MRPL

Equity Metrics

January 13, 2026

Mangalore Refinery and Petrochemicals Limited

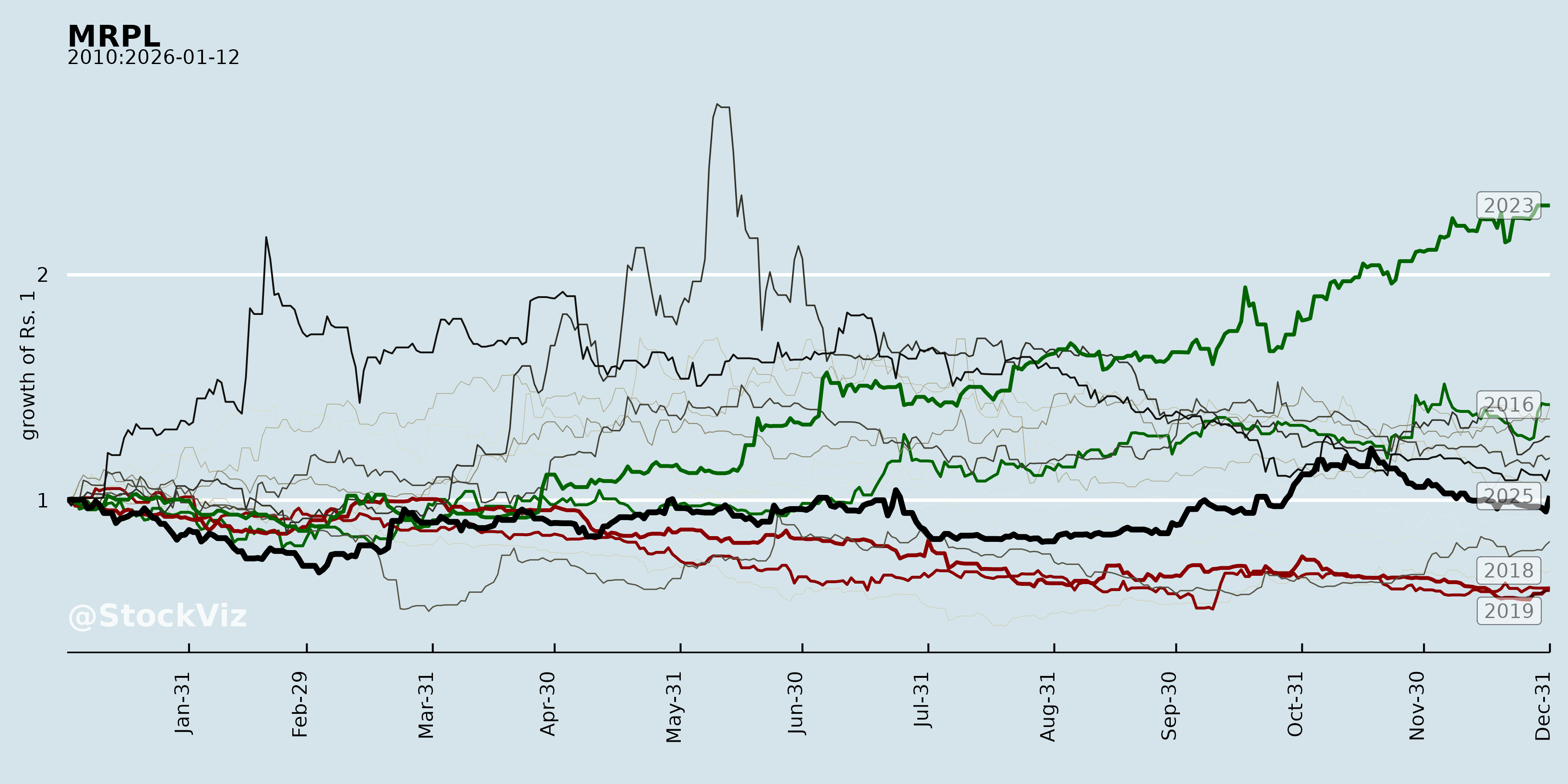

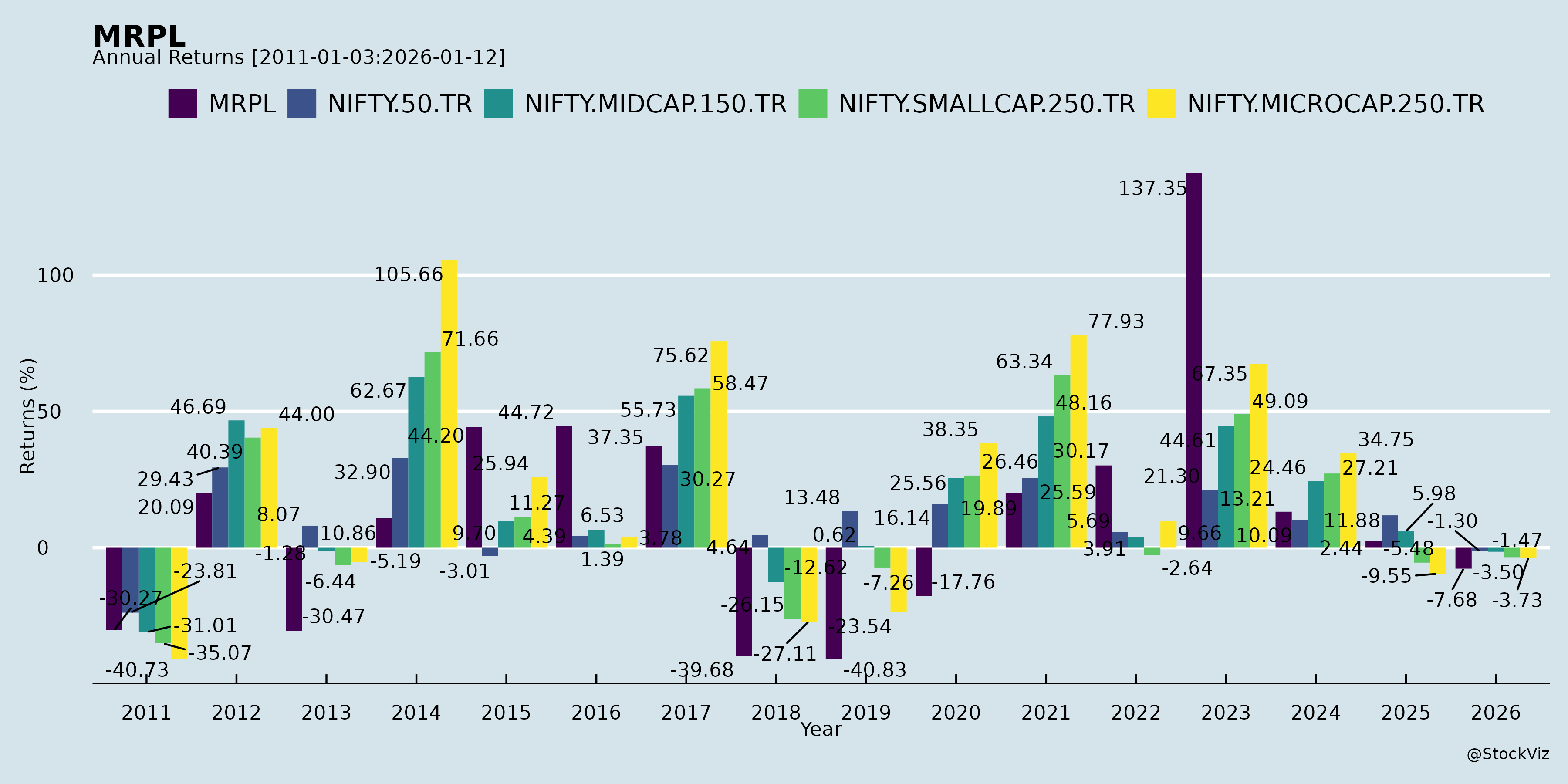

Annual Returns

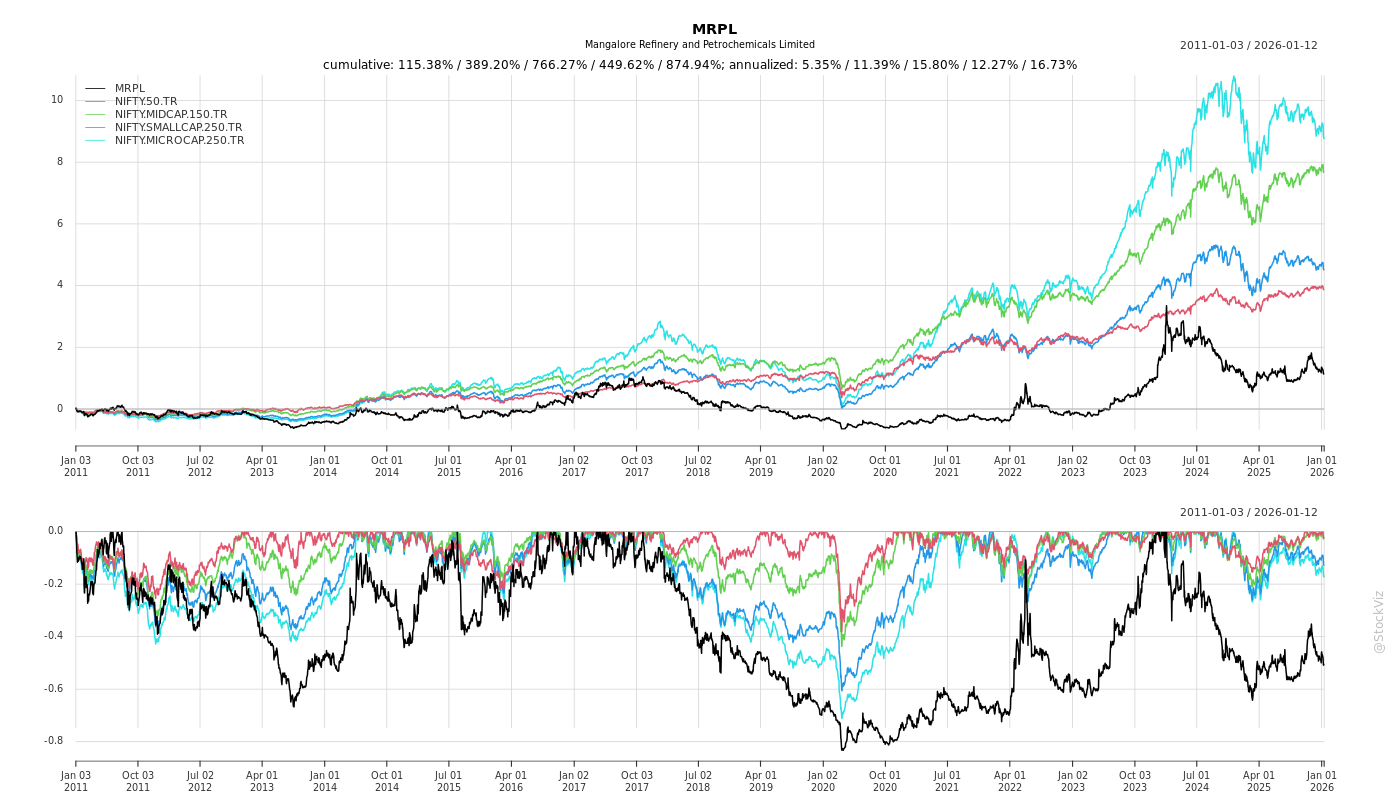

Cumulative Returns and Drawdowns

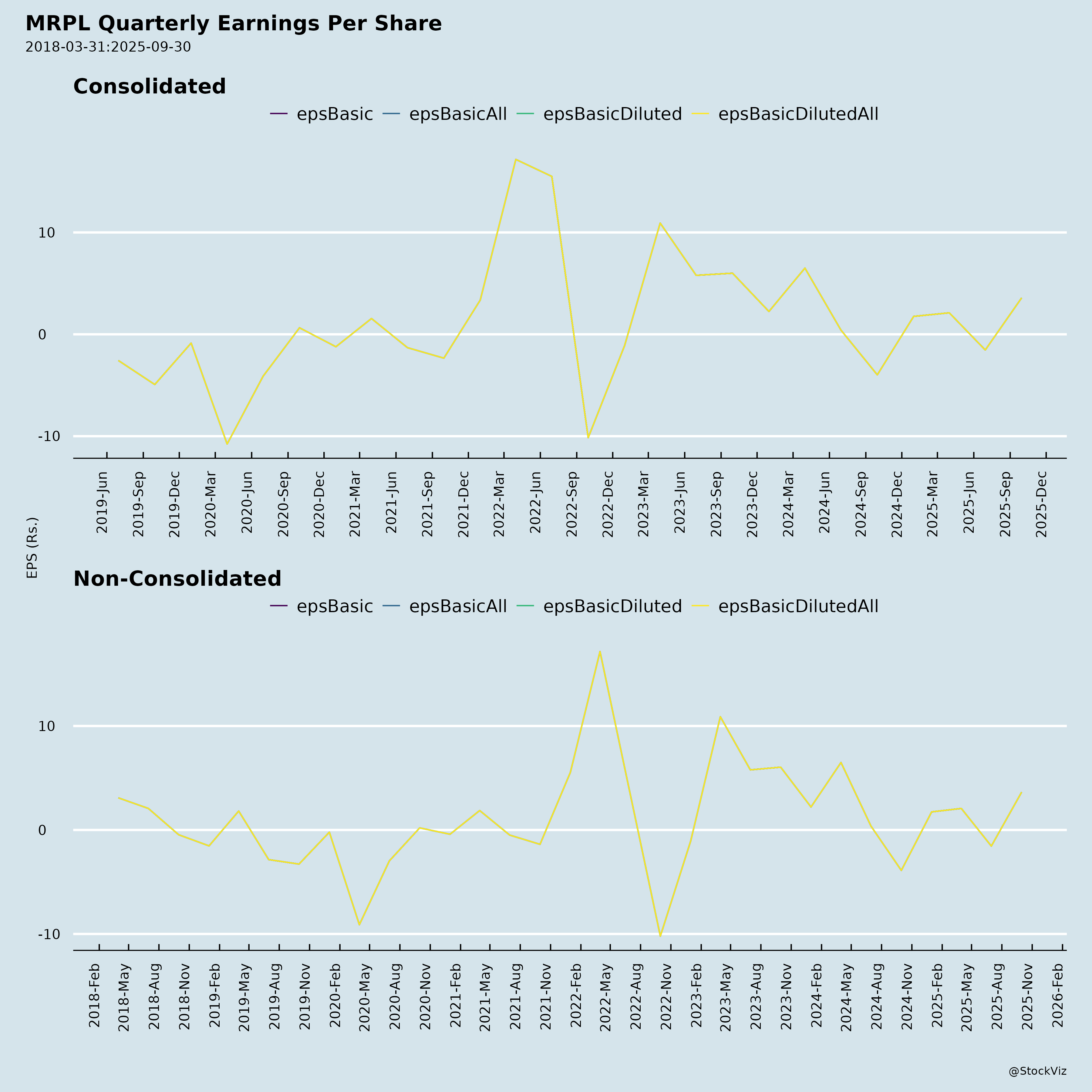

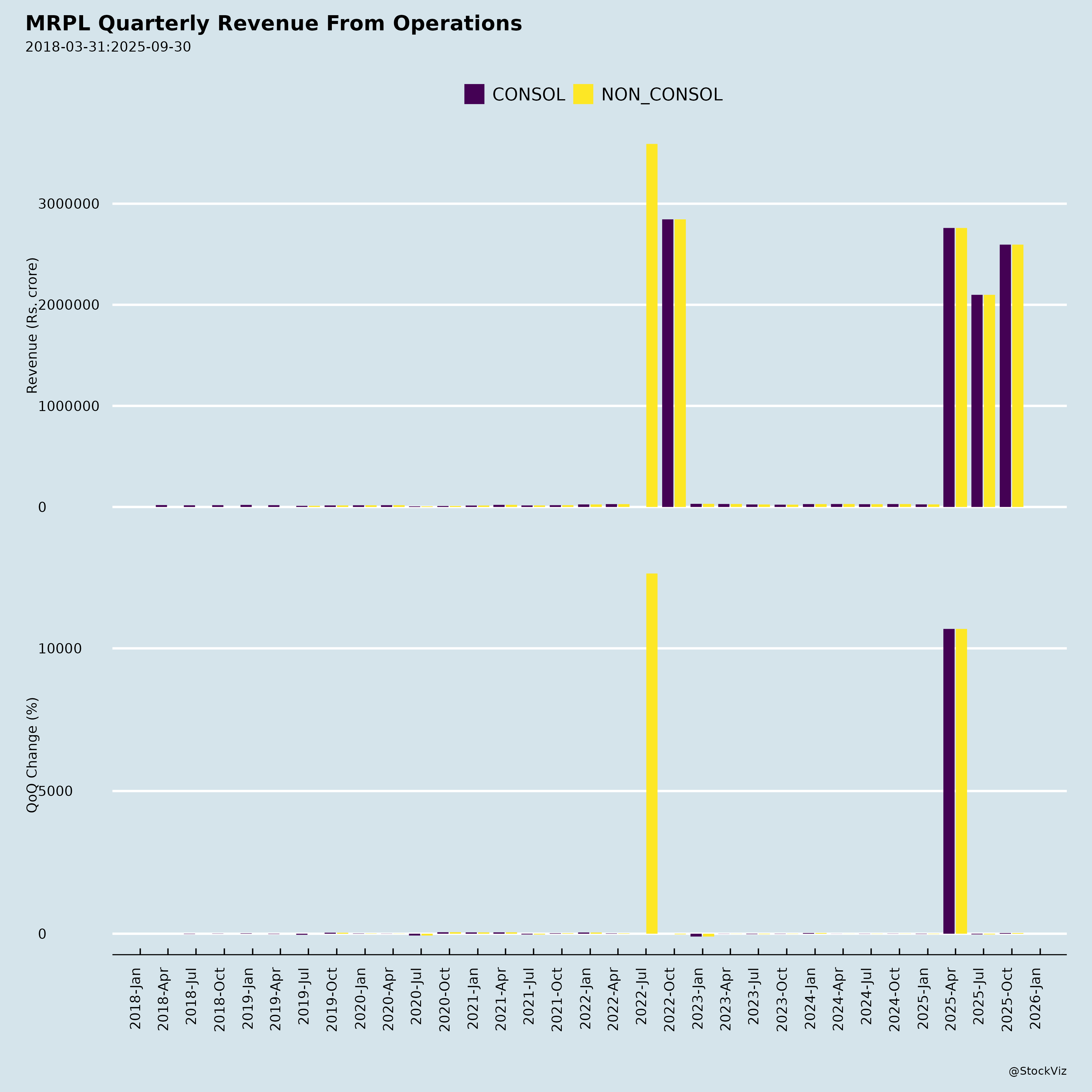

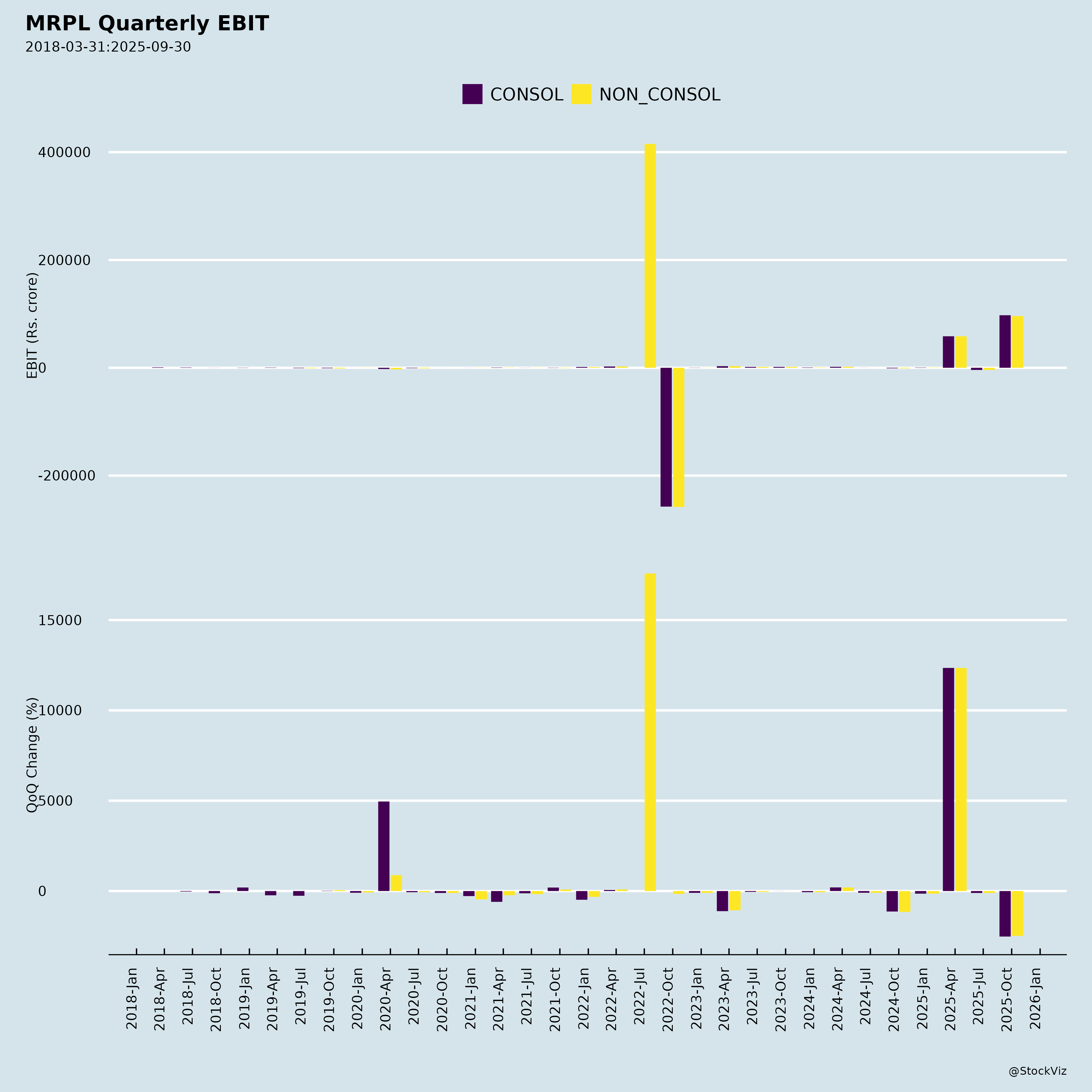

Fundamentals

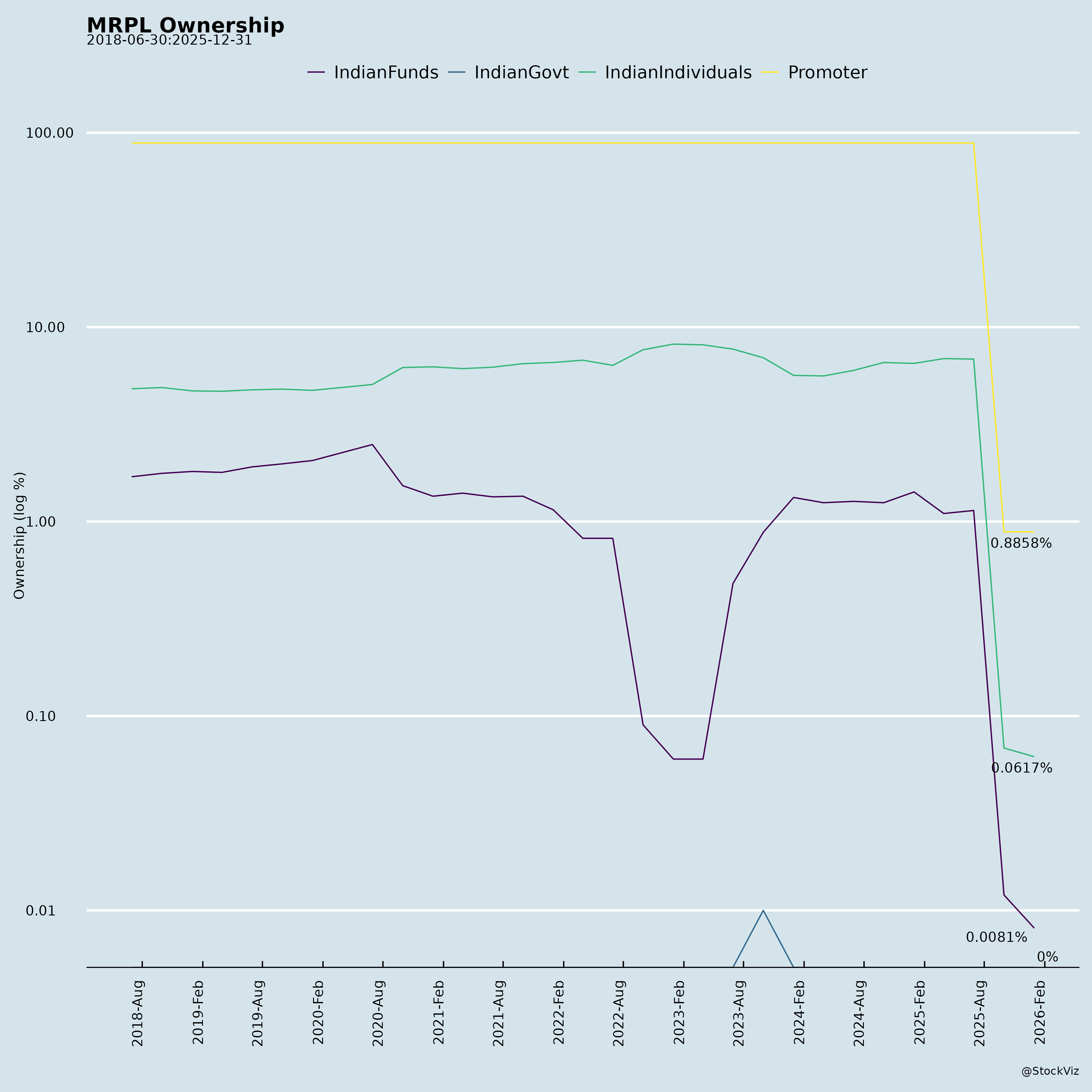

Ownership

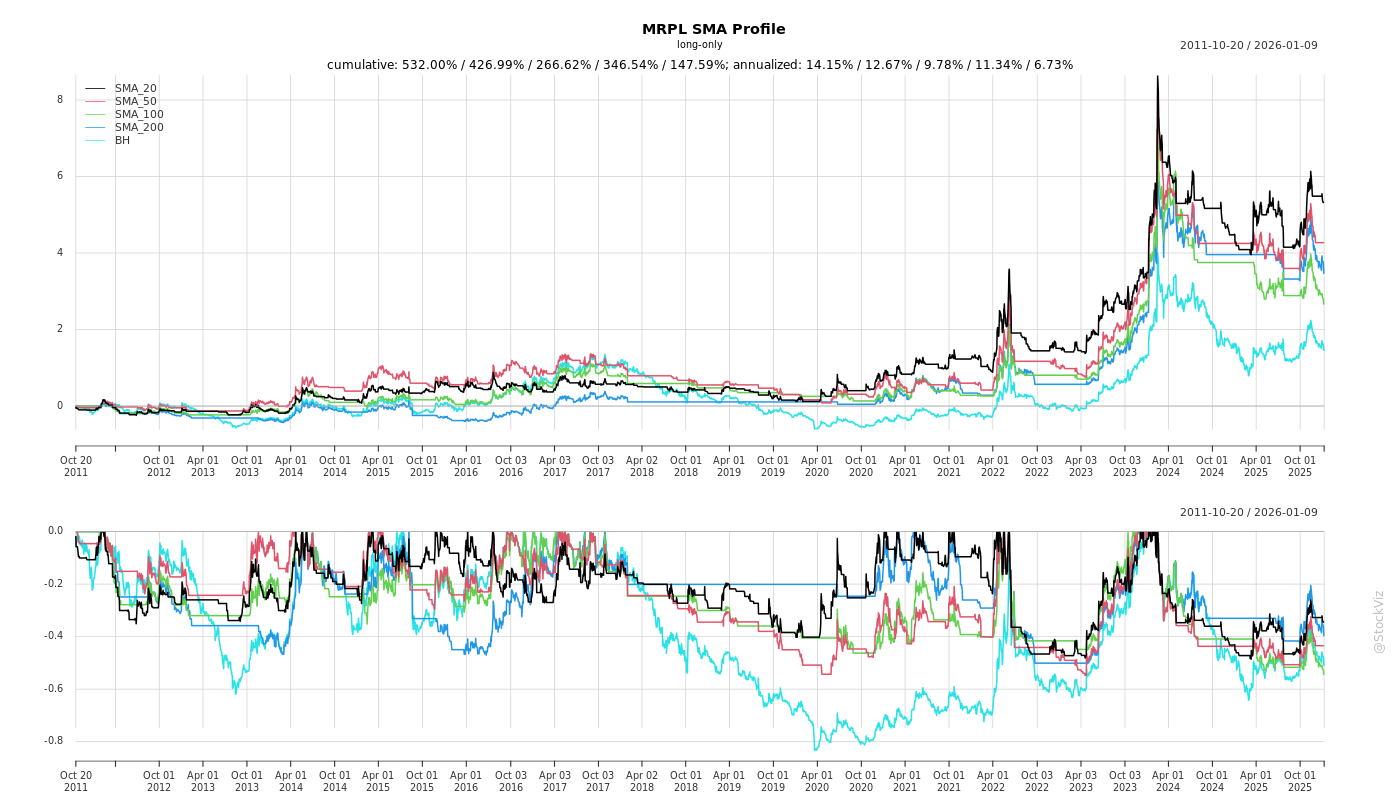

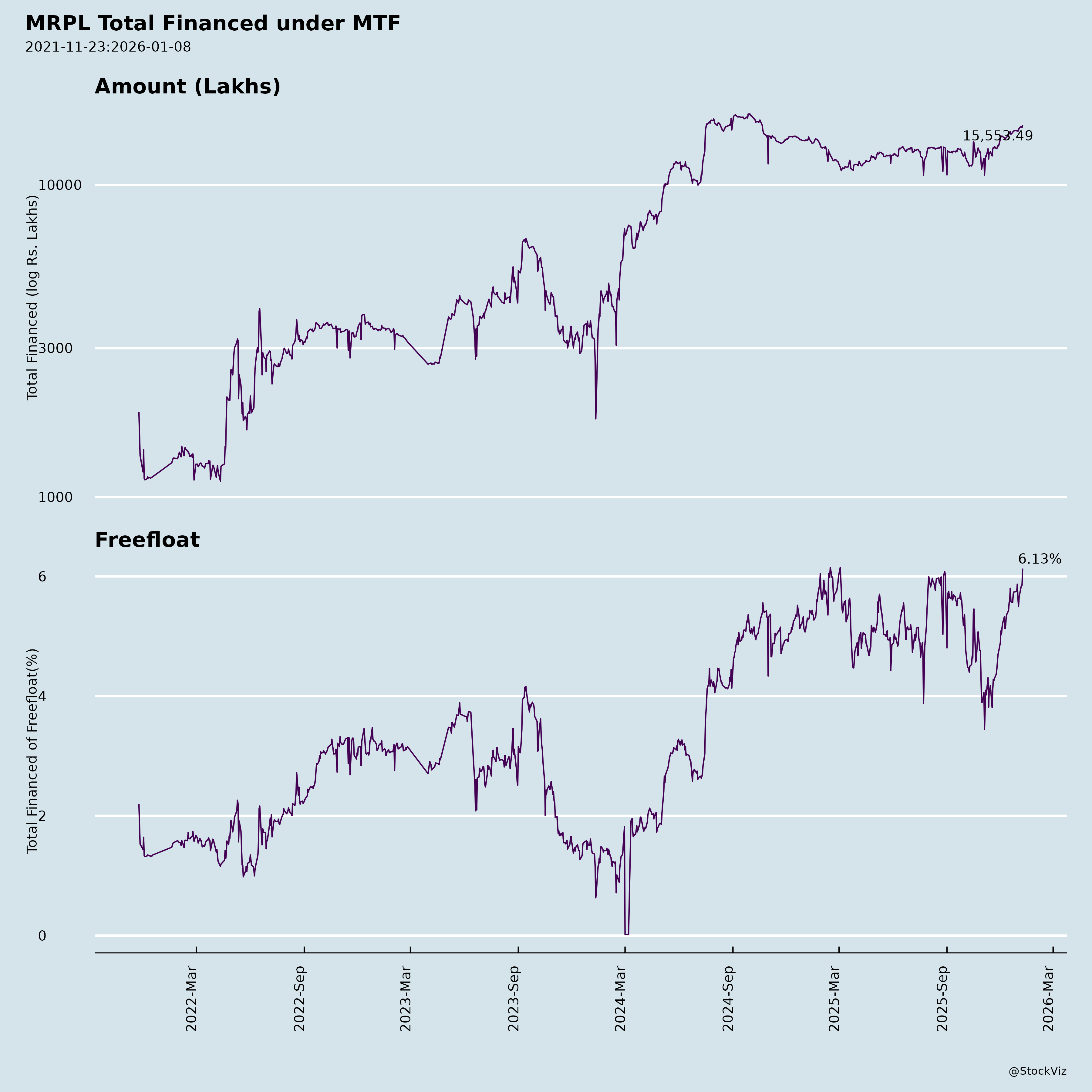

Margined

AI Summary

asof: 2025-12-03

MRPL Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Summary Overview:

MRPL (subsidiary of ONGC) reported a strong turnaround in Q2 FY26 (ended Sep 30, 2025), with PAT of ₹639 Cr (vs ₹682 Cr loss YoY) on revenue of ₹25,953 Cr, driven by 4.43 MMT throughput, improved GRMs (~double prior levels), and healthy cracks amid supply disruptions. H1 PAT ₹367 Cr (vs ₹617 Cr loss). Russian crude (30-40%) remains key, but US pressures pose risks. Retail expansion and petrochemical/SAF diversification signal growth, with Q3 throughput eyed >4.43 MMT.

Headwinds (Challenges Pressuring Performance)

- Crude Sourcing Uncertainty: Heavy reliance on discounted Russian crude (30-40%, DES terms with $0.5-4/bbl discount + timing derisking). US tweets/geopolitical risks could force shift to costlier alternatives (e.g., US crude $6-7/bbl higher logistics; Kuwait slightly positive vs Russia).

- Operational Hiccups: Post-Q1 turnaround, fuel & loss at 10.42% (target ~10% FY26); initial plant issues.

- Forex & Macro Volatility: ₹355 Cr forex loss (realized + ECB revaluation); 40% exports exposed to INR/USD (neutralized somewhat via RTP linkage, minor crude hedging).

- Regulatory/Compliance: SEBI fine of ₹5.43 lakh each from BSE/NSE for Q2 board composition non-compliance (CPSE issue, waiver sought).

- Margin Pressure: Declining crude prices; volatile global cracks (geopolitics, refinery closures in US/Australia/NZ); H1 inventory build-up.

Tailwinds (Positive Catalysts Supporting Momentum)

- Strong Refining Metrics: Throughput rebound to 4.4 MMT (full capacity post-turnaround); GRMs robust (doubled YoY) on supply outages, resilient domestic demand (petrol +7%, diesel +3%, ATF +1%).

- Product Mix & Exports: 40% exports; middle distillates yield up to 53.6% (Q2); light distillates 29.8%.

- Cost Efficiencies: Gas optimization (0.5 MMSC MD current, up to 1 MMSC MD potential); economic crude basket.

- Retail Momentum: 185 outlets (Karnataka/Kerala/TN) at 140-160 KL/month/outlet; +18 added in H1, +35 under construction; target 250 by CY25-end (+100-130 YoY).

- Macro Support: Healthy Q3 cracks (Oct strong); domestic growth resilient.

Growth Prospects (Medium-Term Opportunities)

| Area | Key Details | Timeline/Scale |

|---|---|---|

| Retail Expansion | 250 outlets by YE25; rural/highway focus; EV/CNG provisions. | 100-130 YoY addition; separate reporting FY27+. |

| Petrochemicals/Diversification | Isobutyl benzene pilot commissioning mid-Nov25; aromatics (benzene, toluene, reformate, PP >100% capacity); Phase-4 study/review ongoing. | Near-term pilots; multi-year capex if approved. |

| Sustainable Fuels | SAF project (20 KL/day, EIL/IIP tech) + co-processing; 1% mandate compliance. | Ready by Jan27. |

| Throughput/Volumes | Q3 >4.43 MMT; aromatics/PVC stable. | FY26 normalization post-turnaround. |

| Capex/Deleveraging | Normal ₹1,500 Cr (routine + isobutyl); Phase-4/JVs pending; repay ECB by YE25 from internals. | FY26 capex steady; D/E down to 0.79. |

| Energy Transition | Decarbonization (power input project mid-FY26); biofuels/hydrogen. | FY26 milestones. |

Outlook: Resilient demand + diversification could drive 10-15% EBITDA growth if GRMs sustain $10-15/bbl.

Key Risks (High-Impact Threats)

| Risk | Probability/Impact | Mitigation |

|---|---|---|

| Geopolitical/Crude Supply | High/High | Diversify basket (Kuwait/US tested); spot basis flexibility. |

| Margin Volatility | Medium/High | 40% exports hedged via cracks; gas optimization. |

| Debt/Liquidity | Medium/Medium | DSCR 0.61, ISCR 3.74 (H1); cash ₹808 Cr; payables normalized Q3. |

| FX/Commodity | Medium/Medium | Natural hedge (exports/RTP); minor crude hedging. |

| Execution/Regulatory | Low/Medium | Turnarounds (none FY26 balance); CPSE board delays; no major maintenance. |

| ESG/Macro | Medium/Medium | US tariffs/Russia-Ukraine/Israel-Iran assessed as low-impact; energy transition lag. |

Investment Thesis Snapshot: Positive – Tailwinds from ops recovery/refining cycle outweigh headwinds; growth via retail/petrochem offsets crude risks. Monitor Russian flows and Q3 GRMs. Target upside if Phase-4 advances.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.