POLICYBZR

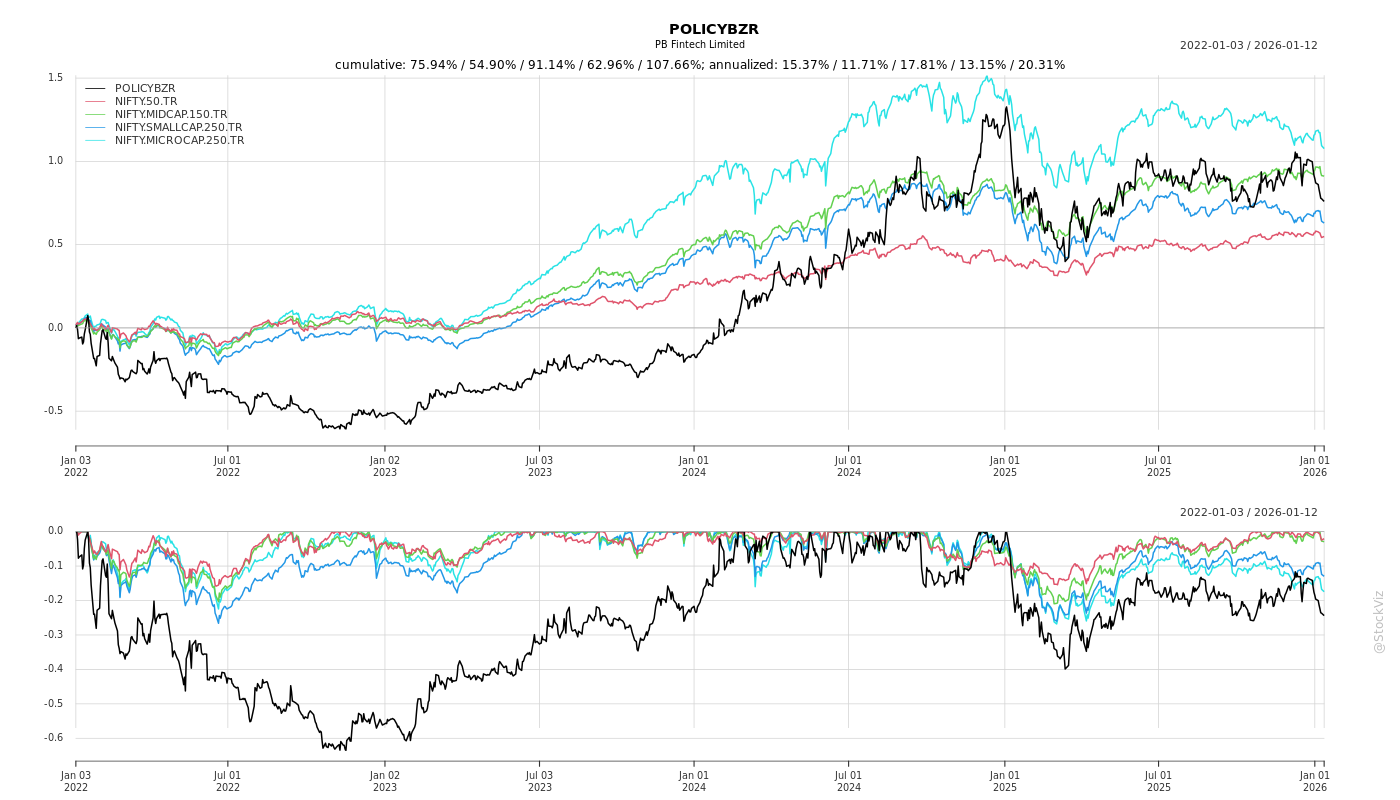

Equity Metrics

January 13, 2026

PB Fintech Limited

Financial Technology (Fintech)

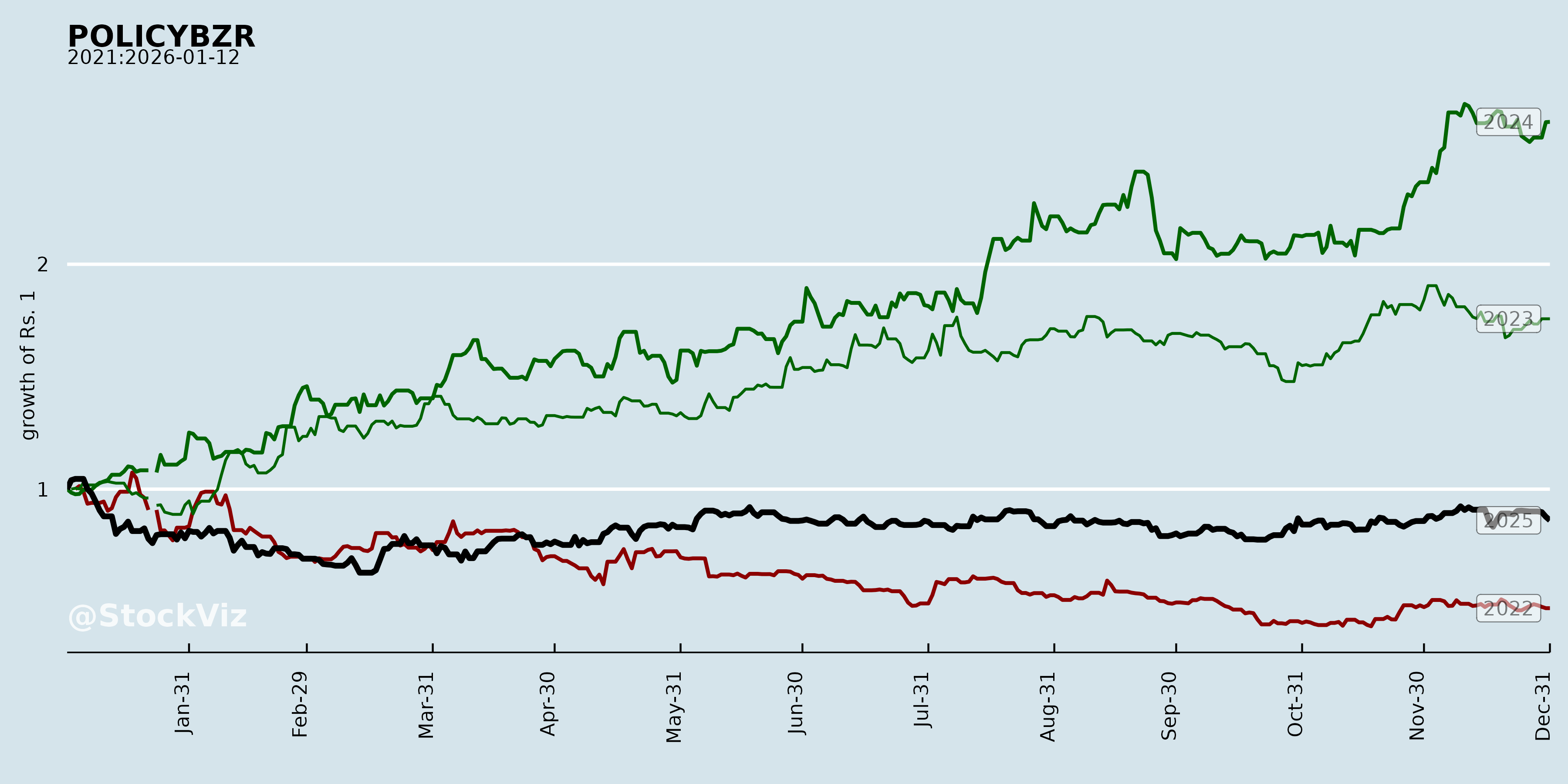

Annual Returns

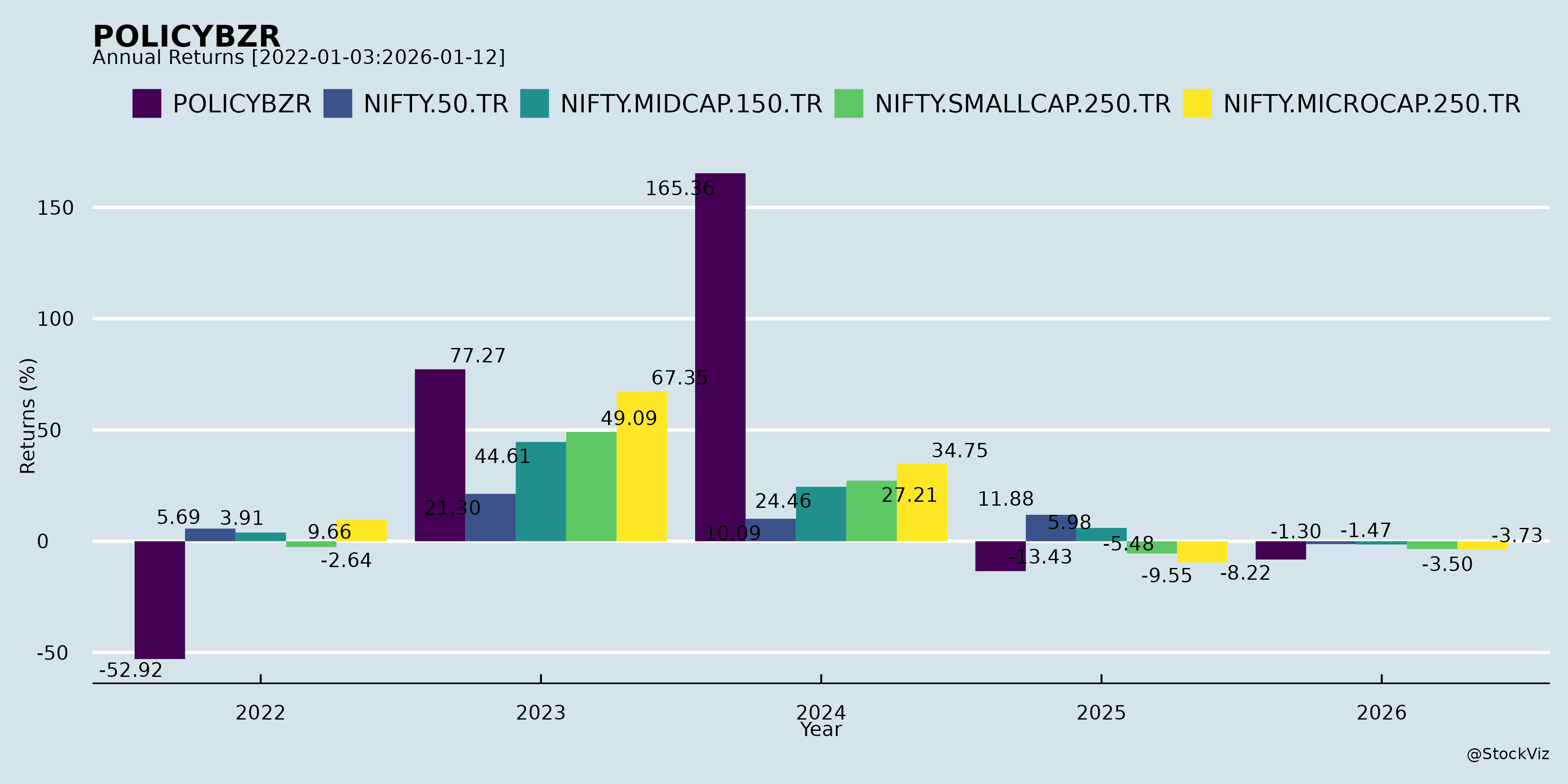

Cumulative Returns and Drawdowns

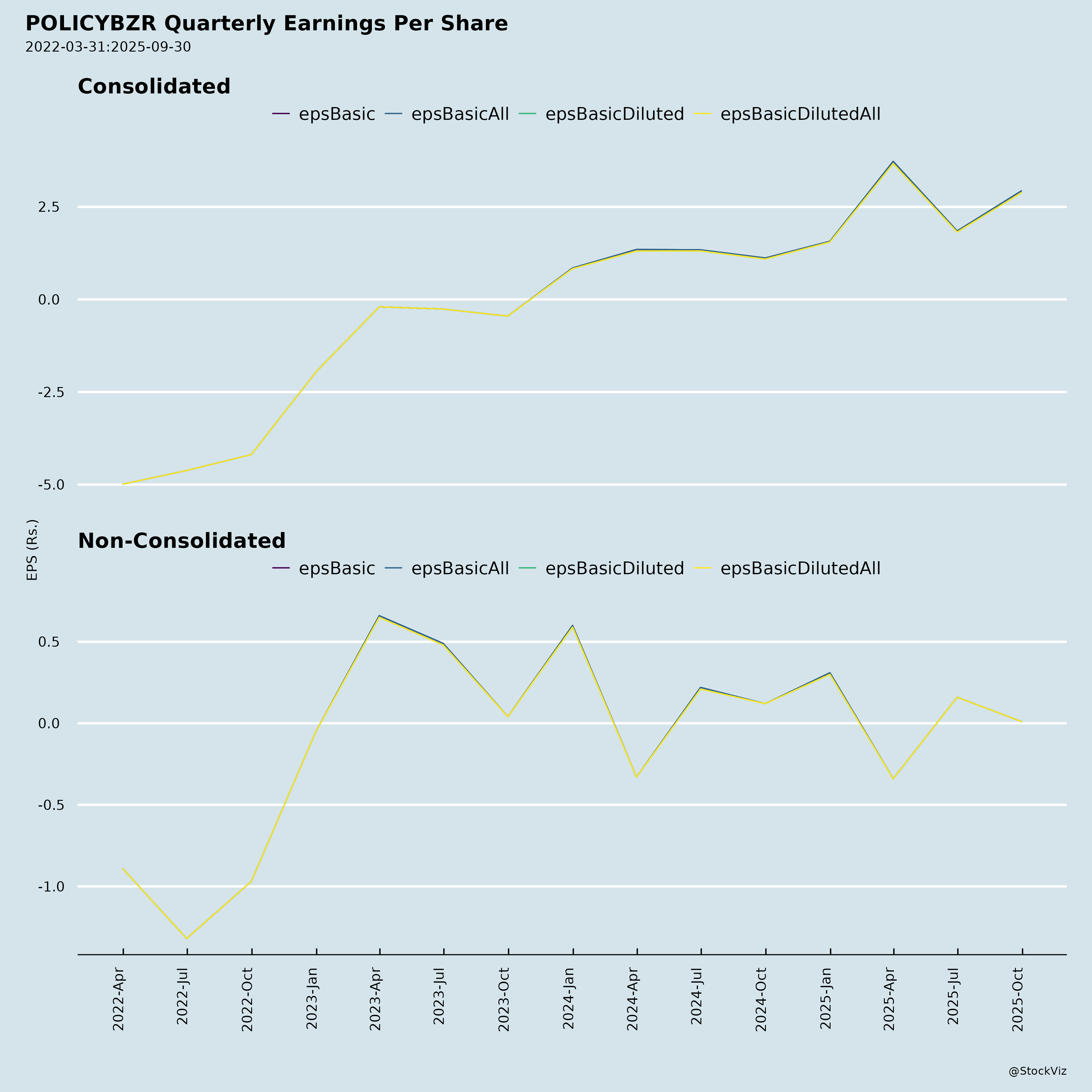

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-08

Based on the provided corporate disclosures for PB Fintech Limited (Stock Symbol: POLICYBZR, BSE SCRIP Code: 543390), we can conduct a comprehensive analysis of the company’s headwinds, tailwinds, growth prospects, and key risks. These documents include:

- Disclosure of Voting Results and Scrutinizer Report of the 17th Annual General Meeting (AGM) held on September 26, 2025.

- Disclosure regarding allotment of equity shares following the Scheme of Amalgamation with Makesense Technologies Limited, dated December 6, 2025.

- Intimation of analyst meet schedule, dated December 1, 2025.

🔍 Summary of Key Events & Corporate Developments

✅ 1. Successful Board Renewals and Leadership Continuity

- Key promoters/executives Mr. Yashish Dahiya (CEO & MD) and Mr. Alok Bansal (Whole-Time Director) were reappointed, along with approval of their remuneration.

- Mr. Sarbvir Singh (Joint Group CEO)’s remuneration also approved.

- All key resolutions (including financial statements adoption and auditor appointment) passed with strong shareholder support, indicating high confidence from investors.

- Resolution 1 (Financials adoption): 99.9999% in favor.

- Resolution 2 (Reappointment of Yashish Dahiya): 94.68% in favor.

- Resolutions 4–6 (Leadership appointments & remuneration): Passed with majority support (89.7% to 91%+ in favor), despite being special resolutions (require 75%+).

✅ 2. Successful Merger with Makesense Technologies Limited

- 5.98 crore fully paid-up equity shares (Rs. 2 face value) have been allotted to former shareholders of Makesense Technologies Limited.

- Effective date: August 29, 2025.

- The scheme was sanctioned by the NCLT, indicating legal and regulatory clarity.

- New shares will rank pari passu with existing shares and are expected to be listed on NSE and BSE, improving liquidity.

Implication: This is a major strategic consolidation, likely aimed at: - Expanding fintech product offerings. - Enhancing technology stack or distribution network. - Adding new revenue streams via Makesense’s digital/insurance platforms.

✅ 3. Engagement with Investors

- Scheduled participation in Citi India Financials Tour 2025 on December 19, 2025.

- Proactive disclosability and transparency observed.

- Indicates strong investor relations and willingness to share business updates.

📈 Growth Prospects & Tailwinds

| Tailwind | Explanation |

|---|---|

| Strategic Merger Completion | Acquisition of Makesense Technologies signals expansion strategy, possibly in embedded finance, data analytics, or insurance tech, aligning with PB Fintech’s core verticals (Policybazaar, Paisabazaar). |

| Pari-Passu Share Allotment | Ensures no dilution in rights; ex-Makesense shareholders are integrated seamlessly, aiding synergy realization. |

| Leadership Stability | Reappointment of Yashish Dahiya and Alok Bansal ensures continuity in vision, critical in a competitive fintech environment. |

| High Shareholder Approval | Over 90% voting support on key issues (even remuneration) shows strong governance perception and trust in management. |

| Proactive Regulatory Compliance | Timely disclosures, use of e-voting, appointment of independent scrutinizer — reflects SEBI LODR compliance, enhancing reputation. |

| Investor Engagement | Participation in roadshows indicates access to institutional investors, beneficial for future fundraising or visibility. |

⚠️ Headwinds & Key Risks

| Risk/Headwind | Analysis and Concern |

|---|---|

| Concentration of Voting Power & Promoter Influence | - Promoter group did not vote in e-voting (0 shares cast under “Promoter and Promoter Group”). - All 2.41 crore votes cast via e-voting at AGM were public/institutional. - High institutional participation, but lack of promoter voting may signal governance opacity or proxy arrangements — a red flag for minority shareholders. |

| High Percentage of Votes “Against” Leadership Remuneration Resolutions | - Around 10% of votes were cast “against” the reappointment and remuneration of top executives. - While still comfortably passed (>89% in favor), this reflects dissent from some retail or institutional investors — possibly due to performance, compensation alignment, or governance concerns. |

| Low Retail Shareholder Participation | - Only 57 shareholders voted during live AGM e-voting. - Despite high institutional turnout (1,287 institutions), retail involvement is minimal, suggesting limited grassroots investor engagement. |

| Integration Risk Post-Merger | - Merging Makesense brings integration, cultural, and operational challenges. - Risk of failure to achieve expected synergies, tech integration issues, or talent attrition. - No disclosure on valuation or acquisition consideration — raises transparency questions. |

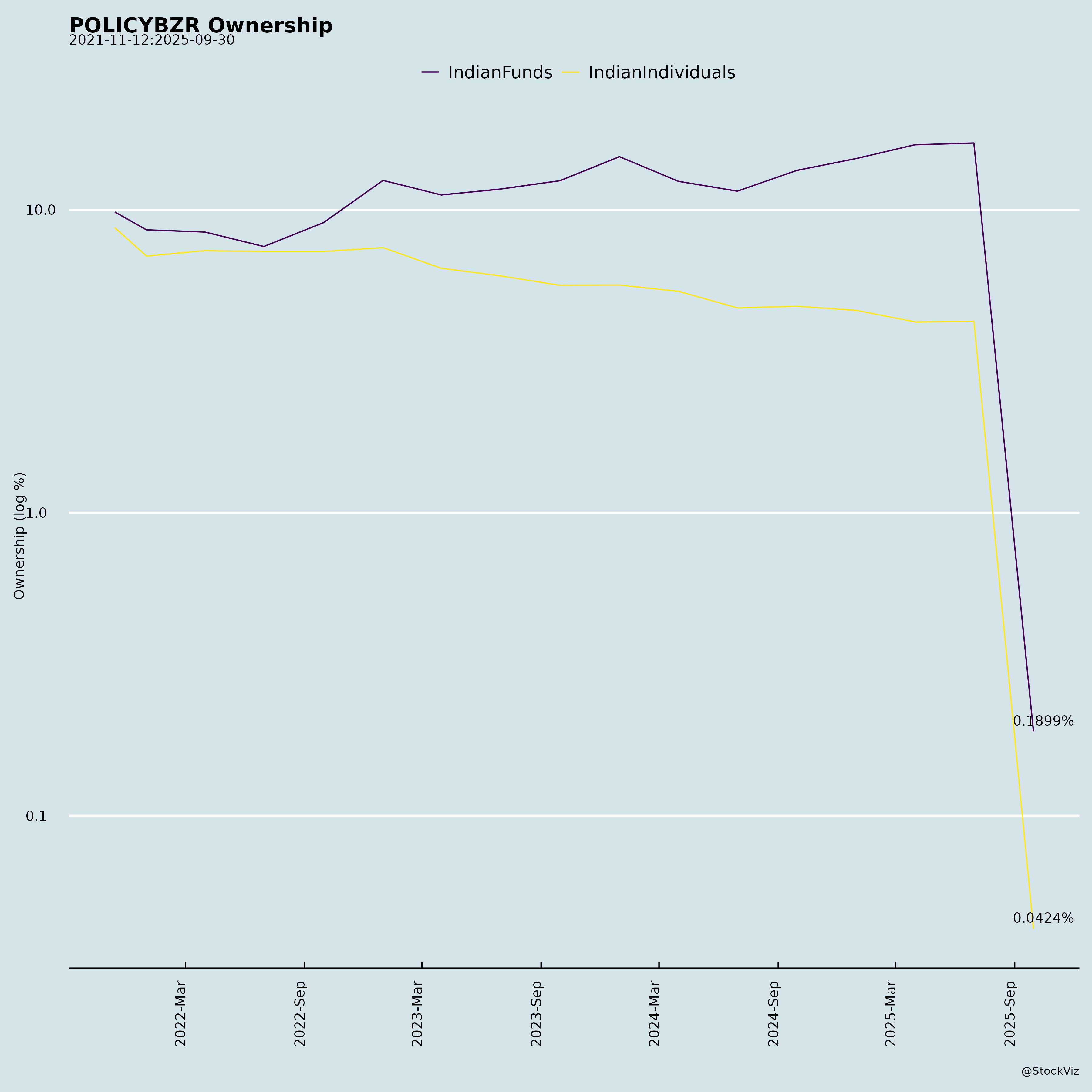

| Dilution Risk from Large Share Allotment | - 5.98 crore new shares issued represents ~12–15% increase in outstanding equity (assuming pre-merger ~40 crore), which could impact EPS unless revenue synergies materialize quickly. |

| Regulatory Oversight in Fintech | As a digital financial marketplace, PB Fintech remains exposed to SEBI, IRDAI, RBI scrutiny — delays in licensing, compliance, or new regulations (e.g., on digital lending, data privacy) could affect operations. |

| Market Competition | Heavily contested space with competitors like Google Pay, Paytm, PhonePe, BankBazaar, etc. Competing on margins, customer acquisition costs, and innovation remains challenging. |

🧩 Sentiment & Governance Analysis

- Voting turnout: ~1,344 shareholders (57 in-person, 1,287 via remote e-voting), showing growing institutional participation.

- Abstentions: Minimal — only isolated votes (under 1 million shares) abstained across resolutions, indicating active participation.

- Transparency: Use of MUFG-Intime as e-voting agency and independent scrutinizer (Dhananjay Shukla) enhances trust.

- Remuneration Scrutiny: The 10% opposition to top management pay suggests need for better disclosure on justifying pay versus performance.

📊 Key Metrics Derived from Voting Data

| Metric | Value |

|---|---|

| Total Votes Cast (Resolution 1) | 397,918,778 shares (~39.8 crore) |

| Free-float Shares (approx) | ~45.9 crore (total voting shares in annexures) |

| % Votes Polled (approx) | ~86.6% |

| Institutional Shareholding (approx) | 14.85 crore (32% of total shares) – highly active voters |

| New Shares Issued (Merger) | 5.98 crore (~12–15% dilution) |

| Effective Share Capital Post-Merger | ~46 crore + 5.98 crore = ~51.98 crore shares |

🔮 Forward-Looking Outlook & Growth Drivers

| Growth Driver | Potential Impact |

|---|---|

| MakeSense Integration | Could enhance customer base, data analytics, and cross-selling capabilities in insurance, lending, or personal finance. |

| Digital AGM & Tech Enablement | Efficient investor engagement and governance, scalable for future shareholder base growth. |

| Dual Brand Power (Policybazaar + Paisabazaar) | Strong brand equity in insurance and credit in India. |

| Expansion into Embedded Finance & AI | Potential to leverage tech from Makesense for hyper-personalization, underwriting, and marketing. |

| Listing of New Shares | Improves liquidity and may attract broader institutional interest post-merger. |

🏁 Final Summary: POLICYBZR – Investment & Business Snapshot (as of Q3 2025)

| Parameter | Assessment |

|---|---|

| Governance | Strong compliance; high votes for leadership but with minority dissent on remuneration. Promoter non-voting needs clarity. |

| Growth Trajectory | Bullish due to merger execution, leadership continuity, and market positioning. |

| Risks | 1. Integration risk post-Makesense merger. 2. Dilution impact on per-share metrics. 3. Regulatory fragility in fintech. 4. Competition and CAC pressure. |

| Tailwinds | 1. Successful NCLT-approved merger. 2. High institutional confidence. 3. Strong brand & digital ecosystem. 4. Active investor engagement. |

| Investor Sentiment | Generally positive, though the ~10% opposition to top management pay signals monitoring needed on governance. |

✅ Recommendation (for Analysts/Investors): HOLD → BUY (on execution clarity)

- Short-term (0–6 months): Monitor listing of new shares and market reaction to merger.

- Medium-term (6–18 months): Watch for synergy realization from Makesense, revenue growth, and client integration progress.

- Long-term: Positive if company leverages data, distribution, and digital advice to grow into a dominant financial super-app.

⚠️ Key Watchouts: - Disclose valuation/terms of Makesense acquisition. - Explain promoter group’s non-participation in e-voting. - Release post-merger integration roadmap.

Conclusion: PB Fintech is executing a strategic transformation with strong governance infrastructure and clear investor communication. The merger with Makesense is a pivotal move, and while risks exist, the company appears well-positioned for mid-to-long-term growth if integration is seamless and synergies are delivered. Investors should monitor quarterly results post-December 2025 for operational validation of this growth thesis.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.