Heavy Electrical Equipment

Industry Metrics

January 13, 2026

Annual Returns

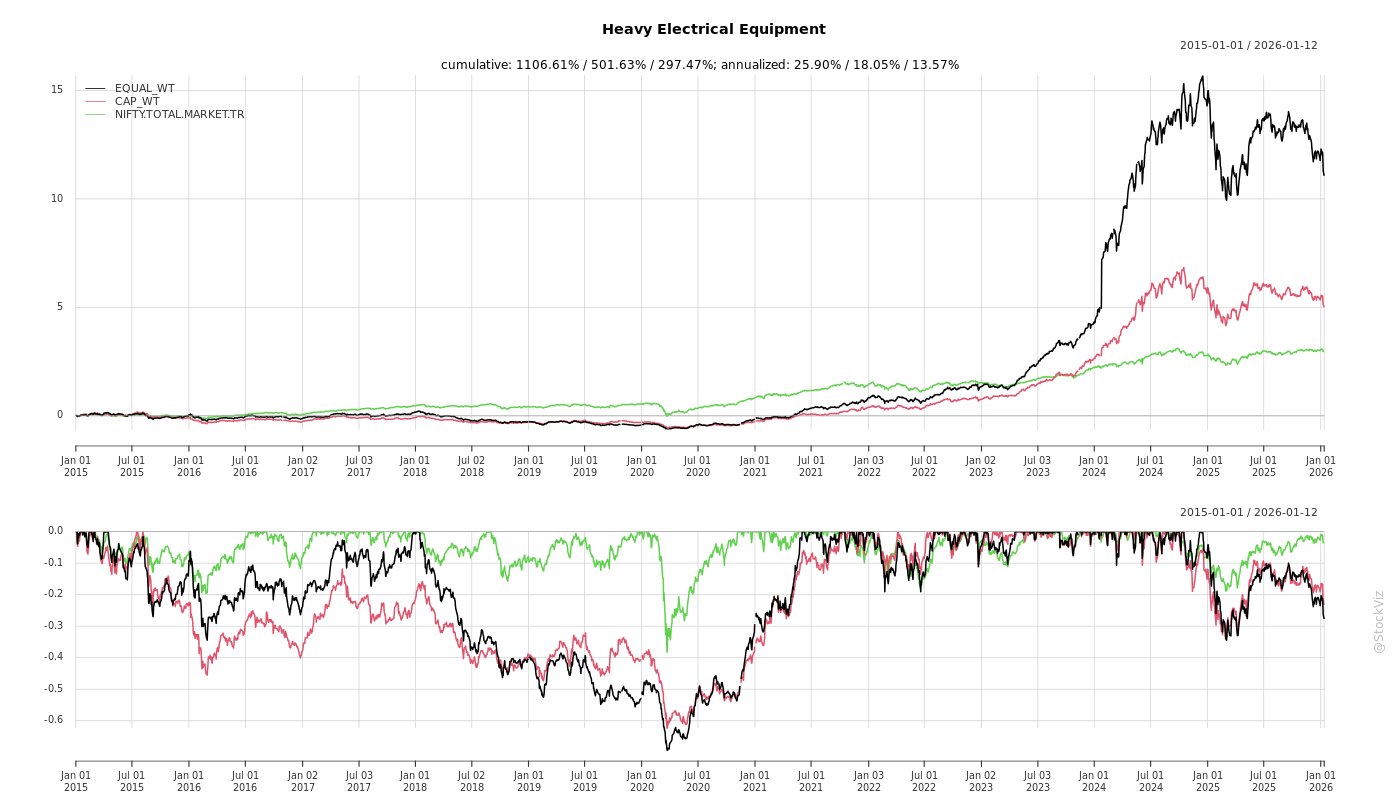

Cumulative Returns and Drawdowns

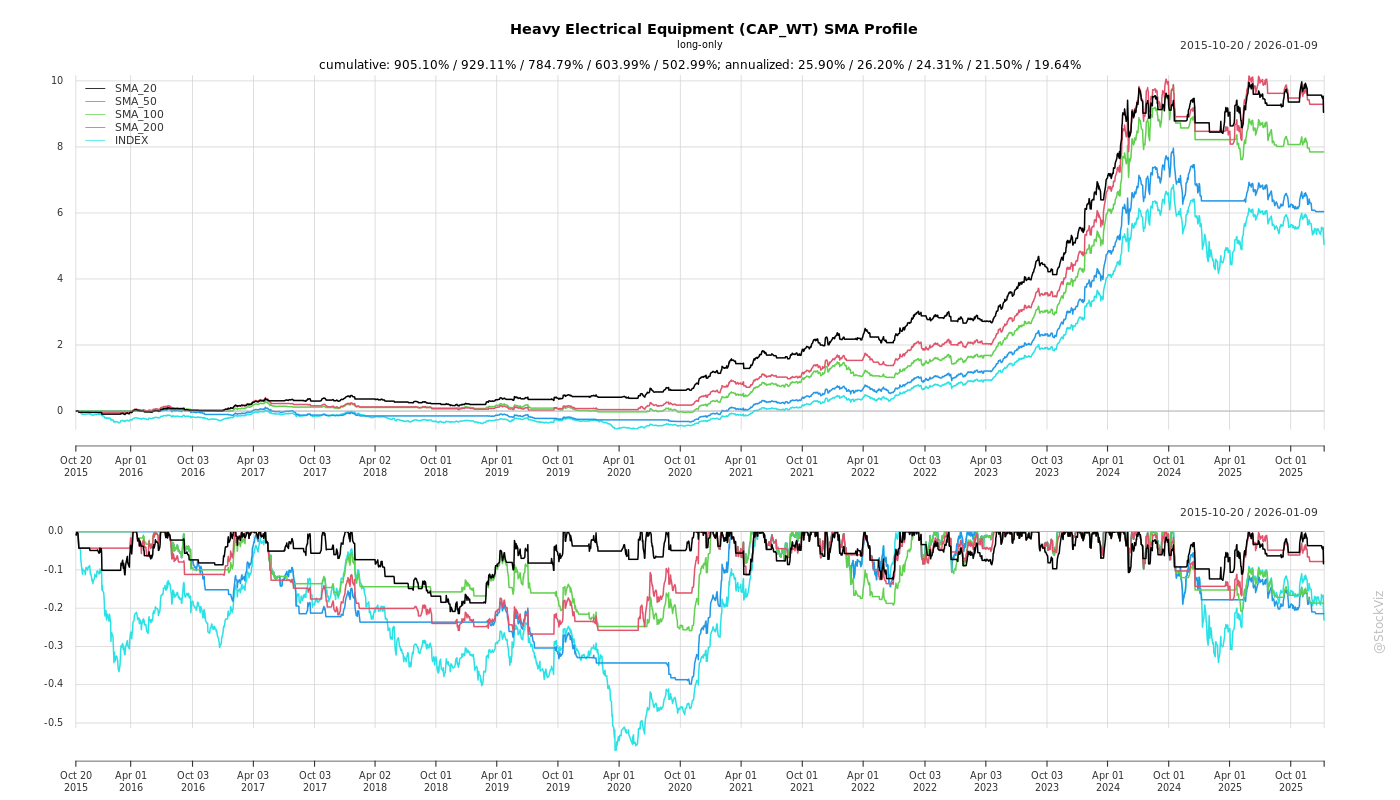

SMA Scenarios

Current Distance from SMA

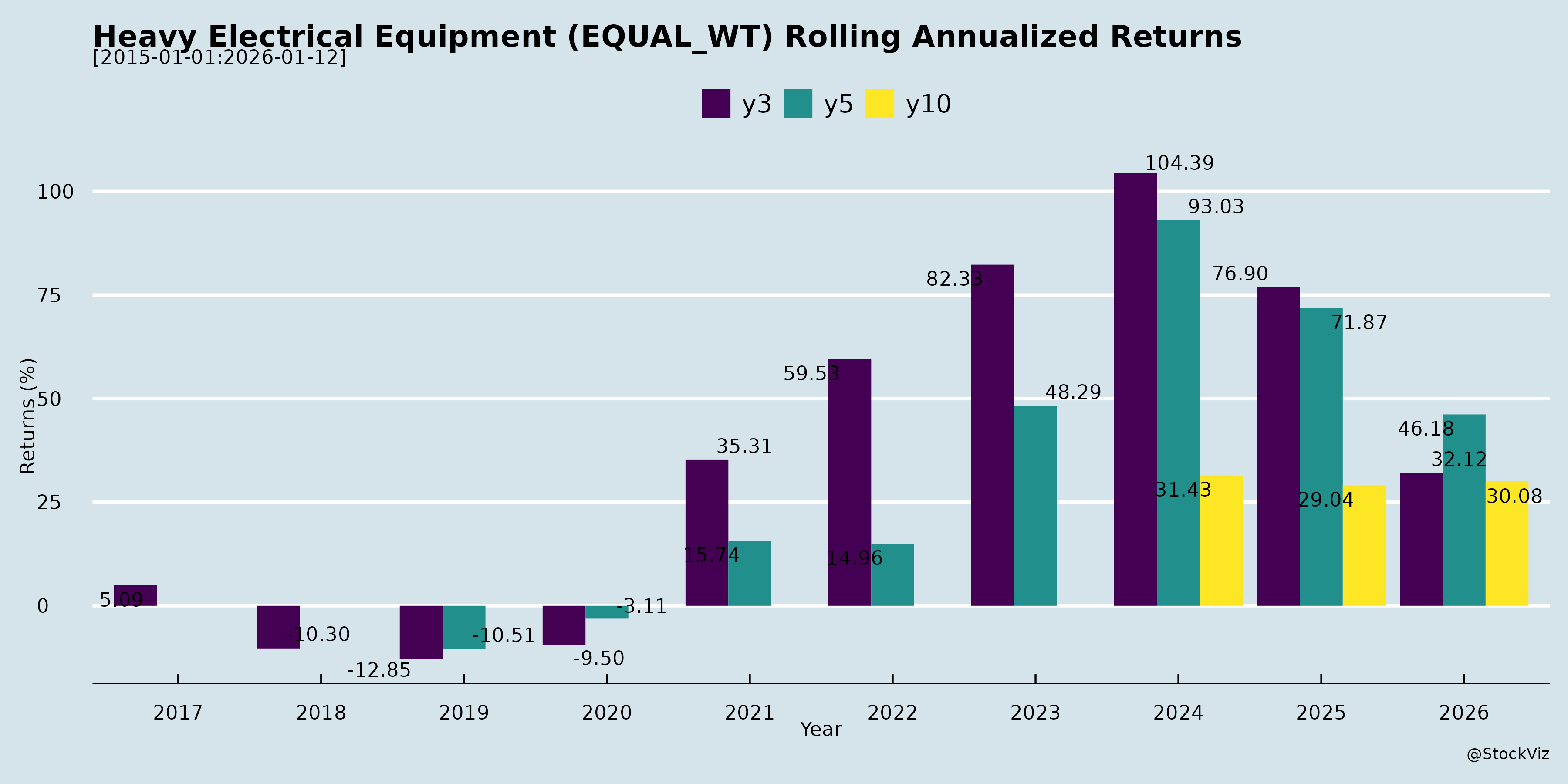

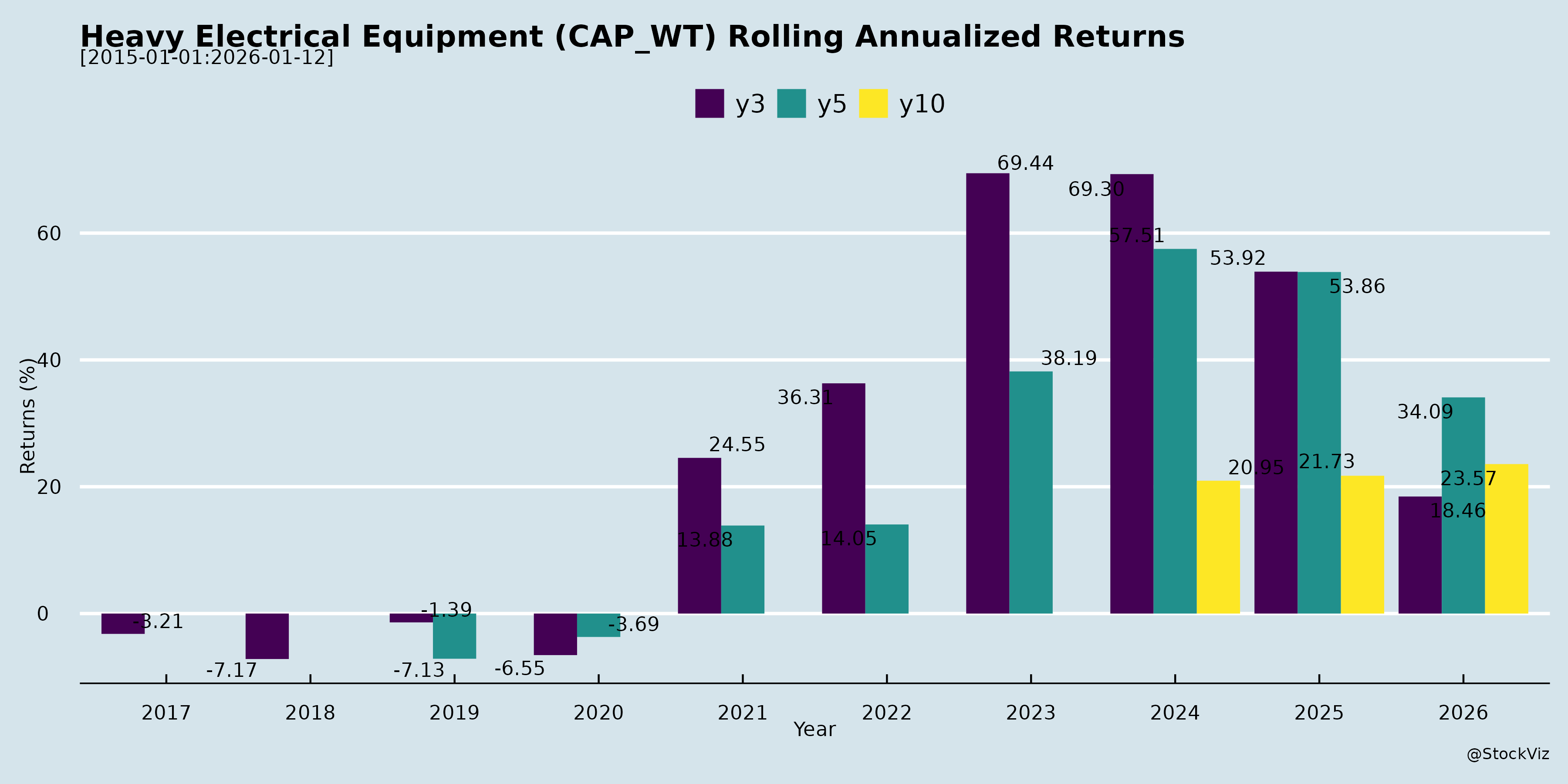

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Analysis of Indian Heavy Electrical Equipment Sector

The Indian Heavy Electrical Equipment (HEE) sector, encompassing players like ABB India, Siemens, CG Power, GE Vernova T&D, Hitachi Energy, Schneider Electric Infrastructure, Inox Wind, Suzlon, BHEL, Triveni Turbine, TD Power Systems, and others, is navigating a post-COVID cyclical moderation amid robust long-term tailwinds from infrastructure and energy transition. Insights are derived from recent Q2/Q3 FY26/CY25 earnings transcripts, investor meets, and announcements (Nov-Dec 2025). The sector shows resilient base orders, healthy backlogs (e.g., ABB Rs9,900cr, GE Vernova Rs131bn), and capex expansions, but faces near-term margin squeezes.

Headwinds

- Margin Pressures (3-5% YoY contraction seen):

- Revenue mix shift toward lower-margin segments (e.g., core/moderate growth markets like metals, cement); post-COVID pricing premium eroded.

- QCO/BIS certification delays forcing imports (0.75-1.5% cost hit, e.g., ABB Electrification/Motion), FOREX volatility (0.6%), and material inflation (metals like aluminum/copper).

- Competition intensification in limited opportunities; services muted in some divisions (e.g., ABB Robotics).

- Cyclical Slowdown: Delayed capex decisions (1-2 qtrs) in core sectors (oil&gas, metals, mining); lumpy large orders absent (e.g., ABB orders -3% YoY net of large; GE Vernova bookings -66% YoY).

- Execution Slack: Monsoons, site readiness delays (e.g., Inox Wind H1 execution 29% of FY target); customer clearances holding FG inventory (Schneider Rs59cr).

- Macro Drag: Geopolitical tensions, trade uncertainty (e.g., US tariffs, China thaw risking imports), moderating inflation/private consumption.

Tailwinds

- Strong Order Visibility: Base orders robust (+13% ABB, diversified across 23 segments); backlogs 3x trailing revenue (GE Vernova); H1 orders +28% (Schneider).

- Govt CAPEX Boost: INR11.2L cr infra spend; RDSS (INR3L cr, 90% disbursed) driving grid modernization; PLI/GST cuts (wind components 12%→5%); renewables (500GW target, 125GW solar ahead of schedule).

- Backward Integration & Efficiency: Capex ramps (GE Rs800cr+Rs240cr; Schneider Kolkata/Vadodara); zero-waste factories (ABB); royalty savings (Inox Wind 3MW platform).

- Cash Richness: Rs4,500-5,000cr net cash (ABB); positive FCF (GE H1 PAT fully converted); enabling dividends/investments.

- Segment Momentum: Renewables (hybrid wind-solar-BESS), data centers (hyperscale/colocation revival), mobility (metros 800-1,000km, Vande Bharat locos).

Growth Prospects

- Near-Term (FY26): Double-digit revenue (ABB/MGE ambition; Inox 1.2GW execution; GE 35-40% YoY); H2 acceleration (70% execution skew, Q4 capex peak). EBITDA mid-20s sustainable (GE 27.3% H1); Inox Green O&M to 17GW (12.5GW now).

- Medium-Term (FY27-28):

- Data centers (10-20% topline potential, Schneider/ABB); HVDC/STATCOM (GE pipeline); renewables (hybrid FDRE RTC, Suzlon/Inox framework deals for 1GW+ annual recurring).

- Exports (17-35% mix, GE/Schneider); grid refurb (HVDC upgrades).

- Overall: 15-20% CAGR feasible on INR2.7L cr RDSS residue + RDSS 2.0; IPP/group synergies (Inox 500-700MW annual).

- Long-Term: Energy transition (500GW non-fossil, 36GW hydro/PSP); GenAI/digitalization; ROE/ROCE uplift post-demerger (Inox Green Rs50-55cr dep savings).

| Company Example | H1/FY26 Guidance | Key Driver |

|---|---|---|

| ABB India | Double-digit rev; 12-15% PBT band | Base orders, backlog execution |

| GE Vernova T&D | Mid-20s EBITDA; Rs5,500-6,000cr rev | 39% H1 growth; capex Rs1,040cr |

| Inox Wind | 1.2GW exec; 18-19% EBITDA | 3.2GW book; framework deals |

| Schneider | Double-digit rev pickup | Orders +28%; data centers |

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Regulatory | QCO extensions (3-4 qtrs more); BIS lab capacity crunch → prolonged imports/costs. | Certifications in progress; strategic stocking. |

| Execution | Site/monsoon delays; customer readiness (FG buildup). | Diversified backlog; 120-day WC cycle (Inox). |

| Macro/Geo | Trade wars/China imports; geopolitics delaying capex. | Domestic focus (83-97% orders); exports diversification. |

| Commodity | Metal inflation (Al/Cu); no full pass-through in spots. | Hedging/clauses in long-term contracts. |

| Competition | Intensifying bids; Chinese dumping post-thaw. | Premium tech (HVDC, digital); risk mgmt (Inox selective bidding). |

| Lumpiness | Large orders (20-30% backlog) absent → volatility. | Base orders focus (13-39% growth). |

Summary

The HEE sector is in a consolidation phase post-COVID boom (revenue 7-39% YoY, margins 16-27%), with healthy fundamentals (cash-rich, Rs10,000cr+ backlogs, capex ramps) offsetting transient headwinds (QCO/mix/competition → 3-5% margin gap). Tailwinds dominate medium-term: Govt infra (RDSS, renewables), data centers, hybrids driving 15-20% CAGR; resolution of QCO/geopolitics key for margin recovery (mid-teens PBT norm). Risks skewed regulatory/execution, but diversified portfolios (23 segments, 50-65% systems/35% products-services) provide resilience. Outlook: Cautious positive – FY26 double-digit growth likely; outperformers (GE/Inox) via execution/capex. Investors should monitor Q4 orders/H2 execution for re-rating.

Financial

asof: 2025-12-03

Summary Analysis: Indian Heavy Electrical Equipment Sector (Q3 FY25 Insights from Filings)

The sector demonstrates robust momentum, driven by India’s infrastructure capex, renewable energy push (e.g., HVDC, wind turbines), and power demand surge. Companies like CG Power, ABB India, Voltamp Transformers, Elecon, and Hitachi Energy reported strong YoY revenue growth (20-80%), healthy order books (e.g., Hitachi’s ₹18,994 Cr backlog), and PAT surges (2-5x). However, challenges persist in receivables and costs. Below is a structured analysis based on the provided Q3 FY25 filings.

Tailwinds (Positive Drivers)

- Explosive Order Inflows & Backlogs: High demand for transformers, power systems, and renewables. E.g., Hitachi Energy’s ₹11,594 Cr Q3 orders (838% YoY, led by HVDC); Elecon’s 52% revenue growth; CG Power’s Industrial Systems up 21%.

- Revenue & Margin Expansion: Sector-wide YoY revenue growth (avg. 25-40%); EBITDA margins 8-15% (ABB 22%, Voltamp 25%). Execution efficiency and localization aiding (e.g., Suzlon’s WTG revenue up 133%).

- Deleveraging & Cash Generation: Debt reduction (e.g., ABB debt-free; Inox Wind improved liquidity); strong cash flows from ops (ABB ₹1,332 Cr).

- Policy Support: RE policies, grid infra (e.g., BHEL Power segment 32% growth); exports rising (ABB 40% share ex-HVDC).

Headwinds (Challenges)

- Elevated Costs & Provisions: Raw material inflation (60-70% of costs); ECL/provisions (BHEL ₹469 Cr restated; Inox Wind ₹1,346 L); forex losses (Elecon, Transrail).

- Receivables Pressure: Overdues (BHEL ₹469 Cr Sudan/RVUNL; Inox Wind litigations); working capital strain despite collections.

- Segment Variability: Power segment volatile (BHEL losses narrowed but thin margins); wind delays (Inox Wind inventory ₹218 Cr).

- High Finance Costs: 1-3% of revenue (Suzlon ₹170 Cr 9M); though declining.

Growth Prospects

- High (Medium-Term: 15-25% CAGR): RE grid infra (HVDC, transformers); India’s 700 GW demand by 2047; capex cycle (Power T&D ₹2.5L Cr). Exports (ABB, Hitachi); M&A (Hitachi RF acquisition).

- Order Pipeline: Backlogs provide FY26 visibility (Voltamp ₹12,391 Cr assets; Elecon Transmission 65% revenue).

- Margin Upside: Localization, capacity expansion (CG Power semis entry); EBITDA potential 15-20%.

- Sector Targets: Wind (Suzlon/Inox scaling); industrial electrification (ABB/Elecon).

Key Risks

- Execution/Receivables (High): Delays, ECL (BHEL notes ₹469 Cr unprovided); litigations (Inox Wind customer disputes).

- Policy/Regulatory (Medium): Tender dependencies, GST/IT reconciliations (Inox/BHEL); state RE policies.

- Macro (Medium): Commodity volatility, forex (Transrail OCI forex losses); competition from China.

- Financial (Low-Medium): Leverage (Suzlon debt:equity 0.15); IPO utilization (Azad/Transrail monitoring).

- Others: Exceptional items (provisions/write-offs); segment concentration (Power 70-80% for many).

Overall Outlook: Bullish near-term (strong orders, infra boom); monitor receivables/costs. Sector poised for 20%+ growth FY26 amid RE transition. (Analysis based solely on filings; not investment advice.)

General

asof: 2025-11-29

Analysis of Indian Heavy Electrical Equipment Sector

Based on the provided announcements from key players (Siemens, CG Power, ABB India, BHEL, Hitachi Energy India, GE Vernova T&D India, Suzlon Energy, Thermax, Inox Wind, Triveni Turbine, TD Power Systems, Voltamp Transformers), the sector shows resilience amid regulatory/tax headwinds but strong execution in expansions and financials. The documents highlight a mix of tax/legal resolutions, project developments, compliance issues, and robust Q2/H1FY26 results from Triveni Turbine. Below is a structured analysis.

Tailwinds (Supportive Factors)

- Legal/Tax Resolutions Favoring Companies: Multiple favorable outcomes, e.g., Siemens’ GST SCN (Rs. 34.83 Cr) quashed by Gujarat HC; GE Vernova’s GST interest (Rs. 2.15L) waived under amnesty; Suzlon’s customs fine/penalty reduced from Rs. 428.5L to Rs. 215.86L. ABB’s minor penalty (Rs. 72.57L) expected to have no material impact post-appeal.

- Capacity Expansion & Project Continuity: CG Power allotted 45 acres for 45,000 MVA greenfield transformer plant in MP (renewable focus). Hitachi Energy’s HVDC project novated smoothly to Adani subsidiary, ensuring execution.

- Strong Financial Performance: Triveni Turbine reported robust Q2/H1FY26 standalone results: Revenue up 8% YoY to Rs. 8,232 Mn (consolidated Rs. 8,775 Mn), PAT up 2% YoY to Rs. 1,625 Mn (consolidated Rs. 1,558 Mn). Healthy order book implied by revenue growth.

- Cash Inflows: Inox Wind divested 2.06% stake in subsidiary IRSL for Rs. 175 Cr, bolstering liquidity without material impact (IRSL contributes 6% revenue, 14% net worth).

Headwinds (Challenges)

- Persistent Tax/Regulatory Disputes: Ongoing GST/customs litigations (ABB, Suzlon appeals pending; historical issues in Siemens/GE). Reflects sector-wide scrutiny on input credits, free supplies, and imports.

- Compliance Fines: BHEL fined Rs. 5.43L each by BSE/NSE for <50% independent directors (Q2FY26), due to govt delays in appointments (as PSU).

- Operational/Minor Delays: ABB’s delayed disclosure; Thermax’s financial results corrigendum (typographical). Neutral but signals administrative burdens.

Growth Prospects

- Renewables & Transmission Boom: CG Power’s transformer plant, Hitachi’s HVDC link (Bhadla-Fatehpur), Suzlon/Inox Wind’s wind focus align with India’s 500 GW RE target by 2030. PLI schemes for transformers (implied via expansions).

- Order Execution & Profitability: Triveni Turbine’s 15% YoY revenue CAGR (FY25 base) and EBITDA margins (~35% implied) signal strong industrial/power demand. Sector benefits from capex in power T&D (Rs. 9.2L Cr grid investment planned).

- Export/International Expansion: Triveni Turbine’s subsidiaries (e.g., TSE Engineering full acquisition post-Q2) enhance global footprint.

- Govt/PSU Opportunities: BHEL’s projects despite compliance issues; land allotments easing setup.

Key Risks

- Tax Litigation Escalation: High exposure to GST/Customs disputes (e.g., non-payment on imports/free supplies); appeals could drag, with interest/penalties impacting cash flows (quantifiable: Rs. 35-400 Cr cases across firms).

- Regulatory/Compliance: PSU-specific issues (BHEL’s board); disclosure delays fines. RTA name changes (Voltamp) minor but operational.

- Project Execution Delays: Novations (Hitachi) or land dependencies (CG) vulnerable to policy shifts.

- Subsidiary/Debt Risks: Inox Wind’s stake dilution; Suzlon’s import duties on China parts highlight supply chain vulnerabilities amid anti-dumping.

- Macro: Dividend campaigns (TD Power) indicate retail investor dormancy; unclaimed funds risk IEPF transfer.

Overall Summary

Bullish Outlook with Regulatory Noise: Tailwinds from expansions (transformers, HVDC, turbines) and strong earnings (Triveni Turbine up ~5% PAT YoY) outweigh headwinds, signaling sector growth at 12-15% CAGR driven by RE/power capex. Prospects tied to India’s energy transition (T&D investments). Key Monitor: Tax appeals outcomes (low materiality but sentiment risk). Recommendation: Positive; focus on execution leaders like Triveni/CG/Hitachi. Risks manageable via appeals/waivers, but PSUs like BHEL lag on governance. Sector PE likely premium on growth.

| Factor | Impact Level | Key Driver |

|---|---|---|

| Tailwinds | High (+) | Expansions & Financials |

| Headwinds | Medium (-) | Tax/Compliance |

| Growth | High (+) | RE/T&D Capex |

| Risks | Medium (-) | Litigations & Execution |

Investor

asof: 2025-12-03

Analysis of Indian Heavy Electrical Equipment Sector

The Indian Heavy Electrical Equipment sector (encompassing transformers, switchgear, turbines, substations, motors, drives, renewables equipment, and related EPC/O&M) is witnessing robust underlying demand driven by infrastructure capex, energy transition, and grid modernization. Insights from recent filings (Q2/Q3 FY26 earnings transcripts, investor meets, and announcements from key players like ABB India, GE Vernova T&D, Inox Wind, Schneider Electric Infra, Siemens, CG Power, Hitachi, BHEL, etc.) highlight a mix of cyclical pressures and structural tailwinds. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, followed by a summary.

Headwinds (Short-term Pressures)

- Execution and Revenue Moderation: Several firms reported single-digit revenue growth in H1 FY26 (e.g., Schneider: 6.6%; ABB: flat orders net of large deals). Monsoons delayed site readiness (Inox Wind: 202 MW executed in Q2 despite rains). Client-side delays in financial closures and commissioning (GE Vernova, ABB) led to FG inventory buildup (Schneider: INR 59 Cr stock adjustment).

- Margin Compression: Profitability dipped due to revenue mix shifts (lower-margin segments), intensified competition (ABB: 1-1.5% premium eroded post-COVID), raw material costs, and FOREX volatility. ABB’s PBT margin fell to 16.4% (vs. 20.5% YoY); Schneider EBITDA at 11.6% H1.

- Regulatory Hurdles: Quality Control Orders (QCO)/BIS certifications caused 0.75-1% margin hits and forced imports (ABB: 3-5% gap in EL/MO divisions; ongoing for 2-3 quarters). Delays in lab slots extended timelines.

- Cyclical Slack: Base orders healthy (ABB: 13%; GE Vernova: aligned ex-large deals), but large project decisions deferred amid trade uncertainties and geopolitical tensions.

Tailwinds (Positive Momentum)

- Strong Order Backlogs and Inflows: Healthy visibility – ABB: Rs. 9,895 Cr backlog; GE Vernova: Rs. 131 Bn (3x FY25 revenue); Inox Wind: 3.2 GW. H1 orders up (Schneider: 28%; GE Vernova robust domestic 83%). Base orders resilient across renewables/infra.

- Capex Expansions: Aggressive investments for capacity – GE Vernova: INR 10.4 Bn (transformers, GIS, reactors); Inox Wind: new blades/towers in South India; Schneider: Kolkata/Vadodara lines. Supported by internal cash (ABB: Rs. 4,500 Cr; GE: Rs. 15.2 Bn debt-free).

- Policy Boosts: RDSS (INR 3L Cr spend, 70% disbursed), GST cut on wind (12%→5%), ALMM for turbines, hybrid ISTS amendments. Govt capex INR 11.2L Cr + private INR 2.67L Cr (up 20%).

- Margin Levers: Shift to high-margin transactional/services (Schneider: systems 65%, transactional 20%, services 15%; up from prior). Operating leverage from volume (GE: 39% revenue growth → 25.8% EBITDA).

Growth Prospects (Medium-Term Opportunities)

| Segment | Key Drivers | Potential TAM/Impact |

|---|---|---|

| Power/Grid | RDSS, HVDC/STATCOM (GE, Hitachi), substation modernization (Schneider). NCT identifies multiple projects. | INR 3L Cr+; 36 GW hydro/PSP, 90-100 GW thermal by 2035. |

| Renewables | 500 GW non-fossil (9 months ahead); hybrid wind-solar+BESS; wind repowering (Inox: 3 GW tender pipeline). | Suzlon/Inox framework deals (1 GW recurring); O&M growth (Inox Green: 12.5 GW portfolio → 17 GW in 2 yrs). |

| Data Centers | Hyperscalers (AWS, MSFT, Google); colo boom; GenAI demand (27 GB/month data use). | 220-765 kV substations; 2-10% of capex (Schneider/GE). FY27 material inflows expected. |

| Mobility/EV | Metros (1,600-1,800 km lines), Vande Bharat locos (Schneider elephant share), UDAN airports, rail plan (40K coaches). | Double-digit revenue share; EV chargers, robotics (ABB). |

| Exports | 30-35% mix (GE: 32% Q2 revenue); Europe/Africa traction for GIS (GE). | Capacity expansions export-ready; RPT approvals (GE: INR 3,000 Cr pipeline). |

- Overall: Double-digit revenue growth feasible (ABB/GE guide mid-20s EBITDA; Inox: 1.2 GW FY26 execution). IPP tie-ups (Inox group: multi-GW annual), demergers (Inox substations), and digital solutions (cybersecurity, APM) to unlock value. Sector poised for 10-15% CAGR through FY28 on infra/energy tailwinds.

Key Risks

- Regulatory/Execution Delays: QCO extensions, tender cancellations (40 GW wind without PPAs → rebidding), site readiness (monsoons, client FC).

- Pricing/Competition: Post-COVID premium erosion; Chinese imports amid India-China thaw (ABB process industries).

- Macro/External: Geopolitical tensions, FOREX volatility (ABB: QCO+FOREX 1-2%); inflation moderating but trade uncertainty.

- Capacity Overhang: New capex (2-3 yr ramp-up) amid softening pipelines (STATCOM lull – GE).

- Sector-Specific: Cyclicality (PA stagnant – ABB); PPA risks in renewables; state utility exposure (<3% backlog for GE, but higher elsewhere).

- Company-Level: Robotics divestment uncertainty (ABB India pending board eval); working capital cycles (Inox: 120 days target).

Summary

The sector is in a consolidation-to-growth phase post strong post-COVID cycle, with tailwinds from govt capex (RDSS, renewables), private infra (data centers, mobility), and policy easing (GST cuts) outweighing near-term headwinds like QCO margins hits (2-4% drag resolving in 3-4Q) and execution slack (H1 revenue muted but orders robust). Growth prospects are strong (10-20% revenue CAGR; data centers/renewables as stars), backed by INR 100 Bn+ backlogs and capex ramps, positioning leaders for double-digit topline and mid-teens EBITDA. Risks remain moderate (cyclical delays, competition), but healthy cash buffers (debt-free peers) and diversification (exports 20-30%) mitigate them. Outlook: Positive; expect H2 acceleration on monsoon easing and tender finalization, with 2026 as a breakout year on hybrid/HVDC awards. Investors should monitor QCO resolution and large-order inflows for confirmation.

Press Release

asof: 2025-11-29

Summary Analysis: Indian Heavy Electrical Equipment Sector

The Indian Heavy Electrical Equipment (HEE) sector, encompassing transformers, turbines, gears, boilers, switchgear, wind solutions, and grid infrastructure, shows robust momentum driven by energy transition, grid modernization, and infrastructure capex. Insights from recent announcements (Q2/Q3 FY26 results, orders, and strategic updates from Siemens Energy India, ABB India, Hitachi Energy India, GE Vernova T&D India, Voltamp Transformers, Elecon Engineering, BHEL, CG Power, Thermax, Suzlon, Inox Wind, and Triveni Turbines) highlight a positive outlook amid some near-term challenges. Below is a structured analysis of tailwinds, headwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Policy and Demand Surge: Strong government push via “Make in India”, renewables (50% non-fossil capacity achieved), HVDC/grid upgrades, railways (Kavach/TCAS), and net-zero by 2070. Private capex doubled in Q2 FY26 (₹10.55 Tn new projects), boosting demand in power, steel, cement, and renewables.

- Order Inflows and Backlogs: Healthy pipelines—e.g., Hitachi (₹29,412 Cr backlog), GEV key GIS/AIS wins, Suzlon’s 838 MW (FY26 largest), Inox Wind’s 2.5 GW MoU, Thermax’s ₹580 Cr export order. Exports contribute 30%+ for Hitachi/ABB.

- Financial Performance: Revenue growth across peers (ABB +14%, Hitachi +23%, GEV +39%, Voltamp +21%, Elecon +14%, BHEL stable ops). EBITDA margins resilient (ABB 13%, Hitachi 15%, GEV 26%, Elecon 22%).

- Capacity & Localization: Expansions (Siemens INR 4.6 Bn in transformers, GEV ₹806 Cr in GIS/AIS, Voltamp greenfield EHV plant). Aftermarket/O&M growth (Inox Green 12.5 GW portfolio).

- Sustainability Edge: SF6-free tech (Hitachi EconiQ), zero-waste factories (ABB), R&D hubs (Triveni-IISc for turbomachinery).

Headwinds (Challenges)

- Cost & Margin Pressures: Rising material costs/import reliance (ABB PBT margin down to 16% from 21%), product mix shifts, competition (Voltamp expects normalization).

- Execution Delays: Weather (Voltamp ₹10 Cr reversal), approvals (CG order cancellation), minor incidents (BHEL fire—contained, no damage).

- Order Volatility: Timing issues (ABB total orders -3% YoY, GEV -66%), heavy rain/inaccessibility.

- Investment Yield Dip: Falling rates hurt MTM gains (Voltamp other income -54%), lower reinvestment yields.

- Global Macro: Trade tensions/US tariffs impacting exports (Elecon, ABB note volatility).

Growth Prospects

- Medium-Term (2-3 Years): Explosive demand from renewables integration (FDRE/wind-solar hybrids: Suzlon/Inox), data centers, EVs, electrification. FY26 guidance intact (Elecon ₹2,650 Cr revenue; Voltamp on track). Exports to Europe/ME/NA rising.

- High-Potential Segments: Transformers/grid (Voltamp ₹1,377 Cr new orders), turbines/boilers (Thermax exports, Triveni R&D), gears/MHE (Elecon 33% MHE growth), wind (15-21 GW annual capacity).

- Strategic Plays: Partnerships (Inox-KP Energy), O&M/services (35% YoY growth at Hitachi), capex cycle (private investments +41% H1 FY26).

- Overall Projection: Sector poised for 15-20% CAGR, led by 50% international revenue target (Elecon by FY30), sustained EBITDA margins ~18-20%.

Key Risks

| Risk Category | Description | Mitigation Noted |

|---|---|---|

| Execution/Geopolitical | Delays from approvals/weather/global tensions (US tariffs, volatility). | Strong backlogs, diversified exports (30%+). |

| Cost/Supply Chain | Raw material volatility, QCO compliance. | Long-term vendor ties (Voltamp), localization. |

| Margin Compression | Competition, mix shifts. | Selective orders (Voltamp), premium tech (Hitachi EconiQ). |

| Financial | Rate fluctuations (MTM losses), one-offs (arbitration). | Robust cash (ABB ₹4,991 Cr, Hitachi ₹4,659 Cr). |

| Regulatory/Policy | Govt. capex slowdown, tender delays. | Alignment with net-zero/railways infra. |

| Operational | Incidents (fire), order cancellations. | Safety measures (BHEL), developmental quals (CG). |

Overall Outlook: Bullish. Tailwinds from India’s energy/grid buildout outweigh headwinds, with peers delivering double-digit growth and FY26 on track. Risks are manageable via strong balance sheets/order books, but monitor global trade/margins. Sector benefits from resilient domestic demand (infrastructure/renewables) amid a ₹34 Tn H1 FY26 investment pipeline. Investors should favor execution-strong players like Hitachi/ABB/Voltamp.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.