KPIL

Equity Metrics

January 13, 2026

Kalpataru Projects International Limited

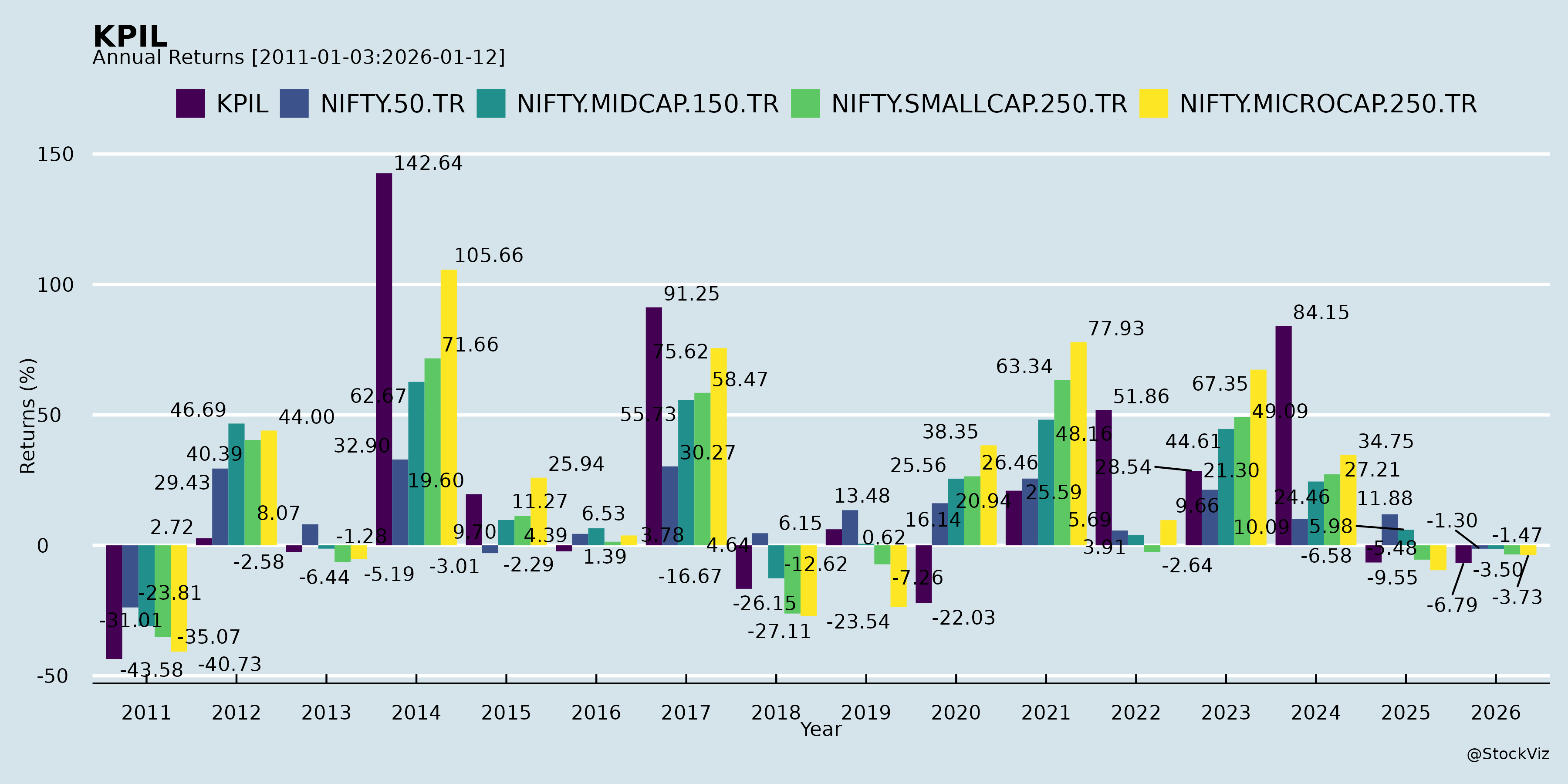

Annual Returns

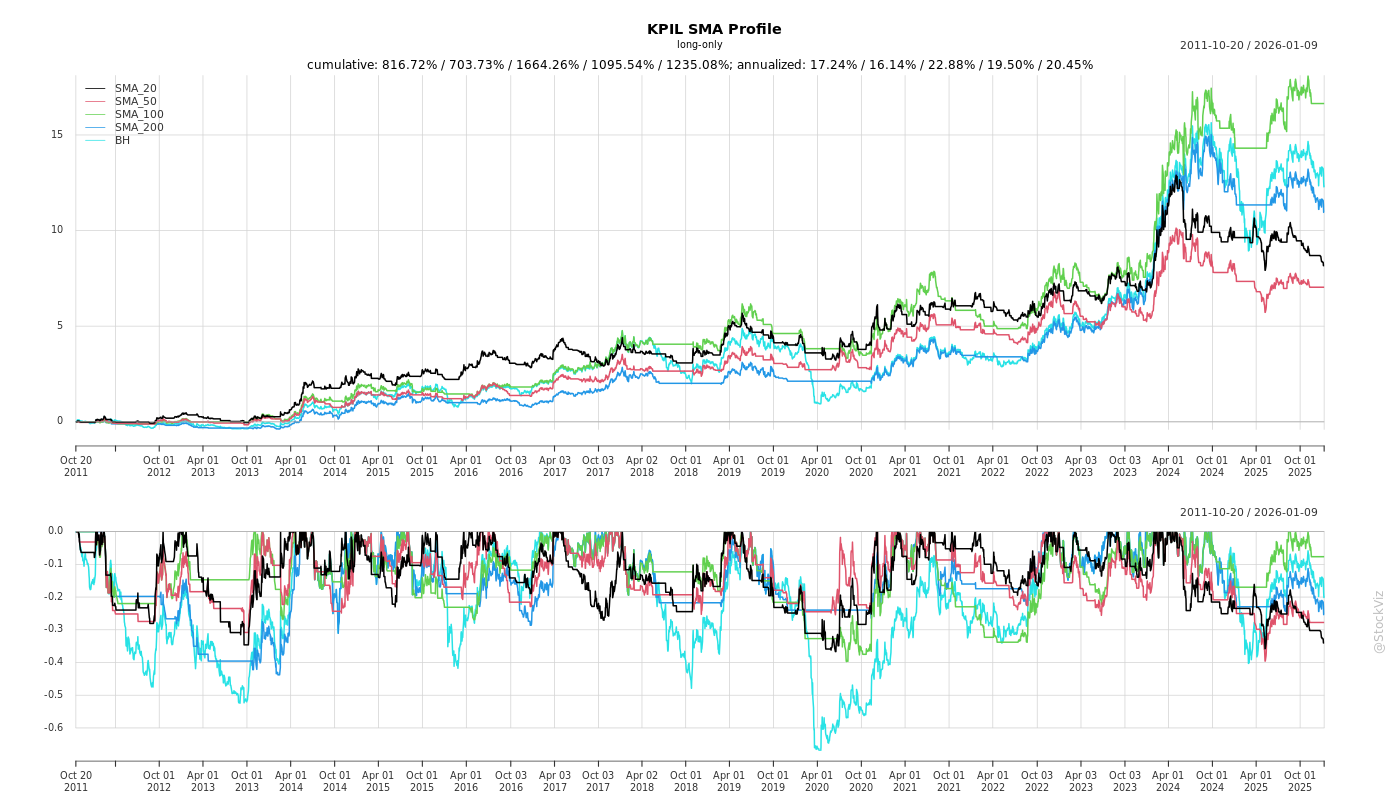

Cumulative Returns and Drawdowns

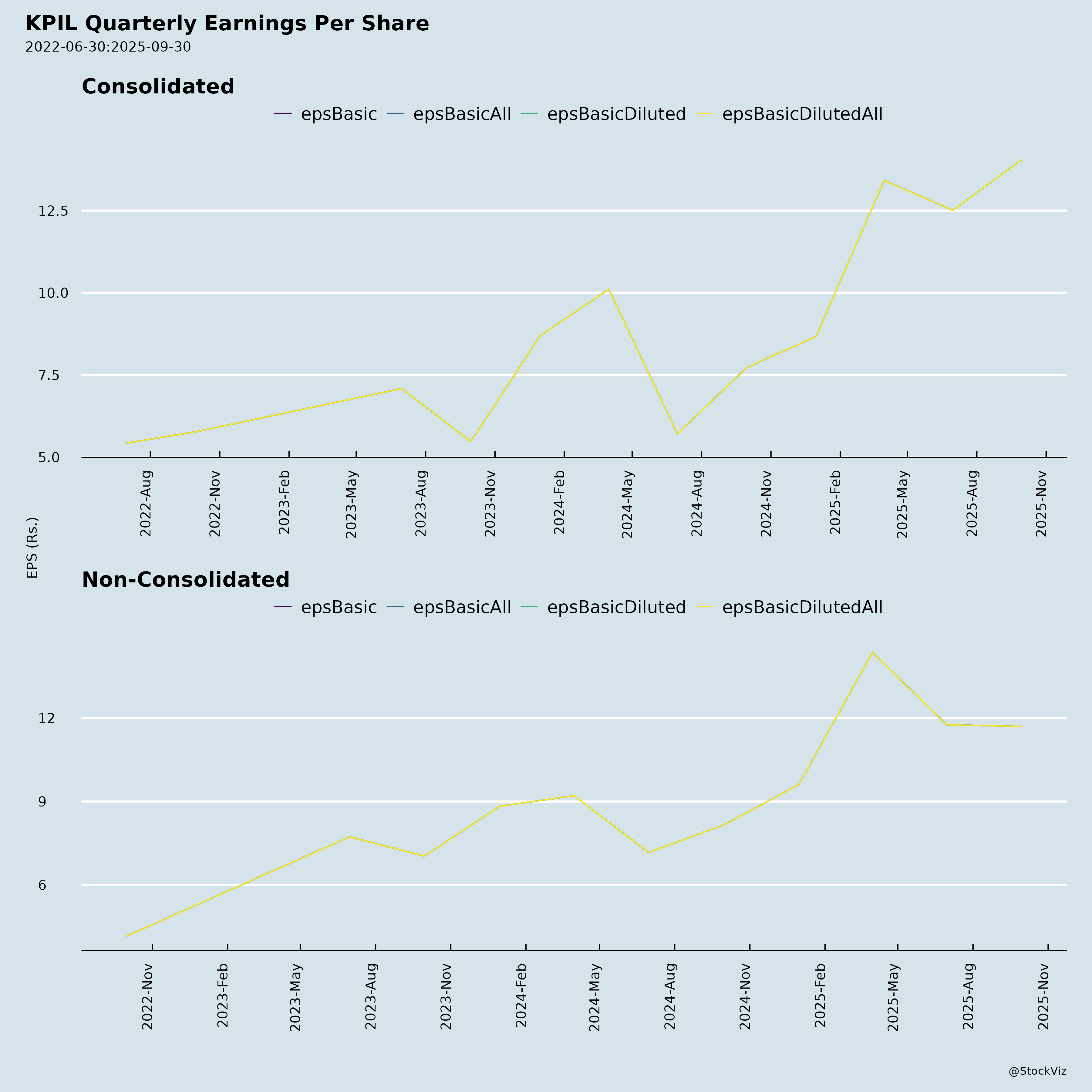

Fundamentals

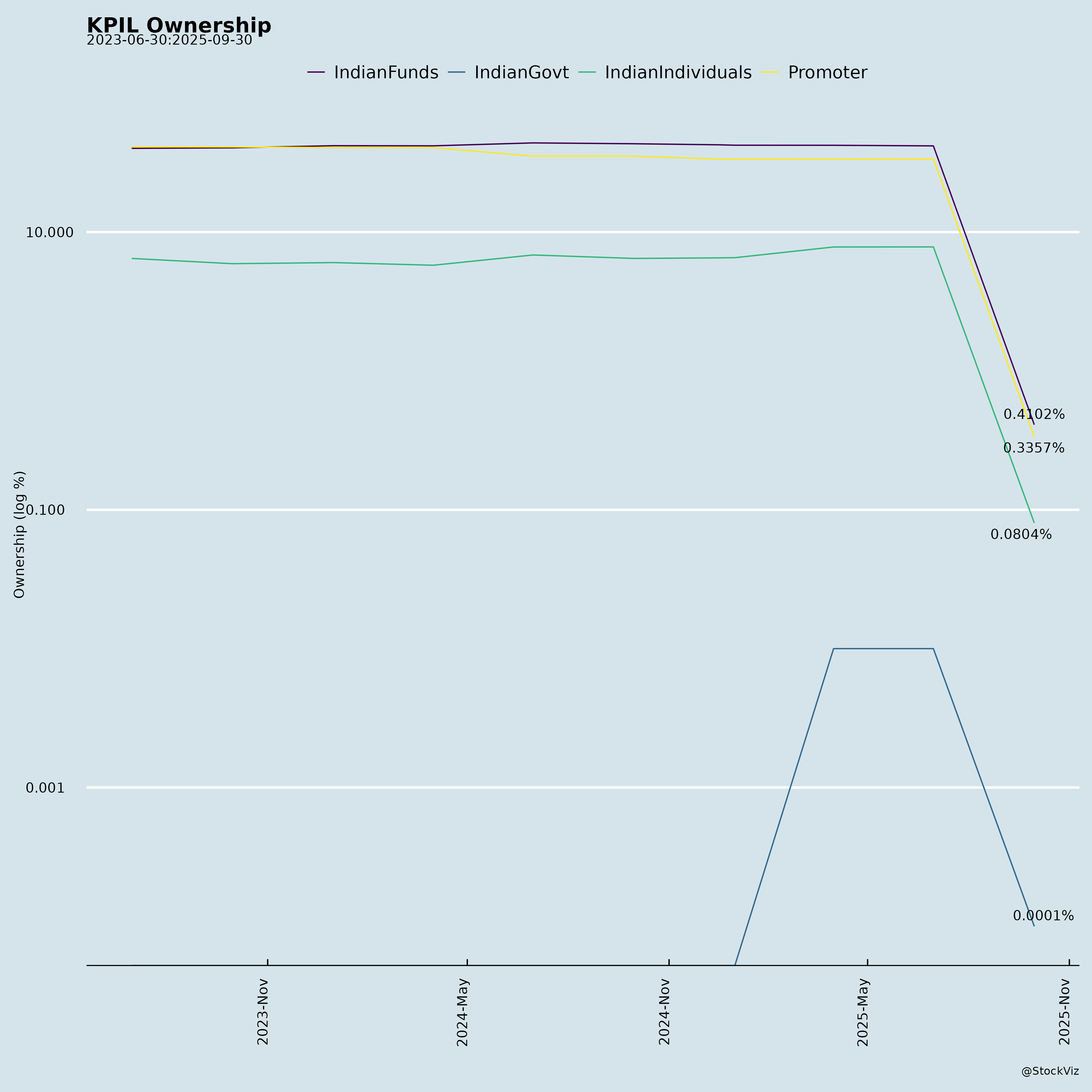

Ownership

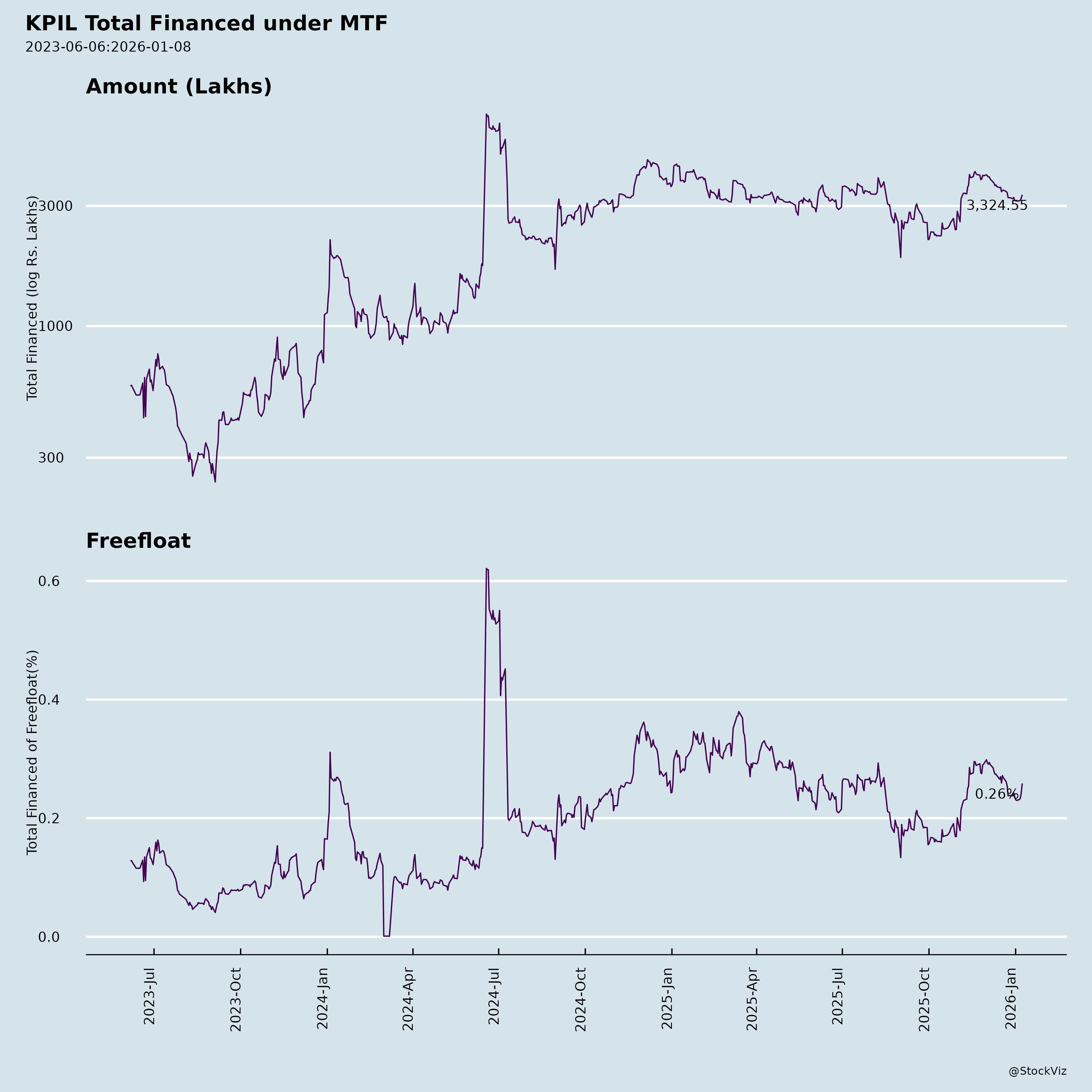

Margined

AI Summary

asof: 2025-12-03

KPIL Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

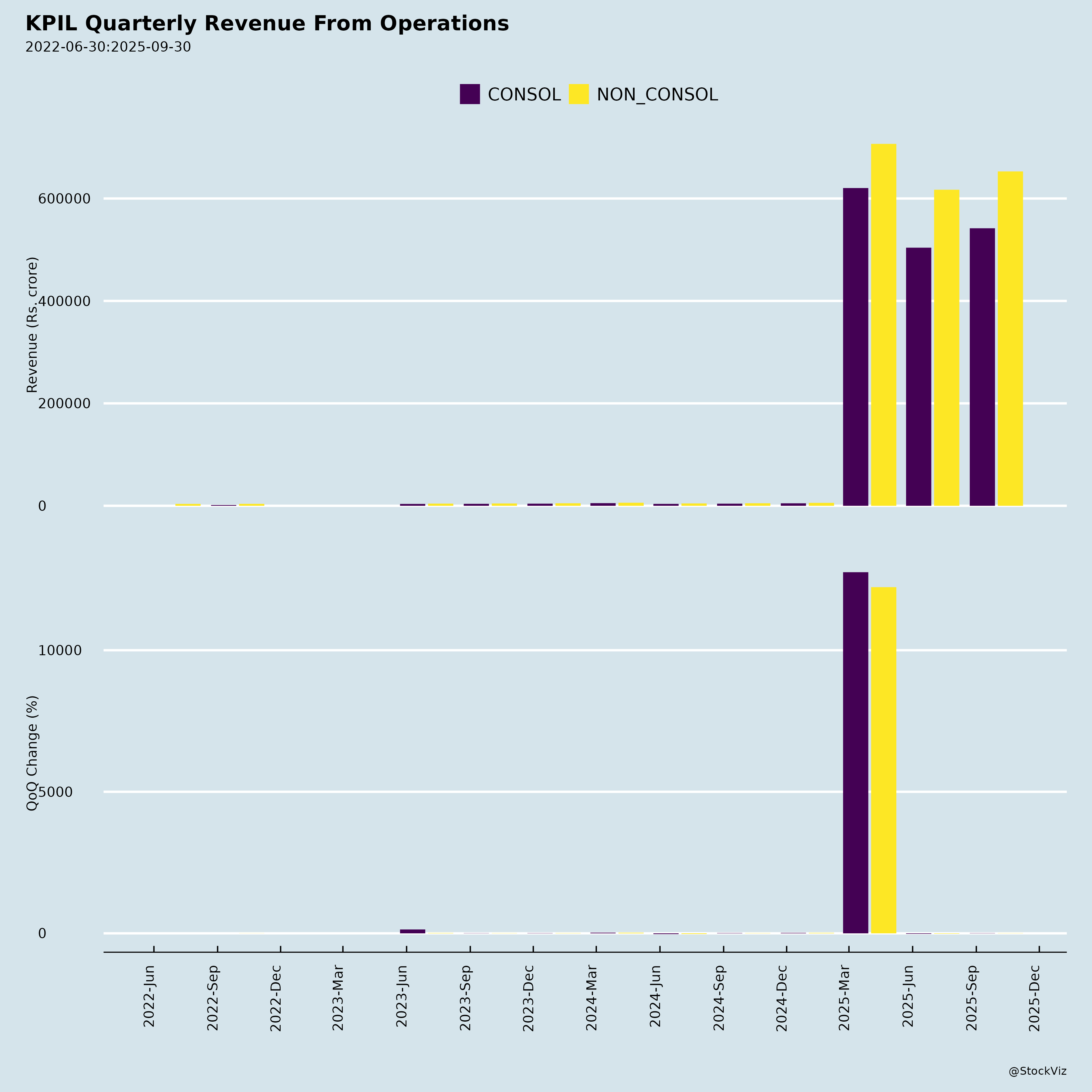

Kalpataru Projects International Limited (KPIL), a leading EPC player in power T&D, buildings & factories (B&F), water, railways, oil & gas, and urban infra, demonstrated robust Q2/H1 FY26 performance with consolidated revenue of ₹12,700 cr (+33% YoY), PAT of ₹451 cr (+115% YoY), and a record order book of ₹64,682 cr. Below is a structured summary based on the provided disclosures (financial results, investor presentation, press releases, and regulatory filings as of Sep 30, 2025).

Tailwinds (Positive Drivers)

- Strong Execution & Revenue Growth: Highest-ever Q2 revenue (₹6,529 cr cons., +32% YoY; ₹5,419 cr standalone, +31% YoY) driven by T&D (+51% YoY), B&F (+20%), Oil & Gas (+21%), and Urban Infra (+65%). Diverse mix (75% international, 25% domestic) mitigates cyclicality.

- Robust Order Book & Inflows: ₹64,682 cr order book (+6% YoY); YTD FY26 inflows ₹14,951 cr (+26% YoY, incl. recent ₹2,332 cr in T&D overseas/B&F India). Favorably placed in ~₹5,000 cr tenders.

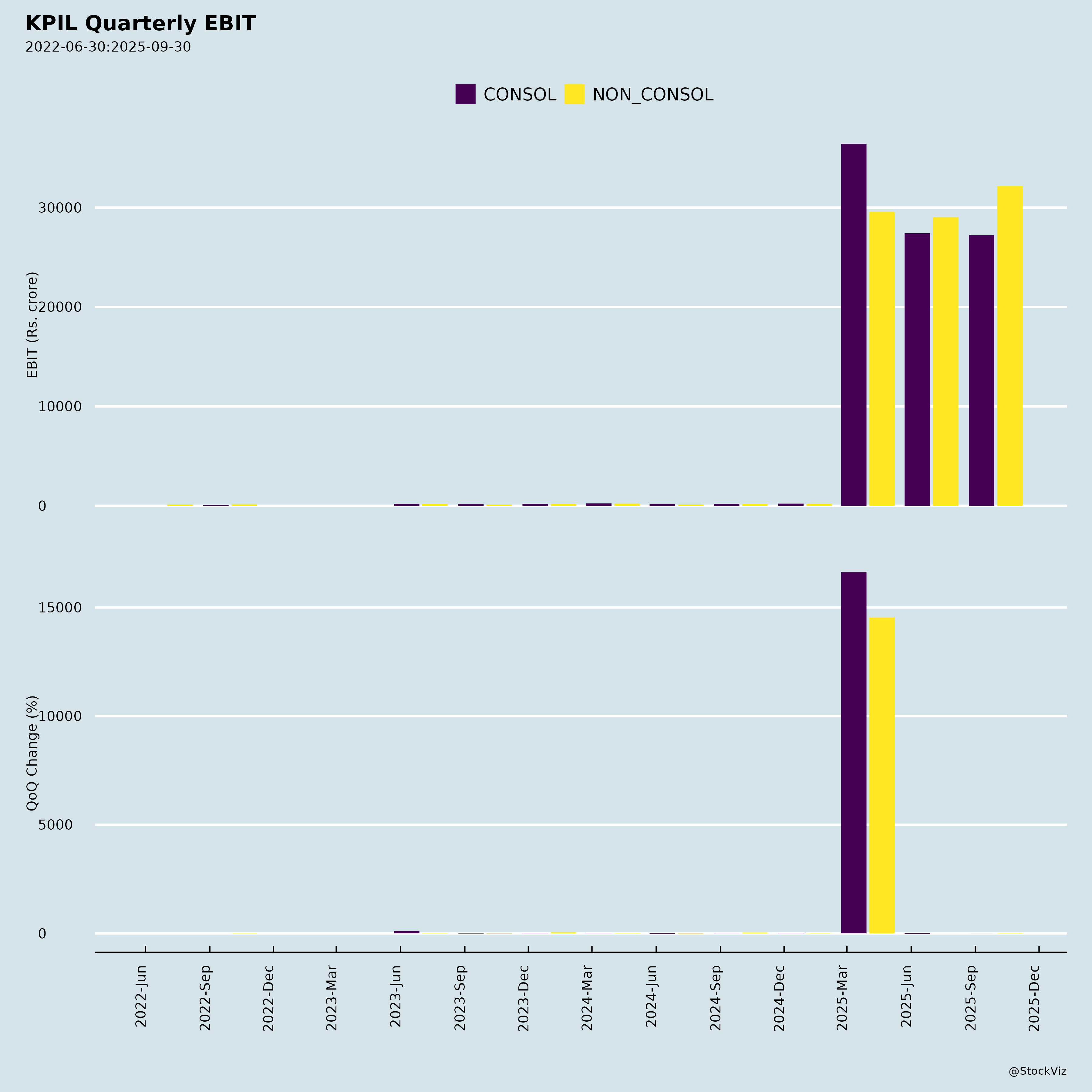

- Margin Expansion & Balance Sheet Strength: Cons. PBT margin +110 bps to 4.9%; standalone NWC days improved to 102 (-16 YoY). Net debt/equity low at 0.29x (standalone)/0.46x (cons.); net debt down 14-22% YoY.

- Subsidiary Performance: LMG Sweden revenue +80% YoY (order book ₹3,623 cr); Fasttel Brazil steady.

- Regulatory Wins: Customs appeal success—83% duty demand (₹83.4 cr) deleted, penalties/interest waived.

- ESG & Capabilities: Carbon-neutral T&D ops; in-house tower manufacturing (240k MTPA); global footprint (75 countries, 30 live projects).

Headwinds (Challenges)

- Segment-Specific Slowdowns: Water revenue -5% YoY due to client fund delays; focus on project closures with prudent WC management.

- Road Assets Drag: WEPL toll termination (handed to NHAI Sep 30, 2025); total road BOOT investment ₹875 cr (net of impairment), with avg. toll revenue +9% YoY but limited growth.

- Moderate EBITDA Margins: Cons. EBITDA margin stable at 8.6% (-30 bps QoQ in Q2), reflecting execution costs in high-growth segments.

- Capex Intensity: ₹2,400 cr capex (FY22-H1 FY26) for equipment, straining short-term cash flows despite improving WC.

Growth Prospects

- High Visibility Pipeline: Strong tendering in T&D (international leadership), B&F (real estate/data centers), and urban infra (metro/HSR). FY26 inflows already ~₹15,000 cr (+25% YoY); capex upcycle in power, renewables, urban mobility.

- Strategic Expansion: International T&D (e.g., LMG/Fasttel), B&F in India (data centers), and diversification into green hydrogen, desalination. VEPL divestment closure expected H2 FY26 for deleveraging.

- Megatrends Alignment: $100 tn global infra need by 2040 (energy transition, urbanization, digital/AI infra, water security). 15% revenue CAGR (FY22-25); targeting sustained 10-15% growth with margin upside via execution efficiencies.

- Order Book Execution: 3-4 yr visibility; 57% T&D, 25% railways, 10% O&G in book supports 20-30% revenue growth in FY26-27.

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Execution & WC | Client payment delays (e.g., water segment); NWC at 90-102 days. | Improving days (-8-16 YoY); focus on closures. |

| Financial/Liabilities | Contingent liabilities (e.g., USD 10 mn counter guarantees extended to Sep 2027 for subsidiary KIOCL); road assets (~₹875 cr exposure). | Low leverage; VEPL sale pending. |

| Regulatory/Tax | Ongoing customs/tax disputes (prior ₹84 cr demand largely resolved). | Strong defense track record. |

| Geopolitical/Intl. | 75% international revenue; exposure to volatile markets (Middle East, Africa, LatAm). | Diversified geography (30 countries); subsidiaries performing well. |

| Competition/Margins | EPC cyclicality; margin pressure from input costs/labor. | Diversification, in-house capabilities; EBITDA stable ~8.4-8.6%. |

| Macro | Infra capex slowdown if govt. spending delays; forex volatility. | Robust domestic/international pipeline. |

Overall Outlook: KPIL is well-positioned for 15-20%+ growth in FY26, fueled by order momentum and balance sheet flexibility. Tailwinds from T&D/B&F dominate headwinds in water/roads. Risks are manageable but warrant monitoring WC and international execution. Stock trades at reasonable multiples given visibility (e.g., Order Backlog/Revenue ~5x). Positive sentiment from Q2 beat and order wins.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.