Gems Jewellery And Watches

Industry Metrics

January 13, 2026

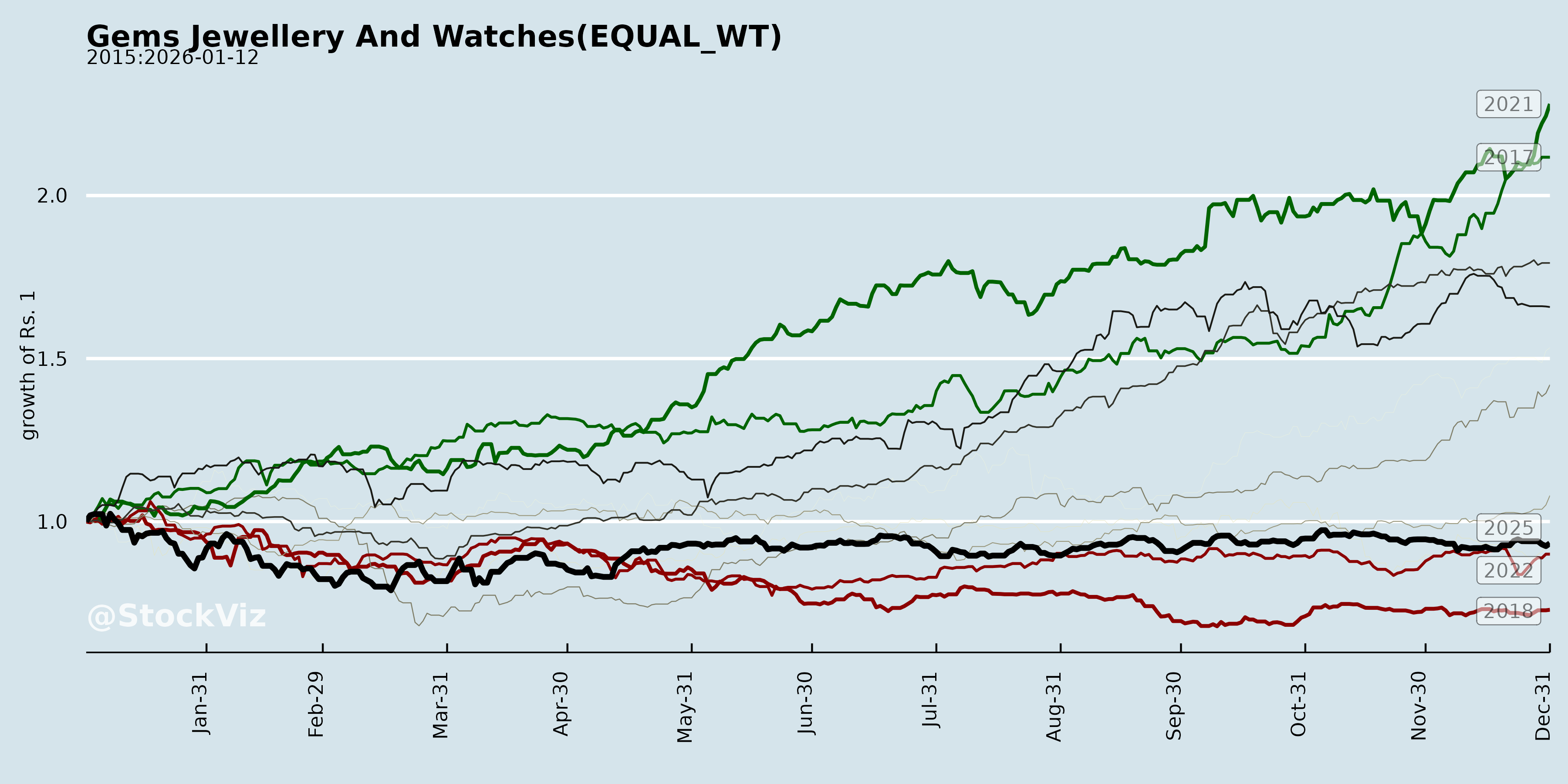

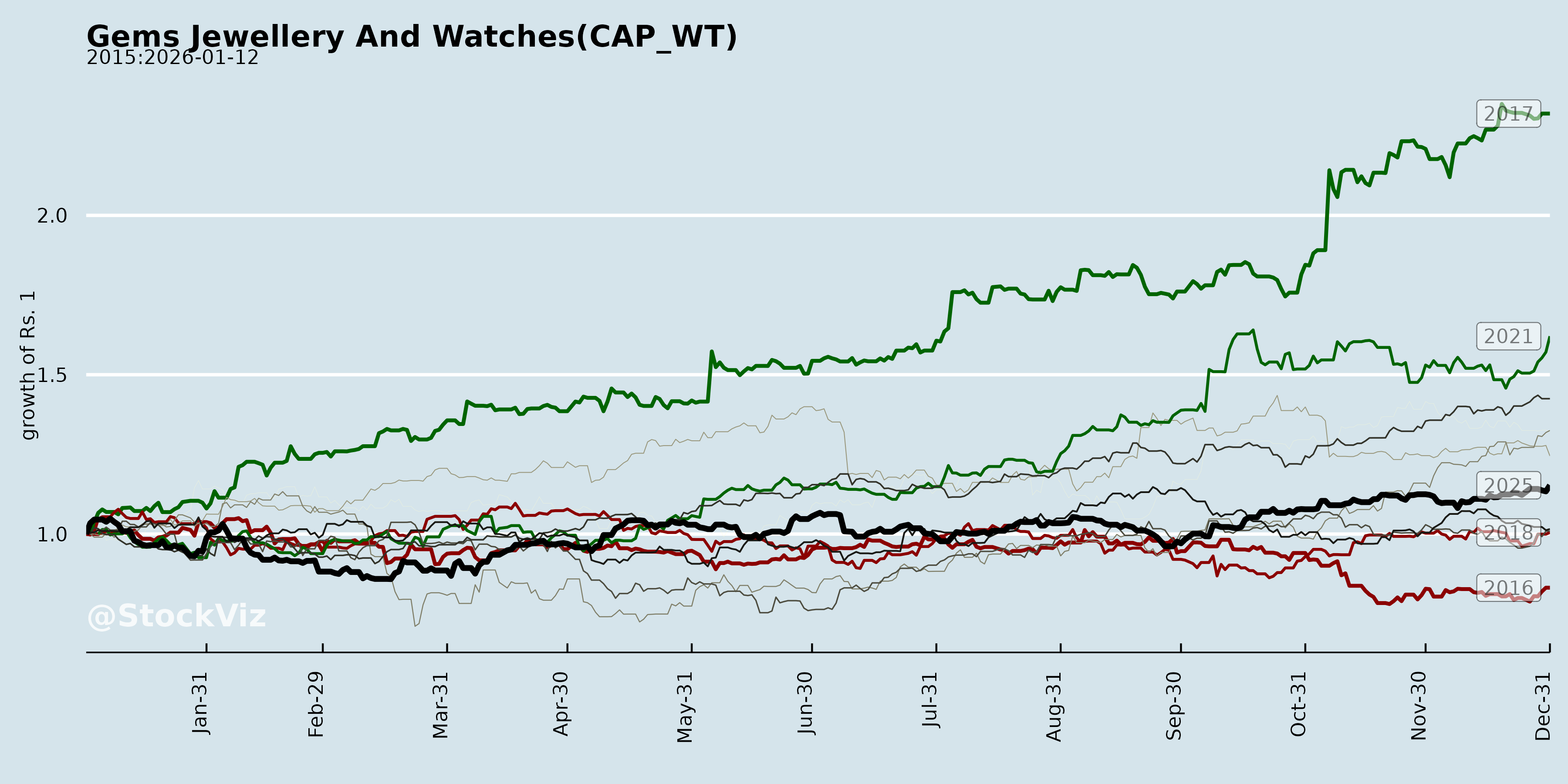

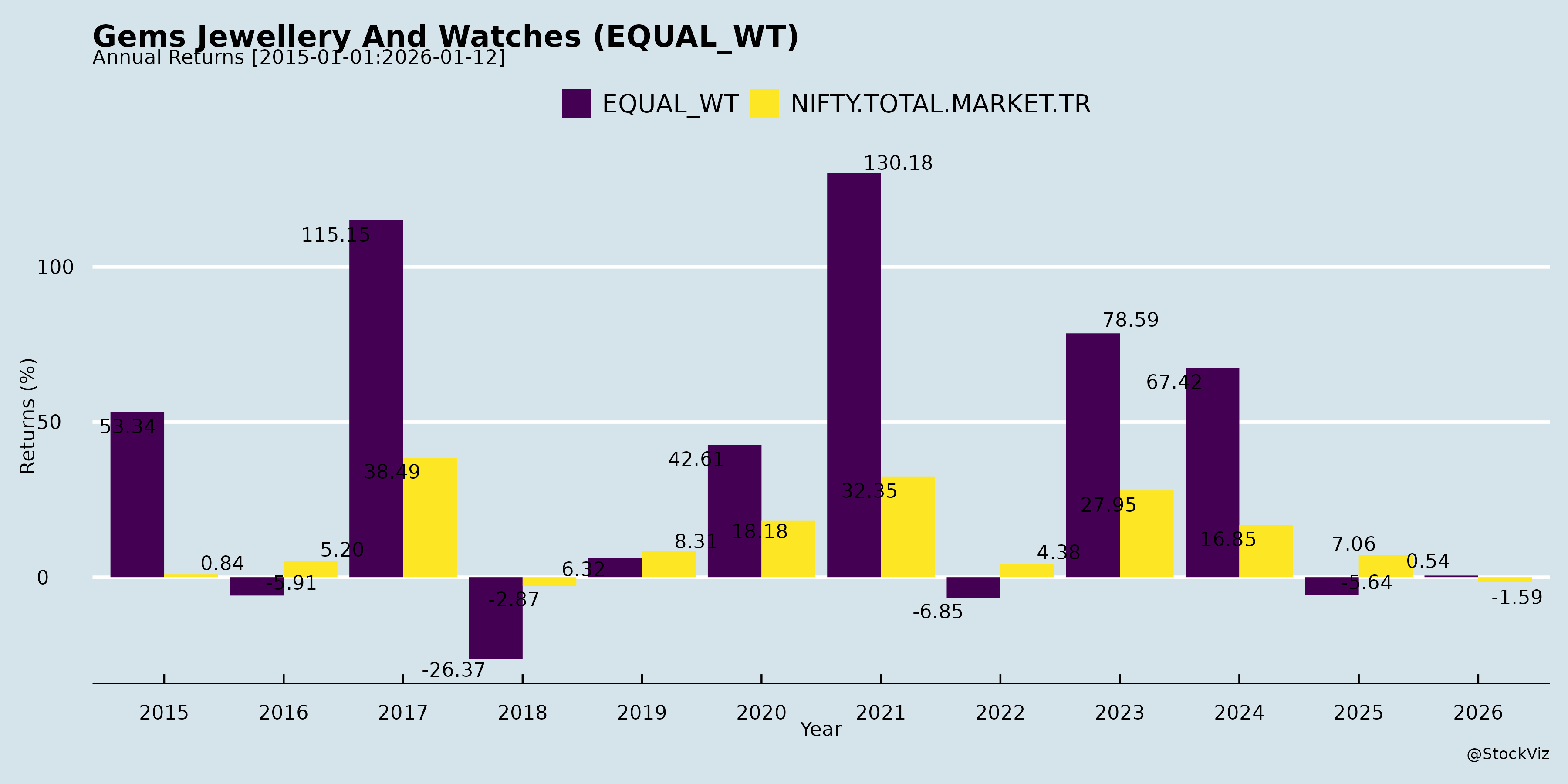

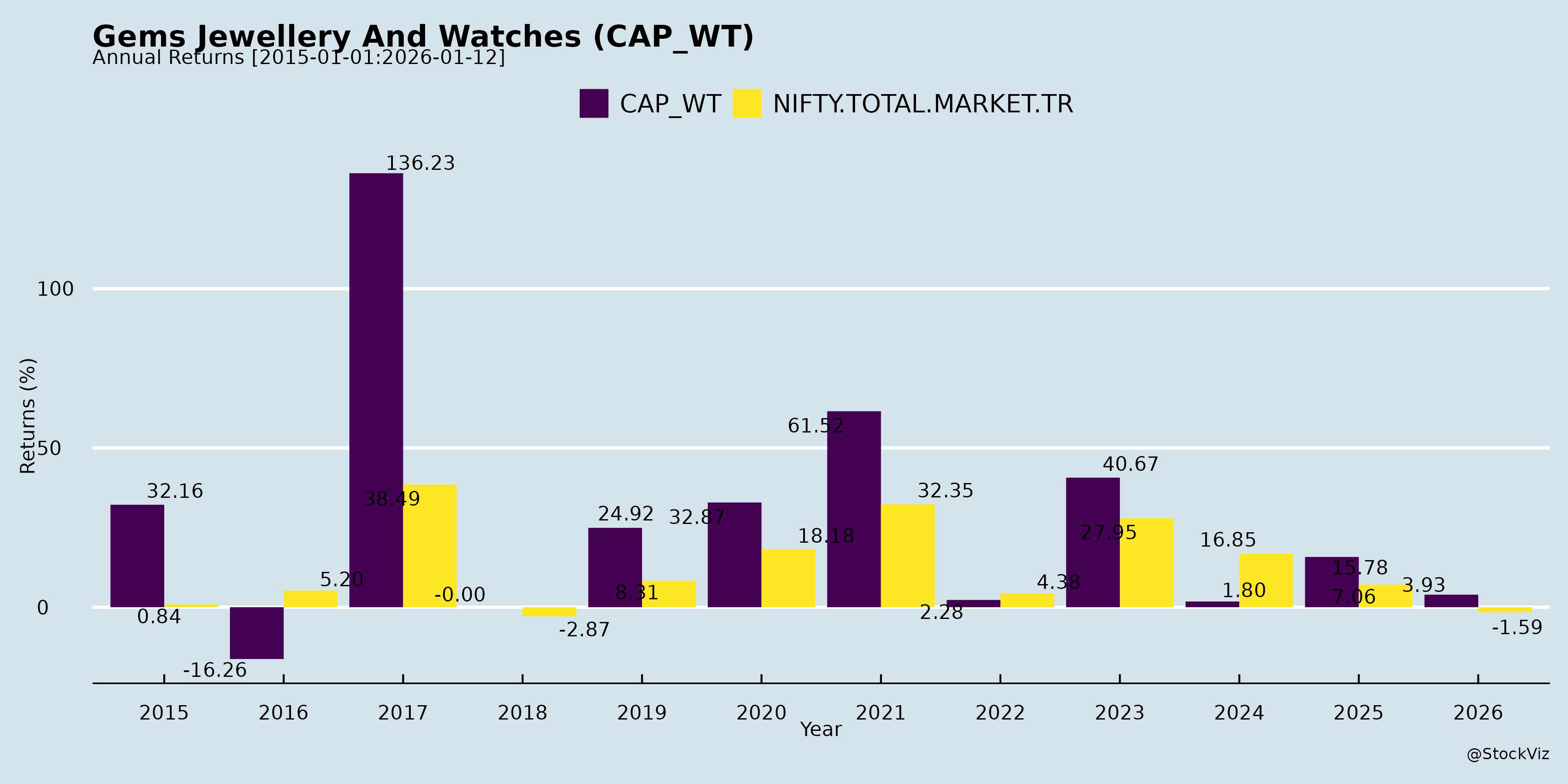

Annual Returns

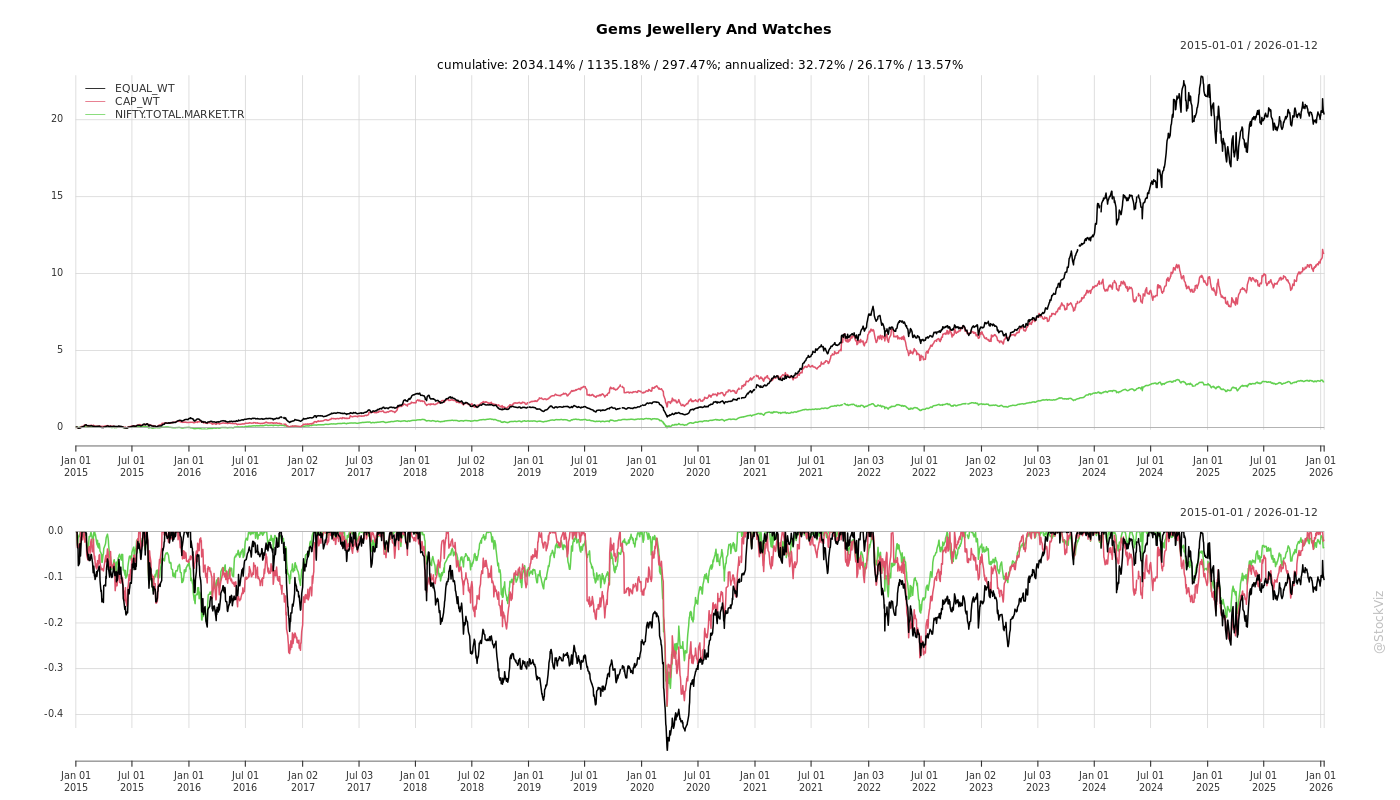

Cumulative Returns and Drawdowns

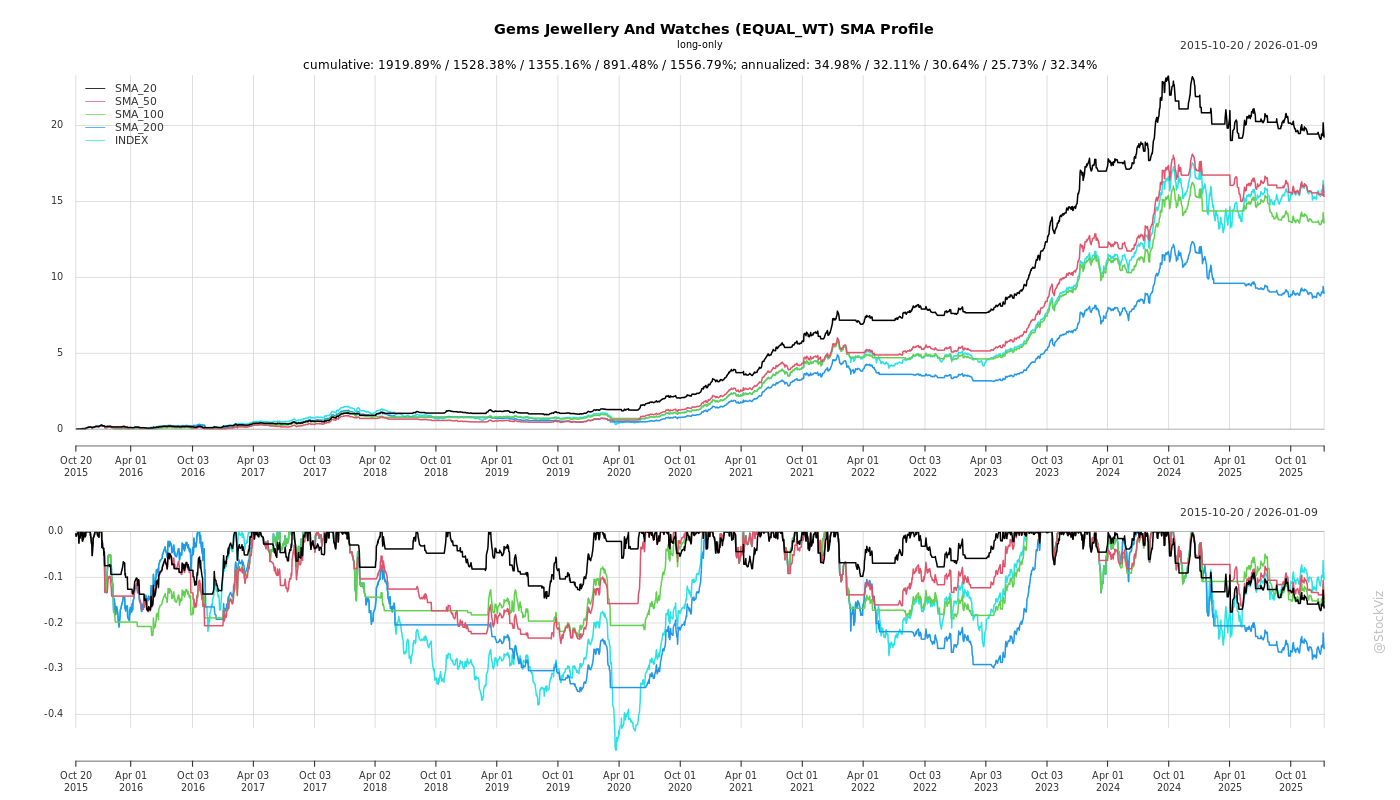

SMA Scenarios

Current Distance from SMA

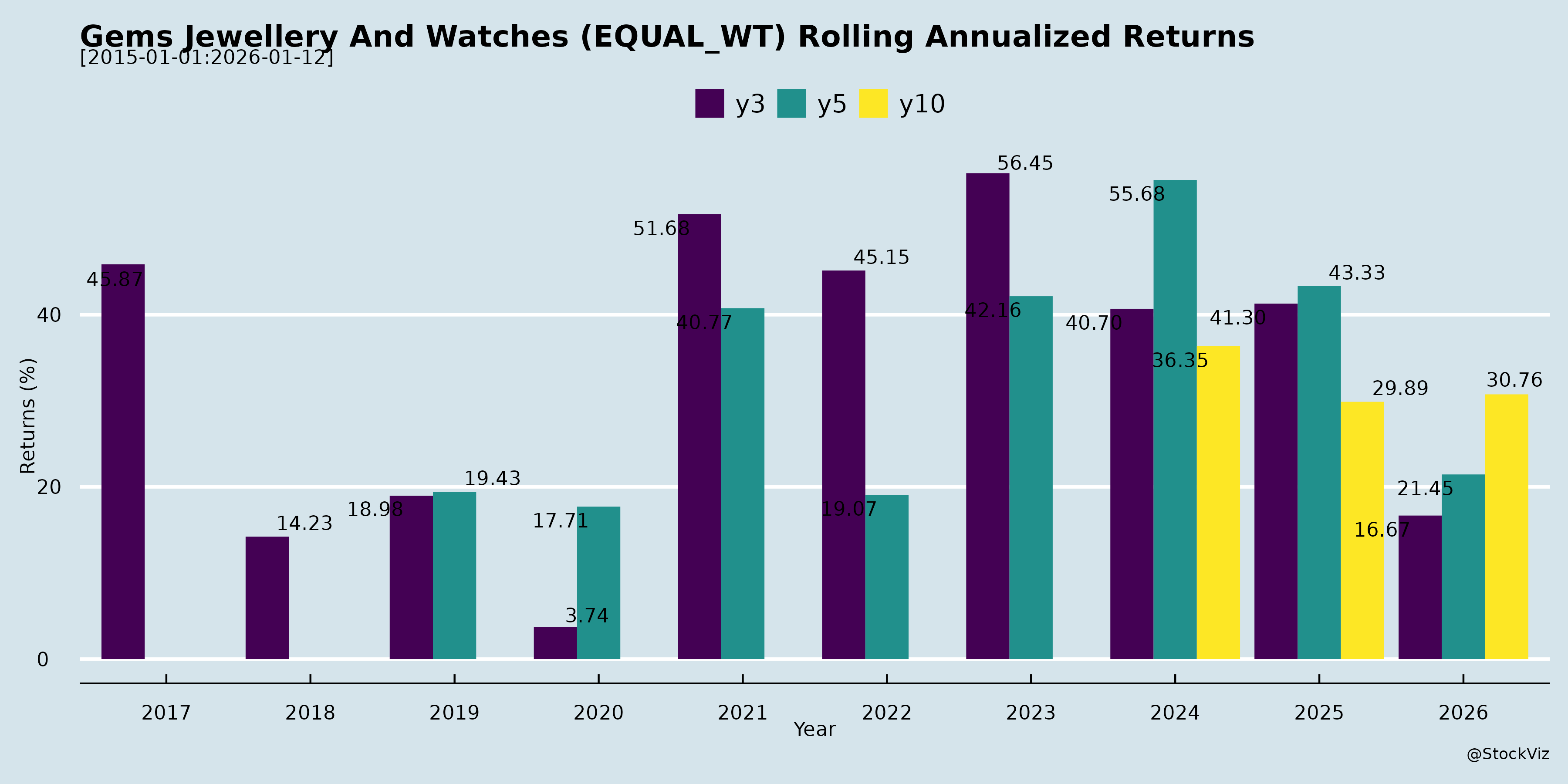

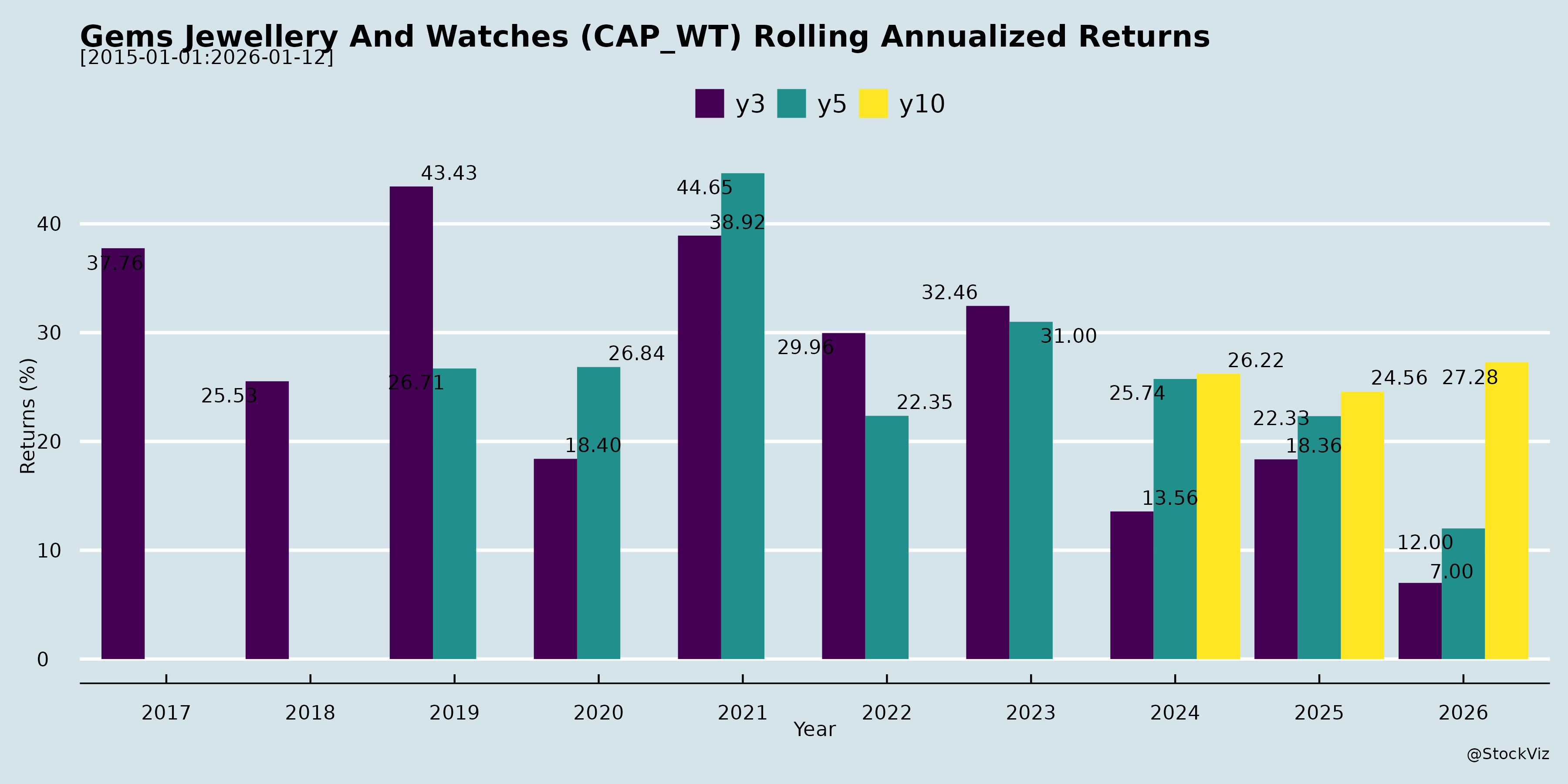

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Indian Gems, Jewellery, and Watches Sector Analysis (Based on Q2/H1 FY26 Filings & Transcripts)

The sector exhibits resilience amid high gold price volatility (~40-50% YoY rise), with organized players (e.g., Titan, Bluestone, Senco, Kalyan, DP Abhushan, Goldiam, KDDL) reporting flat-to-modest H1 revenue growth but strong margin expansion via operating leverage, inventory gains, and product mix shifts. Recovery evident in Oct festive sales (30-100% YoY). Watches face export headwinds but domestic tailwinds.

Headwinds

- Gold Price Volatility & Elevation: 20-30% volume degrowth (e.g., DP Abhushan H1: -20%; Bluestone/Senco similar); consumers postponing buys, shifting to lighter-weight/lower-carat (18k/14k/9k) jewelry (Senco, Bluestone, Titan).

- High Base Effect: Q2 FY25 boosted by customs duty cuts (Bluestone SSSG 43% base).

- Regional/Macro Softness: Rains/floods in East India (Senco); consumer caution amid inflation (Vaibhav Global, KDDL Swiss exports to China/HK down 16-27%).

- Export Tariffs: US tariffs (up to 56% on diamonds/jewelry) disrupted B2B (Goldiam mitigated via US casting); broader trade tensions (KDDL).

- Margin Pressures: Sequential EBITDA dips from A&P/festive phasing (Bluestone); GML mix down due to margin calls (Senco).

Tailwinds

- Festive/Wedding Recovery: Oct sales surge (Bluestone ~50% YoY; Senco 50-60%; DP Abhushan 40%; peers 45-100%); strong Dhanteras/Diwali, upcoming weddings (47L in H2 per DP).

- Margin Expansion: H1 EBITDA up 13-340bps (Bluestone 13.9%, Senco 6.9%, Vaibhav 10%); inventory gains (Bluestone ₹16Cr, Goldiam); fixed-cost leverage (store productivity).

- Product Mix Shift: Studded/lab-grown diamonds (62% Bluestone sales, 12% Senco); silver/daily wear growth; higher ASP/ATV (Senco +16%, Vaibhav lifestyle 36%).

- Operational Efficiencies: Omni-channel (digital 42% Vaibhav); hedging/natural hedging (most firms 50-100%); store expansions (Bluestone 311 stores, Senco 16 new).

- Domestic Watches Strength: India +10-35% Swiss imports (KDDL); premiumization.

Growth Prospects

- Revenue Guidance: Mid-teens overall (Vaibhav 7-9% FY26, mid-teens medium-term; Bluestone 37% H1; Senco 20-25% FY26; DP 20-25%).

- Store/Franchise Expansion: 70-80 stores (Bluestone); Tier 2/3 focus (Senco FOCO pilots; DP 8-10 in 2-3 yrs).

- Premium/Segment Growth: Lab-grown diamonds (Goldiam 90% B2B; ORIGEM retail); bracelets/packaging (KDDL 70% H1 growth); precision engineering (KDDL Eigen +44% H1).

- Organized Retail Penetration: 20-25% CAGR long-term (KDDL non-Ethos); omni-channel (50% digital by FY27 Vaibhav).

- Watches: India nascent (<2% global Swiss exports); Eigen peak potential (KDDL eyes 20-25% CAGR).

Key Risks

- Gold Price Correction: Potential inventory losses (most unhedged/natural hedge; Bluestone/Senco warn); margin compression.

- Demand Volatility: Prolonged slowdown if prices stay high (wait-and-watch); competition in Tier 2/3 (Indore example, DP).

- Debt/Working Capital: Inventory buildup (Bluestone +₹220Cr); GML/CC shifts (Senco 51% mix); debt up for festive prep.

- Tariffs/Exports: US/EU policy shifts (Goldiam/KDDL); forex hedging risks.

- Execution: New store ramp-up (Bluestone cohorts young); digital team changes (Vaibhav Germany).

- Macro/Competition: Consumer sentiment (inflation, geopolitics); unorganized/national players (Titan, Kalyan peers).

Summary: Sector resilient with H1 revenue flat-40% (avg ~10-30% guided FY26), EBITDA margins 7-22% via leverage/mix. Tailwinds from festive recovery, premiumization outweigh headwinds (gold volatility, tariffs). Prospects strong (organized shift, expansions) but risks tied to prices/debt. Positive: Oct momentum, lab-grown/watches upside; watch for Q3 wedding execution. Overall outlook: Moderate Growth (15-25% CAGR medium-term) with margin stability.

General

asof: 2025-11-29

Summary Analysis: Indian Gems, Jewellery & Watches Sector (Based on Provided Announcements)

The provided documents from key players (Titan, Kalyan, Thangamayil, Bluestone, PN Gadgil, Ethos, PC Jeweller, Rajesh Exports, Sky Gold, Senco Gold, Goldiam, Vaibhav Global) highlight robust festive momentum, retail expansion, and operational compliance amid high gold prices in FY26 (Q2-H1). Overall sector sentiment is positive, driven by weddings/festivals, but tempered by input cost pressures. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Festive & Seasonal Demand Surge: Record sales during Diwali/Dhanteras (PN Gadgil: ₹606 Cr, +74% YoY; Dhanteras ₹277 Cr, +105% YoY) and Oct (Thangamayil: ₹1,032 Cr, +178% YoY; gold volume +77%). Gold (PN Gadgil +74%, volumes +10%), diamonds (+54%), silver (+90%) led growth.

- Retail Expansion & Network Growth: Senco added 5 stores (total 184 + SIS expansion); Goldiam opened 11th lab-grown diamond store (ORIGEM brand); Thangamayil notes strong Chennai metro performance.

- Category Diversification: Diamonds (Senco: H1 value +31%, volume +14%; Q2 +12%) and silver (+54%) outperforming; lab-grown diamonds gaining traction (Goldiam).

- Strong Liquidity & Operations: Titan issued ₹4,725 Cr CPs for working capital (adherence certified); ESOP grants (Sky Gold) signal employee confidence.

- Brand & ESG Momentum: Vaibhav Global’s ‘Strong’ ESG rating (72/100) enhances investor appeal; subsidiary rebrands (Kalyan’s Candere).

Headwinds (Challenges)

- High Gold Prices & Volatility: Avg. +43% YoY (Senco); peaked at ₹1,11,650/10g. Thangamayil cites “wide price fluctuations” limiting trend visibility; Senco notes high base from prior duty cuts, Shraddh floods/rains in WB.

- Demand Shifts & External Factors: GST cuts shifted some demand to capital goods (Senco); regional disruptions (rains/floods post-Shraddh).

- High Base Effect: Q2 growth muted at 6.5% YoY (Senco total revenue) due to prior-year duty cuts.

Growth Prospects

- FY26 Topline Outlook: Senco targets 18-20% revenue growth (H1 at 17.8%, SSSG 7.5%, TTM ₹6,800 Cr); Q3 strong on Dhanteras/Diwali/weddings (20 new stores planned).

- Retail & Franchise Scaling: 180+ stores for majors (Senco 184, expansions in Dubai/Bihar/WB); lightweight/9K gold, bridal collections to tap weddings.

- Non-Gold Categories: Diamonds/lab-grown (Goldiam’s retail push), silver as high-growth levers; old gold exchange schemes boosting footfall.

- Digital/Compliance Edge: AGM filings (Bluestone/PC Jeweller) emphasize green initiatives/digital access; ESOPs (Sky Gold) for talent retention.

- Long-Term: Wedding season optimism (PN Gadgil); MCA approvals for AGMs (Rajesh Exports) ensure continuity.

Key Risks

- Commodity Price Volatility: Gold price swings could erode margins/volumes despite volume resilience.

- Consumer Sentiment & Macro: High prices may deter investment-led demand; economic slowdowns or GST/inflation shifts (e.g., capital goods competition).

- Operational/Regulatory: Compliance filings (Titan CPs, Ethos auditor, subsidiary name changes) highlight scrutiny; AGM delays (Rajesh).

- Competition & Execution: Intense retail race (store additions); supply chain (mining/biodiversity noted in Vaibhav ESG).

- Financial: Debt reliance (CPs); unassured ESG data/climate risks (Vaibhav weaknesses like board diversity, Scope 3 emissions).

Overall Sector Outlook: Bullish short-term (festive/wedding boost, 15-20% growth feasible) with resilient demand offsetting gold prices. Focus on diamonds/lab-grown and expansion to sustain momentum; monitor Q3 results for sustained SSSG. ESG integration (e.g., Vaibhav) could attract global capital.

Investor

asof: 2025-12-02

Analysis of Indian Gems, Jewellery, and Watches Sector (Based on Q2/H1 FY26 Earnings Insights)

The Indian gems, jewellery, and watches sector demonstrated resilience amid headwinds in Q2/H1 FY26, with most companies reporting flat-to-moderate revenue growth (2-43% YoY) despite ~20-40% YoY gold price surges. Volume declines (10-30%) were offset by higher ASP (10-16% up) and ASP growth, leading to margin expansions (EBITDA 100-400 bps YoY). Organized players (e.g., Titan, Senco, Bluestone) expanded stores (16-40 new), focused on studded/lightweight jewellery, and digital/omnichannel. Watches (Ethos, KDDL) saw US/China slowdowns but India tailwinds. Lab-grown diamonds (LGD) gained traction (20-90% mix), though US tariffs posed risks.

Headwinds

- Gold Price Volatility: 40-50% YoY rise led to 10-30% volume degrowth (e.g., Senco -20%, DP Abhushan -20-30%, Bluestone flat). Consumers postponed buys (Sep softness), shifted to lighter/lower-karat (18k/14k/9k) pieces.

- Regional/Seasonal Softness: East India (Senco 65% sales) hit by rains/Durga Puja; high base from FY25 duty cuts (Bluestone SSSG 11% vs. 43% prior).

- US Tariffs/Trade Issues: 56% on LGD/natural diamonds disrupted exports (Goldiam mitigated via US casting; KDDL noted Swiss watch export slowdowns).

- Competition & Consumer Caution: Intense rivalry (Tanishq/Kalyan entries); budget constraints favored old gold exchange (35-43% mix).

- Watches-Specific: Global slowdown (Swiss exports to China -16%, HK -27%); KDDL watch components grew modestly via premiumization.

Tailwinds

- Festive/Wedding Recovery: Oct sales surged 40-100% YoY (Senco ₹1,700 Cr, Bluestone strong); 47L weddings ahead (DP Abhushan).

- Margin Expansion: Studded ratio up (12-62%; Bluestone 62%), operational leverage (fixed costs), hedging/inventory gains (₹16-160 Cr). EBITDA margins: Senco 6.9% (+340 bps), Ethos 14.6%, Goldiam 16.3%.

- ASP/ATV Rise: 10-16% (Senco ₹86k, Bluestone strong); silver/LGD traction.

- Store/Channel Expansion: 16-86 new stores (Ethos 86 boutiques); digital 42-50% (Vaibhav 42%, Bluestone omnichannel).

- India Watches Boom: Swiss exports +10-35% YoY (KDDL/Ethos benefited); premiumization.

| Company | Q2 Rev Growth (YoY) | EBITDA Margin (bps Chg) | Key Tailwind |

|---|---|---|---|

| Titan | N/A (meetings) | N/A | Investor meets |

| Senco | +2% (Consol) | +340 bps (6.9%) | Oct +50-60% |

| Bluestone | +37% | +13.9% (vs 1.4%) | SSSG 11% |

| Ethos | +32% | +8.1% | 86 boutiques |

| Goldiam | +43% | Stable 21.6% | LGD 90% mix |

| Vaibhav | +10% | +130 bps (10%) | Digital 42% |

| DP Abhushan | Flat H1 | Strong (margin-led) | Wedding szn |

Growth Prospects

- Revenue (Mid-Teens FY26+): 18-25% guided (Senco/Bluestone/DP); store adds (70-80/yr Bluestone); Tier 2/3 penetration (DP/Sky Gold).

- Digital/Omnichannel: 50% target (Vaibhav); Bluestone omni-channel resilient.

- LGD/Studded/Silver: 13-62% mix growth; higher margins (Goldiam 90% LGD).

- Watches: India +10-35% exports; Ethos 86 boutiques, KDDL Eigen +44%.

- Exports/Expansion: China+1 (Vaibhav B2B); franchisee pilots (DP); 200-300 stores ORIGEM (Goldiam).

- Margin Upside: 7-8% EBITDA sustainable (Senco); leverage from scale/studded.

Medium-Term (3-5 Yrs): Organized share to 40-50% (from 30%); mid-teens CAGR; ROCE/ROE >20%.

Key Risks

- Gold Volatility/Inventory: Unhedged exposure (DP natural hedge); turns slow (Bluestone inventory +₹220 Cr).

- Tariffs/Geopolitics: US 15-56% (Goldiam/KDDL); could hit exports (20-30% cyclical risk).

- Competition: Tanishq/Kalyan entries (DP Indore); unorganized dominance.

- Consumer Shifts: Volume pressure (lightweight/LGD); regional softness (rains/elections).

- Execution: New store ramp-up (2-3 yrs breakeven Ethos); capex (₹15-300 Cr).

- Watches: Global cyclicality (China slowdown); EV exposure in Eigen (40%).

Overall Summary: Sector bullish long-term (organized shift, weddings, LGD/digital), but short-term cautious (gold volatility, tariffs). Revenue resilient via ASP/studded; margins expanding (7-22%). Growth via expansion/digital; watch India outlier. Upside: Festive/wedding; Monitor: Gold (>₹1L/10g), US tariffs. Peers on track for 15-25% FY26 growth.

Press Release

asof: 2025-11-30

Summary Analysis: Indian Gems, Jewellery & Watches Sector (Based on Q2 FY26 Results & Announcements)

The sector demonstrates robust momentum in Q2/H1 FY26, driven by festive demand (Navratri/Diwali), wedding season anticipation, and operational efficiencies. Companies like Titan (GCC expansion), Kalyan (31% H1 revenue growth), Bluestone (37% Q2 standalone revenue), PNG (117% EBITDA growth), Sky Gold (93% Q2 revenue), Senco (16% H1 revenue), Shanti Gold (62% Q2 revenue), and TBZ (14% FY25 revenue) highlight resilience amid high gold prices. Organized players are gaining share via formalization, omni-channel strategies, and product innovation. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges)

- High Gold Prices: Peak levels (e.g., ₹11,650/gm in Sep 2025 per Senco) pressured demand during Shraddh/non-festive periods, leading to softer Q2 revenue for some (Senco +2% Q2 YoY, TBZ Q4 softness).

- Geopolitical/Regulatory Pressures: US tariffs hiked to 50-56% on Indian jewellery imports (Goldiam), disrupting exports; mitigated via strategies like US casting but adds costs/complexity.

- Seasonal & External Disruptions: Floods/rains in East India (Senco), high base effects from prior custom duty cuts (multiple firms).

- Inventory & Working Capital Strain: Rising gold prices inflated inventories (Senco: ₹4,309 Cr), increasing debt (net debt/equity at 0.75x) and requiring GML (Gold Metal Loan) optimization.

- Margin Pressures in Unorganized Shift: Intense competition as sector formalizes, with some firms reporting Q-o-Q dips (e.g., Senco EBITDA -42%).

Tailwinds (Positive Factors)

- Festive Surge: Record sales (PNG Navratri ₹4,281 Mn +66% YoY; Senco Dhanteras ₹1,700 Cr +56%; Kalyan SSSG >30% post-Navratri).

- Margin Expansion: EBITDA margins up significantly (Bluestone +1,255 bps YoY to 13.9%; PNG +327 bps to 6.6%; Shanti Gold +747 bps to 14.7%; TBZ +71 bps FY to 6.7%) via better product mix, lightweight designs, and supply-chain efficiencies.

- Strong Domestic Demand: SSSG robust (Kalyan 30%+ Diwali; PNG 29%; Senco 7.5% H1); rising ATV/stud ratios (Senco 12% stud ratio +31% diamond growth).

- Operational Leverage: Store expansions (Senco 192 stores; TBZ 37 stores), franchise models (PNG +105% franchise revenue), and digital mix (Vaibhav 42%; Bluestone omni-channel).

- International Tailwinds: Titan’s 67% Damas acquisition (AED 1,038 Mn EV) for GCC entry; Sky Gold Dubai office; Goldiam US model.

Growth Prospects

- Wedding/Festive Seasons: Upcoming H2 FY26 (Diwali/weddings) expected to sustain 20-30%+ growth (Senco RoY guidance 20%; Kalyan upbeat).

- Geographic & Channel Expansion: GCC/exports (Titan Damas 146 stores; Sky Gold targeting 15-20% exports); pan-India store adds (Kalyan 436 stores); omni/digital (Bluestone 37% YoY; Vaibhav 10% revenue growth).

- Product Innovation: Lightweight/9kt gold (Sky Gold-SENCO collab), lab-grown diamonds (Goldiam ORIGEM 70 stores target), 24K collections (Shringar), lifestyle brands.

- Sector Formalization: Organized share rising; tailwinds from rising incomes, urbanization, diaspora (Titan post-Damas shift to non-diaspora).

- M&A/Scale: Titan’s path to 100% Damas; synergies in supply chain/talent (multiple firms).

Key Risks

- Commodity Volatility: Gold price swings could erode margins/inventories; forex exposure in exports.

- Tariff/Trade Barriers: US/EU policy shifts (Goldiam tariff neutralization not foolproof); anti-trust delays (Titan Damas).

- Demand Sensitivity: Economic slowdowns/inflation curbing discretionary spends; over-reliance on festivals (Q2 softness in some).

- Execution Risks: Debt-funded expansions (Kalyan/Senco debt mentions); inventory turns amid high GML (target 65% per Senco).

- Competition/Fragmentation: Unorganized players (~90% market); pricing wars in organized space (Bluestone/PNG e-comm growth but Candere loss).

- Regulatory: Hallmarking/HUID mandates, SEBI disclosures; global anti-trust (Titan).

Overall Outlook: Bullish for FY26 with 15-25% revenue growth potential, led by organized players (20%+ RoE/ROCE targets). Tailwinds from weddings/formalization outweigh headwinds, but gold volatility/tariffs warrant monitoring. Focus on lightweight/lab-grown, exports, and efficiency will drive leaders ahead.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.