ITCHOTELS

Equity Metrics

January 13, 2026

ITC Hotels Limited

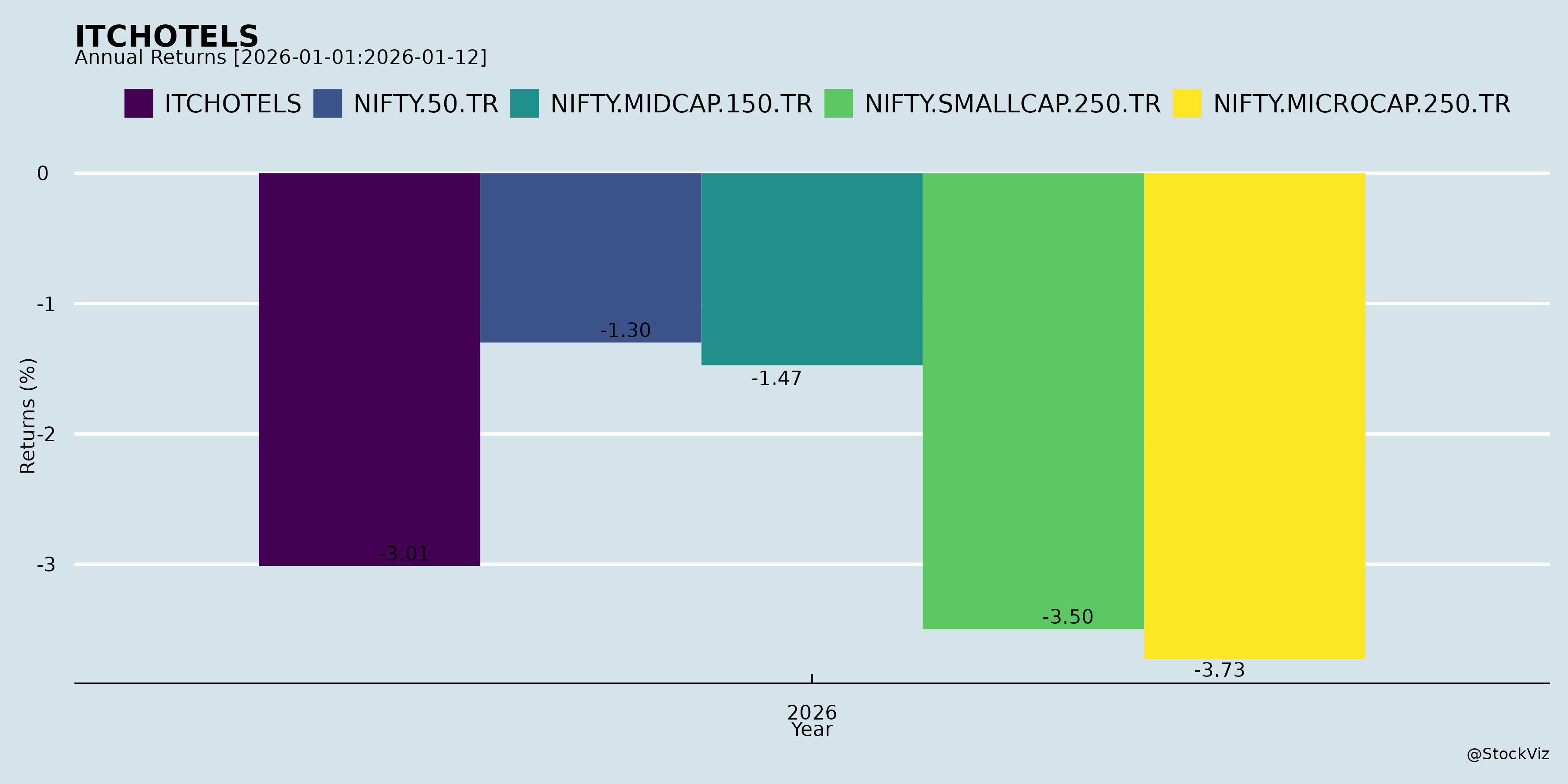

Annual Returns

Cumulative Returns and Drawdowns

Fundamentals

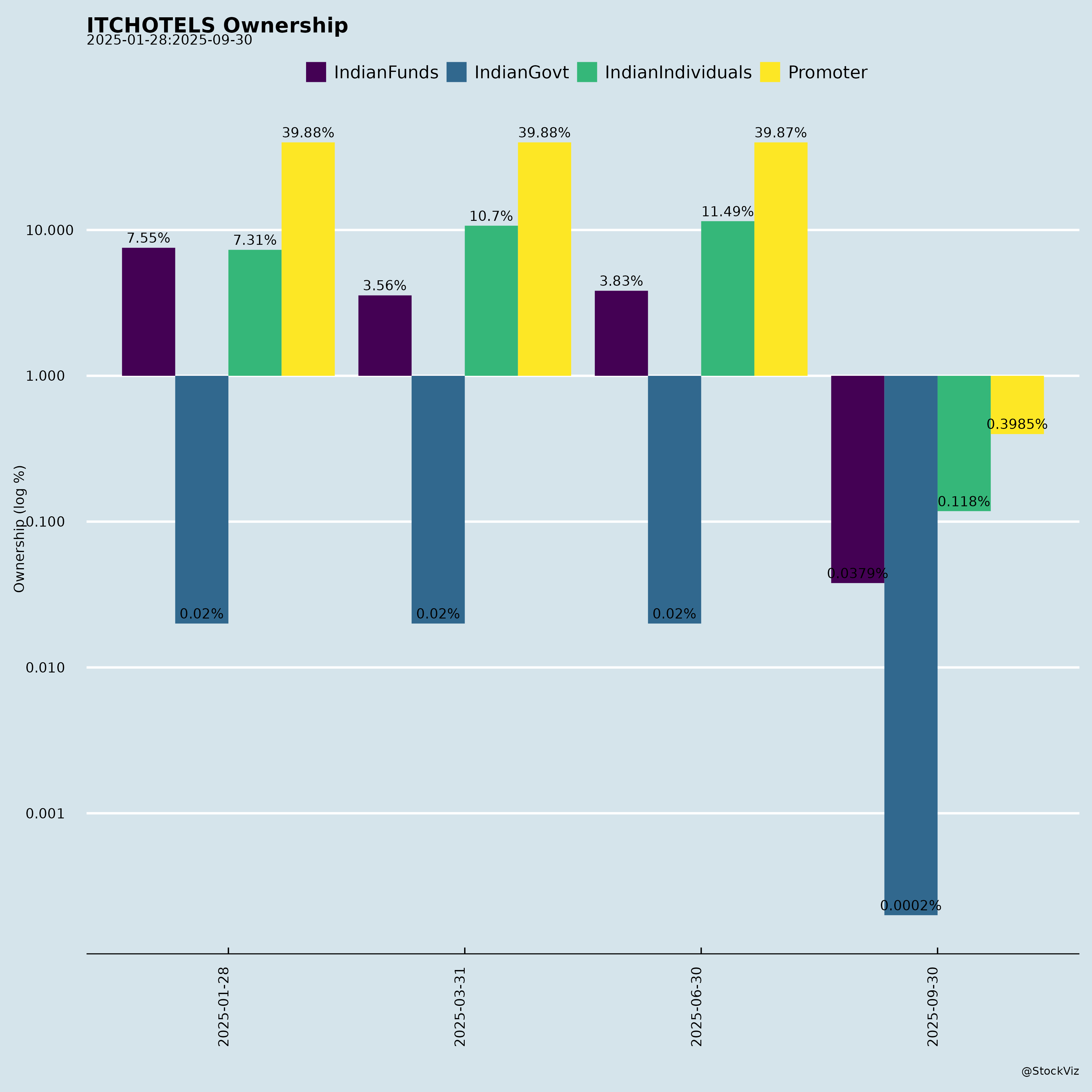

Ownership

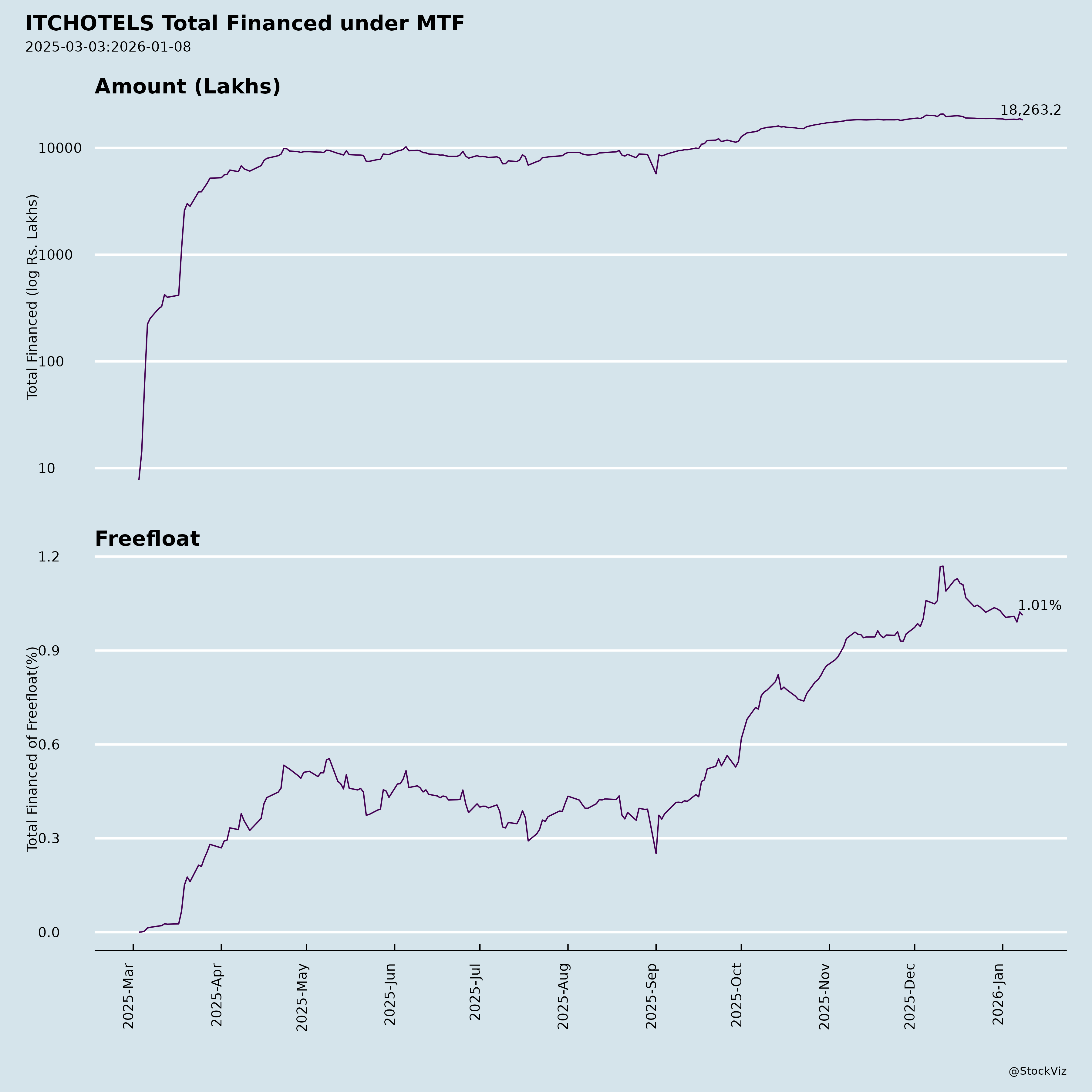

Margined

AI Summary

asof: 2025-12-08

Based on a comprehensive analysis of the unaudited financial results and disclosures by ITC Hotels Limited (ITCHOTELS) for the quarter and six months ended 30th September 2025, along with related corporate announcements and auditor reports, this summary evaluates the headwinds, tailwinds, growth prospects, and key risks for the company. These insights are contextualized within India’s evolving hospitality sector and broader economic environment.

🔍 Executive Summary

ITC Hotels Limited, now an independent listed entity post-demerger from ITC Limited, has successfully established its standalone operations with strong foundational revenues and brand recognition. As of Q2 FY26 (Sep 2025), the company shows robust performance in hospitality, underpinned by revenue growth, improved profitability, and strategic investments in talent and employee engagement.

Despite near-term headwinds related to large capital outlays and margin pressures, ITC Hotels is well-positioned for long-term premium and luxury hospitality leadership in India and select international markets (e.g., Sri Lanka), driven by asset-light real estate partnerships, franchise expansions, and sector tailwinds. However, significant financial, regulatory, and operational risks remain.

✅ Tailwinds: Key Strengths and Growth Drivers

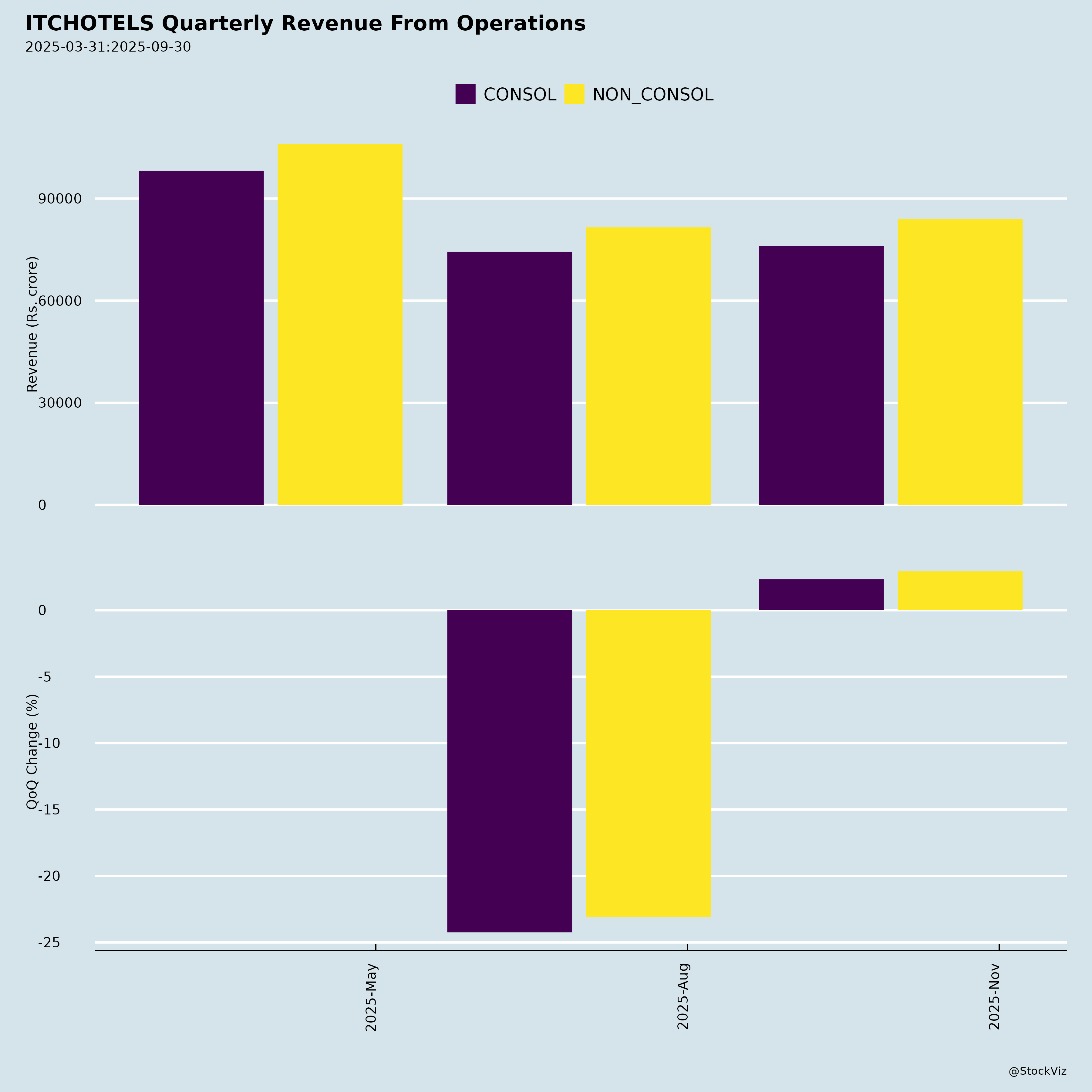

1. Strong Top-Line Growth

- Standalone Revenue (Q2 FY26): ₹760.9 crore (+7.4% YoY)

- Consolidated Revenue (Q2 FY26): ₹839.5 crore (+7.9% YoY)

- 6M Revenue (Consolidated): ₹1,655 crore (+11.5% YoY vs ₹1,483.8 crore)

💡 Growth indicates sustained recovery in domestic and international travel, with premium customer preference for ITC’s luxury brands (e.g., Welcome, Fortune).

2. Improved Profitability and Margins

- Net profit after tax (Standalone): ₹151.6 crore (Q2 FY26) vs ₹104.8 crore (Q2 FY25) → +44% YoY growth

- EBITDA margin (approx): ~26.2% (Standalone Q2, EBITDA estimate: ₹203.3 + ₹73.4 = ₹276.7 crore; margin: 36% of operating revenue)

- Exceptional items minimal, tax stability improved.

💡 Indicates operational efficiency and cost control, even amid rising investments.

3. Post-Demerger Momentum & Clean Balance Sheet Transition

- Demerger effective 1st January 2025, allowing standalone identity and capital structure.

- Share capital increased to ₹208.27 crore (post issuance of 10.48 million options), reflecting employee alignment and fresh capital.

- Successful integration reflected in harmonized standalone/consolidated reporting.

💡 Creates investor confidence and enables targeted capital allocation, M&A, and growth strategies.

4. Real Estate & Branded Residences: Emerging Revenue Stream

- Construction underway on super-premium branded residences in Colombo, Sri Lanka — to be recognized on completion.

- “Real estate” is a distinct segment with assets of ₹1,414 crore (Q2 FY26) — a +16.8% YoY increase.

- Revenue currently negligible (intercompany), but will act as high-margin, capital-light future income stream.

💡 Branded residences are a high-growth, low-capital-risk model, increasingly adopted by luxury players globally.

5. Expansion of Employee Stock Participation

- ₹23.23 crore proceeds from ESOPs issued during Q2 FY26.

- New Employee SAR (Stock Appreciation Rights) scheme proposed, up to 2% of share capital.

💡 Strengthens talent retention and motivation in competitive hospitality labor market.

6. Active Investor Engagement

- Upcoming participation in high-profile investor conferences (Ambit, Macquarie).

- Regular, transparent disclosures aligned with SEBI LODR requirements.

💡 Builds investor confidence during a critical phase of independent operations.

⚠️ Headwinds: Challenges and Performance Drag

1. High Capital Expenditure & Pressure on Cash Flow

- Investing outflows (H1 FY26):

- Standalone: ₹336.85 crore used

- Consolidated: ₹372.27 crore used

- Key drivers: ₹160.9 crore spent on PPE, ₹999 crore on current investments, and ₹227.5 crore on non-current investments.

🔻 Large deployment reflects expansion but leads to: - Net decrease in cash (Standalone): From ₹22.69 crore → ₹10.31 crore - Net decrease (Consolidated): From ₹76.71 crore → ₹16.72 crore

❗ Liquidity is manageable but requires careful management given thin operating margins post-depreciation.

2. Negative Working Capital Impact

- Operating cash flow adjustments show:

- ₹12.95 crore reduction due to rise in trade receivables and advances

- ₹49.5 crore increase in trade payables but offset by inventory build-up and receivables lag

🔻 Suggests working capital inefficiencies or advance capital deployment ahead of peak seasons.

3. Lower Segment Profitability in Real Estate & Others

- Real estate segment loss: ₹0.7 crore (6M FY26)

- Others (incl. golf/ancillaries): Minimal profitability

- While hotels contribute >90% of profit (₹284 crore in 6M), other segments are yet to break even.

🔻 Diversification is costly; only hotels show scale and profitability.

🔮 Growth Prospects

| Area | Outlook | Details |

|---|---|---|

| Hotel Expansion (India) | High | ITC has ongoing brand extensions (e.g., WelcomHotel, Fortune Park); focus on tier-1/2 cities and tourism hubs |

| International (Sri Lanka) | Medium | Colombo branded residences & WelcomeHotels — geopolitical and FX risks, but high-margin potential |

| Franchise & Management Contracts | High | Asset-light model gaining traction; scalable and profitable |

| Sector Tailwinds | High | - India’s travel & tourism sector to grow 9% CAGR till 2030 - MICE (Meetings, Incentives, Conferences) revival - Premiumization trend in domestic travel |

| SAR & ESOP Pool Expansion | Medium | Enhances stakeholder alignment; supports hiring of senior talent (e.g., Gupta’s elevation) |

🛑 Key Risks

1. Macroeconomic & Sector Risks

- High interest rates, inflation → impact consumer discretionary spending.

- Geopolitical instability → affects international tourism (e.g., Sri Lanka exposure).

- Climate change & natural disasters → risk to coastal/resort properties.

2. Liquidity & Capital Structure Risk

- High capex without proportional earnings growth → risk of downgrades or funding needs.

- Limited debt disclosures; reliance on operational cash flows and equity.

- Negative net cash flow from investing activities (₹372 crore) unsustainable long-term.

3. Regulatory & Compliance Risk

- Post-demerger, new entity; regulatory learning curve with SEBI, ROC, NCLT compliance.

- Complex group structure with subsidiaries, associates, and foreign entity — increases disclosure burden.

4. FX & Subsidiary Risk (Sri Lanka)

- Foreign subsidiary financials converted from local GAAP to Ind AS — currency volatility and translation losses (reported in OCI).

- Sri Lanka’s economic instability remains a watch-out.

5. Brand & Reputation Risk

- High reliance on ITC parent brand. As standalone entity, brand recall and trust need rebuilding.

- Cybersecurity, labor relations, or service lapses could damage premium image.

6. Governance & Succession Risk

- While Mr. Sudhir Gupta’s elevation as VP Procurement is disclosed, broader talent pipeline not evident.

- Current Managing Director has DIN 08073567, but succession not disclosed.

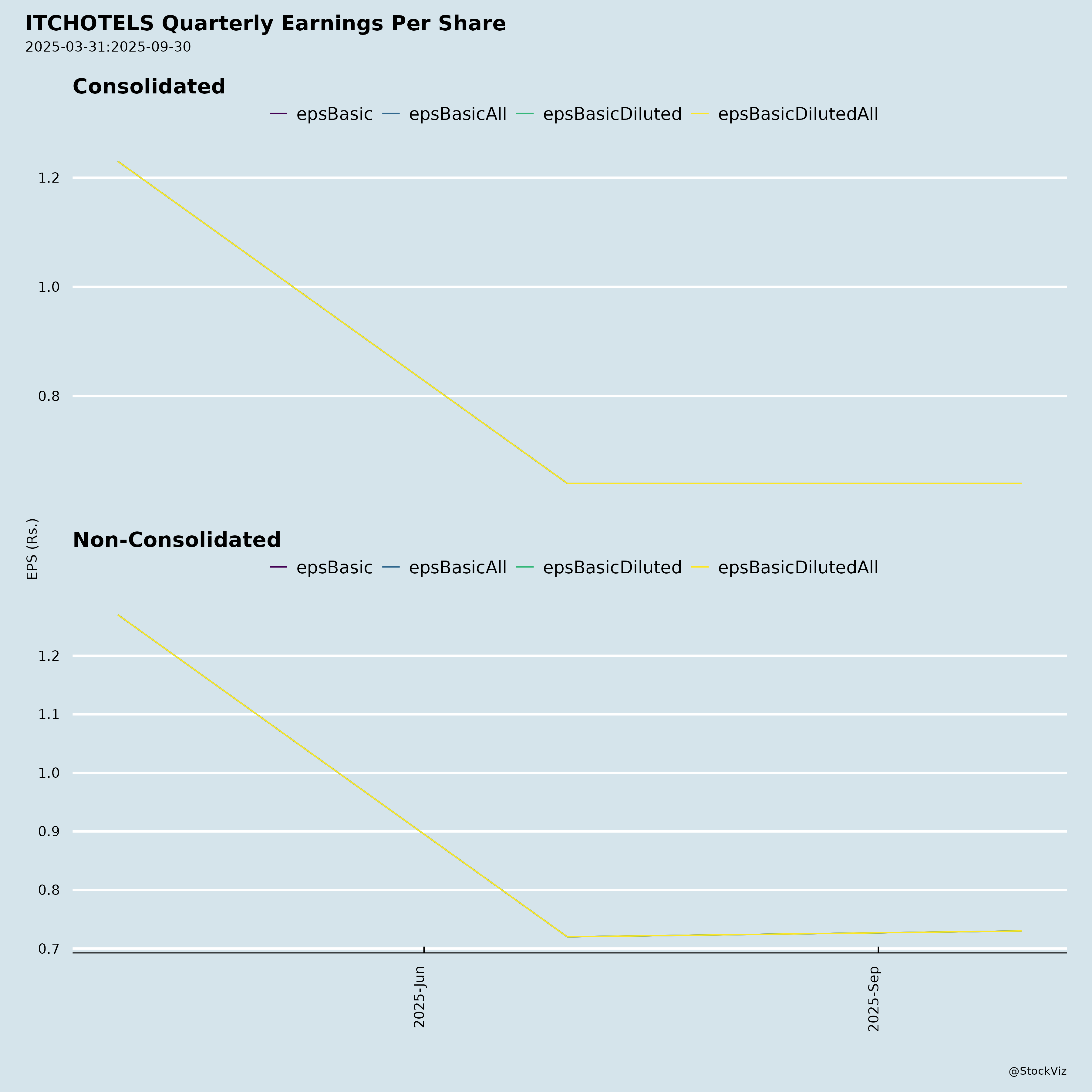

🧮 Financial Snapshot (Q2 FY26 – Sep 2025)

| Metric | Standalone | Consolidated |

|---|---|---|

| Total Revenue (3M) | ₹806.07 Cr | ₹884.89 Cr |

| PBT | ₹203.36 Cr | ₹188.69 Cr |

| PAT (after tax) | ₹151.63 Cr | ₹133.29 Cr |

| EPS (Basic, not annualized) | ₹0.73 | ₹0.64 |

| Total Assets | ₹12,770 Cr | ₹12,822 Cr |

| Cash & Equivalents | ₹10.31 Cr | ₹16.72 Cr |

| ROE (6M, approx) | ~14.5% | ~12.8% |

💡 Standalone shows better profitability, likely due to intercompany elimination and cleaner base.

✅ Conclusion & Recommendation

Overall Outlook: Positive to Cautiously Optimistic

ITC Hotels Limited is navigating a critical phase post-demerger with strong early financial performance in its core hotel operations, benefiting from brand equity, real estate tie-ups, and sector recoveries.

🔑 Key Positives

- Revenue & profit growth accelerating

- Branded residences offer high-margin diversification

- Employee engagement programs boosting retention

- Transparent reporting and investor engagement

⚖️ Key Concerns

- Heavy cash outflows raising liquidity concerns

- Loss-making subsidiary with large asset base

- Limited diversification beyond hotels

- FX and geopolitical risks in Sri Lanka

📈 Forward View

- Near-term (1–2 years): Focus on de-leveraging, improving asset turnover, and completing Colombo projects.

- Medium-term (3–5 years): Target 300+ hotels (franchise-driven), expand international footprint, and rationalize underperforming units.

📣 Final Summary: ITC Hotels Limited (ITCHOTELS)

| Category | Assessment |

|---|---|

| Headwinds | High capex, working capital drag, loss-making subsidiary, Sri Lanka FX risk |

| Tailwinds | Strong brand, luxury hospitality demand, franchise growth, asset-light real estate model |

| Growth Prospects | ✅ High (India expansion), ✅ Medium (International) |

| Key Risks | Liquidity, macro conditions, regulatory compliance, governance |

| Investment Sentiment | Accumulate (long-term); monitor cash flows and subsidiary performance |

📌 Bottom Line: ITC Hotels is an emerging standalone champion of Indian hospitality with legacy strength and modern strategy. Investors should monitor capital efficiency and execution — but the foundation is solid for sustainable luxury-led growth.

For updated disclosures, visit: - www.itchotels.com - www.bseindia.com - www.nseindia.com

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.