KALPATARU

Equity Metrics

January 13, 2026

Kalpataru Limited

Residential Commercial Projects

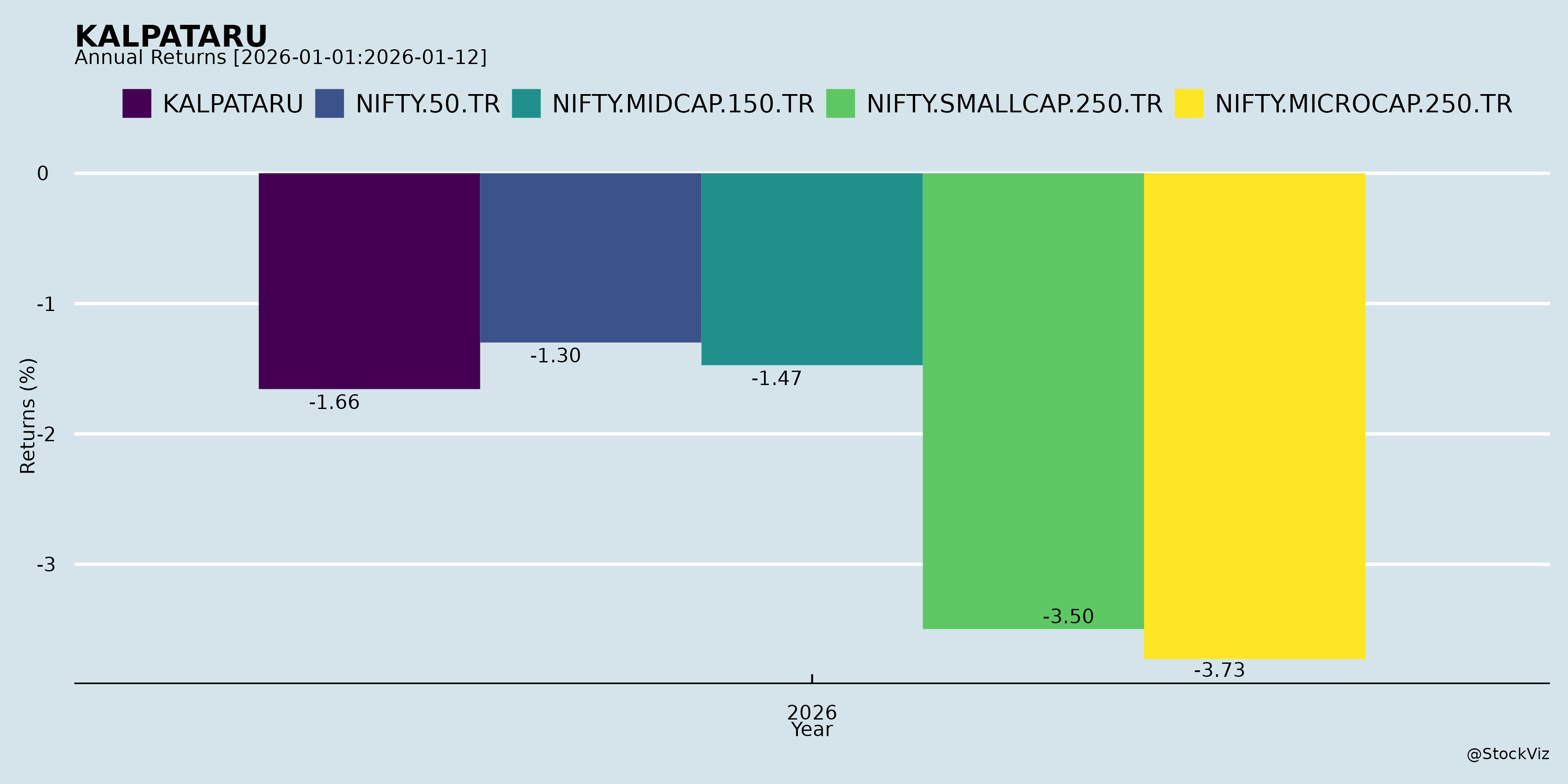

Annual Returns

Cumulative Returns and Drawdowns

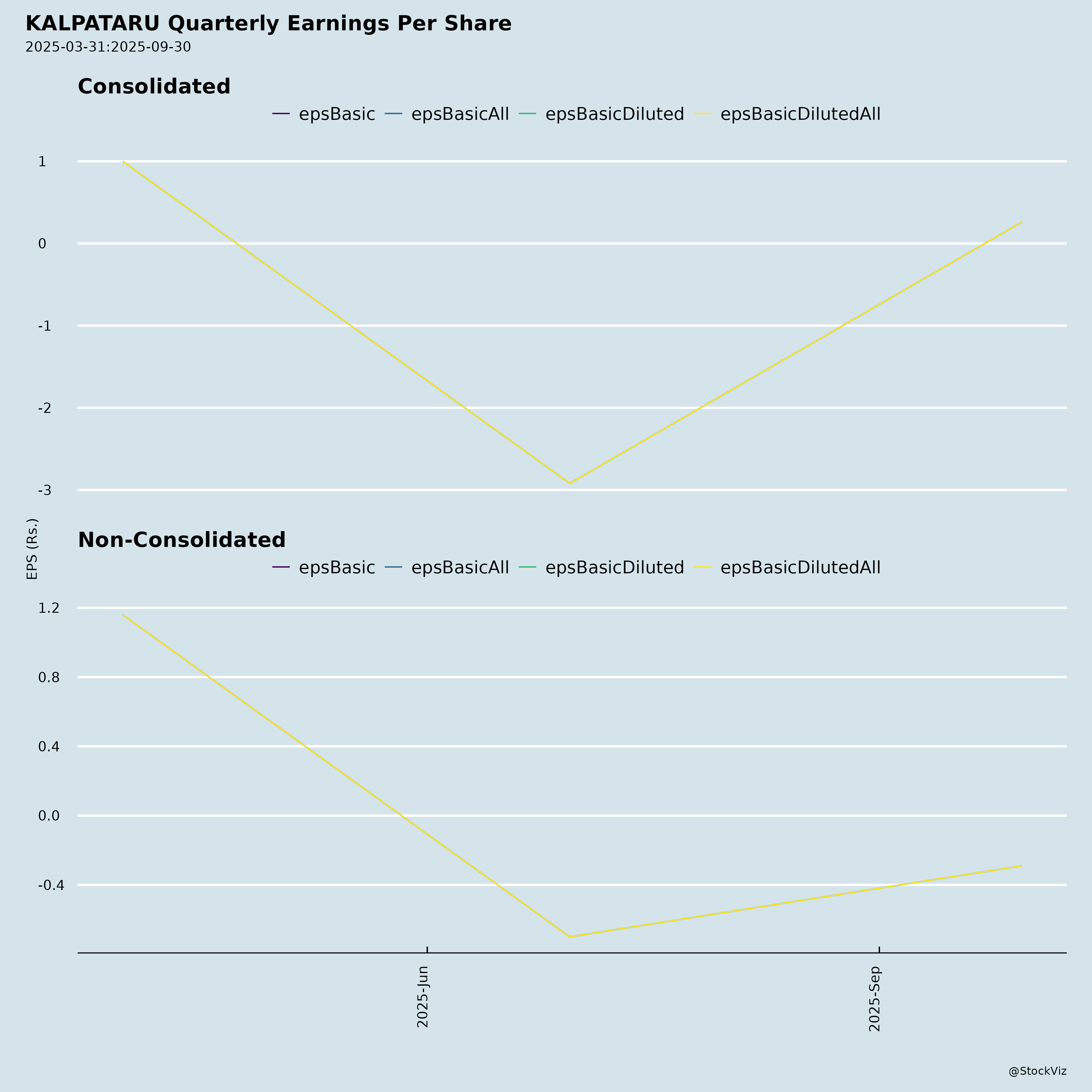

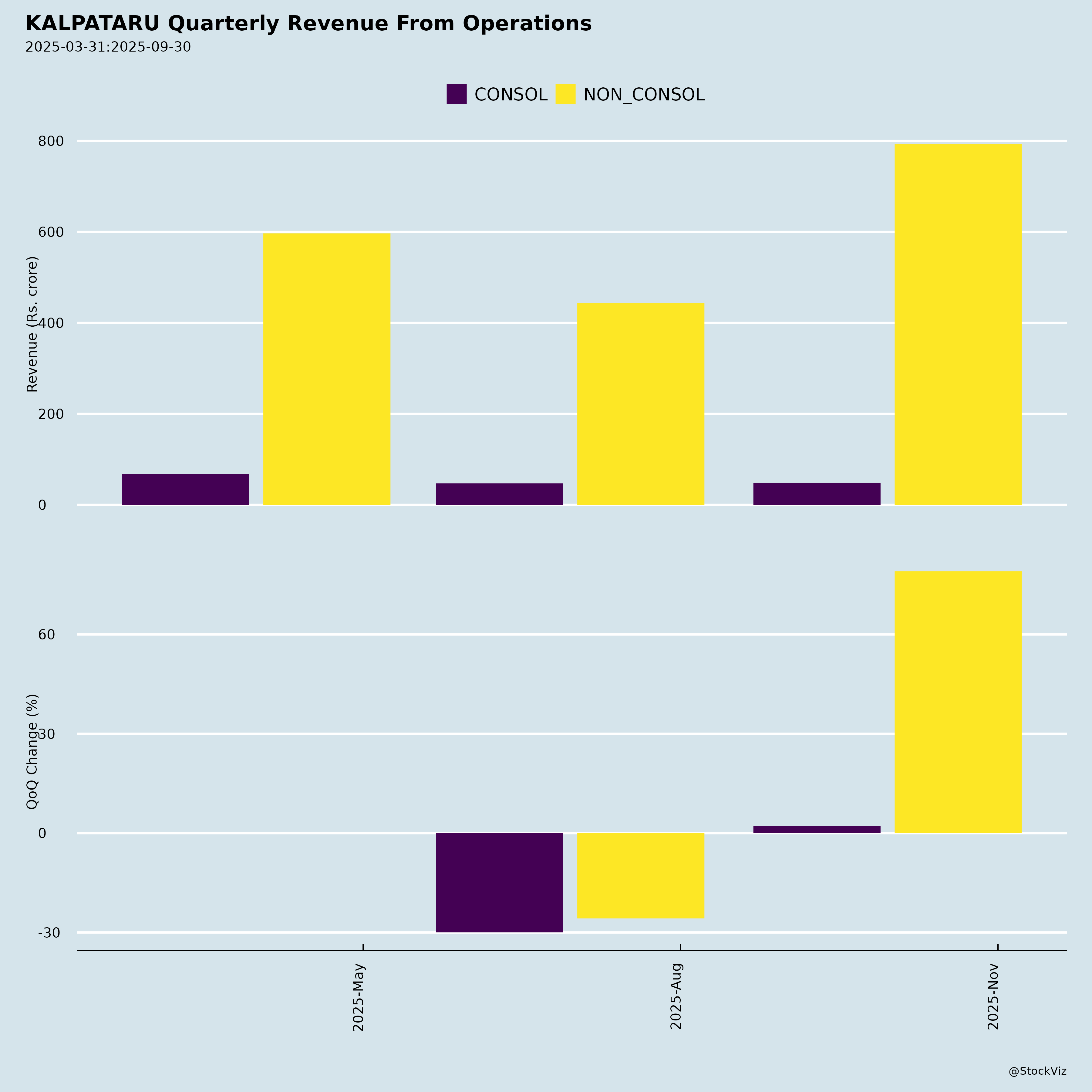

Fundamentals

Ownership

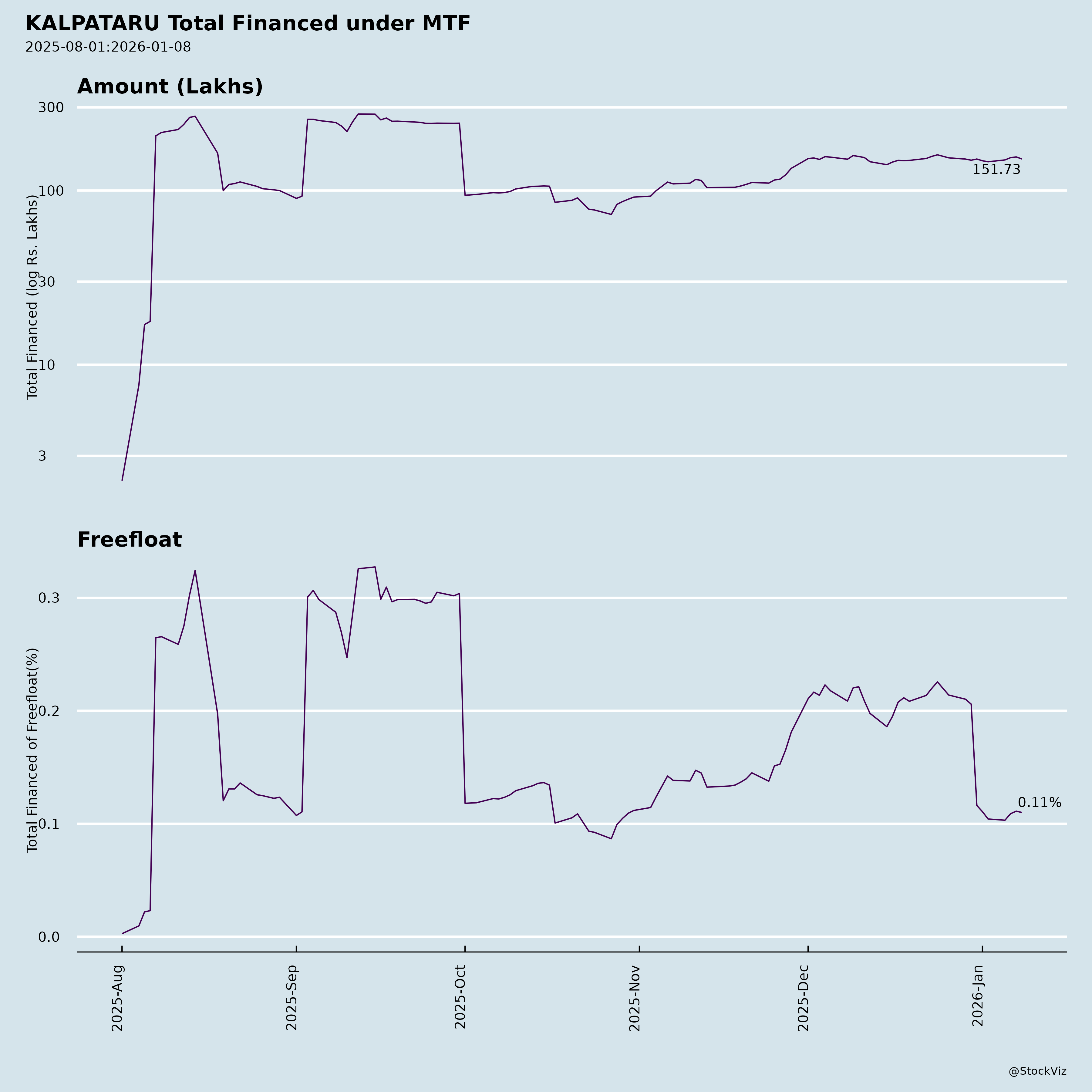

Margined

AI Summary

asof: 2025-11-27

Summary Analysis for Kalpataru Limited (NSE/BSE: KALPATARU)

Kalpataru Limited, a premium real estate developer focused on MMR (Mumbai Metropolitan Region) and Pune, reported strong Q2/H1 FY26 operational metrics amid a transitional financial profile due to revenue recognition under Project Completion Method (PCM) for newer projects. With a 56-year legacy, ~44 msf pipeline (land payments completed), and recent IPO infusion (₹1,590 Cr raised), the company is deleveraging while scaling launches. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks based on the provided documents (earnings call, financials, operational updates, investor presentation, press release, AGM results).

Headwinds (Challenges Pressuring Performance)

- Lumpy Revenue Recognition: PCM for 13/22 ongoing projects (post-Apr 2022) defers revenue until OC, while marketing/overheads are expensed upfront. This caused H1 FY26 PAT loss (₹47 Cr) despite strong pre-sales; Q2 EBITDA margin dipped to 1.7% (adjusted 23.9%).

- High Debt & Interest Burden: Gross debt at ₹8,928 Cr (Sep 2025); FY26 interest cost guidance ₹700-750 Cr. Sequential debt rise in Q2 due to launches/execution; reliant on organic cash flows for reduction.

- Subdued Execution in H1: Monsoon impacted construction (H1 spend ₹900 Cr); some projects (e.g., Immensa, Magnus) nearing completion but delayed possessions.

- Market Competition: Increasing in Thane (company’s 20% of H1 sales); broader T&D/BNF scaling by peers.

Tailwinds (Supportive Factors Driving Momentum)

- Robust Demand & Pricing Power: Pre-sales +19% YoY (Q2: ₹1,329 Cr) / +43% (H1: ₹2,577 Cr); collections +37% YoY. Realizations surged 27% (Q2) / 54% (H1) to ~₹17k-19k psf, reflecting premium positioning (e.g., Worli: ₹850 Cr sales).

- Deleveraging Post-IPO: Net debt down 14% YoY to ₹8,025 Cr; D/E improved to 2.0x. IPO proceeds (₹1,192 Cr used for debt repayment); refinancing lowered costs on ₹1,800 Cr (saving ₹50-75 Cr p.a.), avg. cost ~12% → targeting -0.5%.

- Execution Visibility: 2.13 msf OC in H1; launches like Estella (Park City, 0.93 msf) & Srishti Namaah succeeded. Annuity rentals ~₹105 Cr (H1).

- Infra Tailwinds: Thane benefits from Metro 4/5, tunnels, high-speed rail; Park City’s 25-acre park drives footfall (15-20k visitors/week).

Growth Prospects (Medium-Term Opportunities)

- Strong FY26 Guidance: Pre-sales ₹7,000 Cr (+55% YoY, 37% achieved); collections ₹5,700 Cr (+56%, 40% done); net debt to ₹7,300 Cr (-22%). Launch 3.2 msf (e.g., Andheri, Eternia, Aria).

- Pipeline Strength: ~44 msf developable (71% owned); GDV potential ₹62,054 Cr; unsold inventory inflows ₹53,053 Cr. Balanced mix: luxury (Worli), aspirational (Thane), townships.

- BD Pipeline: Selective JVs/redevelopments (Andheri/Kandivali); plotting in MMR/Pune; future entry into Hyderabad/Noida. Cash EBITDA margins to rise to 35%+.

- Sustainability Edge: 39 green-certified projects; IGBC awards; CSR (healthcare, skilling) enhances brand.

Key Risks (Potential Vulnerabilities)

| Risk Category | Description | Mitigation |

|---|---|---|

| Execution/Regulatory | Delays in approvals/OCs (e.g., Andheri IOD received, but BMC elections); construction ramp-up needed (H2: 1.2-1.3x H1 spend). | Owned land (payments done); strong track record (81 projects delivered). |

| Financial/Liquidity | High leverage (2.0x D/E); free cash flow FY26 est. ₹1,200-1,300 Cr dependent on collections. | IPO strength; refinancing; H1 FCF positive (₹1,200 Cr operating cash). |

| Market/Cyclical | Competition in Thane (5% market share); interest rate sensitivity; softening demand if macro slows. | Premium pricing; diversified micro-markets (MMR 95%); 5-7 yr pipeline visibility. |

| Subsidiary/Compliance | 4 subsidiaries under ‘going concern’ (losses/negative net worth); auditor emphasis. | Parent oversight; ratings upgraded (BBB+/BBB stable). |

| External | Real estate policy changes; monsoon/infra delays. | Focus on high-demand suburbs; selective BD. |

Overall Outlook: Positive with cautious optimism. Tailwinds from demand, deleveraging, and pipeline outweigh headwinds from PCM lumpy profits. Growth on track for FY26 (on pace for guidance), positioning Kalpataru as a mid-cap realty play with premium MMR focus. Monitor debt reduction and OC timelines for sustained profitability. Stock trades at reasonable multiples given 29% pre-sales CAGR (FY22-25).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.