POWERINDIA

Equity Metrics

January 13, 2026

Hitachi Energy India Limited

Annual Returns

Cumulative Returns and Drawdowns

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-03

Analysis for POWERINDIA (Hitachi Energy India Limited)

Tailwinds

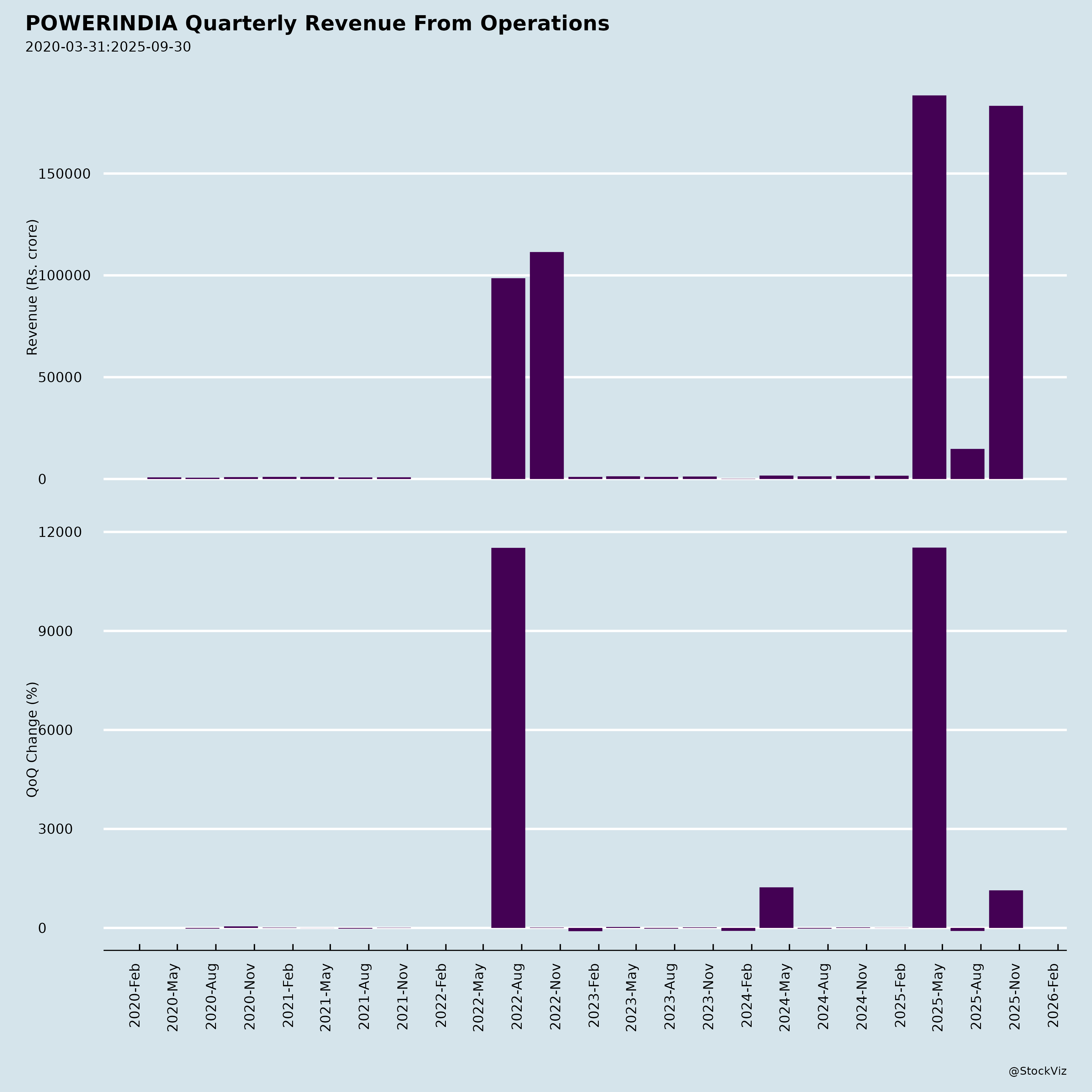

- Robust Order Book & Revenue Visibility: Record backlog of ₹29,412 Cr (as of Sep 30, 2025) ensures multi-quarter revenue stability. Q2FY26 orders grew 13.6% YoY to ₹2,217 Cr; H1FY26 orders surged 209% YoY to ₹13,556 Cr.

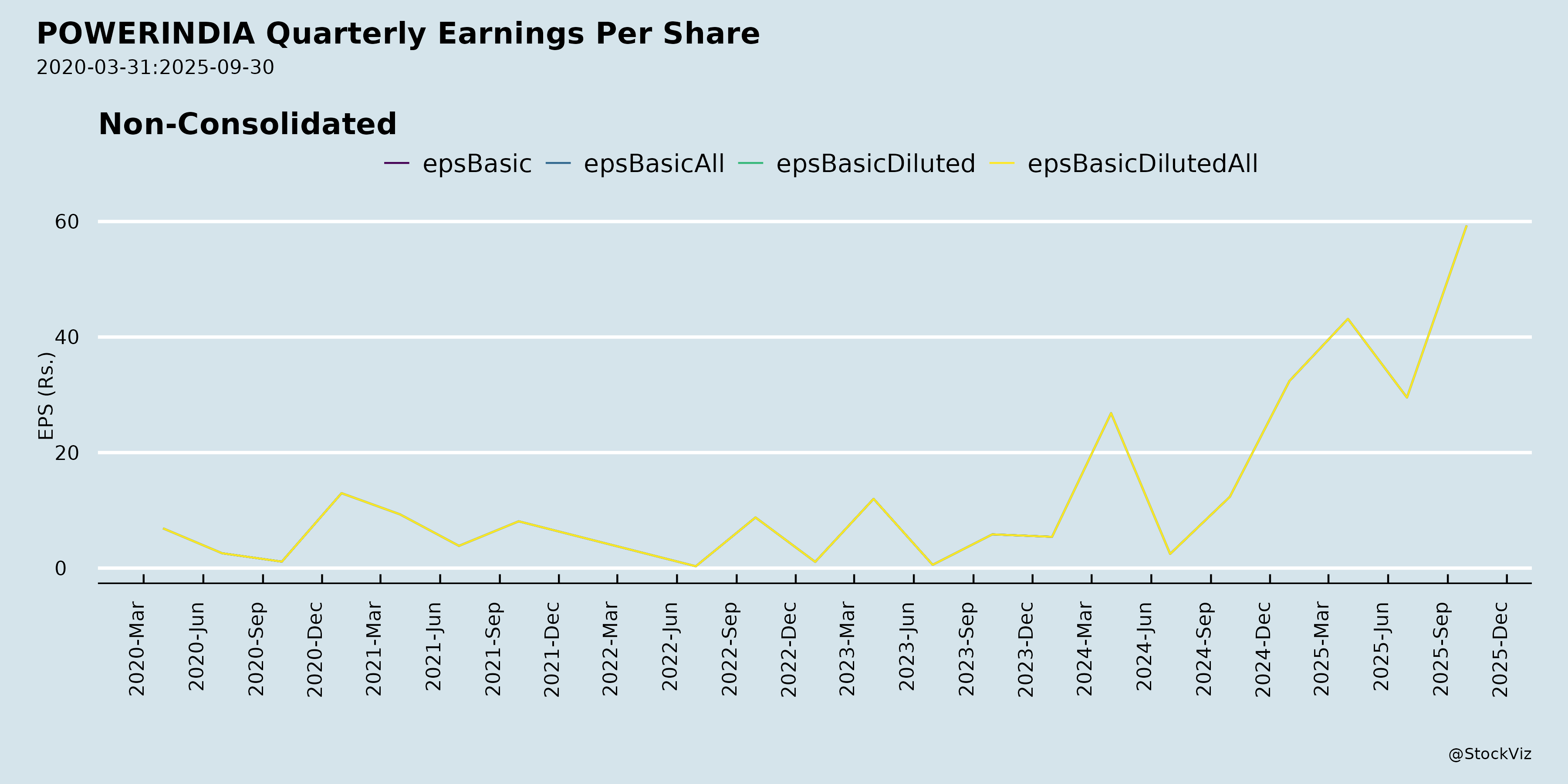

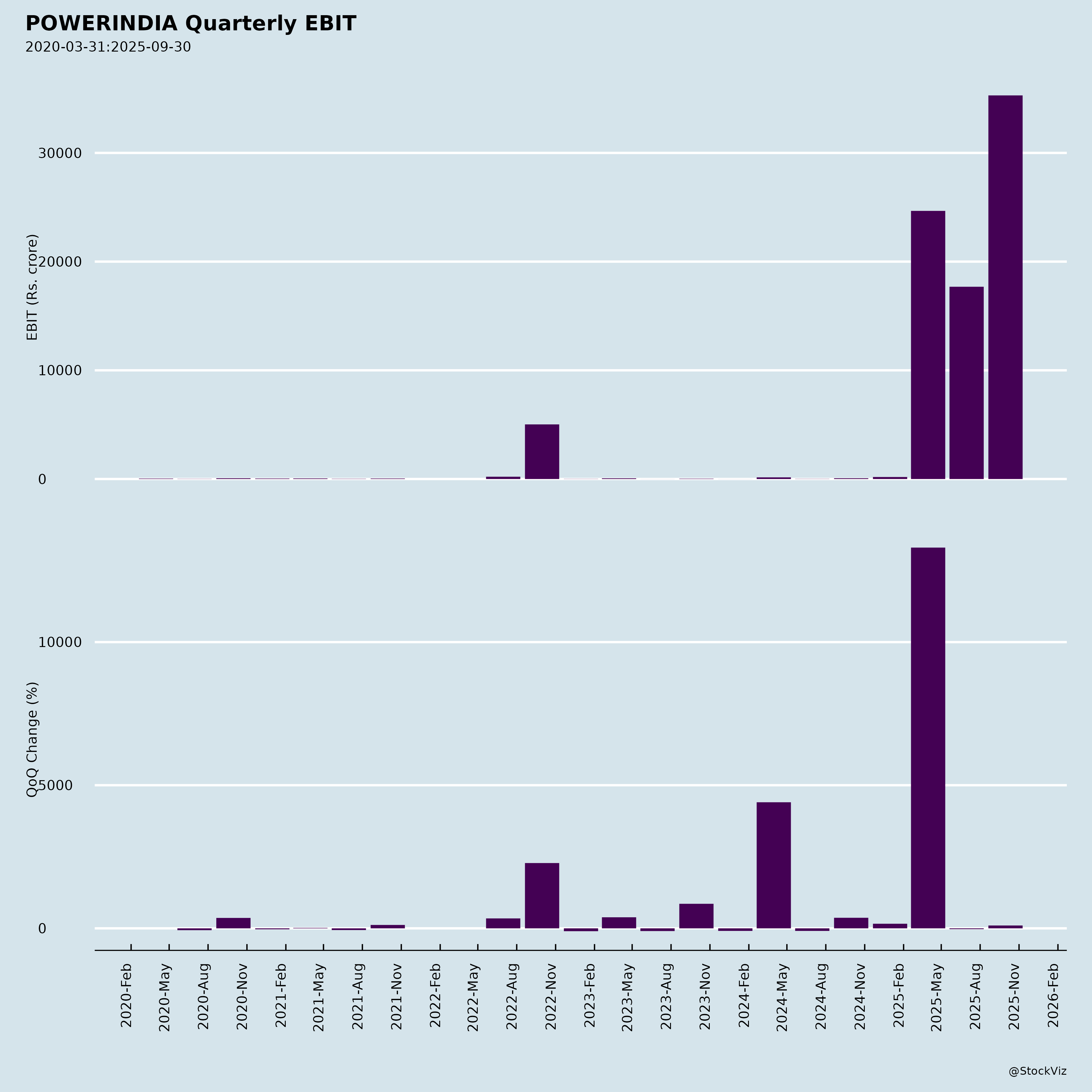

- Strong Financial Performance: Revenue +23.3% YoY (Q2: ₹1,915 Cr), PAT +406% YoY (Q2: ₹264 Cr, margin 13.8%). Op. EBITDA margin at 15.2% (Q2), reflecting execution efficiency, favorable product mix, and export leverage.

- Segmental Strength: Renewables (wind/solar) +40% YoY, Railways/Metro +61% YoY, Industries +10% YoY. Key wins in GIS/AIS substations, transformers for rail/solar-BESS, green steel/aluminum plants.

- Exports & Services Momentum: Exports ~30% of Q2 orders (e.g., CTs to Canada, breakers to Ukraine). Services +35% YoY growth (e.g., EconiQ SF6-free tech, retrofits).

- Macro Support: India’s GDP growth (7.8% Q1FY26), RE investments (₹1L Cr H1 2025), transmission capex (₹2.4L Cr for 500GW RE), manufacturing FDI (+18% to $19B), metro infra (₹2.5L Cr invested).

- Operational Excellence: ESG progress (100% RE electricity, 76% CO2 cut), safety (low injury rate), capacity expansions, NABL accreditation.

Headwinds

- Segmental Weakness: Transmission -43% YoY, Data Centers -51% YoY (cyclical slowdowns).

- QoQ Volatility: Orders -80% QoQ in Q2 due to lumpy HVDC order timing (28% adjusted growth); revenue +25% QoQ but dependent on execution.

- Margin Pressures from Costs: Material costs ~55% of revenue; forex/commodity gains/losses volatile (e.g., Q2 gains offset prior losses).

- External Factors: Global uncertainties (US tariffs at 50% on Indian exports, trade deficits), geopolitical tensions impacting supply chains.

Growth Prospects

- High: India’s energy transition (50% non-fossil capacity; focus on grid integration, HVDC, BESS, hybridization). Key opportunities: RE evacuation (e.g., Rajasthan/Gujarat lines), data centers (Google’s ₹90k Cr Vizag hub), rail/metro, exports (diverse geographies).

- Strategic Focus: Shift to high-margin exports/services/digital (ambition: exports/services in growth corridor); edge-of-grid (BESS), capacity build-up, One Hitachi synergies.

- Pipeline Visibility: Novation of HVDC project (Bhadla-Fatehpur with BHEL/Adani); upcoming analyst meets (Goldman Sachs Dec 3).

- Projections: Backlog execution + new orders could sustain 20%+ revenue CAGR; margins resilient at 13-15% via productivity/quality gains.

Key Risks

- Execution & Backlog Risk: Large projects (HVDC, substations) prone to delays/cost overruns; inventory buildup (₹1,184 Cr, +28% QoQ).

- Forex/Commodity Volatility: Derivatives gains/losses (e.g., ₹12.8 Cr Q2 gain); unhedged exposure in imports/exports.

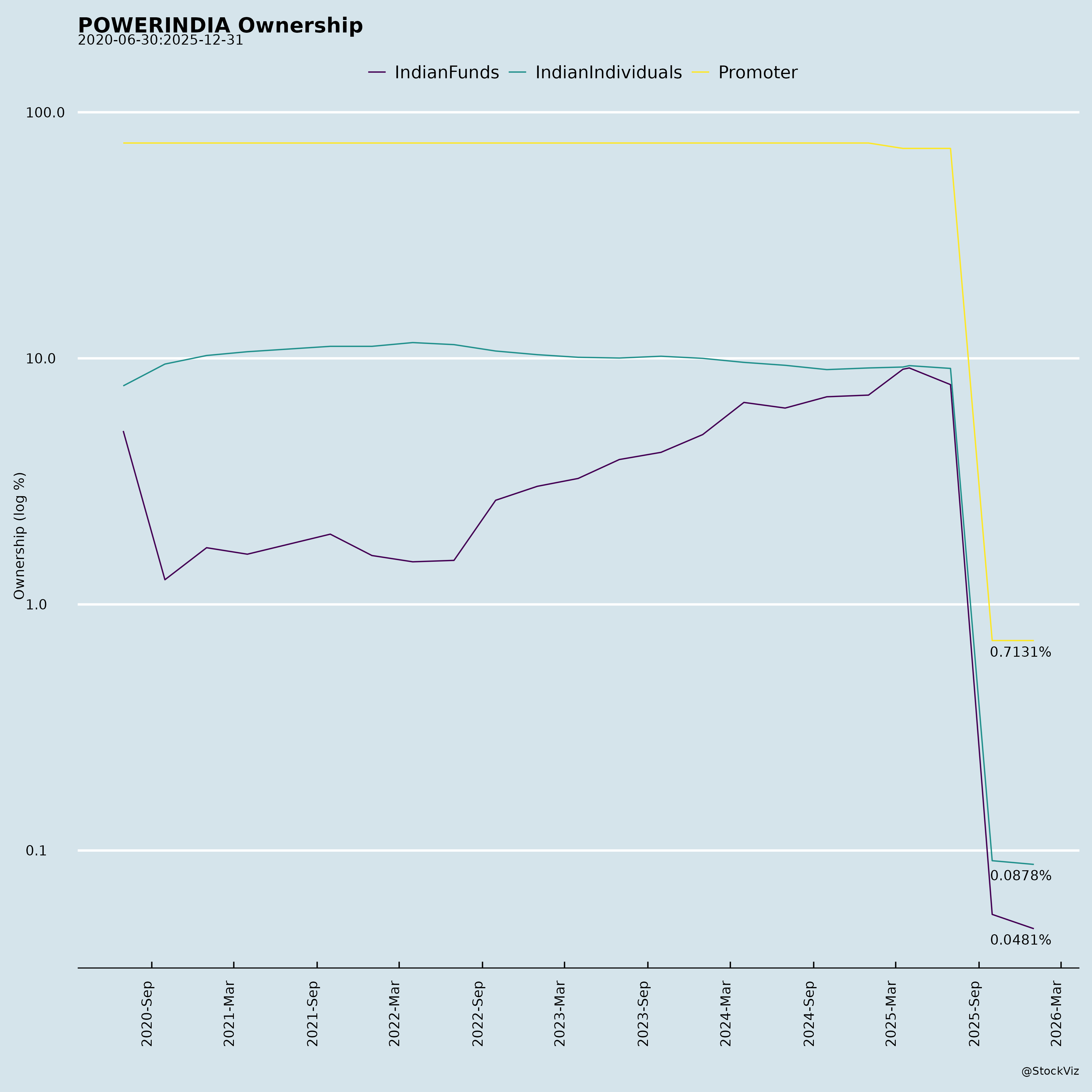

- Concentration: Single segment (“Power Grids”); no subsidiaries/JVs; promoter voting dominance (99.99% in postal ballot).

- Competition/Regulatory: BESS tariffs dipping (₹2.08L/MW/month), GST reforms, policy shifts in RE/transmission.

- Macro/Geo Risks: US tariffs, global slowdowns; capex delays in data centers/transmission.

- Other: Rising working capital (trade receivables ₹2,095 Cr), QIP utilization (₹2,426 Cr unspent as bank deposits).

Summary

Bullish Outlook with Execution Focus: POWERINDIA is riding India’s RE/grid infra boom (tailwinds from backlog, segments like renewables/rail, macro investments), delivering stellar H1FY26 growth (revenue +19%, PAT +531% YoY). Prospects remain strong amid 500GW RE push, exports/services expansion. Headwinds (transmission/data center dips) are cyclical; risks center on execution/FX in a volatile global environment. Recommendation: Positive; monitor Q3 execution and analyst feedback (Dec 3). Target backlog conversion for sustained 15%+ margins. Valuation supported by visibility, but watch geo-trade risks.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.