MPHASIS

Equity Metrics

January 13, 2026

MphasiS Limited

Computers - Software & Consulting

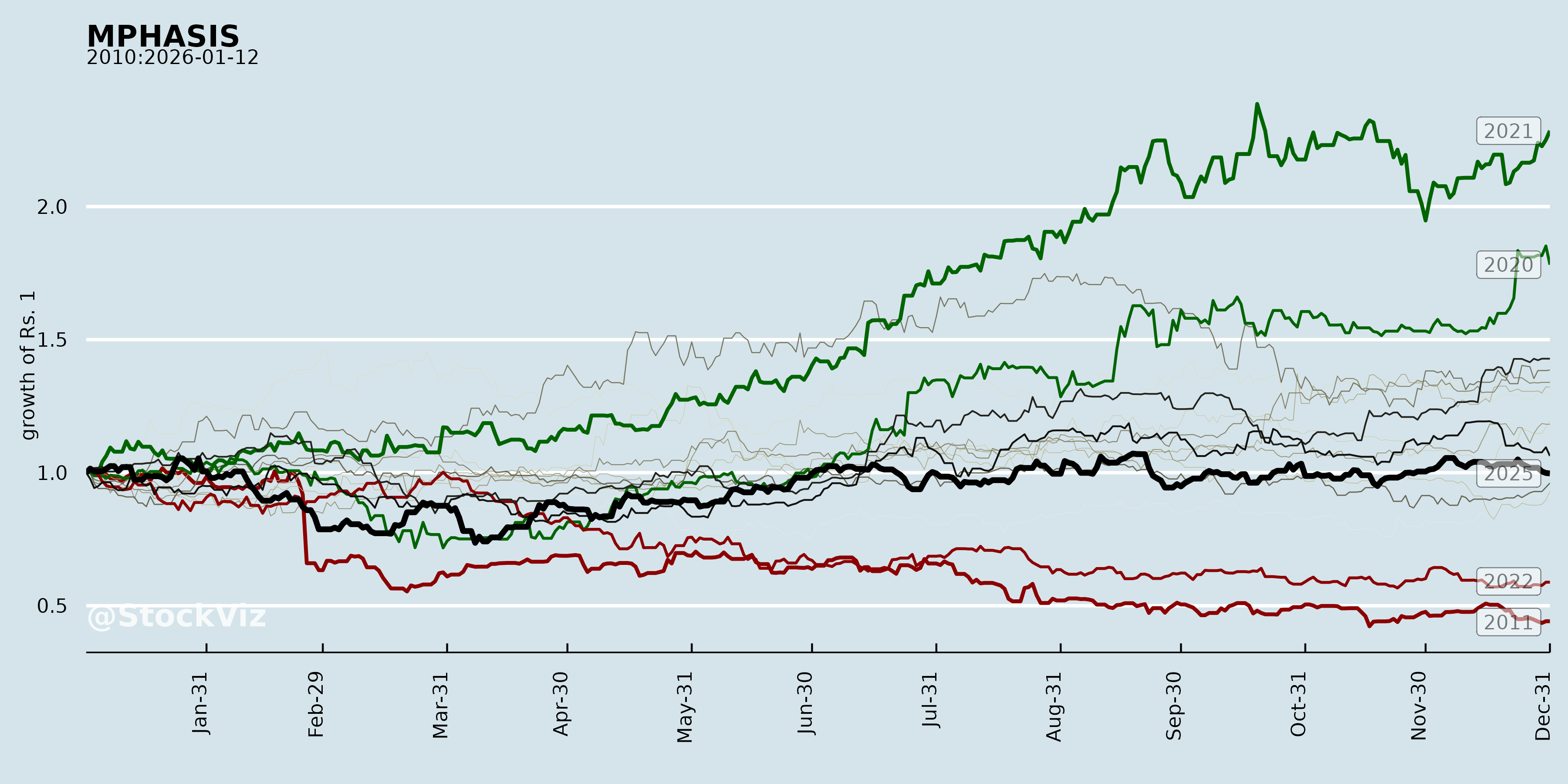

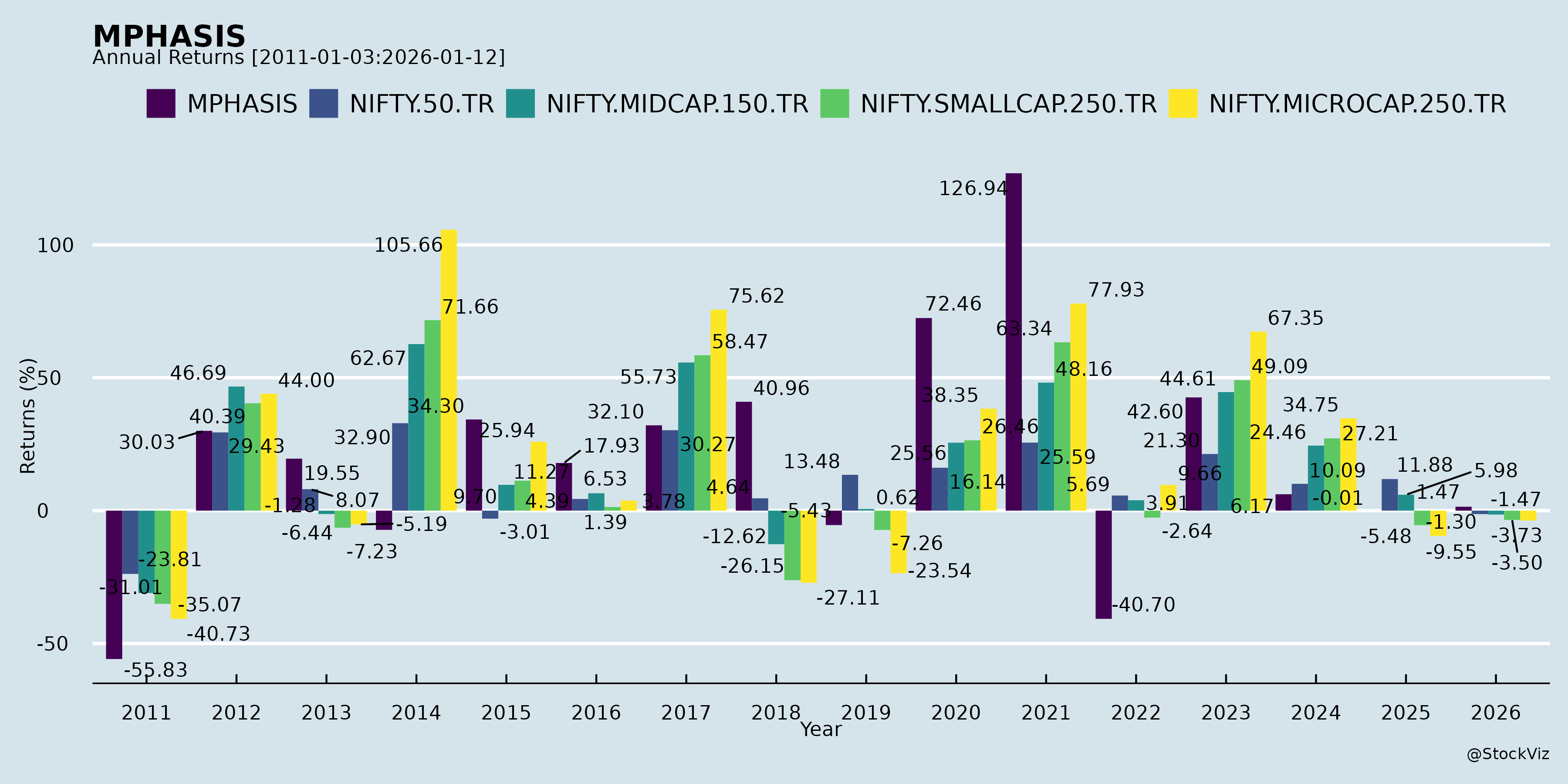

Annual Returns

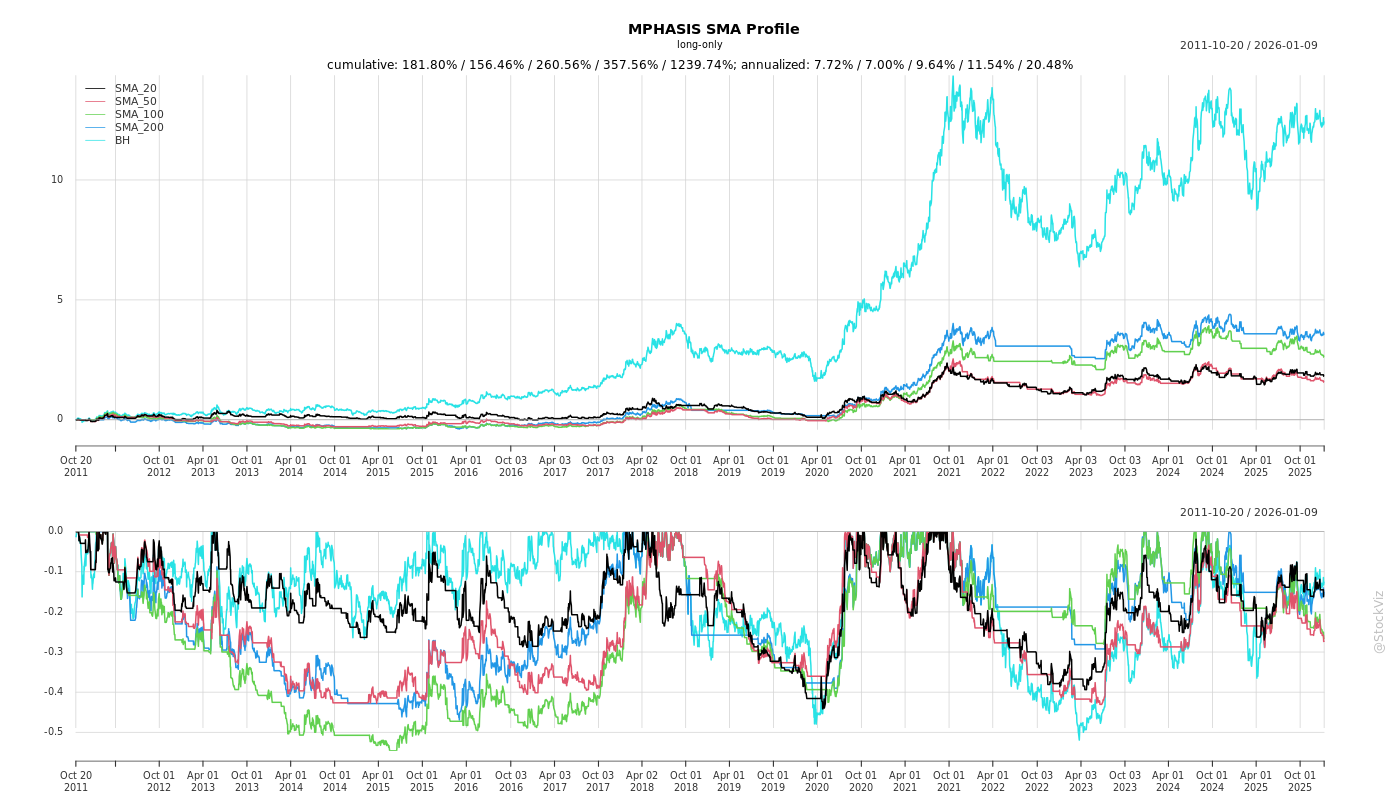

Cumulative Returns and Drawdowns

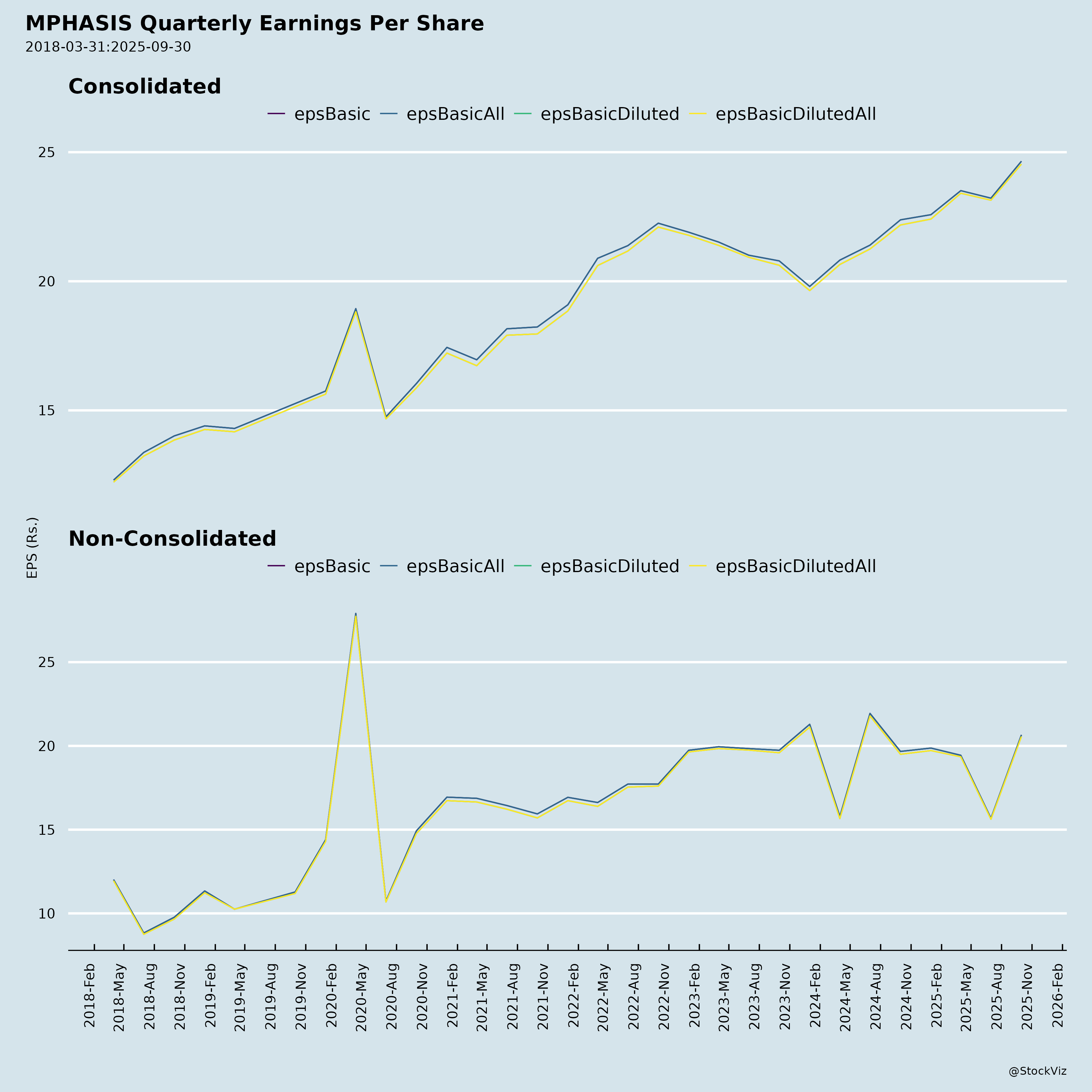

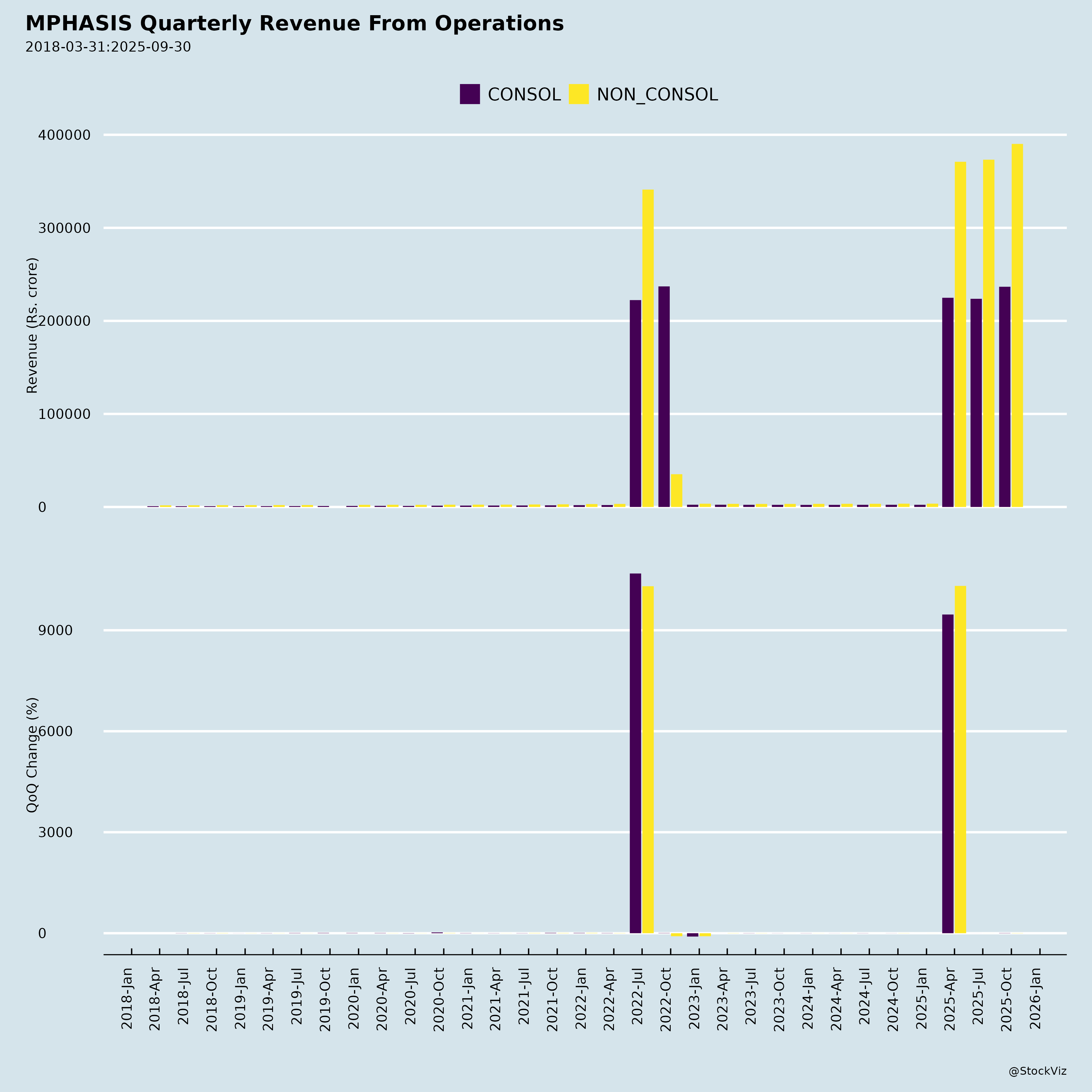

Fundamentals

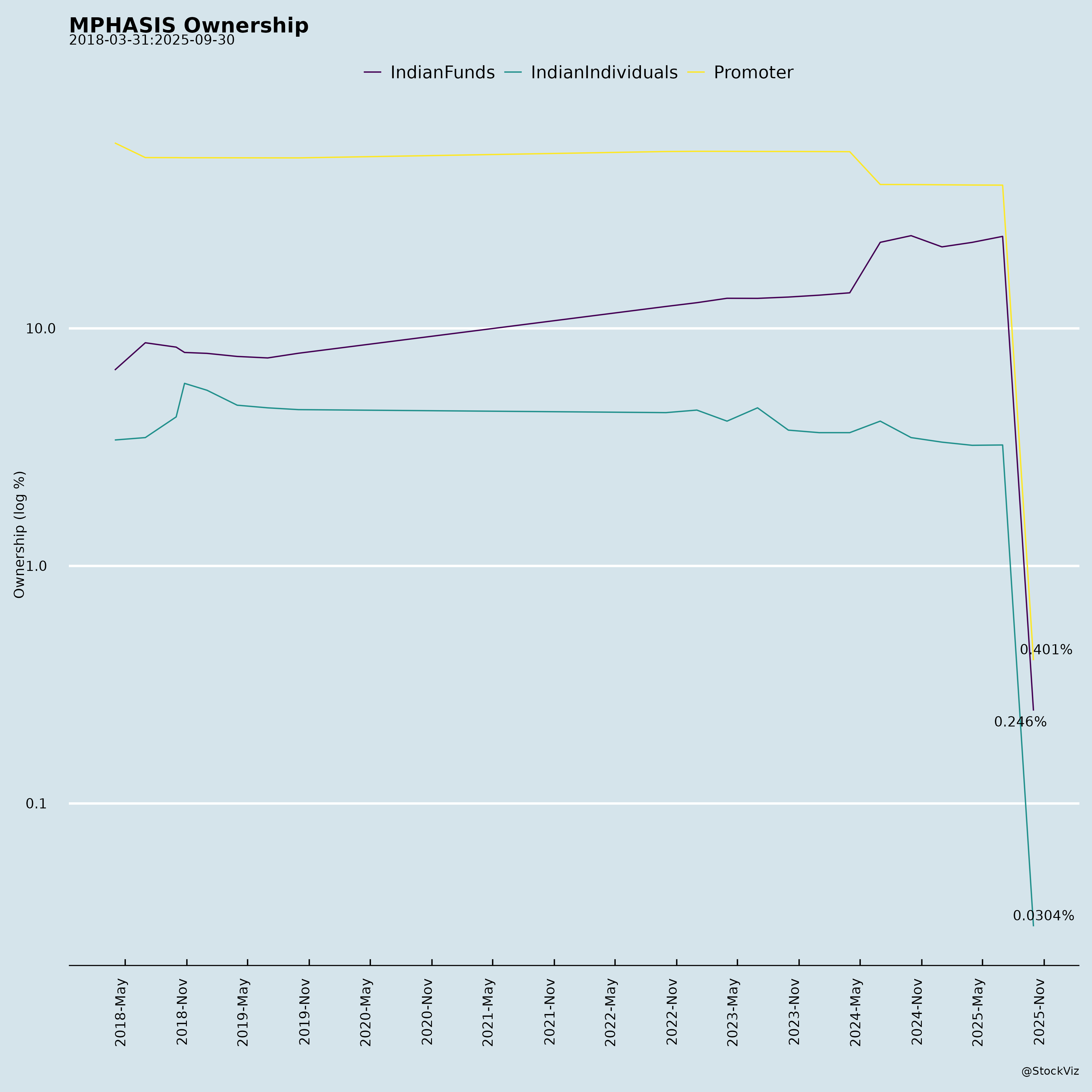

Ownership

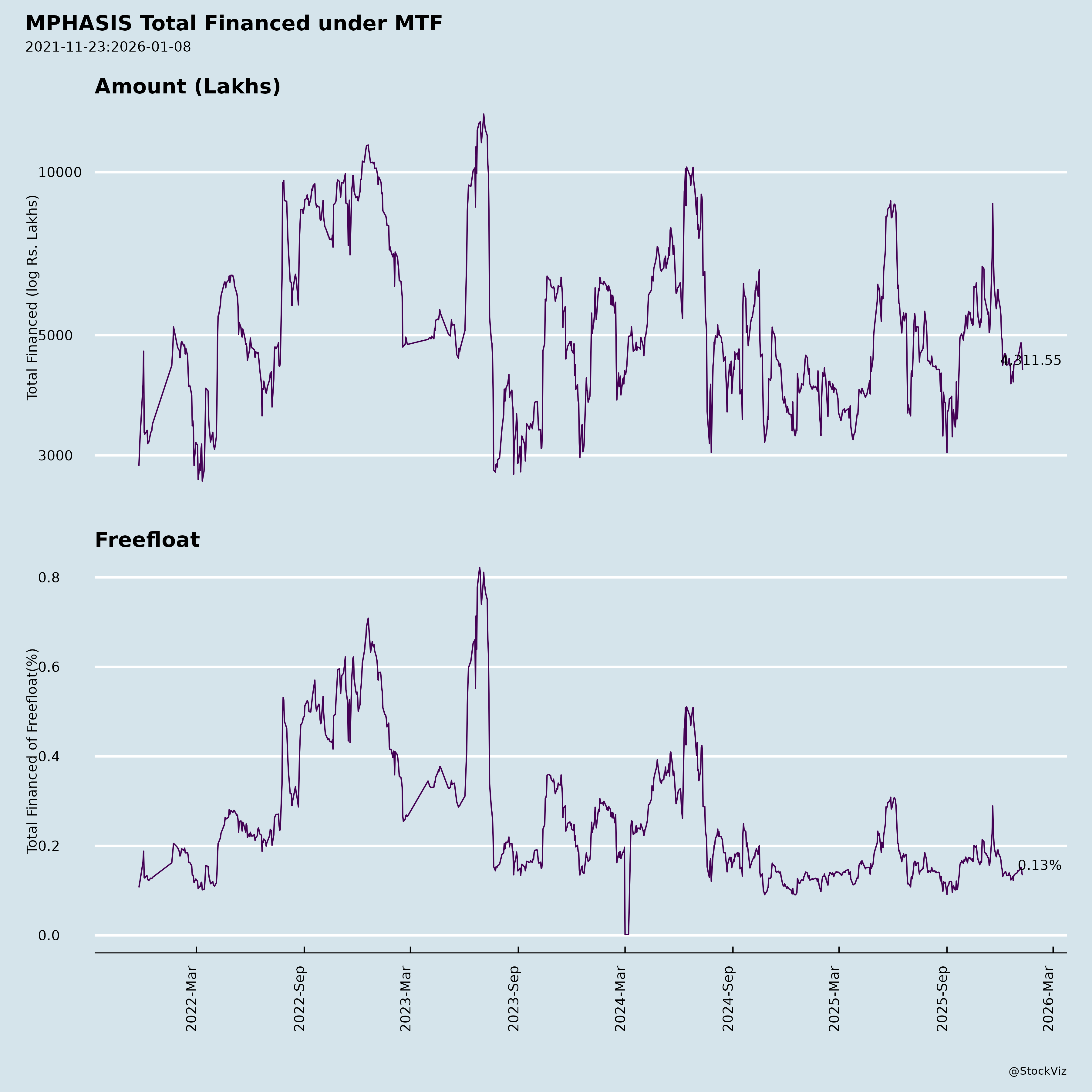

Margined

AI Summary

asof: 2025-12-03

Mphasis Limited (MPHASIS) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview: Mphasis (BSE: 526299; NSE: MPHASIS), a mid-cap IT services firm focused on BFSI, cloud, AI, and cognitive services, reported strong Q2 FY26 results (quarter ended Sep 2025). Revenue hit a record $445Mn (+2% QoQ / +6% YoY CC), driven by AI-led deals and direct business (97.5% of revenue). TCV wins remained robust at $528Mn (42% AI-led), with H1 FY26 TCV at $1.3Bn exceeding FY25 full-year. Margins held steady at 15.3%, EPS at ₹24.7 (+10% YoY). The company emphasized AI platforms (e.g., NeoIP™ launch) and quantum tech (qCryptsec™, QOptiDecision™), positioning for transformation deals. Guidance: >2x industry growth, margins 14.75-15.75%.

Tailwinds (Positive Catalysts)

- AI-Led Momentum: 69% of record pipeline ($ high, +97% YoY / +9% QoQ) is AI-led; 42% TCV AI-led. Proprietary platforms (NeoIP™, NeoCrux™, NeoZeta™) embedded in deals, boosting productivity (e.g., 20-30% SDLC uplift). Early AI bets (since 2014) yielding 2.4x pipeline growth post-Mphasis.ai launch.

- Deal Pipeline & Wins: Broad-based pipeline (+45% BFS YoY, +139% non-BFS; large deals +180%). H1 TCV $1.3Bn > FY25 full-year; LTM $2Bn+. 10 large deals in H1 (incl. $100Mn+ BFS, two $50Mn+). Multi-tower, Savings-Led Transformation™ deals.

- Vertical Strength: Direct BFSI CQGR 4.7% (market-leading); Insurance +32% YoY, TMT +27% YoY. US +10% YoY, EMEA +7.5% QoQ. Client pyramid expanding ($10-100Mn+ bands).

- Strategic Investments: Large Deals team, GTM ramp-up, Healthcare leader hire (leveraging Javelina®). Analyst accolades (Everest PEAK Matrix Major Contender/Star Performer in AI, Insurance BPS, etc.). ESG score 73/100.

- Platform Shift: Software+services reducing headcount-revenue linkage; offshore utilization at 5-yr high.

Headwinds (Challenges)

- Vertical Weakness: Logistics/Transportation -65% YoY revenue, negative margins (one-time client investment; expected Q3 recovery).

- DSO Pressure: 89 days (+5 QoQ) from milestone/fixed-price contracts (mix +50% YoY); normalization expected in 3-4Q.

- Sequential Softness: Overall revenue +2% QoQ CC (BFS -0.7% QoQ); furlough/seasonality risks in H2 (mitigated by fixed-price mix).

- Client Concentration: Top client weakness washed out sequentially but lingers in LTM; top-10/11-30 grew 10-11% LTM.

- Macro Noise: US regional banks, H1B visa uncertainty (low direct impact, but sentiment); mortgage refinance delayed (Fed cuts uncertain).

Growth Prospects

- High Confidence Outlook: >2x industry growth via pipeline/TCV conversion (steady ramp-ups from Q1/Q2 large deals). H2 acceleration from deal ramps, AI archetypes (Ops, Modernization, Data).

- AI/Tech Leverage: NeoIP™ (agents for modernization, app dev, IT/Business Ops) + quantum solutions position for “continuous transformation.” AI-led TCV run-rate elevated ($300-500Mn/quarter sustainable? Lumpy but trending up).

- Geographic/Vertical Expansion: Non-US (EMEA +15% YoY Direct, RoW +16%); Logistics Q3 growth; Healthcare ramp-up.

- Margin Resilience: Stable 15.3% despite investments; currency tailwind from INR depreciation (hedged 80%, losses to normalize).

- LTM Metrics: TCV $2Bn+, pipeline 2x+ YoY; potential FY26 revenue CQGR acceleration if H2 > H1.

| Metric | Q2 FY26 | YoY CC | H1 FY26 | FY25 Full |

|---|---|---|---|---|

| Revenue (\(Mn) | 445 | +6% | Strong | Record high | | TCV (\)Mn) | 528 | Robust | 1.3Bn | <1.3Bn |

| Pipeline Growth | +97% | AI 69% | Record | - |

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Execution | TCV-to-revenue lag (3-6 months for transformation deals); furlough/H2 seasonality. | Steady ramps, fixed-price mix optimizes furloughs. |

| Macro/Geopolitical | US slowdown (e.g., refinance, regional banks), H1B/H1 volatility, elections/shutdowns. | Low H1B dependency; US 70% revenue but diversified verticals. |

| Currency/Financial | INR depreciation → hedge losses (OCI impact); DSO stretch. | Conservative 80% hedge; normalization expected. |

| Competition/Market | AI hype → pricing pressure; commoditization if platforms undifferentiated. | Proprietary IP (NeoIP™), MVPs/hackathons in RFPs; “human-in-loop.” |

| Operational | Utilization volatility with software shift; talent/supply chain (quantum/AI skills). | Dynamic 90-day forecasting; rolling supply chain. |

| Regulatory | Quantum/crypto compliance (e.g., PQC standards); data privacy in AI. | CBOM scanning, ISO certifications. |

Overall Summary & Outlook: Bullish with Resilient Execution. Tailwinds from AI platforms and deal momentum outweigh headwinds (vertical-specific, DSO). Growth prospects strong (>2x industry, AI-driven), supported by record pipeline/TCV and stable margins. Risks are manageable (macro noise, execution lags) given direct model (97.5%), IP differentiation, and broad-based wins. FY26 could see 8-12% CC revenue growth if H2 ramps deliver; monitor Logistics recovery and DSO. Trading at ~20x FY26 EPS (est.); attractive for AI/IT growth play. Positive analyst positioning reinforces momentum.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.