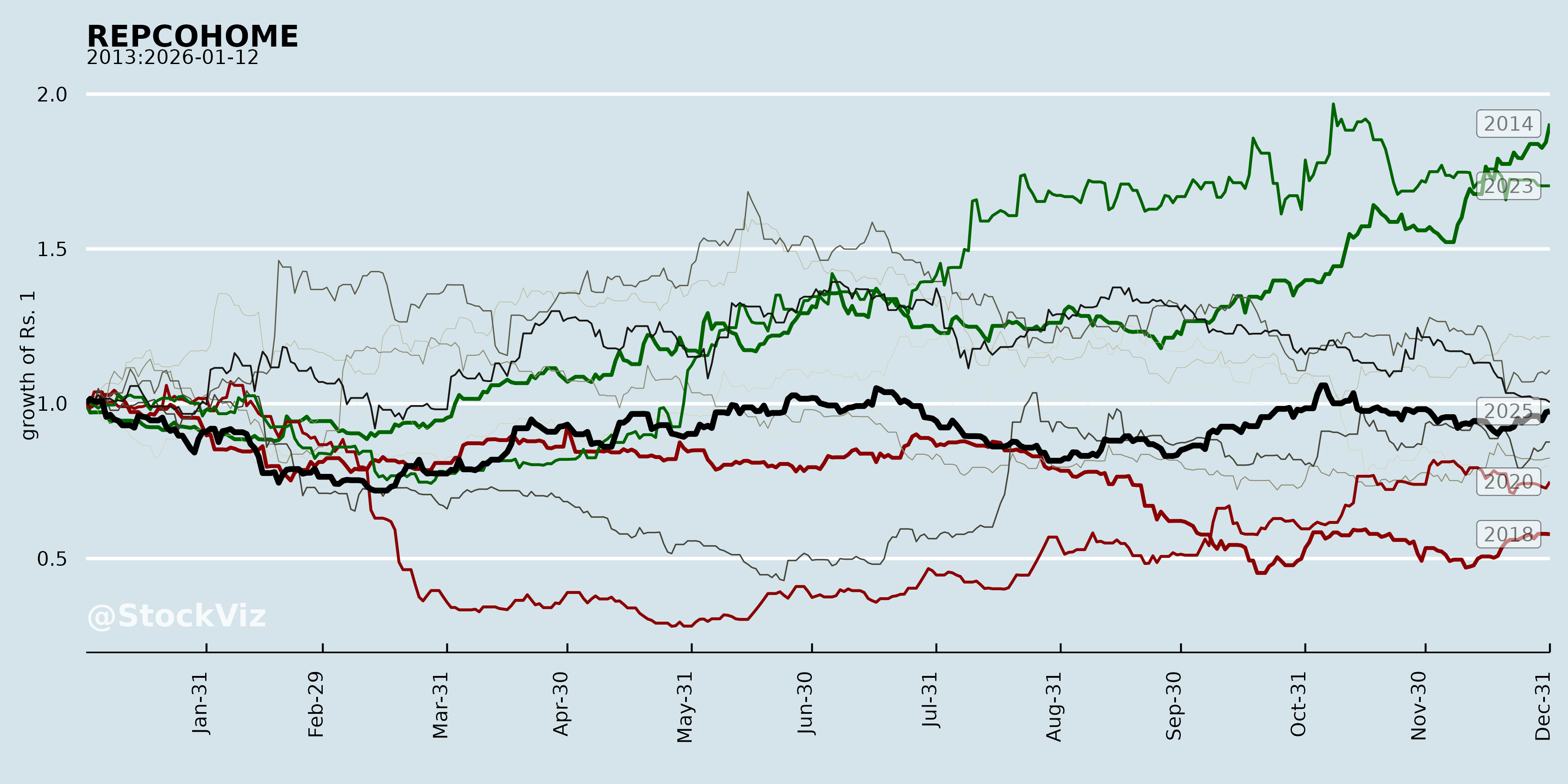

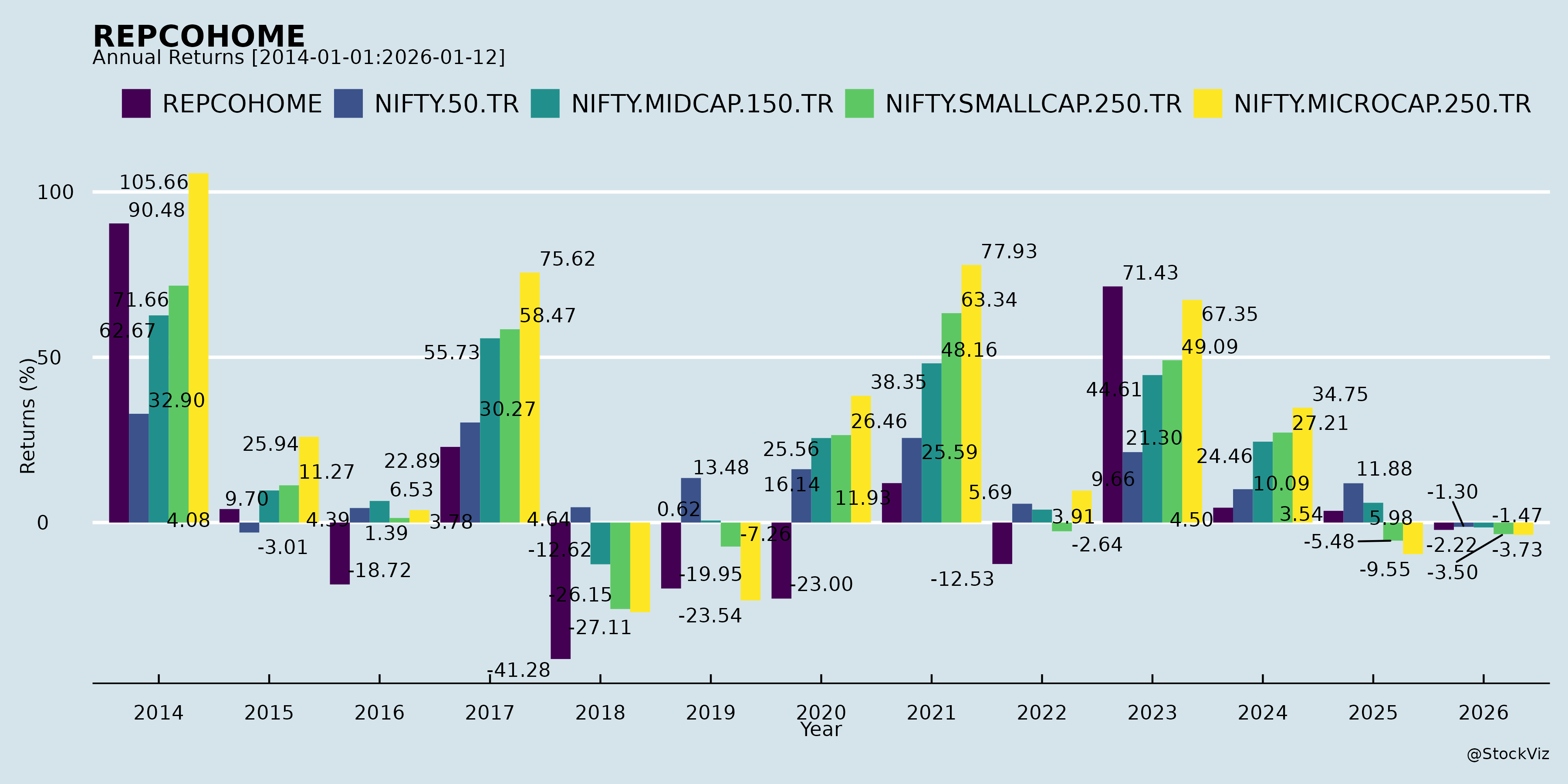

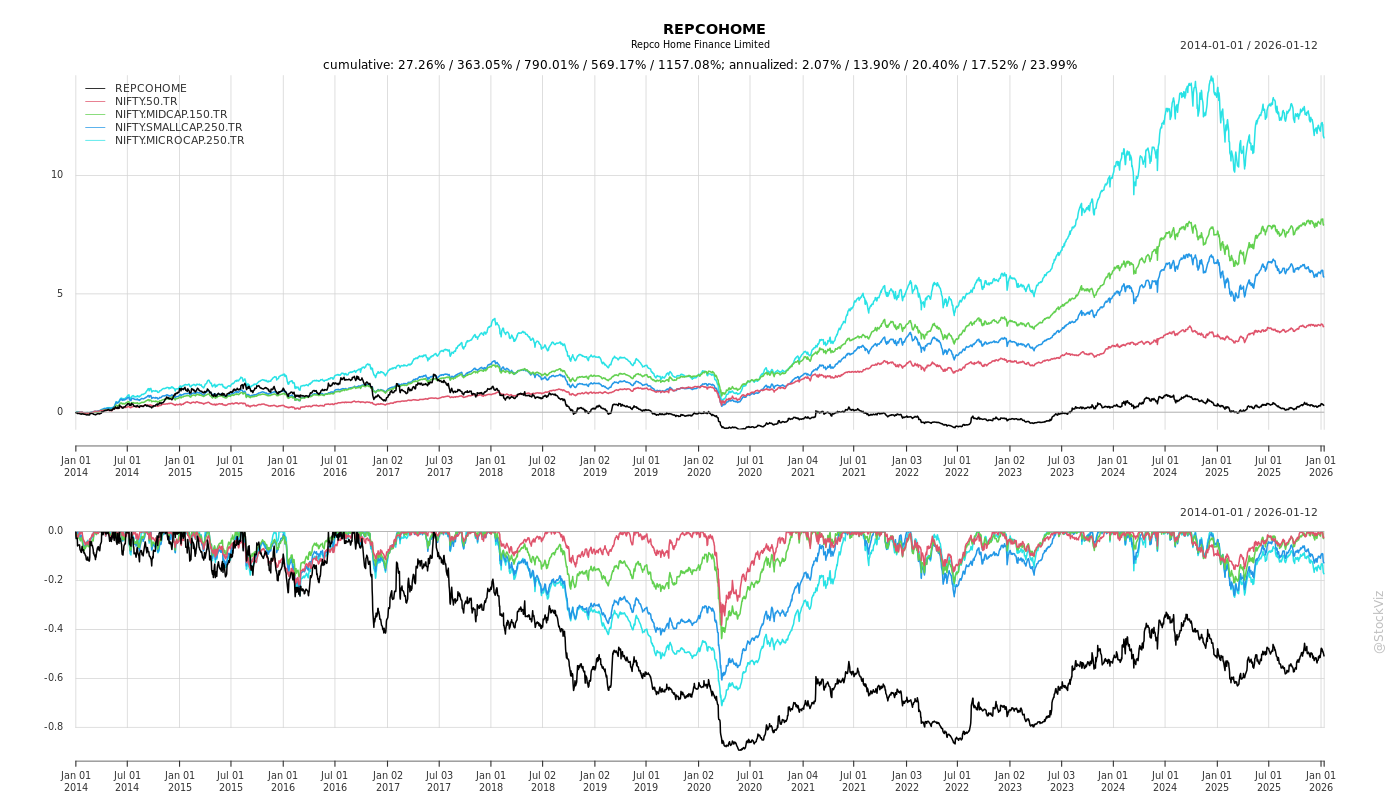

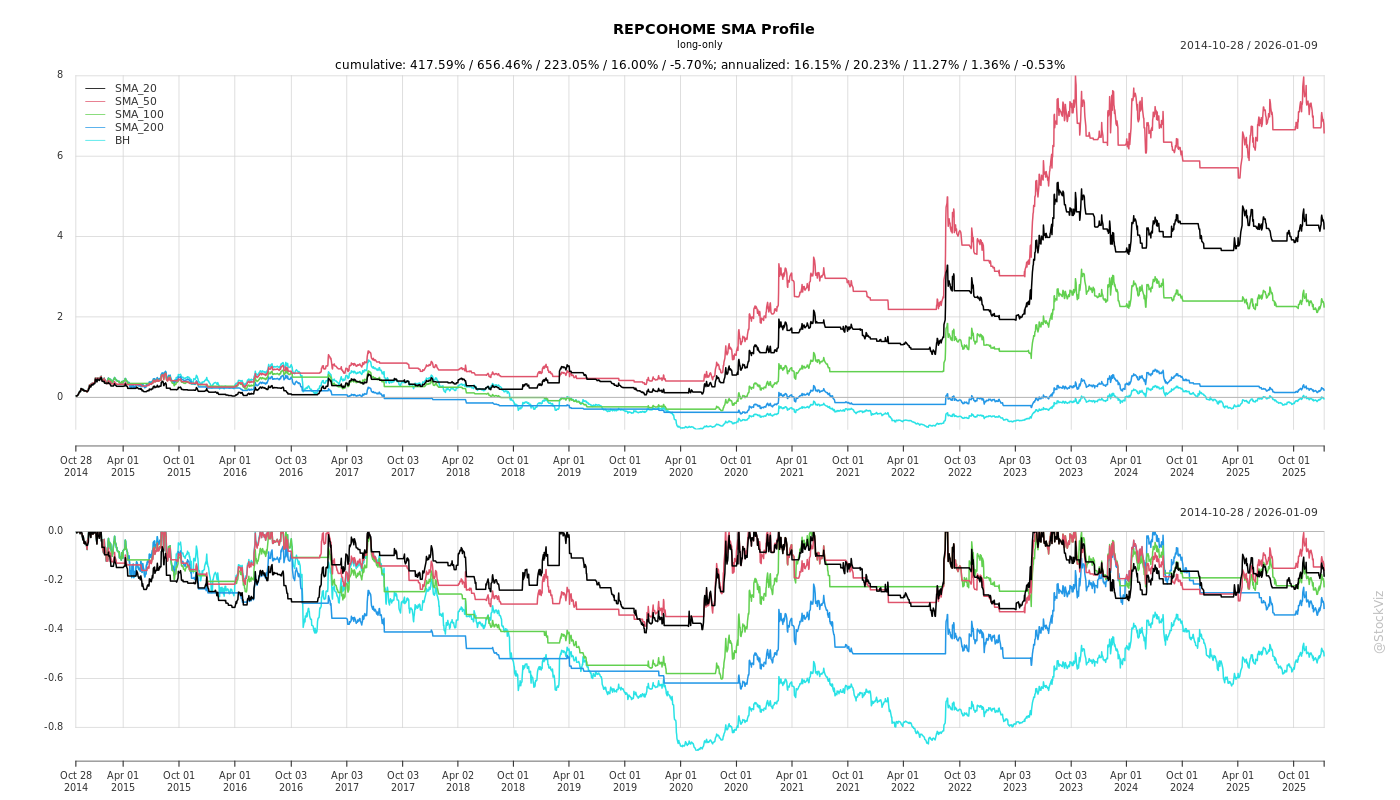

REPCOHOME

Equity Metrics

January 13, 2026

Repco Home Finance Limited

Annual Returns

Cumulative Returns and Drawdowns

Fundamentals

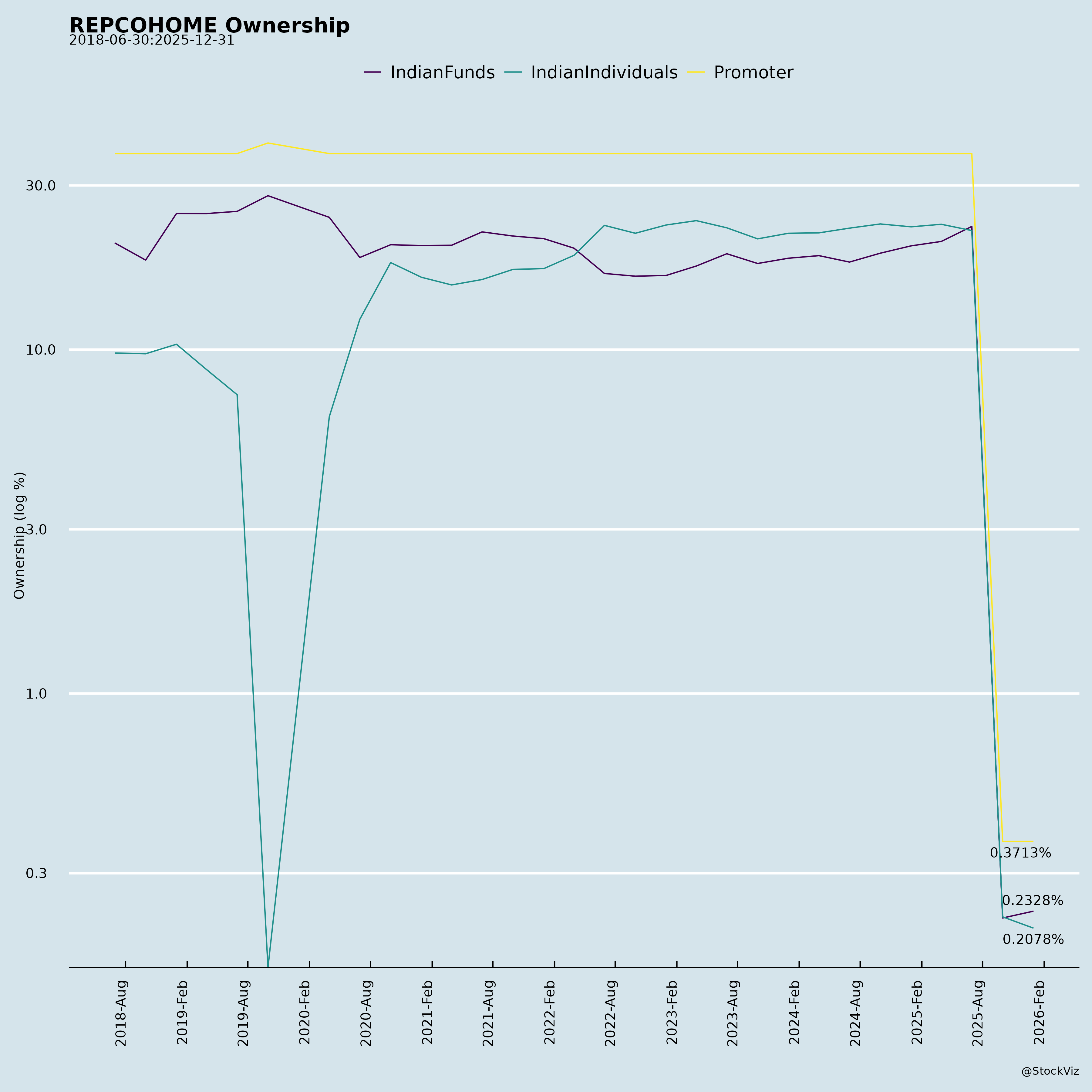

Ownership

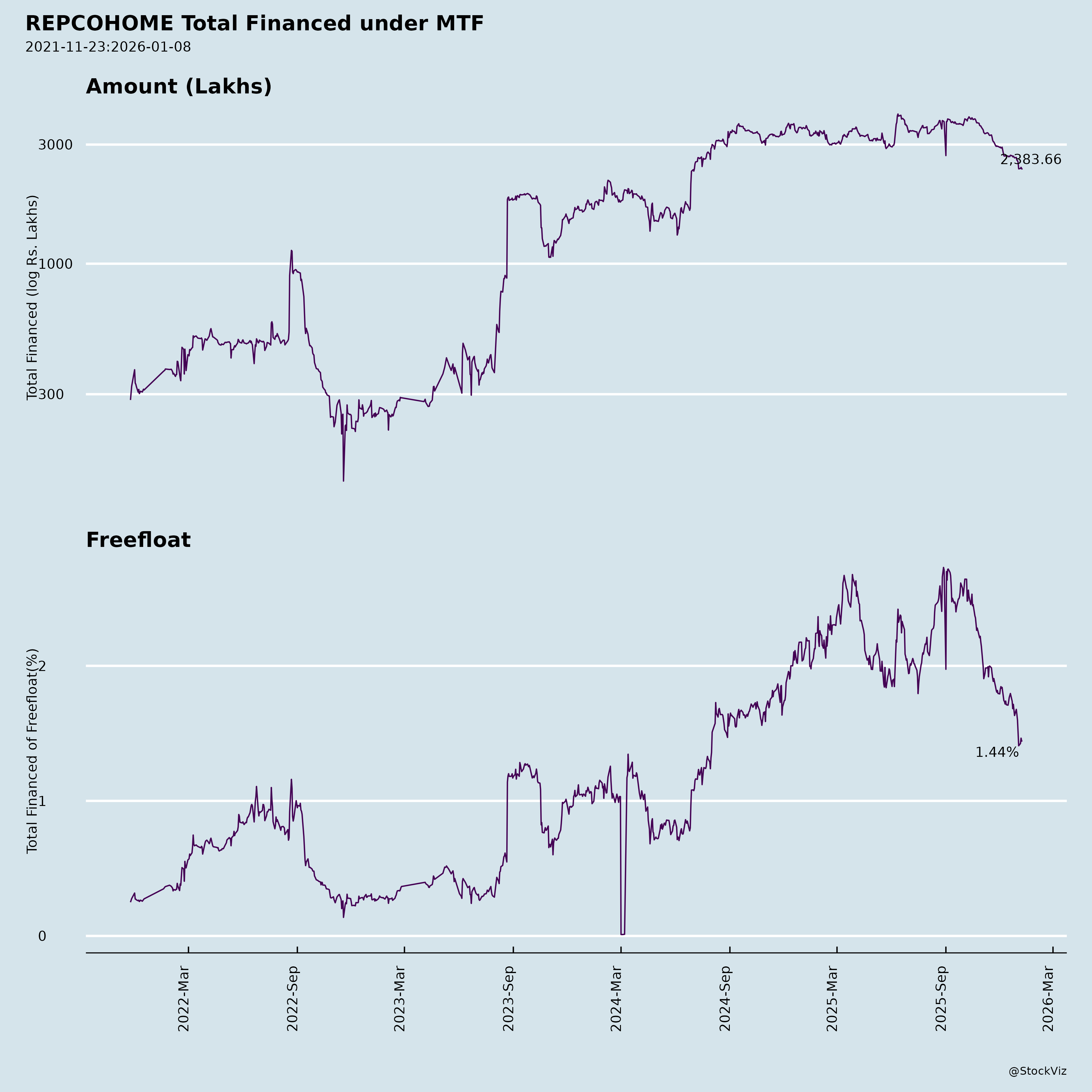

Margined

AI Summary

asof: 2025-11-27

Analysis of Repco Home Finance Limited (REPCOHOME)

Repco Home Finance (RHFL), a housing finance company (HFC) promoted by REPCO Bank, reported strong operational momentum in Q2 FY26 (ended Sep 30, 2025), with record disbursements amid improving asset quality. However, modest AUM growth and slight profit dip highlight execution challenges. Below is a structured summary based on the earnings call transcript, investor presentation, financial results, press release, and other filings.

Tailwinds (Positive Factors Supporting Performance)

- Robust Disbursement & Sanction Growth: Q2 disbursements hit record Rs. 1,069 Cr (+23% YoY, +29% QoQ); sanctions Rs. 1,206 Cr (+30% YoY). Monthly growth stable at ~22%. TN led (62%), with gains in Karnataka, Maharashtra, Telangana.

- Improving Asset Quality: GNPA improved to 3.16% (from 3.96% YoY, 3.30% QoQ); NNPA 1.50%; Stage-2 down to Rs. 1,323 Cr. New book GNPA ~1.2%. PCR 52.5% for Stage-3; negative credit costs (recoveries from write-offs ~Rs. 6 Cr in H1).

- Healthy Margins: NIM stable at 5.5%; spreads 3.4% (yield 12.1% despite competition); cost of funds dipped marginally (repricing Rs. 6,000 Cr borrowings expected to save 10-15 bps).

- Funding Diversification: Issued Rs. 150 Cr CP; NHB sanction Rs. 150 Cr (fully drawn); new NHB proposal Rs. 500-750 Cr. Reduced Repco Bank exposure.

- Operational Efficiency: 234 branches/satellites; employee incentives/promotions driving sales/recovery. DSA sourcing ~48%.

- Capital Strength: CAR 36.88% (vs. 15% regulatory min.); Networth Rs. 3,464 Cr.

Headwinds (Challenges Impacting Performance)

- Modest AUM Growth: Loan book Rs. 15,033 Cr (+8% YoY, +2% QoQ) despite high disbursements, due to high rundowns/BT outs (non-HL loans shorter tenure ~6-7 yrs vs. HL ~8-9 yrs; non-HL now 29%).

- Profit Pressure: Net profit Rs. 107 Cr (-5% YoY) from higher opex (employee costs +21% QoQ on incentives/promotions/silver jubilee; cost-income 28.4%). ROE dipped to 13.5% (from 16% YoY).

- Competitive Landscape: Yields rose to 12.1% amid rate cuts (MLR to 10%); stiff pricing pressure from banks/NBFCs.

- Opex Inflation: Employee/other expenses up (new hires, 42 new branches in 24 months); one-offs like silver jubilee celebrations.

- Legacy Issues: COVID restructurings (Rs. 790 Cr; Rs. 121 Cr already NPA); regional concentration (TN ~57% book).

Growth Prospects

- Short-Term (FY26): AUM target Rs. 16,200 Cr (from Rs. 15,033 Cr); Q3 disb Rs. 1,100 Cr (+3% QoQ); Q4 Rs. 1,350-1,400 Cr. GNPA to Rs. 450 Cr (2.5% by Mar’26); Stage-2 to Rs. 1,275 Cr. Maintain NIM/spreads.

- Medium-Term (FY28): AUM Rs. 25,000 Cr via organic (sales/recovery hires, 10-15 new branches in West/Karnataka/TN/AP/Telangana) + inorganic (small book buys Rs. 30-40 Cr FY26, scaling up).

- Strategic Drivers: Portfolio mix stable (71% HL, 53% non-salaried); avg. ticket size up to Rs. 23-24 lakh (from Rs. 13 lakh book avg.); underwriting enhanced (credit review cell); ESOP discussions for retention.

- Upside Catalysts: Rate cuts passed to customers; NHB/bank refinancing; geographic expansion (12 states + 1 UT).

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Asset Quality | Elevated GNPA (3.16%); legacy COVID book (Rs. 669 Cr); potential stress from TN exports (US tariffs). New book stable but scaling volumes risks dilution. | Recovery verticals (25 RVMs, weekly reviews, OTS schemes); target 2.5% GNPA. |

| Liquidity/Rundown | High BT outs/prepayments (non-HL shorter life); AUM growth lags disb. | Control BT outs; diversify to longer-tenure HL; inorganic buys. |

| Interest Rate/Competition | Falling rates compress spreads; bank competition erodes pricing. | Floating assets (reprice quarterly); yield mix (non-HL 13.55% vs. HL 11.17%). |

| Operational | Opex rise from expansion/hires; cost-income creep. | Incentives tied to performance; one-offs temporary. |

| Regulatory/Macro | HFC norms (ECL, PCR no mandate but bankers watch); macro slowdown in semi-urban/rural focus. | Strong CAR; diversified exposure (no industry concentration). |

| Execution | Aggressive targets (FY26 disb >Rs. 4,500 Cr H2); dividend restraint hurts ROE (investors pushing 25-30% payout). | Proven track record; mgmt. confidence. |

Overall Outlook: Positive momentum with record disb and quality fixes positions RHFL for 10-12% AUM growth FY26. Risks tilted toward execution on rundowns/NPAs, but strong capital/margins provide buffer. Stock likely to re-rate on growth delivery (ROE >15-18% targeted). Investors supportive of employee incentives/ESOPs.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.