Financial Institution

Industry Metrics

January 13, 2026

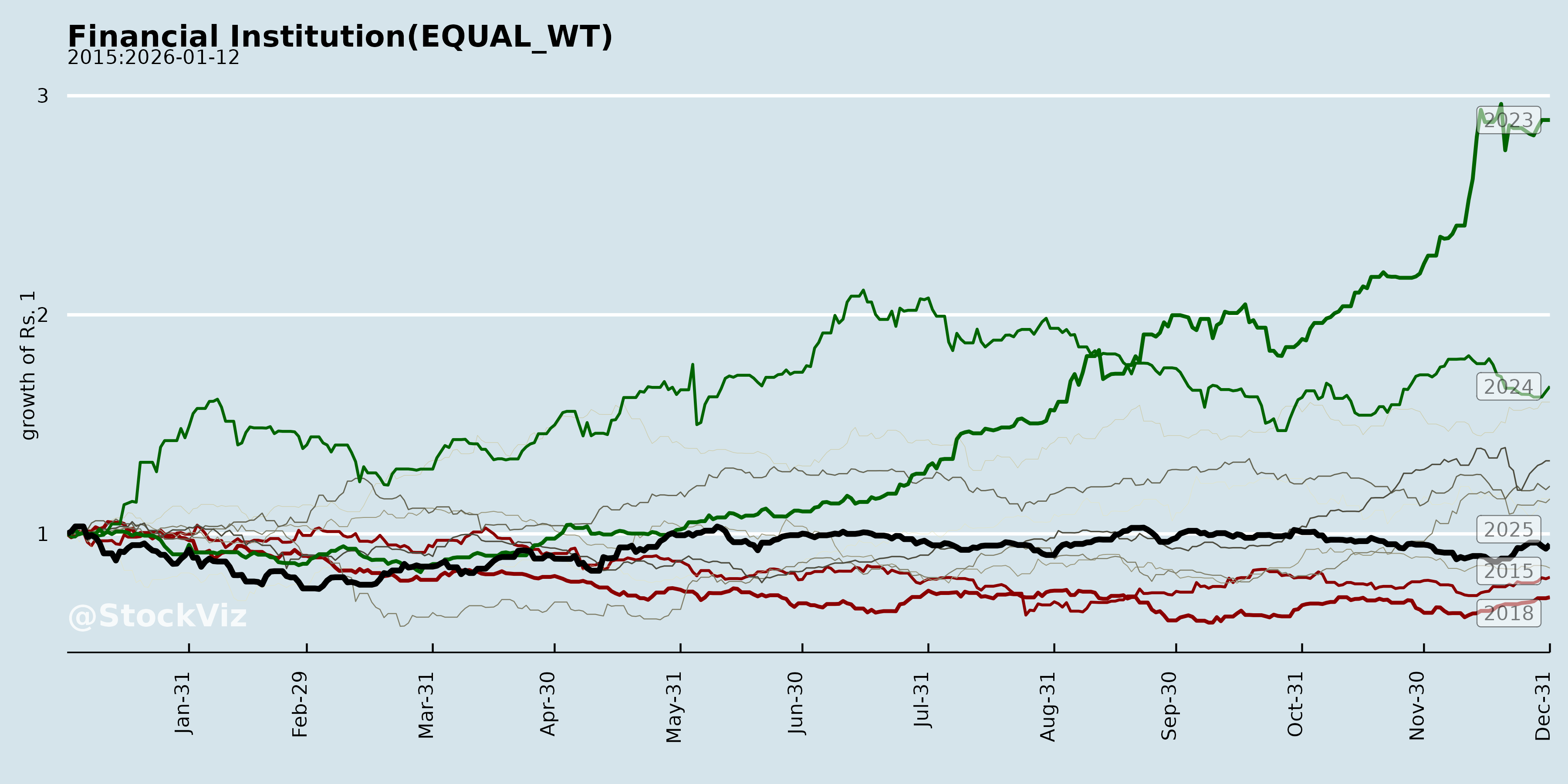

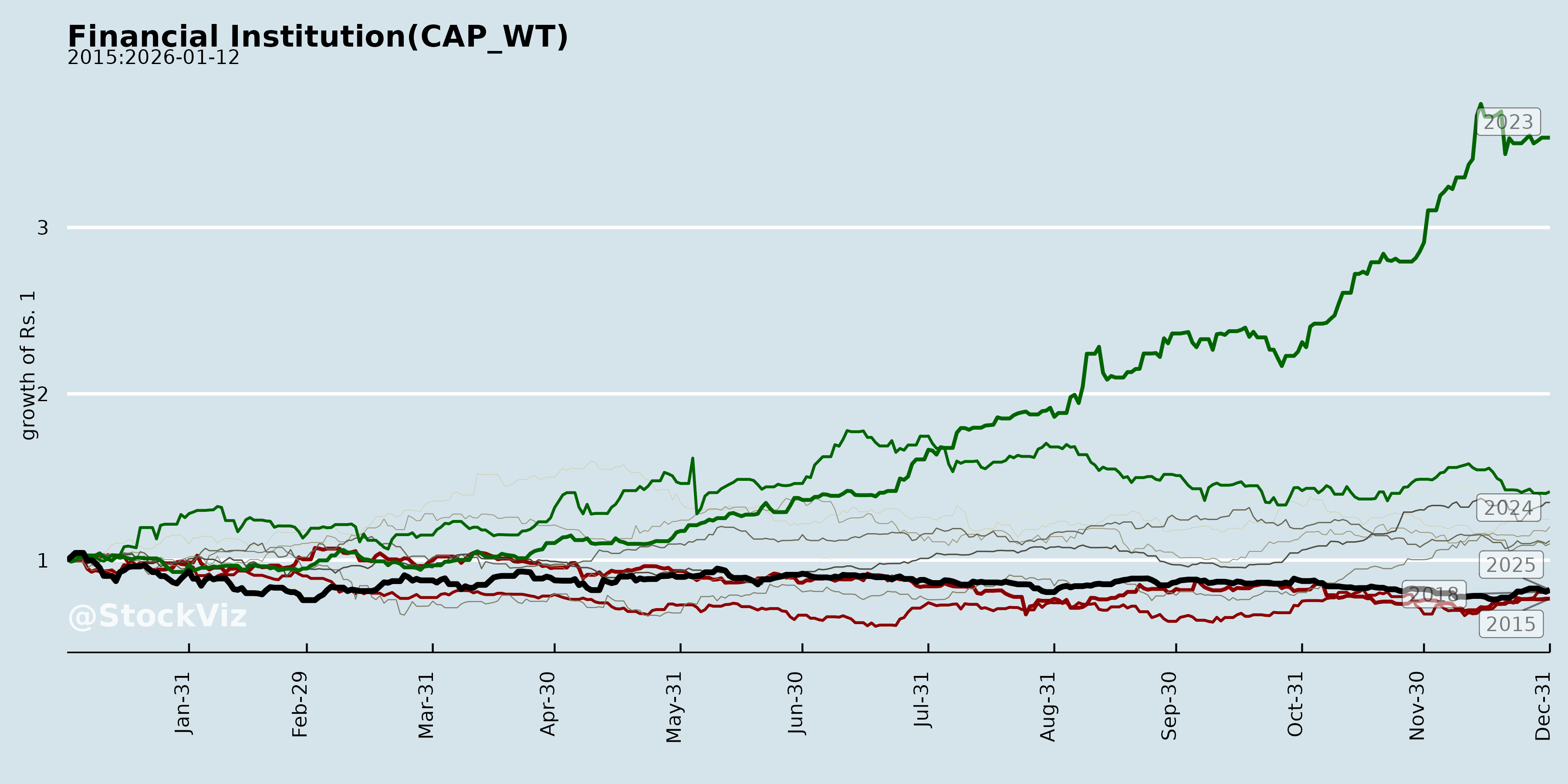

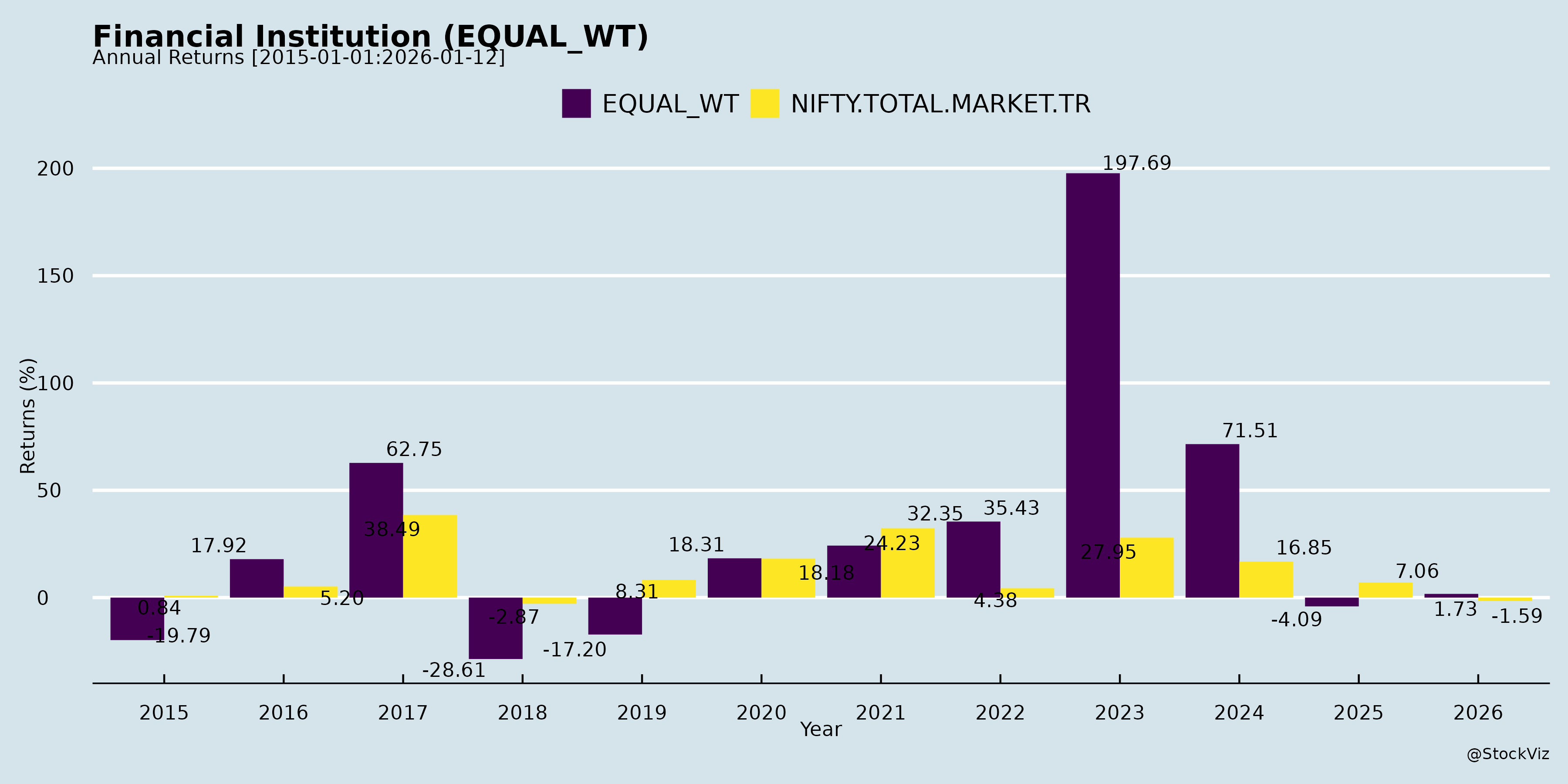

Annual Returns

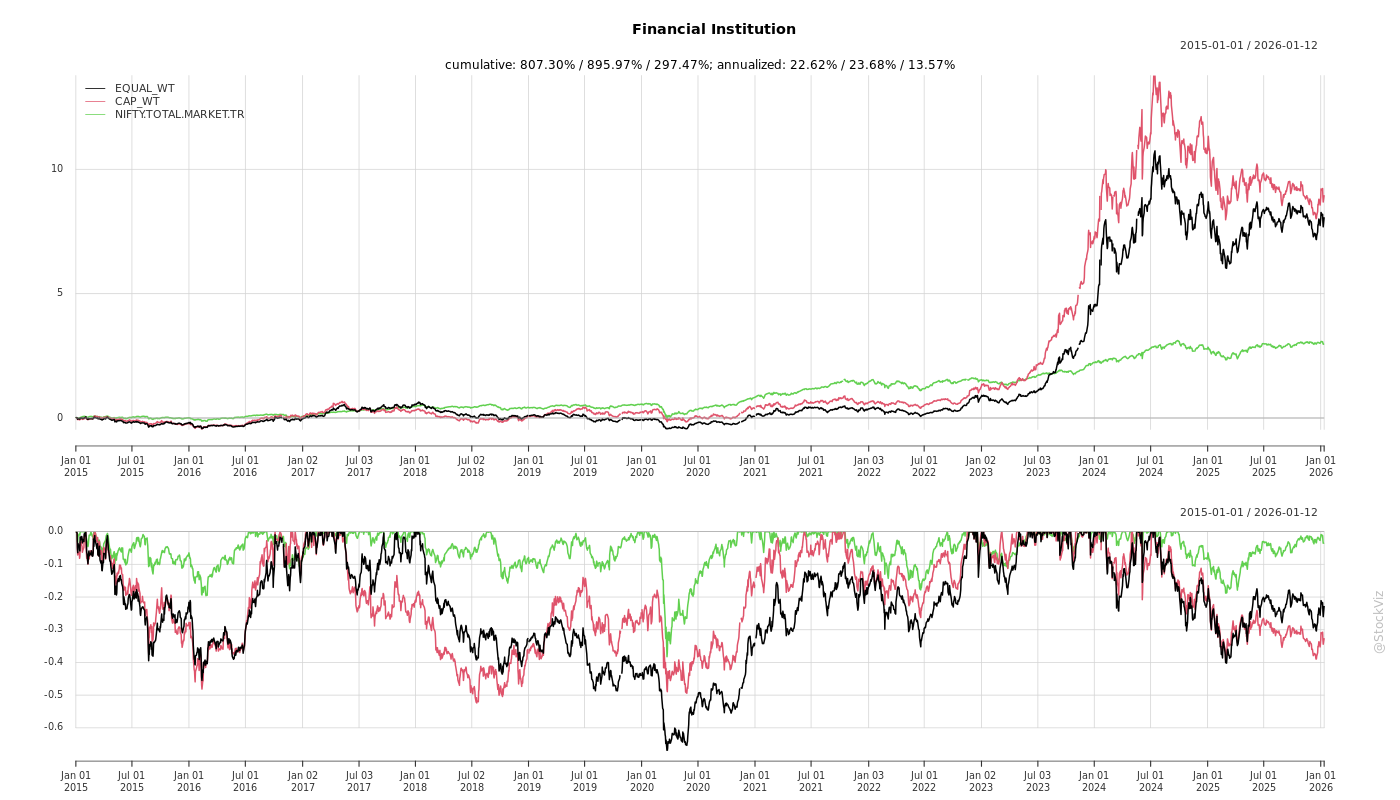

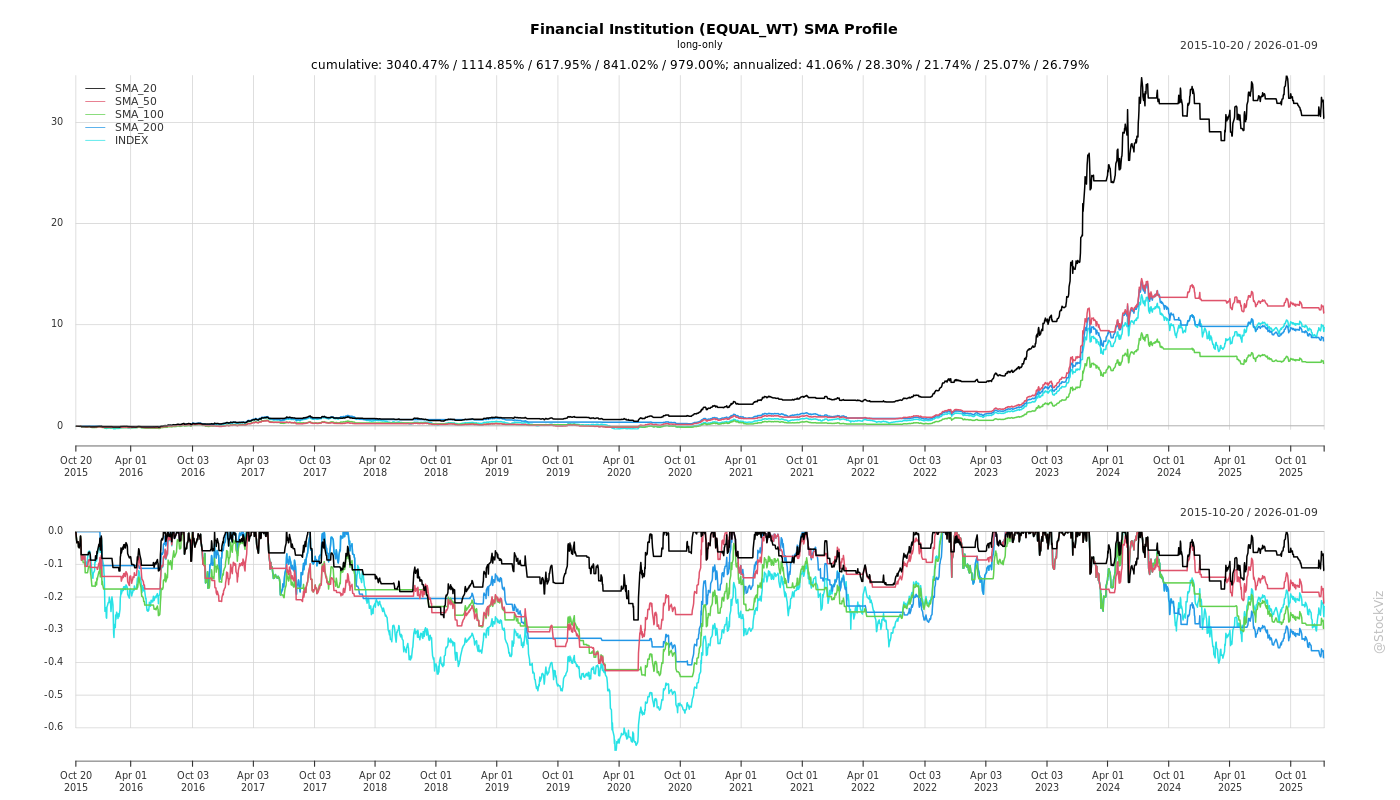

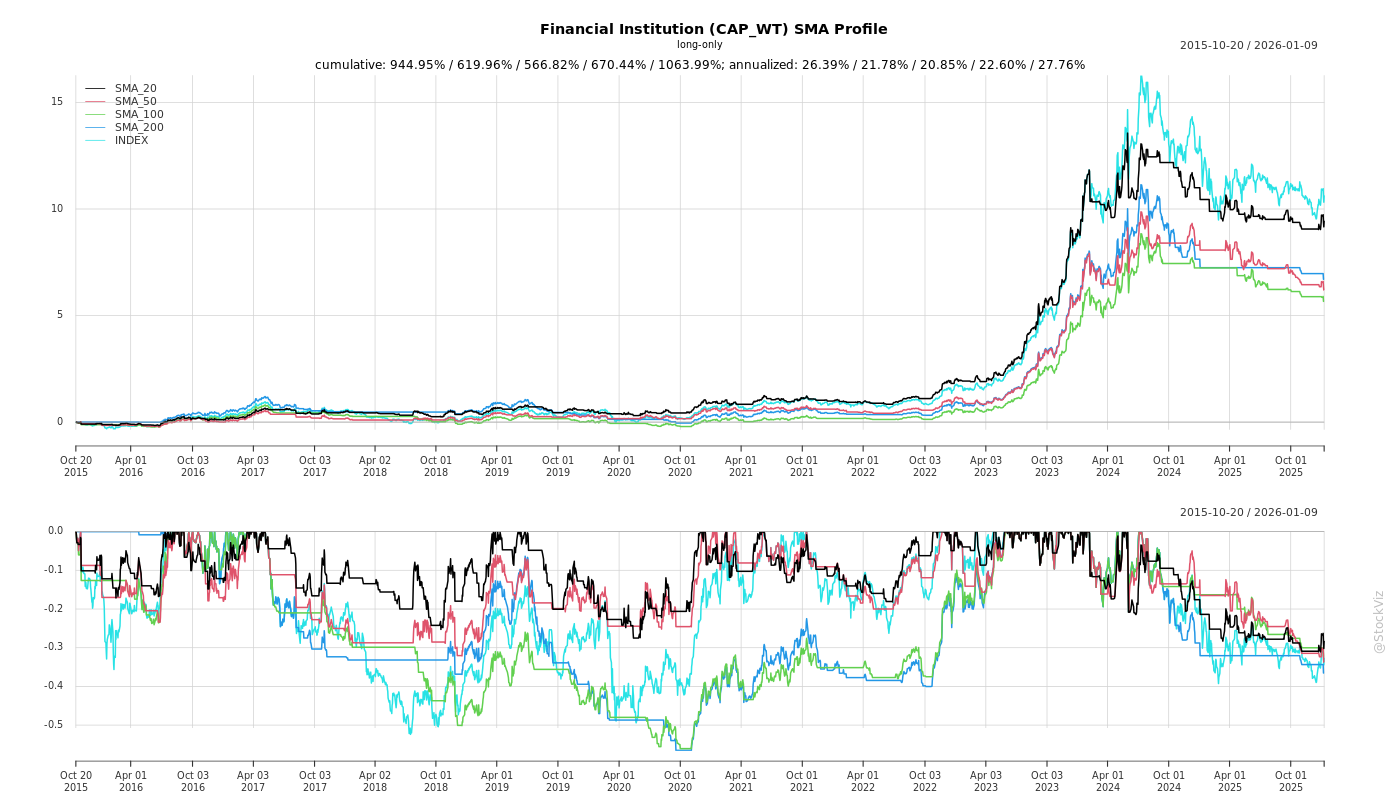

Cumulative Returns and Drawdowns

SMA Scenarios

Current Distance from SMA

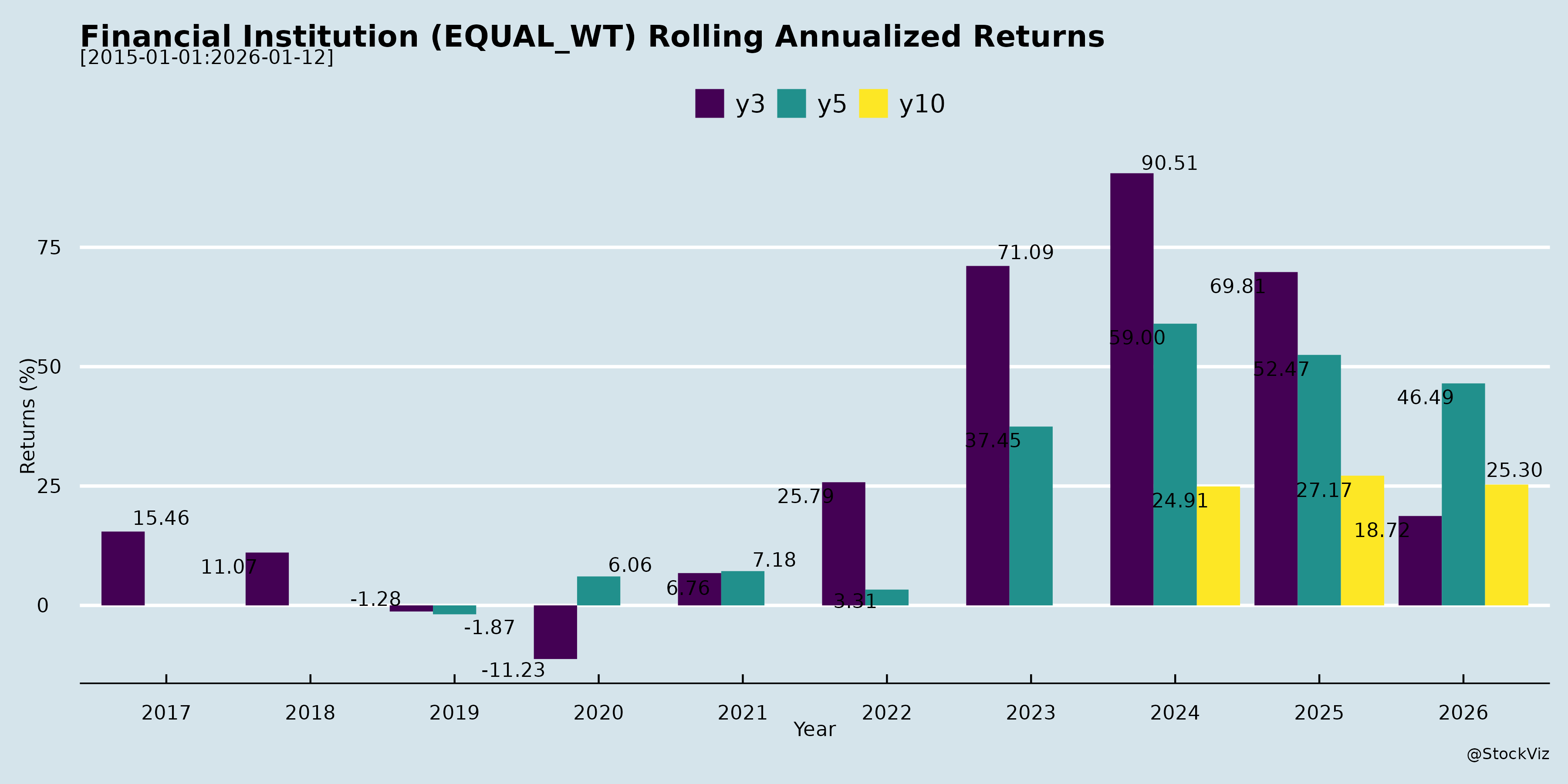

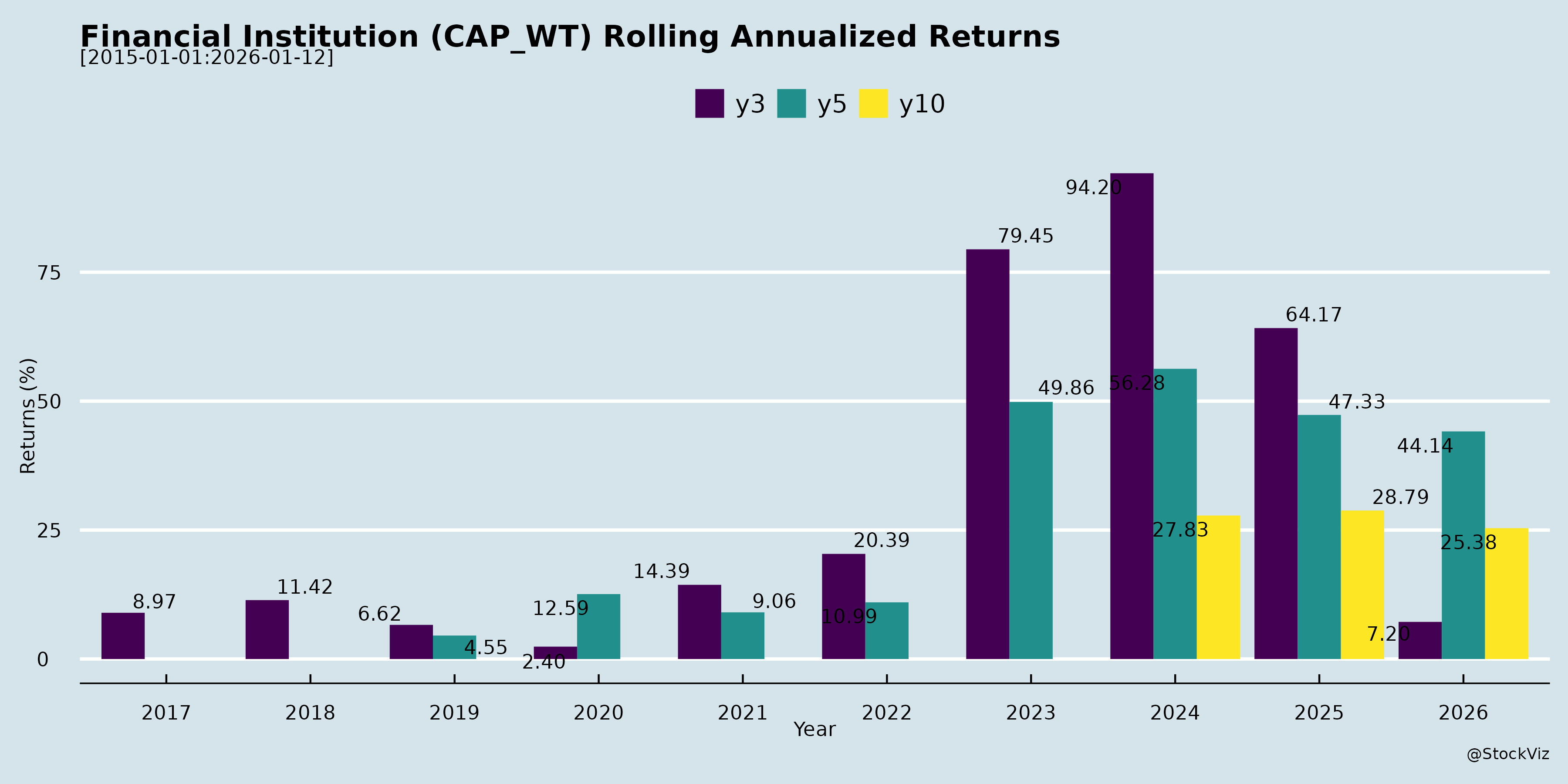

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-30

Analysis of Indian Financial Institutions (Infra NBFCs/CPSEs): IRFC, REC, HUDCO, PFC, IREDA

These documents cover Q2/H1 FY25-26 earnings transcripts (IRFC, REC, HUDCO) and disclosures (PFC, IREDA), representing key govt-backed financiers in rail (IRFC), power (PFC/REC), urban/housing (HUDCO), and renewables (IREDA). They exhibit strong alignment with India’s infra capex push (e.g., NIP, power transition, Viksit Bharat). Below is a structured analysis of tailwinds, headwinds, growth prospects, and key risks, followed by a summary.

Tailwinds (Positive Drivers)

- Robust Financial Performance: Record H1 profits (IRFC: ₹3,523 Cr, +double digits; REC: ₹8,877 Cr, +19%; HUDCO: Revenue +31%). NIMs/spreads improving (IRFC: 1.55%; REC: 3.64%; HUDCO: ~3% ex-govt loans). Cost of funds declining (HUDCO: 7.12% → 6.32%; REC: 7.17%).

- High Disbursements & Sanctions: REC: ₹1.15L Cr (+27%); HUDCO: ₹26k Cr (+19%); IRFC: ₹7k Cr disbursed, ₹45k Cr agreements. Strong pipelines (REC: ₹2.5L Cr committed; HUDCO: ₹3L Cr documented/non-doc).

- Pristine Asset Quality: Zero NPAs (IRFC); REC net NPA 0.24% (PCR 77%); HUDCO net NPA 0.07% (target zero in 15 months). 86-90% backed by govt/state guarantees.

- Govt Backing & Low Funding Costs: Maharatna/Navratna status; sovereign-aligned ratings (REC: Baa3/BBB). Diverse borrowings (bonds, ECBs, FCNR) at competitive rates; high CRAR (REC: 23.74%; HUDCO: 38%).

- Policy Support: Nodal roles in schemes (REC: RDSS, PM Surya Ghar; HUDCO: Urban Challenge Fund). Falling repo rates aiding margins.

Headwinds (Challenges)

- Prepayments Impacting Growth: REC: ₹49k Cr prepayments (e.g., Kaleshwaram ₹11.4k Cr reduced Stage-2 by 52%); offsets organic growth despite high sanctions.

- Forex Volatility: HUDCO: ₹176 Cr H1 loss on FCNR/ECBs (USD-CHF-INR swings); 99% hedged but ongoing costs (e.g., seagull options, EKI hikes).

- Margin Pressure: Competition from banks/NaBFID post-repo cuts; renewables lower yields (REC/HUDCO). Fixed borrowings slow transmission (REC: 80-85% fixed).

- Backloaded Disbursements: Sanctions strong but lag (HUDCO: 3-12 months; IRFC: Q3-Q4 heavy).

- Regulatory Overhead: RBI project finance norms (effective Oct’25) may raise provisioning; ECL reversals/recoveries volatile (HUDCO: ₹120 Cr reversal).

Growth Prospects

- Massive Market Opportunity: Power (REC: ₹46L Cr next 4-5 yrs, 500GW RE); Rail ecosystem (IRFC: upstream diversification); Urban infra (HUDCO: ₹80L Cr by 2036, ₹1L Cr Urban Challenge Fund). Targets: REC ₹10L Cr AUM by 2030 (30% RE); HUDCO ₹3L Cr by 2030 (+25-30% CAGR); IRFC 30k Cr FY26 disbursals.

- Diversification Momentum: IRFC (RE/transmission/ports); REC (infra/logistics/shipping MoU); HUDCO (private sector in ports/airports/roads; Urban Invest window). IREDA/PFC roadshows signal global investor interest.

- Volume-Led Expansion: Govt capex 70% of India’s total; low-risk “whole-of-govt” lending (CPSEs/states). Double-digit PAT/AUM growth guided (IRFC/REC).

- Shareholder Returns: High dividends (REC: ₹9.20/share H1; IRFC: ₹1.05 interim); equity self-funding growth (no dilution).

| Institution | FY26 AUM/Disbursal Guidance | Long-Term Target |

|---|---|---|

| IRFC | ₹30k Cr disbursal | Steady upward AUM/PAT |

| REC | 11-12% loan growth | ₹10L Cr by 2030 |

| HUDCO | ₹50k Cr disbursal (+25%) | ₹1.6L Cr by Mar’26; ₹3L Cr by 2030 |

Key Risks

- Asset Quality Slippage: Diversification into uncharted areas (private sector, non-rail/power); pending resolutions (REC: 11 NCLT cases ₹6k Cr; HUDCO: ₹730 Cr principal in 10 projects). Stage-2 stress (REC: ₹16k Cr).

- Margin Compression: Rate cuts (25-50 bps expected); RE/private lending yields <9% (HUDCO/IRFC). Competition stiffens (banks at lower rates).

- Execution/Conversion Risk: Sanctions-to-disbursal delays; state fiscal health (e.g., DISCOM debt restructuring murmurs); PMAY slow uptake (HUDCO).

- External Shocks: Forex depreciation (USD-INR >90/100 triggers costs); cyclical capex dependency on govt budgets (rail/power ministries compete).

- Regulatory/Policy: RBI caps (30% net worth/single borrower); MAT revival (IRFC: mitigated 5-7 yrs); DISCOM privatization (REC: potential shift to private lenders).

Summary

These institutions are poised for sustained double-digit growth (AUM/PAT +25-30% FY26+), fueled by India’s ₹100L+ Cr infra capex (power/rail/urban/RE) and govt alignment. Tailwinds dominate (pipelines, low NPAs, falling costs), with diversification enhancing margins (2-3x railway yields). Growth is volume-driven, targeting ₹20L+ Cr cumulative AUM by 2030. However, headwinds like prepayments/forex temper near-term loan growth, while risks center on execution, competition, and quality in new segments. Overall bullish outlook (ROE 15-22%; dividends intact), but monitor forex/NPAs quarterly. Sector CRAR/debt-equity remains healthy (<7-8x), supporting self-funded expansion without dilution. Recommendation: Accumulate on dips for long-term infra play.

Financial

asof: 2025-12-01

Analysis of Indian Infrastructure Finance NBFCs (IRFC, PFC, REC, IFCI, TFCI, HUDCO)

The provided documents cover unaudited/audited Q3 FY25 financial results, board outcomes, and disclosures for key Government of India (GoI)-backed NBFCs focused on infrastructure financing (railways, power, rural electrification, housing, industrial, and tourism sectors). These entities benefit from sovereign backing but face sector-specific challenges. Below is a structured analysis of headwinds (challenges), tailwinds (positives), growth prospects, and key risks, based on balance sheets, P&L, cash flows, NPAs, CRAR, dividends, and notes.

Tailwinds (Positive Factors)

- Strong Government Backing & Stable Revenue Streams: All are GoI enterprises (e.g., IRFC 88% GoI-owned, PFC/REC under PFC umbrella). Revenue dominated by interest/lease income from govt-linked sectors (e.g., IRFC lease income ~₹4,793 Cr in Q3; PFC/REC interest ~₹26K Cr consolidated). Low default risk in core assets (e.g., railway/power infra).

- Robust Loan Book Growth: Disbursements/loan assets expanding (IRFC loans ~₹557K Cr, up from ₹509K Cr; REC ~₹565K Cr; PFC consolidated ~₹1,069K Cr). Supported by govt infra push (e.g., REC notes project funding under MoU with Ministry of Railways).

- Profitability & Dividends: Healthy PAT in most (PFC standalone PAT ₹12K Cr 9M; REC ₹11K Cr; TFCI ₹10K Cr FY25). Dividends declared (PFC ₹3.5/sh, REC ₹4.3/sh, TFCI ₹3/sh, IRFC implied stability).

- High Ratings & Funding Access: AAA ratings (PFC/IRFC/REC), easy bond issuance (e.g., PFC ₹11K Cr NCDs fully utilized; REC ₹10K Cr). Security cover >1x (e.g., IRFC 1x, REC 1.4x).

- Low Operational Costs: NIMs stable ~3-4% (PFC op margin 39%, REC 35%). ECL provisions managed (e.g., REC coverage 68-74%).

Headwinds (Challenges)

- High NPAs & Provisions: Elevated stress (IFCI GNPA 96%, net 83%; PFC/REC ~2-3% GNPA but Stage 3 ~2%). Provisions drag profits (IRFC impairment ₹0.46 Cr Q3; REC ₹239 Cr 9M; IFCI heavy write-offs).

- Negative/Thin Margins in Weak Players: IFCI reports losses (PAT -₹229 Cr 9M, CRAR -54%), thin equity (₹963 Cr). TFCI ECL overlay ₹3,372 Cr reflects caution.

- Forex & Funding Costs: Net forex losses (PFC ₹366 Cr 9M; REC ₹161 Cr). High finance costs (IRFC ₹5K Cr Q3; PFC ₹48K Cr consolidated 9M).

- Regulatory Pressure: CRAR breaches (IFCI -54%; some others thin). RBI norms force higher provisions (e.g., REC/IRFC ECL > IRACP in parts).

- Subsidiary Drag: PFC/REC consolidates weak subs (unreviewed); IFCI subs contribute losses.

Growth Prospects

- Infra Boom: Aligned with govt capex (₹11L Cr FY25 budget). Power/rail demand (PFC/REC loan growth 11-15%; IRFC leases stable). Diversification (REC non-power infra; TFCI roads/metro).

- Disbursement Ramp-Up: Net cash from ops positive in strong firms (TFCI ₹7K Cr FY25 inflow). Bond issuances (PFC/REC/IRFC multiple private placements, fully utilized).

- Subsidiary Expansion: PFC/REC JV for renewables; RECPDCL consultancy growth.

- Balance Sheet Strength: Net worth up (PFC ₹88K Cr; REC ₹77K Cr; TFCI ₹121K Cr). CRAR healthy in leaders (PFC 24%, REC 25%).

- Projections: FY25 PAT growth 10-20% YoY for PFC/REC/IRFC (extrapolating 9M trends); TFCI targets 15% loan CAGR.

Key Risks

| Risk Category | Description | Mitigants |

|---|---|---|

| Credit Risk | High GNPA (IFCI 96%; sector 2-3%), SMA stress. ECL overlays signal caution. | Govt guarantees (REC 44% loans covered), diversification. |

| Liquidity/ Funding Risk | Debt:Equity 4-8x (PFC 4.8x, REC 6.4x). Forex exposure (hedged but volatile). | AAA ratings, govt equity infusions (e.g., IFCI ₹500 Cr). |

| Interest Rate Risk | Rising rates squeeze NIMs (finance costs 60-70% expenses). | Hedging (cash flow hedges in OCI). |

| Regulatory/Compliance | CRAR shortfalls (IFCI negative), ECL vs IRACP gaps. | RBI compliance, no defaults noted. |

| Operational/Subsidiary | Weak subs drag (IFCI/PFC unreviewed subs). Litigation (e.g., IFCI SHCIL case). | Consolidation plans (IFCI group merger in-principle). |

| Macro | Slow infra execution, power sector transition risks. | Stable govt patronage. |

Overall Summary: These NBFCs are resilient due to govt backing and infra tailwinds, with PFC/REC/IRFC as sector leaders (PAT growth, strong CRAR). IFCI lags (losses, high NPAs). Growth tied to capex cycle (high potential), but risks from NPAs/FX/regulations persist. Sector outlook positive (projected 12-15% AUM CAGR FY26), monitor IFCI closely.

General

asof: 2025-12-03

Summary Analysis of Indian Financial Institutions (Infra-Focused NBFCs/CPSEs)

The provided disclosures from key Indian financial institutions (IRFC, PFC, REC, HUDCO, IREDA, IFCI, TFCI) – primarily government-owned NBFCs financing infrastructure, power, housing, railways, and tourism – reveal a sector aligned with India’s Viksit Bharat vision. These entities (mostly Navratna CPSEs) benefit from sovereign backing but face governance hurdles. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks, based on the documents.

Tailwinds (Positive Drivers)

- Robust Financial Performance & Expansion: HUDCO’s H1FY26 results show exceptional growth – loan sanctions +21.6% YoY (₹92,985 Cr), disbursements at record ₹25,838 Cr, loan book +30% (₹1.44 lakh Cr), net profit +7.5% (₹1,340 Cr). Low NPAs (GNPA 1.21%, NNPA 0.07%, PCR 94.55%) and cost optimization (borrowing cost down to 7.12%) enhance margins (NIM 2.98%). REC’s incorporation of two WOS subsidiaries for inter-state power transmission (under MoP tariff-based bidding) signals project pipeline execution.

- Government Alignment & MoUs: Strong ties with MoR (IRFC), MoP (REC/PFC/IREDA), MoHUA (HUDCO). HUDCO highlights massive MoUs (e.g., ₹1.5 lakh Cr with MMRDA, ₹1 lakh Cr each with MP/Rajasthan govts) and roles in PMAY 2.0, AMRUT, JJM, Smart Cities. Infra capex surge (1.6x to ₹90-100 lakh Cr by FY30 per CRISIL) favors these lenders.

- Market Confidence & Initiatives: Investor meetings (PFC), detailed presentations (HUDCO), stock split (TFCI 1:5 for liquidity), and ESG focus (HUDCO’s sustainable lending ₹15,000 Cr) boost accessibility. IREDA/IFCI disclosures indicate ongoing engagement despite minor setbacks.

Headwinds (Challenges)

- Regulatory & Governance Pressures: IRFC fined ₹10.77 lakh (incl. GST) by BSE/NSE for Q1FY26 non-compliances (Reg 17/18/19/20/21 on board/committee composition). As a govt company, director appointments rest with MoR, causing delays (similar waivers sought previously). This highlights systemic issues in CPSEs.

- Operational Disruptions: IREDA cancelled London investor roadshows due to “official exigencies,” signaling potential execution delays. IFCI’s EGM notice (via newspaper) may indicate restructuring needs.

- Cost & Margin Pressures: HUDCO notes rising borrowings (₹1.26 lakh Cr), though costs are optimized; sector-wide dependency on govt guarantees exposes to fiscal delays.

Growth Prospects

- High (Strong Outlook): Aligned with ₹10 Tn economy by 2030 & Viksit Bharat@2047. HUDCO projects urban infra/housing boom (loan book to grow via PMAY 2.0, private sector entry in roads/airports/energy). REC/PFC/IREDA tap power transmission/RE (e.g., WR-ER schemes). TFCI’s split enhances retail participation. Sector capex in roads/railways/power/urban infra to surge 1.3-1.8x (CRISIL). HUDCO’s urban invest window, credit enhancement (AMRUT 2.0), and diversified borrowings (ECB, bonds) position for 20-30% AUM CAGR.

- Catalysts: Govt schemes (₹1 lakh Cr Urban Challenge Fund), multilateral funding, SPV models (REC), and private infra push (HUDCO guidelines for real estate/ports).

Key Risks

| Risk Category | Description | Mitigation from Docs |

|---|---|---|

| Governance/Regulatory | Fines/delays in board appointments (IRFC); SEBI compliances. | Waiver requests; govt ministry reliance. |

| Asset Quality | NPAs (HUDCO resolving ₹1,757 Cr GNPA via NCLT/DRT); consortium exposures. | High govt exposure (98.7%), strong PCR; zero NNPA target. |

| Funding & Liquidity | High debt-equity (HUDCO 6.98x); forex/currency risks (ECB). | Diversified sources (bonds 49%, banks 31%); AAA ratings. |

| Execution/Policy | Project delays (REC SPVs to be bid out); scheme dependencies. | TBCB guidelines; MoUs lock pipelines. |

| Market/External | Interest rate hikes; private sector ramp-up risks (HUDCO new division). | Low cost of funds (6.32% incremental); ESG edge. |

Overall Sector Outlook: Positive with Moderate Risks. Tailwinds from infra boom outweigh headwinds; growth pegged at 25-30% loan book CAGR, driven by HUDCO/REC. Risks are manageable due to sovereign support/low NPAs, but governance fixes needed. Investors should monitor Q3FY26 results and regulatory waivers. HUDCO emerges as sector bellwether with superior metrics.

Investor

asof: 2025-11-30

Analysis of Indian Infrastructure NBFCs/CPSEs (IRFC, PFC, REC, HUDCO, IREDA)

These government-backed financiers (all Navratna/Maharatna CPSEs) dominate infra lending in railways, power, housing, urban dev, and renewables. Drawing from Q2/H1 FY26 earnings transcripts and announcements (as of Oct-Nov 2025), here’s a structured analysis of headwinds, tailwinds, growth prospects, and key risks. Data reflects strong H1 performance amid India’s infra boom (e.g., NIP, 500GW RE target by 2030).

Tailwinds (Positive Drivers)

- Govt-Backed Stability & Low-Cost Funding: Sovereign linkages ensure AAA ratings, low NPAs (IRFC: 0%; REC: NNPA 0.24%; IREDA: 1.97%), and cheap capital (HUDCO CoF 6.32%; IREDA 3.65% annualized). Equity infusions/QIPs (IREDA ₹2k Cr QIP; REC/PFC dividends ₹9.2/share) bolster CRAR (20-38%).

- Infra Capex Surge: 70% of India’s capex from govt (IRFC). RE potential ₹31-46L Cr (IREDA/REC); urban infra ₹80L Cr by 2036 (HUDCO). H1 sanctions/disburse: IRFC ₹45k Cr (+9x YoY), REC ₹1.15L Cr (+27%), HUDCO ₹93k Cr (+22%).

- Diversification Success: IRFC (rail ecosystem: RE/transmission/coal); REC/PFC (infra/logistics/shipping); HUDCO (private ports/airports/roads); IREDA (BESS/Green H2). NIM expansion: IRFC 1.55%, REC 3.64%, HUDCO 3%.

- Operational Efficiency: Digitization (IREDA/HUDCO), low overheads, experienced teams (avg 25+ yrs exp). Recoveries (REC ₹11.4k Cr from Kaleshwaram; HUDCO ₹339 Cr).

Headwinds (Challenges)

- Margin Pressure: Repo cuts increase bank competition; RE yields may dip (REC/PFC). Prepayments erode AUM (REC ₹49k Cr H1; IRFC reversing downtrend).

- Forex Volatility: ECB hedging costs up (HUDCO ₹176 Cr loss; IREDA 75% hedged but FX exposure ~₹10k Cr). Rupee depreciation hits (HUDCO: USD/CHF protections to 89-90).

- Regulatory/Provisioning Norms: RBI project finance rules (REC: minimal FY26 impact); potential DISCOM restructuring (REC).

- Slow Legacy Resolutions: NPAs in NCLT (REC 10/11 assets; IREDA slippage 0.96%). MAT risk (IRFC: deferred 5-7 yrs).

Growth Prospects

- High Visibility Pipeline: IRFC ₹30k Cr FY26 disburse (on track); REC 11-12% AUM growth, ₹10L Cr by 2030 (30% RE); HUDCO 25-30% AUM CAGR to ₹3L Cr by 2030; IREDA 27% GLP CAGR (₹84k Cr H1, +31% YoY); PFC/REC H1 disburse ₹1.15L Cr (+27%).

- Sector Tailwinds: RE (IREDA sanctions ₹33k Cr H1); railways upstream (IRFC ₹45k Cr); urban (HUDCO Urban Challenge Fund ₹1L Cr); power infra (PFC/REC ₹46L Cr over 5 yrs).

- CAGR Potential: 20-30% AUM growth (govt capex, diversification). ROE 15-22%; dividends rising (IRFC ₹1.05/share interim record).

- 2030 Targets: REC ₹10L Cr AUM; IREDA GLP scaling via GIFT City/perpetual bonds.

Key Risks

| Risk Category | Details | Mitigants |

|---|---|---|

| Asset Quality | Diversification into uncharted areas (e.g., IRFC non-rail; HUDCO private); Stage-2 NPAs (REC ₹16k Cr). Slippage risk in state utilities. | 70-84% secured/commissd assets; zero NPA history (IRFC); PCR 45-77%; stressed asset teams. |

| Interest Rate/FX | Margin compression (repo cuts); ECB volatility (₹10-15k Cr exposure across entities). | 60% fixed-rate borrowings; hedging (IREDA 75% FCY); low gearing (5-7x). |

| Regulatory/Policy | RBI norms, DISCOM debt restructure, MAT revival (IRFC). Budget dependency. | Govt nodal agency status; whole-of-govt approach. |

| Execution | Delays in COD/milestones; competition from banks/NaBFID. | Tech-enabled monitoring; experienced mgmt; strong pipelines (₹2.5-8L Cr MOUs). |

| Macro | Fiscal slippages in states; cyclical capex slowdown. | 86% state sector (REC); RE policy push. |

Overall Summary:

Bullish Outlook with robust tailwinds from govt infra push (RE/urban/rail) driving 20-30% AUM CAGR. H1 FY26 showcases record sanctions/disburse (avg +30-80% YoY), NIM gains, and pristine balance sheets. Growth anchored in ₹30-80L Cr sector opps to 2030. Headwinds manageable (competition, FX) via diversification/low CoF. Key Risks low (asset quality via govt ecosystem; contained NPAs <2%). Recommendation: High conviction; monitor RE execution/FX. Peers like REC/IREDA lead RE; IRFC/HUDCO infra plays. Valuations attractive on 15-22% ROE trajectory.

Press Release

asof: 2025-12-03

Analysis of IRFC and IREDA as Indian Financial Institutions

IRFC (Indian Railway Finance Corporation Ltd.) and IREDA (Indian Renewable Energy Development Agency Ltd.) are key Government of India enterprises financing critical infrastructure sectors (railways and renewables). The provided disclosures highlight positive developments: IRFC’s ECB raise of ~USD 300M (JPY-denominated, 5-year tenor, unsecured) after 3+ years, and IREDA’s S&P credit upgrade to ‘BBB’ (stable) from ‘BBB-’ (short-term ‘A-2’). Below is a structured analysis based solely on these documents.

IRFC Analysis

- Tailwinds:

- Revival in ECB market after 3+ years, signaling renewed access to international funding at competitive rates (benchmarked to Overnight TONAR).

- Unsecured facility supports flexibility; proceeds for railway-linked projects, aligning with national infra priorities and “IRFC 2.0” diversification.

- Strong execution (signed Dec 2, 2025, at GIFT City), backed by senior leadership presence.

- Headwinds:

- Currency exposure (JPY equiv. USD 300M) amid potential JPY volatility vs. INR/USD.

- Facility not yet drawn (amount outstanding: NIL), delaying liquidity benefits; dependency on future drawdowns.

- Growth Prospects:

- High: Enables lower weighted average borrowing cost, funding backward/forward railway projects. Positions IRFC for deeper international market presence, crucial for nation-building infra (per CMD statement).

- Key Risks:

- Interest rate risk (TONAR-linked floating rate).

- No security provided (unsecured), potentially higher scrutiny if economic conditions worsen.

- Compliance with ECB guidelines; general market/execution risks (e.g., no special rights but standard loan terms).

IREDA Analysis

- Tailwinds:

- Credit upgrade to ‘BBB’ (stable) aligns with India’s sovereign rating, reflecting robust asset quality, capitalization, and liquidity.

- Enhances funding access, reduces cost of capital, boosts investor confidence in equity/debt markets.

- Strategic role in renewable energy mission, reinforcing “premier green financing” leadership (Navratna CPSE status).

- Headwinds:

- None explicitly noted; prior ‘BBB-’ rating implied moderate constraints now alleviated, but sector cyclicality (renewables) could persist.

- Growth Prospects:

- Strong: Upgrade validates financial strength, enabling competitive capital mobilization for India’s energy transition. Expected to deepen market penetration and support long-term strategy (per CMD).

- Key Risks:

- Sector-specific: Dependency on renewable project pipeline and policy support.

- Broader: Potential conflicts if asset quality dips; no direct risks in disclosure, but rating stability assumes sustained performance.

Summary

| Aspect | IRFC | IREDA | Overall for Indian Fin. Insts. (NBFCs like these) |

|---|---|---|---|

| Tailwinds | ECB revival, cost reduction, infra focus | Sovereign-aligned rating, funding ease | Govt backing, infra/renewable tailwinds, global access |

| Headwinds | Currency/drawdown delays | Minimal (pre-upgrade constraints eased) | FX/interest volatility, undrawn facilities |

| Growth Prospects | High (railway infra expansion) | Strong (green energy leadership) | Robust (national priorities: railways/renewables) |

| Key Risks | Rate/FX, unsecured nature | Sector cyclicality | Compliance, economic sensitivity, floating rates |

Overall Outlook: Both exhibit strong tailwinds from strategic funding/rating wins, positioning them for growth in priority sectors amid India’s infra push. Risks are manageable (mostly market-linked), with limited headwinds. These moves underscore resilience and cost-competitiveness for govt-backed financiers, likely supporting positive stock/credit trajectories. No material related-party or conflict issues noted.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.