PHOENIXLTD

Equity Metrics

January 13, 2026

The Phoenix Mills Limited

Residential Commercial Projects

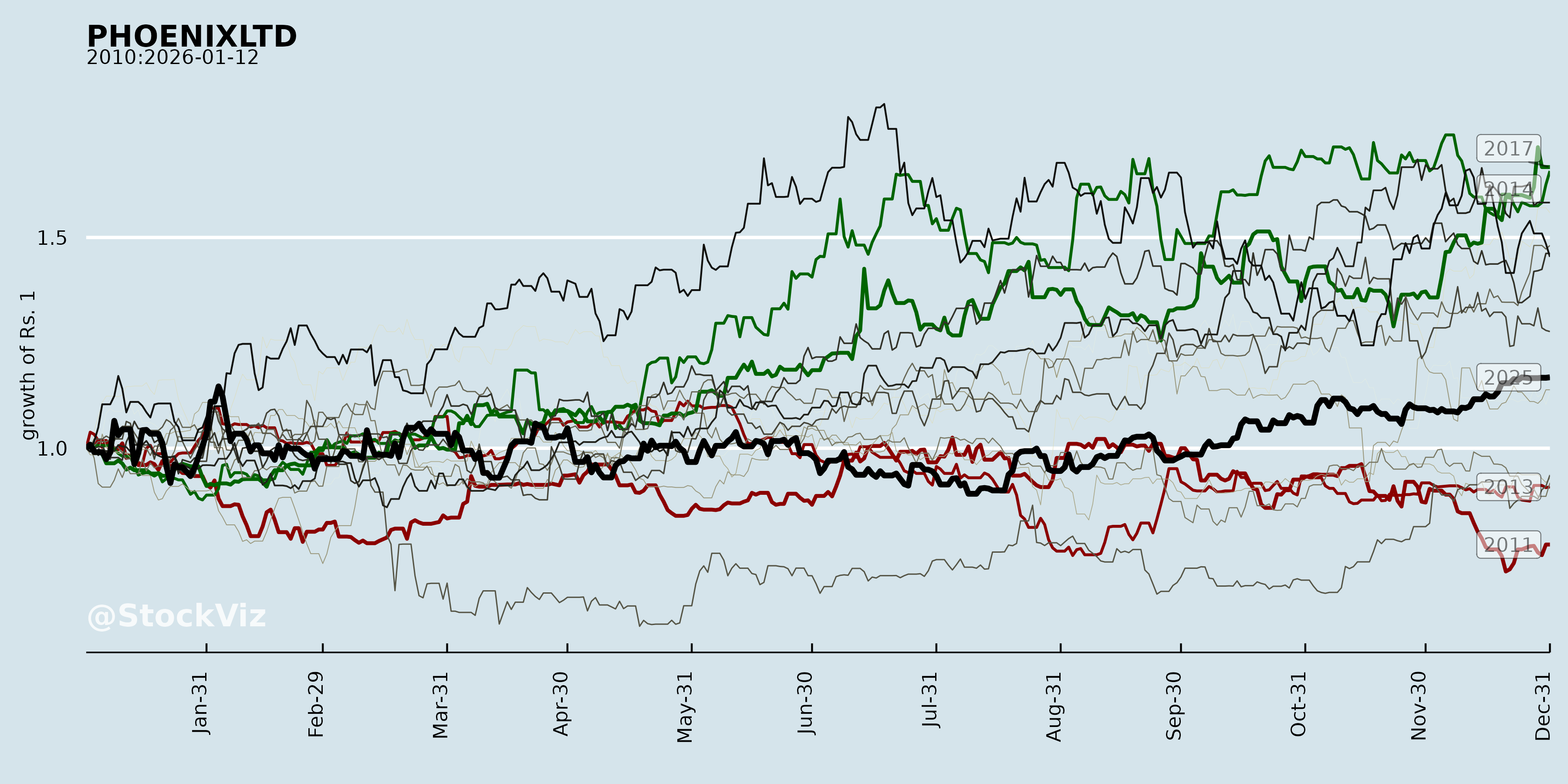

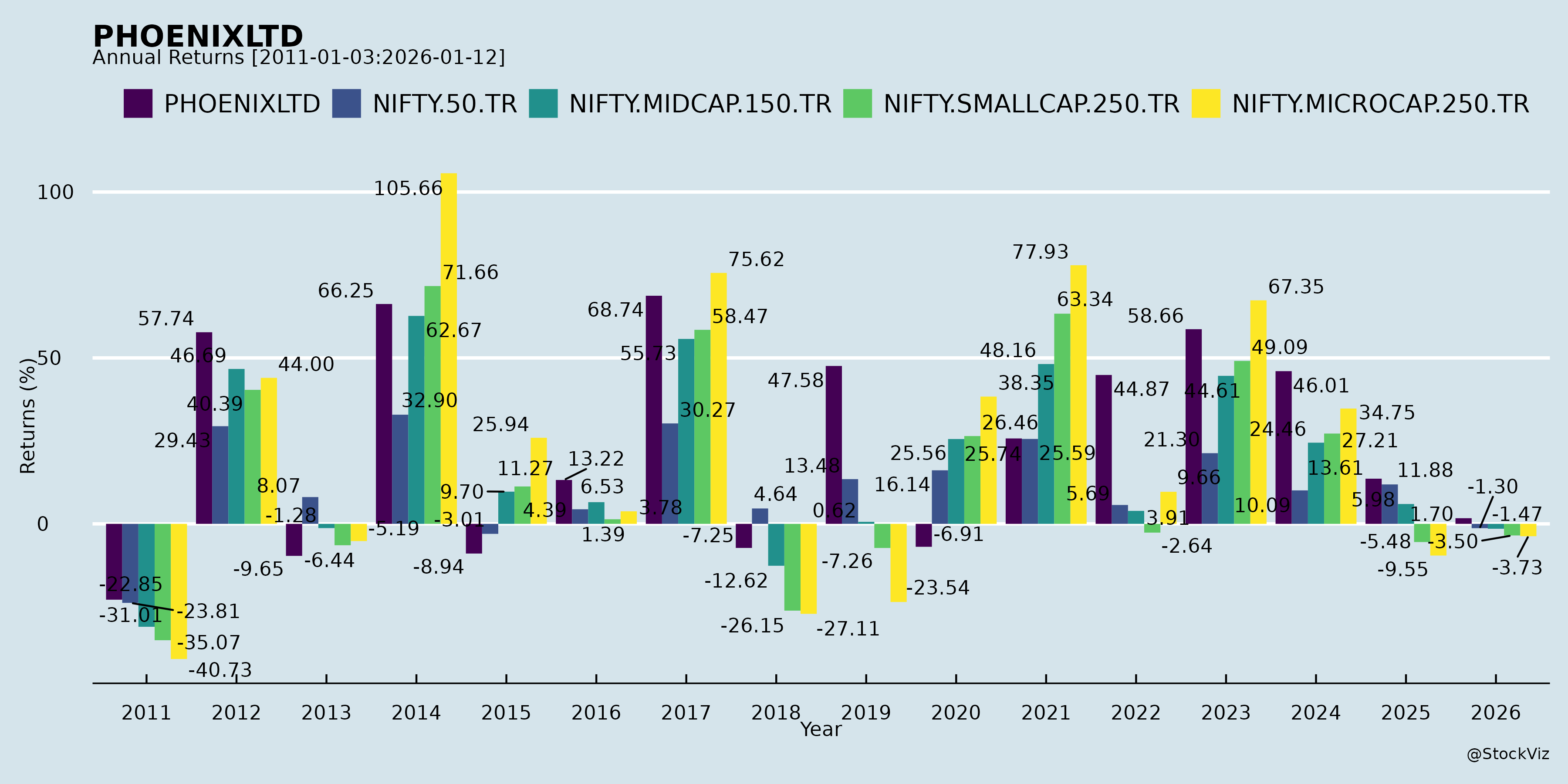

Annual Returns

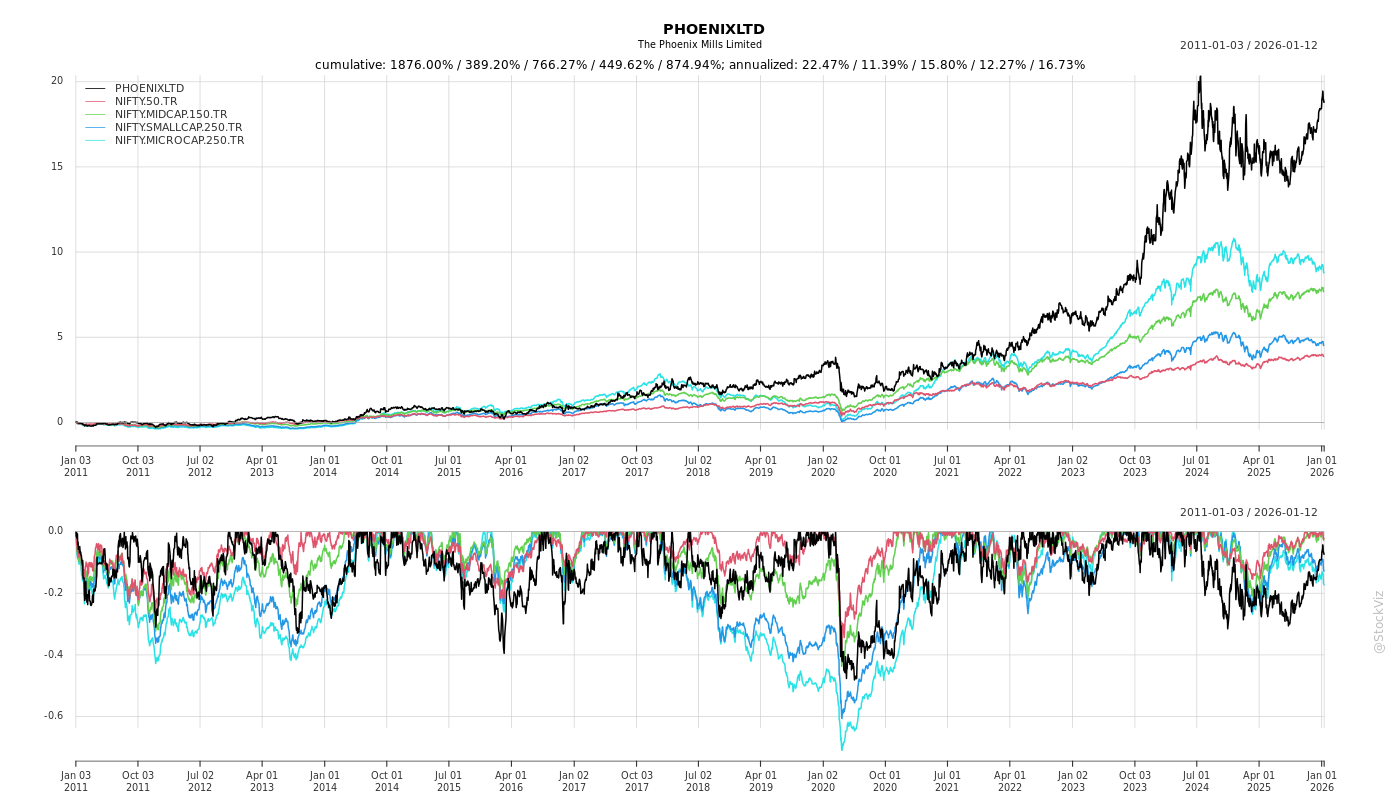

Cumulative Returns and Drawdowns

Fundamentals

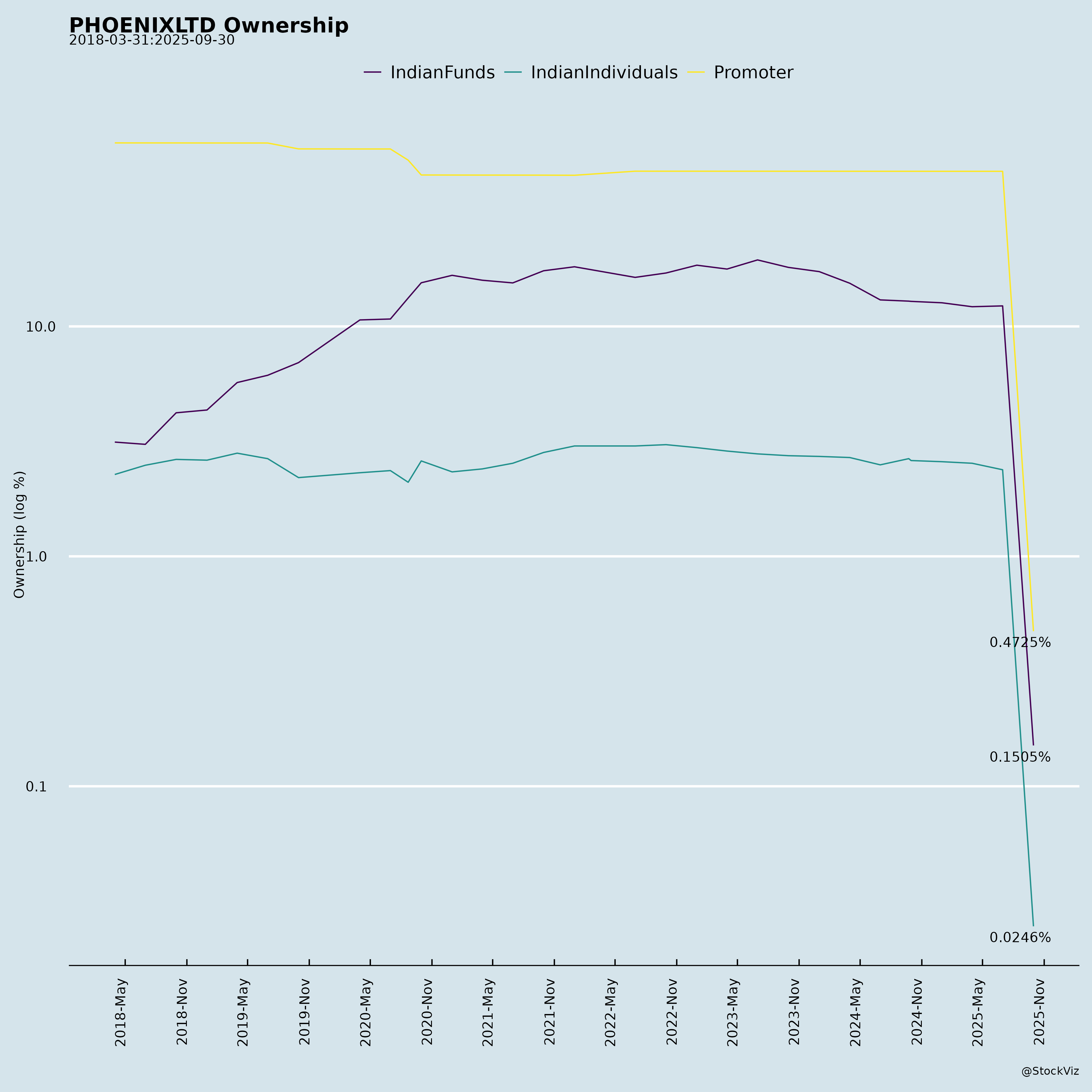

Ownership

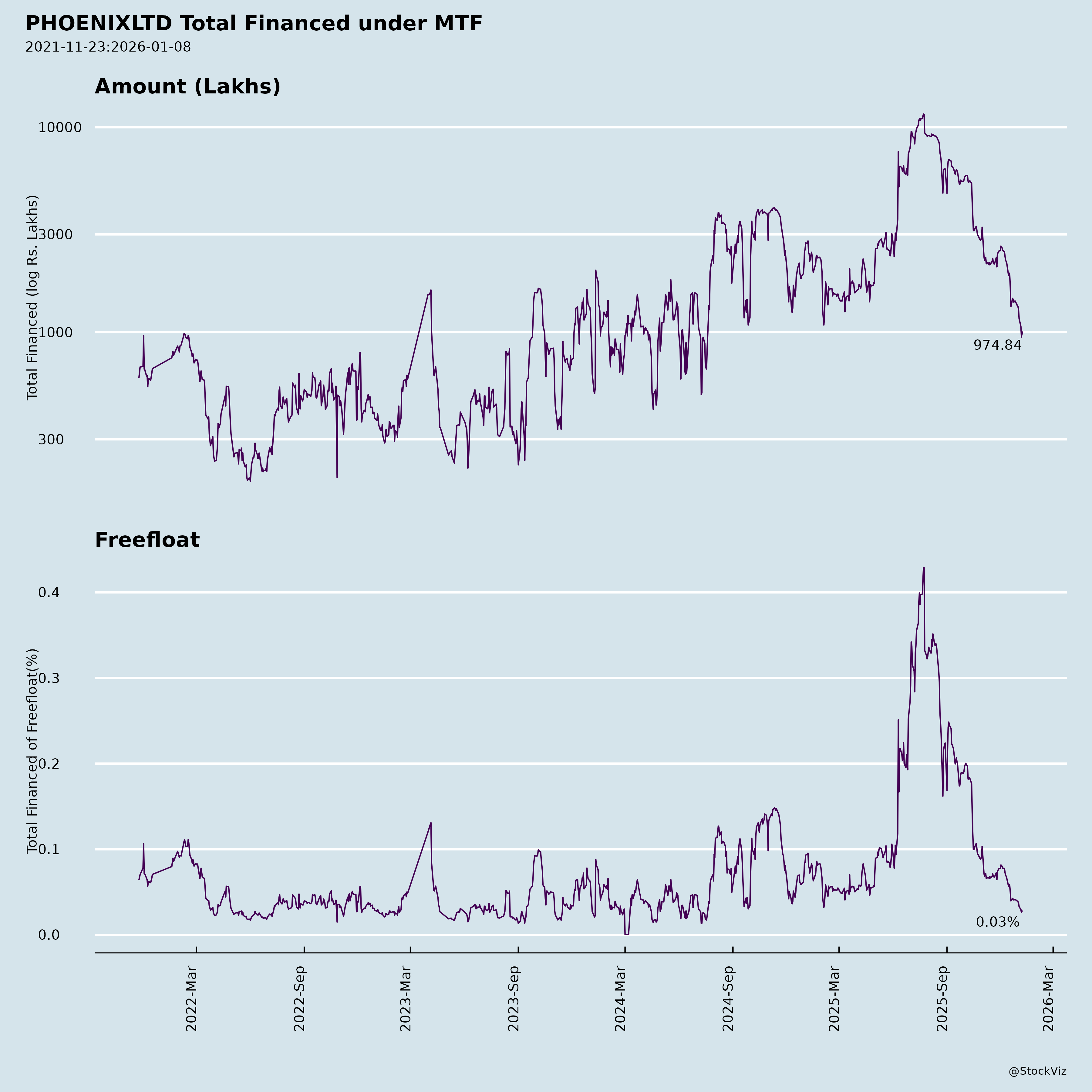

Margined

AI Summary

asof: 2025-12-03

Analysis of The Phoenix Mills Limited (PHOENIXLTD)

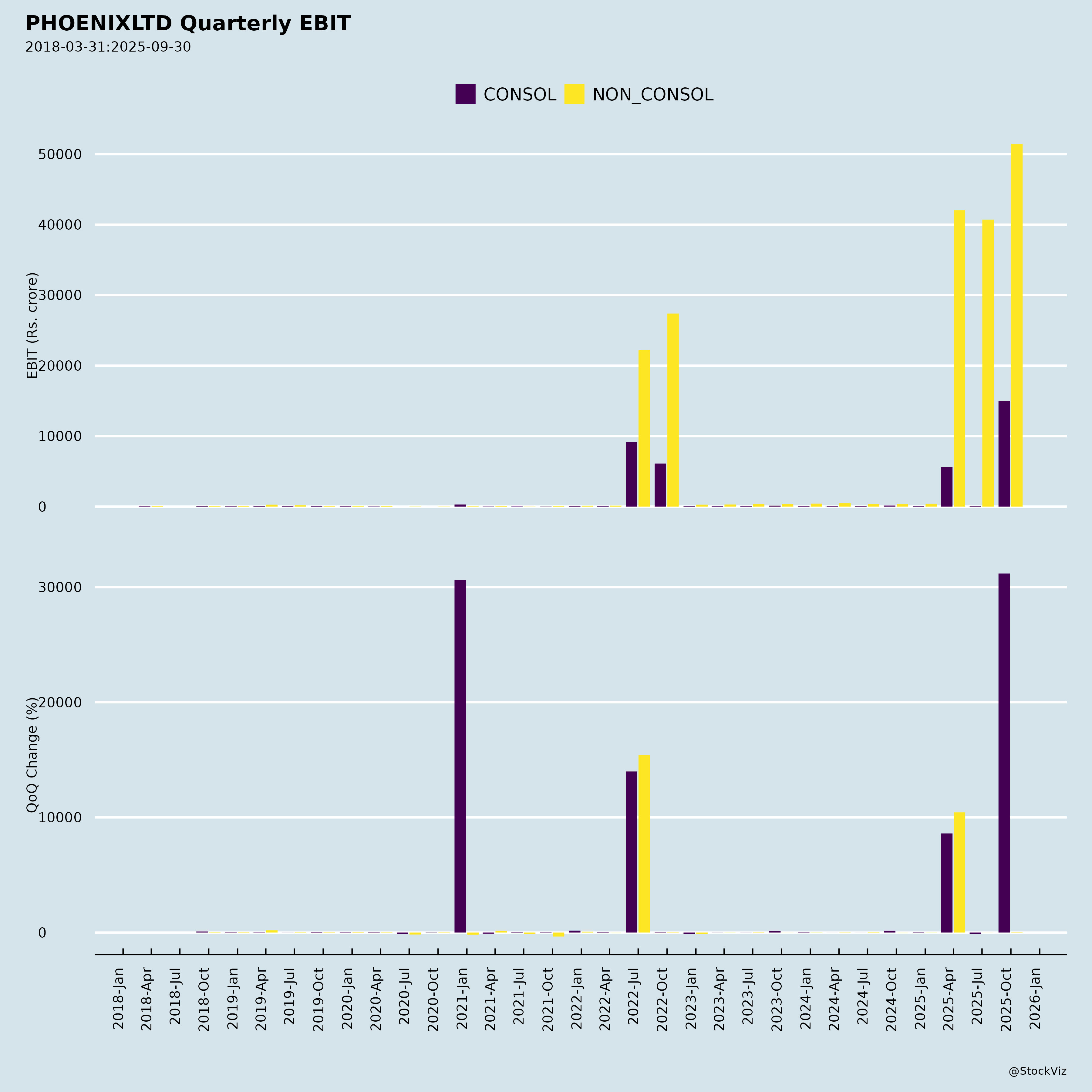

The Phoenix Mills Limited (PML) is India’s leading retail-led mixed-use developer, with a portfolio spanning malls (11+ msft operational GLA), offices (~4.8 msft completed), hospitality (588 keys operational), and residential developments. FY26 H1 results (ended Sep 2025) show robust performance amid strategic repositioning and macro headwinds like monsoons. Consolidated revenue grew 14% YoY to ₹2,068 Cr, EBITDA +17% to ₹1,231 Cr (60% margin), driven by core businesses (retail/offices/hotels). Net profit +16% to ₹545 Cr (post-minority). Balance sheet strengthened: net debt/EBITDA at 0.9x (down from 1.2x), liquidity at ₹2,481 Cr. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks based on the provided documents.

Tailwinds (Positive Catalysts)

- Retail Resilience: H1 FY26 consumption +13% YoY (₹7,335 Cr), Q2 +14% despite monsoons. Led by Phoenix Palladium Mumbai (+10%), Citadel Indore (+68%), and new malls (Palladium Ahmedabad +24%, Mall of Asia Bengaluru +68%). Adjusted growth 19-20% ex-strategic churn. Trading densities up double-digits in repositioning malls (e.g., PMC Bangalore +21%). Rental income +7-10% YoY.

- Offices Momentum: Gross leasing ~9.43 lakh sq ft (Apr-Oct 2025), occupancy +10 pps to 77% in operational assets. Recent completions (One National Park Chennai, Millennium Towers Pune, Phoenix Asia Towers Bengaluru with LEED Platinum).

- Residential Surge: H1 sales ₹287 Cr (+268% YoY, surpassing FY25 full-year), collections ₹214 Cr (+71%). Avg. realization ~₹28K psf. Strong premium demand in Bengaluru/Chennai.

- Hospitality Stability: St. Regis Mumbai RevPAR +2-7% YoY (occupancy 84-85%). Courtyard Agra steady H1.

- Financial Strength: Op. FCF +21% H1 to ₹981 Cr. Cost of debt down to 7.68%. CPPI transaction advancing (Tranche 1 payment Nov 2025). Leadership continuity via Shishir Shrivastava’s elevation to Non-Exec Vice Chairman.

- Macro Support: Discretionary spend recovery (fashion/electronics +17-23%), urban consumption trends favoring premium mixed-use assets.

Headwinds (Challenges)

- Retail Repositioning Drag: PMC Bangalore/Pune/Chennai saw flat/lower consumption (-1% to flat Q2) due to strategic churn (3% impact); trading occupancy down 5-15 pps (82-88%). Sequential Q2 strength but heavy monsoons in key cities.

- Hospitality Softness: Q2 St. Regis flat YoY (no one-offs, muted travel); Courtyard Agra RevPAR -14% Q2 (occupancy -7 pps).

- Macro Pressures: Monsoons, potential consumption slowdown in non-metro malls (e.g., United Bareilly/Lucknow lower growth).

- Elevated Costs: Finance costs -9% H1 but still ₹187 Cr; depreciation +19% due to accelerated charges on investment properties.

- Leadership Transition: Shishir Shrivastava steps down as MD (ceased KMP Sep 30, 2025), though redesignation to Vice Chairman ensures continuity (pending shareholder vote).

Growth Prospects

- Retail Expansion: ~7 msft new/expansion pipeline (e.g., Grand Victoria, Surat). Post-repositioning occupancy ramp-up (target 95%+) to drive rentals. H1 rental +7%, EBITDA +7-8%.

- Offices Scale-Up: ~2 msft under planning; recent certifications enhance premium appeal. Leasing momentum into Oct 2025.

- Hospitality Pipeline: Grand Hyatt Bengaluru (~400 keys) constructing; ~700 keys soon, ~500 under planning.

- Residential Upside: ~1 msft Kolkata project executing; ~2.5 msft pipeline in metros.

- Mixed-Use Synergies: Integrated ecosystems (retail+office+hotel+residential) driving footfalls/densities. Asset mgmt. growth.

- Strategic Deals: CPPI acquisition progressing (approvals secured). FY26 guidance intact: core revenue/EBITDA +6%/5% H1, full-year potential higher on pipeline execution.

- Long-Term: Pan-India footprint (8 cities operational), sustainability focus, partnerships (e.g., J.P. Morgan forums). 5-yr commission approval for non-exec directors to attract talent.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Execution/Development | Delays in ~7 msft retail, offices/hotels pipeline; capex heavy (H1 investing outflow ₹1,207 Cr). | Strong track record; liquidity buffer ₹2,481 Cr; low net debt (0.9x EBITDA). |

| Market/Cyclical | Retail competition, consumption slowdown (e.g., hypermarkets -16% Q2); office oversupply; residential demand volatility. | Premium positioning, diversified portfolio (retail 55% revenue); adjusted consumption +19%. |

| Financial | Debt ₹4,684 Cr (up slightly); interest rate sensitivity (though cost down to 7.68%). | Op. FCF covers debt service; net debt reduction trajectory. |

| Regulatory/External | CPPI deal conditions precedent; land approvals; monsoons/tax changes. | Approvals progressing (CCI/shareholders done); diversified geographies. |

| Governance/Transition | Leadership change (Shishir redesignation pending postal ballot Dec 2025); non-exec remuneration cap at 1% net profit. | Experienced team; board continuity; strong governance (independent directors). |

| Operational | Repositioning occupancy ramp-up; hospitality travel demand. | Trading densities up; resilient St. Regis (85% occupancy). |

Overall Outlook: Strong tailwinds from operational momentum and pipeline outweigh headwinds. FY26 growth likely 15-20%+ revenue/EBITDA on execution, with residential as wildcard upside. Risks manageable via balance sheet strength and premium branding. Positive for investors; monitor CPPI closure and Q3 consumption.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.