KPIGREEN

Equity Metrics

January 13, 2026

KPI Green Energy Limited

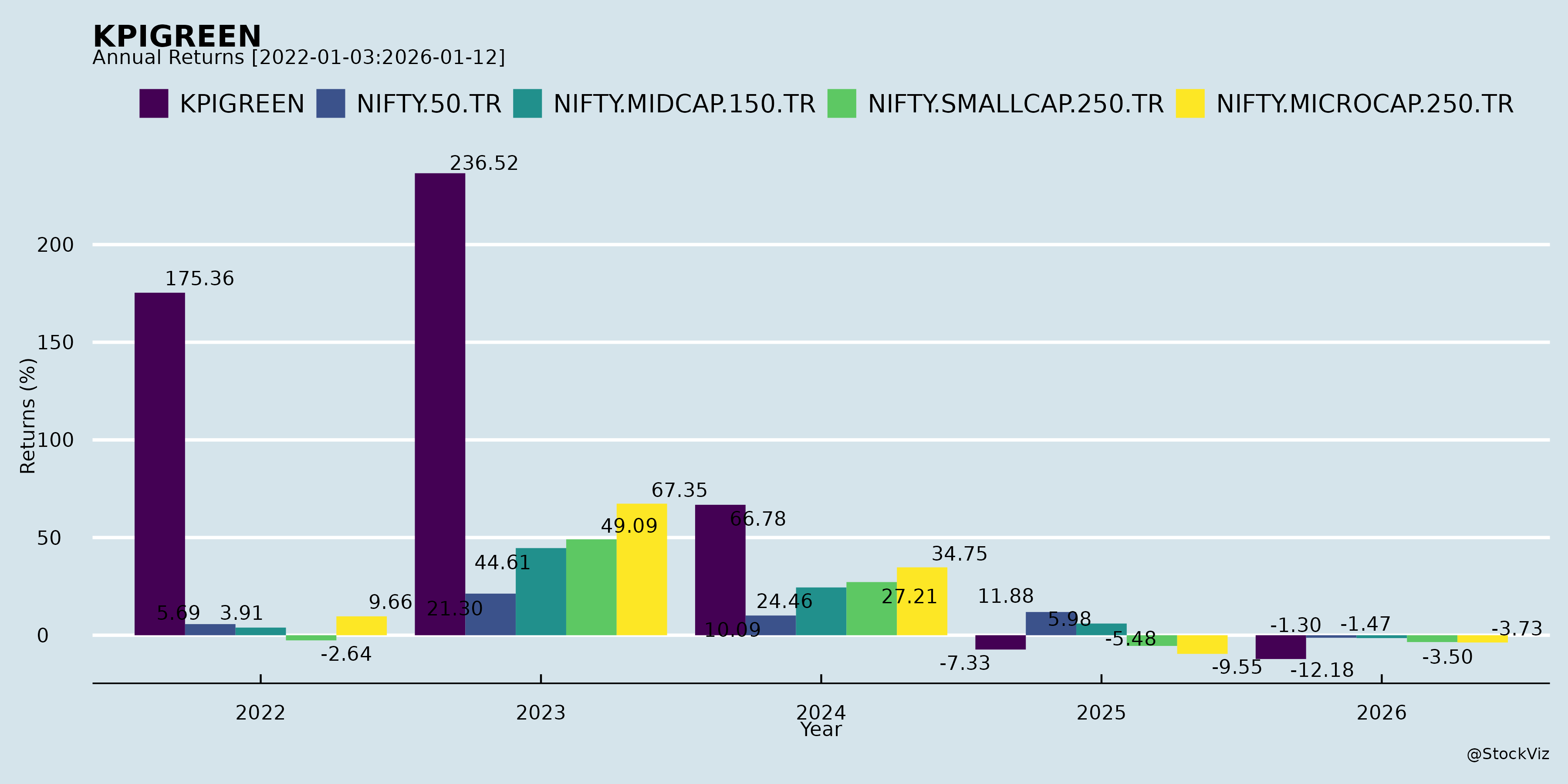

Annual Returns

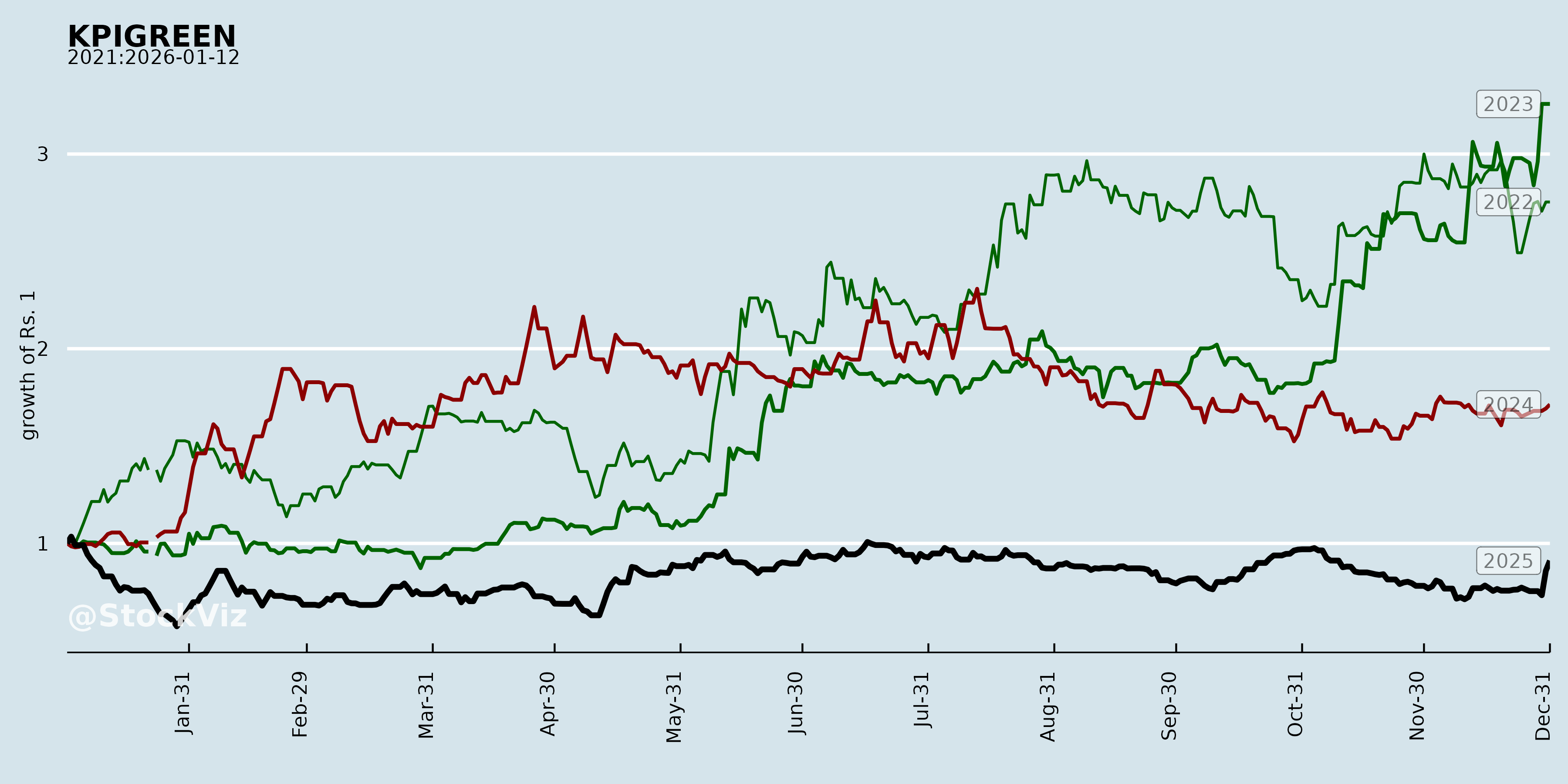

Cumulative Returns and Drawdowns

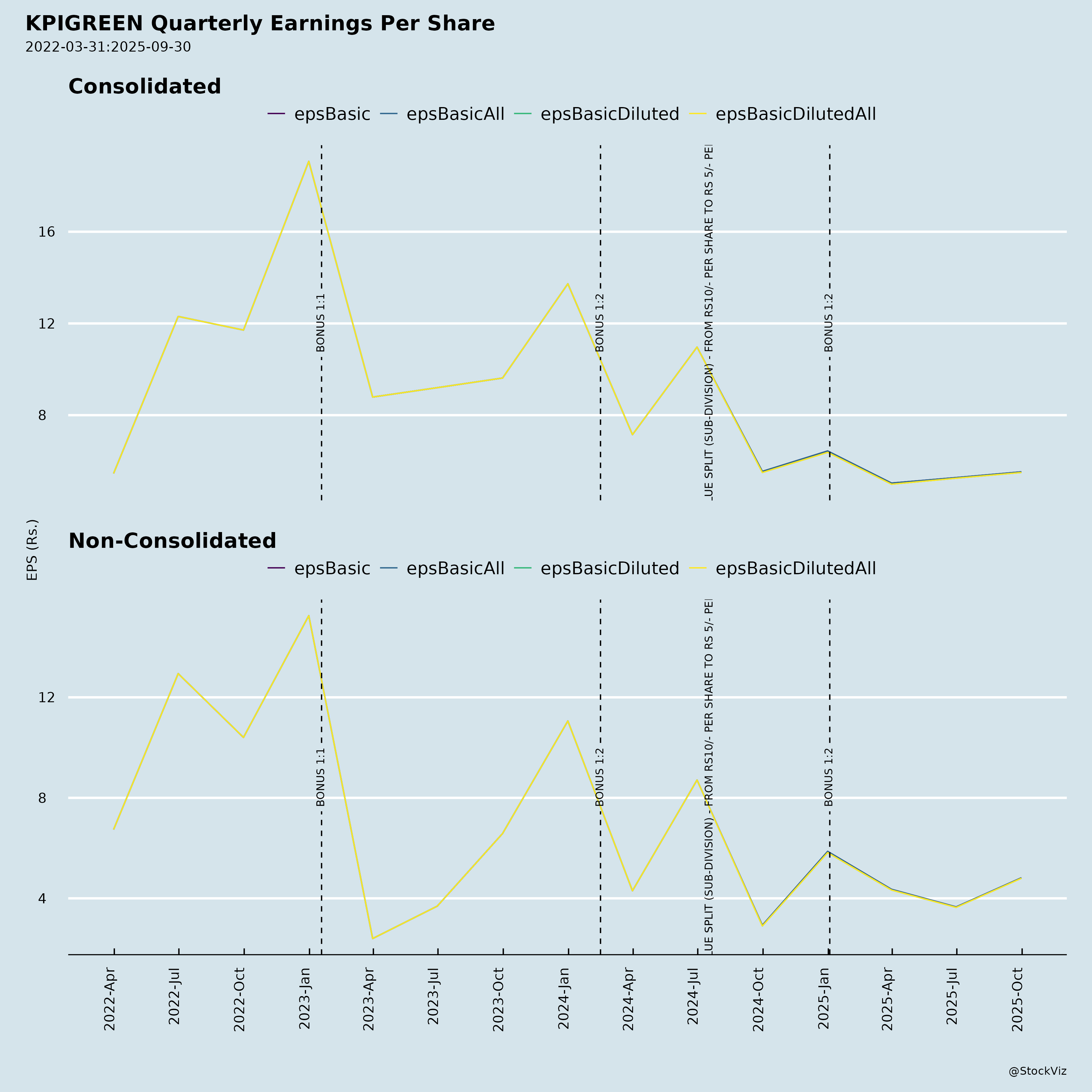

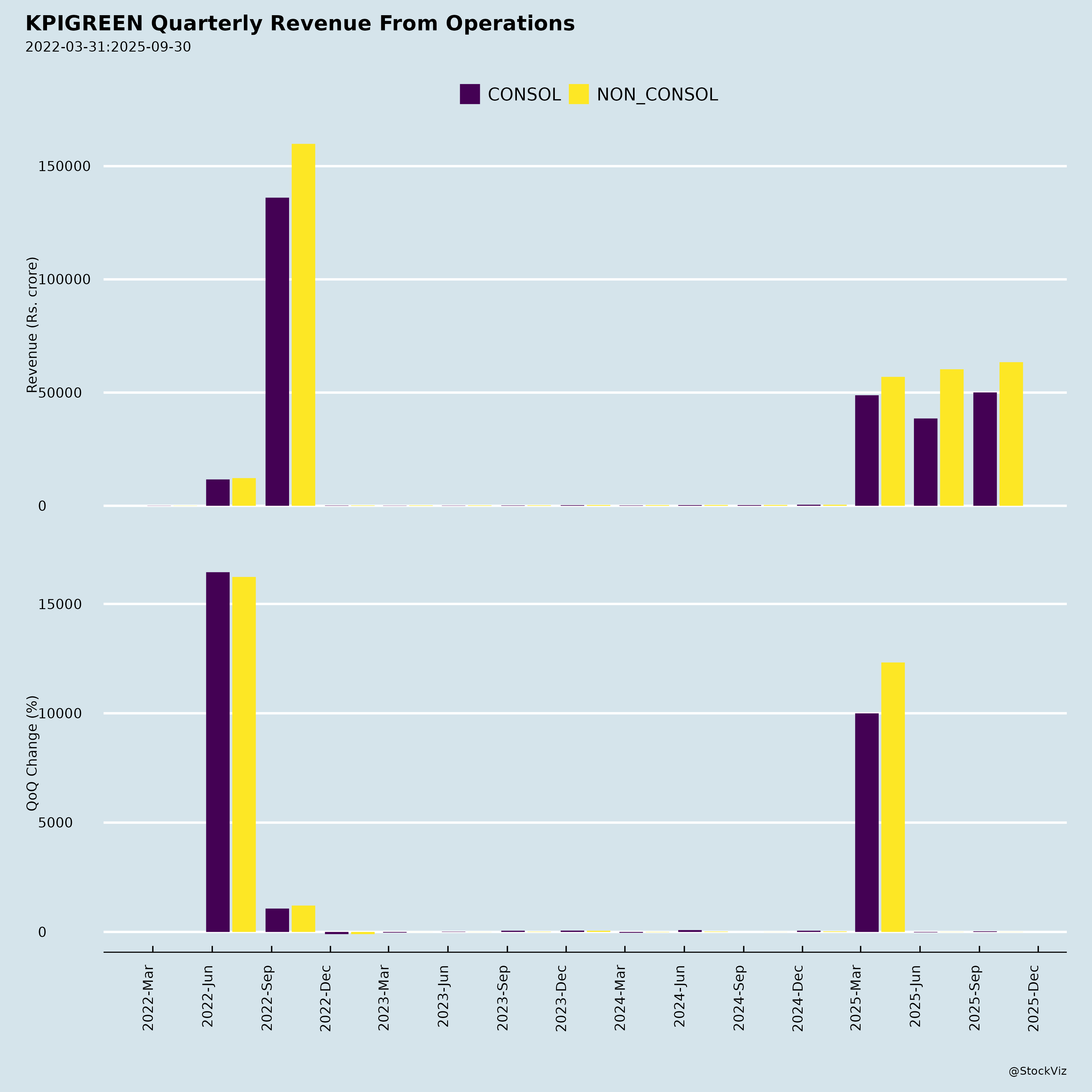

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-08

Based on the Regulatory Filing for the 17th AGM (September 26, 2025) and the Investor Presentation for H1 FY26 (ending September 30, 2025), here is a comprehensive analysis of KPI Green Energy Limited (NSE: KPIGREEN, Scrip Code: 542323) covering tailwinds, headwinds, growth prospects, and key risks.

🔍 Company Snapshot

- Sector: Renewable Energy (Solar & Hybrid IPP/CPP)

- Listed on: BSE & NSE (since 2021)

- Market Cap (as of Nov 6, 2025): ₹10,090 Crores (~$1.14B USD)

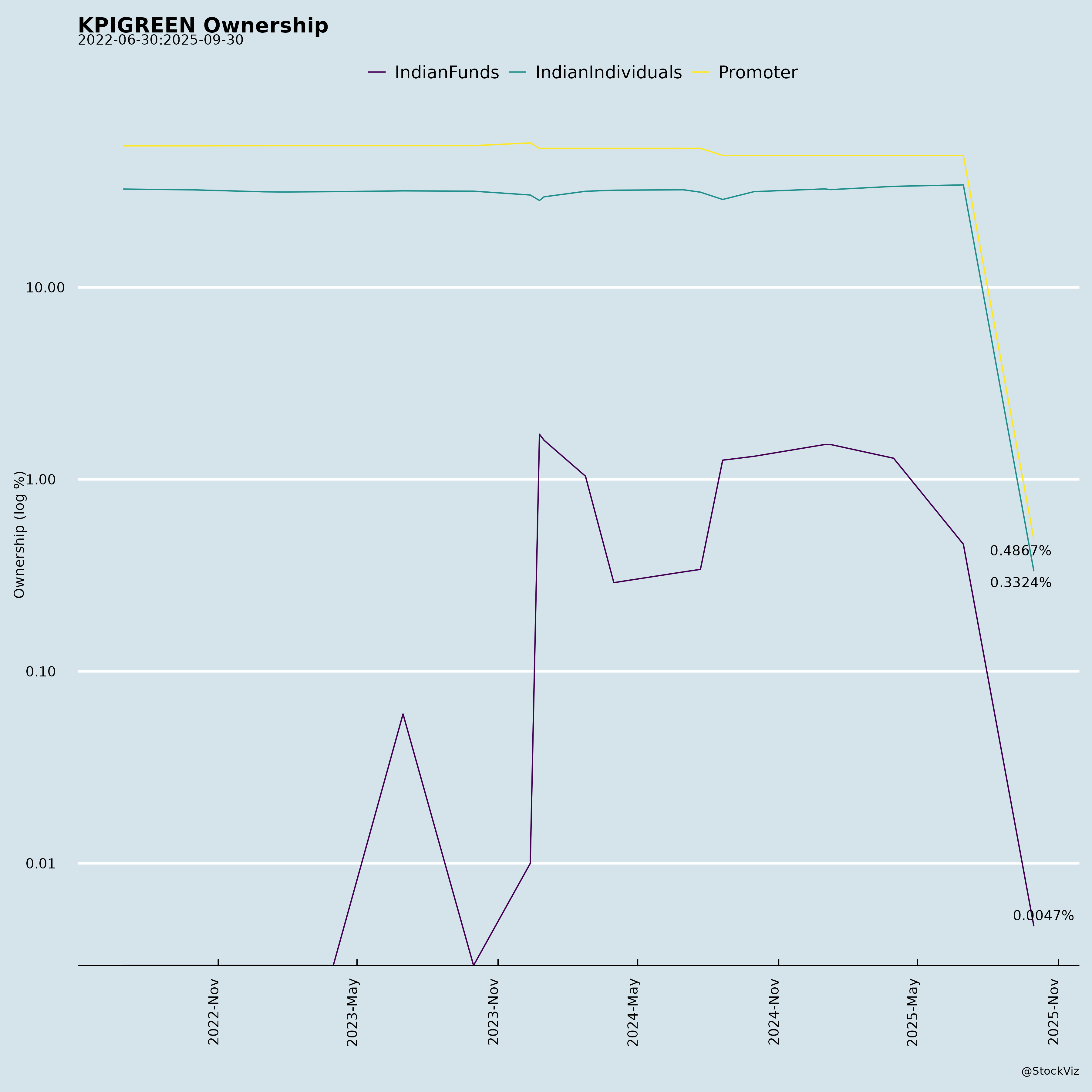

- Promoter Holding: ~48.67%

- Installed Capacity (H1 FY26): 1.07+ GW

- Cumulative Portfolio (Installed + Upcoming): 4.15+ GW

- Revenue (H1 FY26): ₹1,255 Cr ($141M)

- PAT (H1 FY26): ₹228 Cr ($25.7M)

- Key Directors: Dr. Faruk G. Patel (CMD), Sohil Dabhoya (Whole-time Director)

🌿 Tailwinds: Factors Supporting Growth

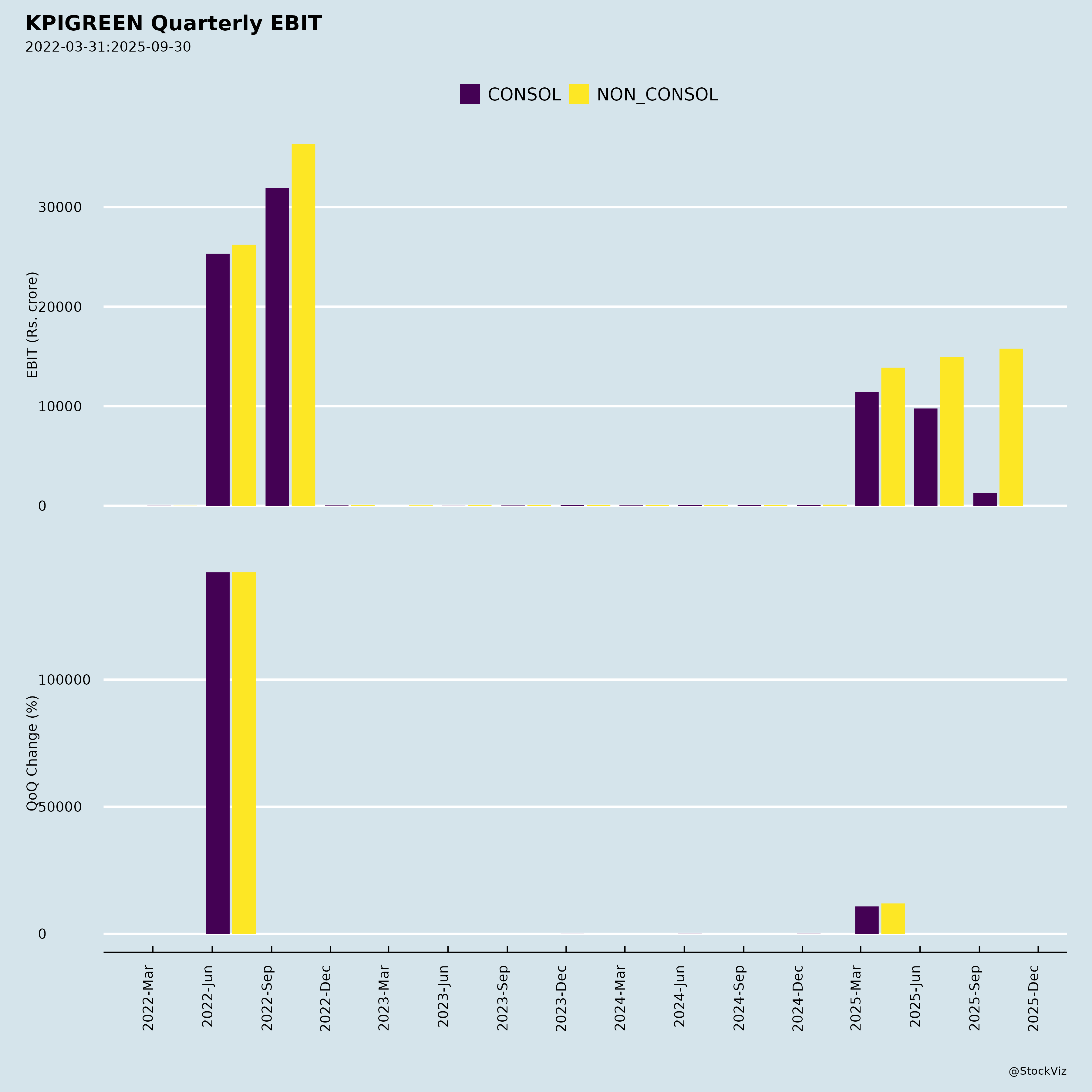

1. Strong Financial Momentum

- 77% YoY Revenue Growth (H1 FY26: ₹1,255 Cr vs. ₹711 Cr)

- 68% PAT Growth (₹228 Cr vs. ₹136 Cr)

- Robust EBITDA growth at 68% (₹449 Cr vs. ₹267 Cr)

- Cash Profit doubled YoY – from ₹172 Cr to ₹334 Cr

- Improving ROE, Net Worth up 9% YoY, strong cash flow generation

2. Diversified Business Model

- Dual model of Independent Power Producer (IPP) and Captive Power Producer (CPP):

- 91% of H1 revenue came from CPP (contractual, shorter-term)

- 9% from IPP (long-term, stable annuity via PPAs)

- IPP model ensures long-term EBITDA visibility and predictable margins with long-tenor PPAs (avg. PPA rate: ₹3.16/kWh).

3. Expansion in High-Growth Segments

- Floating Solar: Actively participating in tenders; leverages land conservation.

- Offshore Wind: Exploring near Gujarat & Tamil Nadu coasts with high PLF potential.

- Green Hydrogen: 1 MW pilot under development; MOUs signed with Jeonbuk Province (South Korea), AHES Ltd, and Delta Electronics.

- Battery Energy Storage Systems (BESS): Strategic partnerships for RTC (Round-the-Clock) power.

4. Innovation & Operational Excellence

- Robotic Panel Cleaning: 730+ robots deployed; patented, waterless, remote-operated.

- Network Operations Centre (NOC): Real-time monitoring via IBM Maximo Renewables; enhanced plant uptime and diagnostics.

- In-house R&D and O&M contracts ensure cost control and service differentiation.

5. Successful Capital Raising & Investor Interest

- Raised ₹670 Crores via India’s first externally credit-enhanced green bond (AA+(CE) rated).

- Backing by GuarantCo (65% partial guarantee), funded by UK, Switzerland, Canada, etc.

- Investor base includes SBI Capital Markets, Edelweiss, ICICI Prudential, Citadel, BlackRock, Vanguard, Norwegian Pension Fund.

6. Large Pipeline & Geographic Expansion

- 3.08+ GW orders in hand

- 123 project sites across Gujarat (DGVCL, MGVCL), Maharashtra (MSEDCL), and CTU-connected

- Land bank: 6,680+ acres, evacuation capacity: 3.46+ GW

- Power Trading Licence (Category A) from GERC allows optimization via short-term power markets.

7. Group Synergy & Strategic Partnerships

- Part of KP Group – a well-established conglomerate with KP Energy (wind), KP Green Engineering (steel structures).

- MoUs with Delta Electronics, Jeonbuk Province, and Gujarat Govt. for EVs & hydrogen.

⚠️ Headwinds: Challenges & Concerns

1. High Dependence on CPP Segment

- 91% of H1 revenue from CPP → less predictable than long-term IPP power purchase agreements.

- CPP model may involve project completion and receivable risks from industrial clients.

- Higher margin pressure and less annuity nature compared to IPP.

2. AGM Voting Shows Institutional Dissent

- Several resolutions received notable “against” votes from institutional investors:

- Resolution 4 (Reappointment of Sohil Dabhoya as Director): 6.59M shares voted against (44.14% of institutional voting pool)

- Resolution 5 (Appointment of Scrutinizer Firm): 1.58M shares against by institutions (10.6% of institutional votes)

- Public institutions (likely funds) showed pushback on governance and related-party transactions.

- Suggests governance or succession concerns despite promoter confidence.

3. Capital Intensity & Leverage

- Interest cost up 59% YoY (₹81 Cr in H1 FY26), and depreciation up 110%, signaling rising capex.

- Despite improved PAT, increasing interest burden could squeeze margins.

- High growth is capital-intensive; future funding needs could lead to equity dilution or debt overhang.

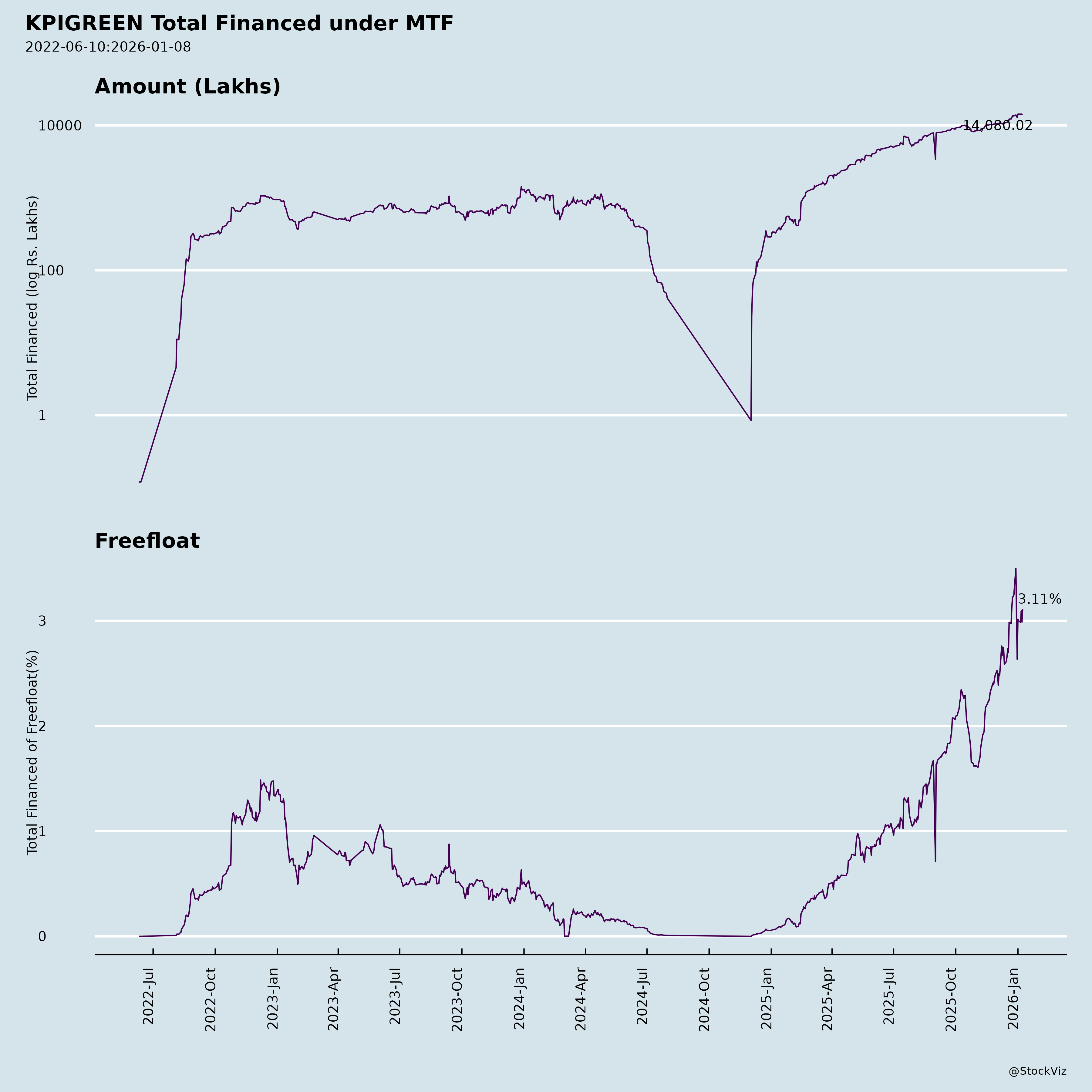

4. Market Valuation is Rich

- P/E (TTM): ~50x based on H1 EPS annualized (~₹21.60) and share price (~₹1000–₹1050)

- No clear dividend yield signal despite rising profits – interim and final dividends declared, but re-investment remains key.

- Rich valuation could make stock vulnerable to sentiment shifts or macro headwinds.

5. Regulatory & PPA Execution Risk

- Expansion into offshore wind and green hydrogen is early-stage and subject to policy evolution and subsidies.

- IPP projects (1.72+ GW) rely on financial closure, PPAs, and evacuation approvals – delays possible.

🚀 Growth Prospects & Long-Term Vision

| Area | Status / Potential |

|---|---|

| Capacity Expansion | 4.15+ GW installed & upcoming; targeting 10+ GW by 2030 |

| IPP Growth | 504 MW installed; 1.72+ GW pipeline. Stable revenue from GUVNL, MAHAGENCO, Coal India |

| CPP Expansion | 2.43+ GW; 200+ industrial clients including Aditya Birla, Tata Motors, Larsen & Toubro |

| New Verticals | Floating solar, offshore wind, BESS, green hydrogen – early movers advantage |

| International Outreach | MoUs with South Korea; export potential in tech, projects, or green hydrogen |

| Trading & O&M Revenue | New power trading license unlocks flexible revenue; high-margin O&M services from 123 sites |

⚠️ Key Risks

| Risk | Implication |

|---|---|

| Governance & Insider Appointments | High institutional dissent on director reappointment and auditor selection |

| PPP & PPA Delay Risk | IPP projects require timely approvals, evacuation, and payment assurance from state DISCOMs |

| Technology & Execution Risk | New areas (offshore, hydrogen) are nascent and capital-intensive |

| Interest Rate Sensitivity | Rising interest cost (₹81 Cr in H1) could impact margins |

| Competition in Renewables | Intense competition from ReNew, Adani, SJVN, Ayana, etc., may compress margins |

| Foreign Dependence on Equipment | Solar modules, inverters, and BESS components often imported; exposed to forex and supply-chain risks |

| Valuation Correction Risk | High P/E leaves little room for underperformance; retail speculation possible |

✅ Summary: Investment Thesis

| Category | Assessment |

|---|---|

| Growth Trajectory | ⬆️ Strong – 77% revenue growth, 3.08+ GW in pipeline |

| Financial Health | ✅ Solid – strong cash flow, growing PAT, low debt-to-equity (implied) |

| Innovation & Tech Edge | ✅ Leading in robotics, monitoring, and O&M services |

| Governance Risk | ⚠️ Moderate – institutional pushback on key appointments |

| Valuation | 💰 Premium – richly valued; needs consistent execution |

| Sustainability & ESG | ✅ Excellent – verified green bonds, carbon savings, waterless tech |

📌 Final Verdict:

KPI Green Energy is a high-growth, innovation-driven renewable energy champion with strong tailwinds from policy, demand, and sector expansion.

It has built a scalable dual-model (IPP + CPP) business with early leads in solar robotics and next-gen tech. The KP Group ecosystem provides strong execution capability.

However, investors should monitor: - Governance concerns raised at AGM (especially on related-party roles), - Execution pace of large IPP projects, - Rising interest burden, - And rich market valuation.

Outlook:

🟡 Hold / Buy on Dips – Suitable for long-term investors with moderate risk appetite, particularly those bullish on India’s renewable transition.

Not ideal for conservative or income-focused investors yet, due to low dividend payout and sector volatility.

Key Catalysts Ahead:

- Execution of GUVNL/PM-KUSUM projects

- Green hydrogen commercialization

- Expansion into floating/offshore solar

- Continued margin improvement from tech & O&M

Data Sources:

- AGM Voting Results (Sept 26, 2025)

- Investor Presentation (H1 FY26, Nov 7, 2025)

- Public filings to BSE/NSE

- Company disclosures on green bonds, projects, and governance

Let me know if you’d like a SWOT analysis, valuation matrix, or comparative benchmarking vs. peers (e.g., ReNew, Inox Wind, Avaada).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.