Civil Construction

Industry Metrics

January 13, 2026

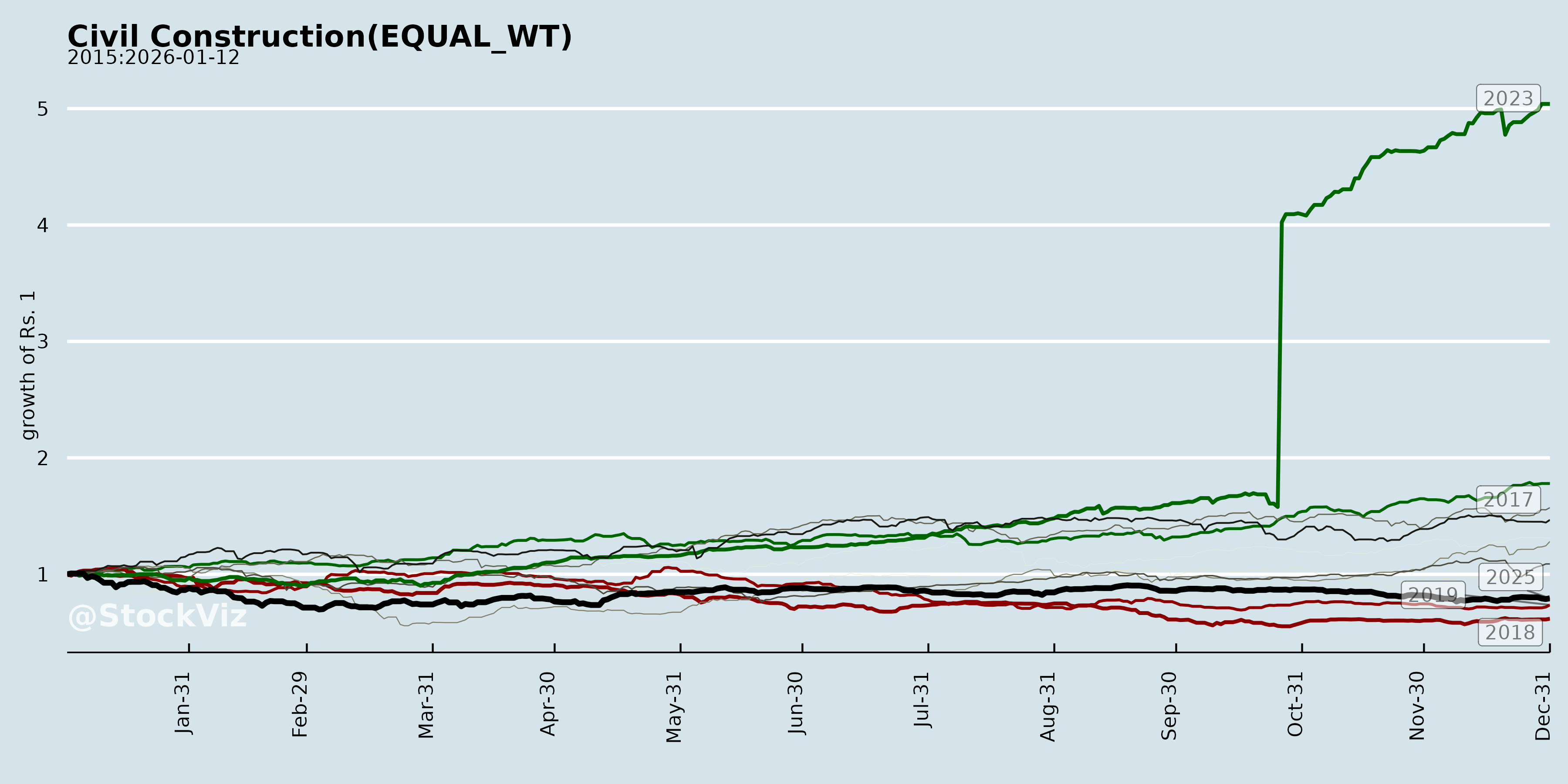

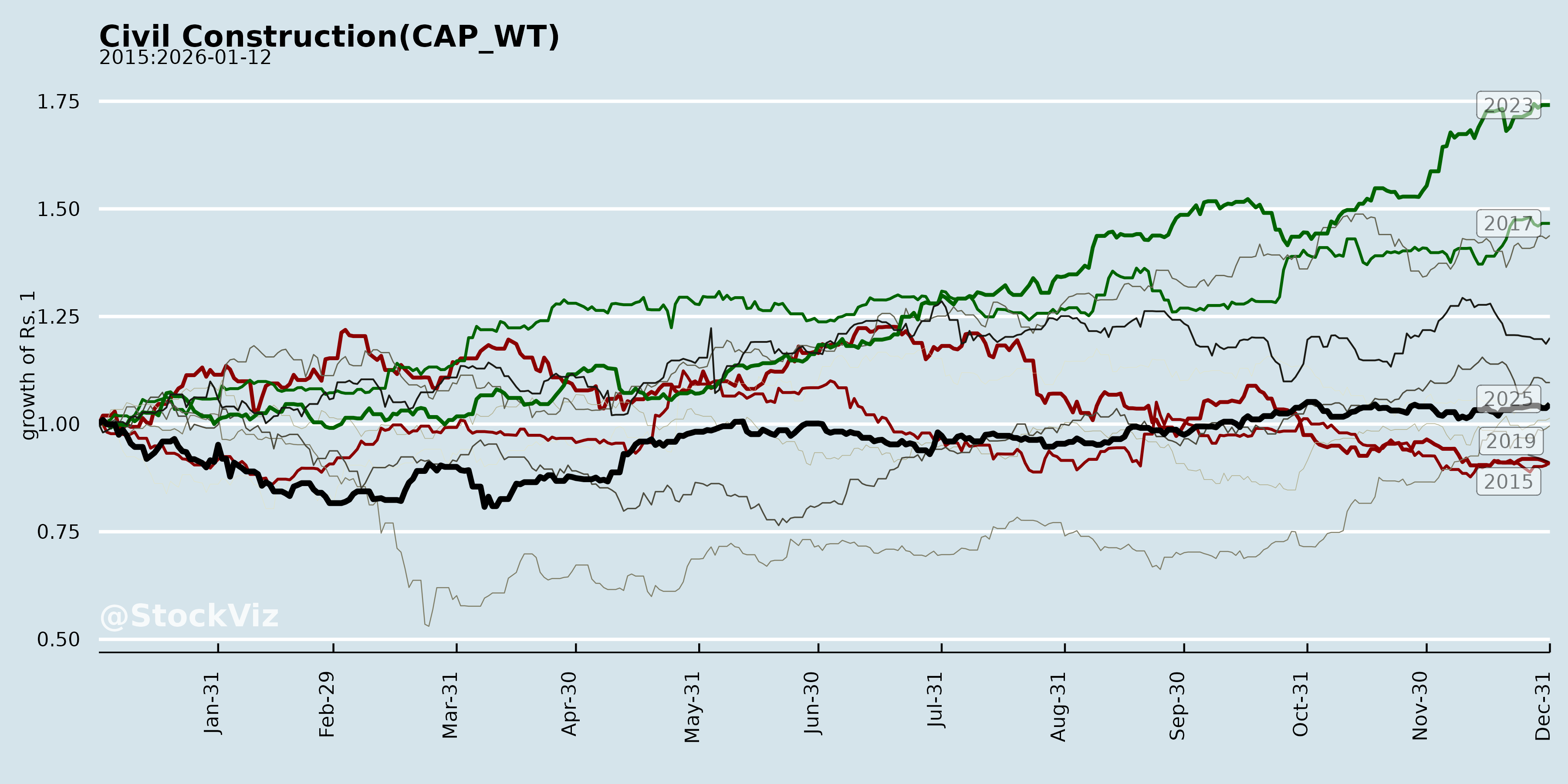

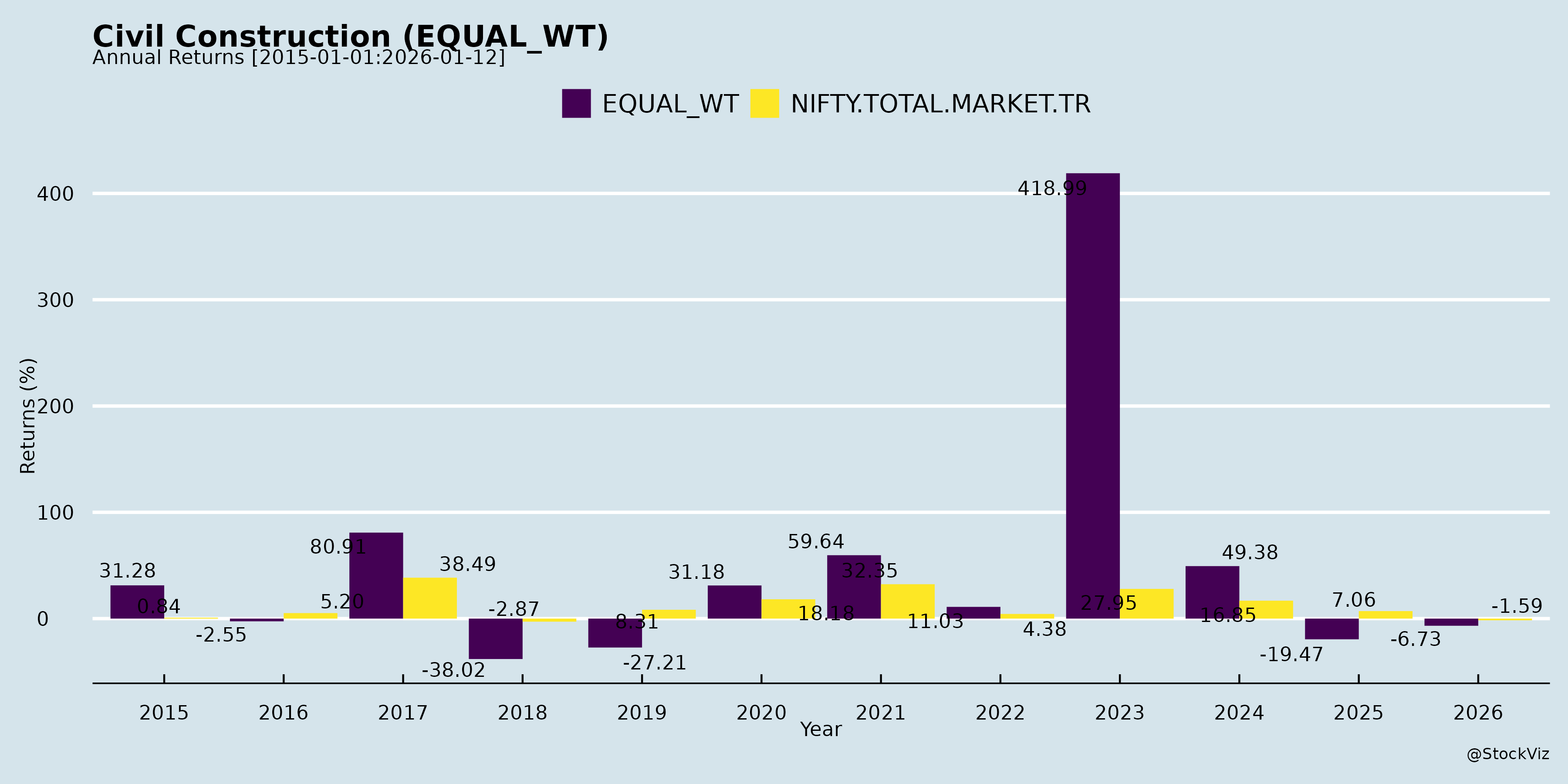

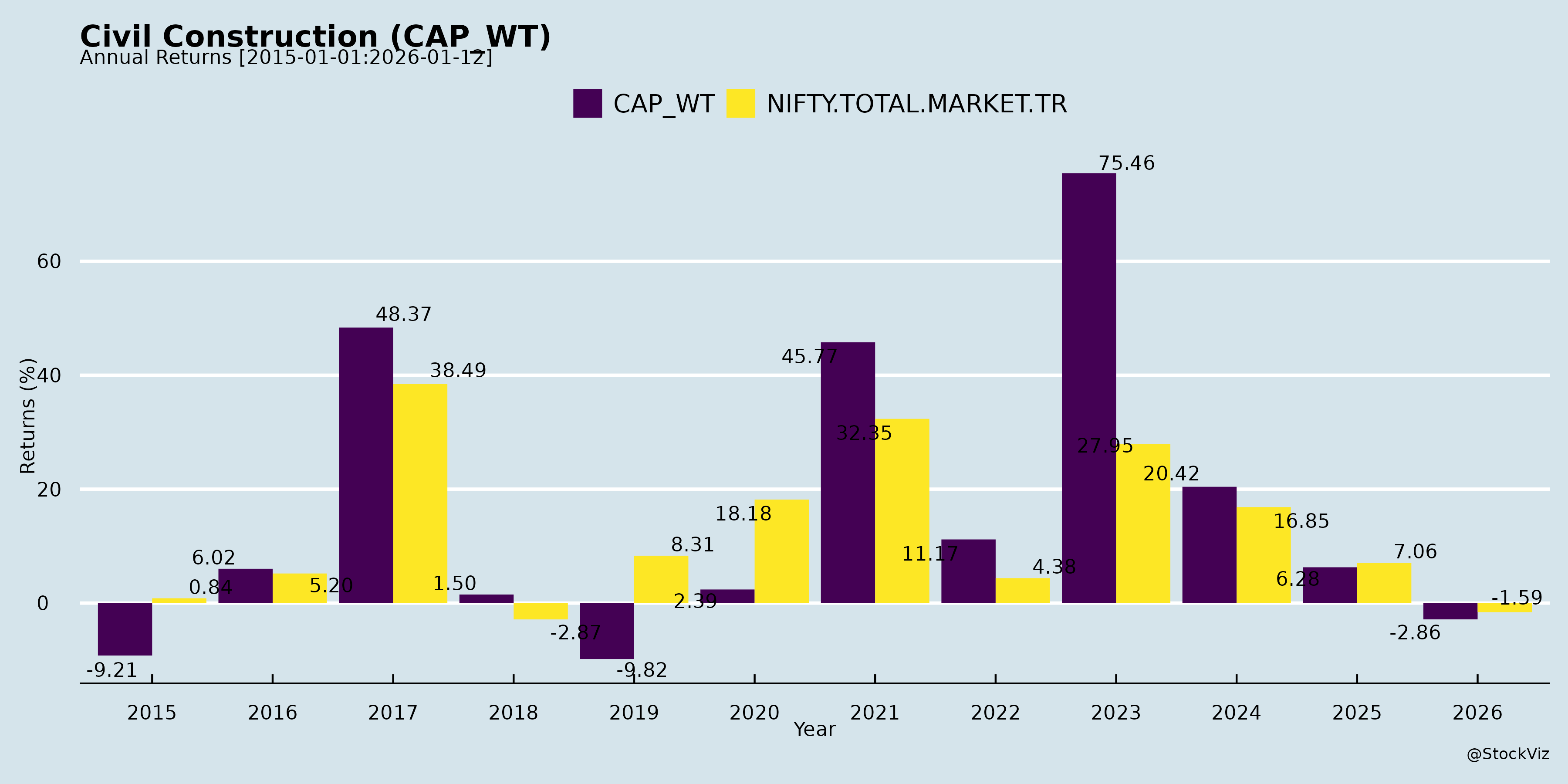

Annual Returns

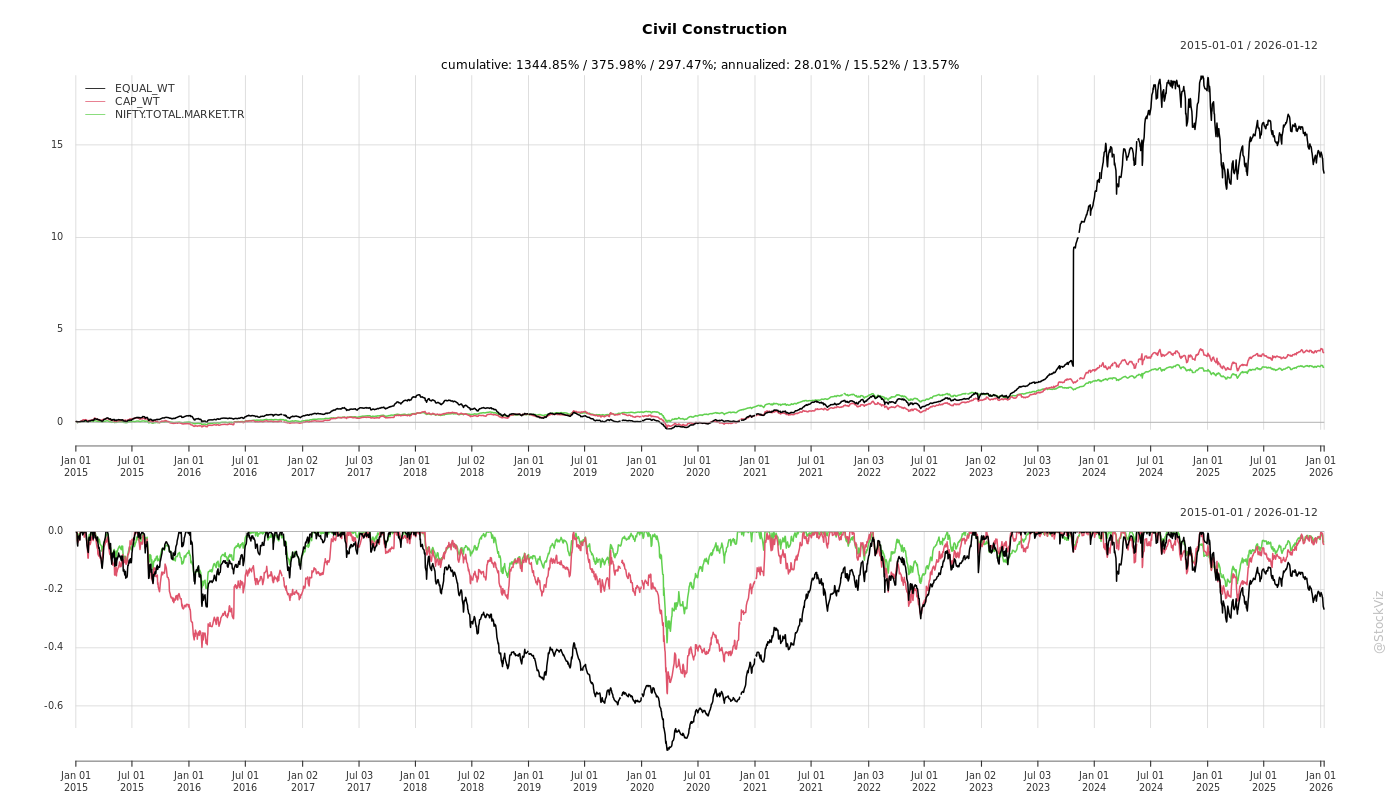

Cumulative Returns and Drawdowns

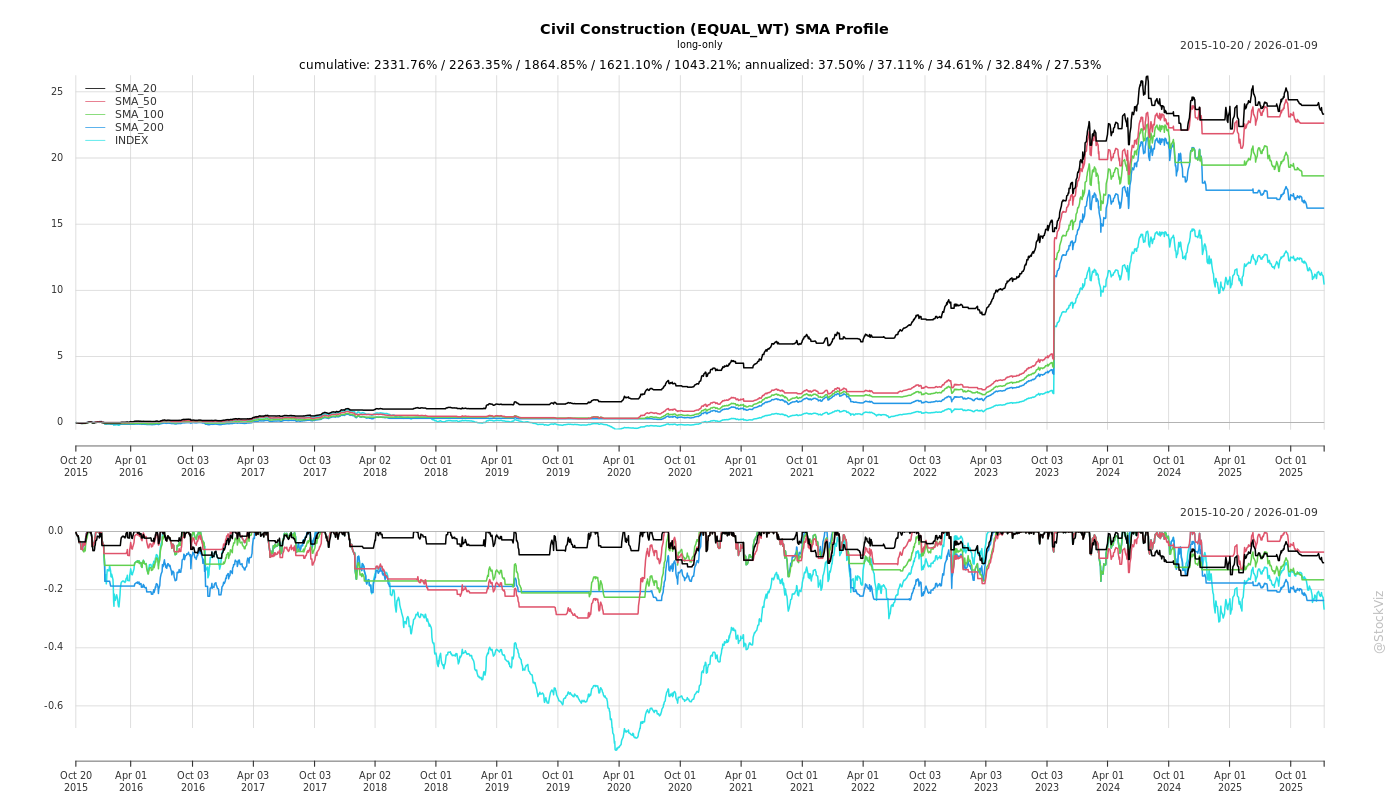

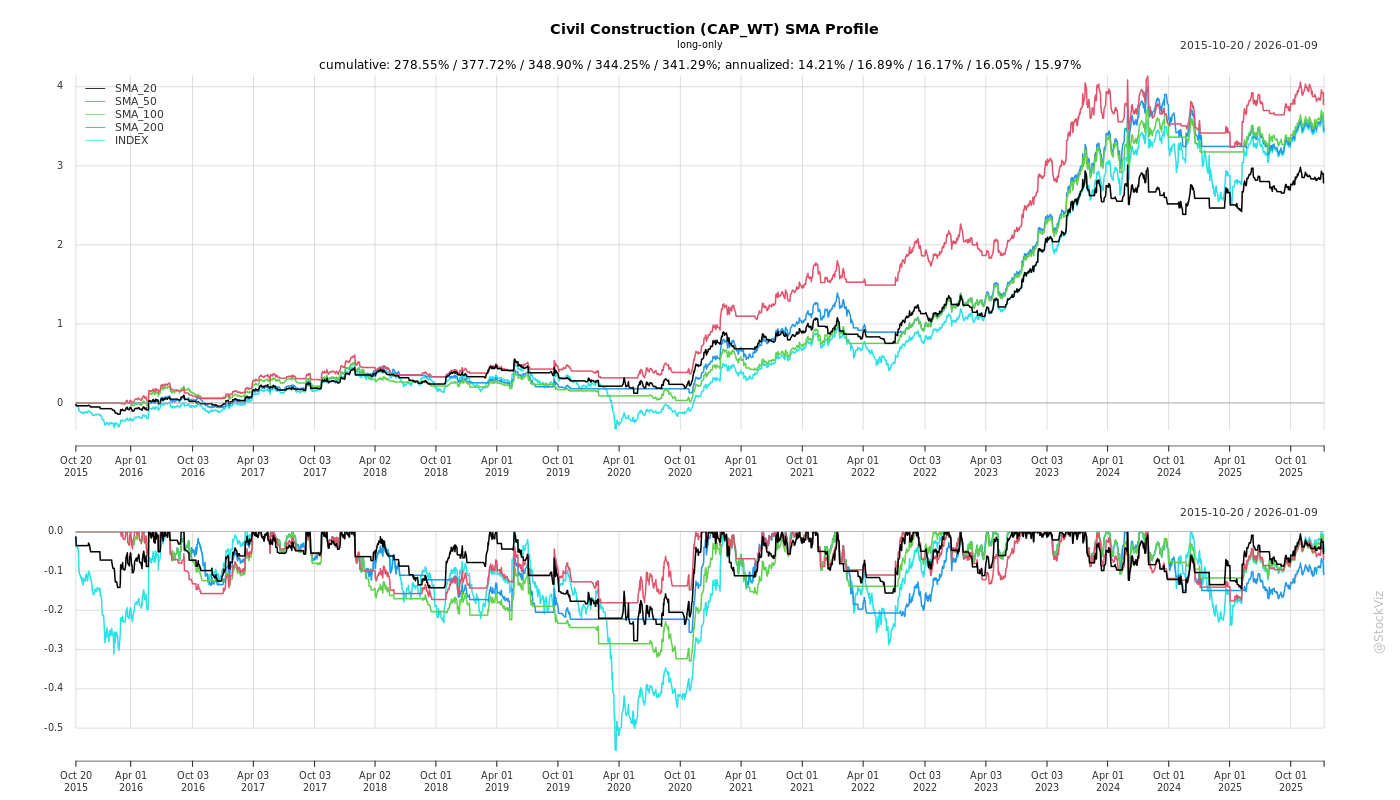

SMA Scenarios

Current Distance from SMA

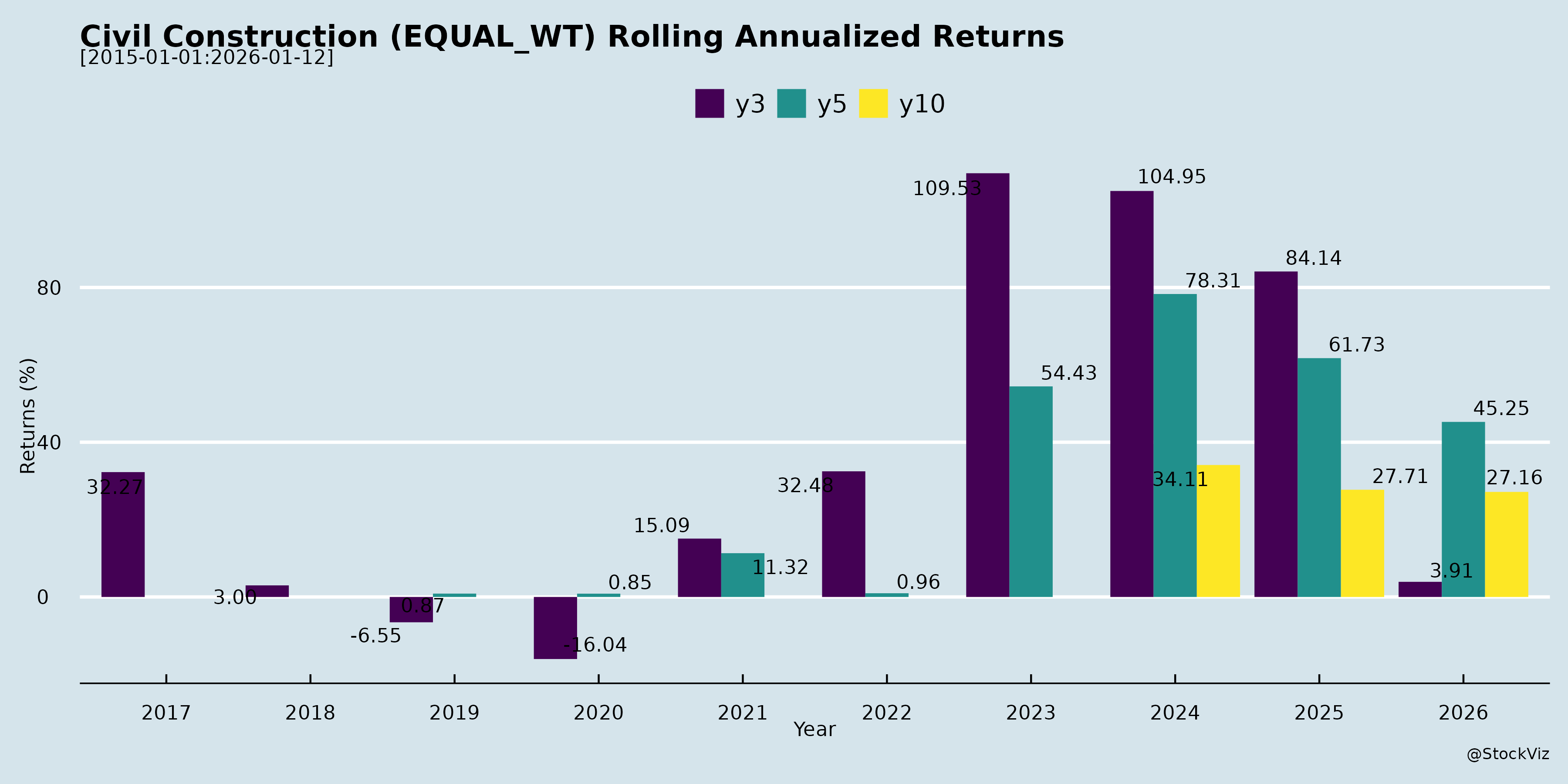

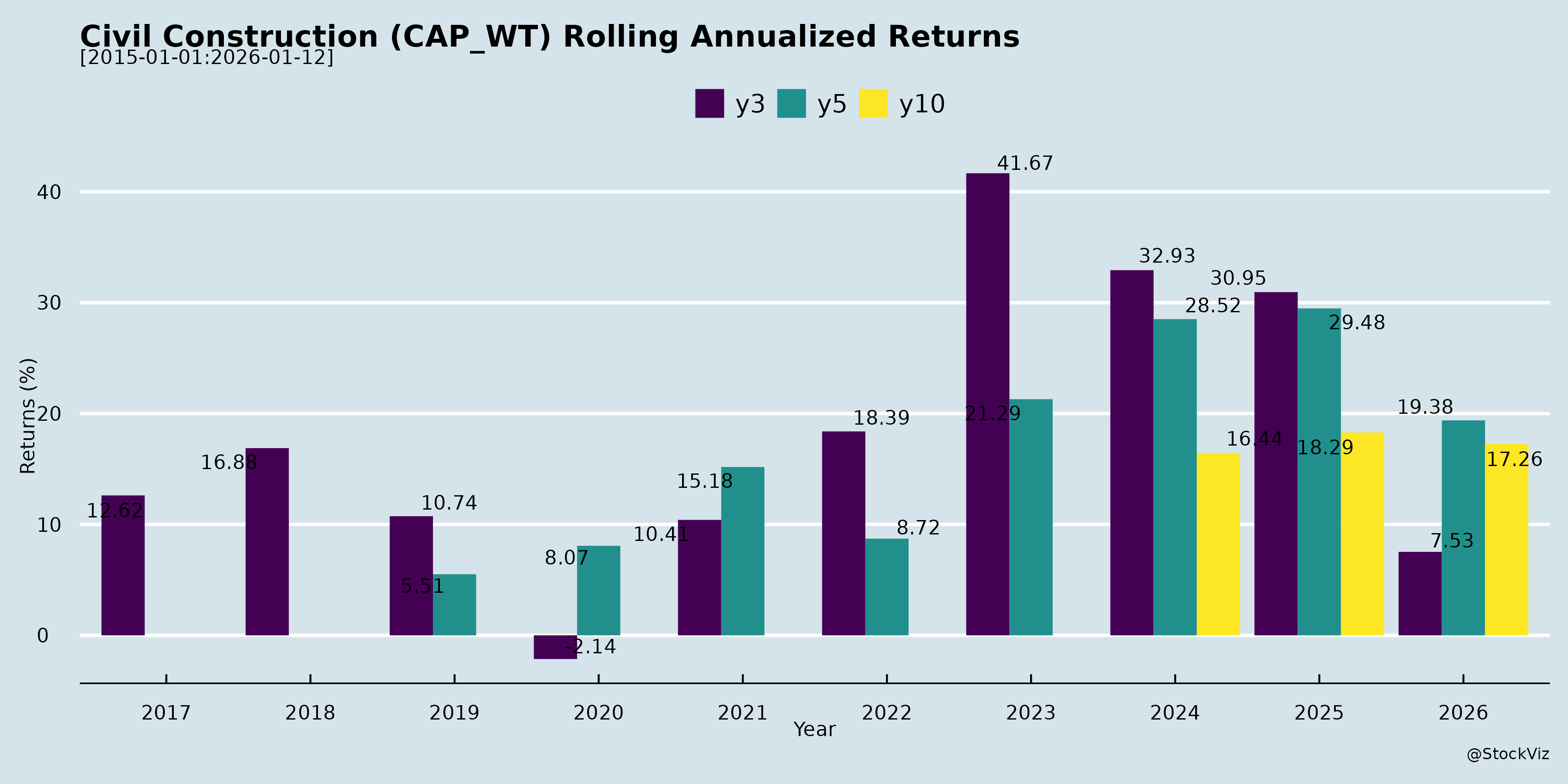

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Analysis of Indian Civil Construction Sector

The provided documents primarily consist of earnings transcripts, regulatory filings, and announcements from key players in the Indian civil construction and infrastructure space (e.g., RVNL, NBCC, IRCON, RITES, Engineers India Ltd. (EIL), L&T, IRB, Kalpataru, KEC, Afcons, Techno Electric, Cemindia). These companies focus on railways, roads, metros, power transmission, engineering consultancy, redevelopment, and EPC projects. The sector benefits from government-led infra push but faces execution and competitive challenges. Below is a structured analysis of tailwinds, headwinds, growth prospects, and key risks, derived directly from the documents.

Tailwinds (Positive Factors)

- Robust Government Capex and Policy Support: Strong emphasis on rail infra (e.g., Rishikesh-Karnaprayag, Bhanupali-Bilaspur in RVNL; IRCON’s rail focus), GPRA redevelopment (NBCC’s Netaji Nagar, Sarojini Nagar), metros, roads (HAM/BOT models), and multimodal logistics. PSUs like RVNL, IRCON, NBCC, RITES highlight flagship projects and stable nomination orders (e.g., RVNL legacy ~43k Cr).

- Diversification into High-Growth Areas: Entry into renewables (solar+BESS, RVNL), O&M (rolling stock, metros), international projects (Maldives harbor in RVNL; EIL’s Africa wins ~1,600 Cr), tunnelling, Vande Bharat (RVNL 10% order book), bio-refineries/coal gasification (EIL), and leasing (RITES).

- Strong Order Books and Inflows: All-time highs across companies (RVNL ~90k Cr; NBCC 128k Cr consolidated; IRCON 23.8k Cr; RITES 9k Cr; EIL 13.1k Cr). H1 inflows solid (RVNL 2k Cr; EIL 3.8k Cr; NBCC 10k Cr). Bidding pipelines ~75-80k Cr (RVNL).

- Margin Stability in Legacy/Consultancy: Higher margins in nomination/consultancy (RITES ~30%; EIL 25%; NBCC PMC 8%+1% marketing). EBITDA guidance maintained (RVNL/IRCON 4-5%; NBCC 6-6.5%; EIL 22-25%).

- Seasonal Execution Pickup: H2 as peak season post-monsoon (RVNL, NBCC, IRCON note Q3/Q4 acceleration).

Headwinds (Challenges)

- Margin Compression from Competitive Bidding: Bid projects (33-50% mix) yield lower margins vs. legacy (RVNL drop to 4-5%; IRCON 0.5-1% hit; NBCC impacted by Amrapali marketing fees). New wins aggressive (IRCON).

- Execution Delays and Seasonality: Monsoon disruptions, elections, land clearances (RVNL roads; NBCC MAHAPREIT/J&K delays). Turnkey revenue lag (RITES young orders 8-10 months old).

- Working Capital Pressure: Negative OCF in H1 (RVNL unbilled revenues); rising employee costs (pay commission in EIL).

- Lower Order Inflows in Spots: H1 softer (RVNL 2k Cr vs. FY25 18k Cr); road sector slowdown (deferred tenders, NHAI strategy shift to HAM/BOT).

- JV/Subsidiary Losses: IRCON CERL losses; NBCC seed money drag; EIL Ramagundam shutdowns (45 days in Q2).

Growth Prospects

- Revenue Guidance: 10-25% YoY (RVNL 21-22k Cr; NBCC 14-15k; IRCON/EIL 25%+; RITES double-digit). H2 ramp-up to meet/exceed FY26 targets; FY27 10-20%+ (RVNL/NBCC).

- Order Inflows: FY26 targets 8-10k+ Cr (RVNL 8-10k; EIL >8k; NBCC 20k+). International traction (RVNL 3.2k Cr; EIL 20-25% mix).

- Sector-Specific Upside: | Sector | Key Highlights | |——–|—————-| | Railways | RVNL/IRCON/RITES order books; Vande Bharat O&M (35 yrs). | | Redevelopment | NBCC GPRA/Amrapali (Phase 2: 17k Cr sales); real estate (Ghitorni 7-8k Cr). | | Roads/Metro | HAM/BOT shift; BharatNet (RVNL 12%). | | Exports/Intl | RITES 1 order/qtr; EIL Africa/MENA. | | New Areas | Renewables, tunnelling leadership (RVNL). |

- Long-Term: 3-5 yr visibility from order books (4-5x FY rev); ROCE via consultancy focus (EIL/RITES).

Key Risks

- Margin Erosion: Aggressive bidding, mix shift to low-margin bids (4-5% EBITDA); pay revision (EIL).

- Execution/External Delays: Monsoon, clearances, elections (roads 1.5 yrs slowdown); J&K/RIICO delays (NBCC).

- Cash Flow/Debt: Negative OCF (RVNL); seed money (NBCC 481 Cr); forex volatility (IRCON intl 4% rev).

- Competition/Geopolitics: High rivalry (roads/rails); intl risks (Bangladesh FX gains but volatility).

- JV/Investment Drag: RFCL losses (EIL Ramagundam); coal JVs breakeven delay (IRCON).

- Policy/Regulatory: NHAI quality focus (blacklisting risk); ethane tariff issues (petchem).

Overall Summary

| Aspect | Outlook | Key Metrics (Aggregated from Cos) |

|---|---|---|

| Tailwinds | Strong | Govt infra boom; Order books 4-5x rev; H2 execution. |

| Headwinds | Moderate | Margins down 1-2%; Execution seasonality. |

| Growth Prospects | High (15-25% FY26) | Rev >FY25 levels; Orders >8k Cr/cos; Diversification. |

| Risks | Medium | Bidding margins (monitor 4-6%); Delays/Cash flow. |

Sector Verdict: Bullish with Cautious Optimism. Infra capex tailwinds dominate, driving 15-20% sector growth in FY26 (led by rails/redevelopment). Monitor H2 execution and bidding margins for sustained profitability. PSUs (RVNL/NBCC/IRCON) offer stability via legacy orders; privates (Kalpataru/KEC) via diversification. Risks mitigated by large pipelines, but cash conversion key.

General

asof: 2025-12-03

Summary Analysis: Indian Civil Construction Sector

Based on the provided documents (primarily L&T’s Q1 FY26 earnings presentation, supplemented by announcements from peers like IRB, NBCC, RVNL, IRCON, Techno Electric, etc.), the Indian civil construction sector exhibits robust momentum driven by government infra spending (e.g., Bharatmala, green energy). L&T’s results (market leader) reflect sector trends: strong order book visibility (₹6.1 Tn, +25% YoY) and execution, but with margin pressures. Peers show steady operations amid routine disclosures (e.g., subsidiary expansions, debt redemptions). Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Supportive Factors)

- Explosive Order Inflows & Backlog: L&T reported ₹945 Bn OI (+33% YoY), led by Infra (44%) and Energy (33%). Order book at ₹6.1 Tn (+25% YoY), with 46% international (Middle East 38%). Peers like IRB highlight HAM/BOT projects (e.g., Vadodara-Mumbai Expressway).

- Revenue Momentum: Group revenue +16% YoY to ₹637 Bn; Energy (+47%), Hi-Tech Manufacturing (+75%). Infra execution strong (e.g., Thane Creek Bridge, Al Khafah Solar).

- Profitability & Efficiency: PAT +30% YoY to ₹36 Bn; ROE (TTM) improved to 17%. Cash flow from ops (ex-FS) swung to +₹62 Bn from -₹14 Bn. NWC improved 380 bps to 10.1%.

- Policy & Govt. Push: Infra boom via renewables, metro (Hyderabad), power (Nabha), green H2 tenders. International expansion (NBCC Dubai sub with RBI nod).

- ESG & Financing: L&T’s green H2 tender win, ESG bond; Kalpataru’s ‘Adequate’ ESG rating. IRB’s InvIT sale (₹513 Cr) aids debt reduction.

Headwinds (Challenges)

- Margin Compression: EBITDA margin dipped to 9.9% (-30 bps) due to revenue mix (higher P&M share), competitive pricing in Hydrocarbon (Energy EBITDA -140 bps). Hi-Tech margins down 230 bps amid early-stage jobs.

- Cost Pressures: MCO expenses +18%, staff costs +14% (hikes, augmentation). Finance costs down but volatile.

- Segment Variability: Hi-Tech OI -49% (deferrals); some sub-segments like CLS revenue -6%. Techno Electric: Project cancellation led to fund reallocation.

- Working Capital & Cash: Despite improvement, Q1 FY26 CFO volatile; net debt/equity up to 0.64.

- Routine Compliances: Dividend unclaims, IEPF transfers (KEC, Engineers India), KYC drives indicate legacy shareholder issues.

Growth Prospects

- Massive Pipeline: L&T’s ₹15 Tn prospects (9 months); Infra ₹8 Tn. Shift to future-ready sectors: Green H2, data centers, semiconductors, offshore wind, SMRs, CCUS.

- International Diversification: 52% revenue international; strong Middle East/USA/Europe bids. NBCC’s UAE sub eyes exports.

- Segment Opportunities: | Segment | Key Drivers | Pipeline/Growth | |———|————-|—————–| | Infra | Buildings, transport, renewables | 42% of OB; metro/power T&D. | | Energy | Hydrocarbon + CLS (BTG packages) | 30% of OB; +>100% OI YoY. | | Hi-Tech Mfg. | LCA wings, precision eng. | Execution ramp-up (+75% rev). | | Services (IT/FS) | LTIMindtree/LTTS growth | +10% rev; data centers. |

- Monetization: IRB’s asset recycling (InvIT sale) model scalable; L&T’s ₹6 Tn OB ensures 3-4 yr visibility.

- Capex Cycle: Govt. infra (Bharatmala Phase I), green transition to fuel multi-year growth (CAGR 15-20% implied by L&T).

Key Risks

- Execution & Cost Overruns: High OB but early-stage jobs pressure margins; L&T disclaimer notes time/cost risks, forex, competition.

- Revenue Mix Volatility: Shift to low-margin EPC (e.g., Hydrocarbon 7.3% EBITDA) vs. services (20%+).

- External Dependencies: Regulatory delays (IRB sale pending approvals); project cancellations (Techno); geopolitical (intl. 46% OB).

- Macro/Financial: Interest rates, fiscal deficits, inflation (staff/MCO up). Net debt/equity rising; JVs volatile (L&T share -₹0.07 Bn).

- Sector-Specific: Competition in bids, policy changes (e.g., HAM viability), unclaimed dividends/IEPF impacting sentiment.

- Disclaimer Risks (L&T): Fluctuations in earnings, skilled labor retention, intl. ops, govt. policies.

Overall Outlook: Strongly Positive with tailwinds from govt. capex/order feast outweighing headwinds. Growth sustained at 15-20%+ via OB execution and green infra shift, but margins key monitorable. Risks mitigated by diversification (intl./segments) and cash generation. Sector poised for FY26 outperformance.

Note: Analysis skewed to L&T (most detailed data); peers confirmatory but less quantitative.

Investor

asof: 2025-12-03

Analysis of Indian Civil Construction Sector

The provided documents consist of earnings call transcripts, regulatory filings, and announcements from key players in the Indian civil construction and infrastructure space (e.g., RVNL, NBCC, IRCON, RITES, Engineers India Ltd. (EIL), L&T, IRB, Kalpataru, KEC, Afcons, Techno Electric, Cemindia). These companies focus on railways, roads, metros, buildings/redevelopment, EPC/LSTK, consultancy/PMC, and exports. The sector benefits from government-led infra push but faces execution and competitive pressures. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, derived directly from the filings.

Headwinds (Challenges Pressuring Performance)

- Margin Compression from Competitive Bidding: Shift from high-margin legacy/nomination orders (e.g., RVNL legacy railways at good margins) to low-margin competitive bids (e.g., RVNL: 30% H1 revenue from bidding projects; margins down to 4-5% vs. prior 5.5-6%). IRCON noted 0.5-1% margin drop; EIL LSTK at 6-7%.

- Execution Delays and Seasonality: Monsoon extensions, elections, land clearances, and statutory approvals delay progress (RVNL, NBCC MAHAPREIT/J&K delayed; IRCON Q3/Q4 pickup expected). Turnkey projects ramp up post-12 months (RITES: 2/3rd order book <1 year old).

- Working Capital and Cash Flow Strain: Negative OCF (RVNL H1 due to unbilled revenue); high debtors/inventory (IRCON). Provisions/write-backs fluctuate (EIL INR 35 Cr reversal from Dangote, net -INR 12 Cr).

- JV/Subsidiary Losses: Coal JVs (RVNL CERL1 losses, breakeven in 18-20 months); Ramagundam Fertilizer (EIL: 45-day Q2 shutdown, H1 losses offset by future INR 500 Cr annual profits).

- International Volatility: Forex gains (IRCON INR 30 Cr) but risks from rupee depreciation and project-specific issues (e.g., Bangladesh Khulna-Mongla).

Tailwinds (Supportive Factors)

- Robust Order Books with Multi-Year Visibility: RVNL INR 90k Cr (4 years execution); NBCC INR 128k Cr (consol.); IRCON INR 23.9k Cr; RITES INR 9.1k Cr; EIL INR 13.1k Cr (all-time high). 60-70% domestic railways/metro focus.

- Government Capex Momentum: Flagship projects (RVNL: Rishikesh-Karnaprayag, Bhanupali-Bilaspur; NBCC: GPRA/Netaji Nagar INR 7k Cr pending award; IRCON railways). Redevelopment (NBCC Amrapali Phase 2 INR 17k Cr sales potential).

- Strong H1 Order Inflows: RVNL INR 2k Cr; NBCC INR 10k Cr H1 (target 20k+ FY26); EIL INR 4k Cr (target 8k+); IRCON INR 4k Cr H1.

- Margin Stabilizers: High-margin streams like consultancy/PMC (RITES 30%; EIL 25%; NBCC 7-8% PAT), exports/leasing (RITES 10-30%), O&M (RVNL Vande Bharat 35 yrs).

- Diversification Gains: HAM/BOT (RVNL roads), solar/storage, multimodal logistics (RVNL 4 parks), international (EIL 40% H1 consultancy overseas).

Growth Prospects

- Revenue Acceleration: FY26 guidance: RVNL INR 21-22k Cr (+flat H1, H2 high double-digit); NBCC INR 14-15k Cr (+37% H1 YoY); EIL +25% (INR 3.8-3.9k Cr annualized); IRCON/RITES INR 10-11k Cr. 10-20% CAGR via H2 execution ramp-up.

- Sector-Specific Upside: | Sector | Key Opportunities | Value Potential | |——–|——————|—————–| | Railways/Metros | Flagships, Vande Bharat (RVNL 10% order book), Kavach signaling (IRCON) | INR 75-80k Cr bidding pipeline (RVNL) | | Redevelopment | GPRA/Sarojini Nagar (NBCC INR 15k Cr pipeline), Amrapali Phase 2 | INR 40k Cr stuck projects starting (HUDCO loans) | | Roads/HAM | Tunneling leadership (RVNL), high-value deferred tenders | INR 8-10k Cr FY26 inflows (RVNL) | | Exports/Intl. | Africa/Middle East (RITES 1 order/qtr; EIL INR 1.6k Cr H1) | 20-25% of inflows; UAE MoUs | | New Areas | Solar/O&M, bio-refinery/coal gasification (EIL), leasing (RITES 100+ locos) | Steady revenue (20-35 yr concessions) |

- EBITDA/PAT Margins: Stabilizing at 4-6.5% (infra EPC) to 20-25% (consultancy); industry std. 4-5% (RVNL). NBCC targets 6-6.5% EBITDA.

- Long-Term: 3-5 yr visibility (order books 2-4 yrs); 10-20% FY27 growth (RVNL/NBCC).

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Execution | Delays (monsoon/clearances), cost overruns (roads lack awards 1.5 yrs) | H2 pickup; young orders maturing FY27 |

| Margins | Competition eroding bids below estimates (IRCON aggressive shift) | Focus high-margin (HAM/O&M/intl.); legacy mix |

| Financial | Negative CF (RVNL), JV losses (Ramagundam stabilization) | Revenue ramp; provisions routine |

| Policy/External | Govt. policy shifts (nomination curbs); NHAI quality focus blacklisting low bidders | Diversification (non-rail 67% RVNL) |

| Geopolitical | Intl. exposure (9-10% order books); forex volatility | Hedging; domestic 90-91% focus |

| Order Dependency | 70% competitive; tender deferrals (roads) | INR 75-80k Cr FY26 pipeline (RVNL) |

Summary

The Indian civil construction sector is poised for robust growth (10-25% FY26 revenue) driven by unprecedented order books (INR 90k-128k Cr across peers) and govt. infra spend (railways/roads/metros/redevelopment), providing 2-4 yr visibility. Tailwinds include diversification (O&M/solar/intl.), H2 execution pickup, and high-margin consultancy (25-30%). However, headwinds like margin pressure (4-6% EPC), competition, and cash strains cap near-term profitability. Growth prospects center on FY27 ramp-up from young orders and new sectors (tunneling/Vande Bharat), targeting 20%+ CAGR. Key risks (execution delays, JV losses) are manageable via domestic focus and policy tailwinds, but sustained competition could erode ROCE. Overall, positive outlook with cautious optimism—strong fundamentals outweigh cyclical pressures. Peers guide surpassing FY25 topline while stabilizing margins at industry norms.

Meeting

asof: 2025-12-03

Indian Civil Construction Sector Analysis (Based on Q2/H1 FY26 Results from Key Players: L&T, RVNL, NBCC, IRB, Kalpataru, KEC, IRCON, Afcons, Cemindia, RITES, Engineers India, Techno Electric)

The sector demonstrates resilience amid govt.-led infra push, with strong order books and revenue growth, but faces execution headwinds from monsoons and claims disputes. Below is a structured summary:

Tailwinds (Positive Drivers)

- Robust Order Inflows & Books: Exceptional momentum—L&T’s H1 inflow up 39% YoY to ₹2.1L Cr (order book ₹6.67L Cr); Afcons ₹32.7k Cr; Cemindia ₹20.6k Cr; Kalpataru growth across EPC. Metro, hydro, highways, renewables dominate (e.g., L&T infra 52% inflow).

- Revenue & Profit Growth: H1 revenue up across board—L&T +13%, NBCC stable, IRB tolls +11%, Cemindia Q2 +9%, Kalpataru +29% YoY. PAT surges: L&T +22%, Cemindia Q2 +49%, Afcons H1 +7%.

- Govt. Capex & Policy Support: Infra focus (India GDP 6.5-7%, NIP/PM Gati Shakti); dividends declared (e.g., IRB 7%, RVNL ₹1.72/share); ratings upgrades (Cemindia CARE A+).

- Diversification & Internationalization: 50-65% int’l revenue (L&T 56%, KEC strong); shift to high-margin areas (data centers, FGDs, smart infra).

Headwinds (Challenges)

- Execution Delays: Extended monsoons slowed progress (L&T infra revenue -1% Q2; Cemindia muted Q2; Afcons/Kalpataru noted weather impacts).

- Margin Pressures: Segment-specific dips (L&T Energy 7.3% vs 8.9%; NBCC real estate impairments); high finance costs (IRCON debt ratios strained).

- Receivables & Claims: Auditor emphasis on overdue claims (Afcons arbitration uncertainties; NBCC ₹4k+ Cr disputes); RVNL AGM voting issues on directors.

- High Base Effect: YoY growth tempered by prior highs (L&T infra +6% despite base).

Growth Prospects

- Order Pipeline: ₹15k Cr+ opportunities (IRB); govt. infra capex ₹11L Cr+ FY26; renewables/metro/hydro boom (L&T 39% inflow; Afcons UG metro 32%).

- Sector Tailwinds: 500GW RE target by 2030 (transmission ₹3.5L Cr); smart metering 25Cr+ units (₹80k Cr); data centers 3GW by 2030.

- Int’l Expansion: ME/Africa focus (L&T 65% Q2 int’l; KEC 41 branches).

- EBITDA Margins: Improving (Afcons 13%; Cemindia 11.1%); debt reduction (Techno debt-free).

Key Risks

- Project/Claims Risks: Arbitrations (Afcons/Kalpataru notes uncertainties; NBCC DVAT/GST demands); delays (monsoons, site issues).

- Receivables Concentration: Govt./PSU heavy (auditor flags recoverability; L&T/NBCC emphasis).

- Forex/Commodity Volatility: Int’l exposure (L&T 54% revenue); input costs.

- Regulatory/Execution: Compliance (env. clearances); geopolitical (Afcons JV risks).

- Liquidity/Debt: Elevated ratios (NBCC 1.09; IRCON AGM concerns).

- Sector-Wide: Slowdown risks if capex slips; competition in bids.

Overall Outlook: Positive—govt. infra ₹11L Cr+ FY26 budget supports 15-20% sector growth; focus on execution/debt mgmt. key. Risks mitigated by strong books (3-4x revenue visibility).

Press Release

asof: 2025-11-29

Summary Analysis: Indian Civil Construction Sector (Based on Provided Announcements)

The provided documents from key players (L&T, NBCC, KPIL, KEC, IRCON, Afcons, Techno Electric, Cemindia, RITES, NCC, Dilip Buildcon, Welspun) highlight a resilient sector buoyed by government capex (e.g., Rs.11.21 lakh Cr infra allocation), strong order books (~Rs.2-3 lakh Cr aggregate across firms), and diversification. However, execution challenges persist. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Robust Order Inflows & Visibility: Aggregate new orders exceed Rs.50,000 Cr YTD (e.g., KPIL Rs.14,951 Cr; Cemindia Rs.6,189 Cr H1; NCC Rs.1,690 Cr; Welspun Rs.3,145 Cr LoA). Order books are strong: KPIL Rs.64,682 Cr; Afcons Rs.32,681 Cr; IRCON Rs.23,865 Cr; Cemindia Rs.20,646 Cr; Welspun Rs.15,600 Cr. This signals 2-3 years of revenue visibility.

- Financial Resilience & Margin Expansion: Many report YoY growth—KPIL (32% revenue, 89% PAT); Cemindia (9% revenue, 49% PAT Q2); Welspun (record 23.9% EBITDA margin); Afcons (6.8% PAT H1). Deleveraging evident (KPIL net debt -14%; Afcons net D/E 0.25x).

- Govt. Push & Policy Support: Make in India (L&T defense licensing), PM Gati Shakti, Bharatmala, Smart Cities, river interlinking (IRCON, Welspun). MoUs/partnerships (NBCC-RIICO Rs.3,700 Cr; RITES-APEDB).

- Diversification: Entry into high-growth areas—data centers (Techno Electric USD 1 Bn plan), defense (L&T BvS10), water (Welspun 910 MLD plant), InvITs (Dilip Buildcon Rs.400 Cr raise).

- Execution Efficiency: Improvements in working capital (KPIL 90 days), credit upgrades (Cemindia CARE/ICRA A+).

Headwinds (Challenges)

- Revenue Pressure in Segments: Declines noted—Welspun (-7% H1 revenue); IRCON (-17% Q2 revenue, -11% H1 PAT); Afcons (modest 3.4% H1 growth, Q2 flat). Extended monsoons slowed execution (Afcons).

- Client-Specific Issues: KEC’s PGCIL letter (4% YTD orders from PGCIL vs. 27% prior year); no material impact claimed, but highlights client concentration risks.

- Margin Volatility: EBITDA margins vary (IRCON 14.1% Q2 down from prior); subcontracting/ material costs up in some (Cemindia).

- Seasonal/External Factors: Monsoons, geopolitical disruptions (L&T notes supply resilience needs).

Growth Prospects

- High Tender Pipeline: KEC Rs.1.8 lakh Cr pipeline + Rs.4,000 Cr L1; KPIL favorably placed Rs.5,000 Cr. Focus on HAM/BOT roads, metro (Afcons 32% urban infra), water/desalination (Welspun treating 70% Mumbai water soon).

- Sector Expansion: T&D (KPIL 32% growth), railways/highways (IRCON Rs.17,952 Cr rail book), marine/ports (Afcons), edge data centers (Techno-RailTel 102 sites), defense localization.

- Monetization & Capital Recycling: InvITs (Dilip Buildcon eyes Rs.20-30k Cr portfolio); asset sales for deleveraging.

- Capex Tailwinds: Infra budget, urbanization (Smart Cities, NaMo Bharat), exports (L&T BvS10 Asia first). 20-30% YoY order growth potential; firms guide Rs.4,000 Cr+ revenue (Welspun).

- International/Adjacent Plays: 30+ countries (KPIL), renewables, tunnelling.

Key Risks

- Execution & Delays: Weather (monsoons), complex terrain (Afcons hydro/metro), geopolitical supply disruptions (L&T).

- Client/Govt. Concentration: Heavy reliance on PSUs (PGCIL-like issues for KEC; 15% PGCIL in KEC book).

- Financial Leverage: Rising debt in some (Welspun gross debt Rs.1,731 Cr); working capital cycles (90-102 days).

- Competition & Bidding: L1 risks, tender cancellations; selective bidding needed (Welspun).

- Macro Risks: Inflation (materials/subcontracting), policy changes, forex (international ops).

- Regulatory/Compliance: SEBI scrutiny (InvITs), credit ratings tied to execution.

Overall Outlook: Bullish with cautious optimism. Sector poised for 15-25% growth (revenue/EBITDA) on govt. capex, but Q3 execution critical. Focus on diversification, deleveraging, and BOT/HAM to mitigate cyclicality. Aggregate order book/revenue ratios suggest sustained 20%+ CAGR potential through FY27.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.