METROPOLIS

Equity Metrics

January 13, 2026

Metropolis Healthcare Limited

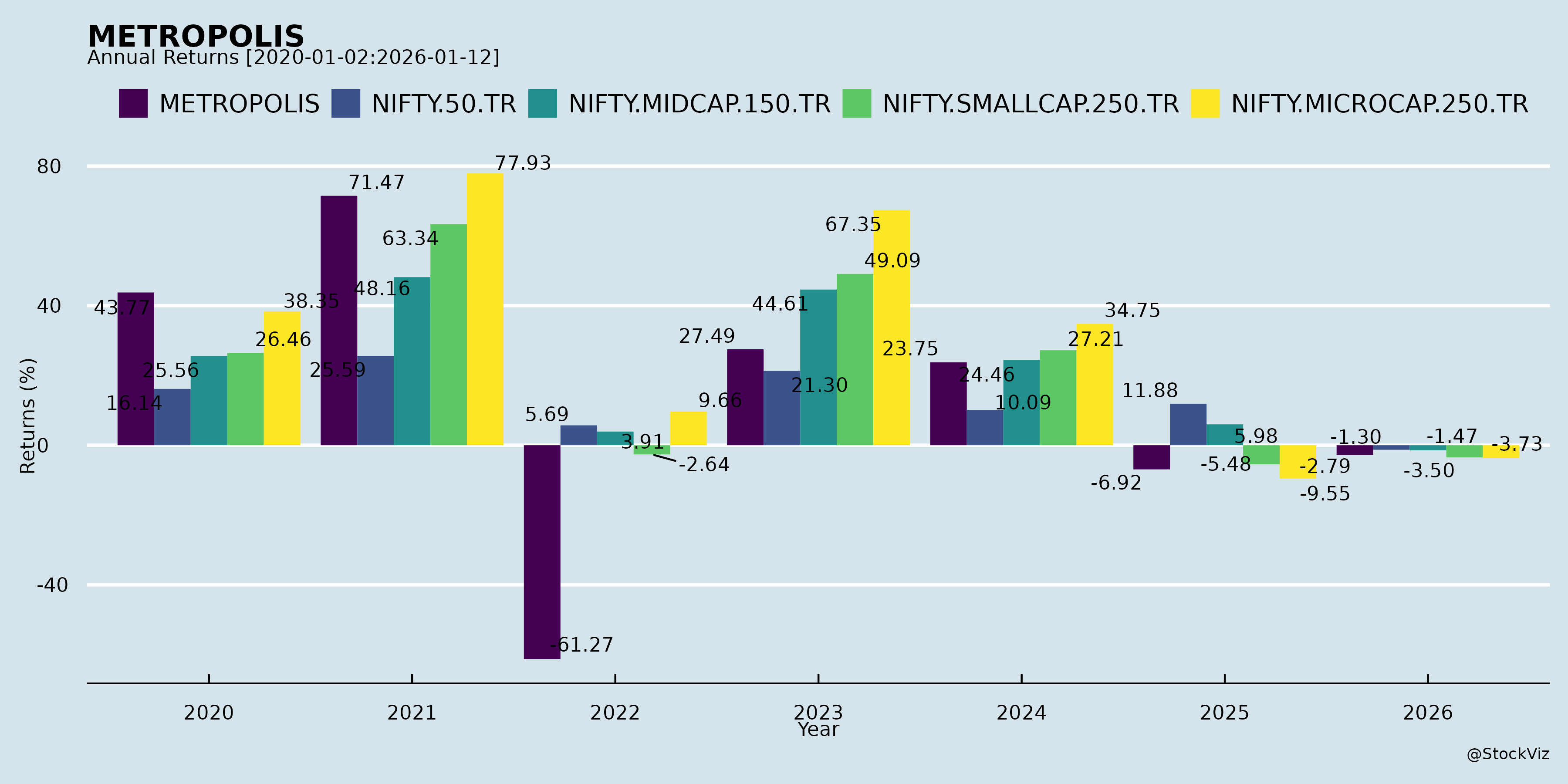

Annual Returns

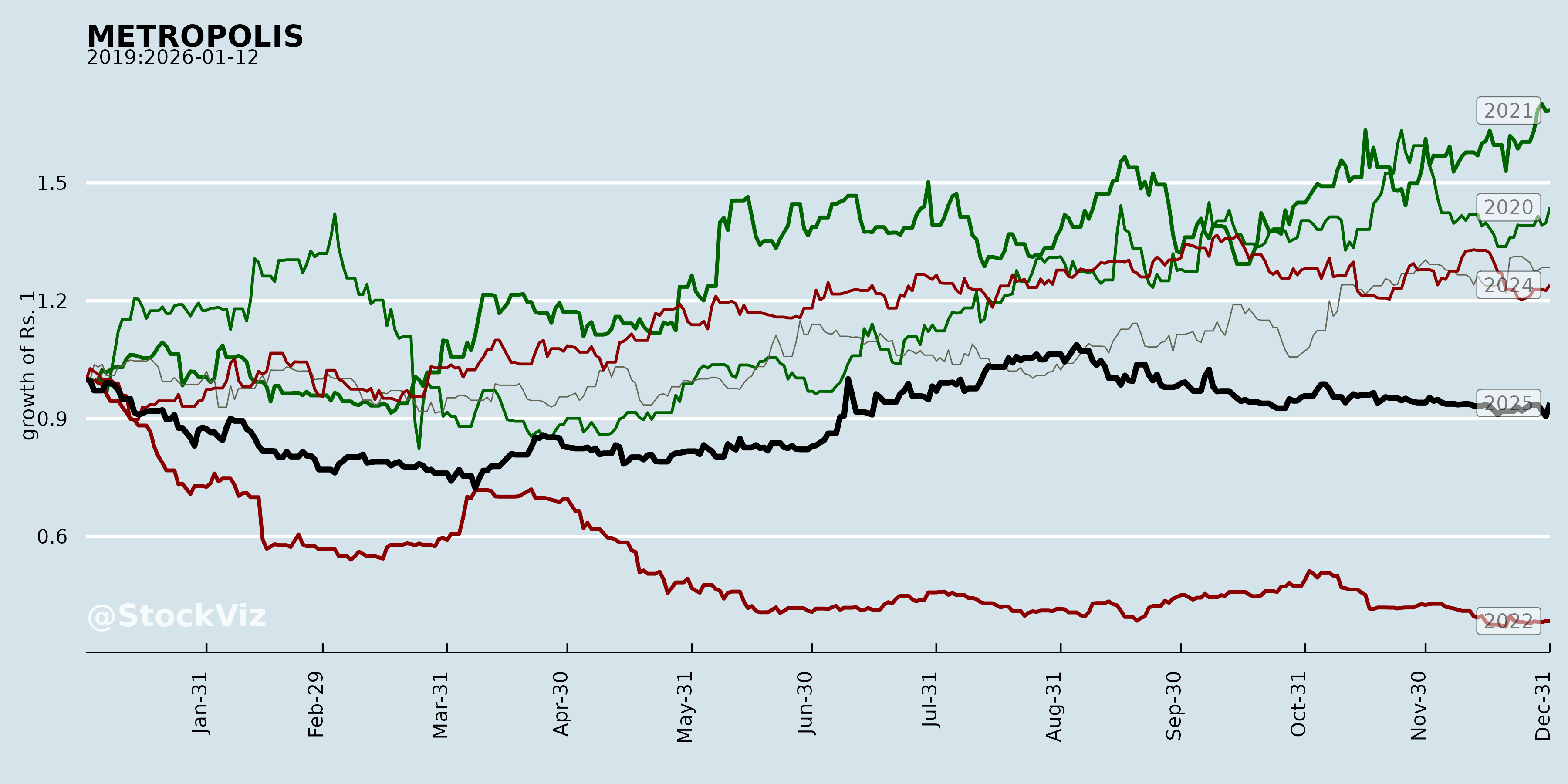

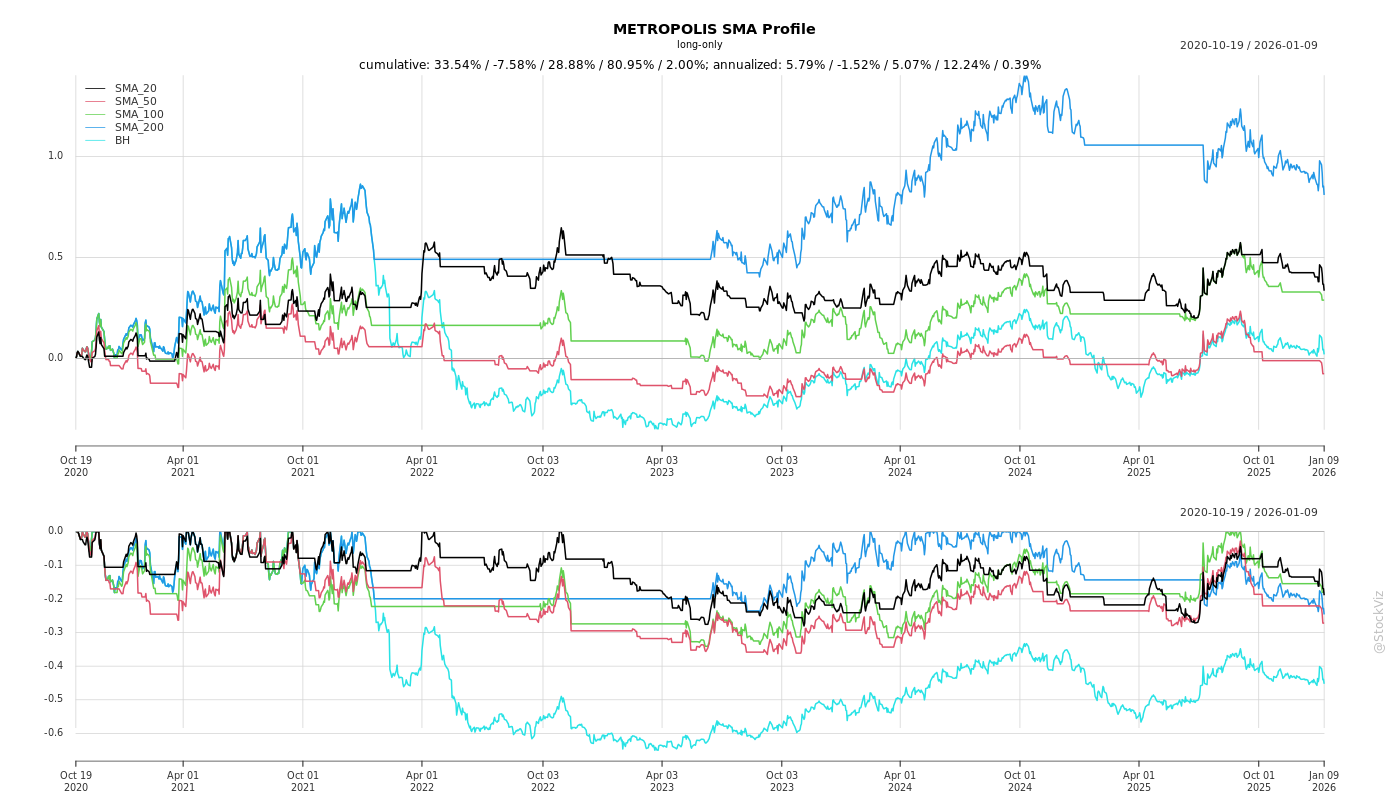

Cumulative Returns and Drawdowns

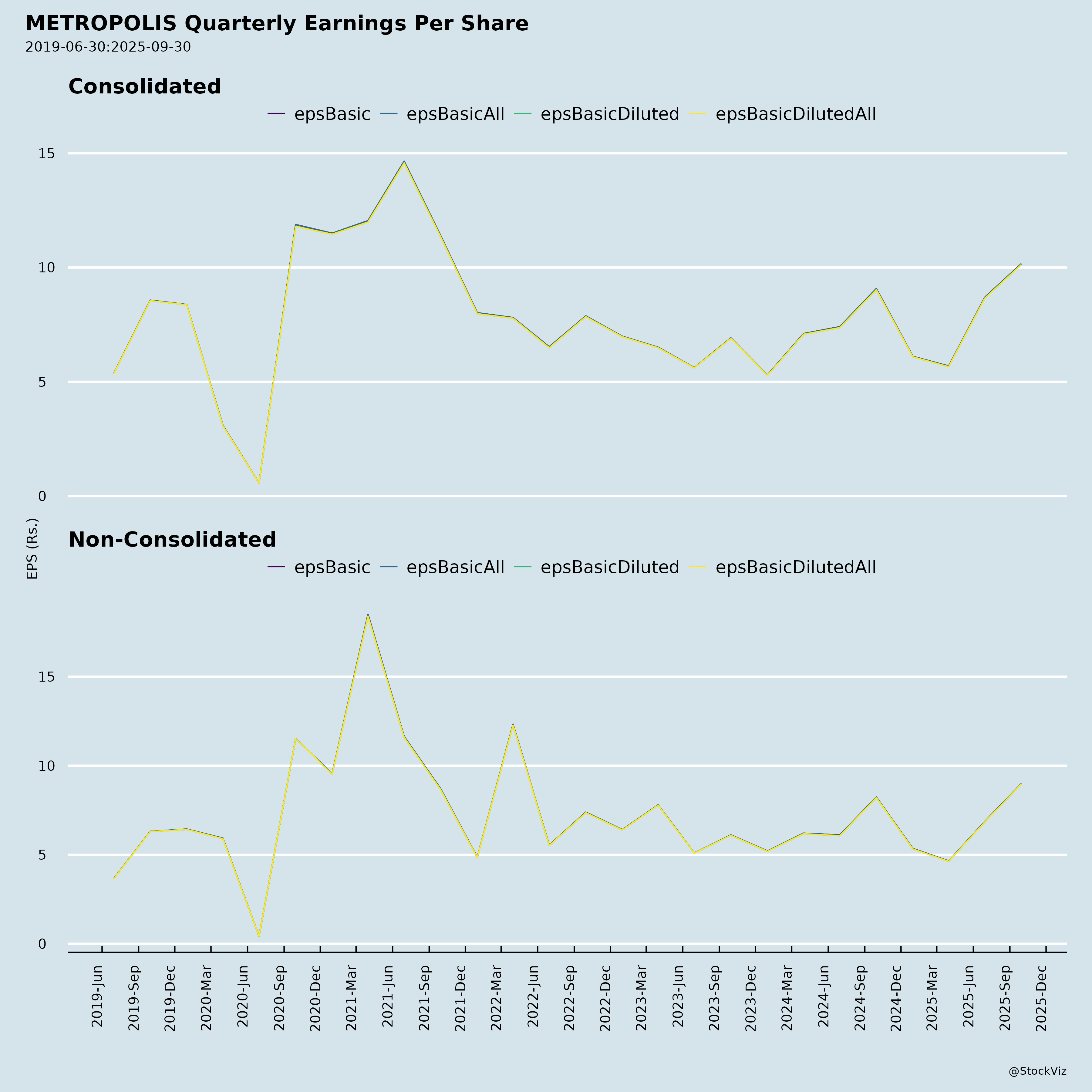

Fundamentals

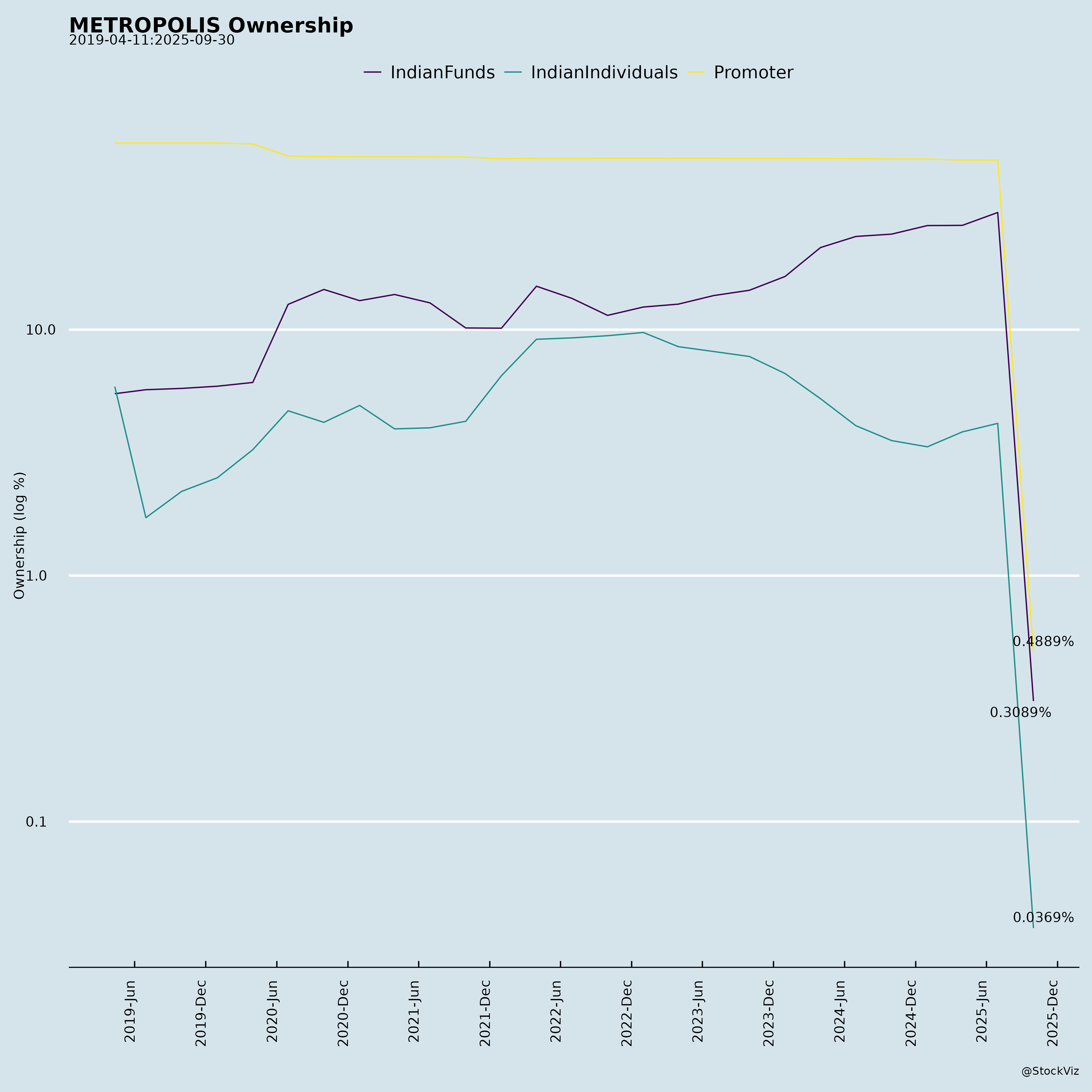

Ownership

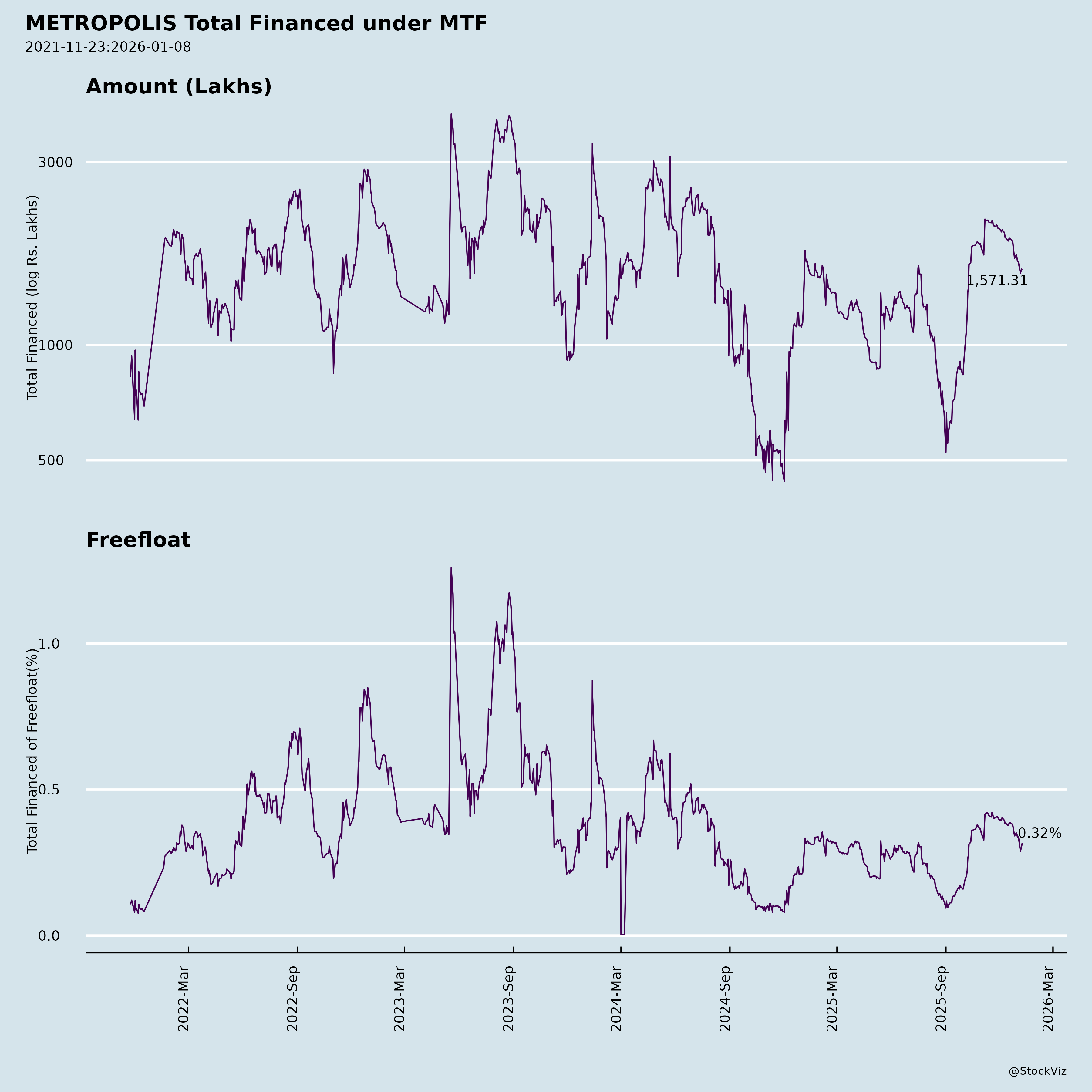

Margined

AI Summary

asof: 2025-12-03

Analysis of Metropolis Healthcare Limited (METROPOLIS) - Q2 & H1 FY26 Overview

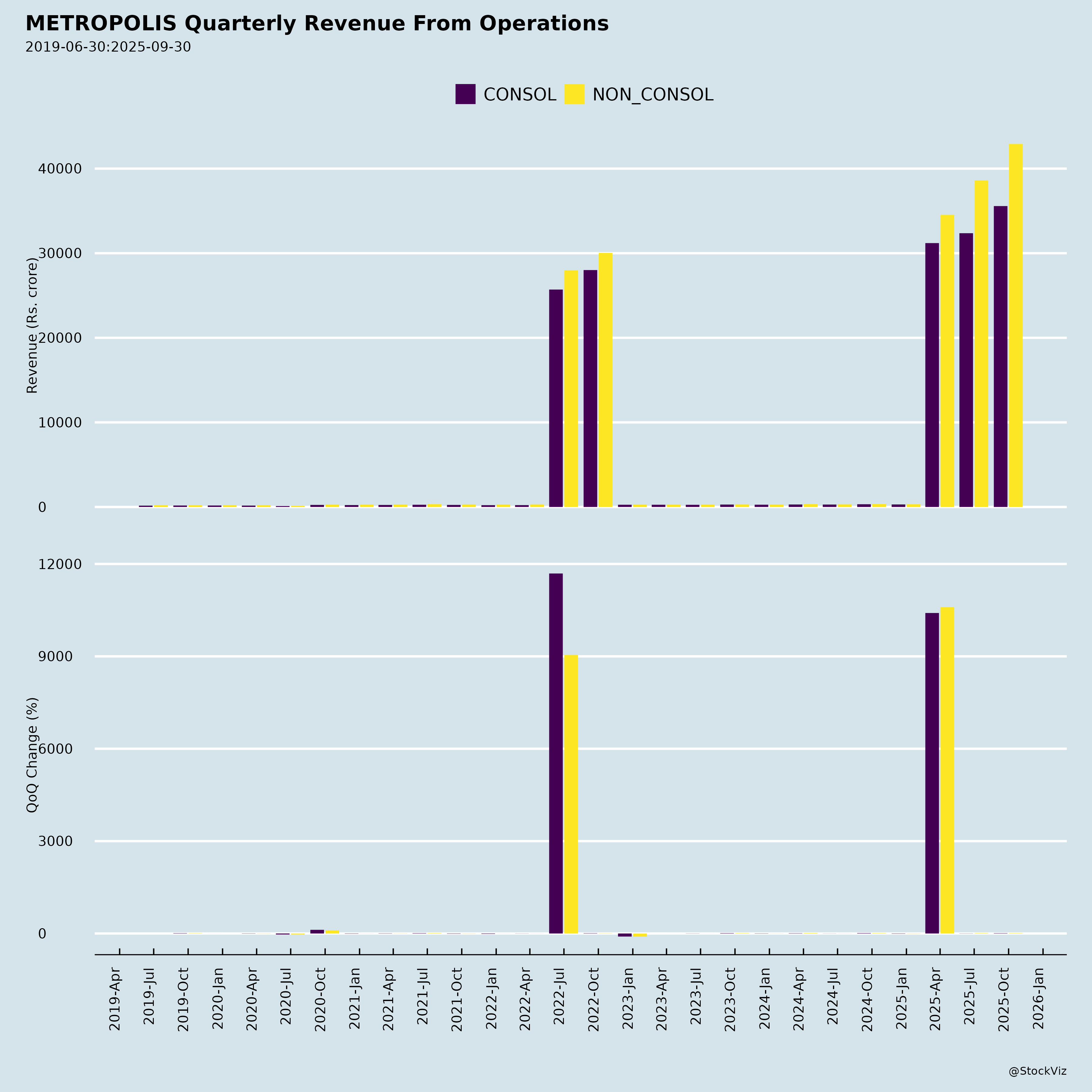

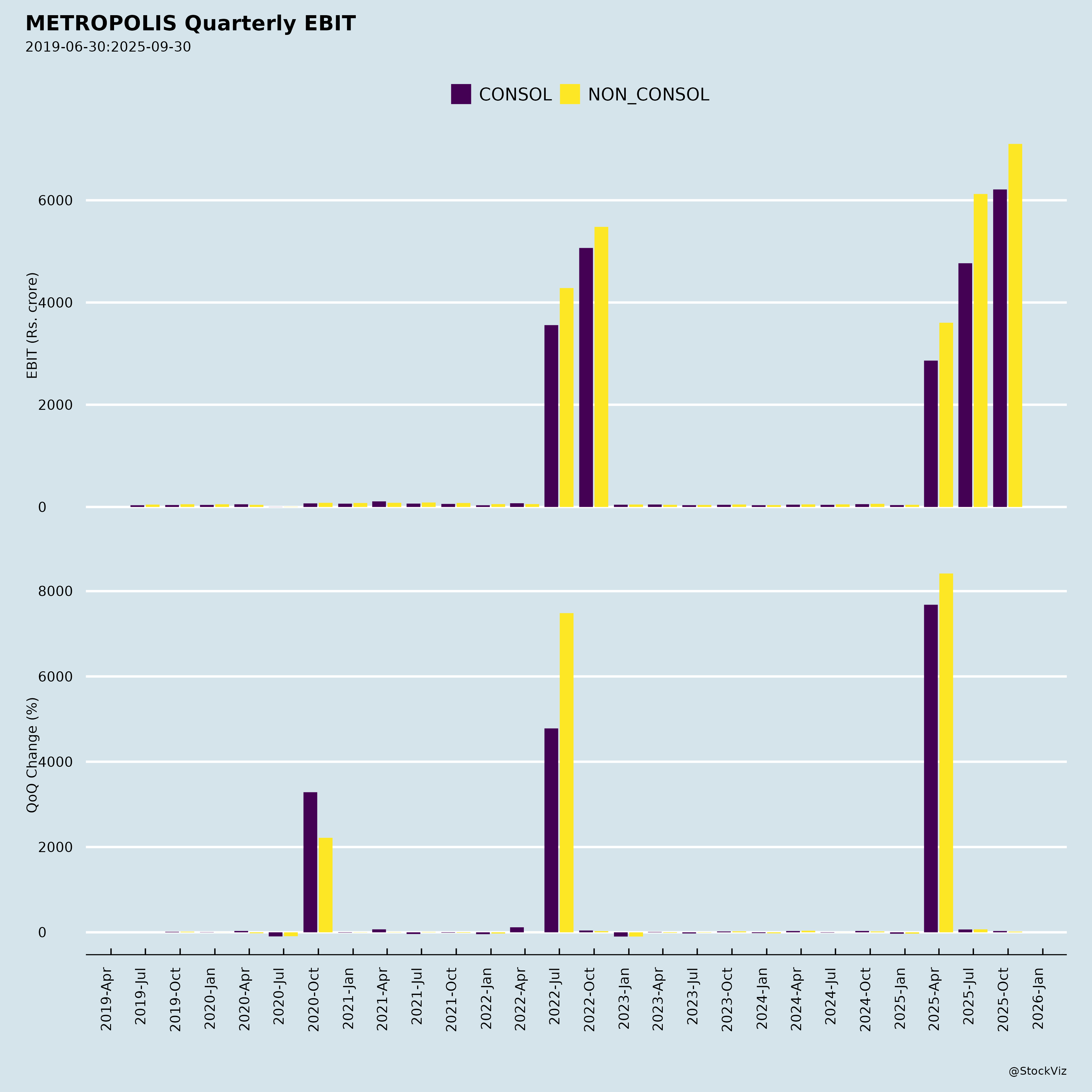

Performance Snapshot (Consolidated, Unaudited): - Q2FY26: Revenue ₹429 Cr (+23% YoY), EBITDA ₹109 Cr (+19% YoY, margin 25.4%), PAT ₹53 Cr (+13% YoY). - H1FY26: Revenue ₹815 Cr (+23% YoY), EBITDA ₹198 Cr (+17% YoY, margin 24.3%), PAT ₹98 Cr (+16% YoY). - Organic (ex-acquisitions): Q2 Revenue +12% YoY; H1 +13% YoY, with EBITDA margins expanding to 26.8% (Q2). - Volumes: +11% patients (3.7 Mn), +12% tests (7.9 Mn); RPP/RPT +11%/10% YoY. - Dividend: ₹4/share (200% on FV ₹2), record date Nov 11, 2025. - Balance Sheet: Net cash positive post-ops; acquisitions funded via OCDs/internal accruals.

Strong execution amid muted seasonal demand (low fevers), driven by 24% TruHealth, 33% Specialty growth, and acquisitions (Core Diagnostics EBITDA turned positive).

Tailwinds (Positive Drivers)

- Robust Segment Momentum: Preventive (TruHealth: +21-24% YoY, 22% premium packs) and Specialty (Genomics/NGS/AI allergy: +15-33% YoY) offset routine slowdown (+4-14%). High RPP from scientific mix/brand trust.

- Acquisition Synergies: Core Diagnostics (high single-digit EBITDA in Q2), DAPIC/Scientific Pathology outperforming group margins. Added Ambika (Kolhapur). Bolt-ons widen footprint (North to 19% contrib.).

- Network Scale: 750+ towns (+ from 300 in FY23), 221 labs (35 ISO/CAP accredited), 4,600+ centers. Tier-3 +13% revenue; focus on UP/MP/AP&TS/Assam.

- Digital & Innovation: AI (MetAdvisor, NGS reporting), CDP/Marketing Cloud, 3x TruHealth adoption. 57+ new tests (H1FY26), 99.99% accuracy, MedTech courses.

- Financial Health: Margin expansion (organic +210 bps QoQ), debt low (near-zero NC borrowings), healthy cash flows (₹129 Cr ops H1). Dividend boosts investor confidence.

- Macro/Strategic: Organized shift in diagnostics; Metropolis 3.0 targets mid-teens CAGR (FY23-26), pre-COVID margins.

Headwinds (Challenges)

- Seasonal/Muted Demand: Low vector-borne illnesses capped routine/semi-special growth (organic +4-8%), softening B2C volumes (+6% vs revenue +11%).

- Acquisition Drag: Group margins dipped to 25.4% (vs organic 26.8%) due to integration costs in Core Diagnostics (Q1 low single-digit EBITDA).

- Cost Pressures: Employee/lab testing costs up (H1 +18-25% YoY), offset by productivity but vulnerable to wage inflation.

- Geographic Imbalance: Heavy reliance on West/South; North/East scaling but nascent (19% contrib).

- Execution in Expansion: Rapid additions (96 labs, 195 centers H1) risk quality dilution if not managed.

Growth Prospects

- High Double-Digit Trajectory: Organic consistency (12-13% H1) + bolt-ons position for mid-teens FY26 revenue CAGR. Target: Fastest national chain growth.

- Product-Led Expansion: TruHealth (radiology integration +1.3x QoQ), Specialty (AI/NGS 3x allergy), Genomics CoE. Adjacencies: Radiology/primary care.

- Geographic Penetration: Tier-2/3 acceleration (13% growth), 800+ top towns via micro-markets/Metlink. International (Africa) stable.

- Tech/ESG Leverage: Digital (Sales CRM, AI personalization) for scalability; ESG (carbon neutrality 2043, NPS 90 by 2028) aids talent/partnerships.

- M&A Pipeline: Priority North/East; seamless integration track record.

- Outlook: H2FY26 guided for sustained growth/margins; analyst meets (Nov 27) signal confidence.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Regulatory/Tax | Ongoing IT disputes (AY14-24; ₹3.9k Cr demand reduced, appeals at ITAT). Provision ₹196 Cr. | Favorable CIT(A) orders; legal recourse. |

| Integration/Execution | Acquisition synergies (Core turnaround swift but Q1 drag); network quality in rapid expansion. | Proven playbook; quality index/star ratings (99% EQAS). |

| Competition | Dr. Lal PathLabs, Thyrocare; unorganized ~70% market. | Differentiation via science/AI (top 1% global CAP), clinician engagement. |

| Macro/External | Economic slowdown curbing preventive spends; forex (minor Africa ops). | Diversified B2B (hospitals/corps +33%); low debt buffers. |

| Operational | Cost inflation (employees 22% revenue); talent attrition. | Efficiency focus; Career 2.0, L&D programs. |

| Strategic | Over-reliance on acquisitions (23% group growth vs 12% organic). | Organic >50% sustained; Metropolis 3.0 balances. |

Overall Summary: Metropolis exhibits resilient growth (23% top-line, margin stability) via organic strength, smart M&A, and premiumization, defying seasonal headwinds. Tailwinds from innovation/network/digital outweigh integration/seasonal challenges. Prospects bright for mid-teens CAGR, backed by 3.0 strategy and healthy BS. Key watch: Tax resolution, Core stabilization. Rating Outlook: Positive – poised as premium diagnostics leader; buy on dips for long-term compounding. (Valuation context: Forward P/E ~40-50x implied; peers 30-60x on growth premium.)

Analysis based solely on provided docs; current mkt price/financials as of Nov 2025.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.