NHPC

Equity Metrics

January 13, 2026

NHPC Limited

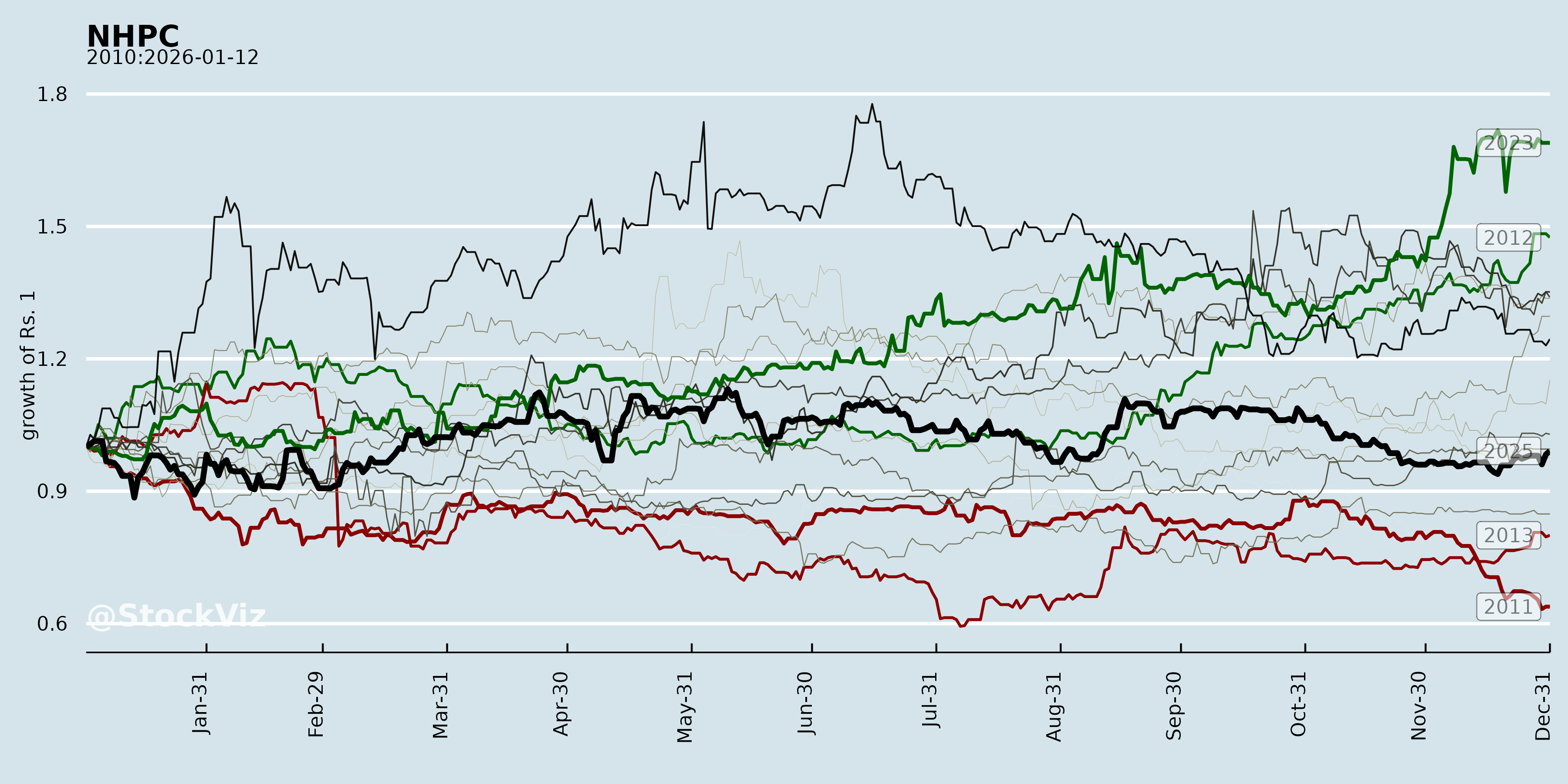

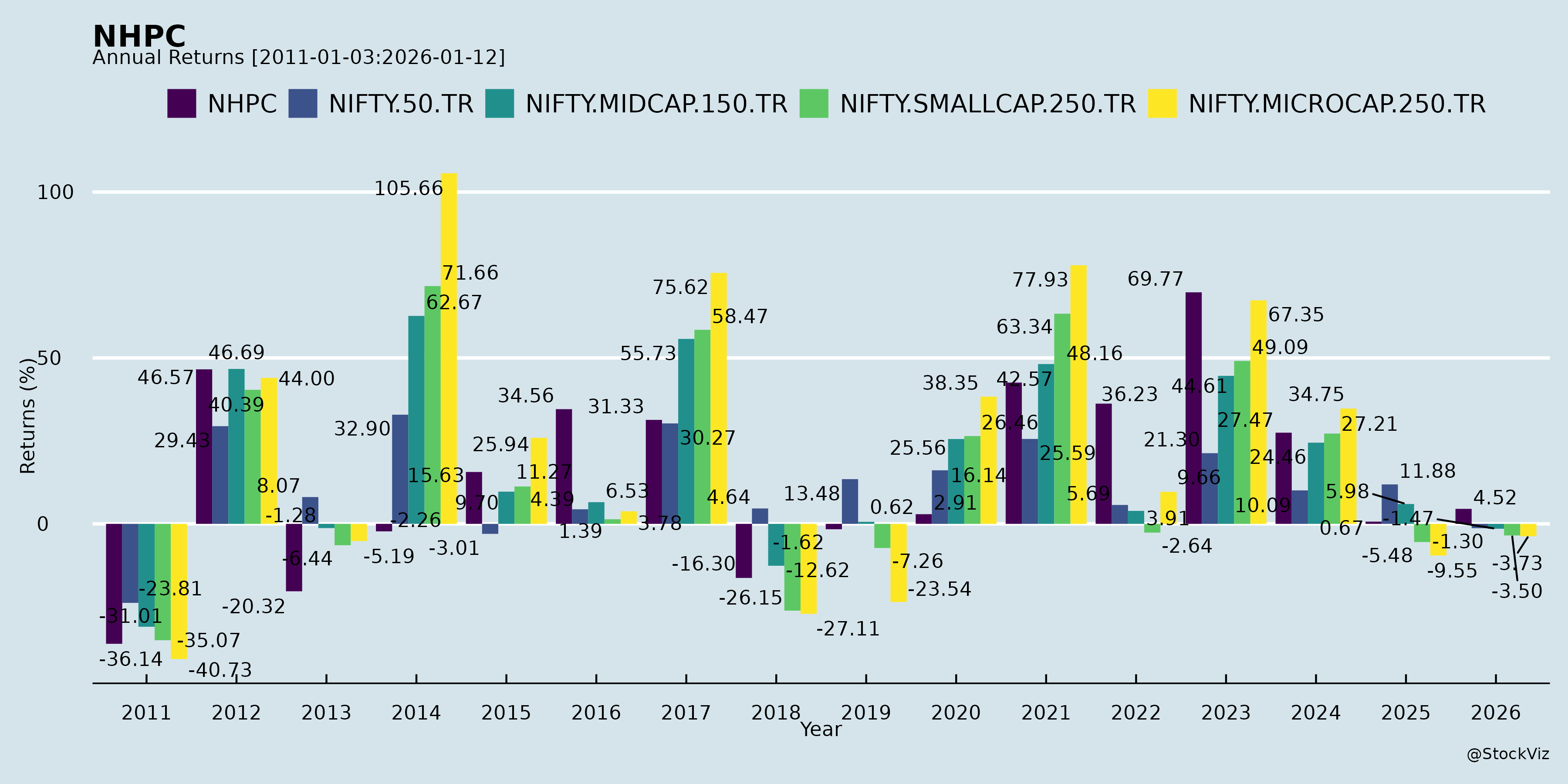

Annual Returns

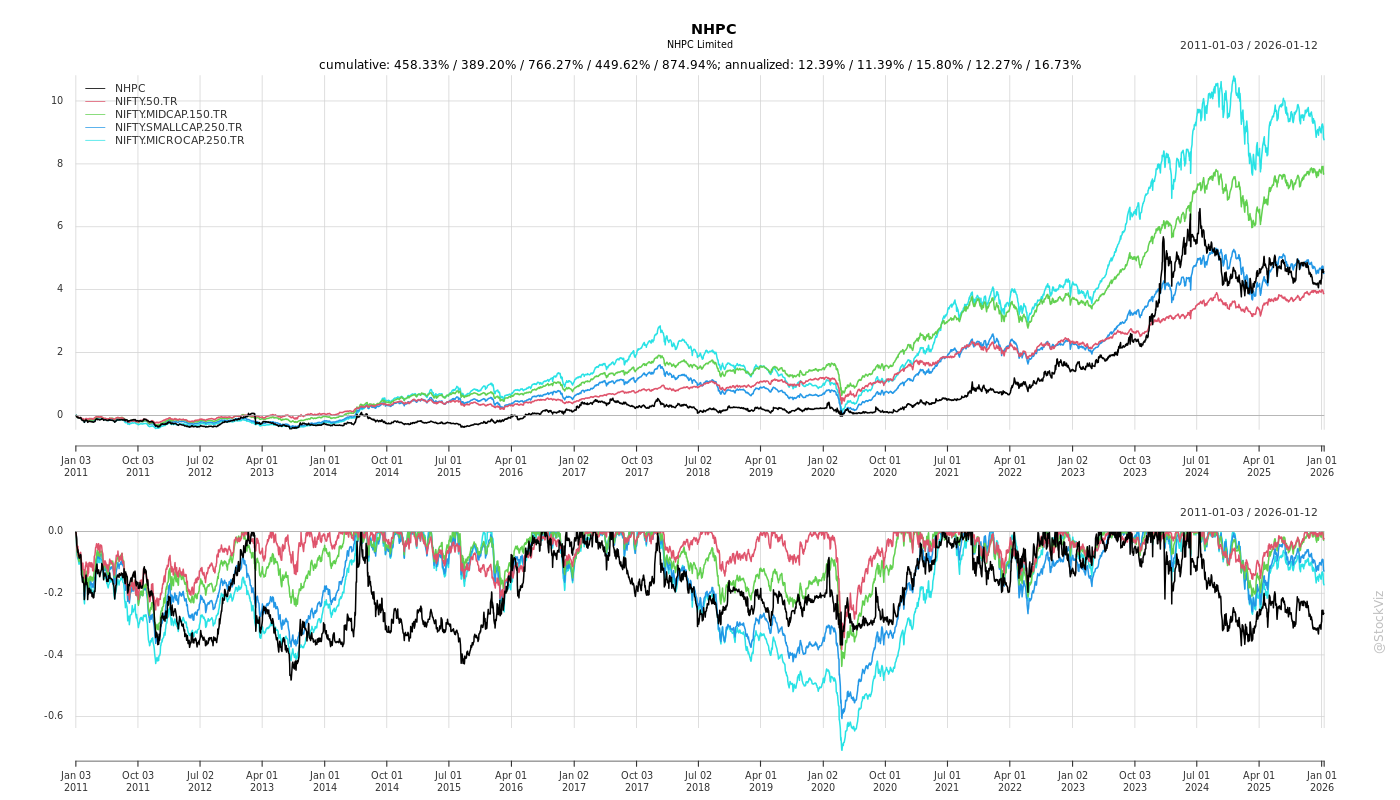

Cumulative Returns and Drawdowns

Fundamentals

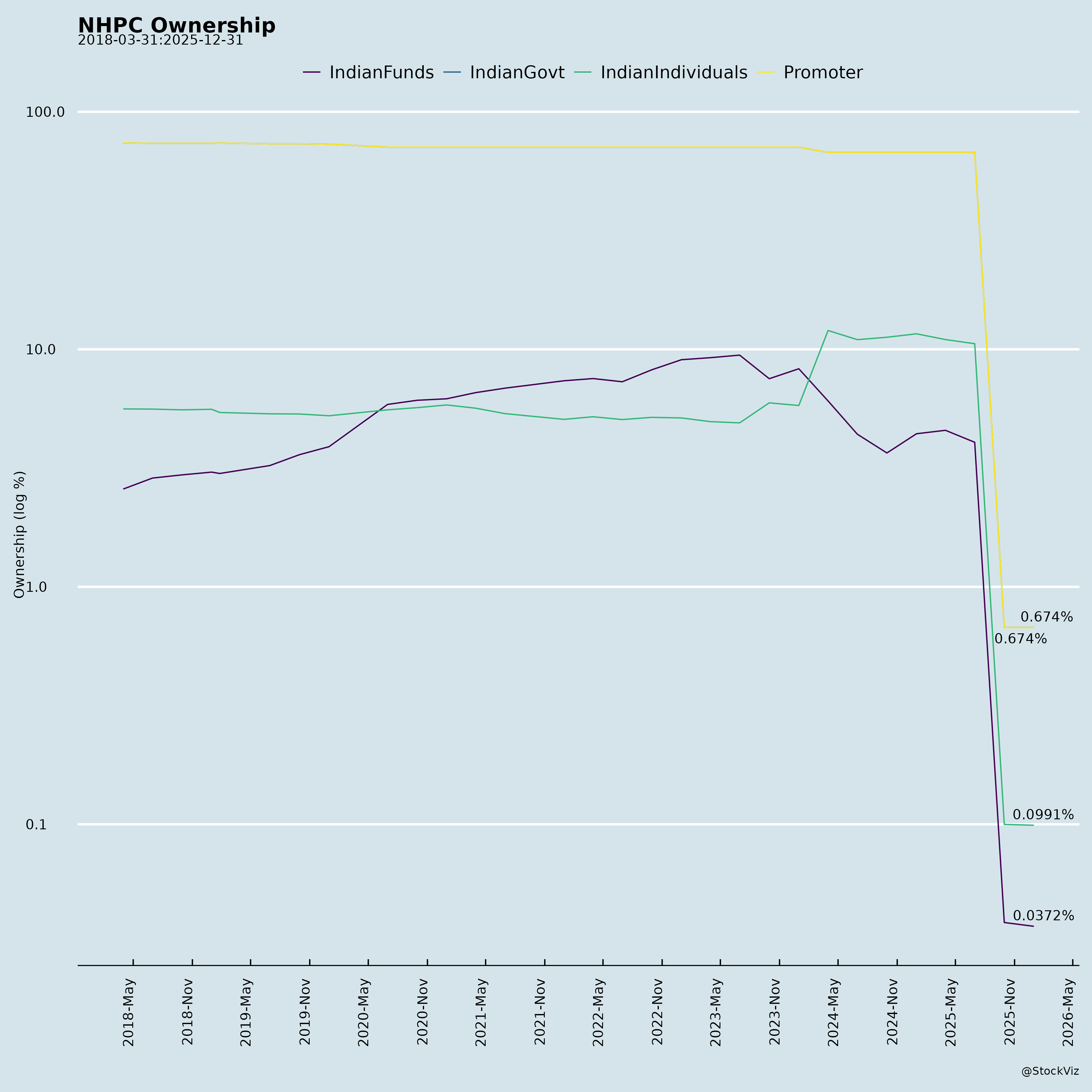

Ownership

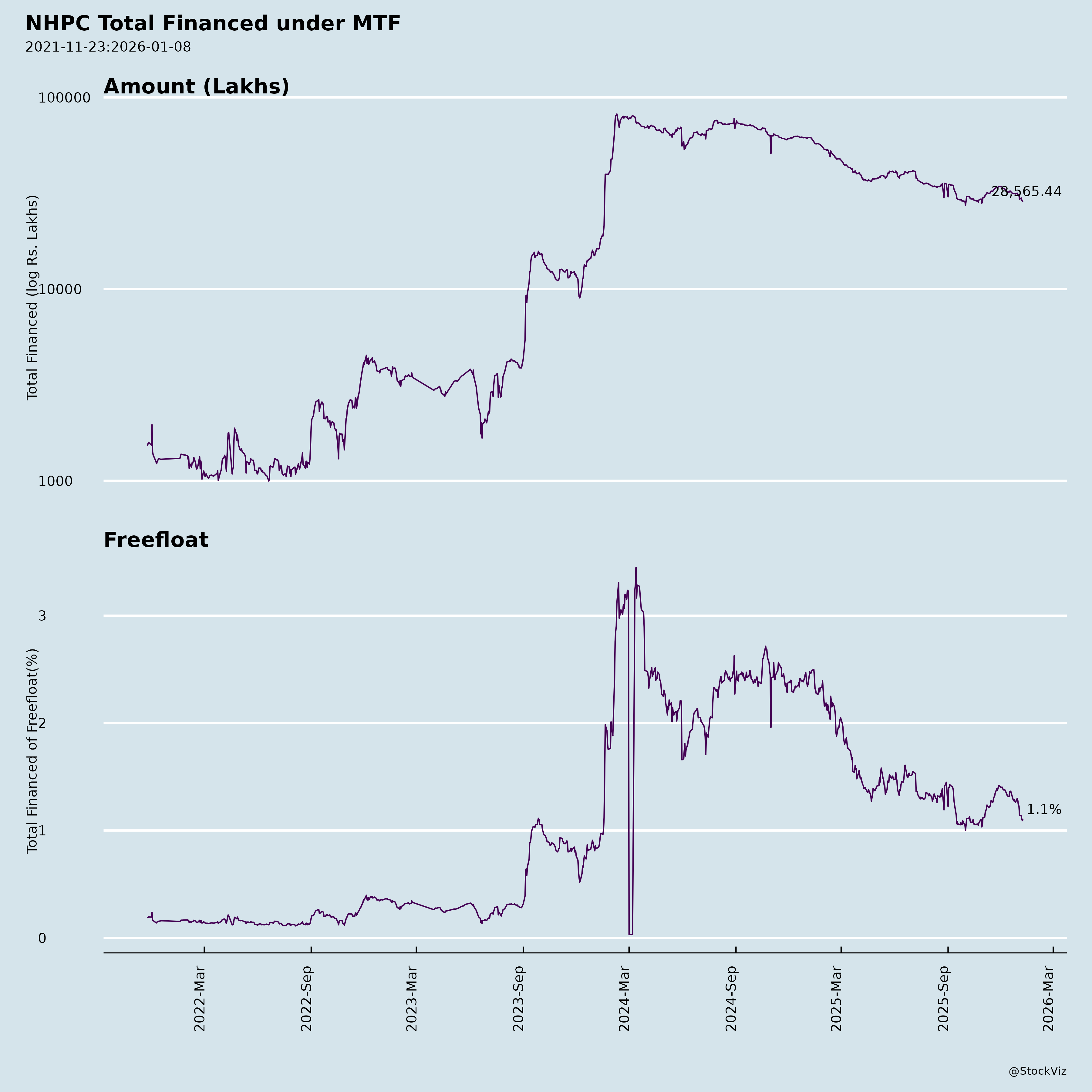

Margined

AI Summary

asof: 2025-12-03

NHPC Limited (NSE: NHPC, BSE: 533098) - Analysis Summary (Based on Q2/H1 FY26 Filings)

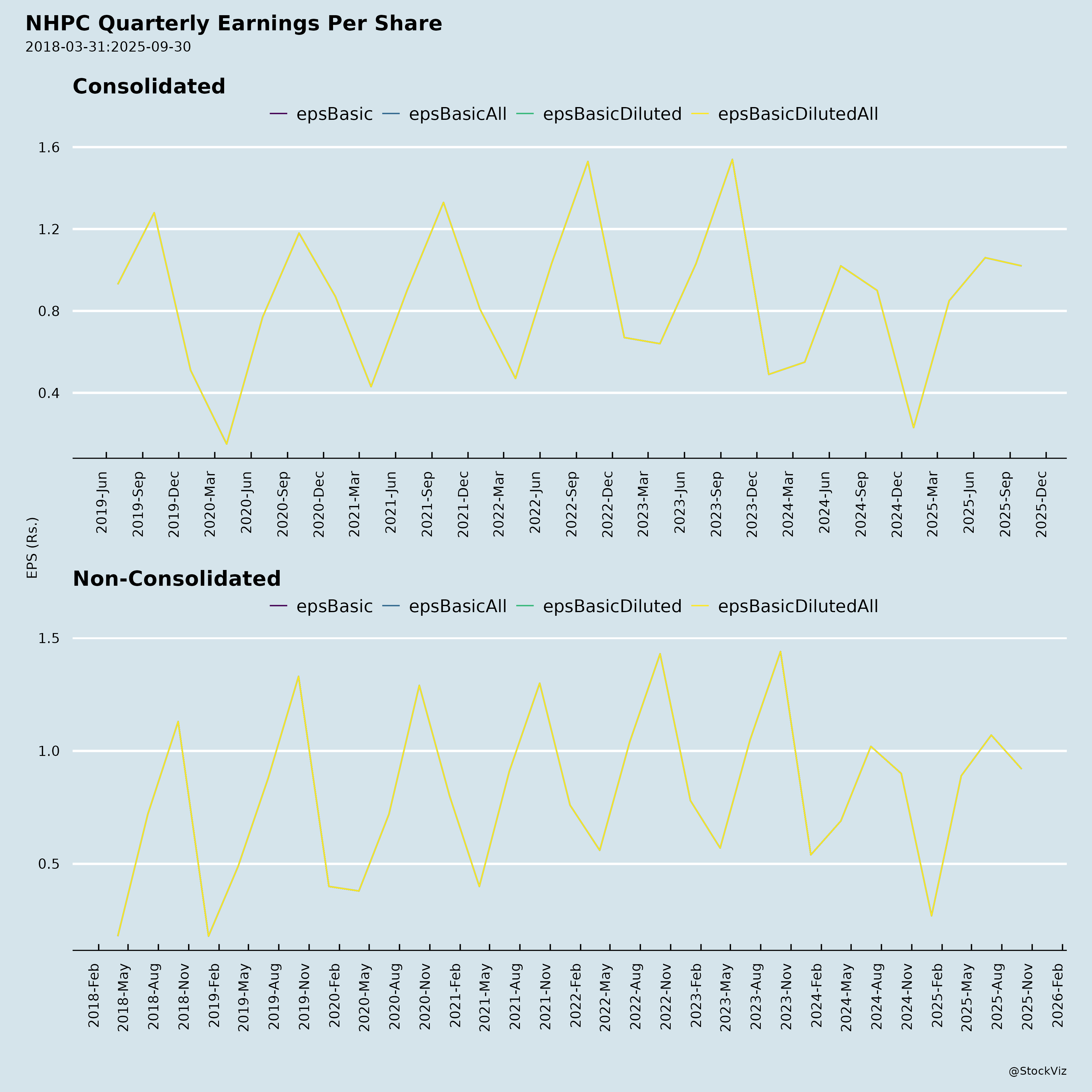

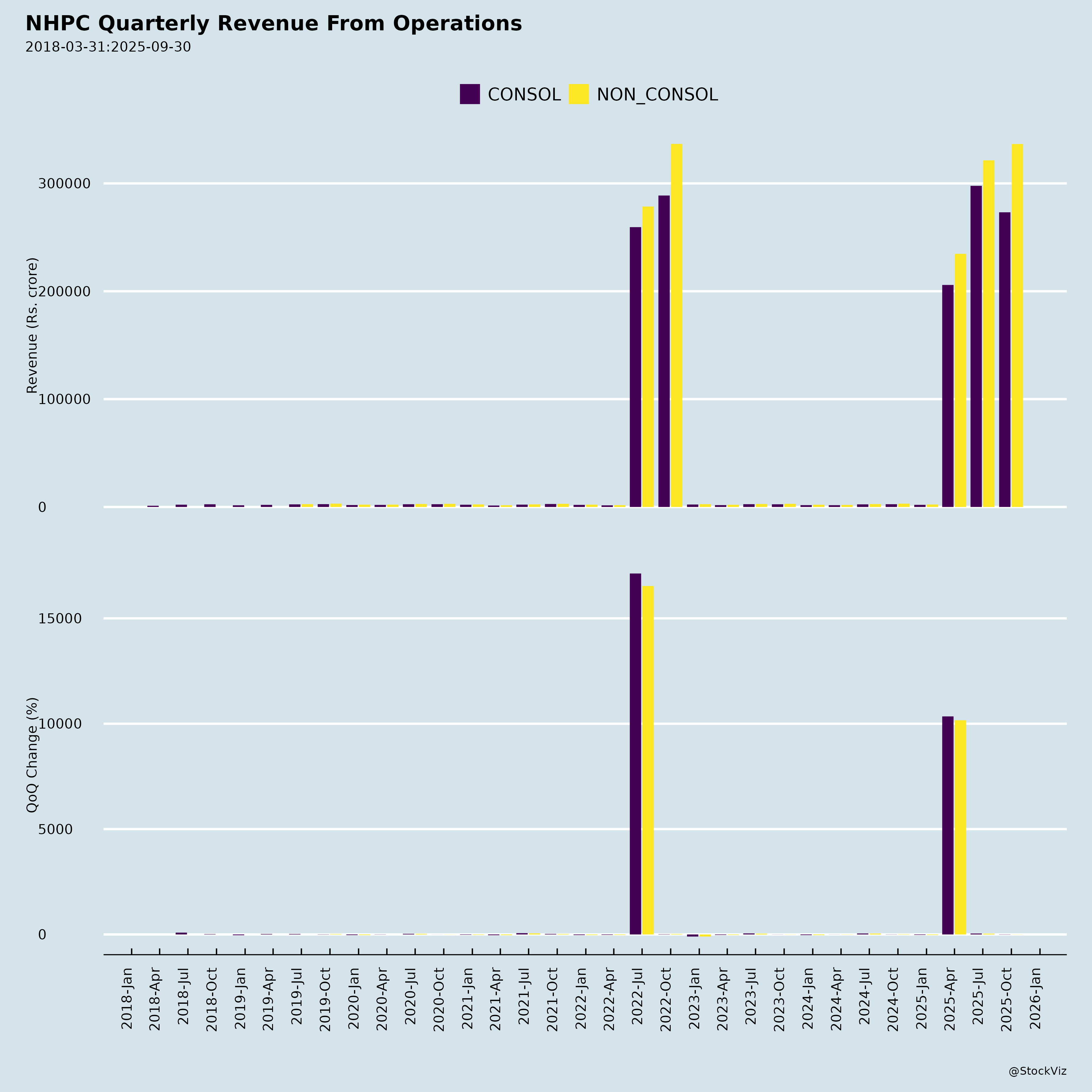

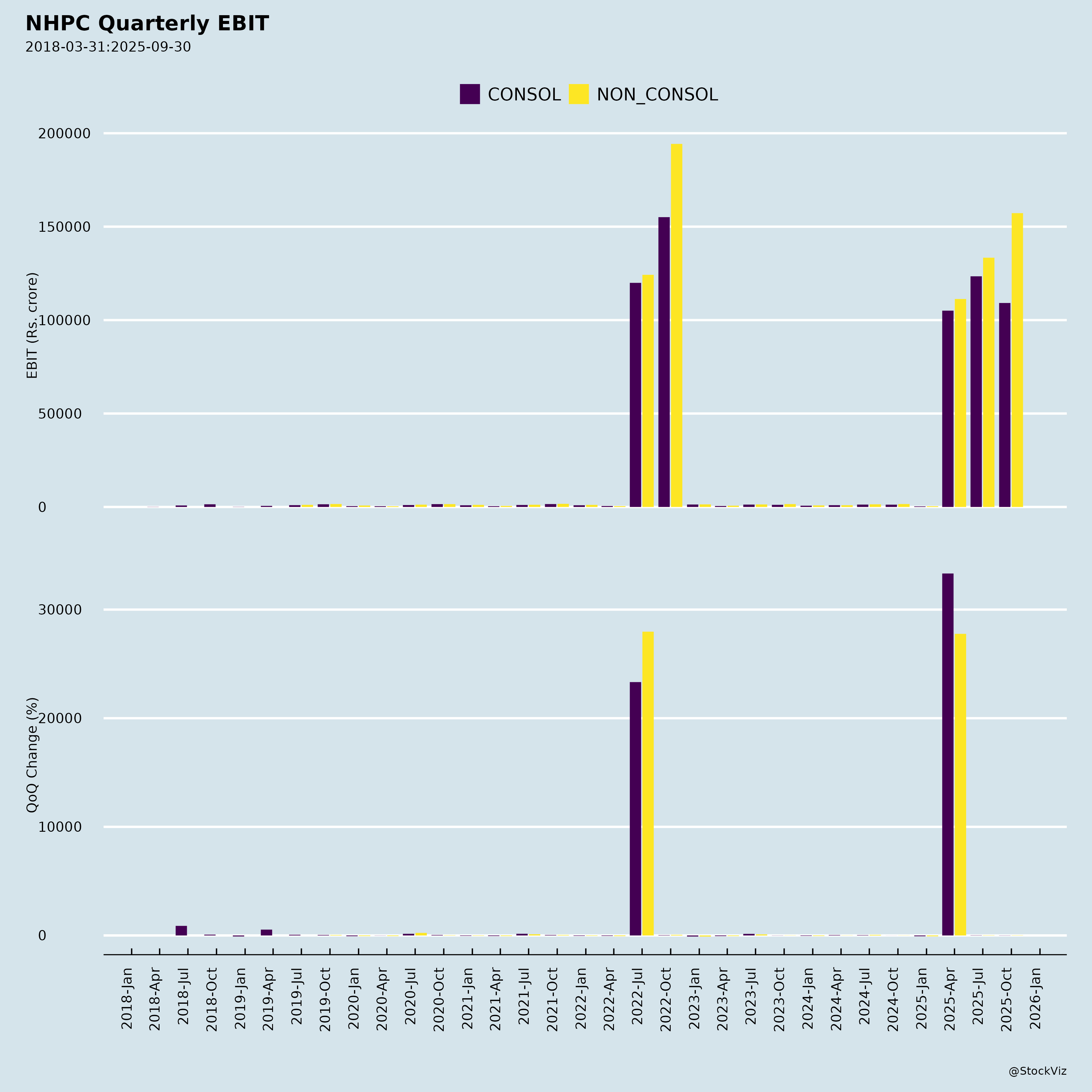

NHPC, a Navratna PSU focused on hydroelectric power generation (with growing renewables), reported robust H1 FY26 performance amid project commissioning milestones. Standalone revenue grew 15% YoY to ₹5,710 Cr, with PAT up 4% to ₹1,997 Cr (EPS ₹1.99). Consolidated figures were stronger: revenue +14% YoY to ₹6,579 Cr, PAT +9% to ₹2,350 Cr (EPS ₹2.08). Balance sheet remains solid (net worth ₹39,831 Cr standalone), with healthy coverage ratios (DSCR 2.57, ISCR 5.38) and no debt defaults/deviations. Key driver: Unbilled revenue recognition from tariff petitions and new capacities (e.g., Parbati-II 800 MW, partial Karnisar Solar 214 MW). Subansiri Lower (2 GW) Unit-2 synchronized on 02-Dec-2025 (CoD Dec-2025).

Tailwinds (Positive Catalysts)

- Operational Momentum: Successful commissioning/synchronization (Parbati-II Apr-2025, Karnisar Solar partial, Subansiri Lower Unit-2). Revenue recognition of ₹264 Cr (H1) + ₹649 Cr (Parbati-II) from CERC tariff petitions boosts near-term topline.

- Financial Strength: YoY profit growth despite seasonal hydro variability; operating margins ~43% (standalone). Strong cash flows (op. cash ₹1,233 Cr H1); debt serviced comfortably (security cover >1.9x).

- Government Support: Navratna status, GoI backing for hydro/renewables push. MAT credit recognition (₹429 Cr H1) aids tax efficiency.

- Diversification: Entry into solar (Karnisar); subsidiaries/JVs (e.g., NHDC 51%, Chenab Valley) contribute to consolidated growth.

Headwinds (Challenges)

- Seasonal Volatility: Hydro-dependent (principal activity); Q2 revenue dipped QoQ (₹2,732 Cr vs. ₹2,977 Cr Q1) due to monsoon variability.

- High Capex Intensity: CWIP elevated at ₹30,149 Cr (standalone), signaling execution pressures; total assets up 7% to ₹93,570 Cr.

- Debt Burden: Paid-up debt rose to ₹41,506 Cr (standalone D/E 1.04; consolidated 1.14), with finance costs up (H1 ₹522 Cr). Refinancing needs (e.g., ₹2,000 Cr NCDs raised Aug-2025 fully utilized).

- Regulatory Delays: Revenue hinges on CERC tariff approvals (petitions filed for 2019-24 truing-up/2024-29); prior periods restated due to mergers (e.g., Lanco Teesta).

Growth Prospects

- Capacity Ramp-Up: Subansiri Lower (2 GW total) nearing completion (Unit-2 CoD Dec-2025); Parbati-III, Ratle, etc., in pipeline. Targets align with India’s hydro/renewable push (500 GW non-fossil by 2030).

- Subsidiary Synergies: Ongoing JPCL merger (second motion filed Oct-2025); strong sub performance (e.g., NHDC). Consolidated revenue CAGR potential 10-15% via 5-7 GW under construction.

- Tariff Upside: New CERC regs (2024-29) + unbilled sales normalization could drive 10-12% revenue growth FY26-27.

- Renewables Pivot: Solar (Karnisar full 300 MW post-Oct-2025); JVs like APGENCO NHPC Green Energy (50%).

- Outlook: FY26 PAT potential ₹4,000-4,500 Cr (consolidated), supported by 10%+ capacity addition.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Execution | Hydro project delays (e.g., Subansiri history of protests/geology); high CWIP signals capex overruns. | GoI fast-tracking; staged commissioning. |

| Regulatory | CERC tariff petition delays/rejections; regulatory deferral balances (₹7,479 Cr debit) volatile. | Historical approvals; MAT credit buffers. |

| Hydrology/Climate | Monsoon/rainfall variability impacts generation (single-segment exposure). | Diversification to solar/pumped storage. |

| Financial | Debt rise (₹46,940 Cr cons.); forex/interest rate sensitivity. | Strong DSCR/ISCR; GoI-guaranteed bonds. |

| M&A/Subsidiary | JPCL merger pending MCA approval; unreviewed sub results (minor, <1% materiality). | Common-control accounting; diversification. |

| Market | Power sector competition; off-take risks (though long-term PPAs). | PSU status ensures priority dispatch. |

Overall: NHPC’s growth trajectory is strong (project milestones + financials), but hydro risks warrant monitoring. Positive for long-term investors (target upside 15-20% from current levels ~₹50-60/share, assuming FY26 EPS ₹3.5-4). Recommended: Buy/Hold for infra/renewable exposure. (Analysis as of filings dated Nov-2025; dates futuristic but treated as current.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.