JIOFIN

Equity Metrics

January 13, 2026

Jio Financial Services Limited

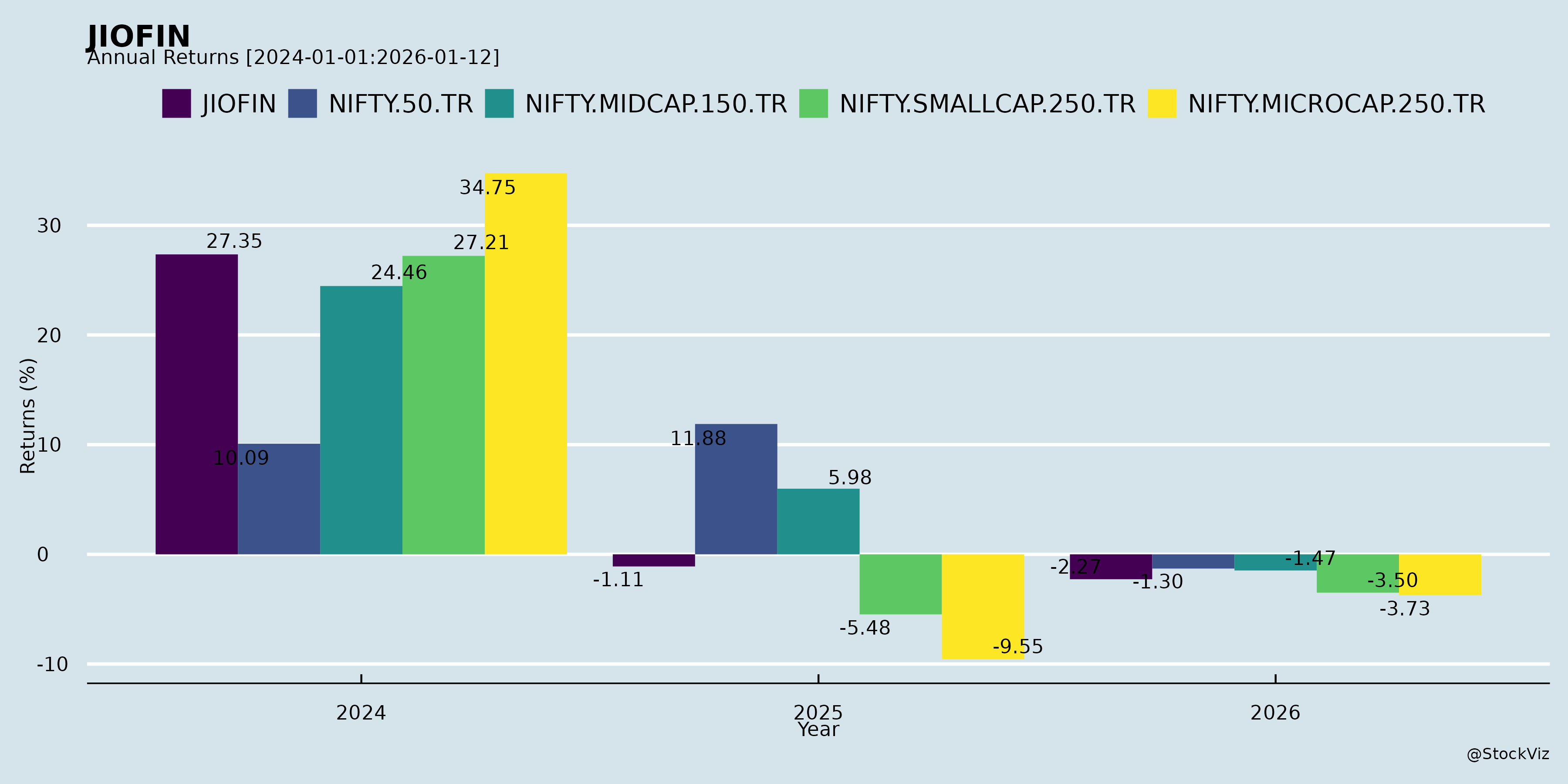

Annual Returns

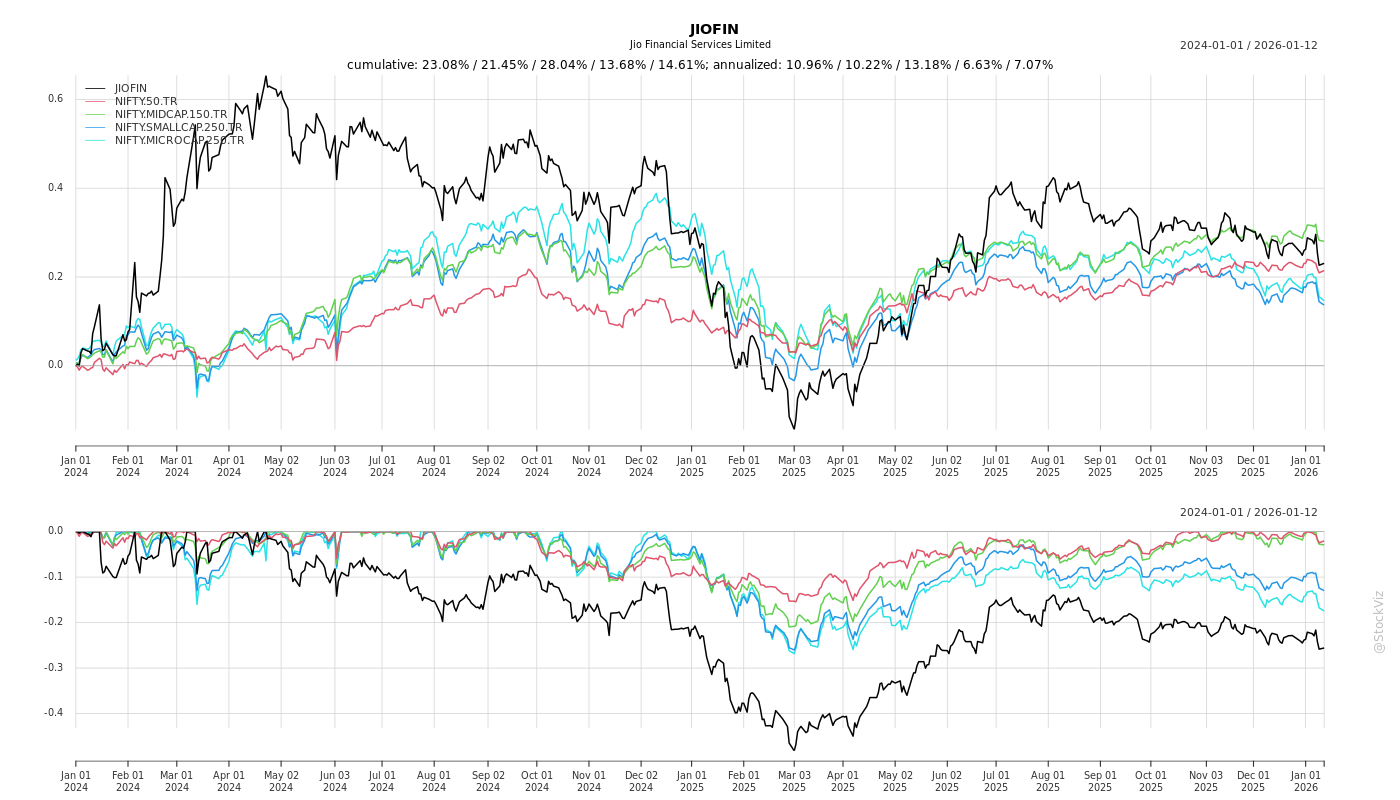

Cumulative Returns and Drawdowns

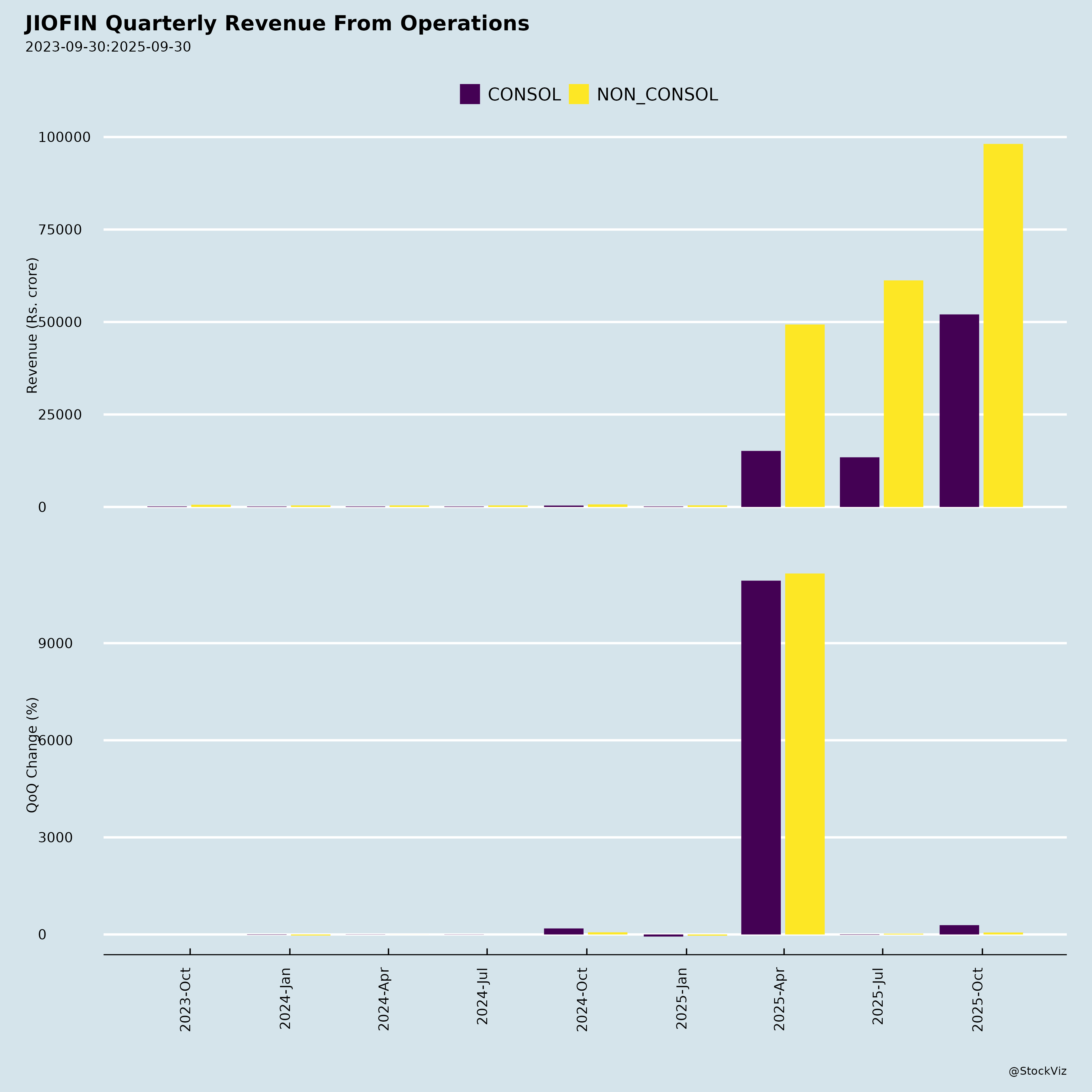

Fundamentals

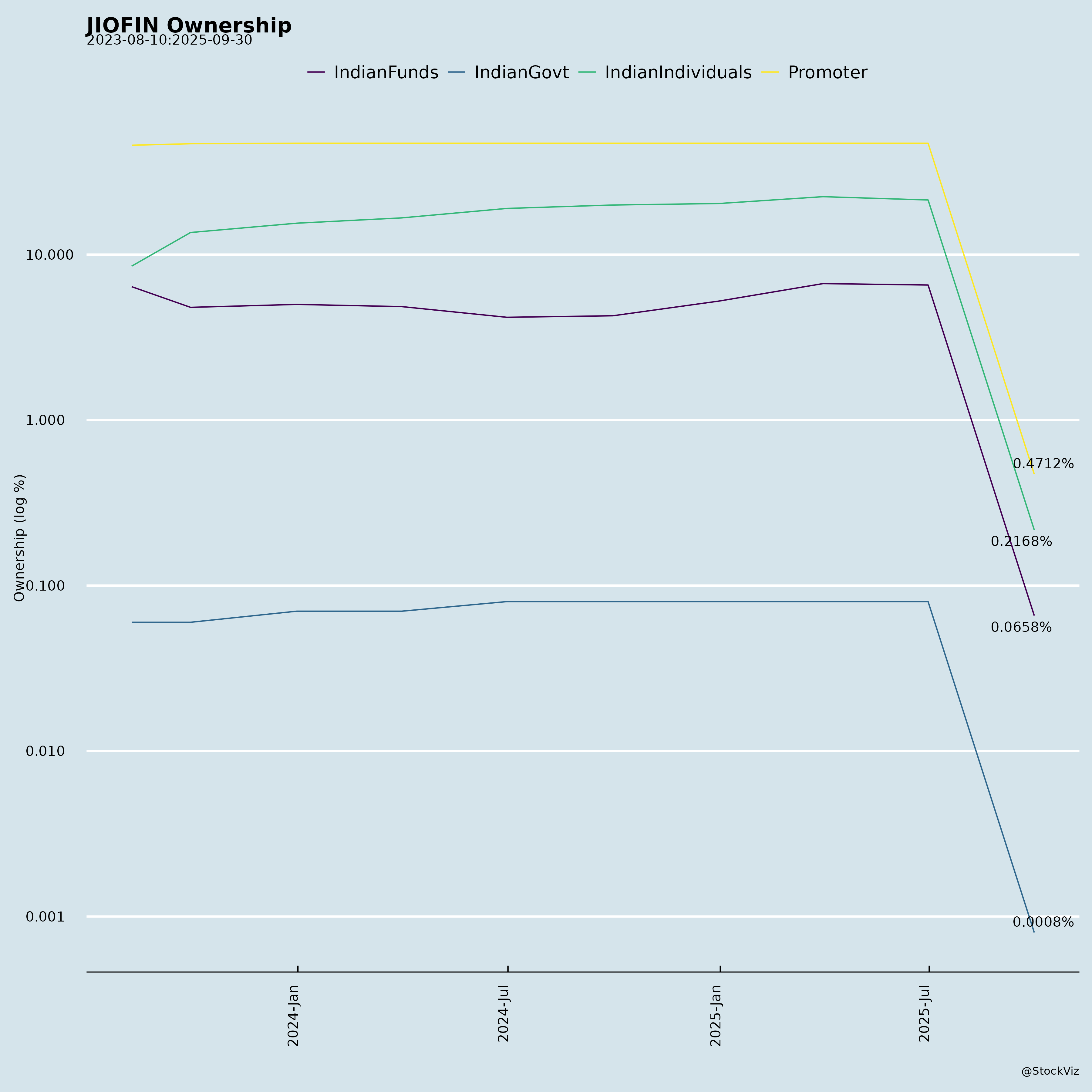

Ownership

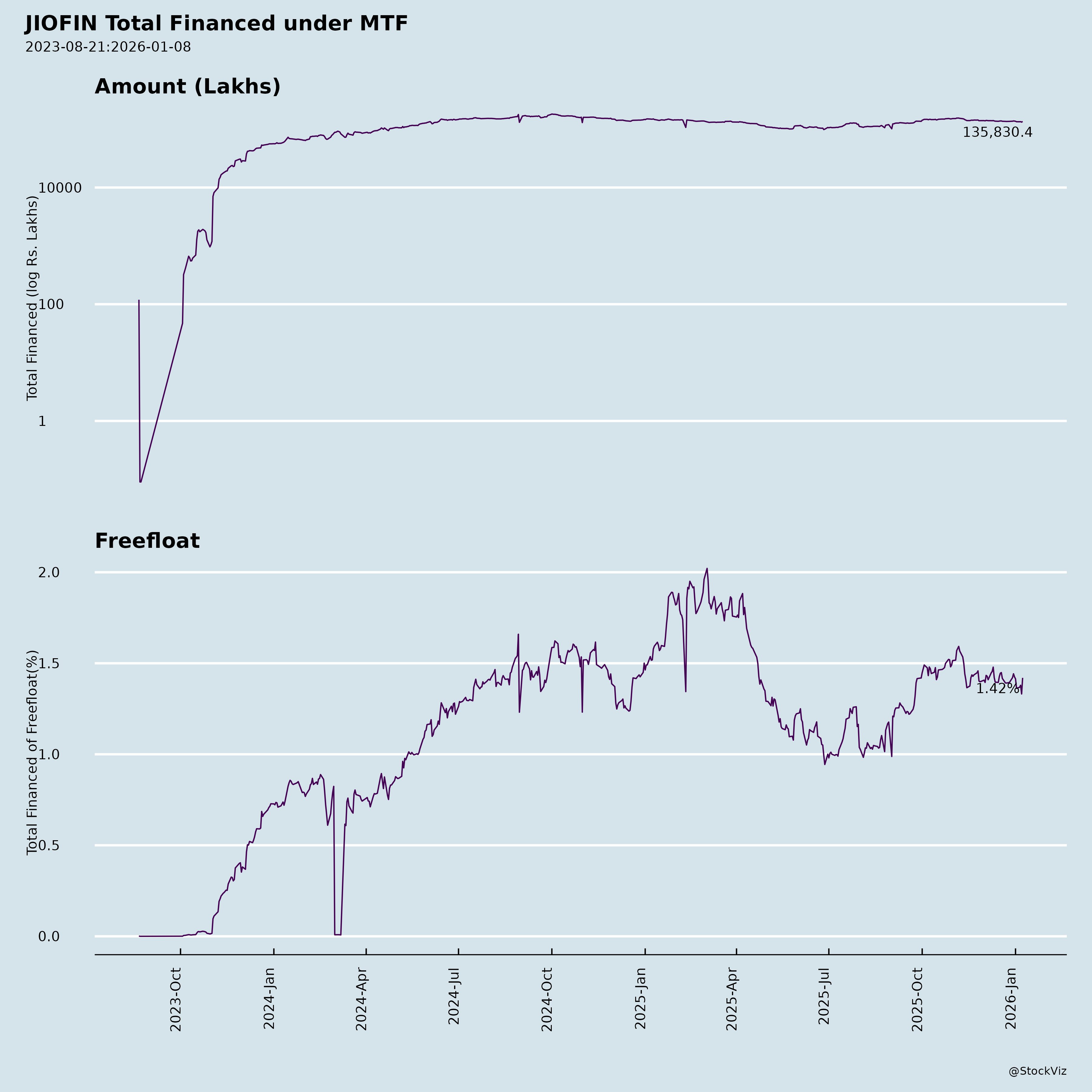

Margined

AI Summary

asof: 2025-12-03

JIOFIN Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

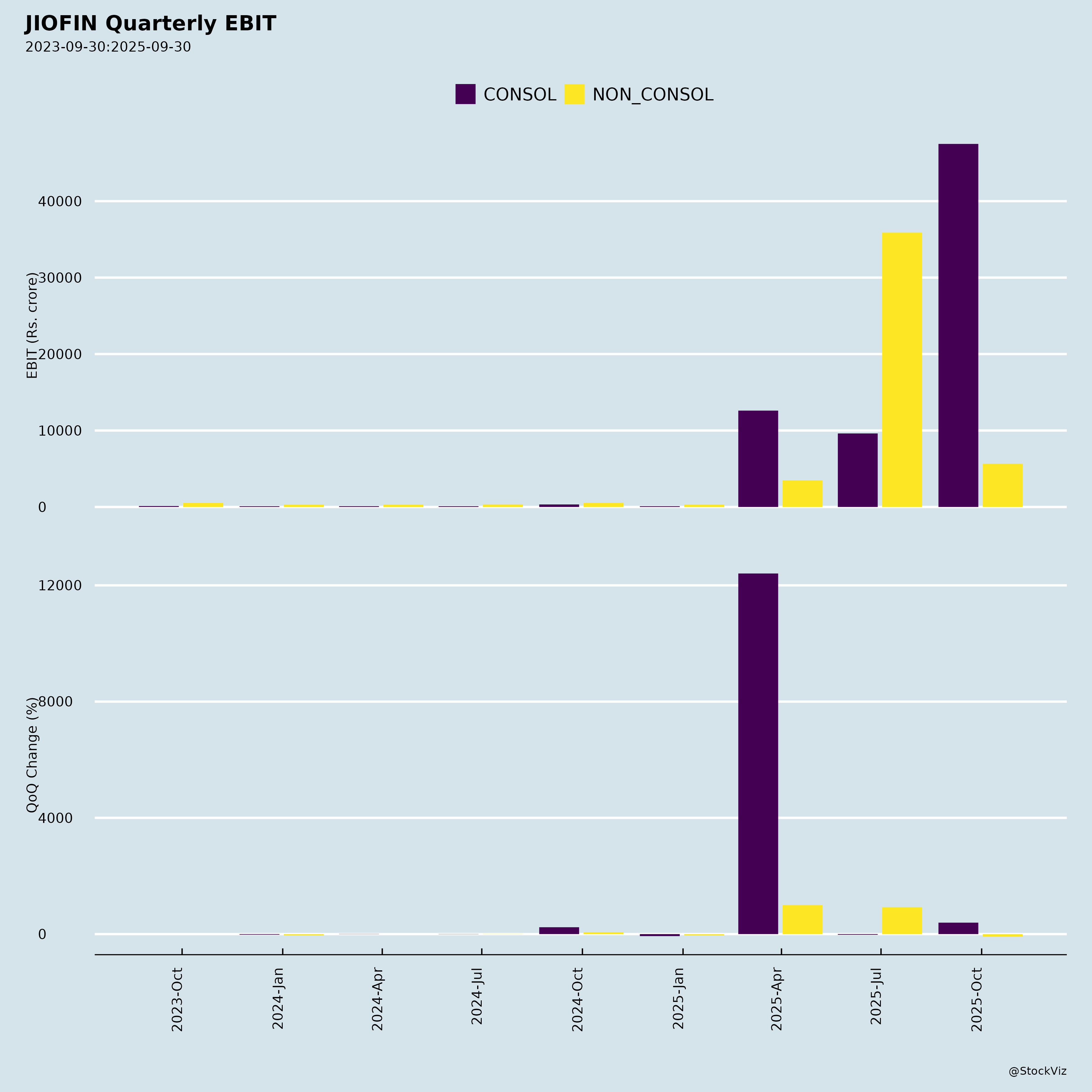

Jio Financial Services Limited (JIOFIN), a digitally native financial services platform leveraging the Jio ecosystem, reported robust Q2/H1 FY26 results (ended Sep 30, 2025), with consolidated total income up 44%/46% YoY to ₹1,002 Cr/₹1,622 Cr, driven by lending growth, payments surge, and early AMC traction. NBFC AUM hit ₹14,712 Cr (12x YoY), payments TPV ₹13,566 Cr (+167% YoY), and AMC AUM ₹15,980 Cr in <4 months. Strategic JVs (BlackRock, Allianz) and ₹3,956 Cr warrant infusion (first tranche of ₹15,825 Cr) bolster scalability. Below is a structured summary based on the filings.

Tailwinds (Supportive Factors)

- Ecosystem Leverage & User Base: 18mn unique users across Jio properties; seamless integration via JioFinance app (new “Track your Finances” dashboard for unified view of accounts/investments). Omni-channel expansion (200k BC agents, 15 lending offices, 19k+ PIN codes).

- Lending Momentum: Quarterly disbursements ₹6,624 Cr; diversified products (home loans, LAMF/LAS, Loan vs ETFs); AUM 12x YoY; cost of borrowing down to 7.06%.

- Payments Scale: Jio Payments Solutions TPV +167% YoY; Payments Bank CASA +14% QoQ (2.95mn customers), 199k BC network; new wins (11/12 toll mandates, MLFF plazas); features like Tap-and-Pay, UPI Autopay.

- Investment & Insurance Ramp: BlackRock AMC: 9 funds, Flexi Cap NFO ₹1,500 Cr; Insurance Broking: ₹347 Cr premium (+), 2.9 lakh policies; Allianz JVs (reinsurance incorporated, life/general in pipeline).

- Funding & Tech Edge: ₹3,956 Cr warrants received; ISO 27001 certified tech stack (AI/ML models, data lake); young team (avg age 34, 1,700+ employees).

- Financial Health: Net worth ₹134,739 Cr; CAR 31.4%; PPO profit +5% YoY (₹579 Cr Q2).

Headwinds (Challenges)

- Income Volatility: Heavy reliance on dividends (₹269 Cr Q2) and fair value gains (₹180 Cr); core ops income only 52% of net total income (ex-dividend), limiting recurring revenue.

- Rising Costs: Finance costs ₹136 Cr Q2 (new borrowings); opex up (staff ₹95 Cr, others ₹193 Cr); provisions ₹13 Cr (up from ₹4 Cr YoY).

- OCI Swings: Massive unrealized losses (₹9,665 Cr Q2) from equity investments, dragging total comprehensive income to -₹8,970 Cr.

- Early-Stage Scaling: Lending profitability nascent (NII ₹140 Cr Q2, PAT ₹50 Cr); payments/AMC still ramping amid competition from incumbents (Paytm, PhonePe) and banks.

- Macro Pressures: Potential rate hikes could squeeze lending margins; toll mandates regulatory-dependent.

Growth Prospects

- High-Upside Segments: | Segment | Key Metrics & Outlook | |———|———————-| | Borrow | AUM to scale via Jio ecosystem/aggregators; new products (LAP, corporate loans); target: sustained 4-5x YoY growth. | Transact | TPV to 2-3x via tolls/MLFF, merchant SDKs, JioBharat SoundPay; CASA/deposits +18% QoQ. | Invest | AMC pipeline (ETFs, SIFs); BlackRock JVs for wealth/broking; D2C via app/MyJio. | Protect | Broking to 5-10x via PoSP/digital; Allianz JVs post-approvals for ₹10,000+ Cr premiums in 3-5 yrs.

- Digital Flywheel: JioFinance app as unified hub (loans, UPI, MF, insurance); AI-driven personalization; 40% AMC AUM from B30 cities signals mass-market penetration.

- Capital Infusion: Full warrants (₹15,825 Cr) to fuel lending/investments; group synergies for 20-30% CAGR in ops income.

- Overall: 4.3-4.9x YoY ops income growth; aim for 46%+ of net income from core biz (vs 14% FY25).

Key Risks

- Credit & Market Risk (High): Lending book young (provisions +3x YoY); equity portfolio volatility (OCI losses >₹9,000 Cr Q2); asset quality stress in macro downturn.

- Regulatory/Execution Risk (Medium-High): Delays in IRDAI/RBI nods for Allianz JVs, Payments Bank scaling; NBFC compliance (2.4x D/E, but borrowings up 3x).

- Competition & Execution (Medium): Fintech wars (lending/payments); retaining Jio users amid rivals; tech integration risks (cybersecurity, data privacy).

- Funding & Liquidity (Medium): Reliance on promoter warrants (75% pending); rising finance costs if rates rise.

- Concentration: Promoter/group heavy (warrants to affiliates); Jio ecosystem dependence.

Overall Outlook: Strong tailwinds from digital scale and JVs position JIOFIN for 25-40% revenue CAGR over 2-3 years, transitioning from investment-heavy to ops-led profitability. However, volatility in investments/OCI and regulatory hurdles warrant caution. Near-term stock catalysts: Q3 results, JV approvals, lending AUM updates. Valuation: Trade at ~3-4x FY26E book value, with upside if core ops hit 60%+ mix. Monitor NIMs and provisions quarterly.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.