Investment Company

Industry Metrics

January 13, 2026

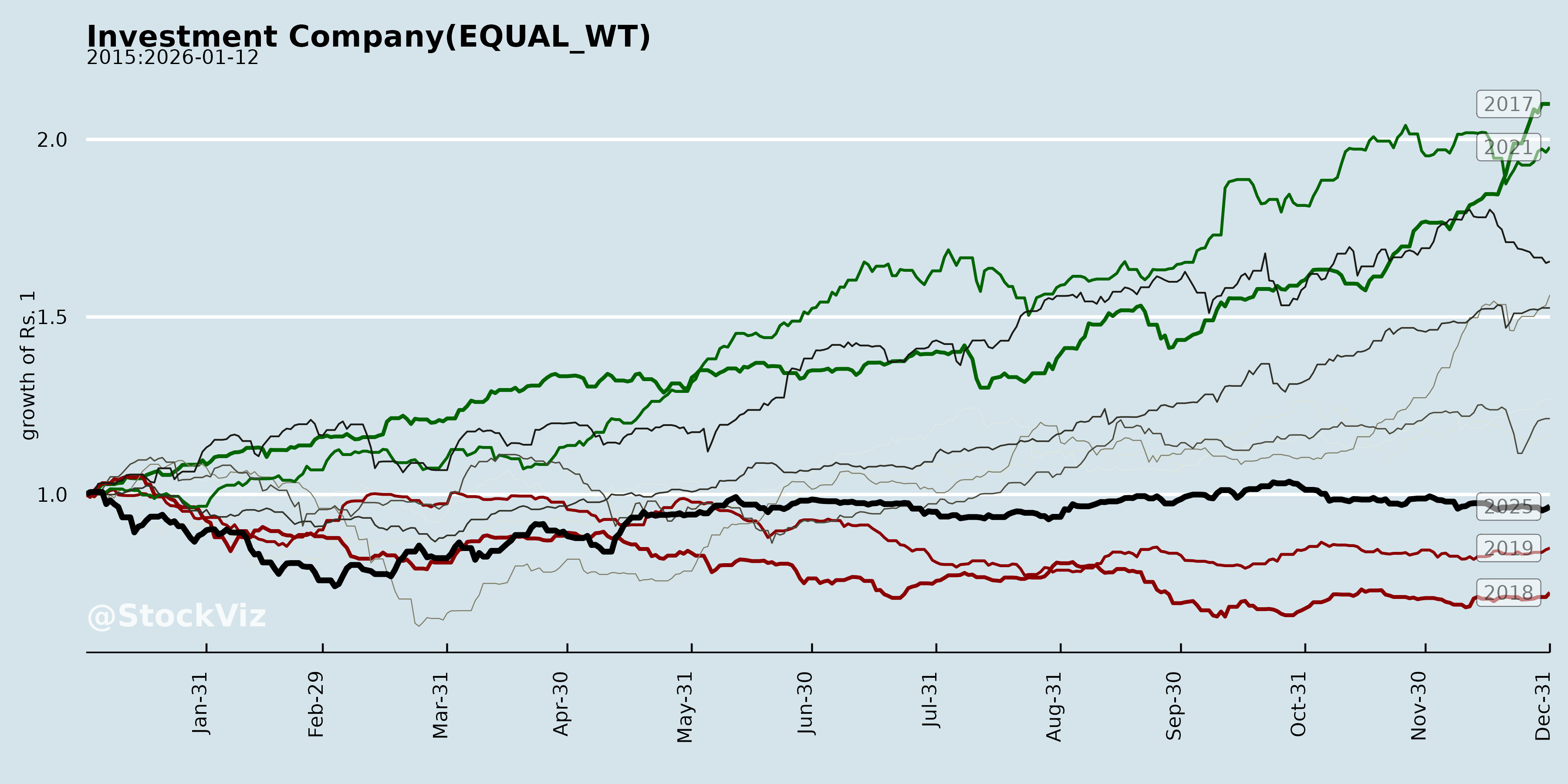

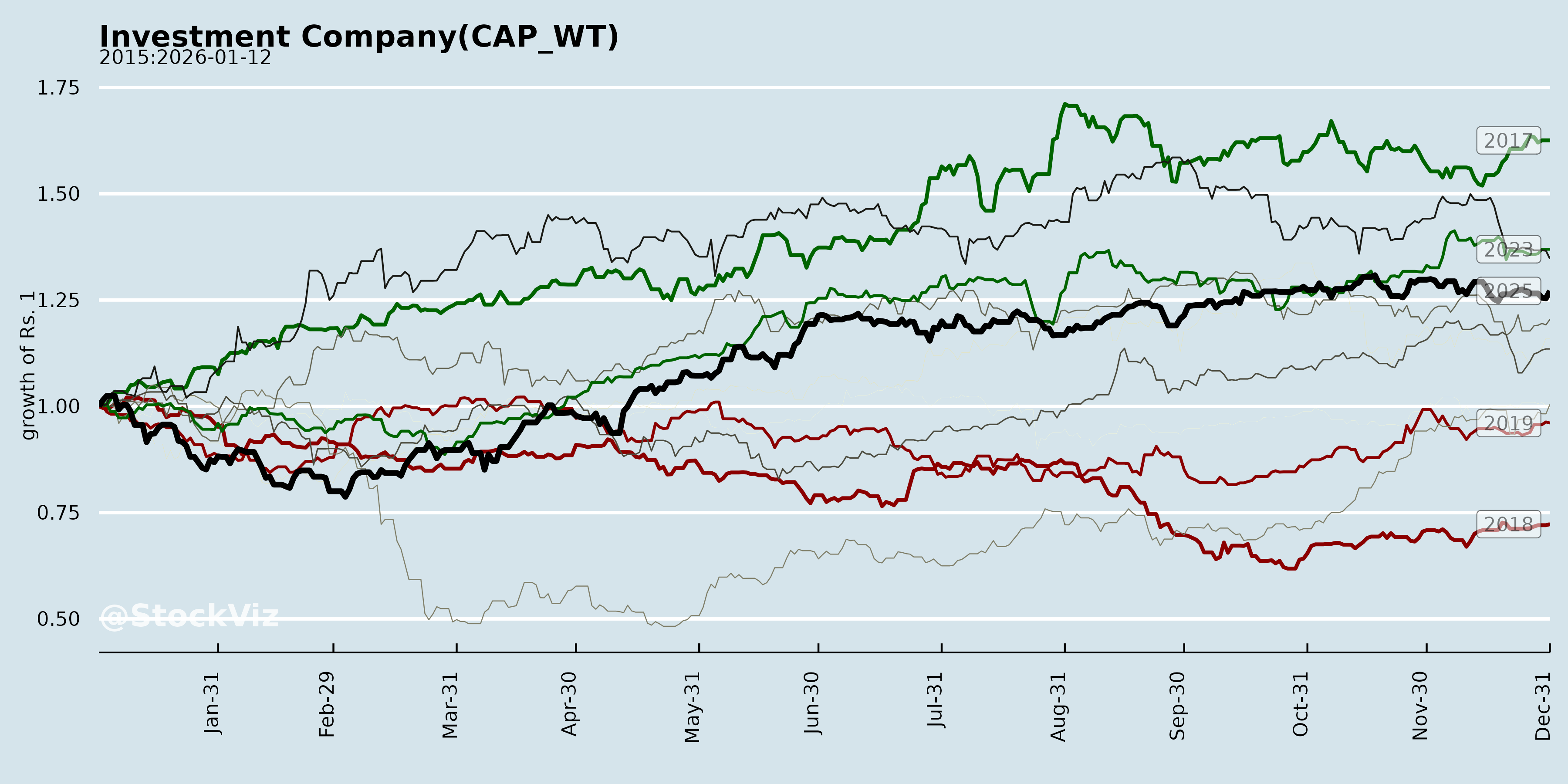

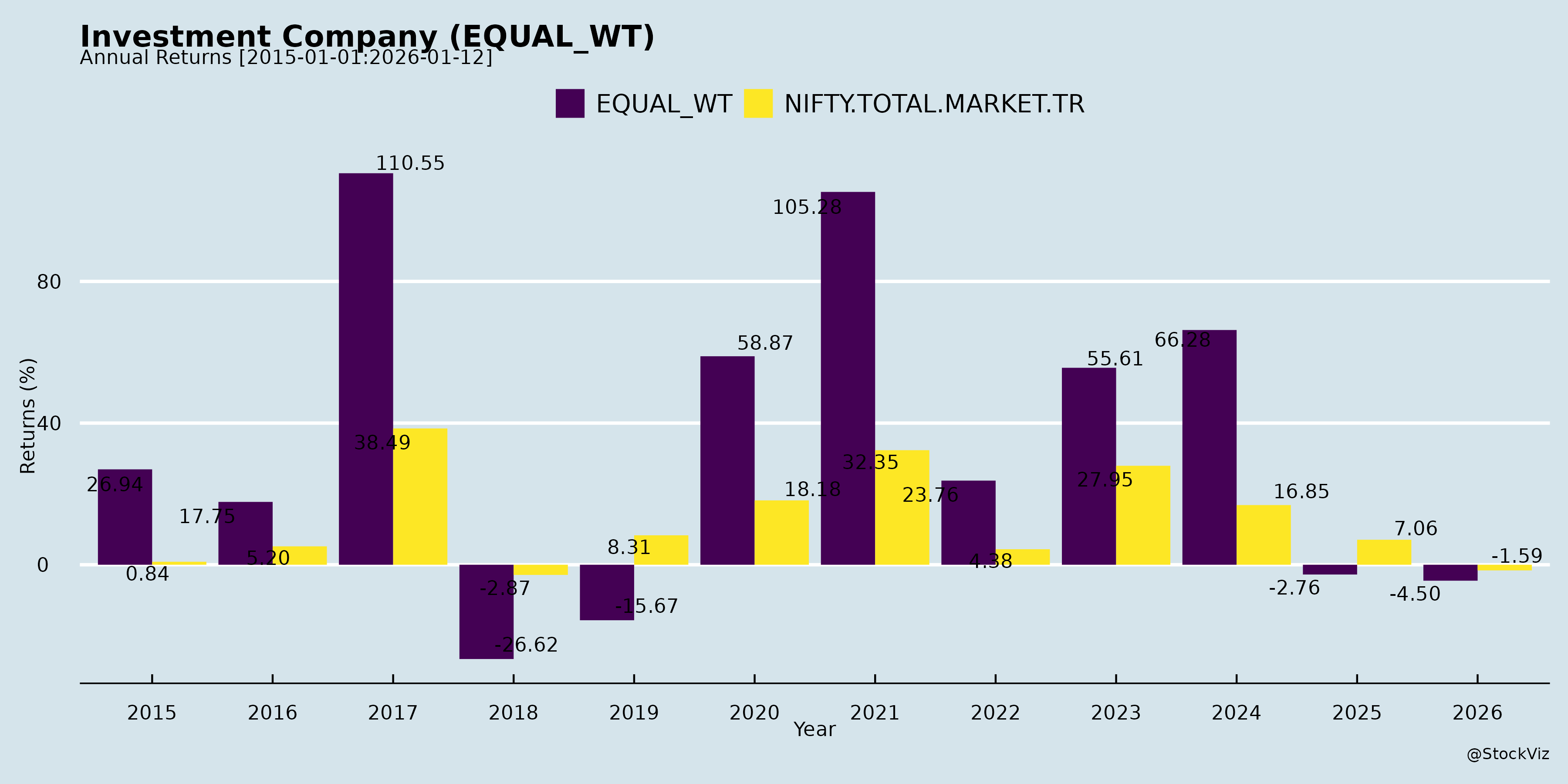

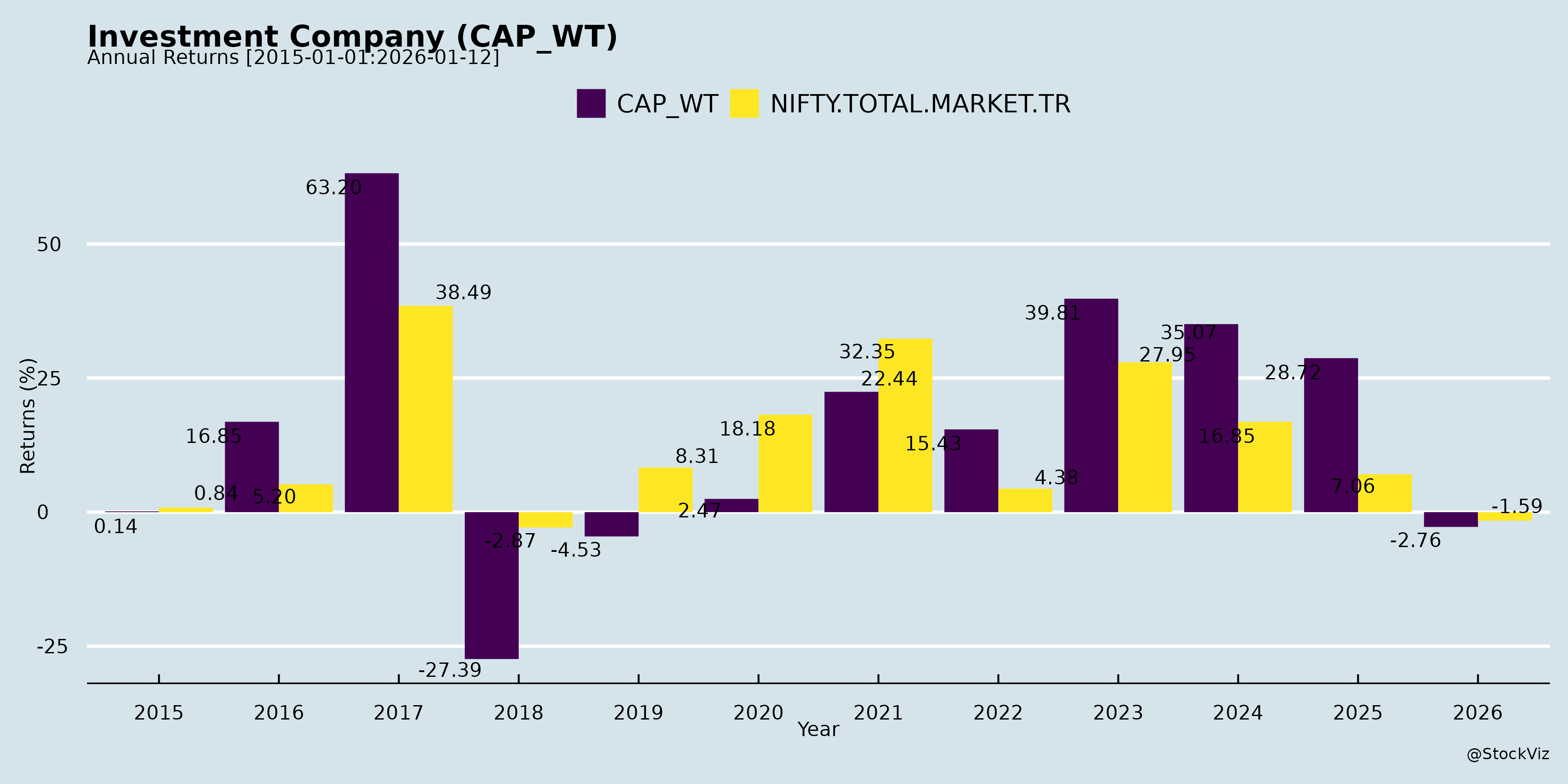

Annual Returns

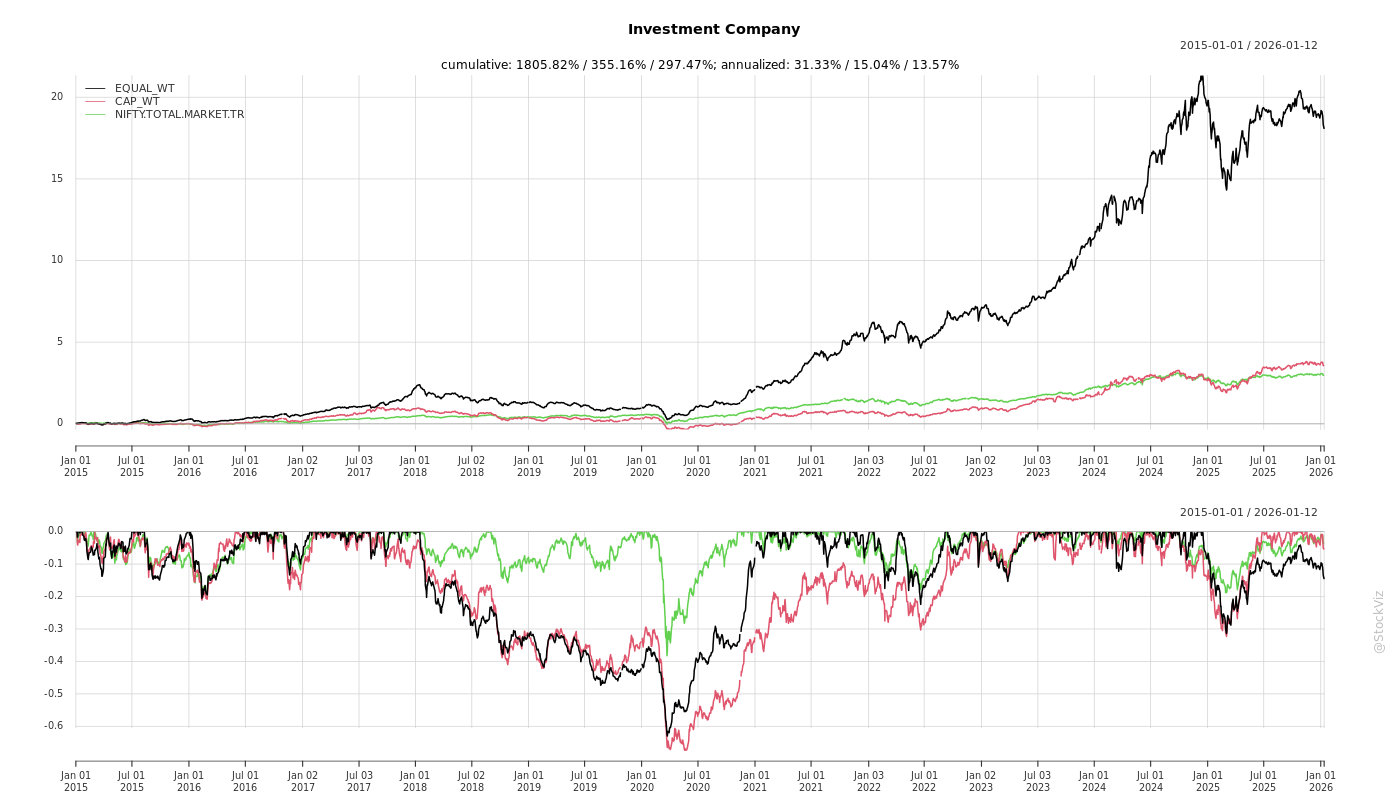

Cumulative Returns and Drawdowns

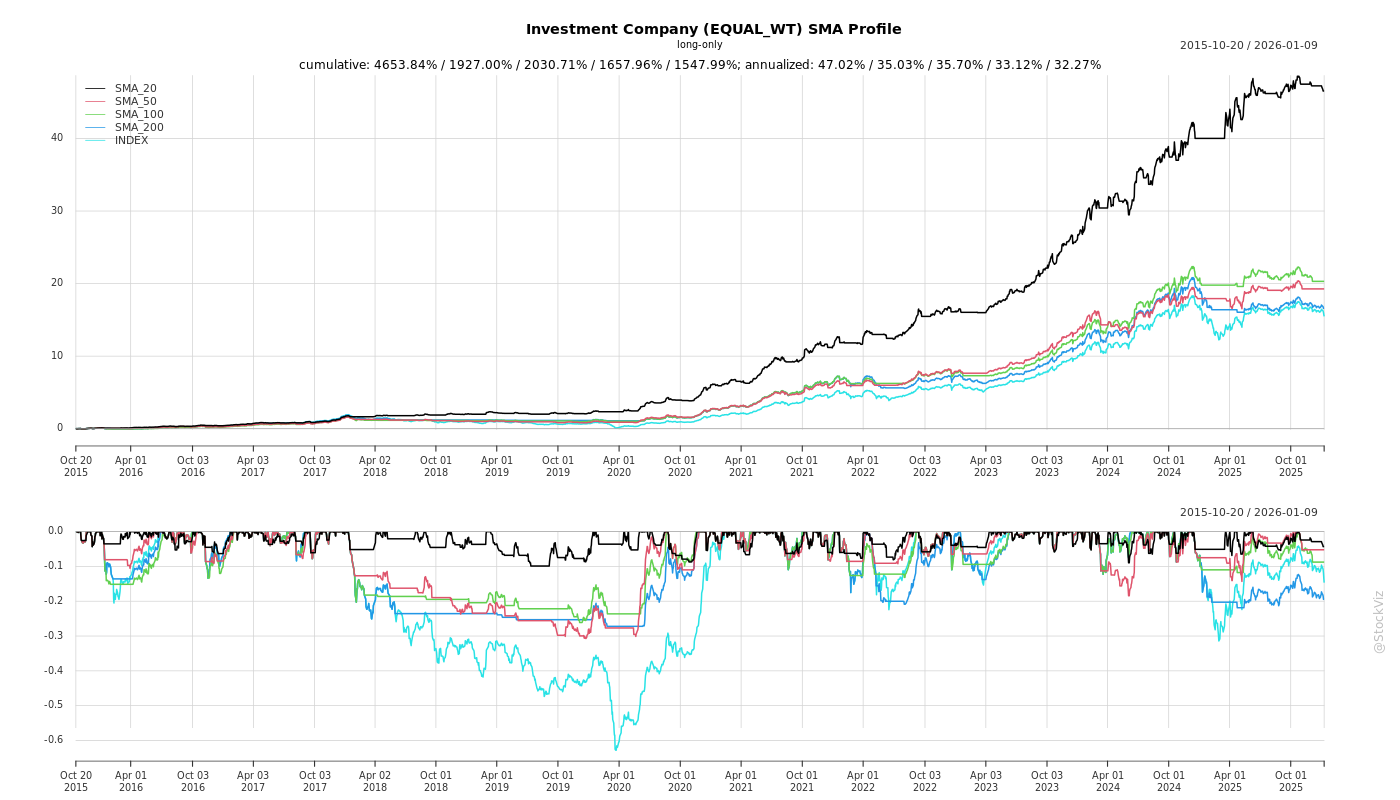

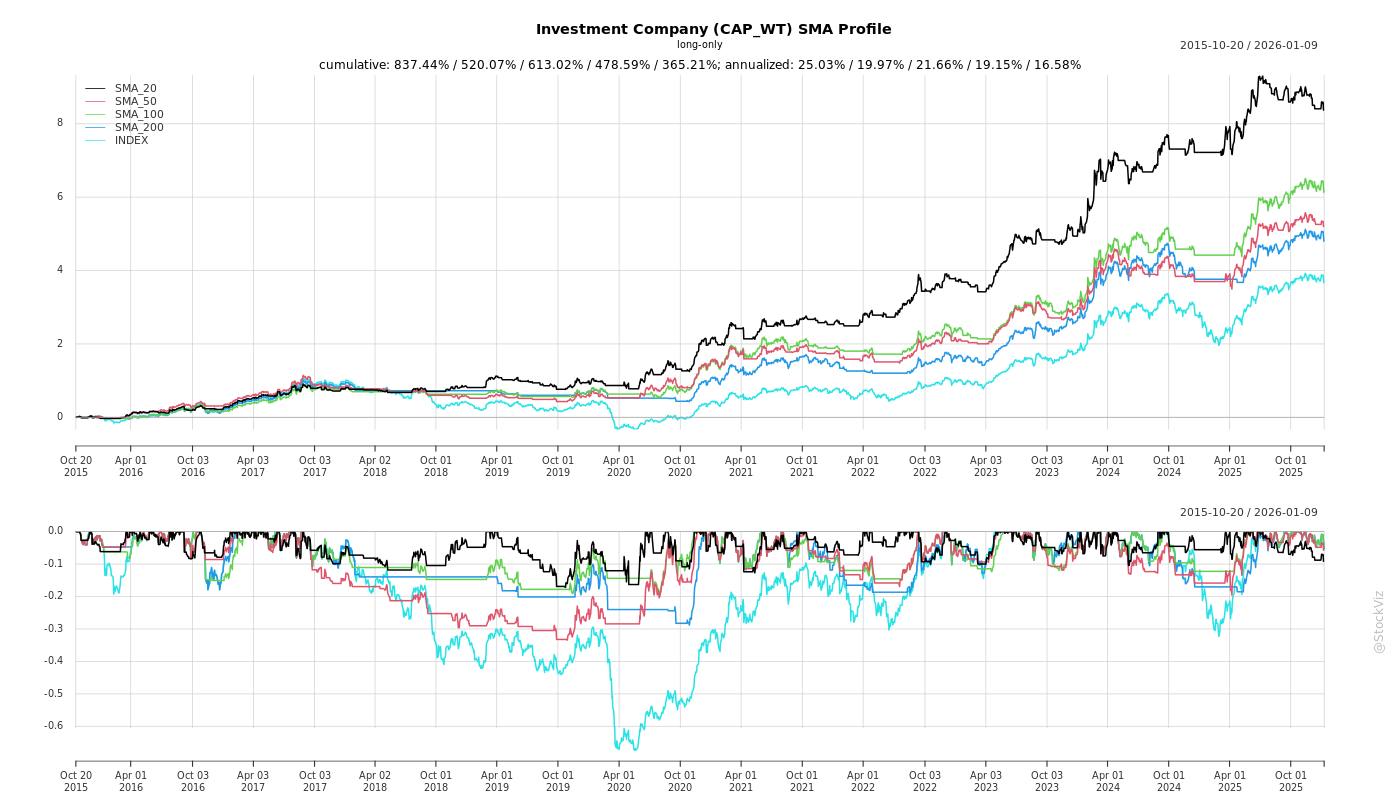

SMA Scenarios

Current Distance from SMA

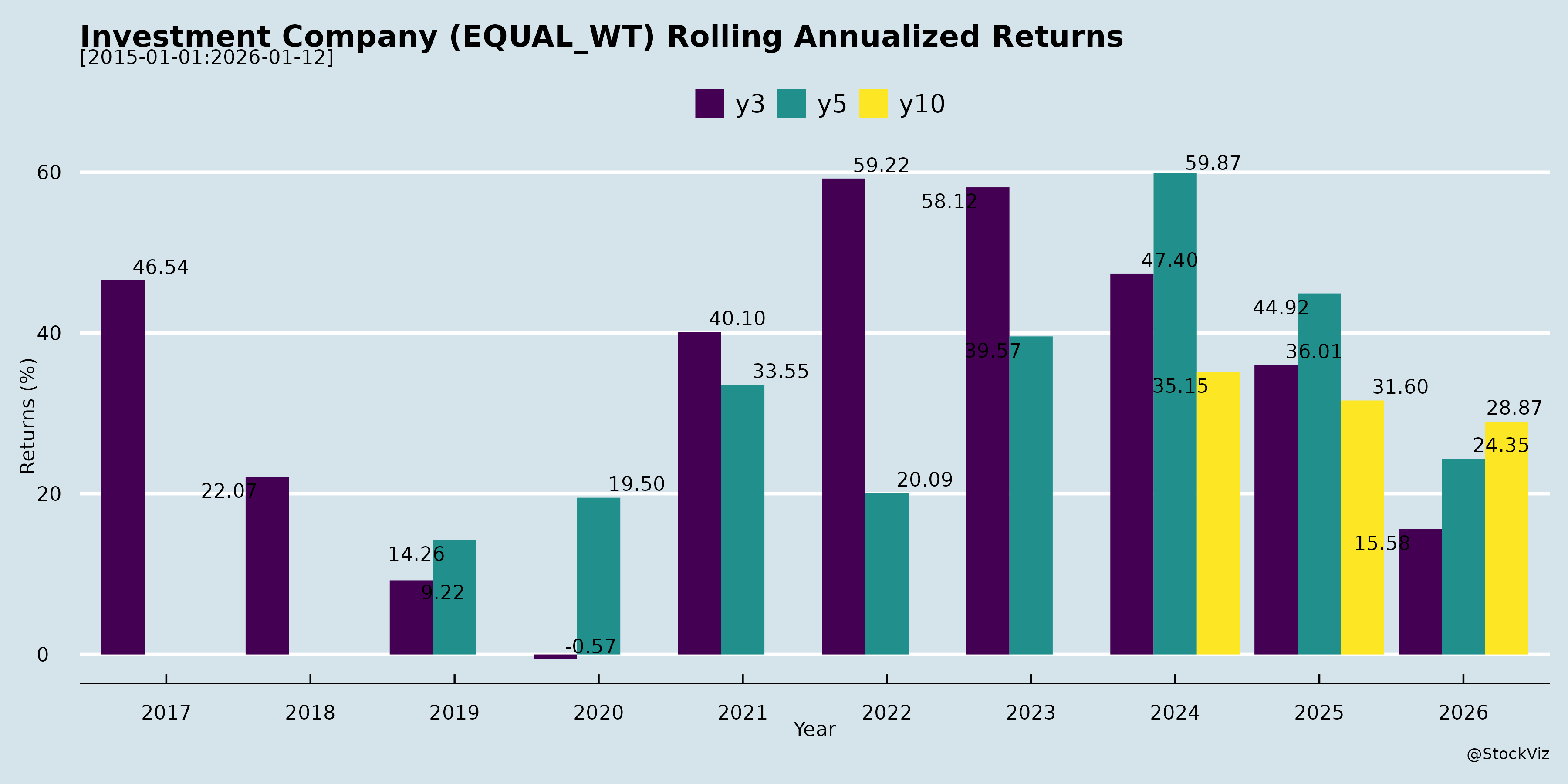

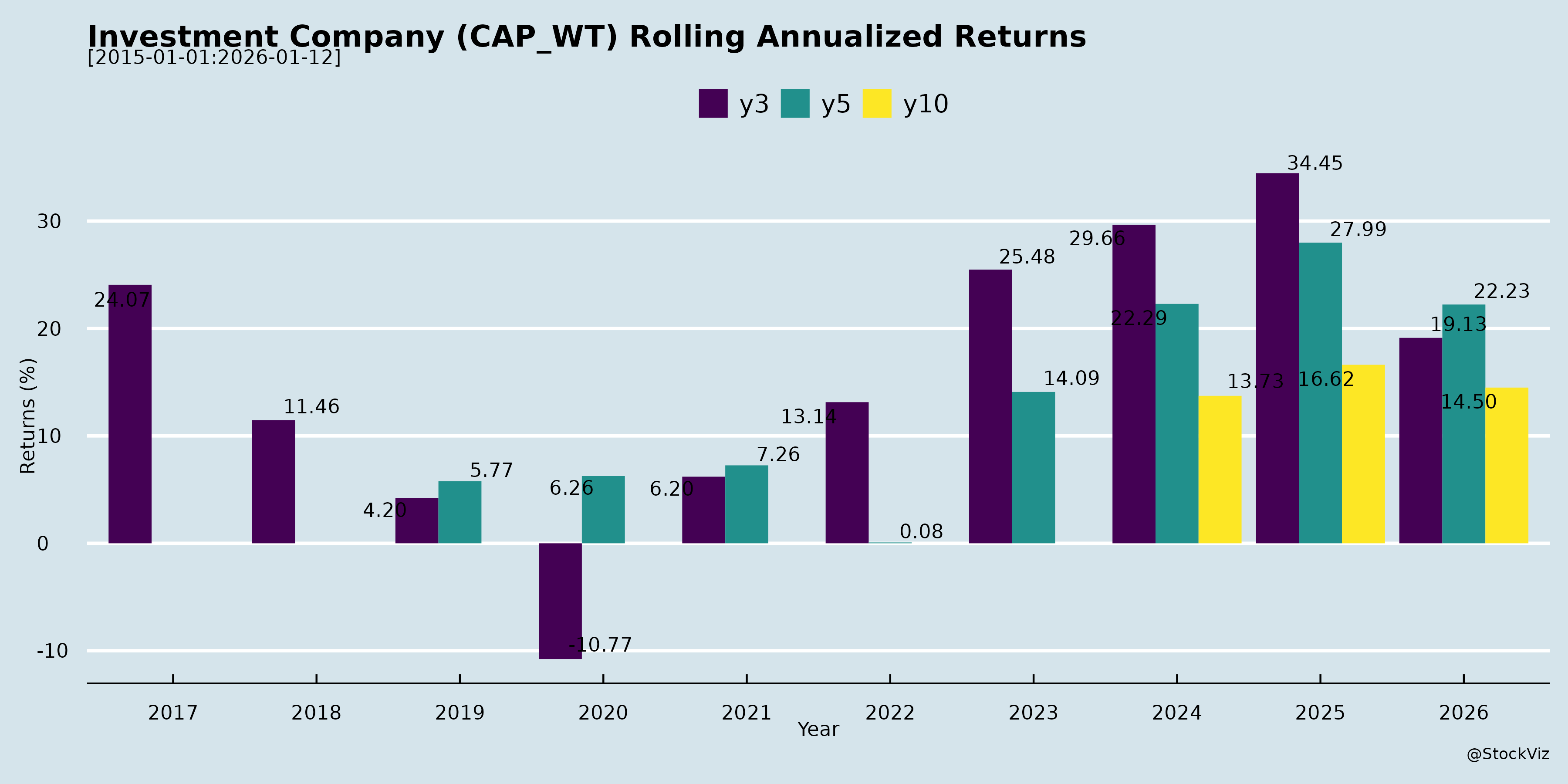

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-30

Analysis for the Indian Investment Company (Financial Services Portfolio)

The provided documents represent disclosures, investor transcripts, and earnings calls from key Indian financial services players (e.g., L&T Finance Holdings, Jio Financial Services, Aditya Birla Capital, Chola Financial Holdings (insurance arm), and Religare Enterprises). These firms operate in NBFC lending (retail, rural, SME, housing, gold), broking, health/general insurance, and fintech services. Collectively, they proxy a portfolio for an Indian Investment Company focused on diversified financial services (NBFCs, insurance, broking). Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, derived from common themes across the documents.

Tailwinds

- Technology & AI Adoption: Strong emphasis on proprietary AI/ML tools (e.g., L&T’s Project Cyclops/Nostradamus for underwriting/portfolio management; Religare’s digital platforms). Reduces TAT (e.g., L&T: 50ms-700ms latency, 3-sec decisions), improves credit quality (e.g., 66% PD reduction in mules), boosts conversions (e.g., 64% approval rates), and cuts costs (e.g., 50% underwriting time via Helios). Embedded finance/partnerships (e.g., CRED, Amazon) scale disbursements 7-10% MoM.

- Retail & Digital Shift: Retail AUM >98% (L&T), digital disbursements surging (e.g., L&T: Rs. 8,000 Cr/month peak). PLANET app (L&T) drives 88% servicing, 4x cross-sell.

- Macro Support: GST 2.0 reforms boost auto/tractor sales (L&T: 49% YoY urban growth). Rural/SURU demand via govt. PLI/MSME push. Low penetration (e.g., India mortgage-to-GDP: 11% vs. UK 69%).

- Capital Strength: Fresh infusions (Religare: Rs. 1,500 Cr warrants), debt-free NBFCs (Religare Finvest CRAR 198%), high solvency (Care Health: 1.89x; Chola: 2.11x).

- Turnaround Momentum: Legacy resolutions (Religare: CAP/fraud tags lifted), clean books (e.g., L&T collections 99.6%).

Headwinds

- Cyclical & Asset Quality Stress: Microfinance/JLG crisis (L&T: industry-wide, but managed at 99.57% collections). Insurance claims inflation (Chola: motor OD 81.9%, up due to competition; Care: 68.1% H1).

- Regulatory/Accounting Changes: 1/n method distorts insurance growth/profitability (Chola: -Rs. 383 Cr GDPI impact; Care: -Rs. 550 Cr top-line). EOM glide paths force tactical shifts (e.g., Chola reinsurance acceptance).

- Pricing/Competition Pressures: Stagnant motor TP premiums (Chola: 4 yrs no hike), OD loss ratios up industry-wide. GST cuts reduce IDVs/claims but hit float/incomes short-term.

- Legacy Drag: Religare NBFCs/HFC still resolving old NPAs (e.g., HFC NNPA 3.3%), low AUM (HFC: Rs. 245 Cr).

- Cost Inflation: Higher reserving (Chola: +3% CoR impact), opex in scaling (Care/Chola combined ratios 100-115%).

Growth Prospects

- Disbursement/AUM Expansion: L&T: 39% YoY disbursements, 19% AUM growth; targets 20-25% risk-calibrated AUM, RoA 2.8-3% by FY27. Religare: Housing (concentric Tier 2/3 expansion, 4-digit AUM goal); NBFC restart (Rs. 423 Cr cash). Care: 19% H1 GWP growth (N-basis), retail 28%; Oct: 22% YoY.

- Product Diversification: Gold loans (L&T: Rs. 1,500 Cr AUM, 200 branches by Mar’26); SME/embedded finance scaling (Religare/L&T partnerships). Insurance: Retail health (Care: 11.2% mkt share); reinsurance inward.

- Market Share Gains: L&T: 7% JLG share; Care: #2 SAHI (22% share). Broking: 192 Mn demat accounts industry-wide, e-gov via 56K agents.

- Efficiency Gains: AI cuts credit/collection costs (L&T: target <2%); digital (Religare: 98% paperless). Projected flywheel: Lower NPAs → Prime penetration → 86-87% share.

- Medium-Term Targets: L&T Lakshya-31 (Q1FY27); Religare: Exponential NBFC/HFC growth; Chola: H2 motor LR -5pp.

Key Risks

- Credit/Portfolio Risks: Cyclicality (e.g., L&T microfinance event risks like Karnataka/Chhatt); high NPAs if macros weaken (geopolitics, rain deficits). Insurance: Claims severity (Chola motor TP/OD), reserving adequacy.

- Regulatory/Compliance: Past CAP/fraud tags (Religare resolved, but recurrence risk); IRDAI EOM/1/n; RBI scale-based norms (middle-layer NBFCs).

- Execution Risks: Tech scaling (L&T: 1 Mn lines code); talent retention (L&T: 5% attrition drop). Insurance IFRS migration.

- Macro/External: Interest rates, GST/PLI delays, competition (Chola: motor intensity). Leverage dilution (Chola: 6.1x → lower via 2W pullback).

- Concentration: Rural/motor heavy (L&T/Chola); legacy recoveries (Religare LVB deposit).

Summary

Bullish Outlook with Tech-Driven Resilience: Strong tailwinds from AI/digital transformation (e.g., L&T’s 39% disbursements, Care’s retail push) and macro (GST/rural demand) position the portfolio for 20-25% AUM/ premium growth, RoA/RoE 2.8-18%. Turnarounds (Religare clean slates) add upside. Near-Term Headwinds (insurance accounting, claims) cap FY26 profits, but H2 recovery expected (e.g., Chola post-1/n). Risks Mitigated by Prudence: Focus on prime/risk-first lending, high CRAR/solvency, but monitor credit cyclicality/regulation. Recommendation: High conviction hold/buy; target 15-20% portfolio CAGR over 3-5 yrs, driven by retail/tech scale. Diversify via NBFC/insurance exposure.

Data as of Nov 2025; assumes sector proxy for investment company.

Financial

asof: 2025-12-01

Summary Analysis for Indian Investment Holding Companies (Based on Q3 FY25 Filings)

The provided filings represent quarterly/9M FY25 financial results (ended Dec 31, 2024) from prominent Indian investment holding companies/NBFCs (e.g., Jio Financial Services, L&T Finance, Tata Investment, JSW Holdings, Summit Securities, Sundaram Finance Holdings, Religare Enterprises, TVS Holdings, etc.). These entities primarily focus on investments (equity/debt), financing, insurance broking, payments, and asset management. They exhibit common traits: heavy reliance on dividends/interest/FV gains, significant OCI volatility from FVTOCI equities, and regulatory oversight as NBFCs/CICs.

Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, derived from trends across filings (e.g., revenue mix, OCI impacts, notes on litigations/RBI norms).

Tailwinds (Positive Factors Supporting Performance)

- Robust Dividend & Interest Income: Core revenue driver (e.g., Jio: ₹241 Cr dividends; JSW: ₹13,343 Cr; Summit: ₹9,012 Cr in Q2). Reflects strong subsidiary performance (e.g., auto/finance JVs).

- Fair Value Gains & Investment Income: Net gains from FV changes (e.g., Jio: ₹616 Cr; TVS: ₹107 Cr) boosted P&L. Equity portfolios benefited from market rally.

- Subsidiary/JV Growth: Expansion via JVs (Jio-BlackRock AMC/advisory; L&T infra funds) and demergers (TVS Emerald sale yielding ₹103 Cr gain).

- RBI Approvals & Debt Settlements: CIC status (Jio, TVS) and OTS completions (Religare RFL: settled ₹3,849 Cr debt) improved liquidity/ratios (e.g., L&T Debt-Equity: 3.46x).

- OCI Tailwinds in Some Cases: Positive FVOCI (e.g., Tata: ₹5,233 Cr gain) offset P&L volatility.

Overall Impact: Q3 profits strong (e.g., JSW: ₹1,941 Cr standalone PAT; Summit: ₹7,516 Cr consolidated), driven by investee dividends amid bull markets.

Headwinds (Challenges Impacting Performance)

- OCI Volatility & FV Losses: Massive OCI losses (e.g., Jio: -₹18,476 Cr; Tata: -₹2,819 Cr; JSW: -₹4,24,433 Cr) from equity FV declines, eroding total comprehensive income.

- High Expenses/Impairments: Employee costs (L&T: ₹1,647 Cr), impairments (Jio: ₹16 Cr; Religare: provisions on SRs), and provisions for NPAs/litigations pressured margins.

- Regulatory Restrictions: RBI CAPs (Religare RFL barred from lending expansion); legacy bans on dividends (Religare).

- Debt & Legacy Burdens: Ongoing settlements (Religare: NCRPS disputes); high finance costs (TVS: ₹44 Cr).

- One-Offs & Non-Comparability: Demergers (TVS die-casting), tax changes (Sundaram: indexation removal hit deferred tax), ESOP litigations (Religare CHIL).

Overall Impact: PBT growth slowed (e.g., Jio 9M: ₹1,551 Cr vs. prior ₹1,563 Cr); some losses in standalone (Religare: -₹1,337 Cr).

Growth Prospects (Opportunities Ahead)

- Subsidiary-Led Expansion: JVs in AMCs/wealth mgmt (Jio-BlackRock: ₹86 Cr invested; L&T infra funds); insurance/payments growth (TVS Credit, Jio Payments Bank).

- Asset Monetization/Demergers: TVS Emerald sale (₹103 Cr gain); potential SCI Land dissolution/unlocking non-core assets.

- NBFC/CIC Tailwinds: RBI approvals (Jio CIC-ND-SI); digital finance (payments, broking via subsidiaries like Religare Broking).

- Market Recovery: Bullish equities could reverse OCI losses; dividend payouts from investees (e.g., JSW/Tata subsidiaries).

- Sector Trends: Rising AUM in AMCs (Tata/Jio); insurance premiums (Religare CHIL: ₹456 Bn 9M).

Outlook: 9M PAT growth (e.g., L&T: ₹2,008 Cr +14%; Summit: ₹7,324 Cr) signals momentum; FY25 PAT could exceed FY24 if markets hold.

Key Risks (Potential Threats)

| Risk Category | Details | Examples from Filings | Mitigants |

|---|---|---|---|

| Market/Volatility | Equity FV swings dominate OCI (80-90% losses in Q3); cap gains tax/indexation changes hit deferred tax. | Jio/JSW/Tata: ₹4-18K Cr OCI hits. | Diversified portfolios; FVTOCI hedging. |

| Regulatory/Litigation | RBI CAPs, ESOP probes, NCRPS/FDR suits; open offers (Religare Burman). | Religare: IRDAI penalty (₹100 Cr, stayed); RFL FDR litigation (₹2,592 Cr). | OTS completions; ongoing appeals. |

| Credit/Impairment | NPAs/SRs provisions; legacy loans. | L&T: Stage 3 3.23%; Religare RHDFCL SRs (₹324 Cr provision). | RBI compliance; CIC status. |

| Operational/Legal | Subsidiary control issues (Religare RCML non-consol.); debt redemptions. | Jio: JV approvals pending; TVS: ESOP suits. | Prudential provisioning; legal opinions. |

| Liquidity/Debt | High leverage (L&T: 3.5x); NCD maturities. | Summit: Debt-free post-sale; Religare: ₹84 Cr NCDs. | Asset sales; cash from dividends. |

Overall Risk Profile: High (volatility/litigation-heavy); conservative provisioning (e.g., Religare impairments) prudent but caps upside.

Executive Summary

- Financial Snapshot (Aggregate Trends): 9M Revenue ~₹20-50K Cr/company; PAT ₹1-15K Cr; OCI swing ±₹1-5L Cr. Dividend/FV gains = 70-90% revenue.

- Positives: Subsidiary dividends, JVs, RBI nods → 10-20% PAT growth potential.

- Negatives: OCI drag, regs → Volatile comprehensive income.

- Recommendation: Bullish on structured plays (CIC/JVs); monitor markets/regulators. Diversify beyond equities; watch Q4 for open offer resolutions.

This analysis is based solely on filings; consult full reports for specifics.

General

asof: 2025-11-30

Analysis for Indian Investment Companies (Based on Provided Filings)

The provided documents are regulatory filings from Indian listed investment/holding companies (e.g., Jio Financial Services, Tata Investment Corp., Nalwa Sons Investments, Kalyani Investment, JSW Holdings, Aditya Birla Capital, etc.) and peers in NBFC/finance space. These highlight routine corporate governance, compliance, and restructuring activities as of mid-2025. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks for the sector (investment holding companies that primarily hold group stakes, earn dividends, and manage investments).

Tailwinds (Positive Factors)

- Strong Shareholder Focus & Dividend Culture: Multiple filings emphasize dividends (e.g., JioFin’s record date for FY24-25 dividend payout within a week of AGM; Maharashtra Scooters’ ₹160/share interim dividend). This supports income stability for holding cos reliant on group dividends.

- Corporate Restructuring for Efficiency: Amalgamations/simplifications (Aditya Birla Capital merging small subs worth ₹3.6Cr/₹6.57Cr turnover; Sundaram Finance Holdings name change to TSF Investments) reduce compliance costs, optimize resources, and streamline structures—boosting operational efficiency.

- Liquidity Enhancements: Share sub-divisions (Tata Invest: 1:10 split to Re.1 FV) and demat mandates improve tradability and attract retail investors.

- Regulatory Compliance Momentum: Proactive filings (e.g., JSW Holdings/Nalwa Sons AGMs via VC/OAVM; KYC/PAN updates; TDS communications) align with SEBI/MCA circulars, enhancing governance perception.

- Digital Adoption: E-voting, QR codes for reports (JSW, Nalwa Sons), and email dispatches reduce costs and support green initiatives.

Headwinds (Challenges)

- Regulatory Scrutiny & Tax Burdens: Persistent GST litigations (Religare’s subsidiary Care Health: ₹36Cr demand + penalty + interest for 2017-22 on co-insurance/re-insurance; upheld post-HC remand). TDS complexities (Maharashtra Scooters’ detailed shareholder comms) add admin burden.

- Debt Management Pressures: Perpetual debt calls (L&T Finance redeeming ₹150Cr Tier-I NCDs at 9.9% coupon post-RBI nod) signal rising funding costs amid rate environment.

- Compliance Overload: Mandatory demat/KYC drives (Tata Invest letters to physical holders; SEBI windows for old transfers till Jan 2026) strain smaller investors/companies.

- Physical-to-Demat Transition Friction: Warnings of escrow accounts for non-compliant physical shares (Tata Invest) could delay payouts/liquidity.

Growth Prospects

- Moderate, Stability-Driven: Sector benefits from group synergies (e.g., Aditya Birla’s arm’s-length swaps at 97:1000 ratio preserve value). Rationalizations enable resource optimization for potential new investments.

- Market Expansion via Reforms: Demat mandates and sub-divisions could broaden investor base, aiding NAV growth (Tata Invest). Digital AGMs/e-voting sustain participation amid hybrid norms.

- Dividend-Led Returns: High payouts (JioFin, Maharashtra) indicate robust FY25 cash flows; holding cos could see 10-15% CAGR in dividend income if group earnings grow (e.g., post-amalgamation efficiencies).

- Long-Term: Name changes/re-classifications (Chola FHL outgoing promoter shift) signal maturity; sector NAVs may rise 12-18% annually on India Inc’s capex cycle, assuming no major slowdown.

Key Risks

| Risk Category | Details | Mitigation from Filings |

|---|---|---|

| Regulatory/Litigation | GST/tax demands (Religare: ₹40Cr+ impact); TDS errors; SEBI non-compliance (e.g., 31A re-classification). | Appeals planned; detailed disclosures/KMP contacts (Kalyani). |

| Operational | Demat delays leading to escrow holds; physical share risks (Tata Invest). | Strict cut-offs (e.g., Oct 9, 2025); RTA support. |

| Financial | Debt redemptions at high coupons (L&T); swap ratios diluting minority value (Aditya Birla). | RBI approvals; independent valuations. |

| Market | Volatility in group cos affecting dividends; low liquidity pre-reforms. | Sub-divisions/AGM focus on liquidity. |

| Execution | AGM delays (TVS Holdings short 15-min meet); email non-registration. | VC/OAVM; QR/web-links. |

Overall Summary

Indian investment holding companies exhibit resilience through governance (tailwinds from dividends/restructuring outweigh routine headwinds like compliance). Growth is steady (10-15% via efficiencies/dividends) but not explosive, tied to group performance. Key risks are regulatory (GST/TDS) and transition-related (demat)—manageable with proactive filings. Sector outlook: Stable/Positive for FY26, favoring diversified holdings; monitor tax litigations and RBI rates. Investors should prioritize KYC-compliant, demat-heavy names like Tata Invest/JioFin.

Data sourced solely from filings (Aug-Nov 2025); no external assumptions.

Investor

asof: 2025-11-30

Analysis of Key Indian Financial Services Companies for Investment Consideration

As an Indian investment company evaluating opportunities in the NBFC, insurance, and broking sectors, I’ve analyzed the provided documents (regulatory disclosures and earnings transcripts from Jio Financial Services, Aditya Birla Capital, L&T Finance Holdings, Chola Financial Holdings/Chola MS General Insurance, and Religare Enterprises). The focus is on L&T Finance (LTF), Chola MS General Insurance (under Chola Financial Holdings), and Religare Enterprises (REL) due to their detailed earnings/investor updates. Jio Financial and Aditya Birla disclosures are routine (investor meetings with no UPSI), indicating stable operations but limited insights.

The analysis covers headwinds (challenges), tailwinds (supports), growth prospects, and key risks for each, followed by a comparative summary and investment recommendation.

1. L&T Finance Holdings (LTF) - NBFC (Retail Lending Focus)

Headwinds: - Cyclicality in rural/microfinance (e.g., past asset quality issues, Karnataka/Chhattisgarh events). - High competition in two-wheeler/tractor segments; regulatory risks (e.g., GST reforms volatility). - Elevated credit costs in legacy book; integration risks from gold loan acquisition.

Tailwinds: - Tech/AI leadership: Project Cyclops (underwriting engine) and Nostradamus (portfolio monitoring) reduce credit costs (e.g., GNS down 40-66%, vintage curves improved 3x better). - Strong disbursements (Oct ’25: ₹8,000 Cr, +39% YoY); retail book >₹1L Cr (98% retailized). - Culture shift (matrix structure, tech mindset); partnerships scaling (₹1,138 Cr QTD). - Gold loans stabilized post-acquisition (AUM ₹1,500 Cr, 200 new branches by Mar ’26).

Growth Prospects: - 20-25% risk-calibrated AUM growth; RoA target 2.8-3% by FY27. - AI expansion (Personal Loans, Rural/Mortgage); new engines (Cyclops to Nostradamus feedback loop). - Multi-product “Sampoorna” branches; SURU/rural focus (Govt push); SME/MSME via PLI schemes. - Lakshya-31 goals: Service AI layer, collections stack; quantum computing pilots.

Key Risks: - Execution on AI scaling (e.g., latency, model drift); attrition (though down 5%). - Macro (geopolitics, rural stress); regulatory (e.g., microfinance leverage caps). - Credit costs if non-prime penetration rises; competition eroding market share.

2. Chola MS General Insurance (under Chola Financial Holdings) - General Insurance

Headwinds: - Crop insurance loss (₹323 Cr Q2 impact); 1/n accounting distorts growth (H1 GDPI flat). - High claims ratio (81.5% H1, motor OD elevated); combined ratio 115.3% (112.1% ex-1/n). - No motor TP premium hike (4 years); competitive intensity; GST cut depresses IDV/claims severity. - EOM glide path pressure (30.5% H1, compliant but tight).

Tailwinds: - Motor market share stable (5.3%); Oct growth +5.4% (vs. industry -1.5%). - Conservative TP provisioning (10% > peers, +3% CoR drag but prudent). - Investment gains (₹500 Cr MTM); solvency 2.11x; reinsurance inward profitable. - GST cut benefits (CV-heavy book: parts GST 12%→5%, lower severity).

Growth Prospects: - H2 acceleration (1/n base effect ends; crop drag ~₹150 Cr); auto sales momentum (GST tailwind). - Retail health/group focus; OD growth via pricing tweaks. - Target CoR improvement (motor OD -5%; reinsurance CoR < core); ROE 16-18%. - Leverage normalization post-2W de-emphasis.

Key Risks: - Prolonged TP pricing freeze; OD loss ratio deterioration (competition/inflation). - Crop retender volatility; regulatory (EOM caps, IFRS transition). - Leverage drop (2.2% from 32.7%); investment yield sensitivity.

3. Religare Enterprises (REL) - Diversified (Health Insurance, Broking, NBFC/HFC)

Headwinds: - Legacy cleanup (RFL CAP/fraud tag lifted Jul ’25; LVB deposit dispute sub-judice). - Under-leveraged NBFCs (RFL AUM ₹95 Cr SME; HFC ₹245 Cr); small scale vs. peers. - Care Health: Claims ratio up (68.1% H1 N-basis); group/SME pricing pressure. - HoldCo discount; past governance scrutiny.

Tailwinds: - New promoters (Burman family, ₹750 Cr warrants); ₹1,500 Cr infusion (₹375 Cr received). - Care Health: #2 SAHI (22% share); H1 growth 19% (retail +28%); CR 100% Q2 (N-basis). - RFL debt-free (CRAR 198%, NNPA 1%, ₹423 Cr cash); broking active clients 2.5L. - Tech refresh (LOS/LMS); asset-light HFC expansion.

Growth Prospects: - Care: Retail share ↑ (11.2% industry); IFRS migration; bancassurance scale. - RFL/HFC: 4-digit AUM target (exponential via co-lending); broking industry+ growth (MTF lines). - E-governance demerger; Gift City ops; ROE via profitability (Care PAT +100% H1). - 3-5 Yr: Large FS platform (NBFC revival, wealth/distribution).

Key Risks: - Execution delays (IT upgrades, hiring); regulatory hurdles (IRDAI ESOPs sub-judice). - Care: GST ITC pass-through erodes margins; group loss ratios. - Capital deployment (GCP flexibility); LVB recovery (₹800 Cr). - Competition in broking (activation ↓26%); affordable HFC scaling risks.

Comparative Summary & Investment Outlook

| Factor | L&T Finance | Chola MS | Religare |

|---|---|---|---|

| Tailwinds | AI/tech edge; disbursements surge | Motor share; GST relief | Capital infusion; legacy cleanup |

| Headwinds | Rural cyclicality | High CoR; 1/n drag | Small scale; sub-judice issues |

| Growth Prospects | High (20-25% AUM; AI flywheel) | Medium (H2 recovery; 16-18% ROE) | High (exponential NBFC; Care retail) |

| Key Risks | Macro/execution | Pricing freeze; OD losses | Hiring/delays; GST margins |

| Valuation Fit | Premium (tech moat) | Defensive (stable share) | Turnaround (multi-bagger potential) |

Overall Recommendation: - Top Pick: L&T Finance – Strongest tailwinds (AI-driven efficiency, 39% disbursement growth); de-risked via tech (credit costs →2%). Buy for growth (target RoA 3%). - Hold: Chola MS – Near-term CoR pressure but H2 inflection (GST/auto sales); prudent reserving supports ROE rebound. - High-Risk/High-Reward: Religare – Transformative (Burman backing, clean slate); monitor Q3 execution/hiring. Accumulate on dips. - Portfolio Allocation Suggestion: 50% LTF (growth), 30% Chola (stability), 20% REL (upside). Sector tailwinds (retail credit CAGR 20%+, health insurance 15-20%) outweigh headwinds (regulation, competition). Risks mitigated by strong solvency/CRAR across. Positive on NBFC/insurance rotation amid rural recovery/GST boost.

Data as of Nov ’25 transcripts; monitor Q3 for GST impact/AI rollout.

Press Release

asof: 2025-11-30

Analysis for Indian Investment Company: NBFC/Fintech Sector Insights from Provided Documents

The provided documents highlight recent announcements from five key players in India’s NBFC and financial services space: Jio Financial Services (JFSL), Aditya Birla Capital (ABCL), L&T Finance (LTF), Cholamandalam Financial Holdings (CFHL), and Sundaram Finance Holdings (SF Holdings). These reflect a sector emphasizing digital transformation, AI-driven personalization, retail lending growth, and diversified portfolios amid a robust economic backdrop. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, followed by an investment summary.

Tailwinds (Positive Macro/Micro Factors)

- Digital & AI Adoption: Strong push across all companies—JFSL’s unified dashboard for accounts/MFs/stocks; ABCL’s SimpliFi AI (7 features for finance/health/credit tracking), voice bots, and gamified literacy (ConseQuest); LTF’s PLANET app (2Cr+ downloads), Project Cyclops/Nostradamus AI engines; CFHL’s scaling via subsidiaries. Enhances efficiency, customer acquisition (ABCL: 6.4M ABCD users), and personalization.

- Retail Lending Momentum: LTF’s retail book hits ₹1.04L Cr (+18% YoY), record Q2 disbursements ₹18,883 Cr (+25% YoY); ABCL lending CAGR 33% to ₹1.57L Cr; CFHL AUM +21% to ₹2.15L Cr; personal loans surging (LTF +114% YoY). Rural/urban balance strong (LTF: 2L villages covered).

- Asset Quality & Ratings Stability: LTF GS3 at 3.29% (stable), credit ratings upgraded to BBB/Stable (S&P); ABCL RoA implied strong via PAT growth.

- Diversification & Partnerships: Entry into gold loans (LTF: 330 branches by FY26), health/legacy products (ABCL), big-tech ties (LTF-Google Pay, JFSL-BlackRock JV). SF Holdings dividend income +31% YoY.

- Macro Support: Good monsoons, festive demand, GST 2.0 (LTF); consolidated PAT growth: LTF +6% YoY, CFHL +8% H1 YoY, ABCL PAT doubled in 3 yrs.

Headwinds (Challenges & Pressures)

- Margin & Cost Pressures: LTF NIM+fees down to 10.22% (from 10.86%); credit cost at 2.41%; ABCL operating profits doubled but competition fragments ecosystem.

- Asset Quality Creep: LTF GS3 up to 3.29% (from 3.19%), NS3 to 1.00%; CFHL insurance PAT down sharply (Q2: ₹46 Cr vs ₹153 Cr) due to ₹99 Cr MTM losses.

- Seasonal/One-off Impacts: CFHL insurance GWP growth muted (+3% YoY) from crop business loss; SF Holdings PAT down ex-one-time (₹175 Cr redemption).

- Execution in Fragmented Market: Multiple apps/accounts tracking pain point (JFSL); scaling AI/tech (ABCL: 22 GenAI use cases in 18 months, but PoC-to-scale gap noted).

- Regulatory/Competition: RBI scrutiny on NBFCs; intense rivalry in digital finance (e.g., UPI, fintechs).

Growth Prospects

| Company | Key Growth Drivers | Projected Upside |

|---|---|---|

| JFSL | JioFinance app unification + AI insights; subsidiaries (insurance, payments, BlackRock JV). | High: Digital scale via Jio ecosystem; “smarter money management” for millions. |

| ABCL | ABCD app (26+ products, SimpliFi AI); lending/insurance CAGR 23-33%; AUM to ₹5.11L Cr. | Strong: AI-first (Sales/Service Assist); omnichannel (6.4M users); Q4 FY26 features. |

| LTF | Retail disbursements +25% YoY; gold loans expansion; AI rollout (Cyclops to more segments). | Robust: H2FY26 festive acceleration; Lakshya 2026 targets; 2.7Cr customer base for cross-sell. |

| CFHL | CIFCL disbursements ₹24K Cr/Q; AUM +21%; insurance GWP scaling. | Steady: 44% stake in high-growth CIFCL; risk services JV. |

| SF Holdings | Dividend/portfolio growth (+31%); acquisitions (Axles India, Forge 2000); divestments yielding ₹54 Cr gain. | Moderate: Automotive focus; total dividend 117% payout. |

Overall Sector: 15-33% YoY growth in books/AUM; digital fintech@scale (Fintech@Scale pillar for LTF); rural penetration + festive/rural demand. Potential 20%+ PAT CAGR if asset quality holds.

Key Risks

- Credit/Asset Quality Deterioration: Rising GS3 (LTF); rural exposure vulnerable to monsoons/economic slowdown.

- Interest Rate/Volatility: NIM compression; insurance MTM losses (CFHL: ₹136 Cr H1 impact).

- Regulatory: RBI norms on NBFC capitalization, data privacy (AI consent-based); SEBI listing obligations.

- Execution/Tech Risks: AI rollout delays (LTF beta ahead, but scaling to FY27); cyberfraud in rural (LTF CSR focus).

- Competition/Macro: Fintech disruption; divestment dependency (SF Holdings); one-offs inflating past PAT.

- Concentration: Retail heavy (LTF 98%); group dependencies (CFHL 44% CIFCL stake).

Investment Summary

Bull Case (Buy/Overweight): Sector tailwinds dominate with digital/AI differentiation driving 20%+ growth. LTF/ABCL stand out for retail scale + tech (target RoE 11-12%); JFSL for Jio synergy. Consolidated PAT momentum (e.g., LTF record ₹735 Cr Q2) signals resilience. Entry valuations attractive if NIM stabilizes.

Bear Case (Sell/Underweight): Headwinds like GS3 creep + MTM could pressure RoA (LTF 2.41%); CFHL insurance drag persists. Macro slowdown risks rural books.

Recommendation: Overweight the sector with preference for LTF (strong execution) > ABCL (AI leader) > JFSL (growth potential). Monitor Q3 disbursements/GS3. Portfolio allocation: 40% LTF/ABCL, 20% JFSL, balance diversified. Risks mitigated by strong ratings/ESG (LTF ‘Strong’). Expected 1-yr returns: 15-25% on growth + dividends (SF 117% payout).

Data as of Nov 2025 announcements; validate with latest filings.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.