Other Agricultural Products

Industry Metrics

January 13, 2026

Annual Returns

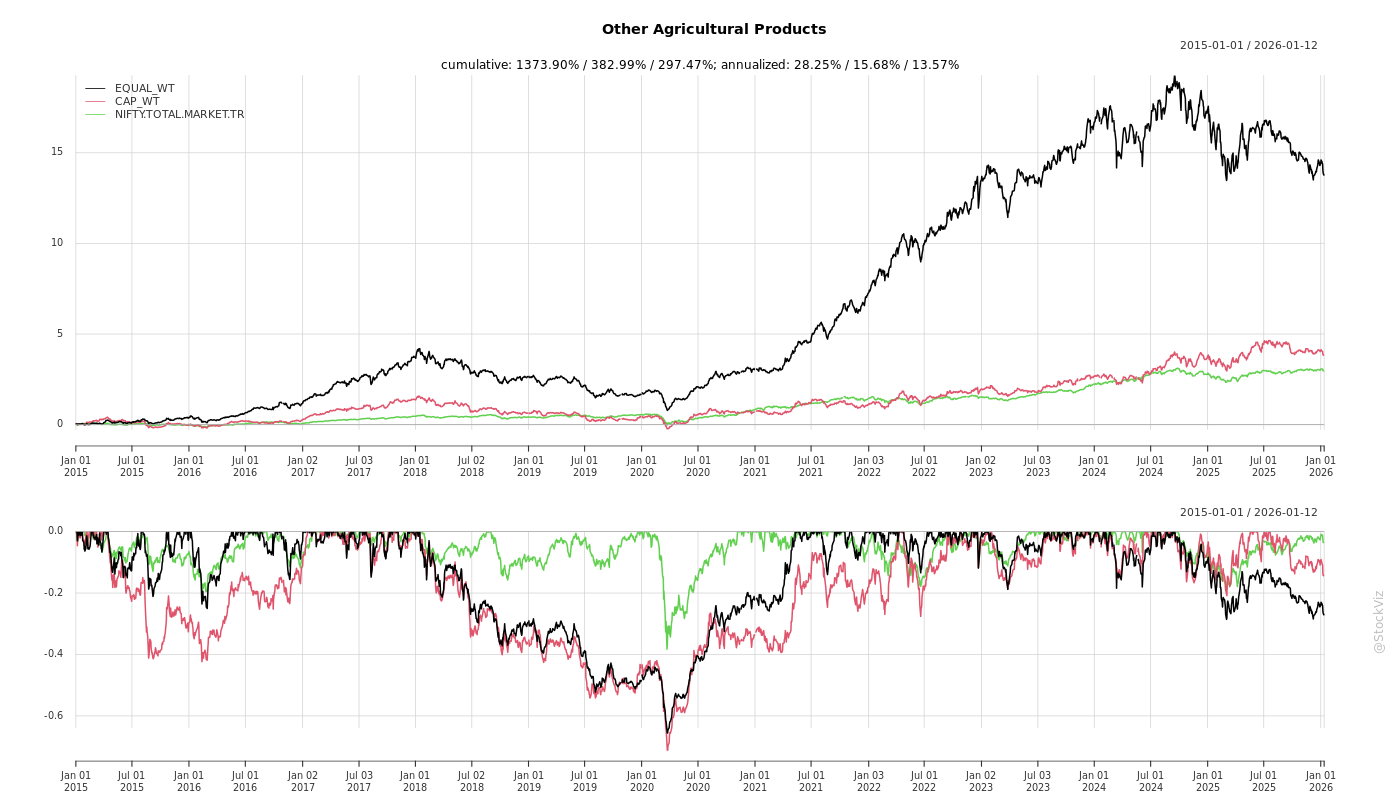

Cumulative Returns and Drawdowns

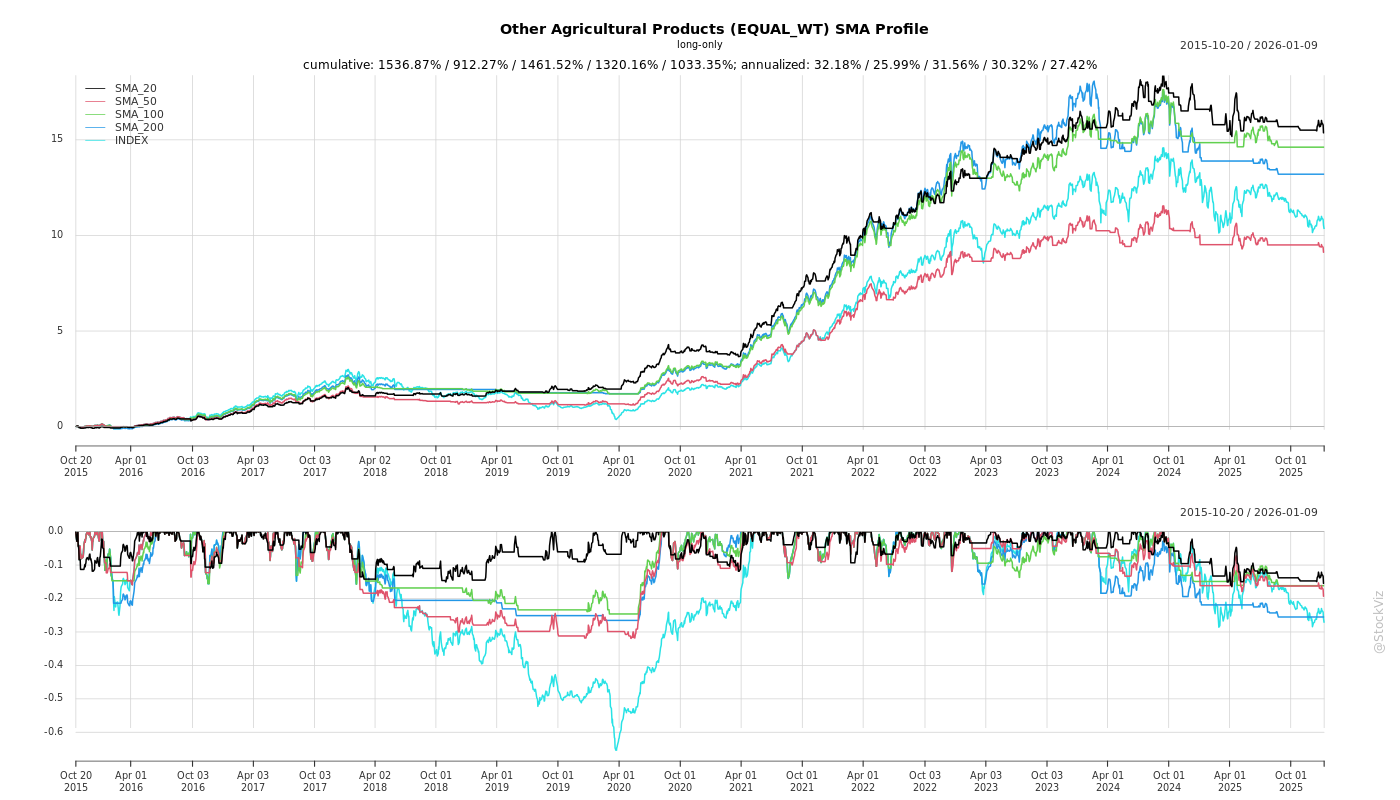

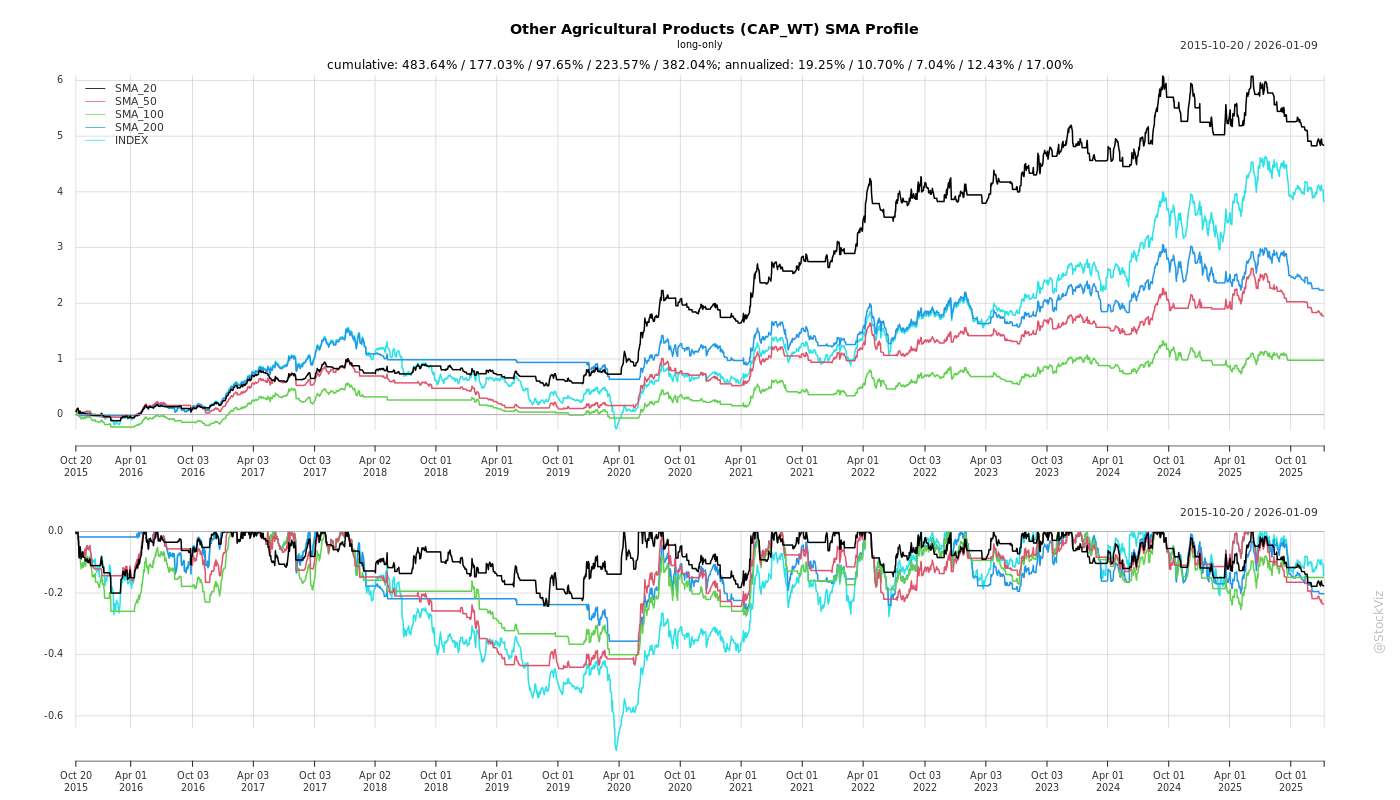

SMA Scenarios

Current Distance from SMA

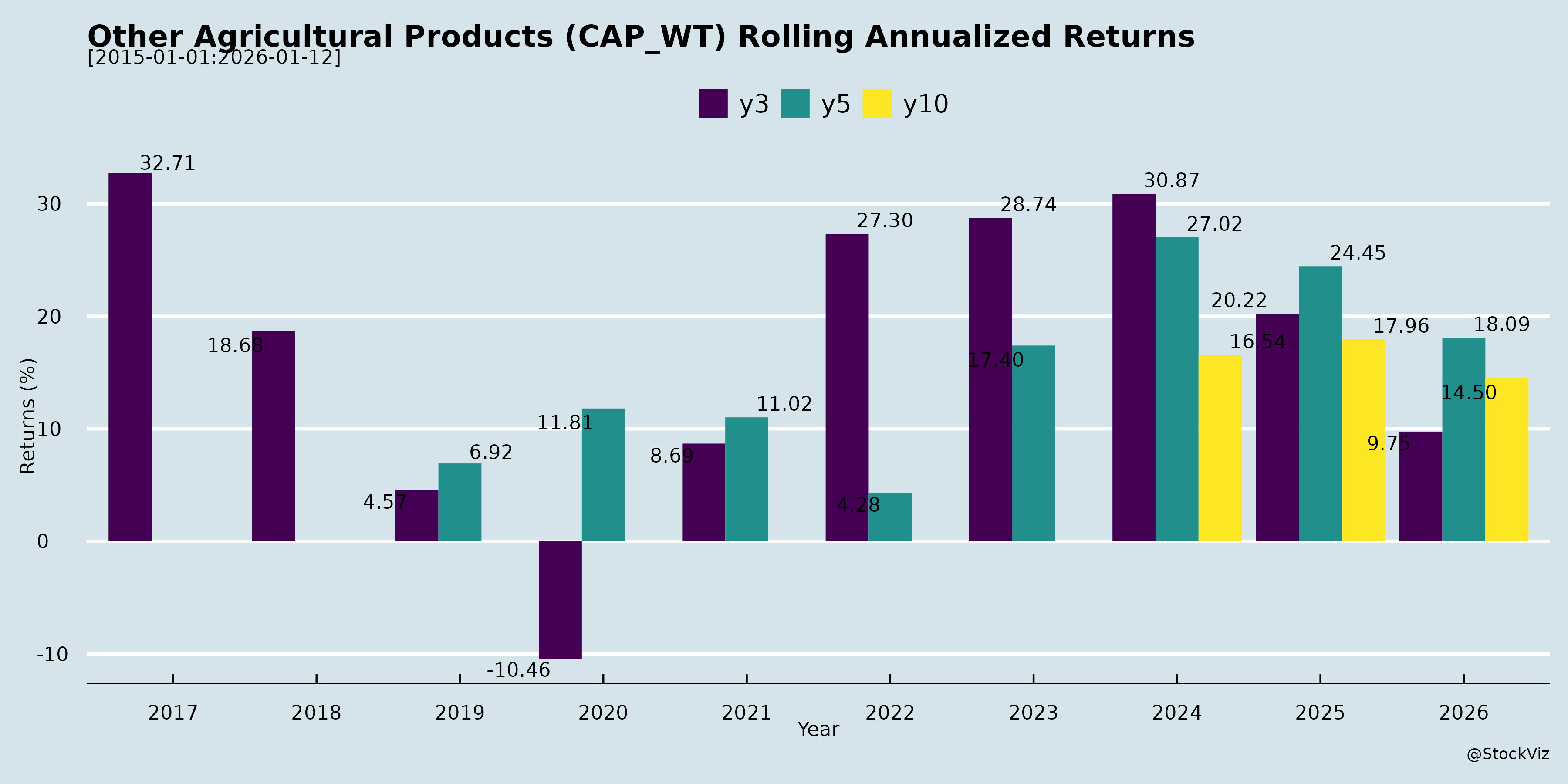

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-02

Analysis of Indian Other Agricultural Products Sector

The “Other Agricultural Products” sector encompasses processed agri-products like rice (basmati/organic), starch & derivatives (maize-based), seeds (hybrid/non-cotton/paddy), and biofuels (ethanol/CBG/SAF from agri feedstocks). Insights drawn from Q2/H1 FY26 earnings transcripts/announcements of key players (Trualt Bioenergy, Sukhjit Starch, Nath Bio-Genes, Sarveshwar Foods, LT Foods, KRBL, etc.) reveal a resilient sector amid cyclical challenges. FY25/FY26 performance shows revenue moderation (e.g., Trualt -26% YoY H1 revenue to ₹418 Cr; Sukhjit Q2 revenue down QoQ) but improving margins via diversification.

Headwinds (Challenges)

- Demand Volatility & Shutdowns: Strategic plant halts for multi-feed upgrades (Trualt: 1,300 KLPD dual-feed integration caused Q2 revenue drop to ₹129 Cr). FMCG/textile slowdown impacted starch (Sukhjit: defensive sales to protect margins).

- Input Cost Pressures: Maize prices softened (Sukhjit: ₹22-23/kg in Q1 to ₹19-20/kg), but earlier spikes hurt; rice/maize diversion to ethanol created glut (1,600 Cr L offered vs. 1,000 Cr taken).

- Policy/Regulatory Hurdles: Ethanol allocations skewed south (Trualt: Karnataka low allottee); cotton seed regulation limited volumes (Nath: 11.35L packets sold despite premium pricing).

- Competition & Subdued Exports: Starch exports paused due to high Indian maize costs; rice exports face bans/gluts (Sarveshwar: minor declines offset by organics).

- Geopolitical/Weather Risks: African markets unstable (Nath); erratic monsoons affected cotton yields.

Tailwinds (Positive Factors)

- Policy Support: Ethanol blending push (20-27%), CBG/SAF mandates (Trualt: Sumitomo/GAIL JVs for 16+ plants); GI tag for J&K basmati boosts premiums (Sarveshwar).

- Cost Efficiencies: Maize softening + bagasse power shift (Trualt: ₹19-20 Cr savings; Sukhjit: stable ops at 40-60 days inventory).

- Diversification Gains: Non-cotton/paddy (NCP) up 22% (Nath: Bajra/maize/veggies at 48% mix, 38% revenue growth); organics/FMCG strong (Sarveshwar: veggies +60% value).

- Export Revival: Basmati/organics demand (Sarveshwar: 25+ countries); starch competitiveness returning (Sukhjit).

- Infrastructure: New CBG/SAF plants (Trualt: Q2 FY27 ops); USFDA milling (Sarveshwar: 350 MTPD).

Growth Prospects

- High Double-Digit Revenue CAGR: Targeting ₹500 Cr (Nath) to ₹1,000 Cr in 2-5 years via NCP/hybrids (NCP 48% mix; paddy hybrids 38% value share). Trualt: H2 FY26 recovery (47 Cr L ethanol allocation + CBG 770% QoQ growth); Sukhjit: exports + efficiency.

- Biofuels Boom: CBG EBITDA 68% (Trualt: 17 plants planned); SAF MoUs (₹2,250 Cr Andhra plant, 19% IRR).

- Premium/Organic Shift: Seeds (Nath: Super-27 Bajra lead); rice (Sarveshwar: Nimbark organics +60% veggies). Global organics market: $8 Bn to $12 Bn by 2034 (4.1% CAGR).

- International Expansion: Uzbekistan JV (600 Ha cotton, breakeven); Philippines BT cotton trials (Nath).

- Margins Expansion: EBITDA 15-20% target (Nath); gross 52-54% sustainable (via hybrids/premiums). Sector tailwinds: India rice output 120 MnT; maize 40 MnT.

| Metric | FY25 Snapshot | Outlook |

|---|---|---|

| Revenue Growth | 9% (Nath); Stable (Sukhjit) | 15%+ (pan-sector) |

| EBITDA Margin | 14-15% | 15-20% |

| PAT Growth | 13% (Nath) | Double-digit via diversification |

Key Risks

- Policy/Allocation Risks (High): Ethanol/CBG tenders, blending delays (Trualt: 14 Cr L pending); cotton regulation (Nath).

- Commodity Volatility (Medium-High): Maize/rice prices (Sukhjit: glut risk); weather impacts yields.

- Competition (Medium): Kaveri/Rice players eroding share (Nath/Sarveshwar).

- Execution/Regulatory (Medium): JV approvals (Uzbekistan/Philippines); hybrid testing delays.

- Working Capital (Low-Medium): High inventory (Nath: debtor days 89); advance bookings mitigate (₹151 Cr).

- Geopolitical/Exports (Low): Bans, currency fluctuations (5-10% revenue exposure).

Overall Outlook: Positive with 12-15% CAGR potential through diversification (NCP/biofuels/organics), policy tailwinds, and premiums. Risks mitigated by R&D (4-5% sales spend), strong cash (₹88 Cr), and pan-India presence. Focus on sustainability (CBG/SAF) aligns with global trends.

Financial

asof: 2025-12-01

Summary Analysis: Indian Other Agricultural Products Sector (Rice, Seeds, Starch, etc.)

Overview: The sector filings (Q3/Nine Months FY25 ended Dec 2024) reflect resilience amid volatility, with aggregate revenue growth ~15-20% YoY across peers (e.g., LT Foods ~₹1,050 Cr Q3 rev., KRBL ~₹1,681 Cr Q3, Kaveri Seeds ~₹1,740 Cr Q3 consolidated). PAT margins stable at 3-8%, driven by agri exports/domestic demand. Key players: Rice (LT, KRBL, GRM), Seeds (Kaveri, Nath), Starch (Sukhjit, Sanstar).

Tailwinds (Supportive Factors)

- Robust Demand: Strong export/domestic sales; rice exports up (KRBL Agri ~₹1,693 Cr Q3, 18% YoY; LT Foods single segment rice). Seeds benefit from hybrid/organic shift (Kaveri ~₹1,740 Cr Q3 rev.).

- Volume/Leverage: Inventory drawdowns boosted margins (KRBL changes in inv. -₹2,354 Cr Q3 aiding PAT ₹132 Cr).

- Diversification: Entry into value-add (GRM B2C castor oil; Gulshan ethanol/grain processing ~₹609 Cr Q3).

- Policy Support: Agri export incentives; stable forex aiding INR rev. from exports (Chaman Lal ~₹3,953 Cr Q3 rev.).

- Financial Health: Low debt in some (Sanstar no debt); dividends (LT 4th interim ₹9.9/shr).

Headwinds (Challenges)

- Cost Pressures: Raw material volatility (paddy/maize); high material costs ~70-80% of rev. (Sukhjit ~81% Q3 expenses).

- Margin Squeeze: Inventory fluctuations, forex hedging costs; PAT dip YoY in some (KRBL 9M PAT down 33% to ₹3,215 Cr despite rev. up).

- Regulatory Scrutiny: ED probes (KRBL JMD/land attachment; qualified audits); insurance litigations (LT ₹1,341 Cr claim pending).

- Seasonality: Q3 Agri slowdown (KRBL Q3 rev. ₹1,682 Cr vs. prior peaks); weather impacts seeds (Kaveri subsidiary losses).

- High Finance Costs: 2-5% of rev. (Sarveshwar ~4% Q3; Mangalam ~1.5%).

Growth Prospects

- Exports/Intl. Expansion: Basmati rice leaders (LT/KRBL/Chaman) target 10-15% CAGR; Middle East/US focus (LT subs in US/Europe).

- Value-Add/Subsidiaries: Seeds hybrids (Nath ~₹3,687 Cr Q3 rev., 16% YoY); starch derivatives (Sukhjit infra div.); acquisitions (GRM Nature Bio-Foods).

- Capacity/Tech: Expansions (Gulshan ethanol; Kaveri micronutrients); B2C branding (GRM castor oil SKUs).

- Outlook: FY25 rev. growth 15-25% projected; EPS 10-20% upside (Kaveri ~₹59; Nath ~₹20); dividends signal confidence.

- Sector Tail: Agri exports ~$50 Bn target; hybrid seeds penetration <30% room to grow.

Key Risks

- Regulatory/Legal (High): ED/PMLA probes (KRBL attachment ₹153 Cr; LT insurance suit); forensic audits (Mangalam SEBI notices).

- Commodity Volatility (High): Paddy/maize prices; inventory risks (negative changes aid Q3 but reverse in Q4).

- Forex/Exports (Medium): 30-50% rev. export-linked; rupee appreciation hurts.

- Liquidity/Debt (Medium): High finance costs (Sarveshwar ₹120 Cr Q3); working capital strain.

- Execution/Subsidiaries (Low-Medium): Losses in subs (Kaveri neg. net worth; Nath JVs); going concern notes.

- Macro: Monsoon/weather; input inflation; global trade barriers.

Overall: Sector buoyant on exports/diversification (Tailwinds > Headwinds), but regulatory overhang caps upside. Growth ~15% FY25 viable if probes resolve; monitor Q4 for inventory normalization. Recommendation: Positive with caution on KRBL/LT legal risks.

General

asof: 2025-12-02

Summary Analysis: Indian Other Agricultural Products Sector

(Based on recent announcements from key players like LT Foods, KRBL, GRM Overseas, Sarveshwar Foods, Gulshan Polyols, Kaveri Seeds, Gujarat Ambuja Exports, Mangalam Global, Chaman Lal Setia, Indo US Bio-Tech, Sanstar, and Trualt Bioenergy. Sector includes rice processing/export, seeds, edible oils, oleo chemicals, ethanol, and starch derivatives.)

Tailwinds (Positive Factors)

- Global Expansion Momentum: Companies aggressively pursuing international footprints—LT Foods (Hungary holding co. for ops overview), Sarveshwar Foods (US WOS for organic foods trading), Mangalam Global (new WOS for oleo speciality products). This aligns with export-driven growth in basmati rice/organics amid rising global demand.

- Robust Financial Performance: GRM Overseas reports H1 FY26 consolidated revenue ~₹689 Cr (flat YoY but stable), net profit up to ₹33.9 Cr (+24% YoY), with food segment dominating (₹612 Cr). Bonus issue (2:1) and capital hike signal shareholder confidence and funding for expansion.

- Government Support: Gulshan Polyols secures incremental 20,825 KL ethanol allocation (₹121 Cr value) under EBPP—bolstered by India’s ethanol blending targets (E20+).

- Sector Networking & Innovation: Indo US Bio-Tech/Kaveri Seeds active in events (APSA Seed Congress, AGMs)—highlighting hybrid seeds/R&D push amid rising farm mechanization.

- Compliance Wins: Chaman Lal Setia gets NSE/BSE fine waivers (₹2.28L)—easing regulatory pressures.

Headwinds (Challenges)

- Governance & Leadership Transitions: Multiple director resignations/investigations—KRBL (Anil Kumar Chaudhary; no financial irregularities but process gaps), GRM (Raj Kumar Garg; health reasons). Signals potential internal reviews, distracting from ops.

- Shareholder Compliance Burden: Gujarat Ambuja/Sanstar emphasize KYC/demat reminders for physical shares (PAN-Aadhaar link, bank details mandatory post-Apr 2024)—risking dividend delays/unpaid finals (e.g., ₹0.25/share).

- Operational Delays: Trualt Bioenergy postpones investor meets—may erode sentiment in bioenergy/ethanol niche.

- Subsidiary Maturity Risks: New entities (e.g., LT Hungary, Sarveshwar US) are nascent (low/no turnover), with unreviewed financials in GRM’s consol results adding opacity.

Growth Prospects

- High Potential in Exports/Diversification: Rice majors (GRM, LT, KRBL) eye Europe/US amid premium basmati demand; oleo/ethanol (Mangalam, Gulshan) tap industrial uses. Seeds (Kaveri/Indo US) benefit from R&D/hybrids for yield boost.

- Capital Infusion: GRM’s bonus/capital raise (₹45 Cr auth.) + warrants conversion funds scaling. Ethanol ESY 24-25 allocations could sustain ₹3,600+ Cr orders.

- Organic/Processed Foods Boom: New subs focus on holding/trading (Hungary/US) for efficiency; GRM’s 10X/Organic brands position for premium segments.

- Projected Trajectory: Sector revenue stable/growing 5-10% YoY (GRM exemplar); global events/AGMs signal 15-20% export-led CAGR potential through FY27, driven by PLI schemes/ethanol mandates.

Key Risks

- Regulatory/Compliance: KYC non-compliance blocks dividends/transfers (physical shares ~legacy issue); SEBI fines/waivers highlight vigilance needs. | Governance/Execution: Director exits (KRBL/GRM) + unreviewed subs (GRM: ₹1,000+ Cr revenue from unreviewed entities) pose audit risks.

- Financial/Operational: High inventories/receivables (GRM: ₹53K Cr ARs), forex exposure (intl subs), commodity volatility (rice/oil prices).

- Market/External: Ethanol dependency on OMCs; delays in subs ops (e.g., Mangalam oleo yet to start); no major irregularities but KRBL’s probe underscores process risks.

- Mitigants: Strong balance sheets (GRM equity ₹478 Cr), audited cores, diversified segments (food/oil/others).

Overall Outlook: Positive with Caution. Tailwinds from expansion/govt policy outweigh headwinds; growth prospects strong (10-15% sector CAGR) via exports/R&D. Risks manageable via compliance/governance fixes—watch GRM/KRBL for peer cues. Sector resilient amid India’s agro-export push (~$50 Bn target).

Investor

asof: 2025-12-02

Summary Analysis: Indian Other Agricultural Products Sector

(Based on filings from rice processors (LT Foods, KRBL, GRM Overseas, Chaman Lal Setia, Sarveshwar Foods), starch/ethanol/bioenergy players (Trualt Bioenergy, Sukhjit Starch, Sanstar), and seeds (Nath Bio-Genes). Sector includes rice milling/exports, maize starch, ethanol/CBG/SAF, organic/FMCG staples, and hybrid seeds. Focus: FY25/Q2FY26 performance amid maize/rice volatility, policy shifts, and diversification trends.)

Headwinds (Challenges Constraining Near-Term Performance)

- Revenue Pressure & Capacity Constraints: Trualt reported 26% YoY H1 revenue decline (₹418 Cr) due to strategic plant shutdowns for multi-feed ethanol upgrades (1,300 KLPD). Sukhjit saw Q2 revenue drop 15% QoQ (₹313 Cr) from GST rationalization pauses and defensive sales amid weak demand.

- Commodity Volatility & Input Costs: Maize prices softened (₹19-20/ton farmyard vs. ₹22-23 prior; Sukhjit), but earlier spikes hurt margins. Ethanol oversupply (1,800 CrL offered vs. 1,250 CrL demand; Trualt) and low Karnataka allocations squeezed volumes.

- Demand Softness: FMCG/textile slowdowns (Sukhjit); regulated cotton sales dipped (Nath: 11.35L packets, minor YoY decline due to production constraints).

- Operational Inefficiencies: Higher finance/depreciation from expansions (Trualt H1: ₹76 Cr finance cost, up 11%); inventory buildup for FY26 (Nath debtor days at 89).

Tailwinds (Positive Structural/Supportive Factors)

- Cost Moderation: Maize softening aids starch/ethanol margins (Sukhjit expects H2 recovery; GRM EBITDA margins stable at 7.7%). Bagasse power shift saved Trualt ₹19-20 Cr in Q2 other expenses.

- Policy & Subsidy Support: Bharat Rice Scheme supplier (Sarveshwar); NAFED export bids (~₹50 Cr; Sarveshwar). GI tag for J&K Basmati boosts premiums (Sarveshwar).

- Diversification Gains: CBG surged 65% YoY (Trualt: ₹21 Cr H1 revenue, 68% EBITDA margin). Nath’s non-cotton/paddy (NCP) at 48% revenue (up from 43%, +38% YoY). GRM domestic FMCG at ₹539 Cr (+huge YoY).

- Export Resilience: GRM top-5 basmati exporter (₹783 Cr standalone); steady global demand despite competition.

Growth Prospects (High-Potential Opportunities)

- Volume & Premiumization: Nath targets 15% revenue CAGR (₹500 Cr in 2 yrs, ₹1,000 Cr long-term) via hybrids (paddy hybrids: 38% value share). GRM eyes ₹2,000 Cr domestic FY28 (FMCG house-of-brands). Sukhjit H2 recovery via exports.

- New Verticals: Trualt’s CBG (16 plants planned, 60% EBITDA), SAF (₹2,250 Cr MOU, 19% IRR), retail fuel (13 outlets). Sarveshwar FMCG/organic (Nimbark stores). GRM 10X Ventures (₹200 Cr acquisitions, e.g., Rage Coffee).

- International Expansion: Nath JVs (Uzbekistan: 600 Ha cotton; Philippines BT cotton). GRM own-brands in 42 countries.

- Market Tailwinds: Global rice at $572 Bn by 2030 (4.7% CAGR); organic rice $12 Bn by 2034 (4.1% CAGR). India rice output record 120 MnT (FY25 Kharif).

- Capex/Expansion: GRM ₹136 Cr fundraise; Trualt multi-feed (year-round ops); Nath infra (25K MT storage).

Key Risks (Potential Downside Factors)

- Policy/Regulatory: Ethanol blending delays (20-27%; Trualt), cotton regulation (govt MRP control; Nath), GST/export curbs.

- Commodity/Weather Volatility: Maize/rice price swings; Kharif disruptions (e.g., Nath cotton production shortfall).

- Competition & Execution: Intense rivalry (Kaveri in seeds; Sukhjit starch exports restarting). Hybrid approvals delays (1-2 yrs; Nath).

- Geopolitical/External: Africa instability (Nath); trade barriers (Brazil/US ethanol cheaper).

- Financial/Leverage: High working capital needs (Trualt debt up; GRM D/E 0.9x); inventory risks (Nath 330 Cr).

- Demand/Macro: FMCG slowdowns; urban/rural consumption weakness.

Overall Outlook: Sector resilient amid diversification (organic/FMCG/seeds/CBG >40% growth pockets). Tailwinds from maize softening/export policies outweigh headwinds; 10-15% CAGR feasible with premiums/hybrids. Risks policy-tied; monitor ethanol/CBG execution. Strong balance sheets (low debt, cash surpluses) support growth.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.