Cuts

- Positively influenced consumer demand, particularly for jewelry and capital goods.

- Expected to support ~20% top-line growth for FY26.

📈 3. Growth Prospects

Expansion Roadmap

- Target: 20 net new store openings in FY26

- 16 completed in H1 → expect 6–8 more in Q3/Q4

- Focus on pan-India presence, with growth in Eastern India (core region) and metro tier-2 cities.

- 16 completed in H1 → expect 6–8 more in Q3/Q4

- SIS & Sennes Brand Growth

- SIS counters reached 100+ integrated within Senco stores

- Sennes fashion brand launched 1 new exclusive store (Hyderabad, total 8 stores)

→ Expanding into youthful, modern & fashion-conscious segments.

- SIS counters reached 100+ integrated within Senco stores

Product & Innovation Strategy

- Launch of >200,000 gold & >100,000 diamond designs annually

- Introduction of 9K lightweight jewelry, Everlite (Shakti Collection), and Silver (Tattva Collection)

→ Captures aspirational and younger buyers.

Marketing & Customer Initiatives

Flexible schemes: Flexi Advance Booking, Jewellery Purchase Scheme

→ Enhances purchase confidence in volatile price environments.Old Gold Exchange Campaigns

- Used effectively to boost footfall amid high gold prices.

Festive & Wedding Season Upside (H2)

- Dhanteras-Diwali momentum sets strong tone for H2

- Wedding season (Q3-Q4) expected to drive peak retail seasonality

Financial Discipline & Capital Allocation

Net debt: ₹1,578.4 Cr, Debt/Equity ratio: 0.75 (incl. GML)

→ Comfortable level given growth needs

Gold Metal Loans (GML) to be increased to 65% of total funding → improves blended ROI and liquidity.

Earnings guidance reiterated:

→ ~20% YoY revenue growth for FY26Focus on improving Inventory turns, ROE, and ROCE through:

- Stock optimization

- Lean operations

- Higher-margin mix

⚠️ 4. Key Risks

Market & Operational Risks

- Volatility in Gold Prices

- As gold prices rise, consumer demand may weaken despite strong brand equity.

- Inventory Risk & Margin Pressure

- High inventory levels (~₹4,309 Cr) are sensitive to sudden price corrections or lower-than-expected demand.

- Requires strong working capital management.

- Execution Risk in Expansion Plans

- Aggressive expansion (20 stores in FY26) needs consistent delivery via both company-owned and franchise models.

- Dependence on Festive Sales & Seasonality

- Majority of profits concentrated in Q3 and Q4 → vulnerable to calendar shifts, festival delays, or weather events.

- Competition from Organized & Unorganized Players

- Increasing competition from Tanishq, CaratLane, Kalyan, Malabar, and regional players.

- Unorganized sector still dominant (~70% market share) with cheaper alternatives.

- Reliance on External Financing (Gold Loans)

- Use of Gold Metal Loans (GML) funded by RBI scheme exposes the company to:

- Changes in RBI policy

- Availability of gold supply

- Interest rate fluctuations in gold lease agreements

- Use of Gold Metal Loans (GML) funded by RBI scheme exposes the company to:

- Currency & Forex Risk (International Operations)

- Dubai presence introduces foreign exchange exposure and geopolitical risks.

- Customer Sentiment Linked to Macro Environment

- Inflation, monsoon, agricultural economy performance impact rural and semi-urban spending, especially in Eastern India.

✅ Summary: SENCO Gold – SWOT Snapshot

| Strengths | Weaknesses |

|---|---|

| ✅ 85-year legacy, strong brand trust in Eastern India ✅ Multi-award-winning “India’s 2nd Most Trusted Jewellery Brand” (2024) ✅ Rapid profitable growth & margin expansion ✅ Diverse showroom formats (COCO, FOFO, SIS) ✅ Strong diamond & lightweight segment traction |

❌ High inventory exposure ❌ Seasonality (major revenue in Q3-Q4) ❌ Dependence on external macro conditions |

| Opportunities | Threats |

|---|---|

| 🟢 Expand to tier-2/3 cities & South India 🟢 Grow Sennes/SIS for younger consumers 🟢 Leverage GML to lower cost of capital & improve ROI 🟢 Launch of budget-friendly designs (9K) to tap aspirational base 🟢 Drive digital sales & omnichannel presence |

🔴 Gold price volatility 🔴 Weather/climatic disruption in core markets 🔴 Rising competition 🔴 Policy changes in customs duty or gold import regulations |

📌 Final Verdict: Investment Outlook

Bullish Case

- SENCO is executing well on its turnaround strategy post-IPO and QIP fundraise.

- Exceptional H1 performance despite extreme headwinds.

- Management delivering on profitability enhancement, brand premiumization, and strategic expansion.

- Strong H2 visibility driven by festivals and weddings.

- On track to deliver 20% top-line growth in FY26, with improving ROE/ROCE.

Valuation Consideration

While not explicitly provided, a PAT jump of 80–142% YoY combined with solid operating cash flows and conservative leverage, suggests improving fundamentals that could justify valuation rerating if sustained.

✅ Conclusion: Positive Growth Trajectory with Moderate Risk

SENCOL is emerging as a well-managed, growing organized player in Indian jewellery retail — leveraging brand equity, disciplined expansion, and smart product innovation to navigate one of the most challenging market environments in years.

Its resilience in Q2’26 (floods, peak gold prices, Shraddh) combined with a record-strong Dhanteras, suggests strong underlying business momentum.

Verdict: Favorable long-term growth story, awaiting margin sustainability and execution consistency. Monitor H2 performance and inventory efficiency.

“We are not just growing revenue — we are growing profitability, brand equity and consumer depth.”

— Management (Senco Gold Ltd., Oct–Nov 2025 Updates)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.