Financial Technology (Fintech)

Industry Metrics

January 13, 2026

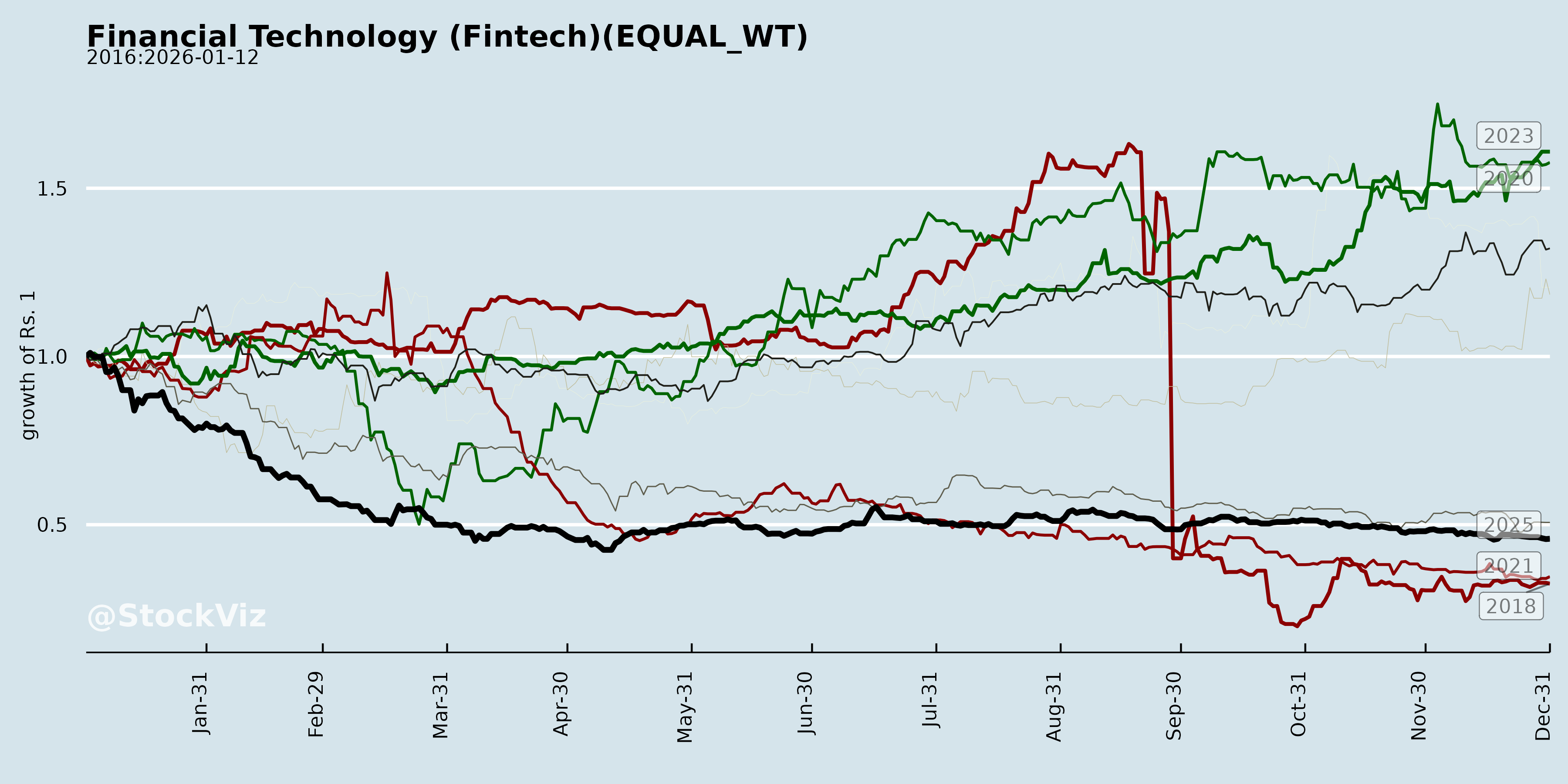

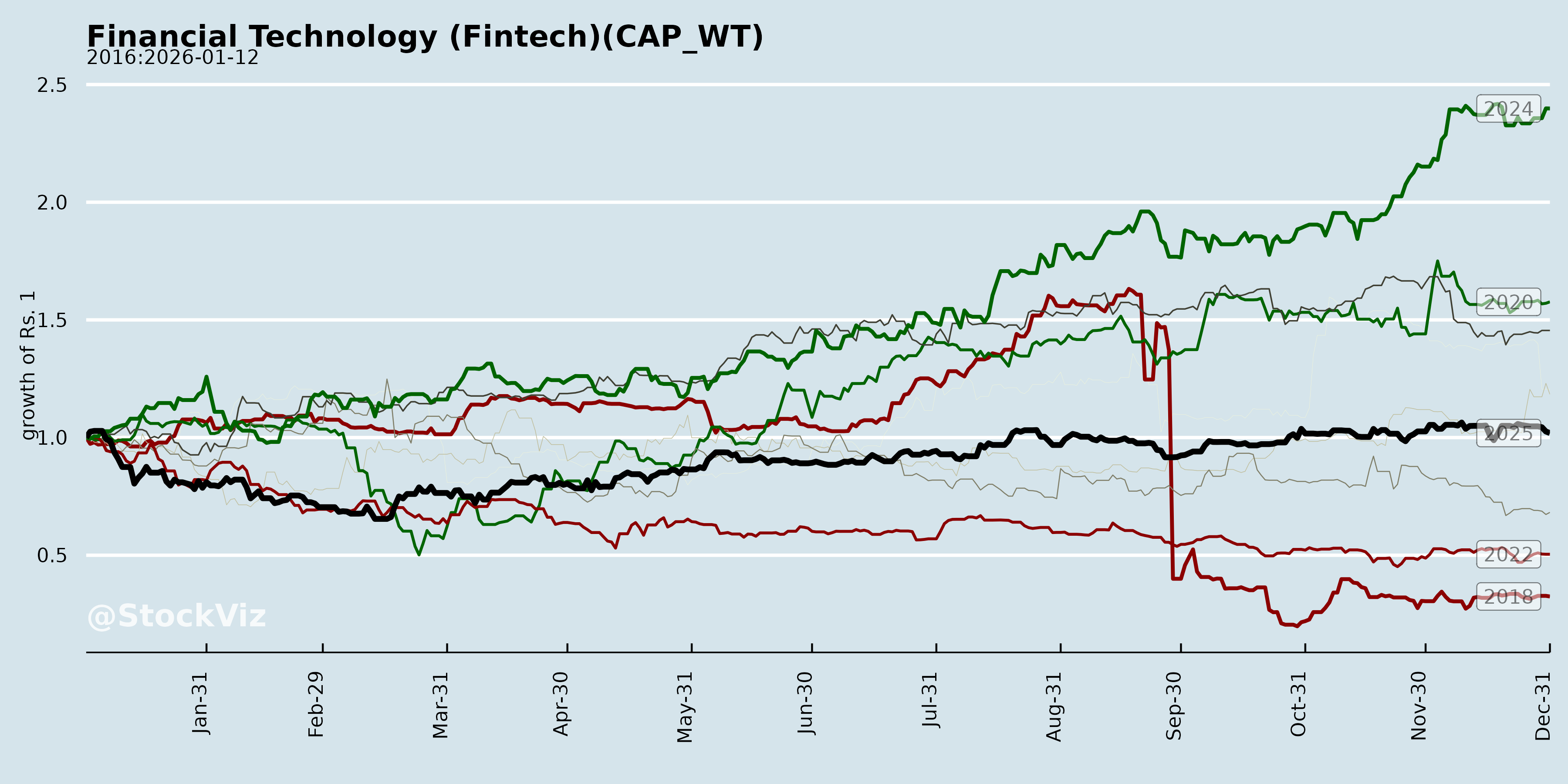

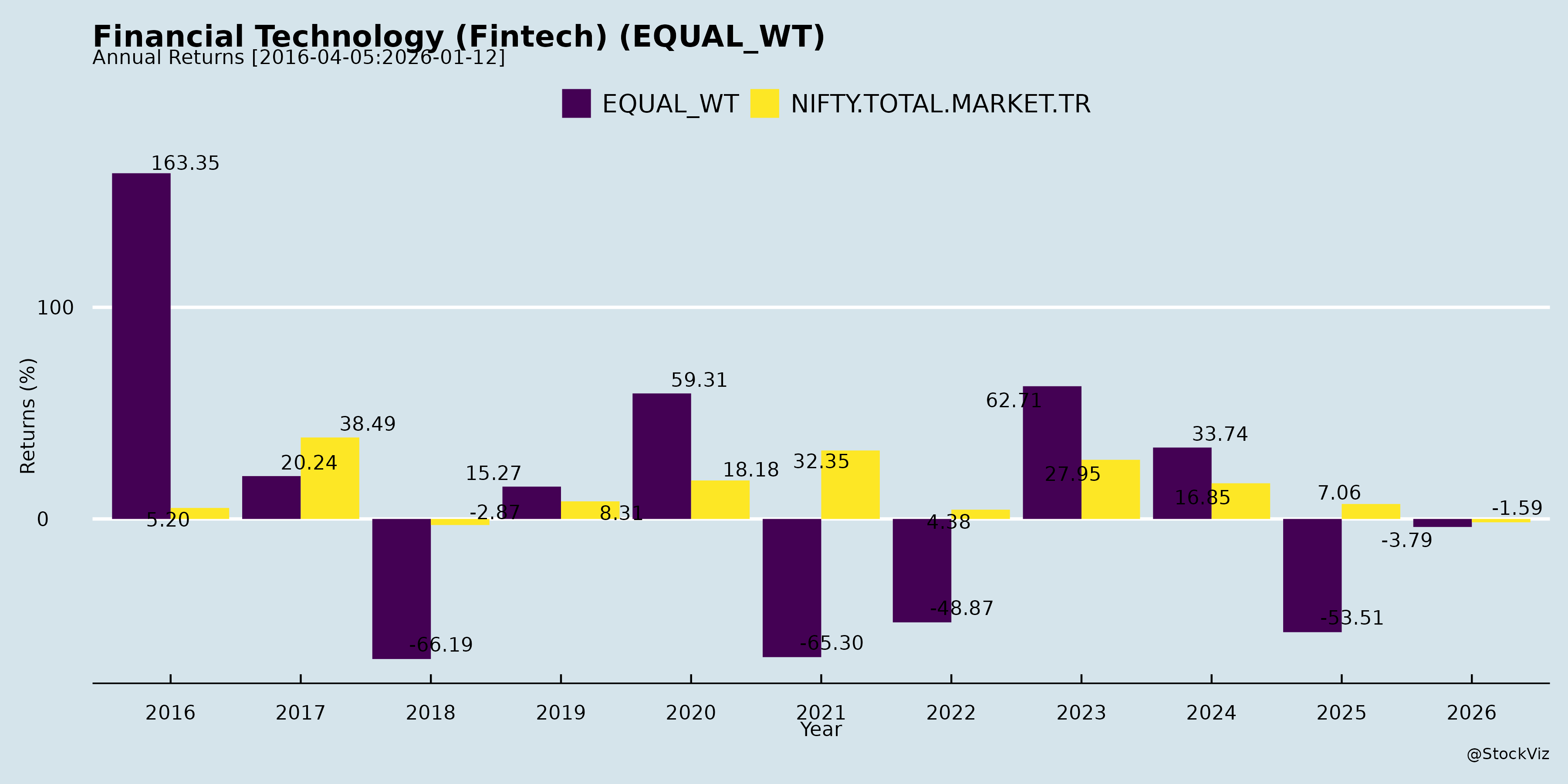

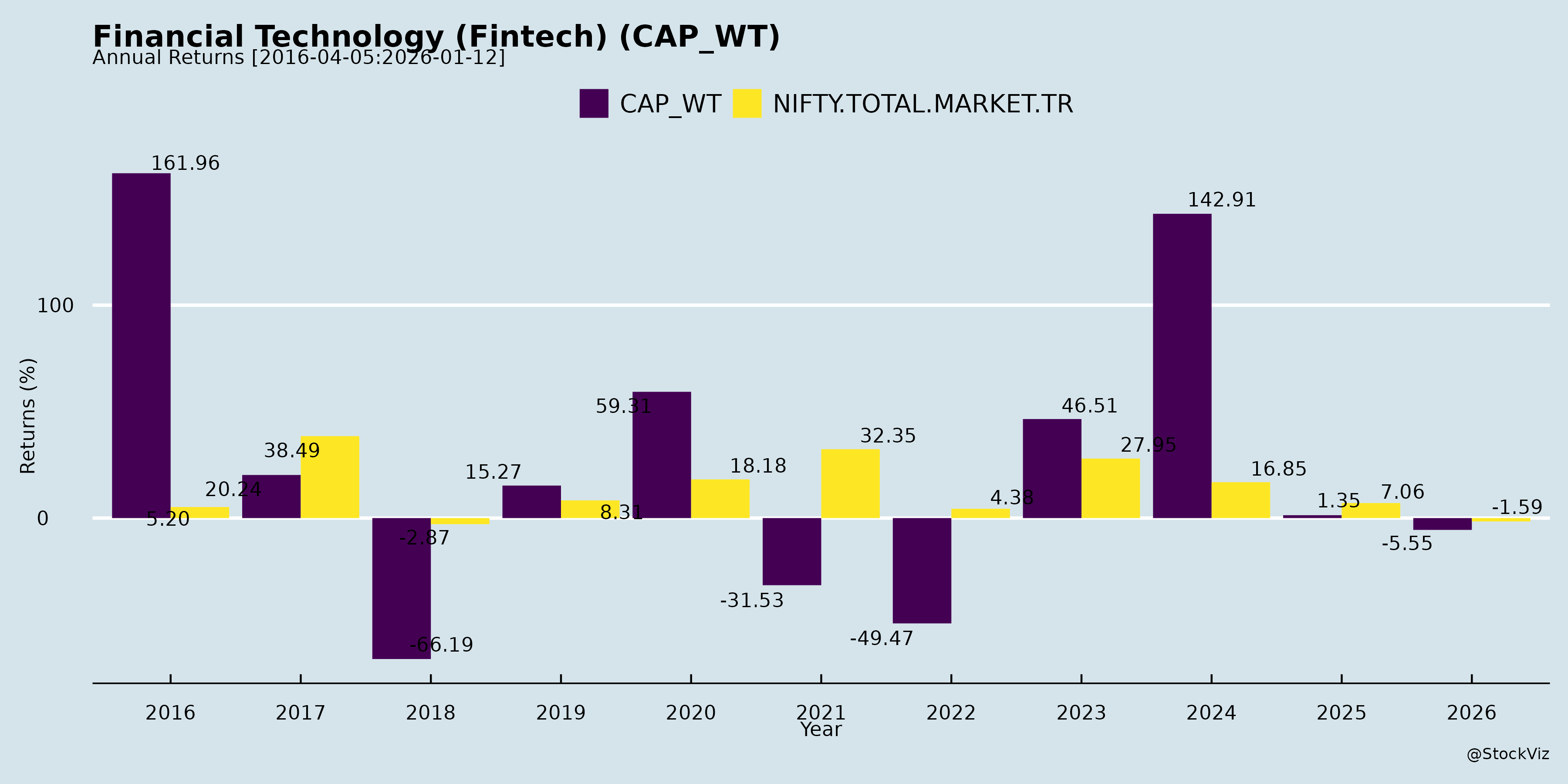

Annual Returns

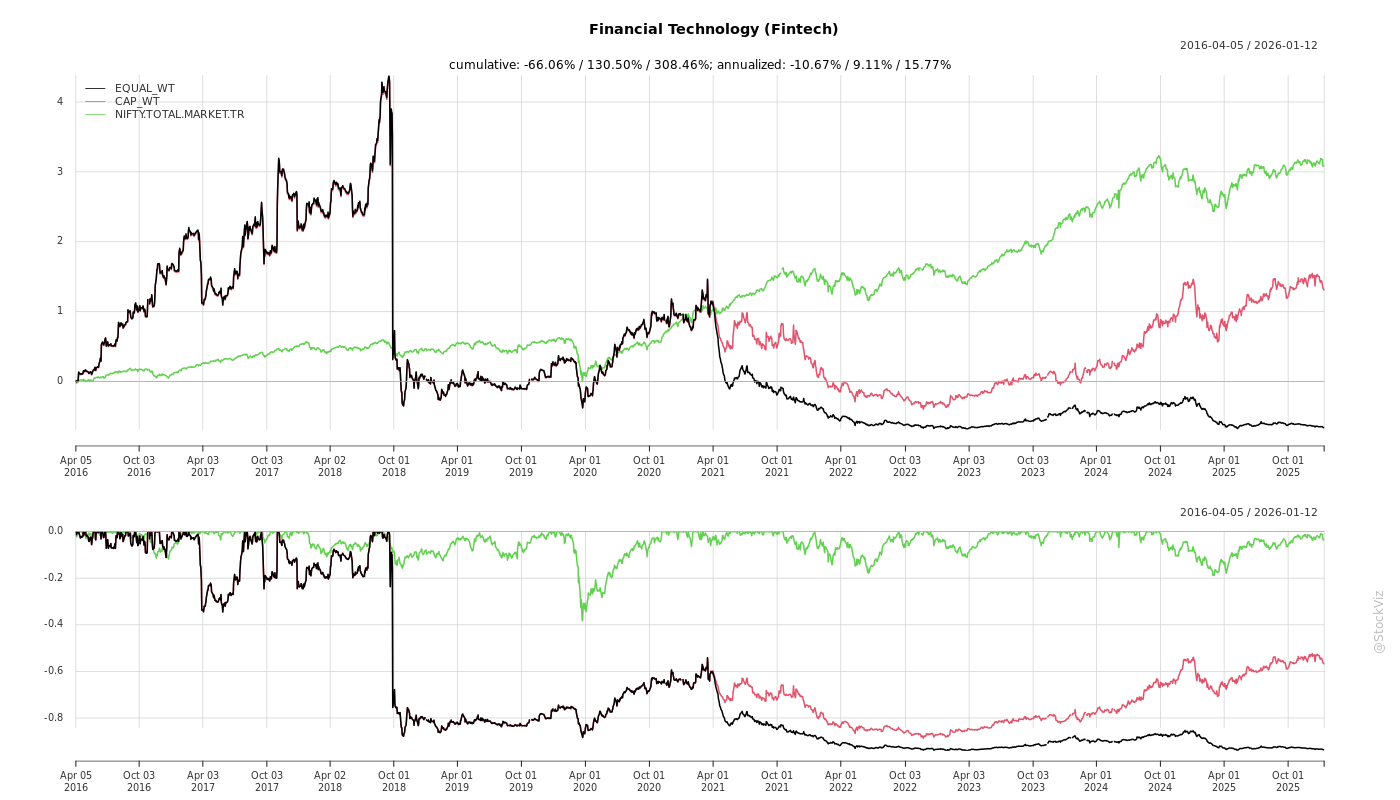

Cumulative Returns and Drawdowns

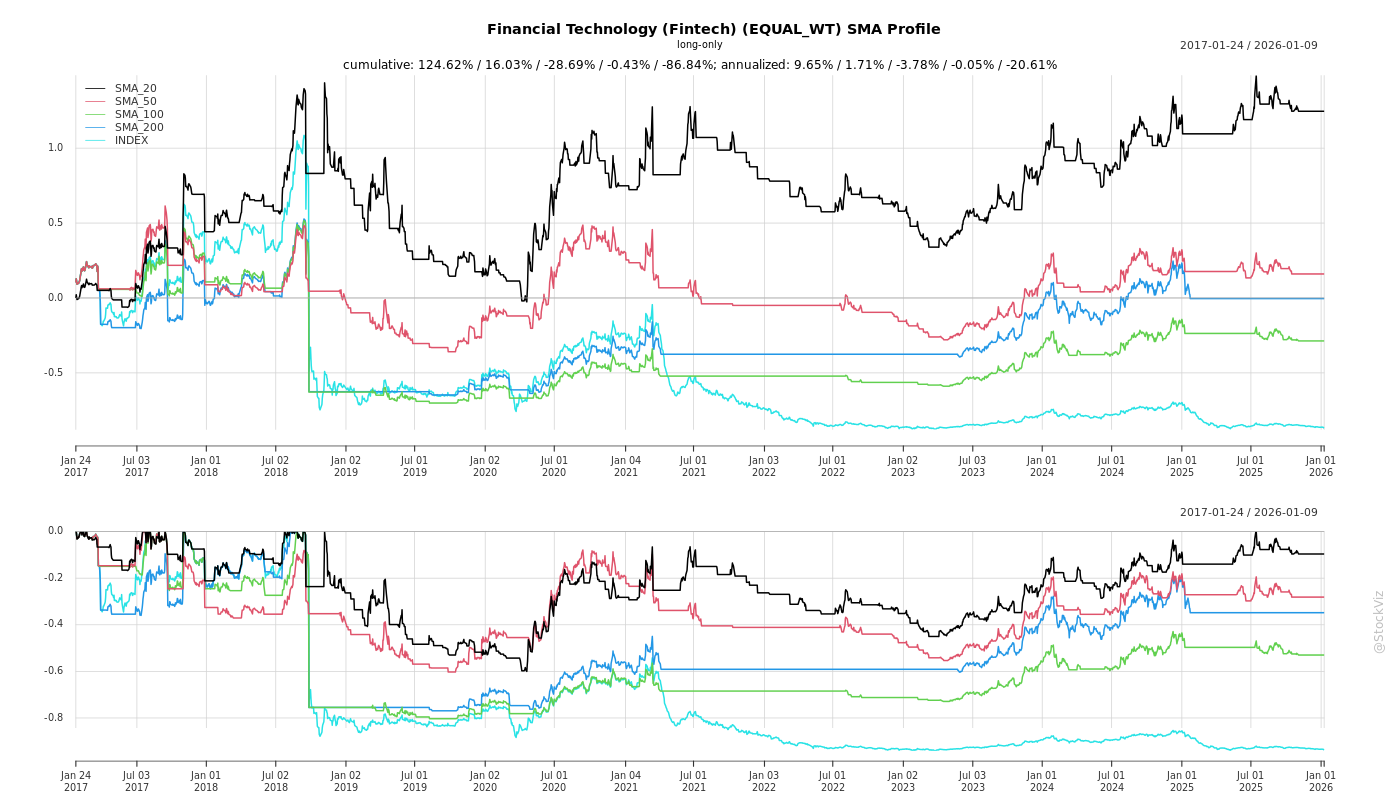

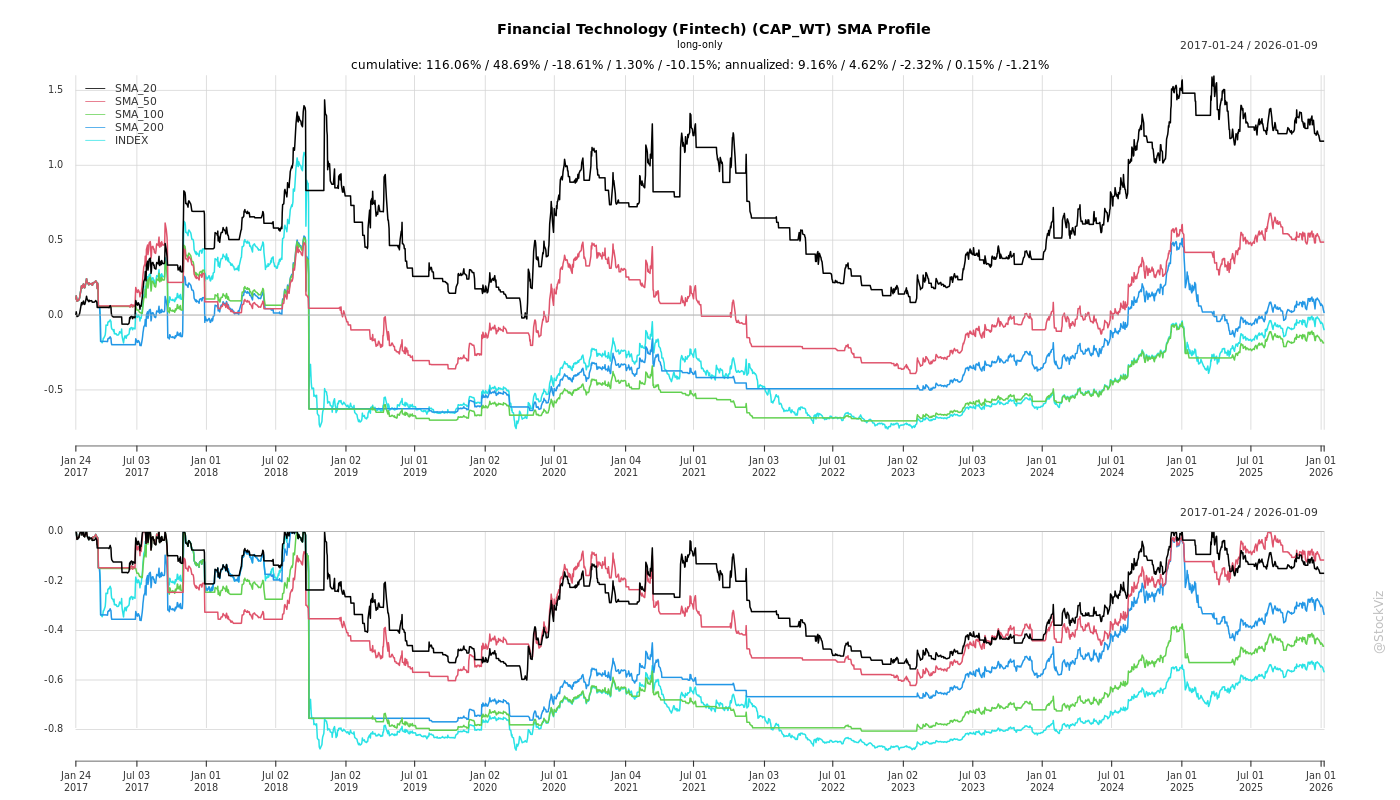

SMA Scenarios

Current Distance from SMA

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Summary Analysis of Indian Fintech Sector (Based on Provided Documents)

The documents cover earnings transcripts and announcements from key players like Paytm (One97 Communications), Infibeam Avenues, Seshaasai Technologies, PB Fintech, Pine Labs, and Mobikwik (Q2 FY26 period, ~Sep 2025). These reflect a resilient sector amid recovery from past regulatory headwinds, with strong emphasis on AI integration, payments infrastructure, merchant/consumer expansion, and diversification into wealth/IoT. Overall, the sector shows sequential improvement (e.g., Paytm’s margin expansion, Infibeam’s record revenue), but H1 moderation in card issuance and consumer MTUs. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges Observed)

- Regulatory and Issuance Slowdown: Lower PMJDY card issuances (13M vs. 38M projected in H1 FY26; Seshaasai), inactive accounts (26% rise), and RBI stress on unsecured lending moderated new card volumes across players (Seshaasai: payments mix down to 50% from 67.5%). Past curbs (Paytm’s 2022-24 onboarding halt) linger as caution.

- Consumer/MTU Pressure: Paytm notes MTU dip despite peak ARPU; competition in UPI (incumbents like PhonePe/Google Pay) fragments share. RediffPay (Infibeam) faces crowded B2C UPI space.

- Macro/External Factors: Geopolitical tensions (Seshaasai’s Middle East setback), supply chain disruptions, and festive prepone effects led to QoQ volatility. Credit cycle at “bottom” (Paytm).

- Cost/Margin Discipline: Indirect costs trimmed (Paytm), but AI/compute investments loom (no major capex yet).

Tailwinds (Positive Factors)

- Payments Ecosystem Boom: UPI P2M growth (20%+), credit card/EMI surge (Paytm: festive EMI “phenomenal”; Infibeam: TPV +93% YoY). Merchant onboarding ramps (Paytm: online/offline omni-channel; Seshaasai: Soundbox-like).

- Regulatory Enablers: New licenses (Infibeam: PPI, PA, BBPOU, IFSC; Paytm: UPI credit card). Postpaid/BNPL relaunch with banks (Paytm: quick scale-up).

- AI Acceleration: Widespread adoption (Paytm: in-house voice models, AI agents/soundbox; Infibeam: PayCentral.AI, agentic payments; Seshaasai: IoT platforms). Drives efficiency (Paytm: non-sales costs down) and revenue (new features like spend analysis).

- Operational Leverage: Margins expanding (Paytm: NPM +EMI mix; Infibeam: EBITDA 61%; Seshaasai: gross margin 46%). Cash-rich balance sheets (Seshaasai: ₹564Cr post-IPO).

Growth Prospects (Medium-Term Outlook: FY26-27)

- Core Payments (High Confidence): Merchant stack expansion (Paytm: EMI/credit instruments; Infibeam: intl. UAE/Saudi). H2 FY26 pickup expected (Seshaasai: seasonal BFSI strength). Run-rate nearing $1B ARR (Infibeam).

- Diversification:

- Financial Services/Wealth: Paytm eyes gold/MF/stocks/insurance; Infibeam: RediffPay UPI super-app.

- IoT/RFID: Fastest growth (Seshaasai: +31% YoY; retail/renewables).

- AI Monetization: New lines (Paytm: commerce cloud; Infibeam: agent marketplace). Global replication (Paytm stack).

- International/High-Margin: IFSC cross-border (Infibeam), Africa/ME exports (Seshaasai), partner-led (Paytm).

- Projections: FY26 at “higher end of guidance” (Infibeam/Paytm); H2 > H1 (all). 20-30%+ revenue growth possible via mix shift (credit/metal cards, BLE sensors).

| Key Metrics Snapshot | Paytm | Infibeam | Seshaasai |

|---|---|---|---|

| Q2 Rev Growth | Seq: Strong NPM | +93% YoY | +13% QoQ |

| EBITDA Margin | Improving | 61% | 26.9% |

| Key Driver | AI/Merchants | Licenses/AI | IoT (+31%) |

Key Risks (High to Medium Impact)

| Risk | Description | Mitigants | Affected Players |

|---|---|---|---|

| Regulatory | UPI caps, lending norms, data privacy (e.g., Paytm’s past). New AI/IFSC rules. | Compliance focus, bank partnerships. | All (Paytm high). |

| Credit/Competition | BNPL delinquency (Paytm: early signs good); UPI share wars. | Bank-led models, AI risk mgmt. | Paytm, Infibeam. |

| Execution | New launches (RediffPay, metal cards) delays; AI capex overruns. | Phased pilots, in-house tech. | Infibeam, Seshaasai. |

| Client Concentration | Top-10 clients ~60-70% rev (Seshaasai/Paytm). | Diversification (new verticals). | Seshaasai. |

| Macro | Geopolitics, slowdown in issuances (PMJDY). | H2 seasonality, intl. | All. |

| Tech/Supply | Chip shortages (IoT), AI model efficacy. | In-house (Seshaasai inlays). | Seshaasai, Paytm. |

Overall Sector Outlook: Optimistic with Steady Recovery. Tailwinds from digital India (UPI/AI) outweigh headwinds; FY26 growth ~15-25% feasible, led by payments/AI. Risks manageable via derisked models (bank partnerships). Watch H2 execution for confirmation. Sector poised for $1T+ digital payments TAM by 2030.

Financial

asof: 2025-11-30

Analysis of Indian Fintech Sector: Insights from Q3 FY25 Financial Results (Paytm, Infibeam Avenues, MobiKwik, Suvidhaa)

The provided documents detail unaudited Q3 FY25 (ended Dec 31, 2024) financial results for four listed Indian fintech players: Paytm (One 97 Communications), Infibeam Avenues, MobiKwik (One MobiKwik Systems), and Suvidhaa Infoserve. These reflect a mixed sector picture—robust digital payments growth amid regulatory headwinds, profitability challenges for some, and strong momentum for payment gateways. Infibeam shines with 18% YoY revenue growth and 49% PAT surge; Paytm and MobiKwik report losses (driven by RBI compliance costs); Suvidhaa remains loss-making at a small scale.

Key Sector Metrics Snapshot: | Company | Revenue (Q3, ₹ Mn) | YoY Change | PAT (Q3, ₹ Mn) | YoY Change | TPV/Notes | |——————|——————–|————|—————-|————|———–| | Paytm | 18,270 | -36% | (2,005) | N/A | Declining; PPBL curbs | | Infibeam | 10,704 | +18% | 644 | +49% | TPV +24% (₹2.24 Tn) | | MobiKwik | 2,695 | +18% | (553) | N/A | Post-IPO loss | | Suvidhaa | 12 | -40% | (12) | N/A | Micro-scale losses |

Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks for the Indian fintech sector, derived from these filings.

Tailwinds (Positive Drivers)

- Explosive Digital Payments Adoption: TPV growth (Infibeam +24% YoY to ₹2.24 Tn) fueled by festive season, POS/utility payments, and UPI/Bharat BillPay integration. Merchant onboarding surged (Infibeam: 1.8L new merchants; ~2K/day). Sector-wide: Transactions up 100x in 12 years; projected $1.89Tn value by 2025.

- Strategic Partnerships & Certifications: Collaborations with banks (e.g., BHIM, NPCI TSP status for Infibeam BillAvenue), fintechs (ShopSe, Tamara BNPL), and intl. players (Google Pay, Tabby). Enables hyper-scaling.

- Innovation & Product Launches: AI/ML (Infibeam/Phronetic.ai), Soundbox POS (Infibeam), payment devices (MobiKwik). Enterprise platforms (GeM procurement) add stable revenue.

- Capital Infusion via IPOs: MobiKwik raised ₹530 Cr (net); unutilized funds for growth (payments/lending). Infibeam demerged Odigma (listed Dec 2024) to unlock value.

- Take-Rate Expansion: Infibeam improved from 8.4 to 11.1 bps (+32% YoY), boosting net revenue/EBITDA.

Headwinds (Challenges)

- Regulatory Clampdowns: RBI actions hit hard—Paytm’s PPBL restricted (full impairment ₹2.27 Bn); MobiKwik waivers for lending compliance (₹678 Mn expense reversals). Pending PA licenses (Paytm subsidiary). Forces high opex (payment processing up sharply).

- Revenue Pressure & Declines: Paytm revenue -36% YoY (₹18.3 Bn); Suvidhaa -40%. High costs (Paytm: employee ₹7.6 Bn, processing ₹5.7 Bn) outpace income.

- Persistent Losses: Paytm Q3 loss ₹2 Bn; MobiKwik ₹553 Mn (lending ops ₹248 Mn). EBITDA negative for MobiKwik/Suvidhaa.

- Scheme Impacts: Infibeam/Paytm restated priors due to demergers/arrangements, masking YoY comparability.

- High Fixed Costs: Employee (Paytm ₹7.6 Bn), ESOPs (₹1.8 Bn), depreciation amid scaling.

Growth Prospects

- Market Tailwinds: Digital payments to hit $3.46Tn by 2029 (16% CAGR). Utility/BillPay, BNPL, intl. expansion (UAE/Saudi for Infibeam/Paytm).

- Diversification: Payments (core for all) + lending (MobiKwik/Paytm), enterprise SaaS (Infibeam platforms), devices/AI. Govt. tie-ups (BHIM/GeM) for sticky revenue.

- Profitability Path: Infibeam EBITDA +40% (₹1 Bn), margins 56% (net rev). Paytm exceptional gain from Zomato divestment (₹15.5 Bn prior); MobiKwik IPO funds for organic growth (₹5.3 Bn unspent).

- Scale via Network Effects: Merchant/TPV flywheel; Infibeam 10M+ clients. Post-IPO visibility aids funding.

- Intl./Adjacent Plays: UAE/Saudi BNPL/PG; Rediff.com integration (Infibeam).

Projected Outlook: Sector revenue could grow 20-30% in FY26, led by payments. Profitable players (Infibeam) scale faster; others pivot to compliance.

Key Risks

| Risk Category | Details & Examples |

|---|---|

| Regulatory | RBI scrutiny (lending/PA licenses; Paytm PPBL uncertainty). Non-compliance waivers erode margins (MobiKwik ₹678 Mn). |

| Financial | High burn (Paytm EBITDA -₹2 Bn); impairments (Paytm PPBL ₹2.3 Bn). IPO utilization delays (MobiKwik ₹4.7 Bn unspent). |

| Operational | Dependence on partners/banks (nodal accounts terminated). High opex (processing 30-50% revenue). |

| Competition | Intense (Razorpay, PhonePe); take-rate pressure. |

| Market | Slowdown in TPV growth; festive dependency. Forex/intl. volatility. |

| Execution | Path to profitability uncertain (Paytm ESOP SCN; MobiKwik lending waivers). Cyber/fraud risks in payments. |

Overall Summary: Indian fintech shows resilience with payments as a bright spot (Infibeam exemplar), but regulatory “headwinds” (RBI) dominate, causing losses/impairments (Paytm/MobiKwik). Tailwinds from UPI/digital boom offer 20%+ growth prospects, but risks center on compliance and profitability. Investors should favor diversified, compliant players like Infibeam; monitor RBI for Paytm/MobiKwik recovery. Sector poised for $3Tn+ TAM by 2029 if regulations stabilize.

Data as of Feb 2025 filings; subject to full-year audits.

General

asof: 2025-11-30

Summary Analysis of Indian Fintech Sector (Based on Provided Disclosures)

The provided disclosures from key listed Fintech players (PB Fintech/Policybazaar, Paytm, Infibeam Avenues, MobiKwik, and Suvidhaa Infoserve) highlight ongoing restructuring, capital raising, subsidiary investments, and financial reporting as of Oct-Nov 2025. These reflect a sector navigating post-COVID recovery, regulatory compliance, and expansion into regulated financial services (e.g., NBFC). Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Supportive Factors)

- Regulatory Progress and Consolidation: NCLT sanction for PB Fintech’s amalgamation with Makesense Technologies (effective Aug 29, 2025) signals smoother M&A approvals under Companies Act, enabling synergies in insurance/fintech (e.g., Policybazaar ecosystem). Similar internal restructurings (e.g., Paytm’s rights issues to subs) indicate supportive SEBI/NCLT environment.

- Capital Infusion and Expansion: Infibeam’s Rs. 700 Cr rights issue approval and Paytm/MobiKwik’s investments (Rs. 455 Cr and Rs. 1 Cr respectively) into subs like Paytm Money/Services and MobiKwik Financial Services bolster balance sheets for lending/NBFC growth. Compliance updates (e.g., Infibeam’s insider trading codes) enhance governance appeal to investors.

- Operational Flexibility: Minor updates like Infibeam’s PIN code change and Suvidhaa’s post-COVID balance sheet clean-up (write-offs/write-backs) show proactive housekeeping, aiding investor confidence.

Headwinds (Challenges)

- Persistent Losses and Weak Financials: Suvidhaa’s Q2/H1 FY26 results reveal sharp revenue decline (H1 revenue Rs. 4.9 Cr vs. Rs. 67 Cr prior; PAT loss Rs. 18.5 Cr), high depreciation (Rs. 3.8 Cr), and negative cash flows (operating cash Rs. 10.2 Cr but financing outflow Rs. 23.6 Cr). Consolidated group losses (Rs. 60.6 Cr pre-tax) highlight cost pressures (employee expenses, other expenses) and low utilization post-COVID.

- High Execution Costs: Heavy reliance on subsidiaries (e.g., Paytm’s Rs. 300 Cr + Rs. 155 Cr infusions) amid regulatory scrutiny (e.g., RBI norms for NBFCs/payments) strains parent liquidity. Infibeam’s rights issue needs shareholder uptake in volatile markets.

- COVID Legacy: Suvidhaa’s extensive review of receivables/payables underscores lingering pandemic impacts, with write-offs signaling impaired assets across sector peers.

Growth Prospects

- Subsidiary-Led Diversification: Investments in NBFC arms (MobiKwik Financial Services for hire-purchase/leasing; Paytm subs for broking/payments) position firms for high-margin lending, wealth management, and payments growth. Infibeam’s Rs. 700 Cr raise could fund CCAvenue-like payment gateways or e-commerce expansion.

- M&A and Scale: PB Fintech’s scheme unlocks shareholder value via integration, potentially boosting cross-sell (insurance + fintech). Sector-wide rights issues/internal funding (total ~Rs. 1,156 Cr across docs) support 20-30% YoY growth in digital payments/lending (projected per RBI trends).

- Digital Ecosystem Build: One-segment focus (e.g., Suvidhaa’s e-commerce/payments) amid India’s UPI boom offers 15-25% revenue upside if losses narrow via cost optimization. Overall, sector TAM (digital finance) eyed at $1 Tn by 2030.

| Company | Key Growth Driver | Potential Upside |

|---|---|---|

| PB Fintech | Amalgamation synergies | 10-15% revenue boost |

| Paytm | Sub investments (Rs. 455 Cr) | Lending/payments scale |

| Infibeam | Rights issue (Rs. 700 Cr) | Payment infra expansion |

| MobiKwik | NBFC sub (Rs. 1 Cr) | Hire-purchase growth |

| Suvidhaa | Balance sheet clean-up | Recovery to breakeven |

Key Risks

- Financial Strain: Ongoing losses (e.g., Suvidhaa’s equity erosion to Rs. 904 Cr other equity; negative EPS) risk dilution via rights issues or covenant breaches on borrowings (e.g., Rs. 12.3 Cr total debt).

- Regulatory/Execution Delays: Scheme effectiveness (PB Fintech), rights issue approvals/subscription (Infibeam), and NBFC investments (MobiKwik/Paytm) hinge on SEBI/RBI nods; delays could spike costs.

- Market and Operational Risks: Low subscriber uptake (e.g., rights entitlements), forex/volatility impacts (Infibeam GIFT City), and asset quality (Suvidhaa’s emphasis-of-matter on receivables/payables). Broader risks: Competition (PhonePe/Google Pay), cyber threats, and economic slowdown curbing fintech adoption.

- Liquidity Squeeze: Negative cash flows (Suvidhaa: Rs. 13.4 Cr drop in cash) amid high opex/depreciation; over-reliance on subs amplifies contagion if they underperform.

Overall Outlook: Indian Fintech shows resilience via fundraising/restructuring (net positive tailwinds), but profitability lags (headwinds dominant for smaller players like Suvidhaa). Growth hinges on NBFC/payments execution (medium-term prospects strong), tempered by liquidity/regulatory risks. Sector PE compression likely short-term; monitor Q3 results for inflection. Recommendation: Selective exposure to leaders like PB Fintech/Paytm post-rights issue success.

Investor

asof: 2025-12-03

Analysis of Indian Fintech Sector Based on Provided Documents

The documents include regulatory filings, earnings call transcripts, and announcements from key players like Paytm (One97 Communications), Infibeam Avenues, Seshaasai Technologies, PB Fintech (PolicyBazaar), Pine Labs, and Mobikwik for Q2/H1 FY26 (quarter/half-year ended Sep 2025). These reflect a maturing sector focused on payments, lending, AI integration, and IoT, amid regulatory evolution and digital India push. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, synthesized from common themes and company-specific insights.

Tailwinds (Positive Factors Driving Momentum)

- Robust Digital Payments Ecosystem: UPI-led growth (e.g., Paytm’s EMI disbursements, credit card on UPI; Infibeam’s CCAvenue TPV up 93% YoY). Merchant onboarding (Paytm adding online/offline omni-channel; Seshaasai’s QR kits) and high festive volumes support scale.

- Regulatory Approvals & Stack Building: In-principle nods for PPI wallets (Infibeam, Paytm implied), TPAP (RediffPay), PA/BBPOU, and IFSC licenses enable end-to-end services (acquiring, issuing, remittances). NPCI’s Bharat BillPay Connect boosts interoperability.

- AI & Tech Integration: Widespread adoption (Paytm’s AI soundbox, spend analysis; Infibeam’s PayCentral.AI agentic payments; Seshaasai’s IoT platforms like izeIoT). Enhances efficiency (cost savings), new revenues (agents, personalization), and differentiation.

- Margin Expansion & Cost Discipline: Paytm’s payment margins up (EMI, credit mix); Infibeam’s EBITDA margin at 61%; Seshaasai’s gross margins at 46% via mix/ops efficiencies. Debt reduction (Seshaasai repaid INR300 Cr) aids profitability.

- Diversification: Cross-sell (Paytm’s merchant loans, gold/wealth); verticals like IoT (Seshaasai +31% YoY); consumer plays (RediffPay super app).

Headwinds (Challenges Impeding Growth)

- Moderated Card/Payments Volumes: Seshaasai’s payments down to 50% mix (from 67.5%) due to lower PMJDY issuances (13M vs. 38M projected), inactive accounts (26%), unsecured lending stress (RBI report), and post-COVID renewal normalization.

- Regulatory & Compliance Pressures: Past echoes (Paytm’s BNPL relaunch post-partner shifts); DLG scrutiny (Paytm disclosures); strict NPCI/RBI guidelines limit aggressive scaling.

- Competitive Intensity: UPI saturation (20% system growth); crowded consumer apps (RediffPay vs. Paytm/PhonePe); merchant pricing discipline caps take-rates (Paytm: 8.2 bps).

- Macro/External Factors: Geopolitical tensions (Seshaasai’s Middle East setback); supply chain disruptions; early festive calendar distortions.

- Customer Concentration: Top-10 clients ~63% revenue (Seshaasai); reliance on PSU/private banks.

Growth Prospects (Medium-Term Opportunities: FY26-FY28)

- Payments & Lending Revival: H2 FY26 pickup (seasonal BFSI spends, Seshaasai/Paytm); BNPL/Postpaid scaling (Paytm targeting prior peaks); EMI/credit card mix (Paytm nearing half of leaders).

- AI Monetization: Revenue lines from agents (Infibeam marketplace), soundboxes (Paytm pilots), IoT analytics (Seshaasai RFID/BLE). Potential “commerce cloud” item (Paytm).

- Consumer & Merchant Expansion: Super apps (RediffPay with 100M users); loyalty/gold (Paytm); omni-channel (Paytm). Infibeam targeting $1B ARR.

- IoT & Niche High-Margin Plays: Seshaasai’s RFID growth (renewables/retail); metal/eco-cards/wearables; SIM cards in H2.

- International & Exports: Paytm’s stack replication (partner-operated); Infibeam’s UAE/Saudi/Oman; Seshaasai’s Africa/Nepal RFPs. Double-digit intl revenue (Infibeam in 12-18 months).

- Projections: Companies eye higher FY26 guidance (Infibeam upper-end); Paytm revenue/bottom-line from India expansion + AI; sector run-rate nearing $1B+ for leaders.

| Company | H1 FY26 Revenue Growth | EBITDA Margin | PAT Margin |

|---|---|---|---|

| Paytm | Strong QoQ (implied) | Improving | N/A |

| Infibeam | +93% YoY (Q2 gross) | 61% | 42% |

| Seshaasai | -12% YoY | 25.3% | Stable |

Key Risks (High-Impact Uncertainties)

- Regulatory/Policy Shifts: RBI/NPCI changes (UPI caps, DLG norms); delays in approvals (e.g., PPI final nods).

- Credit & Economic Cycles: Bottom of credit cycle (Paytm PL headwinds); rising NPAs in unsecured lending.

- Execution Risks: New launches (Paytm Postpaid ramp, RediffPay migration); AI pilots scaling; capex absorption (Seshaasai INR200 Cr plan).

- Competition & Market Share: Incumbents (PhonePe, banks) in UPI/wallets; pricing wars eroding margins.

- External Shocks: Geopolitics (tariffs, conflicts); forex/supply chain volatility (chip imports).

- Concentration & Dependency: Few clients (e.g., Paytm’s partners); seasonal/festive reliance.

Summary

Indian Fintech shows resilience amid moderation (e.g., Seshaasai’s H1 dip), buoyed by UPI/AI tailwinds and regulatory enablers. Growth prospects are strong (20-30%+ medium-term via diversification, intl/AI), with leaders like Paytm/Infibeam targeting $1B+ scales and margin >25-60%. Headwinds (volumes, regs) are transient (H2 recovery expected), but risks (credit/regulatory) warrant caution. Sector poised for 25-35% CAGR FY26-28, driven by digital infra, but success hinges on execution and macro stability. Investors should monitor Q3 volumes, AI traction, and intl pilots.

Meeting

asof: 2025-12-02

Analysis of Indian Fintech Sector: Insights from Recent Announcements

The provided documents highlight key developments from major Indian Fintech players—Paytm (One 97 Communications), Infibeam Avenues, Seshaasai Technologies, MobiKwik (One MobiKwik Systems), and Suvidhaa Infoserve—primarily covering Q1/Q2 FY26 financials, restructuring, rights issues, and postal ballots (as of Oct-Nov 2025). These reflect a sector navigating regulatory tightening, operational restructuring, margin pressures, and fraud risks amid India’s booming digital payments ecosystem (UPI volumes >15 Bn/month). Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, followed by an overall summary.

Headwinds (Challenges)

- Regulatory Compliance Burden: Paytm’s 100% shareholder-approved transfer of Offline Merchants Payment Business (₹486 Cr votes polled, 76% turnout) to subsidiary PPSL signals ongoing RBI-mandated restructuring post-PPI license curbs. MobiKwik’s waiver agreements with lending partners comply with RBI digital lending guidelines, netting off ₹664 Cr in revenues/expenses.

- Revenue Declines & Soft Demand: Seshaasai Q1FY26 revenue fell 14% YoY to ₹3,109 Cr (Payments 48%, Comm. 43%, IoT 9%); MobiKwik H1 revenue down 15% YoY to ₹5,416 Cr amid recalibrating bank/fintech issuance; Suvidhaa negligible revenue (₹4.9 Cr H1).

- Persistent Losses & Cash Burn: MobiKwik H1 loss ₹705 Cr (EBITDA -₹376 Cr); Suvidhaa H1 loss ₹19 Cr; high payment processing (51% of MobiKwik expenses) and lending ops drag profitability.

- Fraud & Operational Glitches: MobiKwik’s ₹118 Cr exceptional loss from merchant bug exploitation (partial recovery ₹219 Cr secured); highlights vulnerability in high-volume transactions.

- Capital Calls & Dilution: Infibeam’s final ₹5 call on 70 Cr partly-paid shares (₹350 Cr inflow) suspends trading, pressuring retail holders.

Tailwinds (Positive Factors)

- Restructuring for Efficiency: Paytm’s seamless business hive-off (100% favour, 0% against) to PPSL positions it for focused growth/compliance; MobiKwik IPO proceeds (₹5,305 Cr net) funding payments/financial services (58% utilized H1).

- Margin Resilience: Seshaasai EBITDA margin expanded 100 bps YoY to 23.7% (gross margin 44.5%); PAT margin +50 bps to 11.7% via cost efficiencies (>95% repeat revenue).

- Capital Infusion: Infibeam’s rights call strengthens balance sheet for scaling; MobiKwik’s subsidiaries (e.g., Zaakpay, lending arms) bolster diversification.

- Segment Momentum: Seshaasai IoT up 42% YoY (₹48 Cr); Payments stable at ~50% mix across players; UPI ecosystem tailwind (RBI’s TPAP push).

Growth Prospects

- Digital Payments Expansion: India’s UPI-led fintech market (projected $1 Tn by 2030) favors scaled players; Paytm/PPSl offline merchants transfer unlocks synergies; MobiKwik targeting organic growth in payments (₹1,350 Cr IPO allocation) and AI/ML R&D.

- Diversification Plays: Seshaasai’s IoT/RFID push (from 6% to 9% revenue); Infibeam/BillAvenue enterprise focus; MobiKwik’s broking/lending subs (7 entities) for cross-sell.

- Post-IPO Momentum: MobiKwik/Seshaasai leverage fresh capital for acquisitions/international (Seshaasai) and wallet share gains (top-10 clients 69% for Seshaasai).

- Margin Tailwinds: Operational discipline (Seshaasai CFO note) + regulatory clarity could drive EBITDA >20-25%; H1 FY26 sets base for festive Q3 ramp-up.

Key Risks

| Risk Category | Details | Impacted Players |

|---|---|---|

| Regulatory | RBI scrutiny on lending/PPI (e.g., waivers, licenses); potential fee caps. | All (Paytm, MobiKwik) |

| Cyber/Fraud | App bugs/merchant collusion (₹404 Cr MobiKwik hit); unsecured ₹118 Cr exposure. | MobiKwik, Payments-heavy |

| Customer Concentration | Top-10 = 69% revenue (Seshaasai); promoter/public voting skew (Paytm public 99.98% favour). | Seshaasai, Paytm |

| Liquidity/Execution | Partly-paid calls suspend trading (Infibeam); IPO unutilized ₹2,551 Cr (MobiKwik) if growth delays. | Infibeam, MobiKwik |

| Macro/Competition | Bank recalibration, global dynamics soften issuance (Seshaasai); UPI dominance squeezes margins. | All |

| Financial | Negative EBITDA (MobiKwik -₹376 Cr H1); high finance costs (5-7% expenses). | MobiKwik, Suvidhaa |

Mitigants: Strong cash piles (MobiKwik ₹1,372 Cr + ₹7,213 Cr nodal); auditor clean reviews; diversified subs.

Overall Summary

Bullish Long-Term, Cautious Short-Term: Indian Fintech (₹20 Tn+ digital payments opportunity) shows resilience via restructuring (Paytm) and efficiency (Seshaasai margins), but H1 FY26 underscores headwinds like regulation (RBI-driven), fraud (MobiKwik), and tepid revenue (declines 10-15%). Tailwinds from UPI scale and IPO capital position leaders for 20-30% CAGR; growth in IoT/lending diversification. Risks tilt towards execution/regulatory, with MobiKwik/Suvidhaa vulnerable (watch fraud recovery). Sector PE compression likely; favor margin-stable players like Seshaasai (11.7% PAT). Recommendation: Accumulate on dips for 12-18 month horizon, monitor RBI circulars/Q3 festive data. Total polled market cap implied ~₹1-2 Lakh Cr across peers.

Press Release

asof: 2025-11-30

Summary Analysis of Indian Fintech Sector (Based on Provided Documents)

The documents highlight recent developments from key players—Paytm, Infibeam Avenues (via Phronetic AI), Seshaasai Technologies, and MobiKwik—focusing on AI integration in payments, agentic platforms, financial results, and Forex innovations. These reflect a maturing Indian fintech ecosystem leveraging AI, partnerships, and regulatory enablers like UPI, NBBL, and RBI frameworks. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Momentum Drivers)

- AI and Tech Advancements: Strong push into real-time AI (Paytm-Groq LPU for inference in fraud detection, risk modeling; Phronetic AI’s PayCentral.ai for agentic A2A payments via Google’s AP2). Enables faster, cheaper, scalable intelligence vs. GPU alternatives, boosting efficiency in payments (51% of Seshaasai’s revenue).

- Regulatory and Infrastructure Support: RBI/NBBL-enabled innovations like instant Forex (MobiKwik as one of first 3 apps), Bharat Connect for transparent FX, and MCP integrations. Aligns with Digital India/UPI success (e.g., Seshaasai’s NPCI/PCI compliance).

- Financial Strength and Capital Access: Seshaasai’s Q2FY26 results show 13.3% QoQ revenue growth (₹3,523 Cr), 26.9% EBITDA margin, PAT up 56% QoQ; post-IPO debt repayment (₹3,000 Cr from proceeds). Broadens wallet share via payments, IoT (up to 10.8% revenue).

- Partnership Ecosystem: Collaborations with Groq, Google, CCAvenue, banks (SBI, ICICI for Forex), enhancing interoperability and reach (e.g., Phronetic’s aggregator-first architecture for MSMEs).

- Market Demand: MSME/enterprise focus (Paytm’s full-stack payments; Seshaasai’s BFSI dominance), with rising AI-native commerce, micropayments, and global expansion.

Headwinds (Challenges Impeding Progress)

- Intense Competition: Overlap in payments/AI (Paytm vs. MobiKwik vs. Infibeam; Seshaasai’s top-10 clients = 63.5% revenue concentration risks client churn).

- High Execution Costs: Capex-heavy (Seshaasai’s ₹572 Cr PPE purchases; Paytm’s high-performance AI models). Gross margins improved (Seshaasai: 45.9%) but vulnerable to input costs.

- Regulatory/Compliance Hurdles: Sovereign data needs (Phronetic’s geo-fencing), RBI approvals for Forex/AI agents, and SEBI disclosures add friction. Forex limited to USD initially.

- Sequential Slowdown: Seshaasai H1FY26 revenue down YoY (₹6,632 Cr vs. prior ₹7,558 Cr), signaling potential demand softness in core payments amid economic caution.

- Tech Dependency: Reliance on external tech (Groq LPU, Google’s AP2) could raise costs if alternatives underperform.

Growth Prospects (Opportunities Ahead)

- AI-Led Disruption: Agentic payments (PayCentral.ai for autonomous refunds/subscriptions) and real-time inference could unlock A2A commerce, personalization, and IoT (Seshaasai’s BLE/RFID growth). Potential for ₹8.67 Tn transaction scale (Infibeam FY25 benchmark).

- Forex and Cross-Border Expansion: MobiKwik’s T+0 USD top-ups via UPI/net banking; multi-currency rollout could tap ₹100 Bn+ remittance market, aiding students/travel/SMEs.

- Vertical Diversification: Payments + IoT/comms (Seshaasai: 37.8% comms, 10.8% IoT); Phronetic’s AOS for auditable AI commerce at national scale.

- Post-IPO Scaling: ₹6,000 Cr+ proceeds (Seshaasai/Infibeam) for capex (manufacturing expansion), debt reduction, acquisitions (e.g., Atoll Solutions, Alomind Labs for IoT/connected tech).

- Inclusive Ecosystem: Serving 500 Mn Indians (Paytm mission); 10 Mn+ clients (Infibeam), with AI making fintech accessible for MSMEs/retail.

Key Risks (Critical Vulnerabilities)

- Cyber/Fraud Risks: AI enhancements target fraud, but new agentic systems vulnerable to exploits (e.g., un-audited AI transactions).

- Regulatory/Policy Shifts: RBI scrutiny on Forex, data localization, or PPI wallets (MobiKwik’s 19% share); non-compliance logs could halt growth.

- Economic/Market Risks: YoY revenue dips (Seshaasai), currency fluctuations, or slowdown in BFSI/MSME spending; commodity/input volatility.

- Operational/Execution Risks: Integration failures (GroqCloud, MCPs); subsidiary performance (Seshaasai’s Rite Infotech/Atoll losses); high working capital needs (inventories up 26%).

- Financial Leverage: Remaining borrowings (Seshaasai: ₹3,170 Cr current); IPO unutilized proceeds (₹5,300 Cr) pressure for ROI amid capex.

- Forward-Looking Uncertainties: Projections based on assumptions (e.g., Seshaasai disclaimer on economic/political risks); unaudited prior periods add opacity.

Overall Outlook: Indian fintech is buoyed by AI tailwinds and regulatory green lights, with strong Q2FY26 momentum (e.g., Seshaasai’s profitability surge). Growth prospects in agentic/AI payments and Forex are high (projected 20-30% CAGR in niche segments), but competition and execution risks demand differentiation. Sector poised for consolidation via partnerships, with balanced risk mitigation via compliance and debt deleveraging. Investors should monitor Q3 results for sustained margins.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.