OIL

Equity Metrics

January 13, 2026

Oil India Limited

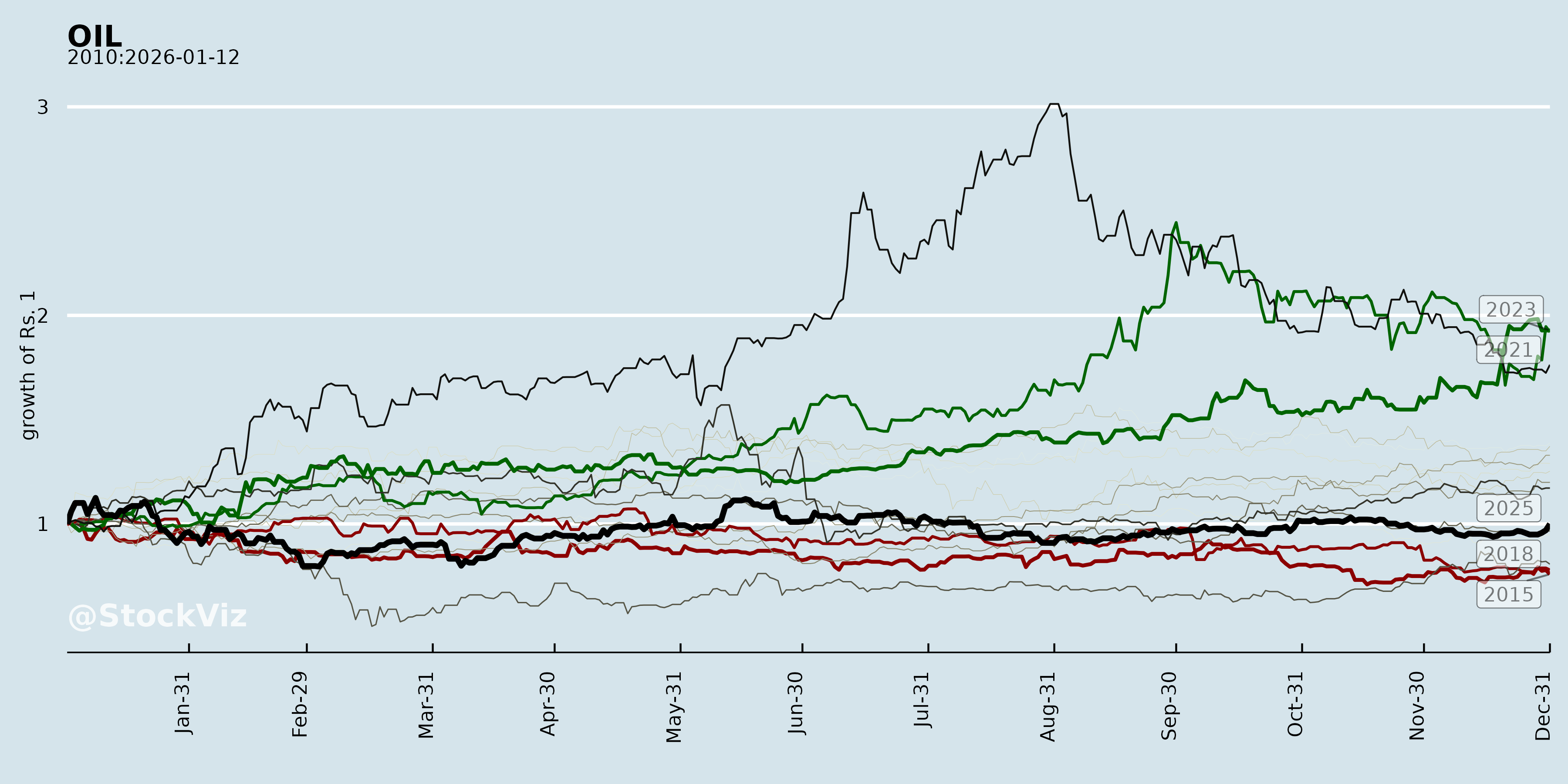

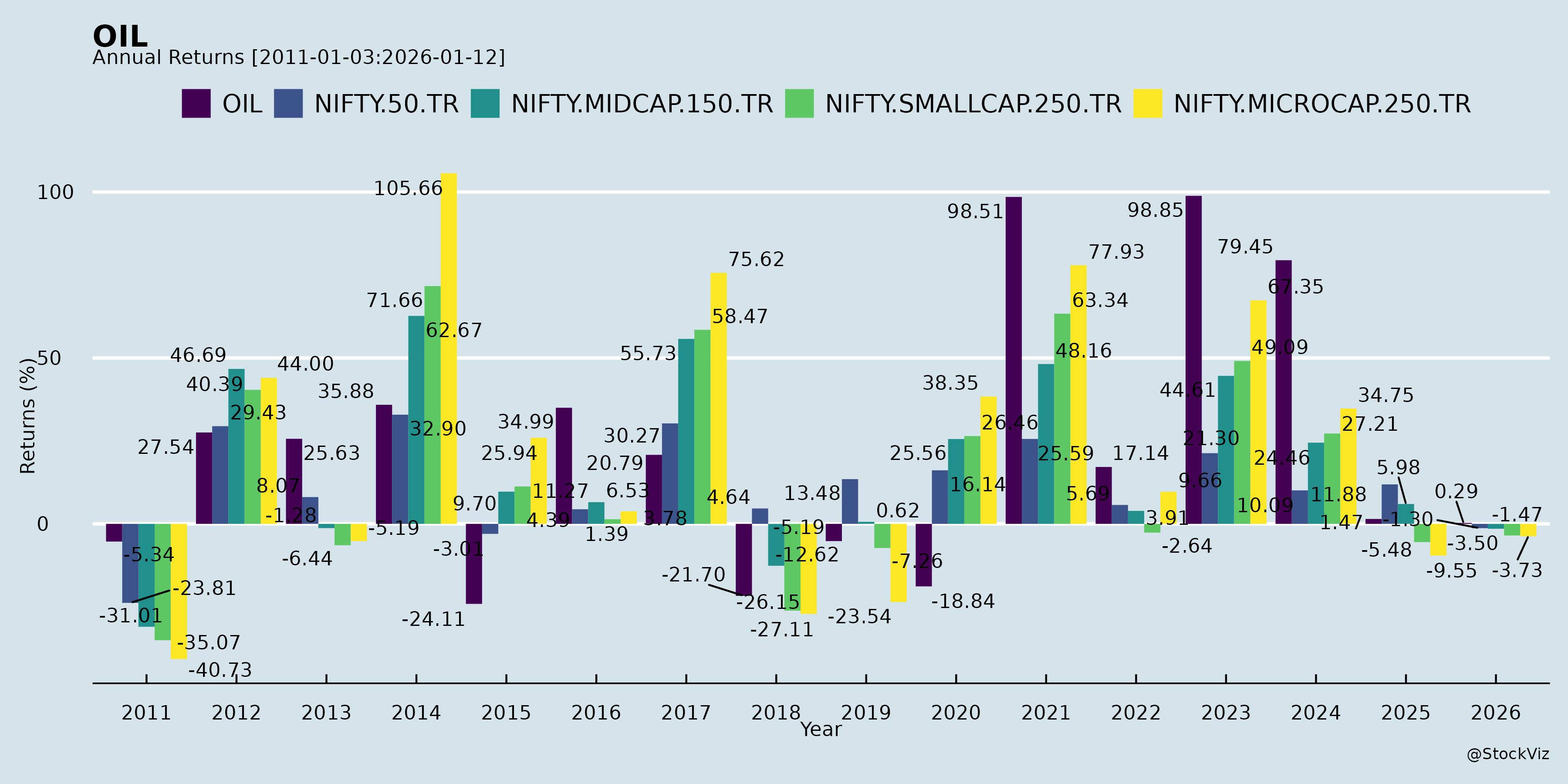

Annual Returns

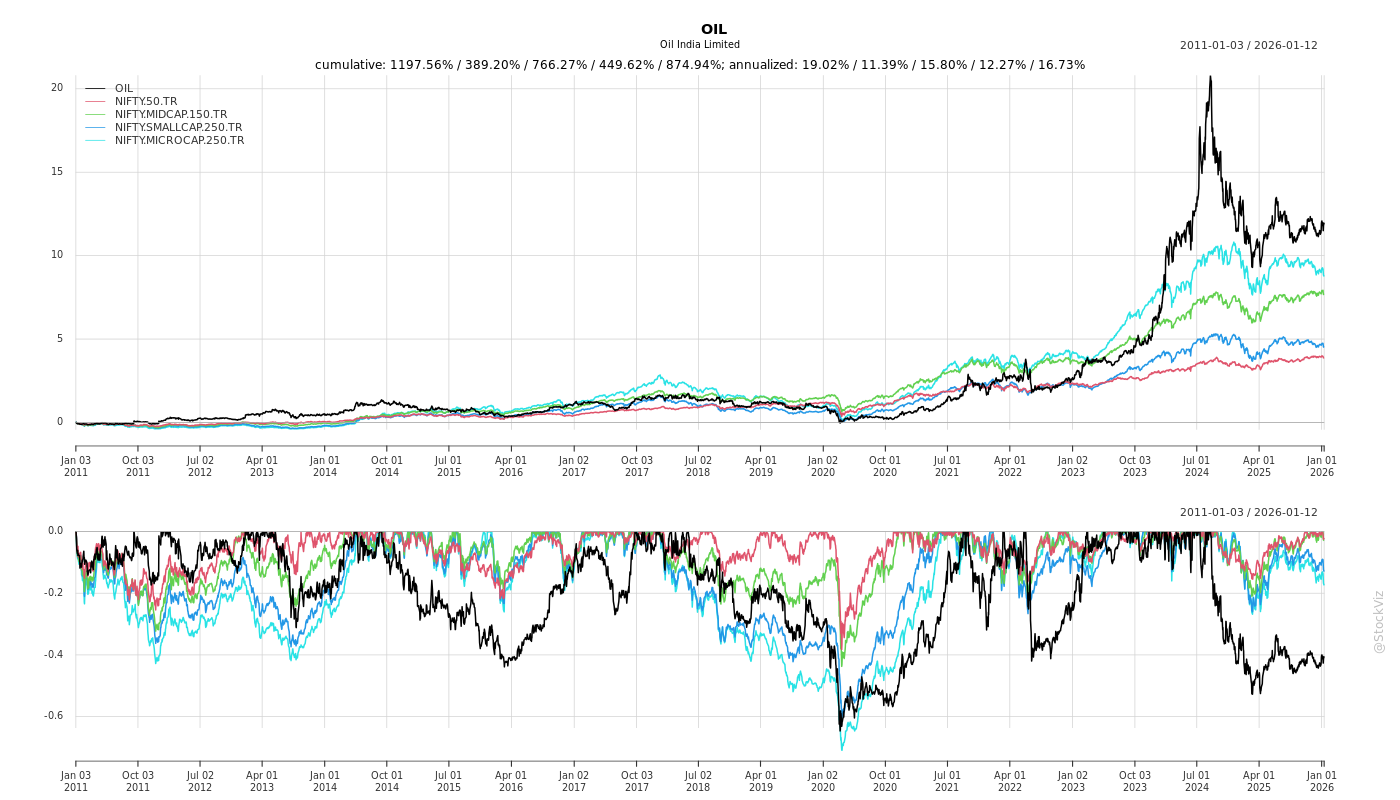

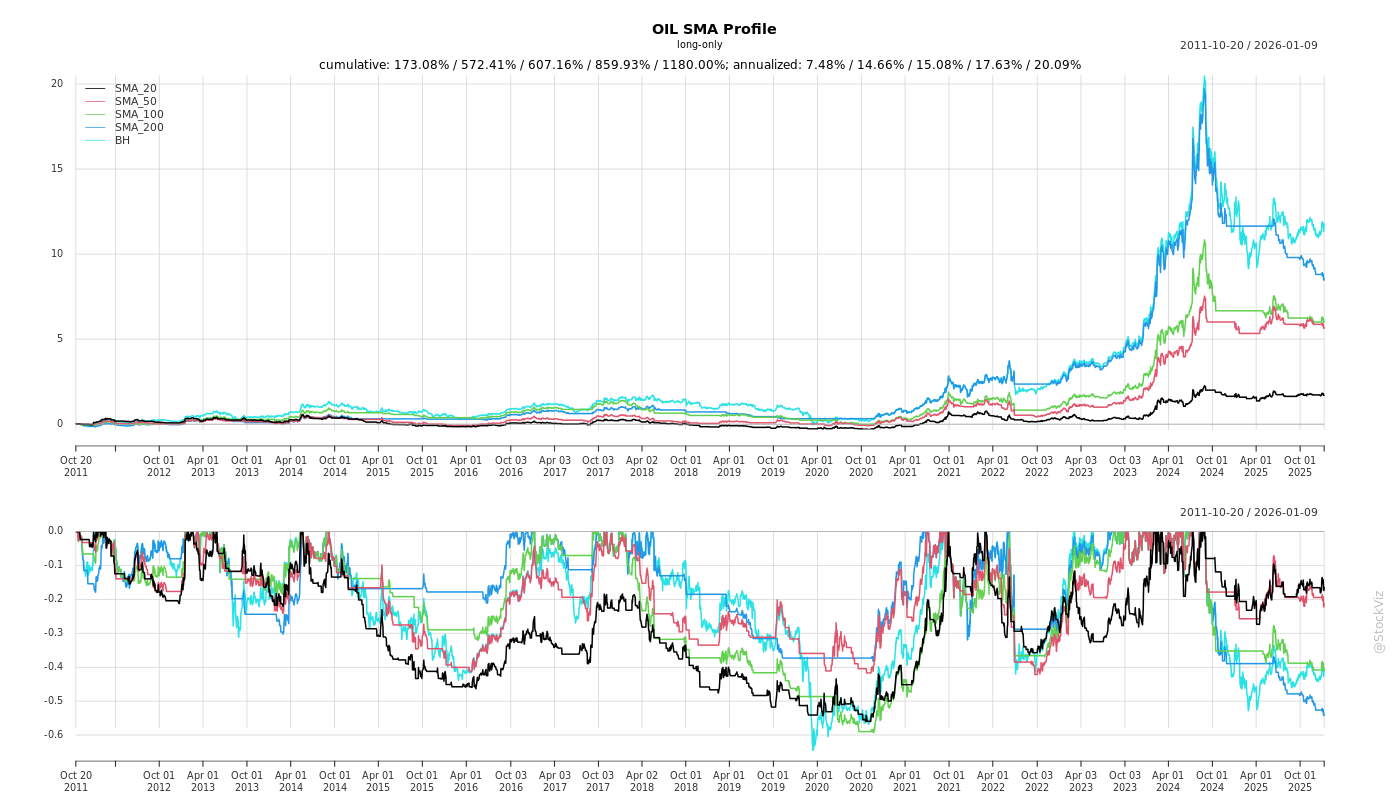

Cumulative Returns and Drawdowns

Fundamentals

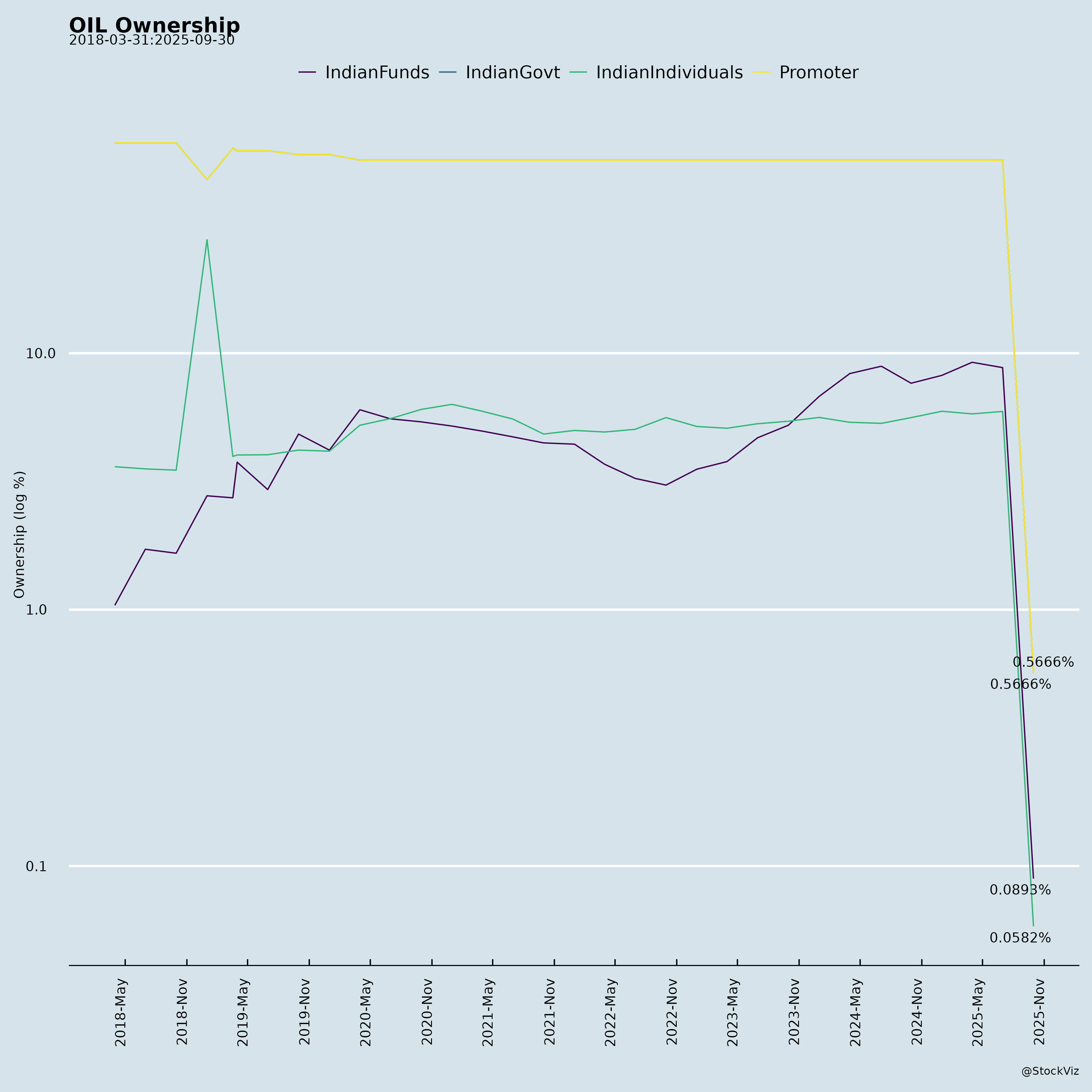

Ownership

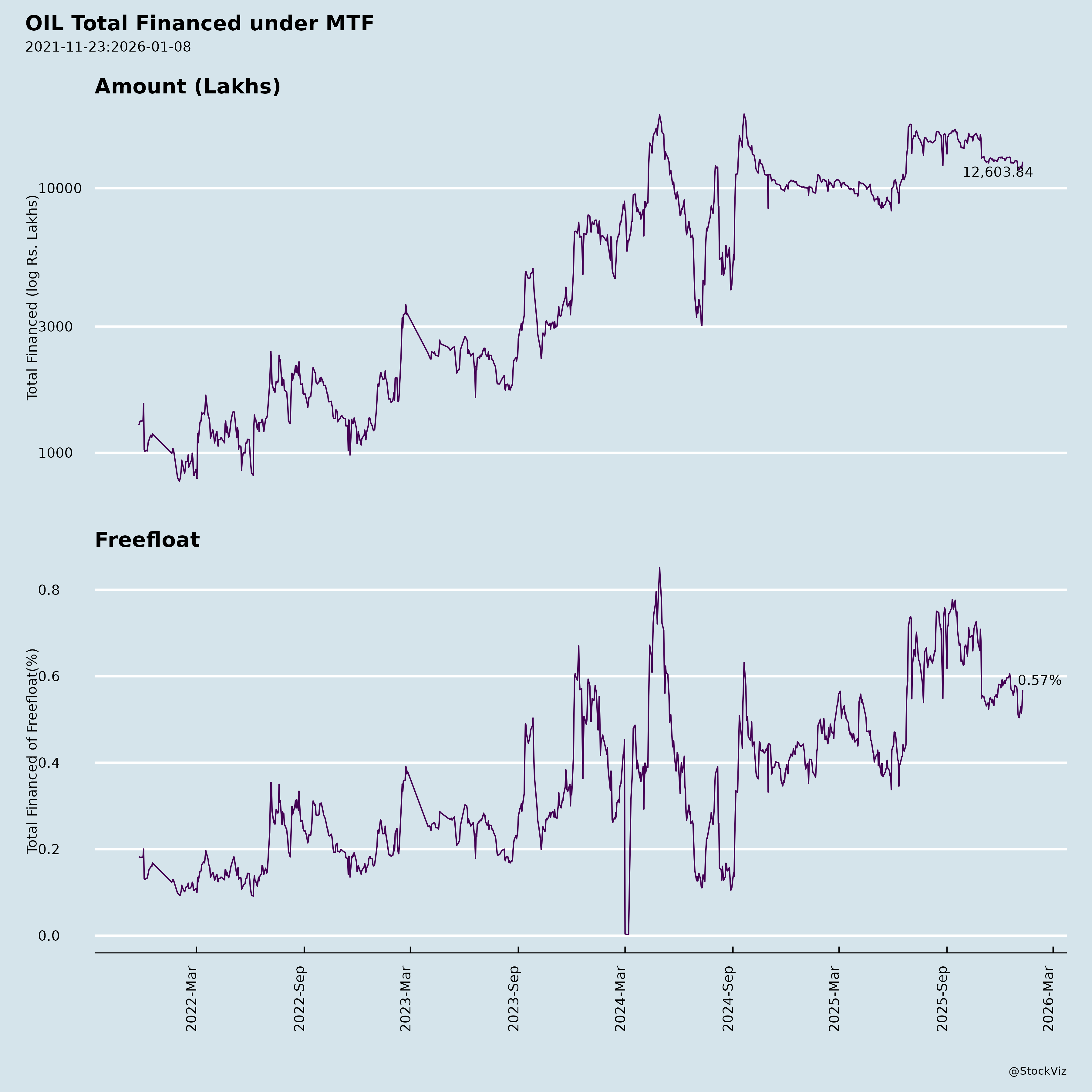

Margined

AI Summary

asof: 2025-12-08

Comprehensive Analysis of Oil India Limited (OIL): Headwinds, Tailwinds, Growth Prospects, and Key Risks

(Based on Conference Call, Press Release, and Regulatory Filings dated October – December 2025)

Company Overview

Oil India Limited (OIL) is a Maharatna CPSE under the Government of India, primarily engaged in upstream exploration and production (E&P) of hydrocarbons, with growing interests in midstream and downstream via its subsidiary Numaligarh Refinery Limited (NRL). OIL is in the process of transitioning into an integrated energy company, aiming to diversify its portfolio across oil, gas, refining, biofuels, and green energy.

1. Headwinds (Challenges & Downside Risks)

| Headwind | Details | Impact |

|---|---|---|

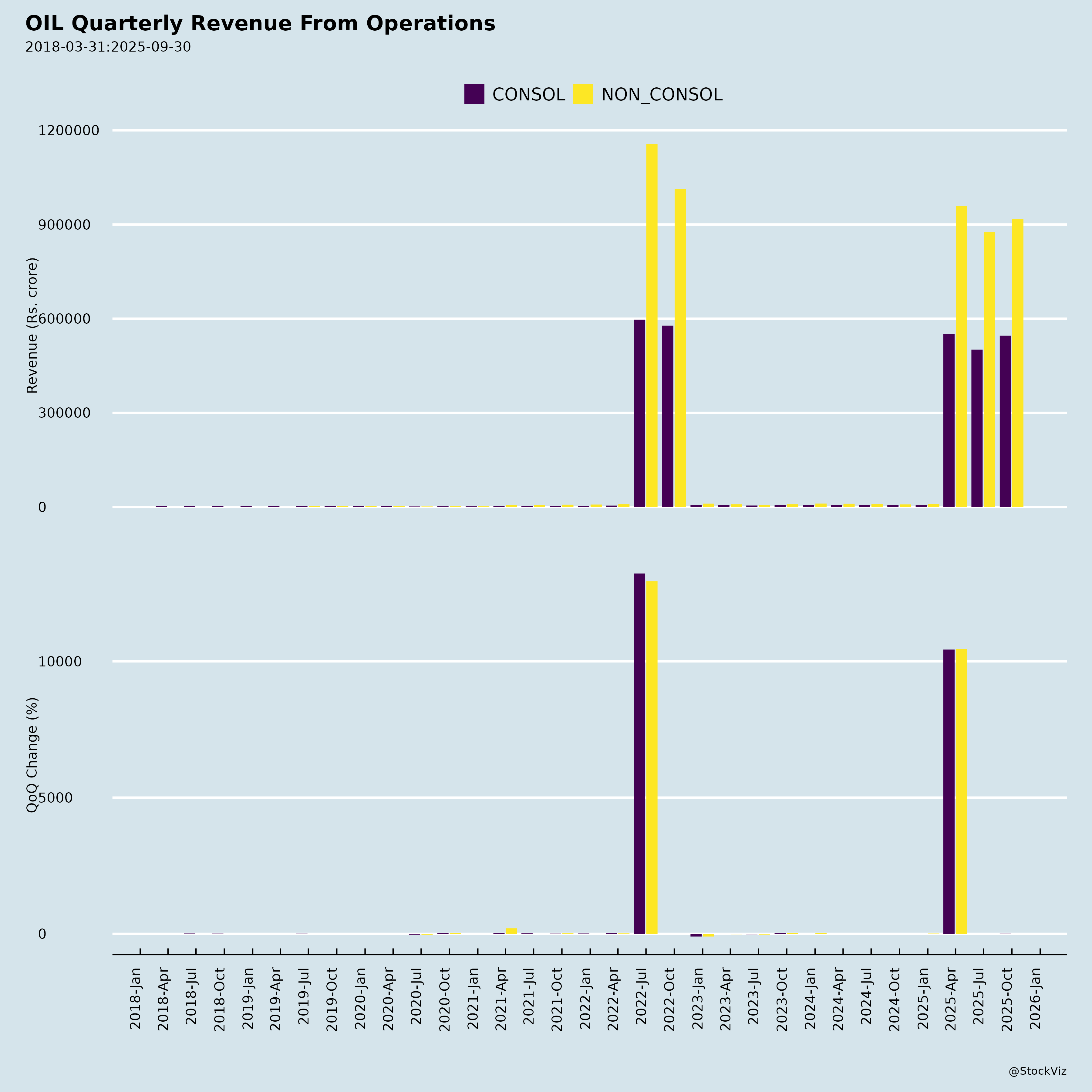

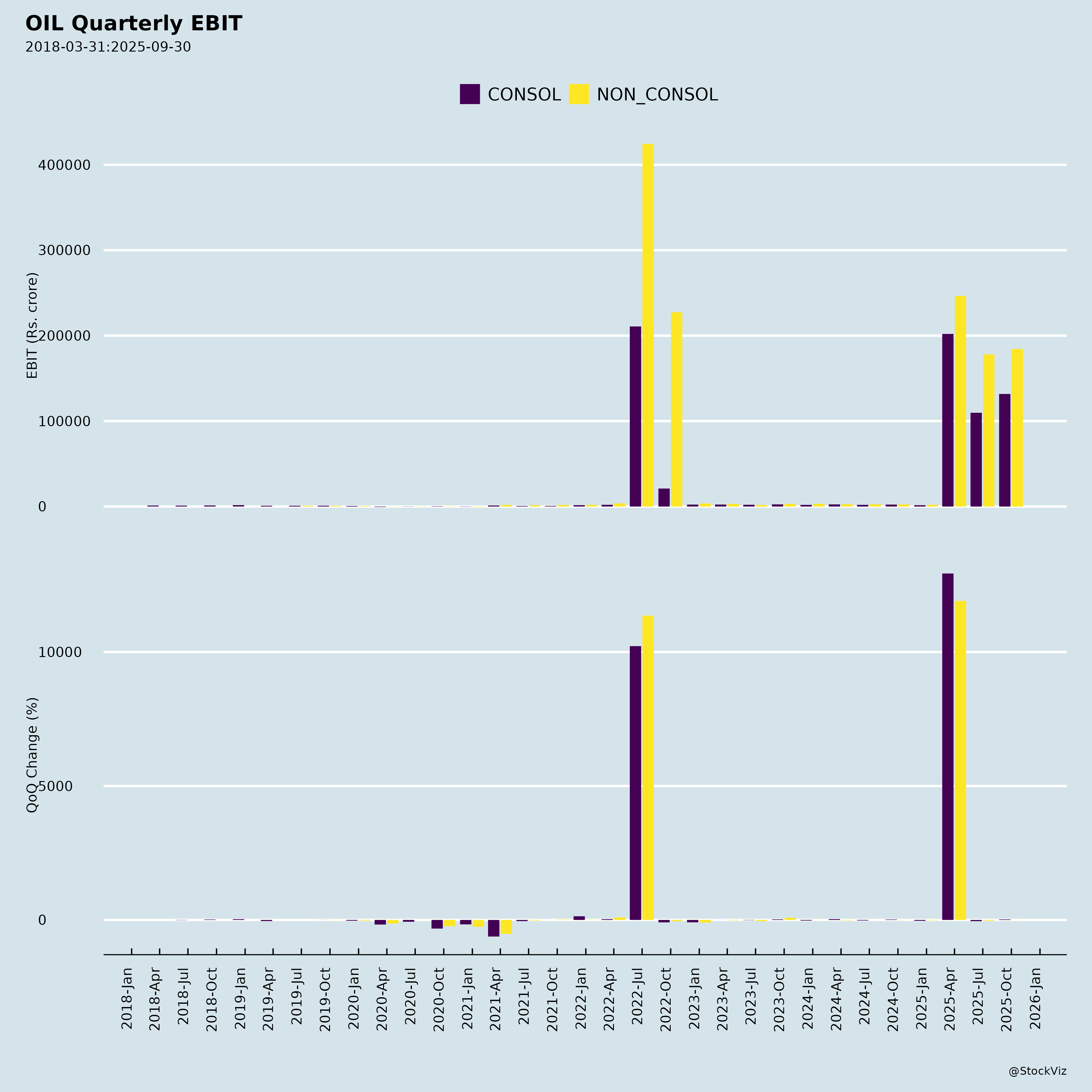

| Declining Crude Prices | Q2 FY26 average realization: $68.19/bbl (↓18.1% YoY vs $82.09). This led to a ~44% drop in revenue YoY despite stable volumes. | Pressure on profitability, narrow EBITDA margins (34% vs 47% earlier). |

| Unplanned Production Disruptions (Northeast Region) | Ethnic community protests/blockades in Eastern Assam disrupted operations. Daily production fell from ~9,720 MT/day to 8,100 MT/day during Q2. | Full FY26 guidance revised down: Oil from 3.7 to 3.55 MMT, earlier 3.7+. |

| High Exploration Write-offs | Q2 saw ~INR1,423 crores in one-off provisions: – INR700 Cr (Gabon & Bangladesh blocks) – INR723 Cr (Vijayapuram-2 well, Andaman). |

Affects short-term earnings; raises concerns about exploration ROI. |

| Regulatory & Accounting Pressures | DA crossing 50% triggered upward revision of gratuity liability (INR60 Cr expense). | Transient employee cost impact, but structural cost pressures may persist under PSU norms. |

| Stuck Dividends in Russia | USD 300 million dividends trapped due to Russian sanctions on Singapore-incorporated JV entities. | Liquidity constraints; uncertainty over repatriation (expected early FY27). |

| Complexity in Refinery Ramp-up | NRL expansion is complex and gradual. No immediate 100% run-rate expected post-commissioning. | Revenue ramp-up delayed; potential for cost overruns. |

2. Tailwinds (Positive Drivers & Opportunities)

| Tailwind | Details | Impact |

|---|---|---|

| Pipeline Infrastructure Expansion (Midstream Growth) | – Numaligarh–Siliguri Pipeline (mechanically complete, Oct 2025). – DNPL (Dhemaji North Lakhimpur Pipeline) expansion from 1 to 2.5 MMSCMD (expected by Apr 2026). |

Enhances gas evacuation, supports domestic supply, prepares for NRL refinery integration. |

| Refinery Expansion – Numaligarh Refinery (NRL) | – Capacity to increase to 9 MMTPA. – Pre-commissioning underway; primary unit commissioning by Dec 2025. – Distillate yield: 86%, GRI: $10.56/bbl (↑110% QoQ). |

Significant earnings upside. NRL PAT: INR725 Cr in Q2. |

| Successful Gas Discovery – Andaman Basin | Gas occurrence confirmed in Vijayapuram-1 and Vijayapuram-2 (East Andaman). 3D seismic planned in 3–4 months to appraise. |

Could unlock new offshore hydrocarbon base. First major exploration success in Northeast in decades. |

| International Operations Rebounding | Force majeure lifted in Mozambique’s Area 1 (Nov 2025) – OIL holds 4% stake via BREML. | Potential revival of large-scale LNG projects; long-term value unlock. |

| Biofuels & Green Energy Ventures | – India’s first 2G bioethanol plant using bamboo (Assam, Sept 2025). – Formalin plant commissioned in Assam (joint venture). – Appointment of ED for Green Energy (Santanu Saikia, effective Jan 2026). |

Supports India’s energy transition; creates non-fossil revenue streams. |

| Dividend Declaration & Investor Confidence | First interim dividend: INR 3.50/share declared in Q2 FY26. | Signals financial discipline; enhances shareholder value. |

| Government and Local Support | Swift coordination in well capping at KSG#76, Kharsang (Arunachal Pradesh) with Cudd Well Control (USA). | Reinforces OIL’s crisis response capability; strengthens state-corporate coordination. |

3. Growth Prospects (Strategic Outlook)

| Area | Growth Drivers |

|---|---|

| Upstream – Domestic | – Focus on assam and shallow Andaman waters. – Drilled 18 wells in Q2; 100% of target achieved. – FY26 oil target revised to 3.55 MMT (conservative), with recovery expected in H2. |

| Upstream – International | – Andaman exploration to enter appraisal phase; potential for commercial discovery by FY27/28. – Mozambique project back on track; possible equity monetization or scale-up. |

| Midstream | – DNPL and other pipeline expansions will enable gas supply scaling to industrial and refinery customers. |

| Downstream (via NRL) | – Post-expansion, target throughput to support 3 MMSCMD gas intake (from current ~0.9–1 MMSCMD). – Refining margin sustainability improved. |

| Integrated Energy Vision | – Joint ventures in bioethanol and petrochemicals. – Green Energy arm forming under Santanu Saikia (CEO-designate). – Diversification beyond fossil fuels. |

| Capex Momentum | FY26 capex: INR7,000 Cr (70–75% spent by H1). Aggressive spending on E&D (60% of capex). Historical trend: actual spend > budget (e.g., INR8,000 Cr in FY24-25 vs INR6,880 Cr budget). |

4. Key Risks & Uncertainties

| Risk Category | Description |

|---|---|

| Operational Risk | – Unrest in Northeast region can recur; vulnerable to local community issues. – Safety incidents like KSG#76 blowout reflect technical complexity and execution risk. |

| Geopolitical Risk | – Russia dividend blockage shows vulnerability to sanctions. May impact future foreign JVs. |

| Exploration Uncertainty | – Andaman discovery not yet commercial. Appraisal and FEED studies needed. – High rig cost (INR2 Cr/day for offshore operations); risk of dry wells. |

| Execution Risk (NRL Expansion) | – Phased commissioning increases timeline risk. – Refinery complexity may delay full capacity utilization to Q2 FY27. |

| Commodity Price Volatility | Revenue highly sensitive to crude prices (↓18% = ↓44% revenue). Despite gas price stability, EBITDA margins compress. |

| Regulatory & Accounting Adjustments | PSU obligations like DA revision → cascading employee liability; less control over cost levers. |

5. Management & Governance Developments (Recent Signals of Maturity)

Board & Executive Reshuffle (Dec 2025):

Nine promotions to Executive Director level, including:- Sanjib Gogoi (Offshore)

- D.S. Manral (E&D)

- Santanu Saikia (Green Energy)

- New ED for Medical Services – Dr. Niruj Das

Interpretation: Clear preparation for post-incumbent transition, showing institutional strength and succession planning.

Retirement of ED (Engineering Services) – Gauranga Borgohain (Nov 2025).

Smooth handover expected.Transparency: Regular disclosures under SEBI LODR Regulation 30; live investor engagement; detailed Q&A.

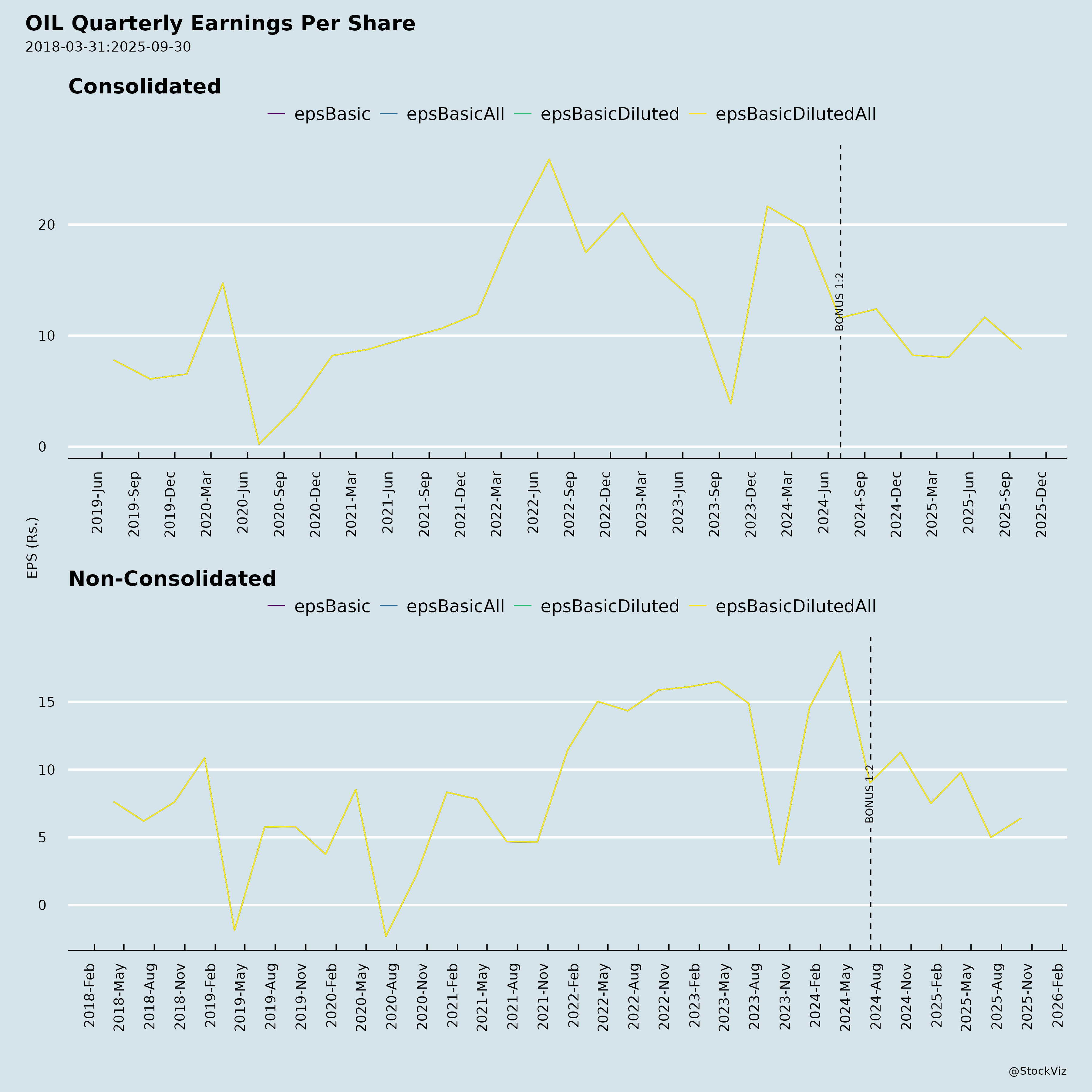

6. Financial Snapshot (Q2 FY26)

| Metric | Value |

|---|---|

| Standalone Revenue | INR 5,456 Cr (↑9% QoQ) |

| PAT | INR 1,044 Cr (↑28.8% QoQ) |

| EBITDA Margin | 34% (↓ from 47% YoY) |

| EPS | INR 6.42 |

| Dividend Declared | INR 3.50/share (1st interim) |

| NRL Revenue | INR 6,442 Cr (↑24% YoY) |

| NRL PAT | INR 725 Cr |

| Consolidated PAT | INR 1,640 Cr |

Summary & Investment Thesis

✅ Bull Case (Upside Potential):

- OIL is on a turnaround path with strong execution in midstream and downstream.

- Andaman Basin discovery could be a game-changer; adds resource optionality.

- Integration via NRL reduces crude-to-margin exposure; high GRI supports refining profitability.

- Dividend initiation builds investor confidence.

- Strong government alignment in biofuels and green energy.

❌ Bear Case (Downside Risks):

- Volume recovery still below guidance; sensitive to regional unrest.

- Crude price exposure without effective hedging.

- Exploration expenses are high and write-offs could recur.

- Russian dividend blockage reflects structural limitations of sovereign JVs.

🎯 Base Case (Neutral to Positive Outlook):

- Revenue recovery likely in H2 FY26 on volume normalization.

- Refinery expansion and gas pipeline to be major value drivers from FY27.

- Strategic shift toward integrated and green energy model enhances long-term resilience.

- Governance improvements and leadership depth signal maturity.

Conclusion: OIL – From Monolithic PSU to Integrated Energy Play

Oil India is no longer just a traditional E&P PSU. The company is building a diversified energy portfolio with tangible progress in: - Downstream integration (NRL) - Midstream infrastructure (pipelines) - Exploration revival (Andaman, Mozambique) - New energy (biofuels, green hydrogen plans)

While near-term earnings are challenged by crude prices and regional disruptions, the strategic repositioning is credible. With disciplined capex, growing operational scale, and first-mover green energy initiatives, OIL presents a turnaround story with optionality on upside.

Verdict: Accumulate on dips for long-term investors, as the company evolves into a resilient integrated energy player. Near-term volatility expected, but medium-to-long term outlook is improving.

Key Dates to Watch: - Dec 2025: NRL primary unit commissioning

- Q1 FY26: Full gas evacuation via DNPL pipeline (target Apr 2026)

- Q3–Q4 FY26: Post-ramp-up benefits from NRL

- Early FY27: Update on Andaman appraisal & Russia dividend release

Sources: OIL Q2 FY26 Earnings Call Transcript (17 Nov 25), SEBI LODR Filings (Nov–Dec 2025), Press Release on Kharsang Well Capping (22 Nov 25), Board Meeting Outcome (4 Dec 25).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.