ITC

Equity Metrics

January 13, 2026

ITC Limited

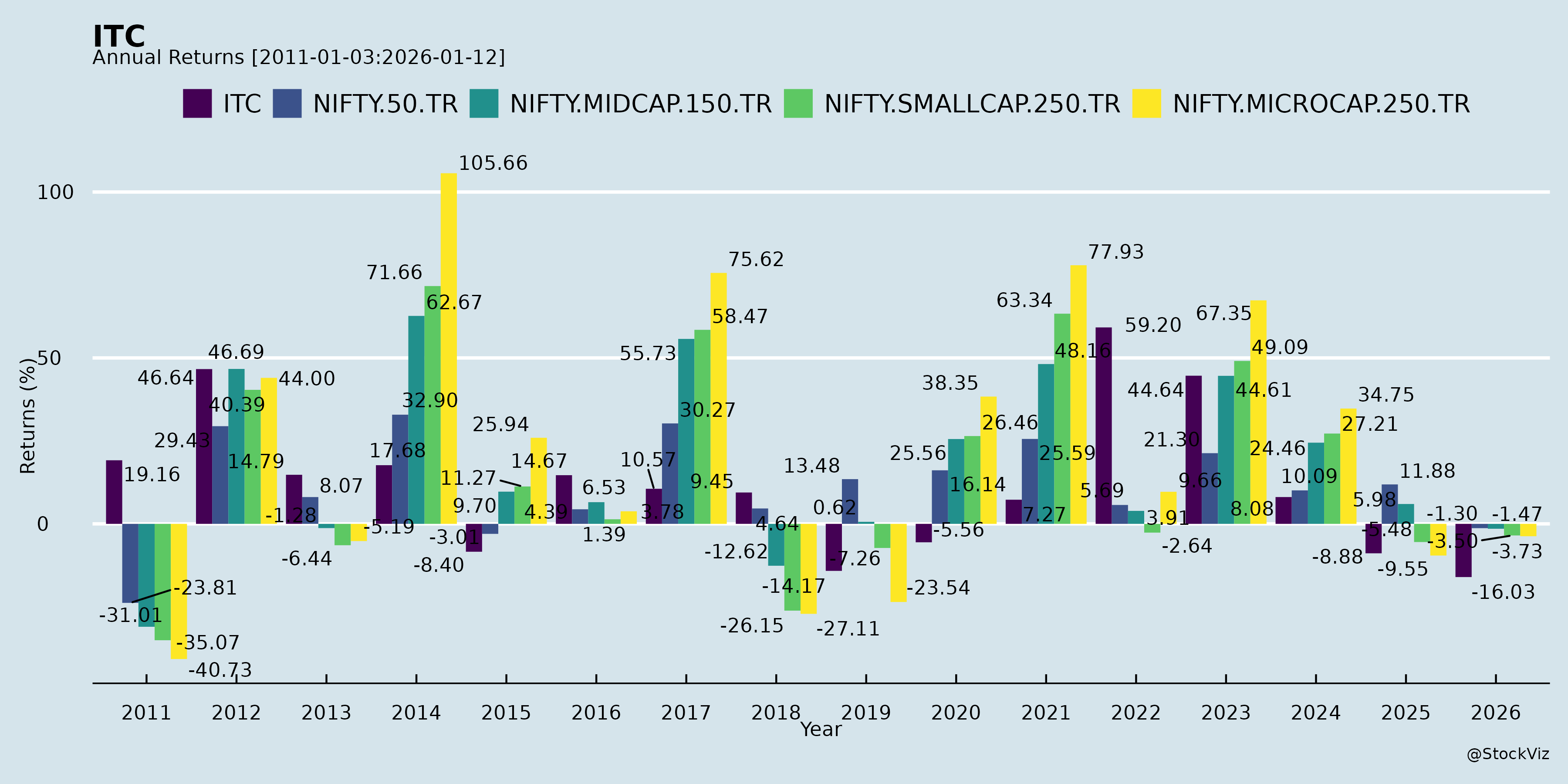

Annual Returns

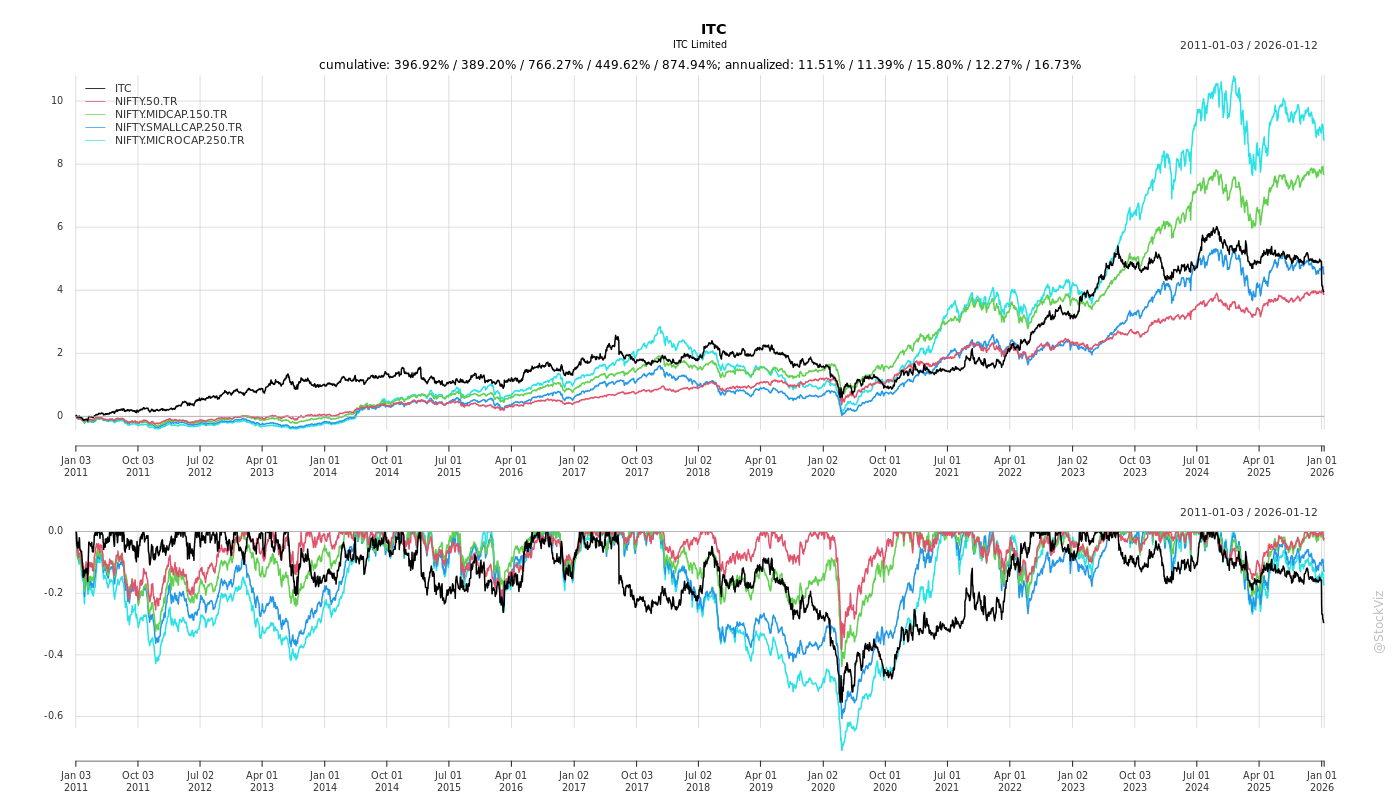

Cumulative Returns and Drawdowns

Fundamentals

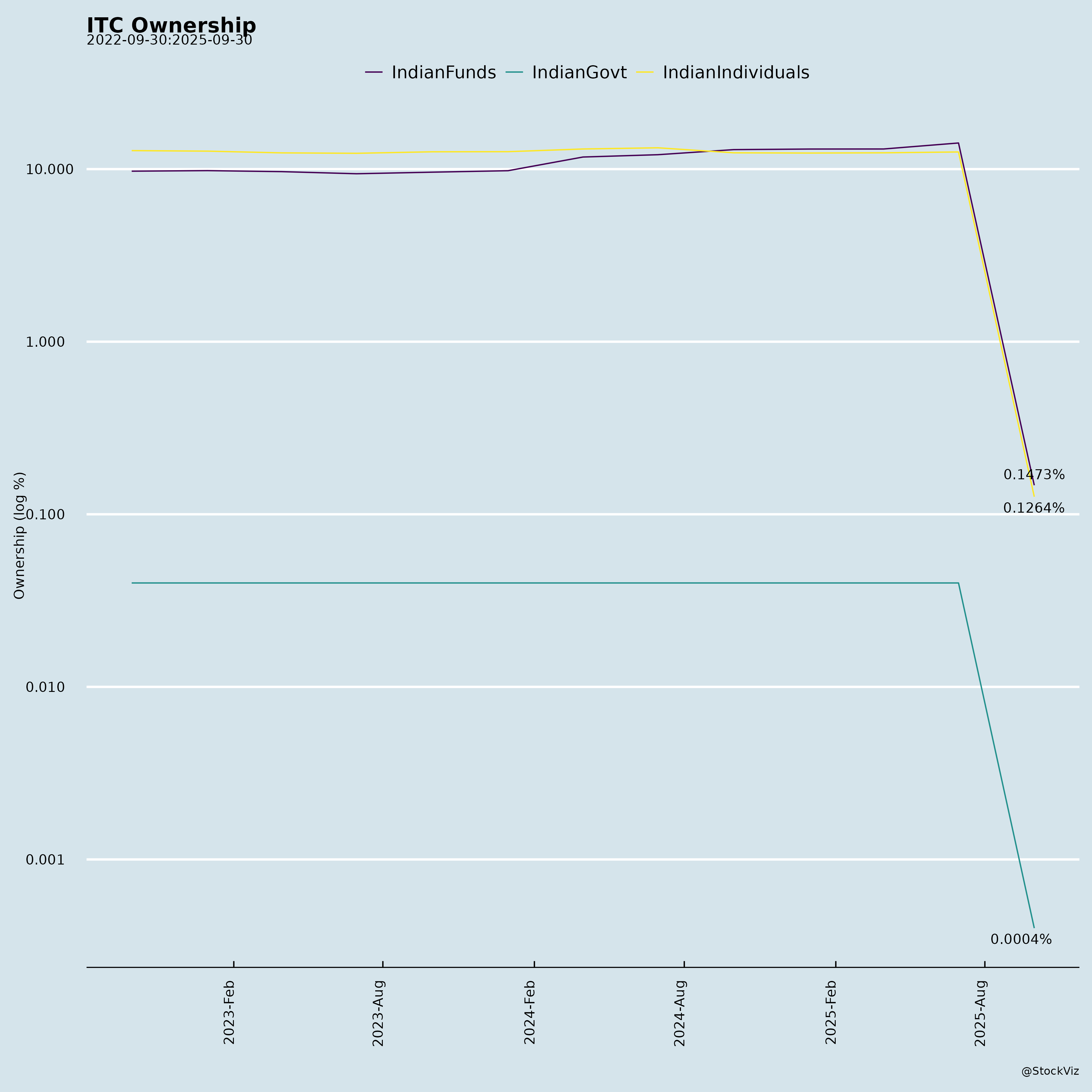

Ownership

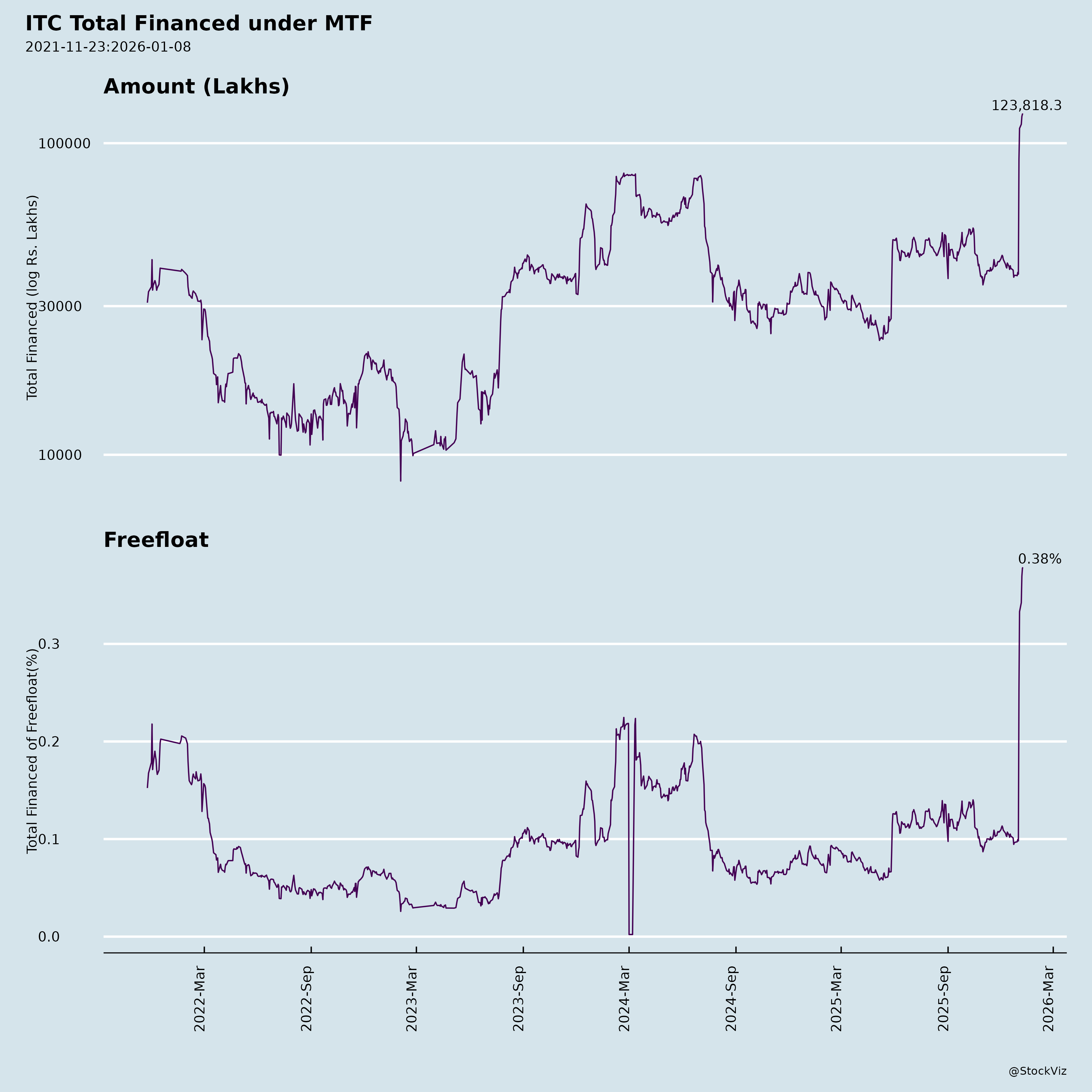

Margined

AI Summary

asof: 2025-12-03

ITC Limited: Analysis of Headwinds, Tailwinds, Growth Prospects, and Key Risks

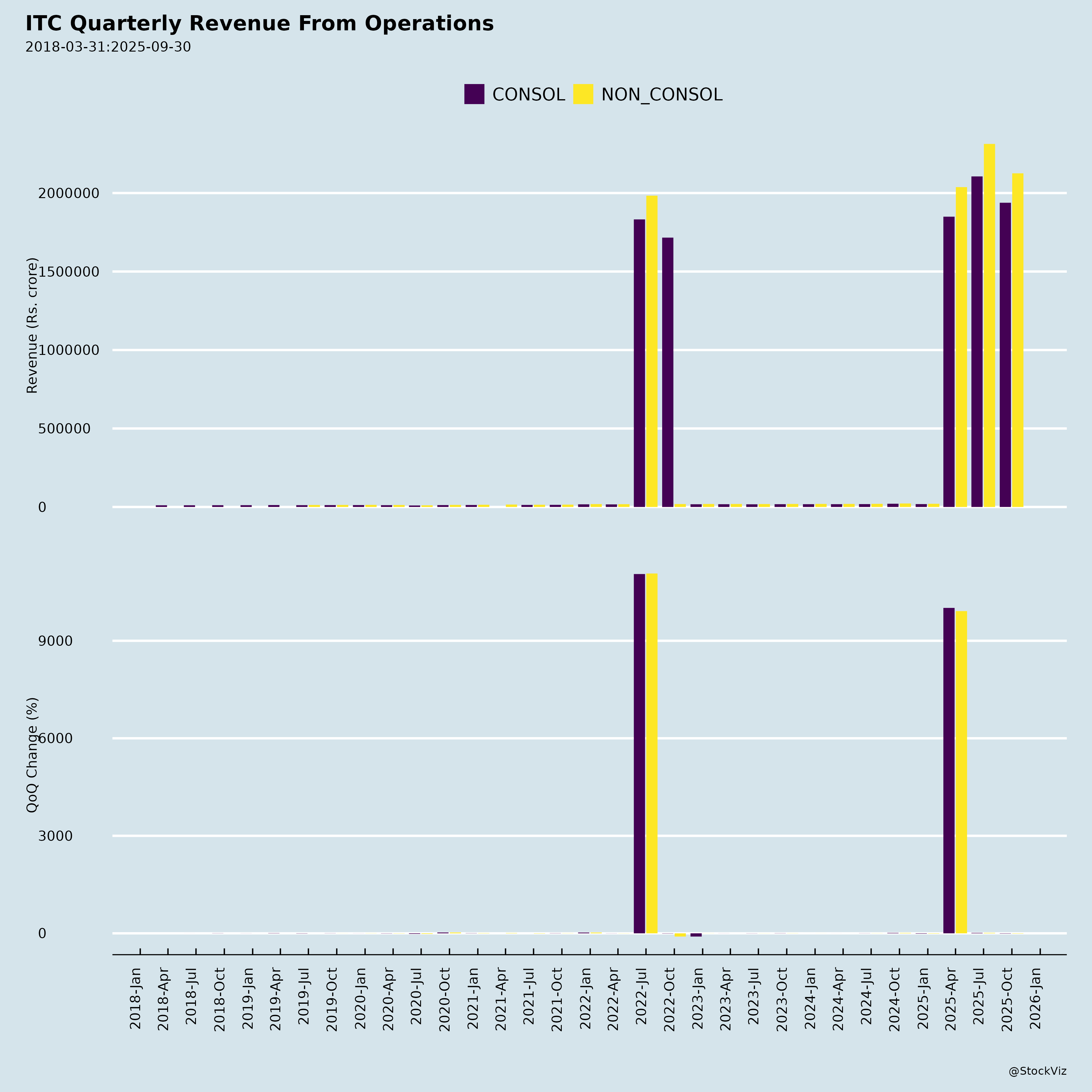

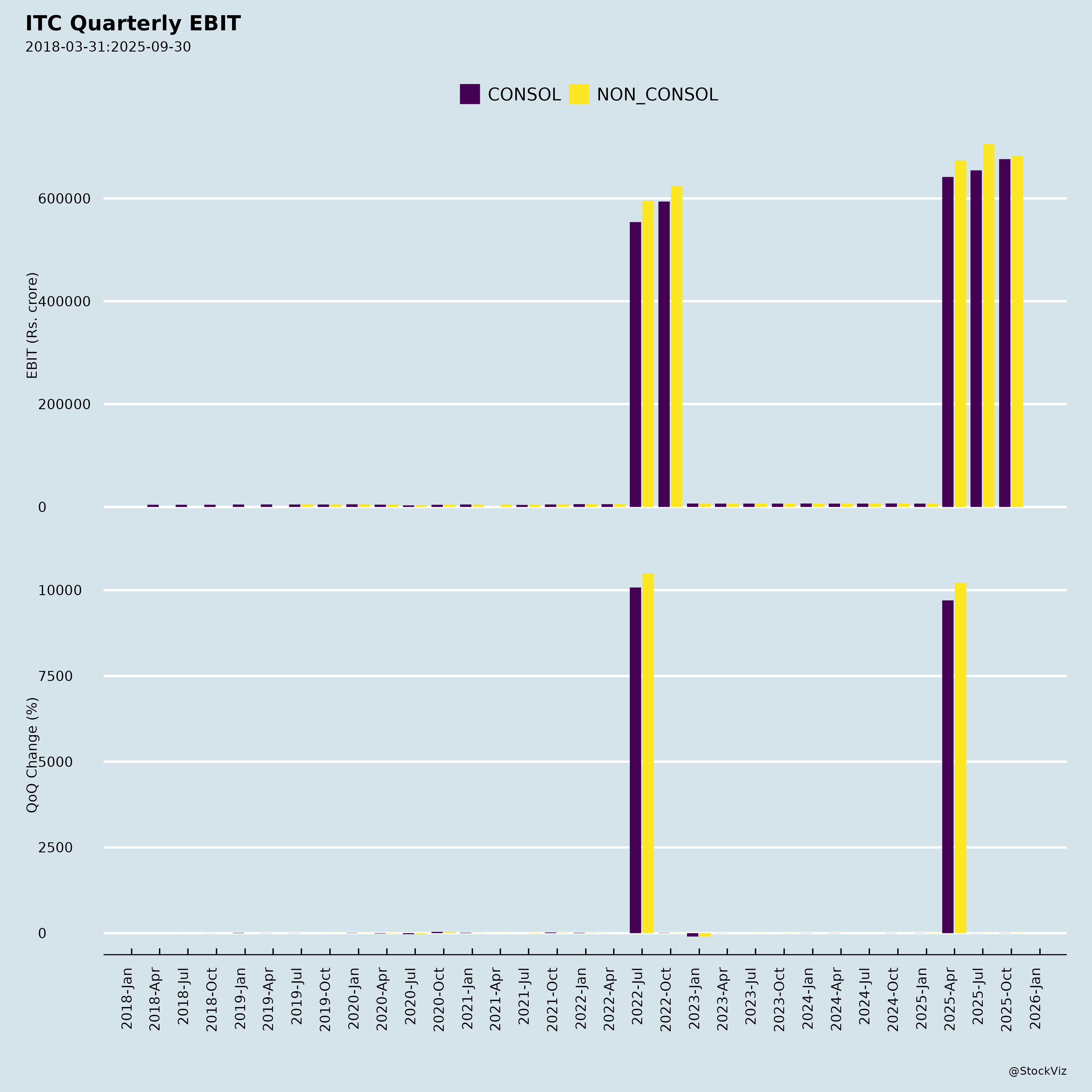

ITC Limited, a diversified FMCG conglomerate with core strength in cigarettes (stable cash cow), FMCG others (growth driver), agri-business, and paperboards/packaging, reported robust H1 FY26 results (ended Sep 30, 2025). Standalone revenue grew 8% YoY to ₹40,441 Cr, PBT up 3% to ₹13,397 Cr, and net profit steady at ₹10,092 Cr (EPS ₹8.06). Consolidated trends similar (revenue +8% YoY to ₹44,385 Cr, net profit ₹10,530 Cr). Cigarettes drove 72% of segment revenue (₹28,984 Cr, +7% YoY), while FMCG-Others grew (revenue ₹11,741 Cr). Balance sheet remains fortress-like (net worth ₹68,584 Cr standalone; low debt), with strong operating cash flow (₹5,782 Cr H1). Hotels business demerged (discontinued ops), unlocking value. Voluntary delisting from CSE (minor; remains listed on NSE/BSE/Luxembourg). Upcoming analysts’ meet (Dec 3, 2025) signals investor engagement. Postal ballot for new Independent Director (Amitabh Kant, policy expert) and Wholetime Director re-appointment (Hemant Malik, Foods DCE).

Tailwinds (Positive Factors)

- Cigarette Dominance: H1 revenue ₹28,984 Cr (+7% YoY), PBT ₹11,224 Cr (+3%). Resilient pricing power and volumes despite taxes; contributes ~70% profits, funding diversification.

- FMCG-Others Momentum: Revenue ₹11,741 Cr (+6% YoY); EBITDA H1 ₹1,140 Cr (stable YoY despite investments in branded foods/personal care). Key brands (Aashirvaad, Sunfeast, Bingo!) scaling; Sresta acquisition (organic foods) integrated from Jun 2025.

- Financial Strength: Zero net debt, ₹13,613 Cr liquid investments (standalone current assets), ₹5,782 Cr op. cash flow. Dividend payout robust (₹9,824 Cr H1). Employee stock options issued (95.9L shares).

- Strategic Moves: Hotels demerger (effective Jan 1, 2025) streamlines focus; insurance gain (₹88 Cr exceptional). New Independent Director (Amitabh Kant) brings policy/digital expertise (ex-NITI Aayog CEO, G20 Sherpa).

- Macro Support: Rural recovery aiding agri/FMCG; strong unallocable income (₹881 Cr H1 from investments).

Headwinds (Challenges)

- Agri Volatility: H1 revenue down to ₹13,661 Cr (-ve YoY impact from lower wheat/rice/spice prices); PBT ₹893 Cr (flat).

- Paperboards Slowdown: Revenue ₹4,336 Cr (+6% YoY), but PBT down 30% to ₹354 Cr (input cost pressures).

- Investment Drag: FMCG-Others EBITDA margins pressured by “significant brand building/gestation costs” (noted repeatedly); inventory build-up (₹18,011 Cr, +20% YoY).

- Tax/Regulatory Drag: Excise duty H1 ₹2,670 Cr (up YoY); GST/levies on tobacco/FMCG.

- Working Capital Strain: Trade receivables up 37% YoY (₹5,355 Cr); inventories +20% amid agri/FMCG growth.

Growth Prospects

- FMCG Acceleration: Non-cigarette FMCG (30%+ of group revenue) poised for 10-15% CAGR; focus on staples/snacks/dairy/personal care. Sresta/Wimco amalgamation pending NCLT approval (expands organics/matches).

- Diversification Playbook: 3 core groups (FMCG, Agri, Paperboards) + IT/WelcomHotels residual. Total segment revenue H1 ₹47,125 Cr (+7% YoY). Aspirational districts-like initiatives via new director could aid rural penetration.

- Capital Allocation: ₹3,546 Cr investing cash flow H1 (capex ₹1,007 Cr); ESOPs/commissions signal talent retention. Analysts’ meet to highlight Q3/H2 outlook.

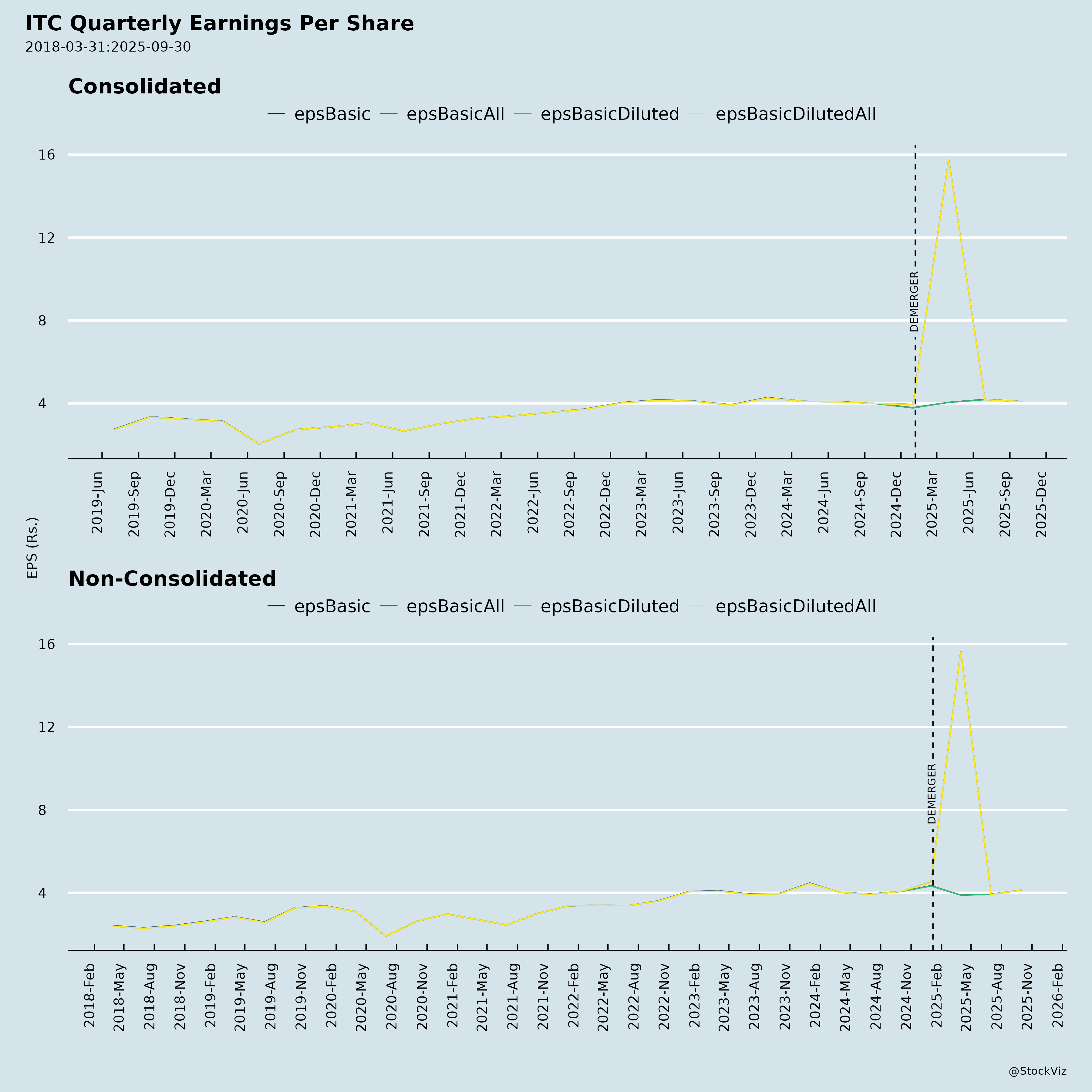

- EPS/ROE Trajectory: H1 EPS ₹8.06 (flat YoY but resilient); ROE ~28-30% sustainable. Potential 8-10% revenue CAGR medium-term.

- Unlocks: Post-demerger, pure-play FMCG narrative; Lux/SEC filings signal ADR/GDR potential.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Regulatory/Tax (High) | Tobacco excise hikes (H1 duty ₹2,670 Cr); potential GST rationalization/FMCG sin taxes. | Pricing power (cigarettes); diversification (FMCG 30%+ revenue). |

| Commodity Volatility (Medium) | Agri (wheat/soy/tobacco) price swings; inventory writedowns (₹183 Cr H1). | Hedging; backward integration (Technico PTC). |

| Execution/Competition (Medium) | FMCG margins squeezed by HUL/Nestle; gestation costs in foods/personal care. | Strong brands (₹11,741 Cr revenue); Hemant Malik’s 36-yr expertise. |

| Macro/Economic (Medium) | Rural slowdown/inflation; forex on exports (agri/IT). | 50%+ urban cigarette base; ₹897 Cr other income buffer. |

| Operational (Low) | Integration risks (Sresta from Jun 2025); discontinued hotels comparability. | Unmodified auditor review; strong governance (new Ind. Dir.). |

| Liquidity/Market (Low) | High dividend (₹9,824 Cr) but cash generative; CSE delisting (negligible volume). | ₹42,358 Cr current assets; NSE/BSE liquidity. |

Overall Outlook: Positive. ITC’s cigarette fortress funds 10%+ FMCG growth amid demerger clarity. H1 resilience (8% topline, steady bottomline) despite agri headwinds signals earnings stability (FY26 EPS est. ₹17-18). Risks tobacco-centric but diversified buffer strong. Buy/Hold for long-term compounding; watch Q3 cigarette volumes/tax policy. (Analysis based solely on provided filings; no external data.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.