ONGC

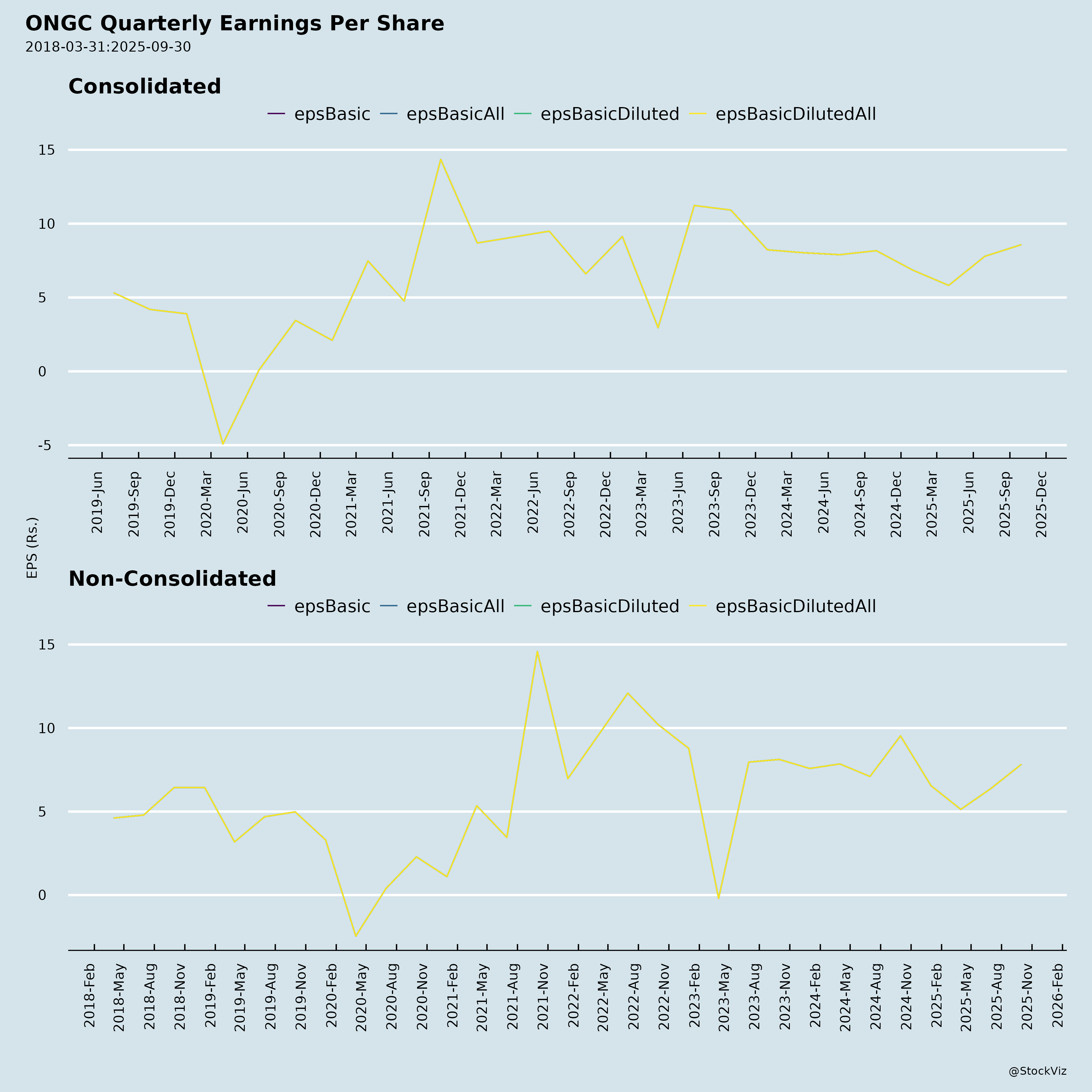

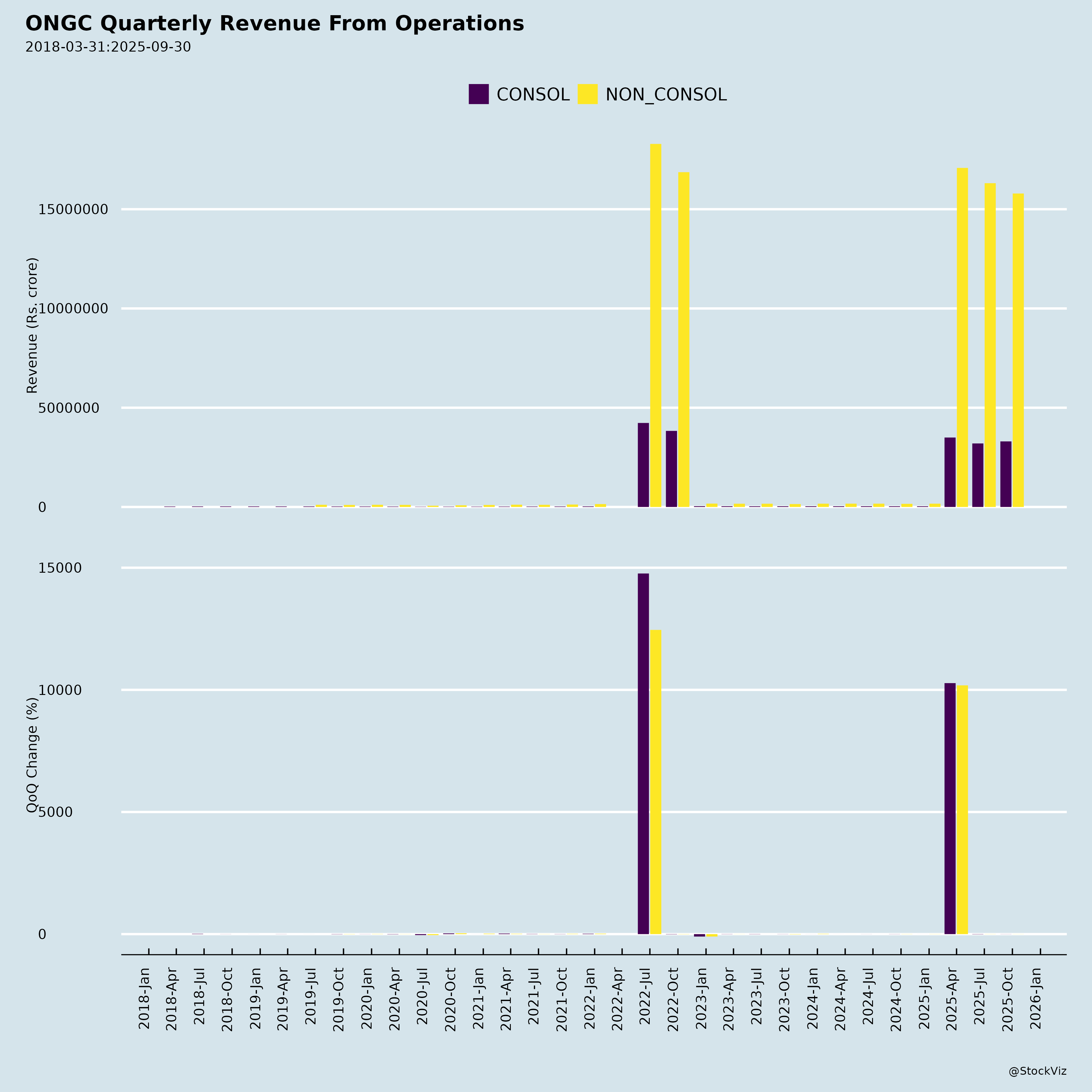

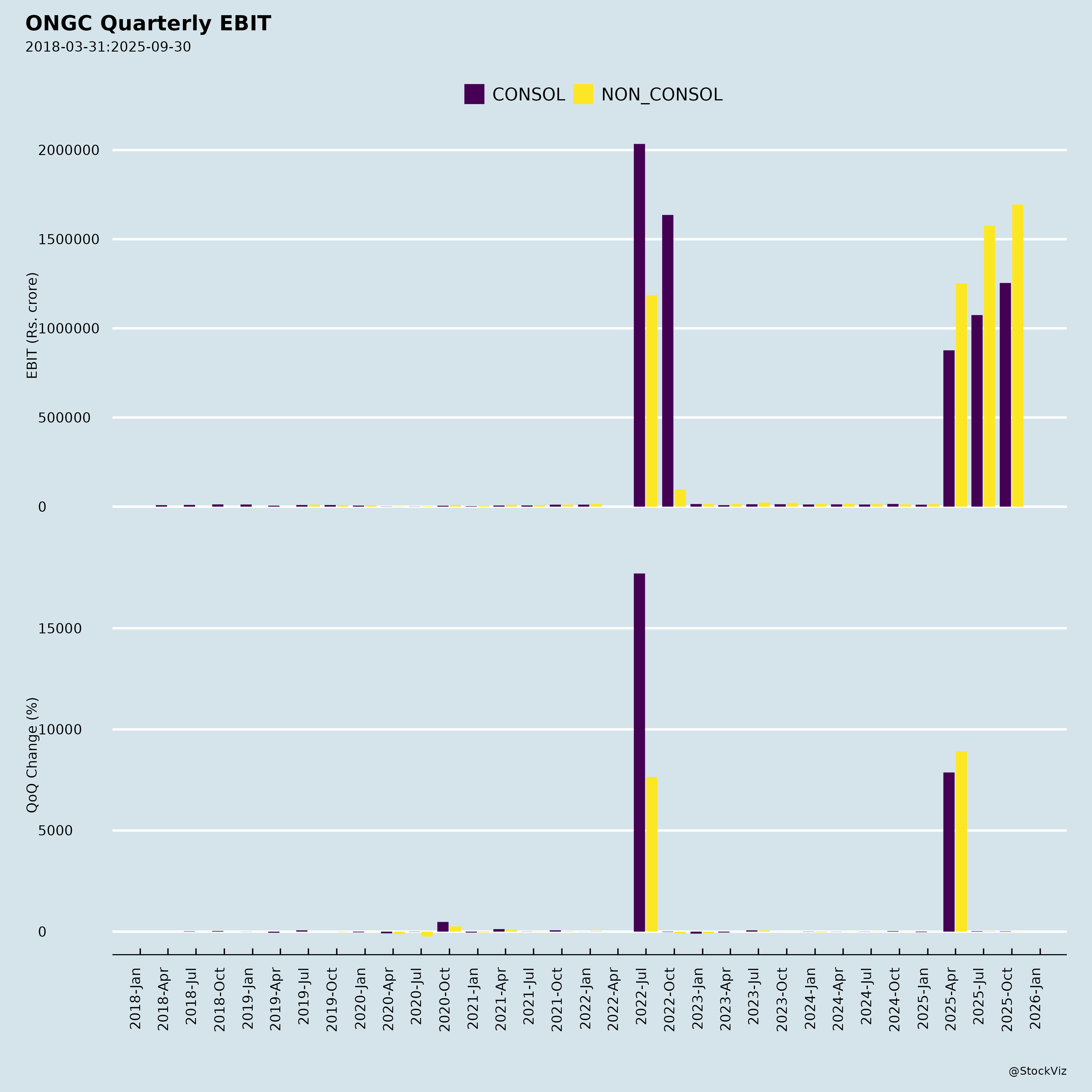

Equity Metrics

January 13, 2026

Oil & Natural Gas Corporation Limited

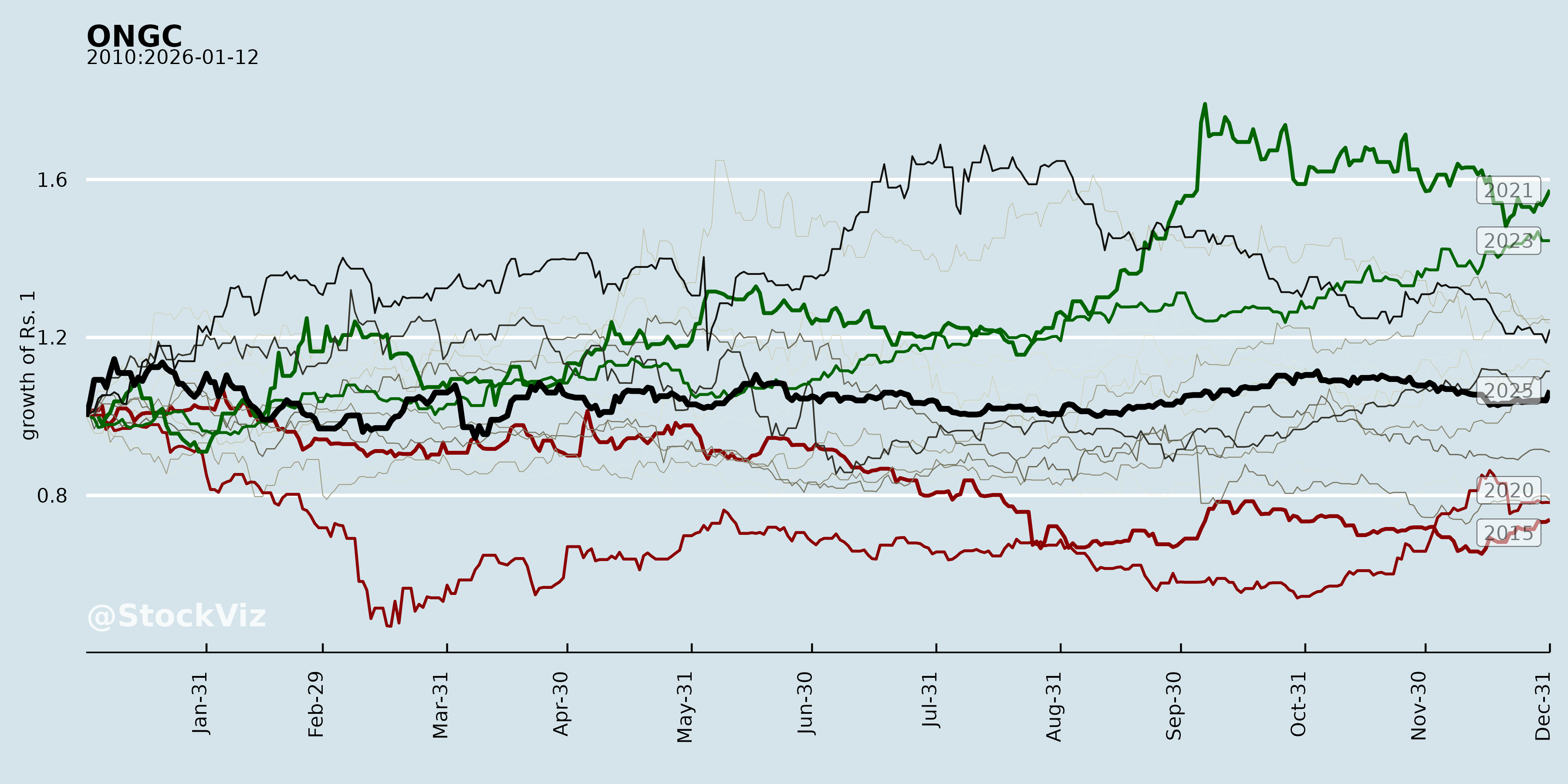

Annual Returns

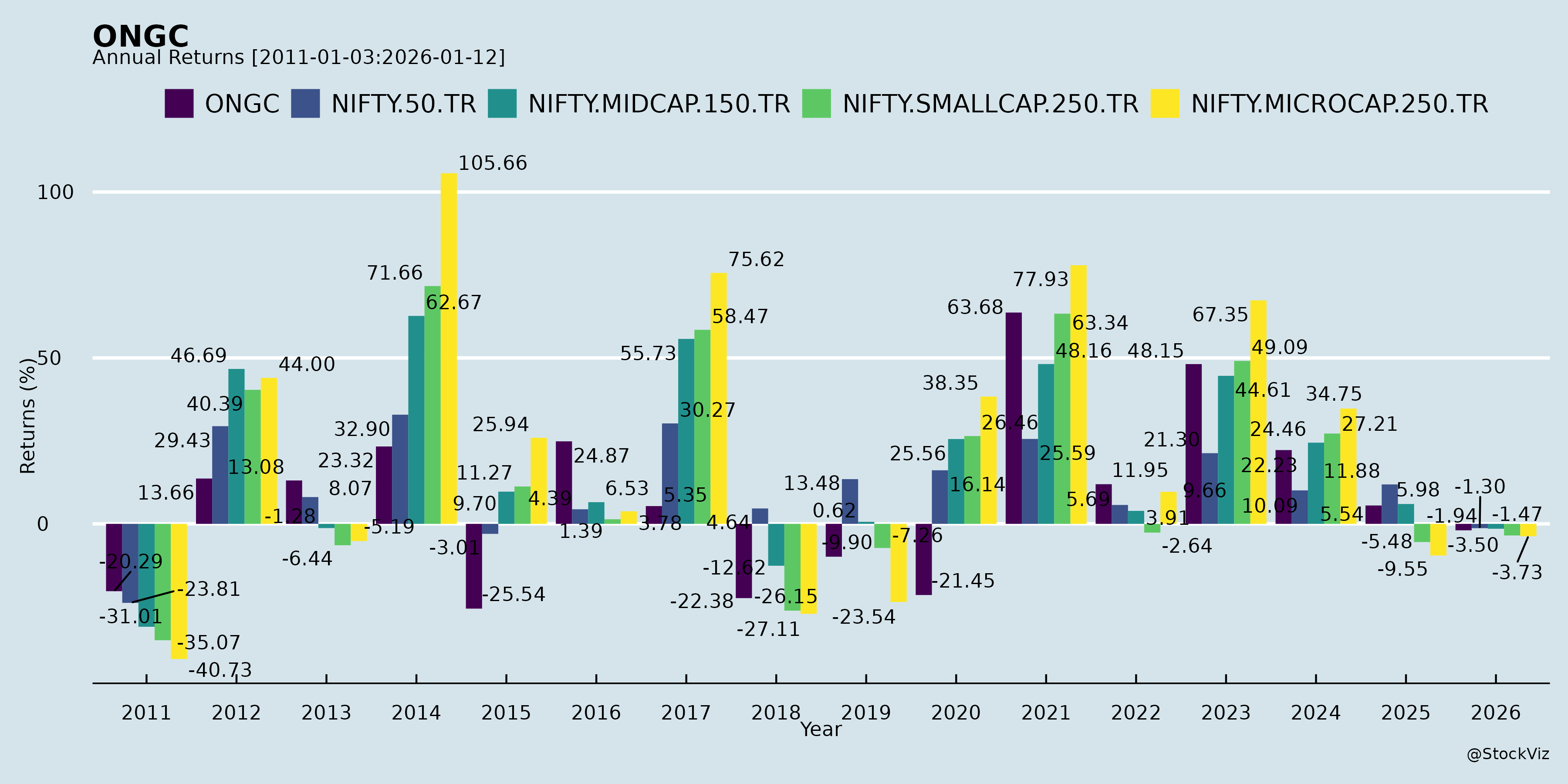

Cumulative Returns and Drawdowns

Fundamentals

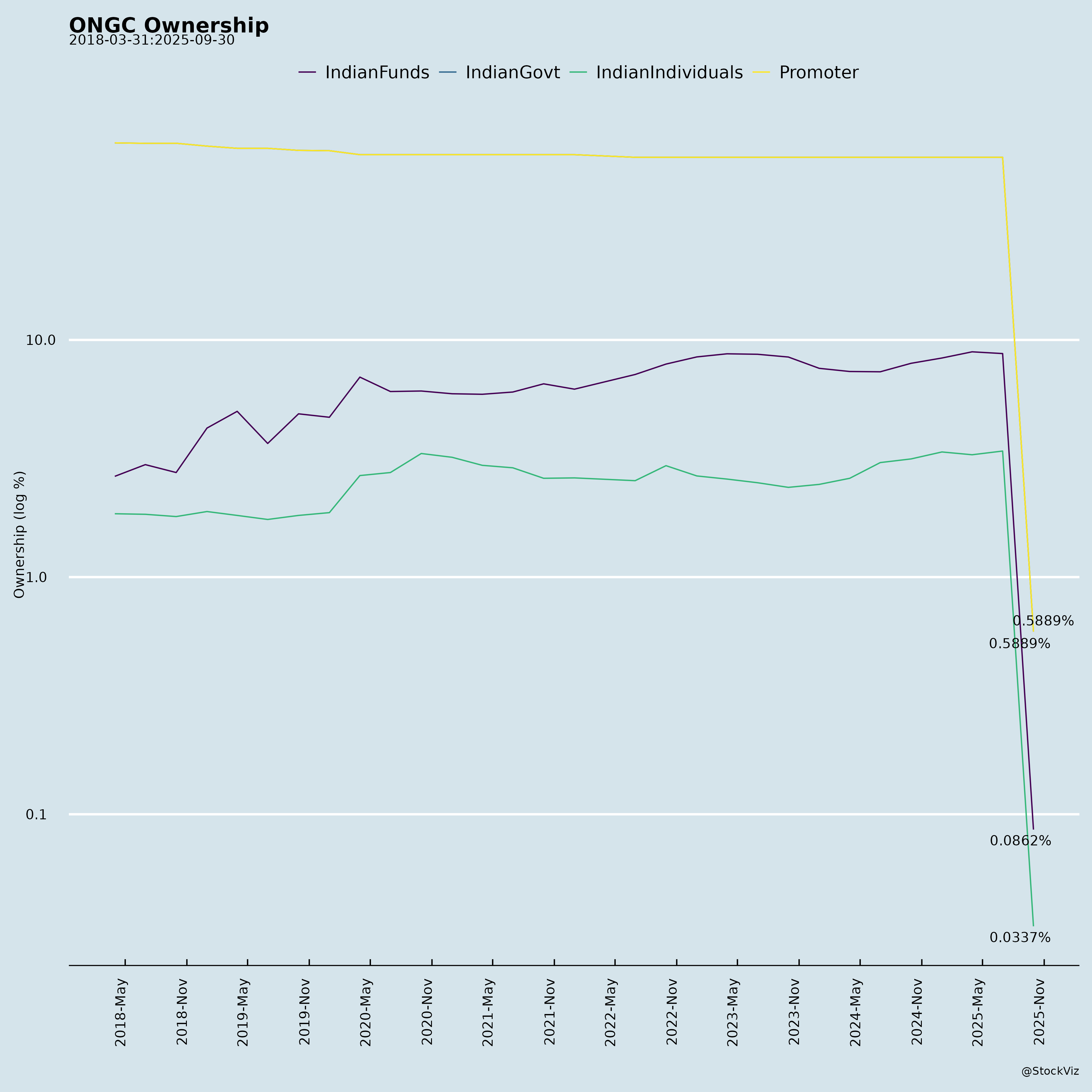

Ownership

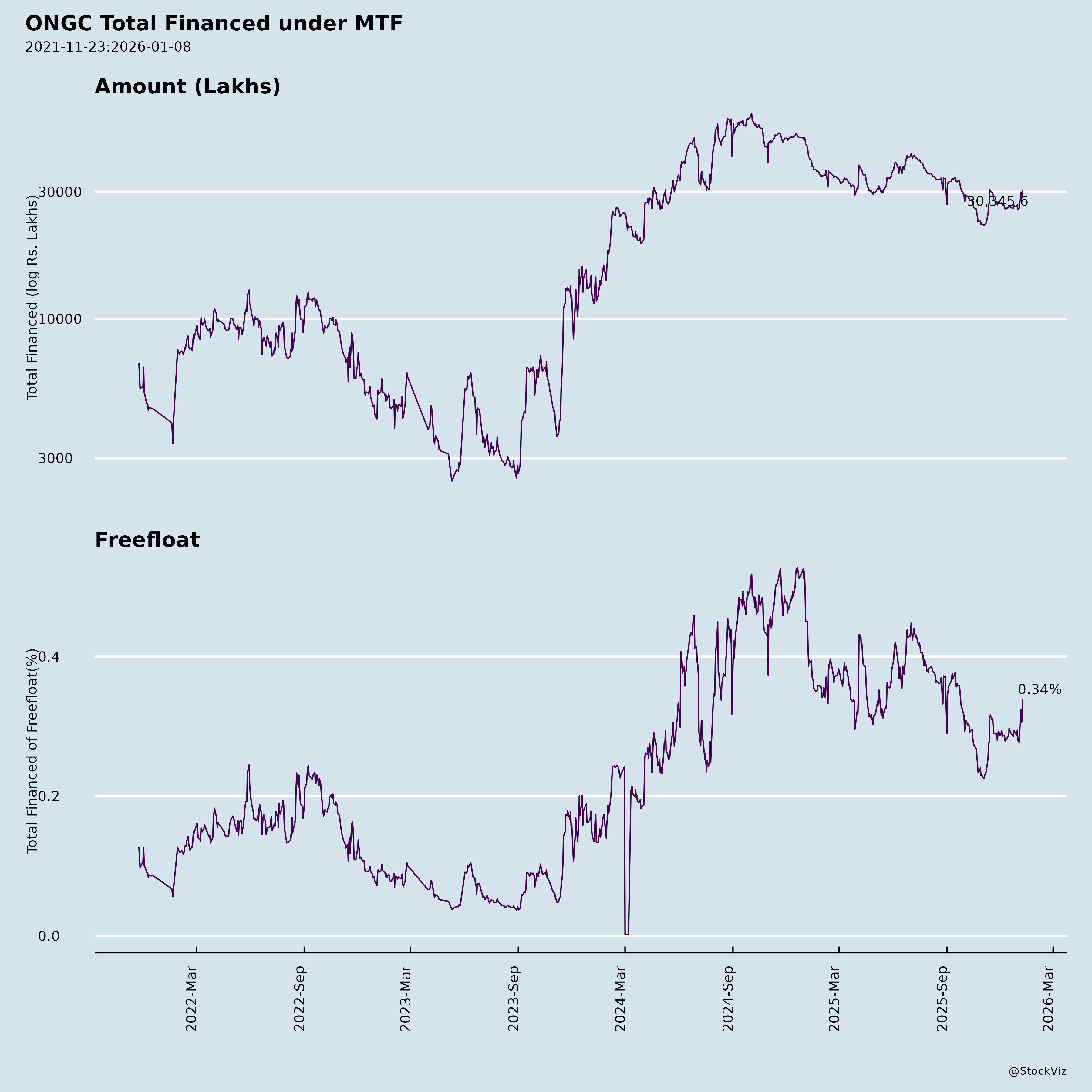

Margined

AI Summary

asof: 2025-12-03

ONGC Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview: Oil and Natural Gas Corporation Limited (ONGC), India’s largest upstream oil & gas player, reported unaudited Q2/H1 FY26 results (ended Sep 30, 2025) on Nov 10, 2025. Standalone revenue declined YoY to ₹65,033 Cr (H1) with PAT at ₹17,872 Cr; consolidated revenue at ₹321,019 Cr with PAT ₹24,169 Cr (up YoY post-restatements). Balance sheet remains robust (standalone net worth ₹336,120 Cr; consolidated ₹401,819 Cr). Board approved ₹6/share interim dividend (₹7,548 Cr payout, 120% on FV ₹5), green energy investment (₹422 Cr in ONGC Green Ltd.), and JVs with Mitsui O.S.K. Lines (USD 49 Mn for ethane carriers). Key positives include Mozambique LNG Force Majeure lift; challenges from tax disputes and contingencies.

Tailwinds (Positive Catalysts)

- Financial Strength & Shareholder Returns: PAT margins healthy (standalone 27.5%; consolidated 7.5%). Debt-equity low (0.02 standalone; 0.36 consolidated). Record Date Nov 14 for dividend signals confidence; attractive yield (~4-5% annualized at current prices).

- Strategic Diversification: ₹422 Cr infusion into ONGC Green Ltd. for renewables (via JV with NTPC); in-principle nod for 50:50 JVs with Mitsui for VLEC ethane transport (aligns with “Maritime Amrit Kaal Vision 2047”).

- Operational Wins: End of Force Majeure (Nov 12, 2025) in Mozambique Area 1 LNG (16% PI via OVL) enables construction restart (13 MMTPA capacity; prod. eyed 2028). Security improved in Cabo Delgado.

- Asset Base: Offshore/onshore E&P stable (H1 revenue ₹45K Cr offshore); strong reserves, site restoration funds (₹30K Cr).

- Leadership Stability: New CS Shashi Bhushan Singh appointed (25+ yrs exp.); minor superannuation.

Headwinds (Challenges)

- Revenue Pressure: H1 standalone revenue -6% YoY (₹65K Cr vs. ₹69K Cr); consolidated -2% (₹321K Cr). Driven by lower realizations, higher statutory levies (₹39K Cr consolidated), exploration write-offs (₹2.9K Cr).

- Cost Inflation: Employee costs, finance costs (₹6.8K Cr cons.), DDA&I (₹18.7K Cr) up; refining/marketing margins squeezed.

- Minor Regulatory Hit: Vijayawada GST order (Oct 6, 2025): ₹60L SAED demand + penalty on Rajahmundry (exemption denied for PEC qty.); appeal planned, “not significant.”

- Restatements: Prior periods adjusted for OVL (Sakhalin-1, Myanmar CWIP, crude trading); minor EPS dilution.

Growth Prospects

| Opportunity | Details | Potential Impact |

|---|---|---|

| Domestic E&P | Offshore (44% H1 rev.) + onshore; capex on wells/CWIP (₹50K+ Cr). | Steady 2-3% prod. growth; nominated/HELP blocks. |

| International (OVL) | Mozambique LNG restart (16% PI); Vankorneft/Imperial Energy ops stable. | LNG ramp-up post-2028; Russia assets resilient despite sanctions. |

| Diversification | Renewables (Ayana via ONGC Green/NTPC JV: 4.1 GW portfolio); ethane logistics JV. | Aligns with energy transition; new revenue streams (logistics/maritime). |

| Refining/Petrochem | MRPL/HPCL/OPaL consolidation (95% stake); OPaL plant restart post-shutdown. | Capacity utilization up; insurance claim pending. |

| Exploration | 214 blocks (NELP/HELP); management reliance on reserves assessment. | High upside if success ratio improves. |

Outlook: Mid-teens PAT growth possible with oil prices >$70/bbl, project restarts; capex ~₹18K Cr H1 signals momentum.

Key Risks

| Risk Category | Details | Quantum/Status |

|---|---|---|

| Contingent Liabilities | PMT JV arbitration (DGH demand ₹14,418 Cr, 40% PI); ST/GST on royalty (provisioned ₹18K Cr own share; ₹6K Cr JV partners + ₹2K Cr penalties contingent). | High; appeals pending (SC on ORD Act royalty). |

| Geopolitical | Russia sanctions (Sakhalin-1, Vankorneft: ₹3.6K Cr dividends stuck); Venezuela receivables (₹4.8K Cr ECL); Mozambique security; Sudan EPSA termination (₹184 Cr receivable). | OVL-heavy; forex/impairment risk. |

| Operational | Dry wells/exploration flops (₹2.9K Cr write-offs H1); decommissioning (₹56K Cr provisions); Force Majeure residuals. | Relies on mgmt. technical eval. |

| Regulatory/Tax | Royalty taxes, TED refund dispute (₹2K Cr receivable litigated); NELP/HELP underperformance penalties. | Cash flow drag if adverse. |

| Commodity | Oil/gas price volatility; refining crack spreads. | Revenue sensitive. |

| Other | OPaL plant issues (insurance pending); 27 unreviewed JV blocks (₹7K Cr assets). | Low materiality but cumulative. |

Summary: ONGC’s robust balance sheet and dividends provide downside protection amid tailwinds from LNG restart and diversification. Growth anchored in E&P/internationals, but headwinds from costs/revenue dip persist. Key Risks (High): Contingencies (~₹20K+ Cr) and geopolitics could impair earnings (10-15% PAT hit if materialize). Rating Outlook: Stable/Positive; monitor oil prices, arbitration outcomes. Investors: Attractive for dividends/E&P play; cautious on taxes/Russia. (Analysis based solely on provided disclosures; no external data.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.