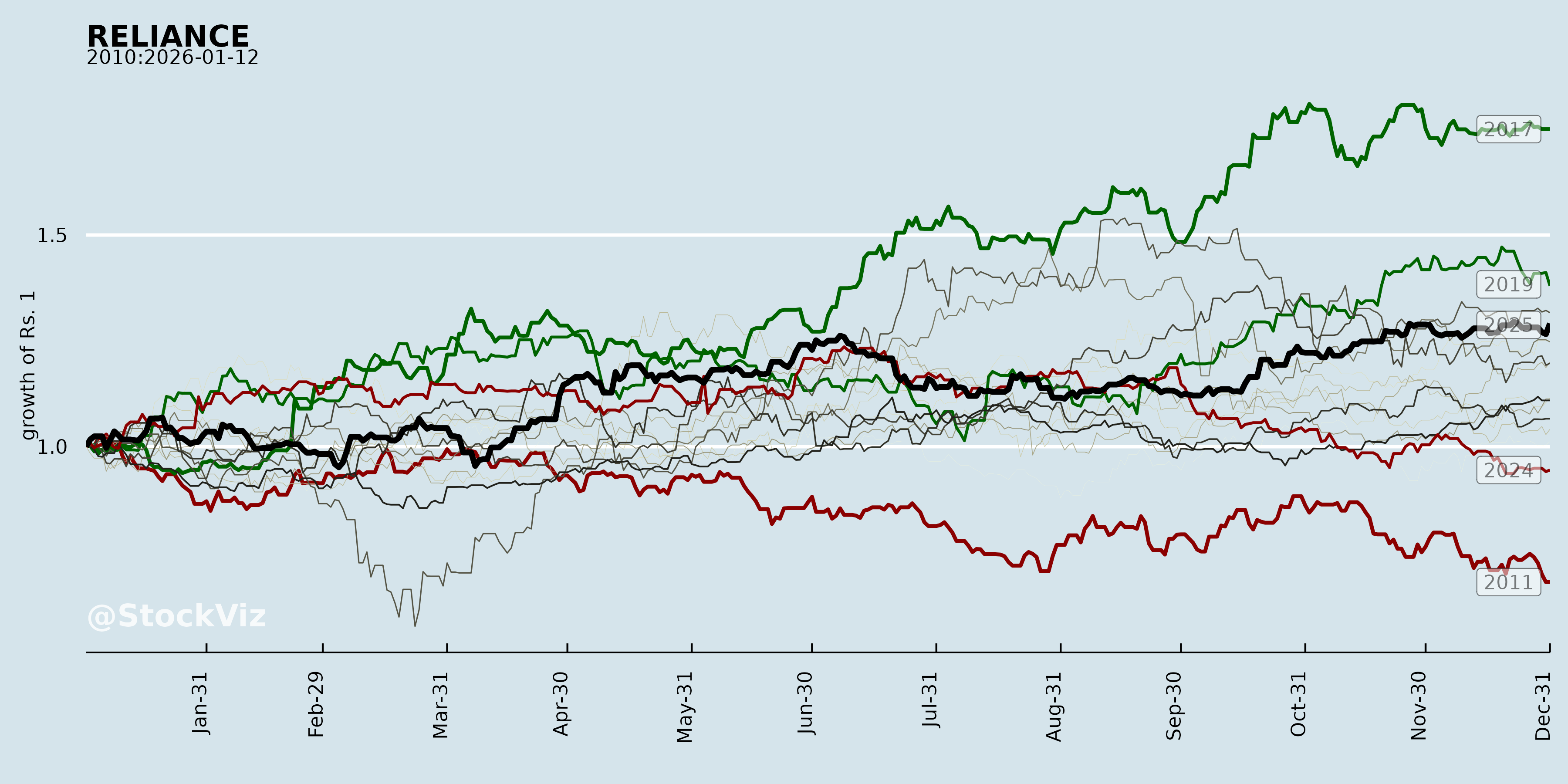

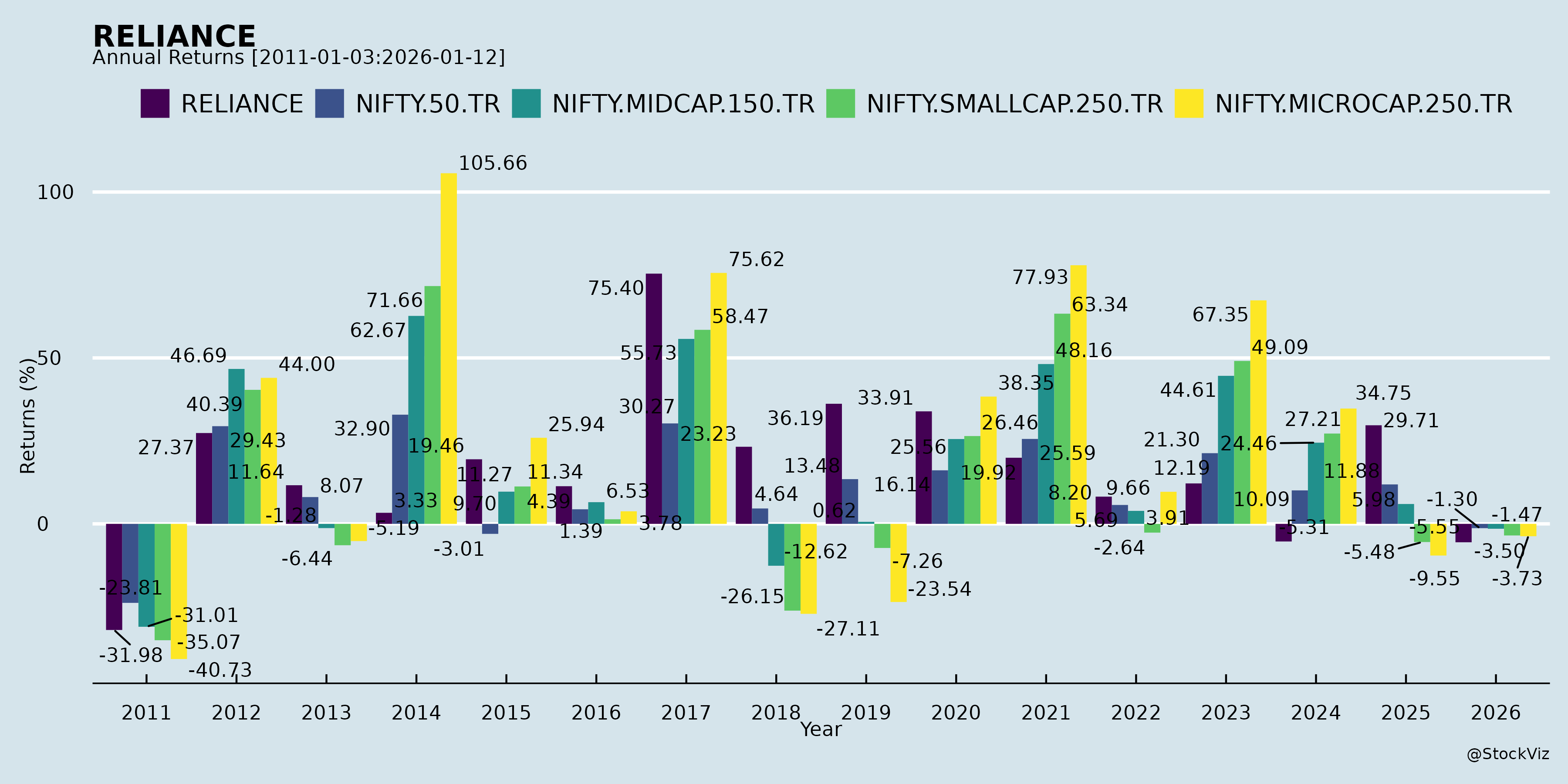

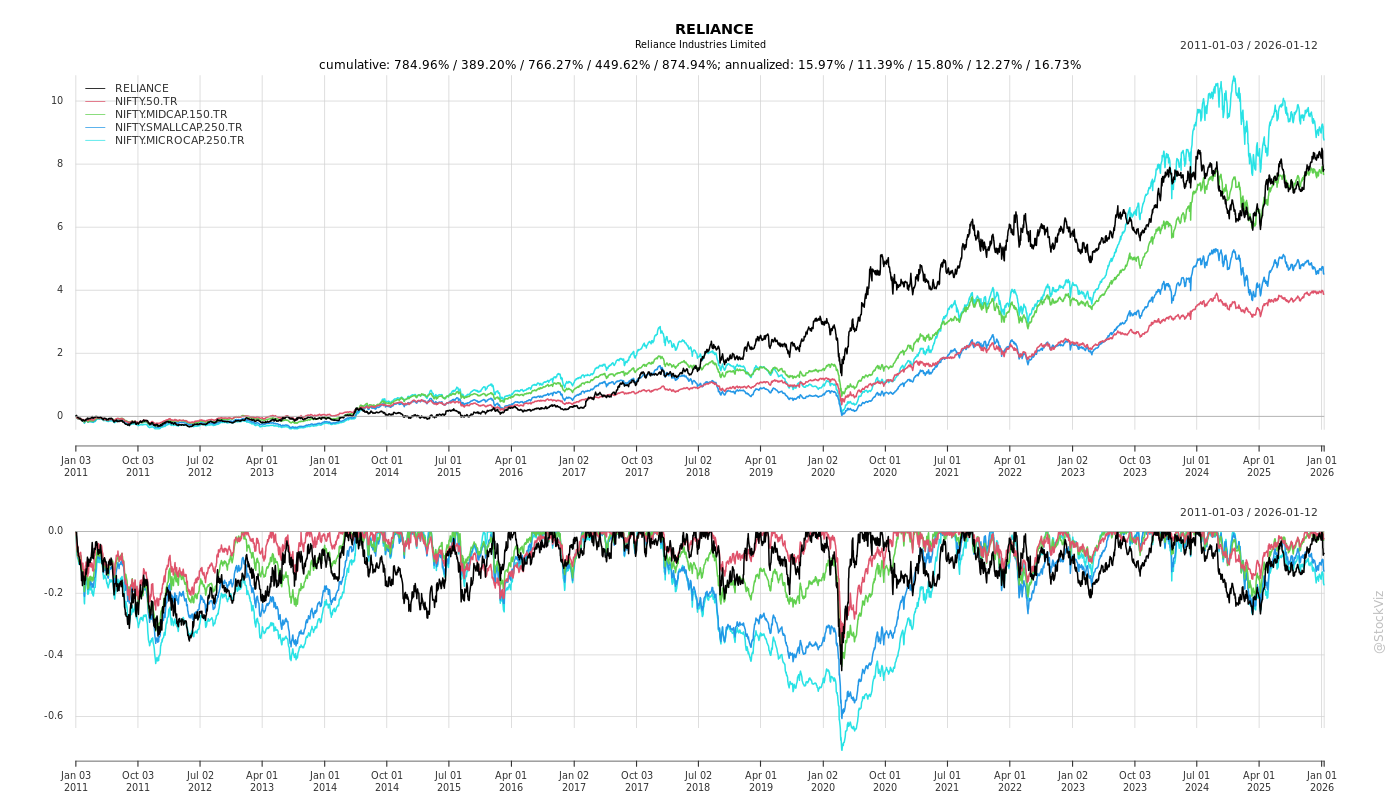

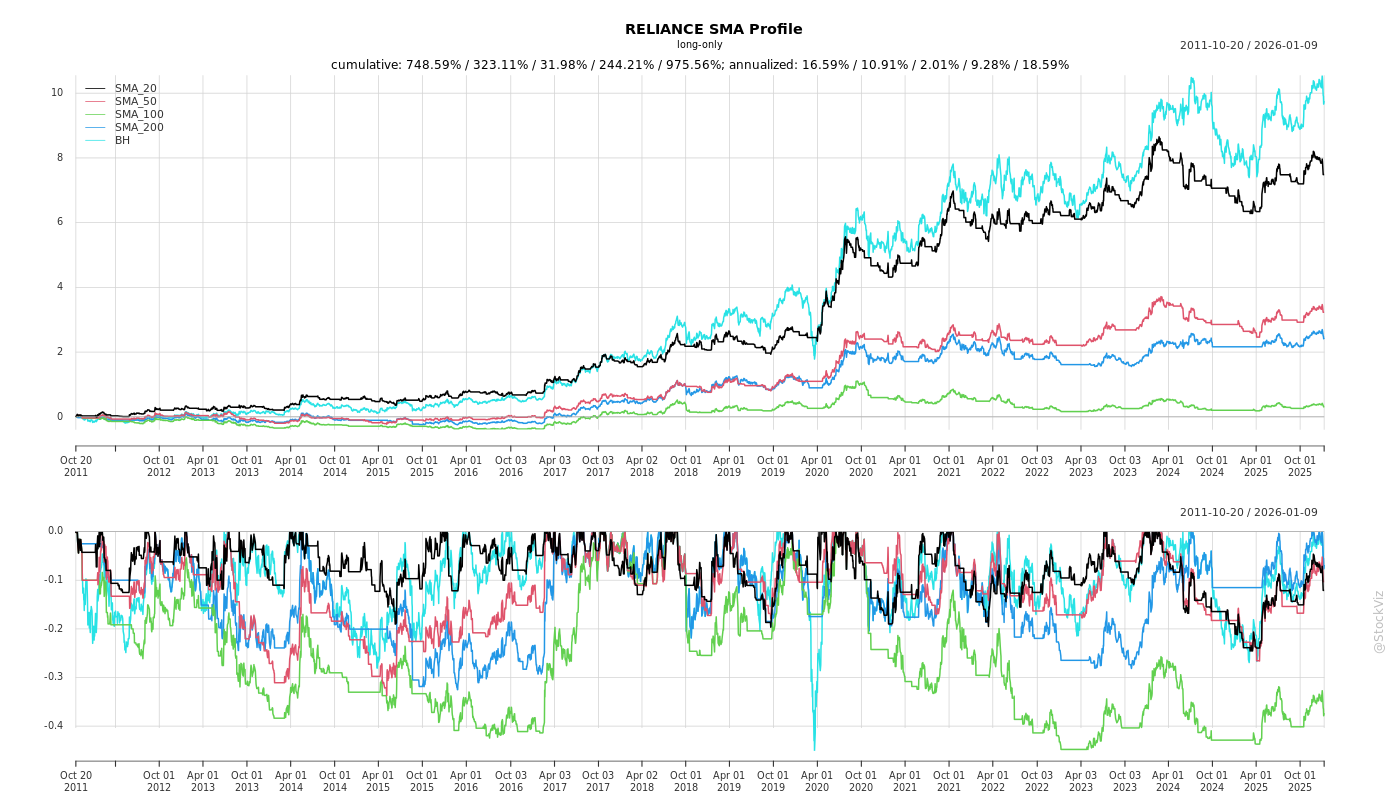

RELIANCE

Equity Metrics

January 13, 2026

Reliance Industries Limited

Annual Returns

Cumulative Returns and Drawdowns

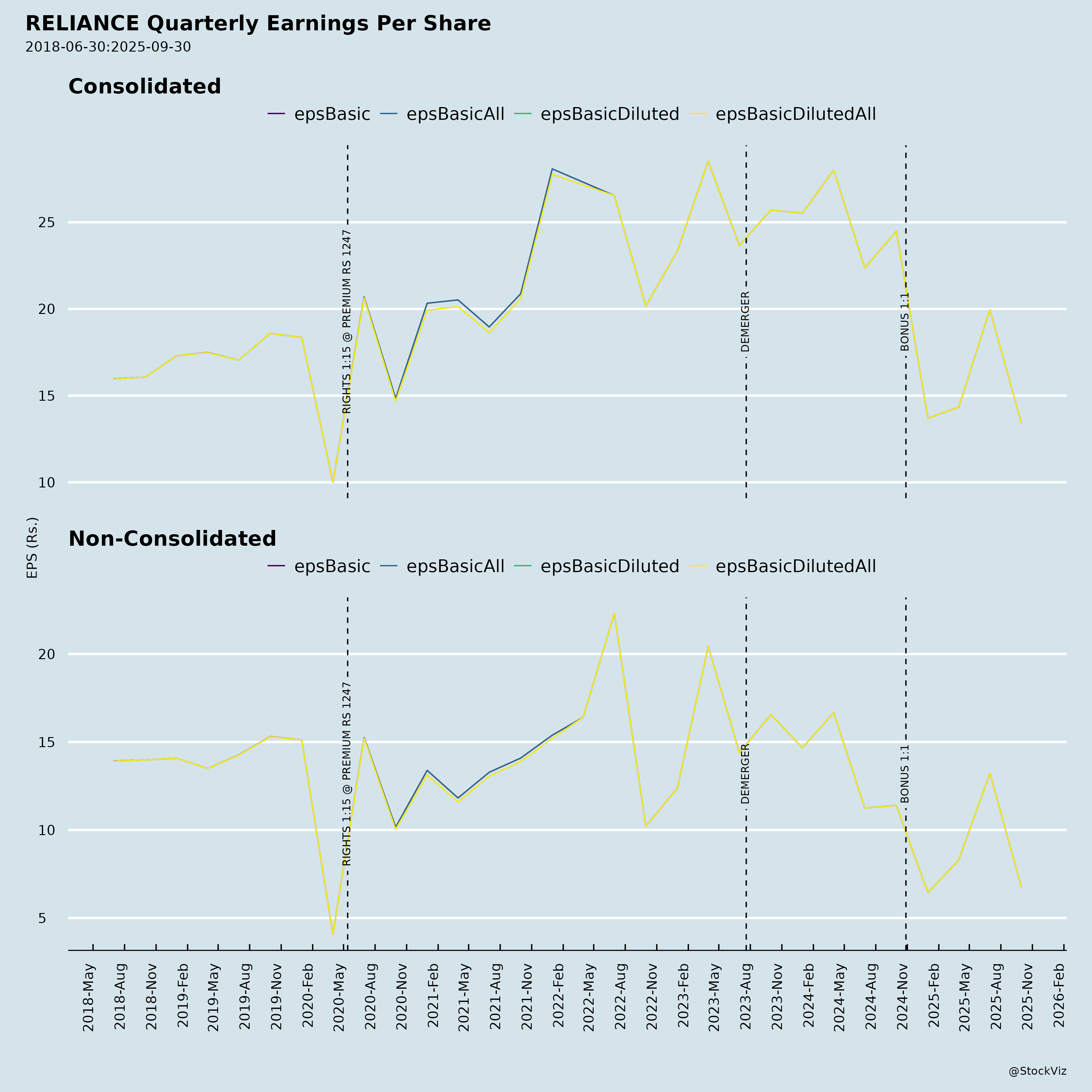

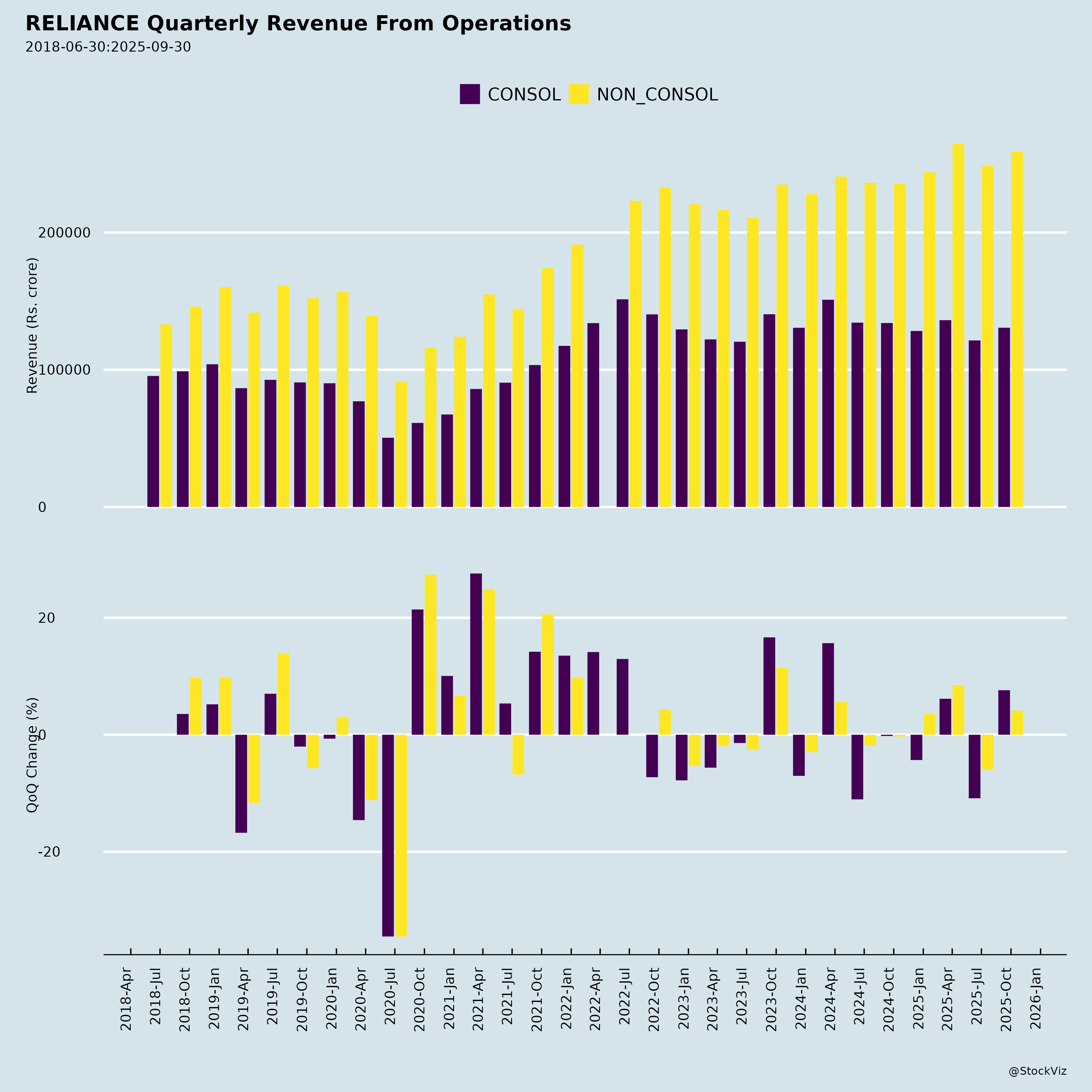

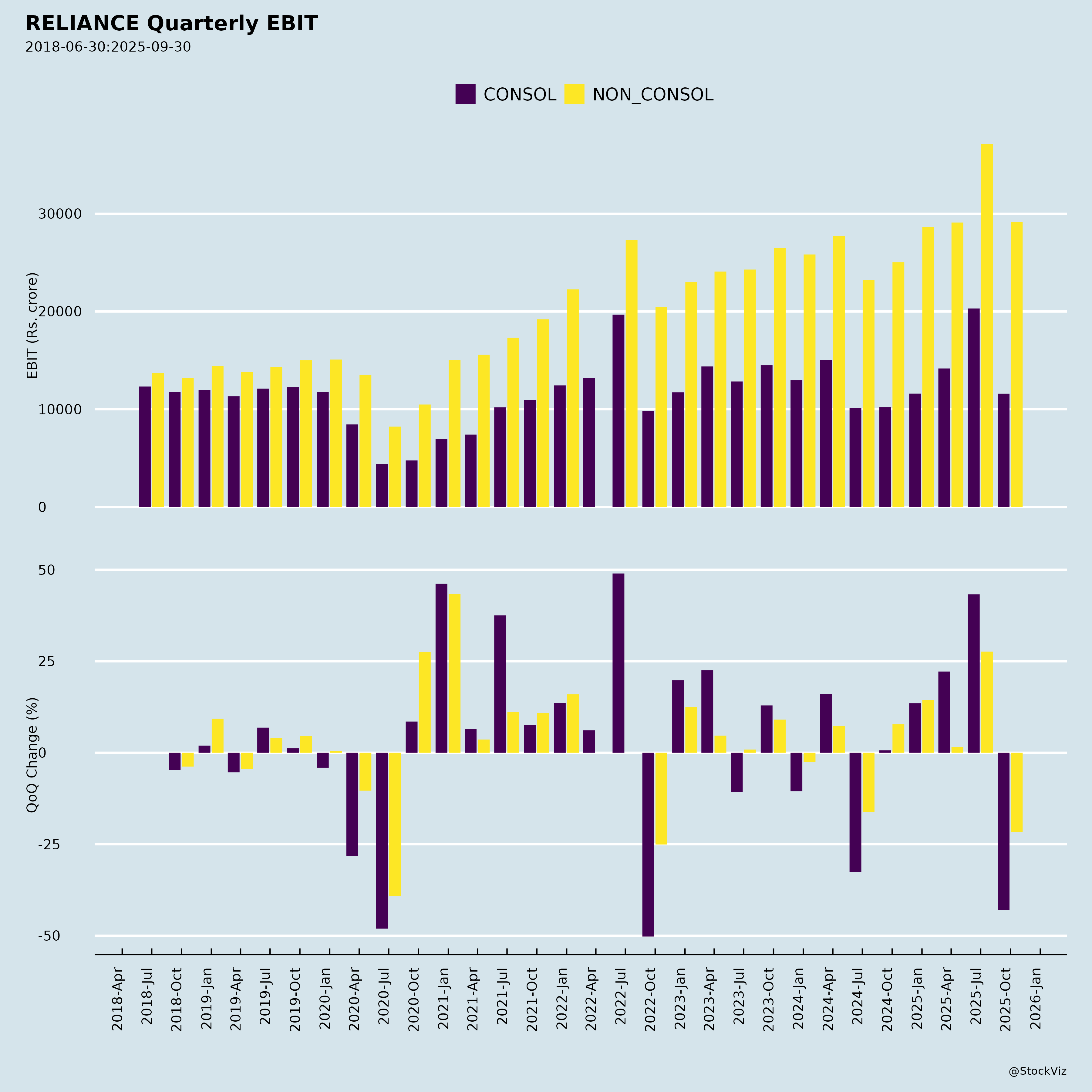

Fundamentals

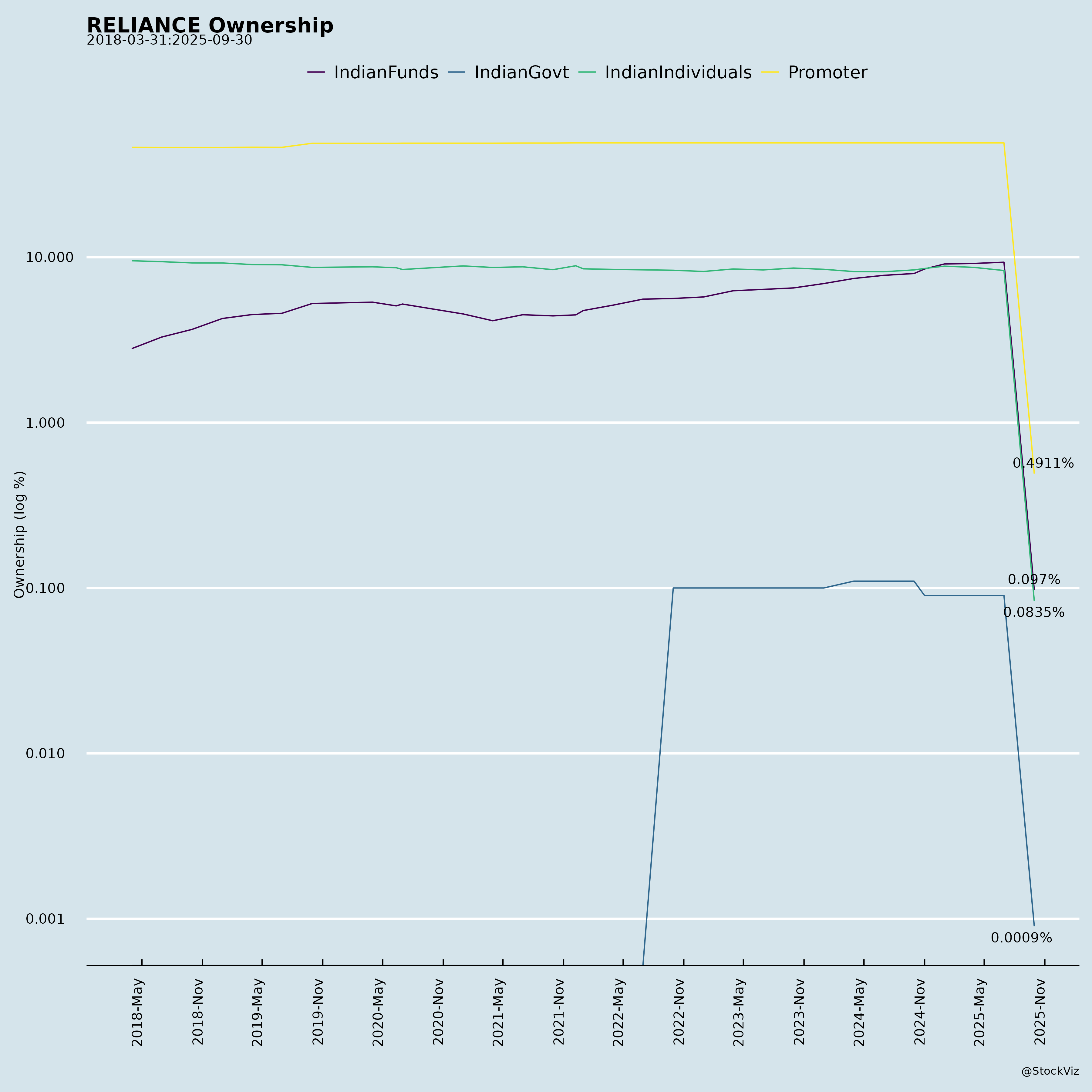

Ownership

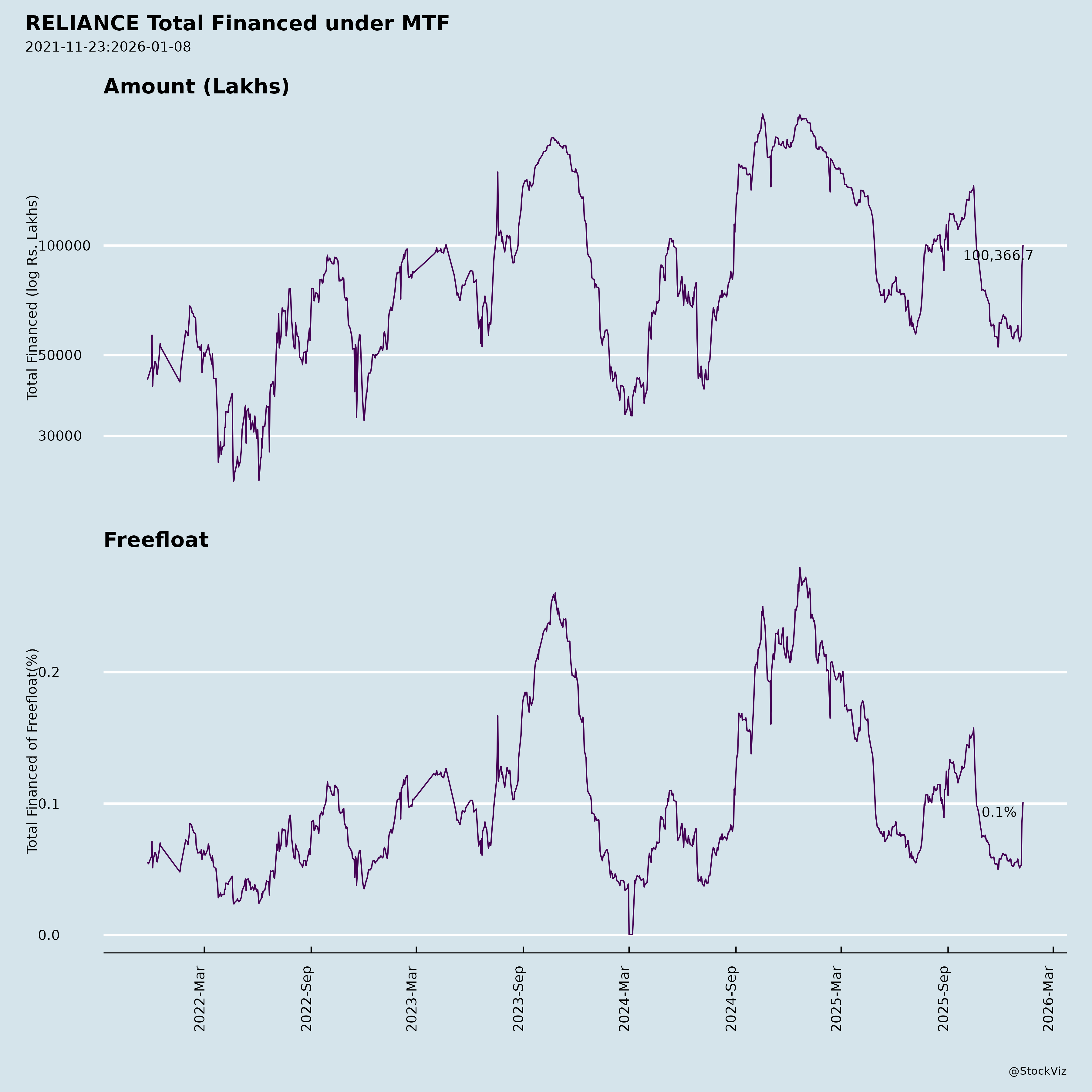

Margined

AI Summary

asof: 2025-12-03

Reliance Industries Limited (RELIANCE) Analysis: Q2 FY26 Overview

Overall Summary: Reliance delivered robust Q2 FY26 results with consolidated revenue up 10% YoY to ₹283,548 Cr, EBITDA up 14.6% to ₹50,367 Cr (margin +80 bps at 17.8%), and PAT up 14.3% to ₹22,092 Cr. Growth was led by Jio (subscriber base >500 Mn, EBITDA +18% YoY), Retail (revenue +18% YoY), and O2C (EBITDA +21% YoY). Balance sheet remains strong (Net Debt/EBITDA at 0.58x). Tailwinds from subscriber growth, retail expansion, and fuel cracks outweigh headwinds like chemical weakness and a minor GST penalty (₹56 Cr, under appeal). Growth prospects in digital services, quick commerce, and New Energy are strong, but risks include commodity volatility and high capex (₹40K Cr/quarter).

| Category | Key Points |

|---|---|

| Tailwinds | - Digital Services (Jio): 506 Mn subscribers (+5.8% YoY), 234 Mn 5G users, ARPU ₹211 (+8.4% YoY), data traffic +30% YoY; EBITDA margin 51.6% (+140 bps). - Retail: Revenue +18% YoY to ₹90K Cr; grocery/fashion +23%/22%; 412 new stores (total 19,821); quick commerce +200% YoY orders. - O2C: Fuel cracks +22-37% YoY; Jio-bp volumes +34% (HSD), network at 2,057 outlets. - Media (JioStar): Record EBITDA ₹1,738 Cr (28% margin); 400 Mn MAUs; strong sports/entertainment content. - Macro: GST cuts boosting consumption; domestic focus. |

| Headwinds | - O2C Chemicals: Weak polyester margins (-9% deltas); global overcapacity. - Oil & Gas: Production decline (KGD6 -8.4% YoY); EBITDA -5.4% YoY. - Regulatory: ₹56.44 Cr GST penalty (input tax credit dispute; appeal planned; no ops impact). - Macro: Oil price volatility (Brent -14% YoY); monsoon impacting PVC/PET demand. |

| Growth Prospects | - Jio: 5G scale (50% traffic share), AirFiber (9.5 Mn subs), AI (JioPC, JioFrames), enterprise services; target 2x EBITDA by FY28. - Retail: Omni-channel, quick commerce (5K pincodes), premium brands (Stella McCartney); consumer products ₹5.3K Cr (+2x YoY). - New Energy: On-track 20 GW solar PV, 100 GWh battery giga-factories; 4 PV lines commissioned. - O2C/Jio-bp: Fuel retail expansion, ethane cracking advantage. - Media: Sports rights, content slate (Bigg Boss, IPL post-merger). Long-term: AI ecosystem, green energy. |

| Key Risks | - Commodity/Volatility: Oil/gas prices, chemical overcapacity; geopolitical tensions. - Regulatory/Legal: GST penalty appeal; competition probes in telecom/retail. - Execution/Capex: High spend (₹70K Cr H1 FY26); New Energy delays. - Competition: Telecom (ARPU pressure), retail (quick commerce wars). - Macro: Demand slowdown, monsoon/rain impacts; debt at ₹348K Cr (manageable ratios). |

Investment Outlook: Positive momentum across core businesses supports growth; New Energy/AI as multi-year catalysts. Monitor O2C chemicals and regulatory outcomes. Strong cash flows (₹99K Cr ops CF H1) fund capex/debt reduction.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.