KOTAKBANK

Equity Metrics

January 13, 2026

Kotak Mahindra Bank Limited

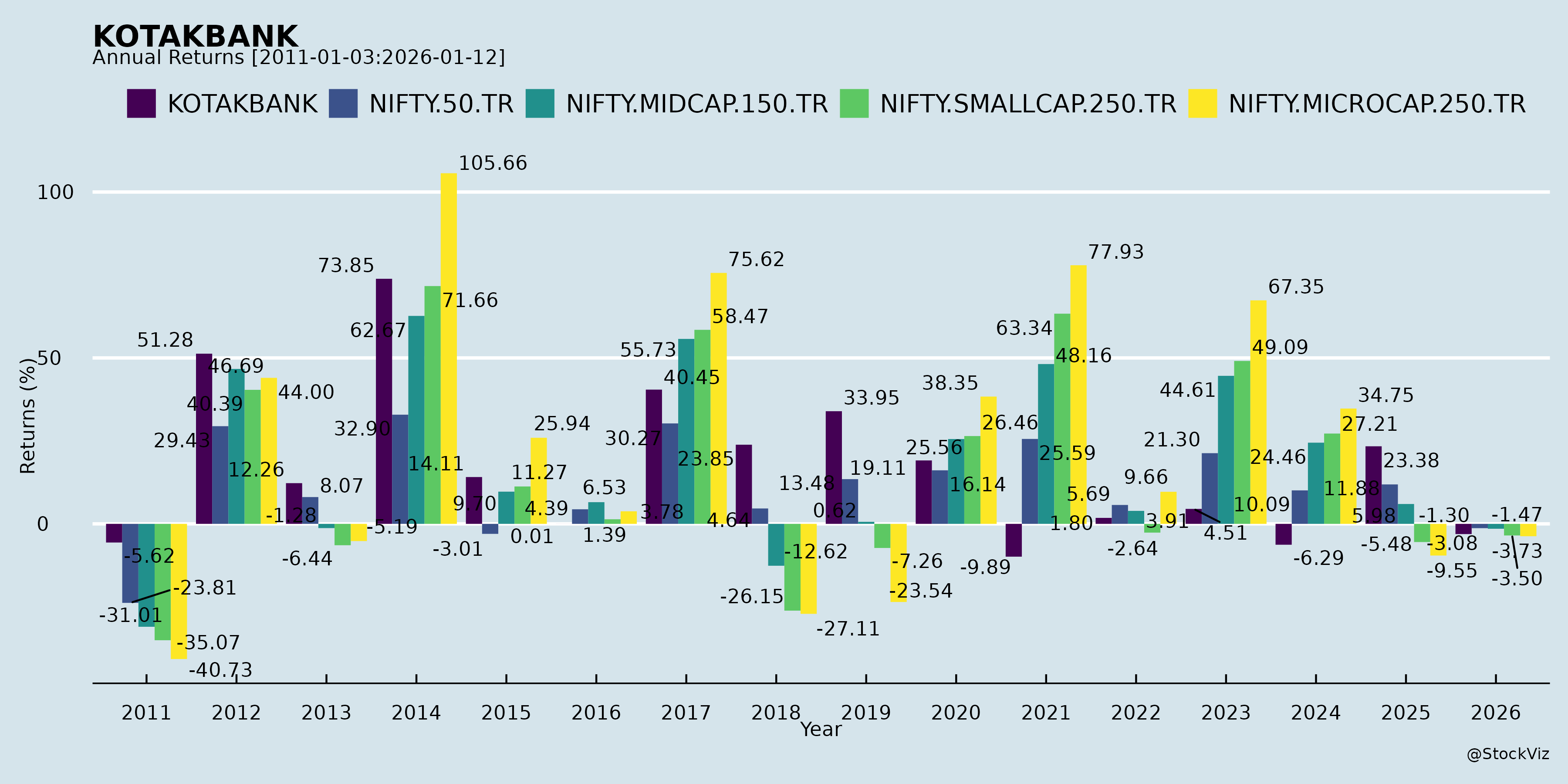

Annual Returns

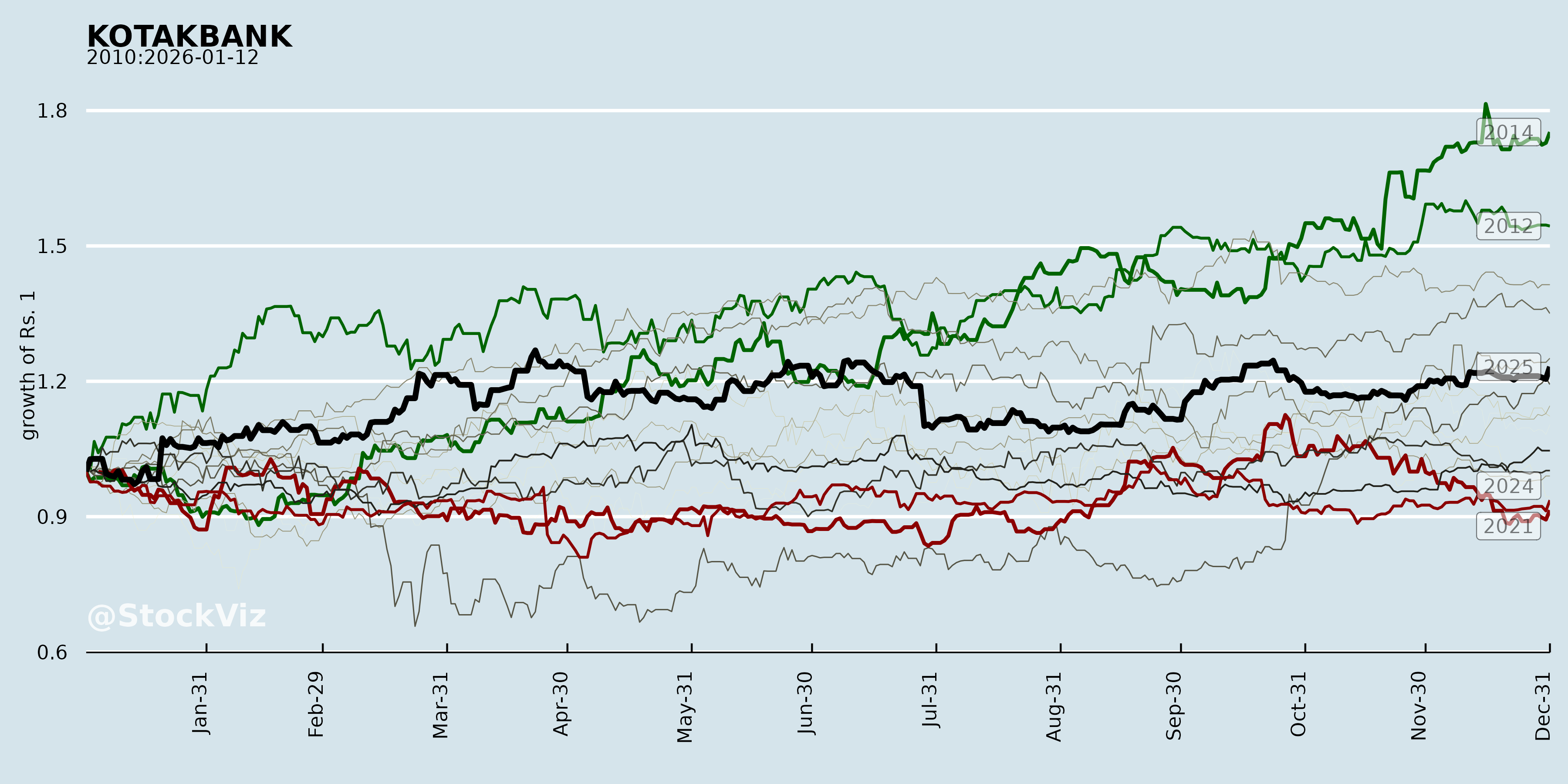

Cumulative Returns and Drawdowns

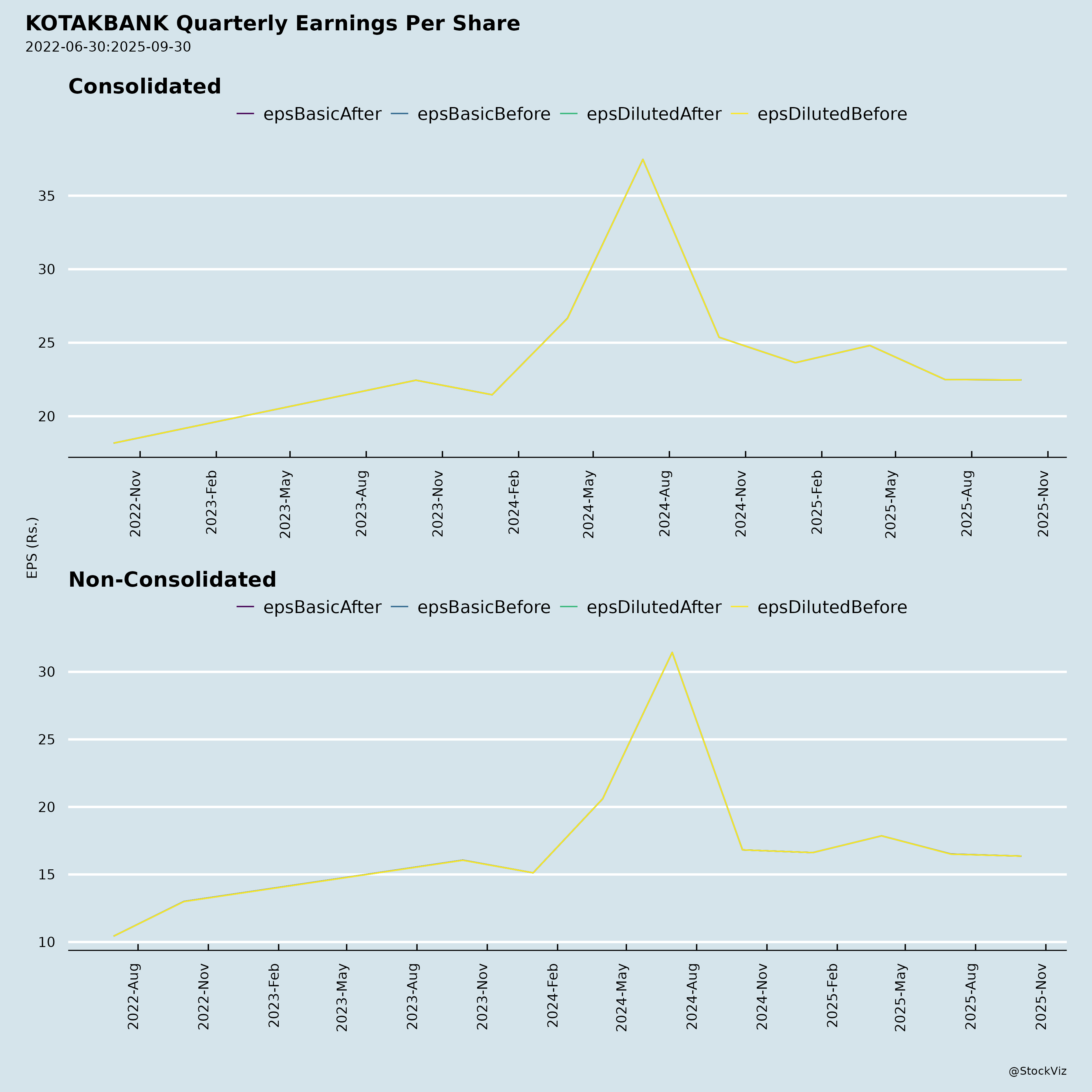

Fundamentals

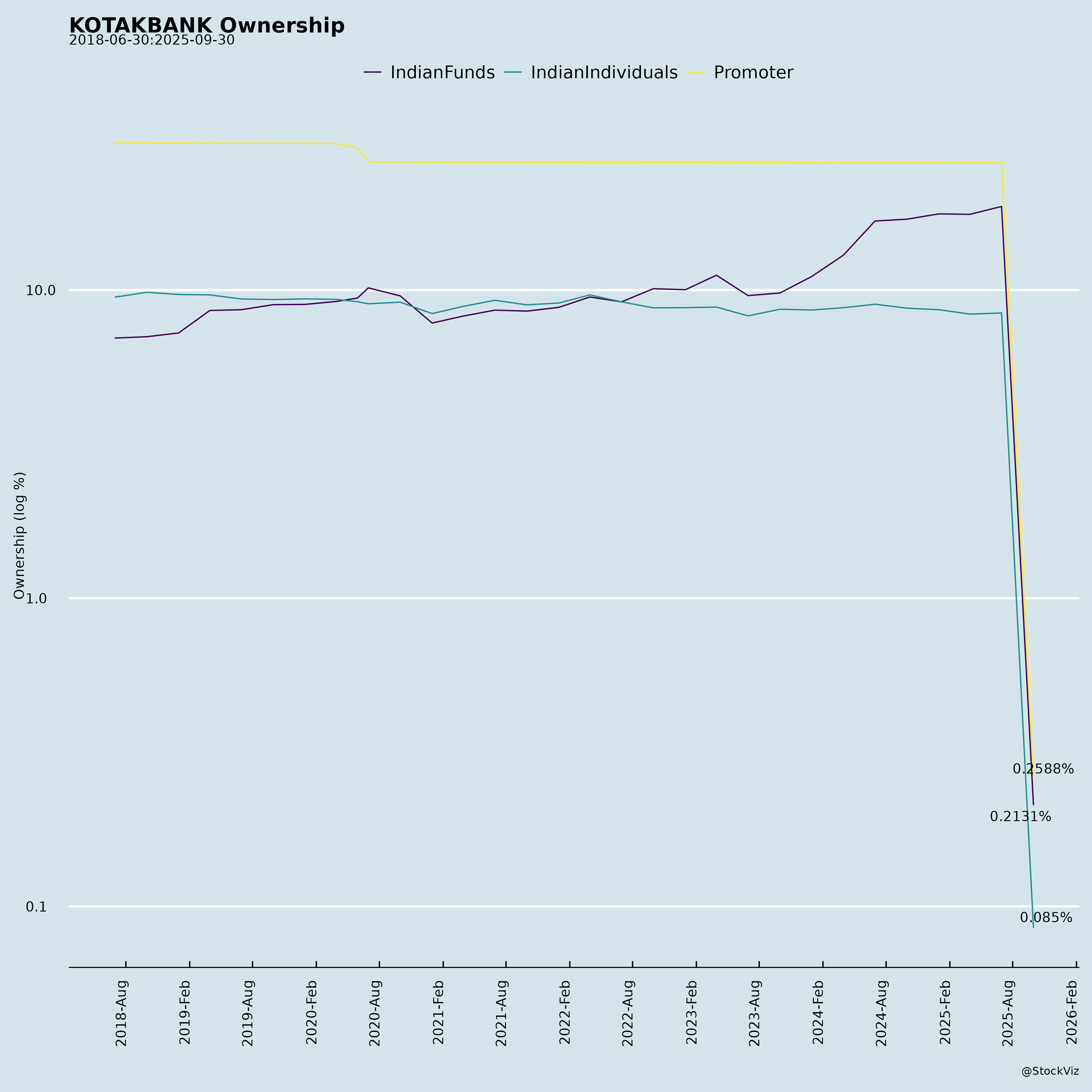

Ownership

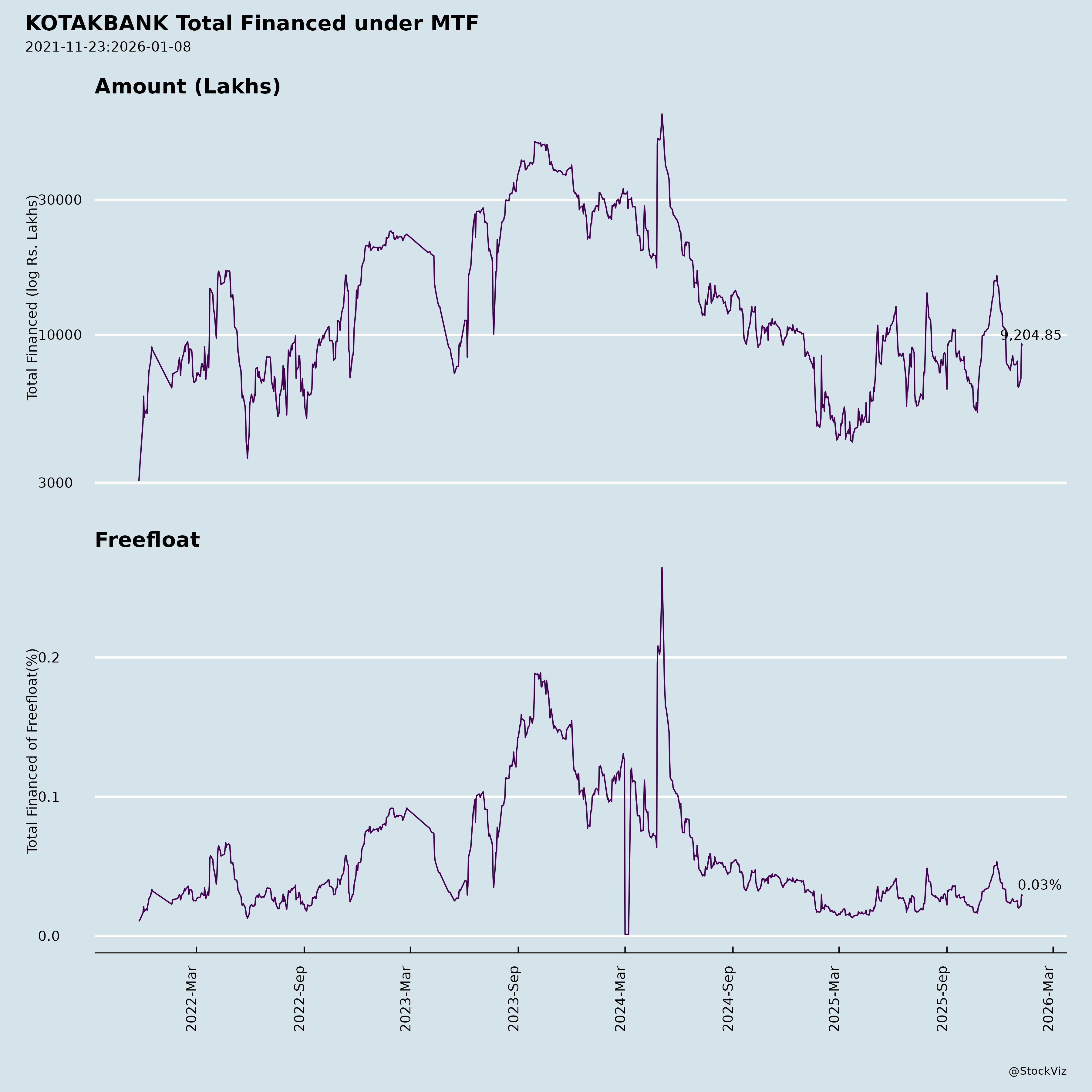

Margined

AI Summary

asof: 2025-12-03

Kotak Mahindra Bank (KOTAKBANK) Analysis

Based on Q2/H1 FY26 Financial Results (ended Sep 30, 2025), Stock Split Announcement, Bond Interest Payment, and Postal Ballot Notice.

Kotak Mahindra Bank demonstrates resilient balance sheet growth amid moderated profitability pressures. Consolidated assets expanded ~13.5% YoY to ₹9.13 lakh crore, driven by retail and corporate lending. Standalone/Consolidated Net Profit declined YoY (H1: ₹8,940 cr vs. ₹12,492 cr), primarily due to prior-year exceptional gains (₹3,803 cr from insurance stake sale) and higher provisions/expenses. Excluding one-offs, core profitability remains steady. Stock split (1:5, FV ₹5 to ₹1) signals investor-friendly moves to boost liquidity.

Tailwinds (Positive Catalysts)

- Robust Deposit & Advance Growth: Consolidated deposits +14.6% YoY (₹5.24 lakh cr); advances +15.5% YoY (₹5.29 lakh cr). Standalone deposits +14.6% YoY. Retail (incl. digital) remains core strength (46% of segment assets).

- Healthy Capital & Asset Quality: CAR at 22.05% (standalone); Gross NPA 1.39% (down from 1.49% YoY); Net NPA 0.32%. Low reliance on govt. exposure.

- Diversified Revenue Streams: Non-interest income ~31% of total (H1); subsidiaries (e.g., asset mgmt, life insurance) contribute via premium growth (₹7,105 cr H1) and broking/advisory.

- Investor-Friendly Actions: 1:5 stock split (pending approvals) to enhance affordability/liquidity (current shareholders >7 lakh, retail <10% holding). Timely bond interest payment (₹114 cr on INE237A08957).

- Governance & Engagement: Frequent disclosures, analyst meets (e.g., Morgan Stanley Summit), postal ballot for transparency.

Headwinds (Challenges)

- Profitability Moderation: Consolidated PAT -28.4% YoY H1 (post-exceptional normalization); NIM pressure from higher interest expended (+6.6% YoY). Operating profit flat YoY.

- Elevated Provisions/Expenses: Provisions +42.7% YoY H1 (₹2,376 cr); op. expenses +13.4% YoY (employee/policyholder costs up). Insurance drag (policy reserves ₹8,992 cr H1).

- Segment Slowdown: Treasury/BMU results down sharply; advisory/transactional services -73% YoY revenue.

- Cash Flow Strain: Operating cash flow positive but investing/financing outflows led to net cash decline (H1: -₹15,141 cr).

Growth Prospects

- Retail/Digital Focus: Retail banking (ex-digital) ~98% of retail assets; digital up +242% YoY assets. Vehicle financing/other lending +15-20% YoY.

- Group Synergies: Subsidiaries drive non-lending growth (insurance premiums +3%; asset mgmt AUM implied growth). BSS Microfinance merger enhances microfinance scale.

- Market Expansion: 5,511 branches; potential from stock split for broader retail investor base. Post-split paid-up capital remains ₹994 cr.

- Medium-Term Outlook: 12-15% loan/deposit CAGR feasible with digital push and RBI DBU compliance. Earnings growth ~15%+ ex-one-offs (EPS H1 ₹44.96 basic).

Key Risks

| Risk Category | Details | Mitigants |

|---|---|---|

| Credit/Asset Quality | AIF provisions (₹-41 cr H1 reversal, but volatile); stressed loans (SMA/NPA transfers minimal but monitored). | Improving NPA ratios; conservative provisioning. |

| Regulatory | RBI approvals pending for stock split/MoA; BR Act limits on chairman remuneration (₹55L cap proposed). Past divestitures (e.g., gen. insurance to associate). | Strong compliance track record; timely filings. |

| Macro/Economic | Rate hikes could squeeze NIM; slowdown in retail/vehicle loans. | Diversified portfolio (retail 50%+ advances). |

| Operational | Insurance volatility (actuarial reliance); dependency on subsidiaries (13 reviewed, some unreviewed). | Independent auditor reviews; Pillar 3 disclosures. |

| Market/Liquidity | Cash equivalents down 19% YoY; borrowings -15% H1. Stock split execution risk. | High CAR; LCR/NSFR via website disclosures. |

| Execution | Chairman re-appointment tied to RBI; merger impacts (Sonata into BSS). | Board/NRC approvals in place. |

Overall Summary: Positive outlook with balanced risks. Tailwinds from balance sheet expansion and strategic moves (stock split) outweigh headwinds from profitability normalization. Growth anchored in retail/digital; target 15%+ ROA/ROE trajectory. Monitor provisions and subsidiary performance. Trading at premium valuations justified by quality franchise. Recommendation: Accumulate on dips for long-term growth. (Data as of Sep 30, 2025; subject to Q3 results.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.