KRBL

Equity Metrics

January 13, 2026

KRBL Limited

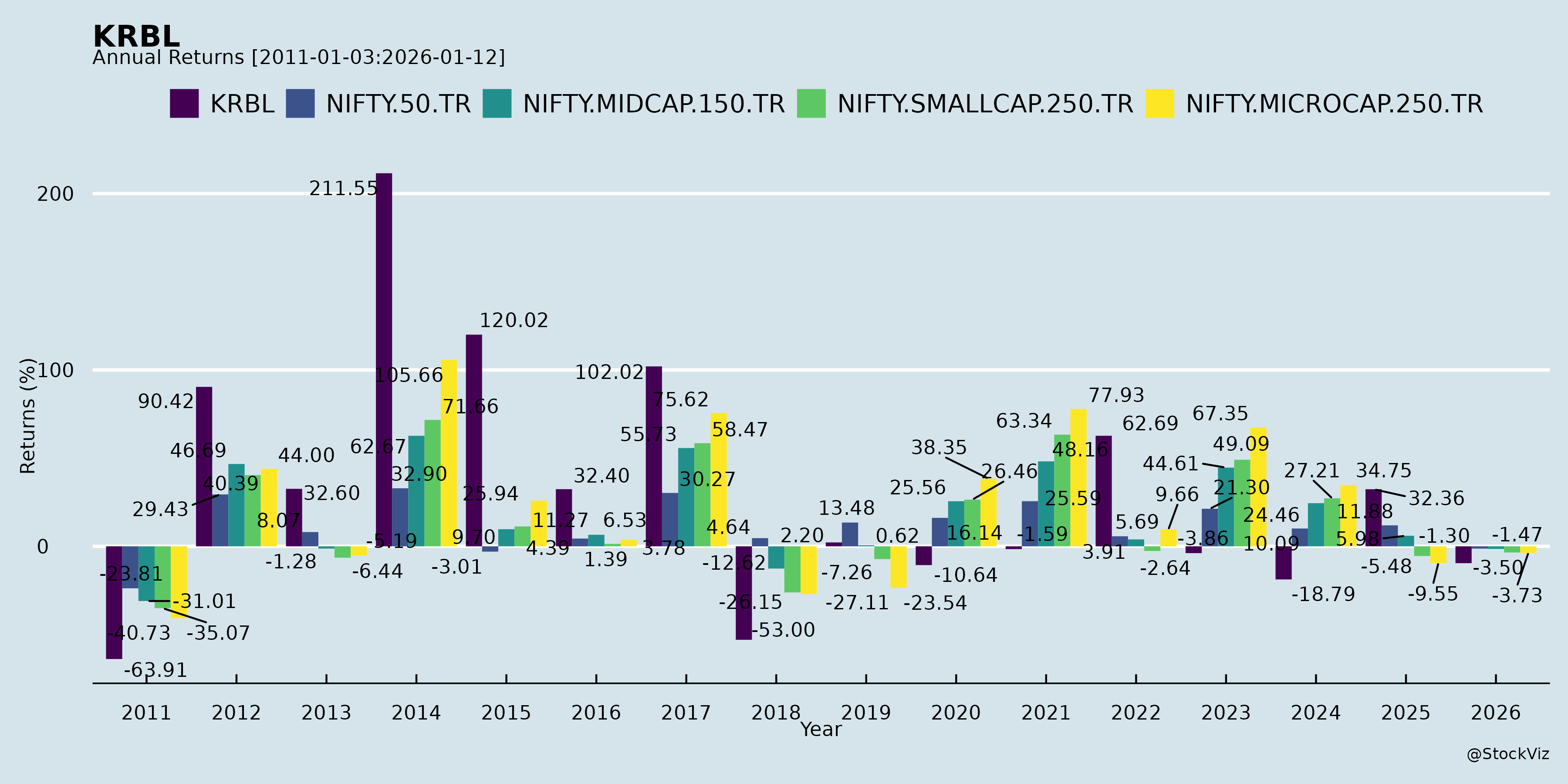

Annual Returns

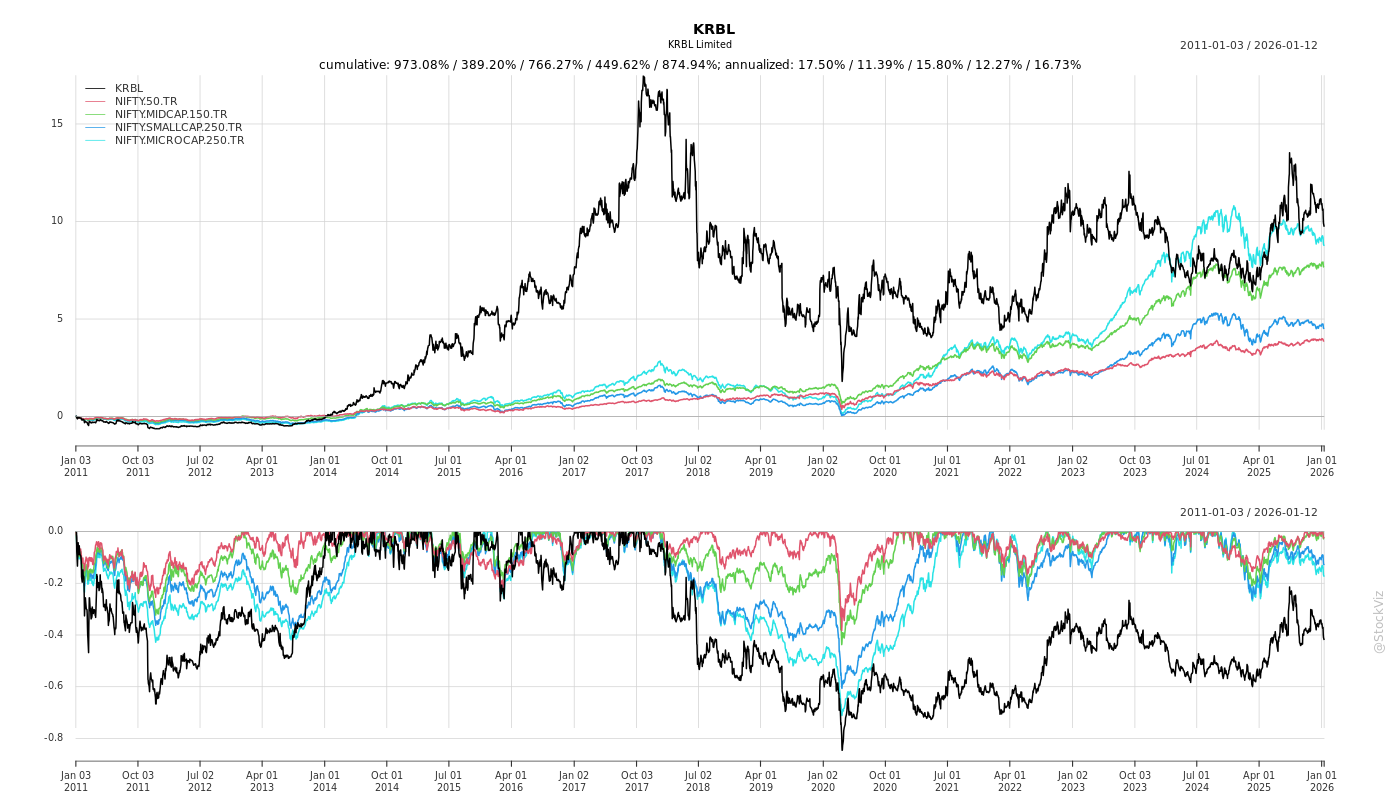

Cumulative Returns and Drawdowns

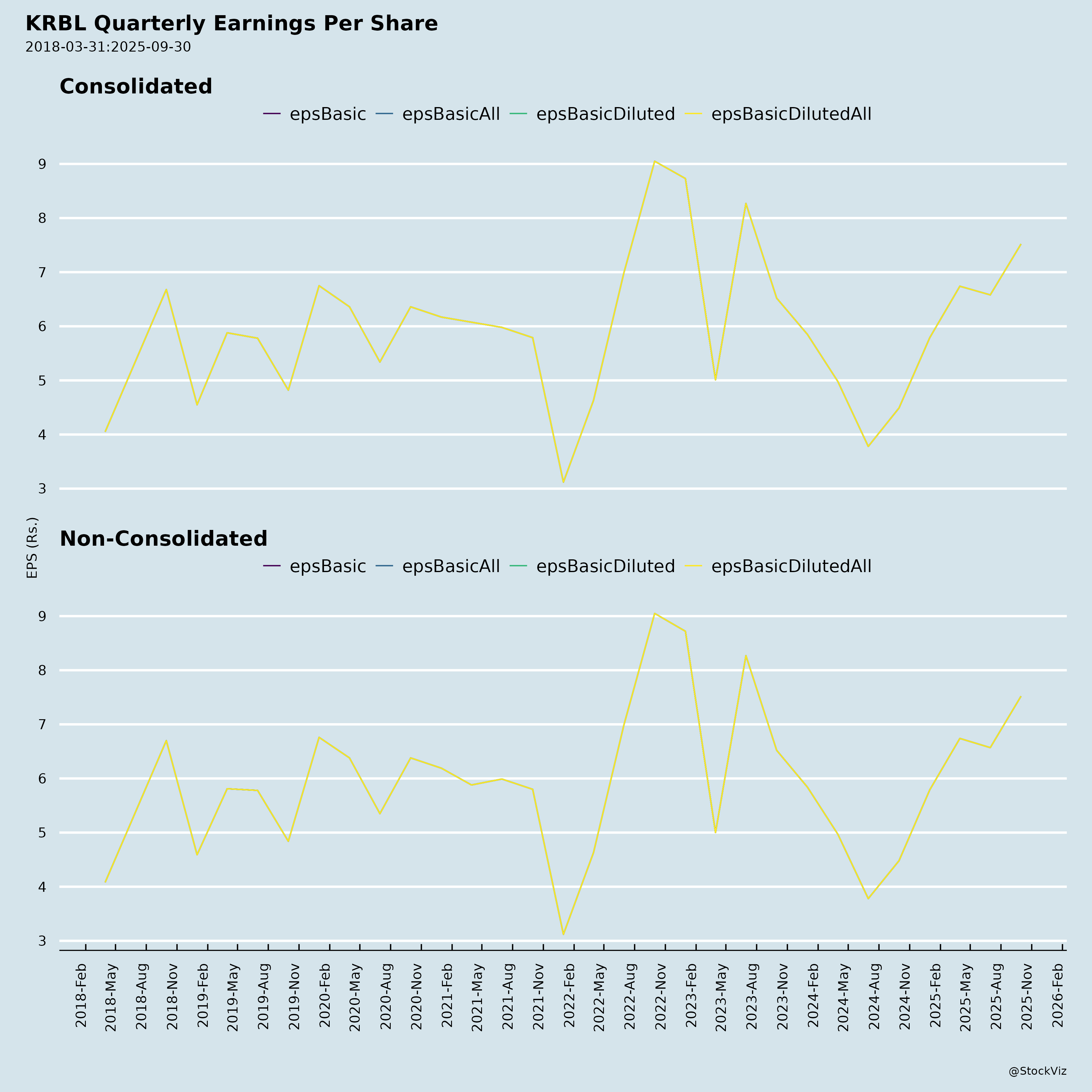

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-03

KRBL Limited (KRBL.NS) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

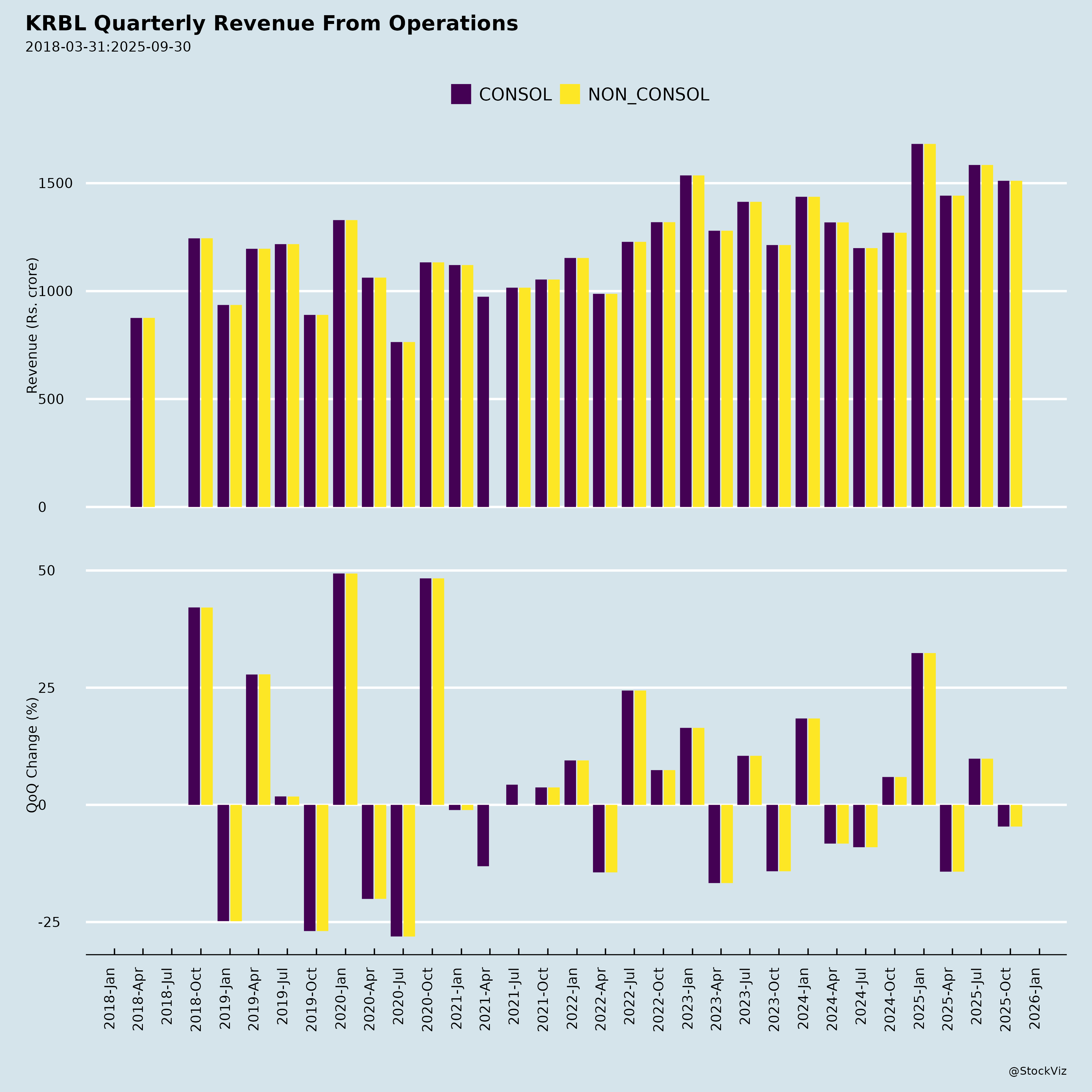

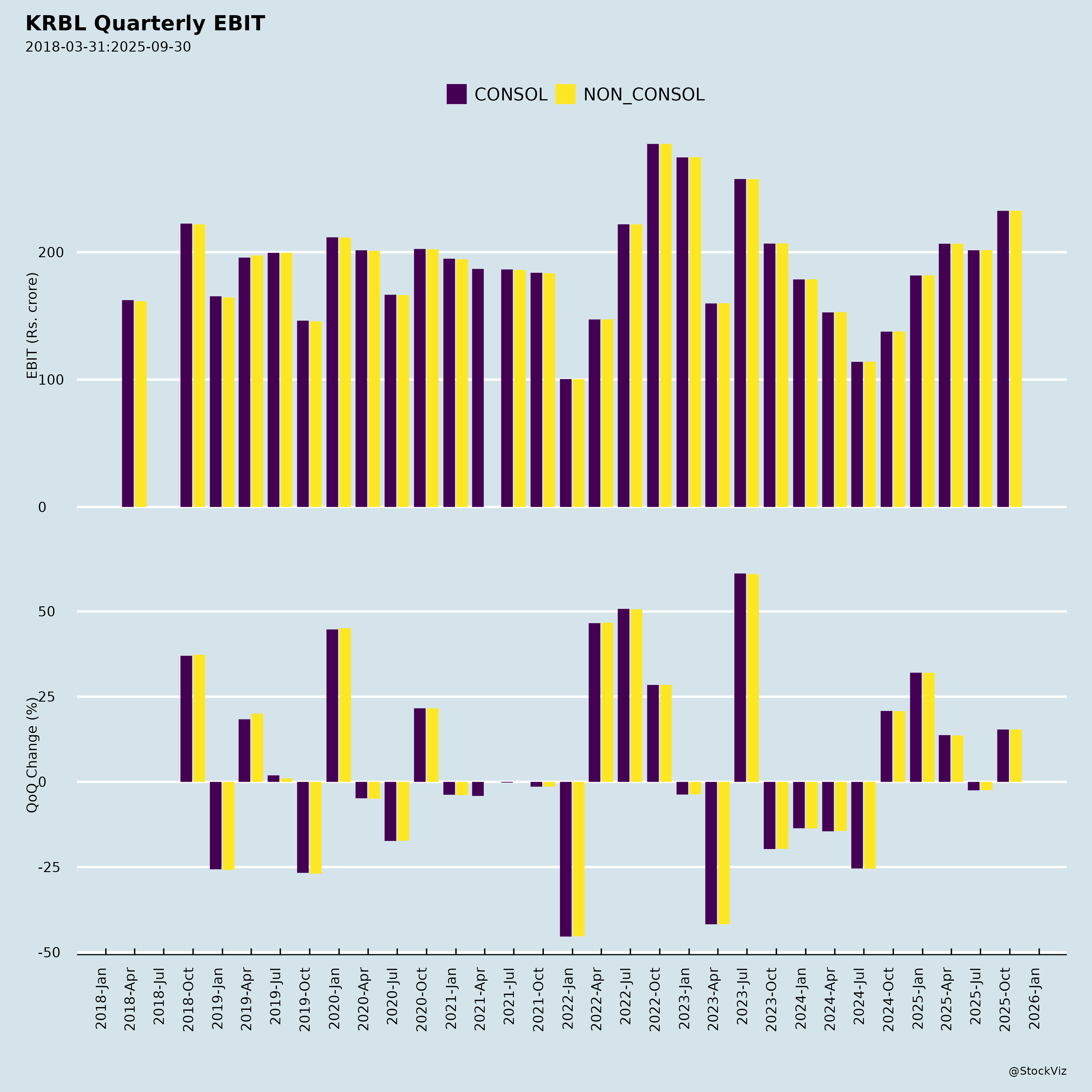

KRBL Limited, the world’s largest rice miller and India’s leading basmati rice exporter (India Gate brand), reported strong Q2/H1 FY26 results (ended Sep 30, 2025): Consolidated revenue up 19%/25% YoY to ₹1,511 Cr/₹3,096 Cr, driven by 74%/86% export growth and margin expansion (Gross margin 29.2% in Q2 vs. 23.7% YoY; EBITDA margin 16.6%). Balance sheet remains robust (net cash ₹2,157 Cr, inventory down to ₹2,279 Cr). Market cap ~₹17,684 Cr as of Sep 30, 2025. Below is a structured summary based on the provided documents (earnings call transcript, investor presentation, financial results, board outcomes, AGM voting).

Tailwinds (Positive Factors Supporting Performance)

- Market Leadership & Brand Strength: India Gate holds 38.5% basmati packaged rice share (Nielsen MAT Sep’25), #1 in GT (38.5%), MT (40.8%), e-commerce (42.2%). World’s #1 basmati brand; premium pricing (41% above India avg. realization).

- Export Surge: 74% YoY Q2 growth (₹438 Cr), driven by branded/bulk to 90+ countries (Middle East ~76% of India’s basmati exports). India remains #1 global rice exporter (16% vol. growth FY25).

- Margin Tailwinds: Lower basmati COGS (-11% Q2 YoY) boosted gross margins; EBITDA/PAT margins at 16.6%/11.2% (Q2).

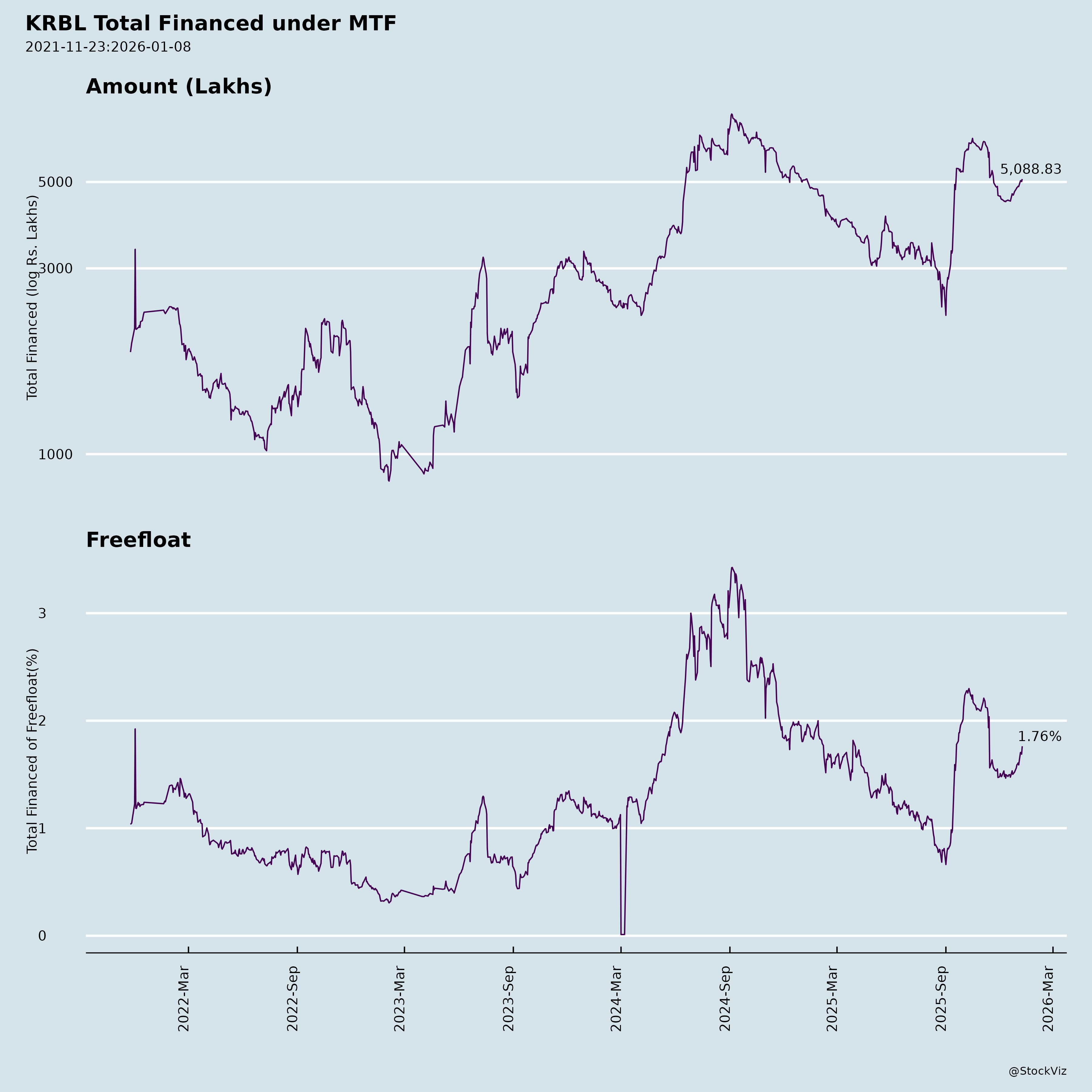

- Financial Strength: Net debt-free (cash & equivalents ₹2,157 Cr); operating cash flow robust (₹1,854 Cr H1 standalone). Strong credit ratings (ICRA AA/Stable, A1+).

- Strategic Execution: Distribution democratization (342k outlets, 56% ND); supply chain remodeling (16 new C&Fs); brand investments (Amitabh Bachchan campaign, GRPs 2,472); new products (biryani masala, oils).

- Awards/Recognition: Gold at LACP 2025 Spotlight Awards; multiple digital/marketing accolades.

Headwinds (Challenges Impacting Performance)

- Regulatory/Legal Scrutiny: Auditor qualification on ongoing ED investigation (AgustaWestland case) involving JMD, KRBL, and subsidiary KRBL DMCC (alleged USD 24.62 Mn proceeds of crime routed via customer). No conclusive impact per independent review, but unresolved (next hearing Nov 19, 2025). Land attachment (₹153 Cr value, ₹111 Cr deposit pending refund).

- Director Resignation Fallout: Independent review (AZB & Partners) on Anil Kumar Chaudhary’s exit found no financial irregularities but flagged process enhancements (e.g., governance). Noted by Board/Independent Directors.

- Domestic Moderation: Growth slowed to 6%/10% YoY (Q2/H1) vs. exports; some MT share loss (-280 bps).

- Inventory/Working Capital: Down YoY (₹2,279 Cr vs. ₹3,013 Cr), reflecting lower volumes/prices, but ties to agri-cyclicality.

- AGM Voting: Special resolution for new Independent Director (Desh Raj Dogra) passed narrowly (92.9% favor, but 7% against from public institutions/non-institutions).

Growth Prospects (Medium-Term Opportunities)

- Domestic Expansion (High Confidence): Target 1-in-10 household penetration (+200 bps YoY); GT/MT/e-com leadership. New categories (biryani masala: 20 Mn+ campaign views; oils via “Grains of Hope”). Distribution to 850+ distributors; sales acceleration project with global consultant.

- Export Upside (Very High): Leverage India’s basmati dominance (85% global share); PUSA varieties for US; HORECA/direct marketing in Middle East (Arabic TVC, geo-targeted social). Channel diversification, economy packs for penetration.

- Operational Leverage: Largest milling capacity (Punjab: 150 MT/hr paddy); contact farming network. Power segment stable (₹12 Cr H1 revenue).

- FY26 Guidance (Implicit): Sustained export momentum, margin stability (13-16% EBITDA); internal accruals fund capex (minimal debt).

- Overall Target: Revenue CAGR 15-20% (branded focus); ROE ~20%+ on strong FCF.

Key Risks (High to Medium Impact)

| Risk Category | Description | Mitigation/Status |

|---|---|---|

| Regulatory/Legal (High) | ED probe (AgustaWestland); potential fines/attachments/reputational damage. Auditor qualification persists. | Independent reviews show no financial impact; favorable court orders pending. Legal counsel optimistic. |

| Commodity/Price Volatility (High) | Paddy/rice price swings, weather, export bans (e.g., non-basmati). Inventory ₹2,279 Cr exposed. | Contract farming, hedging (cash flow hedges noted); premium branding buffers. |

| Forex/Geopolitical (Medium-High) | 30%+ revenue exports; USD/INR volatility; Middle East tensions. | Natural hedge via exports; derivatives used (OCI impact minor). |

| Competition/Governance (Medium) | Domestic rivals eroding MT share; post-resignation governance scrutiny. | Process enhancements underway; strong promoter holding (60%+). |

| Execution (Medium) | New product ramps, distribution scale-up delays. | Partnerships (consultants); robust FCF supports. |

Overall Outlook: Positive with Caution. Tailwinds from brand/export strength outweigh headwinds; Q2/H1 beat supports 15-20% FY26 growth. Legal overhang caps upside (watch ED hearings). DCF implies fair value ~₹650-700 (20% upside from ~₹580 levels implied by mcap). Buy/Hold for long-term; monitor regulatory resolution.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.