Diversified FMCG

Industry Metrics

January 13, 2026

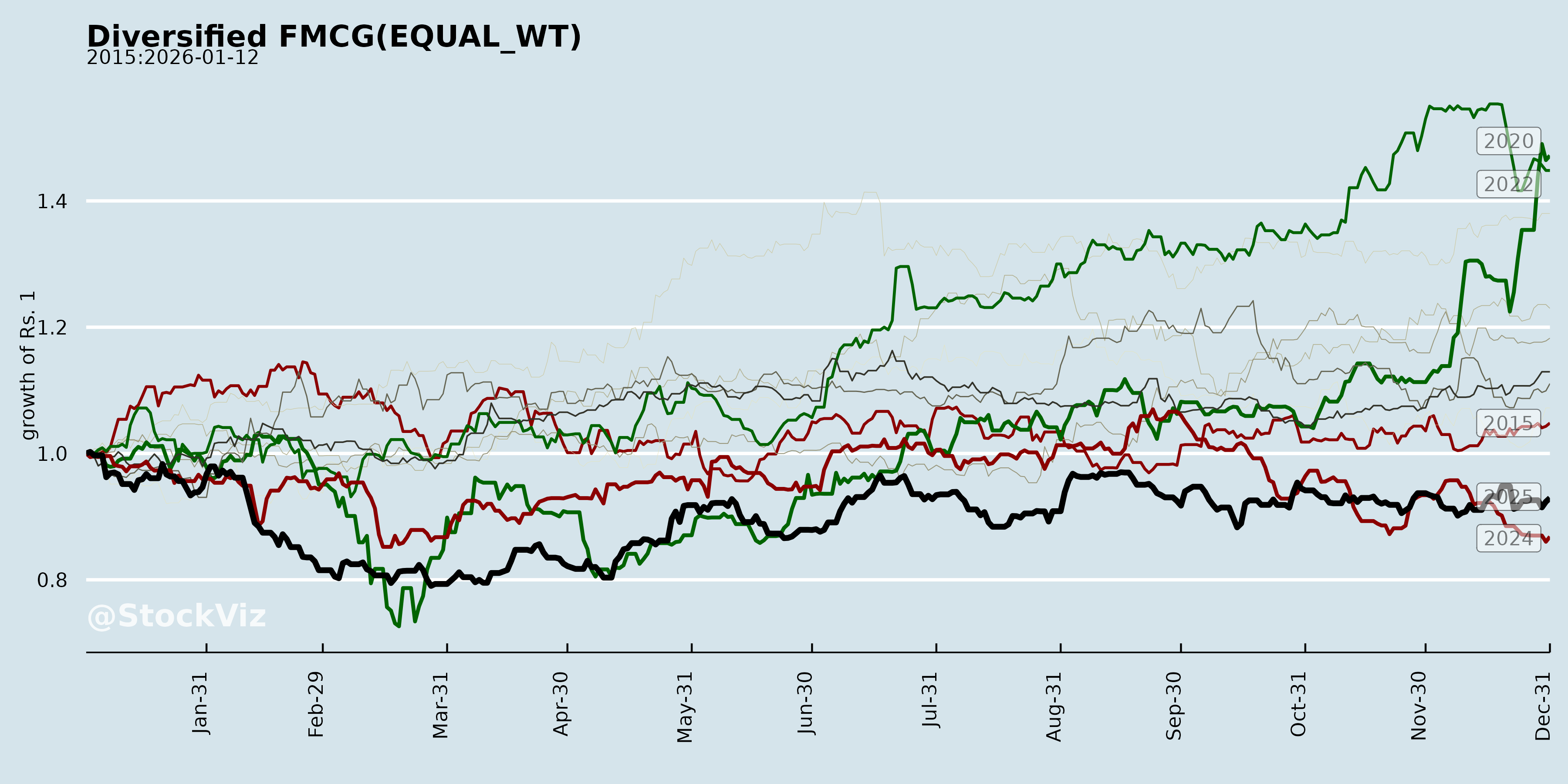

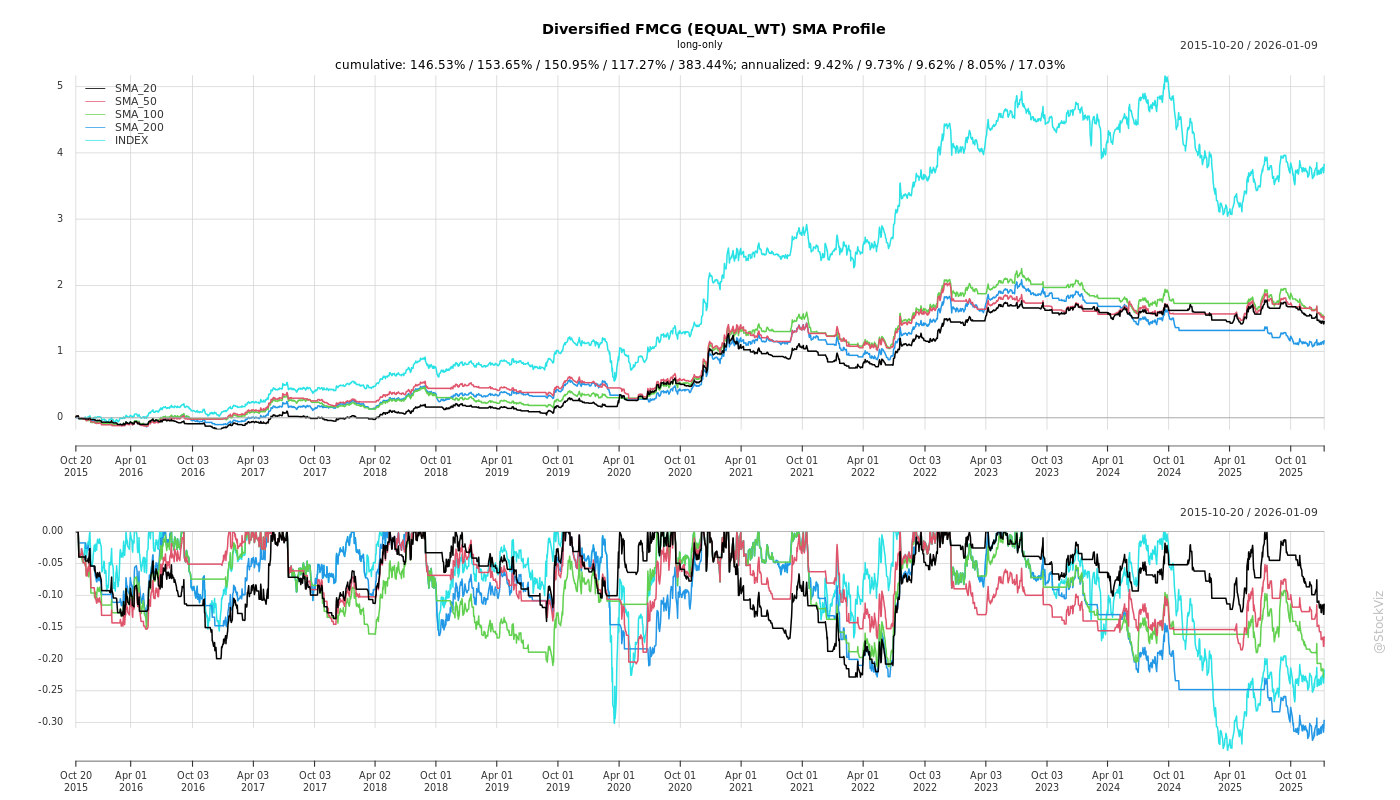

Annual Returns

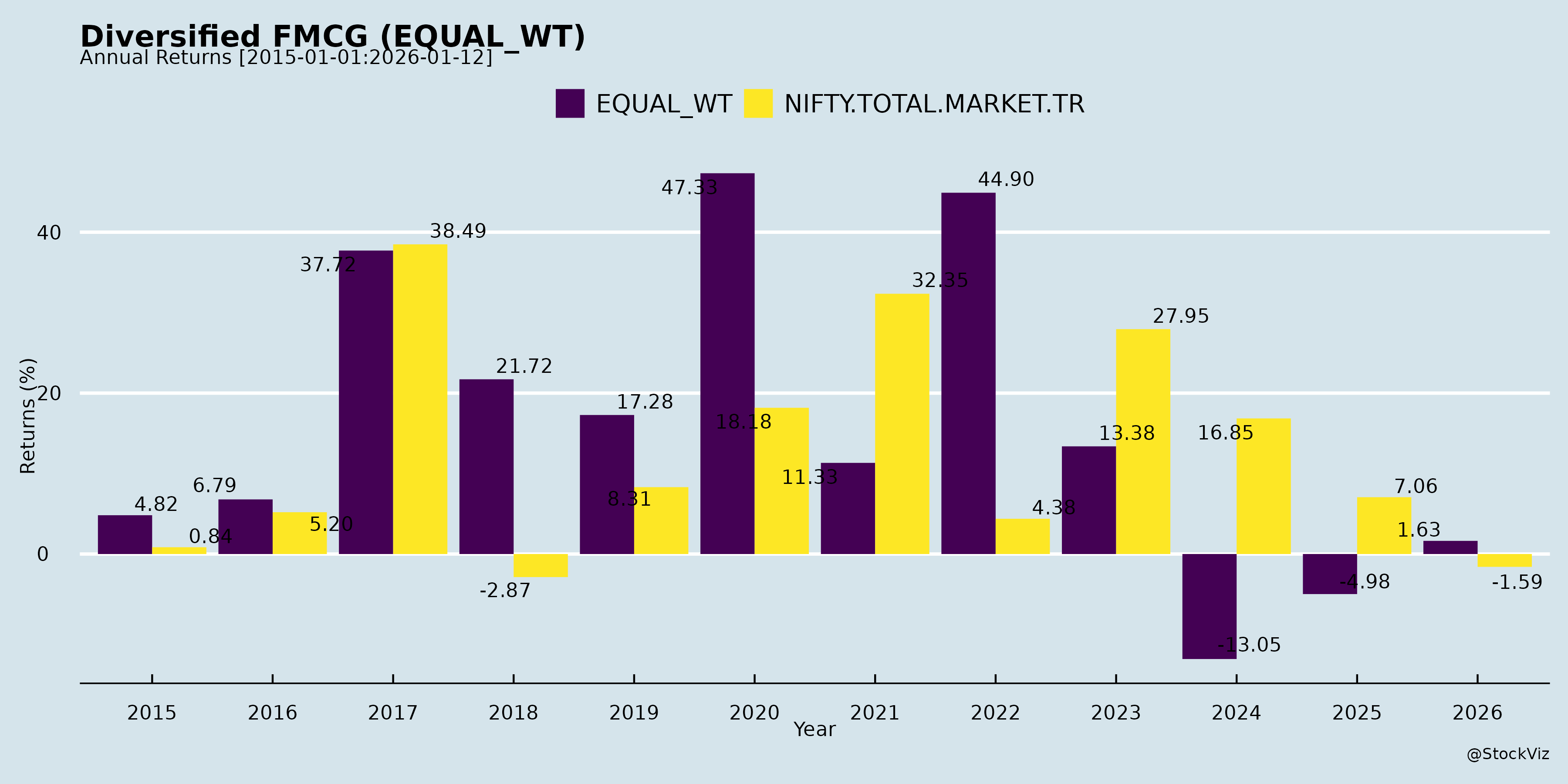

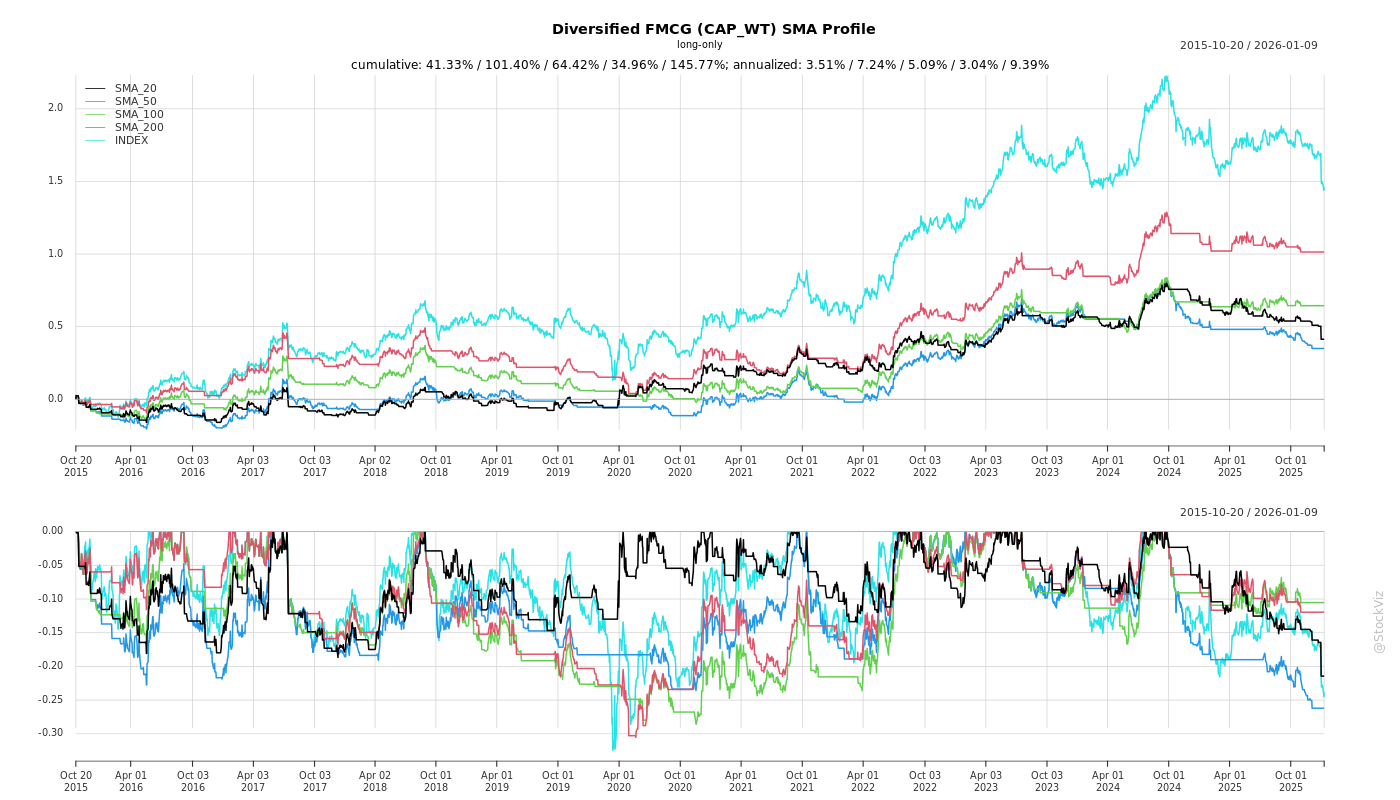

Cumulative Returns and Drawdowns

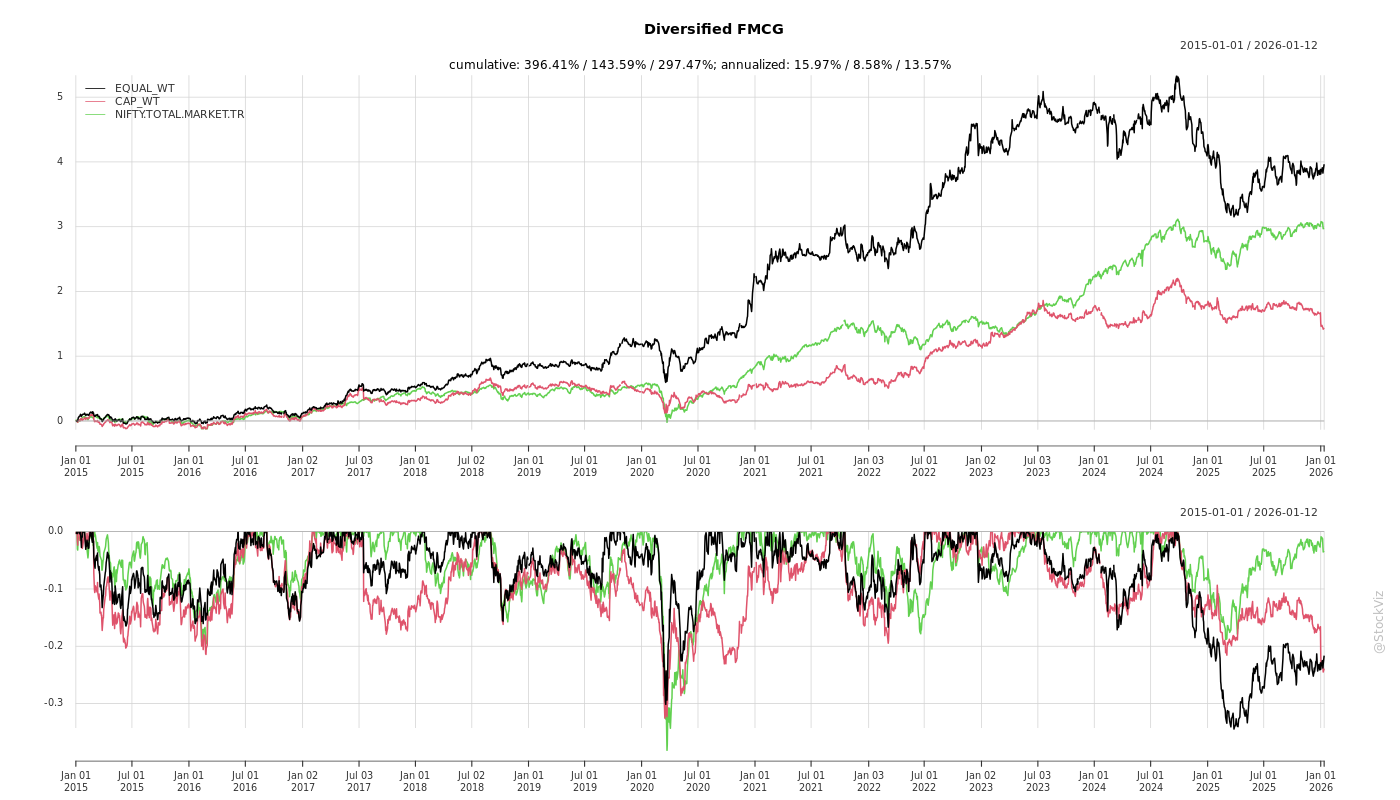

SMA Scenarios

Current Distance from SMA

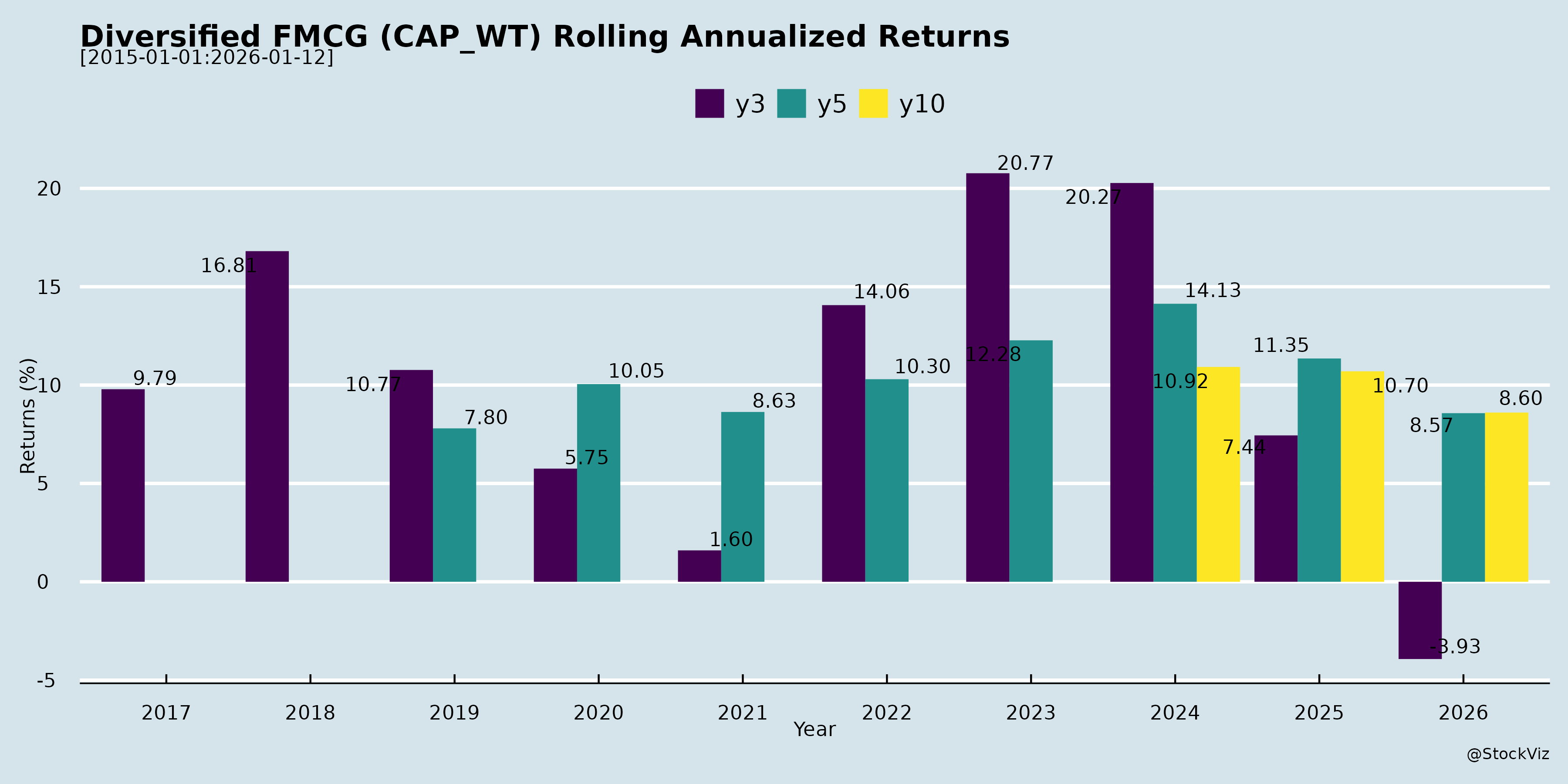

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Analysis of Indian Diversified FMCG Sector

Using the provided documents (earnings transcripts from Godavari Biorefineries Ltd. and Hindustan Foods Ltd., plus analyst meet intimations from Davangere Sugar, HUL, and ITC), this analysis focuses on the Indian Diversified FMCG sector. Insights draw from sugar/ethanol/bio-chemicals (Godavari, Davangere – agri-FMCG linkages via sugars, biofuels, specialty chems), contract manufacturing (Hindustan Foods – HPC, F&B, ice cream, healthcare, footwear), and pure/diversified FMCG (HUL, ITC). The sector shows resilience amid agri-volatility, with growth from diversification, policy tailwinds, and capex execution.

Tailwinds

- Favorable Agri/Policy Environment: Above-average monsoons boosting sugarcane yields/recovery; govt. allowing 1.5MT sugar exports (2025-26) and removing 50% molasses export duty to balance surpluses and improve realizations (Godavari, Davangere).

- Ethanol Blending Momentum: India’s push for 20-30% blending by 2025-26; OMCs tendering ~10.5B liters (offers >17B), validating multi-feedstock strategies (Godavari).

- GST Rationalization: Benefits ice creams, bottled water/beverages (organized players gain vs. unorganized); broader FMCG upside (Hindustan Foods).

- Business Model Shifts: Move to shared manufacturing unlocks operating leverage (27% sales/EBITDA from shared at Hindustan Foods); backward integration (e.g., ice cream cones/sticks).

- Sustainability & Innovation: CO2-to-DME pilot (Godavari), green power/recycled packaging (Hindustan Foods); bio-specialty chems up 60% EBITDA (Godavari).

- FMCG Ecosystem Evolution: Quick commerce, new-age brands, Gen Z/urban demand; diversification into high-growth categories (ice cream, shoes, yogurt).

Headwinds

- Policy & Pricing Stagnation: No ethanol price hikes despite cane FRP rises; grain-based favoritism squeezes sugarcane routes (Godavari).

- Supply-Demand Imbalances: Ethanol oversupply (~17B liters offered vs. tenders); sugar surplus (36MT availability vs. 28.5MT demand).

- Cost Pressures: Retrospective harvesting/transport hikes (exceptional items, Godavari); commodity deflation (20% agri drop) hitting topline despite margins.

- Execution Delays: Capacity ramp-up lags (shoes took 6 quarters; ice cream/Panipat Q4 FY26); long gestation in OTC pharma (6-18 months validation).

- Macro/Geopolitical: Volatility in bio-chems realizations; inflation slowdown (0.25% CPI) but input risks.

Growth Prospects

- Revenue/EBITDA Trajectory: Q2/H1 FY26: Godavari +34%/+14% rev, EBITDA loss narrowing; Hindustan Foods +18%/+16% rev, +24%/+17% EBITDA, PAT +54%/+33%. Aim: 20-25% CAGR topline (Hindustan Foods).

- Capex-Driven Expansion: INR550-770cr FY26 capex (Hindustan Foods: HPC INR120cr, F&B INR80cr, ice cream INR300cr); Godavari’s 200KLPD grain distillery (Q4 FY26, ~INR400cr FY27 potential). Gross block to INR2,000cr by FY26-end (ahead of schedule).

- Diversification: Bio-specialty chems (63% mix), Jivana branded foods (INR108cr FY25), shoes (INR133cr/Q), drug discovery/out-licensing (Godavari); multi-category contract mfg. (Hindustan Foods: 5 verticals, 10+ M&As).

- Long-Term: 2-3yr revenue/EBITDA growth via debottlenecking, M&A (“string of pearls”), ethanol/grain flexibility; FY27 shoe doubling potential post-ramp.

- Analyst Engagement: Upcoming meets (HUL Goldman Sachs Nov27; ITC Macquarie Dec3; Davangere Aug19) signal confidence.

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Policy/Regulatory | Ethanol pricing delays, export curbs, grain bias; GST implementation lags. | Multi-feedstock (grain distillery); policy advocacy. |

| Operational | Seasonality (Q3-Q2 ethanol crush); ramp-up failures (shoes/ice cream); labor hikes. | Backward integration; debottlenecking; 1:1 debt-equity cap. |

| Financial | High capex intensity (INR2,000cr block); WC strain in shoes/F&B; job-work skews topline. | Internal accruals (INR200cr/yr); net D/E 0.67→1.0; ROE focus. |

| Market/External | Ethanol oversupply; bio-chem geopolitics; agri-climate risks. | Diversification (specialty chems 60% EBITDA jump); sustainability. |

| Execution | M&A integration; 6-18mo pharma gestation. | Disciplined allocation; proven 22%/32%/30% 4-yr CAGR (rev/EBITDA/PAT). |

Summary

Bullish Outlook with Balanced Risks: Indian Diversified FMCG benefits from agri tailwinds (monsoons, exports), policy (ethanol/GST), and execution (capex, shared mfg.), driving 15-25% growth. Godavari exemplifies bio-FMCG innovation (chems/ethanol recovery); Hindustan Foods contract mfg. scale (INR1,000cr/Q milestone). Prospects: EBITDA positivity, 20%+ CAGR via diversification. Headwinds (pricing stagnation, ramps) are mitigable; key watch: ethanol tenders, Q3 crush. Sector ROCE/ROE to improve (5%+ PAT in shoes). Overall: Positive, with FY26 as inflection (EBITDA up 17-60% in samples). Investors: Focus EBITDA/PAT over topline due to contract nuances.

Financial

asof: 2025-11-30

General

asof: 2025-12-03

Analysis for Indian Diversified FMCG (Focus: HUL, ITC, and Peers like Hindustan Foods)

Using the provided filings as inputs, the analysis focuses on Hindustan Unilever Limited (HUL)—a core diversified FMCG player—as the primary lens, supplemented by ITC (diversified with strong FMCG), Hindustan Foods (FMCG contract manufacturing), and tangential insights from sugar/biorefinery peers (e.g., input cost linkages via sugar/ethanol). Key themes include corporate restructuring (demergers, delistings), governance transitions, ESG, IP, and expansion plans. Dates are futuristic (2025), indicating forward-looking disclosures.

Tailwinds (Positive Drivers)

- Restructuring & Value Unlocking: HUL’s Scheme of Arrangement with KWIL (ice cream demerger) enables a “pure-play” FMCG focus post-hiving off non-core assets. Board reconstitution and office shift signal efficient transition within Mumbai limits, reducing overheads. ITC’s voluntary delisting from CSE (effective Nov 20, 2025) simplifies compliance/costs while retaining NSE/BSE liquidity—common for diversified FMCG to streamline operations.

- ESG Momentum: Hindustan Foods’ ‘Adequate’ (55/100) Crisil ESG rating (FY24-25) highlights voluntary sustainability disclosures, aligning with SEBI mandates (e.g., Nov 11, 2024 circular). Boosts investor appeal amid rising ESG demand in FMCG.

- Input Cost Stability: Sugar peers (Davangere Sugar) signal ethanol expansions (65→110 KLPD), CO₂ recovery, and grain trading, supporting stable sugar prices/raw materials for FMCG (e.g., beverages, confectionery). Govt’s Ethanol Blending Program aids cost predictability.

Headwinds (Challenges)

- Transition Friction: KWIL’s director resignations (Navin Jain, Vinita Nair, Shalini Sinha; effective Nov 30, 2025) post-scheme reconstitution indicate short-term governance gaps, potentially delaying execution amid regulatory scrutiny (SEBI/NSE/BSE observation letters).

- Compliance Burden: Ongoing disclosures (Reg 30, SEBI circulars) for material updates on KWIL add administrative load for HUL. Smaller peers like Davangere face execution risks in expansions amid volatile agri-inputs.

- Delisting Visibility: ITC’s CSE exit may marginally reduce retail investor access in eastern India, though minimal impact given NSE/BSE dominance.

Growth Prospects

- Core FMCG Expansion: HUL’s demerger positions it for accelerated growth in high-margin segments (personal care, homecare, foods ex-ice cream). KWIL as standalone entity unlocks ice cream potential (premium brands like Kwality Wall’s).

- Diversification & Innovation: Godavari Biorefineries’ anti-cancer patent (Oct 16, 2025) hints at FMCG-pharma adjacencies (nutraceuticals/health). Davangere’s post-rights plans (mechanized harvesting, 5L+ MT cane crushing) ensure agri-supply chain resilience, benefiting FMCG volume growth (rural recovery, premiumization).

- Sector Tailwinds: Ethanol/sugar expansions align with India’s bioeconomy push, stabilizing input costs. ESG ratings and IP filings signal innovation edge; listed FMCG expected 8-12% CAGR (urbanization, e-commerce).

Key Risks

| Risk Category | Description | Mitigation from Filings |

|---|---|---|

| Execution/Regulatory | Scheme delays (NSE/BSE letters); board resignations disrupt KWIL ops. SEBI scrutiny on disclosures. | Ongoing filings ensure compliance; same-city office shift minimizes disruption. |

| Governance | Reconstituted boards in transitions (KWIL); director exits without profiles/relationships disclosed. | SEBI circular adherence; gratitude letters indicate amicable exits. |

| Market/Operational | Agri-volatility (sugar/ethanol peers); delisting reduces visibility. ESG “Adequate” rating signals room for improvement. | Farmer incentives (Davangere); retained major listings (ITC). |

| Financial | Expansion capex (e.g., Davangere’s CO₂ plant); unengaged ESG ratings may overlook gaps. | Rights issue funding; public data-based ratings. |

Overall Summary: Indian Diversified FMCG (e.g., HUL, ITC) benefits from tailwinds like demergers (value unlock) and input stability, with strong growth prospects in premium/rural segments (8-12% CAGR). Headwinds are transitional (board changes), but key risks center on scheme execution and agri-volatility. Positive sentiment from ESG/IP signals resilience; monitor Q4 FY26 for scheme effectiveness. HUL emerges strongest post-KWIL spin-off.

Investor

asof: 2025-11-29

Analysis of Indian Diversified FMCG Sector: Headwinds, Tailwinds, Growth Prospects, and Key Risks

Using the provided documents as inputs, this analysis focuses on the Indian Diversified FMCG sector (e.g., companies like Hindustan Unilever (HUL), ITC, and related players such as contract manufacturers like Hindustan Foods Limited (HFL), and upstream suppliers like sugar/biorefinery firms (Davangere Sugar, Godavari Biorefineries) that feed into FMCG via sugar, ethanol-derived products, and bio-chemicals). Insights are derived from earnings calls, investor presentations, and disclosures highlighting operational/financial performance, industry outlooks, and strategic shifts. The sector shows resilience amid diversification into foods/beverages, HPC, healthcare, ice creams, and biofuels, but faces agro-policy and execution challenges.

Tailwinds

- Robust Domestic Demand & Consumption Growth: Sugar demand (key FMCG input) growing at 5.2% CAGR (FY25-30), driven by household/food/beverage use, organic trends, and exports (4.24 LT till Apr 2025; projected 34.9 MT output in 2025-26). Ethanol blending at 20% (ahead of 2030 target), saving ₹1.96L Cr payouts to distilleries/farmers.

- Policy Support & Incentives: Sugar exports allowed (1.5 MT for 2025-26), 50% molasses export duty removal, ethanol price hikes (e.g., C-Heavy Molasses at ₹57.97/L), GST rationalization boosting ice creams/bottled water/HPC (HFL highlights consumption uplift for organized players).

- FMCG Ecosystem Evolution: Shift to shared manufacturing (HFL: 27% sales/EBITDA from shared; unlocks operating leverage). Quick commerce/new-age brands driving diversification (HFL adding new customers/categories like footwear, yogurt).

- Sustainability & Innovation: Bio-chemicals (Godavari: 60% EBITDA jump), CO2-to-DME pilots, grain-based ethanol (multi-feedstock resilience), backward integration (HFL: cones/sticks for ice creams).

- Financial Momentum: HFL revenue hit ₹1,000 Cr/quarter (16% YoY H1 growth), EBITDA +17%; Godavari revenue +34% QoQ; Davangere FY25 revenue ₹214 Cr.

Headwinds

- Input Cost Volatility & Seasonality: Sugarcane dependency vulnerable to monsoons/climate (Godavari/Davangere: crop yield risks); deflation in agri-commodities (20% drop) skews topline (HFL).

- Pricing Stagnation: Ethanol prices unchanged despite cane hikes (Godavari); sugar balance sheet surplus (36 MT availability vs. 28.5 MT demand).

- Execution Delays in New Ventures: Ramp-up lags in ice creams/shoes/healthcare (HFL: 6-18 months validation; shoes turned PAT+ after losses); high capex intensity (HFL: ₹550-770 Cr H2 FY26).

- Margin Pressures: Transfer pricing in ethanol/sugar (Godavari); exceptional costs (e.g., retrospective labor hikes); shared manufacturing operating leverage risks (HFL).

- Macro Slowdown: Urban/rural consumption gaps, geopolitics affecting bio-chemicals (Godavari).

Growth Prospects

- Capacity Expansion & Diversification: HFL targeting ₹2,000 Cr gross block by FY26-end (ahead of schedule; new categories like yogurt/water/shoes at ₹133 Cr/quarter run-rate). Davangere ethanol to 85 KLPD (2025); Godavari 200 KLPD grain distillery (Q4 FY26).

- High-Growth Segments: Ethanol market to USD 10 Bn by 2033 (14.4% CAGR); bio-specialty chemicals (Godavari: 63% mix, +60% EBITDA); branded foods (Davangere Jivana ₹108 Cr FY25); OTC healthcare/ice creams (HFL).

- M&A & Backward Integration: HFL’s “string of pearls” (10+ acquisitions; ₹120 Cr HPC, ₹80 Cr F&B); cone/stick plants (₹60 Cr revenue potential, margin uplift).

- EBITDA/PAT Leverage: HFL PAT +33% H1 (to ₹67 Cr); Godavari narrowing losses; Davangere PAT ₹10.8 Cr FY25. ROE/ROCE improvement via shared model (HFL target 5% PAT in shoes).

- Long-Term: 20-25% topline CAGR (HFL aspiration); multi-feedstock ethanol, drug discovery (Godavari), E20 blending.

| Metric | H1 FY26 Snapshot (Key Cos) |

|---|---|

| Revenue Growth | HFL: +16%; Godavari: +14% |

| EBITDA Growth | HFL: +17%; Godavari: Loss narrowed |

| PAT Growth | HFL: +33% |

| Capex Plans | HFL: ₹550+ Cr H2; Davangere: Rights issue ₹149 Cr |

Key Risks

- Policy/Regulatory: Ethanol tender shortfalls (17 Bn L offers vs. 10.5 Bn L demand); sugar export caps; GST/MSP changes (Godavari/Davangere).

- Raw Material/Supply Chain: Cane/grain availability (30% radius sourcing); labor hikes (retrospective, Godavari exceptional items).

- Execution/Capex: Ramp-up delays (HFL shoes/ice creams); debt rise (HFL net D/E 0.67→1:1); over-capex if sales lag (HFL topline trails EBITDA due to job-work contracts).

- Competition: Regional mills (Davangere); unorganized in water/ice creams; grain ethanol shift.

- Financial: High leverage post-rights/capex (Davangere debt reduction via issue); forex/climate risks (Godavari forward-looking caveats).

- Market Perception: Topline skew from job-work (HFL); sector undervaluation vs. global peers.

Overall Summary: Indian Diversified FMCG remains buoyant (16-34% revenue growth in sampled firms) on policy tailwinds (ethanol/GST), diversification (new categories/M&A), and sustainability (biofuels/CO2 tech). Prospects point to 20%+ CAGR via capacity ramps, but headwinds like pricing stagnation and execution risks temper optimism. Focus on EBITDA/PAT (not topline) for true growth gauge; monitor Q3 FY26 for season starts (sugar/ice cream). Sector resilient but policy-dependent.

Meeting

asof: 2025-11-29

Analysis of Indian Diversified FMCG Sector (Focus: HUL, ITC, Hindustan Foods; Context from Agro-Inputs like Godavari Biorefineries & Davangere Sugar)

Using the provided filings (board appointments at HUL & ITC, postal ballot/scheme at ITC & Hindustan Foods, Q2/H1 FY26 financials from Godavari & Davangere), here’s a structured analysis for the Indian Diversified FMCG sector. Core players (HUL, ITC) show governance strengthening amid stable operations; ancillary agro-food firms (sugar/distillery) highlight input cost pressures relevant to FMCG (e.g., sugar/ethanol as inputs). Sector faces cyclical commodity headwinds but tailwinds from leadership & restructuring.

Tailwinds (Positive Drivers)

- Governance & Expertise Boost:

- HUL appoints Bobby Parikh (ex-EY India CEO, Infosys/Biocon director) as Independent Director & Risk/Audit Chair (eff. Dec 2025). His financial/regulatory expertise aids transformation amid policy shifts.

- ITC proposes Amitabh Kant (ex-NITI Aayog CEO, G20 Sherpa) as Independent Director (eff. Jan 2026) for policy/digital/stakeholder skills; re-appoints Hemant Malik (Foods DCE, 36+ yrs exp.) as Whole-time Director (eff. Aug 2026) – bolsters Foods (Aashirvaad, Sunfeast) growth.

- Restructuring for Expansion: Hindustan Foods’ NCLT scheme approval (96%+ yes vote) merges Avalon Cosmetics & Vanity Case India – enhances cosmetics/food portfolio, synergies in FMCG manufacturing.

- Operational Resilience: Davangere Sugar’s distillery (₹67 Cr H1 revenue, key profit driver) & “Others” steady; ITC/HUL filings imply stable FMCG demand.

Headwinds (Challenges)

- Commodity Cost Pressures: Godavari Biorefineries reports H1 loss (₹57.6 Cr PAT excl. deferred tax; EBITDA -₹25 Cr) due to sugar inventory drawdown (₹405 Cr decrease), exceptional ₹26.7 Cr harvesting costs (to stay competitive), high finance costs (₹28 Cr). Sugar/cogen/distillery segments loss-making – signals input inflation (sugar/ethanol) for FMCG.

- Seasonal/High Costs: Godavari notes seasonal sugar impact; finance costs up (Godavari: ₹28 Cr H1); Davangere’s sugar/cogen losses (despite overall ₹3.9 Cr H1 profit).

- Margin Squeeze: Godavari’s total expenses > revenue (102% H1); high inventories/payables normalization post-sugar season strains cash (net operating cash +₹94 Cr but investing outflow ₹86 Cr).

Growth Prospects

- FMCG Core Strength: HUL/ITC emphasize “next phase of growth” via directors’ expertise (Parikh: transformations; Kant: policy/digital; Malik: Foods scaling). ITC Foods (Bingo/YiPPee) poised for rural/urban expansion.

- Diversification Synergies: Hindustan Foods scheme unlocks cosmetics/food export (Govt 2-star house); Godavari’s bio-chemicals/distillery (₹288/308 Cr H1 revenue) + capex (₹69 Cr CWIP) target value-add (e.g., ethanol blending push).

- Outlook: Distillery/AVFU strong (Davangere: 87% H1 revenue); sugar cycle recovery post-H1 inventory dump. Sector EPS steady (Davangere: ₹0.14/share); H1 revenue growth in distillery/bio (Godavari +14% YoY). Long-term: Policy tailwinds (ethanol, Incredible India via Kant).

Key Risks

| Risk Category | Details | Mitigation from Filings |

|---|---|---|

| Commodity/Seasonal Volatility | Sugar cycle losses (Godavari sugar: -₹32 Cr H1); harvesting inflation. | Inventory normalization; distillery pivot (Davangere 87% revenue). |

| Debt & Finance Costs | Godavari borrowings ₹493 Cr (up 30% YoY), interest 3% of revenue; Davangere ₹198 Cr. | Cash inflows (Godavari ops: +₹94 Cr); equity infusions (Davangere +₹49 Cr). |

| Regulatory/Execution | ITC postal ballot (e-voting Nov-Dec 2025); Hindustan Foods NCLT scheme (3.9% dissent). | High approvals (96-100%); experienced boards. |

| Demand/Competition | Godavari revenue -ve growth Q2 (-26% QoQ); aviation weak (Davangere). | Leadership for “growth phase” (HUL Nitin Paranjpe quote). |

| Forex/External | Godavari forex gains but foreign subs (unreviewed). | Parikh/Kant expertise in global/policy. |

Overall Summary: Indian Diversified FMCG resilient with strong tailwinds from board upgrades (expertise in finance/policy/foods) & restructuring (Hindustan Foods scheme), targeting 2H recovery post-sugar lows. Headwinds from agro-input costs (sugar losses, ₹27 Cr exceptional) cap near-term margins, but growth in spirits/bio-chemicals/Foods (10-15% segment CAGR potential). Risks moderate (cyclical debt), balanced by cash gen & governance. Sector FY26 outlook: Stable-moderate growth (5-10% revenue), focus on premiumization/digital. Monitor sugar policy/ethanol mandates.

Press Release

asof: 2025-11-29

Summary Analysis: Indian Diversified FMCG Sector

(Insights derived from Q2/H1 FY26 results of Hindustan Foods Ltd (HFL) – a core diversified FMCG contract manufacturer across Food & Beverages, Home & Personal Care, Ice Cream, Healthcare, and Shoes – and Godavari Biorefineries Ltd (GBL) – a biorefinery player supplying ethanol, bio-based chemicals, sugar, and alcohols critical to FMCG supply chains. HFL exemplifies direct FMCG operations; GBL highlights upstream enablers like bio-ingredients.)

Tailwinds

- Robust Demand & Revenue Momentum: HFL achieved a milestone with ₹1,043 Cr Q2 revenue (+18% YoY) and ₹2,041 Cr H1 (+16% YoY), driven by optimal capacity utilization, diversification, and marquee clients. PAT surged 54% YoY to ₹35 Cr in Q2. GBL showed 34% revenue growth to ₹434 Cr in Q2, with Ethanol and Bio-chemicals turning positive.

- Strategic Diversification & Backward Integration: HFL’s multi-category play (e.g., Shoes hit record ₹133 Cr quarterly sales) and integrations (waffle cones, ice cream sticks) enhance margins. GBL’s bio-specialty chemicals (+60% EBITDA growth) and ethanol recovery align with FMCG’s shift to sustainable ingredients.

- Government Support & Sustainability Push: Ethanol Blending Programme revival boosted GBL’s Ethanol EBITDA to ₹4.7 Cr. HFL benefits from FMCG growth (e.g., wellness, exports to Europe/Japan). Both emphasize green initiatives (GBL’s CO2-to-DME pilot).

- Strong Financial Health: HFL’s net debt/equity at 0.67x, ₹162 Cr cash, and ₹109 Cr operating cashflow support capex. GBL narrowing losses (EBITDA -₹4.4 Cr vs. -₹31.5 Cr YoY).

Headwinds

- Seasonality & External Factors: GBL’s sugar/ethanol segments are highly seasonal, leading to Q2 losses despite recovery. HFL noted unseasonal rains impacting beverages.

- Cost Pressures & Exceptional Items: GBL incurred ₹26.7 Cr exceptional expense on harvesting charges for competitiveness. Upstream volatility (feedstock like sugarcane/maize) persists.

- Macro Challenges: HFL faces potential US tariff uncertainties (mitigated by Europe/Japan focus). Broader FMCG sector deals with inflation, competition from unorganized players, and execution delays in expansions.

- Persistent Losses in Upstream: GBL’s overall PAT at -₹41.6 Cr (Q2) reflects biorefinery cyclicality, indirectly pressuring FMCG input costs.

Growth Prospects

- Capacity Expansion & New Launches: HFL plans ₹550+ Cr capex by FY26 end (e.g., Hyderabad/Silvassa HPC, yogurt/water plants, Panipat ice cream). GBL targets 200 KLPD grain distillery by Q4 FY26 for feedstock flexibility.

- Innovation & Premiumization: HFL entering flavored yogurt, bottled water, ayurvedic wellness; Shoes scaling in H2. GBL advances drug discovery (anti-cancer patents), bio-chemicals, and CO2 tech for clean fuels – positioning as sustainable FMCG supplier.

- Export & Category Tailwinds: HFL’s Baddi site approvals for global pharma/skincare; exports resilient. Sector-wide: India’s FMCG growth (10-12% CAGR projected), rising rural demand, health-conscious products.

- Long-Term Value: HFL eyes manifold growth per vertical; GBL confident in debottlenecking and R&D for stakeholder value. Combined, signals 15-20%+ sector revenue CAGR potential.

Key Risks

- Execution & Capex Delays: HFL’s ₹200 Cr commissioned + ₹550 Cr pending (e.g., Nashik soups merger by Q4 FY26); GBL’s distillery timeline. Delays could erode margins.

- Regulatory & Policy Volatility: Ethanol policy changes (GBL), US tariffs/pharma regs (HFL), SEBI compliance, tax/litigation risks (noted in safe harbors).

- Commodity & Input Volatility: Sugarcane/maize prices (GBL), raw material inflation affecting FMCG costs (HFL).

- Competition & Market Dynamics: Intense rivalry in contract manufacturing (HFL); seasonal sugar mills competition (GBL). Forward-looking risks include economic downturns, forex fluctuations.

- Financial Strain: GBL’s ongoing losses (-5.9% PAT margin H1); HFL’s debt for capex if growth slows.

Overall Outlook: Strong tailwinds from diversification, capex, and sustainability drive recovery/growth (HFL thriving, GBL stabilizing). Prospects bright with India’s FMCG boom, but execution, costs, and policy risks warrant caution. HFL positioned for outperformance; GBL as a high-beta upstream play. Investors should monitor Q3 execution and macros.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.