NIACL

Equity Metrics

January 13, 2026

The New India Assurance Company Limited

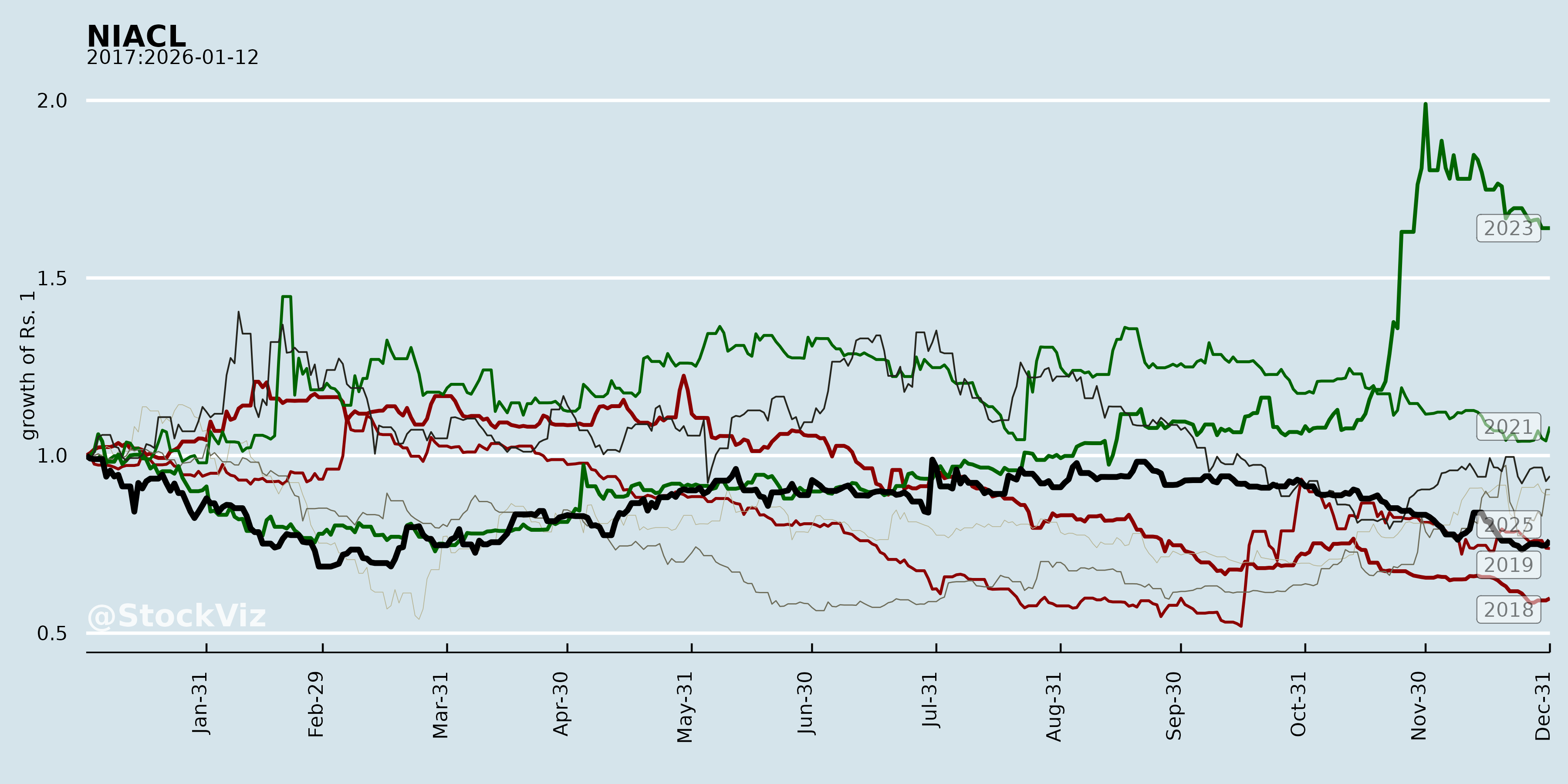

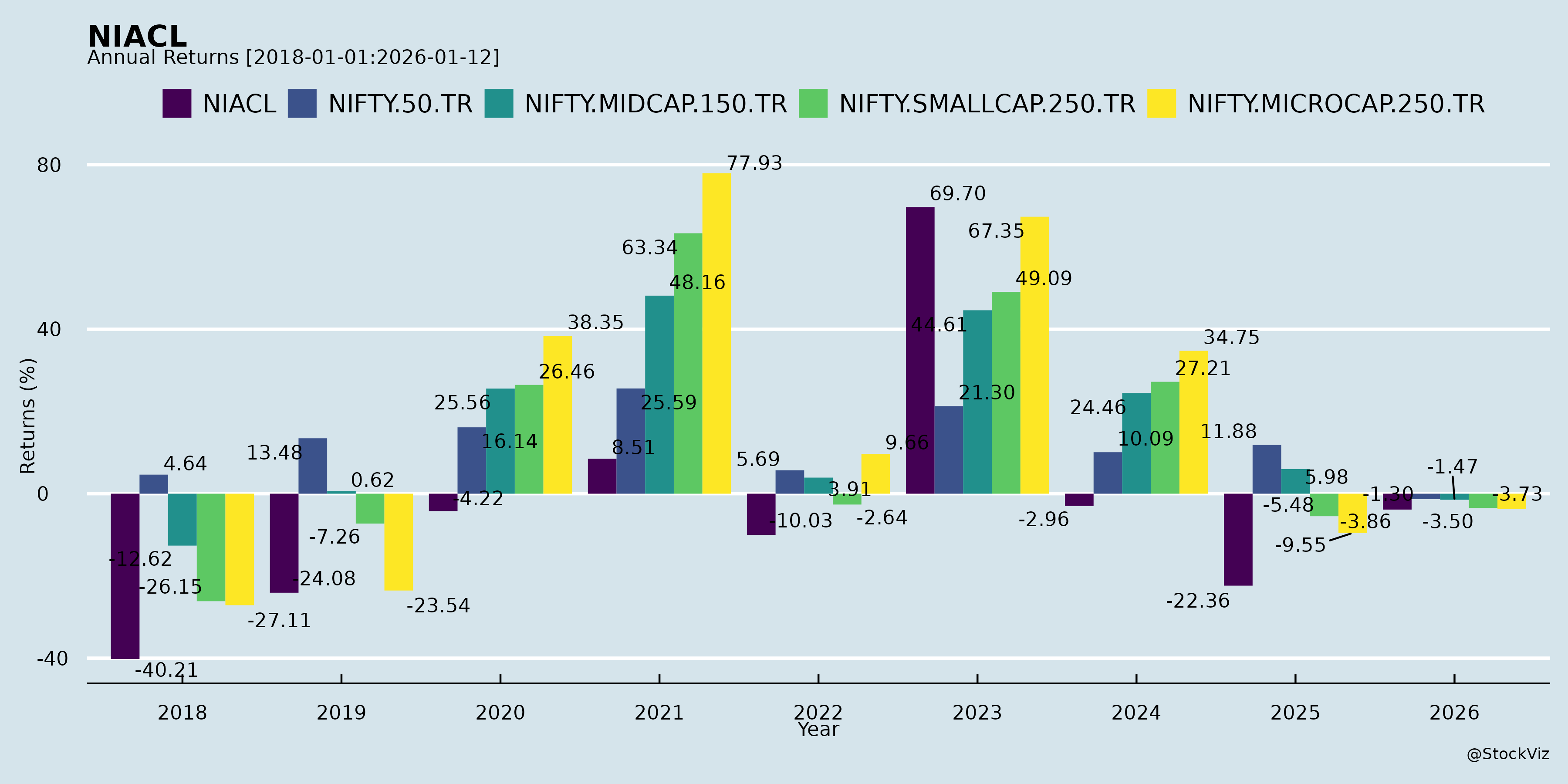

Annual Returns

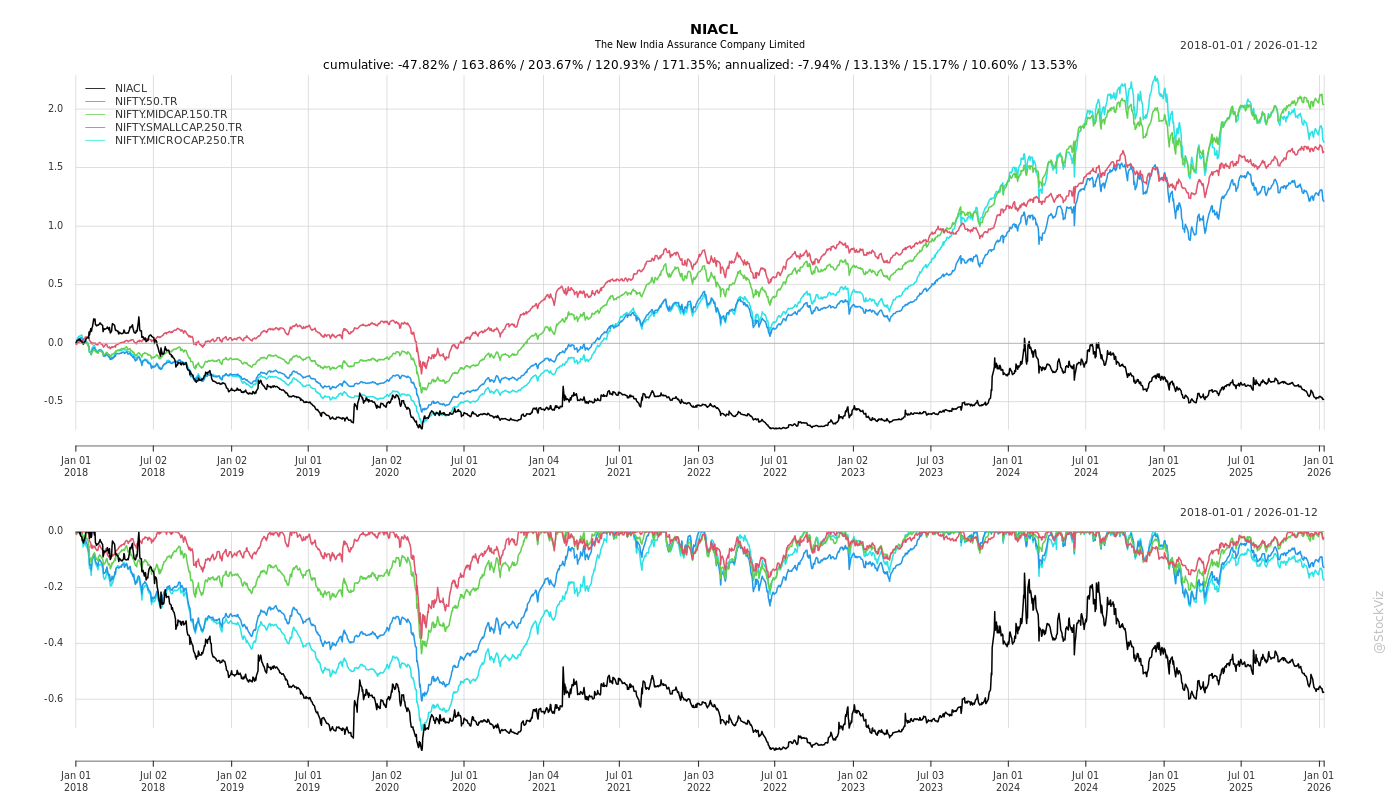

Cumulative Returns and Drawdowns

Fundamentals

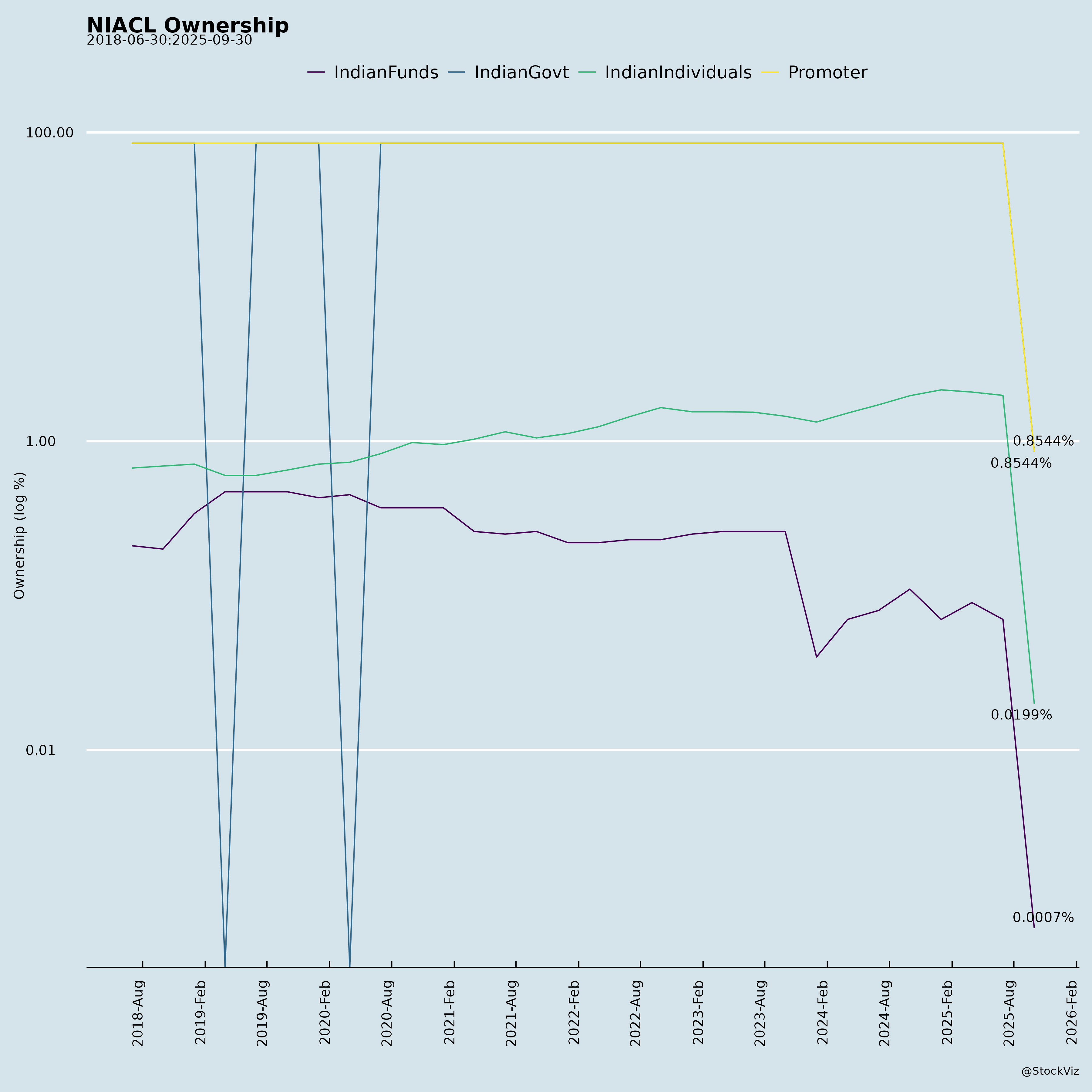

Ownership

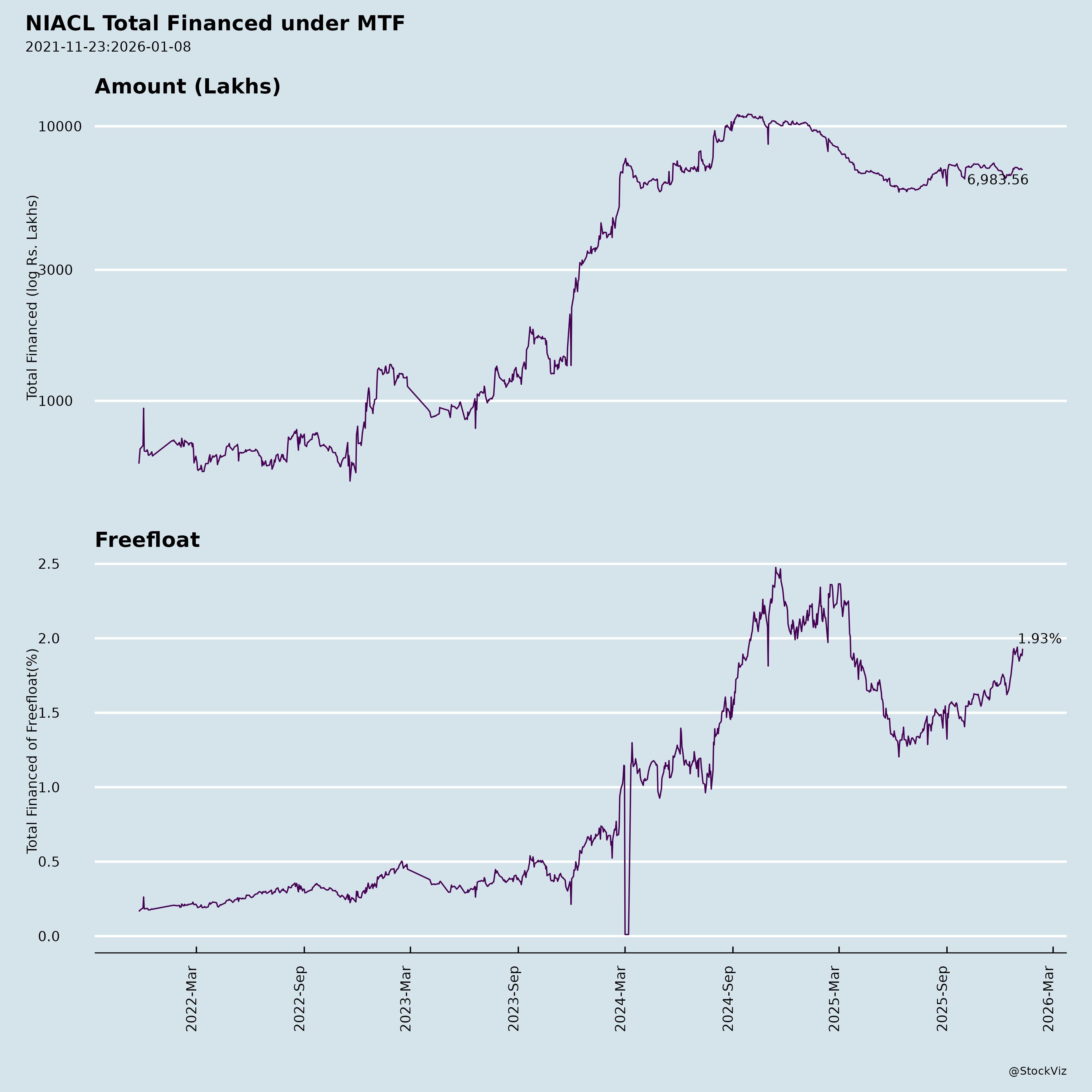

Margined

AI Summary

asof: 2025-12-03

NIACL Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Summary Overview:

The New India Assurance Company Limited (NIACL), India’s largest non-life insurer by Gross Direct Premium (GDP), reported robust H1 FY’26 results with GWP of ₹23,875 Cr (+11.5% YoY), domestic GDP growth of 12.86% (vs. industry 7.31%), and PAT of ₹454 Cr (+57.7% YoY). Market share expanded to 13.25% domestically. Strong investment income (₹4,570 Cr) offset underwriting pressures (ICR 104.22%, Combined Ratio 127.21%), driven by one-time wage provisions (₹1,680 Cr) and weather-related claims. Solvency remains solid at 1.79x. Tailwinds from GST cuts and digital initiatives support growth, but headwinds from catastrophes and costs persist. FY’26 outlook positive with industry outperformance, though H2 normalization expected.

Tailwinds (Positive Factors)

- Market Leadership & Share Gains: Largest non-life insurer; domestic market share rose from 12.6% to 13.25% (Fire: 16.4%, Marine: 17.3%, Health: 16.5%). October’25 growth outpaced industry.

- Premium Growth Momentum: H1 GWP +11.5%; strong segments (Fire +21%, Health +15%, Misc +16%). Q1 FY’26 GWP ₹13,333 Cr (+13.1% YoY).

- Investment Performance: Income ₹4,570 Cr offset underwriting losses; buoyant equity markets aided PAT surge.

- Regulatory Boost: GST on retail health premiums cut to 0% (effective Sep’25), fully passed to customers (~₹100 Cr P&L hit absorbed); expected to drive retail health growth (target 30-50% of book).

- Digital & Product Innovation: AI/OCR for claims, chatbots, fraud detection; new products (parametric weather, SME/women entrepreneurs, pandemic BI cover). MSME focus (90% uninsured gap).

- Ratings & Govt Backing: CRISIL AAA/Stable, AM Best B++(Good), IRDAI D-SII status; 85% govt-owned.

- Cost Discipline (Ex-One-offs): OpEx declined YoY excluding wage provision; office mergers, negative headcount growth.

Headwinds (Challenges)

- Underwriting Pressures: ICR up to 104.22% (+5% YoY) from floods (Fire), monsoons/diseases (Health), cellular claims (Misc), delayed Motor TP hikes. Combined Ratio 127.21% (vs. 120% YoY).

- One-Time Costs: ₹1,680 Cr wage revision arrears (₹1,118 Cr to revenue, ₹562 Cr to P&L); elevated OpEx ratio 13.64%.

- Catastrophe Exposure: Prolonged monsoons, North India floods; H1 CAT losses absorbed net (no reinsurance recovery).

- Segment-Specific Issues: Motor ICR worsening; Health ICR 105.78%; Misc 87.72%.

- GST Input Credit Loss: ~₹100 Cr hit on health premiums (no pass-through to agents).

- Reconciliation Delays: Reinsurance/co-insurance balances pending (provisions: ₹15,177 Cr reinsurance, ₹12,299 Cr co-insurance).

Growth Prospects

- Premium Expansion: Target sustained 11-13%+ growth; outpace industry (7-8%). Retail health/MSME push; parametric/group products for gig workers/informal sector. International ops in 25 countries.

- H2 FY’26 Normalization: Q3/Q4 expected to balance H1 claims; ICR improvement via underwriting discipline (risk selection in Motor).

- Digital Efficiency: Automation to cut TAT/OpEx; fintech/insurtech tie-ups for pricing/risk analytics; target ICR stabilization by FY’26 end.

- Regulatory Tailwinds: IFRS 17 (Apr’27) to improve combined ratio equivalent (investment credit); RBC rollout (data studies ongoing, no solvency strain expected).

- Long-Term: MSME penetration, cyber/pandemic covers, ESG focus. FY’25 GWP ₹43,618 Cr base; Q1 FY’26 momentum signals full-year outperformance. Roadmap: Health ~50% book, retail shift, 5-year GWP ramp-up.

| Metric | H1 FY’26 | YoY Change | FY’25 |

|---|---|---|---|

| GWP (₹ Cr) | 23,875 | +11.5% | 43,618 |

| PAT (₹ Cr) | 454 | +57.7% | 988 |

| Market Share | 13.25% | +0.65% | 12.6% |

| Solvency | 1.79x | -0.02x | 1.91x |

Key Risks

- Catastrophic/Weather Risks (High): Prolonged monsoons/floods; potential aggregate XoL reinsurance review.

- Underwriting/Claims (High): Elevated ICR persistence if Motor TP hikes delayed; Health inflation (dengue, etc.).

- Regulatory/Accounting (Medium): IFRS 17 parallel run FY’27; RBC impact unquantified; contingent tax liabilities (₹5,798 Cr direct, GST/Service Tax ~₹5.5L Cr).

- Operational (Medium): Reinsurance reconciliation (₹8,363 Cr gross recoverable); wage negotiations; foreign branch uncertainties (e.g., Kuwait going concern).

- Cyber/Climate/ESG (Medium): Rising cyber threats (ISO certified, new CISO planned); climate perils; internal controls strengthening needed.

- Market/Competition (Low-Medium): Private peers gaining retail share; equity volatility impacts investments.

- Auditor Notes: Qualified review (reconciliations pending); Emphasis on wage provisions, tax disputes, IT compliance (audit trail for foreign branches).

Investment Outlook: Positive medium-term (buy/hold for growth/dividend stability); monitor H2 claims normalization and wage finalization. Target upside from GST-driven health volumes and digital efficiencies; downside from CAT losses. ROE 4.18% (H1); dividend yield ~2-3% appealing for defensives.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.