Hotels & Resorts

Industry Metrics

January 13, 2026

Annual Returns

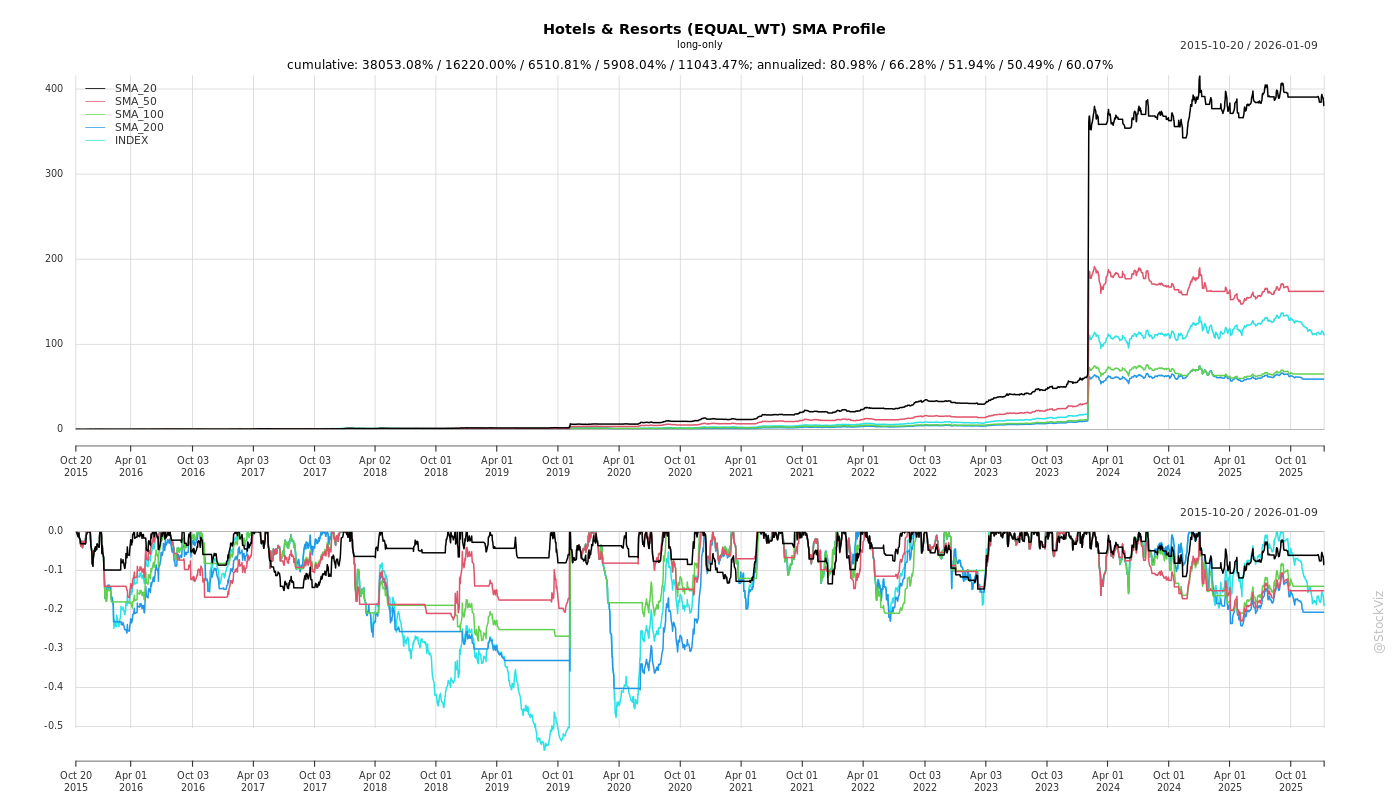

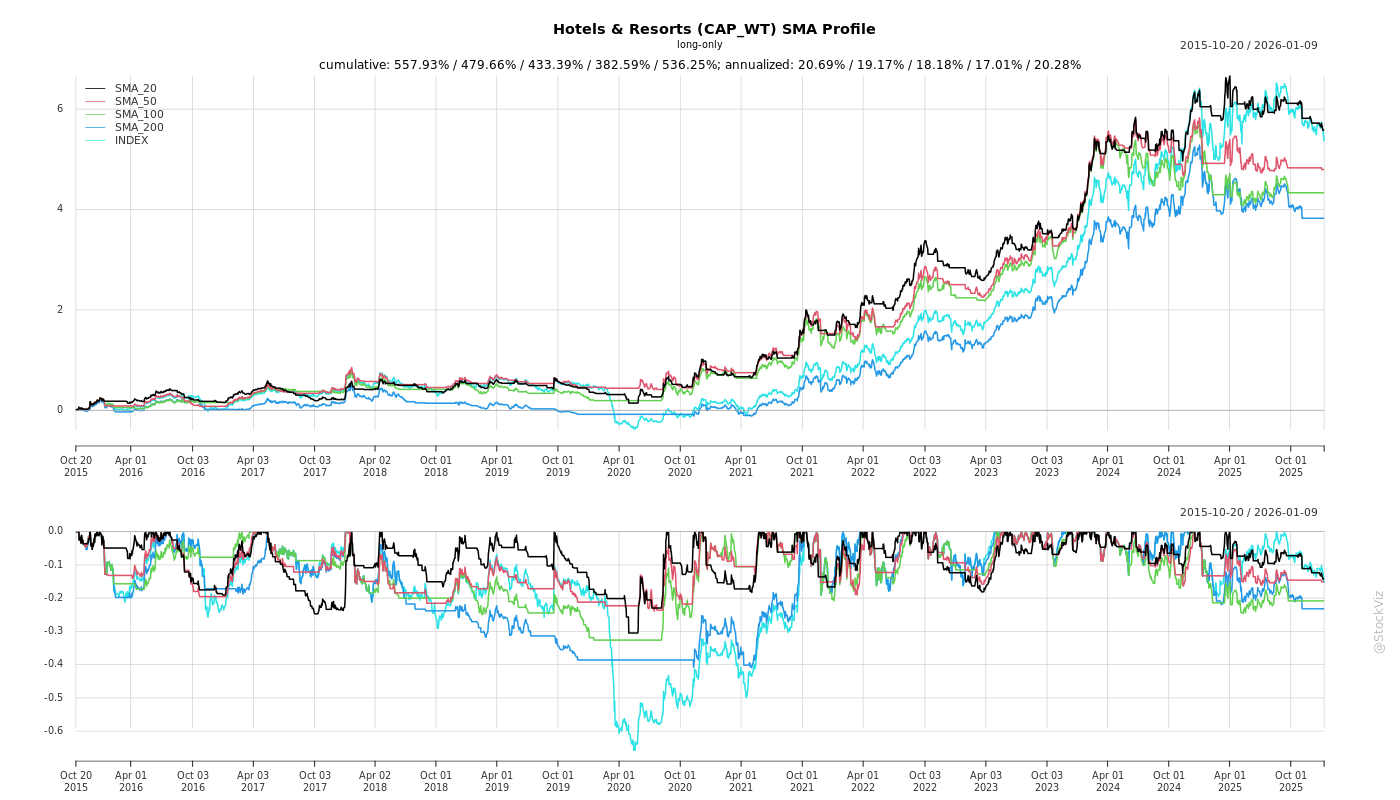

Cumulative Returns and Drawdowns

SMA Scenarios

Current Distance from SMA

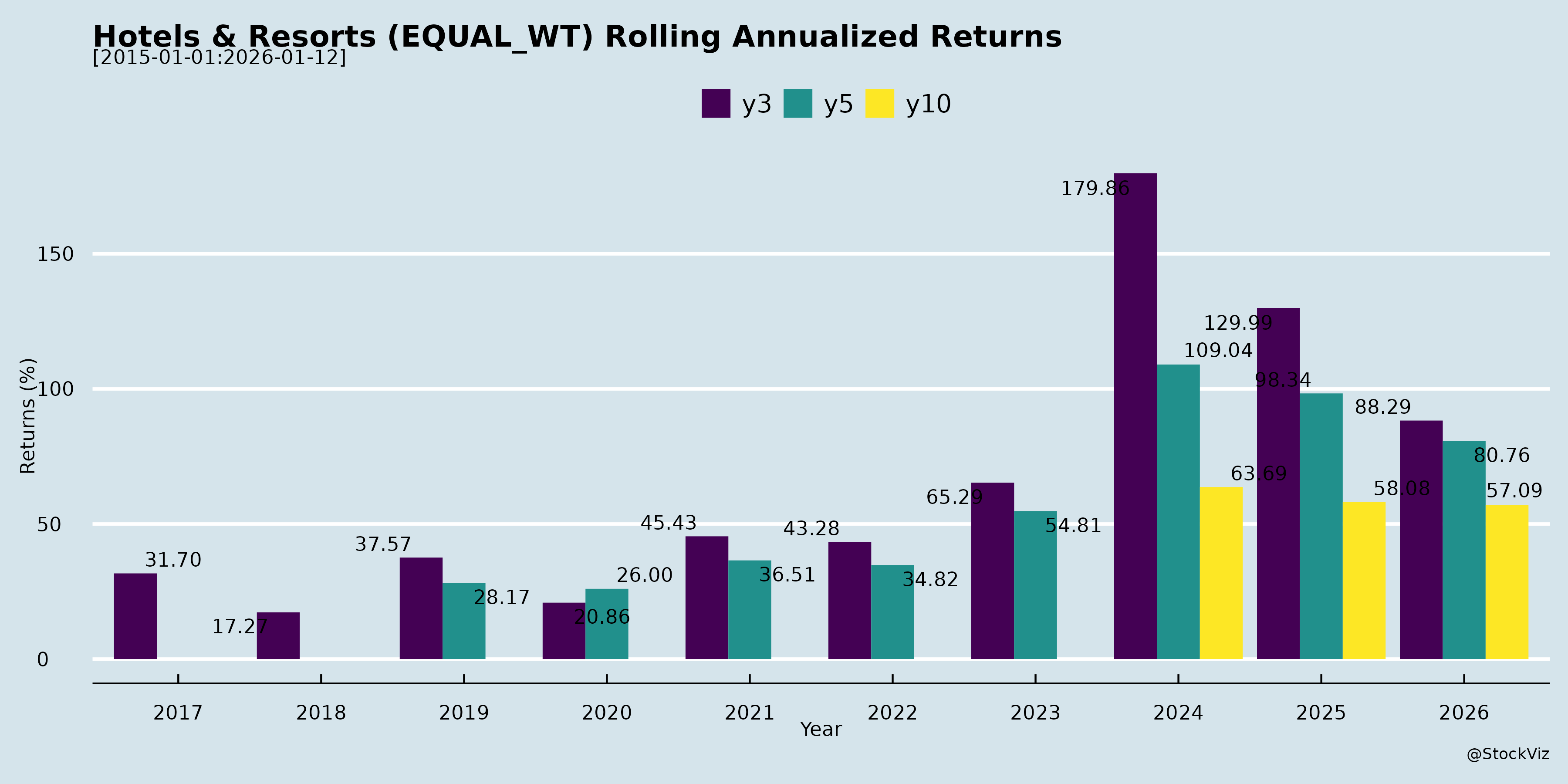

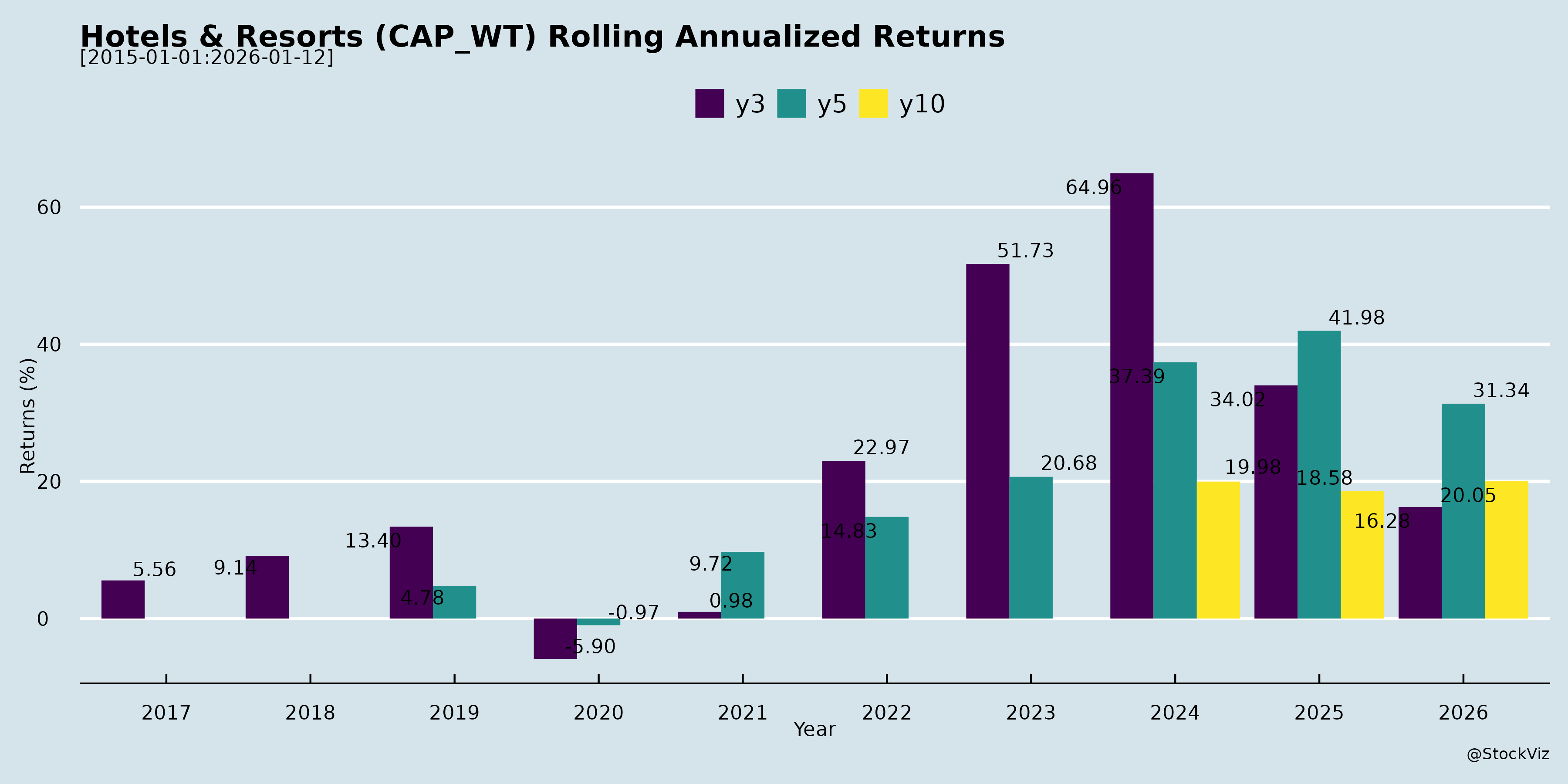

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Summary Analysis: Indian Hotels & Resorts Sector (Based on Q2 FY26 Disclosures)

The provided documents from key players (e.g., Ventive Hospitality, Juniper Hotels, Mahindra Holidays/ClubMahindra, IHCL, ITC Hotels, Lemon Tree, Chalet Hotels, SAMHI, Brigade, etc.) highlight robust sector momentum amid seasonal softness. Active investor engagement (e.g., Ambit Travel Ecosystem Conference on Dec 4, 2025, attended by multiple firms) underscores optimism. Below is a structured analysis of tailwinds, headwinds, growth prospects, and key risks.

Tailwinds (Positive Drivers)

- Demand Resilience & Pricing Power: ARR growth of 7-12% YoY across portfolios (e.g., Ventive India ADR +12% to ₹11,335; Juniper consolidated ARR +7% to ₹10,599; Grand Hyatt Mumbai +6-10%). RevPAR up 9-13% despite Q2 monsoon. Corporate upgrades to premium (bleisure trend), weddings/MICE, and leisure driving occupancy recovery (e.g., Ventive India 66%, Maldives same-store +4pts to 50%).

- Operational Efficiencies: EBITDA margins expanding (Ventive 46%, +7pts; Juniper 36%, +6pts; Mahindra profitability +26% ex-one-offs). Cost optimizations (green energy, cluster purchasing, manpower rationalization) and F&B/banqueting growth (Ventive +17%).

- Favorable Supply-Demand: Limited new supply in Pune/Bangalore (5yr horizon); Northeast/Andaman infrastructure boom (roads, 10 greenfield airports).

- Macro Support: Rising affluence, inbound tourism, govt. push (e.g., ₹44k Cr Northeast projects).

Headwinds (Challenges)

- Seasonality & External Shocks: Q2 softness from monsoons (Juniper occupancy flat at 69%), weather disruptions (Mahindra: Himachal/Uttarakhand -3-4% room nights; Goa marginal dip). Maldives Q2 weakest (50% occupancy).

- Cost Pressures: Employee costs up (Juniper +headcount for F&B/showroom); forex losses (Juniper ₹7cr on ECBs); one-offs (IPO restructuring, grants normalizing).

- High Leverage/Capex: Debt reduction ongoing (Ventive net debt/EBITDA improving; Juniper 1.4x), but expansions strain cash flows. Overseas (Mahindra Finland) lagging due to weak economy.

Growth Prospects

- Portfolio Expansion: Aggressive pipelines to 4k-12k keys by FY27-30 (Ventive: 2140→4000 by FY30 via Soho House, Hilton Goa, ROFOs; Mahindra: 6k→12k keys, Club M +Signature brand; Juniper: 1900→4091 keys via Bangalore 508, Guwahati 340, Kaziranga 111). Bids in Andaman/Delhi/Yashobhoomi.

- Diversification: Entry into lifestyle (Soho), leisure (Northeast/Andaman), vacation ownership (Mahindra Keystone: simplified plans, buybacks). 3x revenue/4x PAT guidance (Mahindra FY20-30).

- High-Return Opportunities: EBITDA-accretive deals (Ventive Hilton Goa EV ₹320cr, 20%+ EBITDA yield); Northeast ARR potential ₹30k+ (Juniper Kaziranga). H2 FY26 acceleration from weddings/peak leisure.

- Sustainability/Margins: Solar/biogas reducing costs (Ventive); awards validating premium positioning.

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Execution | Greenfield delays (2.5-3yr build time); capex ₹1.7-2.2k Cr (Ventive/Juniper/Mahindra), back-loaded FY27-30. ROFO/regulatory hurdles (Juniper: listed entity processes). | Internal accruals + prudent debt; promoter expertise. |

| Demand/Macro | Geopolitical/monsoon slowdowns; Goa/Himachal softness persisting. | Diversified markets (metros + leisure); strong forward bookings. |

| Financial | Forex volatility (Ventive ₹1/cr sensitivity; Juniper ECBs ~$35mn); rising interest (8.3% avg.). | Natural hedges; debt paydown from ₹100cr+ PAT (Ventive H1). |

| Competition/Supply | Metro saturation; leisure supply creep. | First-mover in Northeast/Andaman; premium branding (ARR outperformance vs. compsets). |

| Overseas | Maldives seasonality/Finnish weakness (Mahindra). | Source diversification; cost efficiencies. |

Overall Outlook: Sector poised for 15-20%+ CAGR in revenue/EBITDA (implied from guidance/transcripts), driven by supply constraints and demand tailwinds. H2 FY26 strong; long-term 3-4x growth feasible with disciplined execution. Risks tilted toward capex execution but balanced by low leverage and pipeline quality.

General

asof: 2025-12-02

Analysis of Indian Hospitality Sector (Hotels & Resorts)

Based on the provided filings from key players like IHCL, EIH Limited (Oberoi), Ventive Hospitality, Chalet Hotels, Leela Palaces, Lemon Tree, SAMHI, Brigade, Apeejay Surrendra, Juniper, and others, here’s a synthesized analysis of the Indian Hotels & Resorts sector. Insights are drawn from financials (e.g., Ventive’s Q4/FY25 earnings: ₹20,784 Mn revenue, 47% EBITDA margin), ESG/BRSR disclosures (EIH’s detailed report), operational KPIs (RevPAR/TRevPAR growth), expansions, and corporate actions. The sector shows robust recovery post-COVID, luxury/upscale focus, and international exposure (e.g., Maldives).

Tailwinds (Positive Drivers)

- Strong Demand & Pricing Power: Double-digit RevPAR/TRevPAR growth (e.g., Ventive India: +11% YoY Q4 FY25; EIH: 45-47% rooms revenue). High occupancy (70-80% in luxury Maldives/India assets). Leisure/business travel boom, driven by inbound/outbound tourism, GCC/high-tech growth (Pune/Bengaluru), and events like Maha Kumbh (Apeejay’s Prayagraj launch).

- Operational Excellence: EBITDA margins 46-52% (sector-leading; Ventive at 52% Q4). Annuity assets (e.g., Ventive’s 3.4 Msf, 98% committed occupancy) provide stable cash flows. F&B strength (70+ outlets, top-ranked restaurants).

- ESG Momentum: Green energy (70%+ in some assets), zero-liquid discharge, waste recycling (EIH/Ventive). Coral regeneration, EV charging enhance brand appeal.

- Financial Health: Debt reduction (Ventive Net Debt/EBITDA: 1.7x from 3.6x), IPO proceeds funding growth. High repeat business via loyalty programs (Marriott Honors, Hilton).

Headwinds (Challenges)

- Cost Pressures: Energy/emissions (electricity-intensive; EIH identifies as key risk), water scarcity (stress areas like Delhi/Agra), rising operational costs (11-16% YoY expense growth in Ventive).

- Macro/External: Climate change (extreme weather impacting tourism/infrastructure), geopolitical risks (international ops in Maldives/Egypt), supply chain disruptions.

- Regulatory/Compliance: TDS on dividends (Chalet), ESG reporting mandates (EIH BRSR), corporate guarantees/pledges (SAMHI), NCLT schemes (Valor/Juniper CIRP).

- Labor/Execution: High turnover (EIH: 35-39% permanent employees), dependency on contract workers.

Growth Prospects

- Organic Pipeline: 300+ keys under development (Ventive: Bengaluru/Varanasi/Sri Lanka; Apeejay: 35 hotels/2,450 keys). Brownfield/greenfield expansions in high-demand areas (e.g., Brigade’s 1.35-acre Hyderabad land acquisition for ₹110 Cr).

- Inorganic Opportunities: CIRP participations (Juniper’s JW Marriott Bengaluru bid), ROFO assets (Ventive: 900 keys), subsidiary investments (Leela’s USD 47.72 Mn).

- Luxury/International Focus: 80% revenue from luxury (Ventive); Maldives ramp-up (occupancy +12% YoY). Portfolio diversification (hotels + annuity/retail).

- Sector Tailwinds: Muted supply in luxury/upscale (no Pune luxury for 5 years), airport upgrades (Navi Mumbai), industrial growth. Potential 2x key growth (Ventive’s 5-year history).

Key Risks

| Risk Category | Details | Mitigation (from Filings) |

|---|---|---|

| Environmental | Energy (non-renewable reliance), water stress, emissions, waste, biodiversity impact (EIH material issues). | Solar/heat pumps, ZLD (16+ EIH hotels), 3R waste model. |

| Operational | High attrition (EIH: 35-53%), supply chain disruptions, cyber/data privacy breaches. | Training (66-100% coverage), supplier ESG audits. |

| Financial | Debt (though improving; Ventive 0.4x Net D/E), forex (USD debt), interest rates. | Post-IPO deleveraging, green energy savings. |

| Market/Regulatory | Competition, tourism cyclicality, climate disasters, policy changes (e.g., PAT scheme). | Diversified portfolio (India/Maldives), strong brands (Marriott/Hilton). |

| Execution | Acquisition integration (Juniper CIRP), development delays. | Strong pipeline, ROFOs. |

Summary: The sector is buoyant with tailwinds from demand surge and operational leverage driving 13-20% revenue/EBITDA growth (Ventive FY25). Growth prospects are strong via 20-30% key additions (organic/inorganic), targeting ₹20,000+ Cr revenue clubs. However, headwinds like costs/climate persist, with risks centered on ESG/execution. Overall outlook positive (luxury premiumization), but monitor macro/geopolitical factors. Sector poised for 15-20% CAGR, led by top players like EIH/Ventive.

Investor

asof: 2025-12-03

Summary Analysis: Indian Hotels & Resorts Sector (Based on Provided Filings)

The documents primarily consist of regulatory disclosures (e.g., analyst meet intimations, earnings transcripts, investor presentations) from key players like Chalet Hotels, Ventive Hospitality, Mahindra Holidays (ClubMahindra), Juniper Hotels, IHCL, ITC Hotels, Lemon Tree, SAMHI, Brigade, Leela, EIH, and others for Q2/H1 FY26 (ended Sep 2025). They highlight robust operational momentum, expansion pipelines, and investor engagement (e.g., Ambit Travel Ecosystem Conference on Dec 4, 2025). Overall, the sector exhibits strong tailwinds from demand recovery and limited supply, but faces cyclical headwinds. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Supportive Factors)

- Demand Resilience & Pricing Power: ARR growth of 7-12% YoY across portfolios (e.g., Chalet: strong ADR; Ventive: ₹11,335; Juniper: ₹10,599 portfolio ARR, outperforming compsets in Mumbai/Delhi/Ahmedabad). RevPAR up 9-13% (Ventive: 13%; Juniper: 9%). Corporate (MICE, transient), weddings, leisure, and bleisure trends driving occupancy (66-69%; forward bookings healthy for festive/wedding season).

- F&B & Ancillary Revenue: Key differentiator (Ventive: F&B up 17%, TRevPAR ₹13,630; Chalet: asset sweating via events/showrooms; Juniper: showroom ₹8cr H1).

- Limited Supply in Key Markets: Pune (no new luxury supply for 5yrs), Mumbai, Bangalore, Northeast (e.g., Juniper/Kaziranga first-mover).

- Infrastructure Boost: Northeast (₹44k cr projects, 10 greenfield airports), Andaman (new flights), Delhi (Yashobhoomi/DDA bids), Maldives (new Male airport).

- Margin Expansion: EBITDA margins 36-46% (Ventive: 46%; Chalet: 42-44%; Juniper: 36%, targeting 40%). Cost efficiencies (green energy, procurement).

- Sustainability & Brand Strength: LEED certifications, EV fleets (Chalet); awards (Ventive, ClubMahindra).

Headwinds (Challenges)

- Seasonality & Weather: Monsoon impacted Q2 occupancy (e.g., Ventive India 66%; Juniper Mumbai mid-50s early Q2); Himachal/Uttarakhand/Goa softness (ClubMahindra: 10k room nights loss, ~3-4% occupancy hit); Maldives lean season.

- Forex & Cost Pressures: Unrealized forex losses (Juniper: ₹7cr); employee costs up (Juniper: F&B hires); high capex (ClubMahindra: ₹500-750cr FY26-27).

- Geopolitical/Macro Softness: Maldives recovery post-refurb; Finland ops lagging (ClubMahindra).

- Ramp-up Delays: New assets (e.g., Bangalore Phase 1 Q1 FY27) face initial occupancy drags.

Growth Prospects

- Portfolio Expansion: Aggressive pipelines targeting 3-4x key growth by FY30: | Company | Current Keys | Target/Pipeline | |———|————–|—————–| | Chalet | 3,389 | +1,180 keys (Taj Delhi, Athiva Goa, Hyatt Airoli); 0.9msf CRE; own brand Athiva (900+ keys). | | Ventive | ~2,140 | 4,000 by FY30 (ROFO: JW Navi Mumbai, 3 Moxys; greenfield: Varanasi Ritz-Carlton Reserve FY28). Acquisitions: Soho House, Hilton Goa (104+60 keys). | | ClubMahindra | ~6,000 | 12,000 (10k Club M, 2k Signature Resorts); Keystone membership. | | Juniper | ~1,900 | 4,091 (Bangalore 508, Guwahati 340, Kaziranga 111; bids: Andaman, Delhi Yashobhoomi/DDA). | | Others | Varied | ITC/EIH/Leela/Lemon/SAMHI/Brigade: Active in Ambit conf; Northeast/Andaman focus.

- Financial Outlook: 3x revenue, 4x PAT (ClubMahindra FY20-30); EBITDA CAGR 22-24% (Chalet/Ventive). Capex ₹1,800-2,200cr over 5yrs (funded via accruals/debt; net D/E 1.4x).

- Diversification: Leisure (Northeast/Andaman/Kaziranga), lifestyle (Soho/Athiva/Signature), annuity (90% margins, Ventive).

- Sector-Wide: Branded leisure penetration low (14%); vacation ownership dominance (ClubMahindra 85% share).

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Execution | Project delays (e.g., Bangalore, ROFO procedural hurdles with listed entities); capex overruns (₹1,700-2,200cr). | Internal accruals + low D/E (1.4x); first-mover advantages. |

| Demand/Supply | Seasonality (leisure 50-60% occ.); new supply in metros; Goa/Himachal softness. | Pricing discipline; diversified segments (corporate/leisure). |

| Financial | Forex volatility (ECB exposure); debt for capex (8.3% cost); treasury income drag. | Natural hedges; hedging strategies; strong cash (Ventive ₹484cr). |

| Macro/External | Weather/geopolitical (Maldives, Northeast); slowing corp travel. | Geographic diversification; govt infra push. |

| Operational | Manpower/inflation; ramp-up in new assets. | Efficiency (green energy); F&B leverage. |

Overall Outlook: Bullish. Sector poised for 15-25% CAGR in revenue/EBITDA (driven by 20%+ ARR in high-growth markets like Bangalore/Hyderabad). Tailwinds from infra/demand outweigh headwinds; focus on leisure/Northeast unlocks 3-4x key growth. Monitor execution and macros. Strong investor interest (multiple Dec 2025 meets) signals confidence.

Press Release

asof: 2025-11-29

Analysis of Indian Hospitality Sector (Focus on IHCL & Peers)

Using the provided press releases from IHCL (Taj), EIH (Oberoi), Chalet Hotels, Ventive Hospitality, Leela Palaces, Lemon Tree, Valor Estate (DB Realty Hospitality Demerger), Mahindra Holidays, Juniper Hotels, SAMHI Hotels, Brigade Hotel Ventures, and Apeejay Surrendra Park Hotels as inputs, here’s a summary analysis of headwinds, tailwinds, growth prospects, and key risks for the Indian hospitality sector. IHCL exemplifies sector leaders with record performance (14th straight quarter of growth, 570 hotels), but trends are consistent across peers.

Tailwinds (Positive Momentum)

- Robust Demand & Performance: RevPAR growth of 9-13% YoY (IHCL 9%, SAMHI 11%, Juniper 9%, Brigade 13%, Chalet 5%). Occupancy stable/high at 67-92% (Apeejay 92%, SAMHI/Brigade ~75%). Revenue/EBITDA up 11-22% (IHCL 12%/16%, SAMHI 11%/14%, Brigade 20%/9%).

- Operational Efficiency: Margin expansions (IHCL EBITDA +0.9pp to 30.8%; Chalet core 43.4%; Juniper 37%). Cost controls, renovations completed (IHCL key assets), F&B growth (Brigade 14%, IHCL new biz 22%).

- Strong Balance Sheets: Cash reserves (IHCL ₹2,847 Cr), debt reduction (Valor, SAMHI Net Debt:EBITDA 2.9x from 4.4x).

- Awards & Brand Strength: Taj #1 global brand (Brand Finance), Michelin Keys, high rankings (Travel+Leisure).

Headwinds (Challenges)

- Muted/Declining Metrics in Spots: Occupancy dips (Chalet -7pp to 67%; some Q/Q softness). Flat RevPAR in core ops (Chalet). Weather/geopolitical volatility (Chalet).

- One-Offs & Volatility: Exceptional gains (IHCL PAT ex-gain; SAMHI impairment reversal ₹696 Mn). Prior losses turned profitable but volatile (Juniper/SAMHI PAT N.M.).

- High Base & Seasonality: Q2/H1 growth strong but vs. weak prior (e.g., Chalet PAT from loss). Monsoon impacts leisure.

- Cost Pressures: Implicit via finance costs (SAMHI 8.5% interest), renovations/tax hits (Chalet deferred tax reversal).

Growth Prospects (High Potential)

- Aggressive Expansion: Massive pipelines—IHCL 570 hotels (46 signings, 26 openings, 250+ India ops); EIH 25 props by 2030; Leela 23 props/5,000 keys in 3 yrs; Brigade double to 3,300 keys/FY30; Lemon Tree 250+ total; SAMHI 8% inventory add FY26.

- Diversification: New brands/models (Chalet ATHIVA; Ventive Soho House membership; Mahindra Signature Resorts luxury leisure; IHCL new biz 21-22% growth—TajSATS, Ginger). F&B/retail (Apeejay Flurys +37%; IHCL Qmin 104 outlets).

- Strategic Moves: Management/franchise contracts (low-capex; EIH/Leela/Lemon Tree); tier-2/3/infra hubs (airports, wildlife—Jaisalmer, Kaziranga, Surat); partnerships (Clarks, Ambuja Neotia).

- Demand Drivers: Corporate rebound, weddings/festives, inbound tourism, MICE (global events). ₹3,600 Cr capex (Brigade); ₹1,000 Cr (Mahindra leisure).

- Outlook: H2FY26 strong (IHCL); 9-11% RevPAR CAGR (SAMHI same-store).

Key Risks

- Execution/Development Delays: Large pipelines (e.g., Chalet Taj Delhi FY27; Juniper Bengaluru FY26-end) vulnerable to approvals/construction (Valor BMC nods critical).

- Supply Glut: Rapid signings/openings could pressure occupancy/RevPAR in metros (Bengaluru/Delhi).

- Macro/Economic: Slowdown in corporate/leisure travel; inflation/fuel costs; geopolitical/weather disruptions.

- Debt & Finance: Lingering leverage (SAMHI ₹13.7 Bn net debt); interest rate sensitivity despite cuts.

- Regulatory/Competition: Approvals (Taj Bandstand), tax changes (Chalet indexation), intense rivalry (new entrants like Ventive lifestyle).

- One-Off Dependency: Profitability tied to gains (e.g., SAMHI Caspia sale); forex/impairments.

Overall Summary: Sector enjoys strong tailwinds from demand recovery & expansions, positioning for 10-20%+ growth (mirroring IHCL’s leadership). Growth prospects are exceptional via pipelines/diversification, but headwinds like seasonality/supply need monitoring. Risks center on execution/macro—mitigated by healthy cash flows & brand moats. Bullish H2FY26 outlook, with IHCL/peers targeting portfolio doubling by FY30.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.