Power Generation

Industry Metrics

January 13, 2026

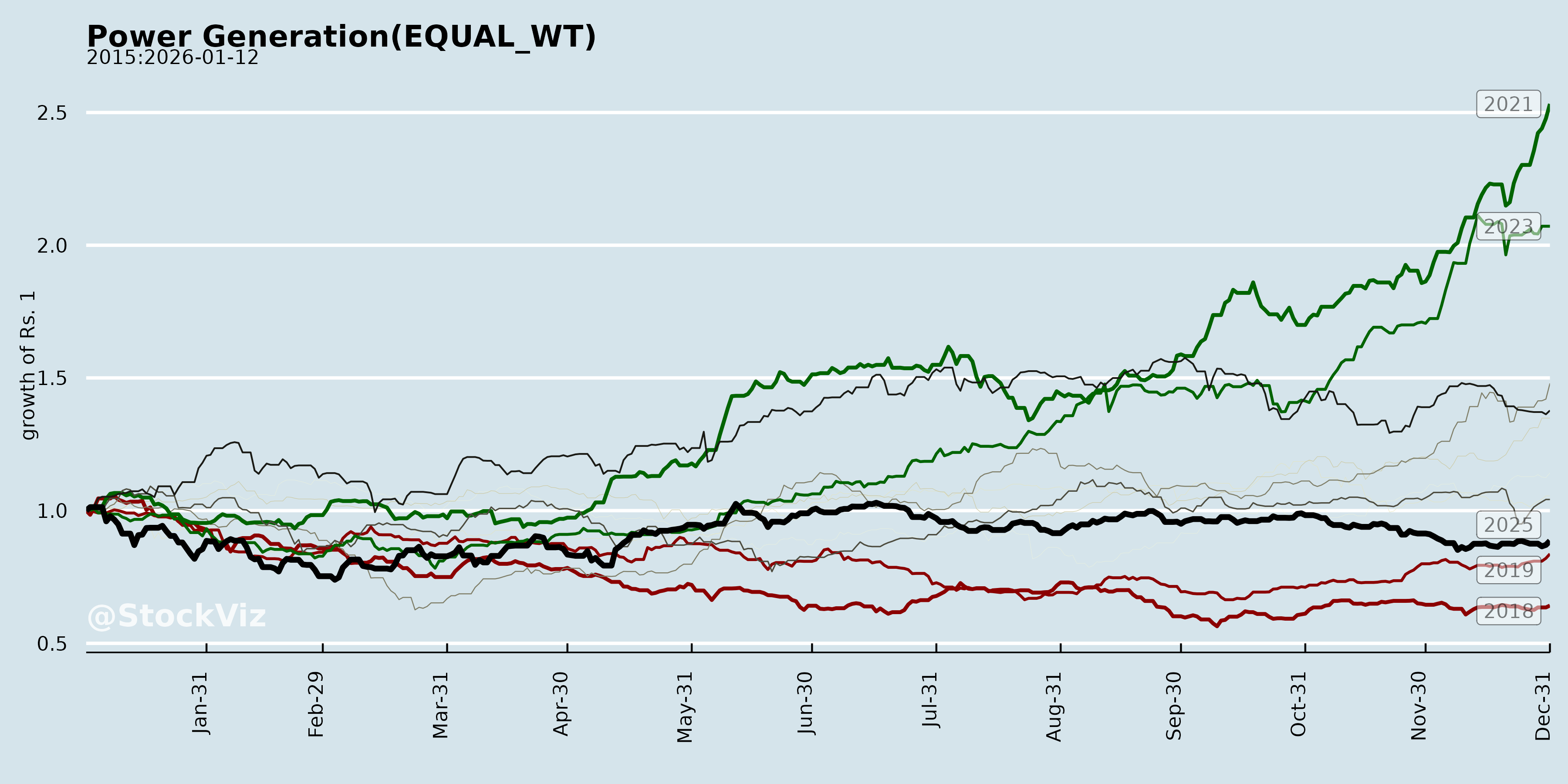

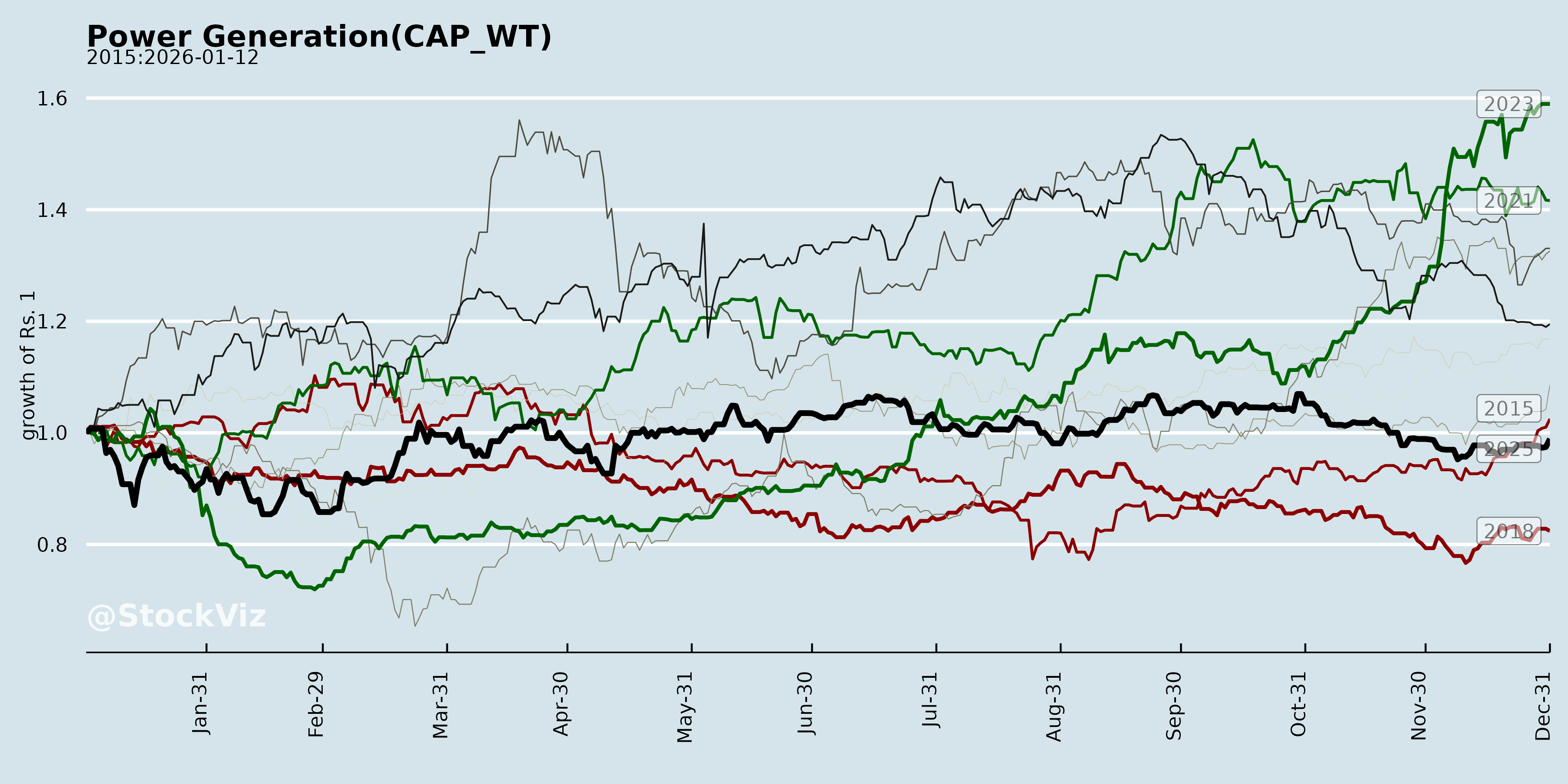

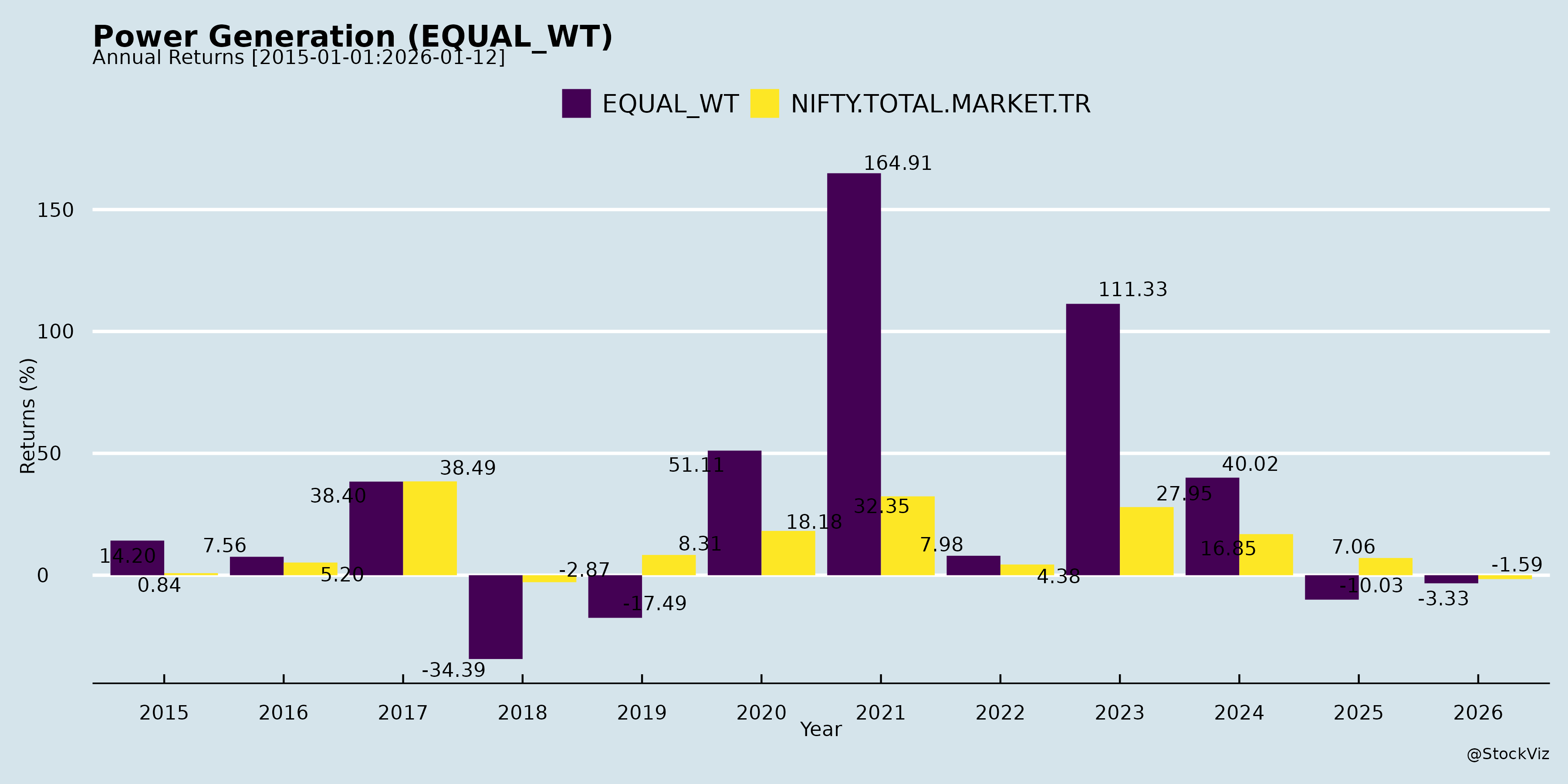

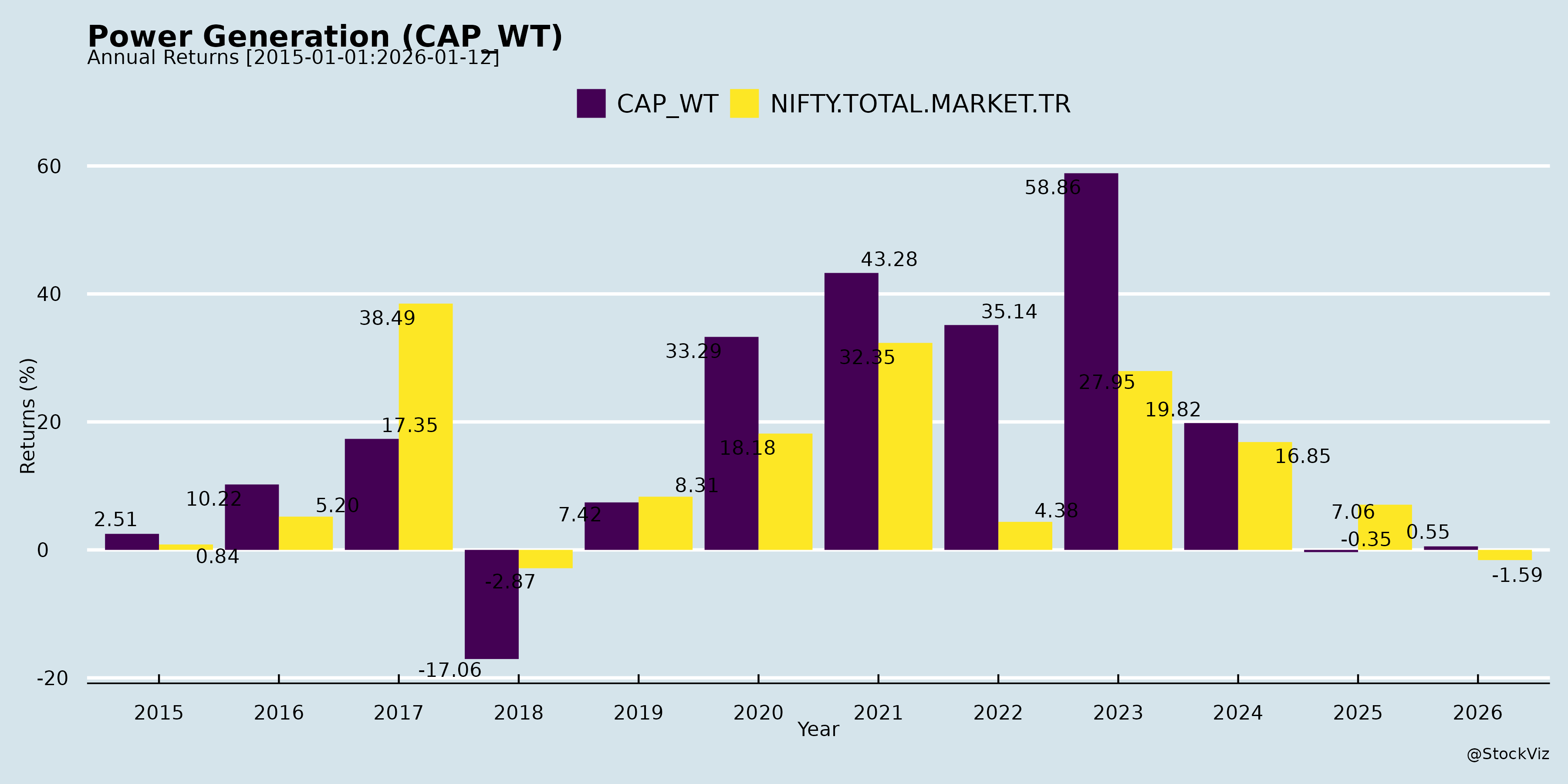

Annual Returns

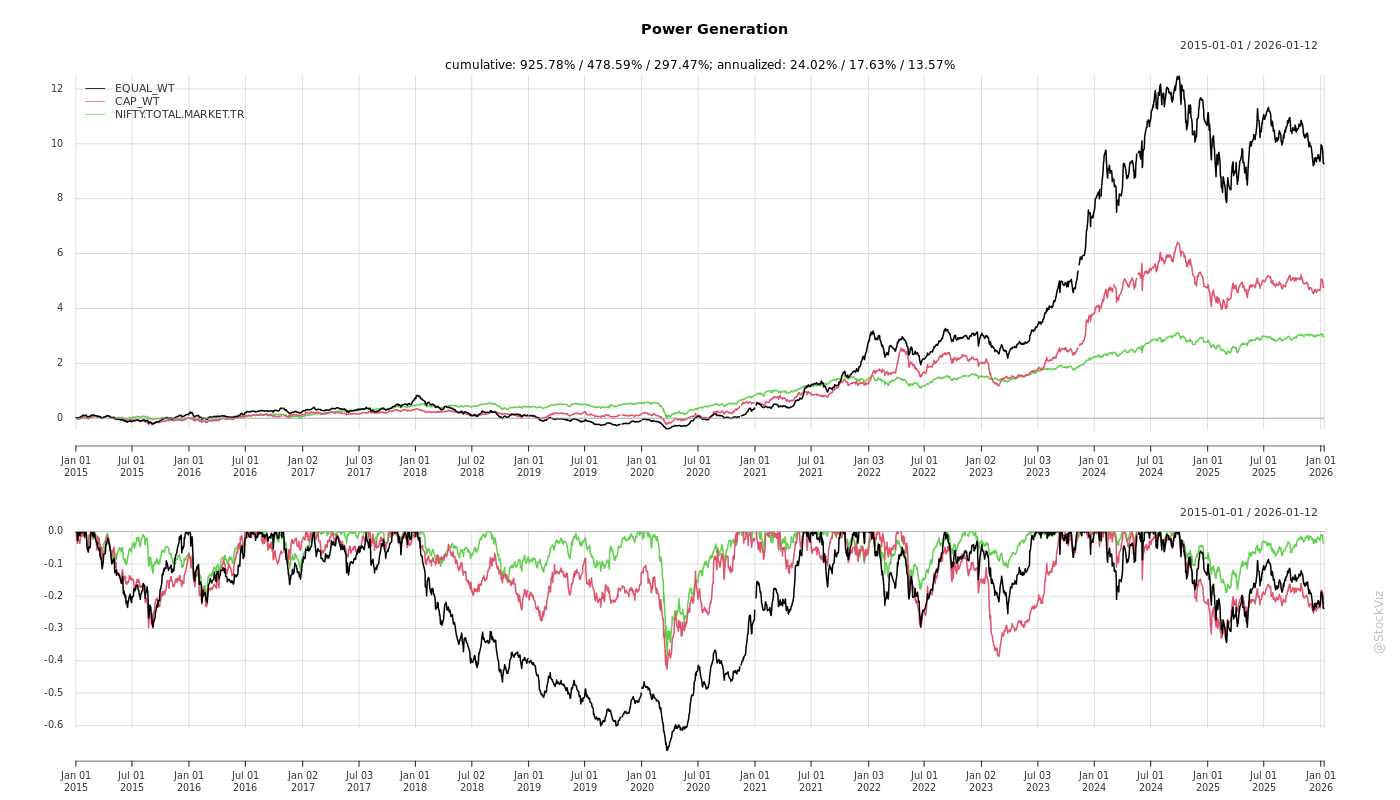

Cumulative Returns and Drawdowns

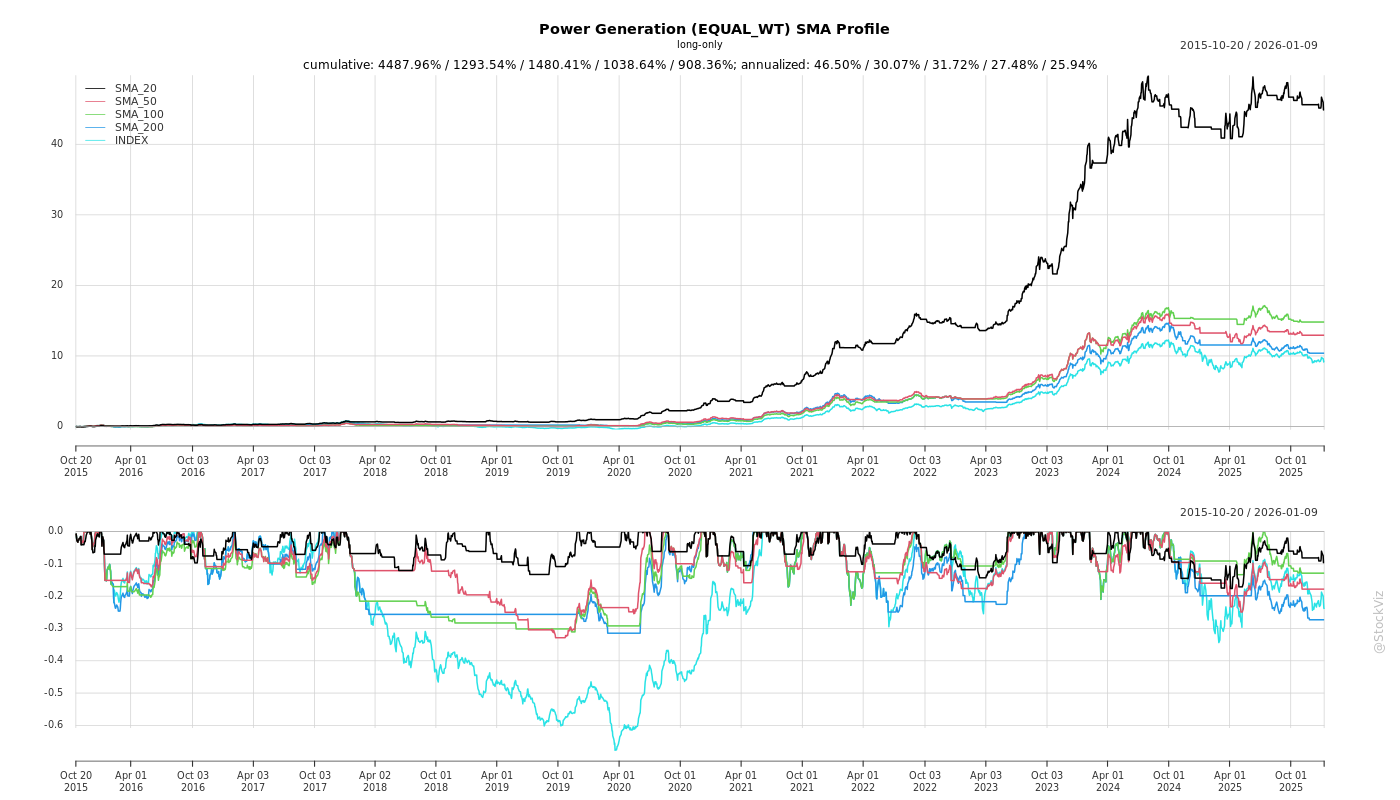

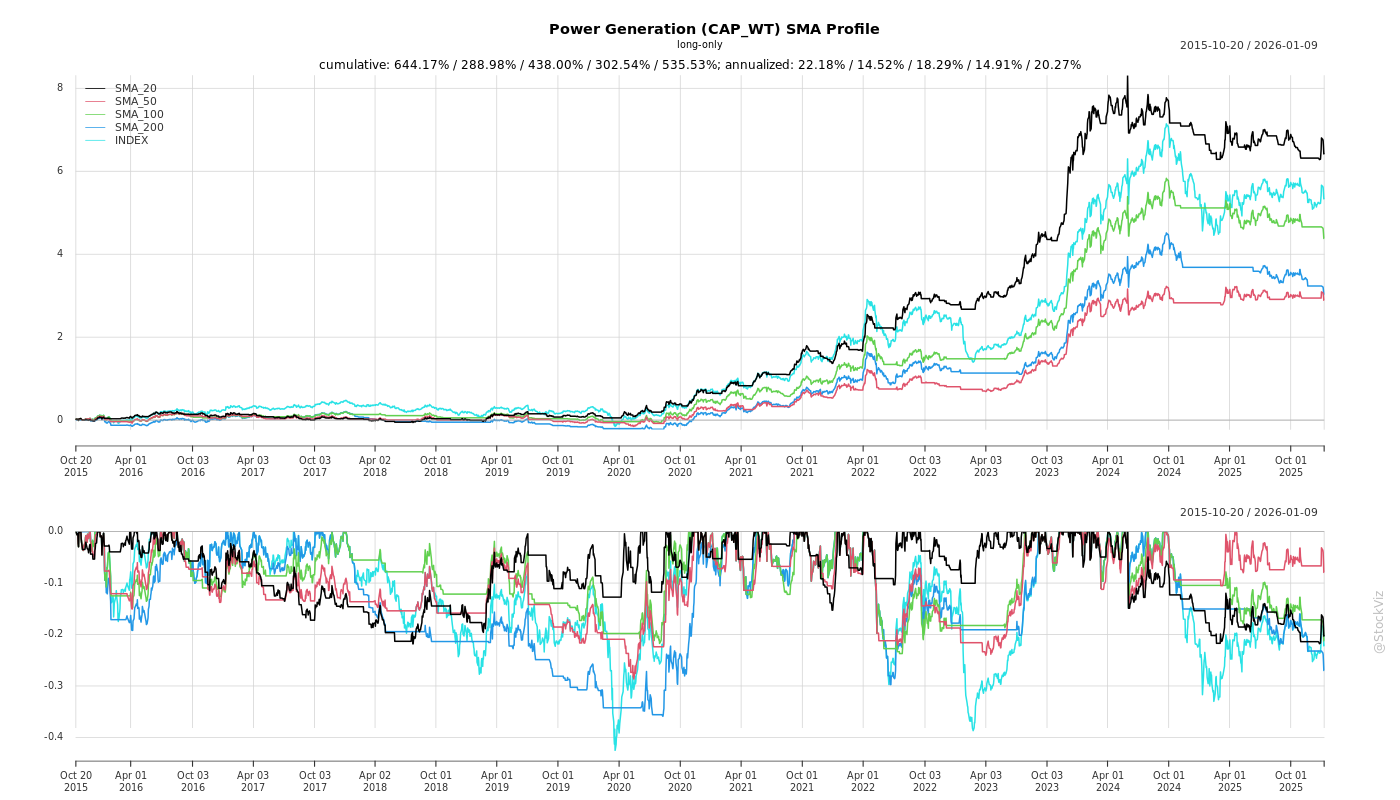

SMA Scenarios

Current Distance from SMA

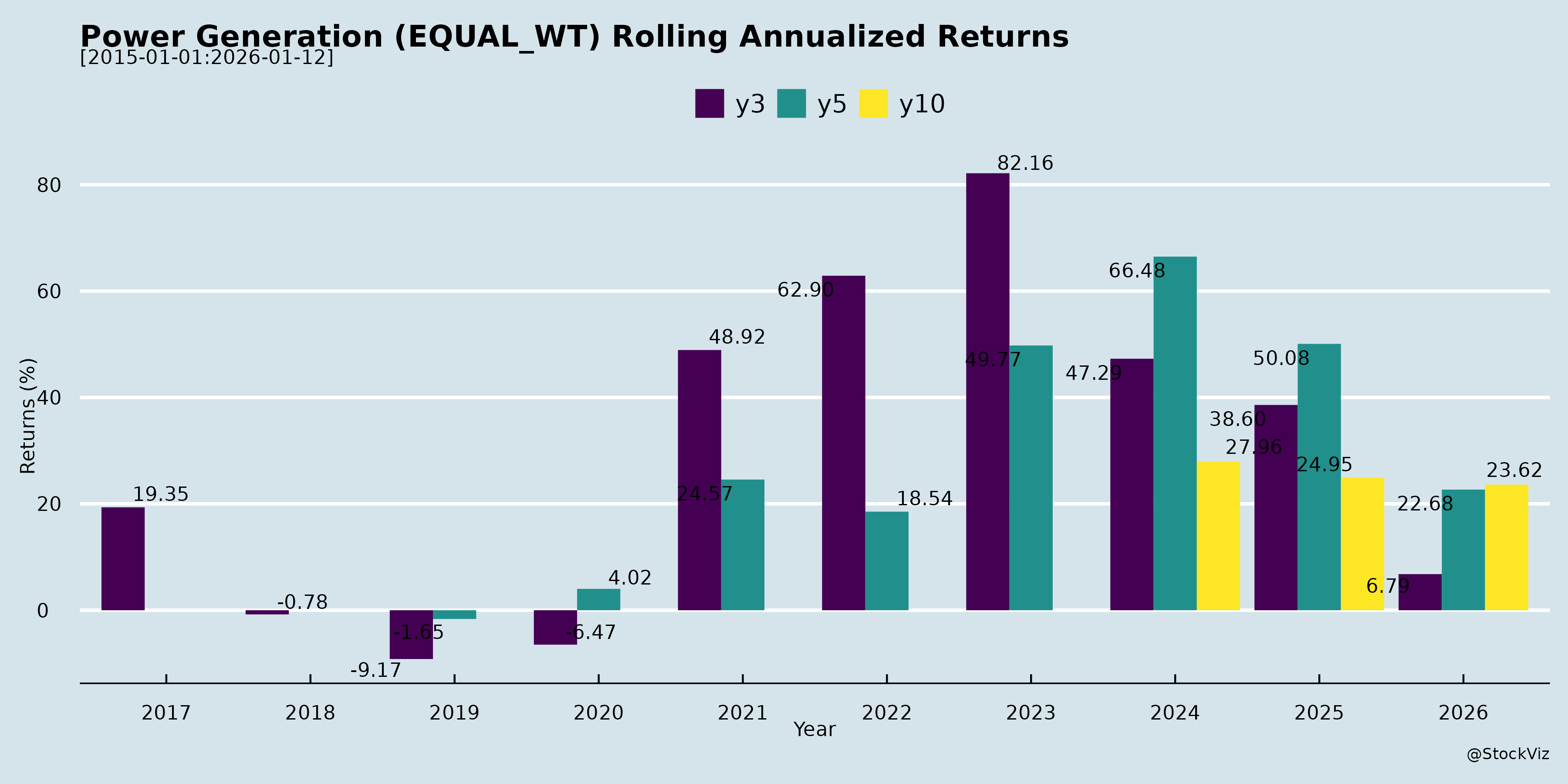

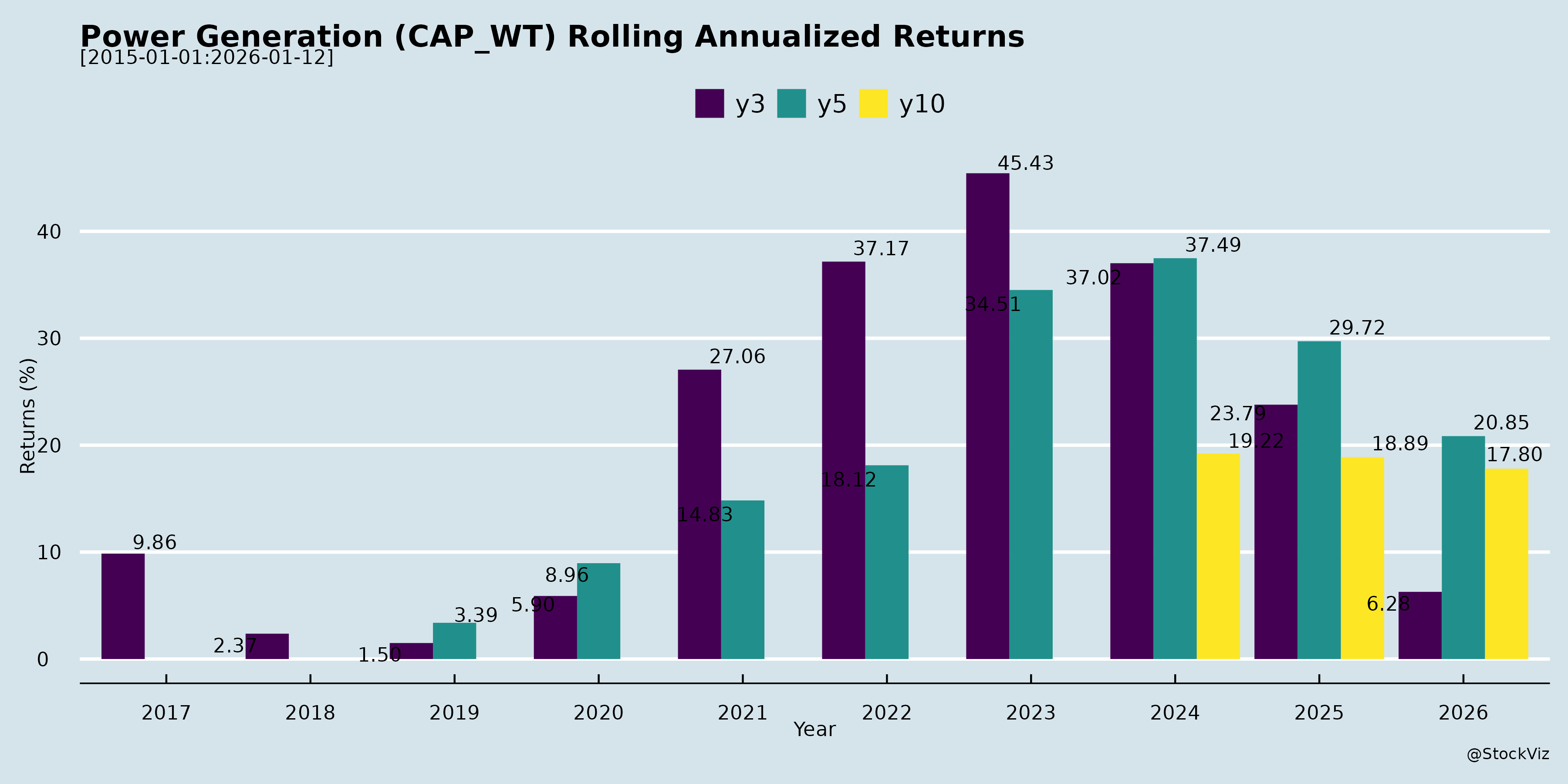

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Indian Power Generation Sector Analysis

Based on Q2/H1 FY26 Earnings Transcripts and Announcements (NTPC, NHPC, SJVN, KPI Green, KP Energy, Inox Wind/Green, etc.)

The sector shows robust momentum driven by surging demand and policy support, but faces execution and grid challenges. Thermal remains baseload king (NTPC’s coal dominance), while RE (solar/wind/hybrid) accelerates toward 500 GW by 2030. Key players report record capacity additions (NTPC: 5.4 GW in 7 months), strong PAT growth (10-70% YoY), and expanding IPP/CPP pipelines.

Tailwinds (Positive Drivers)

- Explosive Demand Growth: GDP at 6.5-7%; urbanization, data centers (AI/giga-scale), manufacturing, EVs fueling 4x electricity rise by 2035. Peak demand up, industrial/commercial segments accelerating.

- Policy Boost: GST cut on wind (12%→5%), ALMM for wind turbines, CERC reforms (feasible scheduling, thermal obligations), VGF for BESS/PSP (₹18L/MWh), PLI schemes, RTC/FDRE tenders favoring hybrids.

- Capacity Acceleration: RE targets (500 GW by 2030); hybrids/RTC (wind+solar+BESS) surging for grid stability/peak tariffs. NTPC: 85 GW operational (+10% YoY), 33 GW UC; SJVN/Inox: Solar/wind ramps; KPI: 6 GW group pipeline.

- Financing Ease: Low-cost debt (NTPC: 6.11%), green bonds (KPI: ₹670 Cr AA+ rated), SBI sanctions (₹3,200 Cr). Ratings upgrades (KP Energy: A-/Stable).

- Tech/Exports: Larger turbines (4-6 MW), nearshore wind, green H2/ammonia MoUs (KPI/KP with Korea/Delta). O&M boom (Inox Green: 12.5 GW portfolio).

Headwinds (Challenges)

- Subdued H1 Demand: Mild summer/extended monsoon led to 6-9% generation drop (NTPC: 214 BU vs. prior); hydro floods (NHPC: Teesta-V shutdown).

- Grid/Evacuation Bottlenecks: Curtailment (Rajasthan), transmission delays (Khavda/Bhuj GSS), connectivity waits (28-31 months). ~40 GW RE projects stalled without PPAs (rebidding).

- Regulatory Hurdles: Stricter DSM (penalties for deviation), water cess reversals, fixed cost under-recoveries (NTPC: ₹625 Cr).

- Execution Delays: Monsoons/ROW for wind (SJVN/NHPC slippage); PPA delays pushing orders (KP Energy: Dec ’25).

- Margin Pressures: EBITDA dips (KPI: 35-37%), rising debt/capex (SJVN: ₹7,500 Cr FY26), EESL losses (NTPC).

Growth Prospects

- RE Dominance: Hybrids/RTC/FDRE tenders to drive wind revival (3.7 GW added in 7 months); solar/wind to 60 GW by FY32 (NTPC/NGEL). BESS/PSP scale-up (NTPC: 13 GW PSP allocated).

- Capex Surge: NTPC: ₹7L Cr by 2032; KPI: 10 GW by 2030; Inox: 1 GW recurring orders. Trading/O&M (NTPC VVN: +11%; Inox Green: FY27 manifold PAT).

- Diversification: Nuclear (NTPC Mahi Banswara: 2.8 GW), green chemicals/H2 (NGEL ammonia win), international (NTPC Sri Lanka/Mauritius; KPI UAE).

- FY26/FY27 Outlook: 50-70% revenue growth (KP Energy); NTPC PAT +6-10%; SJVN 1.5 GW solar. Sector: 40-50 GW solar/wind adds annually.

- Long-Term: 244 GW NTPC by 2037; group IPPs (Inox Clean) for recurring EPC/O&M.

Key Risks

| Risk Category | Details | Mitigants |

|---|---|---|

| Grid/Transmission | Evacuation delays, curtailment, instability (duck curve); 40 GW PPA stalls. | Govt green corridors, One Nation-One Grid, hybrids/BESS. |

| Regulatory/Policy | DSM penalties, PPA cancellations, tariff erosion (LCOE drop), water cess. | Long-term PPAs (25 yrs), RTC focus, CERC reforms. |

| Execution | Monsoon/ROW delays, supply chain (panels/turbines). | Hedging, group cranes/facilities (KP/Inox), backward integration. |

| Financial | High capex/debt (SJVN ₹30K Cr), dilution, receivables (NTPC 28 days). | Strong cash flows (KP: ₹85 Cr H1), ratings upgrades, green bonds. |

| Market/Competition | Subdued wind orders (7 months low), excess solar capacity. | Tech-agnostic (KP/Inox), hybrids, exports (H2). |

| External | Geopolitics (tariffs), floods (NHPC). | Diversified portfolio (thermal/RE/nuclear). |

Overall Summary: Bullish long-term (demand + policy = 500 GW RE), but near-term volatility from grid/PPAs. Leaders like NTPC (regulated stability) and KPI/Inox (RE agility) best positioned. Expect 10-20% PAT CAGR FY26-28; monitor H2 execution/grid upgrades. Sector ROE improving (20%+ for top players).

General

asof: 2025-12-03

Summary Analysis of Indian Power Generation Sector

Based on the provided disclosures from key players (NTPC, Adani Green, JSW Energy, NTPC Green Energy, NHPC, NLC India, SJVN, Reliance Power, Nava, ACME Solar, Jaiprakash Power, GMR Power), the sector shows a clear pivot toward renewables amid coal restructuring, with mixed signals on governance. India’s power demand growth (~7-8% CAGR) and net-zero goals (500 GW renewables by 2030) provide a supportive backdrop. Below is a structured analysis:

Tailwinds (Positive Momentum)

- Renewables Acceleration: Significant capacity additions and expansions. NTPC Green Energy commissioned 75.5 MW solar (part of 1,255 MW Khavda project), boosting group capacity to 7,639 MW. Adani Green incorporated two new hydro subsidiaries (AHE13L, AHE16L) for wind/solar/hydro power generation, signaling aggressive green growth.

- Operational Efficiency: NTPC transferred Kerandari Coal Mine (Jharkhand) to subsidiary NTPC Mining Ltd., streamlining coal operations. JSW Energy’s resolution plan approval for Raigarh Champa Rail (critical for 3,600 MW coal plants) ensures supply chain reliability.

- Investor Confidence: NHPC’s participation in multiple Mumbai investor conferences (CLSA, Avendus, JM Financial) indicates proactive engagement amid strong hydro/renewable fundamentals.

- Routine Compliance: Positive steps like SJVN appointing a secretarial auditor for 5 years enhance governance optics.

Headwinds (Challenges)

- Governance Lapses: Multiple fines for board non-compliance. NLC India fined ₹5.43 lakh each by NSE/BSE for lacking a woman director (Reg 17(1)); Jaiprakash Power fined ₹89,680 each for Reg 17(1A) violations. Requests for waivers cite govt. control but highlight delays in PSU board reconstitution.

- Auditor Instability: GMR Power’s material subsidiary (GMR Warora Energy) saw S.R. Batliboi resign due to internal independence conflicts (non-audit services by EY affiliate), requiring new auditors (Walker Chandiok).

- Legal Distractions: Reliance Power clarified an arrest (Amar Nath Dutta) in a fake bank guarantee case as unrelated, reiterating victim status—but media links to past promoters (Anil Ambani) could dent sentiment.

- Minor Operational Noise: Routine disclosures (e.g., ACME Solar shareholder letters, Nava subsidiary name change) reflect admin burdens but no major disruptions.

Growth Prospects

- Renewables Dominance: High potential in solar/hydro (e.g., NTPC Green’s CPSU scheme, Adani’s new entities). Sector-wide push aligns with RE targets; NTPC/NGEL group’s rapid scaling (from 7,564 MW to 7,639 MW) exemplifies execution.

- M&A and Infrastructure: JSW’s rail acquisition (post-KSK Mahanadi) unlocks synergies for coal evacuation; phased NTPC mine transfers could enable similar deals. Expect more insolvency resolutions (IBC) for stressed assets.

- Capacity Ramp-Up: Phased commissioning (e.g., NTPC’s 1,255 MW solar) and new SPVs indicate pipeline execution amid falling solar tariffs (~₹2.5/kWh).

- PSU Momentum: Navratnas like NTPC, NHPC, SJVN, NLC position for govt. capex (₹10-12 lakh Cr power sector outlay in FY26 budget).

Key Risks

- Regulatory/Compliance: Frequent SEBI LODR violations (board diversity, auditors) risk escalating fines, trading restrictions, or reputational damage—especially for PSUs dependent on govt. appointments.

- Execution Delays: JSW’s deal needs NCLT approval; renewables face land/evacuation bottlenecks.

- Governance Erosion: Auditor resignations (GMR) and fraud clarifications (Reliance) could trigger deeper scrutiny/investor outflows.

- Sectoral: Coal reliance amid green transition (NTPC/JSW moves mitigate but expose to policy shifts); forex/fuel volatility for hybrids.

- Macro: High capex needs (₹15-20 lakh Cr for 500 GW) strain balance sheets; election cycles may slow PSU decisions.

Overall Outlook: Moderately Positive. Tailwinds from renewables (60-70% of growth) outweigh headwinds, with 15-20 GW annual additions feasible. Governance fixes critical for sustained FII inflows (~₹50,000 Cr in power stocks CY25). Monitor Q3FY26 earnings for capex execution. Recommendation: Overweight renewables (Adani Green, NTPC Green); selective on PSUs post-compliance.

Investor

asof: 2025-12-03

Indian Power Generation Sector Analysis (Based on Q2/H1 FY26 Earnings Calls & Announcements)

The Indian power sector is witnessing robust structural growth driven by economic expansion, RE transition, and government mandates (e.g., 500 GW RE by 2030). Key players like NTPC, SJVN, NHPC, KPI Green, KP Energy, INOX Wind/Green, and others report record capacity additions (e.g., NTPC: 5.4 GW in 7 months), stable financials, and ambitious targets (e.g., NTPC: 244 GW by 2037). Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Surging Demand: GDP growth (6.5-7%), industrialization, data centers/AI, urbanization driving 4x electricity demand by 2035 (from 1.4T units). Industrial/commercial segments resilient despite mild H1 summer.

- Policy Support: CERC Suo-Motu orders for thermal scheduling; GST cut on wind (12%→5%); ALMM for wind; hybridization allowed for ISTS; VGF for BESS/PSP; green H2 mission.

- Capacity Ramp-Up: Record additions (NTPC: 8.4 GW group capacity; SJVN: 3.1 GW operational); hybrid/RTC/FDRE models gaining traction for grid stability.

- Financing Ease: Low borrowing costs (NTPC: 6.11%); green bonds (KPI: ₹670 Cr AA+ rated); rating upgrades (KP Energy: A- stable).

- Tech/Integration: Wind complements solar (duck curve solution); BESS/PSP/nuclear entry (NTPC: 5 GW BESS thermal co-located; SJVN/NHPC hydro progress).

Headwinds (Challenges)

- Subdued H1 Demand: Mild weather/extended monsoon led to 6-9% lower generation (NTPC: 214 BU vs. prior; NHPC: 9% down due to floods).

- Grid/Evacuation Bottlenecks: Curtailment in Rajasthan/Gujarat; transmission delays; ~40 GW RE projects at risk of PPA cancellation/rebidding due to low tariffs/viability.

- Regulatory Hurdles: Stricter DSM (deviation penalties); low wind/solar tariffs in legacy bids; DISCOM payment delays (though improving: NTPC receivables 28 days).

- Execution Delays: Monsoon impacts (KPI: Q2 muted); clearances/land (SJVN Etalin hydro); wind ROW/heavy machinery issues.

- Competition: Oversupply in solar modules; tariff-based bidding pressures EPC margins.

Growth Prospects

- Capex Explosion: NTPC: ₹7L Cr by 2032; SJVN: ₹7.5K Cr FY26; KPI/INOX: Multi-GW IPP/CPP pipelines (KPI: 10 GW by 2030 group-level).

- RE Dominance: Hybrid/wind revival (3.7 GW wind added in 7 months); BESS (NTPC: 5 GW regulated); PSP (NTPC: 12.7 GW allocated); green H2/ammonia (KPI MoUs).

- Diversification: Nuclear (NTPC Mahi Banswara 2.8 GW); trading (NTPC VVN: 11% growth); O&M (INOX Green: 12.5 GW portfolio →17 GW in 2 yrs); international (NTPC Sri Lanka/Mauritius; KPI UAE).

- Order Visibility: Strong books (KP Energy: 2.2 GW/₹2.9K Cr; INOX Wind: 3.2 GW); framework agreements (INOX: 1 GW annual recurring).

- Projections: Sector PLF improving (NTPC coal: 70.5% vs. India 64%); EBITDA margins 18-22% sustainable; PAT growth 40-60% YoY for leaders.

Key Risks

| Risk Category | Details | Mitigation (from Cos) |

|---|---|---|

| Regulatory/Policy | PPA cancellations; DSM penalties; tariff truing-up delays/under-recoveries (NTPC: ₹625 Cr). | Long-term PPAs (GUVNL/SJVN); CERC frameworks. |

| Execution/Operational | Monsoon/floods (NHPC Teesta down); land/ROW delays; supply chain (panels). | Diversified portfolio; in-house cranes/mfg (INOX/KP). |

| Financial | High capex/debt (SJVN: ₹30K Cr debt); receivables (NHPC: ₹4.4K Cr). | Low D/E (KP: comfortable); green financing. |

| Market/External | Grid instability/curtailment; low wind sites; geopolitical (fuel imports). | Hybrid/BESS focus; captive coal (NTPC: 16% receipts). |

| Competitive | Low tariffs; Chinese dumping. | Tech edge (3MW+ turbines); group synergies. |

Overall Summary: The sector is bullish with strong tailwinds from demand/policy outweighing cyclical headwinds like weather/grid issues. Growth is anchored in RE/hybrid (100-150 GW additions by FY28), but risks center on execution/grid. Leaders like NTPC (regulated stability) and privates (KPI/INOX agility) are de-risked via IPPs/orders. Expect 15-20% sector CAGR; monitor PPA rebids/DSM for near-term volatility.

Press Release

asof: 2025-12-03

Summary Analysis: Indian Power Generation Sector (Based on Provided Announcements)

The provided documents highlight a vibrant Indian power sector dominated by renewable energy (RE) momentum, with key players like NTPC, Adani Green, SJVN, KPI Green, Inox Group, ACME, and Nava announcing capacity milestones, MoUs, tender wins, and partnerships. Thermal/gas assets show stress, but RE (solar, wind, hybrid, RTC with storage) drives growth. Overall, the sector aligns with India’s 500 GW non-fossil target by 2030 and net-zero goals, with Gujarat’s Khavda as an emerging RE hub.

Tailwinds (Positive Drivers)

- Policy & Govt Support: Strong backing via state MoUs (e.g., NTPC-Gujarat), PM-led events (SJVN 200 MW solar foundation), and RTC tenders (Ayana 140 MW, ACME 130 MW at ₹4.35/kWh). Focus on RE procurement by PSUs like REMC/REMCL, Railways, GUVNL.

- RE Capacity Surge: Adani Green hits 15 GW (India’s largest, +5 GW in 15 months); NTPC at 83 GW total (13.3 GW RE under construction, 60 GW RE target by 2032); mega projects like Khavda (Adani 30 GW, SJVN 200 MW).

- Partnerships & Scale: Large MoUs (KPI-Inox for 2.5 GW solar/wind each, total 5 GW O&M by Inox Green); diversification into storage, hybrid, green H2, e-mobility (NTPC, Nava).

- Financial Resilience: Strong results (Nava Q2 FY26: ₹989 Cr revenue, ₹177 Cr PAT); dividends (Nava 300%); asset monetization (GMR divesting stressed assets for ₹653 Cr).

- Operational Efficiency: High PLF (Nava MEL 80.4%); water-positive certifications (Adani); job creation (~3,700 green jobs by Adani).

Headwinds (Challenges)

- Legacy Thermal/Gas Stress: Non-operational gas plants (GMR Vemagiri/GREL/Bajoli due to unaffordable gas since 2016); divestments signal deleveraging needs (GMR reducing debt by ₹4,400 Cr).

- Fuel Volatility: Coal price cuts aid margins (Nava), but arrears persist (Nava MEL: US$55.5 Mn dues).

- Legal/Resolution Issues: Reliance Power clarifies no impact from RCOM asset attachments (CIRP ongoing since 2019); sub-judice matters.

- Execution Delays: Large projects (e.g., Nava 100 MW solar H2 FY27; GMR divestment by Sep 2025) face land/approvals hurdles.

Growth Prospects

- RE Dominance: 50-60 GW targets (Adani 50 GW by 2030, NTPC 60 GW RE); hybrid/RTC/storage boom (min. 75-85% availability); Khavda as “world’s largest RE park” (30 GW+).

- Pipeline Expansion: 2.5-5 GW MoUs (KP Energy/Inox Wind, KPI Green/Inox Solar); tender wins signal more (REMC 1 GW RTC).

- Diversification: O&M scale-up (Inox Green 12.5 GW AUM to +5 GW); new areas (battery storage, waste-to-energy, nuclear, green H2 by NTPC/Nava); exports/mining/agri synergies.

- Market Leadership: PSUs (NTPC, SJVN, NLC) + privates (Adani, ACME) positioning for 500 GW goal; EPC/value chain integration (e.g., Inox supply + KP development).

- Sustainability Edge: Carbon offsets (Adani ~28.6 Mn tCO2e/yr); ESG rankings boost investor appeal.

Key Risks

| Risk Category | Details | Mitigation from Docs |

|---|---|---|

| Execution/Supply Chain | Delays in mega-projects (land, connectivity, ESS); module/turbine supply (e.g., Inox/KP MoUs). | In-house EPC/O&M (ACME, KPI); partnerships. |

| Regulatory/Tariff | PPA dependencies (25-yr for SJVN); tender competitiveness (₹2.88-4.35/kWh). | Direct PPAs (Railways); govt tenders. |

| Financial/Legal | Debt resolution (GMR OTS, Reliance CIRP); arrears (Nava). | Divestments (GMR ₹653 Cr); debt-free flags (Reliance Infra/Power). |

| Fuel/Commodity | Gas unavailability; coal volatility. | RE shift; coal price cuts. |

| Competition/Geopolitical | Tender intensity; global RE ranking pressures (Adani top-10 IPP). | Scale advantages (15 GW+ players). |

| Environmental/Operational | Weather dependency; maintenance (Nava PLF dips). | Hybrid/storage; certifications. |

Overall Outlook: Strongly Positive for RE (80% of announcements) – Tailwinds outweigh headwinds, with 10-20 GW near-term additions and GW-scale pipelines. Thermal/gas legacy drags growth for some (GMR, Reliance), but sector pivot to RE de-risks. Growth CAGR potential: 15-20% (driven by 2030 targets), but monitor execution amid capex intensity (~₹50,000-1L Cr needed). Investors favor RE pure-plays (Adani, KPI) over stressed thermal.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.