LICHSGFIN

Equity Metrics

January 13, 2026

LIC Housing Finance Limited

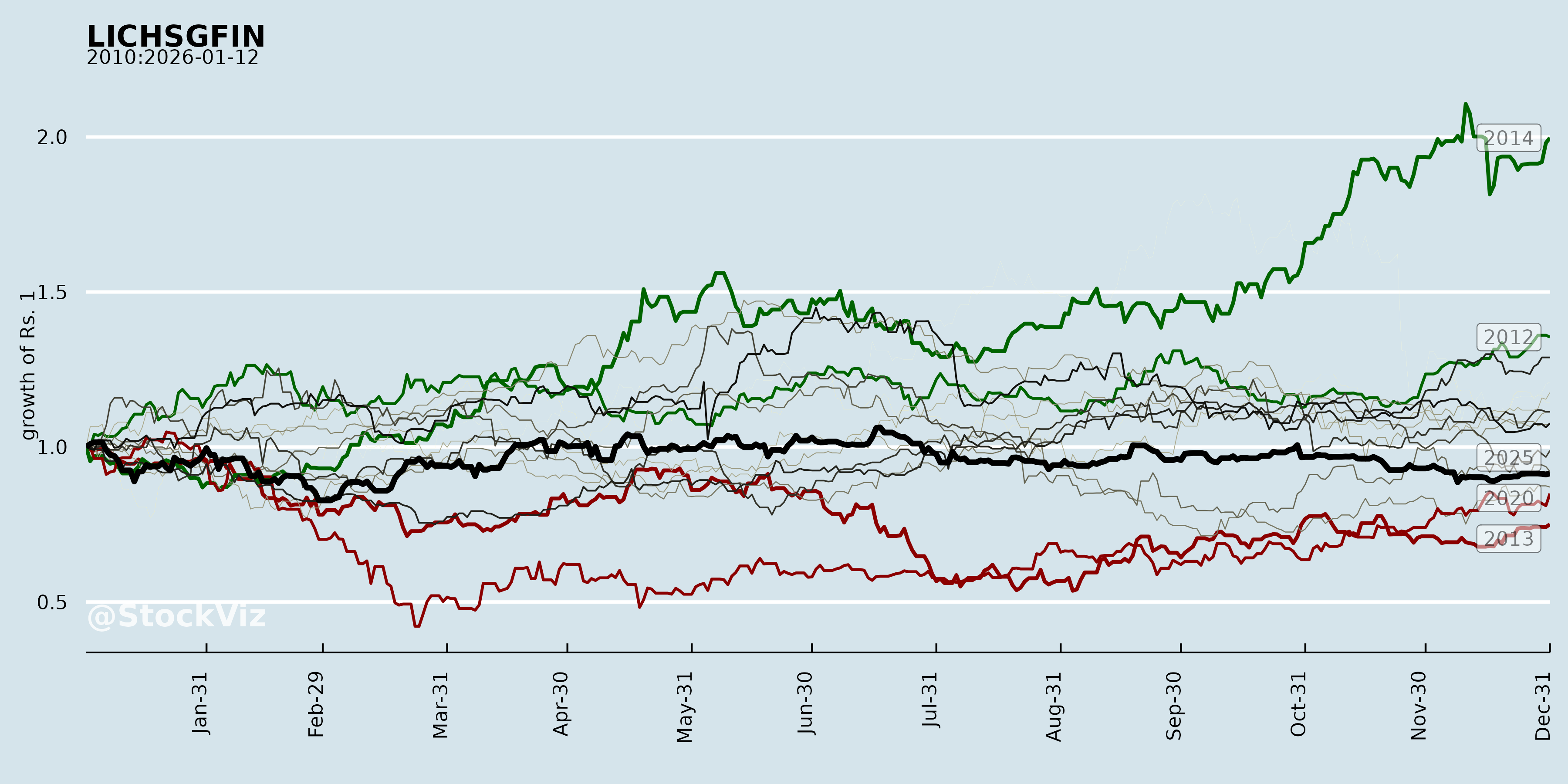

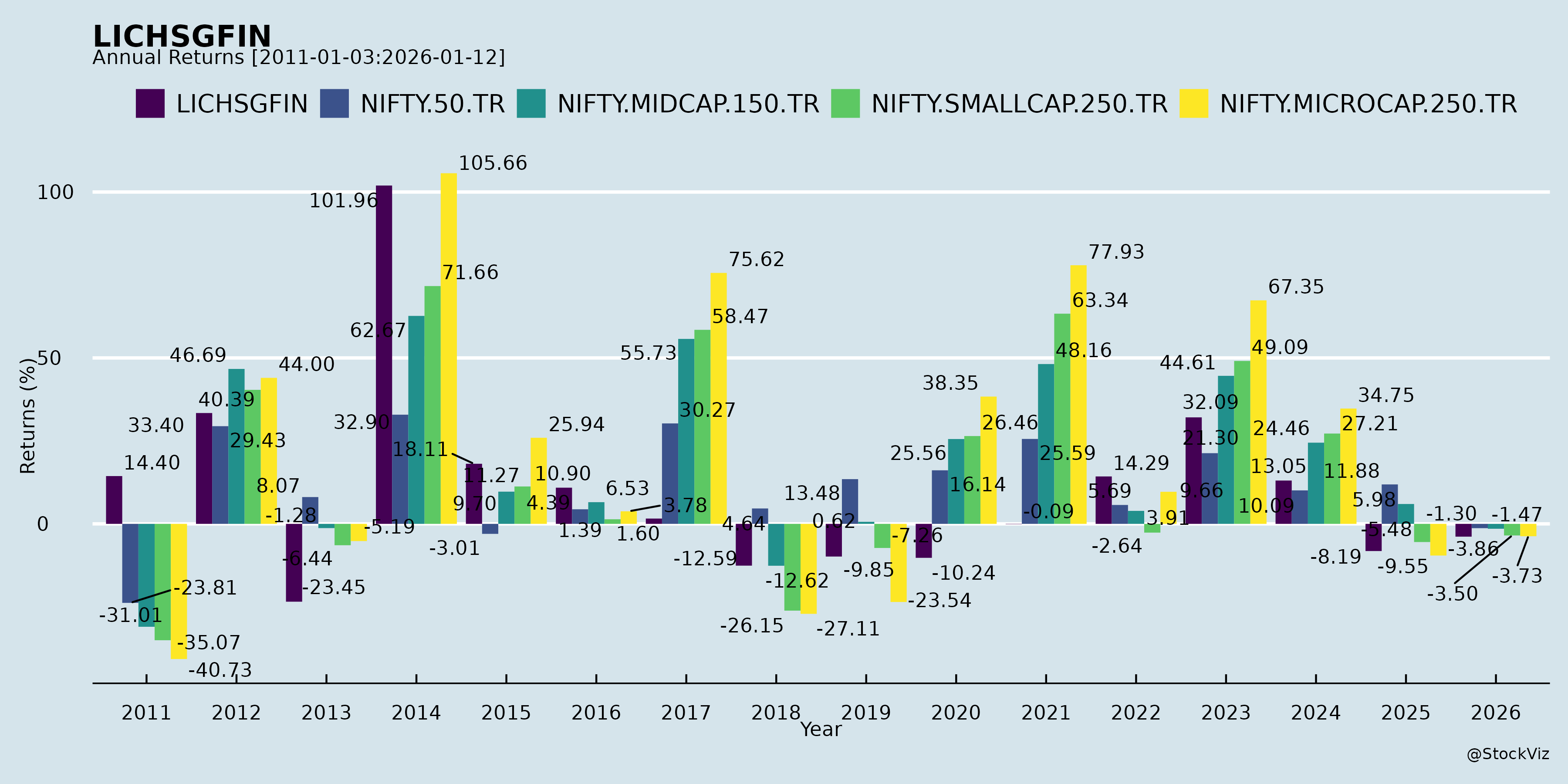

Annual Returns

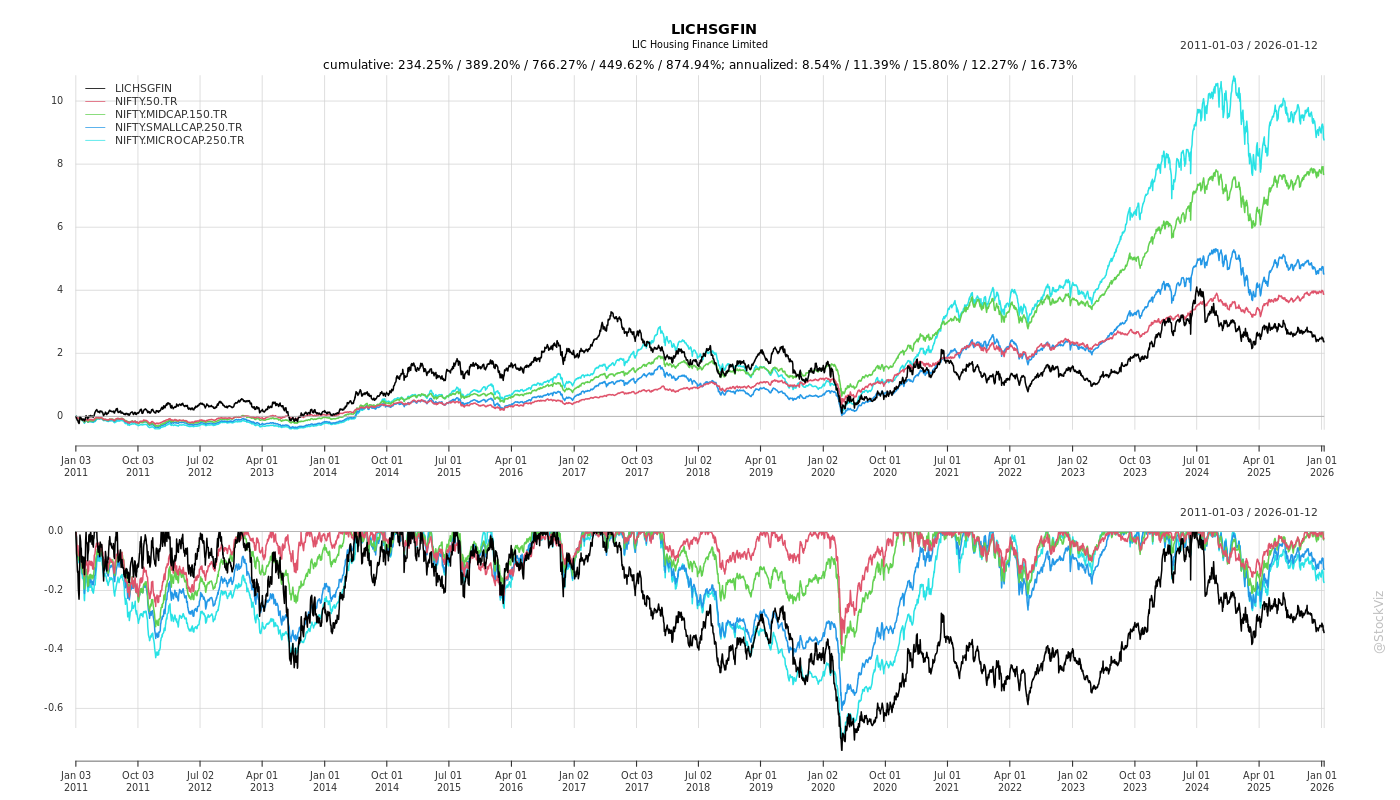

Cumulative Returns and Drawdowns

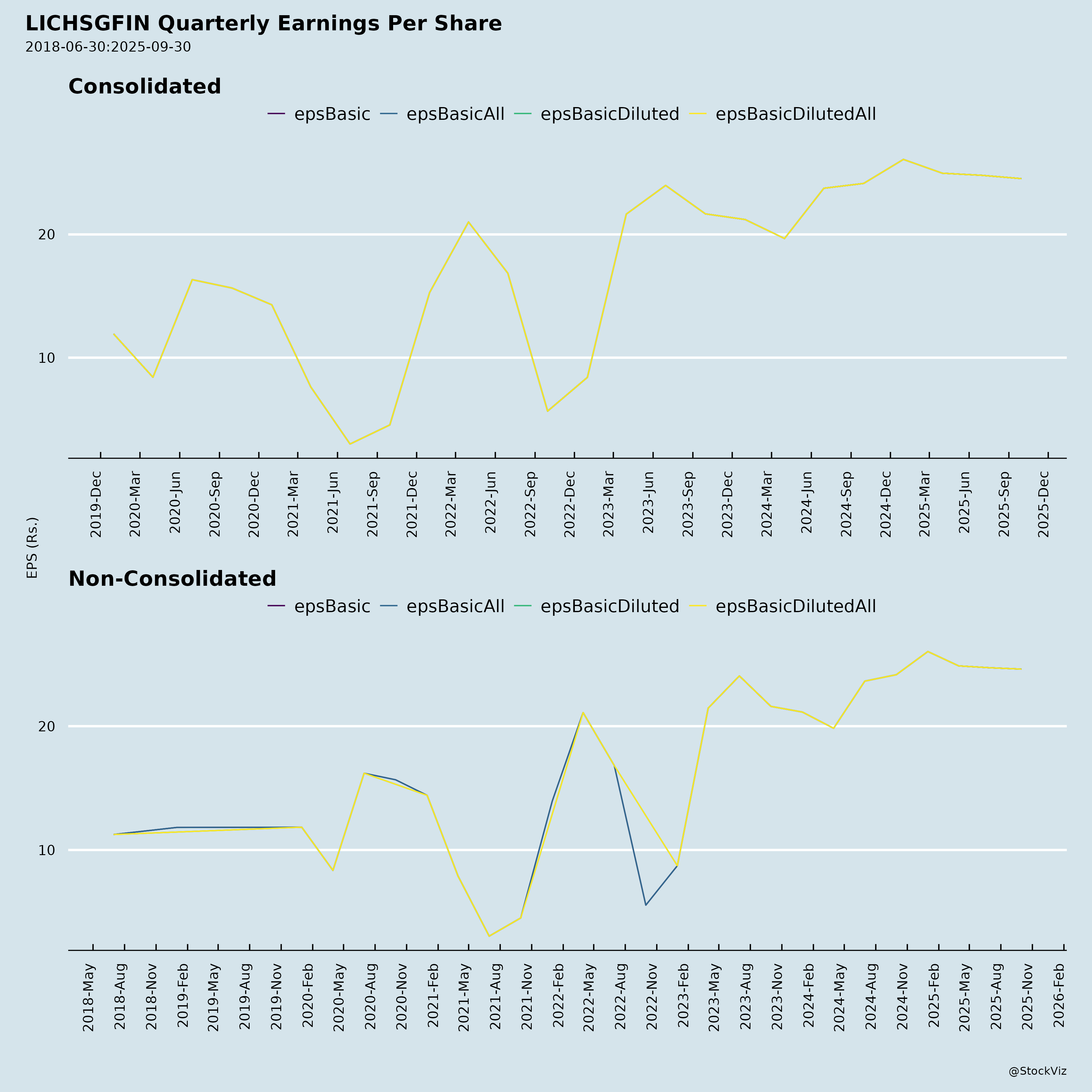

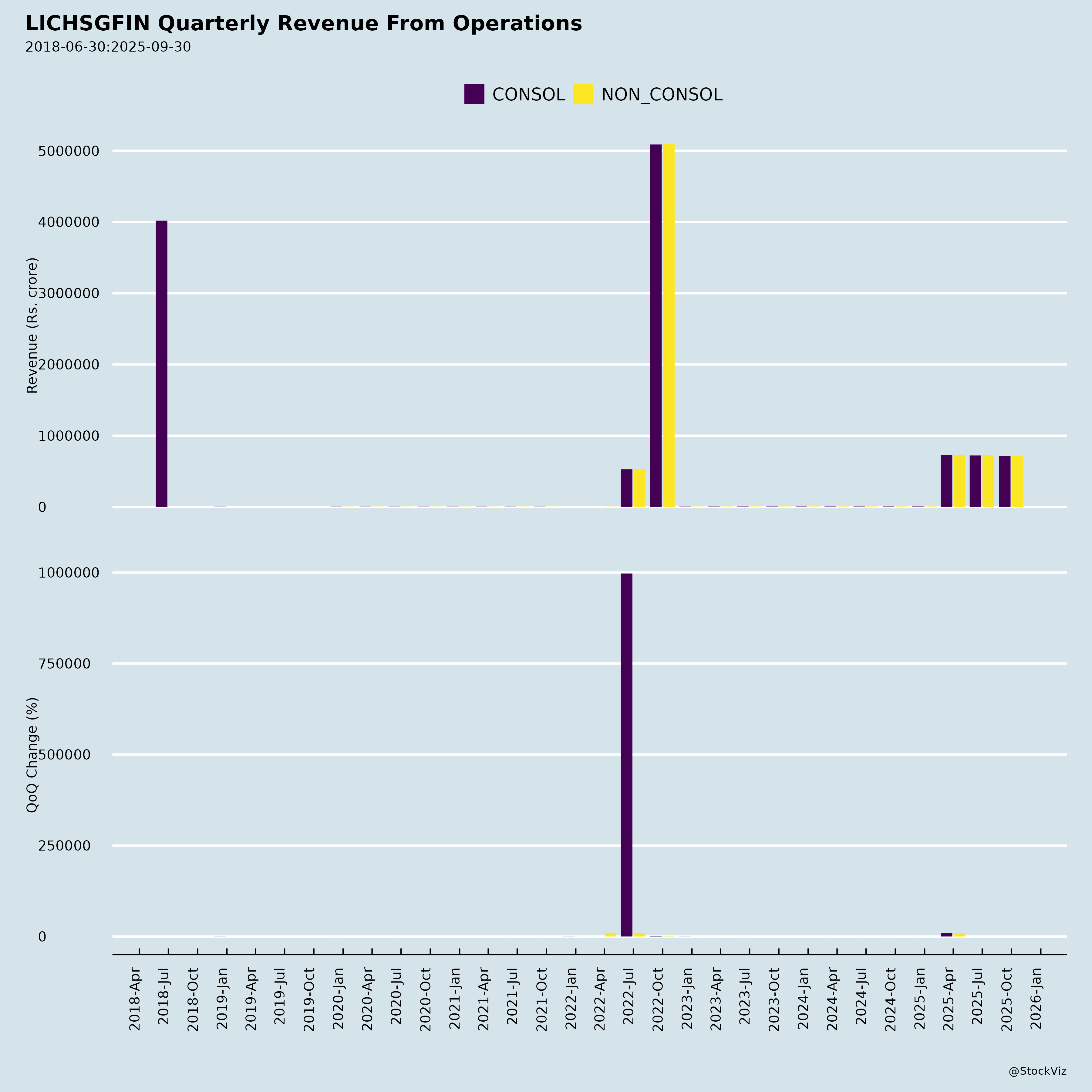

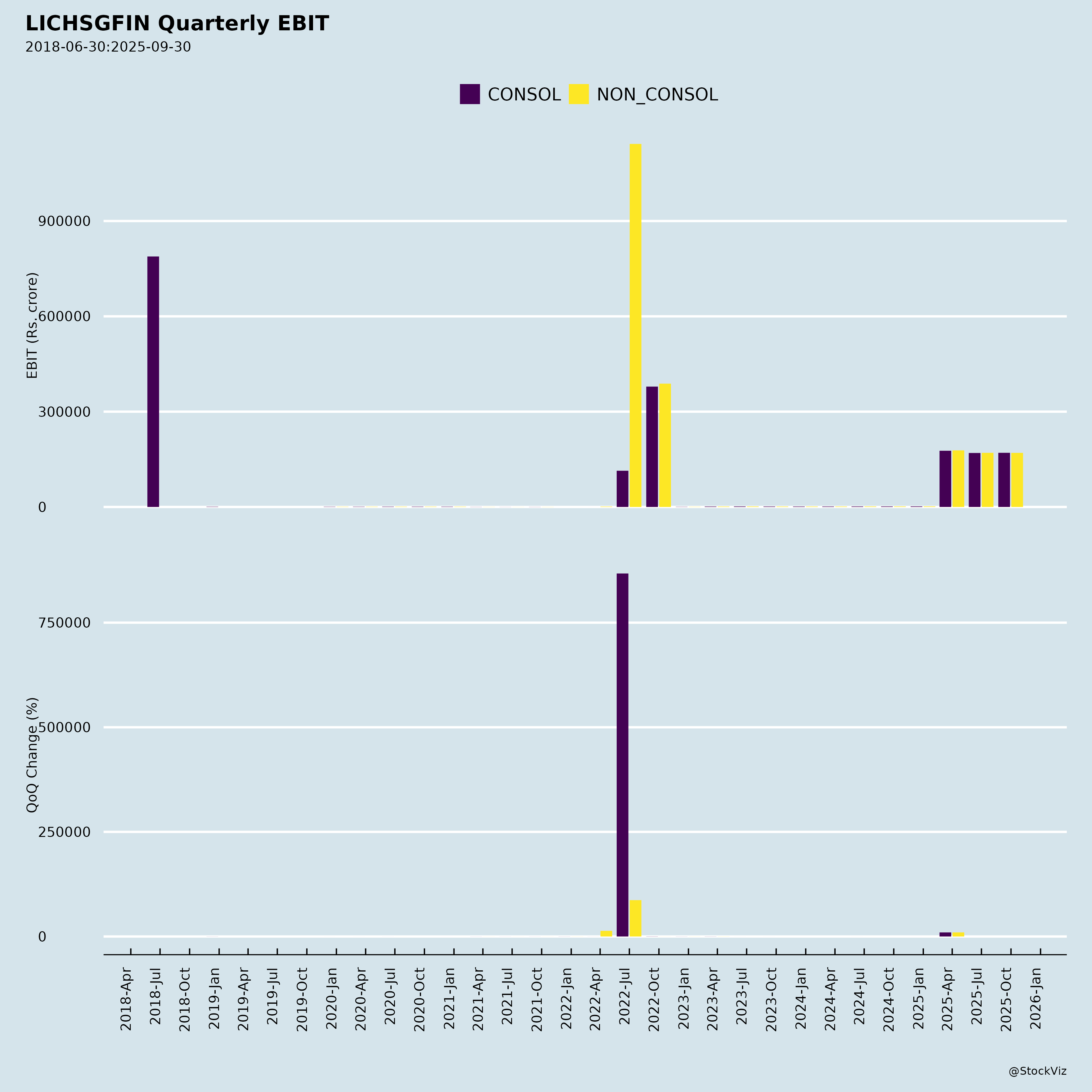

Fundamentals

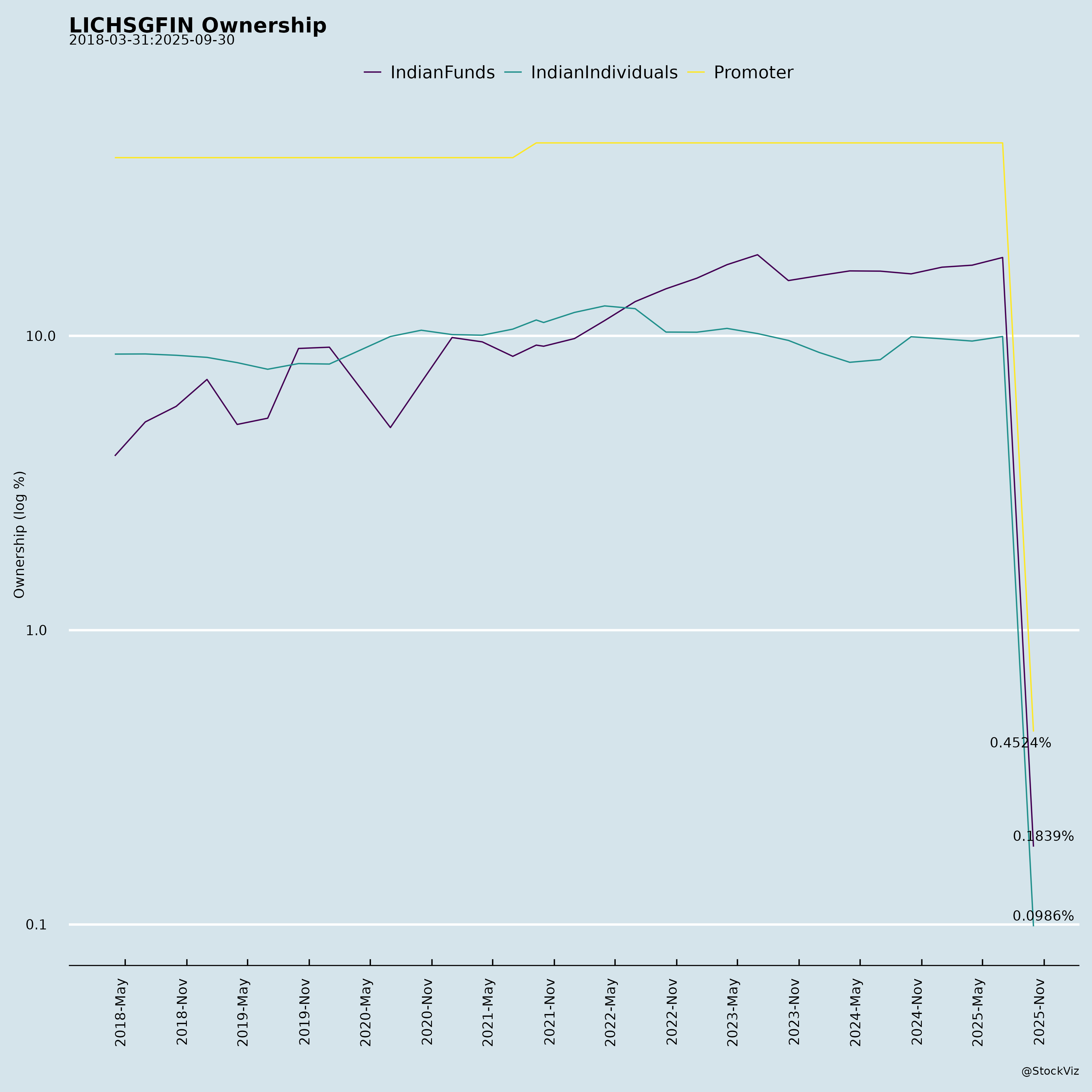

Ownership

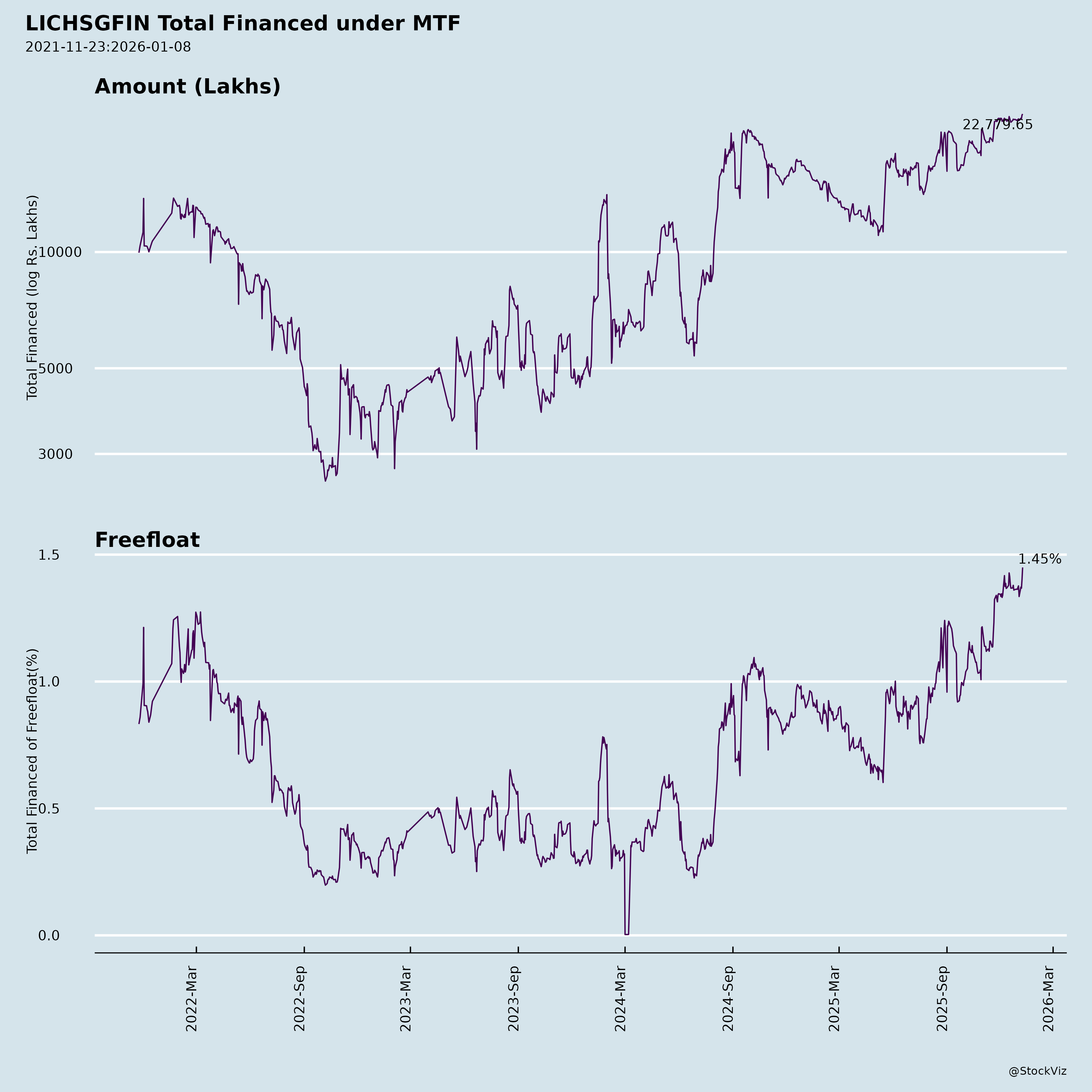

Margined

AI Summary

asof: 2025-12-04

Analysis of LIC Housing Finance Limited (LICHSGFIN)

Based on the provided documents (FY2026 Q2 Results, Press Release, CFO Certification, and Annexures), here is a structured analysis of the company’s headwinds, tailwinds, growth prospects, and key risks:

Headwinds

- Intense Competition:

- PSU banks aggressively offer home loans at 7.35–7.5% (vs. LICHSGFIN’s 8.0%), forcing LICHSGFIN to match rates and erode margins.

- Competition in the project/commercial housing segment is particularly fierce, squeezing margins further.

- PSU banks aggressively offer home loans at 7.35–7.5% (vs. LICHSGFIN’s 8.0%), forcing LICHSGFIN to match rates and erode margins.

- Economic Slowdown and Demand Concerns:

- Q2 FY2026 saw muted growth in disbursements (3% YoY vs. targeted 10%), with sequential QoQ growth only 24%.

- Construction finance disbursements declined 50% YoY (₹378 crores vs. ₹1,397 crores), indicating weak demand for projects.

- Q2 FY2026 saw muted growth in disbursements (3% YoY vs. targeted 10%), with sequential QoQ growth only 24%.

- Rising Funding Costs:

- Despite a 24% YoY drop in incremental cost of funds (to 6.73%), the average PLR remains at 7.42%.

- LICHSGFIN faces pressure to reduce PLR further to retain customers amid competition but risks NIM compression.

- Despite a 24% YoY drop in incremental cost of funds (to 6.73%), the average PLR remains at 7.42%.

- Operational Challenges:

- Over-reliance on agent-driven business (87% of loans) requires restructuring.

- Slow adoption of digital channels (e.g., lead business and direct channels contributed only 15% of disbursements).

- Over-reliance on agent-driven business (87% of loans) requires restructuring.

Tailwinds

- Favorable Macro Environment:

- RBI’s stable repo rates and lower CPI inflation (multi-year lows) support lower borrowing costs.

- LICHSGFIN reduced incremental cost of funds by 24% YoY, improving liquidity.

- RBI’s stable repo rates and lower CPI inflation (multi-year lows) support lower borrowing costs.

- Asset Quality Improvements:

- Stage 3 NPA ratio dropped to 2.51% (from 3.06% YoY), with provisions at 53% PCR (up from 49%).

- Recovery of legacy NPAs (₹83 crores) and write-offs (₹133 crores) improved net worth.

- Stage 3 NPA ratio dropped to 2.51% (from 3.06% YoY), with provisions at 53% PCR (up from 49%).

- Digital Transformation Focus:

- Investment in AI-driven workflows and partnerships aims to reduce costs and enhance customer experience.

- Focus on affordable/mid-segment housing aligns with government initiatives like PMAY 2.0.

- Investment in AI-driven workflows and partnerships aims to reduce costs and enhance customer experience.

- Regulatory Compliance:

- CFO certification confirms adherence to SEBI regulations on fund utilization and disclosure, maintaining market confidence.

Growth Prospects

- Disbursement Acceleration:

- LICHSGFIN anticipates 24% sequential QoQ growth in Q3/Q4 FY2026 (traditionally strong quarters for HFCs).

- Target to increase disbursements to 10% FY2026 growth, up from the missed 6% YoY.

- LICHSGFIN anticipates 24% sequential QoQ growth in Q3/Q4 FY2026 (traditionally strong quarters for HFCs).

- Affordable Housing Expansion:

- Partnerships and co-lending models target underserved segments, leveraging government schemes (e.g., PMAY).

- Subsidiary LIC HFL Financial Services Ltd is scaling direct lending and lead generation.

- Partnerships and co-lending models target underserved segments, leveraging government schemes (e.g., PMAY).

- Asset Quality Recovery:

- Declining Stage 3 NPAs and higher provisions position LICHSGFIN to lower credit costs in FY2027.

- Market Leadership:

- Largest HFC in India with 311,816 crores outstanding loan portfolio (6% YoY growth).

- Strong brand equity and digital initiatives (e.g., app-based home loans) attract tech-savvy customers.

- Largest HFC in India with 311,816 crores outstanding loan portfolio (6% YoY growth).

Key Risks

- Margin Pressure:

- Aggressive competition may force LICHSGFIN to lower loan rates further, compressing NIM below the 2.62% threshold.

- Economic Volatility:

- Potential recession or RBI rate hikes could dampen housing demand, increasing loan delinquencies.

- Regulatory and Compliance Risks:

- Shifts in SEBI/Lawrence guidelines on lending practices or NPAs could increase provisioning costs.

- Audit and certification risks (as seen in the headquarter office certificate) may trigger scrutiny.

- Shifts in SEBI/Lawrence guidelines on lending practices or NPAs could increase provisioning costs.

- Operational Execution Risks:

- Slow adoption of digital channels may delay cost synergies.

- Overreliance on agency distribution may limit market reach in underserved areas.

- Slow adoption of digital channels may delay cost synergies.

- Asset Quality Shocks:

- Delayed recovery of legacy loans or new sector-specific NPAs (e.g., MSME housing) could strain provisions.

Summary

LIC Housing Finance Limited (LICHSGFIN) is positioned to capitalize on macro tailwinds (lower rates, inflation) and digital transformation but faces headwinds from intense competition and operational inefficiencies. While its asset quality and liquidity are strong, the company’s growth remains constrained by delayed disbursement acceleration and dependency on traditional distribution models.

Outlook:

- Short-term (Q3–Q4 FY2026): Limited growth due to competitive pressure; focus on stabilizing disbursements.

- Long-term (FY2027+): Upside potential if affordable housing initiatives scale and digital channels gain traction. However, regulatory and economic risks could undermine progress.

Recommendation: Monitor competitive rate movements, monitor RBI policy cues, and evaluate execution of affordable housing initiatives as key indicators for future performance.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.