IRFC

Equity Metrics

January 13, 2026

Indian Railway Finance Corporation Limited

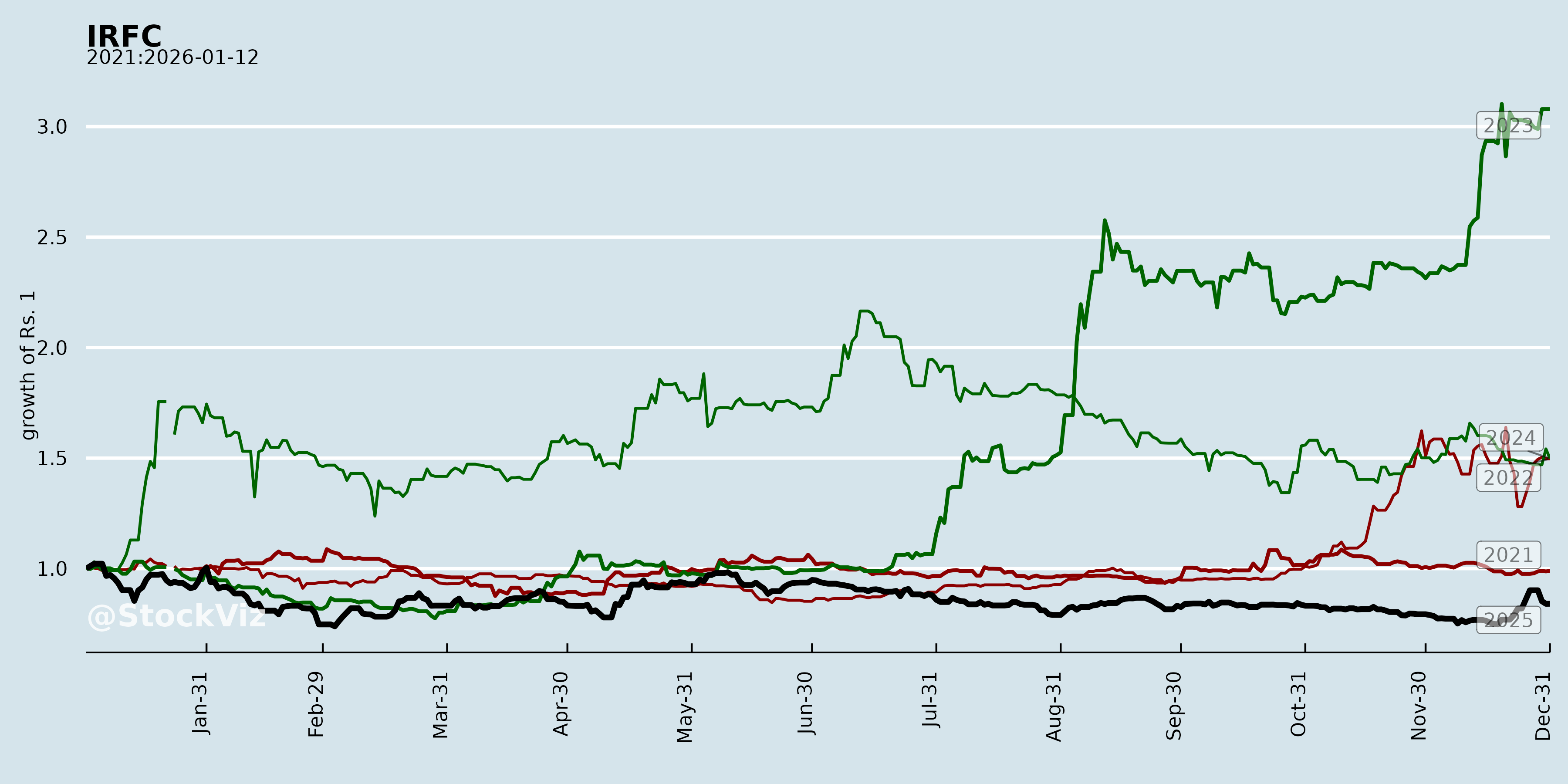

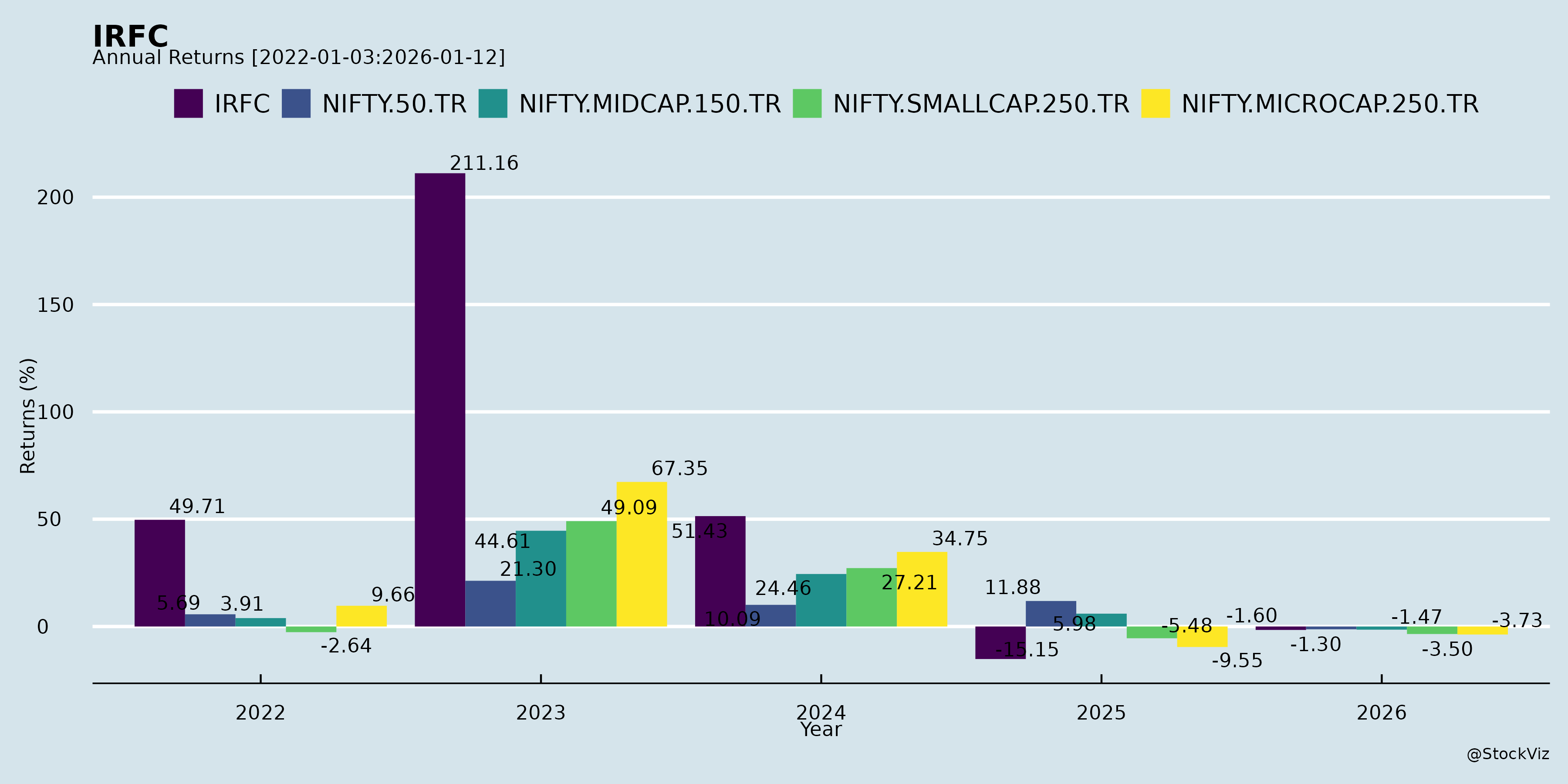

Annual Returns

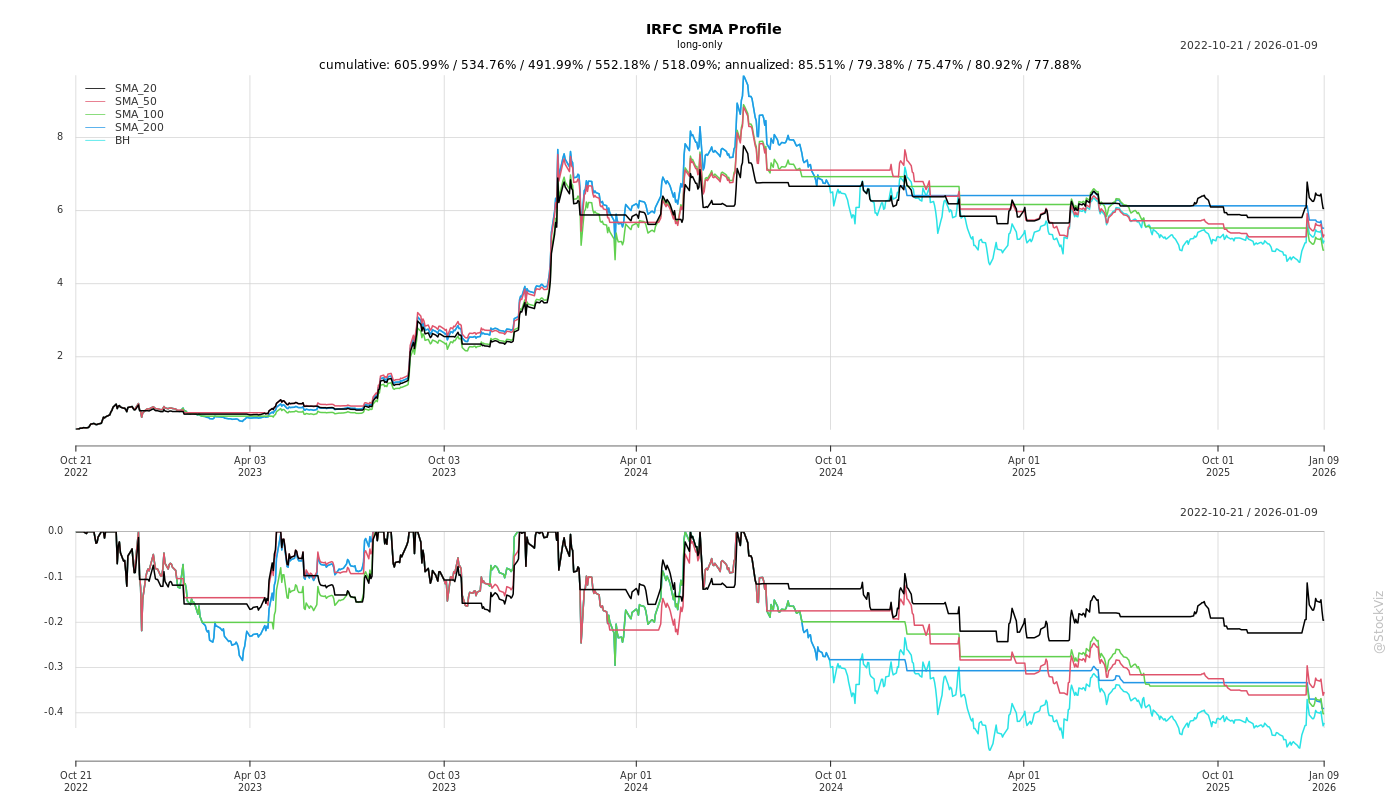

Cumulative Returns and Drawdowns

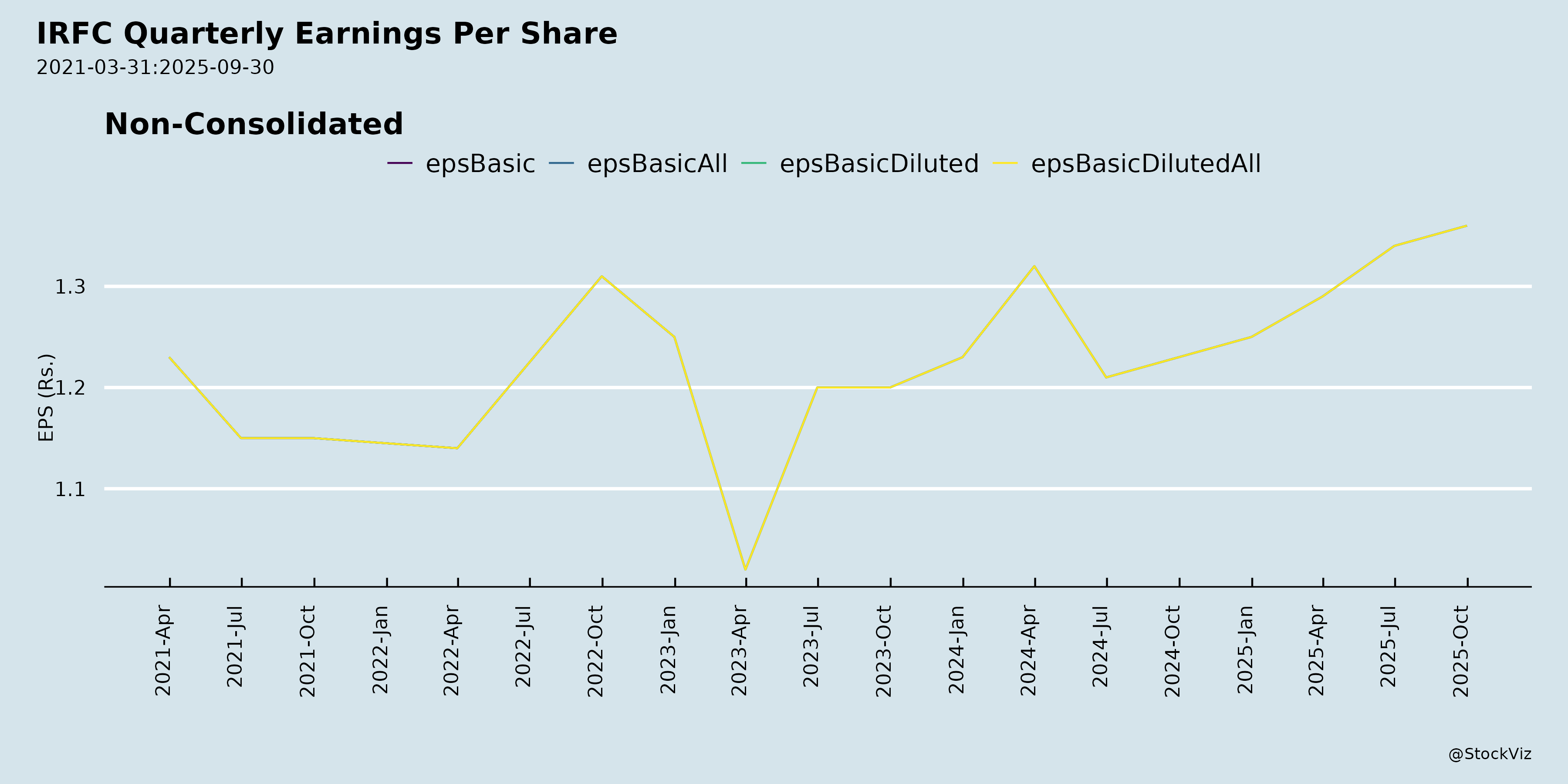

Fundamentals

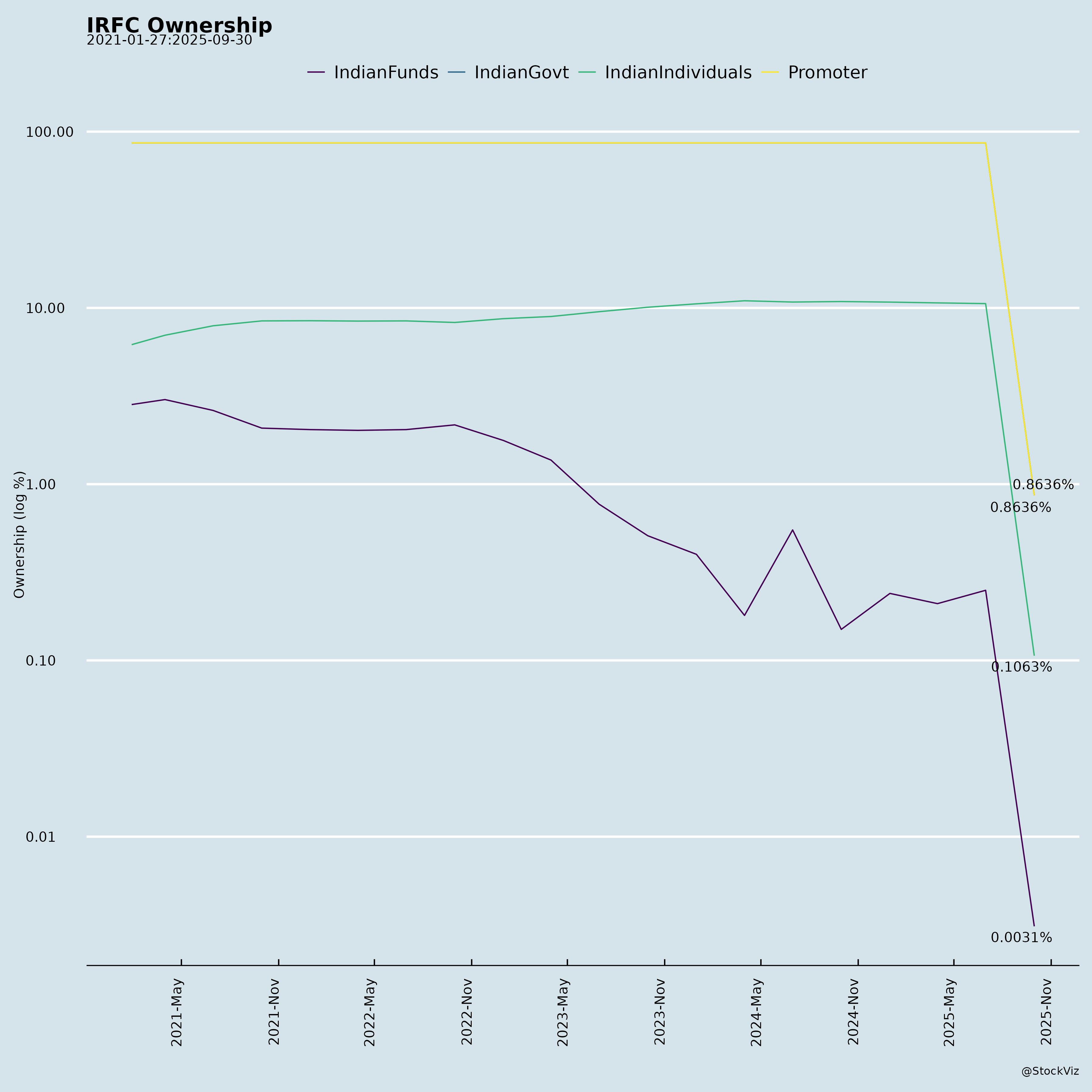

Ownership

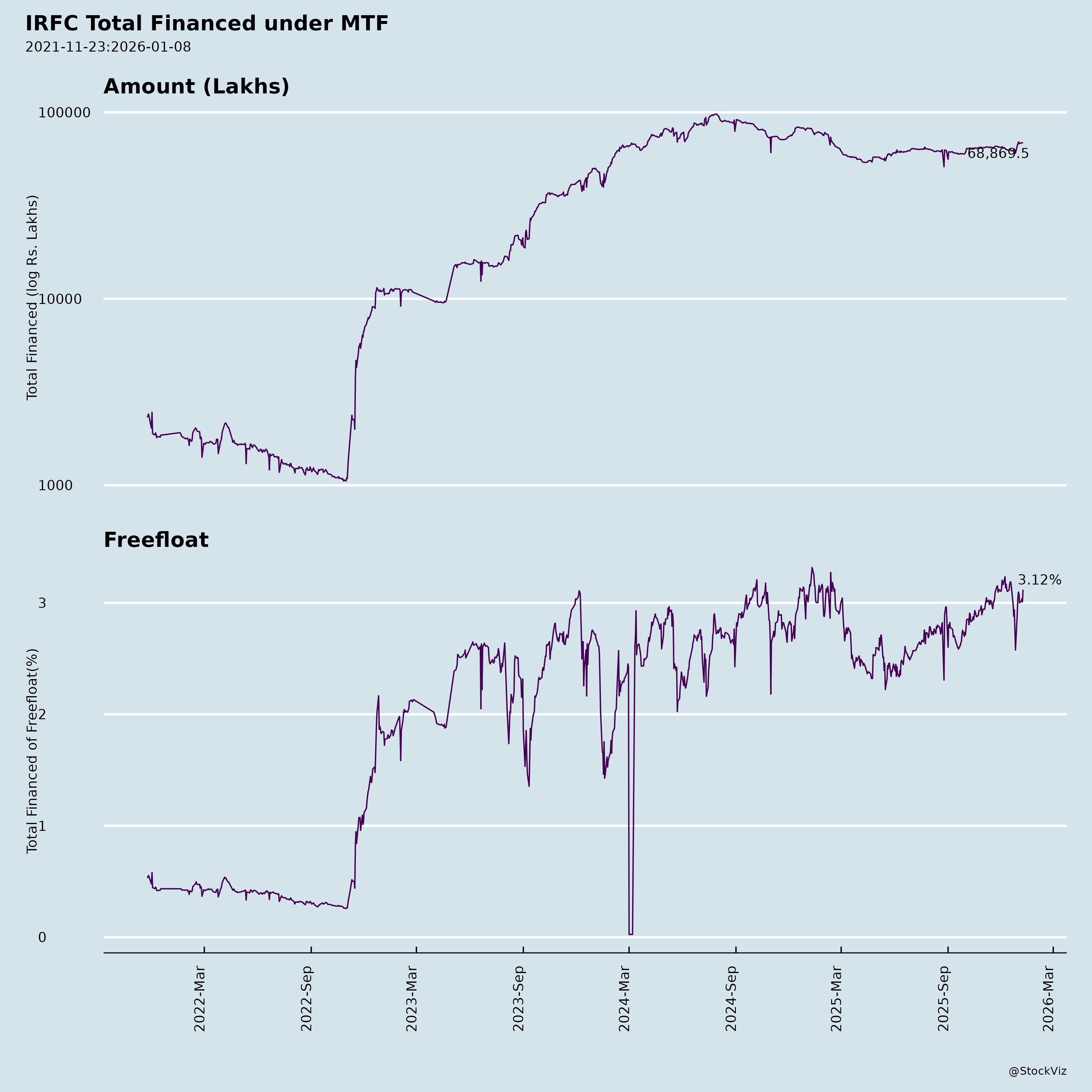

Margined

AI Summary

asof: 2025-12-03

IRFC Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

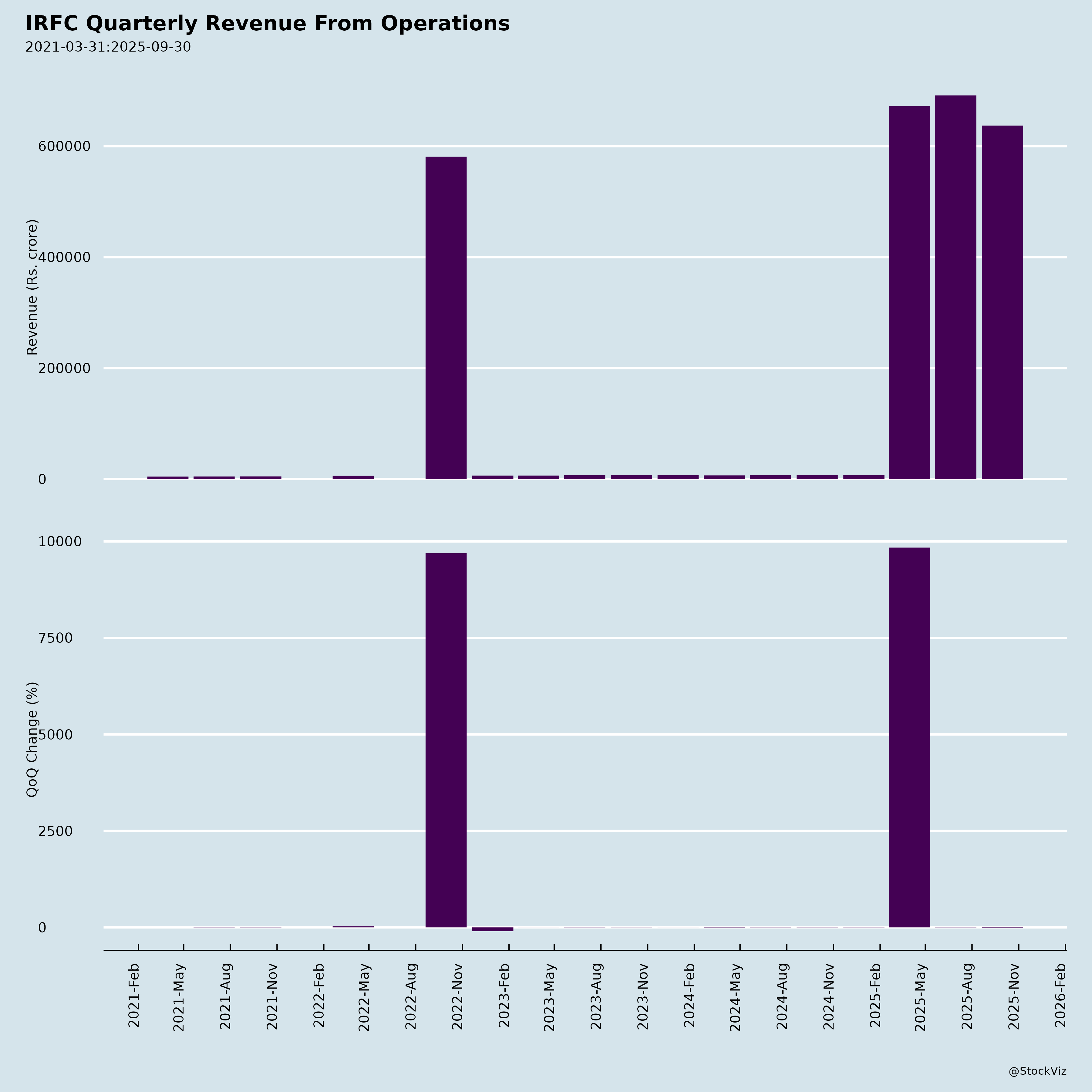

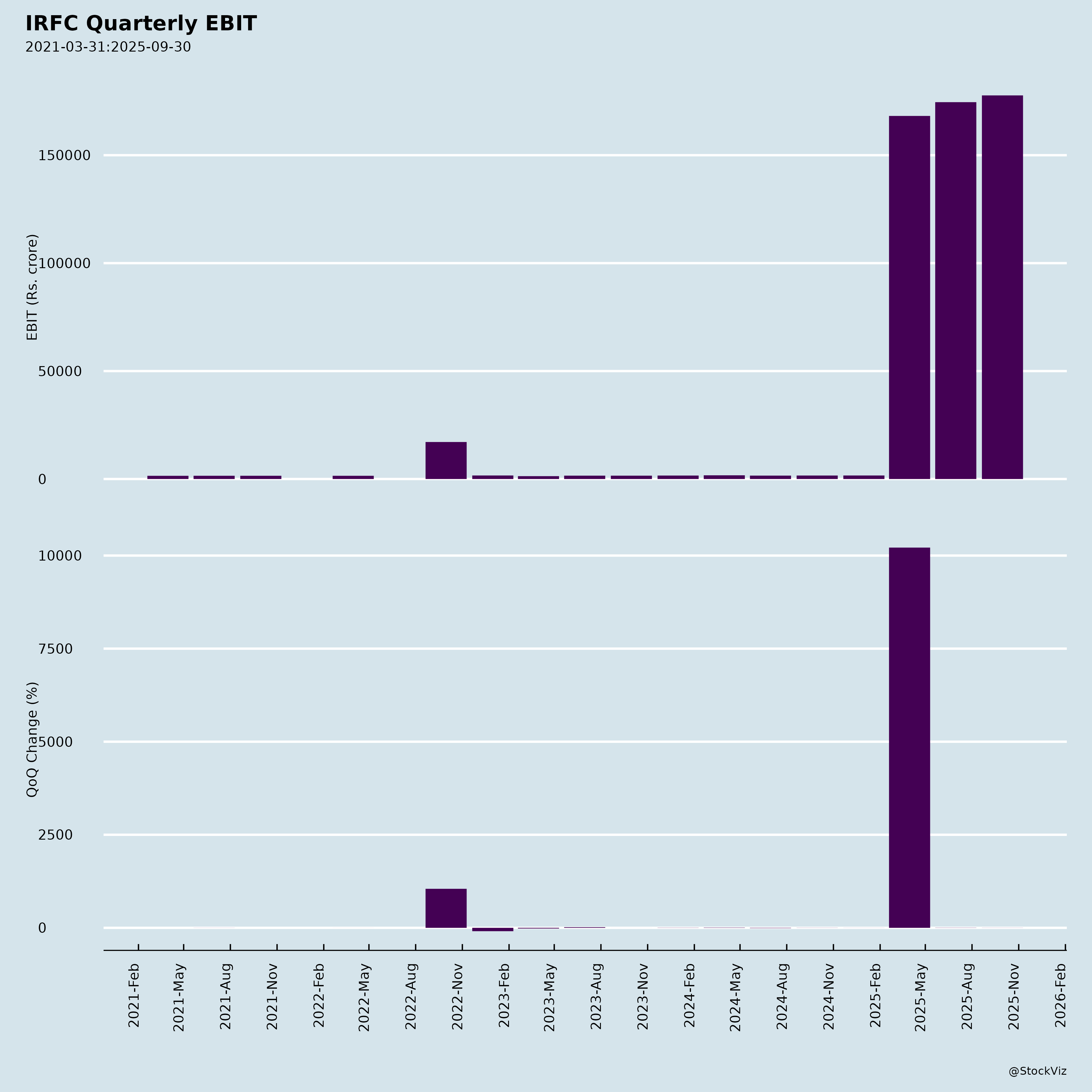

Overview: Indian Railway Finance Corporation Ltd. (IRFC), a Navratna CPSE under Ministry of Railways, is India’s dedicated financier for railway assets via leases/loans. FY25-26 H1 results show robust performance (PAT ₹3,523 Cr, +10% YoY; NIM 1.55%; AUM ₹4.6 lakh Cr; zero NPA). Strategic diversification into railway-linked infra (e.g., renewables, transmission, mining) drives growth amid stagnant direct railway allocations. Recent ECB raise (JPY/USD 300 Mn) signals funding diversification. Below is a structured summary based on Q2/H1 FY26 earnings call, financials, and disclosures.

Tailwinds (Supportive Factors)

- Diversification Success: Signed ₹45,000 Cr agreements in H1 (9x YoY growth) across low-risk govt/CPSE sectors (NTPC, Coal India JV, GAIL, etc.). Higher margins (2x-3x railway’s 40 bps) boosted NIM from 1.42% to 1.55%; expected to sustain/improve.

- Strong Fundamentals: Record PAT (double-digit growth), net worth (₹56,194 Cr), EPS (₹2.70 basic H1), and shareholder returns (record interim dividend ₹1.05/share). Zero NPA for decades; CRAR ~28% (industry-best).

- Govt Ecosystem Leverage: “Whole-of-government” approach; 70% of India’s capex from govt. Flooded pipeline from states/CPSEs; competitive borrowing costs (6.5-7%) enable 100-120 bps spreads vs. market 9%+.

- Funding Access: Revived ECB market (JPY/USD 300 Mn @ TONAR, 5-yr tenor) after 3+ years; reduces cost of funds. Debt:Equity ~7x (healthy).

- Railway Cherry: Potential ₹2.5 lakh Cr annual railway demand as backstop (zero-risk per RBI).

Headwinds (Challenges)

- Railway Stagnation: No new allocations for 3 years; AUM growth reversed only via diversification (H1 disbursals ₹7,000 Cr). Direct railway biz (75% target) remains flat.

- Talent & Overhead Build: Transition from low-touch railway lending to sales/underwriting/collections in competitive infra. Hiring experts (deputations, lateral entries, NTPC veterans); overheads controlled but scaling needed.

- Competition: Banks chasing same quality govt assets; IRFC competes on low-cost govt backing but must maintain spreads.

- Regulatory Constraints: RBI single-borrower (30% net worth) and group (50%) limits cap exposure (e.g., NTPC capped ~₹25k Cr).

- Maturing Legacy Assets: Railway project moratorium extensions (e.g., EBR IF 2019-20); lease income reversals to pre-commencement interest.

Growth Prospects

- AUM/Disbursal Ramp: FY26 guidance intact at ₹30,000 Cr disbursals (Q3: ₹10-15k Cr); H1 upward AUM trend to continue. 5-yr target: 75% railway + 25% diversified (renewables, logistics, ports, metro).

- PAT Trajectory: Double-digit annual/quarterly growth targeted; diversification to drive NIM expansion. No dilution needed (strong Tier-1 capital post-dividend).

- Infra Boom Synergy: India’s NIP/govt capex focus; upstream railway linkages (e.g., power for traction, mining for freight). Potential 20%+ YoY loan book growth feasible with current framework.

- Funding Diversification: More ECBs/international taps at low rates; no near-term equity raise.

- Long-Term: Decade-long upward AUM/PAT trajectory; zero-NPA philosophy intact.

| Metric | H1 FY26 | H1 FY25 | FY25 |

|---|---|---|---|

| PAT (₹ Cr) | 3,523 | 3,189 | 6,502 |

| NIM (ann.) | 1.55% | - | 1.42% |

| AUM (₹ lakh Cr) | 4.62 | - | ~4.1 (est.) |

| New Biz (₹ Cr) | 45,000 | ~5,250 (FY25 full) | - |

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Credit/NPA | Diversification into “uncharted” infra; potential delinquencies 1-2 yrs out despite govt focus. | Cherry-picking AAA CPSEs/states; milestone-based project finance; zero-NPA history. |

| Interest Rate/Cost of Funds | Rising rates could squeeze NIM; ECB forex exposure (JPY). | Benchmark-linked (TONAR); competitive govt borrowing; hedges via diversification. |

| Execution/Operational | Project delays (PERT/CPM monitored); human capital ramp-up. | Seasoned team (20+ hires); low overheads. |

| Regulatory/Tax | RBI exposure limits; MAT revival post 5-7 yrs (₹3k Cr unabsorbed depreciation shields). | Compliance-focused; new policies (e.g., CRAR SOP). |

| Concentration | Heavy govt reliance (86% GoI stake); fiscal slippages in states/CPSEs. | Broad ecosystem (30+ ministries); no single >30% exposure. |

| Liquidity/Market | Debt rollovers (₹4 lakh Cr outstanding); no new railway pipeline. | Strong cash flows (H1 op. CF ₹17k Cr); 100% asset cover. |

Overall Outlook: Bullish. Tailwinds from diversification and govt capex outweigh headwinds; low-risk profile positions IRFC for sustained 10-20% growth. Monitor NIM trajectory and disbursal execution. Valuation likely supported by dividends and PAT compounding. (Analysis based solely on provided docs; no external data.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.