LTF

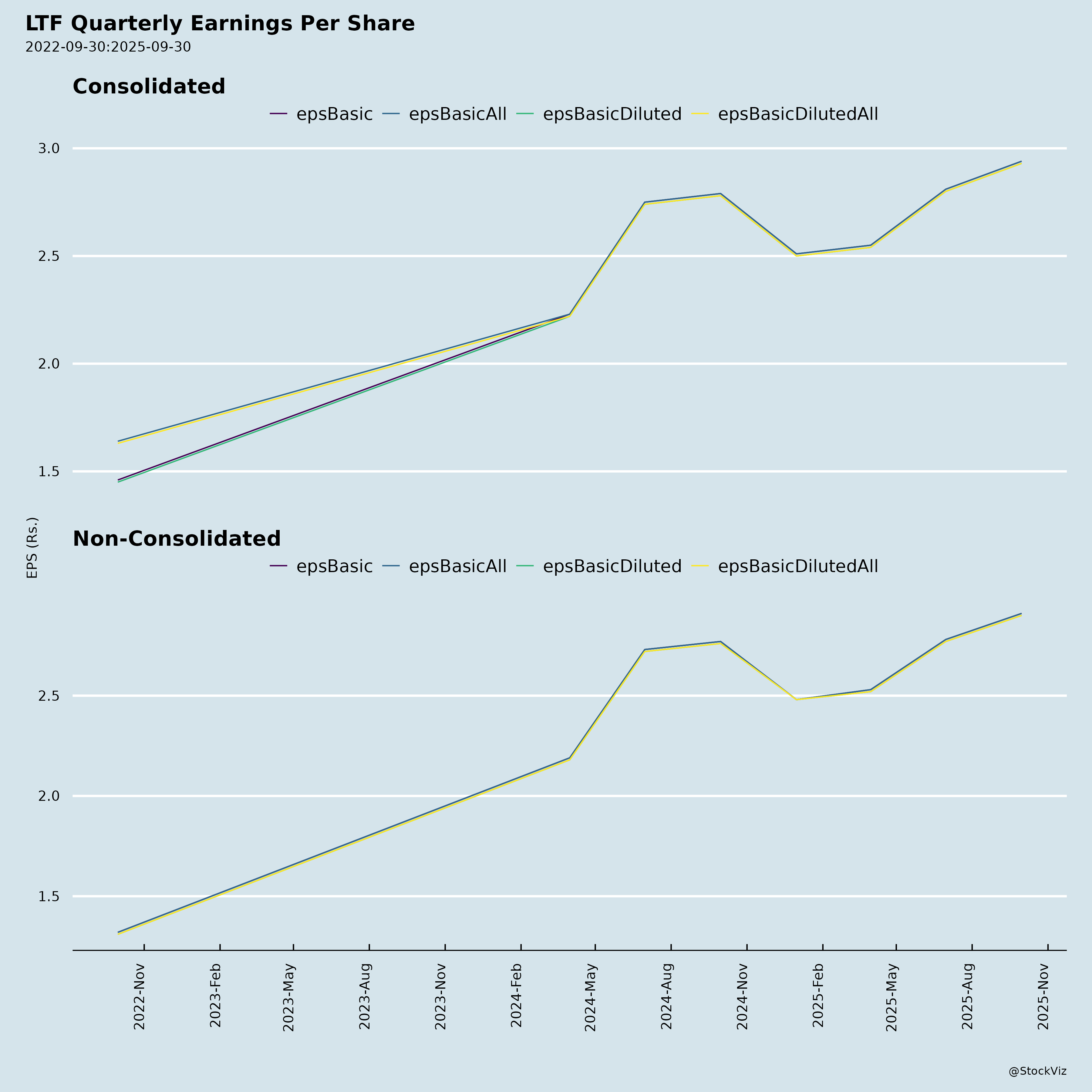

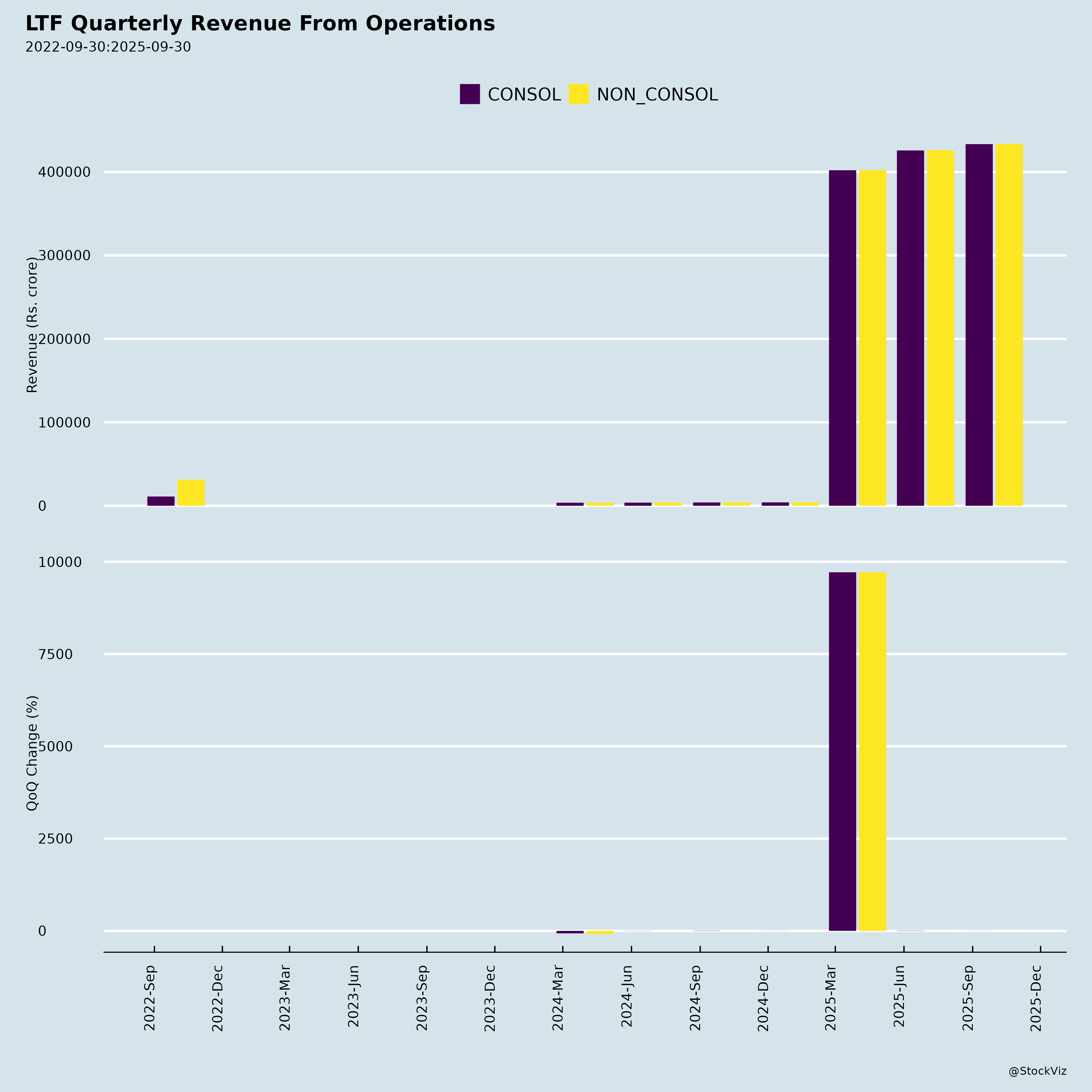

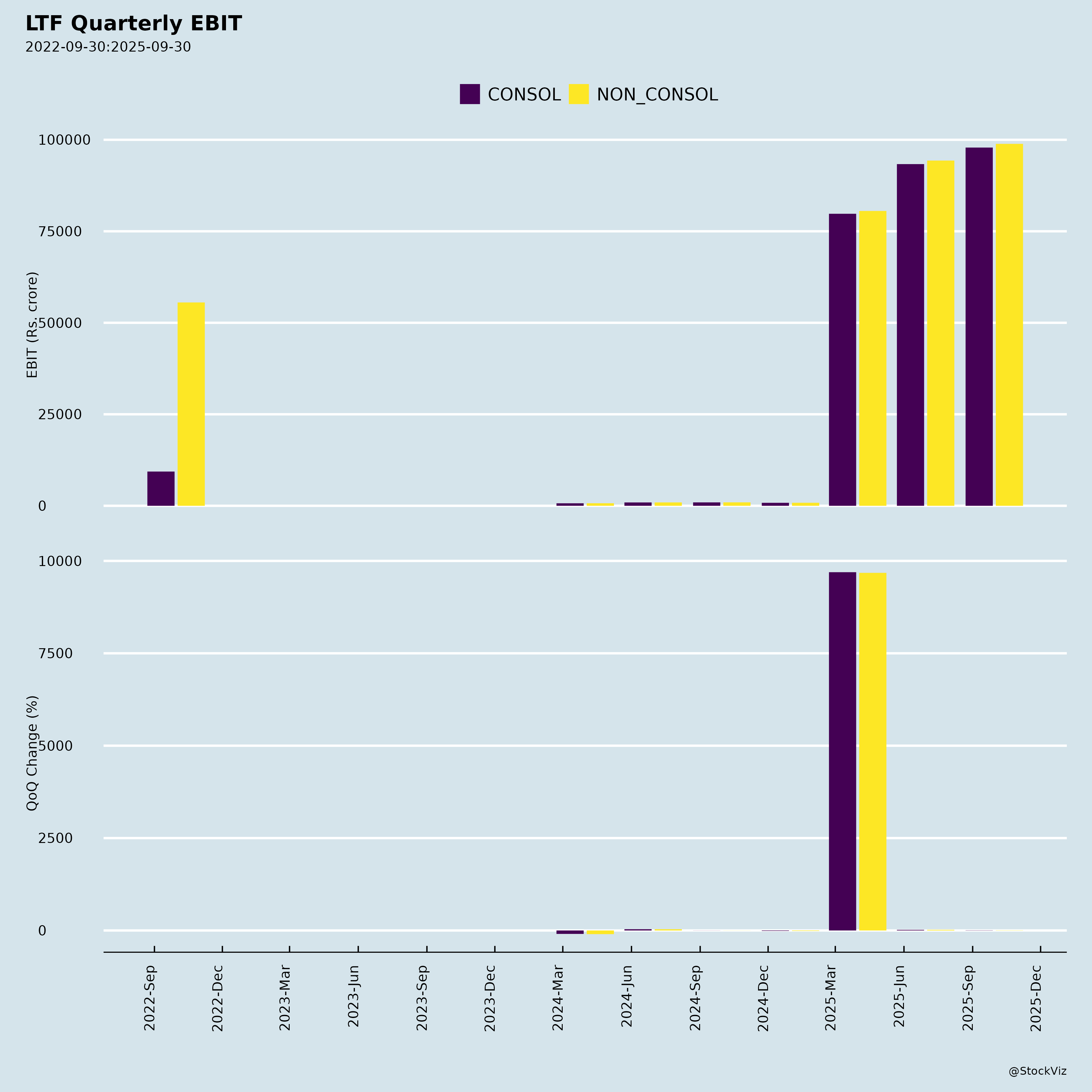

Equity Metrics

January 13, 2026

L&T Finance Limited

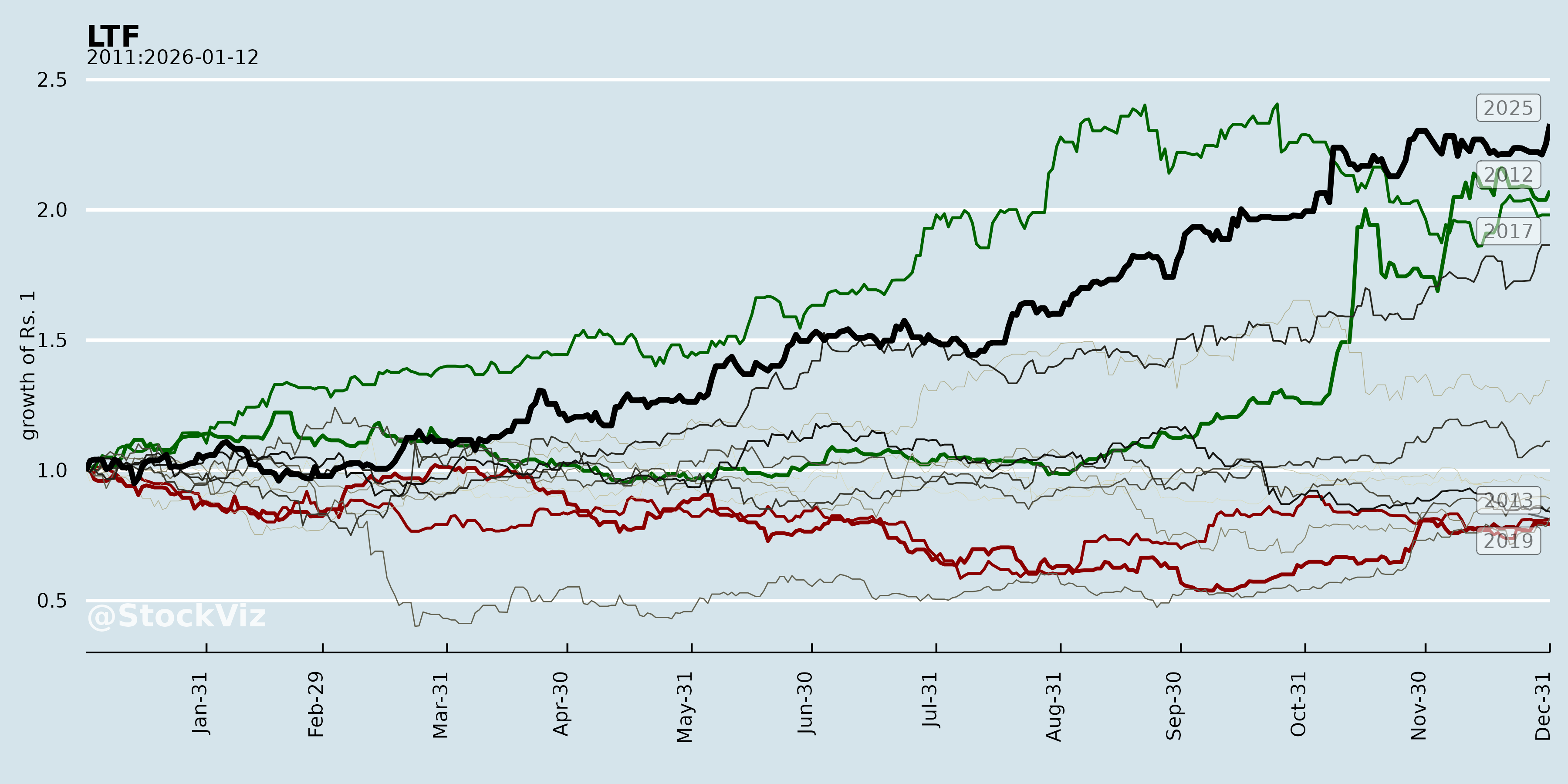

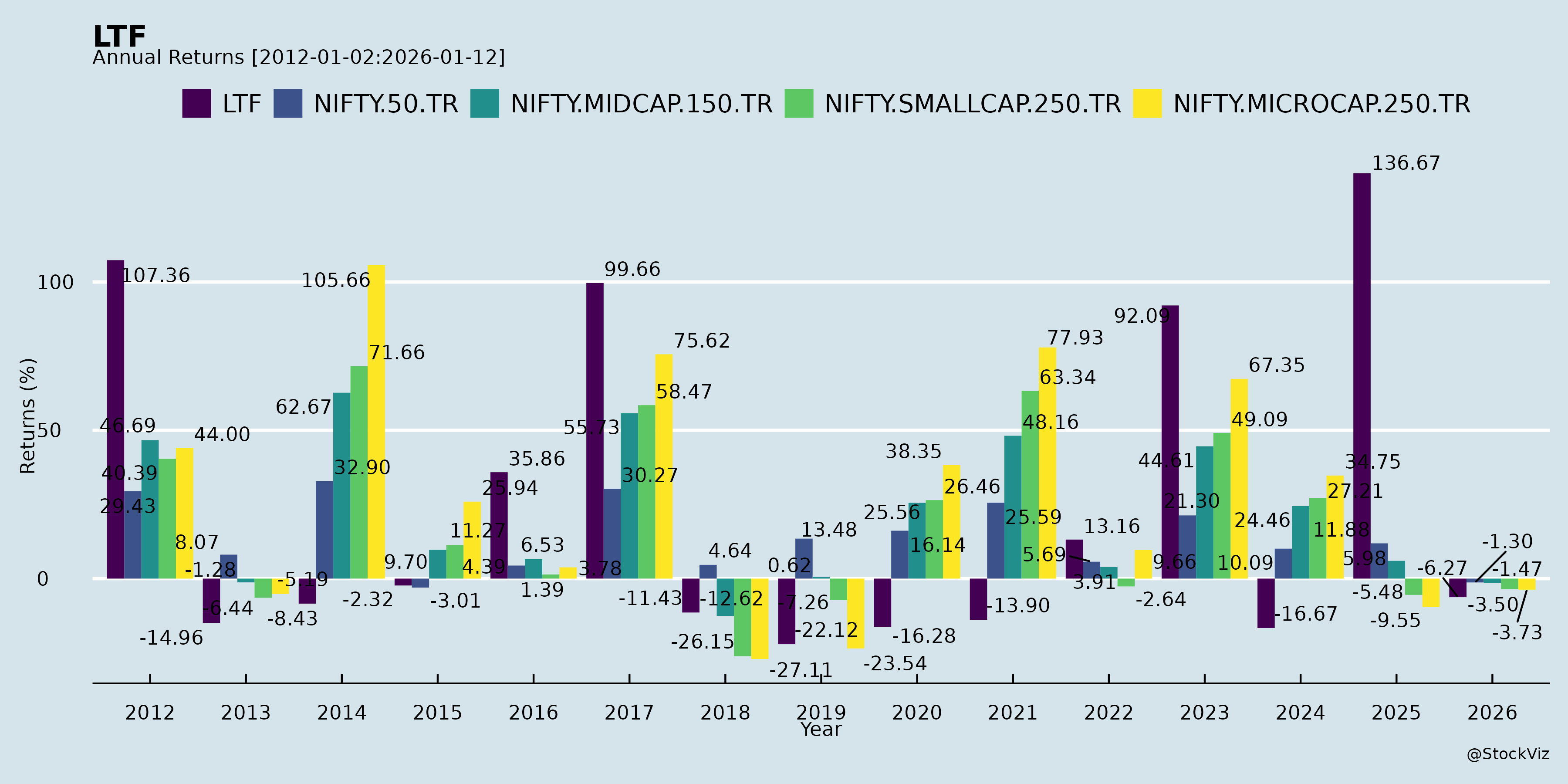

Annual Returns

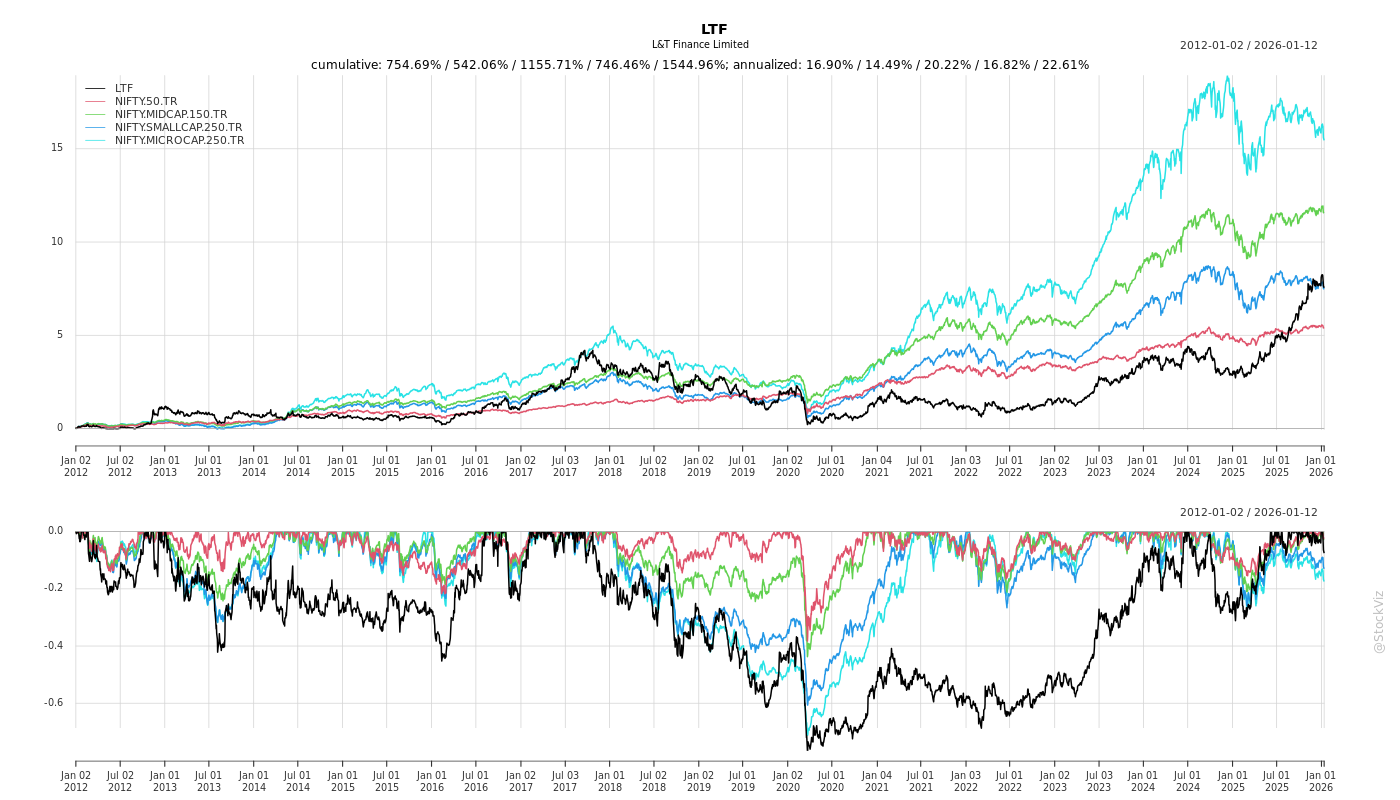

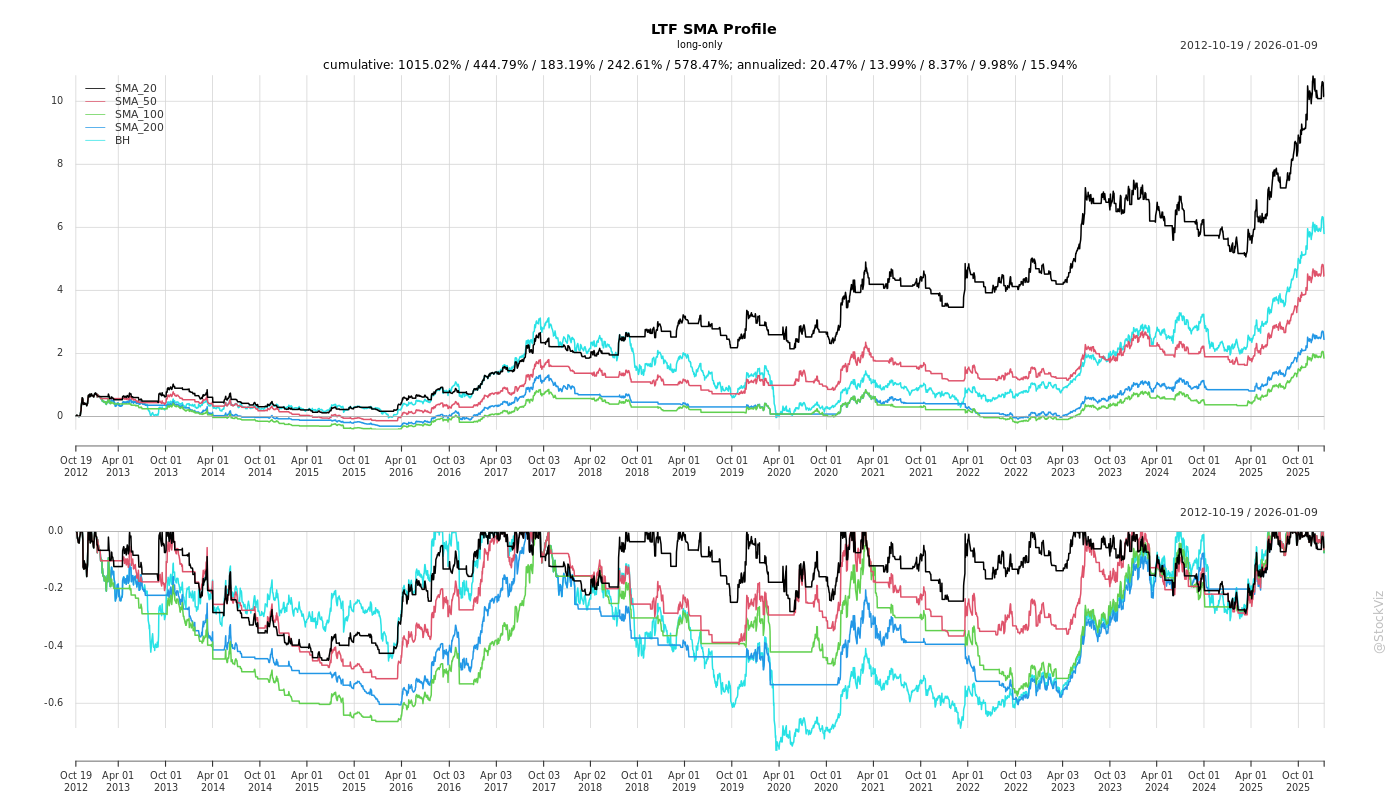

Cumulative Returns and Drawdowns

Fundamentals

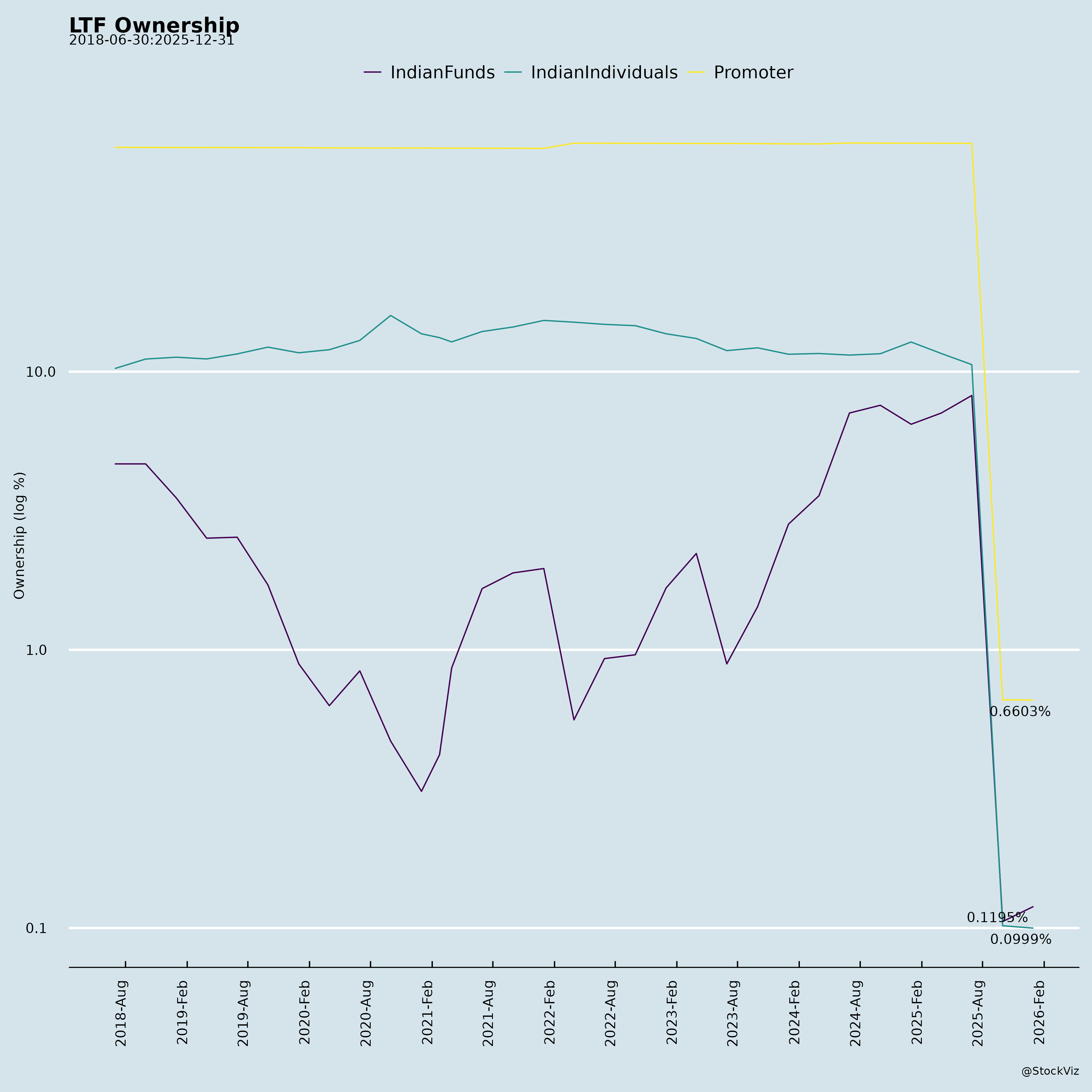

Ownership

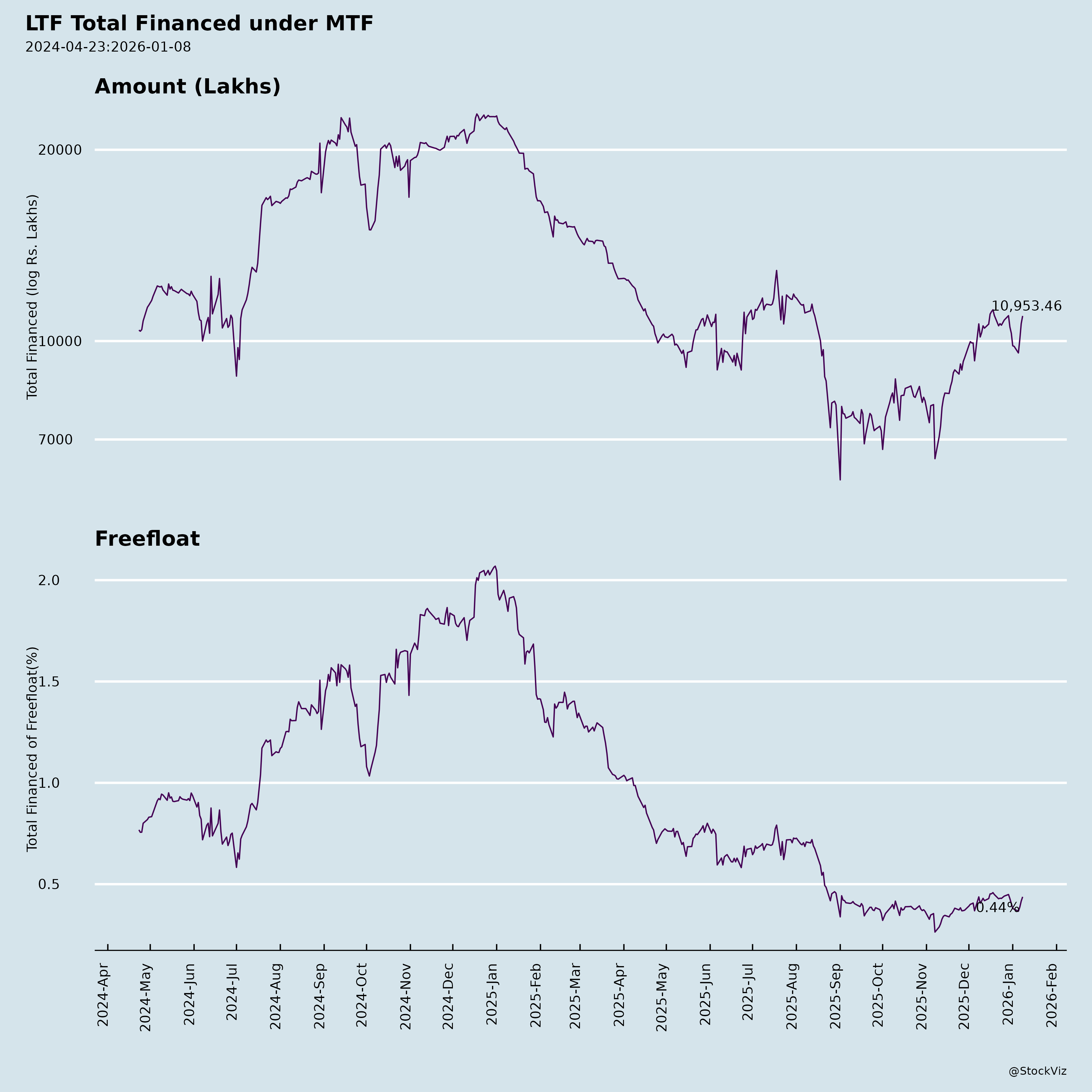

Margined

AI Summary

asof: 2025-12-04

L&T Finance (LTF) Headwinds, Tailwinds, Growth Prospects & Key Risks - Summary Analysis

Based on the provided documents (Q2FY25 results, financial statements, corporate presentations, and press releases), here is a structured analysis of LTF’s key dynamics:

Headwinds (Challenges & Risks):

- Elevated Credit Costs: Q2FY25 credit costs rose to 2.59% vs. 2.41% in Q2FY26. The October 2025 repo rate hike further increases funding costs, pressuring margins unless offset by higher asset yields.

- Liquidity & Asset Coverage Pressures: The company faces potential liquidity crunch risks. While most debentures are covered at 100-125%, a significant portion (e.g., INE27E07AP2 at 125%) relies heavily on the bank’s balance sheet (Rs. 26,406.71 Cr). Any deterioration in asset quality could breach coverage.

- Regulatory & Economic Sensitivity: LTF’s retail franchise is highly exposed to economic slowdowns affecting consumer spending (especially in FMCG, two-wheelers, and personal loans). GST reforms (GST 2.0) and monsoons are key demand drivers.

- Competition: Intense competition in the rapidly growing digital and traditional retail finance space (e.g., Paytm, Aditya Birla, Tata Capital) requires continuous differentiation and pricing discipline.

- Branch Expansion & Integration Risks: Scaling operations rapidly (200 new branches, 330 gold branches) introduces integration, operational efficiency, and cost control risks.

- Tech Dependency & Cyber Risk: Heavy reliance on complex AI platforms (Cyclops, Nostradamus) and digital channels increases vulnerability to technical failures and cybersecurity threats.

- Partner Dependency: Success of high-growth segments (Gold Finance, Large Partnerships) hinges on the performance and stability of key partners (Google Pay, OEMs, MFIs).

Tailwinds (Opportunities & Strengths):

- Strong Retail Franchise: Robust growth across all segments:

- Retail Book: Rs. 1.04,607 Cr (+18% YoY).

- Key Segments: Rural BSF +16% (Rs. 6,316 Cr), Farmer Finance +7% (Rs. 1,654 Cr), Two-wheeler +5% (Rs. 2,512 Cr), Personal Loans +114% (Rs. 2,918 Cr), Home Loans +7% (Rs. 2,713 Cr), SME Finance +18% (Rs. 1,468 Cr), Gold +16% (Rs. 983 Cr).

- Digital Transformation Advantage: Projects (Cyclops, Nostradamus) and platforms (PLANET app with 2 Crore+ downloads) deliver superior customer experience, lower costs, and higher scalability vs. traditional models. Gold Finance expansion benefits from this digital backbone.

- International Credit Upgrade: S&P upgrade to “BBB/Stable” significantly enhances LTF’s global credibility, access to capital, and diversification of liabilities. Fitch “BBB-” rating reinforces stability.

- Big-Tech Partnerships: Strategic alliances (Google Pay for PLs) provide massive customer reach and distribution efficiency, fueling high-growth segments.

- Robust Cash Flow & Profitability: Strong PAT (Rs. 735 Cr, +6% YoY), healthy Gross/Net Stage 3, and stable RoA/ROE indicate underlying profitability and cash generation.

- ESG & Sustainability Position: Strong CRISIL/Sustainability ratings (“Strong”), community programs (Digital Sakhi, Jalvaibhav), and focus on ESG solidify brand value and stakeholder trust.

- Branch Expansion Momentum: Planned 200+ new branches and 330 gold branches provide significant future growth capacity, especially in rural geographies.

Growth Prospects (Near & Medium Term):

- Retail Domination: Sustained double-digit growth in key segments (Rural, Farmer, Two-wheeler, SME) expected to drive overall retail growth above GDP trends. Cross-sell opportunities are significant.

- Gold Finance Leadership: Ambitious target of 330 gold branches by FY26-end and Pan-India dominance through digital enablement and branch network expansion.

- Digital Scale: PLANET app user base (~2 Crore+) and partnerships (Google Pay) position LTF to capitalize on India’s digital finance adoption.

- Capital Raising: Upgraded ratings (BBB/Stable) will facilitate easier access to global debt/equity markets, aiding expansion.

- Diversification: Continued growth in H2FY26 (festive demand) and FY27 driven by GST 2.0, monsoons, and new initiatives.

Key Risks (Critical Concerns):

- Credit Quality Deterioration: Any economic slowdown or regulatory changes impacting consumer repayment capacity could increase default rates (Stage 3), pressuring margins and asset quality.

- Interest Rate Volatility: Reliance on floating-rate debt makes the company vulnerable to unexpected repo rate hikes, squeezing net interest margins.

- Execution Risk: Failure to successfully integrate new branches, scale digital platforms efficiently, or manage large-scale partnerships could lead to cost overruns, customer dissatisfaction, and slower growth realization.

- Competition Intensity: Intensifying competition from established NBFCs (Tata Capital, Aditya Birla), banks, and fintechs could pressure margins and market share gains.

- Regulatory Changes: Changes in SEBI regulations, RBI norms (credit concentration limits, provisioning norms) or tax policies could impact the business model.

- Cybersecurity Threats: The digital-first model increases exposure to sophisticated cyberattacks targeting customer data and transactions.

- Geopolitical/External Shocks: Dependence on India’s domestic economic and geopolitical stability (e.g., global recession, geopolitical tensions) impacts demand.

Conclusion:

LTF presents a compelling story of transformation from a traditional NBFC to a digitally-led, customer-centric retail financier with a strong portfolio. Its deep rural/urban retail franchise, robust profitability, and upgraded international credit ratings provide a solid foundation. The tailwinds of digital growth (Cyclops/Nostradamus, Google Pay partnership), gold finance expansion, and capital market access are significant. However, the company faces headwinds from elevated funding costs, liquidity/asset coverage pressures, intense competition, and execution risk associated with rapid scale-up. Managing credit risk and regulatory compliance remains paramount. Success hinges on effectively executing its expansion and digital strategy while maintaining asset quality and cost discipline to capture the substantial growth opportunities in India’s evolving retail finance landscape.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.