NLCINDIA

Equity Metrics

January 13, 2026

NLC India Limited

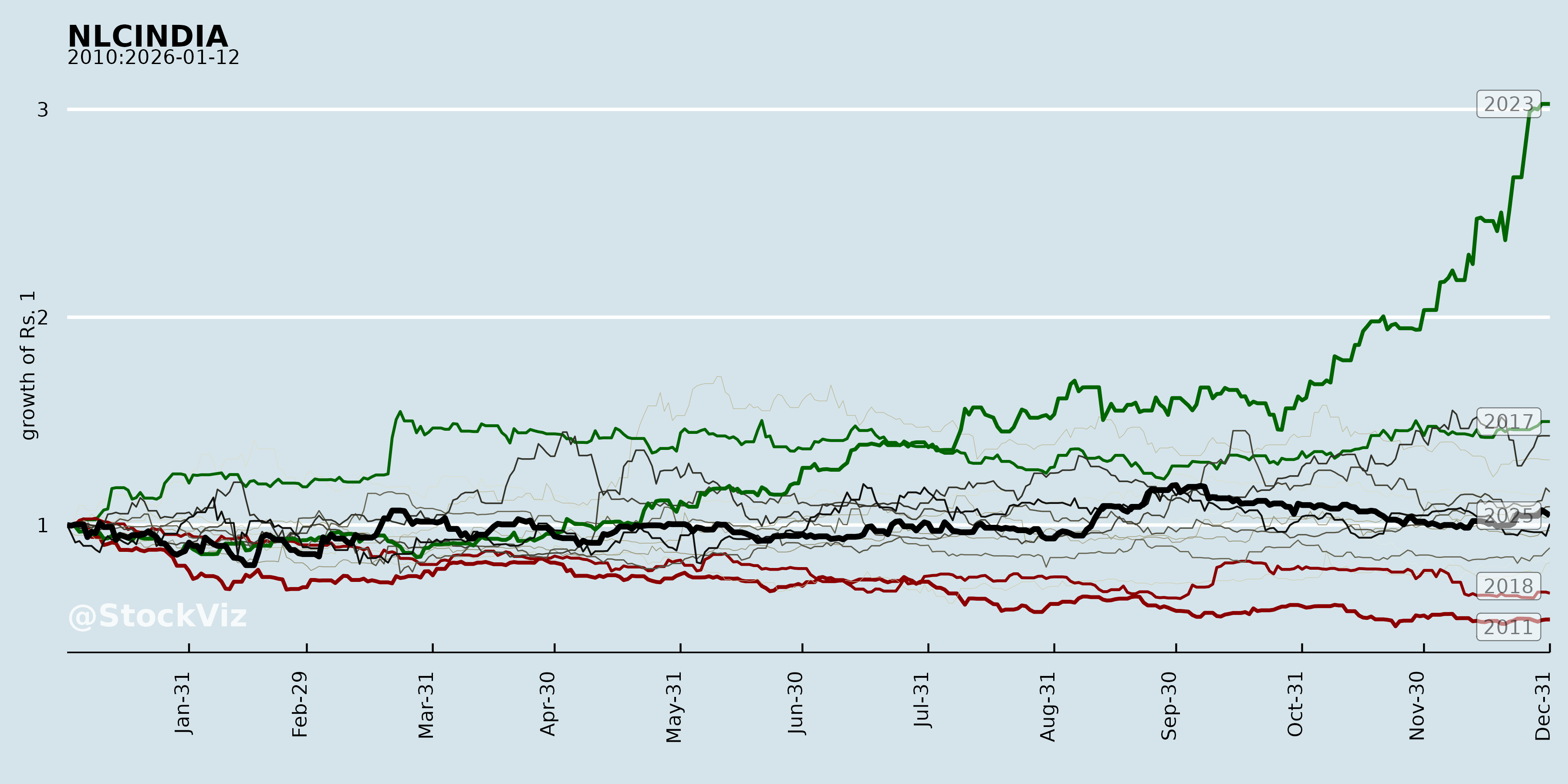

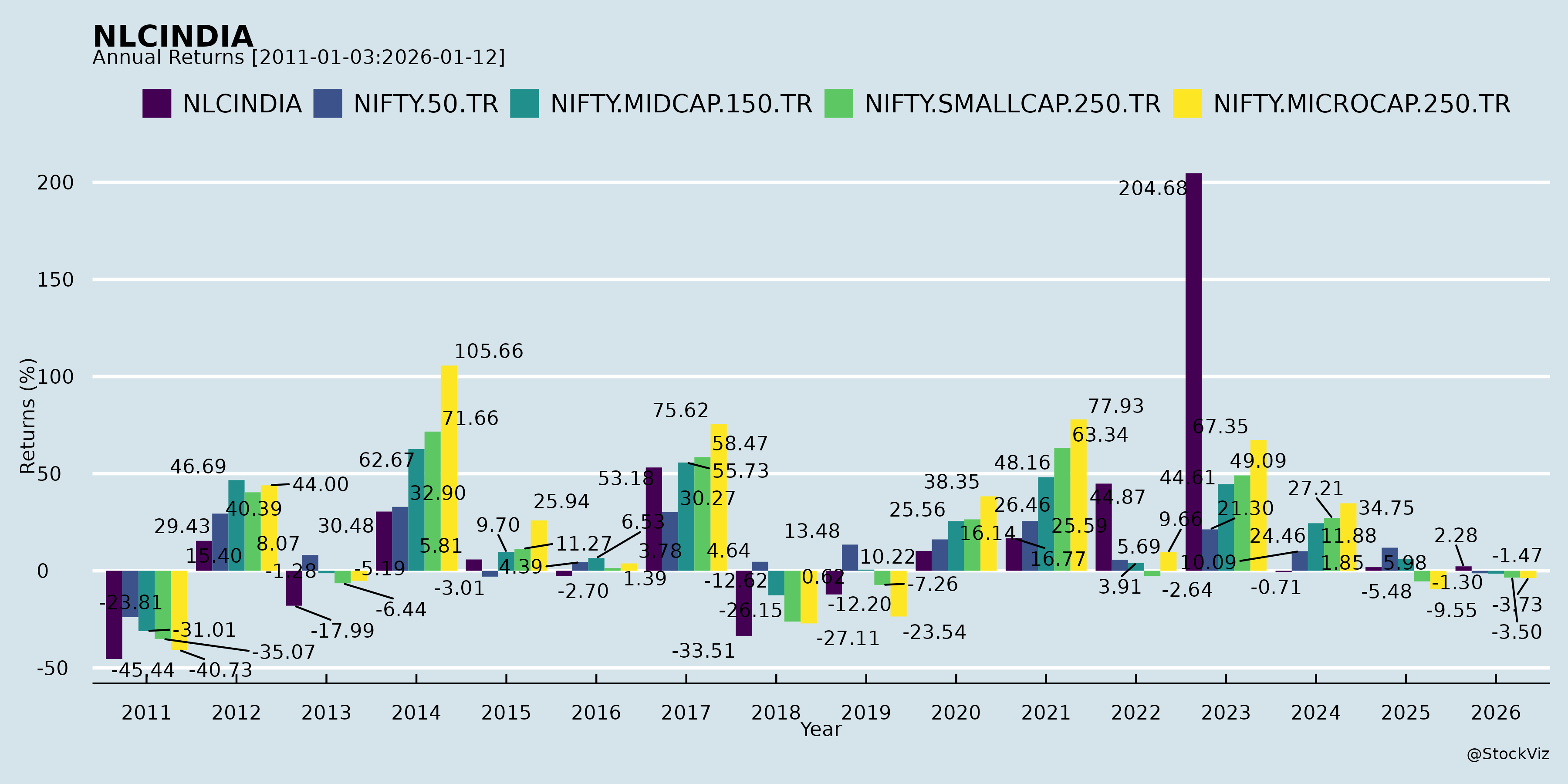

Annual Returns

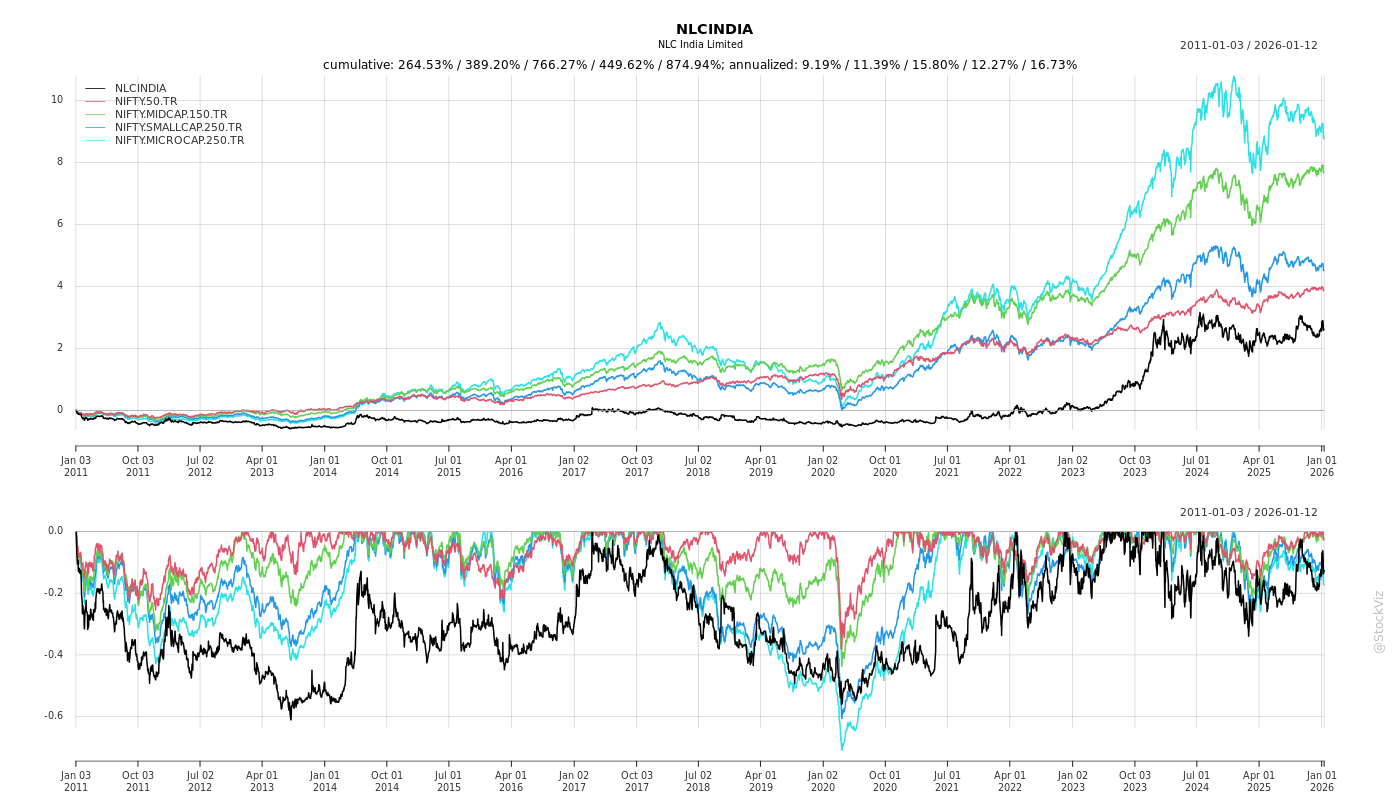

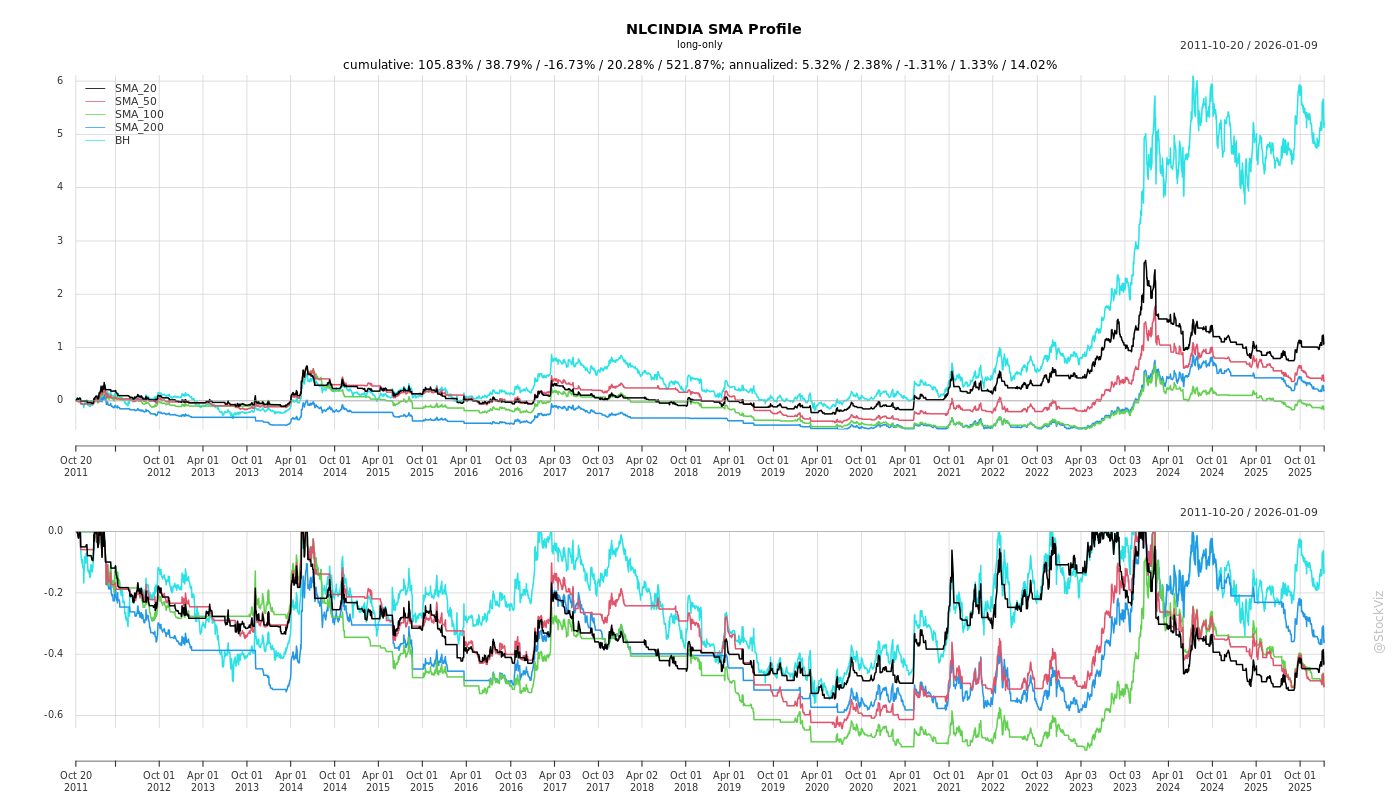

Cumulative Returns and Drawdowns

Fundamentals

Ownership

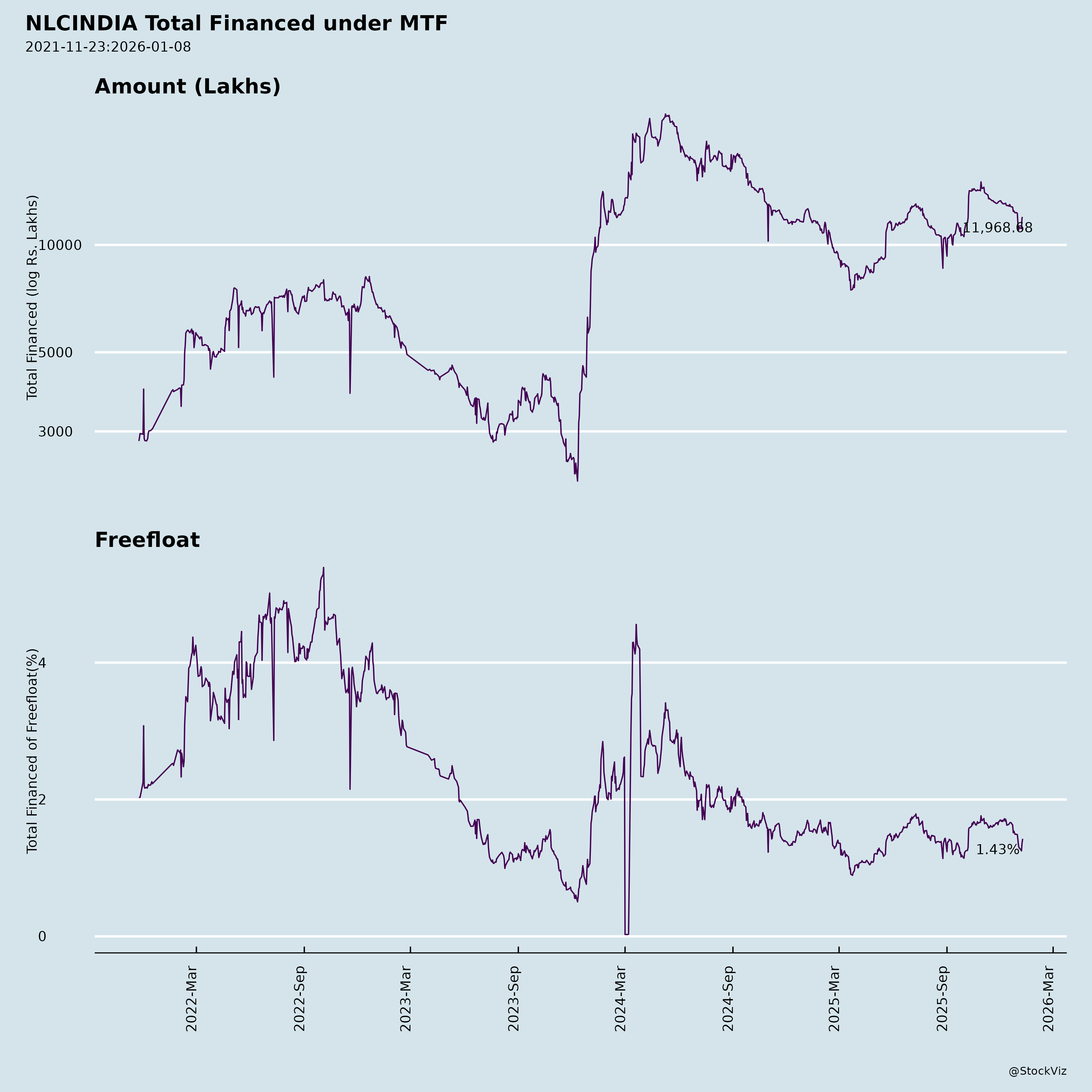

Margined

AI Summary

asof: 2025-12-08

NLC India Limited (NLCINDIA) – Investment Analysis: Headwinds, Tailwinds, Growth Prospects & Key Risks

Based on a comprehensive analysis of the provided corporate presentations, AGM voter reports, regulatory compliance letters, and recent press releases, here is an in-depth assessment of NLC India Limited (NLCINDIA | BSE: 513683 | NSE: NLCINDIA), a Navratna Central Public Sector Enterprise under the Ministry of Coal, Government of India.

🔶 Executive Summary

NLC India Limited is undergoing a strategic transformation from a traditional lignite-based mining and power company into a diversified energy conglomerate with aggressive expansion into renewables (solar, wind, pumped hydro), coal-based power, critical minerals, and green technologies. While strong government backing, disciplined financials, and ambitious greenfield investments provide tailwinds, regulatory non-compliance, execution risks, and reliance on government decisions present notable challenges.

🚀 Tailwinds – Positive Momentum & Growth Drivers

1. Strategic Energy Transition to Green Portfolio

- First CPSU to achieve 1 GW of Renewable Energy (RE) capacity.

- On track to achieve 10,110 MW of RE capacity by 2030, comprising 9,609 MW solar and 501 MW wind.

- Already has operational RE capacity of 1,599 MW (1,548 MW solar, 51 MW wind) as of FY25.

- Commissioned 52.83 MW phase of 300 MW Barsingsar Solar project; progressing on Gujarat Khavda (600 MW solar), Dayapar (50 MW wind), and others.

- EV charging stations, BESS (Battery Energy Storage Systems), and pumped storage (1,600 MW planned) show forward-looking diversification.

✅ Tailwind: Strong alignment with India’s 500 GW RE target by 2030 creates favorable policy and financing environment.

2. Aggressive CAPEX Plan Aligned with Vision 2030

- Total proposed CAPEX: ₹1.17 Lakh Crore (~USD 14 billion) between FY26–FY30.

- Green Energy: ₹41,600 Cr

- Thermal Power: ₹50,000 Cr

- Mining Expansion: ₹14,200 Cr

- Diversification (Gasification, EV, etc.): ₹11,100 Cr

✅ Tailwind: Sustained long-term investment signals confidence in future energy demand and growth scalability.

3. Mining Expansion & Coal Production Growth

- Coal mines won: Machhakata (30 MTPA), South Pathrapara (12 MTPA), Pachwara (9 MTPA).

- Expansion of Neyveli MINE III (11.5 MTPA) and Gurha Lignite Mine underway.

- Total mining capacity expected to increase from 50.1 MTPA (2025) to 104.35 MTPA by 2030.

✅ Tailwind: Increased self-sufficiency in fuel supply supports captive power projects and reduces import dependency.

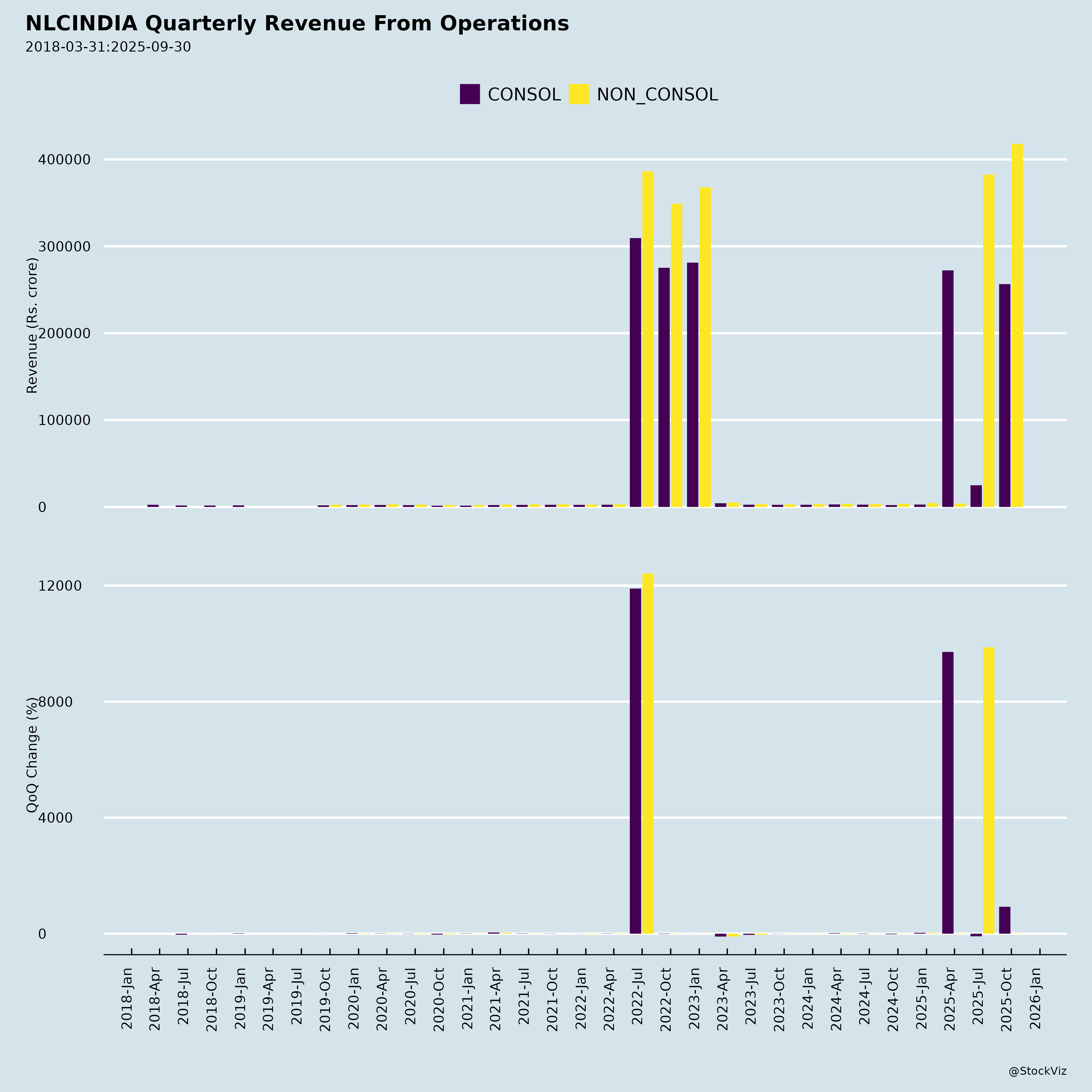

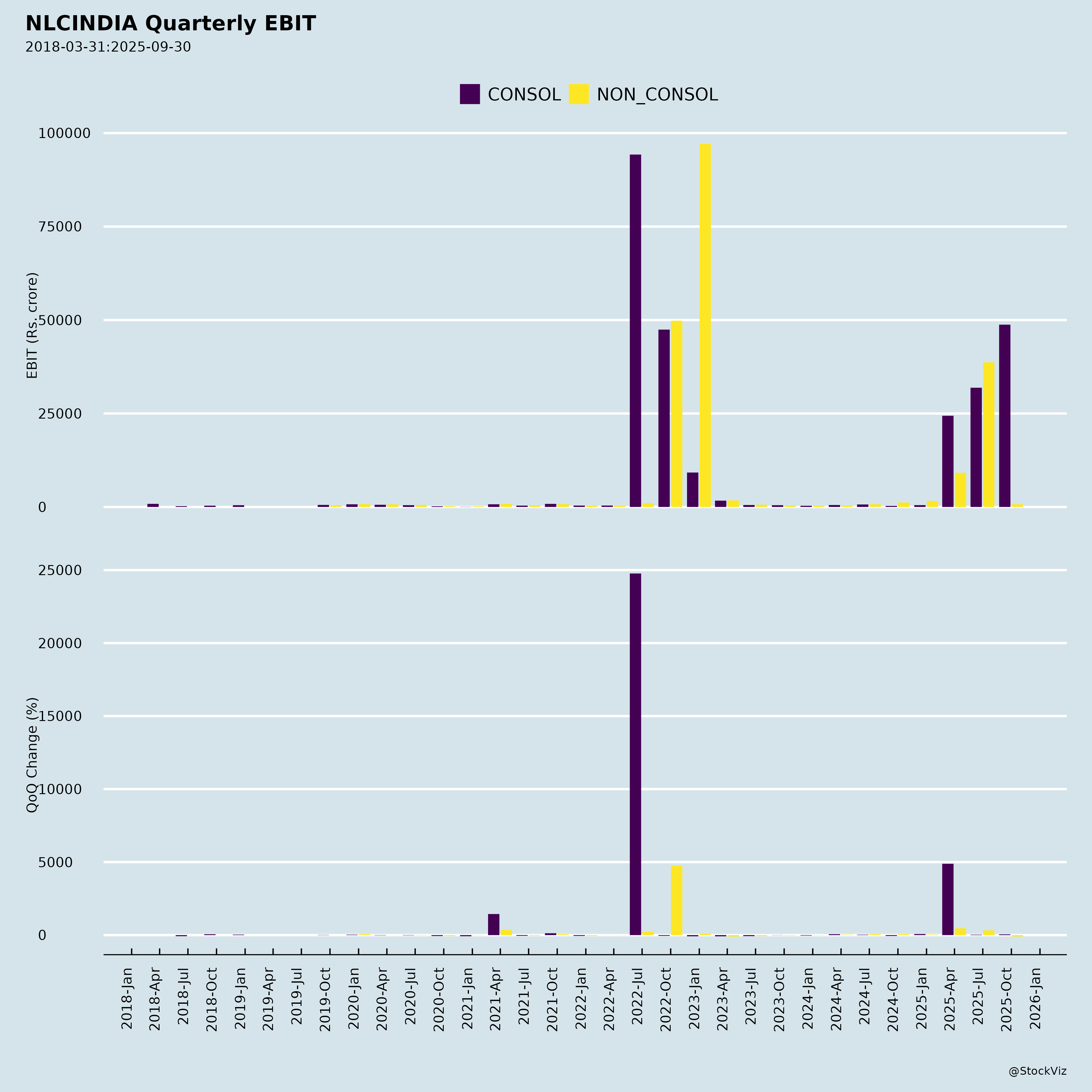

4. Robust & Transparent Financial Performance

- H1 FY26 Revenue: ₹8,004 Cr (All-time high), up 14% YoY.

- H1 FY26 PAT: ₹1,564 Cr (up 1% YoY).

- Maintained Dividend Payout: ₹1.50 per share interim + final (total 30%), continuing 26-year streak of dividend payments.

- Strong ESG Scores: Average ~57.4 (CareEdge & ICRA); higher than industry average (40.1).

- Credit Rating: Long-term AAA/Stable across all rating agencies (CRISIL, ICRA, CARE, etc.).

✅ Tailwind: Financial stability enables self-funding and debt capacity for large projects.

5. Diversification into High-Value Segments

- Critical Minerals: JV with KABIL and IREL; mining rights won; aims to extract rare earths.

- Coal & Lignite Gasification: ₹8,500 Cr project planned – aligning with clean coal and green hydrogen goals.

- Green Hydrogen Pilot Plant under development.

- Circular economy initiatives: Fly ash bricks, OB to M-Sand, mine land reclamation.

✅ Tailwind: Positioned for strategic sectors with high future policy support.

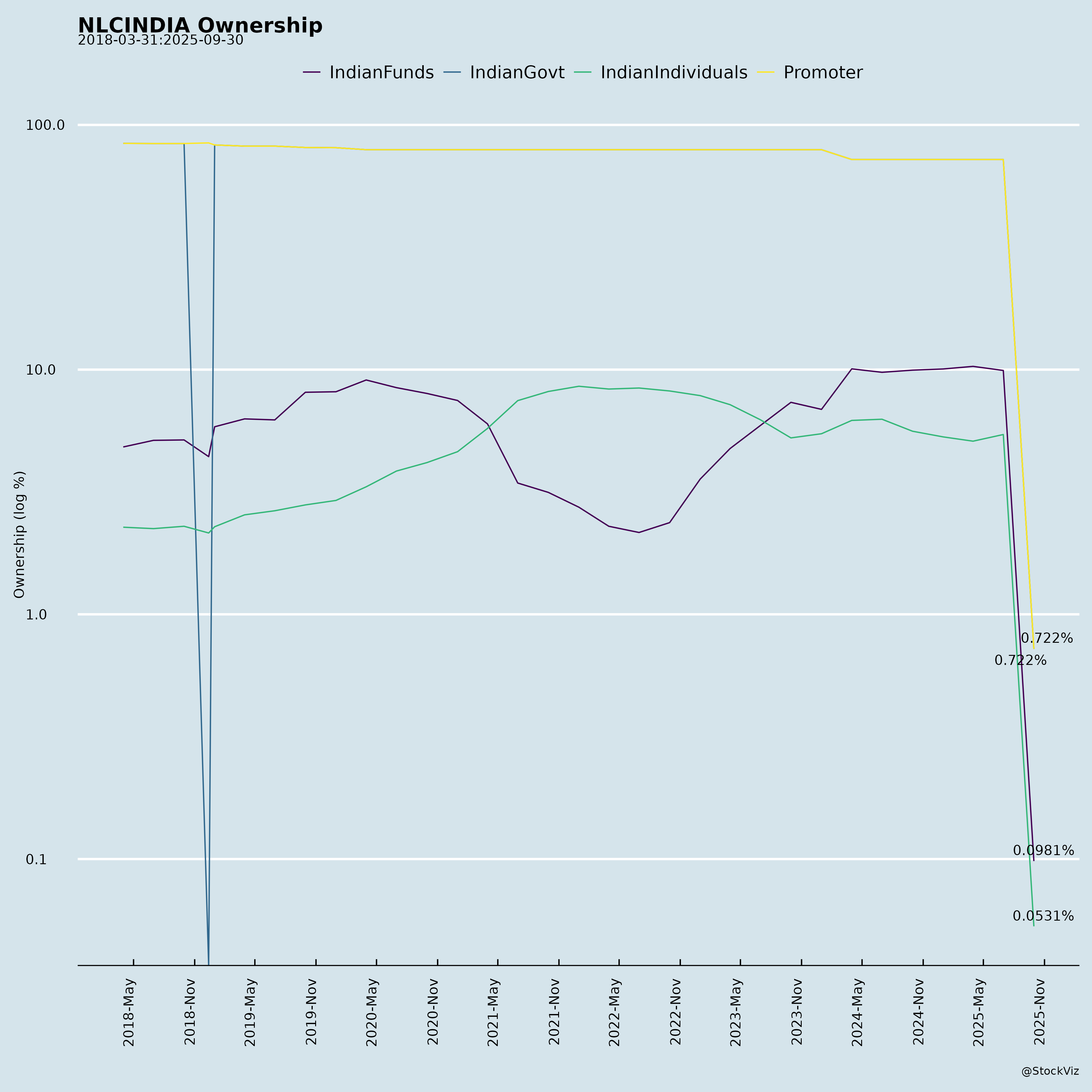

6. Government Backing & Public Ownership

- 72.2% GOI ownership ensures funding, land acquisition support, and policy alignment.

- Navratna status allows operational autonomy and faster investment approvals.

- CEO (CMD) appointed by Ministry of Coal – highlights strategic importance.

✅ Tailwind: Reduced business cycle volatility; access to subsidized capital.

⚠️ Headwinds – Operational & Structural Challenges

1. Regulatory Non-Compliance: Women Director Deficit

- Fine of ₹5.43 Lakh imposed by both NSE and BSE for non-compliance with Regulation 17(1) of SEBI LODR, which mandates at least one woman director on the board.

- NLC cites “power lies with President of India” for director appointments and claims it is beyond management control.

- No woman director on board as of FY25 despite the rule being in place since 2014.

❗ Headwind: Regulatory scrutiny could affect credibility; waivers not guaranteed; shareholder activism may rise.

2. Management Turnover & Succession Planning

- Shri Samir Swarup (HR) and Dr. Suresh Chandra Suman (Mines & Planning) recently retired.

- Shri Rajesh Pratap Singh Sisodia newly appointed as Director (Planning & Projects) in Dec 2025.

- Heavy reliance on government for key appointments slows agility.

❗ Headwind: Transition risk during high-growth phase; dependency on external deployment delays project execution.

3. Delayed Commissioning & Revenue Recognition

- NUPPL 660 MW unit (UP): Construction complete, but COD certificate still awaited from UPSLDC.

- Impacts full revenue realization and P&L.

- Regulatory delays in COD certification are recurring.

❗ Headwind: Project overruns and delayed income increase investor risks.

4. Land & Environmental Clearances

- Mining and thermal projects in Rajasthan, Odisha, Assam, and Gujarat face land acquisition challenges.

- Penalty clauses for delay in RE projects pose risks given clearance volatility.

- Environmental norms are getting stricter (e.g., effluent treatment, air pollution control).

❗ Headwind: Projects vulnerable to social resistance, protests, and green court interventions.

📈 Growth Prospects (2025–2030)

| Metric | 2025 (Current) | 2030 (Target) |

|---|---|---|

| Total Power Capacity | ~7,559 MW | ~10,020 MW |

| Renewable Capacity | 1,599 MW | 10,110 MW |

| Thermal Power | 5,960 MW | 10,020 MW (includes coal) |

| Total Mining Capacity | 50.1 MTPA | 104.35 MTPA |

| Market Cap (Sep 2025) | ₹39,563 Cr | Expected >₹1 lakh Cr |

| Revenue Target (FY30E) | ~₹15,283 Cr | ₹37,713 Cr (CAGR 16.8%) |

| PAT Target (FY30E) | ~₹2,714 Cr | ₹5,294 Cr (CAGR ~14.5%) |

🔹 NLC is betting on scale, vertical integration, and green transition to double market cap and revenue within 5 years.

🔺 Key Risks (K-SIR Framework)

| Risk Category | Details |

|---|---|

| K – Knowledge & Governance | - Delay in appointing woman director despite SEBI norms. - Reliance on government for key appointments affects agility. |

| S – Strategic | - Aggressive CAPEX may lead to leverage; debt-to-equity at 1.22 in H1 FY26 and rising. - Dependence on coal and lignite in a decarbonizing world. |

| I – Institutional & Regulatory | - Fines from exchanges for non-compliance. - Stringent environmental regulations may delay projects. - RE project penal clauses for delays. |

| R – Resource & Execution | - Land acquisition delays and community resistance. - Cost and time overruns in large EPC projects. - Technology absorption lag (e.g., critical minerals, hydrogen). |

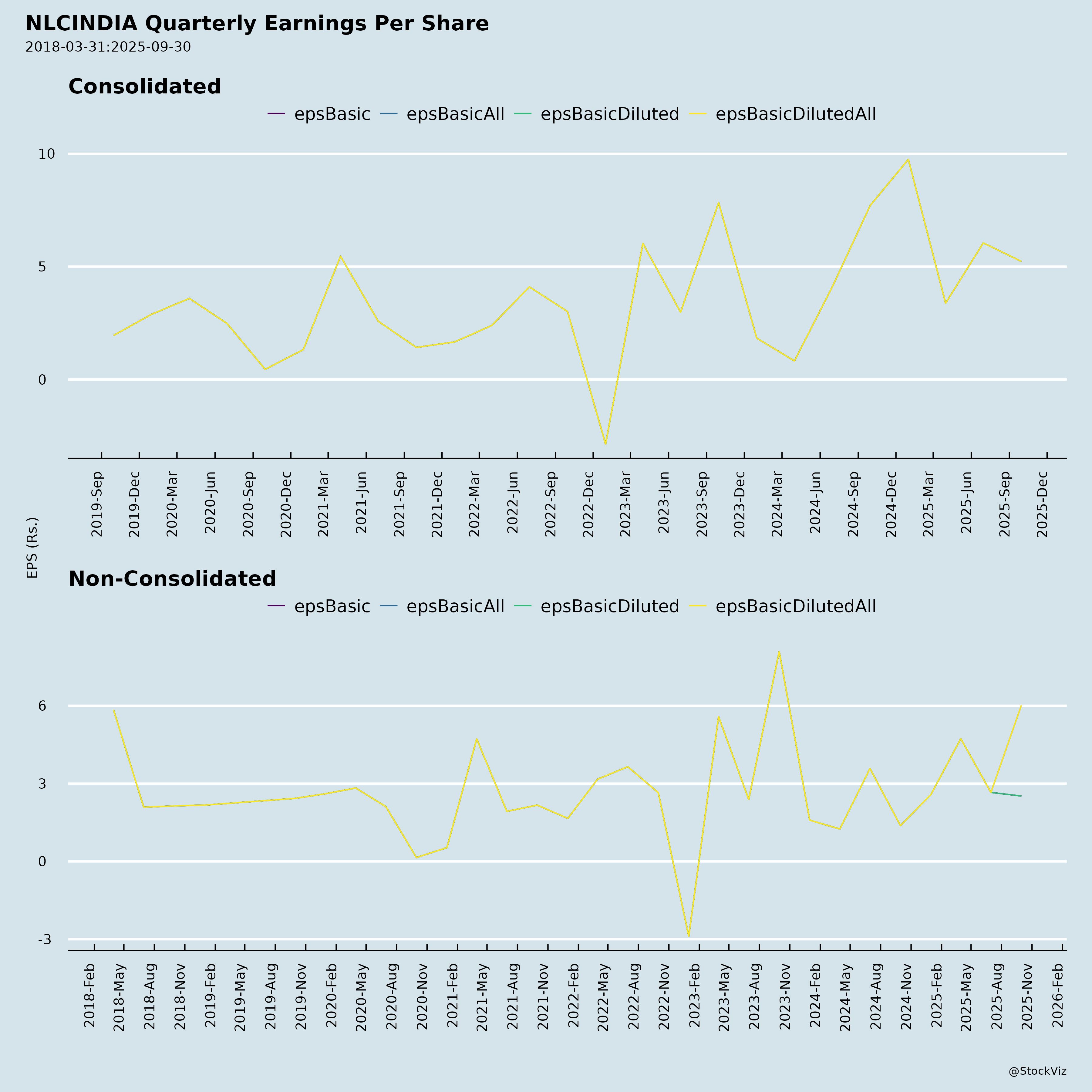

📊 Financial Ratios Snapshot (H1 FY26)

| Metric | Value |

|---|---|

| Total Income | ₹8,463 Cr |

| Revenue from Operations | ₹8,004 Cr |

| PAT | ₹1,564 Cr |

| EBITDA Margin | 37.7% |

| Net Profit Margin | 18.5% |

| Debt-to-Equity | 1.22 |

| Return on Capital Employed (ROCE) | 4.4% (annualized) |

| EPS (H1) | ₹11.28 |

| Book Value per Share | ₹125.95 |

🔸 High margins and stable PAT are positives, but ROCE appears suppressed due to new project capex (pre-revenue phase).

✅ Conclusion: Strong Turnaround Story with Long-Term Upside

Investment Thesis

NLCINDIA is a compelling long-term investment for investors seeking: - Exposure to India’s energy transition via a state-backed, financially stable player. - A high-dividend yield stock with 26 years of consistent payouts. - Massive growth potential in renewables, coal, and critical minerals. - Strategic role in national energy security.

Valuation and Outlook

- Current Market Cap: ₹39,563 Cr (Sep 2025)

- Projected PAT by FY30: ₹5,300 Cr → Potential P/E of ~7.5x if market cap scales to ₹1.3–1.5 lakh Cr.

- Trading at a multi-year low P/E (~26x Sep 2025 earnings) pre-CAPEX cycle; future earnings re-rating likely post-commissioning.

🔄 Recommendation: Accumulate for Long Term

| Factor | Assessment |

|---|---|

| Sector Outlook | Positive (Energy transition in focus) |

| Financial Health | Strong (AAA rating, stable PAT) |

| Growth Visibility | Very High (1.17 Lakh Cr CAPEX pipeline) |

| Governance Concerns | Moderate (Delay in SEBI compliance) |

| Dividend Yield | Attractive (~3.0% at current price) |

| Risk/Reward Ratio | Favorable for patient investors |

✔️ Buy on Dips – NLCINDIA is a core holding for long-term investors seeking exposure to India’s green energy ambition through a trusted PSU.

📌 Final Note:

While short-term headwinds like regulatory fines and commissioning delays are visible, NLC’s long-term vision, execution capabilities, and government backing position it as a key player in India’s energy future. Investors should monitor COD progress in NUPPL, appointment of woman director, and milestone achievements in renewable projects as critical triggers for re-rating.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.