JKLAKSHMI

Equity Metrics

January 13, 2026

JK Lakshmi Cement Limited

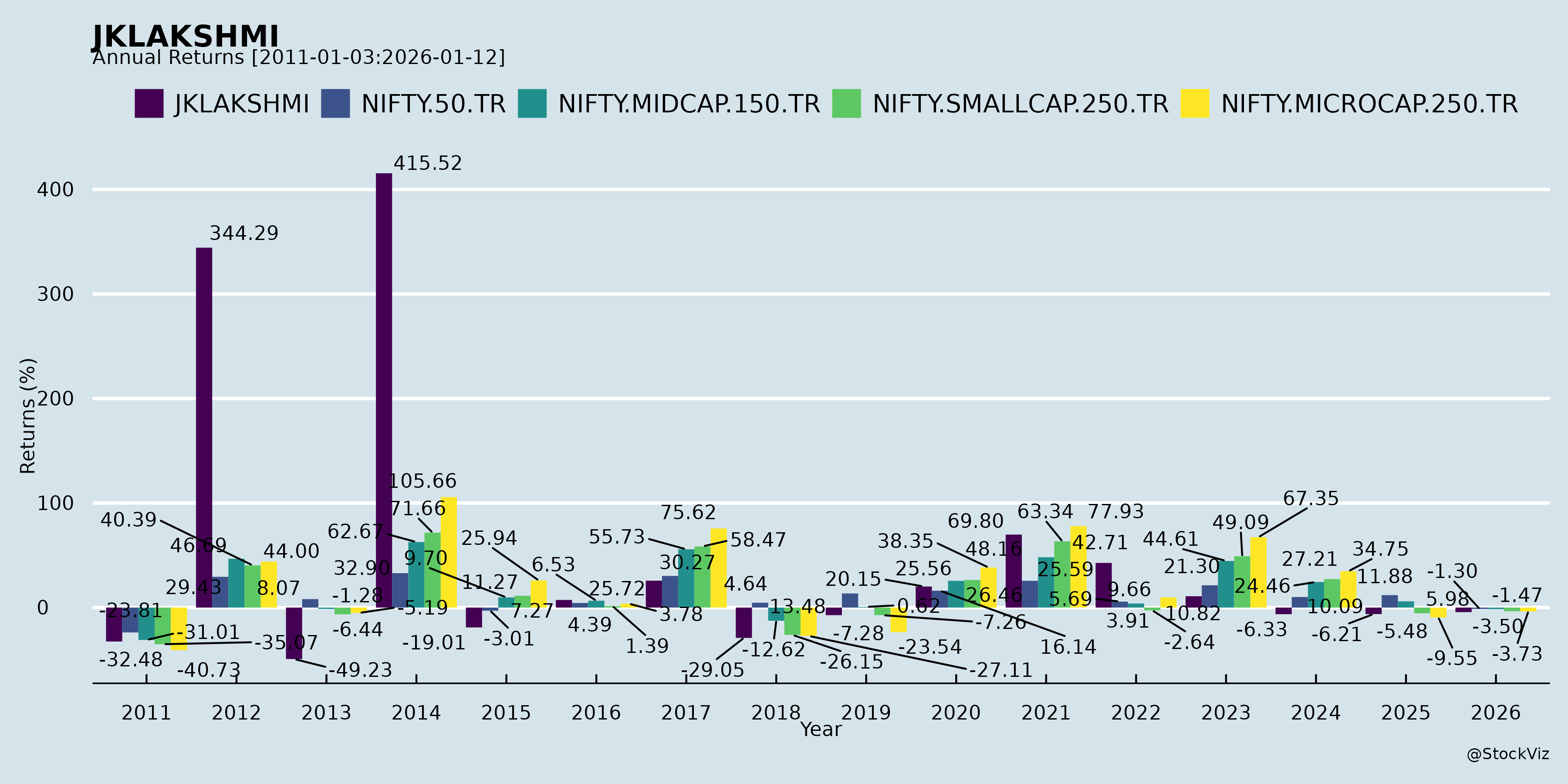

Annual Returns

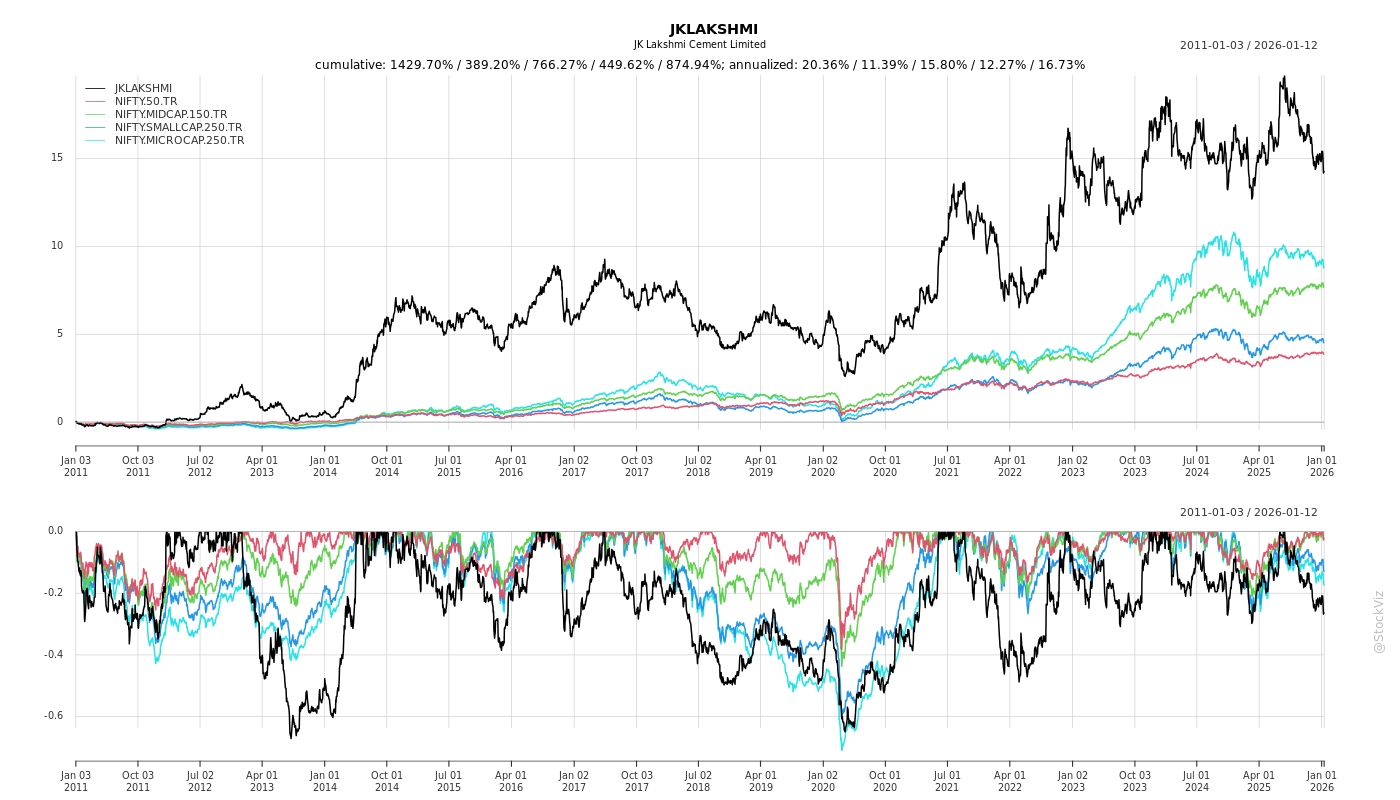

Cumulative Returns and Drawdowns

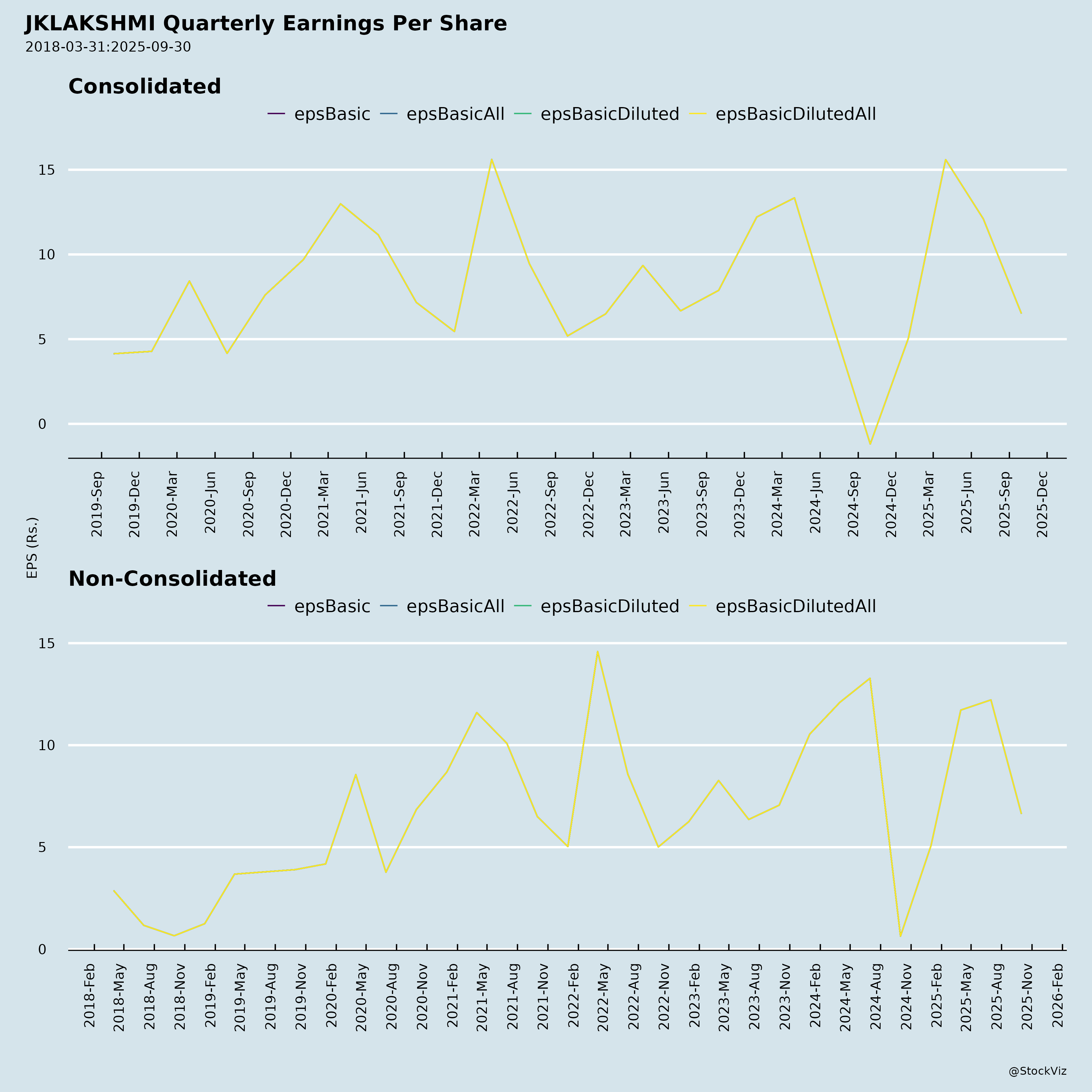

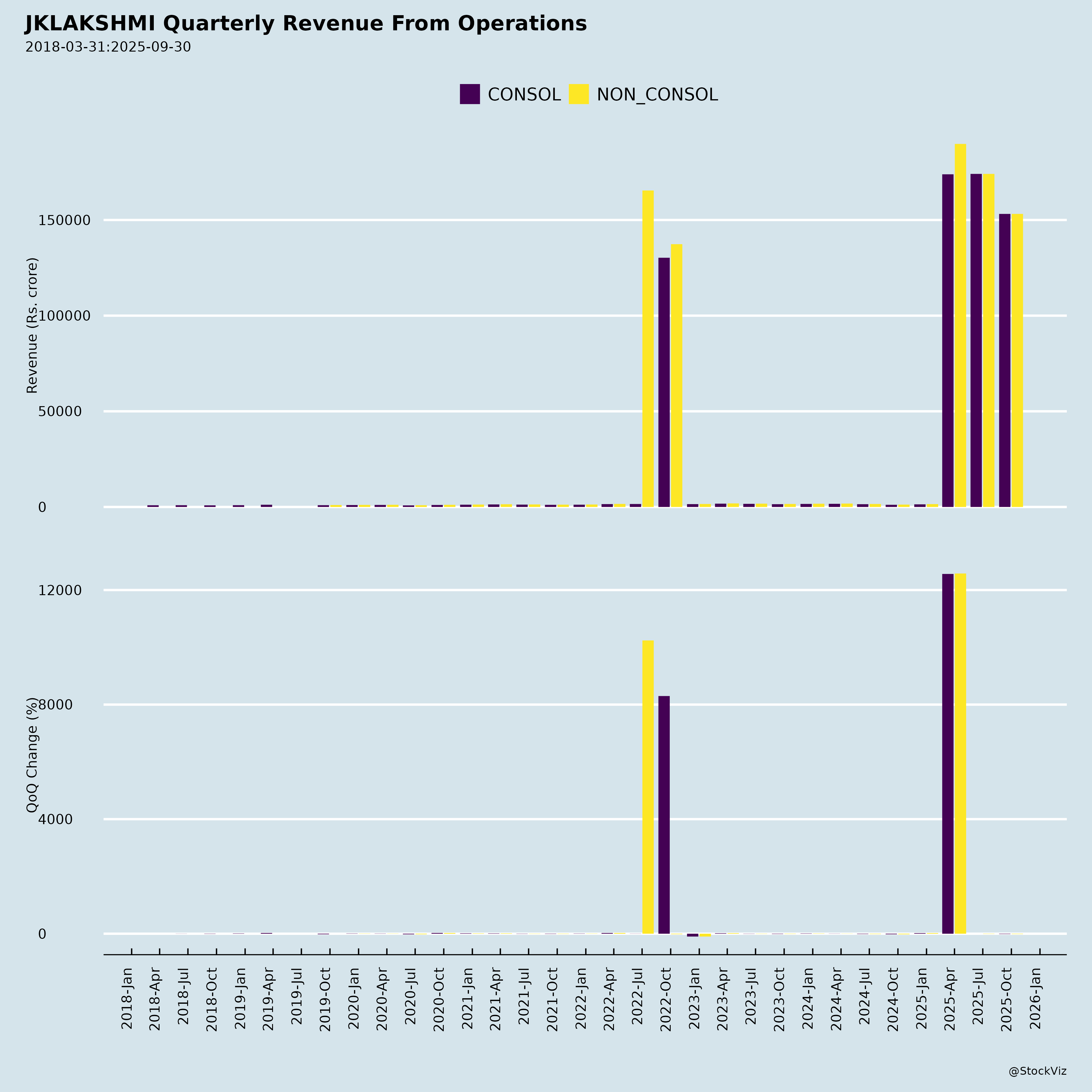

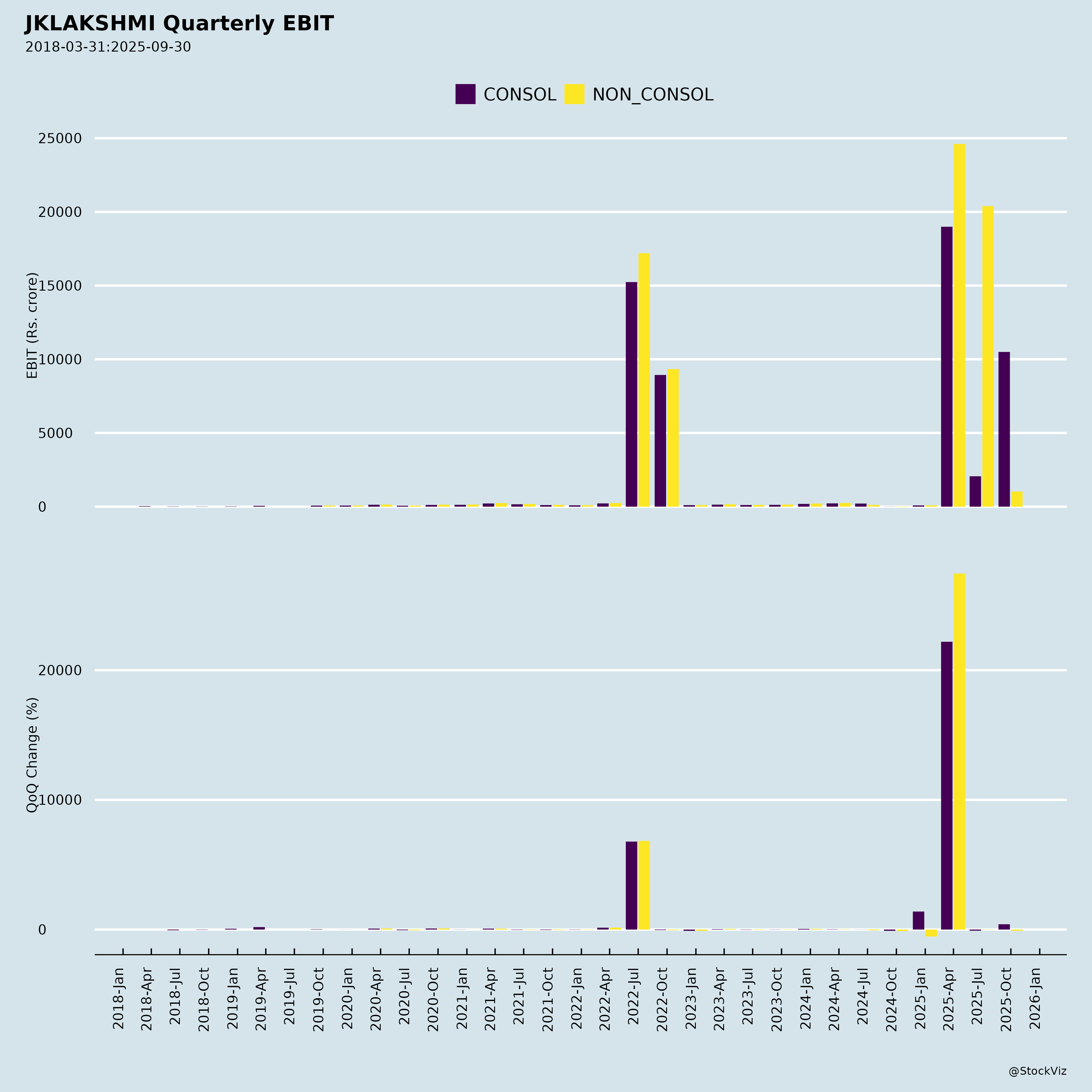

Fundamentals

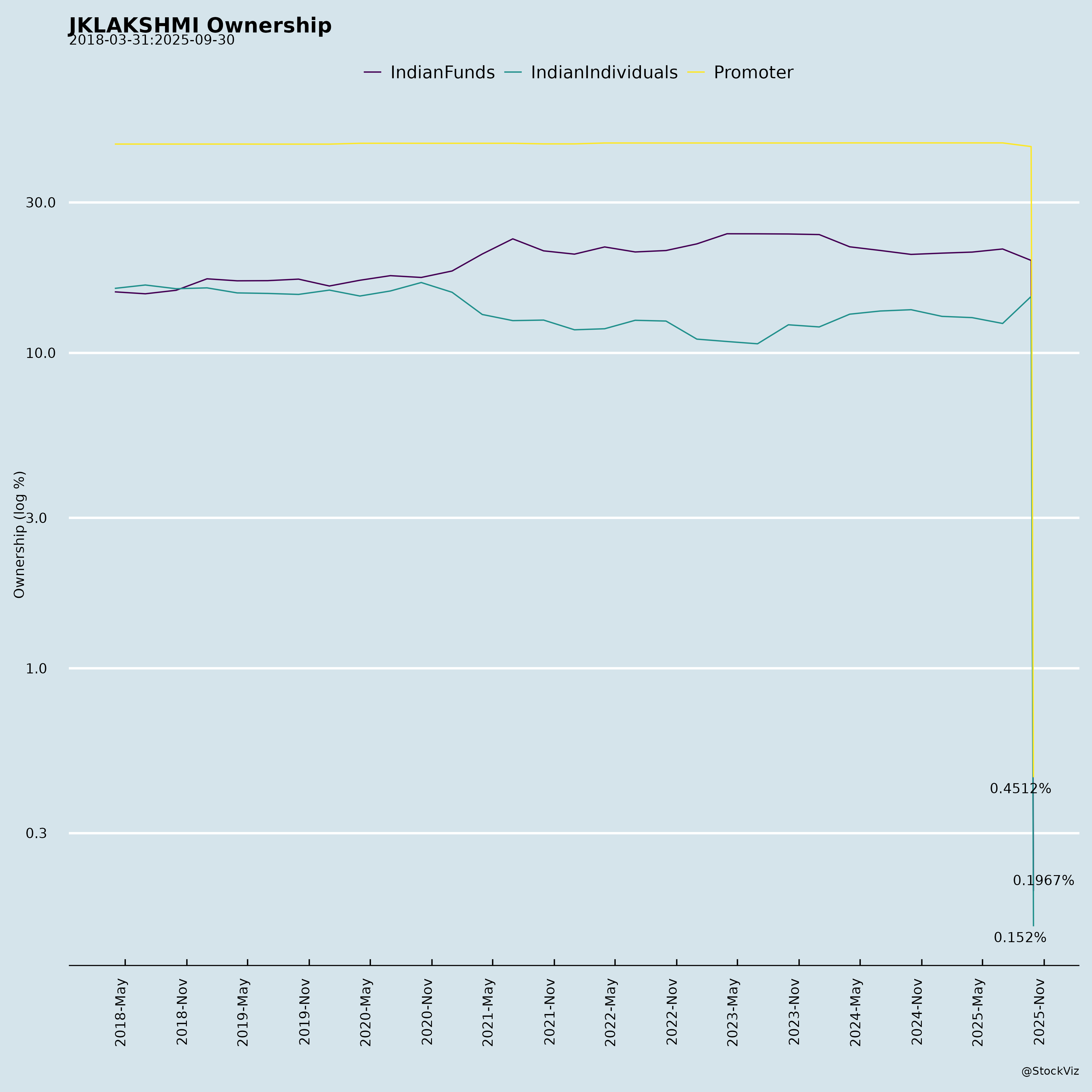

Ownership

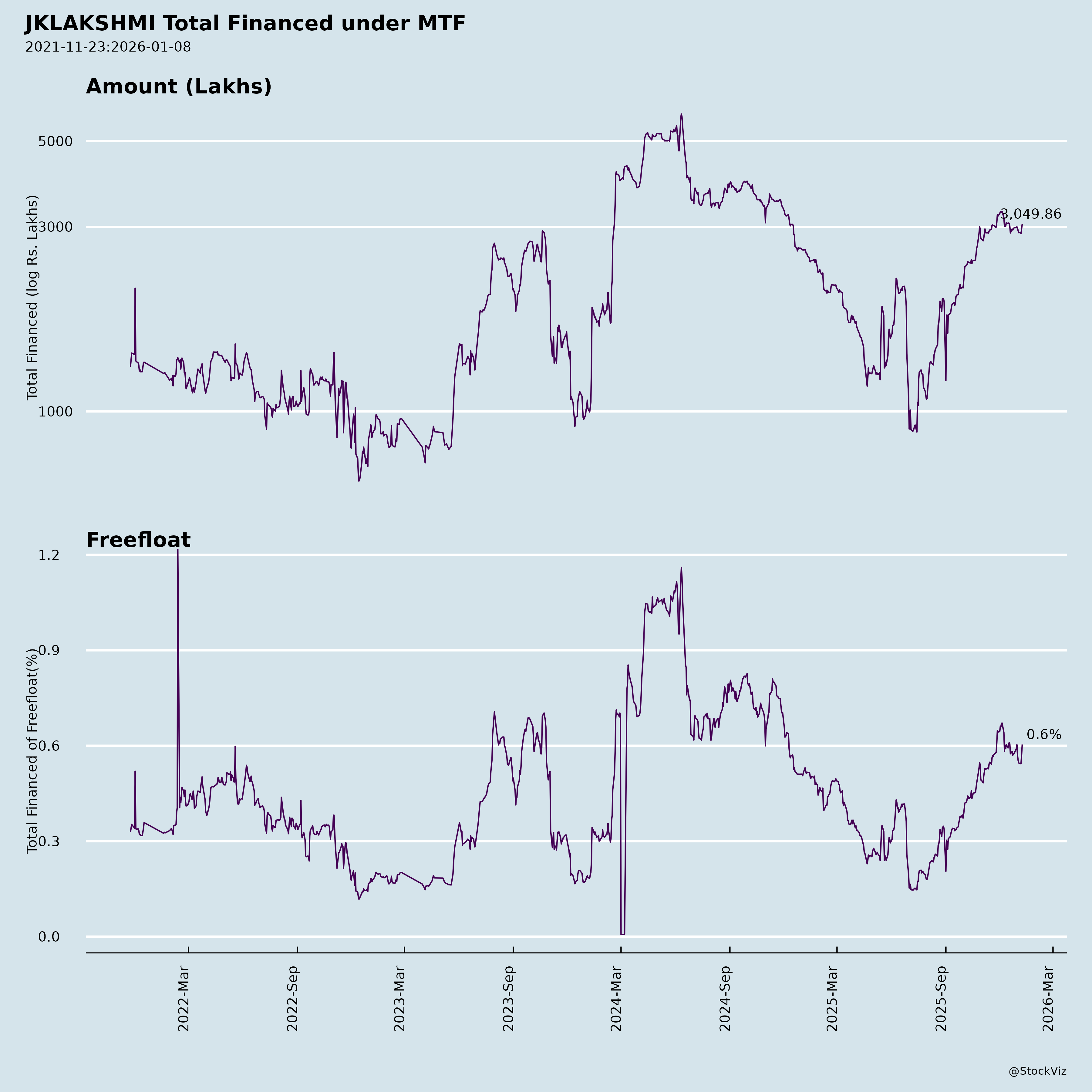

Margined

AI Summary

asof: 2025-12-08

Based on the provided documents—including the JK Lakshmi Cement Limited Q2 & H1 FY’26 Earnings Conference Call Transcript (November 7, 2025), and regulatory filings with BSE/NSE dated September 26, 2025, concerning the AGM results and director appointments—here is a comprehensive investment analysis for JK Lakshmi Cement (JKLAKSHMI).

🔍 Company Overview

JK Lakshmi Cement Limited is a mid-sized Indian cement manufacturer with an existing capacity of 18 MTPA, aiming to scale up to 30 million tons per annum (MTPA) by FY30. The company operates primarily in North and West India, with an increasing focus on premium products and efficiency improvements.

🌪️ HEADWINDS (Challenges & Risks)

1. Slow Execution on Major Projects

- The Durg Brownfield expansion is targeting 22.6 MTPA by FY28, yet only ~Rs. 50 crore spent out of Rs. 3,000 crore as of September 2025.

- Greenfield plants (Nagaur, Kutch, Assam) are not yet finalized in terms of CAPEX, timelines, or capacities. This introduces execution risk and delays in scaling capacity.

- The overland conveyor belt (OLDC) project at the East plant—key to logistics and cost optimization—remains pending with the Ministry of Steel, despite approval from SAIL. Timeline uncertainty is a concern.

2. Rising Production Costs

- Power & Fuel Cost Uptick: QoQ increase due to:

- Decline in green power proportion to 46% (down from prior quarters).

- Reduced Waste Heat Recovery System (WHRS) output during planned shutdowns.

- Lower solar generation due to monsoon weather.

- Rising Petcoke prices (~$116–120/ton).

- Distribution/freight cost per ton rose ~8.5% YoY, signaling strained margins from expanded or non-core market sales during lean demand periods.

3. Market & Pricing Pressure

- Non-trade prices have declined across markets, even post-published realizations.

- East India prices under pressure in October; demand recovery uncertain.

- Industry-wide EBITDA per ton is below Rs. 1,000, making it difficult for JKLC to achieve its target even with internal efficiencies.

4. Working Capital & Liquidity Strain

- Receivables nearly doubled from March to September 2025—though management calls it “normal” post-year-end management, it may indicate weakening collection efficiency or aggressive credit to sustain volumes.

- Upcoming CAPEX surge (~Rs. 4,200 crore over FY26–28, including Durg + maintenance + future prep) could pressure debt metrics.

- Current net debt/EBITDA tolerance capped at 3–3.5x, but future greenfield projects could breach this, raising interest cost and funding risk.

🌬️ TAILWINDS (Positive Catalysts)

1. Strong Volume Growth vs. Industry

- Management confirmed volumes grew at a rate higher than industry average in H1 FY26.

- Driven by increased geographical leverage (especially in Gujarat via Surat grinding unit commissioning in Sept 2025) and improved market access.

- Outlook: “We will do better than industry” in next two quarters.

2. Improved Product Mix & Realizations

- Premium product share increased from 23% to 26% QoQ.

- Launch of “Green Plus” brand doing well—helping narrow price gap vs. peers.

- Geographic mix shift: North (incl. Gujarat) now 69% of sales, up from prior levels—benefiting from better realization markets.

3. Cost Optimization Initiatives

- Target: Reduce costs by Rs. 120/ton over 18–24 months via:

- Technology & digitization: Early-stage deployment of AI/ML algorithms for process optimization.

- Supply chain efficiency improvements.

- Conflict-of-interest resolution in distributor/agent channels, improving ground-level discipline and price realization (initially positive, though not quantified yet).

4. Non-Cement Revenue Growth

- Other income (SBS, RMC, AC) rose to Rs. 153 crore in Q2, from Rs. 144 crore earlier.

- RMC: Rs. 72 crore (up from Rs. 66 crore YoY).

- AC sales: Rs. 52 crore (up from Rs. 40 crore).

- Diversification potential and incremental margin contributor (though low at ~4% EBITDA margin).

5. Incentive & Regulatory Tailwinds

- Eligible for capital incentives at UCWL plant—application filed, pending realization.

- Progress on Nagaur, Kutch, Assam greenfield projects—land acquisition ongoing. CAPEX largely deferred to FY29–30, de-risking near-term financials.

📈 GROWTH PROSPECTS

Capacity Expansion Roadmap

| Project | Capacity | Timeline | Status |

|---|---|---|---|

| Surat Grinding Unit | ~1.0 MTPA (included in 18 MTPA) | Commissioned Sep 2025 | Completed |

| Durg Brownfield Expansion | +4.6 MTPA → 22.6 MTPA | FY28 | Orders placed; execution in progress |

| Nagaur Greenfield | ~3 MTPA | FY29–30 | Land acquisition; no final CAPEX |

| Kutch Greenfield | ~3 MTPA | FY29–30 | Under acquisition |

| Assam Greenfield | ~2.0–2.5 MTPA | FY29–30 | Initial planning |

| Total Target | 30 MTPA | By FY30 | On track, but execution-dependent |

Growth Strategy

- Organic capacity build: Focus on brownfield first, greenfield in the rear end.

- Inorganic expansion: Actively explored “provided right valuation, location, and strategic fit”—no new updates.

- New market seeding: Grinding stations planned in Bihar, Jharkhand, Prayagraj—positions JKLC for East India growth.

Financial Outlook

- CAPEX Guided:

- FY26: Rs. 1,000–1,200 crore

- FY27–28: Rs. 1,300–1,500 crore/year

- Majority (Rs. 3,000 crore) allocated to Durg expansion.

- EBITDA Target: Management still aims for Rs. 1,000/ton, but conditioned on industry recovery—no upward revision despite better mix and controls.

⚠️ KEY RISKS & CONCERNS

| Risk Category | Key Risk |

|---|---|

| Execution Risk | Durg expansion delayed, greenfield projects face clearances or delay. |

| Regulatory Risk | OLDC (overland conveyor) approval stuck with Ministry of Steel. Any change in govt policy (e.g., environmental norms) could slow greenfield development. |

| Commodity Price Volatility | Rising Petcoke, power, and freight costs could erode gains from operational improvements. |

| Capital Intensity | Total CAPEX to reach 30 MTPA may exceed Rs. 6,000 crore (est. ~$100/ton for greenfields). Could strain balance sheet; dependence on debt or hybrid funding. |

| Execution on Inorganic Growth | No visible M&A yet; may be needed to scale fast, but valuations in cement space are high. |

| Demand Cyclicality | Cement demand highly correlated with infrastructure, housing, and monsoon patterns. Weak Diwali, unseasonal rains in Oct 2025 slowed growth. |

🔚 SUMMARY & INVESTMENT CONCLUSION

✅ Strengths (Why Invest?)

- Improving fundamentals: Sales mix, premium product growth, and better realizations.

- Technology & operational discipline: Early benefits from digital/AI initiatives; supply chain cleanup.

- CapEx pacing: Major spend delayed to FY29–30, preserving near-term liquidity.

- Leadership continuity: Re-appointment of Arun Shukla (President) and independent directors ensures strategic consistency.

- Diversified revenue streams: Non-cement income growing steadily.

❌ Weaknesses (Why Cautious?)

- Execution delays on critical infrastructure (OLDC, greenfields).

- Margin pressures from rising input costs.

- EBITDA guidance not aggressive, and tied to industry recovery.

- Receivables buildup may hint at pricing pressure.

📊 Investment Thesis

Neutral to Positive Re-rating Catalysts: - Short-term (6–12 months): Continue to outperform industry in volume growth; deliver Rs. 80–100/ton cost improvement; OLDC approval. - Long-term (FY29–30): Successful execution of greenfield projects; achievement of Rs. 1,000/ton EBITDA.

Valuation Considerations: - If industry EBITDA improves and JKLC closes the gap, margins could expand to peer levels. - P/E and EV/EBITDA likely re-rate if execution improves and debt/EBITDA stays below 3x.

✅ Final Summary: JK Lakshmi Cement (JKLAKSHMI)

| Category | Assessment |

|---|---|

| Headwinds | Rising input costs, slow project execution, non-trade price decline, receivables increase. |

| Tailwinds | Strong volume growth, improved product/geographic mix, Green Plus brand traction, deferred greenfield CAPEX. |

| Growth Prospects | Capacity from 18 → 30 MTPA by FY30; expansion via Durg (FY28) and greenfields (FY29–30). Geographical foray into East India. |

| Key Risks | Regulatory delays (OLDC), Petcoke/power volatility, over-leveraging, missed CAPEX timelines. |

| Outlook | Cautiously optimistic. Stock may trade on execution and margin progression, not just capacity announcements. |

✅ Buy on execution, Hold until clarity on greenfield CAPEX, Watch for margin trends and OLDC resolution.

Note: All data and projections based on public disclosures, management commentary (Nov 7, 2025 call), and BSE/NSE filings (Sept 26, 2025).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.